As filed with the Securities and Exchange Commission on May 2, 2011

Registration No. 333-_______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 AMERICAN ENERGY FIELDS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 1000 | | 26-1657084 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

3266 W. Galveston Drive #101

Apache Junction , AZ 85120

(480) 288-6530

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Joshua Bleak

President

3266 W. Galveston Drive #101

Apache Junction , AZ 85120

Telephone: (480) 288-6530

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Harvey J. Kesner, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| | | | |

Large Accelerated Filer o | | | Accelerated Filer o |

Non-Accelerated Filer o (Do not check if a smaller reporting company) | | Smaller Reporting Company þ |

| CALCULATION OF REGISTRATION FEE |

| |

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maxiumum Offering Price per Share | Proposed Maxiumum Aggregate Offering Price | Amount of Registration Fee |

| Common stock, par value $.0001 per share (3) | 72,281526 | $0.56 | $40,477,654.60 | $4,699.46 | |

| Total | | | | | |

| |

(1) | Pursuant to Rule 416 under the Securities Act, the shares of Common stock offered hereby also include an indeterminate number of additional shares of Common stock as may from time to time become issuable by reason of anti-dilution provisions, stock splits, stock dividends, recapitalizations or other similar transactions. |

(2) | With respect to the shares of Common stock offered by the selling stockholders named herein, estimated at $0.56 per share, the average of the high and low prices of the Common stock as reported on the OTC Bulletin Board on April 29, 2011, for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. |

| (3) | Includes 36,140,763 shares of Common stock and 36,140,763 shares of Common stock issuable upon exercise of warrants. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED May 2, 2011

PRELIMINARY PROSPECTUS

72,281,526 Shares

American Energy Fields, Inc.

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 72,281,526 shares of our Common stock, which includes 36,140,763 shares of Common stock issuable upon exercise of warrants. All of these shares of our Common stock are being offered for resale by the selling stockholders.

The prices at which the selling stockholders may sell shares will be determined by the prevailing market price for the shares or in negotiated transactions. We will not receive any proceeds from the sale of these shares by the selling stockholders.

We will bear all costs relating to the registration of these shares of our Common stock, other than any selling stockholders’ legal or accounting costs or commissions.

Our Common stock is quoted on the regulated quotation service of the OTC Bulletin Board under the symbol “AEFI”. The last reported sale price of our Common stock as reported by the OTC Bulletin Board on April 29, 2011, was $0.56 per share.

Investing in our Common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 6 of this prospectus before making a decision to purchase our Common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2011

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless the context provides otherwise, the terms “the Company,” “we,” “us,” and “our” refer to American Energy Fields, Inc., and its wholly-owned subsidiary, Green Energy Fields, Inc.

Overview

We are primarily engaged in the acquisition and exploration of properties that may contain uranium mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired State Leases and Federal unpatented mining claims in the state of California for the purpose of exploration and potential development of uranium minerals on a total of approximately 5,500 acres. We plan to review opportunities to acquire additional mineral properties with current or historic uranium mineralization with meaningful exploration potential.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain economic concentrations of uranium that are prospective for mining. We have not generated any revenues from our mining exploration to date.

We were incorporated as Sienna Resources, Inc. in the State of Delaware on November 12, 2008. On December 21, 2009 we (1) declared a stock dividend of 11.2 shares of Common stock for every one share of Common stock then outstanding, and (2) amended and restated our articles of incorporation in order to, among other things: (a) change our name to American Energy Fields, Inc. and (b) increase the number of authorized shares of capital stock from 80,000,000 shares to 225,000,000 shares, divided into two classes: 200,000,000 shares of common stock, par value $.0001 per share, and 25,000,000 shares of “blank check” preferred stock, par value $.0001 per share.

On December 24, 2009, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with Green Energy Fields, Inc., a privately-held Nevada corporation (“Green Energy”), and the shareholders of Green Energy. Upon closing of the transaction contemplated under the Exchange Agreement (the “Exchange”), on December 24, 2009, the shareholders of Green Energy transferred all of the issued and outstanding capital stock of Green Energy to the Company in exchange for shares of common stock of the Company. Such Exchange caused Green Energy to become a wholly-owned subsidiary of the Company.

Pursuant to the terms and conditions of the Exchange Agreement:

| ● | At the closing of the Exchange, each share of Green Energy’s common stock issued and outstanding immediately prior to the closing of the Exchange was exchanged for the right to receive one share of our common stock. Accordingly, an aggregate of 28,788,252 shares of our common stock were issued to the shareholders of Green Energy. |

| ● | Following the closing of the Exchange, we issued an aggregate of 9,300,000 shares of our common stock and two-year warrants to purchase an additional 4,650,000 shares of common stock exercisable at $0.40 per share, in a private placement to 16 investors for $1,395,000. |

| ● | Immediately following the foregoing, under an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations, we transferred all of our pre-Exchange assets and liabilities to our wholly-owned subsidiary, Sienna Resources Holdings, Inc. Thereafter pursuant to a stock purchase agreement, transferred all of the outstanding capital stock of Sienna Resources Holdings, Inc. to Julie Carter in exchange for the cancellation of 15,250,000 shares of our common stock that she owned. |

Between December 3, 2010 and March 4, 2011, the Company entered into subscription agreements with certain investors whereby it sold an aggregate of 36,140,763 units with each unit consisting of one share of the Company’s common stock, par value $0.0001 per share and one five year warrant to purchase one additional share of Common Stock at an exercise price of $0.50 per share for a per unit purchase price of $0.50 and an aggregate purchase price of $18,070,381.50 (the “Private Placement”). In connection with the Private Placement, the Company issued warrants to the placement agents to purchase an aggregate of 7,167,986 shares of the Company’s common stock, on the same terms as the warrants issued to the investors.

The 36,140,763 shares of our common stock underlying the units and the 36,140,763 shares of common stock underlying the warrants and the 7,167,986 shares of common stock underlying the warrants issued to placement agents in connection with the Private Placement were not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon an exemption from registration provided by Section 4(2) under the Securities Act and Regulation D or Rule 903 of Regulation S promulgated thereunder. These securities may not be transferred or sold absent registration under the Securities Act or an applicable exemption therefrom.

| | |

| Common stock offered by selling stockholders | This prospectus relates to the sale by certain selling stockholders of 72,281,526 shares of our Common stock consisting of: |

| | (i) 36,140,763 shares of our Common stock issued to investors in the Private Placement; and |

| | (ii) 36,140,763 shares of Common stock underlying the Warrants issued to investors in the Private Placement. |

| | |

| Offering price | Market price or privately negotiated prices. |

| | | |

| Common stock outstanding before and after the offering | 94,119,018 shares (1) | |

| | | |

| Use of proceeds | We will not receive any proceeds from the sale of the Common stock by the selling stockholders. | |

| | | |

| OTC Symbol | AEFI. | |

| | | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 6 of this prospectus before deciding whether or not to invest in our Common stock. | |

_______________________________________

| | | |

| (1) | | Represents the number of shares of our Common stock outstanding as of May 2, 2011. Excludes (i) 3,100,000 shares of our Common stock issuable upon exercise of options granted or reserved under the 2010 Equity Incentive Plan; and (ii) 47,958,749 shares of our Common stock issuable upon exercise of outstanding warrants. |

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information. Although we believe that such sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified such information.

