SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

GIGOPTIX, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Notice of Annual Meeting of Stockholders

To be held on November 12, 2015

To the Stockholders of GigOptix, Inc.:

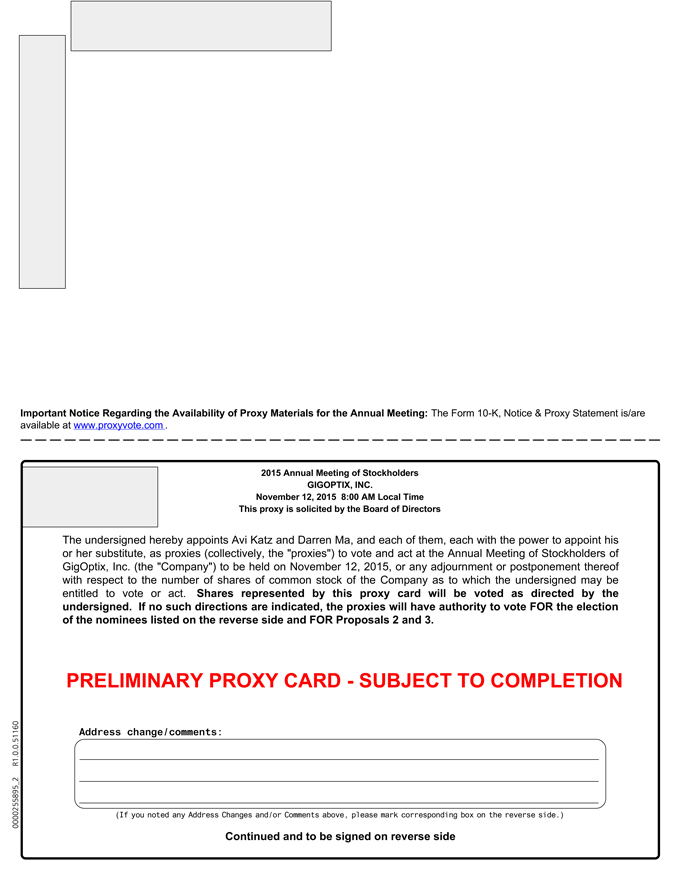

I am pleased to invite you to the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of GigOptix, Inc. (the “Company”), which will be held at 8:00 a.m., local time, on November 12, 2015 at our principal executive offices, located at 130 Baytech Drive, San Jose, California 95134, for the following purposes:

| | 1. | To elect two Class I directors to our Board of Directors to serve a three-year term expiring on the date on which our annual meeting of stockholders is held in 2018 or until their successor is duly elected and qualified; |

| | 2. | To approve, on an advisory basis, the 2014 compensation of the Company’s named executive officers; |

| | 3. | To ratify the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| | 4. | To transact any other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The foregoing items of business are more fully explained in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on October 1, 2015 as the record date for the purposes of determining the stockholders entitled to notice of, and to vote at, the Annual Meeting.

This year’s Annual Meeting is a particularly important one, and YOUR vote is essential. VCM Group LLC (“VCM”), a beneficial holder of 200 shares, or approximately 0.000454%, of our outstanding common stock acquired in April 2015, has notified the Company that it intends to nominate its own slate of Class I directors to our Board of Directors at the Annual Meeting. For additional information about VCM, please see the “Background of the Solicitation” section on Page 9 of the accompanying proxy statement. You may receive solicitation materials, including proxy statements and [—] proxy cards, from VCM seeking your proxy to vote for its slate. At this time, we have no knowledge whether VCM will actually proceed with the solicitation for the election of its slate at the Annual Meeting. We bear no responsibility for the accuracy or completeness of any solicitation materials distributed, or any statements made, by or on behalf of VCM. THE BOARD URGES YOU NOT TO SUBMIT ANY PROXY CARD SENT TO YOU BY, OR ON BEHALF OF, VCM. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE BOARD’S NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

If you already have submitted a proxy card sent to you by, or on behalf of, VCM, you can revoke that proxy by submitting another proxy over the internet or by telephone, or by completing, dating, signing and returning your WHITE proxy card in the postage-paid envelope provided. Only the latest validly executed proxy you submit will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying proxy statement.

, 2015

By Order of the Board of Directors,

Dr. Avi Katz

President and Chief Executive Officer

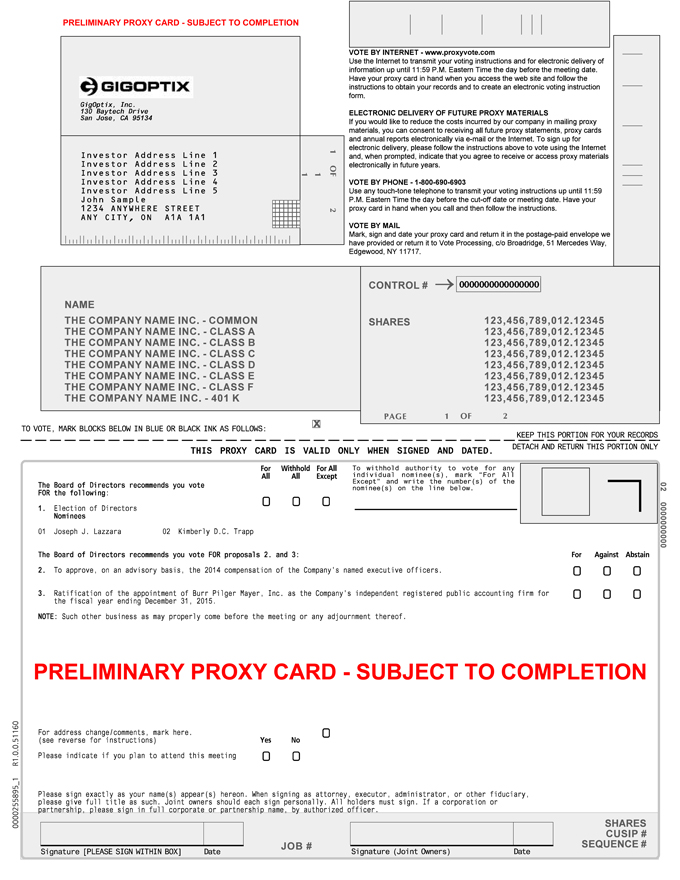

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders: this proxy statement, the WHITE proxy card and the Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the Securities and Exchange Commission on March 17, 2015 (the “Annual Report on Form 10-K”) are available at: www.proxyvote.com.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

TABLE OF CONTENTS

i

GIGOPTIX, INC.

130 Baytech Drive

San Jose, CA 95134

PROXY STATEMENT

INTRODUCTION

This Proxy Statement contains important information regarding our 2015 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 8:00 a.m., local time, on Thursday, November 12, 2015 at our principal executive offices located at 130 Baytech Drive, San Jose, California 95134. Your proxy is being solicited by our Board of Directors.

QUESTIONS AND ANSWERS

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is to consider and vote on the following proposals:

| | 1. | The election of two Class I directors to our Board of Directors to serve a three-year term expiring on the date on which our annual meeting of stockholders is held in 2018 or until their successors are duly elected and qualified; |

| | 2. | To approve, on an advisory basis, the 2014 compensation of the Company’s named executive officers; |

| | 3. | The ratification of the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| | 4. | The transaction of any other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

| | 1. | FOR the election of Joseph J. Lazzara and Kimberly D.C. Trapp as Class I directors (Proposal 1); |

| | 2. | FOR, on an advisory basis, the 2014 compensation of the Company’s named executive officers (Proposal 2); |

| | 3. | FOR the ratification of the selection of Burr Pilger Mayer, Inc. as our independent registered accounting firm for the fiscal year ending December 31, 2015 (Proposal 3); and |

| | 4. | FOR or AGAINST other matters that come before the Annual Meeting as the proxy holders deem advisable. |

The Board strongly urges you not to sign or return any proxy card that may be sent to you by VCM Group LLC (“VCM”).

