As filed with the Securities and Exchange Commission on June 27, 2008

Registration No. 333-150853

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Forbes Energy Services Ltd. *

Forbes Energy Services LLC*

Forbes Energy Capital Inc. *

(Exact name of registrants as specified in their organizational documents)

| | | | |

| Bermuda | | 98-0581100 | | 1389 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) | | (Primary Standard Industrial Classification Code Number) |

3000 South Business Highway 281

Alice, Texas 78332

(361) 664-0549

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John E. Crisp

Chairman, President and Chief Executive Officer

3000 South Business Highway 281

Alice, Texas 78332

(361) 664-0549

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

R. Clyde Parker, Jr., Esq.

Paul Aubert, Esq.

Winstead PC

1450 Lake Robbins Drive, Suite 600

The Woodlands, Texas 77380

(281) 681-5900

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

| Title of Each Class of Securities to be Registered | | Amount to be

Registered | | Proposed Maximum

Offering Price Per

Unit(1) | | Proposed Maximum

Aggregate Offering Price(1) | | Amount of

Registration Fee(1)(2) |

11% Senior Secured Notes due 2015 | | $205,000,000 | | 100% | | $205,000,000 | | $8,060.00 |

Guarantees of 11% Senior Secured Notes due 2015(3) | | — | | — | | — | | — |

| |

| |

| (1) | Represents the maximum principal amount of 11% Senior Secured Notes due 2015 that may be issued pursuant to the exchange offer described in this registration statement. The registration fee was calculated pursuant to Rule 457(f) under the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(n), no registration fee is required for the guarantees of the notes registered hereby. |

| (3) | The notes being registered will be guaranteed by Forbes Energy Services Ltd., the ultimate parent of the issuers, and all of Forbes Energy Services Ltd.’s existing and future domestic restricted subsidiaries, other than the issuers. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| * | Includes (i) Forbes Energy Services Ltd., a Bermuda corporation that is the ultimate parent of the issuers and other guarantors and also a guarantor of the notes, (ii) Forbes Energy Services LLC, a Delaware limited liability company, and an issuer of the notes and (iii) Forbes Energy Capital Inc., a Delaware corporation, and an issuer of the notes. Also includes existing subsidiaries guaranteeing the notes being registered hereby, which are also registrants. Information about Forbes Energy Services Ltd., Forbes Energy Services LLC and Forbes Energy Capital Inc. and these additional registrants appears on the following page. |

TABLE OF ISSUERS AND SUBSIDIARY GUARANTOR REGISTRANTS

| | | | | | |

(Exact name of Additional Registrant as Specified in its Charter)(1) | | (State or Other

Jurisdiction of

Organization) | | (Primary

Standard

Industrial

Classification

Code Number) | | I.R.S. Employer

Identification Number |

Forbes Energy Services Ltd. (Ultimate parent) | | Bermuda | | 1389 | | 98-0581100 |

Forbes Energy Services LLC (Issuer) | | Delaware | | 1389 | | 26-1686176 |

Forbes Energy Capital Inc. (Issuer) | | Delaware | | 1389 | | 26-1697373 |

C.C. Forbes, LLC | | Delaware | | 1389 | | 16-1685695 |

TX Energy Services, LLC | | Delaware | | 1389 | | 74-2505843 |

Superior Tubing Testers, LLC | | Delaware | | 1389 | | 20-0905969 |

| (1) | The address for parent, each issuer and each subsidiary guarantor registrant is 3000 South Business Highway 281, Alice, Texas, 78332. |

PROSPECTUS

$205,000,000

Forbes Energy Services Ltd.

Forbes Energy Services LLC

Forbes Energy Capital Inc.

Offer to Exchange

11% Senior Secured Exchange Notes due 2015

with

issuance registered under the Securities Act of 1933

for

11% Senior Secured Initial Notes due 2015

The Issuers

We are an independent oilfield services company that provides a broad range of drilling and production related services to oil and natural gas companies. The services we provide are used to help oil and natural gas companies develop and enhance the production of oil and natural gas, and include fluid hauling, fluid disposal, well maintenance, completion services, workovers, recompletions, plugging and abandonment. Our principal offices are located at 3000 South Business Highway 281, Alice, Texas 78332. Forbes Energy Services Ltd. wholly owns Forbes Energy Services LLC and, indirectly, Forbes Energy Capital Inc., which are jointly and severally offering the exchange notes. Forbes Energy Capital Inc., a direct wholly-owned subsidiary of Forbes Energy Services LLC, has only nominal assets, does not conduct any operations and was formed solely to act as co-issuer of the exchange notes.

Terms of The Exchange Offer:

| | • | | On February 12, 2008, we issued $205 million aggregate principal amount of 11% senior secured notes due 2015, or the initial notes, under our indenture governing such initial notes at 97.635% of par. |

| | • | | We are offering to exchange up to $205 million in principal amount of 11% senior secured notes due 2015, or the exchange notes, for our outstanding initial notes. The issuance of such exchange notes has been registered under the Securities Act of 1933, such notes are tradable without restriction under the federal securities laws and have terms that are identical to our initial notes. |

| | • | | We will exchange all initial notes that you validly tender and do not validly withdraw before the exchange offer expires for an equal principal amount of exchange notes. |

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on July 30, 2008, unless extended. We do not currently intend to extend the exchange offer. |

| | • | | Tenders of initial notes may be withdrawn at any time before the expiration of the exchange offer. |

| | • | | The exchange of exchange notes for initial notes will not be a taxable event for U.S. federal income tax purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | Each broker-dealer that receives notes in connection with this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. If a broker-dealer acquired initial notes as a result of market-making or other trading activities, such broker-dealer may use this prospectus, as supplemented or amended, in connection with resales of exchange notes. |

The Exchange Notes Offered Hereby:

Maturity. The exchange notes will mature on February 15, 2015.

Interest. We will pay interest in cash on the principal amount of the exchange notes at an annual rate of 11%. We will make interest payments on the exchange notes semi-annually on February 15 and August 15 of each year, commencing August 15, 2008.

Guarantees. The exchange notes will be fully, unconditionally and irrevocably guaranteed jointly and severally on a senior secured basis by each of our existing and future domestic restricted subsidiaries and any new parent.

Ranking. The exchange notes and the guarantees will rank senior in right of payment to all our existing and future subordinated indebtedness and that of the guarantors, as applicable, and equal in right of payment with all of our other existing and future senior indebtedness and that of the guarantors, as applicable.

Security Interest. The exchange notes and the guarantees will be secured by second priority liens on substantially all of our assets, subject to certain exceptions and permitted liens. Pursuant to the terms of an intercreditor agreement that we are seeking to enter into after the closing of this offering, we expect that such liens will be contractually subordinated to liens thereon that secure a new credit facility and certain other permitted indebtedness. Consequently, we expect that the exchange notes and the guarantees will be effectively subordinated to the new credit facility and such other indebtedness to the extent of the value of such assets.

Optional Redemption. Prior to February 15, 2012, we may redeem some or all of the exchange notes at the make-whole redemption price set forth in this prospectus. On or after February 15, 2012, we may redeem some or all of the exchange notes at a premium that will decrease over time as set forth in this prospectus, plus accrued and unpaid interest to the date of redemption. Prior to February 15, 2011, we may redeem up to 35% of the aggregate principal amount of the exchange notes with the net proceeds of specified equity offerings at a redemption price equal to 111.500% of the principal amount thereof, plus accrued and unpaid interest to the date of redemption, provided that, following such redemption, at least 65% of the aggregate principal amount of the exchange notes originally issued under the indenture remains outstanding.

