Exhibit 99.1

Powering High Speed Networks

Investor Presentation

December 2013

NYSE MKT: GIG

© 2013 GigOptix, Inc. All Rights Reserved

Disclaimer

Forward Looking Statements:

This presentation contains statements regarding operating trends, future results, new projects, and other market, business and product trends that are forward-looking. We undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Additional factors that could cause actual results to differ are discussed under the heading “Risk Factors” and in other sections of the GigOptix filings with the SEC, and in GigOptix’s other current and periodic reports filed or furnished from time to time with the SEC.

Use of Non-GAAP and Adjusted EBITDA Financial Measures:

These materials include references to non-GAAP revenue, non-GAAP net income/loss, Adjusted consolidated non-GAAP net income/loss, and Adjusted EBITDA. GigOptix believes that these non-GAAP financial measures are important indicators of the ongoing operations of its business and provide better comparability between reporting periods and provide a better baseline for analyzing trends in GigOptix’s operations. GigOptix does not, nor does it suggest that investors should, consider such non-GAAP and Adjusted EBITDA financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. GigOptix believes the disclosure of the effects of these items increases the reader’s understanding of the underlying performance of the business and that such non-GAAP and Adjusted EBITDA financial measures provide investors with an additional tool to evaluate our financial results and assess our prospects for future performance.

2 | | © 2013 GigOptix, Inc. All Rights Reserved |

GigOptix Overview

Emerging Leader in ICs for High Speed Cloud

Communication Links and Network Applications

Core Products Target 3 Markets:

Cloud connectivity

High-speed optical and wireless networks

Industrial

Customer base: Tier 1 & 2 equipment OEMs and ODMs

Market Leadership: Optical engines for Active Optical Cables and 100Gbps Coherent networking systems

Solid Financial Position:

Q3’13 revs of $7.3M; Non-GAAP GM of 62%; No LTD; ~$15M cash

21.7M shares O/S; Market Cap of ~$35M

113 Patents: Core IP leveraged in our major markets

Headquarters: San Jose, California

83 employees globally, 41 in Engineering

Fabless

3 | | © 2013 GigOptix, Inc. All Rights Reserved |

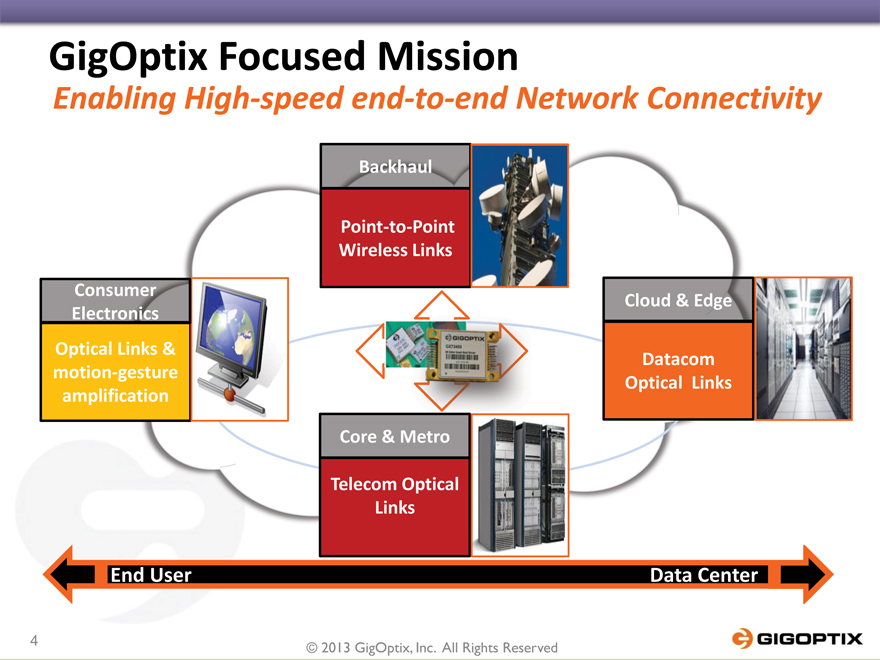

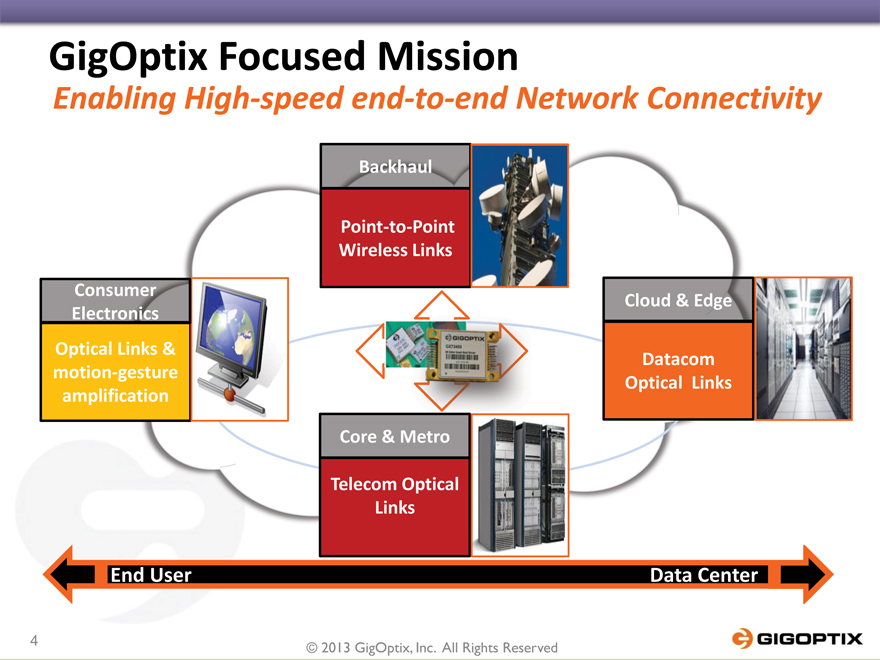

GigOptix Focused Mission

Enabling High-speed end-to-end Network Connectivity

Backhaul

Point-to-Point Wireless Links

Consumer

Cloud & Edge Electronics

Optical Links &

Datacom motion-gesture Optical Links amplification

Core & Metro

Telecom Optical Links

End User Data Center

4 | | © 2013 GigOptix, Inc. All Rights Reserved |

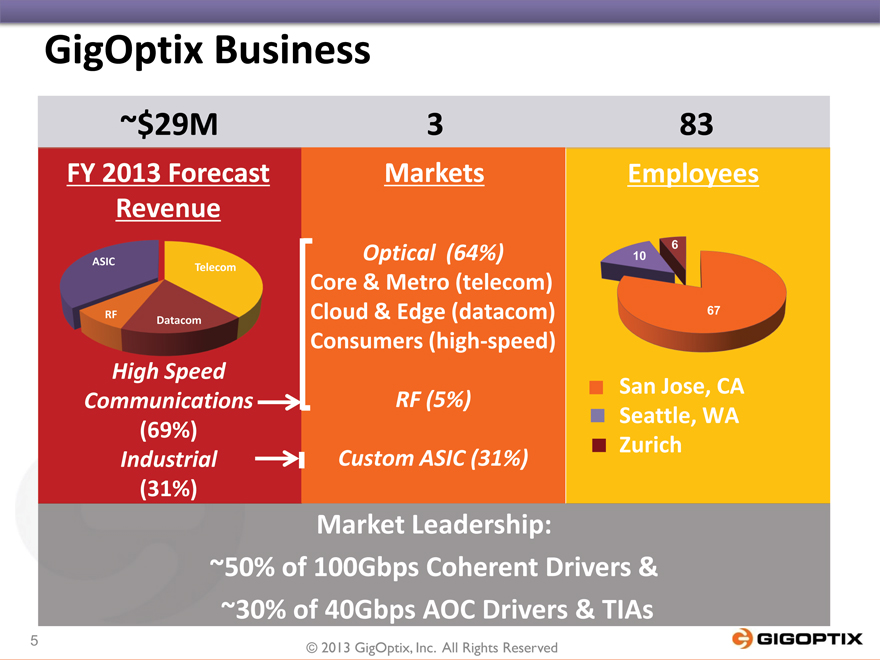

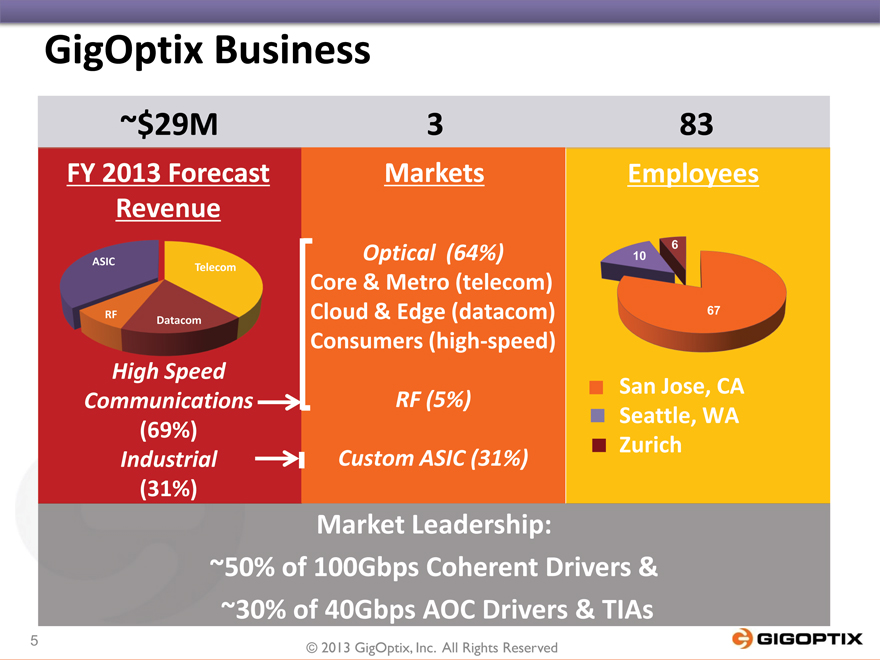

GigOptix Business

~$29M 3 83

FY 2013 Forecast Markets Employees

Revenue

Optical (64%) 10 6

ASIC Telecom

Core & Metro (telecom)

RF Cloud & Edge (datacom) 67

Datacom

Consumers (high-speed)

High Speed Communications (69%) Industrial (31%)

RF (5%) San Jose, CA

Seattle, WA

Custom ASIC (31%) Zurich

Market Leadership:

~50% of 100Gbps Coherent Drivers &

~30% of 40Gbps AOC Drivers & TIAs

5 | | © 2013 GigOptix, Inc. All Rights Reserved |

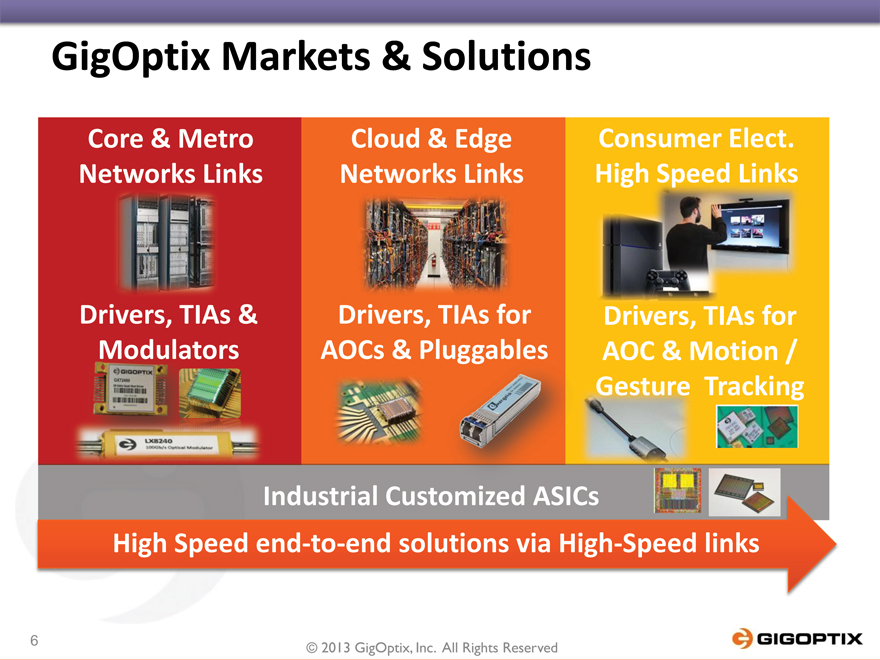

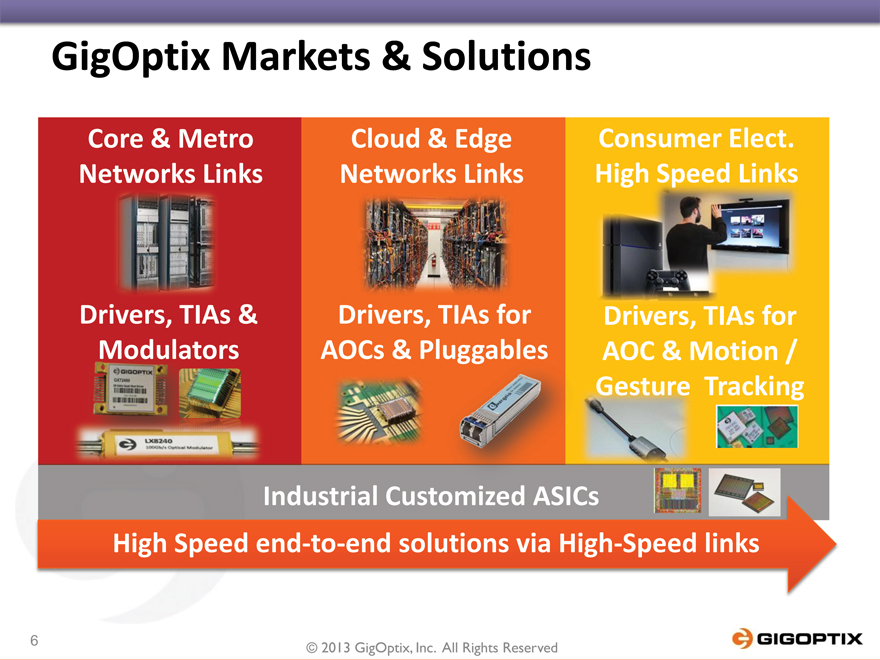

GigOptix Markets & Solutions

Core & Metro Cloud & Edge Consumer Elect.