Who is entitled to vote on the proposals considered at the Annual Meeting?

The record date for the Annual Meeting is October 1, 2015. All holders of our common stock at the close of business on that date are entitled to attend and vote at the Annual Meeting. Each outstanding share of common stock is entitled to one vote on each matter that comes before the Annual Meeting. At the close of business on October 1, 2015 there were [ ] shares of common stock outstanding.

1

What is a quorum, and how is it determined?

A quorum is the minimum number of shares that must be present at the Annual Meeting to conduct business. The presence in person or by proxy of a majority of the shares of common stock issued and outstanding and entitled to vote as of the record date shall constitute a quorum. At least [ ] shares of common stock must be present in person or by proxy at the Annual Meeting to constitute a quorum.

How do I vote?

Your vote is very important, and the procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using the enclosed WHITE proxy card. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| | • | | To vote in person, come to the Annual Meeting, and we will give you a ballot when you arrive. |

| | • | | To vote using the WHITE proxy card, simply complete, sign and date the enclosed WHITE proxy card and return it promptly in the pre-paid envelope provided. If you return your signed WHITE proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| | • | | To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. Your vote must be received by 11:59 p.m., Eastern Time on November 11, 2015 to be counted. |

| | • | | To vote through the internet, go to http://www.proxyvote.com/ to complete an electronic WHITE proxy card. Your vote must be received by 11:59 p.m., Eastern Time on November 11, 2015 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

Contested Election

For broker, bank or other nominee accounts that receive proxy materials from, or on behalf of, both GigOptix and VCM in a contested election, all items listed in the notice for the meeting will be considered “non-routine” matters. Therefore, your custodian will not be able to use its own discretion to vote your shares for any proposal at the Annual Meeting and may only vote based on your instructions. If you do not submit any voting instructions to your broker or other nominee, your shares may not be counted in determining the outcome of any of the proposals at the Annual Meeting, and your shares may not be counted for purposes of determining whether a quorum exists. Accordingly, we urge you to promptly give instructions to your custodian to vote “FOR” each of the Board’s director nominees in Proposal 1 and “FOR” Proposals 2 and 3 by using the voting instruction card provided to you by your custodian.

Uncontested Election

In an uncontested election, if you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a Notice containing voting instructions from that organization rather than from GigOptix. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other nominee. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

2

On or about October [ ], 2015, we expect to mail to our stockholders the proxy statement, WHITE proxy card and Annual Report on Form 10-K. The WHITE proxy card also will instruct you on how to access and submit your proxy by mail, through the internet or by telephone.

What is the difference between holding shares as a stockholder of record and beneficial owner?

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company LLC, you are considered, with respect to those shares, the “stockholder of record.” As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting.

Beneficial Owner. If your shares are held in a brokerage account or by a bank or other nominee, you are considered with respect to those shares to be the “beneficial holder” or “beneficial owner,” and those shares are considered to be held in “street name.” In that case, the broker, bank, or other holder is considered the “stockholder of record.”

How can I vote at the meeting if I am a beneficial owner?

As the beneficial owner, you have the right to direct the broker, bank, or other nominee with respect to voting your shares and may do so by:

(i) completing the voting instruction card (or following any instructions on such form to use internet or telephone voting, if available) provided to you by your broker, bank or other holder of record; or

(ii) you may attend the Annual Meeting and cast your vote. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting, unless you request, complete and deliver a proxy from your broker, bank or other nominee. You will not be able to vote your shares at the meeting without a legal proxy.

Please note that under the New York Stock Exchange (the “NYSE”) rules, the election of directors (Proposal 1), and the approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 2) are both “non-routine” (also referred to as “non-discretionary”) items. Typically, “routine” matters would include the ratification of the appointment of our independent registered public accounting firm (Proposal 3). However, as noted above, when a matter is to be voted on at a stockholder meeting which is a subject of a contested solicitation, banks, brokers and other nominees may not have discretion to vote your shares on that matter. If you do not instruct your broker how to vote with respect to the non-discretionary items, your broker may not vote with respect to this proposal and those votes will be counted as “broker non-votes.” See “What are broker non-votes?” and “What if I don’t vote for all of the items listed on my WHITE proxy card (or what happens if I abstain or my broker does not vote)?” for more information regarding broker non-votes.

What do I need to attend the Annual Meeting?

All stockholders attending the Annual Meeting must present valid government-issued photo identification at the door to be admitted. If you are not the holder of record of your shares (e.g., you hold shares through a brokerage account), you must also present a copy of an account statement reflecting your ownership of the shares as of the close of business on the record date, October 1, 2015. No cameras, recording equipment or other electronic devices will be permitted at the Annual Meeting.

3

How will my shares be voted if I don’t provide specific instructions?

Your shares will be voted in accordance with the instructions that you indicate on your WHITE proxy card. If you execute your WHITE proxy card but do not provide instructions, your shares will be counted “FOR” the election of Joseph J. Lazzara and Kimberly D.C. Trapp as Class I directors as the election of directors, “FOR”, on an advisory basis, the compensation of the Company’s named executive officers, and “FOR” the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015. For any other matters that come before the Annual Meeting, your shares will be voted at the discretion of the proxies, Dr. Avi Katz.

Why might I be receiving proxy materials from VCM?

VCM, a beneficial holder of 200 shares of the common stock of the Company acquired in April 2015, has notified the Company that it intends to nominate a slate of its own Class I directors to stand for election at the Annual Meeting. For additional information about VCM, please see the “Background of the Solicitation” section on Page 9 of this Proxy Statement. You may receive solicitation materials, including a proxy statement and proxy card, from VCM or others seeking your proxy to vote for VCM, although at this time, we have no knowledge whether VCM will send out any solicitation materials. We bear no responsibility for the accuracy or completeness of any such materials or statements made by or on behalf of VCM. IF YOU DO RECEIVE ANY SOLICITATION MATERIALS OTHER THAN FROM THE COMPANY, THE BOARD OF DIRECTORS URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY VCM OR ANY OTHER THIRD PARTY. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE BOARD’S NOMINEES, WHOSE NAMES ARE SET FORTH ON THE ENCLOSED WHITE PROXY CARD.

In the event VCM or any other third party sends you a proxy card, voting to “WITHHOLD” with respect to VCM’s nominations is not the same as voting for the Company’s Board’s director nominees because a vote to “WITHHOLD” with respect to VCM will revoke any proxy you previously submitted. If you have already voted using VCM’s proxy card, you have the right to change your vote by voting via the internet or by telephone by following the instructions on the WHITE proxy card, or by completing and mailing the enclosed WHITE proxy card in the enclosed pre-paid envelope. Only the latest validly executed proxy that you submit will be counted—any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I change my vote after I have submitted a proxy?” below. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Okapi Partners LLC (“Okapi”), toll free at 1 (877) 796-5274 or collect at 1 (212) 297-0720.