Change of Control Offer. If we or any new parent experience a change of control, the holders of the exchange notes will have the right to put their exchange notes to us at 101% of their principal amount, plus accrued and unpaid interest, if any.

Asset Sale Offer. Following certain asset sales, we may have to offer to use the proceeds to purchase a portion of the exchange notes at a price in cash equal to 100% of their principal amount, plus accrued and unpaid interest, if any.

Excess Cash Flow Offer. If we have excess cash flow (as defined) for any fiscal year beginning with fiscal 2008, we may have to use 50% of such excess cash flow (with certain adjustments) to repurchase exchange notes put to us by holders of exchange notes at 101% of their principal amount, plus accrued and unpaid interest, if any.

PORTAL. We expect that the exchange notes will be eligible for trading in The PORTAL MarketSM (“PORTAL”), a subsidiary of The Nasdaq Stock Market, Inc.®

See the “Description of Notes” section beginning on page 94 for more information about our notes, including the exchange notes to be issued in this exchange offer.

See the “Risk Factors” section beginning on page 15 for a discussion of factors you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 27, 2008.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission, or the Commission. In making your decision to participate in this exchange offer, you should rely only on the information contained in this prospectus and in the accompanying letter of transmittal. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed after that date.

Unless otherwise indicated, references in this prospectus to “exchange notes” refer to the 11% Senior Secured Notes due 2015 offered by us in this prospectus and issuable in the exchange offer; to “initial notes” refer to those currently outstanding 11% Senior Secured Notes which were originally issued February 12, 2008 and to “notes” refers to both the exchange notes and the initial notes unless stated otherwise herein.

References in this prospectus to “we,” “us,” “our” or the “Company” are to the operating subsidiaries of Forbes Energy Services LLC on a combined basis through December 31, 2007, to Forbes Energy Services LLC and its subsidiaries on a consolidated basis from January 1, 2008, until the Bermuda Reorganization (as defined herein), and to Forbes Energy Services Ltd. and its subsidiaries on a consolidated basis thereafter, in each case after giving effect to the Delaware Reorganization (as defined herein) and the Bermuda Reorganization, unless the context indicates or requires otherwise.

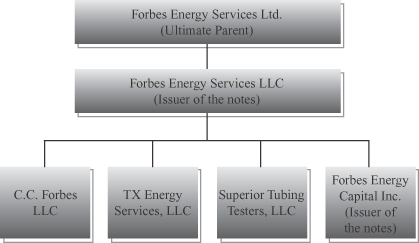

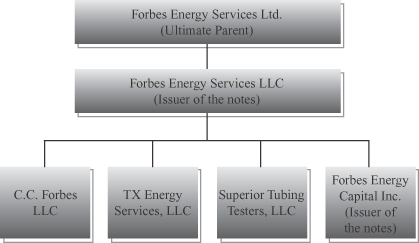

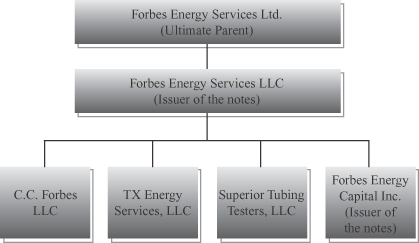

Forbes Energy Services Ltd. is a Bermuda corporation formed to act as the direct holding company of Forbes Energy Services LLC, a Delaware limited liability company. Forbes Energy Services LLC was formed to be the U.S. holding company of the three wholly-owned operating companies that have conducted our business historically. We refer to these three operating subsidiaries, TX Energy Services, LLC, C.C. Forbes, LLC and Superior Tubing Testers, LLC, and their respective predecessor entities, on a combined basis as the “Forbes Group.” Forbes Energy Capital Inc., a Delaware corporation, is a wholly-owned subsidiary of Forbes Energy Services LLC, has only nominal assets, does not conduct any operations and was formed solely to act as co-issuer of the notes. See “Business—Corporate Structure and History.”

References to “any new parent” mean any new parent of Forbes Energy Services LLC that was or is formed after the closing of the offering of the initial notes and becomes the parent of Forbes Energy Services LLC, including Forbes Energy Services Ltd. Forbes Energy Services Ltd. has guaranteed, and any other new parent will be required to guarantee, the notes on a senior secured basis. In addition, any new parent, including Forbes Energy Services Ltd., will be limited in its activities and will be required to join other covenants applicable to Forbes Energy Services LLC and the guarantees pursuant to the indenture. See “Description of Exchange Notes.”

All historical financial statements and other financial data contained in this prospectus as of and for the year ended December 31, 2007 and prior periods are of the Forbes Group on a combined basis, whether identified as such or not. This financial information is presented on a combined basis because the operating subsidiaries were under common management prior to the Delaware Reorganization (as defined herein). Forbes Energy Services LLC reported its financial results on a consolidated basis for the period from January 1, 2008 to May 29, 2008, the effective date of the Bermuda Reorganization. Subsequent to May 29, 2008, Forbes Energy Services Ltd. will report its financial results on a consolidated basis.

The glossary contained in Annex A of this prospectus provides definitions of some oil and natural gas terms used in this prospectus.

i

WHERE YOU CAN FIND MORE INFORMATION

This prospectus includes important business and financial information about us that is not included in or delivered with this prospectus. If we have made references in this prospectus to any contracts, agreements or other documents and also filed any of those contracts, agreements or other documents as exhibits to the registration statement, you should read the relevant exhibit for a more complete understanding of the document or the matter involved.

After the registration statement becomes effective, we will file annual, quarterly and current reports and other information with the Commission. You may read and copy any document we file with the Commission at the Commission’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the public reference room. Our filings with the Commission are also available to the public at the Commission’s website athttp://www.sec.gov.

You may obtain copies of the information and documents incorporated by reference in this prospectus at no charge by writing or telephoning us at the following address or telephone number:

Forbes Energy Services Ltd.

3000 South Business Highway 281

Alice, TX 78332

Attention: Investor Relations

(361) 664-0549

We also maintain an Internet site athttp://www.forbesenergyservices.com. We will, as soon as reasonably practicable after the electronic filing of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports if applicable, make available such reports free of charge on our website.Our website and the information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or registration statement of which this prospectus forms a part, and you should not rely on any such information in making your decision whether to exchange our securities.

