- MMATQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Meta Materials (MMATQ) DEF 14ADefinitive proxy

Filed: 5 Mar 24, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

☐ | Preliminary Proxy Statement | |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material Pursuant to §240.14a-12 |

|

Meta Materials Inc. |

|

(Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

|

|

|

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(p) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

META MATERIALS INC.

60 Highfield Park Drive, Suite 102

Dartmouth, Nova Scotia

March 4, 2024

Dear Stockholder:

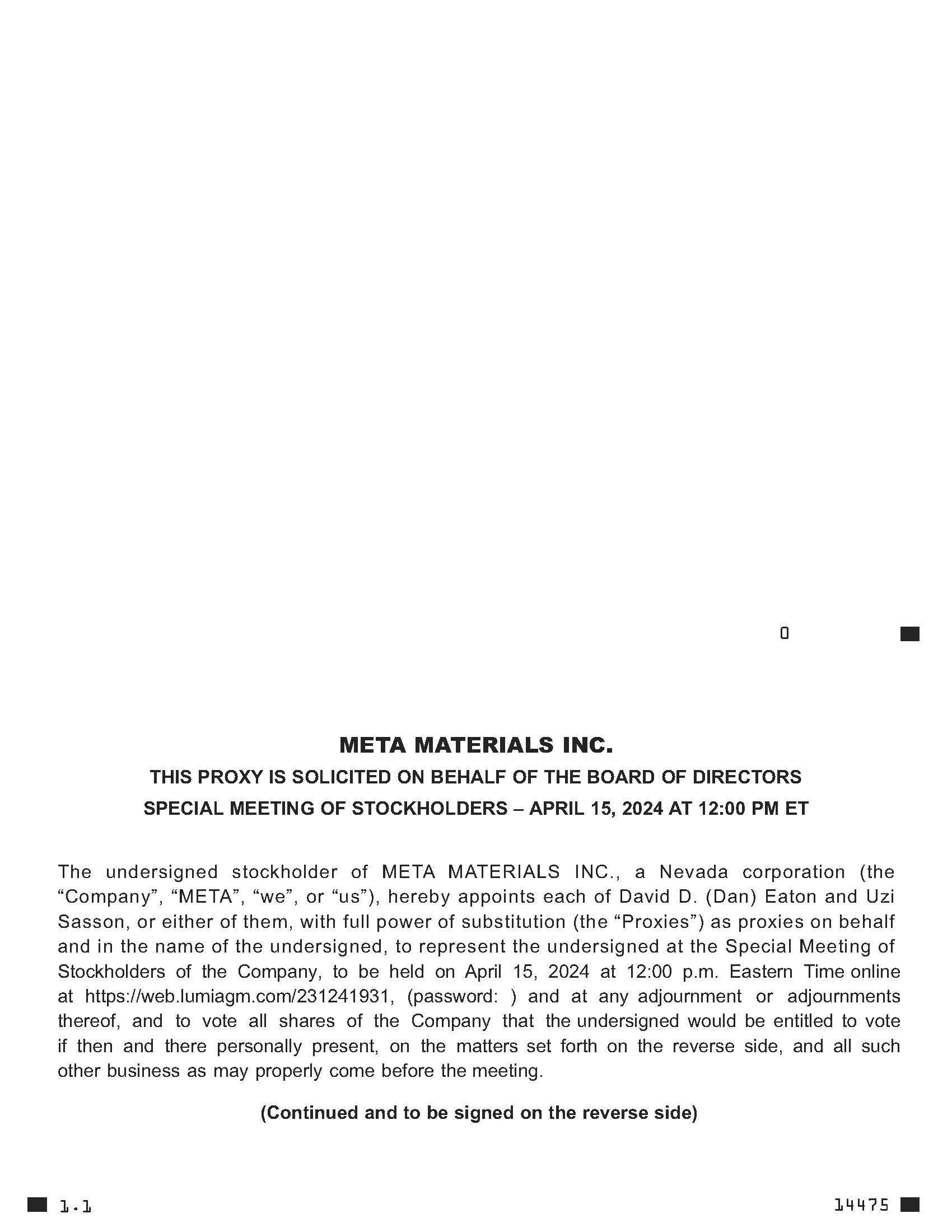

We cordially invite you to attend a special meeting of stockholders (the “Special Meeting”) of Meta Materials Inc., a Nevada corporation, which will be held virtually, via live webcast at https://web.lumiagm.com/231241931, on April 15, 2024 at 12:00 p.m., Eastern Time.

Details regarding the Special Meeting and the business to be conducted at the Special Meeting are more fully described in the accompanying Notice of Special Meeting of Stockholders and proxy statement. You are entitled to vote at the Special Meeting and any adjournments, continuations or postponements thereof only if you were a stockholder as of February 21, 2024.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to attend the Special Meeting in person, please vote as promptly as possible by following the instructions in the accompanying proxy statement to ensure your representation and the presence of a quorum at the Special Meeting. As an alternative to voting online during the live webcast of the Special Meeting, you may vote in advance via the Internet, by telephone or by signing, dating and returning the accompanying proxy card.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary.

On behalf of management and our Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the Special Meeting virtually.

On behalf of management and our Board of Directors, we thank you for your continued support and interest in Meta Materials Inc.

Sincerely,

/s/ Uzi Sasson

Uzi Sasson

President and Chief Executive Officer

META MATERIALS INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 15, 2024

March 4, 2024

Dear Stockholder:

Notice is hereby given that a special meeting of stockholders (the “Special Meeting”) of Meta Materials Inc., a Nevada corporation, will be held virtually, via live webcast at https://web.lumiagm.com/231241931, on April 15, 2024 at 12:00 p.m., Eastern Time. To be admitted to the Special Meeting, you must have your control number available and follow the instructions found on your proxy card.

The Special Meeting will be held for the following purposes:

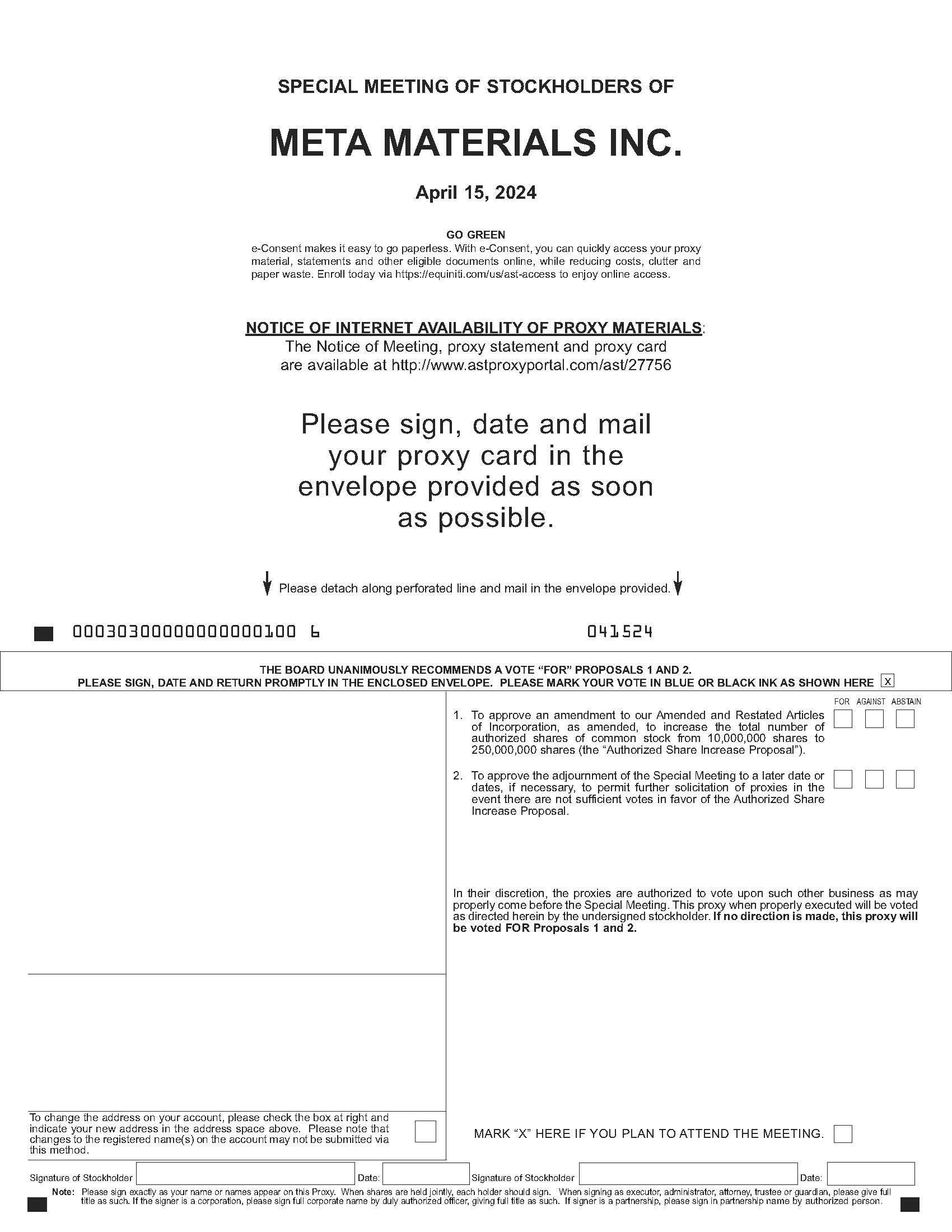

(1) | To approve an amendment to our Amended and Restated Articles of Incorporation, as amended, to increase the total number of authorized shares of common stock from 10,000,000 shares to 250,000,000 shares (the “Authorized Share Increase Proposal”);

|

(2) | To approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes in favor of the Authorized Share Increase Proposal (the “Adjournment Proposal”); and

|

(3) | To transact such other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

|

The foregoing items of business are more fully described in the proxy statement accompanying this Notice of Special Meeting of Stockholders.

Our Board of Directors has fixed the close of business on February 21, 2024 as the record date for the determination of stockholders entitled to vote at the Special Meeting. Only stockholders of record at the close of business on February 21, 2024 are entitled to receive notice of, and to vote at, the Special Meeting and any adjournment thereof.

It is important that your shares be represented and voted, regardless of whether you plan to attend the virtual Special Meeting at https://web.lumiagm.com/231241931. You may vote in advance of the Special Meeting on the Internet, by telephone or by completing and mailing a proxy or voting card. Voting in advance by Internet, telephone or mail will ensure your shares are represented at the Special Meeting. If you attend the meeting virtually, you may choose to revoke your proxy and vote online during the meeting if you are a stockholder of record.

On behalf of management and our Board of Directors, we thank you for your continued support and interest in Meta Materials Inc.

Sincerely,

/s/ Uzi Sasson

Uzi Sasson

President and Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders

to be held on April 15, 2024: This notice and the accompanying proxy statement

are being made available on or about March 4, 2024 at https://www.astproxyportal.com/ast/27756/

TABLE OF CONTENTS

|

|

|

|

|

Page | ||||

|

| |||

| i |

|

| |

1 |

| |||

| 6 |

|

| |

8 |

| |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 9 |

| ||

10 |

| |||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this proxy statement are based on our current expectations and beliefs concerning future developments and their potential effects on Meta Materials Inc. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. We do not guarantee that the actions and events described herein will happen as described (or that they will happen at all).

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this proxy statement, except as required by applicable law. For a further discussion of these and other factors that could cause our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section titled “Risk Factors” in our Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”), in our Quarterly Reports on Form 10-Q filed with the SEC, and in other documents we filed with the SEC. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

i

META MATERIALS INC.

60 Highfield Park Drive, Suite 102

Dartmouth, Nova Scotia

(902) 482-5729

__________________________________________

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To be held on April 15, 2024

__________________________________________

GENERAL INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

General

The enclosed proxy is being solicited by our Board of Directors (our “Board”) for use at a special meeting of stockholders of the Company, to be held virtually, via live webcast at https://web.lumiagm.com/231241931, on April 15, 2024 at 12:00 p.m., Eastern Time, or at any adjournment or postponement thereof (the “Special Meeting”), for the purposes set forth herein and in the accompanying Notice of Special Meeting of Stockholders. To be admitted to the Special Meeting, you must have your control number available and follow the instructions found on your proxy card. As used in this proxy statement, the “Company,” “we,” “us,” and “our” refer to Meta Materials Inc., a Nevada corporation.

This proxy statement contains information relating to the Special Meeting and the matters to be voted upon. Stockholders attending the live webcast of the Special Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. If you hold common stock of the Company, in addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting. If you are a stockholder of Metamaterial Exchangeco Inc. (“Exchangeco”), please refer to the section titled “Holder of Record of the Exchangeable Shares” below for information regarding voting in the Special Meeting.

This proxy statement is first being sent to our stockholders entitled to vote at the Special Meeting on or about March 4, 2024. The Notice of Special Meeting and proxy statement are also available online at https://www.astproxyportal.com/ast/27756/.

Whether or not you expect to attend the live webcast of the Special Meeting, we urge you to vote your shares via proxy at your earliest convenience. This will ensure the presence of a quorum at the Special Meeting. Promptly voting your shares will save us the expenses and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy is revocable at your option as described elsewhere in this proxy statement. Your vote is important, so please act today!

Record Date and Outstanding Shares

Only stockholders of record at the close of business on February 21, 2024 (the “Record Date”), are entitled to receive notice of and to vote at the Special Meeting. Our only outstanding voting securities are shares of common stock, par value $0.001 per share (“Common Stock”), one share of our Series B Special Voting Preferred Stock, par value $0.001 (the “Series B Special Voting Preferred Stock”), and shares of our Series C Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”). As of the Record Date, 6,421,384 shares of our Common Stock, one share of our Series B Special Voting Preferred Stock and 6,421,385 shares of our Series C Preferred Stock were outstanding.

Unless indicated otherwise, all references to share numbers with respect to our Common Stock herein give effect to the 1-for-100 reverse stock split that we effected on January 29, 2024.

Quorum

At the Special Meeting, an inspector of elections will determine the presence of a quorum and tabulate the results of the voting by stockholders. A quorum exists when holders of one-third or more of the outstanding shares of the Company entitled to vote are represented in person (via live webcast) or by proxy at the Special Meeting. A quorum is necessary for the transaction of business at the Special Meeting.

