Exhibit 99.1

NYSE MKT: GIG

Powering High Speed Networks

August, 2015

© 2015 GigOptix, Inc. All Rights Reserved

Disclaimer

Forward Looking Statements:

This presentation contains statements regarding operating trends, future results, new projects, and other market, business and product trends that are forward-looking. We undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Additional factors that could cause actual results to differ are discussed under the heading “Risk Factors” and in other sections of the GigOptix filings with the SEC, and in GigOptix’s other current and periodic reports filed or furnished from time to time with the SEC.

Use of Non-GAAP and Adjusted EBITDA Financial Measures:

These materials include references to non-GAAP revenue, non-GAAP net income/loss, Adjusted consolidated non-GAAP net income/loss, and Adjusted EBITDA. GigOptix believes that these non-GAAP financial measures are important indicators of the ongoing operations of its business and provide better comparability between reporting periods and provide a better baseline for analyzing trends in GigOptix’s operations. GigOptix does not, nor does it suggest that investors should, consider such non-GAAP and Adjusted EBITDA financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. GigOptix believes the disclosure of the effects of these items increases the reader’s understanding of the underlying performance of the business and that such non-GAAP and Adjusted EBITDA financial measures provide investors with an additional tool to evaluate our financial results and assess our prospects for future performance.

2 © 2015 GigOptix, Inc. All Rights Reserved

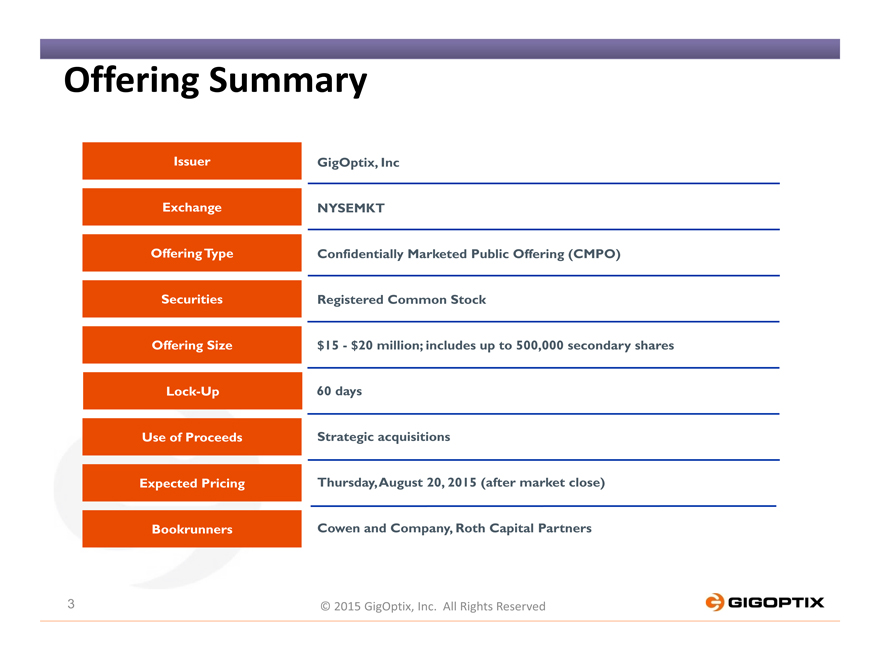

Offering Summary

Issuer GigOptix, Inc

Exchange NYSEMKT

Offering Type Confidentially Marketed Public Offering (CMPO)

Securities Registered Common Stock

Offering Size $15—$20 million; includes up to 500,000 secondary shares Lock-Up 60 days Use of Proceeds Strategic acquisitions Expected Pricing Thursday, August 20, 2015 (after market close) Bookrunners Cowen and Company, Roth Capital Partners

3 © 2015 GigOptix, Inc. All Rights Reserved

GigOptix Overview

Fabless Semiconductor Leader In High-Speed Communication Links for Network Applications

Two Fast Growing Product Lines

High-Speed Communications – devices for Datacom & Telecom Optical Links ASICs – devices for Communications and Industrial applications

Growth Strategy—Fueled By Organic Development and Accretive Acquisitions

6 acquisitions and 1 joint-venture since inception

A Market Leader:

40G to 400G ICs for active optical cables (AOC) and transceivers for Data Centers, and devices for 100G 400G Telecom transceivers infrastructure

One of the most profitable semiconductor companies <$250M MC

Record Profitability in Q2’15:

First quarter of GAAP profitability* with NI of $0.5M, or $0.02 EPS Revenue of $9.8M up 9% Q/Q and 22% Y/Y

Record gross margin: 63% GAAP and 66% non-GAAP ??Record non-GAAP NI of $2.1M, or $0.06 EPS Record Adjusted EBITDA of $2.8M

