UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

Q REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this Shell Company report: N/A

Commission file number: ___________

NAYARIT GOLD INC.

(Exact name of Registrant specified in its charter)

ONTARIO, CANADA

(Jurisdiction of incorporation or organization)

36 Toronto Street, Suite 850

Toronto, Ontario M5C 2C5

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act:

COMMON SHARES, NO PAR VALUE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the registration statement.

48,875,262 Common Shares.

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ¨ No Q

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Yes ¨ No ¨

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ¨ No Q

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer or non-accelerated filer. See definition of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act.

¨ Large Accelerated Filer ¨ Accelerated Filer Q Non-Accelerated Filer

Indicate by check mark which financial statement item Registrant has elected to follow:

Item 17 Q Item 18 ¨

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes ¨ No Q

| | |

| TABLE OF CONTENTS |

| | |

| | |

| Introduction | 1 |

| Technical Glossary | 2 |

| | |

| PART I | |

| | |

| Item 1. Identity of Directors, Senior Management, and Advisors | 4 |

| Item 2. Offer Statistics and Expected Timetable | 6 |

| Item 3. Key Information (including RISK FACTORS) | 6 |

| Item 4. Information on the Company | 10 |

| Item 5. Operating and Financial Review and Prospects | 21 |

| Item 6. Directors, Senior Management and Employees | 29 |

| Item 7. Major Shareholders and Related Party Transactions | 37 |

| Item 8. Financial Information | 38 |

| Item 9. The Offer and Listing | 38 |

| Item 10. Additional Information | 40 |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 50 |

| Item 12. Description of Other Securities Other than Equity Securities | 50 |

| | |

| PART II | |

| | |

| Item 13. Defaults, Dividend Arrearages and Delinquencies | 52 |

| Item 14. Material Modifications to the Rights of Securities Holders and Use of Proceeds | 52 |

| Item 15. Controls and Procedures | 52 |

| Item 16. Audit Committee and Financial Expert | 52 |

| | |

| PART III | |

| | |

| Item 17. Financial Statements | 54 |

| Item 18. Financial Statements | 56 |

| Item 19. Exhibits | 56 |

| | |

| Audited Financial Statements for the twelve month periods ended September 30, 2007 and 2006 | F-1 - F-29 |

| Signature Page | 56 |

| Exhibits | 56 |

| | |

INTRODUCTION

Nayarit Gold Inc. (sometimes referred to herein as "Nayarit Gold," "we," "us" or the "Company") is an exploration stage mining company incorporated pursuant to the laws of Ontario, Canada on November 27, 2003 and became a public issuer by virtue of its amalgamation with Canhorn Chemical Corporation ("Canhorn") on May 2, 2005. The Company's principal business office and registered office is located at 36 Toronto Street; Suite 850, Toronto, Ontario M5C 2C5. The Company also maintains an office located at 76 Temple Terrace, Suite 150, Lower Sackville, Nova Scotia, B4C 0A7. Most of the Company's management work from the Nova Scotia office. The Company is registered as a domestic corporation in Ontario and its common shares trade on the TSX Group's TSX Venture Exchange, Tier 2, under the symbol "NYG".

Nayarit Gold is presently engaged in the acquisition and exploration of mineral properties in the state of Nayarit, Mexico. Our principal property is referred to in this Registration Statement as the "Orion Gold Project." The Orion Gold Project consists of seven mineral concessions located approximately 100 KM north-northwest of the City of Tepic, the capital of Nayarit State. See Item 4 - "Information about the Company." Our objective is to explore, define and develop these claims, if economically warranted. No known bodies of commercial ore or economic deposits have been established on any of our claims and further exploration is required before a final evaluation as to economic feasibility or any one or more of the claim groups can be determined. We have no source of revenues. Our ability to explore and potentially develop our mineral assets will depend upon our ability to attract investment or otherwise finance our activities.

FINANCIAL AND OTHER INFORMATION

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars ("CDN$" or "$"). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$). As of April 22, 2008 the currency exchange rate was approximately US$1.00 equals CDN$1.00. As of the Company's fiscal year end on September 30, 2007, the currency exchange rate was approximately US$1.00 equals CDN$1.00. The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP") and conform in all material respects with United States generally accepted accounting principles ("US GAAP") except as noted. The principal difference between Canadian GAAP and US GAAP affecting the Company's financial statements is that pursuant to Canadian GAAP mineral property acquisition and exploration costs may be deferred and amortized to the extent they meet certain criteria while, under US GAAP, such costs relating to unproved properties are expensed as they are incurred. A reconciliation of the impact of the difference between Canadian GAAP and US GAAP is provided in the Company's consolidated financial statements for the years ended September 30, 2007 and 2006 in Note 10.

FORWARD-LOOKING STATEMENTS

This Registration Statement includes forward-looking statements, principally in Item 4 – "Information about the Company" and Item 5 – "Operating and Financial Review and Prospects". We have based these forward-looking statements largely on our current expectations and projections about future events and trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions including, among other things, the factors discussed in this registration statement under Item 3 – "Key Information – RISK FACTORS" and factors described in documents that we may furnish from time to time to the Securities and Exchange Commission.

The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect" and similar words are intended to identify forward-looking statements. In light of these risks and uncertainties, the forward-looking information, events and circumstances discussed in this registration statement might not occur. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise.

THE PURCHASE OF OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS REGISTRATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

- 1 -

TECHNICAL GLOSSARY

Adits: | Nearly horizontal tunnel from the surface by which a mine is entered and rock and ore is removed. |

Breccia: | Rock consisting of angular fragments in a finer grained matrix, distinct from conglomerate, formed by the breaking up of earlier formed rock by sedimentary, volcanic, tectonic, chemical, mechanical or other processes. |

Deposit: | A concentration of minerals with potential for economic extraction and recovery. |

Dip: | The angle below horizontal of the steepest line that can be drawn on an inclined plane, at right angles to the line of strike within the plane. |

Diamond Drilling: | Method of drilling using diamond-impregnated bits and hollow tubes to produce a solid continuous core sample of the rock. |

Drilling: | Using a rotary drill to obtaining sub-surface rock samples. |

Epithermal: | Pertaining to mineral veins and ore deposits formed from warm waters at shallow depths in the earth, at temperatures ranging from 50-200°C, and generally at some distance from the magmatic source. |

Extrusions: | Igneous rocks that have flowed out onto the surface of the earth (i.e. lava, ash, agglomerate, tuff, etc.). |

Faults: | A fracture or set of fractures, generally planar, in rocks on which there has been movement on one of the sides relative to the other. |

Geochemical Survey: | Exploration techniques that measure the content of certain chemical elements in soils, sediments and rocks to define anomalies for further testing. |

Geological: | Pertaining to the study of the history and properties of the earth. |

Geophysical Survey: | Exploration techniques that measure various physical properties of the earth with the intent of using the mapped variations in those physical properties to define anomalies for further testing. |

Gpt: | (also written g/t or gm/t) Metric system unit of concentration of elements in rock meaning grams per tonne, usually applied to precious metals such as gold, silver and platinum group elements. |

Mobile Metal Ion Sampling: | Mobile Metal Ion (MMI) is a geochemical exploration method that uses a unique analytical technique to measure metals in soils and weathered materials. It differs from traditional techniques by measuring only weak concentrations of mobile target elements between the particles of soil rather than the soil itself and is believed to outline anomalies that are more diagnostic as a guide to further exploration. |

Net Smelter Return Royalty: | (or NSR) Royalty paid based on the proceeds received from the purchaser of mine products with no deduction of production, milling or other pre-shipping costs |

Placer: | Concentrations of heavy minerals in generally unconsolidated sediments in creeks, rivers or beaches, formed by a combination of erosion, gravity, and transport energy . |

- 2 -

| | |

Porphyritic: | Having large, distinct crystals (as of feldspar or quartz) set in a relatively fine-grained groundmass in an igneous rock. |

Portal: | The entrance to an adit. |

Pyrite: | A metallic, brassy-colored mineral, FeS2, occurring widely and a common indicator of deposition of other, less concentrated minerals or metals of economic interest. Also called fool's gold (colloquial). |

Sediments: | Material deposited physically or chemically after transportation as particles or in solution by air, water or ice; “sedimentary rocks” being rock formed from such sediments. |