Networks Links Networks Links High Speed Links

Drivers, TIAs & Drivers, TIAs for Drivers, TIAs for

Modulators AOCs & Pluggables AOC & Motion /

Gesture Tracking

Industrial Customized ASICs

High Speed end-to-end solutions via High-Speed links

6 | | © 2013 GigOptix, Inc. All Rights Reserved |

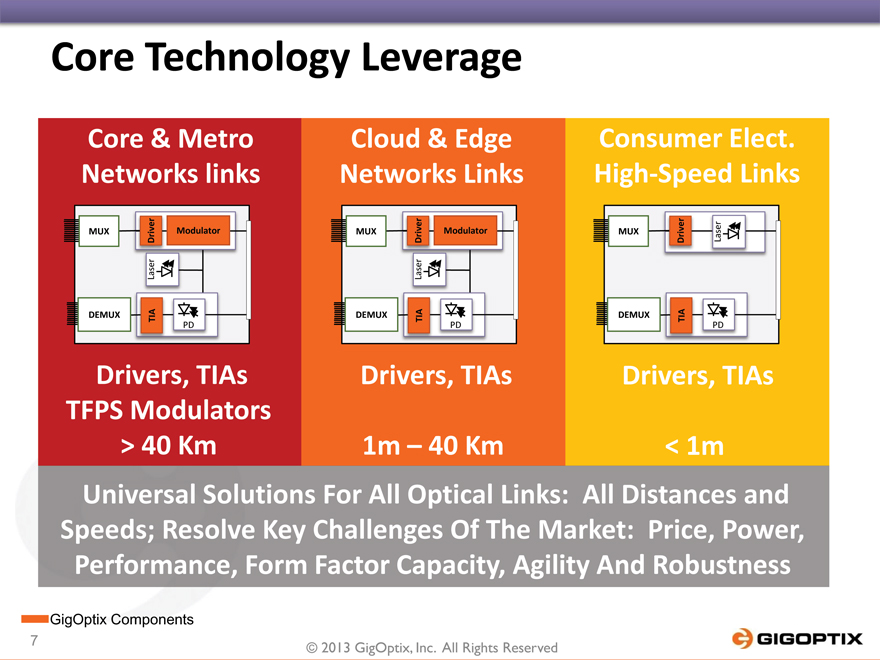

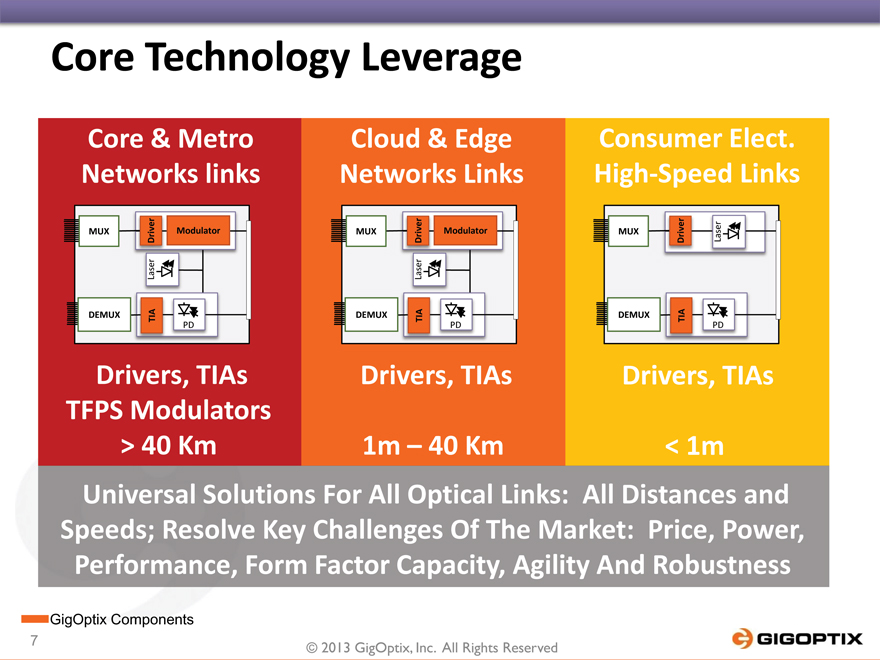

Core Technology Leverage

Core & Metro Cloud & Edge Consumer Elect.

Networks links Networks Links High-Speed Links

MUX Driver Modulator MUX Driver Modulator MUX Driver Laser

Laser Laser

DEMUX TIA DEMUX TIA DEMUX TIA

PD PD PD

Drivers, TIAs Drivers, TIAs Drivers, TIAs

TFPS Modulators

> 40 Km 1m – 40 Km < 1m

Universal Solutions For All Optical Links: All Distances and Speeds; Resolve Key Challenges Of The Market: Price, Power,

Performance, Form Factor Capacity, Agility And Robustness

GigOptix Components

7 | | © 2013 GigOptix, Inc. All Rights Reserved |

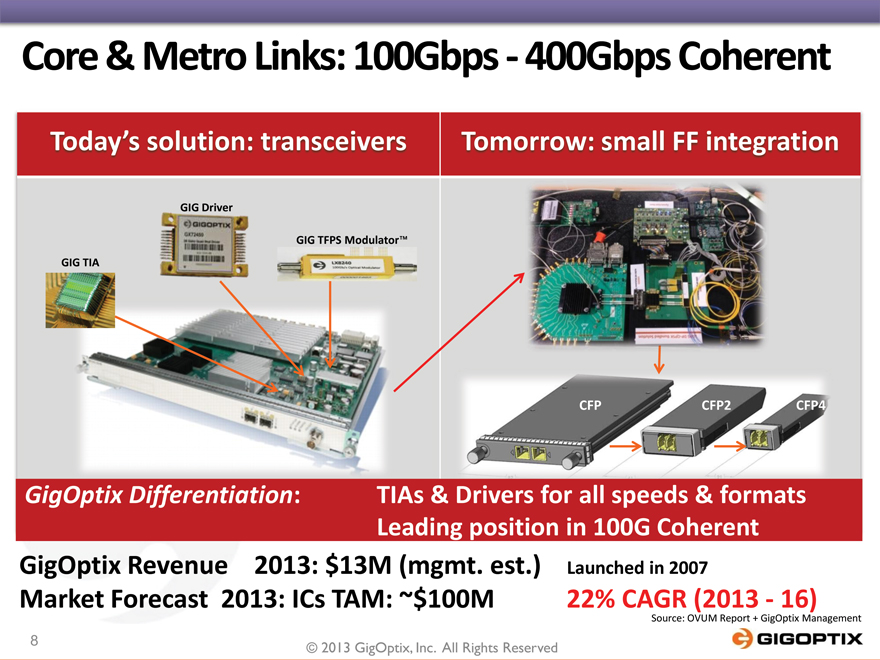

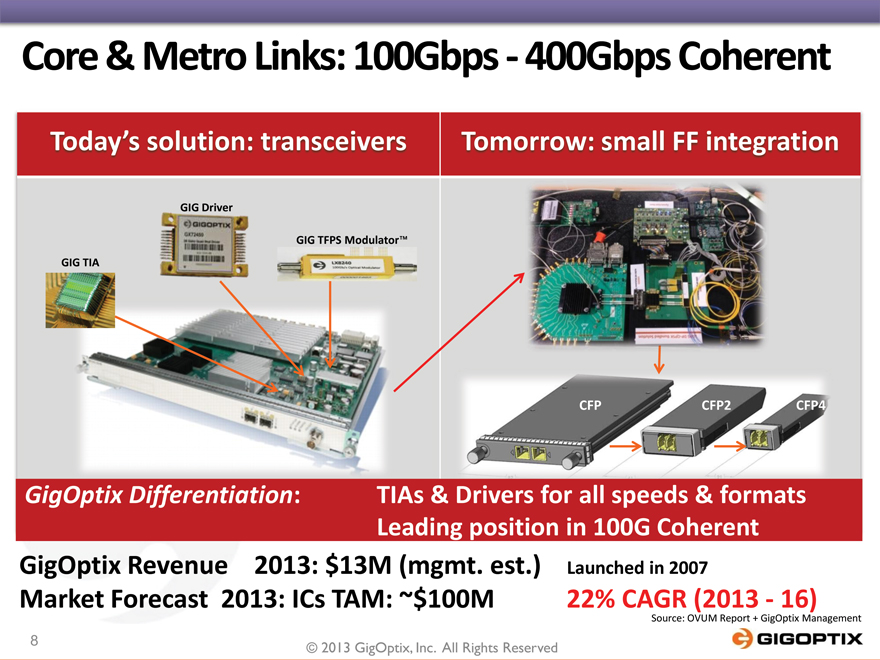

Core & Metro Links: 100Gbps—400Gbps Coherent

Today’s solution: transceivers Tomorrow: small FF integration

GIG Driver

GIG TFPS Modulator™

GIG TIA

CFP CFP2 CFP4

GigOptix Differentiation: TIAs & Drivers for all speeds & formats Leading position in 100G Coherent

GigOptix Revenue 2013: $13M (mgmt. est.) Launched in 2007

Market Forecast 2013: ICs TAM: ~$100M 22% CAGR (2013—16)