Cash balances $18.4M and no debt

*Free of non-recurring items

4 © 2015 GigOptix, Inc. All Rights Reserved

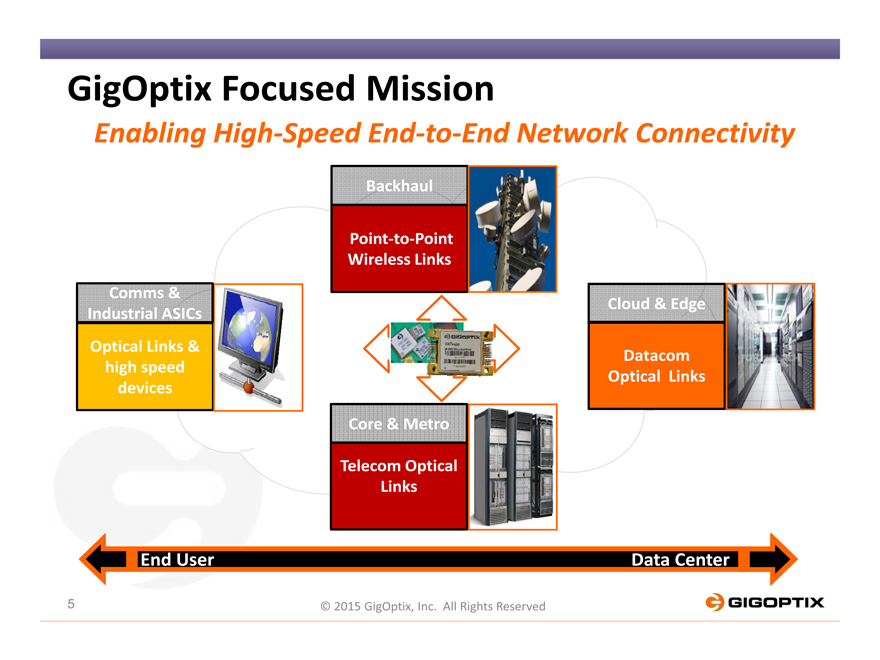

GigOptix Focused Mission

Enabling High-Speed End-to-End Network Connectivity

Backhaul

Point-to-Point Wireless Links Comms &

Cloud & Edge Industrial ASICs

Optical Links &

Datacom high speed Optical Links devices

Core & Metro

Telecom Optical Links

End User Data Center

5 © 2015 GigOptix, Inc. All Rights Reserved

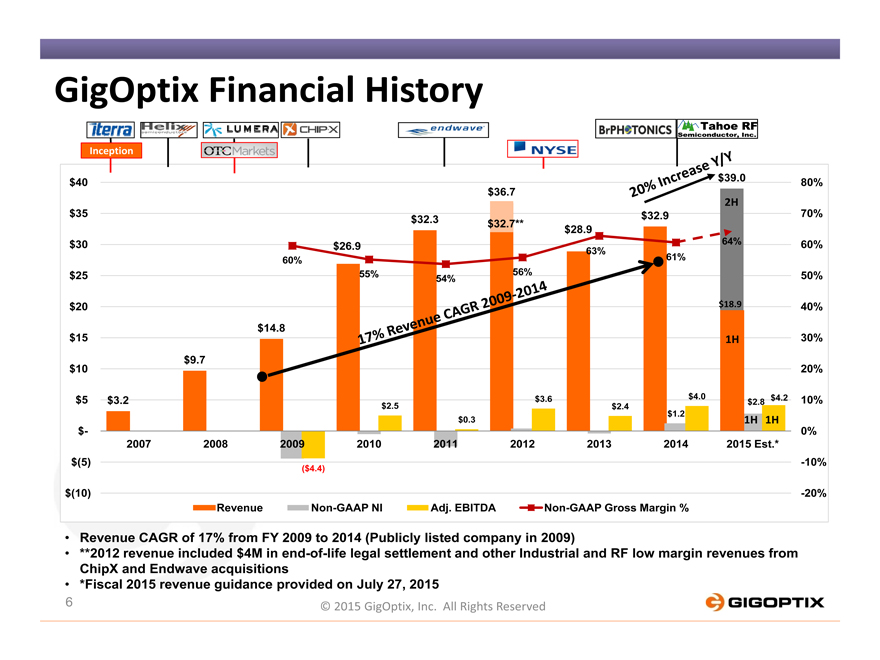

GigOptix Financial History

Inception

$40 $39.0 80%

$36.7

2H

$35 $32.3 $32.9 70%

$32.7** $28.9

$30 $26.9 64% 60%

63%

60% 61%

$25 55% 54% 56% 50%

$20 $18.9 40%

$14.8

$15 1H 30%

$9.7

$10 20%

$5 $3.2 $3.6 $4.0 $2.8 $4.2 10%

$2.5 $2.4

$1.2

$0.3 1H 1H

$- 0%

2007 2008 2009 2010 2011 2012 2013 2014 2015 Est.*

$(5) -10%

($4.4)

$(10) -20%

Revenue Non-GAAP NI Adj. EBITDA Non-GAAP Gross Margin %

Revenue CAGR of 17% from FY 2009 to 2014 (Publicly listed company in 2009)

**2012 revenue included $4M in end-of-life legal settlement and other Industrial and RF low margin revenues from ChipX and Endwave acquisitions