To obtain timely delivery of any of our filings, agreements or other documents, you must make your request to us no later than July 25, 2008. In the event that we extend the exchange offer, you must submit your request at least five business days before the expiration date of the exchange offer, as extended. We may extend the exchange offer in our sole discretion. See “The Exchange Offer” for more detailed information.

ii

FORWARD-LOOKING STATEMENTS

This prospectus and any oral statements made in connection with it include certain forward-looking statements within the meaning of the federal securities laws. You can generally identify forward-looking statements by the appearance in such a statement of words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should” or “will” or other comparable words or the negative of these words. When you consider our forward-looking statements, you should keep in mind the risk factors we describe and other cautionary statements we make in this prospectus. Our forward-looking statements are only predictions based on expectations that we believe are reasonable. Our actual results could differ materially from those anticipated in, or implied by, these forward-looking statements as a result of known risks and uncertainties set forth below and elsewhere in this prospectus. These factors include or relate to the following:

| | • | | supply and demand for oilfield services and oil and natural gas industry activity levels; |

| | • | | potential for excess capacity; |

| | • | | substantial capital requirements; |

| | • | | technological obsolescence of operating equipment; |

| | • | | dependence on certain key employees; |

| | • | | concentration of customers; |

| | • | | substantial additional costs of compliance with reporting obligations, including the Sarbanes-Oxley Act; |

| | • | | material weaknesses in internal control over financial reporting; |

| | • | | seasonality of oilfield services activity; |

| | • | | dependence on equipment suppliers not party to written contracts; |

| | • | | collection of accounts receivable; |

| | • | | environmental and other governmental regulation; |

| | • | | risks inherent in our operations; |

| | • | | market response to global demands to curtail the use of oil and natural gas; |

| | • | | conflicts of interest between the principal equity investors and noteholders; |

| | • | | results of legal proceedings; |

| | • | | ability to fully integrate future acquisitions; and |

| | • | | the other factors discussed under “Risk Factors.” |

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent these risks, uncertainties and assumptions give rise to events that vary from our expectations, the forward-looking events discussed in this prospectus may not occur. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

iii

SUMMARY

This prospectus summary highlights selected information contained elsewhere in this prospectus. We urge you to carefully read all of this prospectus, including the combined financial statements and accompanying notes of the Forbes Group, to gain a more complete understanding of our business and the terms of the notes, as well as some of the other considerations that may be important to you, before making your investment decision. You should pay special attention to the “Risk Factors” section of this prospectus to determine whether an investment in the exchange notes is appropriate for you.

Our Company

We are an independent oilfield services contractor that provides a broad range of drilling-related and production-related services to oil and natural gas companies, primarily onshore in Texas. The services we provide are used to help oil and natural gas companies develop and enhance the production of oil and natural gas, and include fluid hauling, fluid disposal, well maintenance, completion services, workovers and recompletions, plugging and abandonment, and tubing testing. We believe that we operate one of the youngest fleets of well servicing rigs, including those commonly referred to as workover rigs, in Texas.

We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers’ wells. We derive a majority of our revenues from services that support production from existing oil and natural gas operations. We believe that demand for these production-related services, which include well servicing and fluid logistics, tends to remain relatively stable and is not highly sensitive to the prices of oil and natural gas, as ongoing maintenance spending is required to sustain production.

Since our inception in September 2003, we have grown organically from a small South Texas operational base with two well servicing rigs and eight vacuum trucks to a major regional provider of an integrated offering of production and well services. We have successfully executed an aggressive organic growth strategy focused on fleet expansion with the construction of new equipment in a segment of the oilfield services industry characterized by an aging fleet. We believe that our new well servicing rigs and equipment, with an average age of less than three years, significantly differentiate us from our competitors.

As of March 31, 2008, we operated from 19 locations across Texas and one location in Mississippi. We currently provide a wide range of services to a diverse group of over 800 companies. Our blue-chip customer base includes ConocoPhillips Company, Apache Corporation, Chesapeake Energy Corporation, Devon Energy Corporation, Dominion Resources, Inc., EOG Resources, Inc., and Penn Virginia Corporation, among others. John E. Crisp and Charles C. Forbes, our senior management team, have cultivated deep and ongoing relationships with these customers over their average of 30 years of experience in the oilfield services industry. For the three months ended March 31, 2008, we generated revenues and EBITDA of approximately $70.5 million and $20.7 million, respectively.

We currently conduct our operations through the following two business segments:

| | • | | Well Servicing. Our well servicing segment accounted for 55.7% of our revenues for the three months ended March 31, 2008. At March 31, 2008, the well servicing segment utilized our fleet of 125 well servicing rigs, which included 118 workover rigs and seven swabbing rigs and related assets and equipment. Since December 31, 2007, we have added 19 workover rigs and one swabbing rig. These assets are used to provide well maintenance, including remedial repairs and removal and replacement of downhole production equipment, well workovers, including significant downhole repairs, re-completions and re-perforations, completion and swabbing activities, and plugging and abandoning services. In addition, we have a fleet of six tubing testing units that are used to conduct pressure testing of oil and natural gas production tubing. |

| | • | | Fluid Logistics. Our fluid logistics segment accounted for 44.3% of our revenues for the three months ended March 31, 2008. The fluid logistics segment utilizes our modern fleet of fluid transport trucks and related assets, including specialized vacuum, high-pressure pump and tank trucks, frac tanks, water wells, proprietary salt water disposal wells and facilities, and related equipment. Since December 31, 2007, we have added 31 vacuum trucks, seven other heavy trucks, and 175 frac tanks. These assets are used to provide, transport, store, and dispose of a variety of drilling and produced fluids used in, and generated by, oil and natural gas production. These services are required in most workover and completion projects and are routinely used in daily producing well operations. |

We believe that our two business segments are complementary and create synergies in terms of selling opportunities. Our multiple lines of service allow us to capitalize on our existing customer base to grow within existing markets, generate more business from existing customers, and increase operating profits. By offering customers the ability to reduce the number of vendors they use, we believe that we help improve our customers’ efficiency. This is demonstrated by the fact that 85.9% of our revenues for the year ended December 31, 2007, and 80.2% of its revenues for the three months ended March 31, 2008, were from customers that utilized services of both of the business segments. Further, by having multiple service offerings that span the life cycle of the well, we believe that we have a competitive advantage over smaller competitors offering more limited services.

The following table summarizes the major components of our equipment fleet.

| | | | | | | | | | | | |

| | | December 31, | | March 31,

2008 |

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | |

Locations | | 3 | | 4 | | 7 | | 12 | | 18 | | 20 |

| | | | | | |

Well Servicing Segment | | | | | | | | | | | | |

Workover rigs | | 3 | | 11 | | 17 | | 41 | | 95 | | 118 |

Swabbing rigs | | — | | — | | — | | 2 | | 6 | | 7 |

Tubing testing units | | — | | 4 | | 4 | | 4 | | 6 | | 6 |

| | | | | | |

Fluid Logistics Segment | | | | | | | | | | | | |

Vacuum trucks(1) | | 16 | | 26 | | 99 | | 147 | | 205 | | 224 |

High pressure pump trucks | | 2 | | 2 | | 4 | | 7 | | 14 | | 15 |

Other trucks | | 4 | | 6 | | 16 | | 25 | | 43 | | 48 |

Frac tanks(1) | | 32 | | 105 | | 241 | | 568 | | 951 | | 1,096 |

Salt water disposal wells | | 1 | | 4 | | 6 | | 9 | | 14 | | 14 |

| (1) | At March 31, 2008, nine of the vacuum trucks and 134 of the frac tanks were leased. |

Industry Overview

Participants in the upstream oil and natural gas industry in the United States generally fall into one of two categories: (i) oil and natural gas companies and (ii) oilfield services companies. Oil and natural gas companies generally explore for, develop and produce oil and natural gas reserves. Oilfield services companies generally provide equipment, products and services to assist oil and natural gas companies in their efforts to explore for, develop and produce oil and natural gas reserves.

The scope of services provided ranges widely among oilfield services companies, with some companies focusing on the provision of limited services in narrow geographic markets and others providing a broader, integrated range of oilfield services within the continental United States and, in some cases, internationally.