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this prospectus, before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common stock could decline and investors could lose all or part of their investment.

Risks Relating to Our Business

WE ARE AN EXPLORATION STAGE COMPANY AND HAVE ONLY RECENTLY COMMENCED EXPLORATION ACTIVITIES ON OUR CLAIMS. WE EXPECT TO INCUR OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

Our evaluation of the Coso and Blythe mining claims up to this point is primarily a result of historical exploration data. Although we have made field observations, our exploration program is just getting under way. Accordingly, we are not yet in a position to evaluate the likelihood that our business will be successful. We have not earned any revenues as of the date of this report. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from development and production of minerals from the claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

BECAUSE WE HAVE NOT SURVEYED OUR MINING CLAIMS, WE MAY DISCOVER MINERALIZATION ON THE CLAIMS THAT IS NOT WITHIN OUR CLAIMS BOUNDARIES.

While we have conducted mineral claim title searches, this should not be construed as a guarantee of claims boundaries. Until the claims are surveyed, the precise location of the boundaries of the claims may be in doubt. If we discover mineralization that is close to the claims boundaries, it is possible that some or all of the mineralization may occur outside the boundaries. In such a case we would not have the right to extract those minerals.

IF WE DISCOVER COMMERCIAL RESERVES OF PRECIOUS METALS ON OUR MINERAL PROPERTY, WE CAN PROVIDE NO ASSURANCE THAT WE WILL BE ABLE TO OBTAIN FINANCING TO SUCCESSFULLY ADVANCE THE MINERAL CLAIMS INTO COMMERCIAL PRODUCTION.

If our exploration program is successful in establishing ore of commercial tonnage and grade, we will require additional funds in order to advance the claims into commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for the minerals, investor acceptance of our claims and general market conditions. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds is through the sale of equity capital. Any sale of share capital will result in dilution to existing shareholders. We may be unable to obtain any such funds, or to obtain such funds on terms that we consider economically feasible and an investor may lose any investment he makes in our shares.

OUR INDEPENDENT AUDITOR HAS ISSUED AN AUDIT OPINION WHICH INCLUDES A STATEMENT DESCRIBING A DOUBT WHETHER WE WILL CONTINUE AS A GOING CONCERN.

As described in Note 5 of our accompanying financial statements, our lack of operations and any guaranteed sources of future capital create substantial doubt as to our ability to continue as a going concern. If our business plan does not work, we could remain as a start-up company with limited operations and revenues.

GOVERNMENT REGULATION OR OTHER LEGAL UNCERTAINTIES MAY INCREASE COSTS AND OUR BUSINESS WILL BE NEGATIVELY AFFECTED.

Laws and regulations govern the exploration, development, mining, production, importing and exporting of minerals; taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and other matters. In many cases, licenses and permits are required to conduct mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a substantial adverse impact on us. Applicable laws and regulations will require us to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, we may be required to stop exploration activities, once started, until a particular problem is remedied or to undertake other remedial actions.

BASED ON CONSUMER DEMAND, THE GROWTH AND DEMAND FOR ANY URANIUM WE MAY RECOVER FROM OUR CLAIMS MAY BE SLOWED, RESULTING IN REDUCED REVENUES.

Our continued success will be dependent on the growth of demand for uranium. If consumer demand slows our revenues may be significantly affected. This could limit our ability to generate revenues and our financial condition and operating results may be harmed.

THE GLOBAL ECONOMIC CRISIS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR LIQUIDITY AND CAPITAL RESOURCES.

The recent distress in the financial markets has resulted in extreme volatility in security prices and diminished liquidity and credit availability, and there can be no assurance that our liquidity will not be affected by changes in the financial markets and the global economy or that our capital resources will at all times be sufficient to satisfy our liquidity needs. In addition, the tightening of the credit markets could make it more difficult for us to access funds, enter into agreements for new debt or obtain funding through the issuance of our securities.

OUR BUSINESS MAY REQUIRE ADDITIONAL CAPITAL FOR CONTINUED GROWTH, AND OUR GROWTH MAY BE SLOWED IF WE DO NOT HAVE SUFFICIENT CAPITAL.

The continued growth and operation of our business may require additional funding for working capital. We may be unable to secure such funding when needed in adequate amounts or on acceptable terms, if at all. To execute our business strategy, we may issue additional equity securities in public or private offerings, potentially at a price lower than the market price at the time of such issuance. Similarly, we may seek debt financing and may be forced to incur significant interest expense. If we cannot secure sufficient funding, we may be forced to forego strategic opportunities or delay, scale back or eliminate operations, acquisitions, and other investments.

Our ability to obtain needed financing may be impaired by such factors as the condition of the economy and capital markets, both generally and specifically in our industry, and the fact that we are not profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

OUR INABILITY TO USE SHARES OF OUR COMMON STOCK TO FINANCE FUTURE ACQUISITIONS COULD IMPAIR THE GROWTH AND EXPANSION OF OUR BUSINESS.

The extent to which we will be able or willing to use shares of our common stock to consummate acquisitions will depend on (i) the market value of our securities which will vary, (ii) liquidity, which is presently limited, and (iii) the willingness of potential sellers to accept shares of our common stock as full or partial payment for their business. Using shares of our common stock for this purpose may result in significant dilution to existing stockholders. To the extent that we are unable to use common stock to make future acquisitions, our ability to grow through acquisitions may be limited by the extent to which we are able to raise capital through debt or equity financings. We may not be able to obtain the necessary capital to finance any acquisitions. If we are unable to obtain additional capital on acceptable terms, we may be required to reduce the scope of expansion or redirect resources committed to internal purposes. Our failure to use shares of our common stock to make future acquisitions may hinder our ability to actively pursue our acquisition program.

Risks Relating to Our Organization

AS A RESULT OF THE EXCHANGE, GREEN ENERGY BECAME A SUBSIDIARY OF OURS AND SINCE WE ARE SUBJECT TO THE REPORTING REQUIREMENTS OF FEDERAL SECURITIES LAWS, THIS CAN BE EXPENSIVE AND MAY DIVERT RESOURCES FROM OTHER PROJECTS, THUS IMPAIRING OUR ABILITY GROW.

