|

Filed by: TriVascular Technologies, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: TriVascular Technologies, Inc. Commission File No.: 001-36419 TriVascular Employee Presentation

|

TriVascular Employee Presentation

All Employee Meeting

October 26, 2015

Confidential

Today’s announcement

Board has approved merger with Endologix

TriVascular shareholders will receive stock and cash consideration

After closing, new combined entity will continue to market Ovation and legacy products

Santa Rosa facility and core functions to remain intact

Deal is subject to regulatory and shareholder approval

No immediate changes; companies remain independent competitors until transaction closes 2

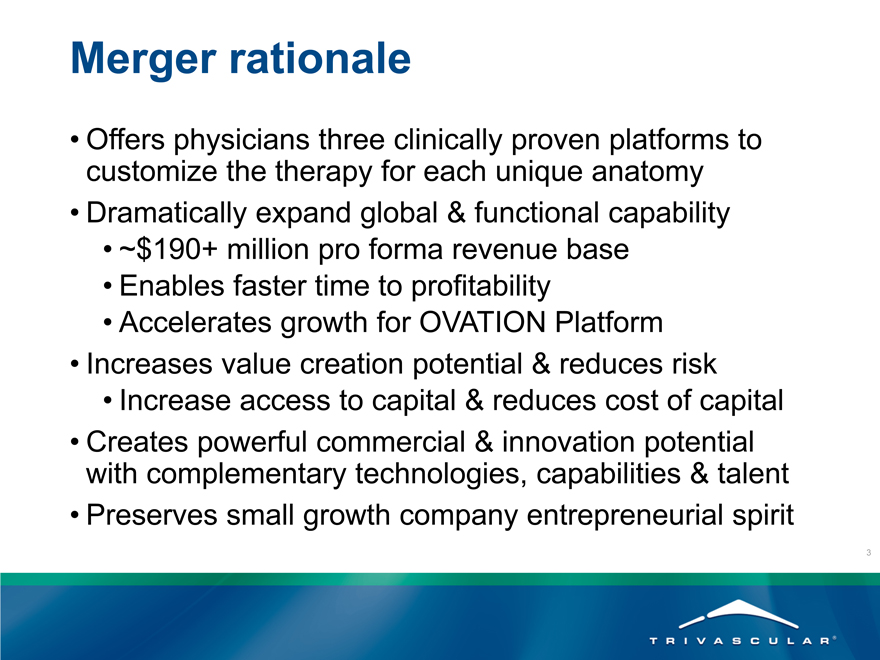

Merger rationale

Offers physicians three clinically proven platforms to customize the therapy for each unique anatomy

Dramatically expand global & functional capability

~$190+ million pro forma revenue base

Enables faster time to profitability

Accelerates growth for OVATION Platform

Increases value creation potential & reduces risk

Increase access to capital & reduces cost of capital

Creates powerful commercial & innovation potential with complementary technologies, capabilities & talent