Silicified: | Converted into or impregnated with silica (SiO2). |

Strike: | The direction, or bearing, of a horizontal line drawn on a plane surface on the outcrop of an inclined bed or other structural surface. |

Structure, Structures: | The relationship between the various repeated planes and lines on or within a rock. Examples include bedding, folding, faulting, and slickensides. |

Tailings: | Those portions of washed or processed ore that are regarded as too low grade and uneconomical to be treated further after separation from the minerals of interest. |

Trenches: | Elongate excavated open cuts made to examine and sample bedrock and/or mineralization. |

Tonne | A unit of metric tonnes equivalent to 1.102 short tons. |

Vein System: | A collection of veins within an area or region formed as the result of a set of related structural and subsequent mineralizing events. |

Veins: | Tabular or sheet-like bodies of minerals which have been formed by precipitation from hydrothermal fluids moving through a system of faults, fractures, or tabular zones of porosity in rocks. |

Mineral references:

Ag – silver

Au – gold

Cu – copper

Pb - lead

Conversion factors |

To Convert From | To | Multiply By |

Feet | Metres | 0.305 |

Metres | Feet | 3.281 |

Miles | Kilometres | 1.609 |

Kilometres | Miles | 0.621 |

Acres | Hectares | 0.405 |

Hectares | Acres | 2.471 |

Grams | Ounces (troy) | 0.032 |

Ounces (troy) | Grams | 31.103 |

Ounces per ton (oz/t) | Grams per tonne (gpt) | 34.28 |

Tonnes | Short Tons | 1.102 |

- 3 -

Item 1. Directors, Senior Management, and Advisors

Directors and Senior Management

Name, Business Address and Position(s) held | Period served as a Director or Officer | Age |

| | | |

Colin P. Sutherland(1) Resident of Halifax, Nova Scotia, Canada Director, President and CEO | June 6, 2007 to date | 36 |

Paul F. Saxton (2) Resident of Furry Creek, British Columbia, Canada Director and Chairman of the Board | April 18, 2007 to date | 61 |

J. Trevor Eyton (3) Resident of Caledon, Ontario, Canada Director | May 2, 2005 to date | 73 |

Donald Flemming (4) Resident of Halifax, Nova Scotia, Canada Director | July 5, 2007 to date | - |

R. Glen MacMullin (5) Resident of Ottawa, Ontario, Canada Director | June 6, 2007 to date | 37 |

Dennis H. Waddington (6) Resident of Toronto, Ontario, Canada Chief Financial Officer | May 18, 2005 to May 12, 2008 | 59 |

William J. Warren (7) Resident of Pensacola, Florida, USA Vice President of Exploration | September 6, 2007 to date | 63 |

Megan G. Spidle (8) Resident of Hammond Plains, Nova Scotia, Canada Chief Financial Officer | Appointment effective as of May 12, 2008 | 31 |

(1) Mr. Sutherland was appointed to the position of President and CEO of the Company on June 6, 2007. Prior to joining the Company, Mr. Sutherland was a Director and Chief Financial Officer of Gammon Gold Inc. ("Gammon") from 2004 to 2007, where he was involved in Gammon's growth from an exploration stage company to a producing mining company with a market capitalization of over CDN$2 billion. Mr. Sutherland also was a director and chief financial offer of Mexgold Resources Inc. from 2004 to 2006. Mr. Sutherland has extensive experience in financing mineral exploration. As of April 21, 2008, Mr. Sutherland was appointed as the interim Chief Executive Officer and director of Silver Dragon Resources Inc. ("Silver Dragon") while Silver Dragon undertakes a search for a new chief executive officer. Prior to becoming its interim chief executive officer, Mr. Sutherland was the chief financial officer of Silver Dragon. Mr. Sutherland is a Chartered Accountant and a graduate of Saint Francis Xavier University in Antigonish, Nova Scotia.

- 4 -

(2) Paul F. Saxton is a mining engineer and has been active in the mining industry since 1969, holding various positions including mining engineer, mine superintendent and President and CEO of several Canadian mining companies. In addition to holding a B.Sc. (Engineering) degree from Queen's University, in Kingston, Ontario Mr. Saxton also earned an MBA from the University of Western Ontario in London, Ontario. Following 10 years with Cominco Ltd., Mr. Saxton became Vice President and then President of Mascot Gold Mines Ltd., initially working on the design and construction of its Nickel Plate mine in British Columbia, Canada. Subsequently Mr. Saxton became a Vice-President of Corona Corporation where he was responsible for western operations and exploration for that company. In 1989, Mr. Saxton was appointed Senior Vice President of Viceroy Resource Corporation where he was responsible for obtaining financing as well as construction and operation of the Castle Mountain mine in California. Mr. Saxton was responsible for bringing the Brewery Creek Gold mine, in Yukon Territory into production. Following his departure from Viceroy Resource Corporation in 1998, Mr. Saxton became President of Standard Mining Corp., supervising its exploration activities until 2001, when Standard Mining Corp. was merged with Doublestar Resources Ltd.

(3) J. Trevor Eyton is a member of the Senate of Canada and a director of Brookfield Asset Management Inc. He presently serves as Chairman of the board of directors of Ivernia Inc. and previously was a director of Noranda Inc. He is also Chairman of Canada's Sports Hall of Fame and a Governor of the Canadian Olympic Foundation. In 2002, Mr. Eyton was awarded Mexico's Aguila Azteca, the highest award given to foreigners by the Mexican government. Senator Eyton is also the co-founder and co-chairman of the Canada/Mexico Retreat, an organization formed in 1990 around NAFTA discussions and now dedicated to promoting two-way trade and investment at the most senior levels in the two countries. Mr. Eyton earned a B.A. from the University of Toronto in 1957 and a S.J.D. from the University of Toronto school of Law in 1960.

(4) Donald Flemming is the president of Don Flemming Insurance, which he established in 1980. He is also a past president of the Chamber of Commerce of Halifax, Nova Scotia and has experience in the mining industry.

(5) R. Glen MacMullin, is currently a Managing Director of Xavier Sussex, LLC, a private investment firm he co-founded in 2004. He also is a member of the board of directors of Silver Dragon Resources Inc. Prior to 2004, he was a Director and the Chief Operating Officer with DB Advisors, LLC, a hedge fund group based in New York and wholly owned by Deutsche Bank AG. He previously served in various positions with Deutsche Bank Offshore in the Cayman Islands including Head of Investment Funds. Mr. MacMullin began his career in public accounting with Coopers & Lybrand in Ottawa, Canada and KPMG in the Cayman Islands. He holds a Bachelor of Business Administration degree from Saint Francis Xavier University in Anigonish, Nova Scotia and is a member of the Canadian Institute of Chartered Accountants.

(6) Dennis H. Waddington is the Chief Financial Officer of the Company as of the date of this registration statement. Mr. Waddington has tendered his resignation effective as of May 12, 2008. He is a consultant with over 30 years of business and professional experience in mineral exploration and related fields. Following graduation from the University of Toronto with a B.Sc. (1970 – Geology) and an M.Sc. (1973 – Structural Geology) he was with Amax Exploration, and later with its public company spin-off, Canamax Resources Inc. as Senior Geologist. After obtaining his MBA from the Schulich School of Business at York University, he joined Phelps Dodge Corporation of Canada, Limited where he had corporate and administrative responsibilities for their operations in Canada and later in India. He has since served as an officer of junior public companies with activities in Mexico, Canada and Brazil. He is a Professional Geoscientist (P.Geo.) registered in Ontario.

(7) William J. Warren is Vice-President of Exploration of the Company. He is a professional geologist who has over 20 years of mineral exploration experience on international precious and base metal projects internationally. Mr. Warren earned a B.S. in Geology from Auburn University and a M.Sc. in Geophysics from the Colorado School of Mines and is a registered Professional Geoscientist in the state of Florida.

(8) Megan Spidle has been appointed the Chief Financial Officer of the Company, effective as of May 12, 2008. She is a member of the Institute of Chartered Accountants of Nova Scotia with over 10 years experience in public accounting. After obtaining a bachelor's degree from Dalhousie University in Halifax (Commerce, 1998) Ms. Spidle worked for Deloitte & Touche, LLP in Halifax. Ms. Spidle also served as the Manager of Financial Reporting for Duke Energy in Houston, Texas.

