UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ___)

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under § 240.14a-12 |

TRIVASCULAR TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

TriVascular Technologies, Inc.

3910 Brickway Blvd.

Santa Rosa, California 95403

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2015

To the Stockholders of TriVascular Technologies, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (“Annual Meeting”) of TriVascular Technologies, Inc., a Delaware corporation (the “Company”), will be held on May 21, 2015, at 9:00 a.m. local time, at the offices of Arnold & Porter LLP, Three Embarcadero Center, San Francisco, California 94111 for the following purposes:

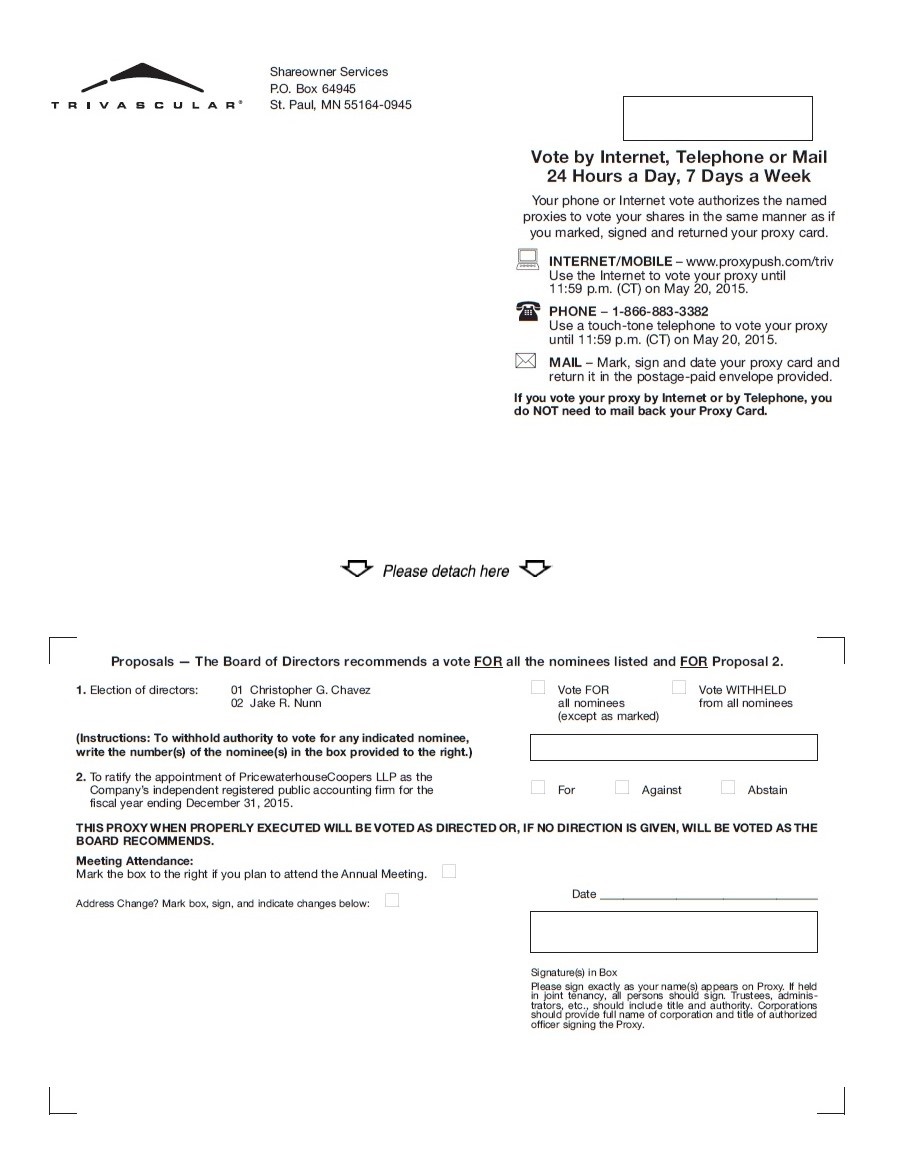

1. To elect two directors to hold office until the 2018 annual meeting of stockholders or until their successors are elected;

2. To ratify the selection, by the Audit Committee of our Board of Directors, of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2015; and

3. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders who owned our common stock at the close of business on March 30, 2015 (the “Record Date”) can vote at this meeting or any adjournments that take place.

Our Board of Directors recommends that you vote FOR the election of the director nominees named in Proposal No. 1 of the Proxy Statement and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm as described in Proposal No. 2 of the Proxy Statement.

