Exhibit 99.1

UNITED STATES BANKRUPTCY COURT CASE NAME: Gastar Exploration Inc., et al. PETITION DATE: 10/31/2018 CASE NUMBER: 18-36057 DISTRICT OF TEXAS: Southern District of Texas PROPOSED PLAN DATE: 12/31/2018 DIVISION: Houston MONTHLY OPERATING REPORT SUMMARY FOR NOVEMBER 2018 ($ in thousands) NOVEMBER REVENUES (MOR-6) 7,643 0 0 0 0 INCOME BEFORE INT; DEPREC./TAX (MOR-6) (1,145) 0 0 0 0 NET INCOME (LOSS) (MOR-6) (7,806) 0 0 0 0 PAYMENTS TO INSIDERS (MOR-9) 917 0 0 0 0 PAYMENTS TO PROFESSIONALS (MOR-9) 108 0 0 0 0 TOTAL DISBURSEMENTS (MOR-8) 20,487 0 0 0 0 ***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee*** REQUIRED INSURANCE MAINTAINED AS OF SIGNATURE DATE Mantained EXP. DATE CASUALTY YES 11/1/2019 LIABILITY & AUTO YES 11/1/2019 WELL & POLLUTION YES 11/1/2019 D & O YES 12/1/2019 OTHER YES 12/1/2019 Are all accounts receivable being collected within terms? Yes No Are all post-petition liabilities, including taxes, being paid within terms? Yes No Have any pre-petition liabilities been paid? Yes No If so, describe Amounts paid pursuant to First Day Orders. Are all funds received being deposited into DIP bank accounts? Yes No Were any assets disposed of outside the normal course of business? Yes No If so, describe Are all U.S. Trustee Quarterly Fee Payments current? No What is the status of your Plan of Reorganization? The Plan is confirmed. See docket for confirmation order, DKT #282. ATTORNEY NAME: Ross M. Kwasteniet I certify under penalty of perjury that the following complete Monthly Operating FIRM NAME: Kirkland & Ellis LLP consisting of MOR-1 through MOR-9 plus attachments, is true and correct. ADDRESS: 300 North LaSalle SIGNED: _/s/ Michael Gerlich _ 1/4/2019 CITY, STATE, ZIP: Chicago, Illinois 60654 Michael A. Gerlich (Sr. VP and CFO) DATE TELEPHONE/FAX: (312) 862-2000 MOR-1

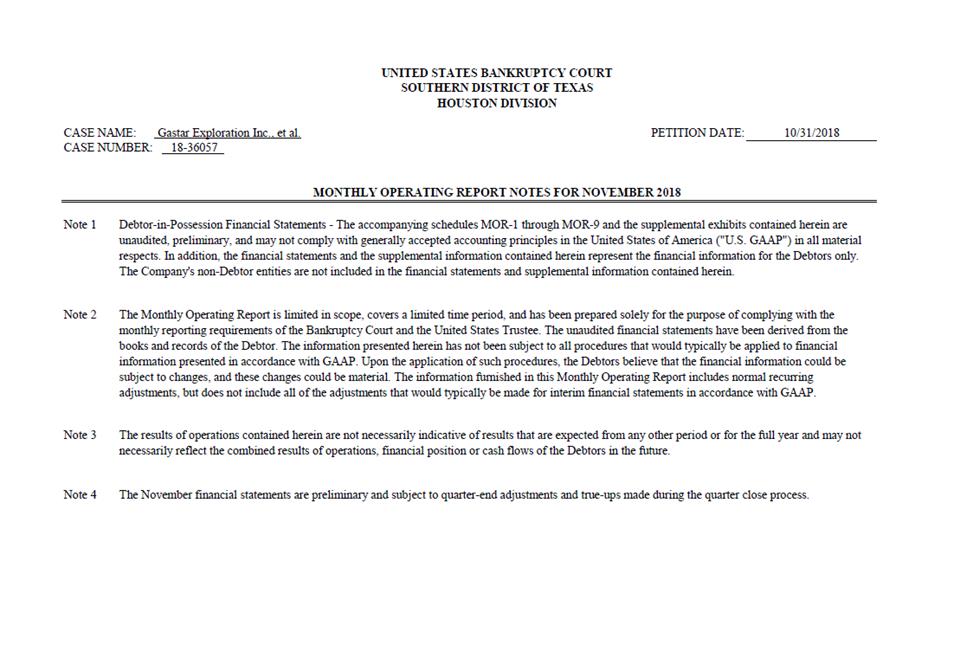

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION CASE NAME: Gastar Exploration Inc., et al. PETITION DATE: 10/31/2018 CASE NUMBER: 18-36057 MONTHLY OPERATING REPORT NOTES FOR NOVEMBER 2018 Note 1 Note 2 Note 3 Note 4 Debtor-in-Possession Financial Statements - The accompanying schedules MOR-1 through MOR-9 and the supplemental exhibits contained herein are unaudited, preliminary, and may not comply with generally accepted accounting principles in the United States of America ("U.S. GAAP") in all material respects. In addition, the financial statements and the supplemental information contained herein represent the financial information for the Debtors only. The Company's non-Debtor entities are not included in the financial statements and supplemental information contained herein. The Monthly Operating Report is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Bankruptcy Court and the United States Trustee. The unaudited financial statements have been derived from the books and records of the Debtor. The information presented herein has not been subject to all procedures that would typically be applied to financial information presented in accordance with GAAP. Upon the application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material. The information furnished in this Monthly Operating Report includes normal recurring adjustments, but does not include all of the adjustments that would typically be made for interim financial statements in accordance with GAAP. The results of operations contained herein are not necessarily indicative of results that are expected from any other period or for the full year and may not necessarily reflect the combined results of operations, financial position or cash flows of the Debtors in the future. The November financial statements are preliminary and subject to quarter-end adjustments and true-ups made during the quarter close process.