As a result of the Exchange, Green Energy became a subsidiary of ours and, accordingly, is subject to the information and reporting requirements of the Exchange Act, and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC (including reporting of the Exchange) and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if Green Energy had remained privately held and did not consummate the Exchange.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We will need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, then we may not be able to obtain the independent accountant certifications required by such act, which may preclude us from keeping our filings with the SEC current and interfere with the ability of investors to trade our securities and for our shares to continue to be quoted on the OTC Bulletin Board or to list on any national securities exchange.

OUR CERTIFICATE OF INCORPORATION ALLOWS FOR OUR BOARD TO CREATE NEW SERIES OF PREFERRED STOCK WITHOUT FURTHER APPROVAL BY OUR STOCKHOLDERS WHICH COULD ADVERSELY AFFECT THE RIGHTS OF THE HOLDERS OF OUR COMMON STOCK.

Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to such holders (i) the preferred right to our assets upon liquidation, (ii) the right to receive dividend payments before dividends are distributed to the holders of common stock and (iii) the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing common stockholders.

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR COMMON STOCK.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

PUBLIC COMPANY COMPLIANCE MAY MAKE IT MORE DIFFICULT TO ATTRACT AND RETAIN OFFICERS AND DIRECTORS.

The Sarbanes-Oxley Act and rules implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these rules and regulations to increase our compliance costs in 2011 and beyond and to make certain activities more time consuming and costly. As a public company, we also expect that these rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers, and to maintain insurance at reasonable rates, or at all.

Risks Relating to Our Common Stock

WE MAY FAIL TO QUALIFY FOR CONTINUED LISTING ON THE OTC BULLETIN BOARD WHICH COULD MAKE IT MORE DIFFICULT FOR INVESTORS TO SELL THEIR SHARES.

Our common stock is listed on the Over the Counter Bulletin Board (“OTCBB”). There can be no assurance that trading of our common stock on such market will be sustained or that we can meet OTCBB’s continued listing standards. In the event that our common stock fails to qualify for continued inclusion, our common stock could thereafter only be quoted on the “pink sheets.” Under such circumstances, shareholders may find it more difficult to dispose of, or to obtain accurate quotations, for our common stock, and our common stock would become substantially less attractive to certain purchasers such as financial institutions, hedge funds and other similar investors.

OUR COMMON STOCK MAY BE AFFECTED BY LIMITED TRADING VOLUME AND PRICE FLUCTUATIONS WHICH COULD ADVERSELY IMPACT THE VALUE OF OUR COMMON STOCK.

There has been limited trading in our common stock and there can be no assurance that an active trading market in our common stock will either develop or be maintained. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

OUR STOCK PRICE MAY BE VOLATILE.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| | • | | changes in our industry; |

| | • | | competitive pricing pressures; |

| | • | | our ability to obtain working capital financing; |

| | • | | additions or departures of key personnel; |

| | • | | sales of our common stock; |

| | • | | our ability to execute our business plan; |

| | • | | operating results that fall below expectations; |

| | • | | loss of any strategic relationship; |

| | • | | regulatory developments; and |

| | • | | economic and other external factors. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

WE HAVE NOT PAID CASH DIVIDENDS IN THE PAST AND DO NOT EXPECT TO PAY CASH DIVIDENDS IN THE FUTURE. ANY RETURN ON AN INVESTMENT IN OUR COMMON STOCK MAY BE LIMITED TO THE VALUE OF THE COMMON STOCK.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on our earnings, financial condition, and other business and economic factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on a shareholder’s investment will only occur if our stock price appreciates.

OFFERS OR AVAILABILITY FOR SALE OF A SUBSTANTIAL NUMBER OF SHARES OF OUR COMMON STOCK MAY CAUSE THE PRICE OF OUR COMMON STOCK TO DECLINE.

If our stockholders sell substantial amounts of our Common stock in the public market, including shares issued in the Private Placement upon the effectiveness of the registration statement of which this prospectus forms a part, or upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of outstanding options or warrants, it could create a circumstance commonly referred to as an "overhang" and in anticipation of which the market price of our Common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate. The shares of common stock sold in the Private Placements will be freely tradable upon the earlier of: (i) effectiveness of a registration statement covering such shares and (ii) the date on which such shares may be sold without registration pursuant to Rule 144 (or other applicable exemption) under the Securities Act.

INVESTOR RELATIONS ACTIVITIES, NOMINAL “FLOAT” AND SUPPLY AND DEMAND FACTORS MAY AFFECT THE PRICE OF OUR STOCK.

We expect to utilize various techniques such as non-deal road shows and investor relations campaigns in order to create investor awareness for the Company. These campaigns may include personal, video and telephone conferences with investors and prospective investors in which our business practices are described. We may provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced by third-parties based upon publicly-available information concerning the Company. We will not be responsible for the content of analyst reports and other writings and communications by investor relations firms not authored by the Company or from publicly available information. We do not intend to review or approve the content of such analysts’ reports or other materials based upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, but whether such disclosure is made or complete is not under our control. In addition, investors in the Company may be willing, from time to time, to encourage investor awareness through similar activities. Investor awareness activities may also be suspended or discontinued which may impact the trading market our common stock.

The SEC and FINRA enforce various statutes and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly in cases where the hallmarks of “pump and dump” activities may exist, such as rapid share price increases or decreases. We, and our shareholders may be subjected to enhanced regulatory scrutiny due to the small number of holders who initially will own the registered shares of our common stock publicly available for resale, and the limited trading markets in which such shares may be offered or sold which have often been associated with improper activities concerning penny-stocks, such as the OTC Bulletin Board or the OTCQB Marketplace (Pink OTC) or pink sheets. Until such time as the common stock sold in the Private Placement is registered and until such time as our restricted shares are registered or available for resale under Rule 144, there will continue to be a small percentage of shares held by a small number of investors, many of whom acquired such shares in privately negotiated purchase and sale transactions, that will constitute the entire available trading market. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Often times, manipulation is associated by regulators with forces that upset the supply and demand factors that would normally determine trading prices. Since a small percentage of the outstanding common stock of the Company will initially be available for trading, held by a small number of individuals or entities, the supply of our common stock for sale will be extremely limited for an indeterminate amount of time, which could result in higher bids, asks or sales prices than would otherwise exist. Securities regulators have often cited thinly-traded markets, small numbers of holders, and awareness campaigns as components of their claims of price manipulation and other violations of law when combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide with false or touting press releases. There can be no assurance that the Company’s or third-parties’ activities, or the small number of potential sellers or small percentage of stock in the “float,” or determinations by purchasers or holders as to when or under what circumstances or at what prices they may be willing to buy or sell stock will not artificially impact (or would be claimed by regulators to have affected) the normal supply and demand factors that determine the price of the stock.