YOUR VOTE IS VERY IMPORTANT TO US. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT AS SOON AS POSSIBLE IN THE ENCLOSED RETURN ENVELOPE. NO POSTAGE NEED BE AFFIXED IF THE ENCLOSED RETURN ENVELOPE IS MAILED IN THE UNITED STATES. IF YOU RECEIVE MORE THAN ONE PROXY CARD BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY CARD SHOULD BE SIGNED AND RETURNED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

By Order of the Board of Directors

Christopher G. Chavez

President, Chief Executive Officer and Chairman

Santa Rosa, California

April 14, 2015

TABLE OF CONTENTS

TriVascular Technologies, Inc.

3910 Brickway Blvd.

Santa Rosa, California 95403

PROXY STATEMENT FOR THE 2014 ANNUAL MEETING

OF STOCKHOLDERS TO BE HELD MAY 21, 2015

We have sent you this Proxy Statement and the enclosed Proxy Card because the Board of Directors (the “Board”) of TriVascular Technologies, Inc. (referred to herein as the “Company”, “TriVascular”, “we”, “us” or “our”) is soliciting your proxy to vote at our 2015 Annual Meeting of Stockholders to be held on Thursday, May 21, 2015, at 9:00 a.m. local time, at the offices of Arnold & Porter LLP, Three Embarcadero Center, San Francisco, California 94111.

· | This Proxy Statement summarizes information about the proposals to be considered at the Meeting and other information you may find useful in determining how to vote. |

· | The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We are mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and Proxy Card to our stockholders of record as of March 30, 2015 (the “Record Date”) for the first time on or about April 14, 2015. In this mailing, we are also including our Annual Report on Form 10-K (“Form 10-K”) for the year ended December 31, 2014, which Form 10-K constitutes our 2014 Annual Report to Stockholders (“2014 Annual Report”). In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the 2014 Annual Report so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. The Company’s Annual Report on Form 10-K is also available in the “Financials & Filings” section of our website at http://investors.trivascular.com.

The only voting securities of TriVascular are shares of common stock, $0.01 par value per share (the “common stock”), of which there were 20,392,915 shares outstanding as of the Record Date. We need the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote, to be present in person or represented by proxy, to hold the Annual Meeting.

1

INFORMATION ABOUT THE PROXY PROCESS AND VOTING

Why am I receiving these materials?

We have sent you this proxy statement and the enclosed proxy card because the Board of Directors of TriVascular Technologies, Inc. is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about April 14, 2015 to all stockholders of record entitled to vote at the Annual Meeting.

When and where will the Annual Meeting be held?

The Annual Meeting will be held on Thursday, May 21, 2015, at 9:00 a.m. local time, at the offices of Arnold & Porter LLP, Three Embarcadero Center, San Francisco, California 94111.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 30, 2015, or the Record Date, will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 20,392,915 shares of common stock issued and outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, Wells Fargo Bank, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed Proxy Card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid Proxy Card from your broker or other agent.

What am I being asked to vote on?

You are being asked to vote on two (2) proposals:

· | Proposal No. 1—the election of two Class I directors to hold office until our 2018 Annual Meeting of Stockholders; and |

· | Proposal No. 2—the ratification of the selection, by the audit committee of our Board, of Pricewaterhouse Coopers LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

2

How do I vote?

· | For Proposal 1, you may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify or you may abstain from voting. |

· | For Proposal 2, you may either vote “For” or “Against” or abstain from voting. |

Please note that by casting your vote by proxy you are authorizing the individuals listed on the Proxy Card to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy by using the accompanying Proxy Card, over the Internet or by telephone. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person. In such case, your previously submitted proxy will be disregarded.

· | To vote in person, you may come to the Annual Meeting, and we will give you a ballot when you arrive. |

· | To vote using the Proxy Card, simply complete, sign and date the accompanying Proxy Card and return it promptly in the envelope provided. If you return your signed Proxy Card to us before the Annual Meeting, we will vote your shares as you direct. |

· | To vote by proxy over the Internet, please follow the instructions provided on the Proxy Card. |

· | To vote by proxy by telephone, please call the toll free number provided on the Proxy Card. |

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Who counts the votes?

Wells Fargo Bank, N.A. (“Wells Fargo”) has been engaged as our independent agent to receive executed Proxy Cards. If you are a stockholder of record, your executed Proxy Card is returned directly to Wells Fargo for tabulation. As noted above, if you hold your shares through a broker, your broker returns one Proxy Card to Wells Fargo on behalf of all its clients. Kimberley Elting, our Vice President, Corporate Affairs, General Counsel, Chief Compliance Officer and Secretary, has been appointed Inspector of Election for the Annual Meeting.