*Fiscal 2015 revenue guidance provided on July 27, 2015

6 © 2015 GigOptix, Inc. All Rights Reserved

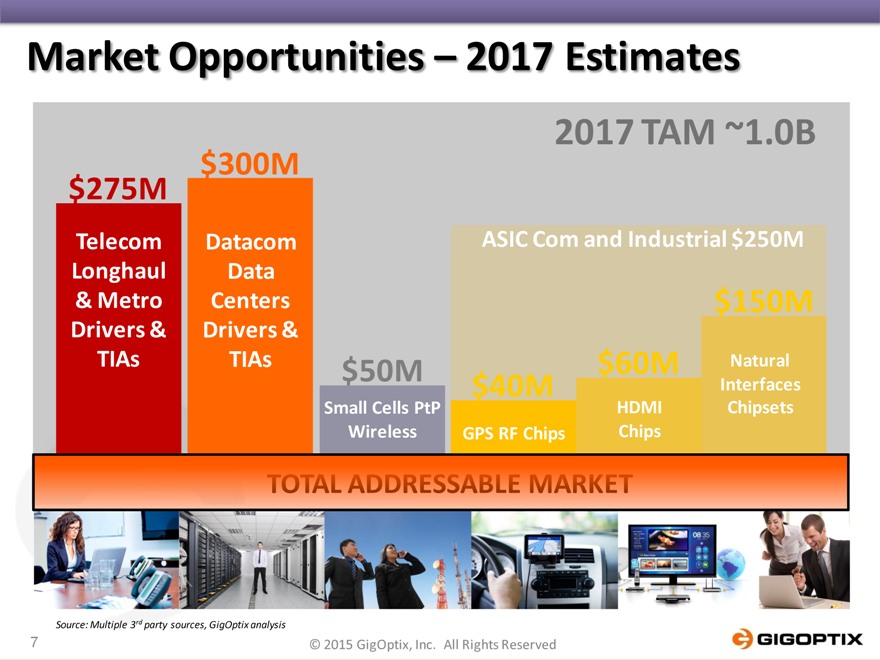

Market Opportunities – 2017 Estimates

2017 TAM ~1.0B

$275M $300M

Telecom Datacom ASIC Com and Industrial $250M Longhaul Data

& Metro Centers $150M

Drivers & Drivers &

TIAs TIAs $50M $60M Natural

$40M Interfaces Small Cells PtP HDMI Chipsets Wireless GPS RF Chips Chips

Source: Multiple 3rd party sources, GigOptix analysis

7 © 2015 GigOptix, Inc. All Rights Reserved

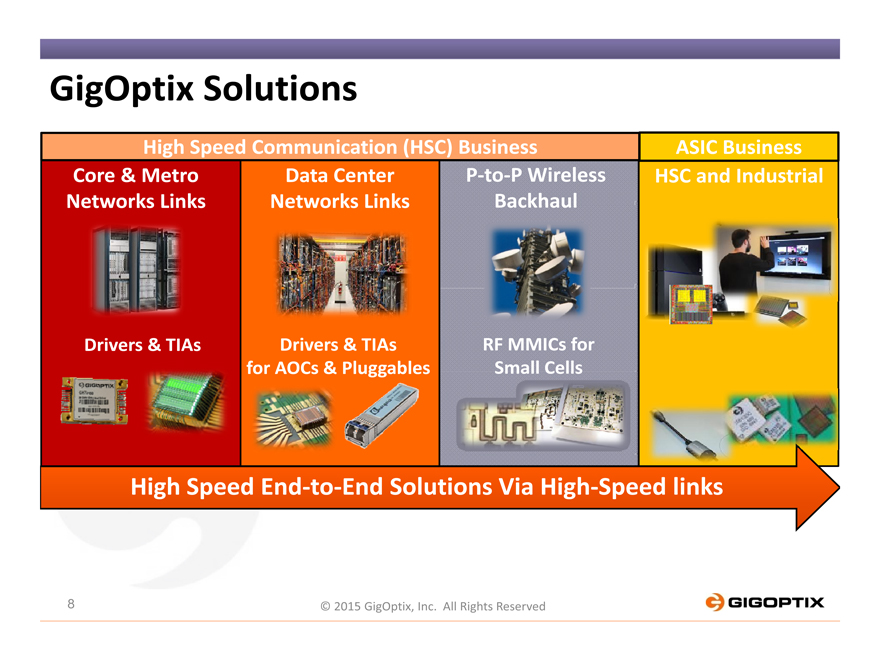

GigOptix Solutions

High Speed Communication (HSC) Business ASIC Business Core & Metro Data Center P-to-P Wireless HSC and Industrial Networks Links Networks Links Backhaul

Drivers & TIAs Drivers & TIAs RF MMICs for for AOCs & Pluggables Small Cells

High Speed End-to-End Solutions Via High-Speed links

8 © 2015 GigOptix, Inc. All Rights Reserved

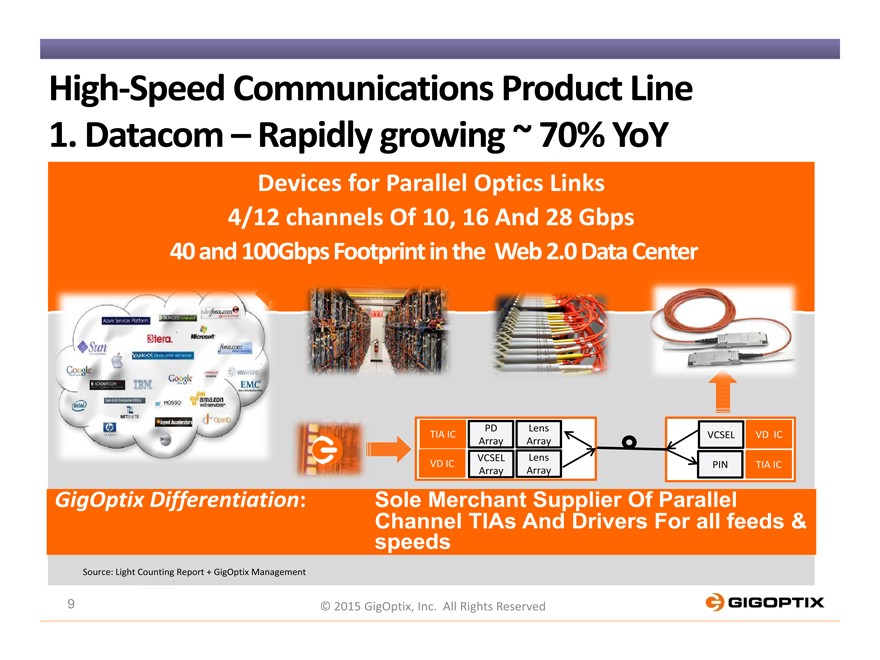

High-Speed Communications Product Line

1. Datacom – Rapidly growing ~ 70% YoY

Devices for Parallel Optics Links 4/12 channels Of 10, 16 And 28 Gbps 40 and 100Gbps Footprint in the Web 2.0 Data Center

PD Lens

TIA IC VCSEL VD IC Array Array VCSEL Lens VD IC PIN TIA IC

Array Array

GigOptix Differentiation: Sole Merchant Supplier Of Parallel Channel TIAs And Drivers For all feeds & speeds

