GigOptix Announces Record Financial Results for Fiscal Year 2008

Palo Alto, CA (March 12, 2009) GigOptix, Inc. (OTCBB: GGOX), a leading provider of electronic engines for the optically connected digital world, today announced its financial results for the fiscal year ended December 31, 2008. GigOptix, Inc. is a result of 18 months of rollup consolidation activity. In July 2007, GigOptix LLC was formed as a restart of iTerra Communications LLC, followed by the acquisition of Helix Semiconductors AG, a company based in Switzerland, in January 2008, and by the signing of a definitive agreement to merge with Lumera Corporation, a company based in Bothell, Washington in March 2008. Upon completion of the merger with Lumera on December 9, 2008, GigOptix Inc. became a publicly traded company on December 10, 2008.

| · | Revenue for fiscal year 2008 increased by 204%, or $6.5 million to $9.7 million |

| · | GigOptix has achieved eight sequential quarters of revenue growth, averaging 34% quarter over quarter |

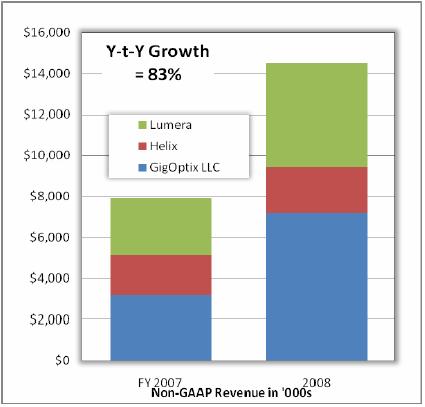

| · | Pro-Forma revenue for fiscal year 2008 increased by 83% to $14.5 million, on a non-GAAP basis |

| · | GigOptix reported $6.9 million in cash, and book value totaled $1.88 per common share as of December 31, 2008 |

“I am pleased with our strong financial results for 2008. We successfully increased our revenue over 200% while significantly strengthening our balance sheet,” stated Dr. Avi Katz, chairman of the board and chief executive officer of GigOptix. “During 2008 we integrated three companies and introduced new product lines that have gained excellent traction in the industry for their strong performance and superior quality. Through our GX, HX, LX, and iT product lines, we provide our customers with the key advantage of offering a one-stop-shop, where they can purchase products to meet their specific technical needs. We believe that with these superior products we will be able to sustain a strong growth rate in 2009.”

Discussion of GigOptix, Inc. Financial Results

We have reported certain non-GAAP information in the text below and in the financial tables at the end of this press release, together with reconciliations to GAAP measures. We believe that this information is relevant and useful to investors because of the acquisitions of Helix and Lumera.

Fiscal year 2008 highlights include:

| · | Revenue for the six months ended December 31, 2008 was $5.7 million, an increase of 196% compared with $1.9 million for the same period in 2007. Revenue for fiscal year 2008 was $9.7 million, an increase of 204% compared with $3.2 million for fiscal year 2007. The increase in revenue year over year is a result of organic growth in the GigOptix telecom and broadband businesses, as well as key transactions, including the acquisition of Helix Semiconductors in January 2008 and the merger with Lumera Corporation in December 2008. |

| · | On an unaudited non-GAAP basis, including the results of the Helix and Lumera acquisitions from the beginning of 2007, revenue for 2008 for the three companies would have increased by 83%, or $6.6 million to $14.5 million, compared to $7.9 million in 2007. |

| · | Gross profit for the six months ended December 31, 2008 was $3.9 million or 69% of revenue, compared with gross profit of $894,000, or 46% of revenue, for the same period in 2007. Gross profit in fiscal year 2008 was $5.9 million, or 61% of revenue, compared with gross profit of $1.4 million, or 43% of revenue, for fiscal year 2007. Improvement in gross profit for both comparative periods is due to increased revenue, a higher margin product mix and lower product costs related to operating efficiencies. |

| · | Operating expenses for the six months ended December 31, 2008 were $7.9 million, compared to $5.4 million for the same period in 2007. This increase is primarily due to professional fees associated with the merger with Lumera Corporation, higher new product development costs and the addition of the Lumera office in Bothell. Operating expenses for fiscal year 2008 were $13.2 million, compared to $7.7 million for the same period in 2007, increasing primarily due to the merger with Lumera Corporation and acquisition of Helix Semiconductors. |