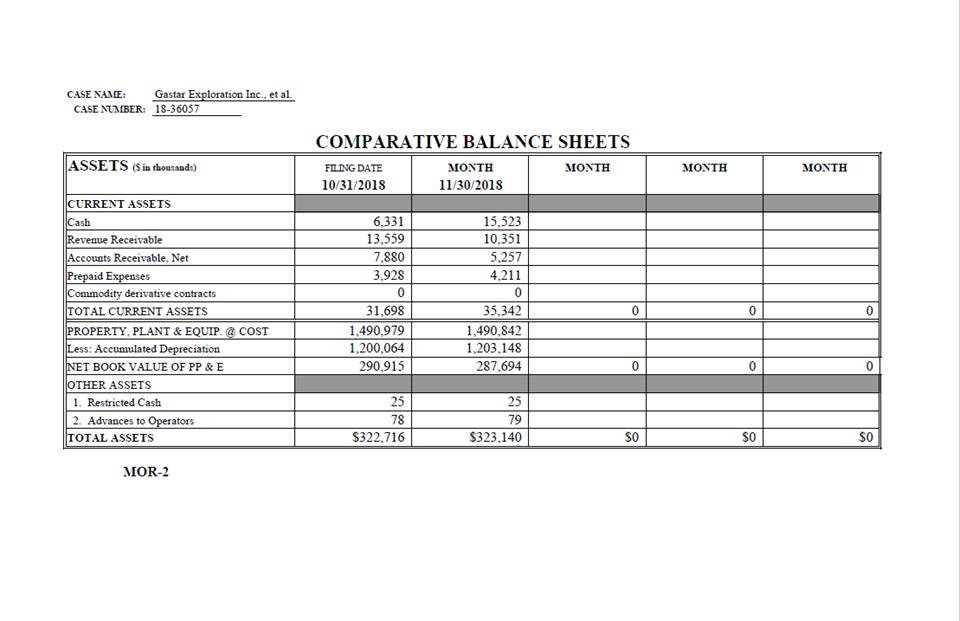

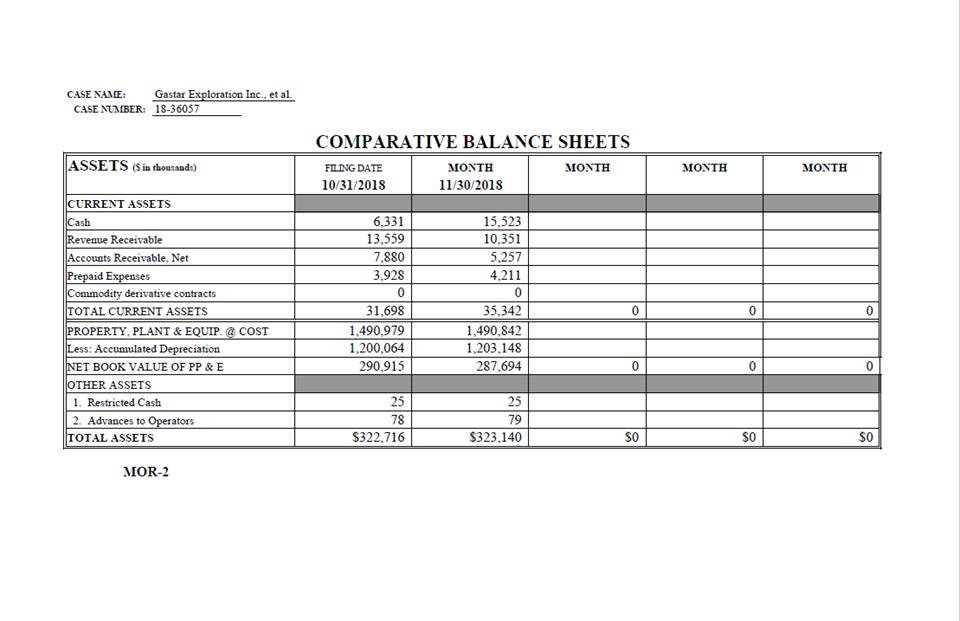

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 COMPARATIVE BALANCE SHEETS ASSETS ($ in thousands) FILING DATE 10/31/2018 MONTH 11/30/2018 MONTH MONTH MONTH CURRENT ASSETS Cash 6,331 15,523 Revenue Receivable 13,559 10,351 Accounts Receivable, Net 7,880 5,257 Prepaid Expenses 3,928 4,211 Commodity derivative contracts 0 0 TOTAL CURRENT ASSETS 31,698 35,342 0 0 0 PROPERTY, PLANT & EQUIP. @ COST 1,490,979 1,490,842 Less: Accumulated Depreciation 1,200,064 1,203,148 NET BOOK VALUE OF PP & E 290,915 287,694 0 0 0 OTHER ASSETS 1. Restricted Cash 25 25 2. Advances to Operators 78 79 TOTAL ASSETS $322,716 $323,140 $0 $0 $0 MOR-2

