GIGOPTIX, INC.

2008 EQUITY INCENTIVE PLAN

Form of Nonstatutory Stock Option

This certificate evidences a nonstatutory stock option (this “Stock Option”) granted by GigOptix, Inc., a Delaware corporation (the “Company”), on [________] to [____________] (the "Participant") pursuant to the Company's 2008 Equity Incentive Plan (as from time to time in effect, the "Plan"). Under this Stock Option, the Participant may purchase, in whole or in part, on the terms herein provided, a total of [___] shares of common stock of the Company (the "Shares") at $[_____] per Share. The latest date on which this Stock Option, or any part thereof, may be exercised is [_________](the "Final Exercise Date"). The Stock Option evidenced by this certificate is intended to be, and is hereby designated, a nonstatutory option, that is, an option that does not qualify as an incentive stock option as defined in section 422 of the Internal Revenue Code of 1986, as amended from time to time (the "Code"). Unless otherwise defined in this Stock Option, the terms used in this Stock Option shall have the meaning defined in the Plan.

This Stock Option is exercisable in the following cumulative installments prior to the Final Exercise Date:

[_______] Shares on and after [___________________, 20__];

an additional [_______] Shares on and after [___________________, 20__]; and

an additional [_______] Shares on and after [___________________, 20__].

/etc./

Notwithstanding the foregoing, upon termination of the Participant's relationship with the Company, any portion of this Stock Option that is not then exercisable will promptly expire and the remainder of this Stock Option will remain exercisable for three months; provided, that any portion of this Stock Option held by the Participant immediately prior to the Participant's death, to the extent then exercisable, will remain exercisable for one year following the Participant's death; and further provided, that in no event shall any portion of this Stock Option be exercisable after the Final Exercise Date.

| 2. | Exercise of Stock Option. |

Each election to exercise this Stock Option shall be in writing in the form attached hereto, signed by the Participant or the Participant's executor, administrator, or legally appointed representative (in the event of the Participant’s incapacity) or the person or persons to whom this Stock Option is transferred by will or the applicable laws of descent and distribution (collectively, the "Option Holder"), and received by the Company at its principal office, accompanied by this certificate and payment in full as provided in the Plan. Subject to the further terms and conditions provided in the Plan, the purchase price may be paid as follows: (i) by delivery of cash or check acceptable to the Administrator; (ii) through a broker-assisted exercise program acceptable to the Administrator; (iii) at the discretion of the Administrator on a case by case basis, by “cashless exercise” (as described in question 9 of the “2008 Equity Incentive Plan – Plan Summary and Prospectus”); or (iv) through any combination of the foregoing. In the event that this Stock Option is exercised by an Option Holder other than the Participant, the Company will be under no obligation to deliver Shares hereunder unless and until it is satisfied as to the authority of the Option Holder to exercise this Stock Option.

The person exercising this Stock Option shall notify the Company when making any disposition of the Shares acquired upon exercise of this Stock Option, whether by sale, gift or otherwise.

| 4. | Restrictions on Transfer of Shares. |

If at the time this Stock Option is exercised the Company or any of its shareholders is a party to any agreement restricting the transfer of any outstanding shares of the Company’s common stock, the Administrator may provide that this Stock Option may be exercised only if the Shares so acquired are made subject to the transfer restrictions set forth in that agreement (or if more than one such agreement is then in effect, the agreement or agreements specified by the Administrator).

| 5. | Withholding; Agreement to Provide Security. |

If at the time this Stock Option is exercised the Company determines that under applicable law and regulations it could be liable for the withholding of any federal or state tax upon exercise or with respect to a disposition of any Shares acquired upon exercise of this Stock Option, this Stock Option may not be exercised unless the person exercising this Stock Option remits to the Company any amounts determined by the Company to be required to be withheld upon exercise (or makes other arrangements satisfactory to the Company for the payment of such taxes) and gives such security as the Company deems adequate to meet its potential liability for the withholding of tax upon a disposition of the Shares and agrees to augment such security from time to time in any amount reasonably determined by the Company to be necessary to preserve the adequacy of such security.

| 6. | Nontransferability of Stock Option. |

This Stock Option is not transferable by the Participant otherwise than by will or the laws of descent and distribution, and is exercisable during the Participant's lifetime only by the Participant (or in the event of the Participant's incapacity, the person or persons legally appointed to act on the Participant's behalf).

| 7. | Provisions of the Plan. |

This Stock Option is subject to the provisions of the Plan, which are incorporated herein by reference. A copy of the Plan as in effect on the date of the grant of this Stock Option has been furnished to the Participant. By exercising all or any part of this Stock Option, the Participant agrees to be bound by the terms of the Plan and this certificate. All initially capitalized terms used herein will have the meaning specified in the Plan, unless another meaning is specified herein.

