UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(RULE 14d–100)

Tender Offer Statement Pursuant to Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

GigPeak, Inc.

(Name of Subject Company)

Glider Merger Sub, Inc.

(Offeror)

a wholly owned subsidiary of

Integrated Device Technology, Inc.

(Offeror)

(Name of Filing Persons and Offerors)

COMMON STOCK

(Title of Class of Securities)

37517Y103

(Cusip Number of Class of Securities)

Matthew Brandalise, Esq.

General Counsel and Secretary

Integrated Device Technology, Inc.

6024 Silver Creek Valley Road

San Jose, CA 95138

(408) 284-8200

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Mark V. Roeder

Josh Dubofsky

Latham & Watkins LLP

140 Scott Drive

Menlo Park, California 94025

(650) 328-4600

CALCULATION OF FILING FEE

| | |

| Transaction Valuation | | Amount of Filing Fee |

| N/A* | | N/A* |

| |

| * | A filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of the tender offer. |

| ☐ | Check box if any part of the fee is offset as provided by Rule 0–11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| Amount Previously Paid: Not applicable. | | Filing Party: Not applicable. |

| Form or Registration No.: Not applicable. | | Date Filed: Not applicable. |

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| | ☒ | third-party tender offer subject to Rule 14d-1. |

| | ☐ | issue tender offer subject to Rule 13e-4 |

| | ☐ | going-private transaction subject to Rule 13e-3 |

| | ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| | ☐ | Rule 13e-4(i) (Cross Border Issuer Tender Offer) |

| | ☐ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This filing relates solely to preliminary communications made before the commencement of aplanned tender offer by Glider Merger Sub, Inc. (the “Purchaser”), a Delaware corporation and a wholly-owned subsidiary of Integrated Device Technology, Inc., a Delaware corporation (“IDT”), to purchase all outstanding shares of common stock, par value $0.001 per share, of GigPeak, Inc., a Delaware corporation (“GigPeak”), to be commenced pursuant to an Agreement and Plan of Merger, dated as of February 13, 2017, by and among IDT, the Purchaser and GigPeak.

The description contained herein is for informational purposes only and is not a recommendation, an offer to buy or the solicitation of an offer to sell any shares of GigPeak’s common stock. The tender offer for the outstanding shares of GigPeak’s common stock described in this report has not commenced. At the time the tender offer is commenced, IDT will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and GigPeak will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to GigPeak’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

EXHIBIT INDEX

| | |

Exhibit No. | | Description |

| |

| 99.1 | | Presentation at meeting for employees of GigPeak on February 13, 2017 |

2

Welcome to GigPeak People February, 2017 Welcome to GigPeak People February, 2017 Exhibit 99.1

Cautionary Note Regarding Forward Looking Statements This presentation contains forward-looking statements, including, but not limited to, statements related to the anticipated consummation of the acquisition of GigPeak, Inc. (“GigPeak”) and the timing, benefits and financing thereof, Integrated Device Technology, Inc.’s (“IDT”) strategy, plans, objectives, expectations (financial or otherwise) and intentions, future financial results and growth potential, anticipated product portfolio, development programs, patent terms and other statements that are not historical facts. These forward-looking statements are based on IDT’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks related to IDT’s ability to complete the transaction on the proposed terms and schedule; whether IDT or GigPeak will be able to satisfy their respective closing conditions related to the transaction; whether sufficient stockholders of GigPeak tender their shares of GigPeak common stock in the transaction; whether IDT will obtain financing for the transaction on the expected timeline and terms; the outcome of legal proceedings that may be instituted against GigPeak and/or others relating to the transaction; the possibility that competing offers will be made; risks associated with acquisitions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the transaction will not occur; risks related to future opportunities and plans for the acquired company and its products, including uncertainty of the expected financial performance of the acquired company and its products; disruption from the proposed transaction, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; and the possibility that if the acquired company does not achieve the perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of IDT’s shares could decline, as well as other risks related to IDT’s and GigPeak’s businesses detailed from time-to-time under the caption “Risk Factors” and elsewhere in IDT’s and the GigPeak’s respective SEC filings and reports, including the Annual Report of GigPeak on Form 10-K for the year ended December 31, 2015 and the Annual Report of IDT on Form 10-K for the year ended April 3, 2016. IDT undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations.

Additional Information and Where to Find It This presentation related to IDT’s acquisition of GigPeak. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. The tender offer for the outstanding shares of GigPeak’s common stock described in this presentation has not commenced. At the time the tender offer is commenced, IDT will file or cause to be filed a Tender Offer Statement on Schedule TO with the SEC and GigPeak will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to GigPeak’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

What We Just Announced Integrated Device Technology to acquire GigPeak Approved by both Management teams and Board of Directors Process started for government approvals and acquiring shares (tender offer) Expected to close during the 2nd calendar quarter of 2017 We intend to grow GigPeak’s business, and are interested in all of it From an IDT perspective, GigPeak isn’t a new strategy It accelerates our current strategy We can now provide ultra-high speed interconnect using electrons, radio, and photons – a unique and valuable position !

Questions You May Have Will there be job loss? We’re very impressed with GigPeak people Yes, there will be some but very little, and mainly in G&A. IDT will actively help everyone in this process No R&D change. Marketing / bus-dev and sales is also complimentary to our own Will IDT invest to grow our business? Yes. We expect commitment to grow along with new investment. We wouldn’t be doing this if we didn’t think we could grow faster together Who will my boss(es) be? Pretty much the same ones you know already This will be run as a standalone business, led by Raluca Dinu who will report to Sean Fan, head of IDT Computing & Communications Division There’s a lot of opportunity to leverage GigPeak IP and knowledge into other IDT businesses too – we’ll figure those out together