| · | Loss from operations for the six months ended December 31, 2008 was $3.9 million, compared to $4.5 million in the same period in 2007, primarily due to increased revenues and gross margins, partially offset by merger-related costs during the 2008 period of $1.6 million. Loss from operations for the fiscal year 2008 was $7.3 million, compared to $6.4 million for the same period in 2007. |

| · | Non-GAAP loss from operations for the six months ended December 31, 2008 was $1.1 million, compared to $2.3 million for the six months ended June 30, 2008 and $4.1 million for the six months ended December 31, 2007. Non-GAAP loss from operations for fiscal year 2008 was $3.3 million compared to $6.0 million for fiscal year 2007. The reduction in non-GAAP loss from operations over the periods presented is due to improvement in the Company’s cost containment efforts and leveraging the synergies obtained from the Company’s acquisitions. |

| · | Our cash position as of December 31, 2008 was $6.9 million, a significant improvement compared to our cash position as of December 31, 2007 of $525,000. Our current ratio, calculated as total current assets divided by total current liabilities, was 2.4 to 1, and book value totaled $9.8 million or $1.88 per common share, based on 5.2 million outstanding shares. |

| · | Prior to the merger with Lumera Corporation, which closed in the fourth quarter of 2008, GigOptix was not required to prepare financial statements on a quarterly basis. In order to be consistent with the presentation in GigOptix' registration statement on Form S-4, and to provide our investors with meaningful financial data regarding our earnings trend, GigOptix has presented its condensed consolidated statements of operations on a six-month basis in this press release. |

2009 Business Outlook

GigOptix’ objective in 2009 is to continue its development as an industry leader that offers a portfolio of electronic integrated circuits, electro-optic devices and integrated components for the optically connected digital world. GigOptix plans to reinvigorate its portfolio of Radio Frequency (RF) products in 2009, capitalizing on the significant progress in developing its Optical Communications focused product lines. To this end, the Company’s business strategy has the following components:

| · | Leverage technology and products developed for the Company’s current markets into next door markets to drive growth and spread risk |

| · | Continue to pursue strategic acquisitions |

| · | Expand relationships with existing customers and governmental agencies |

Dr. Katz, commented, “The six months ended December 31, 2008, with the help of every team member on staff, was our best period to date. I am very proud of every individual who helped us to successfully integrate several complex transactions. Heading into 2009, I am optimistic about our growth prospects, both organically and through strategic acquisitions. The aggressive growth strategy of GigOptix has enabled us to propel our business forward and establish a strong operating platform. We believe that by building upon this platform and continuing to execute on our organic and strategic growth plan, we will emerge as a market leader.”

2009 First Quarter Financial Outlook

Despite the challenging economic conditions and the normal seasonal effects of our business in the first quarter of the year, GigOptix forecasts product revenue for the first quarter of fiscal year 2009 to be flat to up 2%, compared with the fourth quarter of fiscal year 2008, and to increase by more than 80% compared to the first quarter of fiscal year 2008.

Product Line Updates

GX & iT Products – Serial drivers and receivers:

In 2008, revenues from the 10G ultra long haul segment grew by 190% vs. 2007 as the Company's RZ and DQPSK devices were put into production. At the same time the Company began broadening the GX product line moving to production with 10G long haul RZ and NRZ modulator drivers such as GX6134 and GX6155. These are anticipated to drive revenue and market share growth in 2009 as they are sold into a number of transponders from leading suppliers. The company also started shipping the first in a family of its EA drivers for 40Km 10G transceivers, the GX6120.

In 2009, GigOptix will continue to expand its GX product line with the addition of a family of Trans-impedance and Limiting Amplifiers (TIAs and LIAs) as well as developing new products for 40G and 100G applications in cooperation with key customers.

HX Products – Parallel drivers and receivers:

The HX product line was acquired in January 2008, making GigOptix a leader in parallel optical driver/receiver pairs. Revenues from the HX product line grew in 2008 by approximately 20% vs. the 2007 level achieved by Helix as a standalone company. 2008 sales included the last time shipments of its 4 x 3 Gb/s family and the increase in sales of its 4 x 5 Gb/s and 12 x 5 Gb/s devices to both the datacom and consumer market segments. The Company developed, and provided to customers, samples of a new range of four and twelve channel 10G parallel devices in 2008 in anticipation of the market adoption of higher speeds interconnects which is expected to start in 2009.

In 2009, GigOptix will complete its 10G parallel line-up that will serve the 40G Base-SR4, 100G Base-SR10, MSA, QSFP, SNAP12 and InfiniBand QDR markets, and work on optimizing the devices for new low-cost, low-power consumer applications.