Source: Light Counting Report + GigOptix Management

9 © 2015 GigOptix, Inc. All Rights Reserved

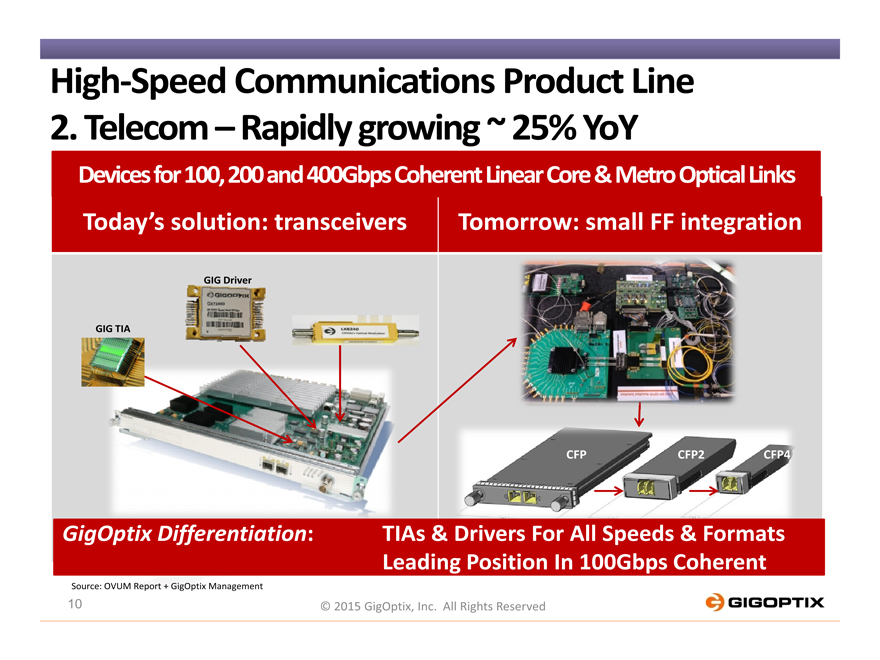

High-Speed Communications Product Line

2. Telecom – Rapidly growing ~ 25% YoY

Devices for 100, 200 and 400Gbps Coherent Linear Core & Metro Optical Links

Today’s solution: transceivers Tomorrow: small FF integration

GIG Driver

GIG TIA

CFP CFP2 CFP4

GigOptix Differentiation: TIAs & Drivers For All Speeds & Formats Leading Position In 100Gbps Coherent

Source: OVUM Report + GigOptix Management

10 © 2015 GigOptix, Inc. All Rights Reserved

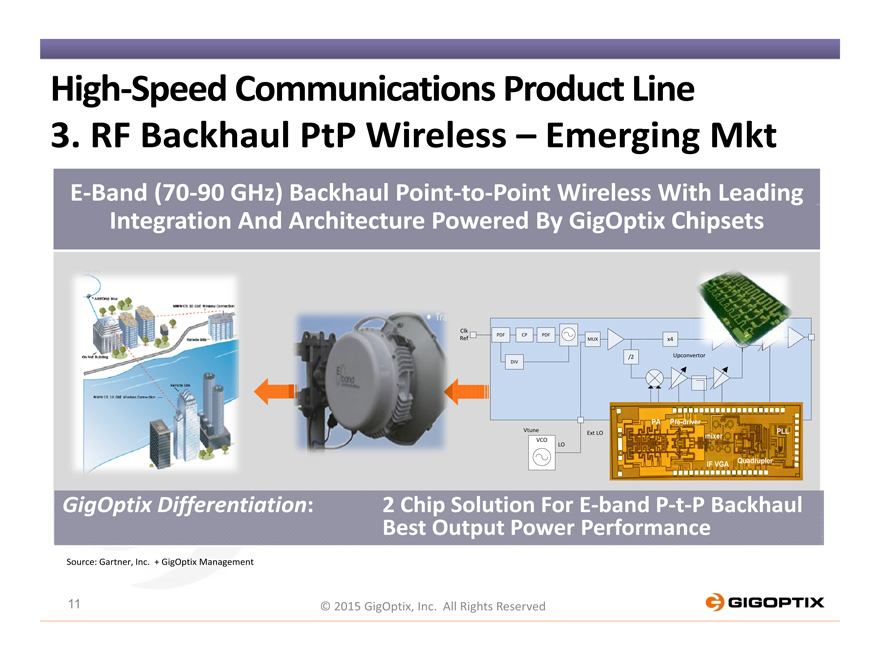

High-Speed Communications Product Line

3. RF Backhaul PtP Wireless – Emerging Mkt

E-Band (70-90 GHz) Backhaul Point-to-Point Wireless With Leading Integration And Architecture Powered By GigOptix Chipsets

Clk PDF CP PDF

Ref MUX x4

/2 Upconvertor

DIV

PA Pre-driver

Vtune I/Q Vc1 IF Vc2 Vctrl PLL Ext LO mixer VCO LO

Quadrupler IF VGA

GigOptix Differentiation: 2 Chip Solution For E-band P-t-P Backhaul Best Output Power Performance

Source: Gartner, Inc. + GigOptix Management

All Rights Reserved

11

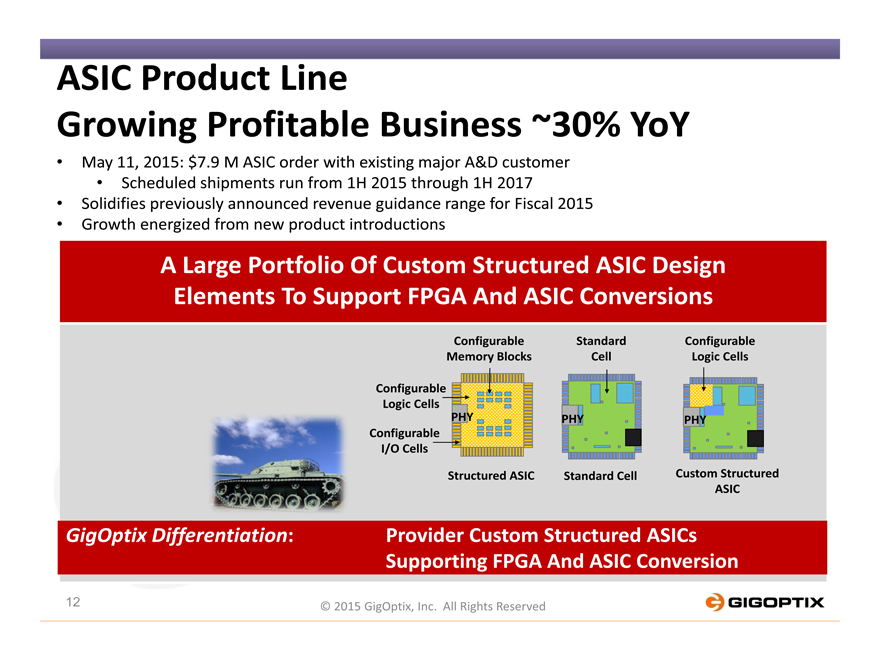

ASIC Product Line

Growing Profitable Business ~30% YoY

May 11, 2015: $7.9 M ASIC order with existing major A&D customer

Scheduled shipments run from 1H 2015 through 1H 2017

Solidifies previously announced revenue guidance range for Fiscal 2015

Growth energized from new product introductions

A Large Portfolio Of Custom Structured ASIC Design Elements To Support FPGA And ASIC Conversions