EXERCISE OF OPTIONS AND WARRANTS MAY HAVE A DILUTIVE EFFECT ON OUR COMMON STOCK.

If the price per share of our Common stock at the time of exercise of any options, or any other convertible securities is in excess of the various exercise or conversion prices of such convertible securities, exercise or conversion of such convertible securities would have a dilutive effect on our Common stock. As of May 2, 2011, we had (i) outstanding options to purchase 3,100,000 shares of our Common stock at an exercise price of $0.25 per share, and (ii) outstanding warrants to purchase 4,650,000 shares of our Common stock at $0.40 per share and outstanding warrants to purchase 43,308,749 shares of our Common stock at $0.50 per share. Further, any additional financing that we secure may require the granting of rights, preferences or privileges senior to those of our Common stock and result in additional dilution of the existing ownership interests of our common stockholders.

OUR COMMON STOCK MAY BE DEEMED A “PENNY STOCK,” WHICH WOULD MAKE IT MORE DIFFICULT FOR OUR INVESTORS TO SELL THEIR SHARES.

Our common stock may be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

The selling stockholders will receive all of the proceeds from the sale of the shares offered by them under this prospectus. We will not receive any proceeds from the sale of the shares by the selling stockholders covered by this prospectus.

Our common stock is quoted on the OTC Bulletin Board under the symbol “AEFI.OB” and commenced trading on April 5, 2010. The following table sets forth the high and low bid quotation prices as reported on the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions. Prior to April 5, 2010, there was no active market for our Common stock. As of May 2, 2011, there were approximately 150 holders of record of our Common stock.

The following table sets forth the high and low bid prices for our Common stock for the periods indicated, as reported by the OTC Bulletin Board. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| Period | High | | Low | |

| January 1, 2011 through March 31, 2011 | $ | 1.43 | | $ | 0.51 | |

| October 1, 2010 through December 31, 2010 | $ | 0.98 | | $ | 0.45 | |

| July 1, 2010 through September 30, 2010 | $ | 0.76 | | $ | 0.30 | |

| April 5, 2010 through June 30, 2010 | $ | 1.04 | | $ | 0.23 | |

The last reported sales price of our Common stock on the OTC Bulletin Board on April 29, 2011 was $0.56 per share.

We have not declared nor paid any cash dividend on our Common stock, and we currently intend to retain future earnings, if any, to finance the expansion of our business, and we do not expect to pay any cash dividends in the foreseeable future. The decision whether to pay cash dividends on our Common stock will be made by our board of directors, in their discretion, and will depend on our financial condition, results of operations, capital requirements and other factors that our board of directors considers significant.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this prospectus. In addition to historical information, this discussion and analysis contains forward-looking statements that involve risks, uncertainties, and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including but not limited to those set forth under “Risk Factors”.

Overview

On December 24, 2009, we entered into the Exchange Agreement with Green Energy, and the shareholders of Green Energy. Upon closing of the Exchange, on December 24, 2009, the shareholders of Green Energy transferred all of the issued and outstanding capital stock of Green Energy to us in exchange for shares of our common stock. Such Exchange caused Green Energy to become our wholly-owned subsidiary. We succeeded to the business of Green Energy, and following the completion of the Exchange, transferred all of our pre-merger assets to certain of our pre-Exchange stockholders in exchange for the cancellation of 15,250,000 shares of our Common stock. Consequently, the assets and liabilities and the operations that are reflected in the historical financial statements of the Company prior to the closing of the Exchange are those of Green Energy, and the consolidated financial statements after completion of the purchase and closing include the assets and liabilities of the Company and Green Energy, historical operations of Green Energy and our operations from the closing date of the Exchange. Since Green Energy was formed on November 23, 2009, there is no comparative period for the year ended March 31, 2010.

We are primarily engaged in the acquisition and exploration of properties that may contain uranium mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired State Leases and Federal unpatented mining claims in the state of California for the purpose of exploration and potential development of uranium minerals on a total of approximately 5,500 acres. We plan to review opportunities to acquire additional mineral properties with current or historic uranium mineralization with meaningful exploration potential.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain economic concentrations of uranium that are prospective for mining.

Results of Operations

Our results of operations for the period of inception (November 23, 2009) through March 31, 2010 and for the nine month period ended December 31, 2010, were as follows:

RESULTS OF OPERATIONS

November 23, 2009 (inception) through March 31, 2010

We are still in our exploration stage and have generated no revenues to date. Since we were formed on November 23, 2009, there is no comparative period for purposes of this analysis. Accordingly, the following discusses activity from inception through March 31, 2010.

We incurred operating expenses of $297,382 for the period of inception through March 31, 2010. These expenses consisted of general operating expenses and professional fees incurred in connection with the day to day operations of our business, obtaining cash from the additional sale of stock and the preparation and filing of our financial reports with the United States Securities and Exchange Commission. Our net loss from inception through March 31, 2010 was $296,345.

LIQUIDITY AND CAPITAL RESOURCES

Our cash balance at March 31, 2010 was $962,392. We had $3,058 in outstanding liabilities.

We have met our liquidity and capital requirements primarily through the private placement of equity securities.

Net Cash Used in Operating Activities. Net cash used in operating activities for the period from inception through March 31, 2010 totaled approximately $226,287. The use of cash was primarily related to working capital and exploration activities.

Net Cash Provided By/Used in Investing Activities. We did not use cash in investing activities for the period from inception through March 31, 2010.

Net Cash Provided By Financing Activities. Net cash provided by financing activities for the period from inception through March 31, 2010 totaled approximately $1,397,879. The cash provided was the result of the sale of common stock and warrants through a PIPE financing.

Working Capital. As of March 31, 2010, we had working capital of $977,334. Based on our current operating activities and plans, we believe our existing working capital will enable us to meet our anticipated cash requirements for at least the next twelve months.

Three months ended December 31, 2010 compared to the period from inception, November 23, 2009 to December 31, 2009.

For the three months ended December 31, 2010, the Company was still in our exploration stage and has generated no revenues to date.

The Company had a net loss of ($2,419,501) for the three months ended December 31, 2010 compared to a net loss of ($120,144) for the period November 23, 2009 (inception) to December 31, 2009, an increase in the net loss of $2,299,357.

Total general and administrative expenses increased by $1,009,107 to $1,129,251 for the three months ended December 31, 2010 as compared to $120,144 for the period from inception November 23, 2009 to December 31, 2009. These expenses consisted of general operating expenses and professional fees incurred in connection with the day to day operation of our business, obtaining additional sale of stock and the preparation and filing of our financial disclosure reports with the U.S. Securities and Exchange Commission.