Demand for services offered by the oilfield services industry in the continental United States is generally a function of the willingness of oil and natural gas companies to make operating and capital expenditures to

2

explore for, develop and produce oil and natural gas in the continental United States, which in turn is affected by current and anticipated levels of oil and natural gas demand and prices.

We believe that the following trends in our industry affect our operations:

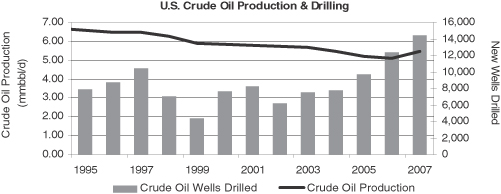

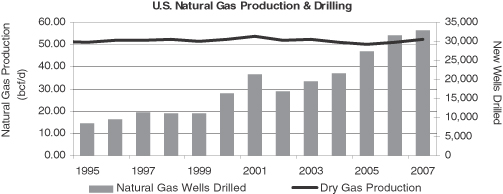

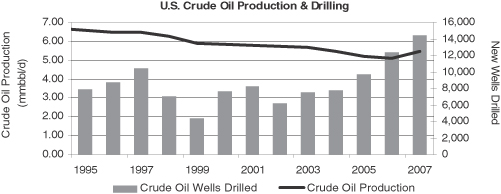

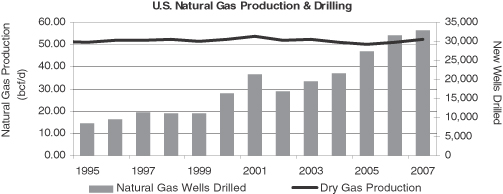

| | • | | High Demand for Oil and Natural Gas in the United States. Demand for oil and natural gas in the United States has increased significantly in recent years and has outpaced domestic supply. From 1990 through 2006, according to the Energy Information Administration, or the EIA, demand for natural gas in the United States grew at an annual rate of 0.8%, while domestic production during the same period increased by only 0.3%. For crude oil during the same time, U.S. demand grew at an annual rate of 0.9% while domestic production declined at an annual rate of 2.3%. This supply and demand imbalance, coupled with perceived geopolitical instability in some oil and natural gas producing regions of the world and limited international supply responses, has resulted in significant increases in exploration and development activities in the United States in recent years. |

| | • | | Need for More Wells Drilled to Achieve Equal Levels of Production. Even though the number of U.S. oil and natural gas wells drilled has increased over the past ten years, corresponding increases in production have not been achieved. The increasing decline rates are likely to result in continued increases in the number of wells drilled. With the increase in the number of wells drilled, we expect that there will be a greater demand for post-drilling service activities, including workover and stimulation services. |

| | • | | Robust Activity in our Core Texas Operating Area. Oil and natural gas industry activity in Texas has increased significantly in recent years. The Baker Hughes active rig count for drilling rigs indicates that in Texas the average number of active land drilling rigs in 2007 was 151% higher than it was in 2000. Texas has nearly 220,000 producing oil and natural gas wells according to the EIA, which is more than any other individual state in the United States. Once initially completed, these wells are typically subjected to a number of workovers throughout their life that are aimed at increasing or maintaining production. |

| | • | | Aging U.S. Workover Rig Fleet. Based on available industry information, we believe that the average age of the workover rigs in the United States is in excess of 20 years. From 2000 to 2007, the average size of the drilling rig fleet in Texas increased by 45%, while the average size of the workover rig fleet decreased 8% as well servicing companies were forced to retire older workover rigs. According to Weatherford International, the total workover rig fleetin Texas for the month of February 2008 numbered approximately 1,299. |

Our Competitive Strengths

We believe that the following competitive strengths position us well within the oilfield services industry:

| | • | | Young and Modern Fleet. We believe we operate one of the youngest and most modern fleets of well servicing rigs among the large well-servicing companies, based on an average age of well servicing rigs. We believe over 80% of the active U.S. well servicing rig fleet was built prior to 1982, resulting in an average age in excess of 20 years. By contrast, approximately 90% of our 125 well servicing rigs at March 31, 2008 were built in the last three years. Many of our customers tell us that a younger and more modern fleet is more attractive to them because newer well servicing rigs require less down time for maintenance and generally are more reliable than older equipment. In addition, we believe that the level of our business is not subject to the same fluctuations as may be experienced by our competitors who operate primarily older equipment because new equipment is typically the first to be deployed and the last to be idled. Also, as part of our strategy, we have undertaken to enhance our design specifications to better address operational and safety issues characteristic of older equipment. |

3

| | • | | Exposure to Revenue Streams Throughout the Life Cycle of the Well. Our maintenance and workover services expose us to demand from our customers throughout the life cycle of a well, from drilling through production and eventual abandonment. Each new well that is drilled provides us a potential multi-year stream of well services revenue, as our customers attempt to maximize and maintain a well’s productivity. Accordingly, demand for our services is generally driven by the total number of producing wells in a region and is generally less volatile than demand for new well drilling services. |

| | • | | High Level of Customer Retention with a Blue Chip Customer Base. Our top customers include many of the largest integrated and independent oil and natural gas companies operating onshore in the United States. We believe we have been successful in growing in our existing markets as well as expanding to new markets with existing customers due to the quality of our well servicing rigs, our personnel and our safety record. For example, members of our senior management have maintained excellent working relationships for the past 20 years with ConocoPhillips, which is currently our largest customer. We believe the complementary nature of our two business segments also helps retain customers because of the efficiency we offer a customer that has multiple needs at the wellsite. Notably, 85.9% of our revenues from the year ended December 31, 2007, and 80.2% of our revenues for the three months ended March 31, 2008, were from customers that utilized services of both of our business segments. |

| | • | | Industry-Leading Safety Record. For 2006, we had approximately 83% fewer incidents than the industry average. Our customers tell us that our safety record and reputation are critical factors to purchasing and operations managers in their decision-making process. Over several years, we have developed a strong safety culture based on our training programs and safety seminars for our employees and customers. For example, for several years, members of our senior management have played an integral part in monthly joint safety training meetings with ConocoPhillips’ personnel. In addition, our purchase and deployment of new well servicing rigs with enhanced safety features has contributed to our strong safety record and reputation. |

| | • | | Experienced Senior Management Team and Operations Staff. Our senior management team of John E. Crisp and Charles C. Forbes have over 63 years of combined experience within the oilfield services industry. In addition, our next level of management, which includes our location managers, has an average of approximately 21 years of experience in the industry. We believe our employee turnover rate is among the lowest in the oilfield services industry due to our younger equipment, strong safety record, ongoing growth opportunities and competitive compensation. |

Our Strategy

Our strategy is to continue to do the following:

| | • | | Invest in New Equipment. We intend to continue to build our fleet organically and maintain one of the youngest fleets in the industry. Our customers tell us that they prefer newer equipment, which is generally safer to operate and has increased capabilities at the wellsite, including less down time and greater operational efficiency. Additionally, employees also prefer to work with new equipment, which allows us to attract and retain the high-quality, experienced personnel that are critical to maintaining customer loyalty. |

| | • | | Focus on Proven and Established Oil and Natural Gas Basins. We focus our operations on customers that operate in well-established basins that have proven production histories and that have remained active throughout various oil and natural gas pricing environments. We believe that this creates a stable revenue stream for us as the production related services we provide our customers are tied more to ongoing production from proven wells and less to exploratory activities driven by near-term fluctuations in oil and natural gas prices. This allows us to maintain high utilization and margins for our fleet of assets. Also, we intend to selectively expand into newer, unconventional resource plays to complement our geographic portfolio by following our customers there. |