Source: OVUM Report + GigOptix Management

8 | | © 2013 GigOptix, Inc. All Rights Reserved |

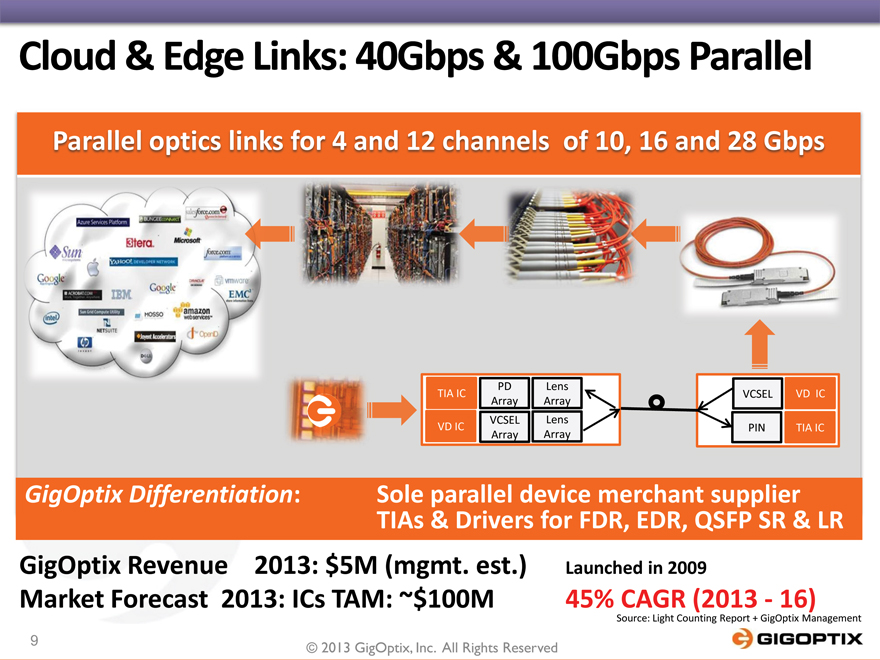

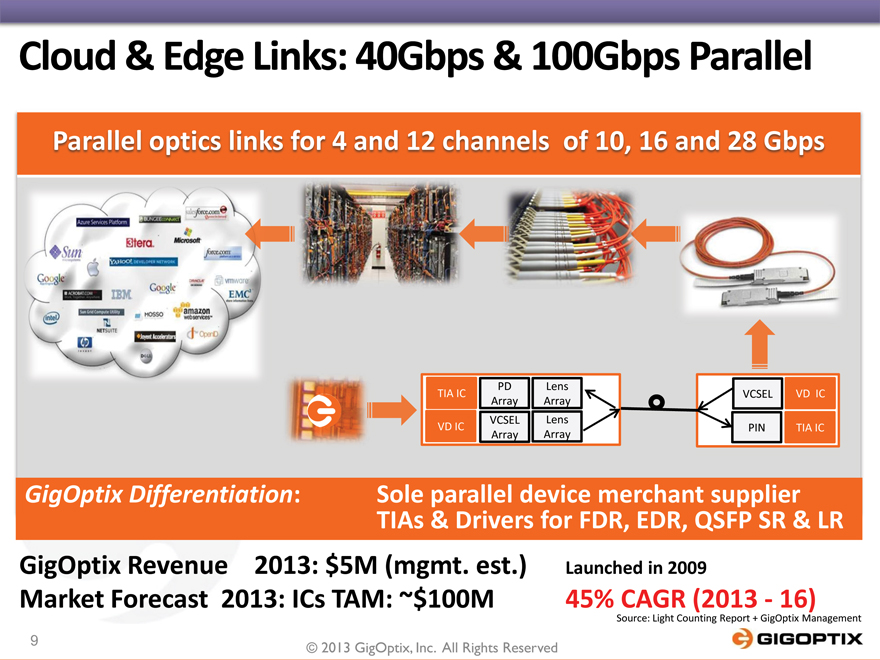

Cloud & Edge Links: 40Gbps & 100Gbps Parallel

Parallel optics links for 4 and 12 channels of 10, 16 and 28 Gbps

PD Lens

TIA IC VCSEL VD IC Array Array VCSEL Lens VD IC PIN TIA IC

Array Array

GigOptix Differentiation: Sole parallel device merchant supplier TIAs & Drivers for FDR, EDR, QSFP SR & LR

GigOptix Revenue 2013: $5M (mgmt. est.) Launched in 2009 Market Forecast 2013: ICs TAM: ~$100M 45% CAGR (2013—16)

Source: Light Counting Report + GigOptix Management

9 © 2013 GigOptix, Inc. All Rights Reserved

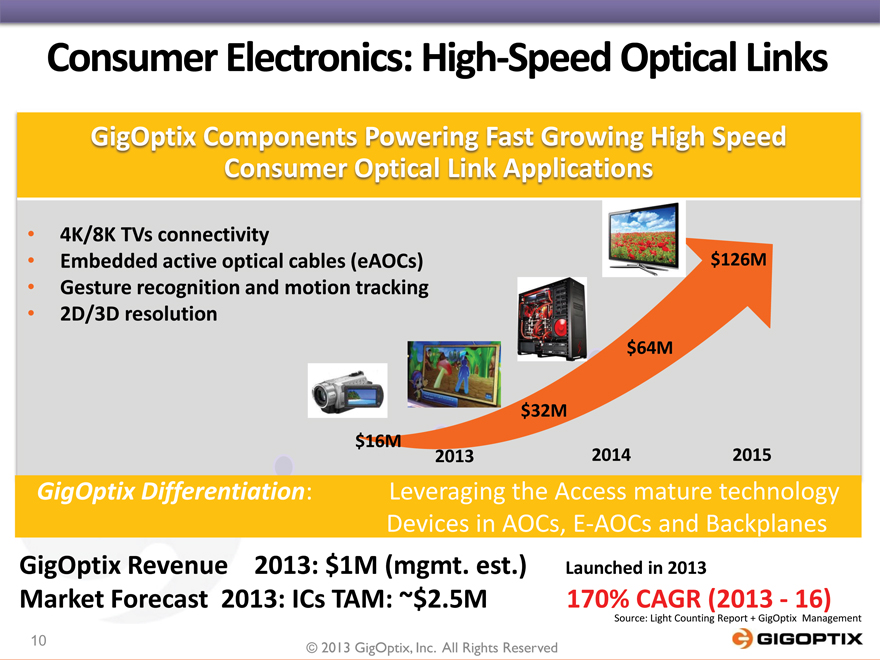

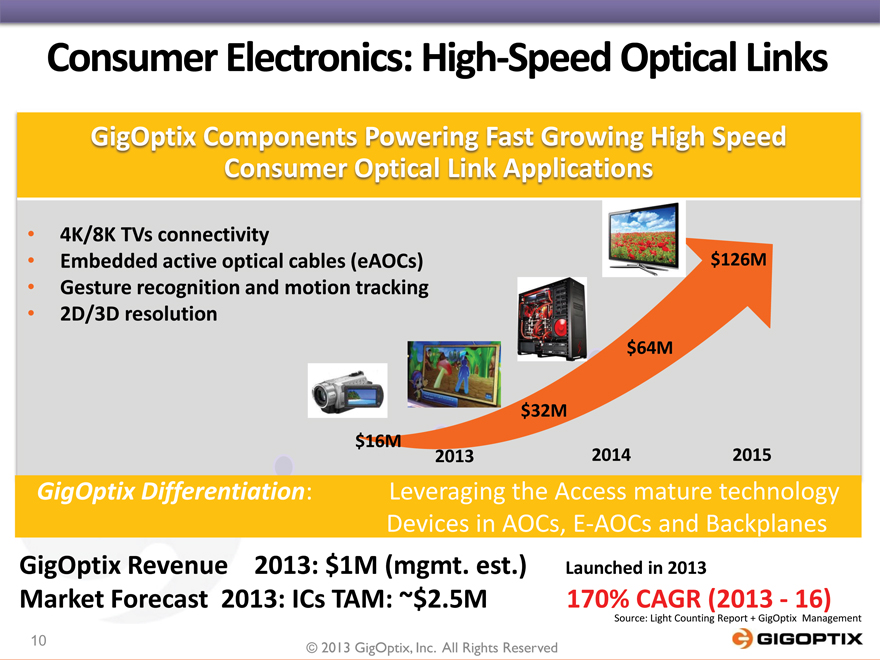

Consumer Electronics: High-Speed Optical Links

GigOptix Components Powering Fast Growing High Speed

Consumer Optical Link Applications

4K/8K TVs connectivity

Embedded active optical cables (eAOCs) $126M

Gesture recognition and motion tracking

2D/3D resolution

$64M

$32M $16M

2013 2014 2015

GigOptix Differentiation: Leveraging the Access mature technology Devices in AOCs, E-AOCs and Backplanes

GigOptix Revenue 2013: $1M (mgmt. est.) Launched in 2013

Market Forecast 2013: ICs TAM: ~$2.5M 170% CAGR (2013—16)