How are votes counted?

Votes will be counted by the Inspector of Election appointed for the Annual Meeting, who will separately count “For” and (with respect to Proposal 2) “Against” votes, abstentions and broker non-votes. In addition, with respect to the election of directors, the Inspector of Election will count the number of “Withheld” votes received for the nominees. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to

3

obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding: “What are “broker non-votes?” and “Which ballot measures are considered “routine” and “non-routine”?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine?”

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2015 (Proposal 2) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2. The election of directors (Proposal 1) is considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal 1.

How many votes are needed to approve the proposal?

With respect to Proposal No. 1, the election of directors, the two nominees receiving the highest number of votes will be elected. Withheld votes and broker non-votes will have no effect on the election of directors.

With respect to Proposal No. 2, the affirmative vote of the holders of a majority of the shares present, in person or represented by proxy and entitled to vote is required to ratify the appointment of Pricewaterhouse Coopers LLP as our independent registered public accounting firm. Abstentions will not be voted and will have the effect of a vote against this proposal. Broker non-votes will not be counted in determining the number of shares necessary for approval and will have no effect on the outcome of this proposal.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What if I return a Proxy Card but do not make specific choices?

If we receive a signed and dated Proxy Card, and the Proxy Card does not specify how your shares are to be voted, your shares will be voted “For” the election of each of the two nominees for director, and “For” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

4

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the Proxy Cards or follow the instructions for any alternative voting procedure on each of the Proxy Cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

· | You may submit another properly completed proxy with a later date. |

· | You may send a written notice that you are revoking your proxy to our Corporate Secretary at 3910 Brickway Blvd., Santa Rosa, California 95403. |

· | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 16, 2015 to our Corporate Secretary at 3910 Brickway Blvd., Santa Rosa, California 95403; provided that if the date of the annual meeting is more than 30 days from May 21, 2016, the deadline is a reasonable time before we begin to print and send our proxy materials for next year’s annual meeting. If you wish to submit a proposal that is not to be included in our proxy materials for next year’s annual meeting or to nominate a director pursuant to our current bylaws, rather than the SEC’s stockholder proposal procedures, you must do so not less than 90 days nor more than 120 days prior to the first anniversary of the mailing of proxy materials for the preceding year’s annual meeting; provided that if the date of that annual meeting is more than 30 days before or more than 70 days after the first anniversary of the preceding year’s annual meeting, you must give notice not earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of (a) the 90th day prior to such annual meeting and (b) the tenth day following the day on which notice of the date of such annual meeting was mailed or public disclosure of the date of such annual meeting was made, whichever first occurs. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote are present in person or represented by proxy at the Annual Meeting. On the Record Date, there were 20,392,915 shares outstanding and entitled to vote. Accordingly, 10,196,458 shares must be represented by stockholders present at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the Annual Meeting may adjourn the Annual Meeting to another time or place.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Are there any implications of TriVascular being an “emerging growth company”?

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements. These

5

reduced reporting requirements include reduced disclosure about the company’s executive compensation arrangements and no non-binding advisory votes on executive compensation, among others. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Whom should I contact with other questions?

If you have any additional questions, please contact TriVascular’s Corporate Secretary by mail at 3910 Brickway Blvd., Santa Rosa, California 95403, or by telephone at 707-573-8800.

6

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Our Board of Directors, or our Board, is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Except as otherwise provided by law, vacancies on the Board (including vacancies created by increases in the number of directors) may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board currently consists of seven seated directors, divided into the three following classes:

· | Class I directors: Christopher G. Chavez and Jake R. Nunn, whose current terms will expire at the Annual Meeting; |

· | Class II directors: Daniel J. Moore and James P. Scopa, whose current terms will expire at the annual meeting of stockholders to be held in 2016; and |

· | Class III directors: Ryan D. Drant, Douglas A. Roeder and Robert W. Thomas, whose current terms will expire at the annual meeting of stockholders to be held in 2017. |

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third subsequent annual meeting of stockholders.

Mr. Chavez and Mr. Nunn have been nominated to serve as Class I directors, and each has agreed to stand for reelection. Each director to be elected will hold office from the date of their election by the stockholders until the third subsequent annual meeting of stockholders or until his successor is elected and has been qualified, or until such director’s earlier death, resignation or removal.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the meeting, meaning you have one vote for each share of common stock you own, and the two nominees receiving the highest number of votes will be elected. Withheld votes and broker non-votes will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF EACH NAMED NOMINEE.

