As filed with the Securities and Exchange Commission on August 20, 2008

Registration No. 333-150638

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

REGISTRATION STATEMENT ON FORM S-1

UNDER

THE SECURITIES ACT OF 1933

NEWPAGE GROUP INC.

(Registrant)

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 26-1292456 |

| (State of Incorporation) | | (I.R.S. Employee I.D. No.) |

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(877) 855-7243

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Douglas K. Cooper

General Counsel

8540 Gander Creek Drive

Miamisburg, Ohio 45342

(877) 855-7243

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| | |

| Stuart D. Freedman, Esq. | | Kirk A. Davenport, Esq. |

| Michael R. Littenberg, Esq. | | Senet S. Bischoff, Esq. |

| Schulte Roth & Zabel LLP | | Latham & Watkins LLP |

| 919 Third Avenue | | 885 Third Avenue |

| New York, NY 10022 | | New York, NY 10022 |

| Ph: (212) 756-2000 | | Ph: (212) 906-1200 |

| Fax: (212) 593-5955 | | Fax: (212) 751-4864 |

Approximate date of commencement of proposed sale to the public:

As promptly as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ¨

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

| Large accelerated filer ¨ | | Accelerated filer ¨ |

| Non-accelerated filer x | | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) | | |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that the Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated August 20, 2008.

Shares

NewPage Group Inc.

Common Stock

This is an initial public offering of shares of common stock of NewPage Group Inc.

NewPage Group Inc. is offering shares in this offering. The selling stockholders identified in this prospectus are offering an additional shares of our common stock. NewPage Group Inc. will not receive any of the proceeds from the sale of shares of common stock being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ per share. NewPage Group Inc. intends to apply to the New York Stock Exchange for listing of its common stock under the symbol “NWP”.

See “Risk Factors” on page 18 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Per Share | | Total |

Initial public offering price | | $ | | | $ | |

Underwriting discount | | $ | | | $ | |

Proceeds, before expenses, to NewPage Group Inc. | | $ | | | $ | |

Proceeds, before expenses, to the Selling Stockholders | | $ | | | $ | |

To the extent that the underwriter sells more than shares of common stock, the underwriter has the option to purchase up to an additional shares from the selling stockholders at the initial public offering price less the underwriting discount.

The underwriter expects to deliver the shares against payment in New York, New York on , 2008.

Goldman, Sachs & Co.

Prospectus dated , 2008.

TABLE OF CONTENTS

Prospectus

Through and including , 2008 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that is important to you. We urge you to read this entire prospectus, including the “Risk Factors” section and the financial statements.

In this prospectus, unless otherwise noted or the context otherwise requires, (i) the terms “we,” “our,” “ours,” “us,” “NewPage” and “Company” refer collectively to NewPage Group Inc. and its consolidated subsidiaries, (ii) the term “NewPage Group” refers to NewPage Group Inc., (iii) the term “NewPage Holding” refers to NewPage Holding Corporation, our direct wholly-owned subsidiary, (iv) the term “NewPage Corporation” refers to NewPage Corporation, our indirect wholly-owned subsidiary, (v) the term “predecessor” refers to the printing and writing papers business of MeadWestvaco Corporation prior to its acquisition by NewPage Corporation, and (vi) the term “SENA” refers to Stora Enso North America Inc. All references to the “Acquisition” refer to the acquisition of SENA by us on December 21, 2007. Following the Acquisition, SENA changed its name to NewPage Consolidated Papers Inc., or “NPCP.” References to each of SENA and NPCP are to the acquired business.

Except where we state otherwise, the information we present in this prospectus assumes no exercise by the underwriter of the option granted by us to purchase additional shares in this offering and has been adjusted to reflect a split of common stock to occur prior to the closing of this Offering.

Our Company

We believe that we are the largest coated paper manufacturer in North America based on production capacity. Coated paper is used primarily in media and marketing applications, such as corporate annual reports, high-end advertising brochures, direct mail advertising, coated labels, magazines, magazine covers and inserts and catalogs. For 2007, after giving effect to our acquisition of SENA and this offering, we had pro forma net sales of $4.7 billion, pro forma EBITDA of $487 million and pro forma income (loss) from continuing operations of $ million. For the six months ended June 30, 2008, we had net sales of $2.3 billion, and, after giving effect to this offering, pro forma EBITDA of $261 million and pro forma income (loss) from continuing operations of $ million.

After giving effect to the announced closure of our Kimberly, Wisconsin mill at the end of August 2008, we will operate 20 paper machines at ten mills located in Kentucky, Maine, Maryland, Michigan, Minnesota, Nova Scotia and Wisconsin. These mills and our distribution centers are strategically located near major print markets, such as New York, Chicago, Minneapolis and Atlanta. We are one of the most efficient coated paper manufacturers in North America. Based on data from Resource Information Systems, Inc., or “RISI”, as of the first quarter of 2008, on a pro forma basis after giving effect to the Acquisition Transactions (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview—The SENA Acquisition and Related Transactions”) and the closure of our Niagara and Kimberly, Wisconsin mills, we believe that all of our non-specialty coated paper machines were in the top 25% of efficiency of all non-specialty coated paper machines in North America, Europe and Asia based on the cash cost of delivered product to Chicago. Industry information in this prospectus is, unless otherwise expressly noted, derived from RISI data. “North American” data included in this prospectus that has been derived from RISI only includes data from the United States and Canada. RISI U.S. industry pricing data represents pricing from the eastern United States only (as defined by RISI). Any reference in industry statistics to grade No. 3, grade No. 4 or grade No. 5 coated paper or SC-A paper relates to 60 lb. weight, 50 lb. weight, 40 lb. weight and 35 lb. weight, respectively.

1

Our mills have a total annual production capacity of approximately 4.5 million short tons of paper, including approximately 3.3 million short tons of coated paper, approximately 900,000 short tons of uncoated paper and approximately 300,000 short tons of specialty paper, after taking into account our announced restructuring and closure plans discussed in this prospectus.

We have long-standing relationships with many leading publishers, commercial printers, retailers and paper merchants. Our key customers include Condé Nast Publications, Hearst Corporation, The McGraw-Hill Companies, Meredith Corporation, Pearson Education and Time Inc. in publishing; Quad/ Graphics, Quebecor World Inc. and R.R. Donnelley & Sons Company in commercial printing; J.C. Penney Company, Inc., Target Corporation and Williams-Sonoma, Inc. in retailing; and paper merchants PaperlinX Limited, Unisource Worldwide, Inc. and xpedx, a division of International Paper Company. Key customers for specialty paper products include Avery Dennison Corporation and Vacumet Corp.

Our History

Our business is the result of two significant acquisitions, the acquisition of the printing and writing papers business of MeadWestvaco Corporation in May 2005, and the acquisition of SENA from Stora Enso Oyj, or “SEO,” in December 2007.

From MeadWestvaco, we acquired four coated paper mills with a total manufacturing capacity of approximately 2.2 million short tons of coated paper. The acquired business was the result of the larger 2002 combination of Mead Corporation and Westvaco Corporation. Following that combination and our acquisition of the MeadWestvaco printing and writing papers business, we have significantly reduced our costs through rationalization of facilities and purchasing, development of integrated marketing strategies, coordination of information and manufacturing systems and consolidation of grades at our mills. Our strategy has been to implement best practices across our mill system and to focus on increasing our overall profitability, rather than on a mill-by-mill basis.

Our acquisition of SENA more than doubled our production capacity and broadened our product line. The acquisition added SENA’s eight mills to NewPage’s existing group of mills and enhanced our market position by expanding our paper offerings to include light-weight and ultra light-weight coated paper and added complementary supercalendered paper and specialty paper products. We subsequently closed one of the acquired mills in June 2008 and announced the closure of a second mill at the end of August 2008. SEO acquired a 19.9% equity interest in NewPage Group at the time of the Acquisition.