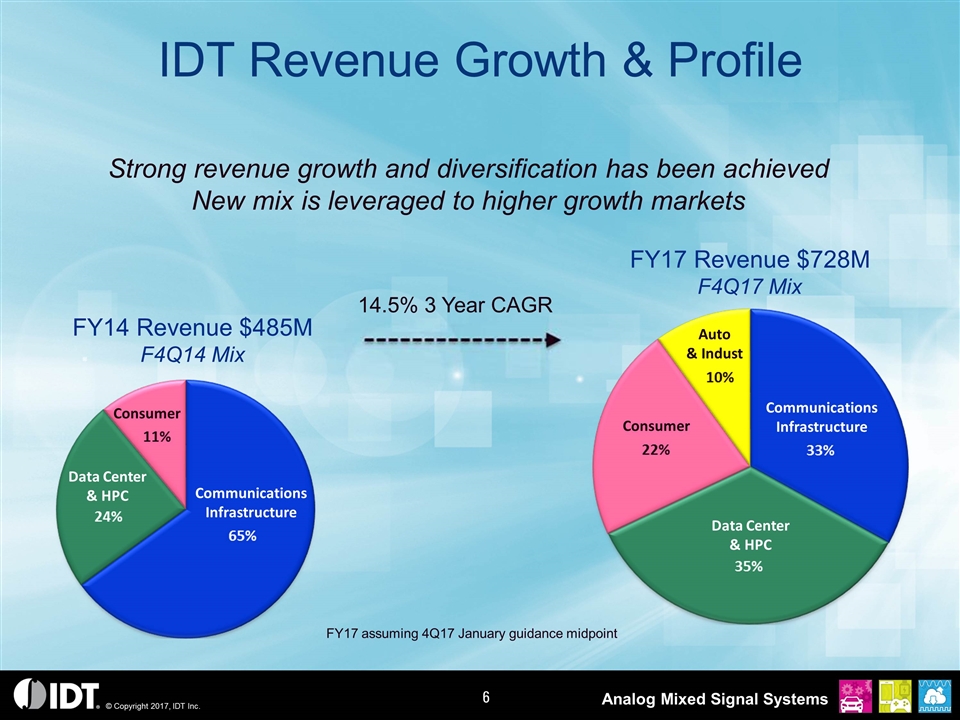

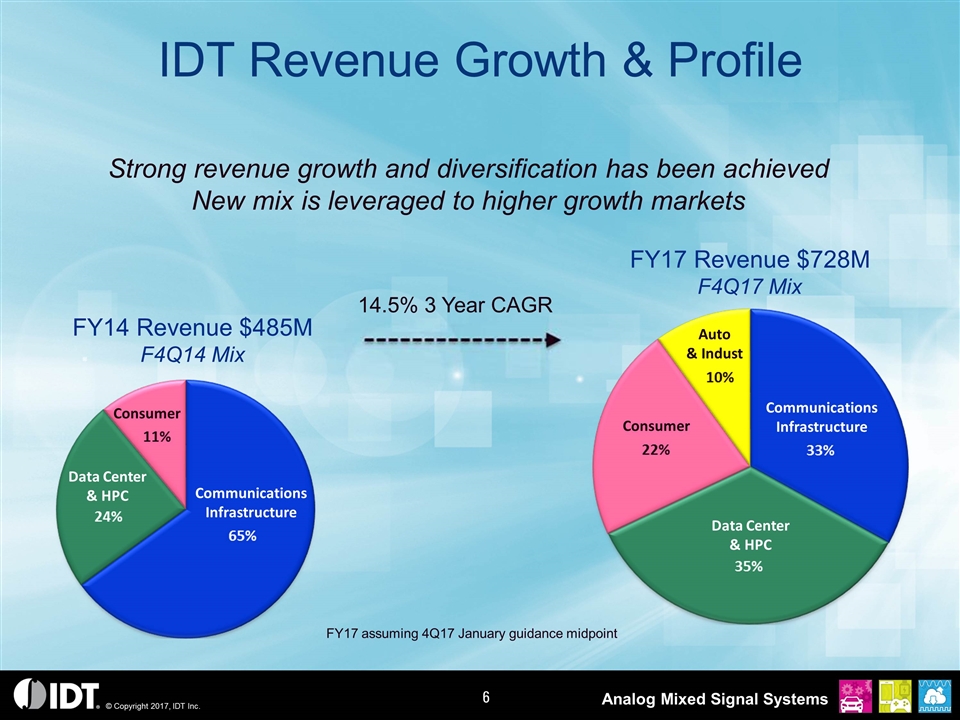

IDT Revenue Growth & Profile FY14 Revenue $485M F4Q14 Mix FY17 Revenue $728M F4Q17 Mix 14.5% 3 Year CAGR Strong revenue growth and diversification has been achieved New mix is leveraged to higher growth markets FY17 assuming 4Q17 January guidance midpoint Communications Infrastructure Data Center & HPC Consumer Communications Infrastructure Data Center & HPC Consumer Auto & Indust

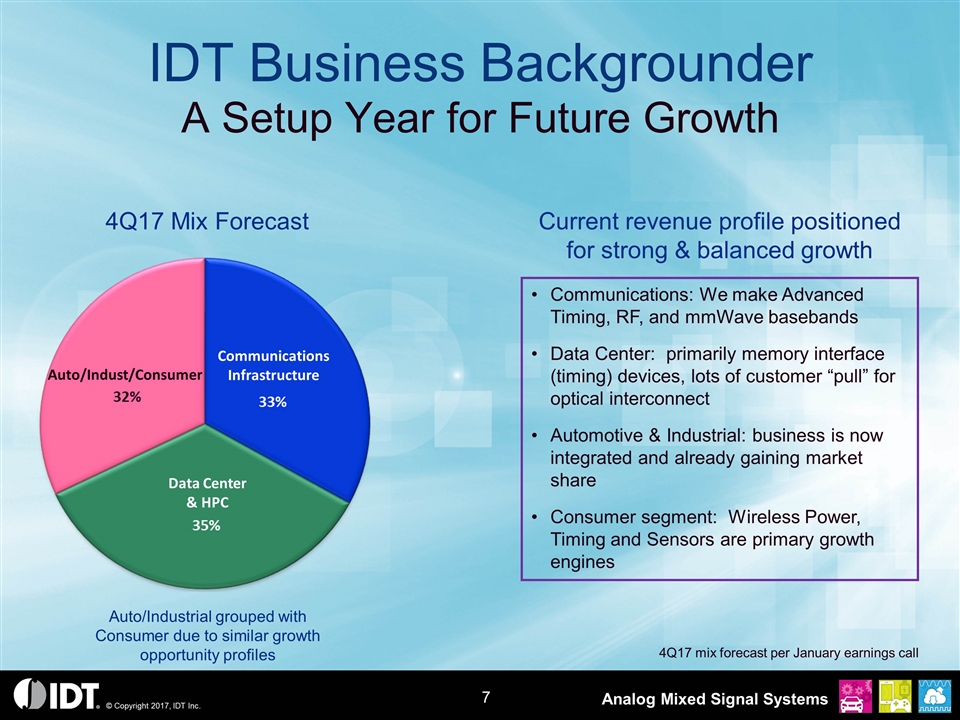

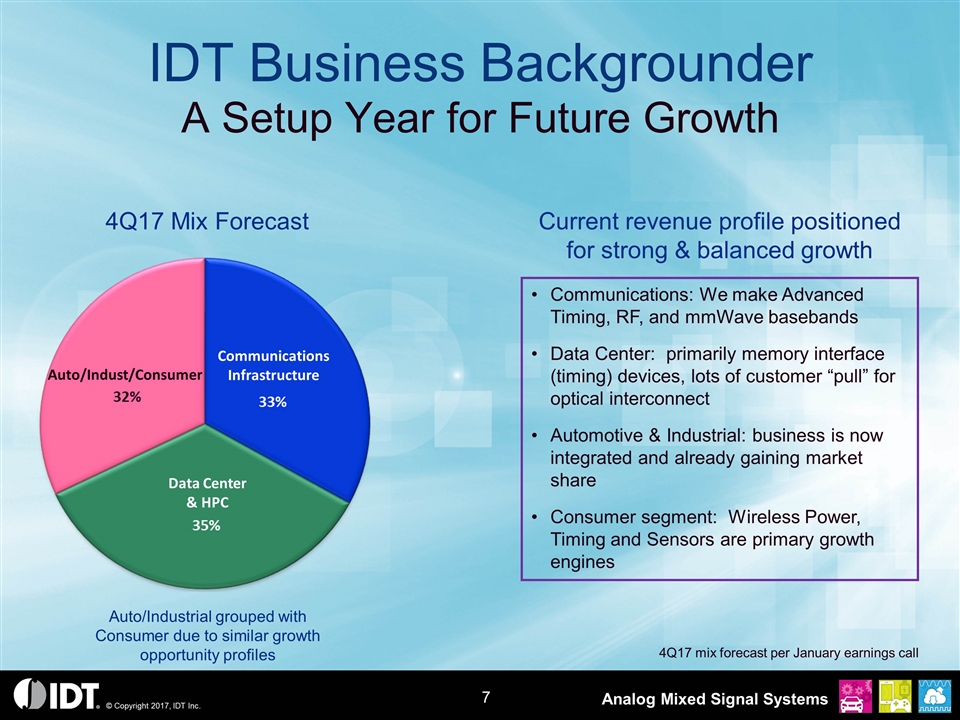

Communications: We make Advanced Timing, RF, and mmWave basebands Data Center: primarily memory interface (timing) devices, lots of customer “pull” for optical interconnect Automotive & Industrial: business is now integrated and already gaining market share Consumer segment: Wireless Power, Timing and Sensors are primary growth engines IDT Business Backgrounder A Setup Year for Future Growth Communications Infrastructure Data Center & HPC Auto/Indust/Consumer 4Q17 Mix Forecast 4Q17 mix forecast per January earnings call Auto/Industrial grouped with Consumer due to similar growth opportunity profiles Current revenue profile positioned for strong & balanced growth © Copyright 2017, IDT Inc.

