UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ALBA MINERAL EXPLORATION, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 1000 | n/a |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

| | | |

2 Mic Mac Place Lethbridge, Alberta, Canada | | T1K 5H6 |

| (Name and address of principal executive offices) | | (Zip Code) |

| | | |

Registrant's telephone number, including area code: (403) 331-0606 | | |

| Approximate date of commencement of proposed sale to the public: | As soon as practicable after the effective date of this Registration Statement. |

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box.|__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company |X|

COPIES OF COMMUNICATIONS TO:

Alba Mineral Exploration, Inc.

Attn: Owen Gibson, President

2 Mic Mac Place, Lethbridge, AB, Canada T1K 5H6

Ph: (403) 331-0606

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED | PROPOSED MAXIMUM OFFERING PRICE PER SHARE | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE (1) | AMOUNT OF REGISTRATION FEE |

| Common Stock | 1,723,450 | $0.10(1) | $172,345 | $6.77(2) |

| (1) | This price was arbitrarily determined by Alba Mineral Exploration, Inc. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

SUBJECT TO COMPLETION, Dated March 31, 2008

PROSPECTUS

ALBA MINERAL EXPLORATION, INC.

1,723,450

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

The selling shareholders named in this prospectus are offering up to 1,723,450 shares of common stock offered through this prospectus. We will not receive any proceeds from this offering and have not made any arrangements for the sale of these securities. We have, however, set an offering price for these securities of $0.10 per share. We will use our best efforts to maintain the effectiveness of the resale registration statement from the effective date through and until all securities registered under the registration statement have been sold or are otherwise able to be sold pursuant to Rule 144 promulgated under the Securities Act of 1933.

| | Offering Price | Underwriting Discounts and Commissions | Proceeds to Selling Shareholders |

| Per Share | $0.10 | None | $0.10 |

| Total | $172,345 | None | |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.10 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board. Although we intend to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section of this Prospectus entitled "Risk Factors."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: March 31, 2008

Alba Mineral Exploration, Inc.

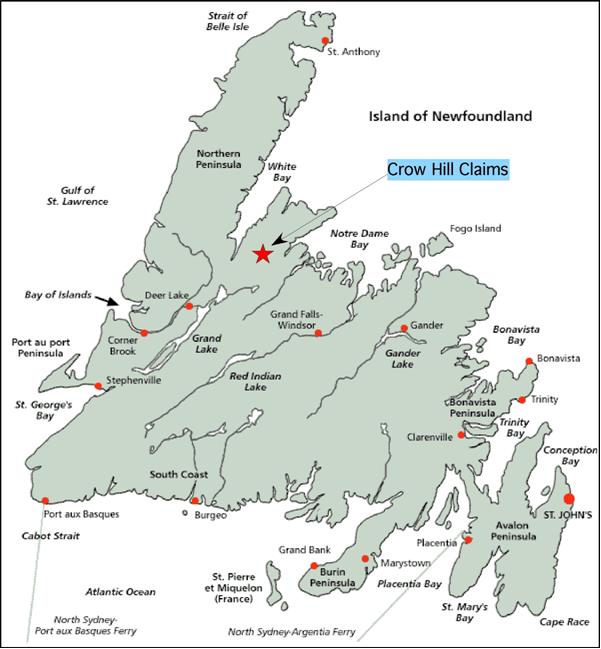

We are in the business of mineral exploration. Through our wholly-owned Canadian subsidiary, Alba Mineral Exploration, Inc., an Alberta corporation, we have acquired a 100% interest in the Crow Hill mineral claim located on the Baie Verte Peninsula on Newfoundland Island, Canada. Our subsidiary’s ownership in the Crow Hill claim was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of Newfoundland and Labrador, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and/or our subsidiary and the Government of Newfoundland and Labrador.

We have not commenced our planned exploration program. Our plan of operations is to conduct mineral exploration activities on the Crow Hill mineral claim in order to assess whether this claim possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of gold and other metallic minerals. We have not, nor to our knowledge has any predecessor, identified any commercially exploitable reserves of these minerals on the Crow Hill mineral claim. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on the Crow Hill mineral claim.

The mineral exploration program, consisting of geological mapping, sampling, and geochemical analyses, is oriented toward defining drill targets on mineralized zones within the Crow Hill mineral claim.

Currently, we are uncertain of the number of mineral exploration phases we will conduct before concluding whether there are commercially viable minerals present on the Crow Hill mineral claim. Further phases beyond the current exploration program will be dependent upon a number of factors such as a consulting geologist’s recommendations based upon ongoing exploration program results, and our available funds.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. As of December 31, 2007, we had $34,386 cash on hand and no liabilities. Accordingly, our working capital position as of December 31, 2006 was $34,386. Since our inception through December 31, 2007, we have incurred a net loss of $959. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business.

Our fiscal year ended is December 31.

We were incorporated on July 24, 2007, under the laws of the state of Delaware. Our principal offices are located at 2 Mic Mac Place, Lethbridge, Alberta, Canada T1K 5H6. Our resident agent is Business Filings, Inc. at 108 West 13th Street, Wilmington, DE 19801. Our phone number is (403) 331-0606.