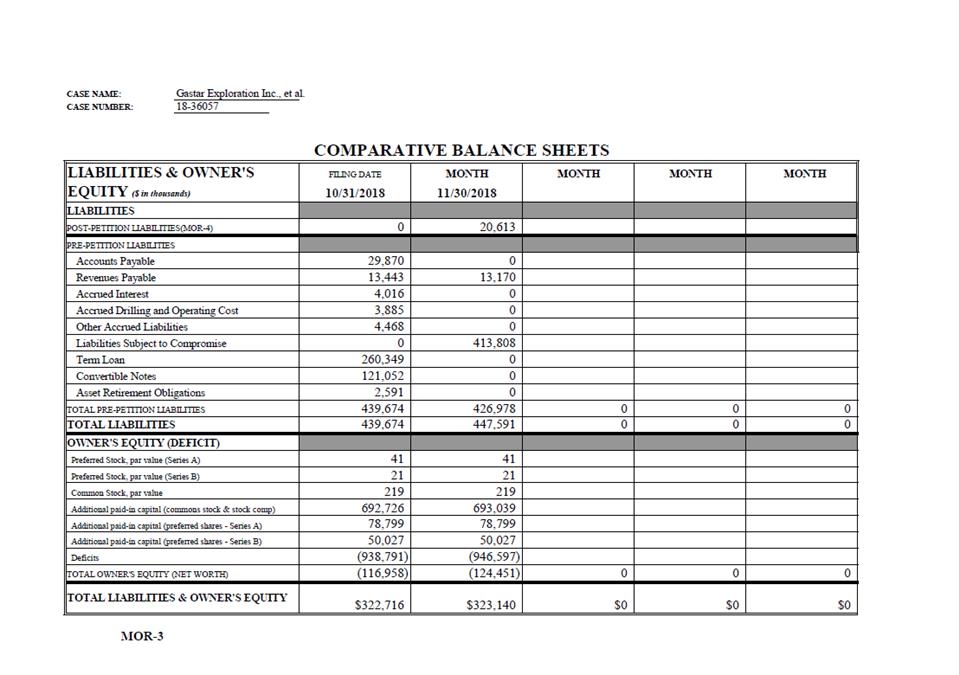

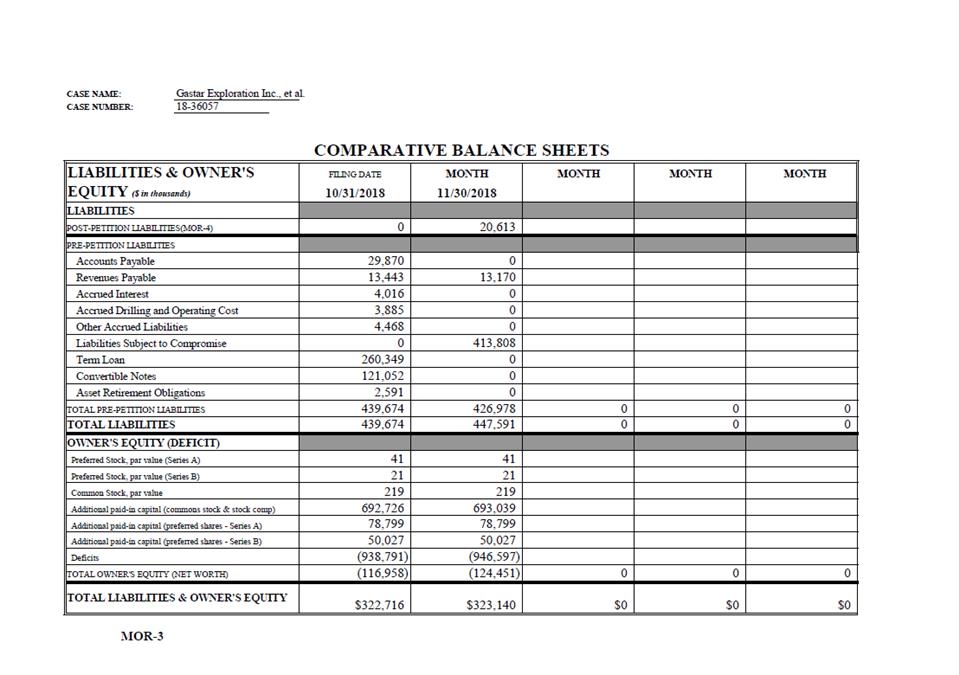

CASE NAME: Gastar Exploration Inc., et al. -------------------- CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 COMPARATIVE BALANCE SHEETS LIABILITIES & OWNER'S EQUITY ($ in thousands) FILING DATE 10/31/2018 MONTH 11/30/2018 MONTH MONTH MONTH LIABILITIES POST-PETITION LIABILITIES(MOR-4) 0 20,613 PRE-PETITION LIABILITIES Accounts Payable 29,870 0 Revenues Payable 13,443 13,170 Accrued Interest 4,016 0 Accrued Drilling and Operating Cost 3,885 0 Other Accrued Liabilities 4,468 0 Liabilities Subject to Compromise 0 413,808 Term Loan 260,349 0 Convertible Notes 121,052 0 Asset Retirement Obligations 2,591 0 TOTAL PRE-PETITION LIABILITIES 439,674 426,978 0 0 0 TOTAL LIABILITIES 439,674 447,591 0 0 0 OWNER'S EQUITY (DEFICIT) Preferred Stock, par value (Series A) 41 41 Preferred Stock, par value (Series B) 21 21 Common Stock, par value 219 219 Additional paid-in capital (commons stock & stock comp) 692,726 693,039 Additional paid-in capital (preferred shares - Series A) 78,799 78,799 Additional paid-in capital (preferred shares - Series B) 50,027 50,027 Deficits (938,791) (946,597) TOTAL OWNER'S EQUITY (NET WORTH) (116,958) (124,451) 0 0 0 TOTAL LIABILITIES & OWNER'S EQUITY $322,716 $323,140 $0 $0 $0 MOR-3

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 SCHEDULE OF POST-PETITION LIABILITIES ($ in thousands) MONTH 11/30/2018 MONTH MONTH MONTH MONTH TRADE ACCOUNTS PAYABLE 1,135 TAX PAYABLE Federal Payroll Taxes State Payroll Taxes Ad Valorem Taxes Other Taxes TOTAL TAXES PAYABLE 0 0 0 0 0 OTHER PAYABLES Revenues Payable TOTAL OTHER PAYABLES 0 0 0 0 0 SECURED DEBT POST-PETITION 12,667 ACCRUED INTEREST PAYABLE 1,047 ACCRUED PROFESSIONAL FEES* 4,694 OTHER ACCRUED LIABILITIES 1. Accrued Drilling and Operating Costs 1,070 TOTAL POST-PETITION LIABILITIES (MOR-3) $20,613 $0 $0 $0 $0 *Payment requires Court Approval MOR-4