Stockholders Entitled to Vote at the Special Meeting

Holders of record of our Common Stock, Series B Special Voting Preferred Stock and Series C Preferred Stock as of the close of business on the Record Date will be entitled to notice of and to vote at the Special Meeting and at any adjournments or postponements thereof. We are also providing these proxy materials to holders of our Exchangeable Shares (as defined below), which shares have voting rights that will be represented by the votes cast, if any, by the holder of our Series B Special Voting Preferred Stock in accordance with the instructions received from the holders of such shares, if any.

1

As a result of the distribution of the shares of Series C Preferred Stock on February 2, 2024, each holder of shares of our Common Stock as of February 2, 2024 also holds one a share of our Series C Preferred Stock equal to the whole number of shares of Common Stock held by such holder. On February 19, 2024, under the terms of a securities purchase agreement relating to the registered direct offering completed on February 21, 2024 (the “Offering”), we also distributed one share of Series C Preferred Stock for each share of Common Stock purchased in the Offering. In addition, we distributed one share of our Series C Preferred Stock in respect of each voting right represented by our Series B Preferred Stock as of February 2, 2024.

Because any shares of Series C Preferred Stock that are not present in person or by proxy at the Special Meeting as of immediately prior to the opening of the polls at the Special Meeting will be automatically redeemed, if you fail to submit a proxy to vote your shares or attend the Special Meeting in order to do so, your shares of Series C Preferred Stock will be redeemed immediately prior to the opening of the polls at the Special Meeting and will not be entitled to vote at the Special Meeting.

You do not need to attend the live webcast of the Special Meeting to vote your shares. Instead, you may vote your shares in advance by marking, signing, dating and returning the enclosed proxy card or voting through the Internet or by telephone as described below.

Voting Rights of the Stockholders

Shares of our Common Stock and Series B Special Voting Preferred Stock are entitled to vote on all matters brought before the Special Meeting. Shares of our Series C Preferred Stock are only entitled to vote on the Authorized Share Increase Proposal and the Adjournment Proposal and will not be entitled to vote on any other matter, except to the extent required under the Nevada law. Shares of our Common Stock, Series B Special Voting Preferred Stock and Series C Preferred Stock vote together as a single class.

Common Stock

Each share of our Common Stock outstanding as of the Record Date is entitled to one vote per share on all matters properly brought before the Special Meeting.

Series B Special Voting Preferred Stock and the Exchangeable Shares

The share of our Series B Special Voting Preferred Stock outstanding as of the Record Date is entitled to one vote on all matters properly brought before the Special Meeting plus up to an additional 368,118 votes on each matter to represent votes entitled to be cast by the Exchangeable Shares (the “Exchangeable Shares”) of Exchangeco, pursuant to that certain Voting and Exchange Trust Agreement (the “Trust Agreement”) by and between the Company, Exchangeco, and the trustee thereunder (the “Trustee”). The Exchangeable Shares are exchangeable for shares of Common Stock on a one-for-one basis.

In accordance with the Trust Agreement, holders of Exchangeable Shares are effectively provided with voting rights for each Exchangeable Share that are nearly equivalent to the voting rights applicable to a share of our Common Stock, and holders are entitled to instruct the Trustee as to how to vote their Exchangeable Shares. The Trustee holds one share of our Series B Special Voting Preferred Stock designated as the “Special Voting Share.” The Special Voting Share entitles the Trustee to vote on matters in which holders of our Common Stock are entitled to vote. The Special Voting Share is entitled to a number of votes equal to the number of Exchangeable Shares outstanding on the Record Date and for which the Trustee has received voting instructions from the holders of such Exchangeable Shares.

In accordance with the terms of the Trust Agreement, we have undertaken to perform the obligations of the Trustee and have authorized TSX Trust Company (“TSX”) to collect and receive directly the votes from the holders of the Exchangeable Shares on our behalf. Based upon the foregoing, holders of Exchangeable Shares are entitled to cast up to 368,118 votes at the Special Meeting, not including any votes that may be cast in respect of the Series C Preferred Stock that was distributed in respect of such shares. However, TSX will receive and tabulate each vote attached to the Exchangeable Shares only on the basis of instructions received from the holders of record of the Exchangeable Shares. In the absence of instructions from a holder as to voting, TSX will not include the Exchangeable Shares held by such holder in the vote.

Series C Preferred Stock

As previously announced on January 23, 2024, our Board declared a distribution of one share of our newly designated Series C Preferred Stock for each outstanding share of our Common Stock and each voting right represented by our Series B Preferred Stock held of record as of 5:00 p.m. Eastern Time on February 2, 2024. On February 19, 2024, in connection with the Offering, we also distributed one share of Series C Preferred Stock for each share of Common Stock purchased in the Offering.

Each share of our Series C Preferred Stock is entitled to 1,000 votes per share with respect to the Authorized Share Increase Proposal and the Adjournment Proposal. Notwithstanding the foregoing, each share of Series C Preferred Stock redeemed pursuant to the Initial Redemption (as defined below) will have no voting power with respect to the Authorized Share Increase Proposal and the Adjournment Proposal or any other matter.

When a holder of our Common Stock submits a vote on the Authorized Share Increase Proposal and the Adjournment Proposal, the corresponding number of shares of Series C Preferred Stock held by such holder will be automatically cast on the Authorized Share Increase Proposal and the Adjournment Proposal, and the proxy with respect to shares of Common Stock held by any holder on whose behalf such proxy is submitted will be deemed to include all shares of Series C Preferred Stock held by such holder. The same will apply when the holder of the Special Voting Share

2

casts its one vote in respect of such share. Similarly, when the Special Voting Share submits a vote on the Authorized Share Increase Proposal and the Adjournment Proposal according to voting instructions provided by a holder of Exchangeable Shares, the corresponding number of shares of Series C Preferred Stock held by such holder of Exchangeable Shares will be automatically cast in the same manner as the vote attributable to such Exchangeable Shares in respect of which such share of Series C Preferred Stock is cast on the Authorized Share Increase Proposal and the Adjournment Proposal, and the proxy representing the voting rights held by a holder of Exchangeable Shares will be deemed to include all shares of Series C Preferred Stock held by such holder. Holders of Series C Preferred Stock will not receive a separate proxy to cast votes with respect to the Series C Preferred Stock on the Authorized Share Increase Proposal and the Adjournment Proposal or any other matter brought before the Special Meeting.

For example, if a stockholder holds 10 shares of Common Stock (entitled to one vote per share) and votes in favor of the Authorized Share Increase Proposal, then 10,010 votes will be recorded in favor of the Authorized Share Increase Proposal, because the stockholder’s shares of Series C Preferred Stock will automatically be voted in favor of the Authorized Share Increase Proposal alongside such stockholder’s shares of Common Stock. Likewise, if the holder of our Special Voting Share is instructed by a holder of 10 Exchangeable Shares to vote in favor of the Authorized Share Increase Proposal and casts such vote, then 10,010 votes will be recorded in favor of the Authorized Share Increase Proposal, because the Series C Preferred Stock held by such holder of Exchangeable Shares of will automatically be voted in favor of the Authorized Share Increase Proposal, as the vote exercised by proxy by the Trustee in accordance with the Special Voting Share and the Voting Agreement will be deemed to include all shares of Series C Preferred Stock held by such holder of Exchangeable Shares.