Preserves small growth company entrepreneurial spirit

3

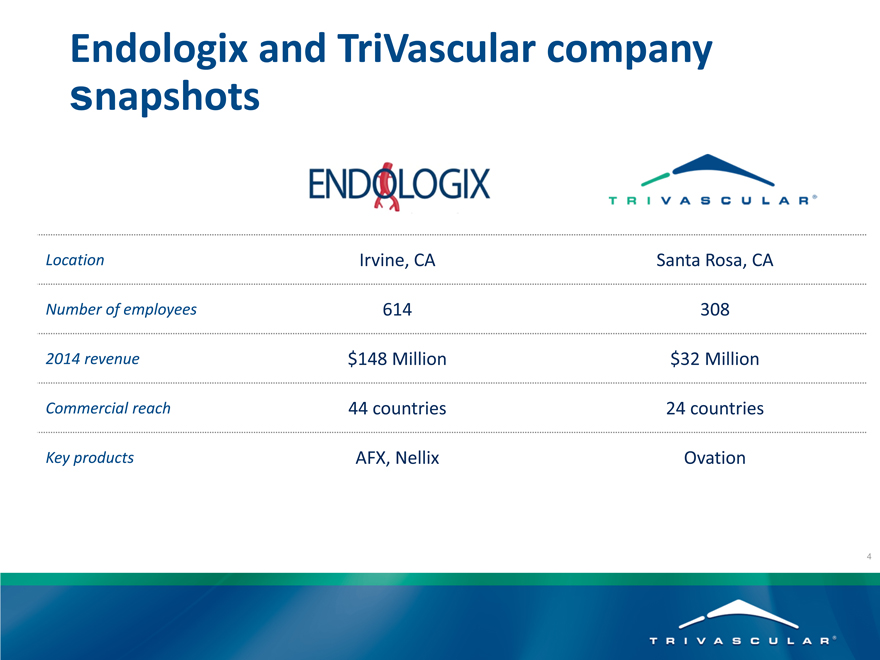

Endologix and TriVascular company snapshots

Location Irvine, CA Santa Rosa, CA

Number of employees 614 308

2014 revenue $148 Million $32 Million

Commercial reach 44 countries 24 countries

Key products AFX, Nellix Ovation

4

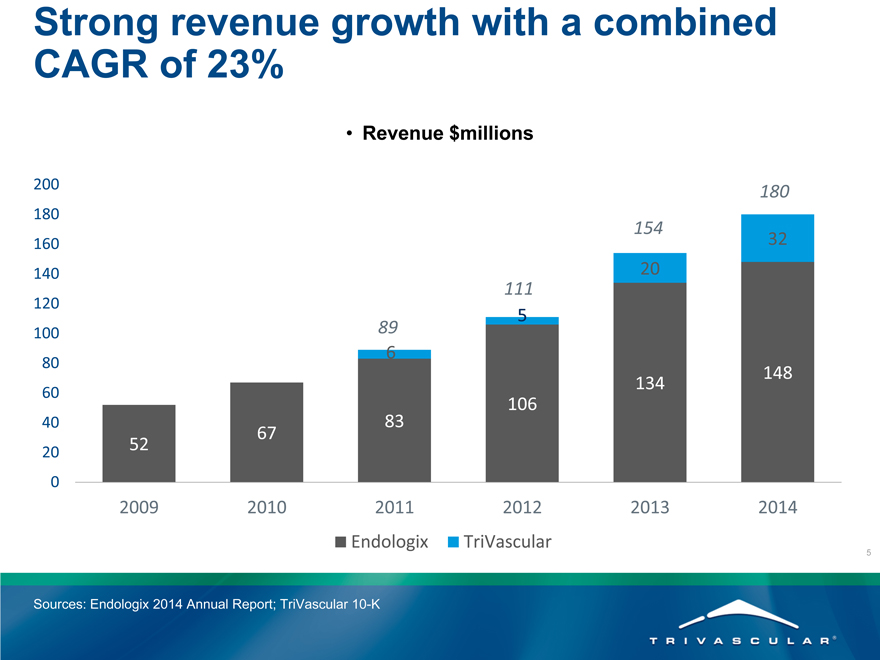

Strong revenue growth with a combined CAGR of 23%

Revenue $millions

200 180

180

154

160 32

140 20

111

120

5

100 89

6

80 148

60 134

106

40 83

67

20 52

0

2009 2010 2011 2012 2013 2014

Endologix TriVascular

Sources: Endologix 2014 Annual Report; TriVascular 10-K

5

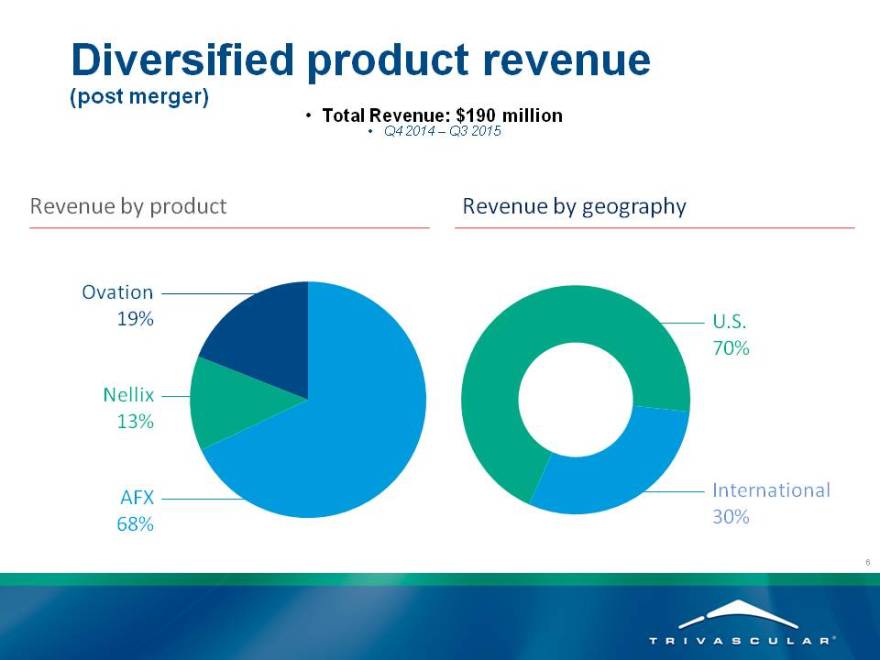

Diversified product revenue

(post merger)

Total Revenue: $190 million

Q4 2014 – Q3 2015

Revenue by product Revenue by geography

Ovation

19% U.S.

70%

Nellix

13%

AFX International

68% 30%

6

Founder’s Perspective

“If you make it clinically relevant, there will always be a path for the business”

John B. Simpson, MD

2002 TV1 “A” (pre-BSC)

[graphcies]

Is there a Better Way?

Can it be Made? Will it Work?

