Exhibit 99.1

| | |

For Immediate Release | | NEWS RELEASE Contacts: Gastar Exploration Inc. Michael A. Gerlich, Chief Financial Officer 713-739-1800 / mgerlich@gastar.com Investor Relations Counsel:

Lisa Elliott, Dennard Lascar Investor Relations: 713-529-6600 / lelliott@DennardLascar.com |

Gastar Exploration UPDATES

THIRD Quarter and Full year 2017 Production GUIDANCE

HOUSTON, October 11, 2017 - Gastar Exploration Inc. (NYSE MKT: GST) (“Gastar” or the “Company”) today updated its guidance for third quarter and full year 2017 production.

Gastar expects to report third quarter 2017 production in the range of 6,100-6,300 barrels of oil equivalent (“Boe”) per day (“Boe/d”), down from prior disclosed guidance of 6,300-6,800 Boe/d, and full year 2017 production in the range of 6,000-6,400 Boe/d, down from prior disclosed guidance of 6,200-6,800 Boe/d, with no change in liquids percentage guidance for either period. The change in production guidance is the result of operational challenges that Gastar believes have been resolved.

J. Russell Porter, Gastar's President and CEO, commented, “We continue to be pleased with recent results that our new COO and his team have produced and look forward to a more comprehensive operational update on our third quarter earnings call.”

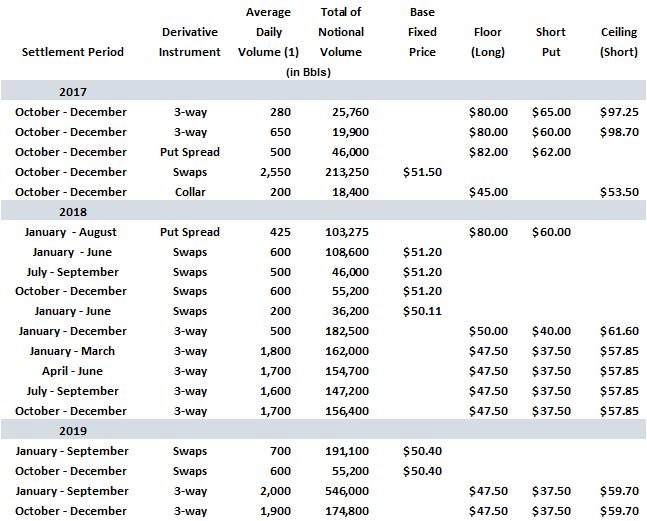

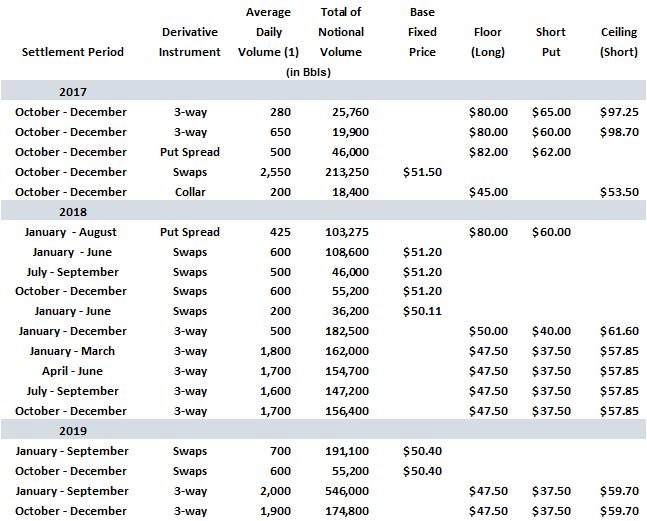

Hedging Activity

Over the last month, Gastar has continued to add to its crude oil hedge position through year-end 2017 and 2018. As of September 30, 2017, the following crude derivative transactions were outstanding with the associated notional volumes and weighted average underlying hedge prices:

___________________________

(1) | Crude volumes hedged include oil, condensate, and certain components of NGLs production. |

There were no recent changes in the Company’s gas hedging positions.

About Gastar Exploration

Gastar Exploration Inc. is a pure play Mid-Continent independent energy company engaged in the exploration, development and production of oil, condensate, natural gas and natural gas liquids. Gastar’s principal business activities include the identification, acquisition and subsequent exploration and development of oil and natural gas properties with an emphasis on unconventional reserves, such as shale resource plays. Gastar holds a concentrated acreage position in what is believed to be the core of the STACK Play, an area of central Oklahoma which is home to multiple oil and natural gas-rich reservoirs including the Meramec, Oswego, Osage, Woodford and Hunton formations. For more information, visit Gastar's website at www.gastar.com.

Forward Looking Statements

This news release includes “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking statements include “guidance” and give our current expectations, opinion, belief or forecasts of future events and performance. A statement identified by the use of forward looking words including “may,” “expects,” “projects,” “anticipates,” “plans,” “believes,” “estimate,” “will,” “should,” and certain of the other foregoing statements may be deemed forward-looking statements. Although Gastar believes that the expectations reflected in such forward-looking statements are reasonable, these statements involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or described in this news release. These include risks inherent in natural gas and oil drilling and production activities, including risks with respect to continued low or further declining prices for natural gas and oil that could result in further downward revisions to the value of proved reserves or otherwise cause Gastar to further delay or suspend planned drilling and completion operations or reduce production levels which would adversely impact cash flow; risks relating to the availability of capital to fund drilling operations that can be adversely affected by adverse drilling results, production declines and continued low or further declining prices for natural gas and oil; risks of fire, explosion, blowouts, pipe failure, casing collapse, unusual or unexpected formation pressures, environmental hazards, and other operating and production risks, which may temporarily or permanently reduce production or cause initial production or test results to not be indicative of future well performance or delay the timing of sales or completion of drilling operations; delays in receipt of drilling permits; risks relating to unexpected adverse developments in the status of properties; risks relating to the absence or delay in receipt of government approvals or third-party consents; risks relating to our ability to integrate acquired assets with ours and to realize the anticipated benefits from such acquisitions; and other risks described in Gastar’s Annual Report on Form 10-K and other filings with the SEC, available at the SEC’s website at www.sec.gov. Our actual sales production rates can vary considerably from tested initial production rates depending upon completion and production techniques and our primary areas of operations are subject to natural steep decline rates. By issuing forward looking statements based on current expectations, opinions, views or beliefs, Gastar has no obligation and, except as required by law, is not undertaking any obligation, to update or revise these statements or provide any other information relating to such statements.

Targeted expectations and guidance for the third quarter and full-year of 2017 are based upon the current 2017 planned capital expenditures budget, which may be subject to revision and reevaluation dependent upon future developments, including changes in commodity prices, drilling results, our liquidity position, availability of crews, supplies and production capacity, weather delays and significant changes in drilling costs.

Unless otherwise stated herein, equivalent volumes of production are based upon an energy equivalent ratio of six Mcf of natural gas to each barrel of liquids (oil, condensate and NGLs), which ratio is not reflective of relative value. Our NGLs are sold as part of our wet gas subject to an incremental NGLs pricing formula based upon a percentage of NGLs extracted from our wet gas production. Our reported production volumes reflect incremental post-processing NGLs volumes and residual gas volumes with which we are credited under our sales contracts.

# # #