Filed by Endologix, Inc. Pursuant to Rule 425 Under the Securities Act of 1933 and deemed filed pursuant to Rule 14d-2 of the Securities Exchange Act of 1934 Subject Company: TriVascular Technologies, Inc. Commission File No.: 001-36419 |

|

OCTOBER 26, 2015

Combining innovation leaders to revolutionize aortic treatments

Endologix Third Quarter 2015 Results and TriVascular Merger

|

Safe Harbor

Endologix and TriVascular will remain separate operational entities until the closing of the proposed merger transaction. Until closing,

Endologix will not offer TriVascular products and TriVascular will not offer Endologix products.

Forward-Looking Statements

This presentation includes statements that may be forward-looking statements. The words “believe,” “expect,” “anticipate,” “project” and similar expressions, among others, generally

identify forward-looking statements. Endologix and TriVascular caution that these forward-looking statements are subject to risks and uncertainties that may cause actual results to

differ materially from those indicated in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the likelihood that the transaction is consummated

on a timely basis or at all, including whether the conditions required to complete the transaction will be met, realization of the expected benefits of the transaction, competition from

other products, changes to laws and regulations applicable to our industry, status of our ongoing clinical trials, clinical trial results, decisions and the timing of decisions of regulatory

authorities regarding our products and potential future products, risks relating to foreign currency fluctuations, and a variety of other risks. Additional information about the factors that

may affect the companies’ operations is set forth in Endologix’s and TriVascular’s annual and periodic reports filed with the Securities and Exchange Commission (the “SEC”). Neither

Endologix nor TriVascular undertakes any obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required

by law.

Additional Information and Where to Find It

The transaction referenced in this presentation has not yet commenced, and no proxies are yet being solicited. Endologix plans to file a registration statement on Form S–4 (“S-4”) that

will serve as a prospectus for Endologix shares to be issued as consideration in the merger and as a proxy statement of TriVascular for the solicitation of votes of TriVascular stockholders

to approve the proposed transaction (the “Proxy Statement/Prospectus”). This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an

offer to sell shares. It is also not a substitute for the S-4, the Proxy Statement/Prospectus or any other documents that Endologix or TriVascular may file with the SEC or send to

stockholders in connection with the proposed transaction. THE DEFINITIVE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT ENDOLOGIX,

TRIVASCULAR AND THE TRANSACTIONS. TRIVASCULAR STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN ITS ENTIRETY WHEN IT BECOMES

AVAILABLE BEFORE MAKING ANY DECISION REGARDING VOTING ON THE PROPOSED TRANSACTION. In addition to the SEC filings made in connection with the transaction, each of

Endologix and TriVascular files annual, quarterly and current reports and other information with the SEC. Endologix ’s and TriVascular’s filings with the SEC, including the Proxy

Statement/Prospectus once it is filed, are available to the public free of charge at the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by

TriVascular will be made available free of charge on TriVascular’s website at http://investors.trivascular.com. Copies of documents filed with the SEC by Endologix will be made available

free of charge on Endologix’s website at http://investor.endologix.com.

Participants in the Solicitation

Endologix, TriVascular and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies from TriVascular’s stockholders in connection

with the proposed transaction. Information regarding Endologix’s directors and executive officers is available in its proxy statement for its 2015 annual meeting of stockholders, which

was filed with the SEC on April 17, 2015; information regarding TriVascular’s directors and executive officers is available in its proxy statement for its 2015 annual meeting of

stockholders, which was filed with the SEC on April 14, 2015. Other information regarding the interests of such potential participants will be contained in the Proxy Statement/Prospectus