Can I change my vote after I have submitted a proxy?

Yes. If you are a stockholder of record, you may revoke a previously submitted proxy at any time before it is voted at the Annual Meeting. In order to revoke a proxy, you must do one of the following prior to the taking of the vote at the Annual Meeting:

| | • | | Provide written notice of revocation to Corporate Secretary, c/o GigOptix, Inc., 130 Baytech Drive, San Jose, CA 95134; |

| | • | | Deliver a valid proxy bearing a later date or submit a new later dated proxy; or |

| | • | | Attend the Annual Meeting and vote in person and request that your proxy be revoked (attendance at the meeting will not by itself revoke a previously granted proxy). |

However, please note that if you are a beneficial owner of shares held in street name, you may revoke your proxy by timely submitting new voting instructions to your broker, bank or other nominee or by obtaining a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares, or by attending the Annual Meeting and voting in person.

All shares that have been properly voted by proxy without timely revocation will be voted at the Annual Meeting.

4

The Board of Directors urges you to revoke any proxy card you may have returned that you received from VCM. If you have previously signed a proxy card sent to you by VCM, you have every right to change your vote. You may revoke that proxy and vote as recommended by the Board of Directors by signing, dating and returning the enclosed WHITE proxy card in the enclosed postage-paid envelope or by voting via the Internet or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only the latest validly executed proxy that you submit will be counted. Submitting a [—] proxy card for VCM—even if you withhold your vote on VCM—will revoke any votes that you previously made on the WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of the Board of Directors, you should disregard any proxy card that you receive that is not a WHITE proxy card. Do not return any proxy card that you may receive from VCM, even as a protest vote against VCM.

What should I do if I receive more than one proxy card?

If you hold your shares of common stock in more than one account, you will receive a WHITE proxy card for each account. To ensure that all of your shares of common stock are voted, please sign, date and return the WHITE proxy card for each account. You should vote all of your shares of common stock.

In addition, VCM has provided notice that it may nominate a slate of its own Class I directors to stand for election. As a result, you may receive solicitation material from VCM. If you wish to vote pursuant to the recommendation of the Board of Directors, you should disregard any proxy card that you receive that is not a WHITE proxy card.

If you withhold your vote on VCM using his proxy card, your vote will not be counted as a vote for the Board of Directors’ nominees and will result in the revocation of any previous vote that you may have cast on the WHITE proxy card. THE BOARD OF DIRECTORS URGES YOU NOT TO RETURN ANY PROXY CARD THAT MAY BE SENT TO YOU BY VCM, EVEN AS A PROTEST VOTE AGAINST VCM.

What are broker non-votes?

Broker non-votes occur when proxies are submitted for shares held in street name by a broker that the broker has no discretionary authority to vote. Brokers do not have authority to vote on matters considered to be non-routine unless they have received instructions from the beneficial owners of the shares. Broker non-votes are counted for the purpose of establishing a quorum but are not considered to be entitled to vote.

What is the effect if I don’t cast my vote?

Stockholders of record—If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

Beneficial owners—

Contested Election

For broker, bank or other nominee accounts that receive proxy materials from, or on behalf of, both the Company and VCM, all items listed in the notice for the meeting will be considered “non-routine” matters. In that case, if you do not submit any voting instructions to your broker, bank or other nominee, your shares will not be counted in determining the outcome of any of the proposals at the annual meeting, and your shares will not be counted for purposes of determining whether a quorum exists.

Uncontested Election

For broker, bank or other nominee accounts that receive proxy materials only from the Company, your broker, bank or other nominee will have discretion to vote any uninstructed shares on the ratification of the appointment of our independent registered public accounting firm (Proposal 3).

5

However, if you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors (Proposal 1), or in the approval, on an advisory basis, of the compensation of the Company’s named executive officers (Proposal 2). In the past, if you held your shares in street name and you did not indicate how you wanted your shares voted in certain non-discretionary proposals, your broker, bank or other nominee was allowed to vote those shares on your behalf as they felt appropriate. Changes in the relevant regulations were made to take away the ability of your broker, bank or other nominee to vote your uninstructed shares for non-discretionary proposals. Thus, if you hold your shares in street name and you do not instruct your broker, bank or other nominee how to vote in the election of directors, or in the approval, on an advisory basis, of the compensation of the Company’s named executive officers, no votes will be cast on your behalf.

What if I don’t vote for all of the items listed on my WHITE proxy card (or what happens if I abstain or my broker does not vote)?

Stockholders of record—If your proxy indicates an abstention from voting on all matters, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be voted on any matter at the Annual Meeting. Because directors are elected based on a plurality vote, if you abstain from voting on the proposal to re-elect the directors (Proposal 1), your abstention will have no effect on the outcome of the vote with respect to this proposal. If you abstain from voting on the advisory vote for executive compensation (Proposal 2) it will have no effect on the outcome of the vote with respect to the proposal as abstentions and broker non-votes will not be counted as votes cast. If you abstain from voting on the proposal to ratify the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm (Proposal 3), your abstention will have the same effect as a vote against the proposal.

Beneficial owners—

Contested Election

For broker, bank or other nominee accounts that receive proxy materials from, or on behalf of, both the Company and VCM, all items listed in the notice for the meeting will be considered “non-routine” matters. In that case, if you do not submit any voting instructions to your broker, bank or other nominee, your shares will not be counted in determining the outcome of any of the proposals at the annual meeting, and your shares will not be counted for purposes of determining whether a quorum exists.

Uncontested Election

For broker, bank or other nominee accounts that receive proxy materials only from the Company, under the rules that govern brokers who have record ownership of shares that are held in “street name” for their clients, who are the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. Thus, if you do not otherwise instruct your broker, the broker may vote your shares “for” routine matters but expressly indicate that the broker is NOT voting on non-routine matters. A “broker non-vote” occurs when a broker expressly indicates on a proxy that it is not voting on a matter, whether routine or non-routine. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum but are not counted for determining the number of votes cast for or against a proposal.

If you are a beneficial owner and your broker holds your shares in its name, the broker is permitted to vote your shares on the ratification of Burr Pilger Mayer, Inc. as our independent registered public accounting firm even if the broker does not receive voting instructions from you. However, because of NYSE rules, your broker does not have discretionary authority to vote on the re-election of directors, or the approval, on an advisory basis, of the compensation of the Company’s named executive officers, so it is very important that you instruct your broker how to vote on the proposals.

How many votes are required to approve the proposals?

Proposal 1—Election of Directors. Directors are elected by a plurality of votes present in person or represented by proxy and entitled to vote. If a quorum is present, the nominees receiving the highest number of votes will be

6

elected to the Board of Directors. You may vote either “for” or “withhold” your vote for the director nominee. A properly executed proxy marked “withhold” with respect to the election of the directors will not be voted with respect to the director nominee and will not affect the outcome of the election, although it will be counted for purposes of determining whether there is a quorum.

Proposal 2 — To approve, on an advisory basis, of the compensation of the Company’s named executive officers. If a quorum is present, the Proposal will be approved if the votes cast for the Proposal exceed the votes cast against it.

Proposal 3 — Ratification of our Independent Registered Public Accounting Firm. For the ratification of the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015, the affirmative vote of a majority of the shares present, represented and entitled to vote on the item will be required for approval. You may vote “for,” “against,” or “abstain” from voting on this Proposal. If you abstain from voting on this matter, your shares will be counted as present and entitled to vote on the matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against this Proposal.