The Offering

Securities Being Offered | Up to 1,723,450 shares of our common stock. |

| Offering Price and Alternative Plan of Distribution | The offering price of the common stock is $0.10 per share. We intend to apply to the NASD over-the-counter bulletin board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders. |

| Minimum Number of Shares To Be Sold in This Offering | None |

| Securities Issued and to be Issued | 5,033,450 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. There will be no increase in our issued and outstanding shares as a result of this offering. |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

Summary Financial Information

| Balance Sheet Data | From Inception on July 24, 2007 through December 31, 2007 (audited) |

| Cash | $ | 34,386 |

| Total Assets | | 34,386 |

| Liabilities | | 0 |

| Total Stockholder’s Equity (Deficit) | | (34,386) |

| | | |

| Statement of Operations | | |

| Revenue | $ | 0 |

| Net Loss for Reporting Period | $ | 959 |

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

As of December 31, 2007, we had cash in the amount of $34,386. Our cash on hand will allow us to complete the initial work program recommended by our consulting geologist. The recommended work program will consist of mapping, sampling, and geochemical analyses aimed at identifying and locating potential gold deposits on the Crow Hill property. If significant additional exploration activities are warranted and recommended by our consulting geologist, we will likely require additional financing in order to move forward with our development of the claim. We currently do not have any operations and we have no income. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade, we will require significant additional funds in order to place the Crow Hill mineral claim into commercial production. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for gold and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

We have incurred a net loss of $959 for the period from our inception, July 24, 2007, to December 31, 2007, and have no sales. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of an interest in mineral claims. Our auditors have issued a going concern opinion and have raised substantial doubt about our continuance as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the company will continue to operate indefinitely and not go out of business and liquidate its assets. This is a significant risk to investors who purchase shares of our common stock because there is an increased risk that we may not be able to generate and/or raise enough resources to remain operational for an indefinite period of time. Potential investors should also be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The auditor’s going concern opinion may inhibit our ability to raise financing because we may not remain operational for an indefinite period of time resulting in potential investors failing to receive any return on their investment.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We have just planned the initial stages of exploration on our recently –staked mineral claims. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on July 24, 2007, and to date have been involved primarily in organizational activities, the staking of our mineral claim, and obtaining independent consulting geologist’s report on this mineral claim. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

Mr. Owen Gibson, our president and director, does not have any training as a geologist or an engineer. As a result, our management may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Gibson’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in geology and engineering.

We have a verbal agreement with our consulting geologist that requires him to review all of the results from the exploration work performed upon the mineral claim that we have purchased and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and our outside auditors to perform auditing functions. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be difficult to enforce a verbal agreement in the event that any of these parties fail to perform.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays

encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time, we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur continuing and significant losses into the foreseeable future. As a result of continuing losses, we may exhaust all of our resources and be unable to complete the exploration of the Crow Hill mineral claim. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues from the exploration of the mineral claims if we exercise our option. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Mr. Gibson, our president and chief financial officer, devotes 5 to 10 hours per week to our business affairs. We do not have an employment agreement with Mr. Gibson nor do we maintain a key man life insurance policy for him. Currently, we do not have any full or part-time employees. If the demands of our business require the full business time of Mr. Gibson, it is possible that Mr. Gibson may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Mr. Gibson is our president, chief financial officer and sole director. He owns 47.68% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or

cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Gibson may still differ from the interests of the other stockholders.

Our president, Mr. Owen Gibson owns 2,400,000 shares of our common stock which equates to 47.68% of our outstanding common stock. There is presently no public market for our common stock and we plan to apply for quotation of our common stock on the NASD over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. If our shares are publicly traded on the over-the-counter bulletin board, Mr. Gibson will eventually be eligible to sell his shares publicly subject to the volume limitations in Rule 144. The offer or sale of a large number of shares at any price may cause the market price to fall. Sales of substantial amounts of common stock or the perception that such transactions could occur, may materially and adversely affect prevailing markets prices for our common stock.

The mineral exploration business is highly competitive. This industry has a multitude of competitors and no small number of competitors dominates this industry with respect to any of the large volume metallic minerals. Our exploration activities will be focused on attempting to locate commercially viable gold deposits on the Crow Hill claim. Many of our competitors have greater financial resources than us. As a result, we may experience difficulty competing with other businesses when conducting mineral exploration activities on the Crow Hill mineral claim. If we are unable to retain qualified personnel to assist us in conducting mineral exploration activities on the Crow Hill mineral claim if a commercially viable deposit is found to exist, we may be unable to enter into production and achieve profitable operations.

Even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. These factors could inhibit our ability to sell minerals in the event that commercial amounts of minerals are found.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. Currently, we have not experienced any difficulty with compliance of any laws or regulations which affect our business. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business, prevent us from carrying out our exploration program, and make compliance with new regulations unduly burdensome.

We are unaware of any outstanding native land claims on the Crow Hill mineral claim. Notwithstanding, it is possible that a native land claim could be made in the future. The federal and provincial government policy is at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. In the event that we encounter a situation where a native person or group claims an interest in the Crow Hill mineral claim, we may be unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we may have in this claim. The Supreme Court of Canada recently ruled that both the federal and provincial governments in Canada are now obliged to negotiate these matters in good faith with native groups and at no cost to us. Notwithstanding, the costs and/or losses could be greater than our financial capacity and our business would fail.