7

The following table sets forth, for the Class I nominees (who are currently standing for re-election) and for our other current directors who will continue in office after the Annual Meeting, information with respect to their ages and position/office held within the company:

| | | | | | | | | | |

Name | | Age | | | Position/Office Held With the Company | | Director

Since | |

Class I Directors whose terms expire at the 2015 Annual Meeting of Stockholders | | | | |

Christopher G. Chavez | | | 59 | | | President, Chief Executive Officer and Chairman | | | 2012 | |

Jake R. Nunn (1) | | | 44 | | | Director | | | 2008 | |

Class II Directors whose terms expire at the 2016 Annual Meeting of Stockholders | | | | |

Daniel J. Moore (1)(2) | | | 54 | | | Director | | | 2010 | |

James P. Scopa (1)(3) | | | 56 | | | Director | | | 2008 | |

Class III Directors whose terms expire at the 2017 Annual Meeting of Stockholders | | | | |

Ryan D. Drant (2)(3) | | | 44 | | | Director | | | 2010 | |

Douglas A. Roeder (2) | | | 44 | | | Director | | | 2008 | |

Robert W. Thomas (3) | | | 53 | | | Director | | | 2008 | |

(1) | Member of the Audit Committee. |

(2) | Member of the Compensation Committee. |

(3) | Member of the Nominating and Corporate Governance Committee. |

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Three-Year Term Expiring at the 2018 Annual Meeting of Stockholders

Christopher G. Chavez joined us as President, Chief Executive Officer and Chairman in April 2012. Mr. Chavez has over 30 years of leadership experience in the medical device industry. From 2005 through August 2011, Mr. Chavez served as President of the Neuromodulation Division of St. Jude Medical, Inc., or St. Jude Medical, and served as CEO, President and Director of Advanced Neuromodulation Systems, or ANS, from 1998 until its acquisition by St. Jude Medical in 2005. Prior to ANS, Mr. Chavez spent 17 years at Johnson & Johnson, most recently as Vice President and General Manager of the Infection Control Business Unit. Mr. Chavez served on the board of directors of Advanced Medical Optics Inc. from 2002 until it was acquired by Abbott Laboratories Inc. in 2009. Mr. Chavez has previously served as Chairman of the Medical Device Manufacturers Association and Chairman of the Dallas/Fort Worth Health Industry Council. Mr. Chavez received his M.B.A. from Harvard Business School and his Bachelors of Accountancy from New Mexico State University, Las Cruces. We believe that Mr. Chavez’s detailed knowledge of our company and his more than 30 years of experience in the medical device industry qualify him to serve on our Board.

Jake R. Nunn has been a member of our board of directors since March 2008. Mr. Nunn joined New Enterprise Associates, Inc., a venture capital firm, in 2006 as a Partner, where he focuses on later-stage specialty pharmaceuticals, biotechnology and medical device investments. From January 2001 to June 2006, Mr. Nunn served as a Partner and an analyst for the MPM BioEquities Fund, a public life sciences fund at MPM Capital, L.P., a private equity firm, where he specialized in life sciences investing. Previously, Mr. Nunn was a healthcare research analyst and portfolio manager at Franklin Templeton Investments and an investment banker with Alex. Brown & Sons. Mr. Nunn currently serves on the boards of directors of Hyperion Therapeutics, Trevena, Inc. and Dermira, Inc. and previously served on the board of directors of Transcept Pharmaceuticals, Inc. Mr. Nunn received his A.B. in Economics from Dartmouth College and his M.B.A. from the Stanford Graduate School of Business. Mr. Nunn also holds the Chartered Financial Analyst designation, and is a member of the CFA Society of San Francisco. We believe that Mr. Nunn’s experience in investing in life sciences, later-stage specialty pharmaceuticals, biotechnology and medical device investments, as well as his business and educational background and CFA certification, qualify him to serve on our Board.

Directors Continuing in Office until the 2016 Annual Meeting of Stockholders

Daniel J. Moore has been a member of our board of directors since September 2010. Mr. Moore has served as President, Chief Executive Officer and Director of Cyberonics Inc. since May 2007. Mr. Moore joined Cyberonics

8

from Boston Scientific Corporation, where he held various positions in sales, marketing and senior management in the United States and in Europe, most recently as President, International Distributor Management. Mr. Moore also currently serves on the boards of directors of GI Dynamics, Inc. and an additional private company. Mr. Moore received his B.A. from Harvard College and his M.B.A. from Boston University. We believe that Mr. Moore’s extensive knowledge and experience from serving in various management and executive roles in the medical devices industry qualify him to serve on our Board.