4

| | • | | Establish and Maintain Leadership Position in Core Operating Areas. Based on our estimates, we believe that we have a majority market share in well servicing and fluid logistics in South Texas. We strive to establish and maintain market leadership positions within all of our core operating areas. To achieve this goal, we maintain close customer relationships and offer high-quality services and the newest equipment for our customers. In addition, our significant presence in our core operating areas facilitates employee retention and hiring and brand recognition. |

| | • | | Maintain a Disciplined Growth Strategy. We have grown our business by following our customers to new locations which have been in close proximity to our existing locations. In 2007, we expanded from our initial presence in the Cotton Valley with a location in Marshall to Kilgore and Carthage, Texas. We have followed the same strategy in the Permian Basin, where we established an initial presence in Ozona and subsequently expanded to San Angelo, Monahans, Odessa and Big Spring, Texas. We believe that this growth strategy allows us to create synergies in geographic areas and then permits us to expand profitably from those geographic areas in which we have created a critical mass. |

Organizational Structure

The diagram below illustrates our organizational structure at March 31, 2008. Upon completion of the Bermuda Reorganization, Forbes Energy Services LLC became the wholly owned subsidiary of Forbes Energy Services Ltd., a Bermuda corporation.

Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

Recent Developments

From December 31, 2007 through May 31, 2008, we have purchased and taken delivery of 30 workover rigs, including one ultra-deep 1,000 horsepower workover rig, one swabbing rig, 177 frac tanks, 43 vacuum trucks and seven other heavy trucks for an aggregate purchase price of approximately $64.0 million.

On January 1, 2008, Forbes Energy Services LLC became the holding company of our three operating subsidiaries, C.C. Forbes, LLC, TX Energy Services, LLC, and Superior Tubing Testers, LLC, through a

5

reorganization agreement, referred to herein as the “Delaware Reorganization,” pursuant to which the equity owners of each of the three operating subsidiaries became the equity owners of Forbes Energy Services LLC in exchange for all of their equity interests in the three operating subsidiaries. See “Business—Reorganizations” for a complete description.

On February 12, 2008, Forbes Energy Services LLC and Forbes Energy Capital Inc. completed the offering of the initial notes in a private placement transaction, referred to herein as the “Debt Offering.” Forbes Energy Services LLC received net proceeds from such offering of $188.7 million, used a portion of these proceeds to repay all of its then-existing indebtedness, and used the remainder for general corporate purposes. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Debt and Leases—Senior Secured Notes” for a compete description.

On April 10, 2008, we entered into a credit agreement with Citibank, N.A. establishing a $20 million revolving credit facility (the “Credit Facility”).

On May 29, 2008, we completed the Canadian initial public offering and simultaneous U.S. private placement of the common shares of Forbes Energy Services Ltd., referred to herein as the “Equity Offering.” Such common shares are listed on the Toronto Stock Exchange under the symbol “FRB.” In connection with the Equity Offering, we completed our reorganization, referred to herein as the “Bermuda Reorganization,” into Bermuda pursuant to which all of the members of Forbes Energy Services LLC assigned a substantial portion of their equity interests in Forbes Energy Services LLC to Forbes Energy Services Ltd. in exchange for Class B Shares of Forbes Energy Services Ltd. A portion of the proceeds of the Equity Offering was contributed as capital to Forbes Energy Services LLC, which repurchased from its members the remaining equity interests they held in Forbes Energy Services LLC, with the result that Forbes Energy Services LLC became a wholly owned subsidiary of Forbes Energy Services Ltd. See “Business—Reorganizations” for a complete description.

6

SUMMARY OF THE EXCHANGE OFFER

In connection with the offering of the initial notes, we entered into a registration rights agreement with the initial purchaser in the offering of initial notes in which we agreed to complete an exchange offer within 210 days after the date we issued the initial notes, offering holders of initial notes the opportunity to exchange their initial notes for exchange notes in a registered exchange offer under the Securities Act. Holders of initial notes should read the discussion under the headings “Summary of the Terms of the Exchange Notes” beginning on page 10 and “Description of Notes” beginning on page 94 for further information regarding the exchange notes and resales of the exchange notes.

Exchange Offer | We are offering exchange notes in exchange for initial notes. Initial notes may be exchanged only in minimum denominations of $2,000 and integral multiples of $1,000 in excess of $2,000. We will exchange exchange notes for all outstanding initial notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer. |

Expiration Time and Date | The exchange offer will expire at 5:00 p.m., New York City time, on July 30, 2008, unless we decide to extend it. No extension will continue beyond July 31, 2008. |

Condition to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. A minimum aggregate principal amount of outstanding initial notes being tendered is not a condition to the exchange offer. |

Procedures for Tendering Initial Notes | To participate in the exchange offer, you must follow the procedures established by The Depository Trust Company, or DTC, for tendering the initial notes. These automated tender offer program procedures require that the exchange agent receive, prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer, a computer generated message known as an “agent’s message” that is transmitted through DTC’s automated tender offer program and that DTC confirm that: |

| | • | | DTC has received your instructions to exchange your initial notes, and |

| | • | | you agree to be bound by the terms of the letter of transmittal. |

For more information on tendering your initial notes, please refer to the sections in this prospectus entitled “Exchange Offer—Terms of the Exchange Offer”, and “—Procedures for Tendering.”

Resale of Exchange Notes | Except as provided below, we believe that the exchange notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act provided that: |

| | • | | the exchange notes are being acquired in the ordinary course of business, |

7

| | • | | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the exchange notes issued to you in the exchange offer, |

| | • | | you are not our affiliate, and |

| | • | | you are not a broker-dealer tendering outstanding initial notes acquired directly from us for your account. |

Our belief is based on interpretations by the staff of the Commission, as set forth in no-action letters issued to third parties that are not related to us. The Commission has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the Commission would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any exchange notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives exchange notes for its own account in exchange for outstanding initial notes, where the outstanding initial notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. See “Plan of Distribution.”

Guaranteed Delivery Procedures | None. |

Withdrawal of Tenders | You may withdraw your tender of initial notes at any time prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer, but you must follow the withdrawal procedures described in “Exchange Offer—Withdrawal of Tenders”. |

Acceptance and Delivery | If you fulfill all conditions required for proper acceptance of initial notes, we will accept all initial notes that you properly tender in the exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return to you without expense any initial note that we do not accept for exchange, or with respect to which all conditions for acceptance have not been met, as promptly as practicable after the expiration date. We will deliver the exchange notes as promptly as practicable after the expiration date and acceptance of the initial notes for exchange. |

Fees and Expenses | We will bear all expenses incident to the exchange offer. |

Use of Proceeds | We will not receive any proceeds for the issuance of the exchange notes. We have filed the exchange offer registration statement to meet our obligation under the registration rights agreement. |

8

Failure to Exchange | If you do not exchange your initial notes in this exchange offer, you will no longer be able to require us to register the initial notes under the Securities Act, except in limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the initial notes unless we have registered the initial notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of or in a transaction not subject to the Securities Act. |

Tax Considerations | The exchange of exchange notes for initial notes in the exchange offer should not be a taxable event for U.S. federal income tax purposes. |

Exchange Agent | We have appointed Wells Fargo Bank, National Association as exchange agent for the exchange offer. You should direct questions and requests for assistance, additional copies of this prospectus or the letter of transmittal to the exchange agent addressed as follows: |

By Registered and Certified Mail:

Wells Fargo Bank, N.A.