The land covered by the Cow Hill mineral claim is owned by the Government of Newfoundland and Labrador. The availability to conduct an exploratory program on the Crow Hill mineral claim is subject to the consent of the Government of Newfoundland and Labrador.

In order to keep the Crow Hill mineral claims in good standing with the Government of Newfoundland and Labrador, the Government of Newfoundland and Labrador requires that before the expiry dates of the mineral claim that exploration work on the mineral claim valued at an amount stipulated by the government be completed together with the payment of a filing fee or payment to the Government of Newfoundland and Labrador in lieu of completing exploration work. In the event that these conditions are not satisfied prior to the expiry dates of the mineral claim, we will lose our interest in the mineral claim and the mineral claim then become available again to any party that wishes to stake an interest in these claims. In the event that either we are

ejected from the land or our mineral claims expire, we will lose all interest that we have in the Crow Hill mineral claim.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

A market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the NASD over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board, or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

The selling shareholders are offering 1,723,450 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of

common stock covered by this prospectus represent 34.24% of the common shares outstanding as of the date of this prospectus.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required order to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 or 60 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

All shares being offered will be sold by existing shareholders without our involvement, consequently the actual price of the stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price will thus be determined by market factors and the independent decisions of the selling shareholders.

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

The selling shareholders named in this prospectus are offering all of the 1,723,450 shares of common stock offered through this prospectus. All of the shares were acquired from us by the selling shareholders in offerings that were exempt from registration pursuant to Rule 903(C)(3) of Regulation S of the Securities Act of 1933. The selling shareholders purchased their shares in two offerings completed on November 9, 2007 and November 27, 2007, respectively.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of December 31, 2006 including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The

percentages are based on 5,033,450 shares of common stock outstanding on December 31, 2007.

| Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Jane Brann 111 Sunmount Bay, SE Calgary, AB T2X 2N1 | 40,000 | 40,000 | zero | zero |

Jennifer Schaffer 167 Sunmount Bay, SE Calgary, AB T2X 2N2 | 40,000 | 40,000 | zero | zero |

Fred Gowland 2625 Westside Drive Lethbridge, AB T1J 4N1 | 150,000 | 150,000 | zero | zero |

Robert Chambers 90 Iroquois Cr. W. Lethbridge, AB T1K 5J4 | 150,000 | 150,000 | zero | zero |

Joyce Chambers 90 Iroquois Cr. W. Lethbridge, AB T1K 5J4 | 65,000 | 65,000 | zero | zero |

Don Dormer 829 27 Street, N Lethbridge, AB T1H 3X7 | 150,000 | 150,000 | zero | zero |

Mark Devine 10720 Maplecrest Road, SE Calgary, AB T2J 1X9 | 40,000 | 40,000 | zero | zero |

Brent Anderson 107 Algonquin Road, N Lethbridge, AB T1K 5B3 | 150,000 | 150,000 | zero | zero |

Wayne Britton 58 Heritage Close Lethbridge, AB T1K 6S1 | 120,000 | 120,000 | zero | zero |

Jon Geske 93 Simon Fraser Blvd. Lethbridge, AB T1K 4R2 | 120,000 | 120,000 | zero | zero |

Dean Sawa 1105 41st Avenue, N Lethbridge, AB T1H 6B8 | 120,000 | 120,000 | zero | zero |

Len Besaw 2022 - 21 Avenue, N Lethbridge, AB T1H 4G6 | 90,000 | 90,000 | zero | zero |

John Grieve 24 Heritage Point, W Lethbridge, AB T1K 7B7 | 90,000 | 90,000 | zero | zero |

Dave Harper PO Box 851 Vulcan, AB T0L 2B0 | 90,000 | 90,000 | zero | zero |

Wayne Williams 442 - 100 2 Avenue, S Lethbridge, AB T1J 0B5 | 65,000 | 65,000 | zero | zero |

Stu Sinclair 161 Covemeadow Crt., NE Calgary, AB T3K 6H1 | 65,000 | 65,000 | zero | zero |

Danielle Sinclair 161 Covemeadow Crt., NE Calgary, AB T3K 6H1 | 65,000 | 65,000 | zero | zero |

Glenys Williams 6627 54 Avenue, NW Calgary, AB T3B 3N4 | 40,000 | 40,000 | zero | zero |

Leanne Robertshaw 5119 Norris Road, NW Calgary, AB T2K 5R6 | 9,500 | 9,500 | zero | zero |

John Pearce 39 Rose Tree Road, NW Calgary, AB T2K 1M8 | 8,000 | 8,000 | zero | zero |

Vanessa Sikora 9129 21 Street, SE Calgary, AB T2C 3Z4 | 6,500 | 6,500 | zero | zero |

Doug Nelson 1212 Lake Fraser Gr. SE Calgary, AB T2J 7H6 | 8,800 | 8,800 | zero | zero |

Doris Nelson 1212 Lake Fraser Gr. SE Calgary, AB T2J 7H6 | 6,900 | 6,900 | zero | zero |

Bonnie Poettcker 29 Silverado Creek Cres., SW Calgary, AB T2X 0C6 | 5,400 | 5,400 | zero | zero |

Chantelle Rauda 88 Stafford Blvd. N Lethbridge, AB T1H 6E3 | 8,650 | 8,650 | zero | zero |

Jose Rauda 88 Stafford Blvd. N Lethbridge, AB T1H 6E3 | 7,500 | 7,500 | zero | zero |

