February 16, 2011

Via EDGAR

Ms. Sandy Eisen

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549-7010

Re: American Energy Fields, Inc.

Form 10-K

Filed July 12, 2010

File No. 333-152023

Dear Ms. Eisen:

American Energy Fields, Inc. (the "Company") has reviewed the comments contained in the letter of the staff of the Securities and Exchange Commission, dated February 2, 2011 (the "Staff Letter") with regard to the above-referenced filing and submit the following responses. For ease of reference, the responses are numbered to correspond to the numbering of the comments in the Staff Letter.

Form 10-K for Fiscal Year Ended March 31, 2010

Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm, page F-1

| 1. | We note that you have provided audited financial statements for the period from inception (i.e., November 23, 2009) to March 31, 2010. However, the report issued by your independent registered public accounting firm makes reference to the year ended March 31, 2010. In addition, the report issued by your independent registered public accounting firm does not disclose the city and state where issued. Please advise your auditor to revise their report accordingly. Refer to Article 2-02 of Regulation S-X. |

Response:

We have included a revised audit report in our Amended Annual Report on Form 10-K in which our Independent Registered Public Accounting Firm has updated their opinion letter to amend the language related to the period ended March 31, 2010 and removed all references relating to terminology regarding the year ended. In addition, they have included the city and state where the financials were issued.

Engineering Comments General

| 2. | We note that your website and some press releases refer to or use terms other than proven and/or probable reserves, such as "measured," "indicated," and "inferred" resources. If you continue to make references on your website or press releases to reserve measures other than those recognized by the SEC, please accompany such disclosure with the following cautionary language or provide a legal disclaimer tab or page: |

Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms on this website (or press release), such as "measured," "indicated," and "inferred" resources, which the SEC guidelines strictly prohibit U.S. registered companies from inducting in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 10K which may be secured from us, or from our website at http://www.sec.gov/edgar.html.

Please indicate the location of this disclaimer in your response.

Response:

The disclaimer noted in your comment #2 has been included in the technical reports section on our website at http://www.americanenergyfields.com/investor_info/technical_reports/.

COSO. page 2

| 3. | Please explain the terms and conditions of your 97% net revenue interest in the COSO property. Please tell us whether this is a royalty interest related to your mineral rights and/or properties or your state lease. |

Response:

The 97% net revenue interest is the result of the Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations dated as of November 30, 2010, referenced in Item 13 of Part III of the 10-K. Under the terms of this agreement, NPX Metals, Inc. retained a 3% net smelter return royalty interest in the Coso Property, leaving a 97% net revenue interest to Green Energy Fields, Inc., a wholly owned subsidiary of American Energy Fields, Inc.

| 4. | Please insert a small-scale map showing the location and access to each material property, as required by Instruction 3(b) to Item 102 of Regulation S-K. Please note the EDGAR program now accepts Adobe PDF files and digital maps, so please include these maps in any amendments that are uploaded to EDGAR. It is relatively easy to include automatic links at the appropriate locations within the document to GIF or PEG files, which will allow figures and diagrams to appear in the right location when the document is viewed on the Internet. For more information, please consult the EDGAR manual, and if additional assistance is required, please call Filer Support at (202) 551-3600 for Post-Acceptance Filing Issues or (202) 551-8900 for Pre-Acceptance Filing Issues. We believe the guidance in Instruction 3(b) of Rule 102 of Regulation S-K would generally require maps and drawings to comply with the following features: |

| | ● | A legend or explanation showing, by means of pattern or symbol, every pattern or symbol used on the map or drawing; |

| ● | A graphical bar scale should be included. Additional representations of scale such as "one inch equals one mile" may be utilized provided the original scale of the map has not been altered; |

| ● | An index map showing where the property is situated in relationship to the state or province, etc., in which it was located; |

| ● | A title of the map or drawing, and the date on which it was drawn; |

| ● | In the event interpretive data is submitted in conjunction with any map, the identity of the geologist or engineer that prepared such data; |

Any drawing should be simple enough or of sufficiently large scale to clearly show all features on the drawing.