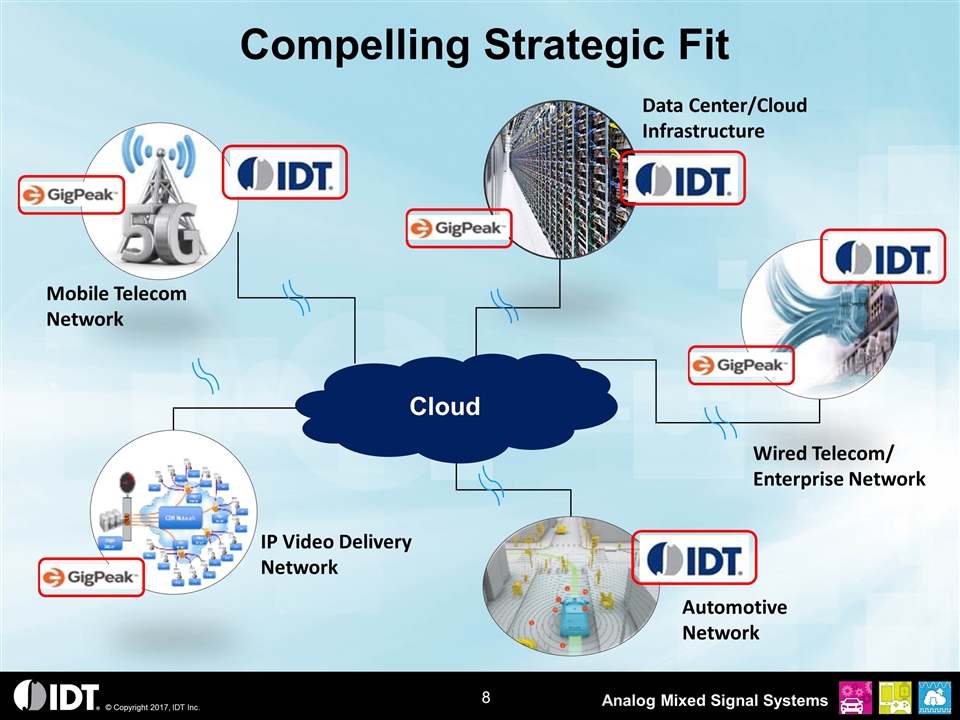

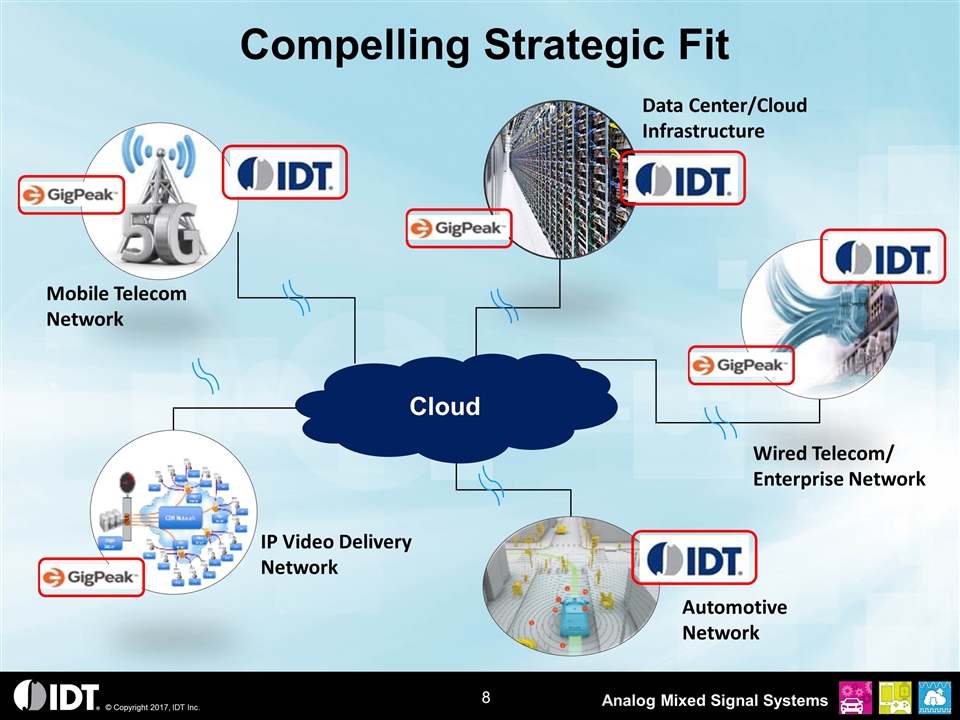

Compelling Strategic Fit Cloud Mobile Telecom Network Wired Telecom/ Enterprise Network IP Video Delivery Network Data Center/Cloud Infrastructure Automotive Network © Copyright 2017, IDT Inc.