11

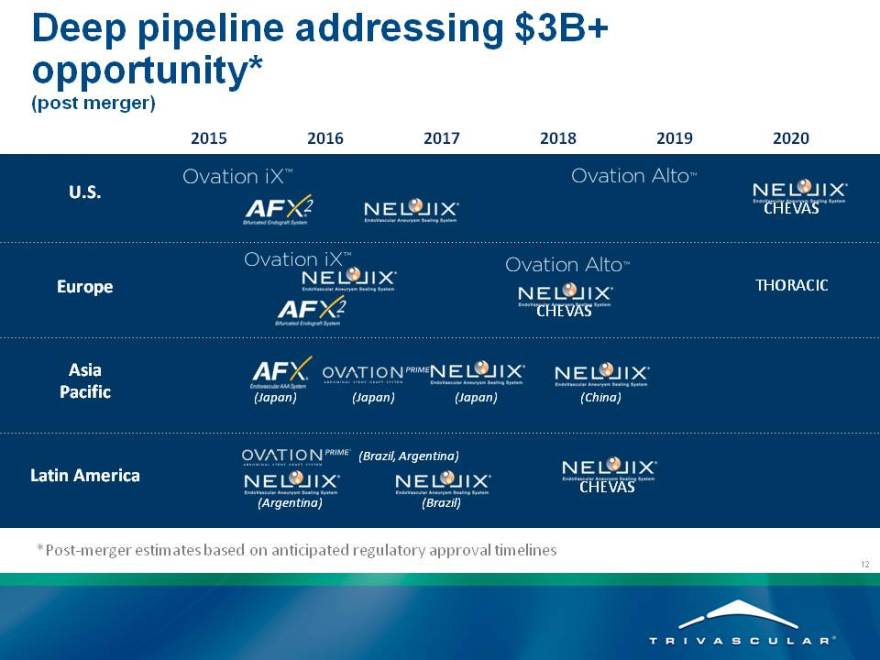

Deep pipeline addressing $3B+ opportunity*

(post merger)

2015 2016 2017 2018 2019 2020

U.S.

CHEVAS

Europe THORACIC

CHEVAS

Asia

Pacific (Japan) (Japan) (Japan) (China)

(Brazil, Argentina)

Latin America

CHEVAS

(Argentina) (Brazil)

*Post-merger estimates based on anticipated regulatory approval timelines

1 2

Clinical Perspective

The only company with multiple AAA treatment options

(post merger)

