Exhibit (a)(17)

|

GigPeak, Inc. Tender Offer PRESENTED TO: GigPeak, Inc. DATE: March 17, 2017 © 2017 American Stock Transfer & Trust Company, LLC

|

The following discussion may not represent the official views of AST, with respect to any of the issues addressed. AST makes no representation or warranty (express or implied) as to the accuracy, completeness, reliability or sufficiency of the contents of this presentation or the opinions or projections expressed in or omitted from this presentation and its presenters, and expressly disclaim any and all liability for any loss or damage (whether direct, indirect, or consequential) suffered or incurred by any person relying on this presentation or in connection with the provision or contents of this presentation including as a result of any omission, inadequacy, insufficiency, or inaccuracy in the contents of this presentation. Moreover, this presentation and the views expressed by the individual presenters should not be construed as investment, legal or tax advice. The outcome of any individual situation depends on the specific facts and circumstances in which the issue arises and on the interpretation of the relevant literature in effect at the time. Anyone viewing this presentation should not act upon this information without seeking professional counsel and/or input from their advisors. 2 Private Copy – Not For Distribution

|

Offer to Purchase for Cash All Outstanding Shares of Common Stock of GIGPEAK, INC. at $3.08 Per Share by GLIDER MERGER SUB, INC. a wholly-owned subsidiary of INTEGRATED DEVICE TECHNOLOGY. INC THE OFFER AND WITHDRAWAL RICH IS WILL EXPIRE AT ONE MINUTE FOLLOWING 11:59 P.M. (12:00 MIDNIGHT), NEW YORK CITY TIME ON MONDAY. APRIL 3, 2017, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED. The Offer (as defined below) is being made pursuant to the Agreement and Plan of Merger, dated as of February ] 3, 2017, by and among Integrated Device Technology, Inc. (“IDT”), a Delaware corporation, Glider Merger Sub, Inc., a Delaware corporation (the “Purchaser”) and a wholly-owned subsidiary of IDT, and GigPeak, Inc. (“GigPeak”), a Delaware corporation (as it may be amended, modified or supplemented from time to time in accordance with its terms, the “Merger Agreement”). 3 Private Copy – Not For Distribution

|

The Offer: $3.08 cash per share of GigPeak, Inc. common stock offered by Glider Merger Sub, Inc., a wholly owned subsidiary of Integrated Device Technology, Inc. (“IDT”) Deadline to ‘Tender’ shares by midnight, April 3rd, 2017 (New York Time)* Special Note: Directors to Tender by Friday, March 17th * With exception of ‘Managed Shares’ which need to be tendered by March 30th 4 Private Copy – Not For Distribution

|

The Deal: If majority of outstanding GigPeak shares are tendered by Midnight, April 3, 2017, IDT will accept the shares and remit $3.08 per share, in cash. IDT has the right to extend the offer. Back-end Merger: If majority of shares are tendered, Merger can close and non-tendered shares will be paid $3.08 in cash a few days after Tender Offer Expiration 5 Private Copy – Not For Distribution

|

Types of shareholdings: 1) “The Street” held with a stockbroker 2) ‘Registered Shareholder’ shares registered at AST 3) ‘Managed Shares’ held at AST 4) Unexercised stock options and unvested Restricted Stock Units 6 Private Copy – Not For Distribution

|

Types of shareholdings: 1) “The Street” held with a stockbroker—May mail notice, email or post an alert to brokerage account—you must notify financial representative to actively tender 7 Private Copy – Not For Distribution

|

Types of shareholdings: 2) ‘Registered Shareholder’ shares registered at AST—materials mailed with yellow Letter of Transmittal (“LT”)—must complete and return LT to be received by Monday, April 3rd Reference ‘Book’ shares if no stock certificates Must include any stock certificates, if issued—if certificates lost, contact AST for Affidavit of Loss AST Tel#: 718-921-8317 8 Private Copy – Not For Distribution