Source: Light Counting Report + GigOptix Management

10 © 2013 GigOptix, Inc. All Rights Reserved

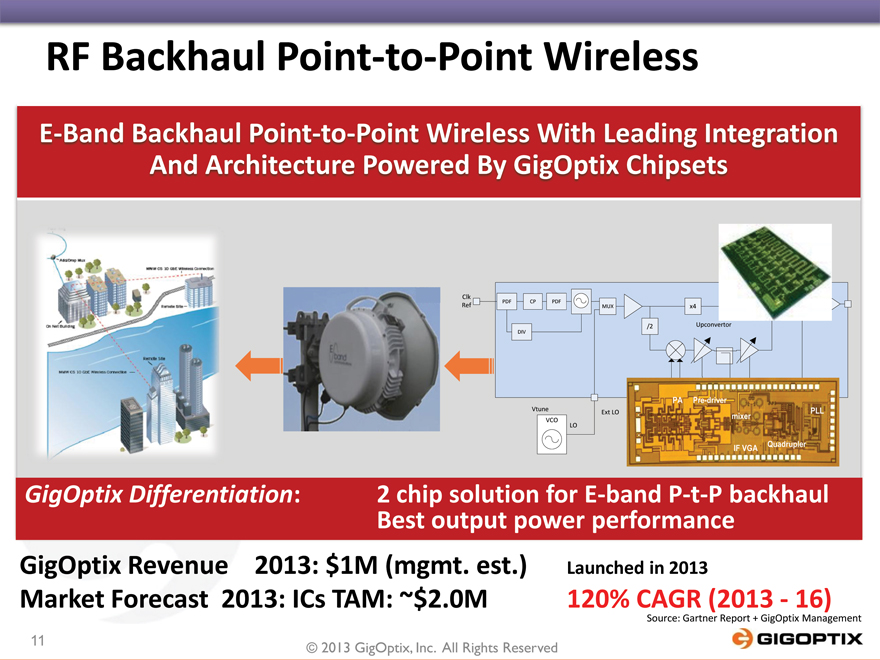

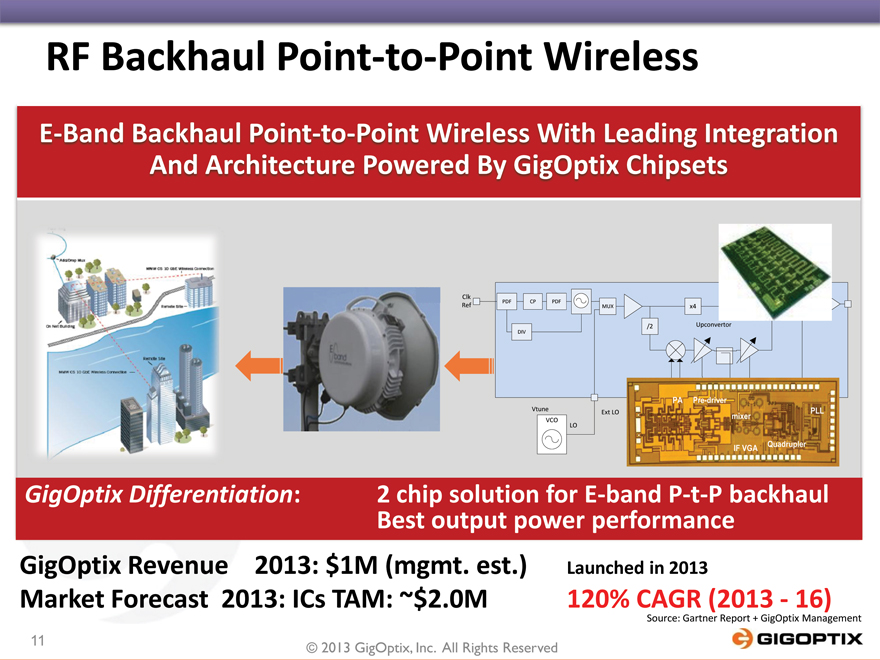

RF Backhaul Point-to-Point Wireless

E-Band Backhaul Point-to-Point Wireless With Leading Integration And Architecture Powered By GigOptix Chipsets

Clk PDF CP PDF

Ref MUX x4

/2 Upconvertor

DIV

PA Pre-driver

Vtune I/Q Vc1 IF Vc2 Vctrl PLL Ext LO mixer VCO LO

Quadrupler IF VGA

GigOptix Differentiation: 2 chip solution for E-band P-t-P backhaul Best output power performance

GigOptix Revenue 2013: $1M (mgmt. est.) Launched in 2013

Market Forecast 2013: ICs TAM: ~$2.0M 120% CAGR (2013—16)

Source: Gartner Report + GigOptix Management

11 © 2013 GigOptix, Inc. All Rights Reserved

Custom ASIC: Industrial & Mil/Aero

GigOptix ASICs Provide High-Value and Cost Efficient Customized

Solutions for FPGA and ASIC Conversions

Configurable Standard Configurable

Memory Blocks Cell Logic Cells

Configurable Logic Cells

PHY PHY PHY Configurable I/O Cells

Structured ASIC Standard Cell Custom Structured ASIC

GigOptix Differentiation: Provider Custom Structured ASICs Supporting FPGA and ASIC conversion

GigOptix Revenue 2013: $9M (mgmt. est.) Launched in 2010 Market Forecast 2013: ICs TAM: ~$100M 5% CAGR (2013—16)