Since 2000, significant investments have been made in our mills to improve productivity and reduce costs. We have also implemented Lean Six Sigma and other initiatives focused on reducing costs and improving operational performance. We believe that these initiatives, combined with the synergies and business strategy discussed below will enable us to further enhance our operating efficiency and profitability.

2

Synergies of the SENA Acquisition and Integration of the Business

We expect to generate annualized synergies as a result of the SENA acquisition of approximately $265 million by June 2009. These synergies are expected to come from optimizing paper production, reducing input costs and reducing selling, general and administrative expenses. On January 16, 2008, we announced restructuring plans that include the shutdown of four of our less efficient, higher cash cost paper machines, which we expect to occur during 2008, as well as selected headcount reductions.

The synergies resulting from the SENA acquisition expand upon the significant investments made in our business over the last several years and involve the implementation of many of the same strategies that were successfully employed in the combination of Mead and Westvaco and following the NewPage acquisition. We intend to continue to implement best practices across our combined mill system and focus on increasing our overall profitability, rather than independently at each individual mill. We believe that the synergies resulting from the SENA acquisition will further improve productivity and reduce costs, which we believe will enhance our competitive position and enable us to serve our customers more efficiently.

The following table sets forth the principal steps we have taken and intend to take to seek to realize the expected synergies from the SENA acquisition:

Optimize Production (expected annualized synergies of approximately $145 million) | • | | Reallocate production of paper grades across our combined machine base, resulting in operation of machines in narrower ranges around their peak production. |

| | • | | Shut down or idle certain of our less efficient, highest cash cost machines. |

| | • | | Permanently closed one paper machine in Rumford, Maine in February 2008, one paper machine in Kimberly, Wisconsin in May 2008, and the pulp mill and two paper machines in Niagara, Wisconsin in June 2008. |

| | • | | Use substantially all of our excess pulp production internally to reduce the amount of pulp purchased from third parties. |

Reduce Input Costs (expected annualized synergies of approximately $80 million) | • | | Lower prices of key raw materials through volume purchases. |

| | • | | Realize cost reductions from improved logistics; through reallocation of production among our combined mills, we expect to produce more product in greater proximity to customers, lowering freight rates. |

| | • | | Permanently close our Chillicothe, Ohio converting facility by the end of November 2008 after transferring the work to other existing facilities. |

Reduce Selling, General and Administrative Expenses (expected annualized synergies of approximately $40 million) | • | | Eliminate duplicative sales, marketing, research and customer service personnel. |

| | • | | Centralize corporate administration, management, finance, information technology and human resource functions, achieving headcount reductions and reduction of associated support costs. |

| | • | | Lower benefit costs by freezing defined benefit pension plans and reducing retiree medical benefits for salaried employees. |

3

For a description of certain risks relating to the achievement of the synergies described above, see “Risk Factors—Risks Relating to our Business—Even if we are able to successfully integrate the business of NPCP into our operations, we may not realize the anticipated synergies of the Acquisition on the timetable currently contemplated, or at all.”

On July 30, 2008, we announced that we intend to permanently close the Kimberly, Wisconsin mill by the end of August 2008. The closure will enable us to further reduce costs and is intended to better balance supply and customer demand.

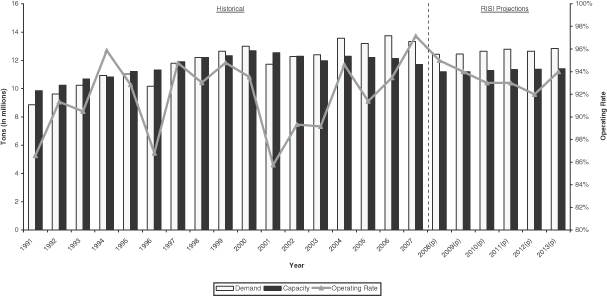

Our Industry

Since 2000, the North American coated paper industry has experienced substantial consolidation. According to RISI, in 2000, 80% of the coated paper capacity in North America was attributable to eleven manufacturers. By 2008, this number had decreased to six manufacturers. According to RISI, over the same time period, there was an overall reduction in North American coated paper production capacity of more than 1.1 million short tons and, from 2004 to 2007, North American coated paper production capacity has declined by 757,000 short tons. In January 2008, we announced a further capacity reduction of 430,000 short tons of coated paper. In addition, we will close our Kimberly, Wisconsin mill at the end of August 2008, which will further reduce North American coated paper production capacity. The Kimberly mill currently produces approximately 500,000 short tons of coated paper annually.

In North America, coated paper supply is determined by both local production and imports, principally from Europe and Asia. From 2004 through the end of 2006, imports of coated paper grew at a slower pace than from 2000 through 2003. We believe that this was largely due to an increase in demand in Asian markets and a reduction of supply in Europe combined with an increase in European demand and less favorable exchange rates for European producers. In 2007, total coated paper imports into North America declined to 19%, compared to 20% of total coated paper purchases in 2006, due in part to less favorable exchange rates for foreign producers, higher ocean-going freight costs and lower U.S. demand, according to RISI. RISI projects coated paper imports into North America to be 18% of total coated paper purchases in 2008, 19% of total coated paper purchases in 2009 and 21% of total coated paper purchases for 2010 to 2013.

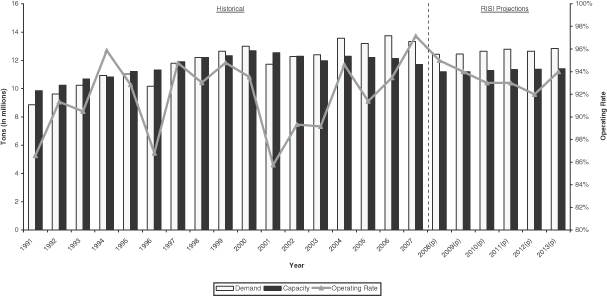

Operating rates for North American coated paper manufacturers, which are a function of North American supply and demand, are expected to remain favorable through 2013 because demand is expected to continue to exceed North American capacity. Historically, high operating rates have resulted in higher prices for coated paper. According to RISI, the average operating rate for North American coated paper manufacturers, which measures the ratio of shipments from producers in a particular region to capacity of producers in the same region, rose from 86% in 2001 to 97% in 2007, as shipments increased more than capacity during this time period. RISI projects the average coated paper operating rate to be 95% in 2008 and remain above 92% through 2013.

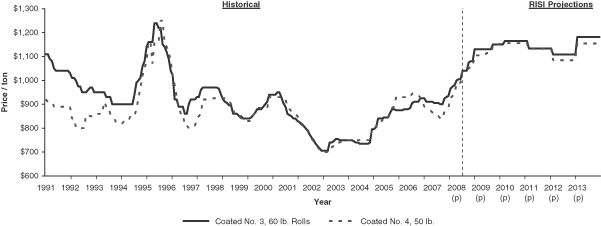

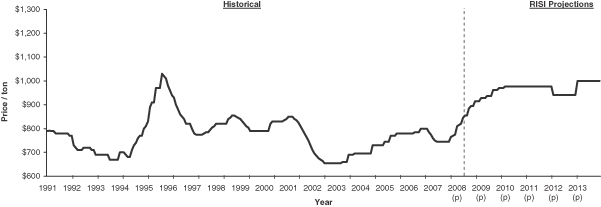

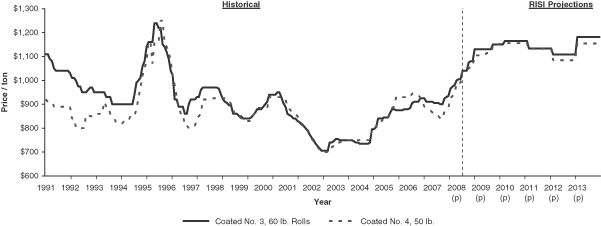

Since mid-2004, coated paper prices in the United States have generally risen due to a combination of demand and decreased North American capacity resulting from capacity rationalization. Our weighted-average coated paper prices rose from $797 per ton in 2004 to $988 per ton for the second quarter of 2008.