when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

2 |

|

|

Endologix 3Q 2015 Results

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

3 |

|

|

Merger Rationale

Growth Technology Synergies

Expanded global sales force

Broad product offering for AAA

Multiple new product launches over next 24 months

An innovation leader with broad clinical indications

Significant clinical evidence

370 issued and pending patents

Leverages best-in-class technology with strong commercial capability

Over $30 million in annual synergies by 2017

EBITDA accretive

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

4 |

|

|

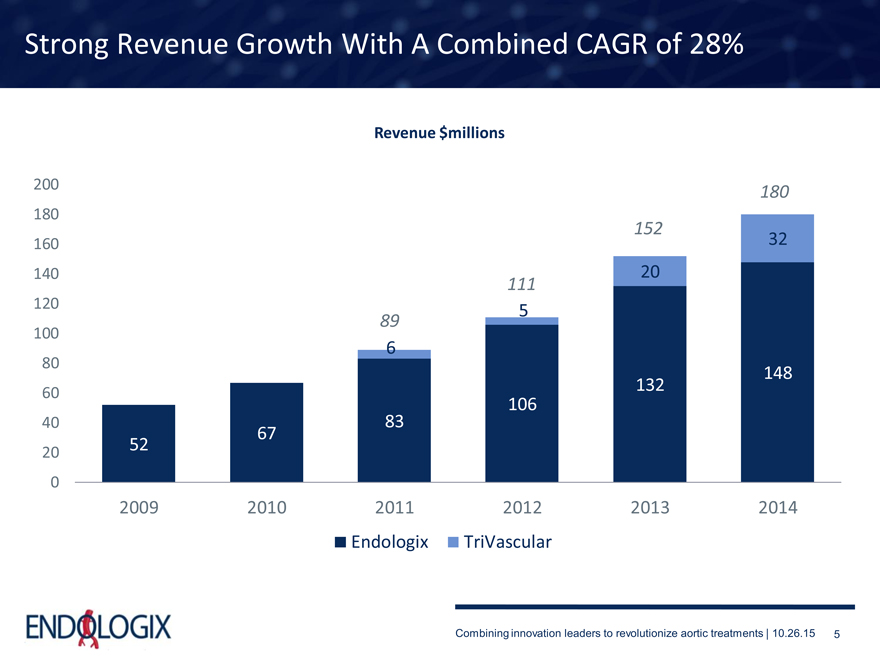

Strong Revenue Growth With A Combined CAGR of 28%

Revenue $millions

200

180

180 152

160 32 140 20

111

120 5

89

100

6 |

|

80

148 132

60

106

40 83

67 52

20

0

2009 2010 2011 2012 2013 2014

Endologix TriVascular

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

5 |

|

|

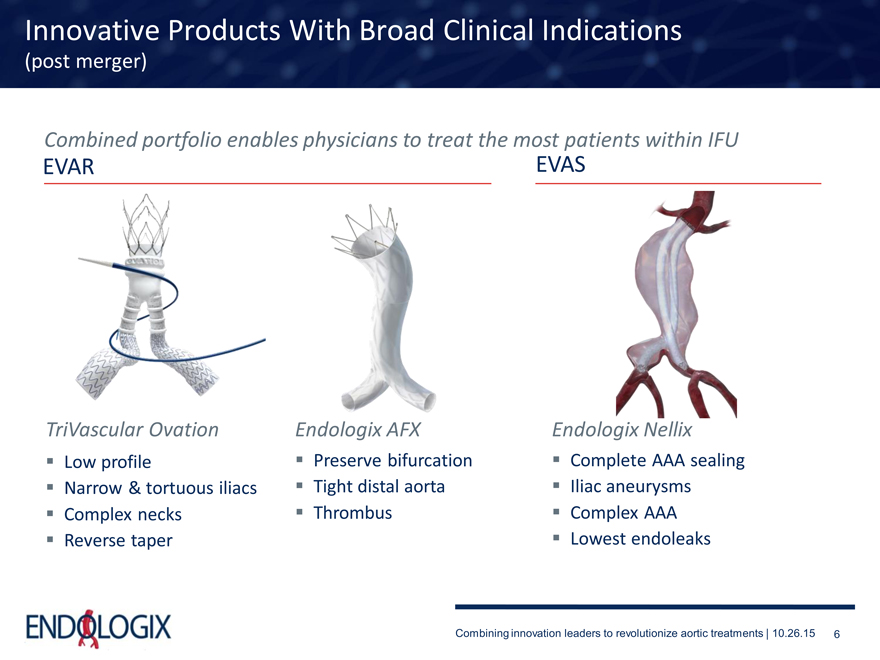

Innovative Products With Broad Clinical Indications

(post merger)