Nine Months Ended December 31, 2010

For the nine months ended December 31, 2010, the Company was still in an exploration stage and has generated no revenues to date.

For the nine months ended December 31, 2010, the Company generated a loss of ($4,573,878).

We incurred operating expenses of $3,284,576 for the nine months ended December 31, 2010. These expenses consisted of general expenses and professional fees incurred in connection with the day to day operation of our business, sales of our stock and the preparation and filing of our financial disclosure reports with the U.S. Securities and Exchange Commission.

LIQUIDITY AND CAPITAL RESOURCES

For the three months ended December 31, 2010, the Company increased its working capital position by $155,921 from $977,334 at March 31, 2010 to $ 1,133,255 at December 31, 2010.

The Company’s capital resources are comprised primarily of private investors. The Company’s ongoing need for capital will require it to enter into additional agreements to raise capital from private individuals or corporations.

Our cash balance at December 31, 2010 was $1,531,655 and we had $398,400 in outstanding liabilities.

Our financial statements from inception (November 23, 2009) through the quarter ended December 31, 2010 reported no revenues and a net loss of ($4,870,223).

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses. Critical accounting policies are those that require the application of management’s most difficult, subjective or complex judgments, often because of the need to make estimates about the effect of matters that are inherently uncertain and that may change in subsequent periods. In preparing the financial statements, we utilized available information, including our past history, industry standards and the current economic environment, among other factors, in forming our estimates and judgments, giving appropriate consideration to materiality. Actual results may differ from these estimates. In addition, other companies may utilize different estimates, which may impact the comparability of our results of operations to other companies in our industry. We believe that of our significant accounting policies, the following may involve a higher degree of judgment and estimation, or are fundamentally important to our business.

Revenue Recognition. We expect to recognize the total revenue provided under a contract ratably over the contract period, including any periods under which we have agreed to provide services at no cost. Deferred revenues are recognized as a liability when billings are issued in advance of the date when revenues are earned. We expect to apply the revenue recognition principles set forth in ASC 605 which provides for revenue to be recognized when (i) persuasive evidence of an arrangement exists, (ii) delivery or installation has been completed, (iii) the customer accepts and verifies receipt, and (iv) collectability is reasonably assured.

Stock Based Compensation

The Company applies ASC 718-10 and ASC 505-50 (formerly SFAS 123R) in accounting for stock options issued to employees. For stock options and warrants issued to non-employees, the Company applies the same standard, which requires the recognition of compensation cost based upon the fair value of stock options at the grant date using the Black-Scholes option pricing model.

Off-Balance Sheet Arrangements.

We have no off-balance sheet arrangements, financings, or other relationships with unconsolidated entities known as ‘‘Special Purposes Entities.’’

Recent Accounting Pronouncements

In December 2007, ASC 808-10 (formerly EITF Issue No. 07-1, “Accounting for Collaborative Arrangements”) was issued. ASC 808-10 provides guidance concerning: determining whether an arrangement constitutes a collaborative arrangement within the scope of the Issue; how costs incurred and revenue generated on sales to third parties should be reported in the income statement; how an entity should characterize payments on the income statement; and what participants should disclose in the notes to the financial statements about a collaborative arrangement. The provisions of ASC 808-10 have been adopted in 2009. ASC 808-10 has had no impact on the Company’s financial statements.

In September 2006, the FASB issued ASC 820-10 (formerly FASB Statement 157, “Fair Value Measurements”). ASC 820-10 defines fair value, establishes a framework for measuring fair value under GAAP and expands disclosures about fair value measurements. ASC 820-10 applies under other accounting pronouncements that require or permit fair value measurements. Accordingly, ASC 820-10 does not require any new fair value measurements. However, for some entities, the application of ASC 820-10 will change current practice. The changes to current practice resulting from the application of ASC 820-10 relate to the definition of fair value, the methods used to measure fair value and the expanded disclosures about fair value measurements. The provisions of ASC 820-10 are effective as of January 1, 2008, with the cumulative effect of the change in accounting principle recorded as an adjustment to opening retained earnings. However, delayed application of this statement is permitted for nonfinancial assets and nonfinancial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), until fiscal years beginning after November 15, 2008, and interim periods within those fiscal years. The Company adopted ASC 820-10 effective November 23, 2009 for financial assets and the adoption did not have a significant effect on its financial statements. The adoption of SFAS No. 157 did not have a material impact on the Company’s condensed consolidated results of operations or financial condition.

In February 2007, ASC issued 825-10, The Fair Value Option for Financial Assets and Financial Liabilities – Including an amendment of ASC 320-10, (“ASC 825-10”) which permits entities to choose to measure many financial instruments and certain other items at fair value at specified election dates. A business entity is required to report unrealized gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting date. This statement is expected to expand the use of fair value measurement. ASC 825-10 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years.

In November 2009, the Company adopted ASC 805, Business Combinations (“ASC 805”). ASC 805 retains the fundamental requirements that the acquisition method of accounting be used for all business combinations and for an acquirer to be identified for each business combination. ASC 805 defines the acquirer as the entity that obtains control of one or more businesses in the business combination and establishes the acquisition date as the date that the acquirer achieves control. ASC 805 will require an entity to record separately from the business combination the direct costs, where previously these costs were included in the total allocated cost of the acquisition. ASC 805 will require an entity to recognize the assets acquired, liabilities assumed, and any non-controlling interest in the acquired at the acquisition date, at their fair values as of that date. ASC 805 will require an entity to recognize as an asset or liability at fair value for certain contingencies, either contractual or non-contractual, if certain criteria are met. Finally, ASC 805 will require an entity to recognize contingent consideration at the date of acquisition, based on the fair value at that date. This will be effective for business combinations completed on or after the first annual reporting period beginning on or after December 15, 2008. Early adoption is not permitted and the ASC is be applied prospectively only. Upon adoption of this ASC, there would be no impact to the Company’s results of operations and financial condition for acquisitions previously completed. The adoption of ASC 805 is not expected to have a material effect on the Company’s financial position, results of operations or cash flows.

In March 2008, ASC issued ASC 815, Disclosures about Derivative Instruments and Hedging Activities”, (“ASC 815”). ASC 815 requires enhanced disclosures about an entity’s derivative and hedging activities. These enhanced disclosures will discuss: how and why an entity uses derivative instruments; how derivative instruments and related hedged items are accounted for and its related interpretations; and how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. ASC 815 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Company does not believe that ASC 815 will have an impact on their results of operations or financial position.