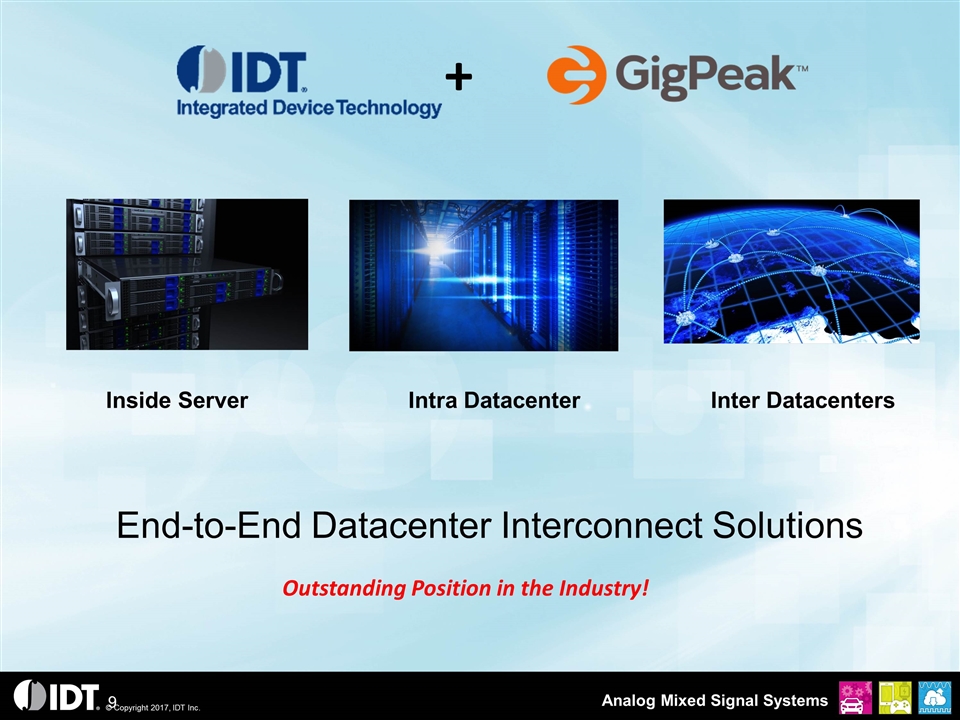

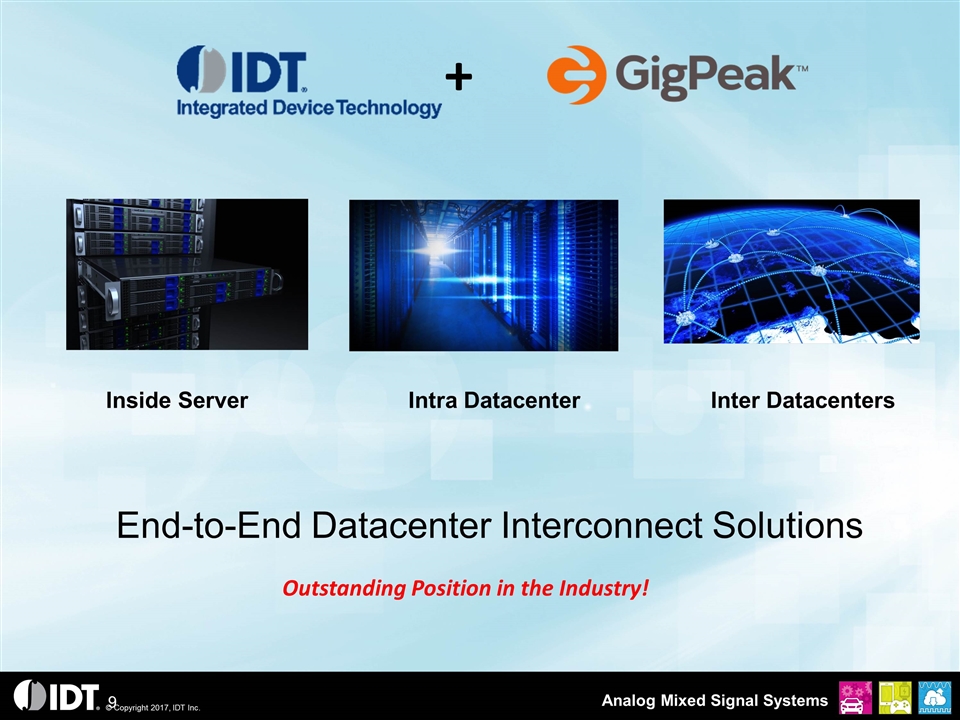

End-to-End Datacenter Interconnect Solutions Inside Server Intra Datacenter Inter Datacenters Outstanding Position in the Industry! + © Copyright 2017, IDT Inc. Analog Mixed Signal Systems

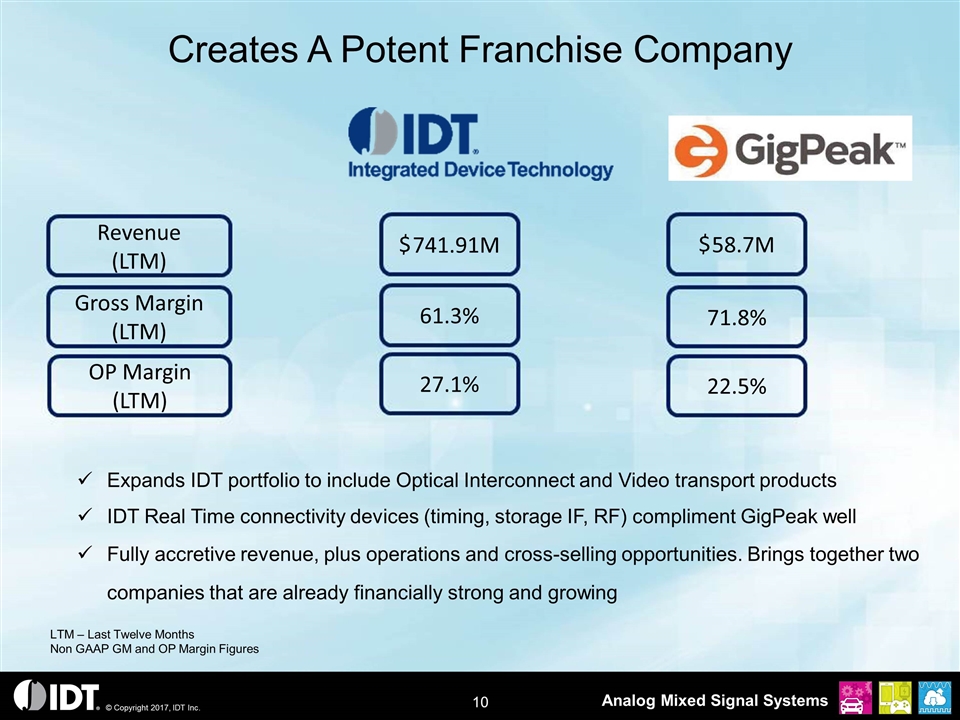

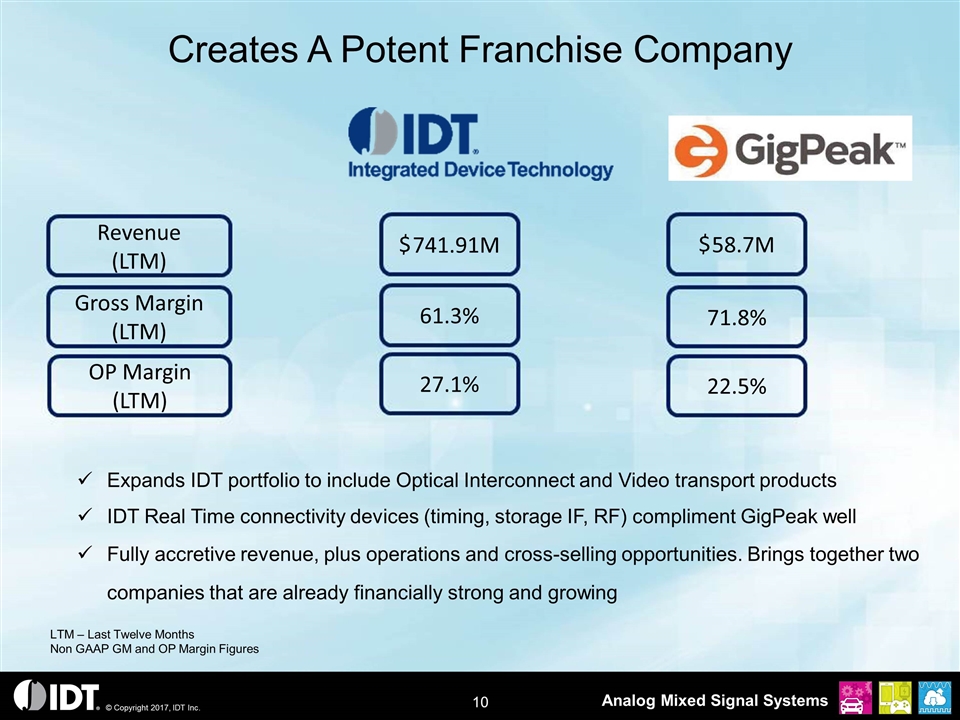

Creates A Potent Franchise Company Revenue (LTM) Gross Margin (LTM) OP Margin (LTM) 741.91M 58.7M 61.3% 71.8% 27.1% 22.5% Expands IDT portfolio to include Optical Interconnect and Video transport products IDT Real Time connectivity devices (timing, storage IF, RF) compliment GigPeak well Fully accretive revenue, plus operations and cross-selling opportunities. Brings together two companies that are already financially strong and growing LTM – Last Twelve Months Non GAAP GM and OP Margin Figures © Copyright 2017, IDT Inc. Analog Mixed Signal Systems $ $