Source: Gartner, Inc. + GigOptix Management

12 © 2013 GigOptix, Inc. All Rights Reserved

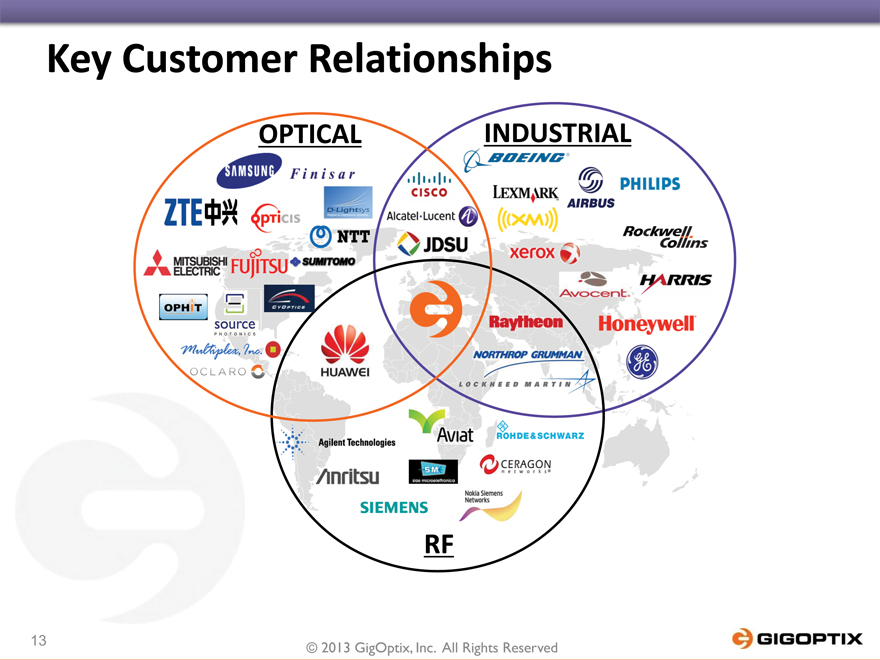

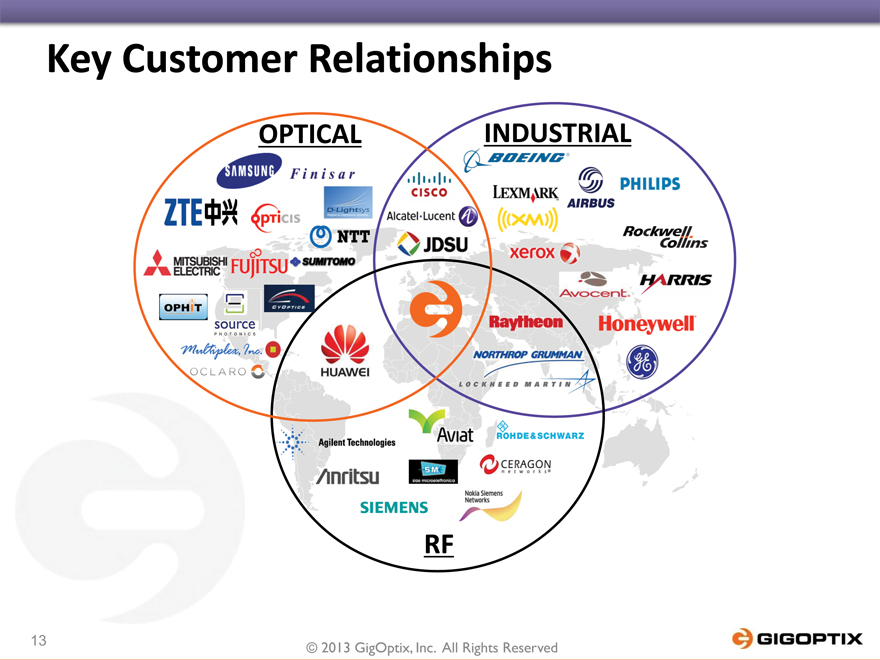

Key Customer Relationships

OPTICAL INDUSTRIAL

RF

13 © 2013 GigOptix, Inc. All Rights Reserved

Multiple Growth Catalysts

Telecom

Leading supplier of 100Gbps Coherent devices for Core long-haul now, expands into Metro in 2014

Leading developer of E-Band wireless Backhaul point-to-point MMICs for high-speed last-mile connectivity for deployment in 2014

Datacom

Sole RF device merchant supplier for Active Optical Cables and Pluggables >10Gbps data-center fiber installations

Leading supplier in High-Speed Optical Links for Edge & Cloud

Consumer Electronics

High-Speed Optical Links in CE deployment late 2013 and show rapid growth into 2014

Game-changing RF amplifiers for gesture & motion tracking technology ramp in 2014 with major OEMs of smart-phones, tablets and interactive-TV’s

Custom ASIC applications revenue to increase in 2014, as more foundries end-of-life the 0.25um and 0.35um lines

14 © 2013 GigOptix, Inc. All Rights Reserved

Intellectual Property

High-speed integrated circuits

113 Patents Standard cells and structured ASIC architectures

High-speed modulator using Thin Film Polymer on

13 Patent Silicon (TFPS)™ technology

Applications RF mm wave circuits

RF communication systems

Telecom:

Reached global settlement in litigation against

M/A-Com in September 2013—Received $7.25M

IP Protection

Datacom:

Solid IP position as largest independent supplier of

chipsets for high-speed optical interconnects

15 © 2013 GigOptix, Inc. All Rights Reserved

Executive Team

Dr. Avi Katz Founder, Chairman & CEO

Curt Sacks SVP & CFO

Andrea Betti-Berutto Founder, SVP & CTO

Steve Choate VP of Operations

Dr. Raluca Dinu VP & GM High Speed Comm.

Anil Chaudhry VP & GM Industrial

16 © 2013 GigOptix, Inc. All Rights Reserved

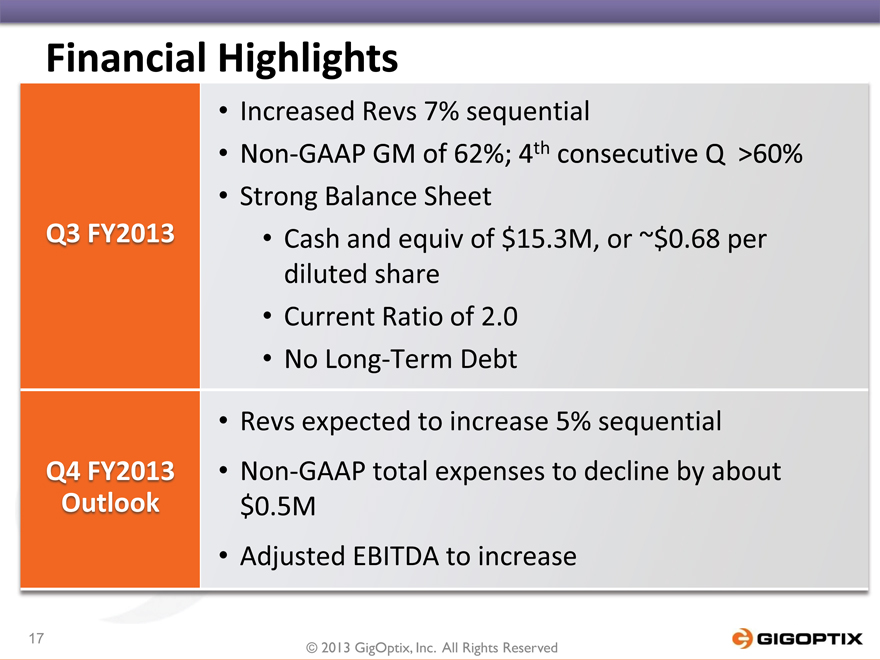

Financial Highlights

Increased Revs 7% sequential

Non-GAAP GM of 62%; 4th consecutive Q >60%

Strong Balance Sheet

Q3 FY2013 Cash and equiv of $15.3M, or ~$0.68 per

diluted share

Current Ratio of 2.0

No Long-Term Debt

Revs expected to increase 5% sequential

Q4 FY2013 Non-GAAP total expenses to decline by about

Outlook $0.5M

Adjusted EBITDA to increase

17 © 2013 GigOptix, Inc. All Rights Reserved

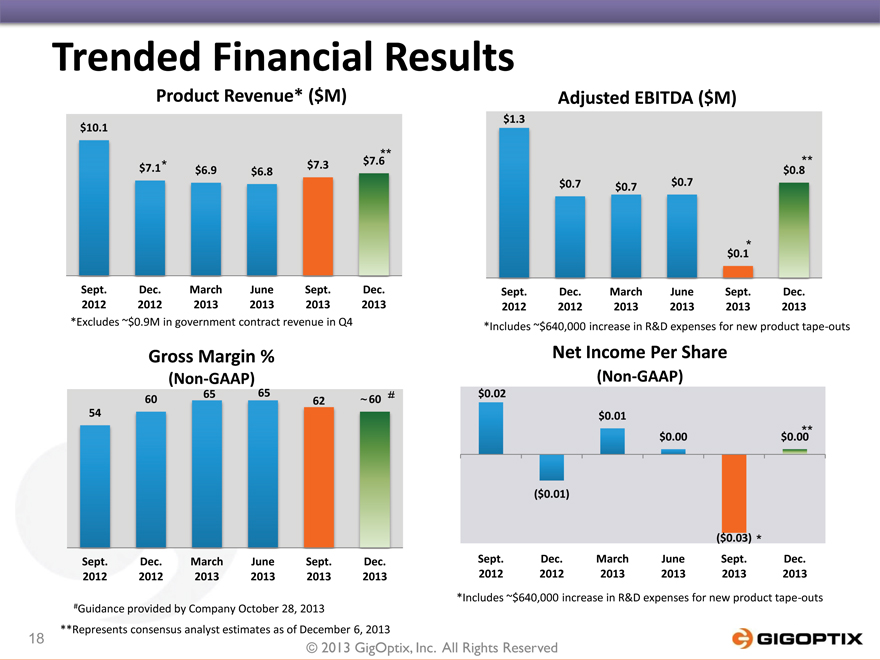

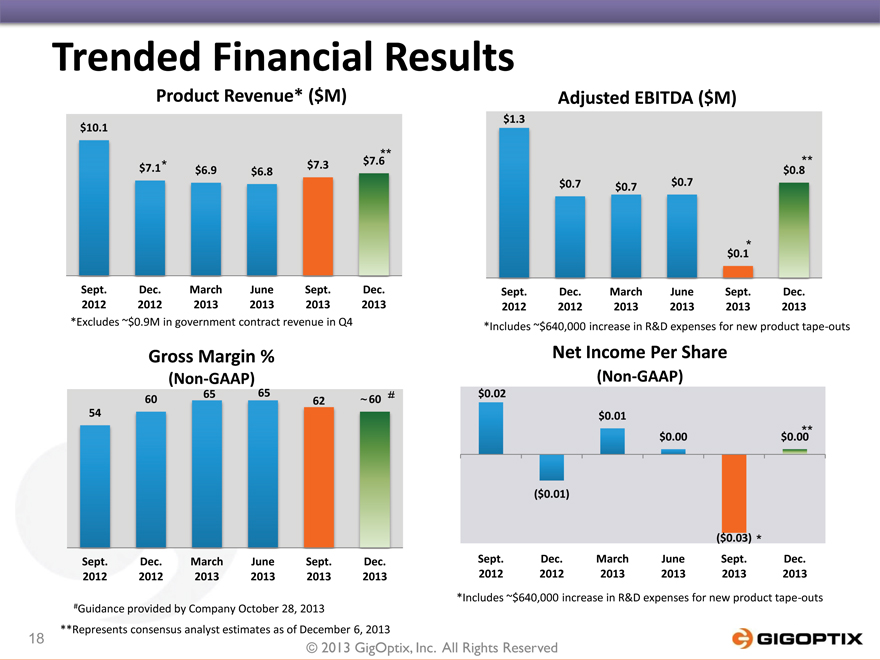

Trended Financial Results

Product Revenue* ($M)