1 4

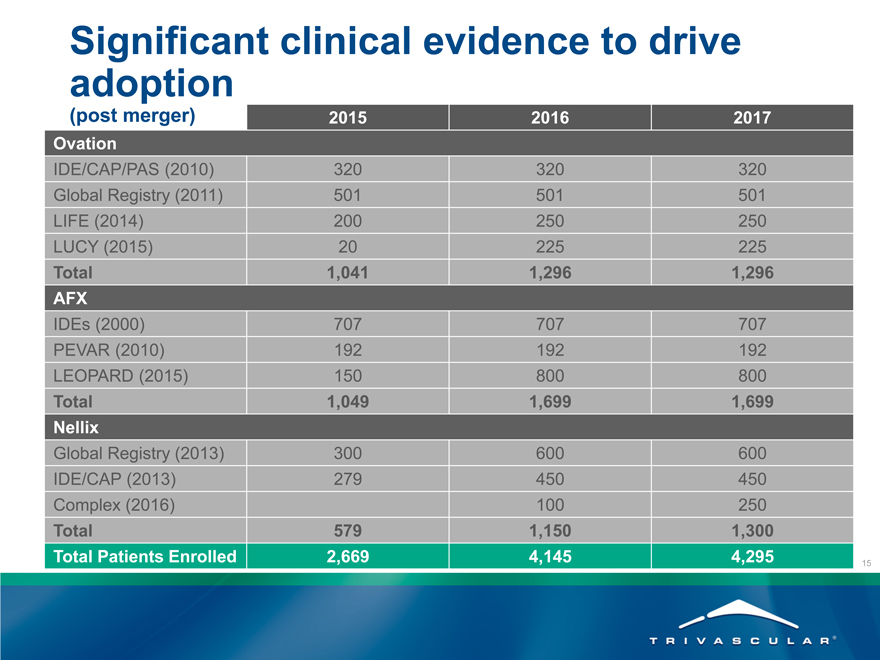

Significant clinical evidence to drive

adoption

(post merger) 2015 2016 2017

Ovation

IDE/CAP/PAS (2010) 320 320 320

Global Registry (2011) 501 501 501

LIFE (2014) 200 250 250

LUCY (2015) 20 225 225

Total 1,041 1,296 1,296

AFX

IDEs (2000) 707 707 707

PEVAR (2010) 192 192 192

LEOPARD (2015) 150 800 800

Total 1,049 1,699 1,699

Nellix

Global Registry (2013) 300 600 600