Configurable Standard Configurable

Memory Blocks Cell Logic Cells

Configurable Logic Cells

PHY PHY PHY

Configurable

I/O Cells

Structured ASIC Standard Cell Custom Structured ASIC

GigOptix Differentiation: Provider Custom Structured ASICs Supporting FPGA And ASIC Conversion

12 © 2015 GigOptix, Inc. All Rights Reserved

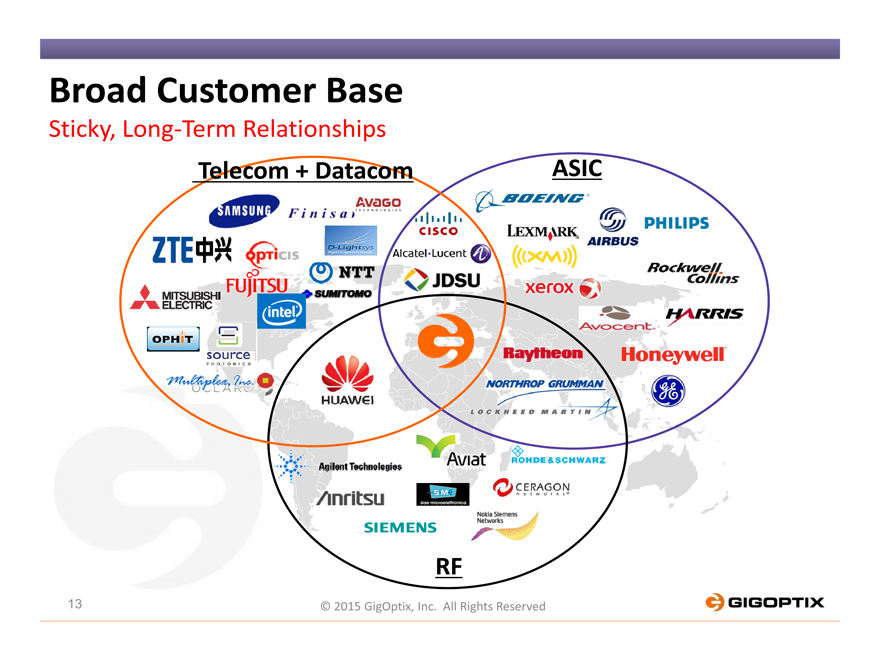

Broad Customer Base

Sticky, Long-Term Relationships

Telecom + Datacom ASIC

RF

13 © 2015 GigOptix, Inc. All Rights Reserved

Competitor Matrix

Telecom Datacom RF

14 © 2015 GigOptix, Inc. All Rights Reserved

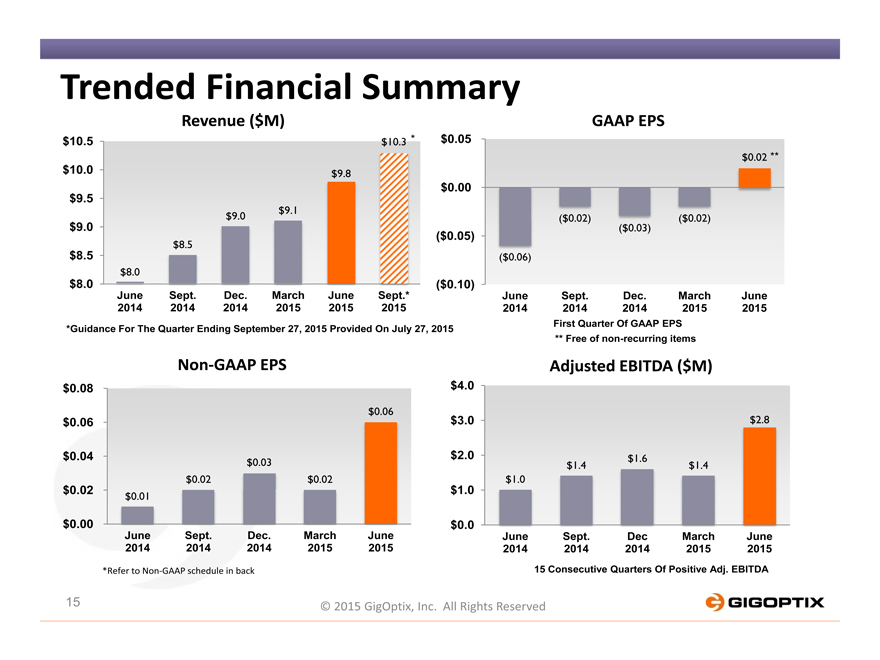

Trended Financial Summary

Revenue ($M) GAAP EPS

$10.5 $10.3 * $0.05

$0.02 **

$10.0 $9.8

$0.00

$9.5

$9.1

$9.0 ($0.02) ($0.02)

$9.0 ($0.03)

($0.05)

$8.5

$8.5 ($0.06)

$8.0

$8.0 ($0.10)

June Sept. Dec. March June Sept.* June Sept. Dec. March June

2014 2014 2014 2015 2015 2015 2014 2014 2014 2015 2015

*Guidance For The Quarter Ending September 27, 2015 Provided On July 27, 2015 First Quarter Of GAAP EPS

** Free of non-recurring items

Non-GAAP EPS Adjusted EBITDA ($M)

$0.08 $4.0

$0.06

$0.06 $3.0 $2.8

$0.04 $2.0 $1.6

$0.03 $1.4 $1.4

$0.02 $0.02 $1.0

$0.02 $1.0

$0.01

$0.00 $0.0

June Sept. Dec. March June June Sept. Dec March June

2014 2014 2014 2015 2015 2014 2014 2014 2015 2015

*Refer to Non-GAAP schedule in back 15 Consecutive Quarters Of Positive Adj. EBITDA