Combined portfolio enables physicians to treat the most patients within IFU

EVAR EVAS

TriVascular Ovation Endologix AFX Endologix Nellix

Low profile

Narrow & tortuous iliacs Complex necks Reverse taper

Preserve bifurcation Tight distal aorta Thrombus

Complete AAA sealing Iliac aneurysms Complex AAA Lowest endoleaks

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

6 |

|

|

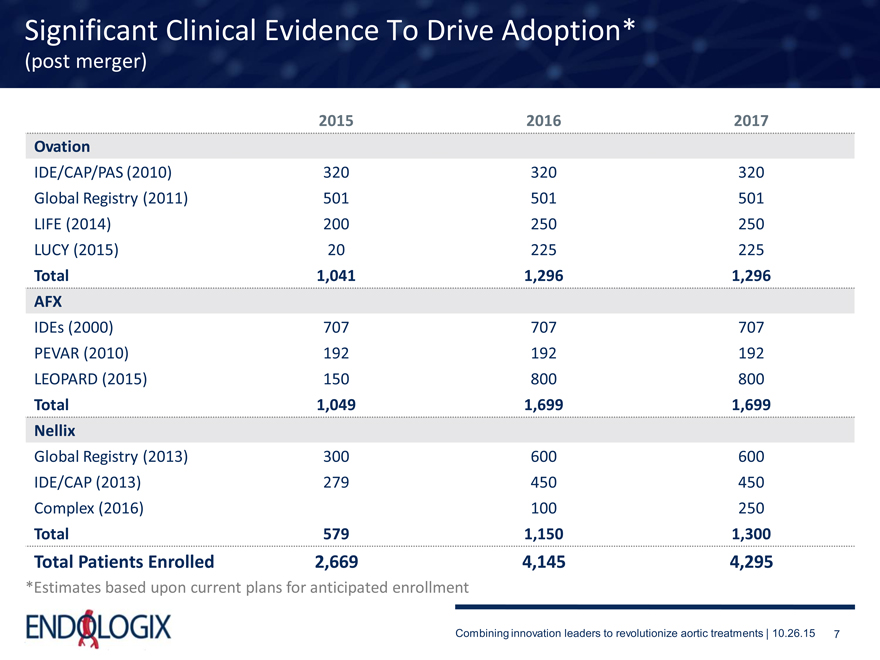

Significant Clinical Evidence To Drive Adoption*

(post merger)

2015 2016 2017 Ovation

IDE/CAP/PAS (2010) 320 320 320 Global Registry (2011) 501 501 501 LIFE (2014) 200 250 250 LUCY (2015) 20 225 225

Total 1,041 1,296 1,296 AFX

IDEs (2000) 707 707 707 PEVAR (2010) 192 192 192 LEOPARD (2015) 150 800 800

Total 1,049 1,699 1,699 Nellix

Global Registry (2013) 300 600 600 IDE/CAP (2013) 279 450 450 Complex (2016) 100 250