LX Products – High Speed electro-optical polymer modulators:

In 2008, the LX product line revenue came almost exclusively from contracts with government agencies and contractors. DARPA Phase III contract was successfully concluded and the Company is currently discussing next future programs with DARPA.

GigOptix's acquisition of Lumera was concluded in December 2008 and subsequently the Lumera team's focus has been on proving the commercial viability of the Company's polymer-based modulators, with industrialization activities including engagement of contract manufacturers, further stress testing and analysis, and manufacturing process optimization to support volume production and transfer to third party manufacturing.

GigOptix has defined the potential commercial deployment opportunities of the polymer modulator to be mainly in the future 40G and 100G markets, rather than in the 10G market, where the prospects of its superior performance and price comparing to existing products, may provide a competitive edge .

The Company intends to release samples of its LX8400 40Gb/s Mach-Zehnder modulator by the end of the second quarter of 2009 and has entered into discussions with a number of customers who have indicated interest in the product.

iT Products – Broadband Amplifiers

In 2008, the legacy iTerra iT line of broadband amplifies grew 117% vs. 2007 levels. Despite limited investment, the line delivered a solid year of expansion of customers and applications, and GigOptix believes there is opportunity to further grow in this segment of Military and Test & Measurement markets especially with the potential synergies possible with the LX product line.

Investors should review these financial results and business information in conjunction with the more comprehensive information regarding the Company's results of operations and financial condition included in its fiscal year 2008 Form 10-K, which is expected to be filed with the SEC on or before March 31, 2009.

Non-GAAP Financial Measures

Non-GAAP revenue includes unaudited 2008 and 2007 revenue results for Helix Semiconductors and Lumera Corporation prior to their acquisition by GigOptix. A reconciliation of GAAP revenue to non-GAAP revenue is included in the tables below.

Non-GAAP loss from operations include adjustments to add back special items, consisting of expensed acquired IPR&D costs, merger and acquisition-related expenses, amortization of acquired intangible assets, acquisition-related compensation expenses, stock-based compensation expense, and costs related to the liquidation of our subsidiary in Italy. A reconciliation of the GAAP loss from operations amount to the non-GAAP loss from operations measure is included in the tables below.

Conference Call

GigOptix will hold its quarterly conference call to discuss the second half and fiscal year 2008 operating results on March 12, 2009 at 4:30 p.m. Eastern Standard Time (1:30 p.m. PST).

Conference call and the live audio web cast details:

When: Thursday, March 12, 2009

Toll-free: 800-510-9691

International: 617-786-2963

Pass code: 72973475

Live Audio web cast: www.gigoptix.com

Telephone replay will be available until March 19, 2009 6:30 p.m.

Toll-free: 888-286-8010

International callers: 617-801-6888

Pass code: 25934930

Web cast will be archived on the Company’s website at www.gigoptix.com.

Open House Reminder

The GigOptix open-house will be on March 13, 2009. It will be held at the GigOptix Inc. corporate headquarters located on 2400 Geng Road in Palo Alto, California between the hours of 10:00 a.m. PST and 12:00 p.m. Please contact Parker Martineau at (650) 424-1937 x102 or at ir@gigoptix.com to RSVP for the event.

About GigOptix Inc.

GigOptix is a leading fabless manufacturer of electronic engines for the optically connected digital world. The Company offers a broad portfolio of high speed electronic devices including polymer electro-optic modulators, modulator drivers, laser drivers and TIAs for telecom, datacom, Infiniband and consumer optical systems, covering serial and parallel communication technologies from 1G to 100G. For more information, please visit www.GigOptix.com.

Forward-Looking Statements

This release may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements by GigOptix regarding its expected financial position, revenues, cash flow and other operating results, business strategy, financing plans, forecasted trends related to the markets in which it operates, and similar matters are forward-looking statements. GigOptix's actual results could be materially different from its expectations because of various risks to its business. Many of these risks are discussed under the caption "Risk Factors" in GigOptix' registration statement on Form S-4 on file with the SEC. Except for any obligation to disclose material information under the Federal securities laws, GigOptix undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this document.

Contact:

GigOptix Inc.