Response:

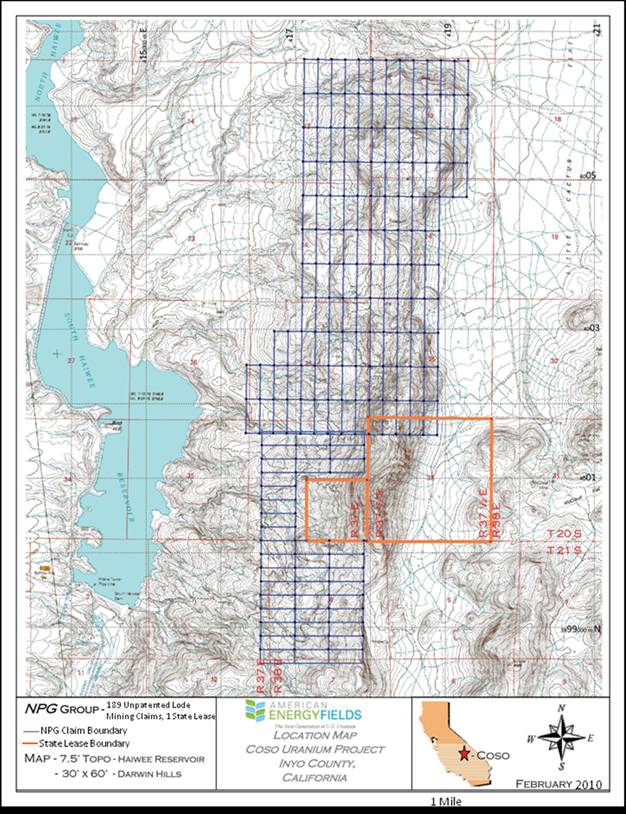

We have amended our 10-K to include the map, which we are also attaching as Exhibit A hereto. We are still in the process of preparing the map of the Blythe Property.

| | 5. | Please disclose the information required under paragraph (b) of Industry Guide 7 for all your material properties listed under this heading. For any properties identified that are not material, please include a statement to that effect clarifying your intentions. For each material property, include the following information: |

| ● | The location and means of access to your property, including the modes of transportation utilized to and from the property; |

| ● | Any conditions that must be met in order to obtain or retain title to the property, whether your have surface and/or mineral rights; |

| ● | A brief description of the rock formations and mineralization of existing or potential economic significance on the property; |

| ● | A description of any work completed on the property and its present condition; |

| ● | The details as to modernization and physical condition of the plant and equipment, including subsurface improvements and equipment; |

| ● | A description of equipment, infrastructure, and other facilities; |

| ● | The current state of exploration of the property; |

| ● | The total costs incurred to date and all planned future costs; |

| ● | The source of power and water that can be utilized at the property; |

| ● | If applicable, provide a clear statement that the property is without known reserves and the proposed program is exploratory in nature. |

You may refer to paragraphs (b) (1) through (5) of Industry Guide 7 for specific guidance pertaining to the foregoing, available on our website at the following address: www.sec.gov/about/fonns/industryguides.pdf.

We have amended our 10-K to include the following information:

Blythe

As of March 31, 2010, we were still collecting information relating to the Blythe Project in addition to that contained in the 10-K.

Coso

Location and Means of Access

The Coso Project is located 32 miles (51 km) south by road of Lone Pine in Inyo County, California, 150 miles (241 km) northeast by road to Bakersfield, CA, 187 miles (300 km) north by road of Los Angeles, CA, and 283 miles (455 km) west by road of Las Vegas, Nevada. The Coso Project is accessible from U.S. highway 395 by taking the Cactus Flat road, an unimproved road for about 3 to 4 miles east of the highway, and climbing approximately 500 to 1200 feet above the floor of Owens Valley.

Conditions to Retaining Title to the Property

To maintain the Coso mining claims in good standing, American Energy Fields, Inc. must make annual maintenance fee payments to the Bureau of Land Management ("BLM"), in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus a recording cost of approximately $50 to Inyo County where the claims are located.

Rock Formations and Mineralization of Existing or Potential Economic Significance

Uranium mineralization at the Coso Property occurs primarily as disseminated deposits in the lower arkosic sandstone/fanglomerate member of the Coso Formation and along silicified fractures and faults within the granite.

History of Previous Operations

Previous work at the Coso Property is associated with exploration activities conducted by a number of entities beginning in the mid-1950s. All previous work has been exploratory in nature, and no mineral extraction or processing facilities have been constructed. Entities that have conducted exploration on the Property include Coso Uranium, Inc., Ontario Minerals Company, Western Nuclear, Pioneer Nuclear, Federal Resources Corp., and Union Pacific / Rocky Mountain Energy Corp. The exploration activities have resulted in over 400 known exploration holes, downhole gamma log data on the drill holes, chemical assay data, and airborne radiometric surveys, and metallurgical testing to determine amenability to leaching.