As a result of the expiration of annual customer price caps and price increases announced in the fourth quarter of 2007, U.S. market prices increased approximately $95 per ton for coated groundwood paper and $60 per ton for coated freesheet paper from December 2007 through June 2008. In May 2008, we announced a $60 per ton price increase on most coated and supercalendered paper grades,

4

effective beginning in July 2008. When coated paper manufacturers announce price increases, they generally take effect over time. Whether a price increase is successful depends on supply, demand and other competitive factors in the marketplace.

According to RISI, in the first half of 2008, North American coated paper demand declined by 5.9%, compared to the same period in 2007, as a result of decreased advertising spending and magazine and catalog circulation. North American coated paper demand is projected by RISI to decline by 10% for the second half of 2008 compared to the second half of 2007.

Notwithstanding the decline in demand, primarily as a result of capacity reductions, RISI forecasts the average price of grade no. 3 coated paper to increase to $1,063 per ton in 2008 from $928 per ton in 2007 and the average price of grade no. 4 coated paper to increase to $1,048 per ton in 2008 from $878 per ton in 2007. RISI forecasts the average prices of both grades to be above $1,000 per ton through 2013.

We believe that we are well positioned to benefit from the strengthening pricing environment for coated paper as result of our business strategy and strengths described below.

Business Strategy

The key elements of our strategy include the following:

Maintain core focus on coated paper business. We believe that our focus on producing coated paper provides us with a significant competitive advantage by enabling us to lower production costs per ton due to greater economies of scale, reduce delivery costs as a result of larger shipment sizes and provide a higher level of customer service. With the acquisition of SENA, we extended our product breadth into light-weight and ultra light-weight coated groundwood papers and added volume to our existing coated paper grades. The Acquisition also added capacity of supercalendered uncoated groundwood papers, a complementary lower cost alternative to coated paper, primarily for magazine and catalog use.

Continue to reduce costs through synergies and further productivity improvements. We expect to generate annualized synergies as a result of the Acquisition of approximately $265 million to be achieved by June 2009. For a further discussion of these plans, see “—Synergies of the SENA Acquisition.” Since January 2000, we have significantly reduced our costs through rationalization of facilities and purchasing, development of integrated marketing strategies, coordination of information and manufacturing systems and consolidation of grade lines. In addition, since 2000, we have implemented best practices across our mill system and have focused on maximizing overall profitability, rather than independently at each individual mill. Without giving effect to the Acquisition or expected synergies, according to RISI, the cash cost per ton excluding delivery of the four original NewPage mills improved from an 8%, or $47 per ton, advantage over the North American average in 2002 to a 15%, or $98 per ton, advantage over the North American average in the fourth quarter of 2007. For the first quarter of 2008, on a combined basis after giving effect to the Acquisition but without giving effect to our announced restructuring and closure plans discussed in this prospectus, according to RISI, our cash cost per ton excluding delivery represented an advantage of 7%, or $48 per ton, over the North American average. We will continue to implement additional measures, including the use of Lean Six Sigma initiatives, to enhance our operating efficiency and productivity. We believe that the synergies resulting from the Acquisition and these additional measures will enhance our ability to further decrease production costs per ton and to increase operating cash flow and margins.

Enhance product mix to improve margins and earnings. We continue to seek opportunities to increase sales of higher-margin grades of coated paper, such as higher-end grades of coated papers and ultra light-weight coated groundwood papers. We intend to continue to do so through

5

increased sales to our existing customers as well as to new customers, in particular printers, publishers and paper merchants. For example, as part of our initiative to enhance product mix, from 2005 to 2007, we increased net sales of our caliper papers, which are higher-end grades of coated paper used largely in direct mail applications, by approximately 35%. We also seek to increase our margins by focusing on more profitable customer categories, such as corporate end users, and expanding our relationships with these customers.

Further improve cash flow and return on capital. Since the inception of our company, we have focused on increasing our cash flow and our return on capital, including through the strategy initiatives discussed above. We also adopted and have continued to implement a capital expenditure plan that is focused on attractive investment projects. In addition, we believe, based on our current business plans, capital structure, tax position and current tax law, that we will not be required to pay material U.S. federal income taxes until 2010. We believe that our current productivity initiatives and the synergies and closure described herein, coupled with favorable pricing trends for coated paper, will enhance our ability to generate cash flow and improve our return on capital. We intend to use our cash flow to repay debt and finance continued improvements in our operations. In addition, we may use our cash flow to return capital to shareholders through dividends and/or share repurchases and to selectively pursue synergistic acquisitions and/or strategic partnerships.

Business Strengths

We believe that our core strengths include the following:

Largest North American manufacturer of coated paper products. Our mills have a total annual production capacity of approximately 3.3 million short tons of coated paper, after taking into account our announced restructuring and closure plans discussed in this prospectus. Our production capacity represents approximately 26% of 2008 North American production capacity and net North American imports of coated paper, according to RISI. The SENA acquisition enhanced our market position by expanding our paper offerings to include light-weight and ultra light-weight coated paper and added complementary offerings in supercalendered paper and specialty paper products. We believe that our broad product portfolio, well-known brands and service will help us to remain a leading supplier of coated paper products.

Well positioned to benefit from strengthening pricing environment. We believe that we are well positioned to benefit from price increases in the coated paper industry as a result of our product breadth and long-standing customer relationships. Since June 2004, North American coated paper prices have generally risen due to a combination of demand and decreased North American capacity resulting from capacity rationalization. From 2000 to 2007, North American production capacity for coated paper declined by over 1.1 million short tons, and production capacity declined by 757,000 short tons from 2004 to 2007, according to RISI. In addition, in 2008, we shut down machines and announced mill closures that will result in the permanent reduction of approximately 930,000 tons of coated paper capacity. We believe that North American and U.S. coated paper demand will continue to exceed North American capacity for the foreseeable future. The strengthening pricing environment has enabled us to successfully raise prices to improve profitability.

Attractive cost position coupled with further profit improvement initiatives. As of the first quarter of 2008, on a pro forma basis after giving effect to the Acquisition Transactions and our announced restructuring and closure plans discussed in this prospectus, we believe that all of our non-specialty coated paper machines were in the top 25% of efficiency of all non-specialty coated paper

6

machines in North America, Europe and Asia based on the cash cost of delivered product to Chicago, based on RISI data. Since 2000, over $500 million has been invested in the original NewPage mills to maintain or improve a cost advantage over our competitors. In addition, since January 2000, we have significantly reduced our costs through rationalization of facilities and purchasing, development of integrated marketing strategies, coordination of information and manufacturing systems and consolidation of grade lines at our mills by implementing best practices across our mill system and focusing on increasing overall profitability, rather than on a mill-by-mill basis. From 2000 until the Acquisition, SENA invested over $700 million in its business, including several major capital projects involving the rebuilding of paper machines at the Biron, Wisconsin Rapids and Whiting mills. We believe that we will be able to further enhance our operating efficiency and profitability as a result of the initiatives described above, the synergies we anticipate in connection with the SENA acquisition, the closures of the Kimberly and Niagara, Wisconsin mills, our ability to generate a substantial portion of our energy needs and to adjust in part our mix of externally and internally sourced energy and our production of low cost pulp through our integrated pulp operations.

Strong relationships with key customers. We have long-standing relationships with leading publishers, paper merchants, commercial printers and retailers. We believe our sales strategy, which includes both direct sales to our larger customers and sales to merchants, who then resell our products, has reduced sales costs and enhanced customer service. Our relationships with our five largest customers, which contributed approximately 39% of our pro forma net sales for 2007, average over 38 years. We seek to continue to enhance our relationships with our key customers by providing them with a high level of value-added customer service.