Cloud Concept Goes Beyond Datacenters Significantly Increases IDT Content Cloud Infrastructure Stuff that We Do

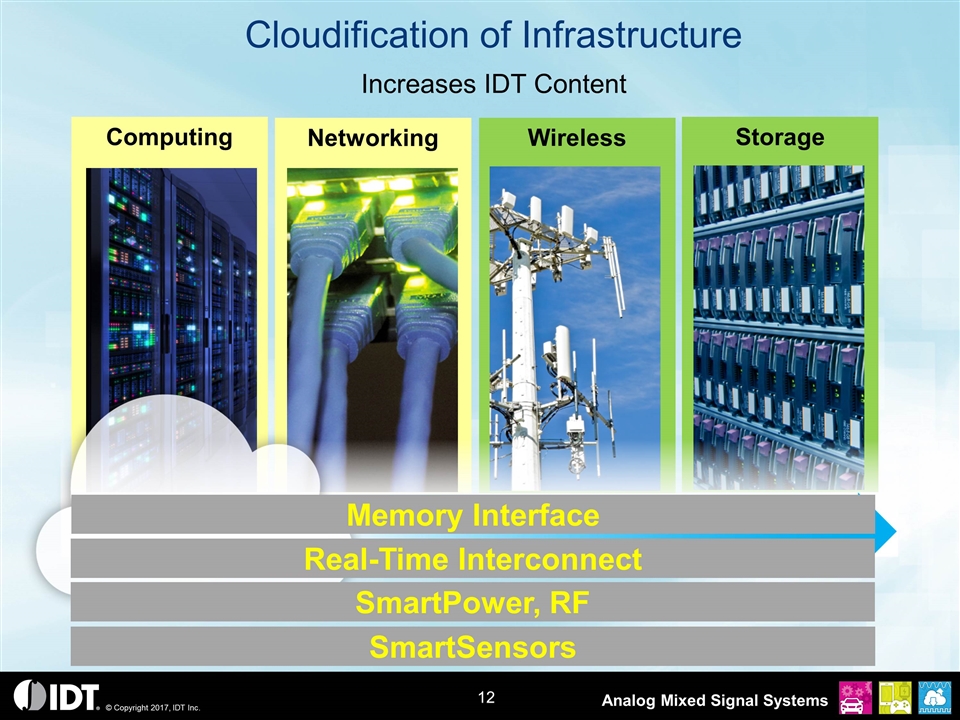

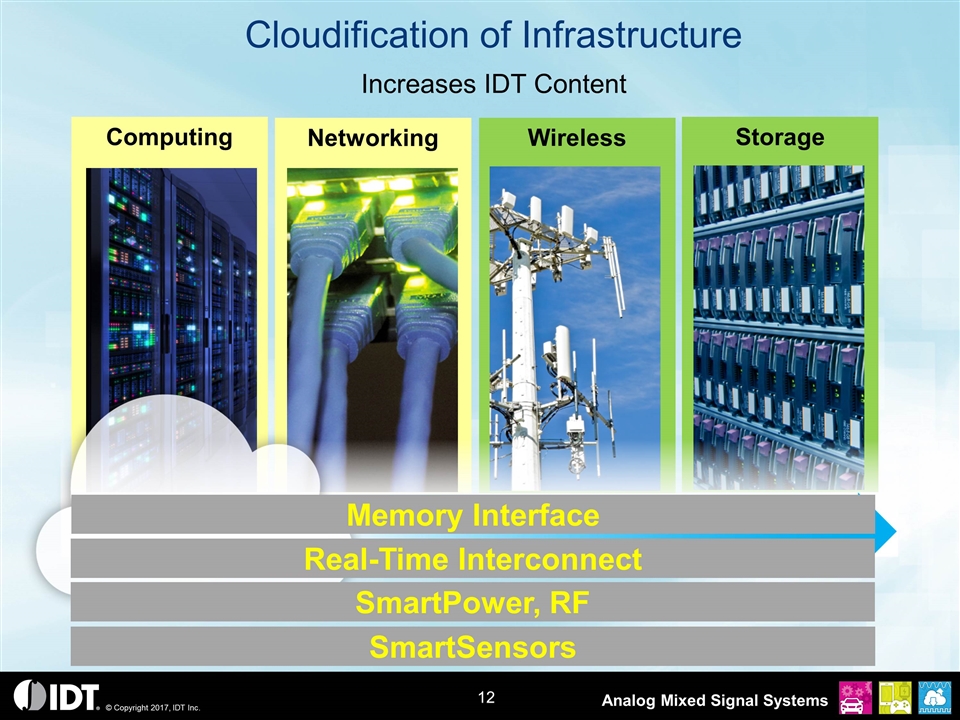

Networking Computing Storage Wireless Cloudification of Infrastructure Increases IDT Content Memory Interface Real-Time Interconnect SmartPower, RF SmartSensors

Real-Time Cloud Services Connecting People to Machines and Machines to Machines Robotics Autonomous Vehicles Industrial Drones Health Services Image Recognition Machine Learning Real-Time Interconnect New RF & Spectrum Intelligent Sensing

