SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT

TO RULE 13d-2(a)

(Amendment No. ____)

| Square 1 Financial, Inc. |

| (Name of Issuer) |

| |

| Common Stock, par value $0.01 per share |

| (Title of Class of Securities) |

W. Kirk Wycoff Patriot Financial Partners, L.P. Cira Centre 2929 Arch Street, 27th Floor Philadelphia, Pennsylvania 19104 (215) 399-4650 | Copies to: Philip Ross Bevan, Esq. Silver, Freedman, Taff & Tiernan LLP 3299 K Street, N.W. Suite 100 Washington, D.C. 20007 (202) 295-4500 |

(Name, Address, Telephone Number of Person Authorized to Receive Notices and Communications)

| March 31, 2014 |

| (Date of Event Which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [ ].

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

| CUSIP No. 85223W101 | 13D | Page 2 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Patriot Financial Partners, L.P. |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS WC |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION Delaware | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 3,380,470 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 3,380,470 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,380,470 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 11.9% |

14 | TYPE OF REPORTING PERSON PN |

| CUSIP No. 85223W101 | 13D | Page 3 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Patriot Financial Partners Parallel, L.P. |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS WC |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION Delaware | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 583,968 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 583,968 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 583,968 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 2.1% |

14 | TYPE OF REPORTING PERSON PN |

| CUSIP No. 85223W101 | 13D | Page 4 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Patriot Financial Partners GP, L.P. |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS AF |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION Delaware | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 3,964,438 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 3,964,438 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,964,438 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

14 | TYPE OF REPORTING PERSON PN |

| CUSIP No. 85223W101 | 13D | Page 5 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Patriot Financial Partners GP, LLC | |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS AF |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION Delaware | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 3,964,438 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 3,964,438 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,964,438 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

14 | TYPE OF REPORTING PERSON CO |

| CUSIP No. 85223W101 | 13D | Page 6 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) W. Kirk Wycoff |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS AF |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 1,145 |

8 | SHARED VOTING POWER 3,964,438 |

9 | SOLE DISPOSITIVE POWER 1,145 |

10 | SHARED DISPOSITIVE POWER 3,964,438 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,965,583 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 14.0% |

14 | TYPE OF REPORTING PERSON IN |

| CUSIP No. 85223W101 | 13D | Page 7 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Ira M. Lubert | |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS AF |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 3,964,438 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 3,964,438 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,964,438 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

14 | TYPE OF REPORTING PERSON IN |

| CUSIP No. 85223W101 | 13D | Page 8 of 14 Pages |

1 | NAMES OF REPORTING PERSON I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) James J. Lynch |

2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP | (a) [ X ] (b) [ ] |

3 | SEC USE ONLY |

4 | SOURCE OF FUNDS AF |

5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) | [ ] |

6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States | |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER 0 |

8 | SHARED VOTING POWER 3,964,438 |

9 | SOLE DISPOSITIVE POWER 0 |

10 | SHARED DISPOSITIVE POWER 3,964,438 |

11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 3,964,438 |

12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES [ ] |

13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 13.9% |

14 | TYPE OF REPORTING PERSON IN |

| CUSIP No. 85223W101 | 13D | Page 9 of 14 Pages |

| Item 1. | Security and Issuer |

This Schedule 13D relates to the Class A common stock, par value $0.01 per share (the “Common Stock”), of Square 1 Financial, Inc., a Delaware corporation (the “Company” or the “Issuer”), whose principal executive offices are located at 406 Blackwell Street, Suite 240, Durham, North Carolina 27701.

| Item 2. | Identity and Background |

This Schedule 13D is being jointly filed by the parties identified below. All of the filers of this Schedule 13D are collectively referred to as the “Patriot Financial Group.” The Joint Filing Agreement of the members of the Patriot Financial Group is filed as Exhibit 1 to this Schedule 13D.