- 5 -

Item 2. Offer Statistics and Expected Timetable

No Disclosure Necessary

Item 3. Key Information

3.A. Selected Financial Data

The selected financial data of the Company for the fiscal years ended September 30, 2007 and 2006 was derived from the consolidated financial statements of the Company which have been audited by McGovern, Hurley, Cunningham LLP as indicated in their auditors' report which is included in Item 17 of this Registration Statement. The Company has declared September 30 as its fiscal year-end and has completed 34 months of operation since the amalgamation which gave rise to the Company's current form on May 2, 2005. The consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP") and conform in all material respects with United States generally accepted accounting principles ("US GAAP") except as noted. The principal difference between Canadian GAAP and US GAAP affecting the Company's financial statements is that pursuant to Canadian GAAP mineral property acquisition and exploration costs may be deferred and amortized to the extent they meet certain criteria. Under US GAAP, such costs relating to unproved properties are expensed as they are incurred. A reconciliation of the impact of the difference between Canadian GAAP and US GAAP is provided in the Company's consolidated financial statements for the years ended September 30, 2007 and 2006 in Note 10.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain future earnings for use in its exploration activities and for working capital.

The following table is derived from the financial statements of the Company for the fiscal years ended September 30, 2007 and 2006.

Selected Financial Data

| September 30, 2007 | September 30, 2006 |

| | $nil | $nil |

Net Income (Loss) | ($3,531,997)(year) | ($2,455,866) (year) |

(Loss) per Share | ($0.09)(year) | ($0.08) (year) |

Dividends Per Share | $nil | $nil |

Wtd. Avg. Shares | 39,978,939 | 30,929,315 |

Working Capital (Deficit) | $1,187,618 | $1,690,259 |

Long Term Debt | $nil | $nil |

Shareholders' Equity (Deficiency) | $7,081,917 | $5,143,564 |

Total Assets | $7,397,763 | $5,303,424 |

- 6 -

Note that under US GAAP, for the year ended September 30, 2007 the Company's net loss was CDN$5,848,604, the loss per share was CDN$0.15, the shareholders' equity was CDN$1,742,524 and the total assets were CDN$2,058,370.

Twelve Months Ended September 30, 2007

During the twelve month period ended September 30, 2007, the Company did not generate any revenue. Operating Expenses during this period (which do not include write-offs for relinquished claims and before inclusion of interest income) were CDN$3,136,254 (US$3,136,254) and included: professional fees of CDN$144,251 (US$144,251), transfer services and listing fees of CDN$55,185 (US$55,185), and office and general fees of CDN$27,056 (US$27,056).

Twelve Months Ended September 30, 2006

During the twelve month period ended September 30, 2006, the Company did not generate any revenue. Operating Expenses during this period were CDN$2,503,710 (US$2,248,707) and include: professional fees of CDN$123,271 (US$110,716), transfer services and listing fees of CDN$34,178 (US$30,697), and office and general fees of CDN$30,988 (US$27,832).

3.B Capitalization and Indebtedness

3.A.3. Exchange Rates

The following table sets forth the rate of exchange for the Canadian Dollar at the end of the five most recent calendar year periods ended December 31, the average rates for the period and the range of high and low rates for the periods. Exchange rates are also disclosed for the preceding eight fiscal quarters and the most recent six monthly periods.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of Canadian dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

- 7 -

| | | | |

| Average | High | Low |

March 2008 | $1.00 | $1..03 | $0.97 |

February 2008 | $1.00 | $1.02 | $0.98 |

January 2008 | $1.01 | $1.03 | $0.99 |

December 2007 | $1.00 | $1.02 | $0.98 |

November 2007 | $0.97 | $1.00 | $0.92 |

October 2007 | $0.97 | $1.00 | $0.94 |

September 2007 | $1.02 | $1.06 | $0.99 |

August 2007 | $1.06 | $1.08 | $1.05 |

July 2007 | $1.05 | $1.07 | $1.03 |

June 2007 | $1.07 | $1.07 | $1.06 |

May 2007 | $1.09 | $1.10 | $1.09 |

April 2007 | $1.13 | $1.16 | $1.11 |

March 2007 | $1.17 | $1.18 | $1.15 |

February 2007 | $1.17 | $1.19 | $1.16 |

January 2007 | $1.18 | $1.18 | $1.16 |

December 2006 | $1.15 | $1.16 | $1.15 |

| | | |

Three Months Ended 12/31/06 | $1.13 | $1.14 | $1.13 |

Three Months Ended 9/30/06 | $1.12 | $1.12 | $1.11 |

Three Months Ended 6/30/06 | $1.14 | $1.14 | $1.12 |

Three Months Ended 3/31/06 | $1.15 | $1.18 | $1.13 |

Three Months Ended 12/31/05 | $1.17 | $1.20 | $1.15 |

Three Months Ended 9/30/05 | $1.20 | $1.24 | $1.16 |

Three Months Ended 6/30/05 | $1.24 | $1.27 | $1.21 |

Three Months Ended 3/31/05 | $1.22 | $1.26 | $1.20 |

| | | |

Calendar Year Ended 12/31/06 | $1.13 | $1.18 | $1.11 |

Calendar Year Ended 12/31/05 | $1.21 | $1.27 | $1.15 |

Calendar Year Ended 12/31/04 | $1.30 | $1.40 | $1.18 |

Calendar Year Ended 12/31/03 | $1.40 | $1.57 | $1.29 |

Calendar Year Ended 12/31/02 | $1.57 | $1.61 | $1.51 |

Calendar Year Ended 12/31/01 | $1.55 | $1.60 | $1.49 |

3.B Capitalization and Indebtedness

3.C Reasons For The Offer and Use of Proceeds

No offer of securities is made by this registration statement.

RISK FACTORS

1.

EXPLORATION STAGE CORPORATION AND EXPLORATION RISKS

The Company is engaged in the business of exploration for precious and base metals in Mexico. We have no known body of commercial ore. Exploration and development of natural resources involves a high degree of risk and few properties which are explored are ultimately developed into producing properties. If our exploration programs do not yield favorable results, we may be unable to finance further exploration activities and our shareholders could lose their entire investment.

- 8 -

2.

WE HAVE NO SOURCE OF OPERATING REVENUE AND EXPECT TO INCUR SIGNIFICANT EXPENSES BEFORE ESTABLISHING AN OPERATING MINE, IF WE ARE ABLE TO ESTABLISH AN OPERATING MINE AT ALL.

We have no source of revenue and we do not have any commitments to obtain additional financing. We have no operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

further exploration of our mineral assets and the results of that exploration;

our ability to raise the capital necessary to conduct this exploration and preserve our interest in these mineral claims; and

our ability to raise capital to develop the mineral assets, if warranted, and operate them profitably. Because we have no operating revenue, we expect to incur operating losses in future periods as we continue to expend funds to explore and develop our properties. Failure to raise the necessary capital to continue exploration and development could cause us to go out of business.

3.

FOREIGN OPERATIONS

All of the Company's property interests are located in the State of Nayarit, Mexico, and are subject to that jurisdiction's laws and regulations. Variations from the current regulatory, economic and political climate in Mexico could have an adverse effect on the affairs of the Company and could expose the Company to unforeseen risks that are outside our ability to mitigate.

4.

GOVERNMENT REGULATIONS

The Company's exploration operations are subject to the Mexican government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labor standards. For the Company to carry out mining activities, exploitation licenses must be obtained and kept current. There is no guarantee that the Company's exploitation licenses will be extended or that new exploitation licenses will be granted. The Company will also have to obtain and comply with permits and licenses which may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances, all of which would add to the cost of development and operation and may with the result that development may not be economically feasible.

5.

MARKET FLUCTUATIONS AND COMMERCIAL QUANTITIES

The Company's revenues, if any, are expected to be in large part derived from the extraction and sale of gold and silver and, to a lesser extent, base and other related metals. The price of those commodities fluctuates and is affected by numerous factors beyond the Company's control, including international economic and political trends, global demand for base and precious metals, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of the Company's exploration projects, cannot be predicted.

- 9 -

6.

CONFLICTS OF INTEREST

Certain of the directors of the Company also serve as directors and officers of other companies involved in gold and precious metal or other natural resource exploration and development. Each of the directors must determine how much time to allocate to the business of the Company and the other companies and organizations with which they are involved.

7.

STOCK PRICE

We cannot predict the results of the exploration that is being conducted. The results of these activities will heavily influence our decisions on further exploration at our properties and are likely to affect the trading price of our stock.