Parker Martineau, 650-424-1937 x102 (Media)

Corporate Communications Manager

pmartineau@gigoptix.com

Or

Alliance Advisors, LLC

Alan Sheinwald, 914-669-0222 (Investor Relations)

President

asheinwald@allianceadvisors.net

GigOptix, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash | | $ | 6,871 | | | $ | 525 | |

| Accounts receivable, net | | | 2,475 | | | | 634 | |

| Inventories | | | 1,019 | | | | 538 | |

| Other current assets | | | 1,043 | | | | 99 | |

| Total current assets | | | 11,408 | | | | 1,796 | |

| Property and equipment, net | | | 771 | | | | 391 | |

| Intangible assets | | | 1,231 | | | | | |

| Restricted cash and investments | | | 749 | | | | | |

| Other assets | | | 712 | | | | 59 | |

| Total assets | | $ | 14,871 | | | $ | 2,246 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | | 1,496 | | | $ | 392 | |

| Accrued and other liabilities | | | 2,472 | | | | 1,036 | |

| Convertible notes payable | | ‐ | | | | 2,105 | |

| Line of credit | | | 800 | | | | 83 | |

| Total current liabilities | | | 4,768 | | | | 3,616 | |

| Pension liabilities | | | 173 | | | | | |

| Deferred tax liabilities | | | 118 | | | | | |

| Total liabilities | | | 5,059 | | | | 3,616 | |

| | | | | | | | | |

| Shareholders' equity (deficit) | | | | | | | | |

| Common stock, $0.001 par value | | | 5 | | | | | |

| Additional paid‐in capital | | | 68,576 | | | | 49,888 | |

| Accumulated deficit | | | (58,952 | ) | | | (51,258 | ) |

| Accumulated other comprehensive income | | | 183 | | | | | |

| Total shareholders' equity (deficit) | | | 9,812 | | | | (1,370 | ) |

| Total liabilities and shareholders' equity (deficit) | | $ | 14,871 | | | $ | 2,246 | |

GigOptix, Inc.

Condensed Consolidated Statements of Operations

(In thousands)

(Unaudited)

| | | | Six Months ended | | | | Twelve Months ended | |

| | | December 31, | | | June 27, | | | December 31, | | | | December 31, | |

| | | | 2008 | | | | 2008 | | | | 2007 | | | | 2008 | | | | 2007 | |

| Revenue | | $ | 5,726 | | | $ | 3,929 | | | $ | 1,936 | | | $ | 9,655 | | | $ | 3,177 | |

| Cost of revenue | | | 1,778 | | | | 1,989 | | | | 1,042 | | | | 3,767 | | | | 1,815 | |

| Gross profit | | | 3,948 | | | | 1,940 | | | | 894 | | | | 5,888 | | | | 1,362 | |

| Research and development expense | | | 2,460 | | | | 1,909 | | | | 870 | | | | 4,369 | | | | 1,705 | |

| Selling, general and administrative expense | | | 5,022 | | | | 3,109 | | | | 4,497 | | | | 8,131 | | | | 6,026 | |

| Acquired in-process research and development | | | 397 | | | | 319 | | | | - | | | | 716 | | | | - | |

| Total operating expenses | | | 7,879 | | | | 5,337 | | | | 5,367 | | | | 13,216 | | | | 7,731 | |

| Loss from operations | | | (3,931 | ) | | | (4,473 | ) | | | (3,397 | ) | | | (7,328 | ) | | | (6,369 | ) |

| Other income (expense), net | | | 82 | | | | (198 | ) | | | 57 | | | | (116 | ) | | | (4 | ) |

| Interest income (expense), net | | | (186 | ) | | | (209 | ) | | | 1,754 | | | | (395 | ) | | | (34 | ) |

Net loss before (provision for) benefit from income taxes | | | (4,035 | ) | | | (3,804 | ) | | | (2,662 | ) | | | (7,839 | ) | | | (6,407 | ) |

| Benefit from (provision for) income taxes | | | 39 | | | | 105 | | | | - | | | | 144 | | | | (43 | ) |

| Net loss | | $ | (3,996 | ) | | $ | (3,699 | ) | | $ | (2,662 | ) | | $ | (7,695 | ) | | $ | (6,450 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss per share - basic and diluted | | $ | (2.11 | ) | | $ | (4.98 | ) | | $ | (3.58 | ) | | $ | (5.78 | ) | | $ | (8.11 | ) |

| Weighted - average shares used in net loss per share | | | | | | | | | | | | | | | | | | | | |

| calculations - basic and diluted | | | 1,894 | | | | 743 | | | | 743 | | | | 1,332 | | | | 795 | |