Total 579 1,150 1,300

Total Patients Enrolled 2,669 4,145 4,295

*Estimates based upon current plans for anticipated enrollment

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

7 |

|

|

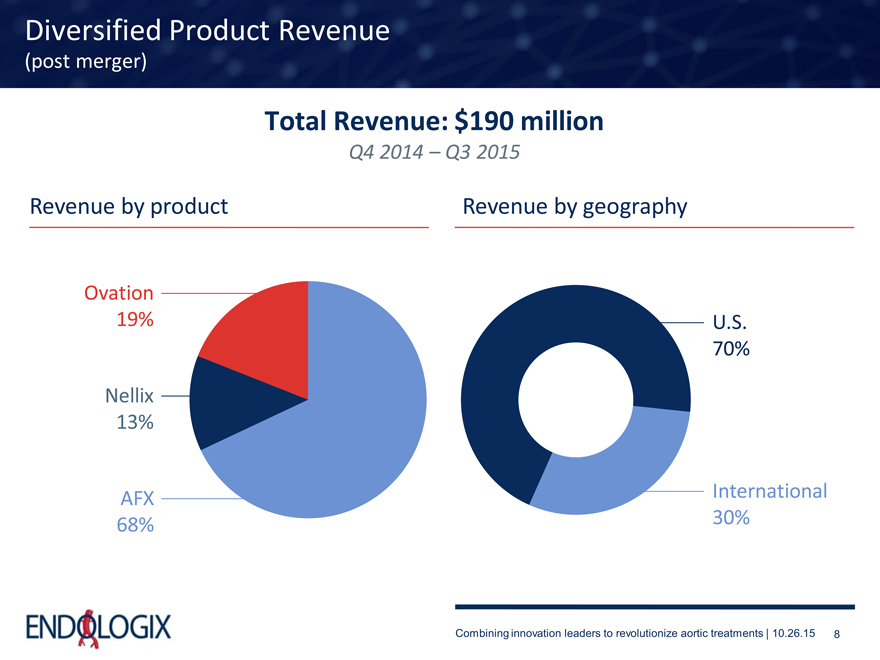

Diversified Product Revenue

(post merger)

Total Revenue: $190 million

Q4 2014 – Q3 2015

Revenue by product Revenue by geography

Ovation

19% U.S.

70%

Nellix

13%

AFX International 68% 30%

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

8 |

|

|

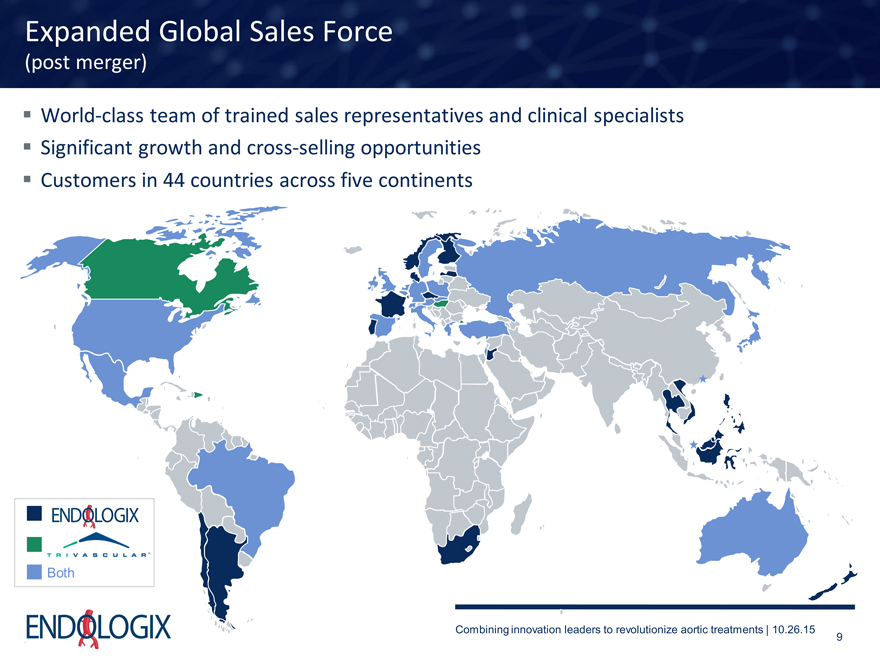

Expanded Global Sales Force

(post merger)

World-class team of trained sales representatives and clinical specialists

Significant growth and cross-selling opportunities Customers in 44 countries across five continents