(a)- (c) The following are members of the Patriot Financial Group:

| ● | Patriot Financial Partners, L.P., a Delaware limited partnership (the “Patriot Fund”); |

| ● | Patriot Financial Partners Parallel, L.P., a Delaware limited partnership (the “Patriot Parallel Fund” and together with the Patriot Fund, the “Funds”); |

| ● | Patriot Financial Partners GP, L.P., a Delaware limited partnership and general partner of the Funds (“Patriot GP”); |

| ● | Patriot Financial Partners GP, LLC, a Delaware limited liability company and general partner of Patriot GP (“Patriot LLC”); and |

| ● | W. Kirk Wycoff, Ira M. Lubert and James J. Lynch as general partners of the Funds and Patriot GP and as members of Patriot LLC. |

The Funds are private equity funds focused on investing in community banks and financial service-related companies throughout the United States. The principal business of Patriot GP is to serve as the general partner of and manage the Funds. The principal business of Patriot LLC is to serve as the general partner of and manage Patriot GP. The principal employment of Messrs. Wycoff, Lubert and Lynch is investment management with each of the Funds, Patriot GP and Patriot LLC.

The business address of each member of the Patriot Financial Group is c/o Patriot Financial Partners, L.P., Cira Centre, 2929 Arch Street, 27th Floor, Philadelphia, Pennsylvania 19104.

(d) During the last five years, no member of the Patriot Financial Group has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

| CUSIP No. 85223W101 | 13D | Page 10 of 14 Pages |

(e) During the last five years, no member of the Patriot Financial Group has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Each natural person who is a member of the Patriot Financial Group is a citizen of the United States.

Item 3. Source and Amount of Funds or Other Consideration

The Patriot Financial Group purchased an aggregate of 3,731,938 shares of Common Stock and acquired the shares at an aggregate cost of approximately $20.4 million. The Patriot Fund purchased 3,182,218 shares of Common Stock acquired at a cost of approximately $17.4 million and the Patriot Parallel Fund purchased 549,720 shares of Common Stock acquired at a cost of approximately $3.0 million. The Funds’ purchases were made with working capital of the Funds through a line of credit in the normal course of business and then paid down from the proceeds from investor capital calls. In addition, in connection with the acquisition of shares of Common Stock, the Funds were granted warrants to purchase 750,000 shares of Common Stock (the “Warrants”) (639,524 Warrants held by the Patriot Fund and 110,476 Warrants held by the Patriot Parallel Fund). Also, includes, with respect to Mr. Wycoff, 1,145 shares of Common Stock granted as a restricted stock award in connection with his services as a director of the Issuer.

On March 31, 2014, the Issuer completed an initial public offering (the “Initial Public Offering”) in which the Company issued 3,125,000 shares of Common Stock and a group of Selling Shareholders (the “Selling Shareholders”), of which the Funds were members, sold 2,656,126 shares of Common Stock to the public.

On March 26, 2014, the Issuer entered into an Underwriting Agreement (the “Underwriting Agreement”) with the underwriters named therein (the “Underwriters”) and the Selling Shareholders. Pursuant to the Underwriting Agreement, the Company and the Selling Shareholders granted the Underwriters an option (the “Purchase Option”) to purchase up to 867,167 additional shares of Common Stock, including 398,417 shares from the Selling Shareholders. On April 2, 2014, the Company announced that the Underwriters exercised the Purchase Option in full, purchasing 468,750 shares of Common Stock from the Company and 398,417 shares of Common Stock from the Selling Shareholders.

Including the shares sold upon the exercise of the Purchase Option, Patriot sold 517,500 shares of Common Stock and received net proceeds of approximately $8.7 million in the Initial Public Offering. As of the date of this filing, Patriot Financial Group beneficially owned 3,965,583 shares of Common Stock (including 750,000 Warrants), of which the Patriot Fund

| CUSIP No. 85223W101 | 13D | Page 11 of 14 Pages |

owned 3,380,470 shares of Common Stock (including 629,524 Warrants), the Patriot Parallel Fund owned 583,968 shares of Common Stock (including 110,476 Warrants) and Mr. Wycoff held 1,145 shares of restricted Common Stock.