Corporate Trust Operations

MAC N9303-121

P.O. Box 1517

Minneapolis, MN 55480

By Overnight Courier or Regular Mail:

Wells Fargo Bank, N.A.

Corporate Trust Operations

MAC N9303-121

6th & Marquette Avenue

Minneapolis, MN 55479

By Hand Delivery:

Wells Fargo Bank, N.A.

Corporate Trust Services

608 2nd Avenue South

Northstar East Building—12th Floor

Minneapolis, MN 55402

By Facsimile Transmission:

(612) 667-6282

or

By Telephone:

(800) 344-5128.

9

SUMMARY OF THE TERMS OF THE EXCHANGE NOTES

The exchange notes will be identical to the initial notes except that the issuance of the exchange notes will be registered under the Securities Act and the exchange notes will not have restrictions on transfer under the Securities Act, registration rights or provisions for payment of additional interest. The exchange notes will evidence the same debt as the initial notes, and the same indenture that governs the initial notes will govern the exchange notes offered by this prospectus.

Issuers | Forbes Energy Services LLC, a Delaware limited liability company, and its wholly-owned subsidiary, Forbes Energy Capital Inc., a Delaware corporation, will co-issue the exchange notes on a joint and several basis. References to “we,” “our” and “us” in this “Summary—The Offering” section refer to the co-issuers and not to any of their subsidiaries. Both of these issuers are wholly owned by Forbes Energy Services Ltd., which has fully guaranteed the exchange notes. |

Exchange Notes Offered | $205,000,000 aggregate principal amount of 11% senior secured notes due 2015. |

Interest | The exchange notes will bear interest from the date of issuance of the initial notes at the rate of 11% per year. Interest on the exchange notes will be payable semi-annually in arrears on each February 15 and August 15, commencing August 15, 2008. |

Maturity Date | The exchange notes will mature on February 15, 2015. |

Guarantees | The exchange notes have been unconditionally guaranteed on a senior secured basis by Forbes Energy Services Ltd., have been so guaranteed by each of our existing domestic restricted subsidiaries, other than the issuers, and will be guaranteed by any future domestic subsidiaries and any other new parent. |

Ranking | The exchange notes will: |

| | • | | be our senior secured obligations; |

| | • | | rank equal in right of payment with all of our existing and future senior indebtedness; |

| | • | | rank effectively senior to all of our existing and future unsecured indebtedness to the extent of the value of the assets securing the exchange notes; and |

| | • | | rank senior in right of payment to all of our existing and future subordinated indebtedness. |

The guarantees of each guarantor will:

| | • | | be senior secured obligations of that guarantor; |

| | • | | rank equal in right of payment with all of that guarantor’s existing and future senior indebtedness, including guarantees; |

10

| | • | | rank effectively senior to all of that guarantor’s existing and future unsecured indebtedness to the extent of the value of the assets securing the guarantees; and |

| | • | | rank senior in right of payment to all of that guarantor’s existing and future subordinated indebtedness. |

Effective April 10, 2008, we entered into a new $20.0 million senior secured revolving credit facility with Citibank, N.A. (the “new credit facility”) to fund working capital and for general corporate purposes. See “Description of Certain Indebtedness—New Credit Facility.”

Security Interest | The exchange notes and the guarantees will be secured by second priority liens on substantially all of our assets, subject to certain exceptions and permitted liens. Such liens will be contractually subordinated to first priority liens that secure our new credit facility and certain other permitted indebtedness pursuant to an intercreditor agreement entered into in connection with our new credit facility. The exchange notes and the guarantees will be effectively subordinated to our new credit facility and such other indebtedness to the extent of the value of the assets securing that debt. |

Optional Redemption | We may redeem some or all of the exchange notes at any time prior to February 15, 2012 at the make-whole redemption price set forth in “Description of Exchange Notes.” At any time on and after February 15, 2012, we may redeem the exchange notes, in whole or in part at the redemption prices described in the section “Description of Notes—Optional Redemption—Optional Redemption on or after February 15, 2012,” plus accrued and unpaid interest to the date of redemption. |

In addition, prior to February 15, 2011, we may redeem up to 35% of the exchange notes with the net cash proceeds from specified equity offerings at a redemption price equal to 111.500% of the principal amount, plus accrued and unpaid interest to the date of redemption, so long as at least 65% of the aggregate principal amount of exchange notes issued under the indenture remains outstanding immediately after the redemption. See “Description of Exchange Notes—Optional Redemption—Optional Redemption Upon Equity Offerings.”

Change of Control Offer | If a change of control, as defined in the indenture, occurs, each holder of exchange notes will have the right to require us or any new parent to repurchase all or any part of its exchange notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the date of repurchase. |

Asset Sale Proceeds | If we engage in certain asset sales, within a period of time we generally must use the net cash proceeds from such sales to repay outstanding credit facility debt, to acquire another company in our industry or to invest in our own business, or we must make an offer to purchase a principal amount of the exchange notes equal to the excess |

11

| | net cash proceeds. The purchase price of each note so purchased will be 100% of its principal amount, plus accrued and unpaid interest to the date of purchase. |

Excess Cash Flow Offer | If we have excess cash flow, as defined in the indenture, for any fiscal year beginning with the fiscal year ended 2008, holders of exchange notes may put their exchange notes to us at 101% of their principal amount, plus accrued and unpaid interest, if any, and we will be required to repurchase the exchange notes in an aggregate amount up to 50% of such excess cash flow, less the amount of any open market purchases and redemptions of exchange notes during such year. |

Certain Covenants | The indenture governing the exchange notes will, among other things, limit our ability and the ability of any new parent and our restricted subsidiaries to: |

| | • | | transfer or sell assets; |

| | • | | pay dividends or distributions, redeem subordinated indebtedness, make investments or make other restricted payments; |

| | • | | incur or guarantee additional indebtedness or issue disqualified capital stock; |

| | • | | make capital expenditures that exceed certain amounts; |

| | • | | incur dividend or other payment restrictions affecting certain subsidiaries; |

| | • | | consummate a merger, consolidation or sale of all or substantially all of our assets; |

| | • | | enter into transactions with affiliates; |

| | • | | designate subsidiaries as unrestricted subsidiaries; |

| | • | | engage in a business other than a business that is the same or similar to our current business and reasonably related businesses; and |

| | • | | take or omit to take any actions that would adversely affect or impair in any material respect the collateral securing the exchange notes. |

Market for Exchange Notes | The exchange notes will be transferable without restriction under U.S. federal securities laws, but we can provide no assurance that an active or liquid market will develop or continue for the exchange notes. |

You should refer to “Risk Factors” for an explanation of certain risks of investing in the exchange notes.