Who pays the cost of proxy solicitation?

The cost of soliciting proxies on behalf of the Board of Directors will be borne by us. These costs will include the expense of preparing, assembling, printing and mailing the notice, this proxy statement and any other material used in the Board of Directors’ solicitation of proxies to stockholders of record and beneficial owners, and reimbursements paid to banks, brokerage firms, custodians and others for their reasonable out-of-pocket expenses for forwarding proxy materials to stockholders and obtaining beneficial owners’ voting instructions.

As a result of the potential proxy contest initiated by VCM, we may incur substantial additional costs in connection with the solicitation of proxies. We have retained Okapi as our proxy solicitor in conjunction with the Annual Meeting for an estimated fee of $[●], plus reimbursement of out-of-pocket expenses. Okapi expects that approximately [●] of its employees will assist in the solicitation. Our expenses related to the solicitation of proxies from stockholders this year may substantially exceed those normally spent for an annual meeting of stockholders if a contest is initiated. Such additional costs are expected to aggregate approximately $[●], exclusive of any costs related to any litigation in connection with the Annual Meeting. These additional solicitation costs are expected to include: the fee payable to our proxy solicitor; fees of outside counsel to advise the Company in connection with a contested solicitation of proxies; increased mailing costs, such as the costs of additional mailings of solicitation material to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding solicitation materials to beneficial owners of common stock; and the costs of retaining an independent inspector of election. To date, we have incurred approximately $[●] of these solicitation costs.

In addition to solicitations by Okapi and solicitations of proxies by mail, solicitations may be made personally, by telephone, internet, fax, or other electronic means by our directors and officers and regular employees, who will not be additionally compensated for any such services. Stockholders voting via the telephone or internet should understand that there may be costs associated with telephonic or electronic access, such as usage charges from telephone companies and internet access providers, which must be borne by the stockholder.

What is householding?

Householding is a procedure approved by the SEC that provides for the delivery of only one copy of our proxy materials to stockholders residing at the same address, unless the stockholders have notified us of their desire to receive multiple copies. This procedure is known as “householding” and is intended to reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy cards.

7

We will promptly deliver, upon request, a separate copy of the proxy statement to any stockholder residing at an address at which only one copy was mailed. Requests should be addressed to Investor Relations at our principal executive offices. If you are eligible for householding, but you and other stockholders of record currently receive multiple copies of these proxy materials, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact Broadridge Householding Department at 51 Mercedes Way, Edgewood, NY 11717 or by telephone at (800) 542-1061.

If you are a beneficial stockholder and own your shares through a bank or broker, please contact your broker, bank or other nominee to request additional copies.

How can I nominate director candidates?

Please refer to the section captioned “Candidates for the Board of Directors” on page 20 of this Proxy Statement.

Who do I contact with additional questions?

We have retained Okapi Partners LLC to act as proxy solicitor. If you have additional questions or need assistance voting your shares of common stock, you should contact them at:

Okapi Partners LLC

437 Madison Avenue 28th Floor

New York, NY 10022

Toll-Free: 877-796-5274

Collect: 212-297-0720

8

BACKGROUND OF THE SOLICITATION

On September 14, 2015, the Company received a letter from VCM Group LLC, a holder of 200 shares of the common stock in the Company or approximately 0.000454% of the outstanding common stock, which VCM stated in the letter it acquired on April 30, 2015. In the letter, VCM nominated and submitted biographical information regarding four individuals to stand for election to the Board of Directors at the Annual Meeting even though there were only two Class I directors to be elected at the Annual Meeting in accordance with the terms of the Company’s certificate of incorporation, as amended. VCM provided no information as to why any changes should be made to the Board of Directors, why the four individuals nominated by it would be qualified or what their intention would be if elected to the Board of Directors.

On September 15, 2015, counsel to the Company informed VCM of the unanimous decision of the Company’s Board of Directors not to include any of the individuals nominated by VCM as nominees of the Board of Directors at the Annual Meeting due to the lack of experience, industry knowledge, seniority and pedigree of these individuals to serve on the Company’s Board of Directors.

The Company has received nothing further from VCM.

9

PROPOSALS AT THE ANNUAL MEETING

PROPOSAL 1—Election of Directors

Our certificate of incorporation, as amended, divides the Board of Directors into three classes with overlapping three year terms, each of which features a term that expires at a different annual meeting of stockholders. One class is elected each year at the annual meeting of stockholders, and the classes are to be as nearly equal in number as possible. The Class I directors are up for election at the Annual Meeting and will serve for a term expiring at the 2018 annual meeting of stockholders. There are currently six directors, two of whom serve as Class I directors.

The Board of Directors has nominated Joseph J. Lazzara and Kimberly D.C. Trapp to serve as Class I directors. These two nominees have a history of service on the Board of Directors with a strong mix of relevant experience. Our Board of Directors has evaluated each of our nominees against the criteria we use to select nominees for director. Based on this evaluation, our Board of Directors concluded that it is in the best interests of the Company and its stockholders for each of the nominees named above to serve as a member of the Board of Directors.

In the event that the nominee is unable or unwilling to accept nomination or election as a director, the proxies authorizing management to vote for such nominee will be voted for such other person as the Board of Directors determines. Stockholders are not entitled to cumulate their votes for nominees for election to the Board of Directors. The nominee receiving the greatest number of “FOR” votes shall be elected.

The Board of Directors recommends that you that you use the enclosed WHITE proxy card (or follow the directions set forth in the WHITE proxy card to vote by telephone or via the Internet) to vote “FOR” the election of Joseph J. Lazzara and Kimberly D.C. Trapp as Class I directors.

Background Information on Director Nominees

Set forth below is certain information, as of September 25, 2015, regarding each director nominee, including information regarding the experience, qualifications, attributes or skills of each nominee that led to the Board of Directors’ conclusion that the person should serve on the Board of Directors. In addition to the information set forth below, this proxy statement sets forth information relating to certain of our directors, officers, and employees who are considered “participants” in this proxy solicitation under the rules of the SEC by reason of their position as Company directors or because they may be soliciting proxies on our behalf.

Class I Directors—up for election at this Annual Meeting with a term expiring at the 2018 annual meeting of stockholders.

Joseph J. Lazzara has over 30 years of public company board of directors’ experience. He joined the GigOptix Board of Directors in July, 2011 with the acquisition of Endwave where he served as a director since February 2004. From 2006 to 2008, Mr. Lazzara served as the Vice Chairman and a director of Omron Scientific Technologies, Inc. (formerly Scientific Technologies, Inc. (NASDAQ: STIZ)), a manufacturer of factory automation products acquired by Omron Corporation in 2006. Mr. Lazzara served in various executive positions with Scientific Technologies, including as the Chief Executive Officer, President and Director and other positions between 1984 and 2006. Since 2006, he has served as the Vice Chairman and Director of Automation Products Group, Inc., a privately held manufacturer of automation sensors. Mr. Lazzara received a B.S. in Engineering from Purdue University and an M.B.A. from Santa Clara University. We believe that Mr. Lazzara’s extensive business expertise, both as the Chief Executive Officer and Board Member of a publicly traded company as well as his technical background qualify him to serve on our Board of Directors.