$10.1

**

* | | $7.3 $7.6 $7.1 $6.9 $6.8 |

Sept. Dec. March June Sept. Dec. 2012 2012 2013 2013 2013 2013

*Excludes ~$0.9M in government contract revenue in Q4

Adjusted EBITDA ($M)

$1.3

**

$0.8 $0.7 $0.7 $0.7

$0.1

Sept. Dec. March June Sept. Dec. 2012 2012 2013 2013 2013 2013

*Includes ~$640,000 increase in R&D expenses for new product tape-outs

Gross Margin %

(Non-GAAP)

65 65 #

60 62 ~ 60 54

Sept. Dec. March June Sept. Dec. 2012 2012 2013 2013 2013 2013

#Guidance provided by Company October 28, 2013

**Represents consensus analyst estimates as of December 6, 2013

Net Income Per Share

(Non-GAAP)

$0.02 $0.01 $0.00 $0.00 **

($0.01)

($0.03) *

Sept. Dec. March June Sept. Dec. 2012 2012 2013 2013 2013 2013

*Includes ~$640,000 increase in R&D expenses for new product tape-outs

18 © 2013 GigOptix, Inc. All Rights Reserved

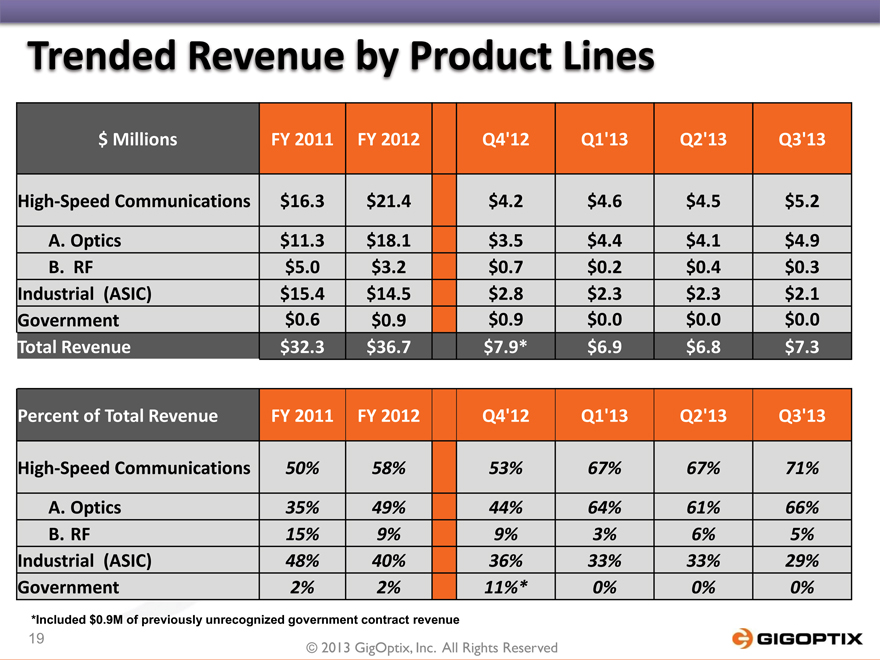

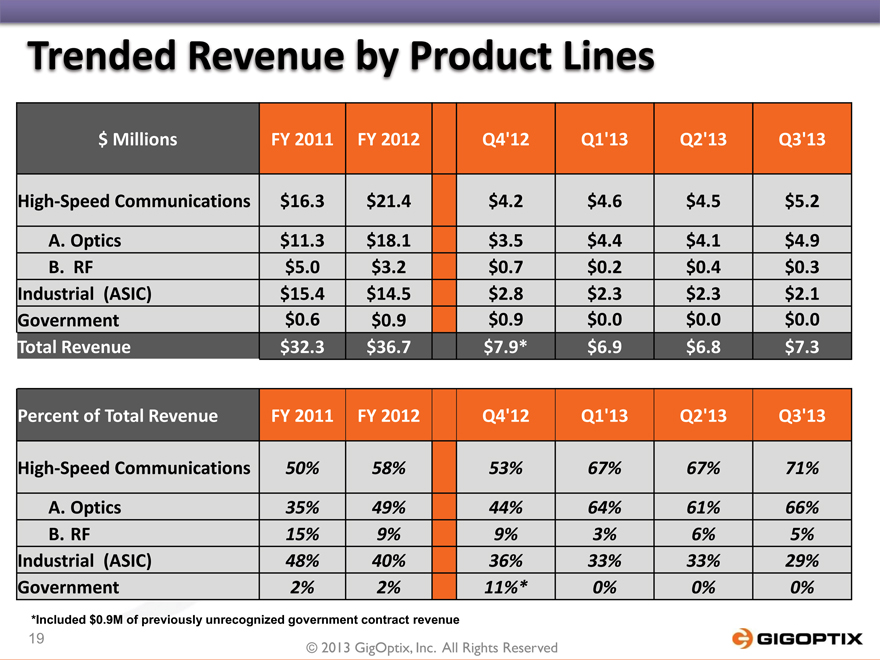

Trended Revenue by Product Lines

$ Millions FY 2011 FY 2012 Q4’12 Q1’13 Q2’13 Q3’13

High-Speed Communications $16.3 $21.4 $4.2 $4.6 $4.5 $5.2

A. Optics $11.3 $18.1 $3.5 $4.4 $4.1 $4.9

B. RF $5.0 $3.2 $0.7 $0.2 $0.4 $0.3

Industrial (ASIC) $15.4 $14.5 $2.8 $2.3 $2.3 $2.1

Government $0.6 $0.9 $0.9 $0.0 $0.0 $0.0

Total Revenue $32.3 $36.7 $7.9* $6.9 $6.8 $7.3

Percent of Total Revenue FY 2011 FY 2012 Q4’12 Q1’13 Q2’13 Q3’13

High-Speed Communications 50% 58% 53% 67% 67% 71%

A. Optics 35% 49% 44% 64% 61% 66%

B. RF 15% 9% 9% 3% 6% 5%

Industrial (ASIC) 48% 40% 36% 33% 33% 29%

Government 2% 2% 11%* 0% 0% 0%

*Included $0.9M of previously unrecognized government contract revenue