12

Summary Historical Financial and Operating Information

The following summary historical financial information has been derived from, and should be read in conjunction with, the audited combined financial statements for the years ended December 31, 2005, 2006 and 2007, the unaudited combined/consolidated financial statements for the three months ended March 31, 2007 and 2008, and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” all included in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended March 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2007 | | | 2008 | |

| | | (dollars in thousands) | |

| | | | | | | | | | | | (unaudited) | | | (unaudited) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Well servicing | | $ | 22,971 | | | $ | 56,728 | | | $ | 101,753 | | | $ | 18,329 | | | $ | 38,754 | |

Fluid logistics | | | 36,799 | | | | 74,141 | | | | 103,405 | | | | 23,290 | | | | 31,239 | |

Other services | | | 1,051 | | | | 1,846 | | | | 1,848 | | | | 433 | | | | 530 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 60,821 | | | | 132,715 | | | | 207,006 | | | | 42,052 | | | | 70,523 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Well servicing | | | 15,696 | | | | 31,472 | | | | 59,515 | | | | 9,662 | | | | 24,085 | |

Fluid logistics | | | 23,684 | | | | 49,620 | | | | 69,887 | | | | 14,926 | | | | 22,295 | |

Other services | | | 650 | | | | 981 | | | | 1,055 | | | | 220 | | | | 320 | |

General and administrative | | | 2,747 | | | | 6,026 | | | | 8,824 | | | | 1,093 | | | | 3,143 | |

Depreciation and amortization | | | 3,771 | | | | 7,410 | | | | 15,342 | | | | 2,708 | | | | 7,122 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 46,548 | | | | 95,509 | | | | 154,623 | | | | 28,609 | | | | 56,965 | |

Operating income | | | 14,273 | | | | 37,206 | | | | 52,383 | | | | 13,443 | | | | 13,558 | |

Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Interest expense | | | (2,182 | ) | | | (5,074 | ) | | | (8,343 | ) | | | (1,777 | ) | | | (5,975 | ) |

Other income (expense) | | | (28 | ) | | | 141 | | | | 237 | | | | (6 | ) | | | 30 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 12,063 | | | | 32,273 | | | | 44,277 | | | | 11,660 | | | | 7,613 | |

Income tax expense(1) | | | — | | | | — | | | | (683 | ) | | | — | | | | (172 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income(2) | | $ | 12,063 | | | $ | 32,273 | | | $ | 43,594 | | | $ | 11,660 | | | $ | 7,441 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratio of earnings to fixed charges | | | 6.4 | | | | 7.1 | | | | 6.1 | | | | 7.3 | | | | 2.3 | |

| | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Well servicing rigs (end of period) | | | 17 | | | | 43 | | | | 101 | | | | 49 | | | | 125 | |

Rig hours | | | 44,086 | | | | 90,941 | | | | 180,700 | | | | 32,955 | | | | 76,993 | |

Heavy trucks(3) (end of period) | | | 119 | | | | 179 | | | | 262 | | | | 191 | | | | 287 | |

Trucking hours | | | 251,511 | | | | 514,082 | | | | 711,171 | | | | 157,022 | | | | 220,847 | |

Salt water disposal wells (end of period) | | | 6 | | | | 9 | | | | 14 | | | | 11 | | | | 14 | |

Locations (end of period) | | | 7 | | | | 12 | | | | 18 | | | | 13 | | | | 20 | |

Frac tanks (end of period) | | | 241 | | | | 568 | | | | 951 | | | | 657 | | | | 1,096 | |

| (1) | Represents Texas margin tax. |

| (2) | Income from continuing operations per share and net income per share are not presented because such information is not relevant for periods prior to completion of the Equity Offering. |

| (3) | Includes vacuum trucks, high-pressure pump trucks, and other heavy trucks. |

13

| | | |

| | | As of March 31,

2008 |

| |

| | | (dollars in thousands) |

| | | (unaudited) |

Balance Sheet Data: | | | |

Cash and cash equivalents | | $ | 10,952 |

Property and equipment, net | | | 262,401 |

Total assets | | | 416,720 |

Total long-term financial liabilities | | | 200,243 |

Members’ equity | | | 165,915 |

Reconciliation of EBITDA to Net Income

EBITDA consists of earnings (net income) before interest, income tax expense, depreciation and amortization. These terms, as we define them, may not be comparable to similarly titled measures employed by other companies and are not measures of performance calculated in accordance with GAAP. EBITDA should not be considered in isolation or as a substitute for operating income, net income or other income or cash flow statement data prepared in accordance with GAAP. We note that the limited liability companies and their predecessor entities that have comprised the Forbes Group historically have not been, and they and Forbes Energy Services LLC will not be, subject to U.S. federal income tax. All of our income, losses, credit, and deductions have been passed through to the equity owners for purposes of their individual income tax returns, which is why these are referred to as “flow through entities” for federal income tax purposes. In 2007, we were subject to the Texas margin tax.

We believe EBITDA is useful to an investor in evaluating our operating performance because it is widely used by investors in our industry to measure a company’s operating performance without regard to items such as interest, depreciation and amortization, which can vary substantially from company to company depending upon accounting methods and book value of assets, capital structure and the method by which assets were acquired. In addition, it helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation) from our operating results.

Our management uses EBITDA for the reasons stated above. In addition, our management uses or expects to use EBITDA in presentations to our Board of Directors to enable them to have the same consistent measurement basis of operating performance used by management; as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations; to assess compliance with financial ratios and covenants included in the indenture governing our notes; and in communications with members, lenders, noteholders, rating agencies and others, concerning our financial performance.

We reconcile in the table below EBITDA to net income, the nearest GAAP equivalent:

| | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | Three Months Ended

March 31, |

| | | 2005 | | 2006 | | 2007 | | 2007 | | 2008 |

| | | (in thousands) |

| | | | | | | | | (unaudited) | | (unaudited) |

Net income | | $ | 12,063 | | $ | 32,273 | | $ | 43,594 | | $ | 11,660 | | $ | 7,441 |

Depreciation and amortization | | | 3,771 | | | 7,410 | | | 15,342 | | | 2,708 | | | 7,122 |

Interest expense | | | 2,182 | | | 5,074 | | | 8,343 | | | 1,777 | | | 5,975 |

Income tax expense(1) | | | — | | | — | | | 683 | | | — | | | 172 |

| | | | | | | | | | | | | | | |

EBITDA | | $ | 18,016 | | $ | 44,757 | | $ | 67,962 | | $ | 16,145 | | $ | 20,710 |

| | | | | | | | | | | | | | | |

| (1) | Represents Texas margin tax. |

14

RISK FACTORS

The following information describes certain significant risks and uncertainties inherent in our business and this offering. You should take these risks into account in evaluating us and in deciding whether to exchange the initial notes for the exchange notes offered hereby. This section does not describe all risks applicable to us, our industry or our business, and it is intended only as a summary of certain material risks. You should carefully consider such risks and uncertainties together with the other information contained in this prospectus. If any of such risks or uncertainties actually occurs, our business, financial condition or operating results could be harmed substantially and could differ materially from the plans and other forward-looking statements included in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Industry Overview” and “Business” and elsewhere in this prospectus.

Risks Relating to Our Business

The industry in which we operate is highly volatile, and there can be no assurance that demand for our services will be maintained at current levels.