Efficient and integrated supply chain. We believe that the location of our mills and distribution centers near major print markets, such as New York, Chicago, Minneapolis and Atlanta, affords us the ability to more quickly and cost-effectively deliver our products to those markets. In addition, we believe that our fully-implemented integrated ERP system enables us to run our operations more cost-effectively through better planning of manufacturing runs and tracking of costs and inventory and will better enable us to realize some of the anticipated synergies of the Acquisition. Our ERP system also enhances our customer service, because it gives many of our customers the ability to order products and to track the real-time progress of their orders online. As part of the reorganization plan associated with the SENA acquisition, we are in the process of migrating the SENA mills to our existing ERP system and integrating SENA’s order management, purchasing, inventory and finance information systems with our existing systems.

Experienced management team with proven track record. Our senior management team averages approximately 12 years of experience in the paper and forest products industry, and several members of our management team were responsible for the successful integration of Mead and Westvaco into a stand-alone business, which has resulted in improved cost structure and meaningful cash flow. Our chairman and chief executive officer, Mark A. Suwyn, was chairman and chief executive officer of Louisiana-Pacific Corporation, a building product materials manufacturing company. Mr. Suwyn headed Louisiana-Pacific from 1996 to 2004. Prior to Louisiana-Pacific, Mr. Suwyn served as an executive vice president at International Paper. Our chief operating officer, Richard D. Willett, Jr., had 13 years of broad management experience with General Electric Company followed by three years with Teleglobe International Holdings, where he was chief financial officer and subsequently chief operating officer. At Teleglobe, Mr. Willett led a major restructuring, cost reduction and acquisition effort. In addition to strong general management skills, Mr. Willett brings extensive leadership experience in disciplined cost management and process management initiatives such as Lean Six Sigma.

7

Our Sponsor

Founded in 1992, Cerberus Capital Management, L.P. and its affiliated management companies, which we collectively refer to as “Cerberus,” comprise one of the largest private investment firms in the world with in excess of $27 billion of capital under management in funds and accounts. Cerberus currently has majority or significant minority investments in companies around the world. In aggregate, these companies generate more than $100 billion in annual revenues and employ over 250,000 people. Cerberus invests in divestitures, turnarounds, recapitalizations, financial restructurings, public-to-privates and management buyouts in a variety of sectors. Cerberus formed NewPage in 2005 to effect the acquisition of the coated paper operations of MeadWestvaco Corporation.

Our Corporate Information

NewPage Group is a Delaware corporation. Our principal executive offices are located at 8540 Gander Creek Drive, Miamisburg, Ohio 45342, and our telephone number at those offices is (877) 855-7243. Our website address is www.newpagecorp.com. The information contained on our website does not constitute part of, nor is it incorporated into, this prospectus.

8

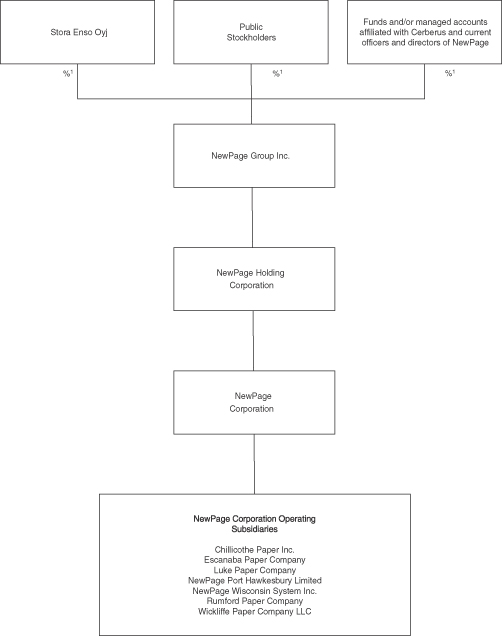

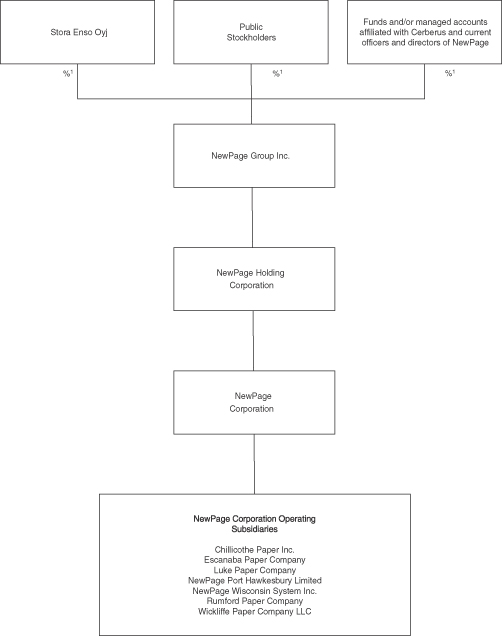

Organizational Structure

The following chart shows our organizational structure immediately after giving effect to the consummation of this offering. All of the direct and indirect subsidiaries of NewPage Group are wholly-owned.

1 | Assumes no exercise by the underwriter of the option to purchase an additional shares from the selling stockholders to cover over-allotments and does not take into account up to shares that may be issued upon the exercise of options under the NewPage Group Inc. 2008 Incentive Plan, or “NewPage Group Incentive Plan.” Also assumes the sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus. |

9

THE OFFERING

Common stock offered by us | shares |

Common stock offered by the selling stockholders | shares |

Common stock to be outstanding immediately after this offering | shares |

Use of proceeds | We will receive net proceeds from the offering of approximately $ million. |

| | We intend to use the net proceeds from this offering as follows: |

| | • | | approximately $ million to redeem in full the outstanding NewPage Holding floating rate senior unsecured PIK Notes due 2013, or “NewPage Holding PIK Notes”; and |

| | • | | approximately $ million to redeem in full the outstanding NewPage Group floating rate senior unsecured PIK Notes due 2015, or “NewPage Group PIK Notes.” |

| | We will not receive any of the proceeds from the common stock sold by the selling stockholders in this offering. |

| | The number of shares to be sold by us will be adjusted upwards or downwards, to the extent applicable, to maintain constant net proceeds to us of approximately $ million, and the aggregate number of shares to be sold by the selling stockholders will be adjusted downwards or upwards by an equal amount. |

Dividend policy | We do not intend to pay cash dividends on our common stock for the foreseeable future. |

Proposed New York Stock Exchange symbol | “NWP” |

Risk factors | For a discussion of risks relating to our company, our business and an investment in our common stock, see “Risk Factors” and all other information set forth in this prospectus before investing in our common stock. |

Unless we specifically state otherwise, the information in this prospectus:

| | Ÿ | | assumes a - for- split of our common stock prior to the closing of this offering, |

| | Ÿ | | assumes the sale of common stock in this offering at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, |

| | Ÿ | | excludes the sale of up to shares of common stock by the selling stockholders, which the underwriter has the option to purchase to cover over-allotments, and |

| | Ÿ | | excludes up to additional shares issuable upon exercise of options outstanding under the NewPage Group Incentive Plan. |

10

Summary Historical and Pro Forma Consolidated Financial Data

The following tables, as indicated below, set forth historical combined predecessor and successor financial data for the year ended December 31, 2005, consisting of the printing and writing papers business of MeadWestvaco for the four months ended April 30, 2005 (predecessor) and NewPage Group and its subsidiaries for the eight months ended December 31, 2005 (successor), and historical consolidated financial data for NewPage Group and its subsidiaries for the years ended December 31, 2006 and 2007. We have derived the historical consolidated financial data for the years ended December 31, 2006 and 2007 from the audited consolidated financial statements of NewPage Group and its subsidiaries included elsewhere in this prospectus. We have derived the historical combined predecessor and successor financial data for the year ended December 31, 2005 in part from the audited consolidated financial statements of NewPage Group and its subsidiaries and in part from the audited combined financial statements of the printing and writing paper business of MeadWestvaco, in each case, included elsewhere in this prospectus. We have derived the historical consolidated financial data for NewPage Group and its subsidiaries as of June 30, 2008 and for the six months ended June 30, 2007 and 2008 from the unaudited consolidated financial statements of NewPage Group and its subsidiaries included elsewhere in this prospectus, which reflect all adjustments (consisting only of normal recurring adjustments) which are, in the opinion of management, necessary for a fair presentation of that information for the periods presented.

