PROPOSAL 4

APPROVAL OF THE FINANCIAL ENGINES, INC.

2018 EMPLOYEE STOCK PURCHASE PLAN

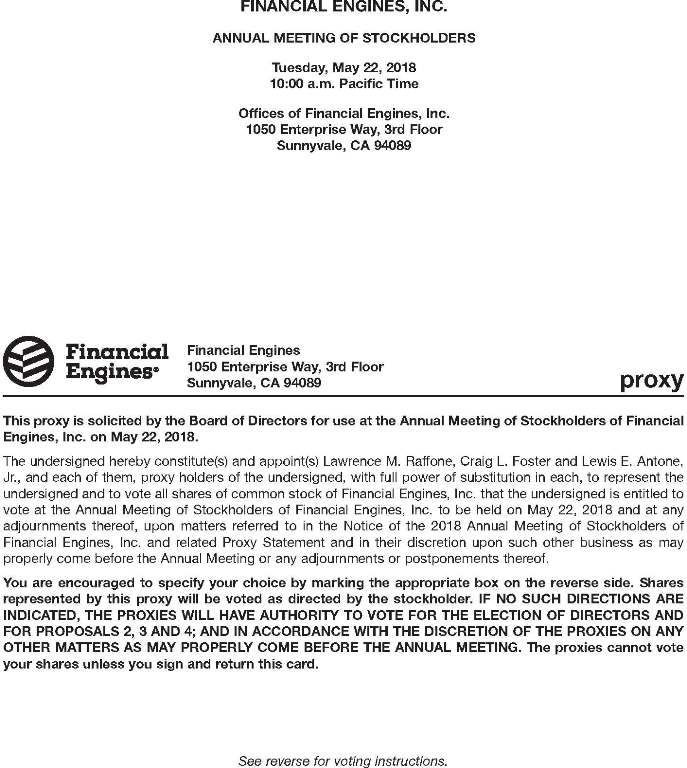

Our Board of Directors adopted the Financial Engines, Inc. 2018 Employee Stock Purchase Plan, or ESPP, on March 12, 2018, to be effective on May 22, 2018, subject to the approval of stockholders at the Annual Meeting. The purpose of the ESPP is to provide eligible employees with an opportunity to increase their proprietary interest in the success of the Company by purchasing Common Stock from us at favorable terms and to pay for their purchases through payroll deductions. The ESPP will become a significant part of our overall equity compensation strategy, especially with respect to ournon-executive employees, if it is approved by our stockholders. If our stockholders do not approve the ESPP, we may not be able to offer competitive compensation to existing employees and qualified candidates, and our ability to recruit or retain talented employees may be impaired. As is further explained under the heading “Summary of the ESPP’s Material Terms and Features — Shares Available for Issuance”, we will immediately reserve 1,500,000 shares of Common Stock for issuance under our ESPP.

Summary of the ESPP’s Material Terms and Features

The following summary of the principal features of the ESPP is qualified by reference to the terms of the ESPP, a copy of which is available without charge upon stockholder request to the Secretary, Financial Engines, Inc., 1050 Enterprise Way, 3rd floor, Sunnyvale, CA 94089. The ESPP has also been filed electronically with the SEC together with this Proxy Statement and can be accessed on the SEC’s website at http://www.sec.gov.

General. The ESPP is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code, as amended. During regularly scheduled “offerings” under the ESPP, participants will be able to request payroll deductions and then expend the accumulated deduction to purchase a number of shares of our Common Stock at a discount and in an amount determined in accordance with the ESPP’s terms.

Shares Available for Issuance. The ESPP will have 1,500,000 of our authorized but unissued or reacquired shares of Common Stock reserved for issuance under the plan.

Administration. Except as noted below, our ESPP will be administered by the compensation committee of our Board of Directors. The compensation committee has the authority to construe, interpret and apply the terms of the ESPP, to determine eligibility, to establish such limitations and procedures as it determines are consistent with the ESPP and to adjudicate any disputed claims under the ESPP.

Eligibility. Each full-time and part-time employee, including our officers and employee directors and employees of participating subsidiaries, who is employed by us on the day preceding the start of any offering period will be eligible to participate in the ESPP. Our ESPP requires that an employee customarily work more than 20 hours per week and more than five months per calendar year in order to be eligible to participate in the ESPP. Our ESPP will permit an eligible employee to purchase Common Stock through payroll deductions, which may not be more than 15% of the employee’s compensation, or such lower limit as may be determined by the compensation committee from time to time. However, no employee is eligible to participate in the ESPP if, immediately after electing to participate, the employee would own stock of the Company (including stock such employee may purchase under this plan or other outstanding options) representing 5% or more of the total combined voting power or value of all classes of our stock. No employee will be able to purchase more than 1,000 shares, or such number of shares as may be determined by the compensation committee with respect to a single offering period, or purchase period, if applicable. In addition, no employee is permitted to accrue, under the ESPP and all similar purchase plans of the Company or its subsidiaries, a right to purchase stock of the Company having a value in excess of $25,000 of the fair market value of such stock (determined at the time the right is granted) for each calendar year. Employees will be able to withdraw their accumulated payroll deductions prior to the end of the offering period in accordance with the terms of the offering. Participation in our ESPP will end automatically on termination of employment with us.

Offering Periods and Purchase Price. Our ESPP will be implemented through a series of offerings of purchase rights to eligible employees. Under the ESPP, the compensation committee may specify offerings with a duration of

50