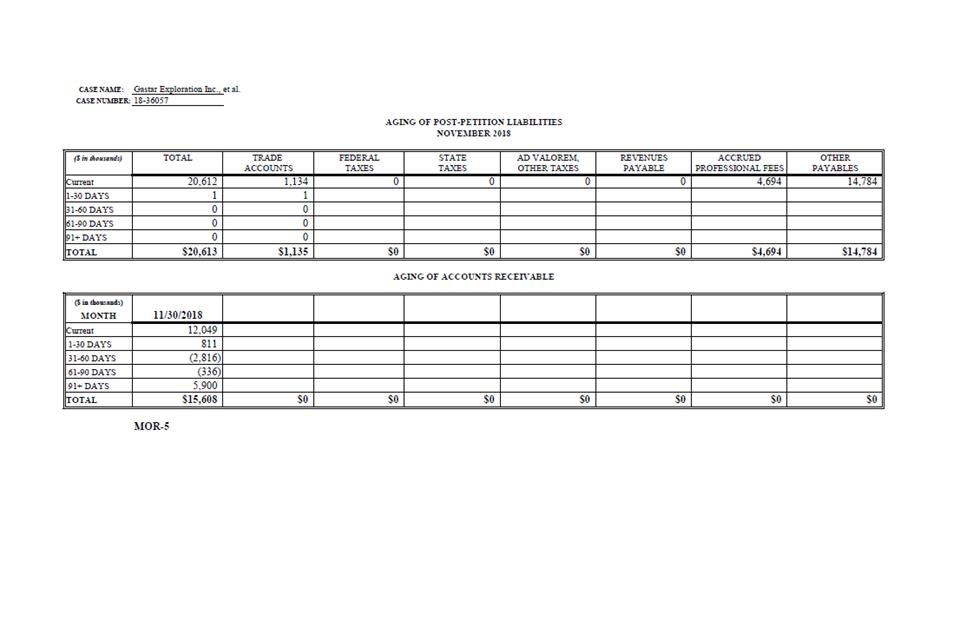

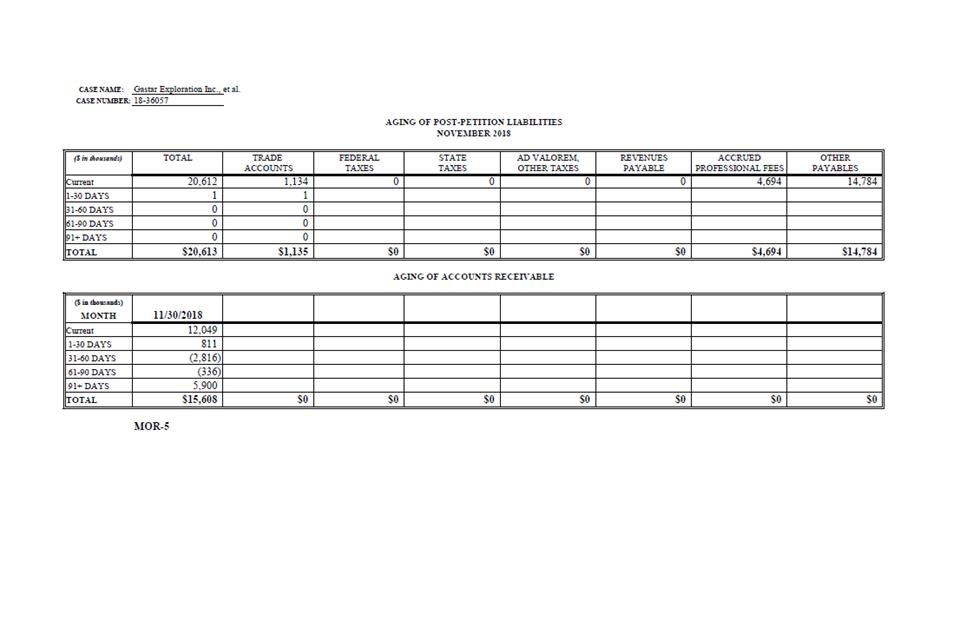

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 AGING OF POST-PETITION LIABILITIES NOVEMBER 2018 ($ in thousands) TOTAL TRADE ACCOUNTS FEDERAL TAXES STATE TAXES AD VALOREM, OTHER TAXES REVENUES PAYABLE ACCRUED PROFESSIONAL FEES OTHER PAYABLES Current 20,612 1,134 0 0 0 0 4,694 14,784 1-30 DAYS 1 1 31-60 DAYS 0 0 61-90 DAYS 0 0 91+ DAYS 0 0 TOTAL $20,613 $1,135 $0 $0 $0 $0 $4,694 $14,784 AGING OF ACCOUNTS RECEIVABLE ($ in thousands) MONTH 11/30/2018 Current 12,049 1-30 DAYS 811 31-60 DAYS (2,816) 61-90 DAYS (336) 91+ DAYS 5,900 TOTAL $15,608 $0 $0 $0 $0 $0 $0 $0 MOR-5