All shares of Series C Preferred Stock that are not present in person or by proxy at any meeting of stockholders held to vote on the Authorized Share Increase Proposal as of immediately prior to the opening of the polls at the Special Meeting will be automatically redeemed (the “Initial Redemption”). Any outstanding shares of Series C Preferred Stock that have not been redeemed pursuant to the Initial Redemption shall be automatically redeemed in whole, but not in part, on the earlier of (i) the date and time specified by the Board in its sole discretion, or (ii) upon the approval by our stockholders of the Authorized Share Increase Proposal at any meeting of the stockholders held for the purpose of voting on the Authorized Share Increase Proposal.

How To Vote

Whether you plan to attend the Special Meeting or not, we urge you to submit your voting instructions by proxy. Voting by proxy will not affect your right to attend the Special Meeting. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board’s recommendations as noted below. If you neither submit by proxy nor vote your shares during the Special Meeting, your shares will not be voted if you are a registered stockholder. If your shares are held in street name, your bank, broker, trustee or other holder of record may vote your shares on certain “routine” matters. See “Abstentions and Broker Non-Votes” below for more information.

Shares Registered in Your Name (“stockholder of record”)

If you are a stockholder of record, you may vote in one of four ways:

For holders of Common Stock, votes submitted via the internet or by telephone must be received by 11:59 p.m., Eastern Time, on April 14, 2024. Submitting your proxy via the internet, by telephone or by mail will not, except as to holders of the Exchangeable Shares, affect your right to vote during the Special Meeting live via the internet. For additional information, please see “Revocability of Proxies” below.

Shares Registered in the Name of a Broker, Bank or Other Nominee (“street name”)

Beneficial owners holding stock in “street name” will receive instructions for voting their shares from their bank, broker or other nominee. Street-name holders generally cannot directly vote their shares and must instead instruct the broker, bank or other nominee how to vote their shares using the voting instruction form provided by that broker, bank or other nominee. Many brokers also offer the option of giving voting instructions over the internet or by telephone. Instructions for giving your vote as a street-name holder are provided on your voting instruction form. However,

3

since you are not the stockholder of record, you may not vote your shares online during the live webcast of the Special Meeting, unless you obtain a valid proxy from your broker, bank, trustee or other nominee.

Holder of Record of the Exchangeable Shares

Holders of Exchangeable Shares are receiving these proxy materials in accordance with the provisions of the Exchangeable Shares and the Trust Agreement. The Exchangeable Shares are exchangeable for shares of Common Stock on a one-for-one basis.

In accordance with the Trust Agreement, holders of Exchangeable Shares are effectively provided with voting rights for each Exchangeable Share that are nearly equivalent to the voting rights applicable to a share of Common Stock, and holders are entitled to instruct the Trustee as to how to vote their Exchangeable Shares. The Trustee holds one share of the Series B Special Voting Preferred Stock designated as the “Special Voting Share.” The Special Voting Share entitles the Trustee to vote on matters in which holders of the Common Stock are entitled to vote. The Special Voting Share is entitled to a number of votes equal to the number of Exchangeable Shares outstanding on the record date for determining holders of Common Stock entitled to vote and for which the Trustee has received voting instructions from the holders of such Exchangeable Shares. The Special Voting Share shall vote together with the holders of Common Stock as a single class.

In accordance with the terms of the Trust Agreement, the Company has undertaken to perform the obligations of the Trustee and has authorized TSX to collect and receive directly the votes from the holders of the Exchangeable Shares on its behalf. Based upon the foregoing, holders of Exchangeable shares are entitled to cast up to 368,118 votes at the Special Meeting. However, TSX will receive and tabulate each vote attached to the Exchangeable Shares only on the basis of instructions received from the holders of record of the Exchangeable Shares. In the absence of instructions from a holder as to voting, TSX will not include the Exchangeable Shares held by such holder in the vote.

Holders of Exchangeable Shares may not vote during the live webcast of the Special Meeting. Holders of Exchangeable shares must instruct TSX how they wish to vote in one of the following ways:

Revocability of Proxies

Stockholders of Record

If you are a stockholder of record and you give us your proxy, you may change or revoke it at any time before the Special Meeting. You may change or revoke your proxy in any one of the following ways:

Beneficial Owners in “Street Name”

If you are a beneficial owner holding shares in “street name” and you have submitted voting instructions to your bank, broker, trustee or other nominee, you may change or revoke your voting instructions in accordance with the instructions your bank, broker, trustee or other nominee provides to you.

Holders of Exchangeable Shares

If you are a holder of Exchangeable Shares and you have submitted voting instructions to TSX, you should contact TSX. You may change or revoke your voting instructions in accordance with the instructions TSX provides to you.

Required Votes and Voting

Each holder of Common Stock is entitled to one vote for each share held on all matters properly brought before the Special Meeting and the holder of our Series B Special Voting Preferred Stock is entitled to one vote per share on all matters properly brought before the Special Meeting plus up to an additional 368,118 votes on each matter, as described under “Voting Rights of Stockholders – Series B Special Voting Preferred Stock and the Exchangeable Shares” above.

4

The holders of Series C Preferred Stock are entitled to 1,000 votes per share and to vote with the Common Stock and Series B Special Voting Preferred Stock, together as a single class, on the Authorized Share Increase Proposal and the Adjournment Proposal, but are not otherwise entitled to vote on any proposals that may be presented at the Special Meeting. The Series C Preferred Stock is described in more detail under “Voting Rights of Stockholders – Series C Preferred Stock” above.

Assuming that a quorum is present at the Special Meeting, the following votes will be required:

| Proposal |

|

| Vote Required to Adopt |

| Effect of |

| Effect of Broker |

1. | Approval of an amendment to our Amended and Restated Articles of Incorporation, as amended, to increase the total number of authorized shares of common stock from 10,000,000 shares to 250,000,000 shares |

|

| Majority of the voting power of the outstanding shares |

| Against |

| Brokers have discretion to vote |

2. | Approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes in favor of the Authorized Share Increase Proposal |

|

| Majority of the shares present in person (via live webcast) or represented by proxy at the Special Meeting and entitled to vote |

| Against |

| Brokers have discretion to vote |

You may vote “FOR,” “AGAINST,” or “ABSTAIN” on each proposal. All shares entitled to vote and represented by properly executed, unrevoked proxies received before the Special Meeting will be voted at the Special Meeting in accordance with the instructions given on those proxies. If no instructions are given on a properly executed proxy, the shares represented by that proxy will be voted “FOR” the Authorized Share Increase Proposal and “FOR” the Adjournment Proposal.

If any other matters are properly presented for consideration at the Special Meeting, the persons named in the enclosed proxy and acting thereunder will have discretion to vote on those matters as they deem advisable, except with respect to any shares of Series C Preferred Stock, which is only entitled to vote on the Authorized Share Increase Proposal and the Adjournment Proposal. We do not currently anticipate that any other matters will be raised at the Special Meeting.

Abstentions and Broker Non-Votes

Broker non-votes can occur as to shares held in street name. Under the current rules that govern brokers and other nominee holders of record, if a street-name holder does not give instructions to its broker or other nominee, such broker or other nominee will be able to vote such shares only with respect to proposals for which the broker or other nominee has discretionary voting authority, i.e., “routine” matters under rules of the New York Stock Exchange. A “broker non-vote” occurs when a broker or other nominee submits a proxy for the Special Meeting but does not vote on a particular proposal because such broker or other nominee either does not exercise its discretionary voting authority or does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner.