19 © 2013 GigOptix, Inc. All Rights Reserved

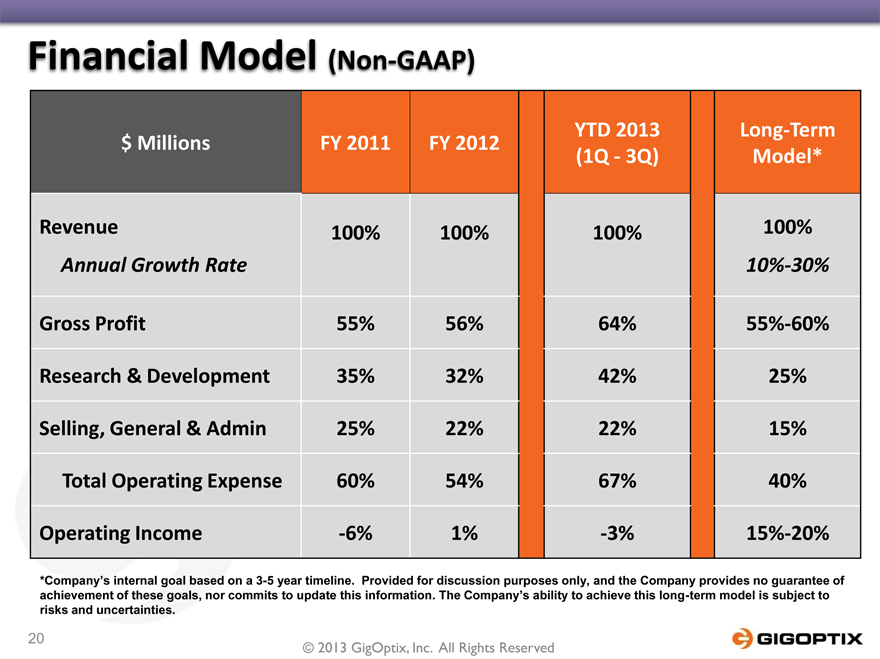

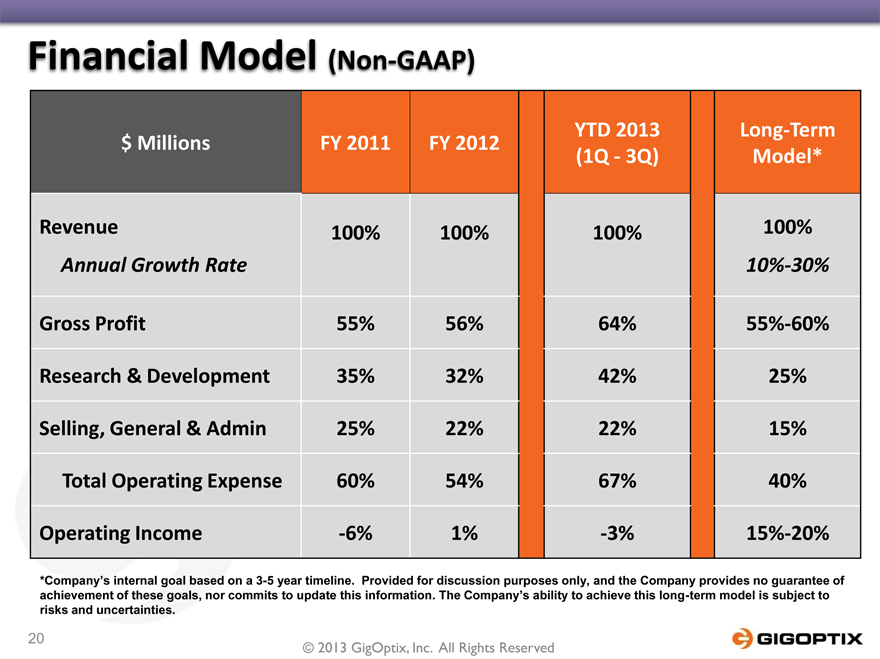

Financial Model (Non-GAAP)

YTD 2013 Long-Term

$ Millions FY 2011 FY 2012

(1Q—3Q) Model*

Revenue 100% 100% 100% 100%

Annual Growth Rate 10%-30%

Gross Profit 55% 56% 64% 55%-60%

Research & Development 35% 32% 42% 25%

Selling, General & Admin 25% 22% 22% 15%

Total Operating Expense 60% 54% 67% 40%

Operating Income -6% 1% -3% 15%-20%

*Company’s internal goal based on a 3-5 year timeline. Provided for discussion purposes only, and the Company provides no guarantee of achievement of these goals, nor commits to update this information. The Company’s ability to achieve this long-term model is subject to risks and uncertainties.

20 © 2013 GigOptix, Inc. All Rights Reserved

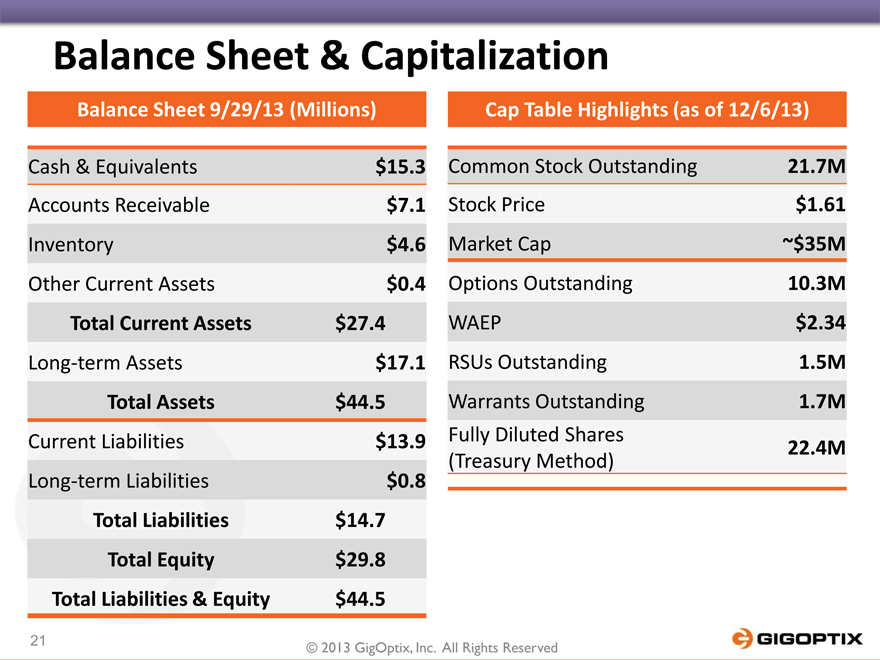

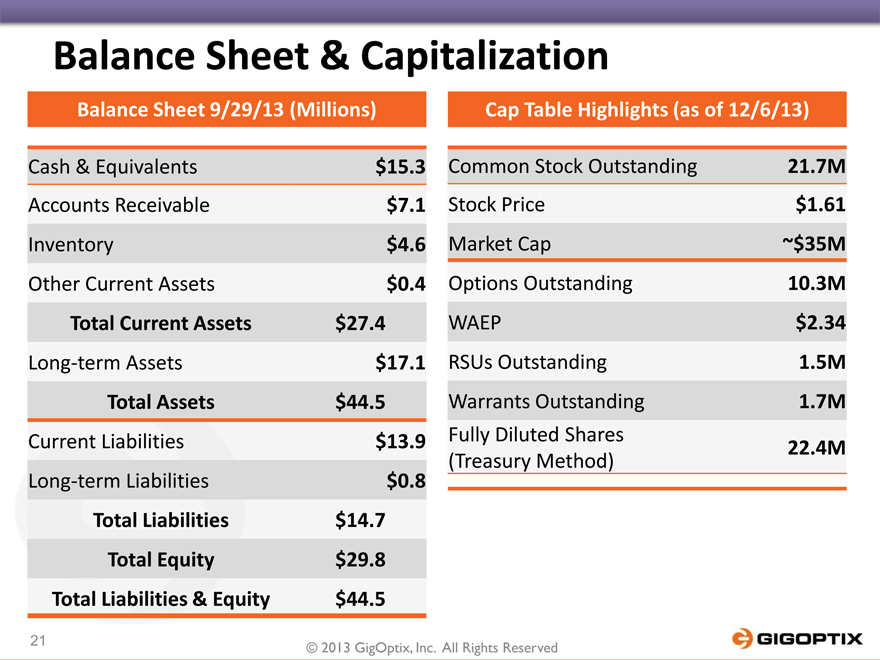

Balance Sheet & Capitalization

Balance Sheet 9/29/13 (Millions)

Cash & Equivalents $15.3

Accounts Receivable $7.1

Inventory $4.6

Other Current Assets $0.4

Total Current Assets $27.4

Long-term Assets $17.1

Total Assets $44.5

Current Liabilities $13.9

Long-term Liabilities $0.8

Total Liabilities $14.7

Total Equity $29.8

Total Liabilities & Equity $44.5

Cap Table Highlights (as of 12/6/13)

Common Stock Outstanding 21.7M

Stock Price $1.61

Market Cap ~$35M

Options Outstanding 10.3M

WAEP $2.34

RSUs Outstanding 1.5M

Warrants Outstanding 1.7M

Fully Diluted Shares

22.4M

(Treasury Method)

21 © 2013 GigOptix, Inc. All Rights Reserved

Thank you

© 2013 GigOptix, Inc. All Rights Reserved