Item 4. Purpose of Transaction

Pursuant to a Securities Purchase Agreement, dated February 23, 2010, by and among the Company and the Funds (the “2010 Purchase Agreement”), the Funds purchased an aggregate of 2,864,078 shares of Common Stock from the Company at a purchase price of $5.15 per share of Common Stock or approximately $14.8 million in the aggregate. The closing of the transaction contemplated by the 2010 Purchase Agreement occurred on May 21, 2010. In addition, in connection with the acquisition of shares of Common Stock, the Funds were granted 750,000 Warrants (639,524 Warrants held by the Patriot Fund and 110,476 Warrants held by the Patriot Parallel Fund).

Pursuant to a Securities Purchase Agreement, dated April 20, 2011, by and among the Company and the Funds (the “2011 Purchase Agreement”), the Funds purchased an aggregate of 140,587 shares of Common Stock from the Company at a purchase price of $4.93 per share of Common Stock or approximately $0.7 million in the aggregate. The closing of the transaction contemplated by the 2011 Purchase Agreement occurred on April 28, 2011.

Pursuant to a Securities Purchase Agreement, dated September 26, 2012, by and among the Company and the Funds (the “2012 Purchase Agreement”), the Funds purchased an aggregate of 727,273 shares of Common Stock from the Company at a purchase price of $6.875 per share of Common Stock or approximately $5.0 million in the aggregate. The closing of the transaction contemplated by the 2012 Purchase Agreement occurred on September 26, 2012.

The shares of Common Stock and the Warrants were acquired for investment purposes to profit from the appreciation in the market price of the Common Stock and through the payment of dividends, if any.

While the Patriot Financial Group intends to exercise its rights as a stockholder (and W. Kirk Wycoff is a member of the Board of Directors of the Company), no member thereof currently has any plans or proposals which relate to or would result in: (a) the acquisition by any person of additional securities of the Company or the disposition of securities of the Company, other than purchases in the open market in the normal course of business; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Company or any of its subsidiaries; (d) any change in the present board of directors or management of the Company, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board; (e) any material change in the present capitalization or dividend policy of the Company; (f) any other material change in the Company's business or corporate structure; (g) any change in the Company's charter or bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Company by any person; (h) causing a class of securities of the Company to be delisted from a

| CUSIP No. 85223W101 | 13D | Page 12 of 14 Pages |

national securities exchange or to cease to be authorized or quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended; or (j) any action similar to any of those enumerated above.

| Item 5. | Interest in Securities of the Issuer |

The percentages used in this Schedule 13D are based upon 27,669,086 outstanding shares of Common Stock as of the date hereof and the Warrants to acquire 750,000 shares of Common Stock held by the Funds.

(a) - (b) Patriot Fund possesses shared voting and dispositive power and beneficially owns 3,380,470 shares, or 11.9%, of the outstanding Common Stock.

Patriot Parallel Fund possesses shared voting and dispositive power and beneficially owns 583,968 shares, or 2.1%, of the outstanding Common Stock.

Because (i) Messrs. Wycoff, Lubert and Lynch serve as general partners of the Funds and Patriot GP and as members of Patriot LLC, (ii) Patriot LLC serves as general partner of Patriot GP and (iii) Patriot GP serves as general partner of the Funds, each of Messrs. Wycoff, Lubert and Lynch, Patriot LLC and Patriot GP may be deemed to possess shared voting and dispositive power over the shares of Common Stock held by the Funds or 3,964,438 shares, or 13.9%, of the outstanding Common Stock (3,965,583 shares in Mr. Wycoff’s case, including the restricted stock awards, or 14.0% of the outstanding Common Stock).

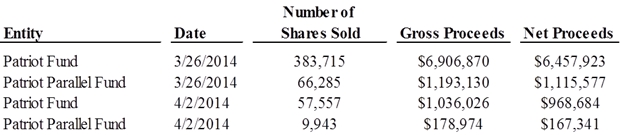

(c) Members of the Patriot Financial Group made the following sales of Common Stock in the last 60 days as Selling Shareholders in the Company’s Initial Public Offering.