10

Kimberly D.C. Trapp has served on the GigOptix Board of Directors since December 2008. Kimberly D.C. Trapp has more than 30 years of experience in the optoelectronics industry. She served as the Industry Liaison Officer for the Center of Optical Technologies at Lehigh University until her retirement in 2010. Before joining Lehigh University, she served as the Director of Marketing Operations of Agere Systems until 2002 and was responsible for business operations, customer marketing, technical product support, product engineering, and program management of Agere’s optoelectronic business and product portfolio. From 1980 until 1995, she served in the development and research organizations of AT&T Bell Laboratories and Lucent Technologies. Ms. Trapp has a BS in Chemistry from Purdue University and an MS in Inorganic Chemistry from Fairleigh Dickinson University. She also has MBA from an AT&T sponsored executive program. From her industry and academic experience of more than 30 years, Ms. Trapp brings a tremendous amount of technical expertise, especially in the area of optical and electro-optic technologies, that we believe makes her uniquely qualified to sit on our Board of Directors.

Members of the Board of Directors and Background Information on Those Directors Not Up For Election

The table below sets forth information regarding all of the members of our Board of Directors as of September 25, 2015. The term of each class of directors expires as follows: Class I at the 2015 Annual Meeting, Class II at the 2016 annual meeting of stockholders, and Class III at the 2017 annual meeting of stockholders. Each director shall hold office until his or her successor is duly qualified.

| | | | | | | | | | | | |

Name | | Age | | | Position | | Class | | Director

Since | |

Dr. Avi Katz | | | 57 | | | Chairman of the Board, Founder, Chief Executive Officer and President | | III | | | 2008 | |

Joseph J. Lazzara | | | 64 | | | Director | | I | | | 2011 | |

John J. Mikulsky | | | 70 | | | Director | | II | | | 2011 | |

Neil J. Miotto | | | 69 | | | Director | | II | | | 2008 | |

Frank W. Schneider | | | 73 | | | Director | | III | | | 2010 | |

Kimberly D.C. Trapp | | | 57 | | | Director | | I | | | 2008 | |

Set forth below is certain information, as of September 25, 2015, regarding the Class II and Class III directors whose terms are continuing after this year’s Annual Meeting and whom are therefore not up for election.

Class II Directors—continuing directors with a term expiring at the 2016 annual meeting of stockholders.

John J. Mikulsky has served on the GigOptix Board of Directors since June 2011. Mr. Mikulsky served as President and Chief Executive Officer of Endwave Corporation from December 2009 until June 2011, when Endwave was acquired by GigOptix. From May 1996 until November 2009, Mr. Mikulsky served Endwave in a multitude of capacities including Vice President of Product Development, Vice President of Marketing and Business Development and Chief Operating Officer. Prior to Endwave, Mr. Mikulsky worked as a Technology Manager for Balazs Analytical Laboratory, from 1993 until 1996, a provider of analytical services to the semiconductor and disk drive industries. Prior to 1993, Mr. Mikulsky worked at Raychem Corporation, most recently as a Division Manager for its Electronic Systems Division. Mr. Mikulsky holds a B.S. in electrical engineering from Marquette University, an M.S. in electrical engineering from Stanford University and an S.M. in Management from the Sloan School at the Massachusetts Institute of Technology. We believe Mr. Mikulsky’s extensive industry knowledge and experience, including his years of experience at Endwave Corporation in both technical and leadership roles, qualify him to serve on our Board of Directors.

Neil J. Miotto joined the GigOptix Board of Directors in December, 2008. Mr. Miotto is a financial consultant and a retired assurance partner of KPMG LLP where he was a partner for twenty-seven years until his retirement in September 2006. Since his retirement from KPMG Mr. Miotto has provided high level financial consulting services to companies in need of timely accounting assistance and in serving on public company boards including Micrel Inc.. He is deemed to be a ‘financial expert ´under SEC and NYSE rules. While at KPMG Mr. Miotto focused on serving large public companies, primarily semiconductor companies. Among the clients he served

11

were National Semiconductor Corporation, Fairchild Semiconductor Corp, and nVIDIA Corporation. Mr. Miotto also served as an SEC reviewing partner while at KPMG. He is a member of the American Institute of Certified Public Accountants. He holds a Bachelor of Business Administration degree from Baruch College, of The City University of New York. He also serves on the board of directors of Micrel, Incorporated. Mr. Miotto brings extensive financial risk assessment and financial reporting experience to our Board of Directors. We believe that Mr. Miotto’s extensive experience with public companies and financial accounting matters makes him well qualified to be on our Board of Directors.

Class III Directors—continuing directors for a term expiring at the 2017 annual meeting of stockholders.

Dr. Avi Katz is a serial entrepreneur. Since founding GigOptix LLC, the predecessor company to GigOptix, Inc. in July 2007, he served as the Chairman of the Board of Directors, Chief Executive Officer and President of the Company and all its subsidiaries, including its overseas operations, GigOptix-Helix AG in Switzerland, the newly established GigOptix-Terasquare-Korea (GTK) Co., Ltd., and GigOptix Israel Ltd., as well as Chairman of the Board of Directors of the Company’s joint venture BrPhotonics Produtos Optoeletronicos LTDA. (“BrP) in Brazil. He led the Company through the public listing on the OTC Exchange in December 2008, the listing on the NYSE-MKT in April 2012, and its follow-on public offerings, including in December 2013 and August 2015. Prior to founding the GigOptix group of companies, Dr. Katz was the Managing Partner of APU-Global, which he founded in 2005, the Chief Executive Officer, President and a board member of Intransa, Inc., from 2003 to 2005, and of Equator Technologies, Inc., from 2000 to 2003. Earlier in his career he held various sales and marketing, business development, technology and operational corporate executive positions, following his tenure as a Member of the Technical Staff with AT&T Bell Labs, Murray Hill, NJ, between 1988 and 1995. He holds more than 70 U.S. and international patents, has published about 300 technical papers and is the editor of a number of technical books. Dr. Katz received his Ph.D. in materials engineering and a B.S. in engineering from Technion-IIT, Israel, and is a graduate of the Israeli Naval Academy. As our co-founder, and the CEO since the inception, Dr. Katz has the benefit of understanding our Company’s complete history. This background, together with his extensive executive experience and exceptional technical skills, make Dr. Katz uniquely qualified to serve on our Board of Directors.

Frank W. Schneider joined the GigOptix Board of Directors in June 2010. Frank W. Schneider has over 40 years of experience in the electronics and semiconductor industries, serving on the boards and executive management teams of both privately held and publicly traded companies. He retired in 2009 from MKS Instruments Inc., where he served as vice president and general manager. Previously, he served as president and CEO at both ION Systems Inc., a privately held manufacturer of electrostatic management systems, and GHz Technology Inc., a privately held manufacturer of RF power transistors that was merged into Advanced Power Technology Inc. (NASDAQ: APTI), where he served as COO of the RF products group during the years 2002 & 2003. Additionally, he was a member of the technical advisory board of Neomagic Inc., a display controller chip company, and was a member of the Board of Directors of GMT Microelectronics, Inc. He began his career at Corning Electronics and subsequently moved to Philips Semiconductor, then known as Signetics Corporation, where he held many senior positions during his tenure. He also was a group vice president at Sharp Electronics. We believe Mr. Schneider is well qualified to serve on our Board of Directors due to his leadership skills and industry experience, which he has demonstrated through more than 40 years of management and experience in the semiconductor, electronic component and systems industries.