Both of the proposals you are being asked to vote on at the Special Meeting are considered “routine.” Stockholders are urged to give their bank or broker instructions on voting their shares on all matters.

Abstentions and broker non-votes are treated as shares present for the purpose of determining whether there is a quorum for the transaction of business at the Special Meeting.

Solicitation

This proxy solicitation is made by the Board, and we will bear the entire cost of soliciting proxies for the Special Meeting, including costs associated with the preparation, assembly, printing and mailing of the proxy materials and any additional information furnished to stockholders. We have retained D.F. King to assist with the solicitation of proxies and provide related advice and informational support in connection with the Special Meeting. We have agreed to pay D.F. King a non-refundable fee of $17,500, plus variable amounts for additional proxy solicitation services and reasonable out-of-pocket expenses incurred by D.F. King. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers or administrative employees without the payment of any additional consideration. Solicitation of proxies may be made by mail, by telephone, by email, in person or otherwise.

Voting Results

The preliminary voting results will be announced at the Special Meeting. The final voting results will be reported in a Current Report on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (“SEC”) within four business days after the Special Meeting.

5

PROPOSAL 1: AUTHORIZED SHARE INCREASE PROPOSAL

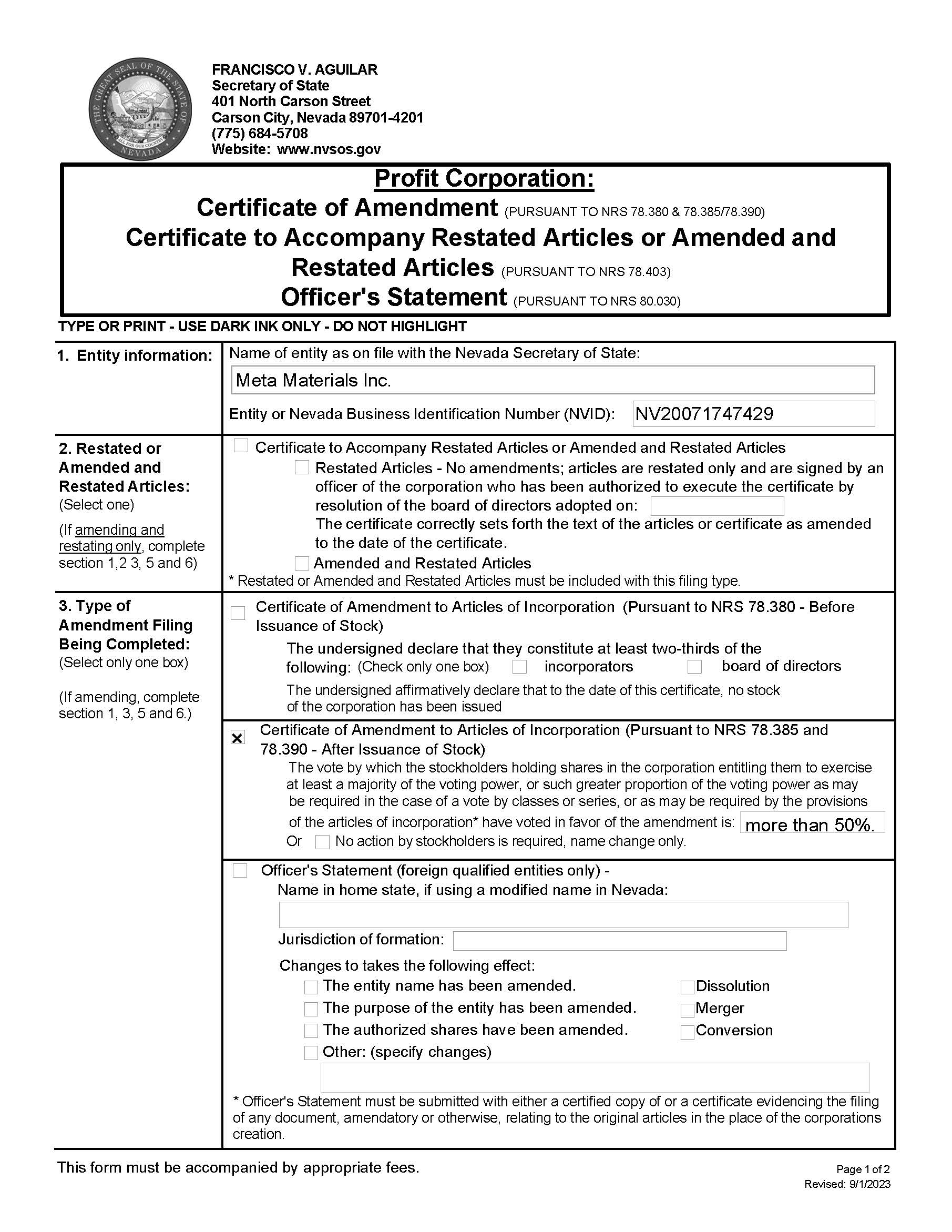

Our stockholders are being asked to approve an amendment to our articles of incorporation to increase the number of shares of authorized Common Stock from 10,000,000 shares to 250,000,000 shares.

Background

The Board proposed a reverse stock split pursuant to Nevada Revised Statute 78.2055 for approval by our stockholders at our 2023 annual meeting of stockholders that was held on December 11, 2023 to attempt to regain compliance with certain of the Nasdaq Listing Rules, but the proposal failed by a narrow margin of approximately 2.5% of our outstanding voting shares, or 4.4% of the total voting power represented at the 2023 annual meeting. If this proposal were approved at our 2023 annual meeting, we would have been able to implement a reverse stock split without any corresponding adjustment to the number of shares of our authorized Common Stock at such time.

On January 23, 2024, the Company announced a 1-for-100 reverse split of the Company’s issued and outstanding Common Stock (the “Reverse Stock Split”), and the Reverse Stock Split became effective on January 29, 2024. The Reverse Stock Split was part of the Company’s continued plan to maintain its Nasdaq listing by regaining compliance with the Nasdaq Listing Rules, and more specifically, to regain compliance with (i) Nasdaq Listing Rule 5550(a)(2) as the minimum bid price of the Common Stock had been trading below $1.00 per share for at least 30 consecutive trading days (the “Minimum Bid Price Requirement”) and (ii) Nasdaq Listing Rule 5810(c)(3)(A) as the minimum bid price of our Common Stock had been trading below $0.10 per share or less for ten consecutive trading days. On February 12, 2024, the Company received a letter from Nasdaq notifying the Company that it has regained compliance with the Minimum Bid Price Requirement, and as a result, the Company is currently in full compliance with Nasdaq listing requirements.

The Company implemented the Reverse Split following approval by the Board of Directors under the Nevada Revised Statute 78.207 without stockholder approval, which also proportionally reduced the number of authorized shares of Common Stock in the same 1-for-100 ratio from 1,000,000,000 shares to 10,000,000 shares. As a result of the Reverse Stock Split and capital raising activities to fund ongoing operations and product commercialization and development, as of February 21, 2024, the Company has 1,824 shares of Common Stock authorized and unissued and not reserved for any other purpose, which is insufficient for the Company’s ongoing needs and operations. Accordingly, the Company seeks stockholder approval of an amendment to the Company’s articles of incorporation to increase the authorized shares of Common Stock from 10,000,000 shares to 250,000,000 shares.