James P. Scopa has been a member of our board of directors since March 2008. Mr. Scopa is a Managing Director in MPM Capital’s San Francisco office, having joined the firm in 2005. Previously, Mr. Scopa spent 18 years advising growth companies in biopharmaceuticals and medical devices at Deutsche Banc Alex. Brown and Thomas Weisel Partners. At Deutsche Banc Alex. Brown he served as Managing Director and Global Co-Head of Healthcare Investment Banking. At Thomas Weisel Partners he served on the Investment Committee for TWP’s Health Care venture fund as well as Co-Director of Healthcare Investment Banking. Mr. Scopa currently serves on the boards of directors of Conatus, Inc. and five additional private companies. Mr. Scopa received his A.B. from Harvard College, his M.B.A. from Harvard Business School and his J.D. from Harvard Law School. We believe that Mr. Scopa’s extensive knowledge of the healthcare industry, and experience with growth companies in the medical devices industry in particular, qualify him to serve on our Board.

Directors Continuing in Office until the 2017 Annual Meeting of Stockholders

Ryan D. Drant has been a member of our board of directors since July 2010. Mr. Drant has served as a General Partner with New Enterprise Associates, Inc. since 2004 where he specializes in healthcare investments in the medical device, healthcare information technology and specialty pharmaceutical sectors. Prior to joining NEA, Mr. Drant worked in the Health Care Investment Banking Group of Alex. Brown & Sons. Mr. Drant currently serves on the boards of directors of several additional private companies. Mr. Drant received his B.A. from Stanford University. We believe that Mr. Drant’s extensive knowledge of the healthcare industry, and in particular his substantial experience with medical device companies of various sizes, qualify him to serve on our Board.

Douglas A. Roeder has been a member of our board of directors since March 2008. Mr. Roeder joined Delphi Ventures as an Associate in 1998, and has been a Partner since 2000, focusing on medical devices, diagnostics and biotechnology. Prior to joining Delphi Ventures, Mr. Roeder was an Associate with Alex. Brown & Sons Healthcare Investment Banking Group in San Francisco, where he focused on the medical device, life sciences and healthcare services industries. He also previously worked with Putnam Associates, a strategy consulting firm focused on the pharmaceutical and biotechnology industries. Mr. Roeder currently serves on the boards of directors of Tandem Diabetes, Inc. and three additional private companies. Mr. Roeder received his A.B. from Dartmouth College. We believe that Mr. Roeder’s experience on several boards of directors of companies in the life sciences industry provides him with key skills in working with directors, understanding board process and functions and working with financial statements. We also believe that he brings to our board his long-term investing experience with numerous companies in the healthcare and medical device industries, all of which qualify him to serve on our Board.

Robert W. Thomas has been a member of our board of directors since March 2008. Mr. Thomas served as our interim executive chairman from January 2012 to April 2012. Mr. Thomas has served as a Venture Partner at Aphelion Capital, LLC, or Aphelion, since March 2013. Prior to joining Aphelion, Mr. Thomas served as Chief Executive Officer at Foxhollow Technologies Inc. from 1998 to 2006. Mr. Thomas also currently serves on the board of directors of Corium International Inc., and has served on the boards of four other private companies in the past five years. Mr. Thomas received his B.A. degree in Economics from Ursinus College. We believe that Mr. Thomas’ extensive knowledge and experience from serving as CEO of a public company and as an investor in companies at various stages of development qualify him to serve on our Board.

9

CORPORATE GOVERNANCE

Code of Conduct and Ethics

We have adopted a code of conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct and ethics is available on our website at http://investors.trivascular.com. We expect that any amendments to the code, or any waivers of its requirements, will be disclosed on our website. The reference to our web address does not constitute incorporation by reference of the information contained at or available through our website.

Independence of the Board of Directors

As required under the NASDAQ Stock Market, or NASDAQ, rules and regulations, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent NASDAQ listing standards, as in effect from time to time.

Consistent with these considerations, our Board has determined that all of our directors, other than Mr. Chavez, qualify as “independent” directors in accordance with the NASDAQ listing requirements. Mr. Chavez is not considered independent because he is one of our executive officers. The NASDAQ independence definition includes a series of objective tests, such as, for example, that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by NASDAQ rules, our Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

As required under NASDAQ rules and regulations, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present. All of the committees of our Board are comprised entirely of directors determined by the Board to be independent within the meaning of NASDAQ rules and regulations.