IDE/CAP (2013) 279 450 450

Complex (2016) 100 250

Total 579 1,150 1,300

Total Patients Enrolled 2,669 4,145 4,295

15

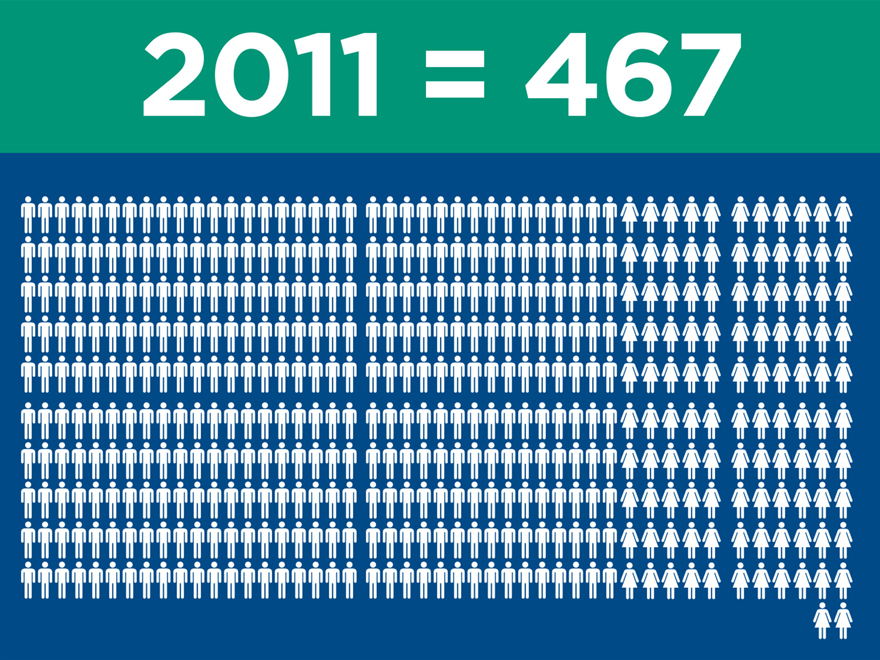

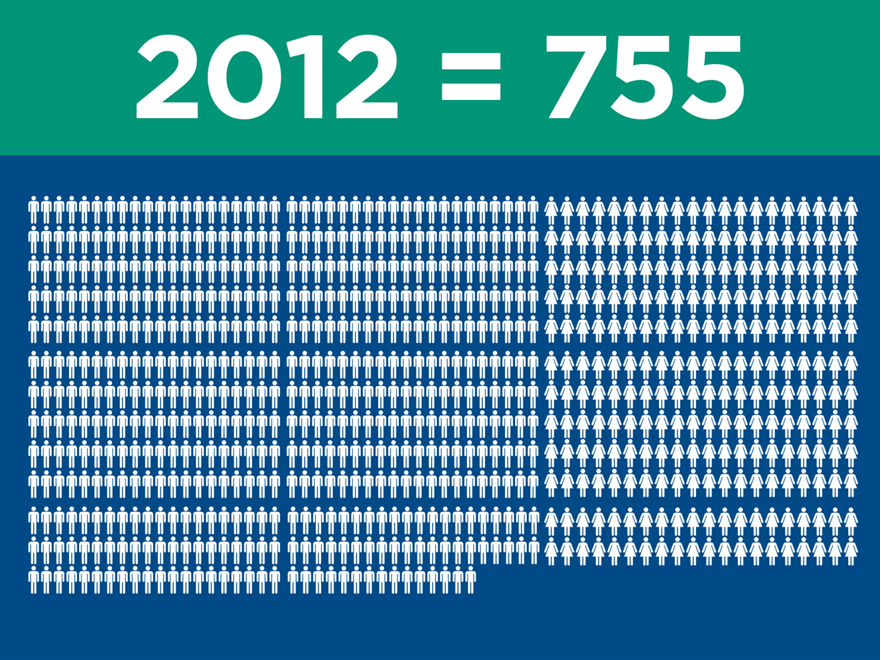

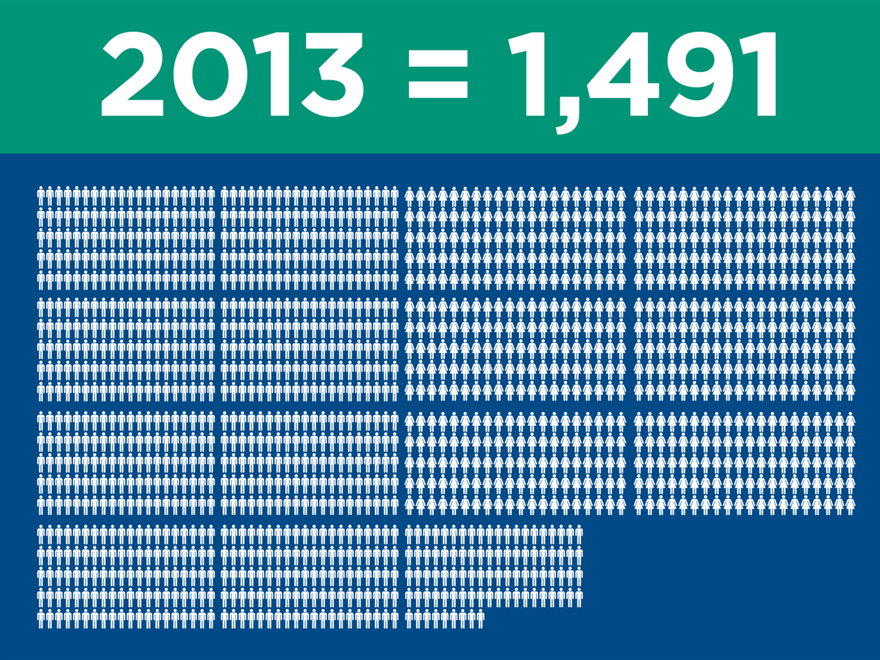

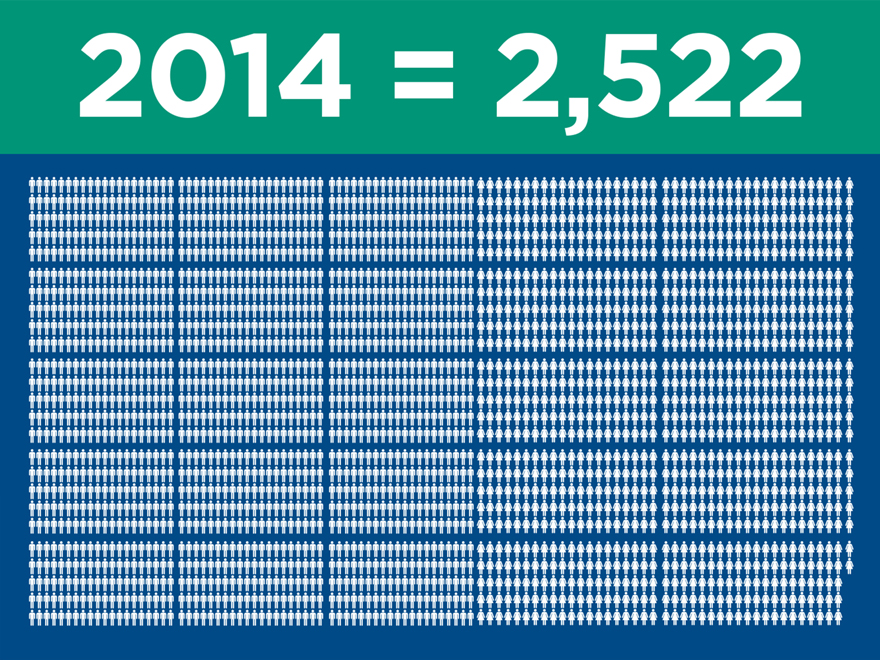

Commercial Perspective

16

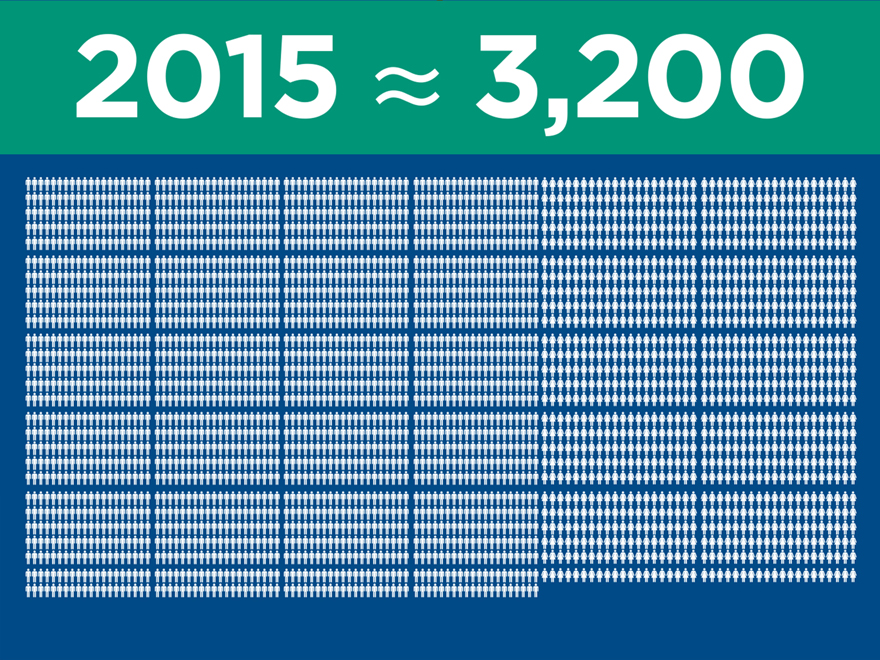

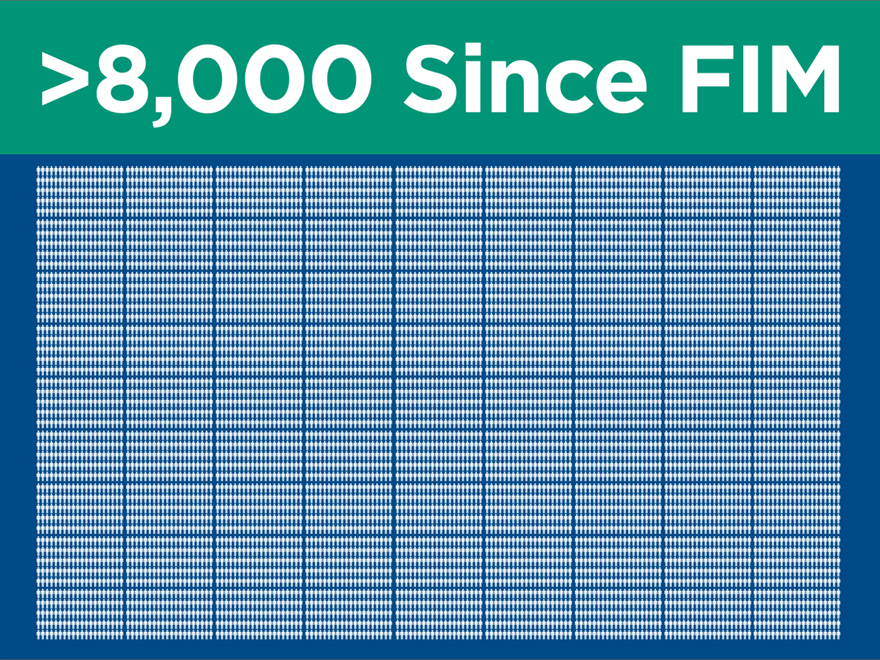

[graphcies]

[graphcies]