In June 2008, the FASB ratified ASC 815-40-25 (formerly EITF Issue No. 07-05, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity's Own Stock”). ASC 815-40-25 mandates a two-step process for evaluating whether an equity-linked financial instrument or embedded feature is indexed to the entity's own stock. Warrants that a company issues that contain a strike price adjustment feature, upon the adoption of ASC 815-40-25, results in the instruments no longer being considered indexed to the company's own stock. On November 23, 2009, the Company adopted ASC 815-40-25 and re-evaluated its issued and outstanding warrants that contain a strike price adjustment feature. Based upon the Company’s re-evaluation, ASC 815-40-25 has had no material impact on the Company’s condensed consolidated financial statements.

Effective November 23, 2009, the Company adopted a new accounting standard for subsequent events, as codified in ASC 855-10 (formerly SFAS No. 165, Subsequent Events). The update modifies the names of the two types of subsequent events either as recognized subsequent events (previously referred to in practice as Type I subsequent events) or non-recognized subsequent events (previously referred to in practice as Type II subsequent events). In addition, the standard modifies the definition of subsequent events to refer to events or transactions that occur after the balance sheet date, but before the financial statements are issued (for public entities) or available to be issued (for nonpublic entities). It also requires the disclosure of the date through which subsequent events have been evaluated. The update did not result in significant changes in the practice of subsequent event disclosures, and therefore the adoption did not have any impact on our condensed consolidated financial statements. In accordance with ASC 855-10, the Company evaluated all events or transactions that occurred after November 23, 2009, the date the Company issued these condensed consolidated financial statements.

Effective November 23, 2009, the Company adopted The “FASB Accounting Standards Codification” and the Hierarchy of Generally Accepted Accounting Principles (ASC 105-10), (formerly SFAS No. 168, The “FASB Accounting Standards Codification” and the Hierarchy of Generally Accepted Accounting Principles). This standard establishes only two levels of U.S. generally accepted accounting principles (“GAAP”), authoritative and non-authoritative. The Financial Accounting Standard Board (“FASB”) Accounting Standards Codification (the “Codification”) became the source of authoritative, nongovernmental GAAP, except for rules and interpretive releases of the SEC, which are sources of authoritative GAAP for SEC registrants. All other non-grandfathered, non-SEC accounting literature not included in the Codification became nonauthoritative. The Company began using the new guidelines and numbering system prescribed by the Codification when referring to GAAP in the third quarter of fiscal 2009. As the Codification was not intended to change or alter existing GAAP, it did not have any impact on the Company’s condensed consolidated financial statements.

Effective for the interim reporting period ending December 31, 2009, the Company adopted two new accounting standard updates which were intended to provide additional application guidance and enhanced disclosures regarding fair value measurements and impairments of securities as codified in ASC 820-10-65 (formerly FASB Staff Position Financial Accounting Standard 107-1 and Accounting Principles Board 28-1 and “Interim Disclosures about Fair Value of Financial Instruments”. ASC 820-10-65 requires disclosures about fair value of financial instruments for interim reporting periods of publicly traded companies as well as in annual financial statements. ASC 820-10-65 requires related disclosures in summarized financial information at interim reporting periods. ASC 820-10-65 was effective for the interim reporting period ending December 31, 2009. The adoption of ASC 820-10-65 did not have a material impact on the Company’s condensed consolidated financial statements.

In January, 2010, The Company adopted FASB ASU No. 2010-06, Fair Value Measurement and Disclosure (Topic 820) – Improving Disclosures about Fair Value Measurement (“ASU 2010-06”). These standards require new disclosures on the amount and reason for transfers in and out of Level 1 and 2 fair value measurements. The standards also require new disclosures of activities, including purchases, sales, issuances, and settlements with the Level 3 fair value measurements. The standard also clarifies existing disclosure requirements on levels of disaggregation and disclosures about inputs and valuation techniques. These new disclosures are effective beginning with the first interim filing in 2010. The disclosures about the roll forward of information in Level 3 are required for the Company with its first interim filing in 2011. The Company does not believe this standard will impact their financial statements. Other ASU’s that have been issued or proposed by the FASB ASC that do not require adoption until a future date and are not expected to have a material impact on the financial statements upon adoption.

In January 2010, the FASB issued Update No. 2010-05 “Compensation—Stock Compensation—Escrowed Share Arrangements and Presumption of Compensation ” (“2010-05”). 2010-05 re-asserts that the Staff of the Securities Exchange Commission (the “SEC Staff”) has stated the presumption that for certain stockholders escrowed share represent a compensatory arrangement. 2010-05 further clarifies the criteria required to be met to establish a position different from the SEC Staff’s position. The Company does not have any escrowed shares held at this time. The adoption of this update by the Company did not have any material impact on its consolidated financial position, results of operations or cash flows.

In January 2010, the FASB issued Update No. 2010-04 “Accounting for Various Topics—Technical Corrections to SEC Paragraphs” (“2010-04”). 2010-04 represents technical corrections to SEC paragraphs within various sections of the Codification. Management is currently evaluating whether these changes will have any material impact on its consolidated financial position, results of operations or cash flows.

In January 2010, the FASB issued Update No. 2010-02 “Accounting and Reporting for Decreases in Ownership of a Subsidiary—a Scope Clarification ” (“2010-02”) an update of ASC 810 “Consolidation.” 2010-02 clarifies the scope of ASC 810 with respect to decreases in ownership in a subsidiary to those of a: subsidiary or group of assets that are a business or nonprofit, a subsidiary that is transferred to an equity method investee or joint venture, and an exchange of a group of assets that constitutes a business or nonprofit activity to a non-controlling interest including an equity method investee or a joint venture. Management does not expect adoption of this update to have any material impact on its consolidated financial position, results of operations or operating cash flows. Management does not intend to decrease its ownership in its wholly-owned subsidiary.

In February 2010, the FASB issued FASB ASU 2010-09, Subsequent Events, and Amendments to Certain Recognition and Disclosure Requirements, which clarifies certain existing evaluation and disclosure requirements in ASC 855 related to subsequent events. FASB ASU 2010-09 requires SEC filers to evaluate subsequent events through the date in which the consolidated financial statements are issued and is effectively immediately. The new guidance does not have an effect on its consolidated results of operations and financial condition.

In April 2010, the FASB issued ASC Update No. 2010-17, Milestone Method of Revenue Recognition (ASU 2010-17). ASU 2010-17 provides guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. ASU 2010-17 is effective for interim and annual reporting periods beginning after June 15, 2010, with early adoption permitted. The adoption of this standard will not have a material impact on our consolidated financial position or results of operations.