The following tables, as indicated below, set forth historical financial data for SENA for the periods indicated. We have derived the financial data for SENA for the years ended December 31, 2005 and 2006 from the audited financial statements of SENA included elsewhere in this prospectus. We have derived the financial data for SENA for the nine months ended September 30, 2006 and 2007 from the unaudited financial statements of SENA included elsewhere in this prospectus, which reflect all adjustments (consisting only of normal recurring adjustments) which are, in the opinion of management, necessary for a fair presentation of that information for the periods presented.

The pro forma statement of operations data gives effect to the Acquisition Transactions and this offering as if they had occurred on January 1, 2007. The unaudited pro forma consolidated balance sheet at June 30, 2008 gives effect to this offering as if it had occurred on June 30, 2008. The pro forma consolidated financial data are unaudited, are for informational purposes only and are not necessarily indicative of what our financial position or results of operations would have been had the Acquisition Transactions and this offering been completed as of such dates and do not purport to represent what our financial position, results of operations or cash flows might be for any future period. The pro forma data assumes that the common stock is offered at $ per share, the midpoint of the range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount on the shares offered by us and our estimated expenses of the offering.

The Acquisition has been accounted for using the purchase method of accounting. Under purchase accounting, the total Acquisition consideration was allocated to the assets and liabilities of SENA based upon the fair value of assets being acquired and liabilities being assumed. The June 30, 2008 balance sheet data reflects management’s preliminary valuation of assets being acquired and liabilities being assumed. The final allocation of the Acquisition consideration will be based upon management’s consideration of final valuations and adjustments relating to the finalization of the restructuring plan and uncertain and deferred tax positions. Any adjustments based on that final valuation may change the allocations of the Acquisition consideration, which could affect the fair value assigned to the assets and liabilities and could result in a material change to the June 30, 2008 balance sheet data.

11

The following summary historical and pro forma consolidated financial data should be read in conjunction with “Unaudited Pro Forma Consolidated Financial Data,” “Selected Financial Information and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements, and the accompanying notes thereto, of each of NewPage and SENA included elsewhere in this prospectus.

12

NewPage Group and Pro Forma for the Acquisition and this Offering

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Non-GAAP(1) | | | Successor | |

| | | Combined

Predecessor

and Successor

Year Ended

December 31,

2005 | | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2007 | | | Six

Months

Ended

June 30,

2007 | | | Six

Months

Ended

June 30,

2008 | | | Pro Forma

Year Ended

December 31,

2007 | | | Pro Forma

Six

Months

Ended

June 30,

2008 | |

| | | (dollars in millions, except per share amounts and price per ton) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 1,863 | | | $ | 2,038 | | | $ | 2,168 | | | $ | 971 | | | $ | 2,253 | | | $ | | | | $ | �� | |

Cost of sales | | | 1,690 | | | | 1,825 | | | | 1,895 | | | | 877 | | | | 2,032 | | | | | | | | | |

Selling, general and administrative expenses | | | 100 | | | | 112 | | | | 127 | | | | 52 | | | | 117 | | | | | | | | | |

Interest expense | | | 142 | | | | 165 | | | | 176 | | | | 75 | | | | 160 | | | | | | | | | |

Other (income) expense net | | | 16 | | | | (25 | ) | | | (1 | ) | | | — | | | | (8 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before income taxes | | | (85 | ) | | | (39 | ) | | | (29 | ) | | | (33 | ) | | | (48 | ) | | | | | | | | |

Income tax (benefit) | | | (10 | ) | | | (3 | ) | | | (6 | ) | | | (1 | ) | | | (13 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (75 | ) | | | (36 | ) | | | (23 | ) | | | (32 | ) | | | (35 | ) | | | | | | | | |

Income (loss) from discontinued operations | | | — | | | | (16 | ) | | | — | | | | — | | | | — | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (75 | ) | | $ | (52 | ) | | $ | (23 | ) | | $ | (32 | ) | | $ | (35 | ) | | $ | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) per share-basic and diluted: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | $ | (1.67 | ) | | $ | (0.80 | ) | | $ | (0.51 | ) | | $ | (0.70 | ) | | $ | (0.63 | ) | | $ | | | | $ | | |

Income (loss) from discontinued operations | | | — | | | | (0.35 | ) | | | — | | | | — | | | | — | | | | — | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1.67 | ) | | $ | (1.15 | ) | | $ | (0.51 | ) | | $ | (0.70 | ) | | $ | (0.63 | ) | | $ | | | | $ | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted-average number of common shares outstanding (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 45,056 | | | | 45,056 | | | | 45,395 | | | | 45,288 | | | | 56,073 | | | | | | | | | |

Diluted | | | 45,056 | | | | 45,056 | | | | 45,395 | | | | 45,288 | | | | 56,073 | | | | | | | | | |

| | | | | | | |

Income (loss) per share assuming the stock split contemplated by this offering—basic and diluted: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | |

Income (loss) from discontinued operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | | | $ | | (3) | | $ | | (3) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted-average number of common shares outstanding assuming the stock split contemplated by this offering (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(2) | | $ | 231 | | | $ | 262 | | | $ | 281 | | | $ | 109 | | | $ | 261 | | | $ | 487 | | | $ | 261 | |

Capital expenditures | | | 76 | | | | 88 | | | | 102 | | | | 34 | | | | 71 | | | | 152 | | | | 71 | |

| | | | | | | |

Selected Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Coated paper volume sold (in thousands of short tons) | | | 2,032 | | | | 2,116 | | | | 2,261 | | | | 1,025 | | | | 1,912 | | | | 4,342 | | | | 1,912 | |

Weighted-average coated paper price per ton | | $ | 872 | | | $ | 893 | | | $ | 886 | | | $ | 875 | | | $ | 969 | | | $ | 900 | | | $ | 969 | |

13

| | | | | | |

| | | Actual | | Pro Forma |

| | | As of June 30, 2008 |

| | | (dollars in millions) |

Balance Sheet Data: | | | | | | |

Cash and cash equivalents | | $ | 41 | | $ | |

Working capital(4) | | | 509 | | | |

Total assets | | | 4,841 | | | |

Long-term debt | | | 3,293 | | | |

SENA

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31,

2005

(Restated) | | | Year Ended

December 31,

2006

(Restated) | | | Nine Months

Ended

September 30,

2006

(Restated) | | | Nine Months

Ended

September 30,

2007

(Restated) | |

| | | (dollars in millions, except price per ton) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Net sales | | $ | 2,374 | | | $ | 2,176 | | | $ | 1,584 | | | $ | 1,864 | |

Cost of sales | | | 2,303 | | | | 2,135 | | | | 1,552 | | | | 1,846 | |

Selling, general and administrative expenses | | | 113 | | | | 108 | | | | 81 | | | | 67 | |

Goodwill impairment | | | 162 | | | | — | | | | — | | | | — | |

Property, plant and equipment impairment | | | — | | | | 113 | | | | — | | | | — | |

Interest expense | | | 75 | | | | 92 | | | | 68 | | | | 61 | |

Other (income) expense net | | | (4 | ) | | | (1 | ) | | | (1 | ) | | | (1 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (275 | ) | | | (271 | ) | | | (116 | ) | | | (109 | ) |