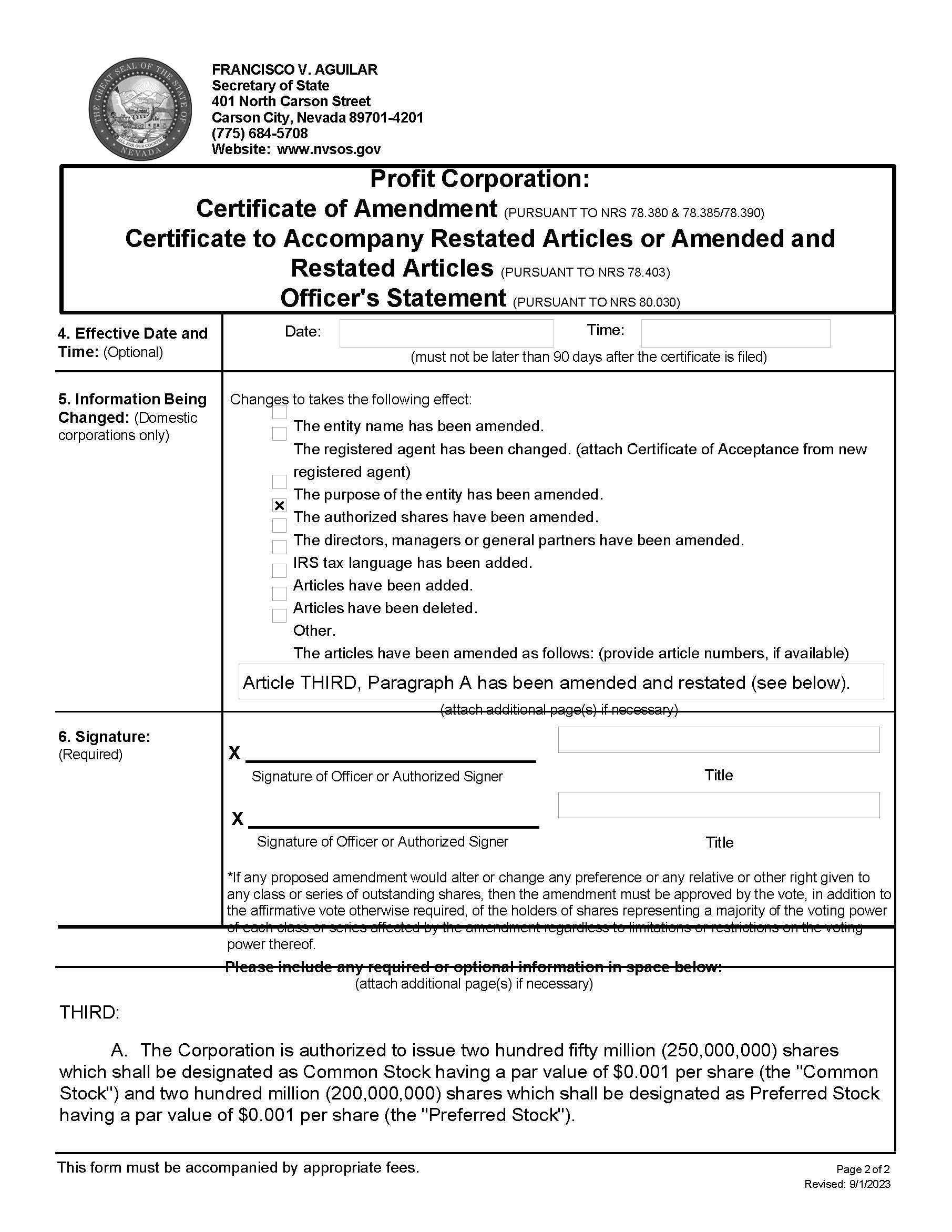

The text of the proposed amendment to our articles of incorporation (the “Amendment”) is attached hereto as Exhibit A. This proposal to increase the number of shares of Common Stock authorized for issuance, if approved at the Special Meeting, will become effective, and the number of authorized shares of Common Stock will be increased to 250,000,000 shares (the “Share Increase”), upon the filing of the certificate of amendment with the Secretary of State of the State of Nevada. The following discussion is qualified in its entirety by the full text of the certificate of amendment, which is attached to this Proxy Statement as Exhibit A and is incorporated herein by reference.

Reasons for the Authorized Share Increase

The Board believes it is in the best interest of the Company to increase the number of authorized shares of Common Stock so that the Company has greater flexibility in considering and planning for its future potential business and financial needs. In addition, the Board believes that it is essential to the Company’s continued operations and product commercialization and development to have additional authorized shares of Common Stock available for future issuance, as discussed in more detail below. These needs include: (i) future financings to raise the capital needed to continue to operate the Company’s business and pursue its strategic goals, including product commercialization, (ii) potential negotiations with third parties to satisfy the Company’s existing payment obligations in shares of Common Stock rather than cash; (iii) possible strategic transactions or partnerships; and (iv) other general corporate purposes. In addition, an increase in the authorized shares would allow the Company to issue more shares of Common Stock, if needed, to increase its market value to maintain long term compliance with Nasdaq Listing Rule 5550(b), the minimum market value of listed securities of at least $35 million required by The Nasdaq Capital Market. Although such issuances of additional shares of Common Stock would dilute existing stockholders, management believes that such transactions would increase the overall value of the Company to its stockholders. In addition, the Board believes the Company’s successful implementation of its strategic goals depends in part on its continued ability to attract, retain, and motivate highly qualified personnel and advisors, as well as independent directors with requisite skills and experience.

As of the date of this Proxy Statement, less than 0.02 percent of the 10,000,000 shares of Common Stock authorized for issuance under our articles of incorporation remain available and unreserved for issuance. Thus, without an increase in authorized shares of Common Stock, the Company will not be able to issue additional shares for any of the purposes described above. The Board believes that additional authorized shares of Common Stock is critical to maximize the potential value of the Company’s business plans. Failure to increase the authorized shares of Common Stock could lead to the Company having to halt operations.

Potential Adverse Effects of the Amendment

Approval of the Authorized Share Increase Proposal will have no immediate dilutive effect on the proportionate voting power or other rights of our existing stockholders. In addition, the Board has no current plans to issue shares from the additional authorized shares approved at the Special Meeting. However, any future issuance of additional authorized shares of our Common Stock may, among other things, dilute the earnings per

6

share of Common Stock and the equity and relative voting rights of those holding Common Stock at the time the additional shares are issued and the voting rights of our Exchangeable Shares may be similarly impacted. Additionally, this potential dilutive effect may cause a reduction in the market price of our Common Stock.

Potential Anti-Takeover Effects

By increasing the number of authorized but unissued shares of Common Stock, the increase in the authorized shares could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the Board. For example, the increase in the authorized shares could adversely affect the ability of third parties to take over the Company or effect a change of control of the Company by, for example, permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of us with another company that the Board determines is not in our best interests or in the best interests of our stockholders. The ability of the Board to cause the Company to issue substantial amounts of Common Stock or preferred stock without the need for stockholder approval, except as may be required by law or regulation, upon such terms and conditions as the Board may determine from time to time in the exercise of its business judgment may, among other things, result in practical impediments with respect to changes in control of the Company or have the effect of diluting the stock ownership of holders of Common Stock seeking to obtain control of the Company. The issuance of Common Stock or preferred stock, while providing desirable flexibility in connection with potential financings and other corporate transactions, may have the effect of discouraging, delaying or preventing a change in control of the Company. The Board, however, does not intend or view the Amendment to effect the Share Increase as an anti-takeover measure, nor does the Board contemplate using the Share Increase in this manner at any time in the foreseeable future.