[graphcies]

[graphcies]

21

22

24

Employee Issues

25

Organization and talent

No decisions on employment will be made or communicated until after the merger is completed (Q1 2016)

Antitrust laws require that we continue to function as independent competing companies until the merger is complete – Business as usual

Endologix has indicated that Santa Rosa will continue to be an important part of the future of the organization

After the merger is complete, efficiencies will be identified across the new company – core functions will remain intact

Significant number of people will be invited to be part of the new Company post closing

26

Benefits and compensation

Merger Agreement requires compensation and benefits at least as favorable as what you have now for one year

Endologix required to honor eligibility and years of service (vacation, PTO)

Open Enrollment – TRIV Health Plan will remain in place through early 2016

ESPP – will be terminated just before merger is complete and any cash remaining will be refunded

27

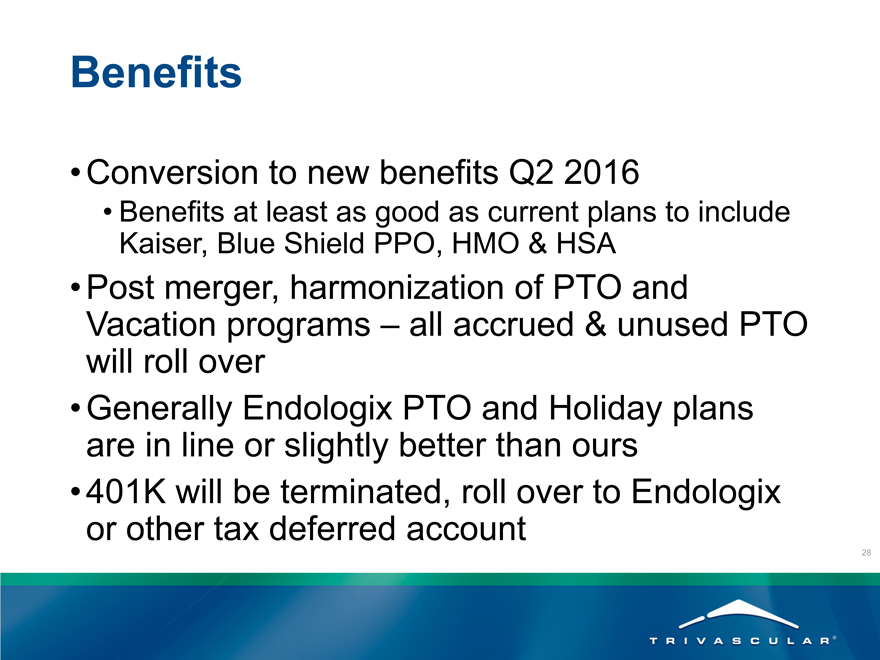

Benefits

Conversion to new benefits Q2 2016

Benefits at least as good as current plans to include Kaiser, Blue Shield PPO, HMO & HSA

Post merger, harmonization of PTO and

Vacation programs – all accrued & unused PTO will roll over

Generally Endologix PTO and Holiday plans are in line or slightly better than ours

401K will be terminated, roll over to Endologix or other tax deferred account

28

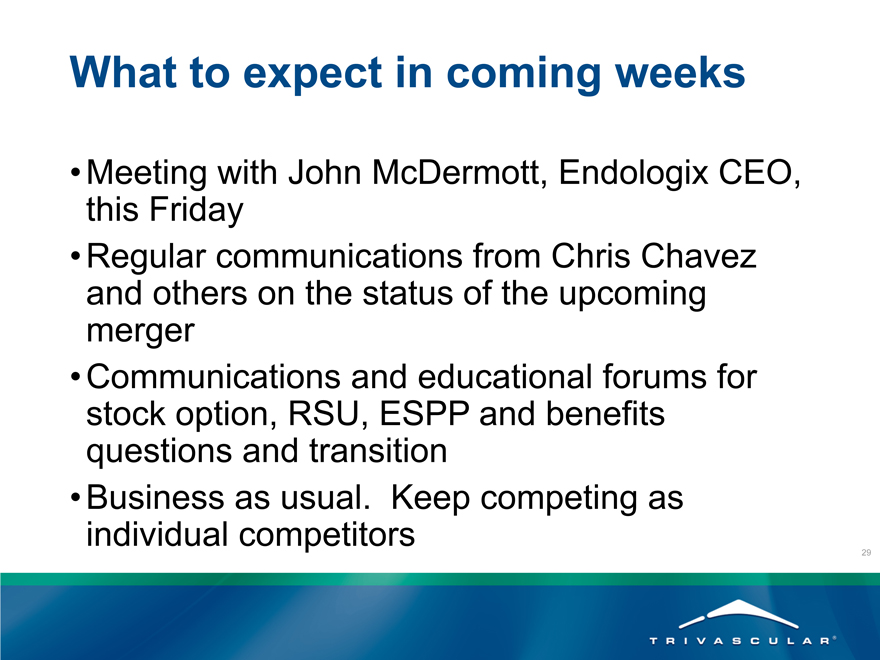

What to expect in coming weeks

Meeting with John McDermott, Endologix CEO, this Friday

Regular communications from Chris Chavez and others on the status of the upcoming merger

Communications and educational forums for stock option, RSU, ESPP and benefits questions and transition