The following table sets forth our condensed consolidated statements of operations components, expressed as a percentage of revenue, for the periods indicated:

| | | Six Months ended | | | Twelve Months ended | |

| | | December 31, | | | June 27, | | | December 31, | | | December 31, | |

| | | 2008 | | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| Revenue | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| Cost of revenue | | | 31.1 | % | | | 50.6 | % | | | 53.8 | % | | | 39.0 | % | | | 57.1 | % |

| Gross margin | | | 68.9 | % | | | 49.4 | % | | | 46.2 | % | | | 61.0 | % | | | 42.9 | % |

| Research and development expense | | | 43.0 | % | | | 48.6 | % | | | 44.9 | % | | | 45.3 | % | | | 53.7 | % |

| Selling, general and administrative expense | | | 87.7 | % | | | 79.1 | % | | | 232.3 | % | | | 84.2 | % | | | 189.7 | % |

| Acquired in - process research and development | | | 6.9 | % | | | 8.1 | % | | | 0.0 | % | | | 7.4 | % | | | 0.0 | % |

| Total operating expenses | | | 137.6 | % | | | 135.8 | % | | | 277.2 | % | | | 136.9 | % | | | 243.3 | % |

| Loss from operations | | | -68.7 | % | | | -86.5 | % | | | -231.0 | % | | | -75.9 | % | | | -200.5 | % |

| Other income (expense), net | | | 1.4 | % | | | -5.0 | % | | | 3.0 | % | | | -1.2 | % | | | -0.1 | % |

| Interest income (expense), net | | | -3.2 | % | | | -5.3 | % | | | 90.6 | % | | | -4.1 | % | | | -1.1 | % |

| Net loss before (provision for) benefit from income taxes | | | -70.5 | % | | | -96.8 | % | | | -137.5 | % | | | -81.2 | % | | | -201.7 | % |

| Benefit from (provision for) income taxes | | | 0.7 | % | | | 2.7 | % | | | - | | | | 1.5 | % | | | -1.4 | % |

| Net loss | | | -69.8 | % | | | -94.1 | % | | | -137.5 | % | | | -79.7 | % | | | -203.0 | % |

GigOptix, Inc.

Reconciliation of GAAP Revenue to Non-GAAP Revenue

(In thousands)

(Unaudited)

| | | | Quarters Ended | | | | Twelve Months ended | |

| | | Mar 31, | | | | Jun 30, | | | | Sep 30, | | | | Dec, 31 | | | Mar 28, | | | | Jun 27, | | | | Sep 26, | | | | Dec, 31 | | | | December 31, | |

| | | | 2007 | | | | 2008 | | | | 2007 | | | | 2008 | |

| GAAP Revenue | | $ | 446 | | | $ | 795 | | | $ | 833 | | | $ | 1,103 | | | $ | 1,683 | | | $ | 2,246 | | | $ | 2,622 | | | $ | 3,104 | | | $ | 3,177 | | | $ | 9,655 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pre-acquisition revenue relating to: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Helix Semiconductors | | $ | 385 | | | $ | 359 | | | $ | 445 | | | $ | 786 | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 1,975 | | | $ | - | |

| Lumera Corporation | | $ | 860 | | | $ | 934 | | | $ | 624 | | | $ | 356 | | | $ | 484 | | | $ | 1,499 | | | $ | 1,565 | | | $ | 1,278 | | | $ | 2,774 | | | $ | 4,826 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Revenue | | $ | 1,691 | | | $ | 2,088 | | | $ | 1,902 | | | $ | 2,245 | | | $ | 2,167 | | | $ | 3,745 | | | $ | 4,187 | | | $ | 4,382 | | | $ | 7,926 | | | $ | 14,481 | |

Notes to Non-GAAP Revenue

To supplement its consolidated revenue in accordance with GAAP, GigOptix uses a non-GAAP revenue measure which is computed from the most directly comparable GAAP revenue amount to include revenue prior to the acquisitions of Helix Semiconductors and the merger of Lumera Corporation. The above tables includes pre-acquisition revenue for the four quarters and year ended December 31, 2007 for Helix Semiconductors and for Lumera Corporation, the following periods are included: the four quarters of fiscal year 2007, the first three quarters of fiscal year 2008, the period from October 1, 2008 through December 9, 2008 and the year ended December 31, 2007, respectively. Management believes that providing this non-GAAP revenue measure, in addition to the GAAP revenue is useful to investors because the non-GAAP revenue measure enables investors to better assess changes in revenue across different reporting periods on a consistent basis. GigOptix uses this non-GAAP revenue measure for internal purposes and believes that this non-GAAP revenue measure provides meaningful supplemental information regarding operational and financial performance.