15 © 2015 GigOptix, Inc. All Rights Reserved

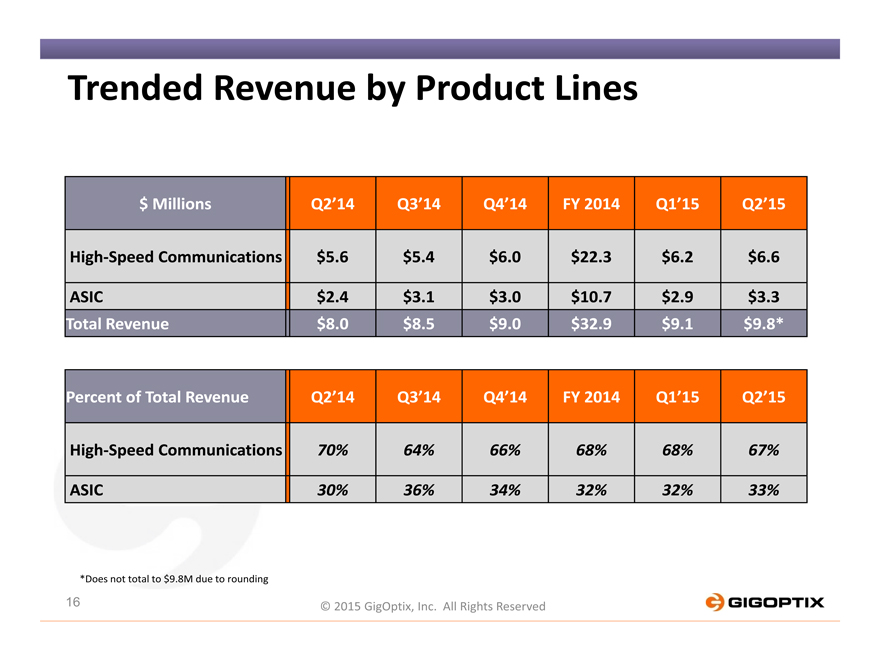

Trended Revenue by Product Lines

$ Millions Q2’14 Q3’14 Q4’14 FY 2014 Q1’15 Q2’15

High-Speed Communications $ 5.6 $ 5.4 $ 6.0 $ 22.3 $ 6.2 $6.6

ASIC $ 2.4 $ 3.1 $ 3.0 $ 10.7 $ 2.9 $3.3

Total Revenue $ 8.0 $ 8.5 $ 9.0 $ 32.9 $ 9.1 $9.8*

Percent of Total Revenue Q2’14 Q3’14 Q4’14 FY 2014 Q1’15 Q2’15

High-Speed Communications 70% 64% 66% 68% 68% 67%

ASIC 30% 36% 34% 32% 32% 33%

*Does not total to $9.8M due to rounding

16 © 2015 GigOptix, Inc. All Rights Reserved

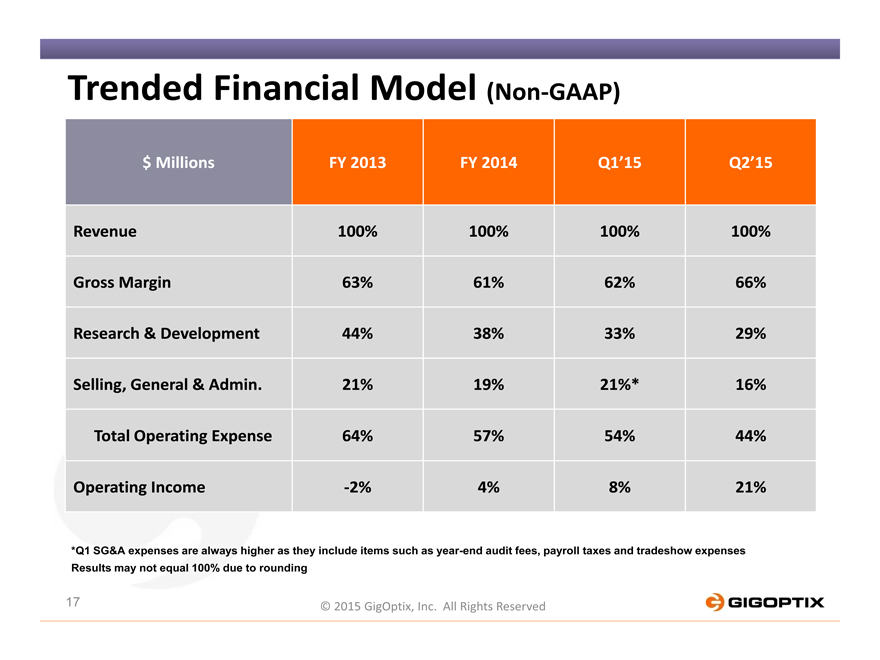

Trended Financial Model (Non-GAAP)

$ Millions FY 2013 FY 2014 Q1’15 Q2’15

Revenue 100% 100% 100% 100%

Gross Margin 63% 61% 62% 66%

Research & Development 44% 38% 33% 29%

Selling, General & Admin. 21% 19% 21%* 16%

Total Operating Expense 64% 57% 54% 44%

Operating Income -2% 4% 8% 21%

*Q1 SG&A expenses are always higher as they include items such as year-end audit fees, payroll taxes and tradeshow expenses