Don Maclean Box 2042 Fort Macleod, AB T0L 0X0 | 5,500 | 5,500 | zero | zero |

Paul Elser 27 Heritage Green, W Lethbridge, AB T1K 7Z7 | 5,500 | 5,500 | zero | zero |

None of the selling shareholders: (1) has had a material relationship with us other than as a shareholder at any time within the past three years; or (2) has ever been one of our officers or directors.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | on such public markets or exchanges as the common stock may from time to time be trading; |

| 2. | in privately negotiated transactions; |

| 3. | through the writing of options on the common stock; |

| 5. | in any combination of these methods of distribution. |

The sales price to the public is fixed at $0.10 per share until such time as the shares of our common stock become traded on the NASD Over-The-Counter Bulletin Board or another exchange. Although we intend to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. the market price of our common stock prevailing at the time of sale;

2. a price related to such prevailing market price of our common stock, or;

3. such other price as the selling shareholders determine from time to time.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. not engage in any stabilization activities in connection with our common stock;

2. furnish each broker or dealer through which common stock may be offered, such copies of this

prospectus, as amended from time to time, as may be required by such broker or dealer; and;

3. not bid for or purchase any of our securities or attempt to induce any person to purchase any of

our securities other than as permitted under the Securities Exchange Act.

Common Stock

We have 65,000,000 common shares with a par value of $0.001 per share of common stock authorized, of which 5,033,450 shares were outstanding as of March 31, 2008.

Voting Rights

Holders of common stock have the right to cast one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy, on all matters submitted to a vote of holders of common stock, including the election of directors. There is no right to cumulative voting in the election of directors. Except where a greater requirement is provided by statute or by the Articles of Incorporation, or by the Bylaws, the presence, in person or by proxy duly authorized, of the holder or holders of a majority of the outstanding shares of the our common voting stock shall constitute a quorum for the transaction of business. The vote by the holders of a majority of such outstanding shares is also required to effect certain fundamental corporate changes such as liquidation, merger or amendment of the Company's Articles of Incorporation.

Dividends

There are no restrictions in our articles of incorporation or bylaws that restrict us from declaring dividends. The Delaware General Corporation Law (the “DGCL”) provides that a corporation may pay dividends out of surplus, out the corporation's net profits for the preceding fiscal year, or both provided that there remains in the stated capital account an amount equal to the par value represented by all shares of the corporation's stock raving a distribution preference.

We have not declared any dividends, and we do not plan to declare any dividends in the foreseeable future.

Pre-emptive Rights

Holders of common stock are not entitled to pre-emptive or subscription or conversion rights, and there are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of common stock are, and the shares of common stock offered hereby will be when issued, fully paid and non-assessable.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Preferred Stock

We have 10,000,000 preferred shares with a par value of $0.001 per share of preferred stock authorized. As of March 3, 2008, no shares of preferred stock had been issued.

Transfer Agent

Our transfer agent is Empire Stock Transfer, located at 2470 St. Rose Pkwy, Suite 304 Henderson, NV 89074. Phone: (702) 818-5898.

Delaware Anti-Takeover Laws

We are subject to the provisions of Section 203 of the DGCL, which applies to "business combinations" such as a merger, asset or stock sale or other transaction that result in financial benefit to an "interested stockholder". An "interested stockholder" is a person who, together with affiliates and associates, owns, or within three years prior, did own, 15% or more of a corporation's outstanding voting stock. Section 203 generally prohibits a publicly held Delaware corporation from engaging in a "business combination" with an "interested stockholder" for a period of three years following the time that the stockholder became an interested stockholder, unless:

| · | prior to entering into the business combination,, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder; |

| · | upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding, those shares owned by persons who are directors and also officers, and employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| · | on or subsequent to that time, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder. |

This provision may have the effect of delaying, deterring or preventing a change in control over us without further actions by our stockholders.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

David S. Jennings, Esq., our independent legal counsel, has provided an opinion on the validity of our common stock.

Moore & Associates, Chtd., Certified Public Accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Moore & Associates, Chtd. has presented their report with respect to our audited financial statements. The report of Moore & Associates, Chtd. is included in reliance upon their authority as experts in accounting and auditing.

Richard A. Jeanne, Consulting Geologist has provided a geological evaluation report on the “Crow Hill” mineral property. He was employed on a flat rate consulting fee and he has no interest, nor does he expect any interest in the property or securities of Alba Mineral Exploration, Inc.

In General

We are an exploration stage company that intends to engage in the exploration of mineral properties. We have acquired a mineral claim that we refer to as the Crow Hill mineral claim. Exploration of this mineral claim is required before a final determination as to its viability can be made.