Arrangements with Directors

Pursuant to the terms of the merger agreement between GigOptix LLC and Lumera Corporation, Dr. Katz was elected to serve as the Chairman of our Board of Directors, and each of Ms. Trapp and Mr. Miotto were elected to serve as our directors immediately following the effectiveness of that merger. Pursuant to the terms of the merger agreement with Endwave Corporation, Messrs. Lazzara and Mikulsky were elected to serve as our directors following the effectiveness of that merger.

12

The Board of Directors does not endorse any director nominee of VCM Group, LLC and urges you not to sign or return any proxy card that may be sent to you by VCM. Please note that voting to “WITHHOLD” with respect to any of VCM’s nominees on a proxy card supplied by or on behalf of VCM is not the same as voting for the Board of Directors’ nominees because a vote to “WITHHOLD” with respect to any of nominees on VCM’s proxy card will revoke any proxy you previously submitted. If you have already voted using VCM’s proxy card, you have the right to change your vote by voting via the Internet or by telephone by following the instructions on the WHITE proxy card, or by completing and mailing the enclosed WHITE proxy card in the enclosed pre-paid envelope. Only the latest validly executed proxy that you submit will be counted—any proxy may be revoked at any time prior to its exercise at the Annual Meeting by following the instructions under “Can I change my vote after I have submitted a proxy?” on page 4. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, Okapi Partners LLC, toll free at 1 (877) 796-5274 or collect at 1 (212) 297-0720.

13

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE TWO CLASS I DIRECTOR NOMINEES LISTED ABOVE.

PROPOSAL 2—Approval, on an advisory basis, of the compensation of the Company’s named executive officers

Pursuant to the applicable rules and regulations of the SEC promulgated under the Exchange Act and adopted in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act, we are providing stockholders with the opportunity to vote to approve, on an advisory basis, the 2014 compensation which we paid to our named executive officers. This advisory vote, commonly known as a “Say-on-Pay” vote, gives our stockholders the opportunity to express their views on the Company’s executive compensation policies and programs and the compensation paid to the named executive officers in 2014.

This advisory vote can be conducted every year, every two years, or every three years. In 2014, we conducted a Say-on-Pay vote to approve, on an advisory basis, the 2013 compensation which we paid to our named executive officers. We also asked the stockholders in a separate advisory vote how frequently we should conduct the Say-on-Pay vote. We recommended every three years, but every year received the most votes of our stockholders. Therefore, we are following the advice of our stockholders and again this year are holding the Say-on-Pay vote, this time to approve, on an advisory basis, the 2014 compensation which we paid to our named executive officers.

We are asking our stockholders to indicate their support for the 2014 compensation of our named executive officers as described in this proxy statement by approving the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 2015 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and accompanying narrative disclosure.”

The Board of Directors recommends a vote “FOR” approval of the advisory resolution in this Proposal 2 because it believes that the Company’s executive compensation program effectively reflects the goals and objectives described in the Executive Officer and Director Compensation section of this proxy statement and the overall compensation philosophy of the Company.

The vote on this Proposal 2 is advisory and therefore not binding on the Company, the Board of Directors or the Compensation Committee. However, stockholders can be assured that the Board of Directors and the Compensation Committee will review and consider the voting results in crafting their approach to future executive compensation matters.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ADVISORY RESOLUTION APPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

PROPOSAL 3—Ratification of Independent Registered Public Accounting Firm

The Audit Committee has approved the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015. If our stockholders do not ratify this appointment, the Audit Committee will reconsider the appointment but will not resubmit it for approval by our stockholders. A representative of Burr Pilger Mayer, Inc. will be present at the Annual Meeting and will have an

14

opportunity to make a statement. We also expect that the representative will be available to answer any appropriate questions.

The Board of Directors recommends that you vote “FOR” the ratification of the appointment of Burr Pilger Mayer, Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2015.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE SELECTION OF BURR PILGER MAYER, INC. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of September 25, 2015 by:

| | • | | each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

| | • | | each of our named executive officers and directors (including Curt Sacks, who resigned as our Chief Financial Officer as of November 17, 2014; and |

| | • | | all of our current executive officers and current directors, as a group. |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Applicable percentages are based on 44,056,207 shares of our common stock outstanding as of September 25, 2015, adjusted as required by such rules. As provided by such rules, shares of our common stock issuable pursuant to options to purchase, restricted stock units, or other rights to acquire shares of common stock that are exercisable or vest within 60 days of September 25, 2015 are deemed to be both beneficially owned by the person holding such options and outstanding for the purpose of computing ownership of such person, but are not treated as outstanding for the purpose of computing the ownership of any other person. Except as indicated by footnote, to our knowledge, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The information contained in the following table is not necessarily indicative of beneficial ownership for any other purpose and the inclusion of any shares in the table does not constitute an admission of beneficial ownership of those shares.

| | | | | | | | |

| | | Beneficial

Ownership of Our

Common Stock as of

September 25, 2015

Common Stock (1) | |

| | | Shares | | | Percent of

Class | |

5% Stockholders | | | | | | | | |

PENN Capital Management Co Inc. (2) | | | 3,137,959 | | | | 7.1 | % |

Fred H. Brenner (3) | | | 2,300,188 | | | | 5.2 | % |

Name Executive Officers and Directors | | | | |

Dr. Avi Katz (4) (5) | | | 3,322,490 | | | | 7.0 | % |

Andrea Betti-Berutto (4) | | | 1,174,507 | | | | 2.6 | % |

Curt Sacks (8) | | | 192,942 | | | | * | |

Darren Ma | | | 65,650 | | | | * | |

Dr. Raluca Dinu (4) | | | 426,150 | | | | 1.0 | % |

Neil J. Miotto (4) | | | 379,962 | | | | * | |

Kimberly D.C. Trapp (4) | | | 291,577 | | | | * | |

Frank Schneider (4) (6) | | | 323,642 | | | | * | |

John J. Mikulsky (4) | | | 273,256 | | | | * | |

Joseph J. Lazzara (4) (7) | | | 212,444 | | | | * | |

All current directors and executive officers; 9 persons | | | 6,469,678 | | | | 13.1 | % |

| * | Represents less than 1% of our outstanding common stock. |

| (1) | Unless otherwise indicated, each person’s address is c/o GigOptix, Inc., 130 Baytech Drive, San Jose, California 95134. |

| (2) | The information as to PENN Capital Management Co Inc. (“PENN”) is derived from a Form 13F filed with the SEC on August 12, 2015, as supplemented by a letter dated September 25, 2015 confirming the inclusion of shares purchased in a public offering by the Company that closed on August 26, 2015 and that PENN is the beneficial owner of the amount stated in the table above. Richard Hocker is the founder, Chief |

16

| | Investment Officer and Chief Executive Officer of PENN. Investment decisions made on behalf of PENN are made primarily by its founder. The principal business address is Navy Yard Corporate Center, Three Crescent Drive, Suite 400, Philadelphia, PA 19112. |

| (3) | The information as to Fred H. Brenner is derived from a Schedule 13G filed with the SEC on April 16, 2015. The principal business address is 77 Middle Road, Apt. 355, Bryn Mawr, Pennsylvania 19010. |

| (4) | Includes restricted stock units vesting within 60 days of September 25, 2015 and options to purchase shares of common stock exercisable within 60 days of September 25, 2015 as follows: 3,080,488 for Dr. Katz, 1,093,149 for Mr. Betti-Berutto, 64,000 for Mr. Ma, 399,791 for Dr. Dinu, 233,136 for Mr. Miotto, 212,956 for Ms. Trapp; 181,870 for Mr. Schneider, 79,514 for Mr. Mikulsky, and 79,514 for Mr. Lazzara. |

| (5) | Dr. Katz exceeded 5% beneficial ownership of our common stock on August 18, 2011, as initially reported in his Schedule 13D filed on August 19, 2011, as most recently amended in his Schedule 13D/A Amendment No. 8 filed on August 28, 2015. |

| (6) | Includes 12,542 shares held in the Schneider Family Trust. |

| (7) | Includes 82,525 shares held in the Lazzara Family Trust. |

| (8) | Although Curt Sacks is a named executive officer for the fiscal year of 2014, he tendered his resignation effective on November 17, 2014. The shares reported here are as of the date of his resignation. |

17

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has determined that Mr. Lazzara, Mr. Mikulsky, Mr. Miotto, Mr. Schneider and Ms. Trapp are “independent” directors. Mr. Lazzara and Ms. Trapp are each a nominee for election as a Class I director at the Annual Meeting.