The demand, pricing and terms for oilfield services in our existing or future service areas largely depend upon the level of exploration and development activity for both crude oil and natural gas in the United States. Oil and natural gas industry conditions are influenced by numerous factors over which we have no control, including oil and natural gas prices, expectations about future oil and natural gas prices, levels of consumer demand, the cost of exploring for, producing and delivering oil and natural gas, the expected rates of declining current production, the discovery rates of new oil and natural gas reserves, available pipeline and other oil and natural gas transportation capacity, weather conditions, political, regulatory and economic conditions, and the ability of oil and natural gas companies to raise equity capital or debt financing.

The level of activity in the oil and natural gas industry in the United States is volatile. No assurance can be given that currently favorable trends in oil and natural gas exploration and production activities will continue at their current levels. Any prolonged substantial reduction in oil and natural gas prices would likely affect oil and natural gas production levels and therefore affect the demand for drilling and well services by oil and natural gas companies. Any addition to, or elimination or curtailment of, government incentives for companies involved in the exploration for and production of oil and natural gas could have a significant effect on the oilfield services industry in the United States. Lower oil and natural gas prices could also cause our customers to seek to terminate, renegotiate or fail to honor our services contracts, affect the fair market value of our equipment fleet which in turn could trigger a write down of our assets for accounting purposes, affect our ability to retain skilled oilfield services personnel, and affect our ability to obtain access to capital to finance and grow our business. A material decline in crude oil or natural gas prices or industry activity could have a material adverse effect on our business, financial condition, results of operations and cash flows.

There is potential for excess capacity in our industry.

Because oil and natural gas prices and drilling activity have been at historically high levels, oilfield service companies have been acquiring new equipment to meet their customers’ increasing demand for services. If these levels of price and activity do not continue, there is a potential for excess capacity in the oilfield services industry. This could result in increased competition, which could lead to lower prices for and utilization of our services and could adversely affect our business.

The industry in which we operate is highly competitive.

The oilfield services industry is highly competitive and we compete with a substantial number of companies, some of which have greater technical and financial resources. Our four largest competitors are Basic Energy Services, Inc., Complete Production Services, Inc., Key Energy Services Inc. and Nabors Industries Ltd.

15

Our ability to generate revenues and earnings depends primarily upon our ability to win bids in competitive bidding processes and to perform awarded projects within estimated times and costs. There can be no assurance that competitors will not substantially increase the resources devoted to the development and marketing of products and services that compete with ours, or that new or existing competitors will not enter the various markets in which we are active. In certain aspects of our business, we also compete with a number of small and medium-sized companies, that, like us, have certain competitive advantages such as low overhead costs and specialized regional strengths. In addition, reduced levels of activity in the oil and natural gas industry could intensify competition and the pressure on competitive pricing and may result in lower revenues or margins to us.

We anticipate having substantial capital requirements that, if not met, may slow our operations.

Our business strategy is based in part upon the continued expansion of our fleet through the purchase of new well servicing rigs and related equipment. In order to continue to implement our business strategy, we will be required to expend substantial sums for any such purchases. We expect to pay for these capital expenditures through cash flow from operations and borrowings under our new credit facility. To continue to fund future growth and, over the longer term, to remain competitive, we may need to make additional capital expenditures to purchase additional equipment. This may require us to obtain additional financing, some of which may be secured, and/or to raise capital through the sale of additional debt or equity securities. Our ability to obtain financing or to access the capital markets for future offerings may be limited by the restrictive covenants in the indenture, our new revolving credit facility and future debt agreements, by our future financial condition and by adverse market conditions resulting from, among other things, general economic conditions and contingencies and uncertainties beyond our control.

We are subject to the risk of technological obsolescence.

Our ability to maintain our current business and win new business will depend upon continuous improvements in operating equipment, among other things. There can be no assurance that we will be successful in our efforts in this regard or that we will have the resources available to continue to support this need to have our equipment be technologically up to date and competitive. Our failure to do so could have a material adverse effect on us. No assurances can be given that competitors will not achieve technological advantages over us.

We are highly dependent on certain of our officers and key employees.

Our success is dependent upon our key management, technical and field personnel, especially John E. Crisp, our President and Chief Executive Officer, Charles C. Forbes, our Executive Vice President and Chief Operating Officer, and L. Melvin Cooper, our Senior Vice President, Chief Financial Officer and Assistant Secretary. Any loss of the services of any one of such officers or a sufficient number of other employees could have a material adverse effect on our business and operations. Our ability to expand our services is dependent upon our ability to attract and retain additional qualified employees. The ability to secure the services of additional personnel may be constrained in times of strong industry activity.

Our customer base is concentrated within the oil and natural gas production industry and loss of a significant customer could cause our revenue to decline substantially.

We served in excess of 600 customers during the three months ended March 31, 2008. For this same time period, our largest customer comprised approximately 9.9% of our combined revenues, our five largest customers comprised approximately 32.8% of our combined revenues, and our top ten customers comprised approximately 46.9% of our combined revenues. Although we have been continually expanding our market base and adding new customers during the period from inception through 2007, these customers currently represent a large portion of our combined revenues. The loss of our top customer or of several of our top customers would adversely affect our revenues and results of operations. We may be able to replace customers lost with other customers, but there can be no assurance that lost revenues could be replaced in a timely manner, with the same margins or at all.

16

We will incur significant increased costs as a result of being obligated to file reports under the Securities Exchange Act and similar legislation in Canada, and our management will be required to devote substantial time to new compliance initiatives.

In connection with the registration of the exchange offer of exchange notes for the initial notes, we will be required to file reports under the Securities Exchange Act of 1934 with the Securities and Exchange Commission, or the Commission. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the Commission have imposed various requirements on public companies, including the establishment and maintenance of effective disclosure controls and procedures, internal controls and corporate governance practices. Since the completion of the Equity Offering, we are also required to comply with the rules and regulations applicable to public companies in Canada and to file reports with Canadian regulatory commissions and the Toronto Stock Exchange. Accordingly, we will incur significant legal, accounting and other expenses that we did not incur as a private company. Our management and other personnel will need to devote a substantial amount of time and resources to comply with these requirements. These rules and regulations will increase our legal and financial compliance costs.

The Sarbanes-Oxley Act of 2002 requires, among other things, that we maintain effective internal controls for financial reporting and disclosure. In particular, commencing in fiscal 2008, we are performing system and process evaluation and testing of our internal controls over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. Our testing, or the subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses or significant deficiencies in addition to the ones discussed below. We expect to incur significant expense and devote substantial management effort toward ensuring compliance in particular with Section 404. Previously, we did not have an internal finance and accounting staff and hired outside consultants to prepare our financial statements. Subsequently, we have hired a chief financial officer and additional finance and accounting staff. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, if we or our independent registered public accounting firm identifies possible future deficiencies in our internal controls in addition to the ones discussed below that are deemed to be material weaknesses or if we fail to adequately address existing and future deficiencies, we could be subject to sanctions or investigations by the Commission or other regulatory authorities, which would entail expenditure of additional financial and management resources.

We face several risks relating to material weaknesses in our internal controls.

In connection with the preparation of the Forbes Group’s combined financial statements for the years ended December 31, 2005, 2006 and 2007, we identified control deficiencies that constitute material weaknesses in the design and operation of our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The following material weaknesses existed at March 31, 2008:

| | • | | We did not maintain an appropriate accounting and financial reporting organizational structure to support the activities of the Forbes Group. Specifically, we did not maintain a sufficient complement of personnel with an appropriate level of accounting knowledge, experience and training to ensure the proper selection, application and implementation of U.S. GAAP. |