Description of Previous Work and Present Condition of Property

The property is undeveloped, and there are no facilities or structures. There are a number of adits and trenches from previous exploration activities, as well as more than 400 exploration drillholes.

Physical Condition of Plant and Equipment

None.

Description of Equipment, Infrastructure, and Other Facilities

None.

Current State of Exploration of the Property

The last major exploration activities on the Coso Property occurred during a drilling campaign in the mid-1970s. To date, American Energy Fields, Inc. has conducted field reconnaissance and mineral sampling on the property, but has not conducted any drilling or geophysical surveys.

Total Costs Incurred to Date

As of March 31, 2010, American Energy Fields, Inc. had incurred $81,500 in costs to date on the Coso Property. Future costs will include annual mining claim maintenance fees to the BLM of $23,660. Other future costs include conducting a sampling and drilling program, the specifics of which had not been determined as of March 31, 2010.

Power and Water Source

Power is available from the Mono Power Company transmission lines, which parallel U.S. highway 395. As of March 31, 2010, the water source had not yet been determined.

Reserve Statement

The Coso Property does not currently have any known reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

| | 6. | It appears you should also expand your disclosure concerning the exploration plans for the properties to address the following points. |

| ● | Disclose a brief geological justification for each of the exploration projects written in non-technical language; |

| ● | Give a breakdown of the exploration timetable and budget, including estimated amounts that will be required for each exploration activity, such as geophysics, geochemistry, surface sampling, drilling, etc. for each prospect; |

| ● | If there is a phased program planned, briefly outline all phases; |

| ● | If there are no current detailed plans to conduct exploration on the property, disclose this prominently; |

| ● | Disclose how the exploration program will be funded; |

| ● | Identify who will be conducting any proposed exploration work, and discuss what their qualifications are. |

Response:

We have amended our 10-K to include the following information:

Geological Justification for Conducting Exploration at Coso

Historical exploration activities from the mid 1950s to present have resulted in over 400 known exploration holes, downhole gamma log data on the drill holes, chemical assay data, and airborne radiometric surveys, and metallurgical testing to determine amenability to leaching. This historical data indicates that a significant uranium deposit is present at the Coso Property. Preliminary field observations by American Energy Fields, Inc. of the geology and the historical workings utilizing handheld Geiger counters indicate that the historical literature presents a consistent and predictable model of uranium mineralization in the Coso area.

Exploration Timetable and Budget

As of March 31, 2010, an exploration timetable and budget had not yet been developed, and there were no current detailed plans to conduct exploration on the property.

| 7. | Detailed sampling provides the basis for the quality estimate or grade of your mineral discovery. Please provide a brief description of your sample collection, sample preparation, and the analytical procedures used to develop your analytical results. In addition, please disclose any Quality Assurance/Quality Control (QA/QC) protocols you have developed for your exploration program. These procedures would serve to inform potential investors regarding your sample collection and preparation, assay controls, sample custody, assay precision and accuracy procedures and protocols. |

Response:

As of March 31, 2010, American Energy Fields did not have a sample collection.

Compliance with Government Regulation, page 3

| 8. | We note your two claim groups are subject to exploration permitting requirements of the Bureau of Land Management (BLM) in addition to California State Environmental requirements. Please provide a short summary of the permits and/or operational plans required to perform your planned exploration activities on your properties. For each of your exploration projects or claim groups, clarify the status of your exploration and/or environmental permits and disclose your obligations with estimated costs for the use of these properties. |

With regard to the unpatented lode mining claims, future exploration drilling at the Coso Project will require American Energy Fields, Inc. to either file a Notice of Intent or a Plan of Operations with the Bureau of Land Management, depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

With regard to the state mineral prospecting permit, American Energy Fields, Inc. is currently authorized to locate on the ground past drill holes, adits, trenches and pits, complete a scintilometer survey, and conduct a sampling program including a bulk sample of 1,000 pounds for leach test. The Company is not currently authorized to conduct exploration drilling on the state lease. Any future drilling on the state mineral prospecting permit will require the Company to file environmental documentation under the California Environmental Quality Act.

The Company hereby acknowledges the following:

| ● | The Company is responsible for the adequacy and accuracy of the disclosures in the filings; |

| ● | Staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| ● | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We appreciate your timely consideration of these matters in your review of the filing referenced above. If you or others have any questions or would like additional information, please contact me at (480) 288-6530.

| | Very truly yours, | |

| | /s/ Joshua Bleak | |

| | Joshua Bleak | |

| | President | |

Exhibit A

7