Leadership Structure of the Board

Our amended and restated bylaws and corporate governance principles do not require that our chairman and chief executive officer positions be separate, and our board of directors believes that Mr. Chavez’s service as both chairman of the board and Chief Executive Officer is in the best interest of our company and our stockholders. Mr. Chavez possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing us and our business and is, therefore, best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters in exercising its fundamental role of providing advice to and independent oversight of management. His combined role enables decisive leadership, ensures clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and suppliers. The Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate and in the best interests of the Company and its stockholders.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

10

Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related-party transactions. Our nominating and governance committee monitors the effectiveness of our corporate governance guidelines. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Board Committees

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process. Among other matters, the audit committee’s responsibilities include:

· | overseeing our company’s corporate accounting and financial reporting practices, the audits of the our financial statements by the company’s independent registered public accounting firm, and our internal audit function; |

· | monitoring the periodic reviews of the adequacy of the accounting and financial reporting processes and systems of internal control that are conducted by the independent registered public accounting firm and our company’s senior management, and internal audit function; |

· | appointing the independent registered public accounting firm; determining and approving the fees paid to such firm and reviewing and evaluating the qualifications, independence and performance of such firm; |

· | reviewing and evaluating the organization and performance of our company’s internal audit function; and |

· | preparing a report to be included in our company’s annual proxy statement as required by the rules and regulations of the SEC under U.S. federal securities laws. |

The current members of our audit committee are Mr. Moore, Mr. Nunn and Mr. Scopa. Mr. Nunn serves as the chairperson of the committee. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our Board has determined that Mr. Nunn qualifies as an “audit committee financial expert” as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of NASDAQ. Our Board has determined that each of the members of the audit committee are independent under the applicable rules of NASDAQ and under the applicable rules of the SEC, in particular, Rule 10A-3 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and NASDAQ. A copy of the audit committee charter is available on our website at http://investors.trivascular.com.

Compensation Committee

Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. Among other matters, the compensation committee’s responsibilities include:

· | reviewing our company’s overall compensation strategy, including base salary, incentive compensation and equity-based grants, to assure that it promotes stockholder interests and supports our strategic and tactical objectives, and that it provides for appropriate rewards and incentives for our management and employees; |

· | administering and, if necessary, revising our company’s 401(k) plan, any deferred compensation plans, and any additional employee benefit plans; |

11

· | reviewing with management our company’s major compensation-related risk exposures and the steps management has taken, or should consider taking, to monitor or mitigate such exposures; and |

· | overseeing our company’s compliance with regulatory requirements associated with compensation of our directors, executive officers and other employees, including reviewing the any executive compensation disclosures, any conflict of interest disclosure with regard to any compensation consultant retained by the compensation committee, and any other compensation disclosure prepared in response to disclosure requirements to the extent applicable to us. |

The compensation committee will review and evaluate, at least annually, its compliance with its charter. The current members of our compensation committee are Mr. Drant, Mr. Moore and Mr. Roeder. Mr. Roeder serves as chairperson of the compensation committee. Each of the members of our compensation committee is independent under the applicable rules and regulations of NASDAQ, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the U.S. Internal Revenue Code, or the Code, of 1986, as amended, or Section 162(m). The compensation committee operates under a written charter. A copy of the compensation committee charter is available on our website at http://investors.trivascular.com.

In 2014, as part of our process leading up to our initial public offering, we retained Barney & Barney, a national executive compensation consulting firm, determined to be independent based upon consideration of the factors set forth in the SEC rules and NASDAQ listing standards, to conduct market research and analysis to assist the committee in developing executive and non-employee director compensation levels, including appropriate salaries and target bonus percentages, as well as equity awards for our executives, non-employee directors, and employees based on compensation practices of publicly-traded peer companies.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for making recommendations to our Board regarding candidates for directorships and the size and composition of our Board. Among other matters, the nominating and corporate governance committee’s responsibilities include:

· | identifying, considering and nominating candidates for membership on the board of directors consistent with criteria approved by the board of directors; |

· | developing and recommending corporate governance guidelines and policies for our company; |

· | overseeing the evaluation of the board of directors and its committees, including an annual evaluation of the corporate governance committee; and |

· | advising the board of directors on corporate governance matters and board of directors performance matters, including recommendations regarding the structure and composition of the board of directors and its committees. |

The current members of our nominating and corporate governance committee are Mr. Drant, Mr. Scopa and Mr. Thomas. Mr. Scopa serves as the chairperson of the committee. Each of the members of our nominating and corporate governance committee is an independent director under the applicable rules and regulations of NASDAQ relating to nominating and corporate governance committee independence. The nominating and corporate governance committee operates under a written charter. A copy of the nominating and corporate governance committee charter is available on our website at http://investors.trivascular.com.