Income tax (benefit) | | | 7 | | | | (28 | ) | | | (14 | ) | | | (25 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (282 | ) | | $ | (243 | ) | | $ | (102 | ) | | $ | (84 | ) |

| | | | | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | |

EBITDA(2) | | $ | 92 | | | $ | 88 | | | $ | 153 | | | $ | 142 | |

Capital expenditures | | | 83 | | | | 60 | | | | 42 | | | | 38 | |

| | | | |

Selected Operating Data: | | | | | | | | | | | | | | | | |

Coated paper volume sold (in thousands of short tons) | | | 1,933 | | | | 1,999 | | | | 1,506 | | | | 1,601 | |

Weighted-average coated paper price per ton | | $ | 911 | | | $ | 927 | | | $ | 929 | | | $ | 904 | |

| (1) | For comparison purposes, we have presented the results of operations for 2005 on a combined basis, consisting of the historical results of our predecessor for the four months ended April 30, 2005 and the historical results of operations of the successor for the eight months ended December 31, 2005. For a presentation of these periods on a predecessor and successor basis, see “Selected Financial Information and Other Data.” The presentation of the operations of our predecessor during the periods prior to our acquisition of the printing and writing paper business of MeadWestvaco do not reflect the significant effect that the accounting for that acquisition and related transactions has had on the reporting of our financial condition and results of operations. We believe that this presentation is beneficial to the reader by providing an easier-to-read discussion of results of operations and provides the reader with information from which to analyze our financial results that is consistent with the manner that management reviews and analyzes results of operations. Furthermore, disclosures regarding sales volumes, spending and other operational measures are determined on a comparable basis for all periods presented. The |

14

| | discussion is provided for comparative purposes only, but the value of such a comparison may be limited. Some of the factors that limit the usefulness of this presentation include the combination of results based on different accounting bases for predecessor and successor periods, differences in capitalization and the effects resulting from the change from a division of a larger entity to a stand-alone company. |

| (2) | EBITDA is defined as net income (loss) before interest expense, income taxes, depreciation and amortization. |

| | EBITDA is not a measure of our performance under GAAP and not intended to represent net income (loss), as defined under GAAP, and should not be used as an alternative to net income (loss) as an indicator of performance. EBITDA is included in this prospectus because it is a primary component of certain covenants under our senior secured credit facilities and is a basis upon which our management assesses performance. For a more detailed discussion of the covenants, see “Description of Certain Indebtedness.” In addition, our management believes EBITDA is useful to investors because it and similar measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies with substantial financial leverage. |

| | The use of EBITDA instead of net income (loss) has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: |

| | • | EBITDA does not reflect our current cash expenditure requirements, or future requirements, for capital expenditures or contractual commitments; |

| | • | EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| | • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized often will have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and |

| | • | our measure of EBITDA is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the methods of calculation. |

Because of these limitations, EBITDA should not be considered as discretionary cash available to us to reinvest in the growth of our business.

15

The following table presents a reconciliation of NewPage Group’s net income (loss) to EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Non-GAAP | | | | | Successor |

| | | Combined

Predecessor

and Successor

Year Ended

December 31,

2005 | | | | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2007 | | | Six

Months

Ended

June

30,

2007 | | | Six

Months

Ended

June

30,

2008 | | | Pro Forma

Year Ended

December 31,

2007 | | Pro Forma

Six

Months

Ended

June 30,

2008 |

| | | (dollars in millions) |

Net income (loss) | | $ | (75 | ) | | | | $ | (52 | ) | | $ | (23 | ) | | $ | (32 | ) | | $ | (35 | ) | | $ | | | $ | |

Income tax provision (benefit) (including amount in discontinued operations) | | | (11 | ) | | | | | (3 | ) | | | (6 | ) | | | (1 | ) | | | (13 | ) | | | | | | |

Interest expense | | | 142 | | | | | | 165 | | | | 176 | | | | 75 | | | | 160 | | | | | | | |

Depreciation and amortization | | | 175 | | | | | | 152 | | | | 134 | | | | 67 | | | | 149 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 231 | | | | | $ | 262 | | | $ | 281 | | | $ | 109 | | | $ | 261 | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The following items included in NewPage Group’s results of operations are excluded under the definition of “consolidated adjusted EBITDA” used to calculate compliance with the financial covenants in our senior secured credit facilities. See “Description of Certain Indebtedness—Senior Secured Credit Facilities—Covenants” for a description of these covenants and the definition of “consolidated adjusted EBITDA.” Pro forma information for the six months ended June 30, 2008 is not presented because it would be the same as the historical information presented for the six months ended June 30, 2008.

| | | | | | | | | | | | | | | | | | | | | |

| | | Non-GAAP | | | | Successor |

| | | Combined

Predecessor

and Successor

Year Ended

December 31,

2005 | | | | Year Ended

December 31,

2006 | | | Year Ended

December 31,

2007 | | Six

Months

Ended

June 30,

2007 | | Six

Months

Ended

June 30,

2008 | | Pro Forma

Year Ended

December 31,

2007 |

| | | (dollars in millions) |

Equity awards(a) | | $ | 1 | | | | $ | 11 | | | $ | 14 | | $ | 1 | | $ | 15 | | $ | 14 |

LIFO effect(b) | | | 10 | | | | | (2 | ) | | | 1 | | | 4 | | | 14 | | | 1 |

(Gain) loss on the sales of business/assets(c) | | | — | | | | | (63 | ) | | | 3 | | | 1 | | | 2 | | | 9 |

Unrealized (gain) loss on commodity basket option(d) | | | 25 | | | | | 47 | | | | — | | | — | | | — | | | — |

Pension loss/OPEB curtailment loss | | | — | | | | | — | | | | 1 | | | 1 | | | — | | | 4 |

Transition costs(e) | | | 14 | | | | | 8 | | | | — | | | — | | | — | | | — |

Discontinued operations(f) | | | — | | | | | 19 | | | | — | | | — | | | — | | | — |

Closure/restructuring(g) | | | — | | | | | 6 | | | | — | | | — | | | — | | | 8 |

Integration-related costs(h) | | | — | | | | | — | | | | 5 | | | — | | | 24 | | | 5 |

Other adjustments(i) | | | — | | | | | — | | | | 3 | | | 3 | | | — | | | 10 |

| | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 50 | | | | $ | 26 | | | $ | 27 | | $ | 10 | | $ | 55 | | $ | 51 |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Represents the non-cash charge for equity awards granted to certain members of management. |

| (b) | Represents the difference in accounting treatment for LIFO methodology compared to FIFO methodology for inventory. |

| (c) | Represents the non-cash (gain) loss on the sale of assets. The gain for the year ended December 31, 2006 is primarily from the sale of the hydroelectric generating facilities in Maine. |

| (d) | Represents a non-cash loss based on the mark-to-market value of the commodity basket option contract. |

| (e) | Represents transitional costs incurred relating to the setup of our business as a stand-alone business, including professional services and consulting costs related to information technology, human resources and finance. |

| (f) | Represents the loss from the sale of our carbonless paper business, including curtailment and settlement costs related to the employee benefit plans. |

| (g) | Represents machine closure costs and costs for severance and the restructuring charge taken in connection with fixed cost reduction efforts and contract settlements. |

16

| (h) | Represents costs related to the integration of SENA and NewPage, including severance and benefits for duplicative sales and administration positions. |

| (i) | Represents expenses of SENA for periods prior to the Acquisition that are no longer incurred. Expenses include costs allocated to SENA from SEO that did not continue after the Acquisition, costs for legal matters that were retained by SEO and costs expensed for information technology investments. |