Corporate History

We were organized as Sienna Resources, Inc. in the State of Delaware on July 20, 2007 to engage in the acquisition, exploration and development of natural resource properties. We were an exploration stage company with no revenues or operating history. On December 21, 2009, we filed an Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware in order to, among other things, change our name to “American Energy Fields, Inc.”.

On December 24, 2009, we entered into an Exchange Agreement with Green Energy, and the shareholders of Green Energy. Upon closing of the transaction contemplated under the Exchange Agreement, on December 24, 2009, the shareholders of Green Energy transferred all of the issued and outstanding capital stock of Green Energy to us in exchange for 28,788,252 shares of our common stock. Such exchange caused Green Energy to become our wholly-owned subsidiary. Following the closing of the Exchange, we issued an aggregate of 9,300,000 shares of our common stock and two-year warrants to purchase an additional 4,650,000 shares of common stock exercisable at $0.40 per share, in a private placement to 16 investors for $1,395,000. Immediately following the closing of the foregoing, we transferred all of our pre-Exchange assets and liabilities to our wholly-owned subsidiary, Sienna Resources Holdings, Inc. Thereafter, we transferred all of the outstanding capital stock of Sienna Resources Holdings, Inc. to Julie Carter, our prior sole officer and director, in exchange for the cancellation of 15,250,000 shares of our common stock that she owned. Following the Exchange and the split-off transaction, we discontinued our former business and succeeded to the business of Green Energy as our sole line of business. Therefore, all discussions regarding (1) our financial statements and (2) our business relate to the business of Green Energy operating as our wholly-owned subsidiary.

Our principal executive offices are located at 3266 W. Galveston Drive, Suite 101 Apache Junction, Arizona 85120. Our telephone number is 480-288-6530.

General

We are primarily engaged in the acquisition and exploration of properties that may contain uranium mineralization in the United States. Our target properties are those that have been the subject of historical exploration. We have acquired State Leases and Federal unpatented mining claims in the state of California for the purpose of exploration and potential development of uranium minerals on a total of approximately 5,500 acres. We plan to review opportunities to acquire additional mineral properties with current or historic uranium mineralization with meaningful exploration potential.

Our properties do not have any reserves. We plan to conduct exploration programs on these properties with the objective of ascertaining whether any of our properties contain economic concentrations of uranium that are prospective for mining.

COSO

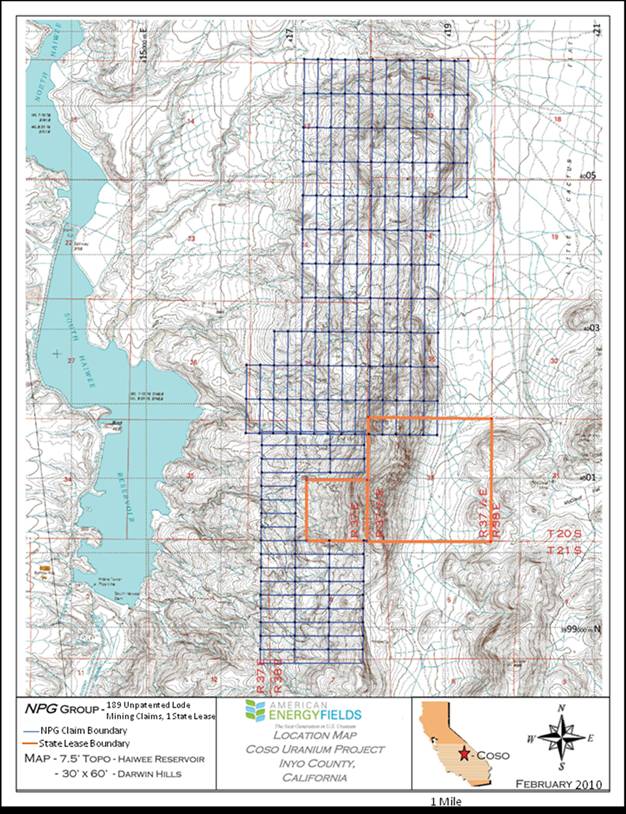

The Coso property is located in Inyo County, California near the town of Lone Pine on the western margin of the Coso Mountains, 32 miles (51 km) south by road of Lone Pine in Inyo County, California, 150 miles (241 km) northeast by road to Bakersfield, CA, 187 miles (300 km) north by road of Los Angeles, CA, and 283 miles (455 km) west by road of Las Vegas, Nevada. The Coso Project is accessible from U.S. highway 395 by taking the Cactus Flat road, an unimproved road for about 3 to 4 miles east of the highway, and climbing approximately 500 to 1200 feet above the floor of Owens Valley.

On December 24, 2009, as a result of the Exchange, we acquired a 100% working interest and 97% net revenue interest in the Coso property. Prior to our acquisition, Green Energy acquired the project on November 30, 2009 from NPX Metals, Inc., a Nevada Corporation. The 97% net revenue interest is the result of the Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations, dated as of November 30, 2009. Under the terms of the agreement, NPX Metals, Inc. retained a 3% net smelter return royalty interest in the Coso Property, leaving a 97% net revenue interest to Green Energy.

The Coso property consists of 169 Federal unpatented lode mining claims on Bureau of Land Management ("BLM") land totaling 3,380 acres, and 800 State leased acres, in Inyo County, California. The unpatented mining claims overlie portions of sections 12, 13, 24, 25, 26, 35, and 36 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian), sections 13, 24, and 25 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian), sections 1 and 12 of Township 21 South, Range 37 East (Mount Diablo Base & Meridian), and sections 6 and 7 of Township 21 South, Range 37 1/2 East (Mount Diablo Base & Meridian). The state lease covers portions of section 6 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian) and section 36 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian). To maintain the Coso mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus a recording cost of approximately $50 to Inyo County where the claims are located. With regard to the unpatented lode mining claims, future exploration drilling at the Coso Project will require us to either file a Notice of Intent or a Plan of Operations with the BLM , depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

The Coso property and the surrounding region is located in an arid environment in the rain shadow of the Sierra Nevada mountains. The property is located near the western margin of the Basin and Range province, a large geologic province in western North America characterized by generally north-south trending fault block mountain ranges separated by broad alluvial basins. The geology of the area includes late- Jurassic granite bedrock overlain by the Coso Formation, which consists of interfingered gravels, arkosic sandstone, and rhyolitic tuff. The Coso Formation is overlain by a series of lakebed deposits and volcanic tuffs.

Uranium mineralization at the Coso Property occurs primarily as disseminated deposits in the lower arkosic sandstone/fanglomerate member of the Coso Formation and along silicified fractures and faults within the granite. Uranium mineralization appears to have been deposited by hydrothermal fluids moving along fractures in the granite and the overlying Coso Formation. Mineralization is often accompanied by hematite staining, silicification, and dark staining from sulfides. Autinite is the only positively identified uranium mineral in the area. The main uranium anomalies are found within the basal arkose of the lower Coso Formation and the immediately adjacent granitic rocks.