Business as usual. Keep competing as individual competitors

29

Deal Structure/Overview

30

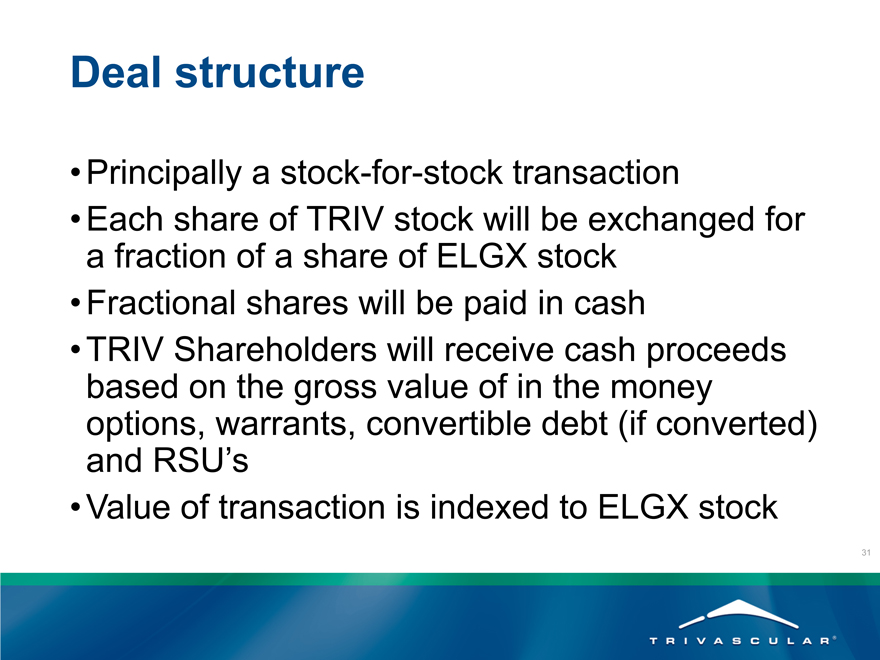

Deal structure

Principally a stock-for-stock transaction

Each share of TRIV stock will be exchanged for a fraction of a share of ELGX stock

Fractional shares will be paid in cash

TRIV Shareholders will receive cash proceeds based on the gross value of in the money options, warrants, convertible debt (if converted) and RSU’s

Value of transaction is indexed to ELGX stock

31

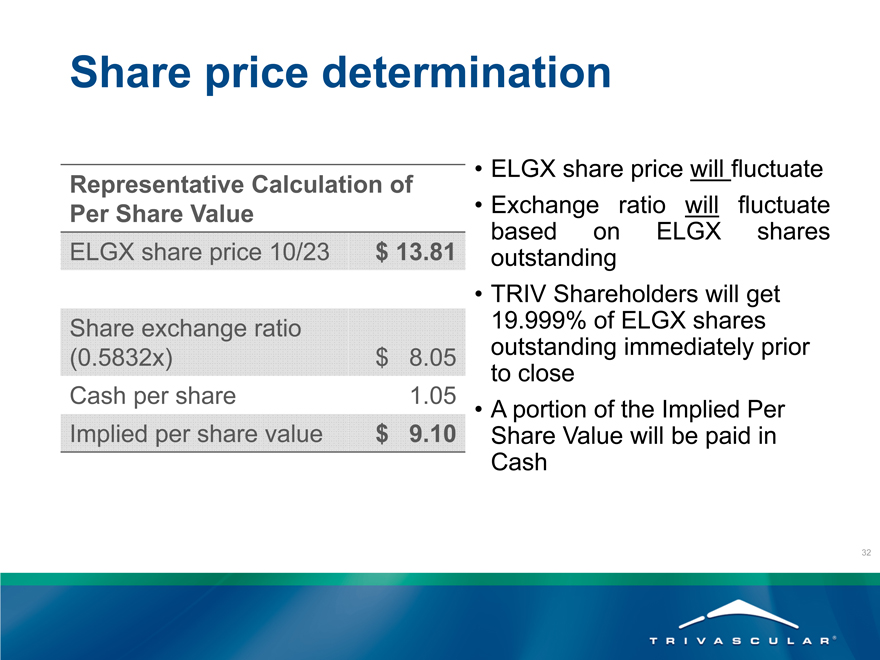

Share price determination

Representative Calculation of

Per Share Value

ELGX share price 10/23 $ 13.81

Share exchange ratio

(0.5832x) $ 8.05

Cash per share 1.05

Implied per share value $ 9.10

26

ELGX share price will fluctuate Exchange ratio will fluctuate based on ELGX shares outstanding TRIV Shareholders will get

19.999% of ELGX shares outstanding immediately prior to close A portion of the Implied Per Share Value will be paid in Cash

32

Options & RSU’s

All outstanding Options and RSU’s will vest prior to close

Employees will have a window to exercise “in-the-money” options

Exercised options and RSU’s will receive ELGX stock + cash consideration at close