|

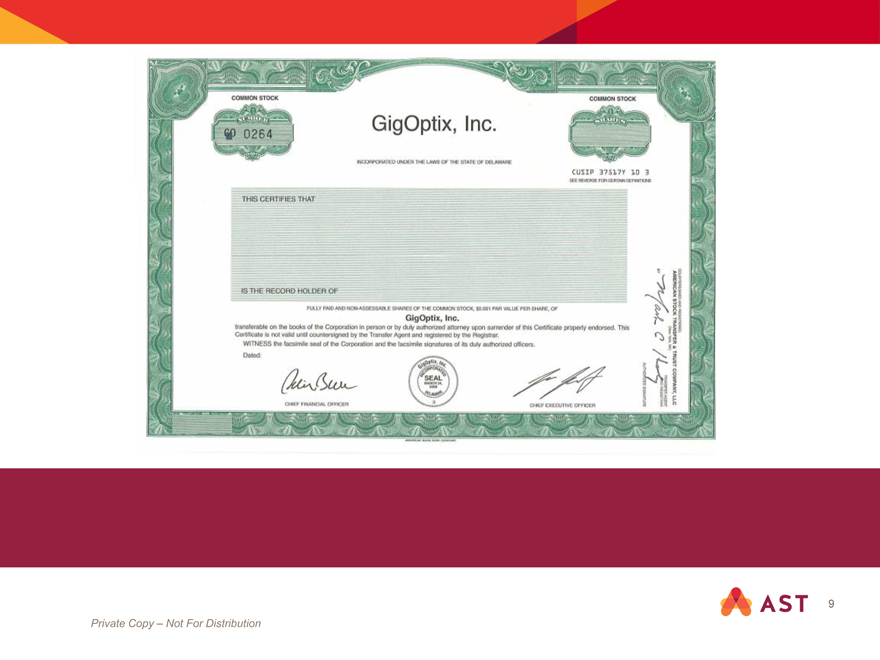

9 Private Copy – Not For Distribution

|

Types of shareholdings: 3) ‘Managed Shares’ held at AST—materials mailed with pink Letter of Transmittal (“LT”)—must complete and return LT to be received by Friday, March 30th—all shares held in ‘book’ form 10 Private Copy – Not For Distribution

|

Types of shareholdings: 4) Unexercised stock options and unvested Restricted Stock Units—Stock options with exercise prices at $3.08 or above to be cancelled—Stock options below $3.08 will be ‘net’ exercised (less option price & taxes)—Unvested RSUs will be assumed by IDT and converted into IDT RSUs 11 Private Copy – Not For Distribution

|

Payments: 1) “The Street” – cash credited to brokerage account 12 Private Copy – Not For Distribution

|

Payments: 2) ‘Registered Shareholder’ shares registered at AST – checks mailed 13 Private Copy – Not For Distribution

|

Payments: 3) ‘Managed Shares’ held at AST – checks mailed, Direct Deposit or Wire for Direct Deposit or Wire, must register your bank information log into your account at www.astepsdiv.com/ View Plan Details->Manage Proceeds->Direct Deposit or US Wire—no fee for Direct Deposit; $25 fee for US Wire 14 Private Copy – Not For Distribution

|

Payments: 4) Unexercised stock options -checks mailed, Direct Deposit or Wire for Direct Deposit or Wire, must register your bank information log into your account at www.astepsdiv.com/ View Plan Details->Manage Proceeds->Direct Deposit or US Wire—no fee for Direct Deposit; $25 fee for US Wire 15 Private Copy – Not For Distribution

|

Timing: 1) “The Street” – cash credited to broker account Tender – cash paid next business day after Expiration (exp April 4th) Back-End Merger – cash paid approx 2-3 business days after Merger Closing * Some brokers post cash daily, some weekly, some monthly 16 Private Copy – Not For Distribution

|

Timing: 2) ‘Registered Shareholder’ shares registered at AST – checks mailed Tender—checks issued and mailed day after Expiration (April 4th) Back-end Merger – checks issued after Merger LT is submitted 17 Private Copy – Not For Distribution

|

Timing: 3) ‘Managed Shares’ held at AST – checks mailed, Direct Deposit or Wire Tender – payments made 4-5 business days after Expiration Back-end Merger – payments made 4-5 business days after Merger Closing 18 Private Copy – Not For Distribution

|

Timing: 4) Unexercised stock options Tender – not applicable Back-end Merger – 5-10 business days (‘in the money options’ and accelerated RSU vestings only) No payments made to ‘out of the money’ options and non-accelerated RSUs 19 Private Copy – Not For Distribution

|

Information: Information Agent: MacKenzie Partners, Inc. 800-322-2885 212-929-5500 Transfer Agent: AST 877-248-6417 718-921-8317 Equity Plan Administrator: AST 866-665-2258 20 Private Copy – Not For Distribution

|

Joshua McGinn SVP, Relationship Management jmcginn@astfinancial.com Tel: 415.366.8086 Cel: 415.471.0423 21 Private Copy – Not For Distribution

|

© 2017 American Stock Transfer & Trust Company, LLC