(d) Not applicable.

| CUSIP No. 85223W101 | 13D | Page 13 of 14 Pages |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

As of the date of this Schedule 13D, other than (i) the Joint Filing Agreement, which is attached as Exhibit 1 hereto, (ii) the Underwriting Agreement, which is included as Exhibit 2 hereto, and (iii) the Lock-Up Agreement entered into by the Funds in connection with the Underwriting Agreement and the Initial Public Offering, none of the Patriot Financial Group is a party to any contract, arrangement, understanding or relationship among themselves or with any other person with respect to any securities of the Company, including but not limited to transfer or voting of any of the Common Stock, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, the giving or withholding of proxies, or otherwise subject to a contingency the occurrence of which would give another person voting or investment power over the Common Stock.

In connection with the Underwriting Agreement and the Initial Public Offering, the Funds entered into a Lock-Up Agreement with the Underwriters. Under the Lock-Up Agreement, for a period of 180 days after the date of the Underwriting Agreement (March 26, 2014), the Funds may not, without the prior written approval of the Underwriters, subject to limited exceptions, (i) offer, pledge, sell, contract to sell, sell any options or contract to purchase, purchase any options or contract to sell, grant any options, right or warrant for the sale of, or otherwise dispose of or transfer any of Common Stock or any securities convertible into or exchangeable or exercisable for Common Stock, whether owned or acquired or with respect to which the Funds has or hereafter acquires the power of disposition, or file any registration statement under the Securities Act, with respect to any of the foregoing; or (ii) enter into any swap or any other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of Common Stock, whether any such swap or transaction is to be settled by delivery of Common Stock or other securities, in cash or otherwise.

| Item 7. | Material to Be Filed as Exhibits |

| 2 | Underwriting Agreement* |

____________________

| * | Incorporated by reference to the Current Report on Form 8-K filed by Square 1 Financial, Inc. (Commission File No. 001-36372) on April 1, 2014. |

| CUSIP No. 85223W101 | 13D | Page 14 of 14 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: April 9, 2014

| | PATRIOT FINANCIAL PARTNERS, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC, the general partner of Patriot Financial Partners GP, L.P., the general partner of Patriot Financial Partners, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS PARALLEL, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC, the general partner of Patriot Financial Partners GP, L.P., the general partner of Patriot Financial Partners Parallel, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS GP, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC., the general partner of Patriot Financial Partners GP, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS GP, LLC | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff | |

| | | | |

| | By: | /s/Ira M. Lubert | |

| | | Ira M. Lubert | |

| | | | |

| | By: | /s/James J. Lynch | |

| | | James J. Lynch | |

EXHIBIT INDEX

| | |

| | | |

| | 1 | | Joint Filing Agreement |

| | 2 | | Underwriting Agreement* |

____________________

| * | Incorporated by reference to the Current Report on Form 8-K filed by Square 1 Financial, Inc. (Commission File No. 001-36372) on April 1, 2014. |

EXHIBIT 1

JOINT FILING AGREEMENT

Pursuant to Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree that the Schedule 13D to which this Joint Filing Agreement is being filed as an exhibit shall be a joint statement filed on behalf of each of the undersigned.

Date: April 9, 2014

| | PATRIOT FINANCIAL PARTNERS, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC, the general partner of Patriot Financial Partners GP, L.P., the general partner of Patriot Financial Partners, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS PARALLEL, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC, the general partner of Patriot Financial Partners GP, L.P., the general partner of Patriot Financial Partners Parallel, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS GP, L.P. | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member of Patriot Financial Partners GP, LLC., the general partner of Patriot Financial Partners GP, L.P. | |

| | | | |

| | PATRIOT FINANCIAL PARTNERS GP, LLC | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff, a member | |

| | | | |

| | By: | /s/W. Kirk Wycoff | |

| | | W. Kirk Wycoff | |

| | | | |

| | By: | /s/Ira M. Lubert | |

| | | Ira M. Lubert | |

| | | | |

| | By: | /s/James J. Lynch | |

| | | James J. Lynch | |