The following table presents a reconciliation of SENA’s net income (loss) to EBITDA:

| | | | | | | | | | | | | | | | |

| | | Year Ended

December 31,

2005

(Restated) | | | Year Ended

December 31,

2006

(Restated) | | | Nine Months

Ended

September 30,

2006

(Restated) | | | Nine Months

Ended

September 30,

2007

(Restated) | |

| | | (dollars in millions) | |

Net income (loss) | | $ | (282 | ) | | $ | (243 | ) | | $ | (102 | ) | | $ | (84 | ) |

Depreciation and amortization | | | 292 | | | | 267 | | | | 201 | | | | 190 | |

Income tax (benefit) | | | 7 | | | | (28 | ) | | | (14 | ) | | | (25 | ) |

Interest expense | | | 75 | | | | 92 | | | | 68 | | | | 61 | |

| | | | | | | | | | | | | | | | |

EBITDA | | $ | 92 | | | $ | 88 | | | $ | 153 | | | $ | 142 | |

| | | | | | | | | | | | | | | | |

The following items included in SENA’s results of operations are excluded under the definition of “consolidated adjusted EBITDA” used to calculate compliance with the financial covenants in our senior secured credit facilities. See “Description of Certain Indebtedness—Senior Secured Credit Facilities—Covenants” for a description of these covenants and the definition of “consolidated adjusted EBITDA.”

| | | | | | | | | | | | |

| | | Year Ended

December 31,

2005 | | Year Ended

December 31,

2006 | | Nine Months

Ended

September 30,

2006 | | Nine Months

Ended

September 30,

2007 |

| | | (dollars in millions) |

Port Hawkesbury lockout(a) | | $ | — | | $ | 41 | | $ | 41 | | $ | — |

Goodwill impairment | | | 162 | | | — | | | — | | | — |

Property, plant and equipment impairment | | | — | | | 113 | | | — | | | — |

Loss on sale of assets | | | 13 | | | 3 | | | 1 | | | 3 |

Pension/OPEB curtailment loss | | | — | | | 14 | | | 14 | | | 3 |

Closures/restructuring(b) | | | 15 | | | — | | | — | | | 8 |

Other adjustments(c) | | | 9 | | | 15 | | | 10 | | | 11 |

| | | | | | | | | | | | |

Total | | $ | 199 | | $ | 186 | | $ | 66 | | $ | 25 |

| | | | | | | | | | | | |

| | (a) | Represents the costs incurred that were not absorbed because of lost production during the closure of the Port Hawkesbury mill from December 2005 until October 2006 due to a labor dispute. SENA continued to incur the same types of costs following the reopening of the mill. |

| | (b) | Represents machine closure costs and costs for severance and the restructuring charge taken in connection with fixed cost reduction efforts and contract settlements. |

| | (c) | Represents expenses of SENA for periods prior to the Acquisition that are no longer incurred. Expenses include costs allocated to SENA from SEO that did not continue after the Acquisition, costs for legal matters that were retained by SEO and costs expensed for information technology investments. |

| (3) | A $1 increase in the assumed initial public offering price would increase our pro forma net income (loss) per share for the year ended December 31, 2007 by approximately $ per share and for the six months ended June 30, 2008 by approximately $ per share. A $1 decrease in the assumed initial public offering price would decrease our pro forma net income (loss) per share for the year ended December 31, 2007 by approximately $ per share and for the six months ended June 30, 2008 by approximately $ per share. |

| (4) | “Working capital” is defined as current assets net of current liabilities. |

17

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors discussed below as well as the other information contained in this prospectus before buying shares of our common stock. If any of the following risks or uncertainties occurs, our business, financial condition and operating results could be materially and adversely affected. As a result, the trading price of our common stock could decline and you may lose all or a part of the money you paid to buy our common stock.

Risks Relating to our Business

We may not realize the anticipated benefits of the Acquisition.

We completed the Acquisition on December 21, 2007. Although we expect to realize strategic, operational and financial benefits as a result of the Acquisition, we cannot predict whether and to what extent these benefits will be achieved. Successful integration of NewPage and NPCP will depend on management’s ability to manage the combined operations effectively and to benefit from cost savings and operating efficiencies. There are significant challenges to integrating the NPCP operations into our business, including:

| | Ÿ | | integrating the senior management and key personnel of NewPage and NPCP; |

| | Ÿ | | potential disruptions of both companies’ businesses caused by the Acquisition; |

| | Ÿ | | successfully managing the operations, manufacturing facilities and supply chain of NPCP and integrating them with our existing business; |

| | Ÿ | | maintaining the customer base for NewPage and NPCP products; |

| | Ÿ | | the diversion of management’s and other’s attention; |

| | Ÿ | | maintaining effective internal control procedures for the combined company; and |

| | Ÿ | | integrating management information, inventory, accounting and sales systems of NewPage and NPCP. |

In addition, the Acquisition created a significantly larger combined company, which may increase the challenge of integrating the NPCP operations into our business.

If we are not able to successfully integrate the NPCP business, the anticipated synergies and cost savings may not be achieved. In addition, our failure to successfully integrate and operate the NPCP business, and to realize the anticipated benefits of the Acquisition, could adversely affect our operating performance and financial results.

Even if we are able to successfully integrate the business of NPCP into our operations, we may not realize the anticipated synergies of the Acquisition on the timetable currently contemplated, or at all.

We expect to generate annualized synergies as a result of the Acquisition of approximately $265 million by June 2009. We cannot assure you that these synergies will be achieved on the timetable contemplated and in the amounts expected, or at all. In connection with achieving these synergies, we expect to make capital expenditures of approximately $35 million in 2008. In connection with achieving these synergies, we also expect to incur expenses and restructuring charges in 2008 and to a lesser extent in 2009 of up to approximately $50 million in the aggregate, which relate to severance and early retirement benefits, costs of relocating employees and assets and costs of integrating the two businesses, including investments in information systems. In addition, we expect to record up to

18

approximately $45 million in the aggregate as a liability in the initial purchase price allocation in connection with achieving these synergies, which relates to cash payments that we expect to make in 2008 and to a lesser extent in 2009 in connection with severance and early retirement benefits of NPCP employees, costs of relocating employees of NPCP and contract termination costs. Additional adjustments to these estimates are likely to occur as we finalize union negotiations and severance arrangements and finalize the restructuring plan, including the effects of sales or dispositions of assets and facilities.

Achieving the expected synergies, as well as the costs of achieving them, is subject to a number of uncertainties, including our ability to negotiate lower raw material prices from suppliers and transportation providers, to make necessary investments in information systems and equipment to rebalance production in a timely and cost efficient manner and to avoid unexpected downtime resulting from changing production on machines or at mills. If we encounter difficulties in achieving the expected synergies, incur significantly greater costs related to these synergies than we anticipate or activities related to these synergies have unintended consequences, our business, financial condition and results of operations could be adversely affected.

The pro forma financial information that is contained in this prospectus is not necessarily indicative of our future financial condition or performance.

The pro forma financial information of NewPage Group giving effect to the Acquisition Transactions and this offering is intended to provide information regarding how NewPage Group might have looked if the Acquisition and this offering had occurred as of the dates indicated in that information. The pro forma information is based on the historical results of each of NewPage Group and SENA and therefore may not be indicative of our actual results for periods when the two businesses are operated together. Moreover, the pro forma information does not reflect all of the changes that may result from the Acquisition, including, for example, transition and integration costs; challenges of achieving anticipated synergies; ability to retain qualified employees; maintaining satisfactory relationships with represented employees and customers; or the shutdown or divestiture of less efficient or less profitable mills or machines. The pro forma adjustments to the statement of operations represent management’s best estimates based on information available at the time the pro forma information was prepared and may differ from the adjustments that may actually be required. Accordingly, the pro forma financial information should not be relied upon as being indicative of the historical results that would have been realized had the Acquisition Transactions and this offering occurred as of the dates indicated or that may be achieved in the future.

We have a history of net losses and we may not generate net income in the future.