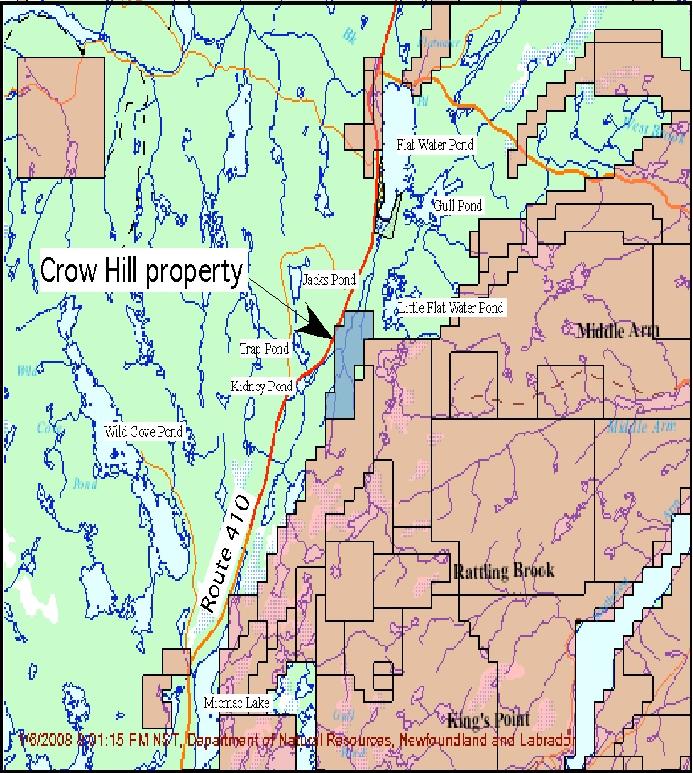

The property is located on the east side of the Baie Verte highway (Route 410) approximately 8 km (about 5 miles) south-southwest of Flat Water Pond on the Baie Verte Peninsula, Newfoundland, Canada. It can be accessed from the Baie Verte highway via secondary roads and several 4x4 tracks.

Our plan of operations is to carry out exploration work on this claim in order to ascertain whether it possesses commercially exploitable quantities of gold and other metals. We will not be able to

determine whether or not the Crow Hill mineral claim contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

Phase I of our exploration program will begin in the Summer of 2008 and will cost approximately $11,290. This phase will consist of a thorough review of the geologic literature, compilation of maps and cross sections pertinent to the Crow Hill property, as well as on-site surface reconnaissance, mapping, sampling, and geochemical analyses. Phase II of our program will consist of on-site trenching, mapping, and sampling, followed by geochemical analyses of the various samples gathered and preparation of a report and data compilation. Phase II of our exploration program will cost approximately $13,290 and will commence in the late Summer or early Fall of 2008. The existence of commercially exploitable mineral deposits in the Crow Hill mineral claim is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Acquisition of the Crow Hill mineral claim.

Through our wholly-owned Canadian subsidiary, Alba Mineral Exploration, Inc., an Alberta corporation, we have acquired a 100% interest in the Crow Hill mineral claim located on the Baie Verte Peninsula on Newfoundland Island, Canada. Our subsidiary’s ownership in the Crow Hill claim was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of Newfoundland and Labrador, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and/or our subsidiary and the Government of Newfoundland and Labrador.

The Crow Hill claim is administered under the Mineral Act of Newfoundland and Labrador. Our interest in the Crow Hill mineral claim will continue for up to twenty years provided that the minimum required expenditures toward exploration work on the claim are made in compliance with the Act. The required amount of expenditures toward exploration work is set by the Province of Newfoundland and Labrador and can be altered in its sole discretion. Currently, the amount required to be expended annually for exploration work within the first year that the mineral claim is acquired is $200 per claim. The required expenditures per claim increase gradually each year up to a maximum of $1,200 per claim for the sixteenth year and beyond. Within 60 days following the anniversary date of the claim, an assessment report on the work performed must be submitted to the Mineral Claims Recorder. Every five years, renewal fee of between $25 and $100 per claim is also required.

We selected the Crow Hill mineral property based upon an independent geological report which was commissioned from Richard A. Jeanne, a Consulting Geologist. Mr. Jeanne recommended an exploration program on this claim which will cost us approximately $24,580.

Description and Location of the Crow Hill mineral claim

The Crow Hill property is located on the Baie Verte Peninsula on Newfoundland Island, Canada. It comprises 575 hectares (1421 acres), approximately centered at latitude 490 42’ 43" North, longitude 560 20’ 25" West (UTM Zone 21, 547565 Easting - 5506598 Northing). It lies within the area covered by NTS map sheet 12H09.

The Government of Newfoundland and Labrador owns the land covered by the Crow Hill mineral claim. Currently, we are not aware of any native land claims that might affect the title to the mineral claim or to Newfoundland and Labrador’s title of the property. Although we are unaware of any situation that would threaten this claim, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. If we should encounter a situation where a native person or group claims and interest in this claim, we may choose to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we hold in this claim.

Geological Exploration Program in General

We have obtained an independent Geological Report and have acquired a 100% ownership interest in the Crow Hill mineral claim. Richard A. Jeanne, Consulting Geologist, has prepared this Geological Report and reviewed all available exploration data completed on this mineral claim.

Mr. Jeanne is a geologist with offices at 3055 Natalie Street, Reno Nevada, 89509. He has a B.S. in Geology from Northern Arizona University and an M.A. in Geology from Boston University with over 27 years experience since graduation. Mr. Jeanne is a Certified Professional Geologist with the American Institute of Professional Geologists (Certificate Number 8397).

The property that is the subject of the Crow Hill mineral claim is undeveloped and does not contain any open-pit or underground mines which can be rehabilitated. There is no commercial production plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. We have not yet commenced the field work phase of our initial exploration program. Exploration is currently in the planning stages. Our exploration program is exploratory in nature and there is no assurance that mineral reserves will be found. The details of the Geological Report are provided below.