The Company uses the independence standards set forth by Section 803(a)(2) of the NYSE MKT Company Guide. In reviewing the independence of our directors against these standards, we consider relationships and transactions between each director and members of the director’s family with us and our affiliates. Each member of our two standing committees, the Audit Committee and the Compensation Committee, is independent as defined by Section 803(a)(2) of the NYSE MKT Company Guide, and each member of our Audit Committee is also independent as defined by Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

There are no immediate family relationships between or among any of our executive officers and directors.

Meetings of the Board of Directors

The Board of Directors held 9 meetings during fiscal year 2014. Each director attended at least 75% of the meetings of the Board of Directors and the committees of the Board of Directors on which that director served, except for the former member of the Board of Directors, Mr. David T. Mitchell, who served on the Board of Directors from June 2012 to July 2014. We recommend that directors attend each annual meeting of stockholders and all six of the directors, who were directors at the time of the 2014 annual meeting, attended the 2014 annual meeting of stockholders.

Board Leadership Structure

Our Board of Directors believes that our Chief Executive Officer is best situated to serve as our Chairman of the Board, because he is the director most familiar with our business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Independent directors and management have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside the Company and industry, while the Chief Executive Officer brings Company-specific experience and expertise. Our Board of Directors believes that the combined role of Chairman of the Board and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and our Board of Directors, which are essential to effective governance.

One of the key responsibilities of our Board of Directors is to develop strategic direction and hold management accountable for the execution of strategy once it is developed. Our Board of Directors believes the combined role of Chairman of the Board and Chief Executive Officer, together with our independent directors, is in the best interest of stockholders because it provides the appropriate balance between strategy development and independent oversight of management.

Board Committees

The Board of Directors has a standing Audit Committee and Compensation Committee and has adopted a written charter for each of them. The written charter for each committee can be found at our website, www.gigoptix.com.

We do not currently have a standing nominating committee. The entire Board of Directors participates in the consideration of director nominees upon a recommendation from a majority of the then-existing independent directors.

18

Audit Committee

We have a separately designated standing Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee is comprised of not less than three directors, each of whom is independent as determined by the Board of Directors and as defined by Rule 10A-3(b)(1) under the Exchange Act and Section 803(a)(2) of the NYSE MKT Company Guide. The Board of Directors has also determined that Mr. Miotto is an “audit committee financial expert” as defined in SEC rules and Section 803(b)(2)(iii) of the NYSE MKT Company Guide. This designation does not impose on Mr. Miotto any duties, obligations or liabilities that are greater than is generally imposed on him as a member of our Audit Committee or our Board of Directors. The current members of the Audit Committee are Mr. Miotto (who serves as chairman of the committee), Mr. Lazzara, Ms. Trapp, Mr. Schneider and Mr. Mikulsky.

The Audit Committee held 4 meetings during fiscal year 2014. The Audit Committee has adopted a written charter approved by the Board of Directors, which is available at our website at ir.gigoptix.com—Corporate Governance.

The Audit Committee is responsible for monitoring and overseeing: (i) our accounting and financial reporting processes; (ii) the preparation and integrity of our consolidated financial statements; (iii) our compliance with financial statement and regulatory requirements; (iv) the performance of our internal finance and accounting personnel and our independent registered accounting firm and (v) the qualification and independence of our independent registered accounting firm.

The Audit Committee has the authority to retain legal, accounting or other experts that it deems necessary to carry out its duties. It also has the authority to determine the compensation of such advisors, as well as that of our independent registered accounting firm, and to determine appropriate funding needs for ordinary administrative expenses that are necessary or appropriate for carrying out its duties.

The Audit Committee Report is included in this Proxy Statement on page 33.

Compensation Committee

Our Compensation Committee approves, administers and interprets our named executive officer compensation and benefit policies and plans. Our Compensation Committee is appointed by our Board of Directors, and consists entirely of independent directors who are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code and “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act. The current members of the Compensation Committee are Ms. Trapp (who serves as chairperson of the committee), Mr. Lazzara, Mr. Mikulsky, Mr. Miotto and Mr. Schneider.

Our Compensation Committee has primary responsibility for ensuring that our executive compensation and benefit program is consistent with our compensation philosophy and is responsible for determining the executive compensation packages offered to our named executive officers. The responsibilities of the Compensation Committee, as stated in its charter, include the following:

| | • | | Review and approve goals and objectives relevant to CEO and other named executive officer compensation, evaluate the CEO’s and other named executive officers’ performance in light of these corporate goals and objectives, and set CEO and other named executive officer compensation levels consistent with its evaluation and the company philosophy; |

| | • | | Approve the salaries, bonus and other compensation for all named executive officers; |

| | • | | Adopt, administer, amend or terminate compensation plans applicable to the employees of the Company and/or any subsidiary of the Company, and review and make recommendations concerning long-term incentive compensation plans, including the use of stock options and other equity-based plans; and |

| | • | | Undertake all further actions and discharge all further responsibilities imposed upon the Committee from time to time by the Board, the federal securities laws or the rules and regulations of the SEC. |

19

Our Compensation Committee plays an integral role in setting the named executive officer compensation each year. Generally, during the fourth quarter of each year and leading up to the adoption by the Board of the annual operating plan for the following year, the Compensation Committee meets to discuss recent data and current trends in executive compensation and equity ownership programs for comparable companies. During such meeting, an independent compensation consultant engaged by the committee provides a report to the Compensation Committee regarding this information. Generally, in the first quarter or the early part of the following year, our Compensation Committee holds a regular meeting in which our Chief Executive Officer and Chief Financial Officer review with the Compensation Committee GigOptix’ financial and business performance for the prior year and management’s business outlook and operating plan for the current year as adopted by the Board at the end of the prior year. In reviewing the prior year’s performance, the Compensation Committee compares our performance to the financial and operational goals set for such year and any management by objectives targets set for such year. In this meeting, the Chief Executive Officer also reviews with the Compensation Committee his assessment of the individual performance of each named executive officer, including his own performance, according to a variety of qualitative and quantitative performance criteria and salary and bonus trends. Taking into account the information conveyed and discussed at these meetings and the recommendations of our Chief Executive Officer and the independent compensation consultant engaged by the committee, the Compensation Committee then determines:

| | • | | The amount and type of any bonus compensation to be awarded to each named executive officer in respect of their performance; |

| | • | | Whether to raise, lower or maintain the named executive officer’s base salary for the current year; and |

| | • | | Option grants and restricted stock units, if any, to be awarded to each named executive officer. |

Each element of our named executive compensation system is described in more detail below.