We incurred a net loss in each of the five years ended December 31, 2007 and for the six months ended June 30, 2008. As of June 30, 2008, our accumulated deficit was $(177) million. In addition, SENA incurred a net loss in each of the years ended December 31, 2004, 2005 and 2006 and the nine months ended September 30, 2007. Our ability to pay future dividends, if any, will be limited by the amount of net income that we generate. See “—Risks Related to the Offering—We do not currently intend to pay dividends on our common stock and the instruments governing our indebtedness contain various covenants that limit our ability to pay dividends.” Furthermore, if we are unable to generate net income in satisfactory amounts or at all, this may adversely affect our business and the price of our common stock.

We have limited ability to pass through increases in our costs. Increases in our costs or decreases in our paper prices could adversely affect our business, financial condition and results of operations.

Our earnings are sensitive to changes in the prices of our paper products. Fluctuations in paper prices, and coated paper prices in particular, historically have had a direct effect on our net income (loss) and EBITDA for several reasons:

| | Ÿ | | Market prices for paper products are a function of supply and demand, factors over which we have limited influence. We therefore have limited ability to control the pricing of our products. |

19

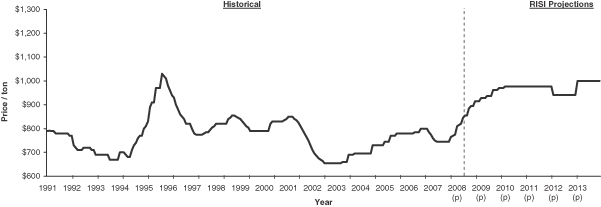

| | Market prices of grade No. 3 coated paper, 60 lb weight, which is an industry benchmark for coated freesheet paper pricing, have fluctuated since 2000 from a high of $1,040 per ton to a low of $705 per ton. Market prices of grade No. 4 coated paper, 50 lb. weight, which is an industry benchmark for coated groundwood paper pricing, and grade SC-A, 35 lb. weight, which is an industry benchmark for supercalendered paper pricing, have generally followed a similar trend. Because market conditions determine the price for our paper products, the price for our products could fall below our production costs. |

| | Ÿ | | Market prices for paper products typically are not directly affected by raw material costs or other costs of sales, and consequently we have limited ability to pass through increases in our costs to our customers absent increases in the market price. Thus, even though our costs may increase, our customers may not accept price increases for our products, or the prices for our products may decline. |

| | Ÿ | | Paper manufacturing is highly capital-intensive and a large portion of our and our competitors’ operating costs are fixed. Additionally, paper machines are large, complex systems that operate more efficiently when operated continuously. Consequently, both we and our competitors typically continue to run our machines whenever marginal sales exceed the marginal costs. |

Our ability to achieve acceptable margins is, therefore, principally dependent on managing our cost structure and managing changes in raw materials prices, which represent a large component of our operating costs and fluctuate based upon factors beyond our control. If the prices of our products decline, or if our raw material costs increase, or both, it could have a material adverse effect on our business, financial condition and results of operations. As a result of a slowdown in demand and higher raw material and transportation costs driven by oil and natural gas prices, we announced the closure of our Kimberly, Wisconsin mill at the end of August 2008 in order to better balance supply and customer demand and to further reduce costs. For a further discussion of the variability of our paper prices and our costs and expenses, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Selected Factors That Affect Our Operating Results.”

Over the last five years, the U.S. dollar has decreased significantly in value relative to the Canadian dollar. Most of the raw material, labor and other cost of sales at our Port Hawkesbury mill are denominated in Canadian dollars. Because North American sales prices for the products produced at Port Hawkesbury are determined primarily by the U.S. dollar price per ton charged by U.S. producers, the weaker U.S. dollar has impaired the ability of the Port Hawkesbury mill to profitably compete in the U.S. market.

The paper industry is cyclical. Fluctuations in supply and demand for our products could materially adversely affect our business, financial condition and results of operations.

The paper industry is a commodity market and is subject to cyclical market pressures. North American demand for printing paper products tends to decline during a weak U.S. economy. Accordingly, deteriorating general economic conditions may have a material adverse effect on the demand for our products, which could have a material adverse effect on our business, financial condition and results of operations. North American coated paper demand is primarily driven by advertising and print media usage. In particular, the demand for certain grades of coated paper is affected by spending on catalog and promotional materials by retailers and spending on magazine advertising, which affects the number of printed pages in magazines. According to RISI, in the first half of 2008, North American coated paper demand declined by 5.9%, compared to the same period in 2007, as a result of decreased advertising spending and magazine and catalog circulation. North American coated paper demand is projected by RISI to decline by 10% for the second half of 2008 compared to the second half of 2007. In response to this reduction in coated paper demand, we

20

accelerated our previously announced closure of two paper machines in Niagara, Wisconsin and announced the closure of the Kimberly, Wisconsin mill. We also took 18,000 tons of coated paper market-related downtime during the second quarter of 2008 and we intend to take an additional 41,000 tons of coated paper market-related downtime during the third quarter of 2008. Currency fluctuations can also have a significant effect on the supply of printing paper products in North America. If the U.S. dollar strengthens, imports may increase, which, in turn, would cause the supply of paper products available in the North American market to increase. An increased supply of paper in North America could put downward pressure on prices and cause us to lose sales to competitors, either of which could have a material adverse effect on our business, financial condition and results of operations.

The markets in which we operate are highly competitive and imports could materially adversely affect our business, financial condition and results of operations.

Our business is highly competitive. Competition is based largely on price. We compete with numerous North American paper manufacturers. We also face competition from foreign producers, some of which we believe are lower cost producers than we are. Foreign overcapacity could result in an increase in the supply of paper products available in the North American market. Asian producers, in particular, have significantly increased imports to the U.S. in recent years, and we believe that producers in China, Indonesia and South Korea are selling in our markets at less than fair value and are being subsidized by their governments. We filed petitions seeking antidumping and countervailing duties on imports of coated freesheet paper from China, Indonesia and South Korea. The U.S. Department of Commerce determined that several producers in these countries were subsidized and engaged in dumping. However, the U.S. International Trade Commission determined that no material injury to the domestic industry has occurred and, as a result of that determination, no antidumping and countervailing duties will be imposed on imports of coated freesheet paper from these countries.

Our non-U.S. competitors may develop a competitive advantage over us and other U.S. producers if the U.S. dollar strengthens in comparison to the home currency of those competitors, if the home currency of those competitors (particularly in China) is maintained by their governments at a low value compared to the U.S. dollar, if those competitors receive governmental subsidies or incentives or if ocean shipping rates decrease. If the U.S. dollar strengthens, if foreign currencies are maintained at low values, if shipping rates decrease, if foreign producers receive governmental subsidies or incentives or if overseas supply exceeds demand, imports may increase, which, in turn, would cause the supply of paper products available in the North American market to increase. An increased supply of paper could cause us to lower our prices or lose sales to competitors, either of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, the following factors will affect our ability to compete:

| | Ÿ | | the quality of our products; |

| | Ÿ | | our breadth of product offerings; |

| | Ÿ | | our ability to maintain plant efficiencies and high operating rates and thus lower our average manufacturing costs per ton; |

| | Ÿ | | our ability to provide customer service that meets customer requirements and our ability to distribute our products on time; |

| | Ÿ | | costs to comply with environmental laws and regulations; |

21

| | Ÿ | | our ability to produce products that meet customer requirements for the use of sustainable forestry principles, recycled content and environmentally friendly energy sources; and |

| | Ÿ | | the availability or cost of chemicals, wood, energy and other raw materials and labor. |

Furthermore, some of our competitors have greater financial and other resources than we do or may be better positioned than we are to compete for certain opportunities.

If we are unable to obtain raw materials, including petroleum-based chemicals, at favorable prices, or at all, it could adversely affect our business, financial condition and results of operations.