Results may not equal 100% due to rounding

17 © 2015 GigOptix, Inc. All Rights Reserved

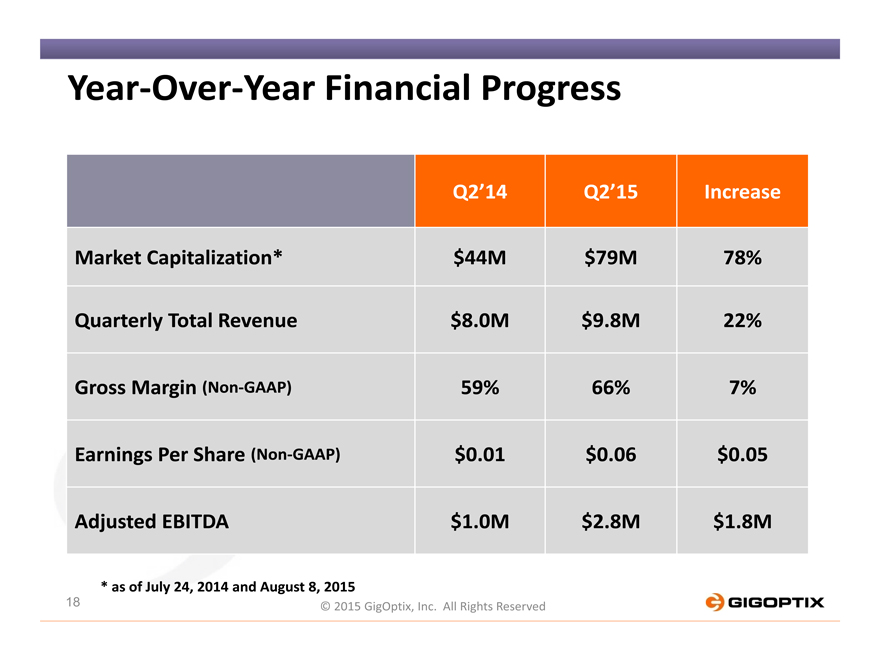

Year-Over-Year Financial Progress

Q2’14 Q2’15 Increase

Market Capitalization* $44M $79M 78%

Quarterly Total Revenue $8.0M $9.8M 22%

Gross Margin (Non-GAAP) 59% 66% 7%

Earnings Per Share (Non-GAAP) $0.01 $0.06 $0.05

Adjusted EBITDA $1.0M $2.8M $1.8M

* as of July 24, 2014 and August 8, 2015

18 © 2015 GigOptix, Inc. All Rights Reserved

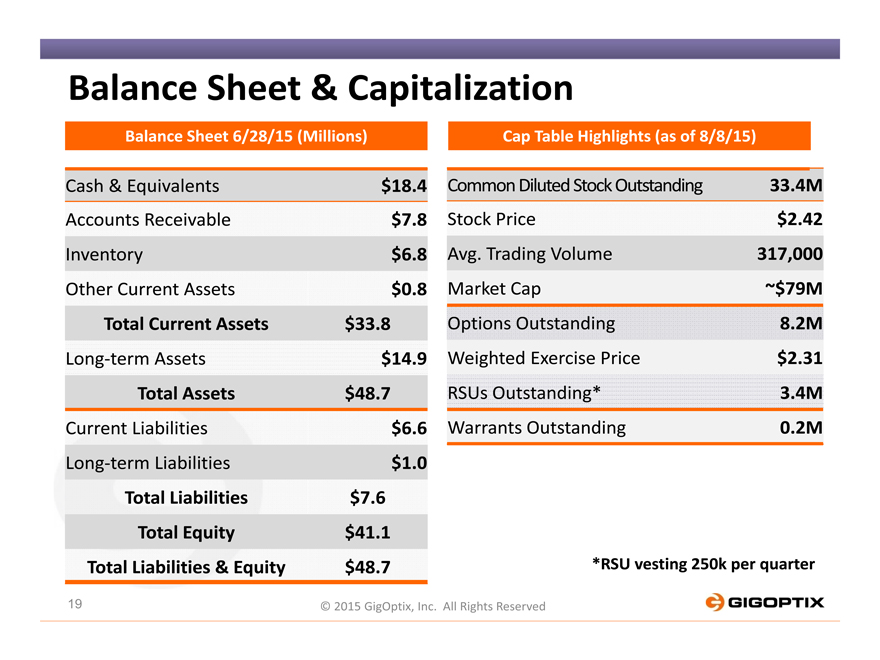

Balance Sheet & Capitalization

Balance Sheet 6/28/15 (Millions) Cap Table Highlights (as of 8/8/15)

Cash & Equivalents $18.4 Common Diluted Stock Outstanding 33.4M

Accounts Receivable $7.8 Stock Price $2.42

Inventory $6.8 Avg. Trading Volume 317,000

Other Current Assets $0.8 Market Cap ~$79M

Total Current Assets $33.8 Options Outstanding 8.2M

Long-term Assets $14.9 Weighted Exercise Price $2.31

Total Assets $48.7 RSUs Outstanding* 3.4M

Current Liabilities $6.6 Warrants Outstanding 0.2M

Long-term Liabilities $1.0

Total Liabilities $7.6

Total Equity $41.1

Total Liabilities & Equity $48.7 *RSU vesting 250k per quarter

19 © 2015 GigOptix, Inc. All Rights Reserved

GigOptix Growth Catalysts & Summation

Very profitable small cap semiconductor company growing at ~20% CAGR

(3 years) with positive record of “meet or beat” on all provided guidance

Data Center Connectivity Infrastructure

Sole 40G device merchant supplier for Active Optical Cables and Pluggables

A pioneer and leading supplier of 100G optical links

~70% YoY continuous growth rate in Datacom and Telecom

Telecom Core & Metro Network Connectivity (100G-400G)

Lead supplier of 100G and 200 G Coherent Linear MCMs and devices for Core Long-Haul and Metro Telecom applications

Sole supplier of 400G MCMs and devices for Core long-haul Telecom

Emerging supplier of V-Band (60GHz) and E-Band (70GHz-90GHz) MMICs for wireless PtP backhaul networks

Track record of quality and successful acquisition of companies and IP that are leveraged to enhance the high speed device market domination success