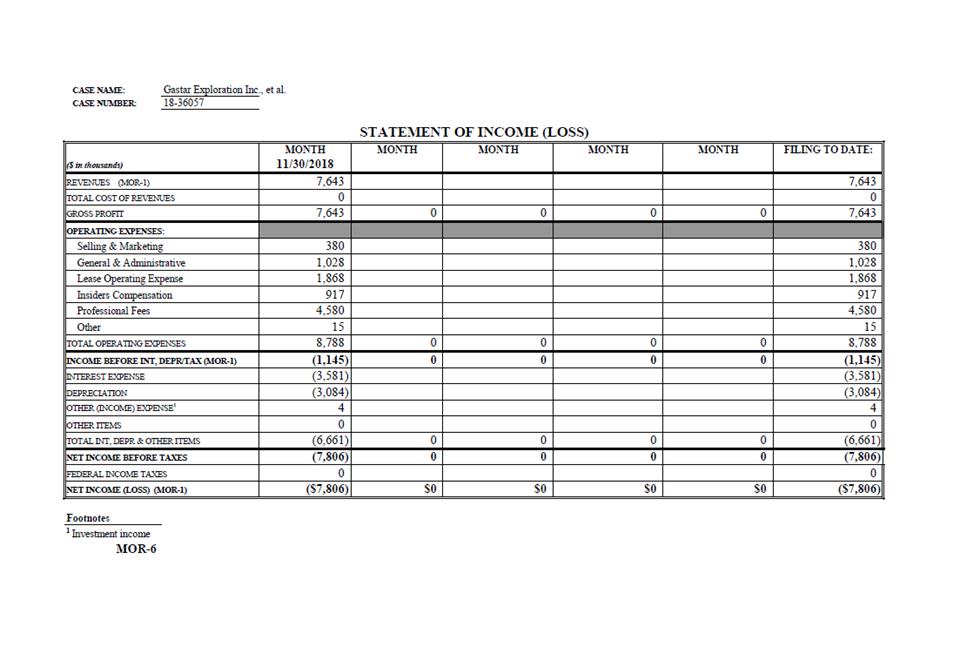

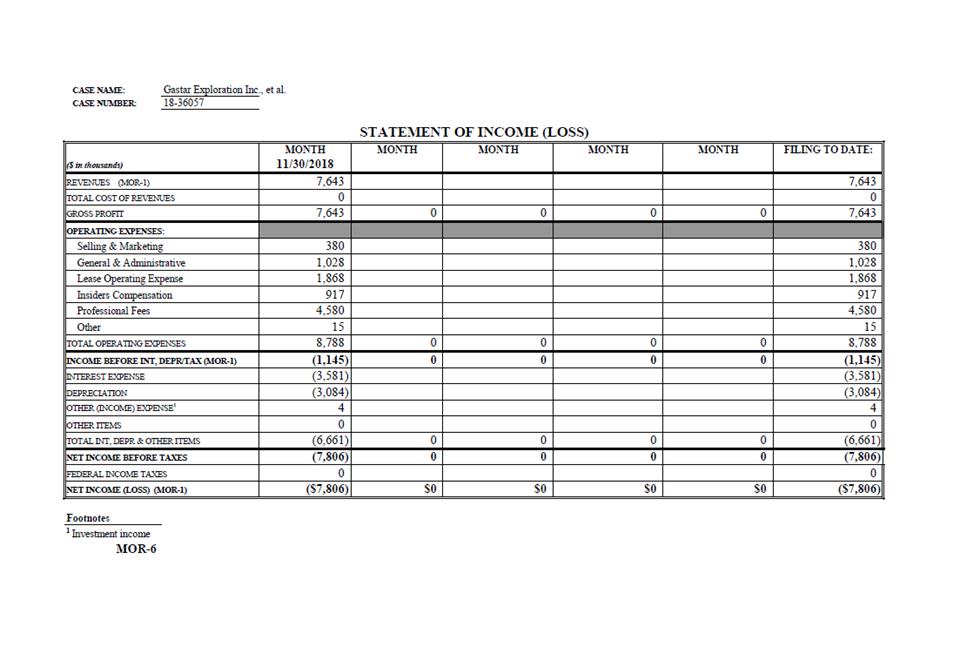

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 STATEMENT OF INCOME (LOSS) ($ in thousands) MONTH 11/30/2018 MONTH MONTH MONTH MONTH FILING TO DATE: REVENUES (MOR-1) 7,643 7,643 TOTAL COST OF REVENUES 0 0 GROSS PROFIT 7,643 0 0 0 0 7,643 OPERATING EXPENSES: Selling & Marketing 380 380 General & Administrative 1,028 1,028 Lease Operating Expense 1,868 1,868 Insiders Compensation 917 917 Professional Fees 4,580 4,580 Other 15 15 TOTAL OPERATING EXPENSES 8,788 0 0 0 0 8,788 INCOME BEFORE INT, DEPR/TAX (MOR-1) (1,145) 0 0 0 0 (1,145) INTEREST EXPENSE (3,581) (3,581) DEPRECIATION (3,084) (3,084) OTHER (INCOME) EXPENSE1 4 4 OTHER ITEMS 0 0 TOTAL INT, DEPR & OTHER ITEMS (6,661) 0 0 0 0 (6,661) NET INCOME BEFORE TAXES (7,806) 0 0 0 0 (7,806) FEDERAL INCOME TAXES 0 0 NET INCOME (LOSS) (MOR-1) ($7,806) $0 $0 $0 $0 ($7,806) Footnotes 1 Investment income MOR-6