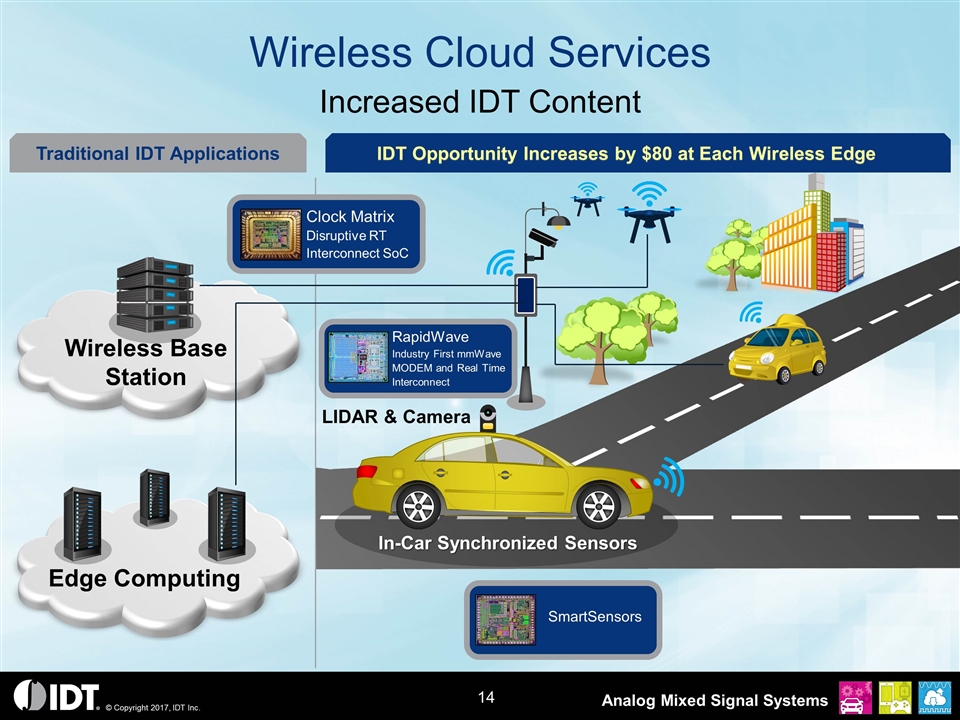

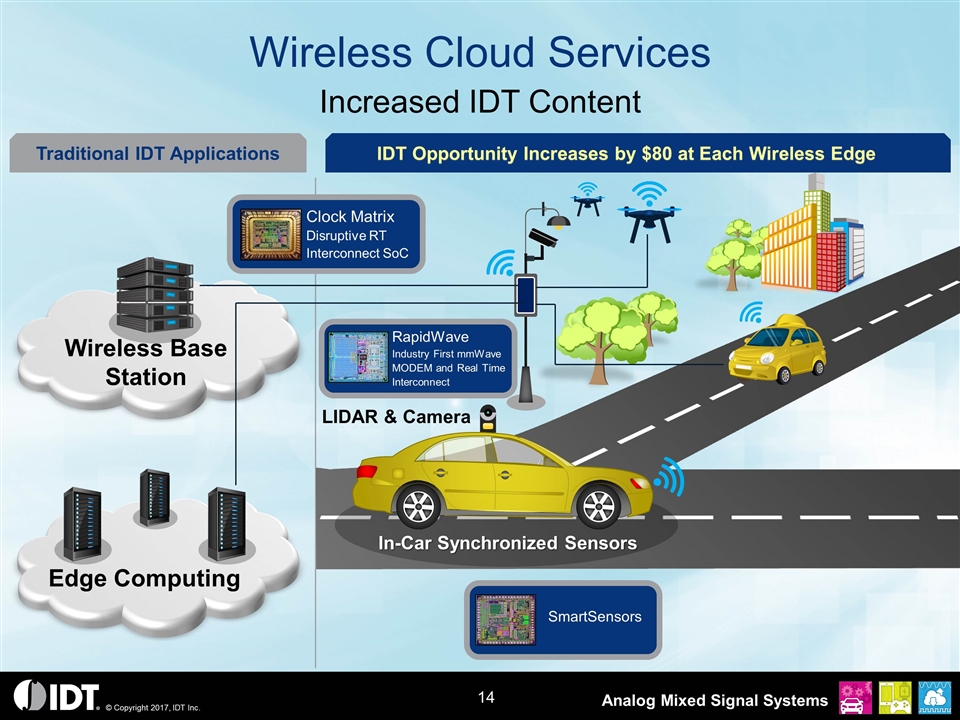

Wireless Base Station Edge Computing Traditional IDT Applications LIDAR & Camera IDT Opportunity Increases by $80 at Each Wireless Edge In-Car Synchronized Sensors Wireless Cloud Services Increased IDT Content RapidWave Industry First mmWave MODEM and Real Time Interconnect SmartSensors Clock Matrix Disruptive RT Interconnect SoC Edge Computing Wireless Base Station

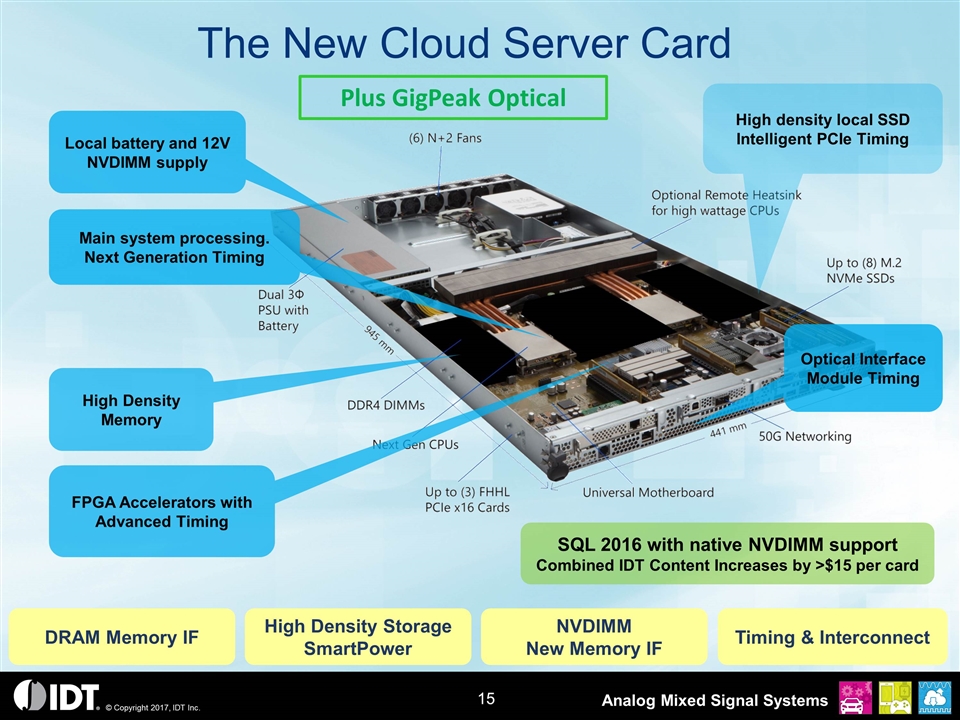

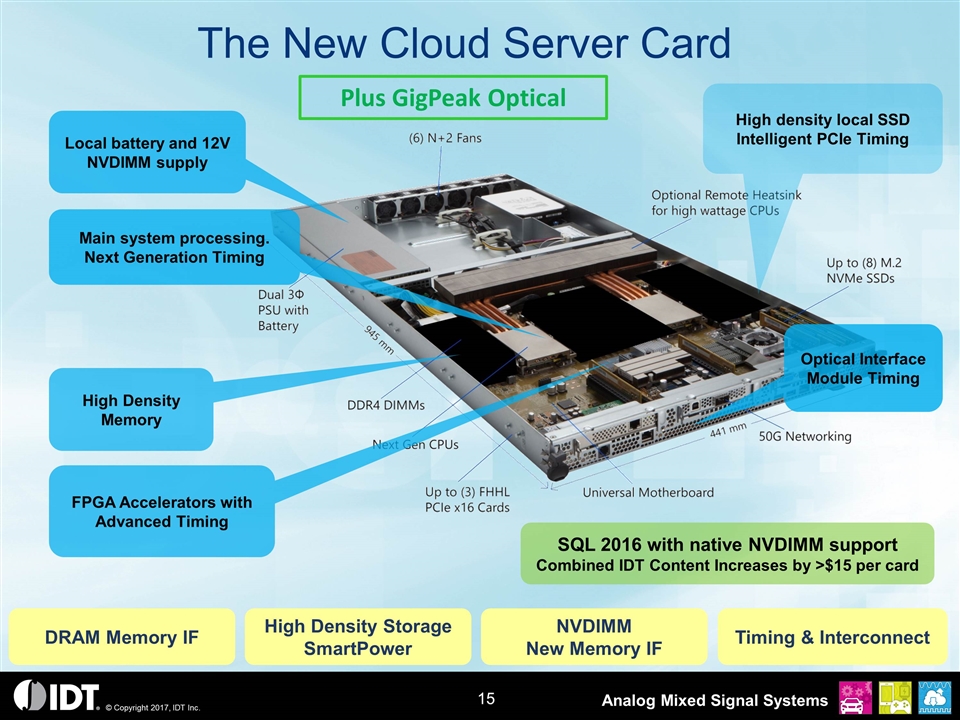

The New Cloud Server Card Local battery and 12V NVDIMM supply High Density Memory High density local SSD Intelligent PCIe Timing SQL 2016 with native NVDIMM support Combined IDT Content Increases by >$15 per card Main system processing. Next Generation Timing FPGA Accelerators with Advanced Timing Optical Interface Module Timing DRAM Memory IF High Density Storage SmartPower NVDIMM New Memory IF Timing & Interconnect Plus GigPeak Optical