8.

PENNY STOCK

Our common stock is considered a "penny stock" and the sale of our stock by you will be subject to the "penny stock rules" of the Securities and Exchange Commission. The penny stock rules require broker-dealers to take steps before making any penny stock trades in customer accounts. As a result of these factors there could be delays in the trading of our stock and some brokers may decline to handles transactions involving our stock which could negatively affect the liquidity of your shares.

9.

CURRENCY RISKS

The Company conducts its business activities in Canadian dollars. Consequently, the Company is subject to gains or losses due to fluctuations in Canadian currency relative to the U.S. dollar. Likewise, its operational activities in Mexican pesos may be affected by the fluctuations in relative value with other currencies.

Item 4. Information About the Company

History and Development of the Company

Nayarit Gold Inc. is a junior mineral exploration company that was incorporated in the Province of Ontario on November 27, 2003 under the Business Corporations Act (Ontario). On May 2, 2005 the Company amalgamated with Canhorn Chemical Corporation ("Canhorn"), a then inactive reporting issuer formed under the laws of the Province of Ontario. Each common share of the Company and each common share of Canhorn was exchanged for one common share of the amalgamated company. As a result, Nayarit's former shareholders owned approximately 63% of the newly amalgamated company. This transaction was accounted for as a reverse take-over with Nayarit as the acquirer.

The Company's head office is located at:

36 Toronto Street

Suite 850

Toronto, Ontario

M5C 2C5

Telephone: (647)-477-6264

Fax: (647)-477-6265

Most of the Company's management, including the President and Chief Executive Officer work from an office located at:

- 10 -

76 Temple Terrace

Suite 150

Lower Sackville, Nova Scotia

B4C 0A7

Telephone: (902)-252-3833

Fax: (902)-252-3836

The contact person for the Company is our President and CEO, Colin P. Sutherland. Effective as of May 12, 2008, all senior management will be located in the Company's Halifax office.

The Company's fiscal year end is September 30.

The Company's common shares trade in Toronto on the TSX Venture Exchange, Tier 2 under the symbol "NYG". The Company has an unlimited number of common shares authorized, without par value. As of April 30, 2008, the Company had 48,875,262 shares of its common stock issued and outstanding.

The Company's Canadian counsel is Peterson Law Professional Corporation, Toronto, Ontario where the contact person is Dennis H. Peterson. The Company's U.S. counsel is Kavinoky Cook LLP, Buffalo, New York. The contact person at Kavinoky Cook LLP is Jonathan Gardner.

Business Overview

We are an exploration stage mining company. Our objective is to explore and, if warranted and feasible, to develop our interest in certain mineral concessions located in the Municipality of Acaponeta, State of Nayarit, Mexico (the "Orion Gold Project") more fully described herein. There is no assurance that commercially viable mineral deposits exist on any of our mineral claims and further exploration will be required before a final evaluation as to economic feasibility is determined.

We own our interest in the Orion Gold Project through our subsidiary, Nayarit Gold de Mexico S.A. de C.V., a Mexican corporation ("Nayarit Gold Mexico"). The authorized capital of Nayarit Gold Mexico is unlimited. Currently, there are 50 shares of common Series "A" stock with a par value of 1,000 pesos in Mexican Currency ("MXN") issued and outstanding (the "Mexico Shares"). Because Mexican law requires that there be at least two shareholders of a Mexican corporation, the Company owns 49 Mexico Shares and Gerald Shefsky, a former Director of the Company, owns 1 Mexico Share. Mr. Shefsky entered into an agreement with the Company on April 1, 2004 pursuant to which he has acknowledged and agrees that he owns his Mexico Share for the benefit of the Company. Under the terms of the agreement, Mr. Shefsky has agreed that any distribution of income or capital, any right in respect of his Mexico Share and any proceeds from the sale thereof are to be paid or delivered to the Company.

- 11 -

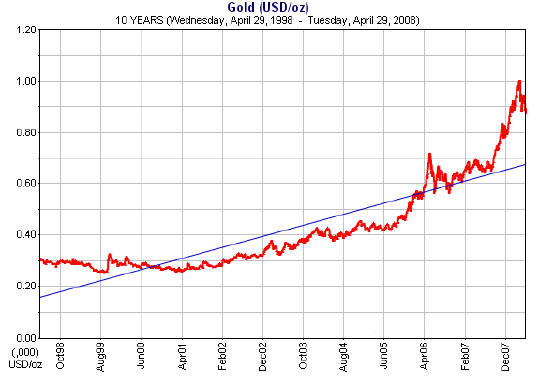

The following graph shows historic prices in US dollars (per troy ounce) of Gold from April 29, 1998 through April 29, 2008 (based upon information available at http://www.infomine.com)

- 12 -

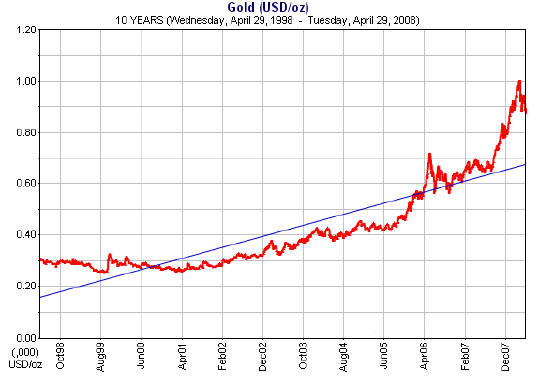

The following graph shows historic prices in US dollars (per troy ounce) of Silver from April 29, 1998 through April 29, 2008, (based upon information available at http://www.infomine.com)

Orión Gold Project Properties

The Orión Gold Project, in the state of Nayarit on Mexico's west coast, originally comprised 8,324 hectares (20,569 acres) and has been expanded since September, 2005 to a total area of 101,795 hectares (251,541 acres) centered approximately 100 km north-northwest of Tepic, the capital city of Nayarit State. Nayarit Gold's exploration work, including diamond drilling of gold-mineralized zones, commenced in the quarter ended June 30, 2005 and has been underway more or less continuously since that time. A 7,000 meter diamond drilling program referred to as the "Phase One Drill Program" is nearing completion and the Company is awaiting results. The Orión Gold Project consists of seven mineral concessions, two of which comprise more than one fraction. All are held through the Company's subsidiary Nayarit Gold de Mexico S.A. de C.V., as outlined below. The Evaristo concession is a residual concession from the Company's work on the Company's Dorosa project in the State of Mexico and no further work is planned for that area at this time.

- 13 -

As of April 30, 2008 Nayarit Gold Mexico has a 100% interest in the following claims:

Claim | Expiration Title Certificate Effective Date | Title Certificate Number | Surface Areas (Hs.) |

Orion* | September 18, 2003* | 205616 | 527.5021 |

El Magnifico Fracc. 1 | March 1, 2054 | 221588 | 6.9029 |

El Magnifico Fracc. II | March 1, 2054 | 221589 | 32.0000 |

El Magnifico Fracc. III | March 1, 2054 | 221590 | 6.9575 |

El Magnifico Fracc. IV | March 1, 2054 | 221591 | 8.8388 |

El Magnifico | March 1, 2054 | 221592 | 7,595.7440 |

Bonanza I | July 17, 2056 | 227603 | 200.0000 |

Reese | August 9, 2056 | 227775 | 3,104.2929 |

Gross Fracc. I | February 6, 2057 | 228826 | 67,148.7686 |

Gross Fracc. II | February 6, 2057 | 228827 | 16.0000 |

La Estrella** | September 9, 2042 | 196009 | 146.3529 |

El Dorado | February 16, 2057 | 228887 | 23,001.8200 |

Evaristo | March 13, 2057 | 119141 | 17,366.7533 |

Total area | | | |

*Issuance of an exploitation concession regarding the Orion mining claim is currently in process.

** The La Estrella property is subject to an option agreement, as more fully described below.

- 14 -

Two of the concessions, Orión and La Estrella, are subject to certain provisions of agreements related to their acquisition, including the following: future production from the Orión concession is subject to a 3.5% net smelter return royalty, which may be purchased at any time by paying US$250,000 and granting a 10% net profits interest. The La Estrella claim is subject to an option agreement that provides that the concession may be acquired over a period of six years for an aggregate price of US$1,450,000. As of the date of this registration statement, the Company has made payments totaling US$350,000 under the La Estrella option agreement.