Unexercised options will be canceled

33

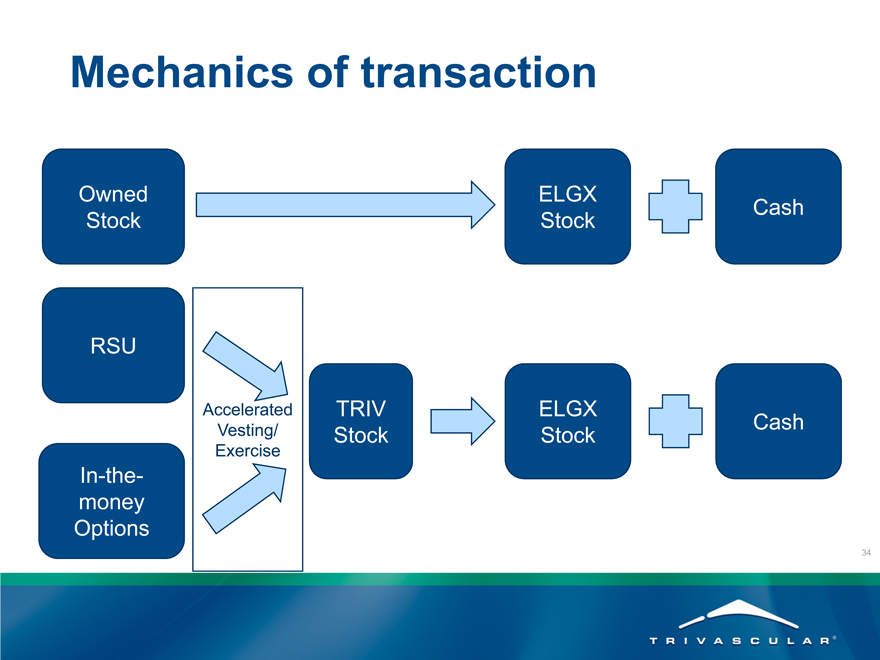

Mechanics of transaction

Owned

Stock

RSU

In-the-money Options

Accelerated Vesting/ Exercise

TRIV Stock

ELGX

Stock

ELGX Stock

Cash

Cash

34

Wrap-up

35

Highlights of our future merged company: benefits to key stakeholders

Patients

Customers

Employees

Investors

Broadest indications for more on-label treatments Complex AAA and TAA solutions Enabling individualized AAA treatment

Aortic innovation leader with 370 patents and robust pipeline Broadest portfolio of solutions and clinical indications Exceptional clinical support and significant clinical evidence

Opportunity to save lives through advanced technology Global innovation leader Financial strength with strong revenue growth

Significant revenue growth powered by differentiated technology

Substantial synergies accretive in 2018

36

Timing/next steps

Now – Deal Close ? Continue to operate as independent competitors ? Integration planning (primarily by Endologix) ? Communications regarding intended organization

? Employees ? Customers ? Suppliers ? Partners

Post Deal Close ? Begin integration process

? Clarify new roles in organization (within 1 week)

37

|

|

Forward-Looking Statements: This communication includes statements that may be forward-looking statements. The words “believe,” “expect,” “anticipate,” “project” and similar expressions, among others, generally identify forward-looking statements. Endologix and TriVascular caution that these forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the likelihood that the transaction is consummated on a timely basis or at all, including whether the conditions required to complete the transaction will be met, realization of the expected benefits of the transaction, competition from other products, changes to laws and regulations applicable to our industry, status of our ongoing clinical trials, clinical trial results, decisions and the timing of decisions of regulatory authorities regarding our products and potential future products, risks relating to foreign currency fluctuations, and a variety of other risks. Additional information about the factors that may affect the companies’ operations is set forth in Endologix’s and TriVascular’s annual and periodic reports filed with the Securities and Exchange Commission (the “SEC”). Neither Endologix nor TriVascular undertakes any obligation to release publicly any revisions to forward-looking statements as a result of subsequent events or developments, except as required by law.

38

Additional Information and Where to Find It: The transaction referenced in this communication has not yet commenced, and no proxies are yet being solicited. Endologix plans to file a registration statement on Form S–4 (“S-4”) that will serve as a prospectus for Endologix shares to be issued as consideration in the merger and as a proxy statement of TriVascular for the solicitation of votes of TriVascular stockholders to approve the proposed transaction (the “Proxy Statement/Prospectus”). This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares. It is also not a substitute for the S-4, the Proxy Statement/Prospectus or any other documents that Endologix or TriVascular may file with the SEC or send to shareholders in connection with the proposed transaction. THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT ENDOLOGIX,

TRIVASCULAR AND THE TRANSACTIONS. TRIVSCULAR STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY DECISION REGARDING VOTING ON THE PROPOSED TRANSACTION. In addition to the SEC filings made in connection with the transaction, each of Endologix and TriVascular files annual, quarterly and current reports and other information with the SEC. Endologix’s and TriVascular’s filings with the SEC, including the Proxy Statement/Prospectus once it is filed, are available to the public free of charge at the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by TriVascular will be made available free of charge on TriVascular’s website at http://investors.trivascular.com. Copies of documents filed with the SEC by Endologix will be made available free of charge on Endologix’s website at http.//investor.endologix.com.

Participants in the Solicitation: Endologix, TriVascular and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies from TriVascular’s stockholders in connection with the proposed transaction. Information regarding Endologix’s directors and executive officers is available in its proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 17, 2015; information regarding TriVascular’s directors and executive officers is available in its proxy statement for its 2015 annual meeting of stockholders, which was filed with the SEC on April 14, 2015. Other information regarding the interests of such potential participants will be contained in the Proxy Statement/Prospectus when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

39