Crow Hill Mineral Claim Geological Report, Dated January 9, 2008

A primary purpose of the geological report is to review information, if any, from the previous exploration of the mineral claims and to recommend exploration procedures to establish the feasibility of commercial production project on the mineral claims. The summary report lists results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The summary report also gave conclusions regarding potential mineralization of the mineral claims and recommended a further geological exploration program.

Exploration Potential of the Crow Hill Mineral Claim

The Crow Hill property is located within an area of widespread gold mineralization. Four occurrences of gold have been discovered on the property by previous workers. At the time this previous exploration was conducted, the price of gold was less that US$ 400 per ounce and the grades encountered were not significant enough to justify continued exploration. Today's gold prices exceed US$ 850 per ounce, so many deposits that were sub-economic in the 1980's and 1990's are now being reevaluated.

Much of the area east and south of the Crow Hill property is covered by current claims owned by various competitors. The extent of current exploration activities in the area is unknown to this author. Potential for bonanza grade mineralization being discovered in the region is excellent. The high grade sample that assayed 105.3 g/t Au reported by Noranda-Muscocho joint venture geologists was collected from quartz float on the east side of Micmac Lake, about 20 km south of Crow Hill. The Micmac Lake area is currently covered by a competitor's valid claims.

Gold mineralization has been documented by Noranda-Muscocho geologists on the Crow Hill property. Anomalies revealed by reconnaissance sampling were followed up by trenching and drilling. In the south zone, they recognized a 20 x 70 meter zone of quartz-sericite altered felsic volcanic rocks and a second, parallel zone to the east. Analyses ranged to 1.03 g/t Au from a 12 m channel sample and 1.87 g/t Au over 11.0 m from a diamond drill hole. From one of the trenches, a 1 m interval assayed 6.0 g/t Au and a grab sample yielded 16.0 g/t Au. Samples of mineralized float from the area assayed up to 5.6 g/t Au.

The alteration zone in the northern part of the property, exposed by seven trenches, is up to 20 m wide and has been traced for a strike length of 365 m. In addition to samples collected from the trenches, the zone was tested by two diamond drill holes. Assays from channel samples from the north zone included 2.27 g/t Au over 8.0 m and 1.1 g/t over 10 m. No analytical data from the drilling is reported.

The region is underlain by rocks of the Omineca tectonic belt. West of the claim are the Rossland and Ymir group rocks of Early Jurassic age, and to the east are rocks of the North American Terrane comprised of the Middle Proterozoic Windermere Supergroup and Lower Cambrian Quartzite Range and Reno formations. In the vicinity of the claim, and structurally overlying the Quartzite Range and Reno formations, are rocks of the Kootenay terrane comprised of the Lardeau Group and the Laib and Active formations. The claim itself appears to be underlain by the Active Formation.

Access to the property can be gained by traveling north on highway 410 approximately 25 km from its intersection with Trans-Canada Highway 1 to a secondary road extending eastward toward Middle Arm. At this point, highway 410 crosses two corners of the claim. The secondary road crosses the north central portion of the claim block and 4x4 trails extending north and south from this road provide access to most of the property.

The area typically is blanketed with snow during the winter months but during the remainder of the year the climate is moderate. The property is dotted with numerous ponds, streams and boggy areas.

Groceries and general supplies and services such as restaurants and lodging are available in the town of Baie Verte, about an hour's drive north from the property. A power line parallels Route 410, from which electrical power could probably be obtained if necessary. Naturally occurring surface water for drilling or other exploration needs should be readily available within a short distance from most any location on the property.

The claim is underlain by terrain of modest slopes and relief between the approximate elevations of 150 m and 400 m above sea level. No visit to the property has been made by us or our consulting geologists, so the current extent of vegetative cover is uncertain. Descriptions of the property, however, indicate that it is covered with a dense growth of spruce and balsam fir, with minor birch and aspen.

Recommendations From Our Consulting Geologist

In order to evaluate the exploration potential of the Crow Hill claim, our consulting geologist has recommended a thorough review of the literature of the region to provide background information on the local and regional geology. In addition, our geologist has recommended on site surface reconnaissance, mapping, sampling, and trenching to be followed by geochemical analyses of the samples to be taken. The primary goal of the exploration program is to identify sites for exploratory drilling.

| Exploration Budget | |

| | |

| Phase I | Exploration Expenditure |

| Review of geologic literature, compilation of maps & cross sections | $ | 3,000 |

| | | |

| On site surface reconnaissance, mapping and sampling | $ | 4,200 |

| | | |

| Geochemical Analyses | $ | 1,800 |

| | | |

| Other expenses | $ | 2,290 |

| | | |

| Phase II | | |

| On site trenching, mapping, and sampling | $ | 8,000 |

| | | |

| Geochemical Analyses | $ | 1,800 |

| | | |

| Data compilation and report preparation | $ | 1,200 |

| | | |

| Other expenses | $ | 2,290 |

| | | |

| Total, Phases I and II | $ | 24,580 |

While we have not commenced the field work phase of our initial exploration program, we intend to proceed with the initial exploratory work as recommended. We expect that Phase I will begin in the Summer of 2008, with Phase II to begin in the late Summer or Fall of 2008. Upon our review of the results, we will assess whether the results are sufficiently positive to warrant additional phases of the exploration program. We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. In order to complete significant additional exploration beyond the currently planned Phase I and Phase II, we will need to raise additional capital.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We were incorporated on July 24, 2007 and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Crow Hill mineral claim. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The main agency that governs the exploration of minerals in the Province of Newfoundland and Labrador is the Department of Natural Resources.