Option Payment Schedule

La Estrella concession, Orion Gold Project

Date | Amount to pay (USD) | Status |

On signing | 25,000 | Paid |

November 28, 2004 | 50,000 | Paid |

November 28, 2005 | 75,000 | Paid |

November 28, 2006 | 100,000 | Paid |

November 28, 2007 | 50,000 | Paid* |

April 28, 2008 | 50,000 | Paid |

November 28, 2008 | 100,000 | |

November 28, 2009 | 1,000,000 | |

Total payments | 1,450,000 | |

| | | |

*Note that the payment due in November 2007 was split into two payments by an amending agreement. The first payment of $50,000 was made by November 28, 2007, and the second payment of $50,000 was made on April 28, 2008.

The El Magnifico, Bonanza I, Reese, Gross, El Dorado and Evaristo concessions are not subject to any royalty or other agreements. The Bonanza I concession was acquired during December, 2005 under the Mexican government lottery system for disposing of concessions forfeited for non-payment of mining duties, and title was granted on July 18, 2006. The Bonanza I concession lies within the boundaries of the El Magnifico concession. The Reese concession was staked contiguous with the southeast quadrant of the El Magnifico concession, during December, 2005. The staking of the Gross concession, contiguous with the Reese and El Magnifico concessions, was announced in March, 2006 and extended the total land package to the east and south to cover prospective territory containing a number of previously documented showings. The El Dorado concession was added onto the east side of the Gross concession and registered in April, 2006.

The Evaristo concession was acquired by staking, adjacent to the "Dorosa" silver property (a property the Company previously had under an option that was terminated in March of 2007). It is located some 120 km southwest of Mexico City in Mexico State.

Under Mexican Mining Law there are certain obligations that holders of mineral exploration and exploitation concessions must comply with in order to maintain their concessions in full force and effect. Each May, concessionaires with more than 1,000 hectares in concessions must file with the General Bureau of Mines (the "GBM") assessment reports in respect of work carried out on each concession during the preceding calendar year. Regulations to the Mining Law establish minimum investment amounts that must be made on a concession in order to remain in compliance. During the months of January and July of each year concession holders must pay the mining taxes for the area that pertains to each concession (on a per hectare basis), and to file payment evidences before the GBM during the months of February and August of each year. The GBM is in the process of implementing a mandatory electronic filing system, which will eliminate the need to file payment evidence. As of the date of this Registration Statement, the Company elects to pay its mining tax owed electronically.

- 15 -

Orion Gold Project Accessibility, Climate and Topography

The concessions are located approximately 100 km northwest of Tepic, which is the state capital of Nayarit. The nearest town is Acaponeta, which is located 8 km southeast from the claims. Secondary dirt roads provide access to the concessions from the paved national highway that crosses the western part of the concessions.

The general climate in the region is warm and sub-humid with a well-defined rainy season between June and September, and which commonly extends through October. Average annual rainfall is in the order of 1,307 millimeters, of which 92% falls from July to September. A secondary winter rainy season is commonly present in January and February. The annual mean temperature is 26.7 ° Centigrade.

In the area of the concessions, vegetation consists mainly of perennial scrub trees and bushes. The area is sparsely populated and cattle raising, along with some cultivation of market crops, comprises the main district land use. Crops grown in the area include corn, beans, nuts, sorghum, avocado and a variety of other fruits and vegetables.

The main topographic features of the area are the northwest-trending ridges including La Estrella, Cerro Verde and Cerro La Pedregosa to the northeast of La Estrella, and El Salto de Tecapan and Cerro El Vigia to the south of La Estrella. The principal drainage in the area is the Tecapan stream, which cuts across the area to join the San Francisco River, which in turn flows to the west to an estuary on the coast.

Orión Gold Project General Geology

The Sierra Madre Occidental metallogenic province, in which the Orión Gold Project is located, is one of the world's largest epithermal precious metal terrains and hosts most of Mexico's gold and silver deposits. The general geology of the Orión Gold Project area is characterized by Early to Mid-Tertiary volcanic rocks, locally intruded by shallow, fine-grained to porphyritic igneous rocks. This assemblage is typical and extends through the Sierra Madre Occidental, eastern Sonora, and western Chihuahua, Durango, Sinaloa and Nayarit states. The map below shows the location of the Orion Gold Project.

- 16 -

- 17 -

Orión Gold Project Exploration History

Our properties do not contain known reserves. Our programs described herein are exploratory in nature.

Our original exploration focus after commencement of operations in May, 2005 was on drilling the La Estrella zone that had been explored in the 1990's by Lac Minerals. Simultaneously, a reconnaissance mapping, prospecting and sampling effort on various parts of the larger but less well known El Magnifico concession commenced, resulting in the initial work to define drilling targets at the Minas de Animas area. This field work paralleled a continuing investigation and review of historical documents to inventory as much information as possible about the location and nature of gold and/or silver showings. This work lead to identification and classification of other discrete mineralized zones, resulting in expansion of the property through staking additional ground. This exploration of the roughly 400 square mile Orión Gold Project area outlined a pattern of mineralized and altered zones related to northwest-southeast and east-west trending structures, locally characterized by silicified, pyrite and gold-rich breccias and precious metal quartz veins that also contain varying amounts of silver. The exploration approach evolved, as a result of this new understanding, from a single target focus at La Estrella to a district scale strategy of evaluating numerous mineralized zones and grooming the best for drill testing, which has now begun. The following table identifies the zones identified to date, the present understanding of the metals present and the concession on which they are found.

Mineralized Zone | Metals | Concession |

Orion Main Zone (and sub-zones) | Au | Orión and La Estrella |

El Rey | Ag, Au | Orión |

Bonanza | Ag, Au | Bonanza 1 |

Bonanza 1 | Ag, Au | Bonanza 1 |

El Carmen | Ag, Au | Bonanza 1 |

Minas de Animas | Au, Ag | El Magnifico (Frac 2) |

Coppernicus | Cu | El Dorado |

Lázaro Cárdenas | Ag, Au | Gross |

Navro | Au, Ag, Cu, Pb | Gross |

Benita | Au, Ag | Gross |

Cu Show | Cu, Ag | Gross |

El Frontal | Ag | Gross |

Mineralized Zones identified on Orión Gold Project

Glossary:

Ag – silver

Au – gold

Cu – copper

Pb - lead

The earliest recorded work on Orión Main Zone ("OMZ") on the La Estrella property was from the mid-1980's when the Mexican government's Consejo de Recursos Minerales Subdireccion Tecnica (the "Consejo") investigated the OMZ by sampling at surface and in underground workings. The workings were all on one level accessed by an adit, and consisted of a crosscut leading to a drift along the main vein with several shorter crosscuts apparently following smaller cross-veins into the wall rock.

In 1993-94 Lac Minerals investigated the property with surface sampling, geochemical soil sampling and magnetic and IP geophysical surveying followed by 18 reverse circulation drill holes. Their 1994 reverse circulation drilling program comprised 2,464 metres of drilling in 21 holes with steep to vertical inclination and an average depth of 117 metres. They encountered a number of mineralized intersections with significant gold values but did not document any controls, continuity or a resource before the project was terminated as a consequence of the takeover of Lac by Barrick Gold.

- 18 -

The Company's "2005 Drill Program" began in May, 2005 with a diamond drilling program on the La Estrella mineralized vein system, intended to confirm the Lac results and fill in the gaps in their coverage. The 2005 Drill Program comprised 2,027.5 meters of drilling in 18 holes. While the 2005 Drill Program encountered gold mineralization in interesting quantities in several holes, the correlation with the older reverse circulation results was not good and the goal of advancing the understanding towards a resource calculation was not met. Simultaneously, a sustained reconnaissance mapping, prospecting and sampling program at La Estrella and several other areas of the property began.

Drilling conducted in 2006 at Orión/La Estrella (the "2006 Drill Program") comprised another 3,567 meters of diamond core drilling in 11 holes, bringing the Company's drilling totals at the OMZ to 29 holes and 5,595 meters. The 2006 Drill Program drilling was designed to test for depth and strike extensions of mineralization outlined by the 2005 Drill Program and the Lac reverse circulation drilling and by the detailed surface and underground sampling work on the main OMZ and parallel structures. The drilling did encounter the target structures and zones of gold mineralization at depths well below what was previously known, but still did not prove continuity and overall potential.