Uranium exploration has been occurring in the area since the 1950s by a number of mining companies including Coso Uranium, Inc., Ontario Minerals Company, Western Nuclear, Pioneer Nuclear, Federal Resources Corp., and Union Pacific / Rocky Mountain Energy Corp. Previous uranium exploration and prospecting on the Coso property includes geologic mapping, pitting, adits, radon cup surveys, airborne geophysics and drilling. Our preliminary field observations of the geology and historical working appear to corroborate the historical literature. These historical exploration programs have identified specific exploration targets on the property. All previous work has been exploratory in nature, and no mineral extraction or processing facilities have been constructed. The exploration activities have resulted in over 400 known exploration holes, downhole gamma log data on the drill holes, chemical assay data, and airborne radiometric surveys, and metallurgical testing to determine amenability to leaching.

The property is undeveloped, and there are no facilities or structures. There are a number of adits and trenches from previous exploration activities, as well as more than 400 exploration drillholes.

The last major exploration activities on the Coso Property occurred during a drilling campaign in the mid-1970s. As of March 31, 2010, we have conducted field reconnaissance and mineral sampling on the property, but have not conducted any drilling or geophysical surveys. We plan to locate and identify the uranium anomalies targeted by previous exploration for further evaluation. If feasible, old drill holes in prospective areas will be re-entered and logged by down-hole radiometric probes to identify zones and grades of subsurface uranium mineralization. We are currently developing a detailed exploration plan for the Coso Property, together with budgets and timetables.

Power is available from the Mono Power Company transmission lines, which parallel U.S. highway 395. To date, the water source had not yet been determined.

With regard to the state mineral prospecting permit, we are currently authorized to locate on the ground past drill holes, adits, trenches and pits, complete a scintilometer survey, and conduct a sampling program including a bulk sample of 1,000 pounds for leach test. The Company is not currently authorized to conduct exploration drilling on the state mineral prospecting permit. Future drilling on the state mineral prospecting permit will require the Company to file environmental documentation under the California Environmental Quality Act.

The Coso Property does not currently have any reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

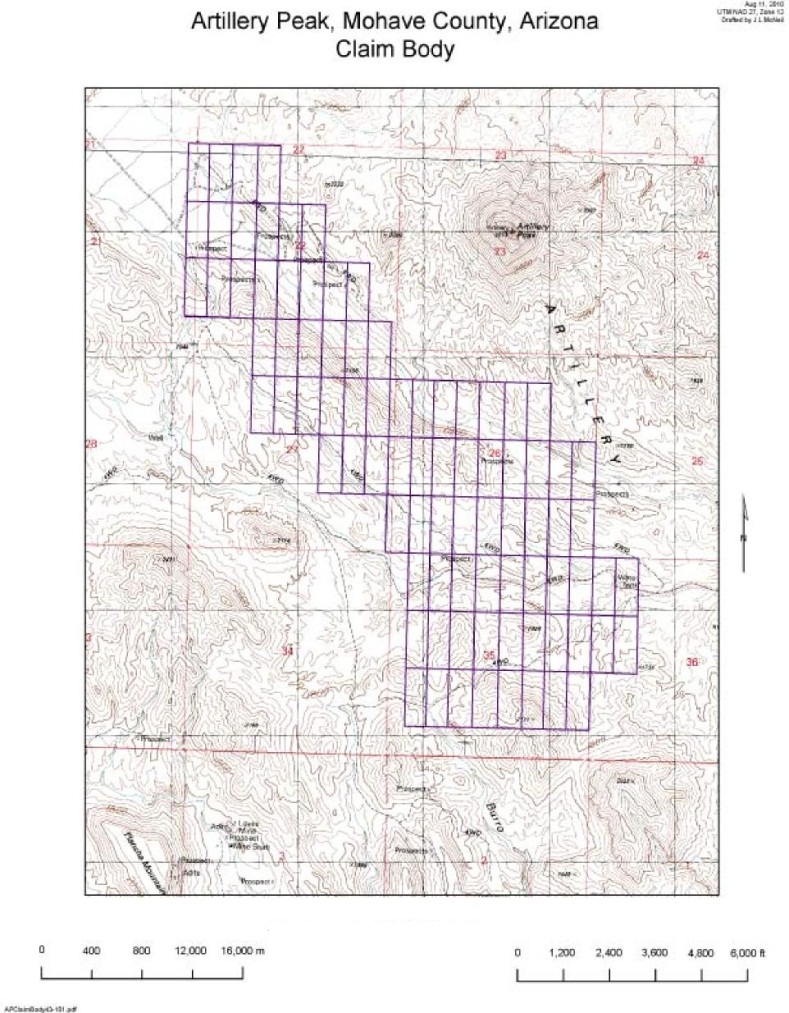

ARTILLERY PEAK

The Artillery Peak Property is located in western north-central Arizona near the southern edge of Mohave County. The Company’s claim group is composed of a total of 86 unpatented contiguous mining claims in Sections 22, 26, 27, 35, and 36 of Township 12 North, Range 13 West, Gila & Salt River Base & Meridian. All of the claims lie within lands managed by the BLM.

On April 26, 2010, the Company acquired a 100% interest (minus a 4% net smelter royalty interest) in 86 unpatented lode mining claims, located in Mohave county, Arizona for $65,000 in cash and 200,000 shares of common stock.

To maintain the Artillery Peak mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus minimal per claims cost of approximately $10 to $15 per claim recording fees to Mohave County where the claims are located.

The Artillery Peak Property is subject to an agreement to pay a net smelter return royalty interest of 4%. To date, there has been no production on the Property, and no royalties are owing. The claims are not subject to any other royalties or encumbrances.

The Artillery Peak Property lies within the Date Creek Basin, which is a region well known for significant uranium occurrence. Uranium exploration has been occurring in the Artillery Peak region since the 1950’s by a number of exploration and mining entities. Radioactivity was first discovered in the Date Creek Basin area by the U.S. Atomic Energy Commission in 1955 when a regional airborne radiometric survey was flown over the area. The Artillery Peak Property was first acquired by Jacquays Mining and first drilled in 1957. Subsequently the Property was acquired by Hecla Mining (1967), Getty Oil (1976) with a joint venture with Public Service Co of Oklahoma, Hometake Mining (1976) on adjacent properties to the south, Santa Fe Minerals (also around 1976), and Universal Uranium Limited in 2007. As of 2007, a total of 443 exploration holes were drilled into the Artillery Peak Property area.