Appraisal or Dissenter’s Rights

Pursuant to the Nevada Revised Statutes, our stockholders are not entitled to appraisal rights or dissenter’s rights with respect to the Amendment or the Share Increase.

Executive Officer and Director Interest

Our directors and executive officers do not have an interest in the Authorized Share Increase Proposal.

Vote Required

The approval of the Authorized Share Increase Proposal requires the affirmative “FOR” vote of the majority of the voting power of the outstanding shares of Common Stock, Series B Special Voting Preferred Stock and Series C Preferred Stock, voting together as a single class. Abstentions and broker non-votes will have the same effect as a vote “AGAINST” the proposal as they will not be counted toward reaching a majority of the issued and outstanding voting power. As described above, the Authorized Share Increase Proposal is considered a “routine” matter. Therefore, your bank, broker, trustee or other nominee may vote your shares without receiving instructions from you on this proposal and accordingly, we do not expect any broker non-votes on this proposal. A failure to instruct your bank, broker, trustee or other nominee on how to vote your shares will not necessarily count as a vote against this proposal.

On February 19, 2024, in connection with, and as a condition to, the Offering, the Company entered into a letter agreement with the institutional investor in such Offering pursuant to which, among other things, the investor agreed to use commercially reasonable efforts to vote all of the shares of Common Stock (including the corresponding shares of Series C Preferred Stock) that it either owns or that it has discretion to vote in favor of Authorized Share Increase Proposal and the Adjournment Proposal.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE AUTHORIZED SHARE INCREASE PROPOSAL.

7

PROPOSAL 2: ADJOURNMENT PROPOSAL

Our stockholders are being asked to vote in favor of adjourning the Special Meeting, to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes in favor of the Authorized Share Increase Proposal, as described in this proxy statement. If our stockholders approve this proposal, we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, and use the additional time to solicit additional proxies, including the solicitation of proxies from our stockholders that have previously voted, in favor of the Authorized Share Increase Proposal.

Our Board believes that if there are not sufficient votes to approve the Authorized Share Increase Proposal, it is in the best interests of the stockholders to enable our Board to continue to seek to obtain a sufficient number of additional votes to approve the Authorized Share Increase Proposal.

Additionally, approval of the Adjournment Proposal could mean that, in the event we receive proxies representing a sufficient number of votes to defeat the Authorized Share Increase Proposal, we could adjourn the Special Meeting without a vote on the Authorized Share Increase Proposal and seek to convince our stockholders to change their votes in favor of such proposal.

If the Adjournment Proposal is approved and the Special Meeting is adjourned, no notice of the adjourned meeting is required to be given to our stockholders, other than an announcement at the Special Meeting of the time and place to which the Special Meeting is adjourned, so long as the meeting is adjourned for 60 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business that could have been transacted at the original meeting.

Vote Required

The affirmative “FOR” vote of a majority of the voting power of Common Stock, Series B Special Voting Preferred Stock and Series C Preferred Stock, voting together as a single class, present in person (via live webcast) or represented by proxy at the Special Meeting and entitled to vote on this proposal is required to approve this proposal. An abstention will have the same practical effect as a vote against this proposal and a broker non-vote would have no effect on the outcome of the proposal. As described above, the Adjournment Proposal is considered a “routine” matter. Therefore, your bank, broker, trustee or other nominee may vote your shares without receiving instructions from you on this proposal and accordingly, we do not expect any broker non-votes on this proposal. A failure to instruct your bank, broker, trustee or other nominee on how to vote your shares will not necessarily count as a vote against this proposal.

As described above, on February 19, 2024, in connection with, and as a condition to, the Offering, the Company entered into a letter agreement with the institutional investor in the Offering pursuant to which, among other things, the investor agreed to use commercially reasonable efforts to vote all of the shares of Common Stock that it either owns or that it has discretion to vote in favor of Authorized Share Increase Proposal and the Adjournment Proposal.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ADJOURNMENT PROPOSAL.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents certain information with respect to the beneficial ownership of our Common Stock as of February 21, 2024 by (i) each person we know to be the beneficial owner of 5% or more of our outstanding shares of Common Stock, (ii) each named executive officer and director and (iii) all current executive officers and directors as a group. Information with respect to beneficial ownership is based on a review of our stock transfer records and on the Schedules 13D and 13G that have been filed with the SEC prior to the filing date of this proxy statement by, or on behalf of, the stockholders listed below. Except as indicated by the footnotes below, we believe, based on the information available to us, that the persons named in the table below have sole voting and investment power with respect to all shares of Common Stock that they beneficially own, subject to applicable community property laws.

Percentage of beneficial ownership is calculated based on 6,421,384 shares of Common Stock outstanding as of February 21, 2024. We have determined beneficial ownership in accordance with SEC rules. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed as outstanding shares of Common Stock subject to stock options ("Options") held by that person that are currently exercisable or exercisable within 60 days of February 21, 2024. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Except otherwise indicated in the footnotes below, the address of each beneficial owner listed in the table is Meta Materials Inc., 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9.

Name and principal position |

| Common Stock Shares |

| % of Class | ||||||

Greater than 5% stockholders |

|

|

|

|

|

|

|

| ||

George Palikaras |

|

| 339,607 |

| (1) |

|

| 5.3 |

| % |

Executive Officers and Directors |

|

|

|

|

|

|

|

| ||

John R. Harding |

|

| 3,421 |

| (2) |

| * |

|

| |

Allison Christilaw |

|

| 7,508 |

| (3) |

| * |

|

| |

Steen Karsbo |

|

| 7,542 |

| (4) |

| * |

|

| |

Kenneth Hannah |

|

| 1,970 |

| (5) |

| * |

|

| |

Vyomesh Joshi |

|

| 2,018 |

| (6) |

| * |

|

| |

Philippe Morali |

|

| 239 |

| (7) |

| * |

|

| |

Uzi Sasson |

|

| — |

|

|

| * |

|

| |

Dan Eaton |

|

| — |

|

|

| * |

|

| |

All directors and executive officers as a group (8 persons) |

|

| 22,698 |

|

|

| * |

|

| |

|

|

|

|

|

|

|

|

| ||

* Represents less than 1% |

|

|

|

|

|

|

|

| ||

(1) | Represents (a) 38,788 shares of Common Stock held by Mr. Palikaras, which includes 23,549 shares of the Exchangeable Shares, (b) 229,823 shares of Common Stock held by Lamda Guard Technologies LTD ("Lamda Guard"), which represents 229,823 shares of the Exchangeable Shares, (c) 33,200 shares of Common Stock held by Mr. Palikaras’ wife, which includes 33,077 shares of the Exchangeable Shares, (d) 18,245 shares of Common Stock that Mr. Palikaras has the right to acquire from us within 60 days of February 21, 2024 pursuant to the exercise of Options, (e) 1,690 shares of Common Stock that Mr. Palikaras’ wife has the right to acquire from us within 60 days of February 21, 2024 pursuant to the exercise of Options, (f) 14,613 shares of Common Stock that Mr. Palikaras has the right to acquire from us within 60 days of February 21, 2024 pursuant to the redemption of deferred stock units ("DSUs"), and (g) 3,248 shares of Common Stock that Mr. Palikaras’ wife has the right to acquire from us within 60 days of February 21, 2024 pursuant to the redemption of DSUs. Please note, subsequent to his tenure as our President and CEO and director, Mr. Palikaras is no longer obligated to report changes in ownership to us in the same manner as active officers and directors. As such, we have made reasonable efforts to ascertain the accurate beneficial ownership of Mr. Palikaras; however, without recent direct communication or updated filings, the disclosed numbers may not reflect the most current ownership status. |