Director Nomination Process

In recommending candidates for election to the Board, the independent members of the nominating and corporate governance committee may consider the following criteria, among others: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience in the industries in which we compete; experience as a board member or executive officer of another publicly held company; diversity, including diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; conflicts of interest; and practical

12

and mature business judgment. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

The nominating and corporate governance committee will consider director candidates recommended by stockholders. For a stockholder to make any nomination for election to the Board at an annual meeting, the stockholder must provide notice to the Company, which notice must be delivered to, or mailed and received at, the Company’s principal executive offices not less than 90 days and not more than 120 days prior to the one-year anniversary of the mailing of proxy materials for the preceding year’s annual meeting; provided, that if the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, the stockholder’s notice must be delivered, or mailed and received, not earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of (a) the 90th day prior to such annual meeting and (b) the tenth day following the day on which notice of the date of such annual meeting was mailed or public disclosure of the date of such annual meeting was made, whichever first occurs. Further updates and supplements to such notice may be required at the times, and in the forms, required under our bylaws. As set forth in our bylaws, submissions must include, among other things, the name and address of the proposed nominee, information regarding the proposed nominee that is required to be disclosed in a proxy statement or other filings in a contested election pursuant to Section 14(a) under the Exchange Act, information regarding the proposed nominee’s indirect and direct interests in shares of the Company’s common stock, and a completed and signed representation and agreement of the proposed nominee. Our bylaws also specify further requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to make a nomination for director review a copy of our bylaws, as amended and restated to date, which is available, without charge, from our Corporate Secretary, at 3910 Brickway Blvd., Santa Rosa, California 95403.

Meetings of the Board of Directors, Board and Committee Member Attendance and Annual Meeting Attendance

Our Board met 6 times during the last fiscal year. The audit committee met 5 times, the compensation committee met 5 times and the nominating and corporate governance committee did not meet during the last fiscal year. During 2014, each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served. We encourage all of our local directors and nominees for directors, if any, to attend our annual meeting of stockholders; however, attendance is not mandatory.

Stockholder Communications with the Board of Directors

Should stockholders wish to communicate with the Board or any specified individual directors, such correspondence should be sent to the attention of the Corporate Secretary, at 3910 Brickway Blvd., Santa Rosa, California 95403. The Secretary will forward the communication to the Board members.

Compensation Committee Interlocks and Insider Participation

During 2014, our compensation committee consisted of Mr. Drant, Mr. Moore and Mr. Roeder. Mr. Roeder serves as the chairperson of the compensation committee. None of the members of our compensation committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers on our Board or compensation committee.

13

DIRECTOR COMPENSATION

In connection with, and effective as of, our IPO in April 2014, we implemented a Director Compensation Program for our non-employee directors. Under this Director Compensation Program, we pay our non-employee directors an annual cash retainer for services on the Board of Directors and for services on each committee of the Board of which the director is a member, payable in quarterly installments, and prorated for the remainder of the year in which our IPO was completed. The chairman of each committee receives higher retainers for such services instead of the fees other committee members receive. The annual fees payable to non-employee directors for services on the Board and for services on each committee of the board of directors of which the director is a member are as follows:

| | Member

Annual Retainer | | | Committee

Chairman

Annual Retainer | |

Board of Directors | | $ | 40,000 | | | $ | N/A | |

Audit Committee | | | 10,000 | | | | 20,000 | |

Compensation Committee | | | 7,500 | | | | 15,000 | |

Nominating and Corporate Governance Committee | | | 4,000 | | | | 8,000 | |

We also reimburse our non-employee directors for reasonable travel and out-of-pocket expenses incurred in connection with attending our Board and committee meetings.

In addition, under our Director Compensation Program, each non-employee director joining our board of directors following the completion of the IPO will be automatically granted an initial stock option to purchase 20,000 shares of our common stock, vesting monthly over a three-year period, subject to the director’s continued service as a director. Further, on the date immediately following the date of each of our annual stockholder meeting, including this Annual Meeting, each non-employee director who continues to serve as a non-employee member of the Board will be automatically granted an annual stock option for 10,000 shares of our common stock, vesting monthly over a one-year period, subject to the director’s continued service as a director. The exercise price of these options will equal the fair market value of our common stock on the date of grant. Each of these options will be granted under our 2014 Equity Incentive Plan, will have a term of ten years from the date of grant (subject to earlier termination in connection with a termination of service as provided in the plan), and will be subject to 100% vesting acceleration in the event of certain events constituting a change of control of our company.