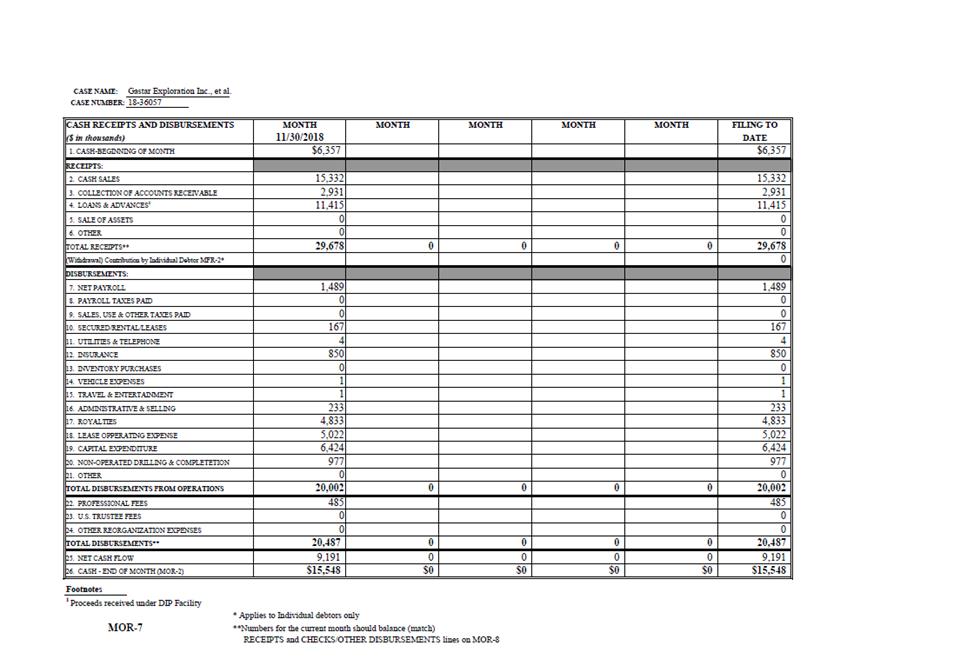

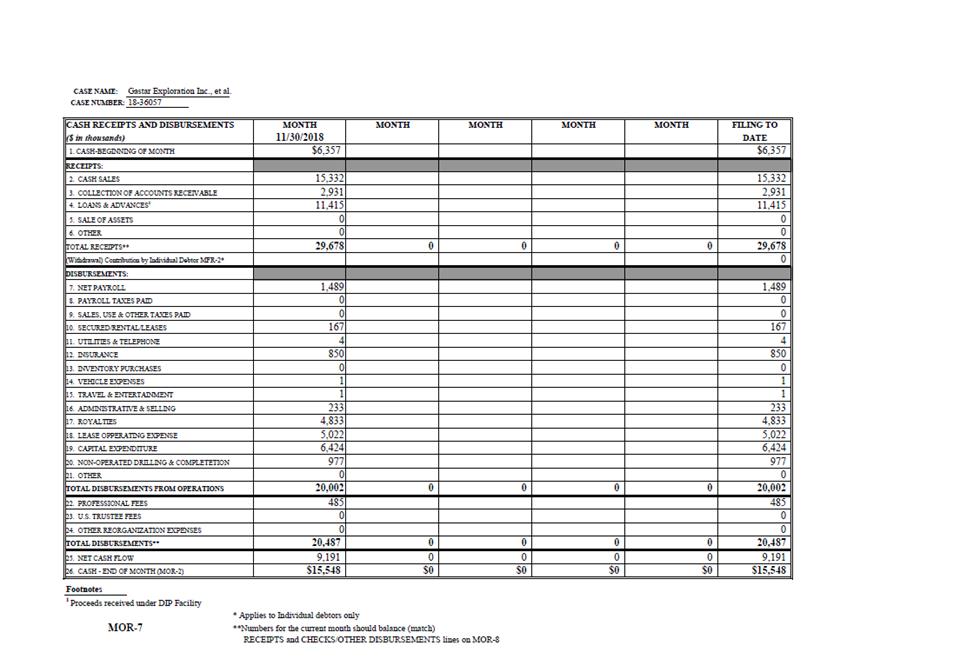

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 CASH RECEIPTS AND DISBURSEMENTS ($ in thousands) MONTH 11/30/2018 MONTH MONTH MONTH MONTH FILING TO DATE 1. CASH-BEGINNING OF MONTH $6,357 $6,357 RECEIPTS: 2. CASH SALES 15,332 15,332 3. COLLECTION OF ACCOUNTS RECEIVABLE 2,931 2,931 4. LOANS & ADVANCES1 11,415 11,415 5. SALE OF ASSETS 0 0 6. OTHER 0 0 TOTAL RECEIPTS** 29,678 0 0 0 0 29,678 (Withdrawal) Contribution by Individual Debtor MFR-2* 0 DISBURSEMENTS: 7. NET PAYROLL 1,489 1,489 8. PAYROLL TAXES PAID 0 0 9. SALES, USE & OTHER TAXES PAID 0 0 10. SECURED/RENTAL/LEASES 167 167 11. UTILITIES & TELEPHONE 4 4 12. INSURANCE 850 850 13. INVENTORY PURCHASES 0 0 14. VEHICLE EXPENSES 1 1 15. TRAVEL & ENTERTAINMENT 1 1 16. ADMINISTRATIVE & SELLING 233 233 17. ROYALTIES 4,833 4,833 18. LEASE OPPERATING EXPENSE 5,022 5,022 19. CAPITAL EXPENDITURE 6,424 6,424 20. NON-OPERATED DRILLING & COMPLETETION 977 977 21. OTHER 0 0 TOTAL DISBURSEMENTS FROM OPERATIONS 20,002 0 0 0 0 20,002 22. PROFESSIONAL FEES 485 485 23. U.S. TRUSTEE FEES 0 0 24. OTHER REORGANIZATION EXPENSES 0 0 TOTAL DISBURSEMENTS** 20,487 0 0 0 0 20,487 