The following graphs detail the Company’s non-GAAP revenue for the quarters and twelve months in fiscal year 2008 and 2007 for the combined companies of GigOptix LLC, Helix Semiconductors and Lumera Corporation:

GigOptix, Inc.

Reconciliation of GAAP Loss from Operations to Non-GAAP Loss from Operations

(In thousands)

(Unaudited)

| | | | Six Months ended | | | | Twelve Months ended | |

| | | December 31, | | | June 27, | | | December 31, | | | | December 31, | |

| | | | 2008 | | | | 2008 | | | | 2007 | | | | 2008 | | | | 2007 | |

| GAAP loss from operations | | $ | (3,931 | ) | | $ | (3,397 | ) | | $ | (4,473 | ) | | $ | (7,328 | ) | | $ | (6,369 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Special items: | | | | | | | | | | | | | | | | | | | | |

| Acquired IPR&D | | | 397 | | | | 319 | | | | - | | | | 716 | | | | - | |

| Merger and acquisition - related expenses | | | 1,568 | | | | 130 | | | | - | | | | 1,698 | | | | - | |

| Acquisition - related compensation charge | | | 350 | | | | 350 | | | | - | | | | 700 | | | | - | |

| Amortization of acquired intangible assets | | | 325 | | | | 285 | | | | - | | | | 610 | | | | - | |

| Stock-based compensation expense | | | 228 | | | | 55 | | | | 72 | | | | 283 | | | | 72 | |

| Costs related to liquidation of our subsidiary | | | | | | | | | | | | | | | | | | | | |

| in Italy | | | | | | | - | | | | 300 | | | | - | | | | 300 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total special items | | | 2,868 | | | | 1,139 | | | | 372 | | | | 4,007 | | | | 372 | |

| | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP loss from operations | | $ | (1,063 | ) | | $ | (2,258 | ) | | $ | (4,101 | ) | | $ | (3,320 | ) | | $ | (5,997 | ) |

Notes to Non-GAAP Loss from Operations

To supplement its consolidated loss from operations in accordance with GAAP, GigOptix uses non-GAAP loss from operations results which are computed adjusted from the most directly comparable GAAP loss from operations amounts and adjusted with the certain items as shown above and described below. Management believes that this non-GAAP financial measure reflects an additional and useful way of viewing aspects of GigOptix' operations that, when viewed in conjunction with its GAAP results, provide a more comprehensive understanding of the various factors and trends affecting GigOptix' business and operations. Thus, management believes that this non-GAAP financial measure provides investors with another method for assessing GigOptix's operating results in a manner that is focused on the performance of its ongoing operations. In addition, this non-GAAP financial measure facilitates comparisons to GigOptix's historical operating results and to competitors' operating results.

There are limitations in using non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies. In addition, non-GAAP financial measures may be limited in value because they exclude certain items that may have a material impact upon GigOptix's reported financial results. Management compensates for these limitations by providing investors with reconciliations of the non-GAAP financial measure to the most directly comparable GAAP financial measure. The presentation of non-GAAP financial information is not meant to be considered in isolation or as a substitute for or superior to the most directly comparable GAAP financial measures. The non-GAAP financial measure supplements, and should be viewed in conjunction with the GAAP financial measure. Investors should review the reconciliations of the non-GAAP financial measures to their most directly comparable GAAP financial measures as provided above.

Acquired in-process research and development charges relate to projects in process as of the respective acquisition date that have not reached technological feasibility and are immediately expensed.

| · | Merger and acquisition-related expenses. |

The Company incurred certain expenses related to the acquisition of Helix Semiconductors and the merger of Lumera Corporation, including legal, accounting, and auditing services.

| · | Acquisition-related compensation charge |

As a result of the acquisition of Helix Semiconductors, the Company is required to pay compensation expense, which is contingent on the employment retention of certain key employees established in accordance with the terms of the acquisition.

| · | Amortization of acquired intangible assets. |

Amortization of acquired intangible assets consists of the amortization of assets acquired in the acquisition of Helix Semiconductor and the merger with Lumera Corporation, such as customer relationships, backlog, existing technology, and patents.

| · | Stock-based compensation expense. |

Stock-based compensation expense relates primarily to equity awards such as stock options and restricted stock units. Stock-based compensation is a non-cash expense that varies in amount from period to period and may be dependent on market forces.

| · | Expenses related to the liquidation of our subsidiary in Italy. |

The Company liquidated its R&D center in Italy in 2007. Certain charges occurred related to this dissolution, related to employee separation costs and certain professional fees.