This field work was complemented by a continuing investigation and review of historical documents for digitization and inclusion into the property database, inventorying as much information as possible about the location and nature of gold and/or silver showings. This work identified and classified more discrete mineralized zones, which were prioritized for future exploration efforts.

The results of the Company's 2005 and 2006 Drill Programs led to the expansion of the Orión Gold Project from its original 8,000 hectares in three concessions to an estimated 102,000 hectares in seven concessions, and continues to outline a pattern of mineralized and altered zones related to northwest-southeast and east-west trending structures, locally characterized by silicified pyrite and gold breccias and precious metal-bearing quartz veins containing varying amounts of silver along with the gold.

In 2005 and 2006, mapping, soil geochemistry, trenching and surface sampling at Lazaro Cardenas, about 25 km south of the OMZ, outlined one or more zones of dominantly silver vein mineralization associated with a roughly east-west structure that dips steeply to the south, prompting the Company to add the Lazaro Cardenas area of the Gross concession. Evidence of the structure and vein system was traced for over 8,000 meters at surface. Silver mineralization seems to occur in veins generally parallel to the structure and in mineralized faults cutting across these veins and the general structure. Some of the better early surface outcrop sampling results by the Company that encouraged optimism here include a 0.8 meter chip/channel sample running 2.59 gpt gold and 1,620 gpt silver. Another chip-channel sample of 1.2 meters ran 0.2 gpt gold and 233 gpt silver. "Gpt" (also written g/t or gm/t) is a metric system unit of concentration of elements in rock meaning grams per ton. This unit of measurement is usually applied to precious metals such as gold, silver and platinum group elements. Two grab samples from surface ran 1.18 gpt gold with 228 gpt silver and 6.24 gpt gold with 26.6 gpt silver respectively. Ten lines of Mobile Metal Ion ("MMI") soil sampling completed across 1,700 metres of that length resulted in a clearly defined silver anomaly. The MMI geochemical survey outlined an extensive anomaly coinciding with evidence of historical trenching, some pits and shafts of unknown size and gold and silver bearing surface rock samples. The 2006 Drill Program also included the first drill hole to be completed on the Lazaro Cardenas Zone, and three other attempted holes that failed to reach their objectives. This drilling was designed to test the anomaly in several locations but unfavourable core recoveries due to badly fractured and poorly consolidated bedrock prevented completion of three of the planned holes. Some weakly mineralized vein material was encountered in Upper Volcanic Group rocks which could not be correlated with the target structures and no reliable conclusions could be made. Further work was left for a later drilling program with improved drilling tools.

While the structurally hosted gold mineralization of the Orión Main Zone, which lies mostly within the La Estrella concession close to the western boundary of the Orión concession, remains the most intensely explored structural zone in Nayarit's Orión Gold Project, historical underground workings, probably of a mainly exploratory nature, and/or trenching, are also observed at Animas on the El Magnifico Fraccion 2, on the Bonanza vein immediately east of the Bonanza 1 property, on the Bonanza 1, El Carmen and La Escondida showings, at El Rey, at Lazaro Cardenas, and at El Frontal, a historic mine with several levels of development located in the southeastern portion of Gross.

- 19 -

These major vein systems on the property display characteristics of gold-silver, quartz-adularia epithermal vein systems. The two dominant sets are those striking approximately east-west and those striking approximately northwest-southeast.

The OMZ appears to be a southeast striking, steeply northeast dipping zone with several possible cross-cutting veins or breccia zones. The host structure can be traced at surface for approximately 800 meters and a gold-bearing portion has been outlined underground over widths of several meters and along a strike length of about 60 meters. The depth and strike extent of the gold-bearing part of the zone, and the nature and orientation of mineralization controls, remain to be determined through additional exploration work.

At Minas de Animas, a number of openings along and across the mineralized veins were located and sampled since 2005 by the Company, providing access for underground sampling to the main southerly dipping Minas de Animas structure for a total of more than 360 meters underground. Another entrance lies a short distance to the north in a footwall structure. Sampling at surface and in the old workings revealed silver and gold material associated with two sub-parallel quartz breccia veins that trend East-West to NW-SE. The presence of 16 gold assays equal to or greater than 10 g/t gold and 25 silver assays equal to or greater than 500 g/t silver, with 9 assays equal to or greater than 1000 g/t silver led to the conclusion that the system needed to be tested by drilling. This was one of the principal target areas of the Phase One Drill Program.

Sampling work by the Company on the Bonanza I concession has defined well mineralized silver-gold vein systems, including El Carmen, La Escondida, La Cumbre, and La Morena (these include underground workings) and the main Bonanza I structure. The El Carmen mineralized vein system runs northwest-southeast and intersects the Bonanza vein structure, which trends east-west. It has been chip-channel sampled at surface and underground along approximately 400 metres of strike length. The mineralized veins of the Bonanza I concession constitute another target for the Phase One Drill Program which is still underway.

Orión Gold Project Exploration during and subsequent to the 2007 Fiscal Year

Work since October, 2006 consisted initially of preparation of access roads and drill pads, in-fill sampling and mapping of several areas to plan and prioritize of future work, particularly on the Bonanza I, Animas, Lázaro Cárdenas and El Carmen areas. The Phase One Drill Program, a 7,000 meter diamond drilling program was designed to carry out first pass drill testing of a number of these vein systems known from the ongoing mapping and sampling work. A drilling contractor was engaged and work began in the summer of 2007 and is still continuing.

The first mineralized area to be drilled in the Phase One Program, was the Minas de Animas vein structures where seven holes totaling 1,904.1 meters of drilling were completed. The Minas de Animas structure is more than 2.0 km south east of OMZ, and 2.3 km south of the Bonanza 1 workings and has been traced over a strike length of more than 850 meters on surface.

- 20 -

A number of these holes intersected significant mineralization in vein material, as reported in the following table. Two holes OR-07-33 and OR-07-35 hit identifiable vein material without significant precious metal values, apparently indicating a raking geometry of mineralized shoots within the veins, open and improving to the east.

Drill Hole # | True Width (m) | Gold (g/t) | Silver (g/t) | Vein |

OR-07-30 Zone A | 1.60 | 2.51 | 48.50 | Animas |

OR-07-30 (includes) | 16.48 | 1.30 | 99.07 | Del Norte |

OR-07-30 Zone B | 10.70 | 3.57 | 287.60 | Del Norte |

OR-07-30 Zone C | 1.90 | 14.00 | 335.00 | Del Norte |

OR-07-30 Zone D | 3.20 | 1.17 | 158.40 | Del Norte |

OR-07-31 | 6.32 | 3.03 | 350.16 | Animas |

OR-07-32 | 5.42 | 9.59 | 980.15 | Del Norte |

OR-07-33 | 10.8 | | | Del Norte |

OR-07-34 | 4.20 | 1.67 | 138.90 | Del Norte |

OR-07-35 | 10.5 | | | Del Norte |

OR-07-36 | 9.20 | 7.97 | 100.90 | Del Norte |

Assay summaries from Phase One drill holes at Minas de Animas

We are awaiting assay data and interpretation on the rest of the holes completed to date under the Phase One Drill Program.

Item 5. Operating Results and Financial Review and Prospects

History

Nayarit Gold amalgamated with Canhorn Chemical Corporation, a public issuer, on May 2, 2005. This transaction was accounted for as a reverse take-over with Nayarit Gold as the acquirer. Nayarit Gold was initially formed as a private company in November of 2003

Following the amalgamation in 2005, Nayarit Gold raised $2,250,000 through the sale of units which, along with the proceeds of earlier private placements, provided the funds to operate the Company and carry out the first phases of its exploration program on the Orión Gold Project. This consisted of an intensive phase of diamond drilling in the year ended September 30, 2005 followed by a continuous phase of prospecting, reconnaissance mapping and sampling of showings along with data acquisition and compilation and new property additions. For more information about our exploration program, see Item 4 "Information about the Company" "Orion Gold Project Exploration History" and "Orion Gold Project Exploration during and subsequent to the 2007 Fiscal Year." During the quarter ended 31 March 2006, the Company completed a private placement financing that raised additional funds, before expenses, of $3,042,000 through the non-brokered, no fee, no commission sale of 4,056,000 units consisting of one common share and one half of one warrant allowing purchase of a common share for $1.25 per share before March 20, 2007. Another non-brokered private placement financing for $1,968,050 before expenses consisting of 2,811,500 units sold at $0.70 each was completed at the end of February, 2007. Each unit consisted of a common share and half a common share purchase warrant that could be exercised for $1.00 for a period of 12 months after closing. In January 2008, the Company completed a non-brokered private placement financing for $2,273,000, consisting of 5,682,500 units, where each unit consisted of one common share and one common share purchase warrant allowing for the purchase of a common share for $0.60 until January 11, 2009 or a common share for $0.70 from January 12, 2008 until January 11, 2010.