IN WITNESS WHEREOF, the Company has caused this instrument to be executed by its duly authorized officer.

| | GIGOPTIX, INC. |

| | |

| | |

| | By _____________________________ |

| | |

Dated: [_________________]

| | Acknowledged |

| | |

| | |

| | _______________________________ |

| | [Name of Participant] |

Dated: [_________________]

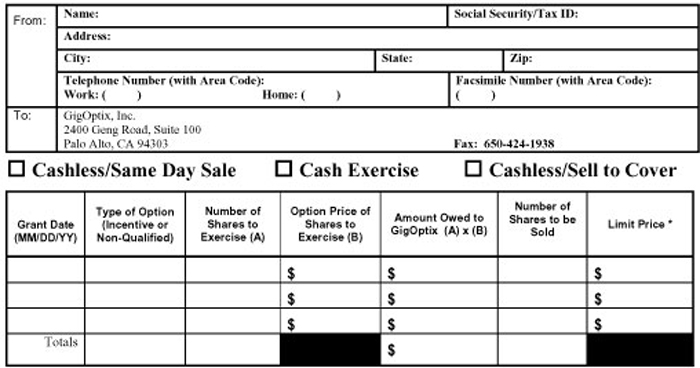

EXERCISE OF STOCK OPTIONS

GIGOPTIX, INC.

| | * Limit orders and will remain outstanding until cancelled, or commencement of a trading blackout, unless you specify when the limit order is verbally confirmed with the selling broker that the limit order is good for that day only. |

Notes:

For a Cashless Exercise or a Sell to Cover Exercise, this exercise form does not constitute a sale order for shares of GigOptix, Inc. common stock. You must verbally your broker for any share sales, following submission of this form.

For a Cash Exercise, you must remit the full amount of the option cost accompanied by a copy of this form. For a Sell-to-Cover Exercise, where expected gross proceeds on sale after broker’s commission are short of the amount owed to GigOptix, you must remit payment for the option cost shortfall immediately. Payment of the option cost, shortfall and taxes, as applicable, may be in the form of a check (or checks) payable to GigOptix, Inc. and sent to GigOptix, Inc., 2400 Geng Road, Suite 100, Palo Alto, California 94303. GigOptix will calculate any taxes due and relay that amount to you the day following exercise. A check for any taxes due must be received by GigOptix within four business days of the exercise date.

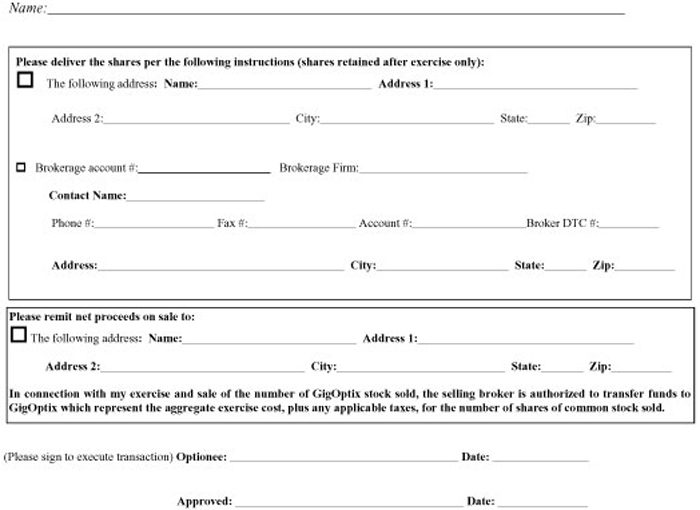

To Whom It May Concern:

Pursuant to the terms of the GigOptix, Inc. 2008 Equity Incentive Plan, I hereby elect to exercise the above stated number of shares of GigOptix, Inc. Common Stock at the above stated option price(s) per share from the non-qualified/incentive stock option(s) granted to me on the above stated date(s). Also, if indicated above, this notice reflects my request to sell the above-designated number of shares.

I understand that my exercise date will be the date that this notice of exercise is received, with approval if required, and that, if required, GigOptix has received payment for the number of shares exercised. I also understand that an Exercise Notice received after 3:30 p.m. Eastern time may have an exercise date of the following business day. If applicable, GigOptix will advise of taxes due on exercise of an option.

| | | |

| Signature of Optionee | | Date |

Exercise of Stock Options

GigOptix, Inc.

Note A: GigOptix, Inc. is hereby authorized and instructed by me to deliver the stock to be issued upon the exercise of my stock options(s) via [DWAC] to the selling broker. GigOptix, Inc. is acting as my agent and nominee for further credit to my brokerage account. This letter authorizing you to deliver the stock pursuant to my stock option(s) exercise cannot be revoked or rescinded by me under any circumstances, and as the transfer for the exercise price (plus any applicable taxes) represents, in whole or in part, funds advanced by my broker, I have granted the selling broker a security interest in the shares to be issued pursuant to this exercise of my stock option(s), which security interest will not be terminated even if the securities are delivered to me contrary to these instructions.