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

Both

9

|

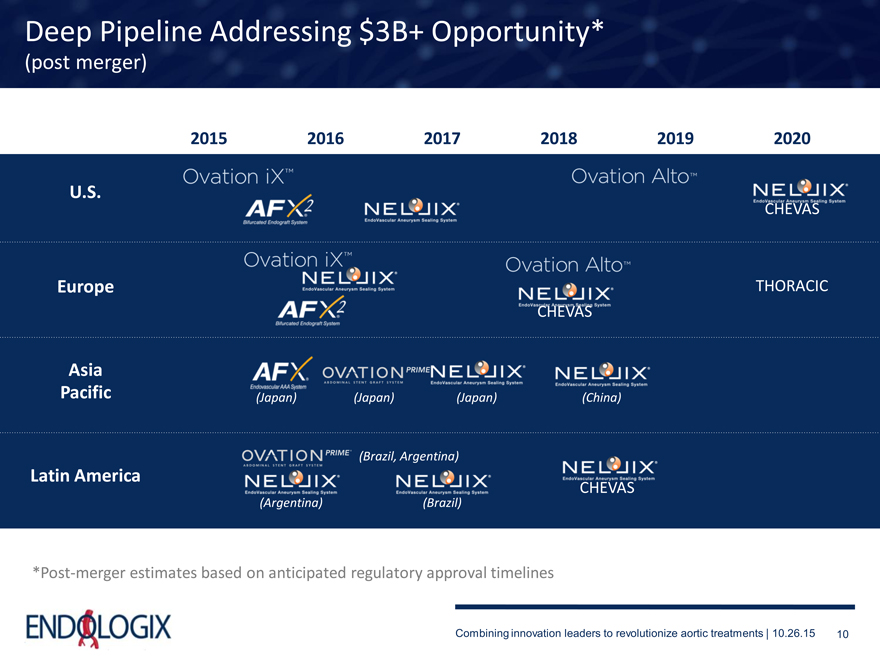

Deep Pipeline Addressing $3B+ Opportunity*

(post merger)

2015 2016 2017 2018 2019 2020

U.S.

CHEVAS

Europe THORACIC CHEVAS

Asia

Pacific (Japan) (Japan) (Japan) (China)

(Brazil, Argentina)

Latin America

CHEVAS

(Argentina) (Brazil)

*Post-merger estimates based on anticipated regulatory approval timelines

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

10

|

Transaction Overview

$211 million of consideration consisting of Endologix stock and cash(1)

Transaction $9.10 per share

Terms 13.56 million Endologix shares, representing ~16.2% ownership

~$24 million in cash consideration

~$13 million for intrinsic value of outstanding equity awards(2)

~$11 million representing conversion value of TriVascular convertible debt(3)

Combined cash balance of $123 million as of June 30, 2015(4)

Balance Sheet

$150 million convertible debt offering to pay down higher cost TriVascular

existing debt and fund growth initiatives

Expected to close in the first quarter of 2016

Timing / Regulatory approvals

Next Steps Subject to customary closing conditions

Subject to TriVascular shareholder approval

1 As of October 23, 2015 and subject to change based upon Endologix stock price at closing. Assumes conversion of TriVascular convertible debt

2 Intrinsic value of TriVascular equity awards will be paid to shareholders and is based on 2.3M options, 0.8M restricted stock units, and 0.4M warrants

3 Assumes conversion of TriVascular convertible debt into 1.25M TriVascular shares and payment of conversion value to shareholders

4 Combined cash balance includes Endologix and TriVascular cash and cash equivalents and short-term marketable securities as of June 30, 2015 before the effect

of the issuance of the convertible notes and cash payments related to the acquisition of TriVascular

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

11

|

Creating a Leader in Growth and Innovation

Increased revenue growth

Broad AAA product line Expanded global sales force Significant clinical evidence

$30M+ synergies in 2017 and EBITDA accretive in 2018

Combining innovation leaders to revolutionize aortic treatments | 10.26.15

12

|

Treat more patients more effectively