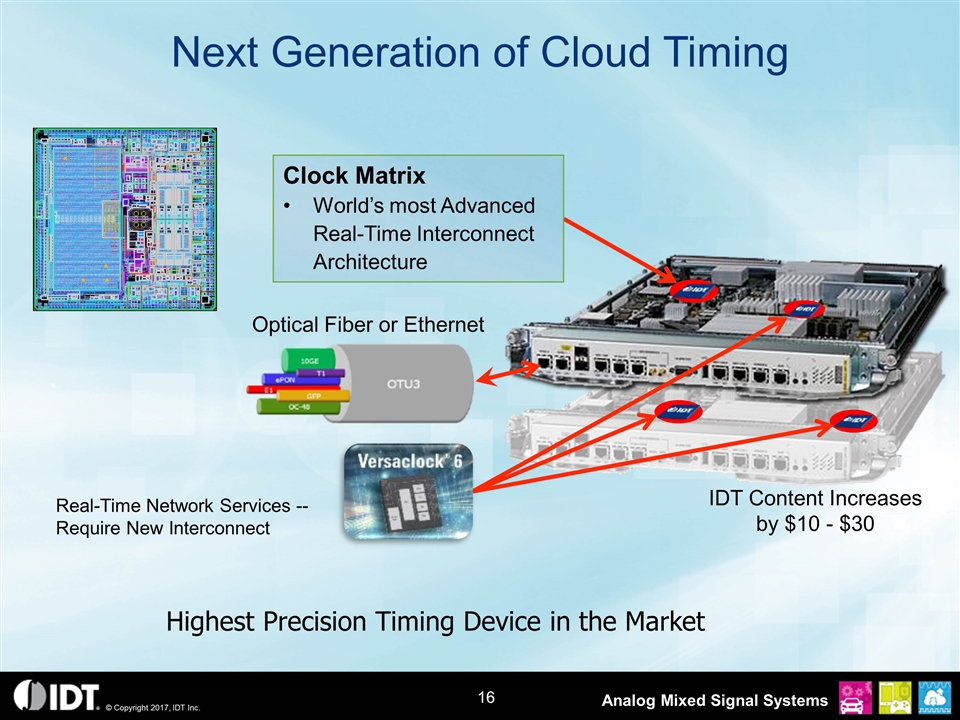

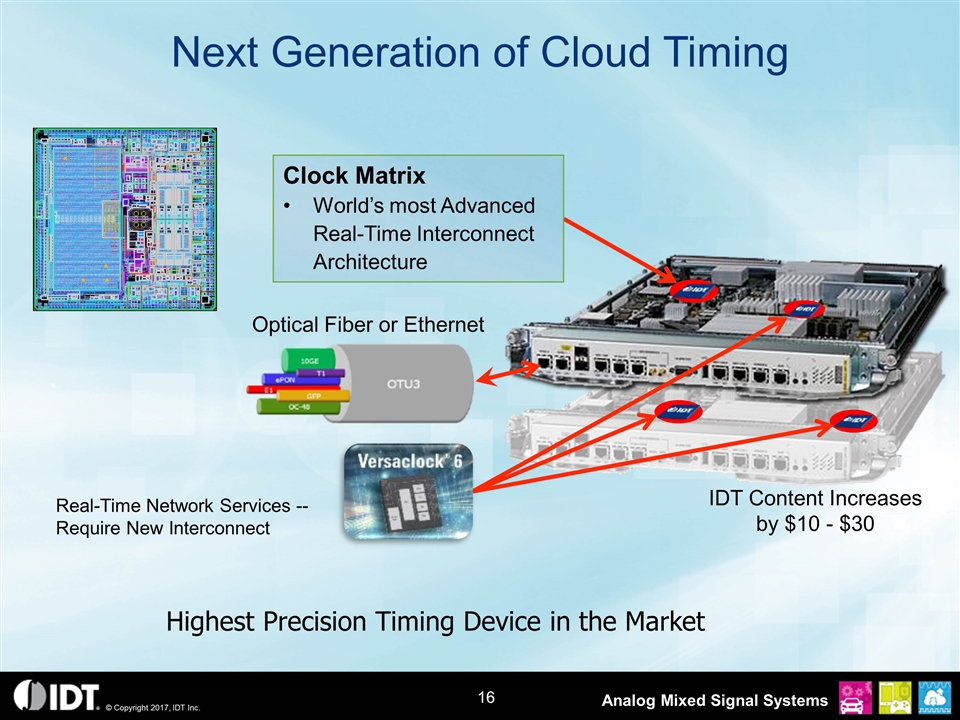

Next Generation of Cloud Timing Optical Fiber or Ethernet Real-Time Network Services -- Require New Interconnect IDT Content Increases by $10 - $30 Clock Matrix World’s most Advanced Real-Time Interconnect Architecture Highest Precision Timing Device in the Market