- 21 -

RESULTS OF OPERATIONS

TWELVE MONTH RESULTS ENDED SEPTEMBER 30, 2007, 2006 AND 2005

Details of the Company's administrative expenses for the year ended September 30, 2007, compared to the previous two years, are presented in the Consolidated Statements of Loss and Other Comprehensive Loss, forming part of the related consolidated financial statements, which are included as a part of this Registration Statement. Non-cash components of these expenses are Amortization and Stock-based Compensation. The latter is a calculated (Black-Scholes method) fair value assigned to options granted under the Company's stock option plan which vested during the quarter ended September 30, 2007, and also appears as contributed surplus within the Shareholders' Equity. Such expenses will continue to be incurred as more options vest over time. If and when options are exercised the assigned value is removed from the Contributed Surplus account. For ease of comparison, the previous three years' expenses (2005, 2006 and 2007) are compiled and summarized in the following table.

| Year ended |

Operating Expenses | 30-Sep-07 | 30-Sep-06 | 30-Sep-05 |

Stock based compensation | 1,963,915 | 1,351,339 | 579,620 |

Management and consulting fees (includes salaries) | 325,849 | 254,697 | 228,300 |

Occupancy costs | 190,947 | 17,183 | 10,120 |

Professional fees | 144,251 | 123,271 | 49,214 |

Promotion | 134,931 | 414,903 | 224,142 |

Travel | 66,111 | 17,967 | 29,503 |

Shareholder information | 62,134 | 53,508 | - |

Transfer agent, listing and filing fees | 55,185 | 34,178 | 13,896 |

General exploration expense | 47,642 | 55,381 | - |

Insurance expense | 46,561 | 43,016 | 20,437 |

Office and general | 27,056 | 30,988 | 19,995 |

Management bonus | - | 55,000 | - |

Communications | 13,283 | 10,533 | 4,125 |

Interest and bank charges | 7,462 | 9,269 | 2,798 |

Foreign exchange (gain) loss | (26,808) | 15 | 2,489 |

Amortization | 77,735 | 32,462 | 416 |

Total operating expenses | 3,136,254 | 2,503,710 | 1,185,055 |

| | | |

Loss before under-noted | (3,136,254) | (2,503,710) | (1,185,055) |

| | | |

Other (Expense) Income | | | |

Transaction costs in excess of cash acquired | - | - | (249,578) |

Write-off mining interests | (441,713) | - | - |

Interest income | 45,970 | 47,844 | 227 |

| | | |

Net Loss | (3,531,997) | (2,455,866) | (1,434,406) |

Comparison of Operating and Other Expenses for the fiscal years ended 2005, 2006 and 2007

Apart from the non-cash stock-based compensation and amortization amounts, which together constitute 65% of the Operating Expenses for 2007 the five top expenses are for management and consulting fees, occupancy cost, professional fees; office space rent, promotion, and travel expense (in decreasing magnitude). They total $862,089 ($828,021 and $541,279 in 2006 and 2005 respectively) representing 25% of the Operating Expenses for the year (33% and 46% for the previous years.) The occupancy costs (office rent) is sharply higher for 2007, reflecting the Company's move out of shared office space early in the year and to lease larger space of its own, and the subsequent costs of terminating the lease early when most of the management function was moved from Toronto to the Halifax area. The increase in Management and Consulting Fees (which includes management salaries) increased over time as the number of people increased to meet the needs of the increasing programs. These are believed to be reasonable amounts for operating a public company of the scale of Nayarit Gold in comparable circumstances.

- 22 -

The Consolidated Statements of Exploration Property Interests forming part of the related audited consolidated financial statements of the Company for the year ended September 30, 2007 (the "Year") provide details of the deferred exploration expenditures which make up the Exploration Property Interests, grouped by individual property. During the Year, a total of $2,459,729 (when the Mexican Value Added Tax ("IVA") recoverable is included) of such expenditures were accumulated as Exploration Property Interests on the accompanying balance sheet (compared to $2,151,670 a year earlier). Some additional exploration expenditures related to new project investigations and final invoices received for the terminated Dorosa project were expensed directly. This brings the Mining Interests cumulative total to $5,705,405 at September 30, 2007, including exploration advances, prepaids and estimated IVA recoverable.

Total additions to properties held by the Company during 2007, 2006 and 2005 are presented on a property by property basis in the following table, for quick reference.

Property | Year ended Sept 30, 2007 | Year ended Sept 30, 2006 | Year ended Sept 30, 2005 |

Orión | 192,875 | 410,156 | 118,641 |

La Estrella | 279,744 | 543,817 | 556,917 |

El Magnifico | 602,819 | 190,156 | 158,659 |

Bonanza 1 | 281,641 | 105,515 | - |

Reese | 15,823 | 37,735 | - |

Gross | 468,189 | 472,592 | - |

El Dorado | 64,749 | 87,210 | - |

Dorosa | (115,597) | 115,597 | - |

Evaristo | 128,037 | - | - |

Advances | 257,046 | 188,890 | - |

Totals | $2,175,326 | $2,151,668 | 834,217 |

During the year ended September 30, 2006, a total of $2,151,668 in exploration and property costs was incurred and added to the property and deferred exploration expense balance, bringing Mining Interests to $3,245,676. The expenditures reflected the diamond drilling in both years at the OMZ, the small Lazaro Cardenas drill program and the reconnaissance mapping and prospecting, on top of the ongoing data compilation and interpretation work to generate additional exploration and drilling targets and evaluate other properties for acquisition. A year earlier (fiscal 2005), $834,217 was spent on exploration and property costs. The increase in the expenditure levels for 2006 compared to 2005 was due to the increased property base and the fact that 2005 was not a full year. The drilling programs on the OMZ are reflected primarily in the La Estrella totals. The increasing amount of work away from the original OMZ area and the larger size of the newer concessions on which increasing amounts of work are being done account for the magnitude of expenses on those properties.

- 23 -

The Company's policy, in keeping with the practice of comparable participants in the industry and Canadian GAAP, is to accumulate the cost of exploration properties and exploration expenditures at cost on the Balance Sheet as "Exploration Property Interests" until a property comes into production. After commencement of production the accumulated costs will be depleted on a unit of production basis pro rata to the proportion of total reserves and resources mined in any period, thus matching in time the costs of finding and developing the mine with the revenues from the mine. If a property is determined not to be economic but is still retained as an asset, the accumulated value will be written down to the net realizable value of the asset and any excess expensed. If a property with accumulated value is abandoned or sold, its deferred expenses will be expensed to operations in the period of such sale or abandonment. Losses incurred since inception are due mainly to general and administrative expenses, which include professional staff time related to planning and supporting the ongoing exploration program on the Orión Gold Project, corporate maintenance, shareholder relations and advertising and promotion. Such losses will continue given the nature of the Company's business, until such time as it may bring a mine into production.

Summary of Quarterly Results

The following three-part table sets out key financial data on a quarter by quarter basis for the last three fiscal years to the end of September, 2007. The effects of the March, 2006 and February, 2007 equity financings and the exercise of options and warrants from time to time can be seen in the fluctuation in the level of Working Capital. General administration costs are generally steady as reflected in "Operating Expenses," but when the non-cash component for the value of vesting stock options is considered, shown in the Stock-based Compensation line, the Net loss is generally rising over the periods illustrated. Exploration levels increase more steeply during drilling phases, such as the last two quarters of the 2007 fiscal year.