25. NET CASH FLOW 9,191 0 0 0 0 9,191 26. CASH - END OF MONTH (MOR-2) $15,548 $0 $0 $0 $0 $15,548 Footnotes 1 Proceeds received under DIP Facility * Applies to Individual debtors only MOR-7 **Numbers for the current month should balance (match) RECEIPTS and CHECKS/OTHER DISBURSEMENTS lines on MOR-8

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 CASH ACCOUNT RECONCILIATION MONTH OF NOVEMBER 2018 BANK NAME Wells Fargo Wells Fargo Wells Fargo Wells Fargo Texas Capital ACCOUNT NUMBER (LAST 4) 6232 8071 1937 7838 2715 ACCOUNT TYPE OPERATING/SWEEP ZBA ROW MONEY MARKET RESTRICTED CASH TOTAL BANK BALANCE ($ in thousands) 23,086 0 30 0 25 $23,141 DEPOSITS IN TRANSIT 0 0 0 0 0 $0 OUTSTANDING CHECKS 0 7,593 0 0 0 $7,593 ADJUSTED BANK BALANCE $23,086 ($7,593) $30 $0 $25 $15,548 BEGINNING CASH - PER BOOKS 13,055 (6,754) 30 0 25 $6,357 RECEIPTS* 29,678 0 0 0 0 $29,678 TRANSFERS BETWEEN ACCOUNTS (15,551) 15,551 0 0 0 $0 (WITHDRAWAL) OR CONTRIBUTION BY INDIVIDUAL DEBTOR MFR-2 0 0 0 0 0 $0 CHECKS/OTHER DISBURSEMENTS* 4,096 16,391 0 0 0 $20,487 ENDING CASH - PER BOOKS $23,086 ($7,593) $30 $0 $25 $15,548 MOR-8 *Numbers should balance (match) TOTAL RECEIPTS and TOTAL DISBURSEMENTS lines on MOR-7