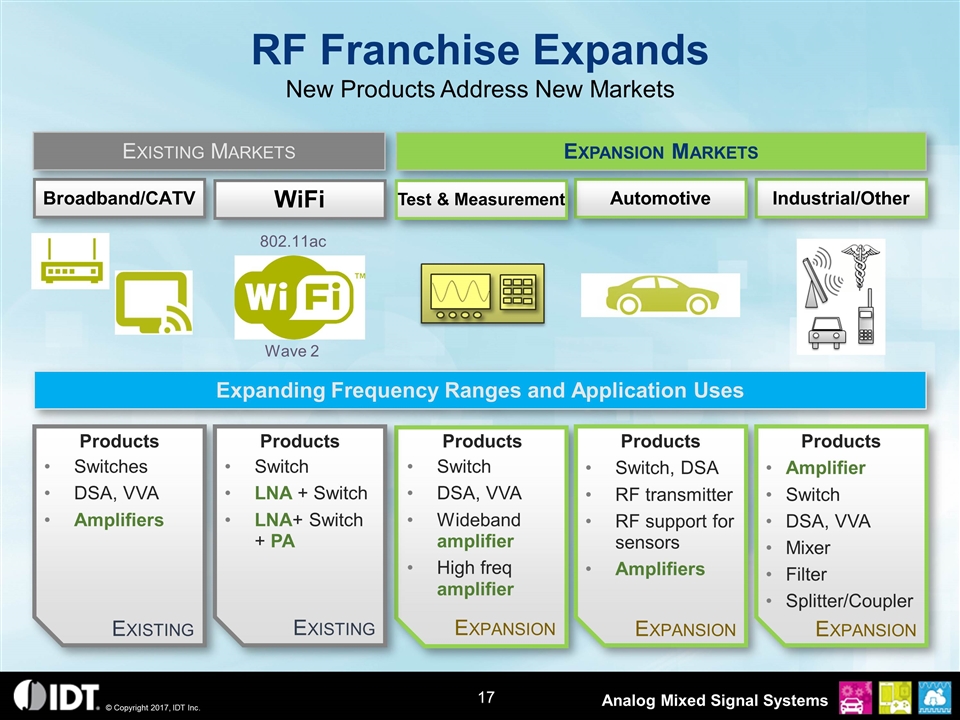

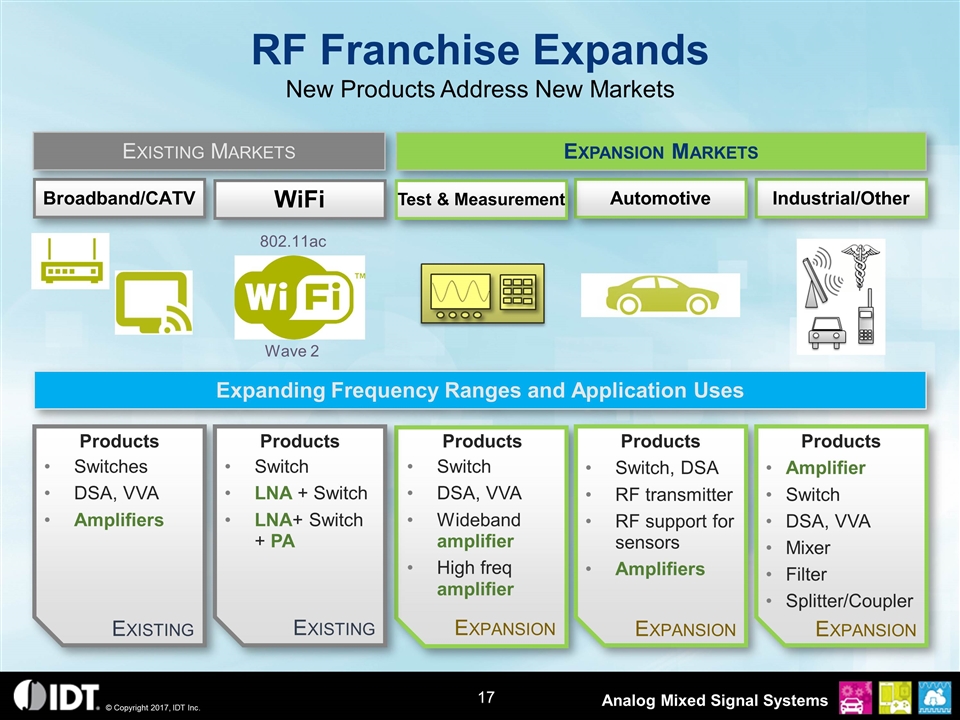

RF Franchise Expands New Products Address New Markets Broadband/CATV Industrial/Other Products Switches DSA, VVA Amplifiers Products Switch LNA + Switch LNA+ Switch + PA Products Switch, DSA RF transmitter RF support for sensors Amplifiers Products Amplifier Switch DSA, VVA Mixer Filter Splitter/Coupler Expanding Frequency Ranges and Application Uses Existing Existing Expansion Expansion Expansion Products Switch DSA, VVA Wideband amplifier High freq amplifier WiFi Automotive Test & Measurement Existing Markets Expansion Markets 802.11ac Wave 2

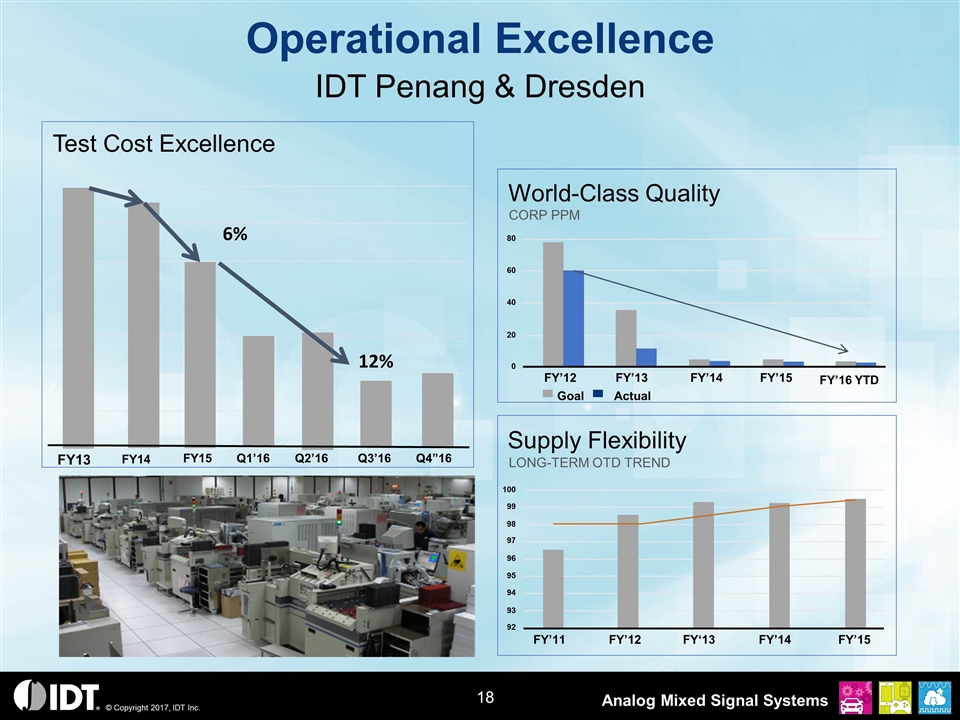

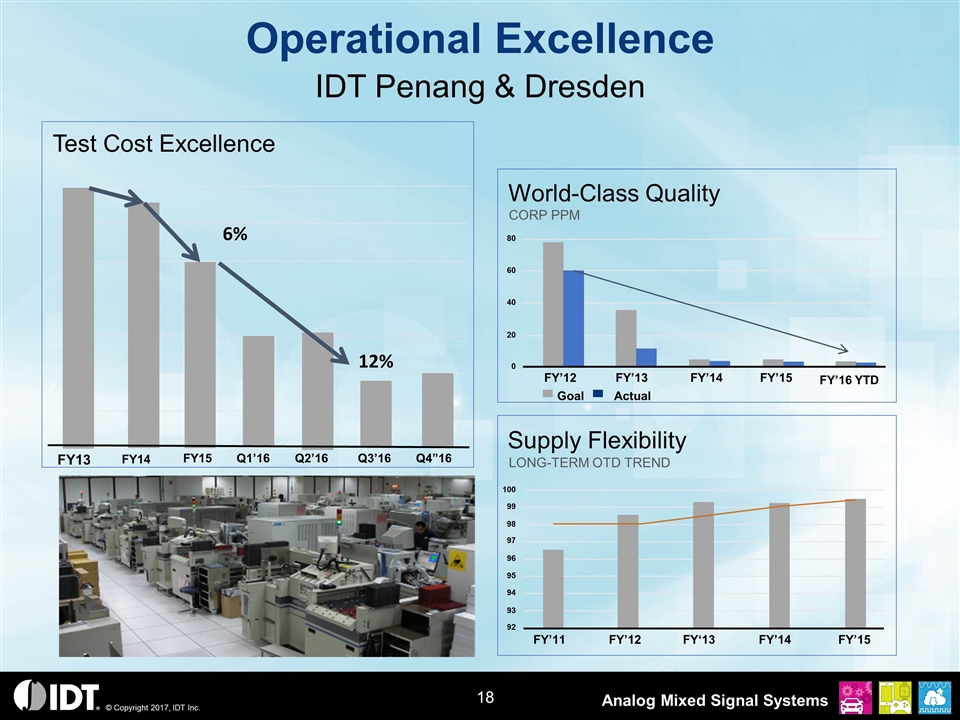

Operational Excellence World-Class Quality Supply Flexibility IDT Penang & Dresden Test Cost Excellence FY13 FY14 FY15 Q1’16 Q2’16 Q3’16 Q4”16 6% 12% 80 60 40 20 0 FY’12 FY’13 FY’14 FY’15 FY’16 YTD CORP PPM Goal Actual FY’11 FY’12 FY‘13 FY’14 FY’15 100 99 98 97 96 95 94 93 92 LONG-TERM OTD TREND

Discussion