Management owns about 20% and has demonstrated solid fiscal management

20 © 2015 GigOptix, Inc. All Rights Reserved

NYSE MKT: GIG

Powering High Speed Networks

August 17, 2015 Road show

© 2015 GigOptix, Inc. All Rights Reserved

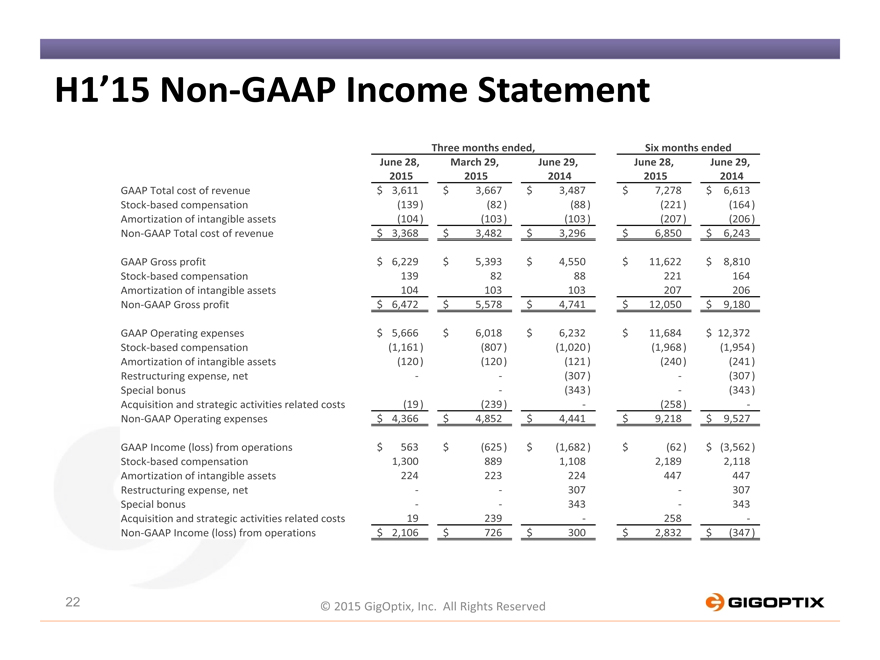

H1’15 Non-GAAP Income Statement

Three months ended, Six months ended

June 28, March 29, June 29, June 28, June 29,

2015 2015 2014 2015 2014

GAAP Total cost of revenue $ 3,611 $ 3,667 $ 3,487 $ 7,278 $ 6,613

Stock-based compensation (139 ) (82 ) (88 ) (221 ) (164 )

Amortization of intangible assets (104 ) (103) (103 ) (207 ) (206 )

Non-GAAP Total cost of revenue $ 3,368 $ 3,482 $ 3,296 $ 6,850 $ 6,243

GAAP Gross profit $ 6,229 $ 5,393 $ 4,550 $ 11,622 $ 8,810

Stock-based compensation 139 82 88 221 164

Amortization of intangible assets 104 103 103 207 206

Non-GAAP Gross profit $ 6,472 $ 5,578 $ 4,741 $ 12,050 $ 9,180

GAAP Operating expenses $ 5,666 $ 6,018 $ 6,232 $ 11,684 $ 12,372

Stock-based compensation (1,161 ) (807) (1,020 ) (1,968 ) (1,954 )

Amortization of intangible assets (120 ) (120) (121 ) (240 ) (241 )

Restructuring expense, net — — (307 ) — (307 )

Special bonus — (343 ) — (343 )

Acquisition and strategic activities related costs (19 ) (239) — (258 ) -

Non-GAAP Operating expenses $ 4,366 $ 4,852 $ 4,441 $ 9,218 $ 9,527

GAAP Income (loss) from operations $ 563 $ (625) $ (1,682 ) $ (62 ) $ (3,562 )

Stock-based compensation 1,300 889 1,108 2,189 2,118

Amortization of intangible assets 224 223 224 447 447

Restructuring expense, net — — 307 — 307

Special bonus — — 343 — 343

Acquisition and strategic activities related costs 19 239 — 258 -

Non-GAAP Income (loss) from operations $ 2,106 $ 726 $ 300 $ 2,832 $ (347 )

22 © 2015 GigOptix, Inc. All Rights Reserved

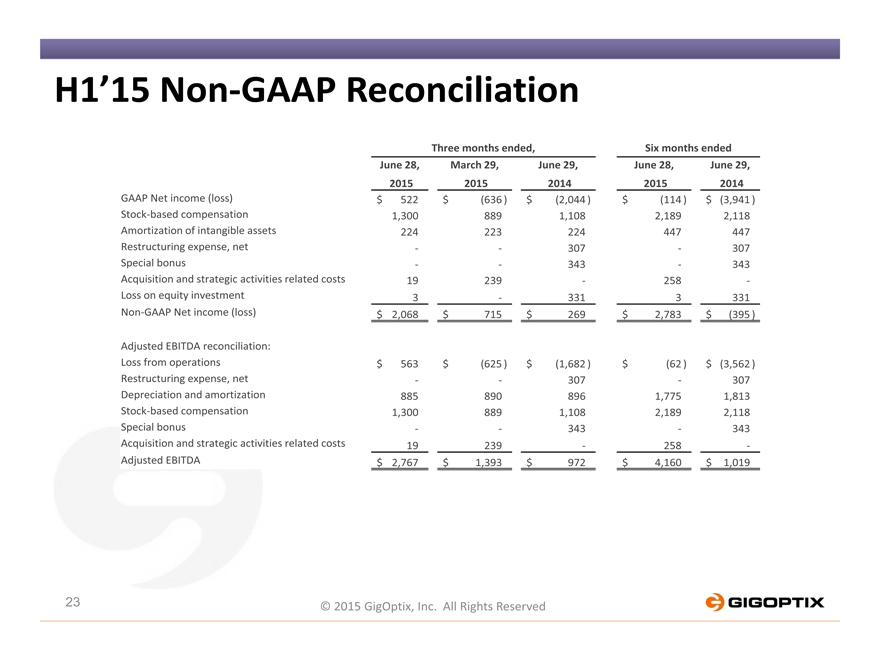

H1’15 Non-GAAP Reconciliation

Three months ended, Six months ended

June 28, March 29, June 29, June 28, June 29,

2015 2015 2014 2015 2014

GAAP Net income (loss) $ 522 $ (636 ) $ (2,044 ) $ (114 ) $ (3,941)

Stock-based compensation 1,300 889 1,108 2,189 2,118

Amortization of intangible assets 224 223 224 447 447

Restructuring expense, net — — 307 — 307

Special bonus — — 343 — 343

Acquisition and strategic activities related costs 19 239 — 258 -

Loss on equity investment 3 — 331 3 331

Non-GAAP Net income (loss) $ 2,068 $ 715 $ 269 $ 2,783 $ (395 )

Adjusted EBITDA reconciliation:

Loss from operations $ 563 $ (625 ) $ (1,682 ) $ (62 ) $ (3,562)

Restructuring expense, net — — 307 — 307

Depreciation and amortization 885 890 896 1,775 1,813

Stock-based compensation 1,300 889 1,108 2,189 2,118

Special bonus — — 343 — 343

Acquisition and strategic activities related costs 19 239 — 258 -

Adjusted EBITDA $ 2,767 $ 1,393 $ 972 $ 4,160 $ 1,019

23 © 2015 GigOptix, Inc. All Rights Reserved