The Department of Natural Resources manages the development of Newfoundland and Labrador’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Department regulates and inspects the exploration and mineral production industries in Newfoundland and Labrador to protect workers, the public and the environment.

The material legislation applicable to Alba Mineral Exploration, Inc. is the Mineral Act of Newfoundland and Labrador. Any person who intends to conduct an exploration program on a staked or licensed area must submit prior notice with a detailed description of the activity to the Department of Natural Resources. An exploration program that may result in major ground disturbance or disruption to wildlife or wildlife habitat must have an Exploration Approval from the department before the activity can commence.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy any environmental damage caused such as refilling trenches after sampling or cleaning up fuel spills. Our initial exploration program does not require any reclamation or remediation because of minimal disturbance to the ground. The amount of these costs is not known at this time because we do not know the extent of the exploration program we will undertake, beyond completion of the recommended exploration phase described above, or if we will enter into production on the property. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially-economic deposit is discovered.

Employees

We have no employees as of the date of this prospectus other than our president and CEO, Mr. Gibson. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

Subsidiaries

We plan to conduct our business operations in Canada through our wholly-owned Canadian subsidiary, Alba Mineral Exploration, Inc., an Alberta corporation (“Alba Canada”). Alba Canada, which holds our interest in the Crow Hill mineral claim, was incorporated under the laws of the Province of Alberta on August 26, 2007. Our sole officer and director, Mr. Owen Gibson, also serves as the sole officer and director of Alba Canada.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

The Crow Hill property is located on the Baie Verte Peninsula on Newfoundland Island, Canada. It comprises 575 hectares (1421 acres), approximately centered at latitude 490 42’ 43" North, longitude 560 20’ 25" West (UTM Zone 21, 547565 Easting - 5506598 Northing). It lies within the area covered by NTS map sheet 12H09.

Figure 1. Location map of the Crow Hill property

Figure 2. Claim plan, Crow Hill property, outlined in blue.

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Delaware is Business Filings, Inc., 108 West 13th Street, Wilmington, DE 19801.

No Public Market for Common Stock.

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the NASD over the counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. We can provide no assurance that our shares will be traded on the bulletin board, or if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;(b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;(d) contains a toll-free telephone number for inquiries on disciplinary actions;(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and;(f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with; (a) bid and offer quotations for the penny stock;(b) the compensation of the broker-dealer and its salesperson in the transaction;(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, because our common stock is subject to the penny stock rules, stockholders may have difficulty selling those securities.

Holders of Our Common Stock

Currently, we have thirty-four (34) holders of record of our common stock.

Rule 144 Shares

None of our common stock is currently available for resale to the public under Rule 144.

In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed the greater of:

| 1. | one percent of the number of shares of the company's common stock then outstanding, which, in our case, will equal approximately 80,440 shares as of the date of this prospectus, or; |

| 2. | the average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale. |

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Under Rule 144(k), a person who is not one of the company's affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least two years, is entitled to sell shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

Stock Option Grants

To date, we have not granted any stock options.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

We are paying the expenses of the offering because we seek to: (i) become a reporting company with the Commission under the Securities Exchange Act of 1934; and (ii) enable our common stock to be traded on the NASD over-the-counter bulletin board. We plan to file a Form 8-A registration statement with the Commission to cause us to become a reporting company with the Commission under the 1934 Act. We must be a reporting company under the 1934 Act in order that our common stock is eligible for trading on the NASD over-the-counter bulletin board. We believe that the registration of the resale of shares on behalf of existing shareholders may facilitate the development of a public market in our common stock if our common stock is approved for trading on a recognized market for the trading of securities in the United States.

We consider that the development of a public market for our common stock will make an investment in our common stock more attractive to future investors. In the near future, in order for us to continue with our mineral exploration program, we will need to raise additional capital. We believe that obtaining reporting company status under the 1934 Act and trading on the OTCBB should increase our ability to raise these additional funds from investors.

Index to Financial Statements:

Index to Financial Statements:

1. Audited consolidated financial statements for the fiscal year ended December 31, 2007 including:

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORS

PCAOB REGISTERED

To the Board of Directors

Alba Mineral Exploration Inc.

(A Development Stage Company)

We have audited the accompanying balance sheet of Alba Mineral Exploration Inc. (A Development Stage Company) as of December 31, 2007, and the related statements of operations, stockholders’ equity and cash flows for the period ended December 31, 2007 and since inception on July 24, 2007 through December 31, 2007. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Alba Mineral Exploration Inc. (A Development Stage Company) as of December 31, 2007, and the related statements of operations, stockholders’ equity and cash flows for the period ended December 31, 2007 and since inception on July 24, 2007 through December 31, 2007, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company does not have a consistent source of revenues, which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Moore & Associates, Chartered