(2) | Represents (a) 962 shares of Common Stock held by Mr. Harding, (b) 1,260 shares of Common Stock held by Harding Partners LP in which Mr. Harding is a General Partner, and (c) 1,199 shares of Common Stock that Mr. Harding has the right to acquire from us within 60 days of February 21, 2024. |

(3) | Represents (a) 150 shares of Common Stock held by Ms. Christilaw, (b) 5,535 shares of Common Stock that Ms. Christilaw has the right to acquire from us within 60 days of February 21, 2024 pursuant to the exercise of Options and (c) 1,823 shares of Common Stock that Ms. Christilaw has the right to acquire from us within 60 days of February 21, 2024 pursuant to the redemption of DSUs. |

(4) | Represents (a) 184 shares of Common Stock held by Mr. Karsbo, (b) 5,535 shares of Common Stock that Mr. Karsbo has the right to acquire from us within 60 days of February 21, 2024 pursuant to the exercise of Options, and (c) 1,823 shares of Common Stock that Mr. Karsbo has the right to acquire from us within 60 days of February 21, 2024 pursuant to the redemption of DSUs. |

(5) | Represents 1,970 shares of Common Stock that Mr. Hannah has the right to acquire from us within 60 days of February 21, 2024, pursuant to the redemption of DSUs. |

(6) | Represents (a) 705 shares of Common Stock held by Mr. Joshi, and 1,313 shares of Common Stock that Mr. Joshi has the right to acquire from us within 60 days of February 21, 2024 pursuant to RSUs. |

(7) | Represents 239 shares of Common Stock held by Mr. Morali. |

9

OTHER MATTERS

Stockholder Proposals and Director Nominations

As previously disclosed in our proxy statement filed with the SEC on October 30, 2023, stockholder proposals may be included in our proxy statement and form of proxy for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in Rule 14a-8 under the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored proxy materials. For a stockholder proposal to be considered timely pursuant to Rule 14a-8 for inclusion in our proxy statement and form of proxy for the annual meeting to be held in 2024, we must receive the proposal at our principal executive offices, addressed to our Secretary, no later than July 4, 2024. Any proposals received after such date will be considered untimely. Submitting a stockholder proposal does not guarantee that it will be included in our proxy statement and form of proxy.

Notice of a stockholder proposal submitted outside the processes of Rule 14a-8 for our 2024 annual meeting of stockholders will be considered untimely unless received by us no later than 45 days before the one-year anniversary of the date on which we first sent our proxy materials for the 2023 annual meeting of stockholders, or September 17, 2024.

In addition, to comply with Rule 14a-19 of the Exchange Act, stockholders must provide notice of the intent to solicit proxies in support of director nominees (other than our nominees) for our 2024 annual meeting of stockholders by notifying our Corporate Secretary no later than October 12, 2024. In addition, Rule 14a-19 under the Exchange Act requires additional information be included in director nomination notices, including a statement that the stockholder intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors. If any change occurs with respect to such stockholder’s intent to solicit the holders of shares representing at least 67% of such voting power, such stockholder must notify us promptly.

Stockholders are advised to review our bylaws for additional information regarding other matters, and procedures related to such matters, that may be considered at an annual meeting of stockholders.

All notices of stockholder proposals, whether or not intended to be included in our proxy materials, should be in writing and sent to our principal executive offices, located at: Meta Materials Inc., 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9, Attn: Corporate Secretary.

Stockholder Communications with the Board of Directors

Our contact information is available on our website at https://investors.metamaterial.com/. Interested parties may send communications to the non-management members of our Board. Communications to the Board must be in writing and sent care of our Corporate Secretary by mail to our offices Meta Materials Inc., Attn: Corporate Secretary, 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9. This centralized process will assist the Board in reviewing and responding to stockholder and interested party communications in an appropriate manner. The name of any specific intended recipient should be noted in the communication. All communications must be accompanied by the following information:

Communications should be addressed to the attention of our Corporate Secretary and should not exceed 500 words in length, excluding the information required to accompany the communication as described above. Copies of written communications received by our Corporate Secretary will be provided to the relevant director(s) unless such communications are considered, in the reasonable judgment of our Corporate Secretary, to be improper for submission to the intended recipient(s). Examples of stockholder communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to us or our business, or communications that relate to improper or irrelevant topics.

Householding

Stockholders who have the same mailing address and last name may have received a notice that their household will receive only one copy of the proxy materials. This practice, commonly referred to as “householding,” is designed to reduce the volume of duplicate information and reduce printing and postage costs. A single copy of the proxy materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice, from the Company or from your bank, broker or other registered holder, that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. A number of banks, brokers and other registered holders with account holders who are our stockholders

10

household our proxy materials. If you hold your shares in street name, and no longer wish to participate in householding and would prefer to receive separate proxy materials in the future, or currently receive multiple copies of the proxy materials and would like to request householding, please notify your bank, broker or other registered holder. If you are a holder of record, and no longer wish to participate in householding and would prefer to receive separate proxy materials in the future, or currently receive multiple copies of the proxy materials and would like to request householding, please notify us in writing at Meta Materials Inc., 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9, Attention: Investor Relations, or by telephone at (877) 255-8483. Any stockholder residing at a shared address to which a single copy of the proxy materials was delivered who wishes to receive a separate copy of our proxy statement may obtain a copy by written request addressed to Meta Materials Inc., 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9, Attention: Corporate Secretary. We will deliver a separate copy of our proxy statement to any stockholder who so requests in writing promptly following our receipt of such request.

Transaction of Other Business

Our Board knows of no other matters to be submitted at the Special Meeting. If any other business is properly brought before the Special Meeting, proxies will be voted in respect thereof as the proxy holders deem advisable.

Where You Can Find Additional Information

We have filed reports, proxy statements and other information with the SEC. The SEC maintains a website that contains the reports, proxy statements and other information we file electronically with the SEC. The address of the SEC website is http://www.sec.gov.

You may request, and we will provide at no cost, a copy of these filings, including any exhibits to such filings, by writing or telephoning us at the following address: Meta Materials Inc., 60 Highfield Park Drive, Suite 102, Dartmouth, Nova Scotia, Canada, NS B3A 4R9, Attention: Corporate Secretary. You may also access these filings on our website at https://investors.metamaterial.com/sec-filings/.

|

|

|

| By Order of the Board of Directors, | |

|

| |

/s/ Uzi Sasson | ||

| Uzi Sasson | |

March 4, 2024 | President and Chief Executive Officer | |

11

Exhibit A

Exhibit A