Quarter ending | 30-Sep-07 | 30-Jun-07 | 31-Mar-07 | 31-Dec-06 |

| | | | |

Working Capital | 1,187,618 | 2,574,333 | 2,077,842 | 1,059,121 |

Exploration Property Interests and Deferred Exploration | 5,705,405 | 4,581,325 | 4,143,531 | 4,069,351 |

| | | | |

Revenue | - | - | - | - |

Operating expenses | 317,748 | 302,308 | 379,722 | 172,561 |

Stock-based compensation | 611,059 | 506,300 | 413,193 | 433,363 |

Net loss for period (after interest income and exploration write-offs) | (933,849) | (793,751) | (1,218,163) | (586,234) |

Net loss per share | (0.02) | (0.02) | (0.03) | (0.02) |

Wtd Avg. number of shares in quarter | 43,186,443 | 42,025,953 | 38,702,260 | 35,941,997 |

- 24 -

| | | | | |

Quarter ending | 30-Sep-06 | 30-Jun-06 | 31-Mar-06 | 31-Dec-05 |

| | | | |

Working Capital | 1,690,259 | 3,079,038 | 3,697,225 | 519,961 |

Exploration Property Interests and Deferred Exploration | 3,245,676 | 2,301,236 | 1,565,562 | 1,325,432 |

| | | | |

Revenue | - | - | - | - |

Operating expenses | 320,916 | 404,069 | 314,202 | 113,188 |

Stock-based compensation | 808,795 | 118,486 | 194,849 | 229,209 |

Net loss for period (after interest income and exploration write-offs) | (1,109,022) | (495,812) | (508,639) | (342,397) |

Net loss per share | (0.03) | (0.01) | (0.02) | (0.01) |

Wtd Avg. number of shares in quarter | 35,815,406 | 35,468,997 | 26,960,888 | 25,407,641 |

| | | | |

Quarter ending | 30-Sep-05 | 30-Jun-05 | 31-Mar-05 | 31-Dec-04 |

| | | | |

Working Capital | 864,465 | 1,424,104 | 206,895 | 327,313 |

Exploration Property Interests and Deferred Exploration | 1,094,008 | 677,242 | 388,504 | 355,542 |

| | | | |

Revenue | - | - | - | - |

Operating expenses | 142,873 | 320,634 | 87,595 | 54,106 |

RTO costs | (5,202) | 254,780 | 0 | 0 |

Stock-based compensation | 510,620 | 69,000 | 0 | 0 |

Net loss for period (including interest income and exploration write-offs) | (648,291) | (644,414) | (87,595) | (54,106) |

Net loss per share | (0.04) | (0.03) | (0.01) | (0.01) |

Wtd Avg. number of shares in Quarter | 25,407,641 | 20,305,094 | 9,500,001 | 8,000,001 |

Quarterly financial data summary for past three fiscal years

In the last quarter of 2007, it was decided to move the estimated recoverable IVA from current assets to long term assets due to uncertainties in the recovery process that were causing delays in receiving refunds.

Liquidity

At September 30, 2007, the Company's cash (including short term investments) position of $1,420,543 was relatively unchanged from the $1,472,627 balance at the beginning of the year. The funds from the second quarter (January 2007) private placement and the exercise of warrants from earlier private placements that expired at the end of April, along with proceeds from the exercise of a number of options, more or less balanced the outlay for exploration and managing the Company. Over the three months ending September 30, 2007 the change in cash was from $2,143,749 at the beginning of the quarter to $1,420,543 at the end of the quarter. This change was largely a result of the increased exploration program costs with the commencement of the Phase One Drill Program at the Orion Gold Project during the Quarter. Working Capital decreased from $1,690,259 to $1,187,618 over the Year (compared to increasing from $864,465 to $1,690,259 over the previous year). Over the final quarter of the Year, the Working Capital change was from $2,574,333 to $1,187,618 (compared to $3,078,038 to $1,690,259 in the final quarter of the previous year). These final quarter decreases in both years reflect mainly the startup of drilling programs following earlier financings and significant warrant or option exercises, and in the case of 2007, the change in the classification of the IVA from a current to a long term asset until a timely recovery process can be developed. The fluctuations in these measures reflect the relative timing of more expensive exploration programs and financing activity.

- 25 -

Capital Resources

The Company is required to make certain additional expenditures for exploration work to keep the concessions making up the Orión Gold Project in good standing, including minimum exploration expenditures required by Mexican mining laws, semi-annual payment of mining taxes calculated on the basis of surface area in all titled concessions and option payments under the La Estrella agreement. The exploration work being done will be sufficient to satisfy these minimum work requirements with the current programs. After the end of the Year, the Company determined that additional financial resources would be required to allow the Company to complete the full Phase One Drill Program at the Orion Gold Project, which led to the completion of the non-brokered private placement described herein totaling $2,273,000. With the proceeds of that private placement the Company is now in a position to meet all its current financial commitments, including completion of the Phase One Drill Program and preparations for a Phase Two Drill Program targeting the areas with the best results coming from the Phase One Drill Program.

The net proceeds of the Company's earlier private placements are currently being used by the Company to fund its mineral exploration programs, as well as for general working capital purposes. The Company intends to fund future commitments with cash on hand, or through any other financing alternative it may have available at the time in question.

The Company's share capital consists of an unlimited number of common shares without par value. Apart from the share purchase warrants and the incentive stock options described elsewhere, the Company has no convertible securities outstanding.

The Company had 43,192,762 common shares issued and outstanding at September 30, 2007, representing an increase of 115,000 during the quarter for new shares issued for options exercised, and an increase of 7,262,356 during the rest of the year that represents new shares issued equity financings and for warrants and options exercised. As of the date of this Registration Statement, 725,601 of the issued and outstanding shares were still held in escrow by three separate parties.

As of the date of this Registration Statement, the Company had Warrants outstanding as outlined in the following table.

Series | Number | Expiry | Exercise price | To purchase |

| | | | |

VI | 5,682,500 | 1/11/2010 | $0.60 until 1/11/2009 and after that time $0.70 until 1/11/2010 | 1 common share |

In the six months ended March 31, 2007, 1,275,000 Series II warrants were exercised at $0.25 per share and 52,857 Series III warrants were exercised at $0.45 per share. The Series IV warrants expired unexercised. The February financing included Series V warrants. During the quarter ended June 30, 2007, all the Compensation warrants, the remaining Sponsor warrants and all but 14,286 of the Series III warrants were exercised.

- 26 -

Following the increase in the Company's incentive stock option plan approved by the shareholders at an April 17, 2008 Annual and Special Meeting, options may be granted on a total of 9,775,000 shares. This is a fixed number approval that may not exceed 20% of issued and outstanding shares. The total number of shares on which options had been granted and remained outstanding under the Company's incentive stock option plan at the end of the fiscal year ended September 30, 2007, taking into account all prior exercises, expiries and cancellations, was 5,985,000.

Expiry | Number | Exercise price | To purchase |

May 2010 | 2,500,000 | $0.35 | 1 common share |

February 2011 | 400,000 | $0.85 | 1 common share |

May 2011 | 1,050,000 | $1.30 | 1 common share |

May 2011 | 75,000 | $1.33 | 1 common share |

May 2012 | 1,550,000 | $0.98 | 1 common share |

June 2012 | 50,000 | $0.90 | 1 common share |

August 2012 | 100,000 | $0.80 | 1 common share |

August 2012 | 50,000 | $0.90 | 1 common share |

September 2012 | 210,000 | $0.60 | 1 common share |

Total | 5,985,000 | | |

Summary of outstanding stock options under the Company's plan

During the fourth quarter of the fiscal year ended September 30, 2007, 115,000 options were exercised at a price of $0.38 per share. A further 100,000 options were granted to a consultant (expiring August 2012 and exercisable at $0.80 per share); 50,000 options were granted to a director (expiring August 2012 and exercisable at $0.90 per share) and 210,000 options were granted to employees and consultants (expiring September 2012 and exercisable at $0.60 per share). Subsequent to the end of the quarter a director resigned from the board and 100,000 unvested options were cancelled, leaving 500,000 options (400,000 at $0.85 and 100,000 at $1.30) exercisable for 90 days from December 17, 2007, the effective date of the resignation. Also subsequent to the end of the fiscal year ended September 30, 2007, a total of 140,000 options were granted to two employees, subject to shareholder approval at the next annual meeting because they were in excess of the shares available in the plan at the time of grant. In addition, in February of 2008, the Company granted 100,000 incentive stock options to an investor relations firm. These stock options are exercisable at $0.49 per share for a period equal to the lesser of 30 days after termination and November 20, 2012. These options are subject to vesting at a rate of 25% every three months from the date of grant.