Moore & Associates Chartered

Las Vegas, Nevada

March 27, 2008

2675 S. Jones Blvd. Suite 109, Las Vegas, NV 89146 (702) 253-7499 Fax (702) 253-7501

ALBA MINERAL EXPLORATION, INC.(A Development Stage Company)

| ASSETS | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| CURRENT ASSETS | | |

| | | |

| Cash | $ | 34,386 |

| | | |

| Total Current Assets | | 34,386 |

| | | |

| OTHER ASSETS | | |

| | | |

| Mineral properties | | - |

| | | |

| Total Other Assets | | - |

| | | |

| TOTAL ASSETS | $ | 34,386 |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | |

| | | |

| CURRENT LIABILITIES | | |

| | | |

| Accounts payable | $ | - |

| | | |

| Total Current Liabilities | $ | - |

| | | |

| STOCKHOLDERS' EQUITY | | |

| | | |

Common stock; 75,000,000 shares authorized, at $0.001 par value, 5,033,450 shares issued and outstanding | | 5,033 |

| Additional paid-in capital | | 30,312 |

| Deficit accumulated during the exploration stage | $ | (959) |

| | | |

| Total Stockholders' Equity | | 34,386 |

| | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 34,386 |

The accompanying notes are an integral part of these financial statements.

ALBA MINERAL EXPLORATION, INC.(A Development Stage Company)

| | From Inception on July 24, |

| | |

| REVENUES | $ | - |

| | | |

| OPERATING EXPENSES | | |

| | | |

| General and administrative | | 959 |

| | | |

| Total Expenses | | 959 |

| | | |

| LOSS FROM OPERATIONS | | (959) |

| | | |

| NET LOSS | $ | (9590 |

| | | |

| BASIC LOSS PER COMMON SHARE | $ | (0.00) |

| | | |

| | | |

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | | 2,516,725 |

The accompanying notes are an integral part of these financial statements.

ALBA MINERAL EXPLORATION, INC.(A Development Stage Company)

| | Common StockShares Amount | | | | | | |

| | | | | | | | | |

Balance at inception on July 24, 2007 | - | | $ | - | | $ | - | | $ | - | | $ | - |

| | | | | | | | | | | | | | |

Common stock issued for cash at $0.001 per share on September 4, 2007 | 2,400,000 | | | 2,400 | | | - | | | - | | | 2,400 |

| | | | | | | | | | | | | | |

Common stock issued for cash at $0.01 per share on November 9, 2007 | 2,560,000 | | | 2,560 | | | 23,040 | | | - | | | 25,600 |

| | | | | | | | | | | | | | |

Common stock issued for cash at $0.10 per share on November 27, 2007 | 73,450 | | | 73 | | | 7,272 | | | - | | | 7,345 |

| | | | | | | | | | | | | | |

Net loss from inception through December 31, 2007 | - | | | - | | | - | | | (959 | ) | | (959) |

| | | | | | | | | | | | | | |

| Balance, December 31, 2007 | 5,033,450 | | $ | 5,033 | | $ | 30,312 | | $ | (959 | ) | $ | 34,386 |

The accompanying notes are an integral part of these financial statements.

ALBA MINERAL EXPLORATION, INC.

(A Development Stage Company)

| | From Inception on July 24, |

| | |

| CASH FLOWS FROM | |

| OPERATING ACTIVITIES | |

| | |

| Net loss | $ | (959) |

| | | |

| Net Cash Used by | | |

| Operating Activities | | (9590 |

| | | |

| INVESTING ACTIVITIES | | - |

| | | |

| FINANCING ACTIVITIES | | |

| | | |

| Proceeds from issuance of common stock | | 35,345 |

| | | |

| Net Cash Used by | | |

| Financing Activities | | 35,345 |

| | | |

| NET DECREASE IN CASH | | 34,386 |

| | | |

| CASH AT BEGINNING OF PERIOD | | - |

| | | |

| CASH AT END OF PERIOD | $ | 34,386 |

| | | |

| | | |

| SUPPLEMENTAL DISCLOSURES OF | | |

| CASH FLOW INFORMATION | | |

| | | |

| CASH PAID FOR: | | |

| | | |

| Interest | $ | - |

| Income Taxes | $ | - |

The accompanying notes are an integral part of these financial statements.

ALBA MINERAL EXPLORATION, INC.

(A Development Stage Company)

December 31, 2007

NOTE 1 – NATURE OF ORGANIZATION

| a. | Organization and Business Activities |

Alba Mineral Exploration, Inc. (the Company) was organized on July 24, 2007, under the laws of the State of Delaware, having the purpose of engaging in the mineral exploration and development. The Company became qualified in the Province of Alberta Canada on August 26, 2007.

The cost of the property and equipment will be depreciated over the estimated useful life of 5 to 7 years. Depreciation is computed using the straight-line method when assets are placed in service.

The Company’s financial statements are prepared using the accrual method of accounting. The Company has elected a December 31 year-end.

| d. | Cash and Cash Equivalents |

For the purpose of the statements of cash flows, the Company considers all highly liquid investments purchased with a maturity of three months or less to be a cash equivalent.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

The Company recognizes revenue when products are fully delivered or services have been provided and collection is reasonably assured.

The Company has expensed the costs of its incorporation.

ALBA MINERAL EXPLORATION, INC.

(A Development Stage Company)

Notes to Financial Statements

December 31, 2007

NOTE 1 – NATURE OF ORGANIZATION (CONTINUED)

The Company follows the policy of charging the costs of advertising to expense as incurred.

| i. | Concentrations of Risk |