Candidates for the Board of Directors

It is the policy of the Board of Directors to consider candidates recommended by stockholders for membership on the Board of Directors. Individuals recommended by stockholders will be considered on the same basis and be subject to the same qualification criteria as those recommended by our management or other members of the Board of Directors. Stockholders should submit their recommendations to the following address and should include verification of the stockholder’s status as a stockholder and relevant information about the recommended candidate, including such candidate’s name and qualifications for membership on our Board of Directors.

GigOptix, Inc.

130 Baytech Drive

San Jose, CA 95134

Attn: Investor Relations

While we do not have a formal diversity policy for board membership, the Board of Directors seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of our Board of Directors’ deliberations and decisions. The Board of Directors has not established minimum qualifications of director nominees but considers a broad range of criteria to evaluate individual candidacies. Such criteria include but are not limited to: (i) industry experience; (ii) management experience; (iii) integrity and judgment; (iv) independence; (v) conflicts of interest and (vi) the current needs and expertise of the Board of Directors. The Board of Directors generally considers candidates in connection with upcoming elections and specific vacancies but may evaluate additional candidates on an ongoing basis as such candidates are recommended by our stockholders, directors or management.

The directors, who have been nominated for election as Class I directors at the Annual Meeting, are Joseph J. Lazzara and Kimberly D.C. Trapp. Mr. Lazzara has served on the Board of Directors since June 2011. Ms. Trapp has served on the Board of Directors since December 2008. Joseph J. Lazzara and Kimberly D.C. Trapp were both nominated for election at the Annual Meeting by the entire Board of Directors.

20

Board’s Role in Risk Oversight

Our Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. With the oversight of our full Board of Directors, our senior management is responsible for the day-to-day management of the material risks we face. In its oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Our Board of Directors holds strategic planning sessions with senior management to discuss strategies, key challenges, risks and opportunities for us. This involvement of the Board of Directors in setting our business strategy is a key part of its oversight of risk management, its assessment of management’s appetite for risk, and its determination of what constitutes an appropriate level of risk for us. Additionally, our Board of Directors regularly receives updates from senior management and outside advisors regarding certain risks we face, including various operating risks. Our senior management attends meetings of our Board of Directors and its committees on a quarterly basis, and as is otherwise needed, and are available to address any questions or concerns raised by the board on risk management and any other matters.

Each of our board committees oversees certain aspects of risk management and reports their findings to the full Board of Directors on a quarterly basis, and as is otherwise needed. Our Audit Committee is responsible for overseeing risk management of financial matters, financial reporting, the adequacy of our risk-related internal controls, internal investigations, and enterprise risks, generally. Our Compensation Committee oversees risks related to compensation policies and practices, and is responsible for establishing and maintaining compensation policies and programs designed to create incentives consistent with our business strategy that do not encourage excessive risk-taking.

Additional review or reporting on enterprise risks is conducted as needed or as requested by the Board of Directors or a committee thereof.

Communications with the Board of Directors

Any stockholder may send communications to our Board of Directors and to any individual director. Communications addressed to the Board of Directors will be forwarded to the Chairman for review and distribution to the other members of the Board of Directors. Communications addressed to an individual director will be forwarded directly to the individual director. All communications to our executive offices should be sent to the attention of the Secretary.

Information regarding our Executive Officers

The table below sets forth information regarding those individuals who were our non-director executive officers as of December 31, 2014:

| | | | | | |

Name | | Age | | | Title |

Dr. Raluca Dinu | | | 41 | | | Executive Vice President of Global Sales and Marketing |

Andrea Betti-Berutto | | | 50 | | | Senior Vice President and Chief Technical Officer |

Darren Ma | | | 35 | | | Vice President and Chief Financial Officer |

Dr. Raluca Dinu is our Executive Vice President of Global Sales and Marketing. She has more than 15 years of experience in the telecommunication industry. A visionary executive with an established track record of driving increased revenue and profitability, building and leading cross functional teams, and developing and commercializing advanced technologies, Dr. Dinu joined GigOptix as the Vice President of Product Development in 2008 through the acquisition of Lumera Inc., where she served as the Vice President of the Electro-Optic Business Unit since 2007. From 2001 to 2007, Dr. Dinu served Lumera in various capacities as technology and business leader. In her current role, she leads the global marketing and sales organizations for GigOptix. She has an exceptional ability to manage and lead in rapidly changing and competitive environments

21

while demonstrating an innate ability to achieve corporate goals within defined resources. Dr. Dinu holds more than 15 patents, obtained her B.Sc. in Optics, and Ph.D. in Physics, at the University of Bucharest in 2000 specializing in ferroelectric thin films for random access memories, and also graduated from the Executive MBA program at the AeA/Stanford Institute in 2007.

Andrea Betti-Berutto is our Senior Vice President and Chief Technical Officer and has served as the Chief Technology Officer of the company since its inception in 2007 through the acquisition of the iTerra LLC assets, where he was a co-founder and served as the Vice President of Engineering since the inception in 2001. In iTerra LLC he led the development of analog and digital high speed ICs for the 10 Gb/s and 40Gb/s optical network, wireless application and instrumentation. Previously, Mr. Betti-Berutto worked at Fujitsu Compound Semiconductor as manager of product development for microwave and millimeter-wave IC for point-to-point and satellite communication applications, at Space Engineering S.p.A Rome, Italy, and European Space Agency R&D laboratory, Noordwijk, The Netherlands, as payload system engineer and MMIC designer. Mr. Betti-Berutto has more than 20 years of experience in the design of high speed ICs and multichip modules for microwave, millimeter-wave, and fiber optics application. He is the author of several papers in technical journals in the area of power amplifiers, high-speed ICs, and broadband design for optical network applications and received his M.Sc. degree in electrical engineering from the University of Rome “La Sapienza”.

Darren Ma is our Vice President and Chief Financial Officer, and joined GigOptix in November 2014. He brings over 12 years of semiconductor experience and financial leadership to GigOptix. He began his career at Intel Corporation from 2002 to 2008, where he worked in various finance positions, specializing in budgeting, cost and inventory, strategic financial planning, and P&L management. Prior to joining GigOptix, he worked in roles of increasing responsibility at Semtech Corporation from 2009 to 2014, and served as the primary financial partner to several members of the executive staff. He contributed to increasing the profitability of the Power Management business unit, and, most recently, was the Business Unit Controller for the Power Management and High Reliability and Systems Innovation business units at Semtech Corporation. From 2008 to 2009 he also held a senior financial position at Fisher Investments, supporting the M&A, Institutional, and United Kingdom investment groups. Mr. Ma holds a Managerial Economics B.S. degree from the University of California, Davis and received his MBA from W.P. Carey School of Business at Arizona State University.

22

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Our primary objectives with respect to executive compensation are to attract and retain the best possible executive talent, to link annual compensation (cash and stock-based) and long-term stock-based compensation to achievement of measurable corporate goals and individual performance, and to align executives’ incentives with stockholder value creation. To achieve these objectives, we have implemented and maintain compensation plans that tie a portion of executives’ overall compensation to our financial performance and common stock price. Overall, the total compensation opportunity is intended to create an executive compensation program that is competitive with comparably-sized companies where we are based, as it is these companies with whom we compete most vigorously for executive and technical talent.

Comparable Company Comparisons