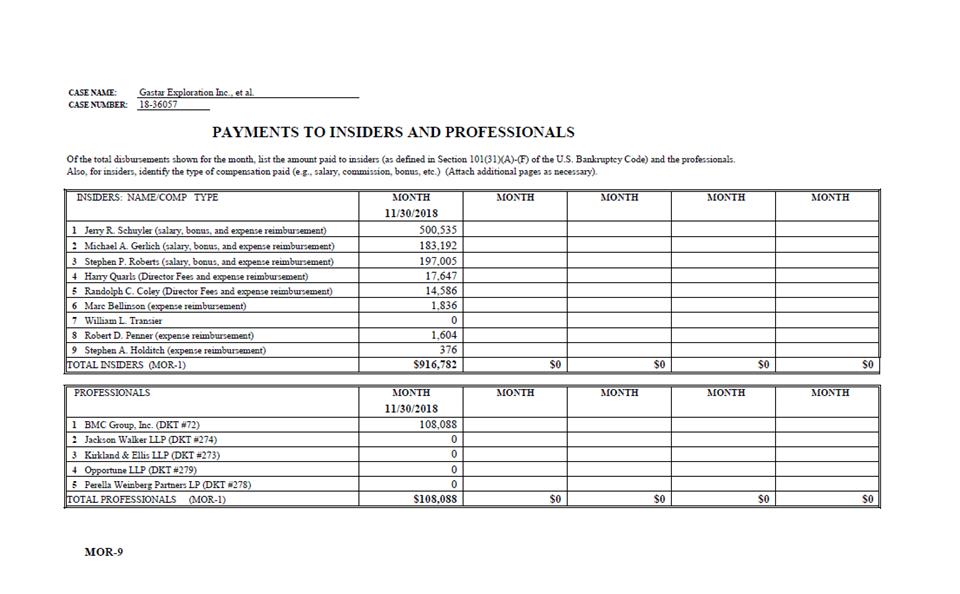

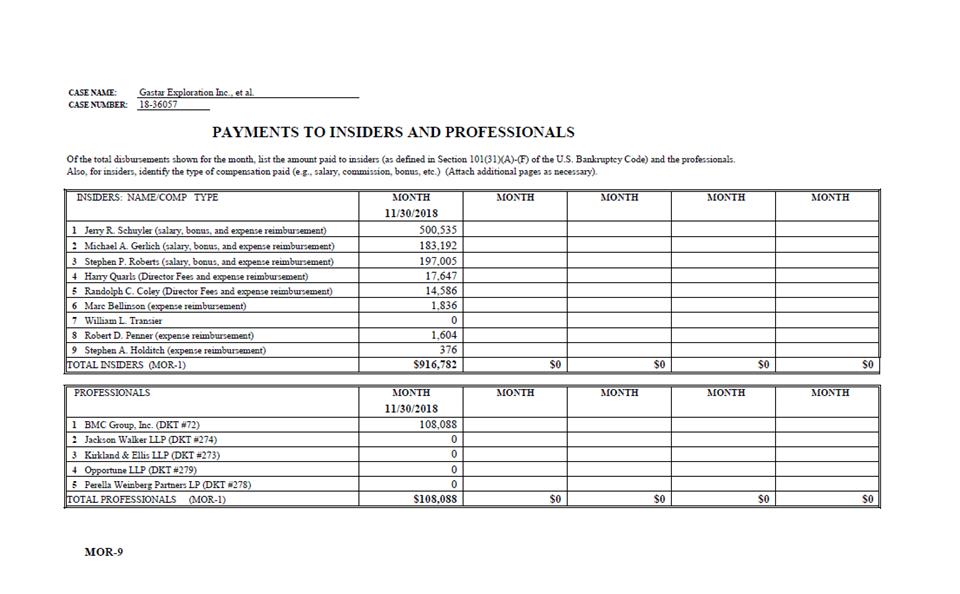

CASE NAME: Gastar Exploration Inc., et al. CASE NUMBER: 18-36057 PAYMENTS TO INSIDERS AND PROFESSIONALS Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals. Also, for insiders, identify the type of compensation paid (e.g., salary, commission, bonus, etc.) (Attach additional pages as necessary). INSIDERS: NAME/COMP TYPE MONTH 11/30/2018 MONTH MONTH MONTH MONTH 1 Jerry R. Schuyler (salary, bonus, and expense reimbursement) 500,535 2 Michael A. Gerlich (salary, bonus, and expense reimbursement) 183,192 3 Stephen P. Roberts (salary, bonus, and expense reimbursement) 197,005 4 Harry Quarls (Director Fees and expense reimbursement) 17,647 5 Randolph C. Coley (Director Fees and expense reimbursement) 14,586 6 Marc Bellinson (expense reimbursement) 1,836 7 William L. Transier 0 8 Robert D. Penner (expense reimbursement) 1,604 9 Stephen A. Holditch (expense reimbursement) 376 TOTAL INSIDERS (MOR-1) $916,782 $0 $0 $0 $0 PROFESSIONALS MONTH 11/30/2018 MONTH MONTH MONTH MONTH 1 BMC Group, Inc. (DKT #72) 108,088 2 Jackson Walker LLP (DKT #274) 0 3 Kirkland & Ellis LLP (DKT #273) 0 4 Opportune LLP (DKT #279) 0 5 Perella Weinberg Partners LP (DKT #278) 0 TOTAL PROFESSIONALS (MOR-1) $108,088 $0 $0 $0 $0 MOR-9