This program is intended to provide a comprehensive compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders.

The following table sets forth information concerning the compensation earned by our non-employee directors during the year ended December 31, 2014:

Name | | Fees Earned or Paid in Cash | | | Option Awards | | | Total | |

Ryan D. Drant (1) | | $ | 38,625 | | | $ | — | | | $ | 38,625 | |

Daniel J. Moore | | $ | 43,125 | | | $ | — | | | $ | 43,125 | |

Jake R. Nunn (1) | | $ | 45,000 | | | $ | — | | | $ | 45,000 | |

Douglas A. Roeder (1) | | $ | 41,250 | | | $ | — | | | $ | 41,250 | |

James P. Scopa (1) | | $ | 43,500 | | | $ | — | | | $ | 43,500 | |

Robert W. Thomas | | $ | 33,000 | | | $ | — | | | $ | 33,000 | |

(1) | The fees paid with respect to the director’s services on our Board are paid directly to NEA, Delphi and MPM Capital, respectively, in accordance with their internal policies. |

14

As of December 31, 2014, our non-employee directors held the following outstanding options:

Name | | Number of Securities Underlying Unexercised Options Exercisable(1) | | | | Number of Securities Underlying Unexercised Options Unexercisable | | | Option Exercise Price | | | | Option Expiration Date |

Robert W. Thomas | | | 2,824 | | | | — | | | $ | 14.20 | | | | 10/5/2020 |

| | | 3,337 | | | | — | | | $ | 2.43 | | (2) | | 10/5/2020 |

| | 123 | | | | — | | | $ | 14.20 | | | | 1/30/2022 |

| | 574 | | | | 288 | | | $ | 2.43 | | (3) | | 1/30/2022 |

| | | 7,702 | | | | | 4,622 | | | $ | 2.43 | | | | 8/29/2022 |

| | | 1,334 | | | | | 3,595 | | | $ | 8.93 | | | | 11/29/2023 |

Daniel J. Moore | | | 2,824 | | | | — | | | $ | 14.20 | | | | 10/5/2020 |

| | | 3,337 | | | | — | | | $ | 2.43 | | (2) | | 10/5/2020 |

| | | 7,702 | | | | | 4,622 | | | $ | 2.43 | | | | 8/29/2022 |

| | | 1,334 | | | | | 3,595 | | | $ | 8.93 | | | | 11/29/2023 |

(1) | These option awards were granted to our non-employee directors under our 2008 Equity Incentive Plan and 1/48th of the options vest in equal monthly installments over a four-year period beginning one month following the applicable vesting commencement date. All options have a ten-year term and are subject to full vesting acceleration in the event of a change in control. |

(2) | Represents the portion of the option originally granted in October 2010 that was repriced from $14.20 to $2.43 per share in August 2012. |

(3) | Represents the portion of the option originally granted in January 2012 that was repriced from $14.20 to $2.43 per share in August 2012. |

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our Board has engaged PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2015, and is seeking ratification of such selection by our stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited our financial statements since the year ended December 31, 2008. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm. However, the audit committee is submitting the selection of PricewaterhouseCoopers LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain PricewaterhouseCoopers LLP. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

15

Principal Accountant Fees and Services

The following sets forth the types of services and aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for 2014 and 2013. All fees described below were approved by the audit committee:

| | Years Ended December 31, | |

| | 2014 | | | 2013 | |

Audit Fees (1) | | $ | 867,529 | | | $ | 1,437,456 | |

Audit-Related Fees | | — | | | — | |

Tax Fees | | — | | | — | |

All Other Fees | | — | | | — | |

Total Fees | | $ | 867,529 | | | $ | 1,437,456 | |

(1) | This category consists of fees for professional services rendered for the audit of our financial statements, review of interim financial statements, assistance with registration statements filed with the SEC, and services that are normally provided by PwC in connection with statutory and regulatory filings or engagements. Related to the year ended December 31, 2013, fees of $696,500 were billed in connection with the filing of our Registration Statements on Form S-1 in connection with the IPO. |

Pre-Approval Policies and Procedures

The audit committee pre-approves all audit and non-audit services provided by our independent registered public accounting firm. This policy is set forth in the charter of the audit committee and available at http://investors.trivascular.com/.

The audit committee approved all audit, audit-related, tax and other services provided by PricewaterhouseCoopers LLP for 2014 and 2013 and the estimated costs of those services. Actual amounts billed, to the extent in excess of the estimated amounts, were periodically reviewed and approved by the audit committee.

You have one vote for each share of common stock you own. The affirmative vote of the holders of a majority of the shares present, in person or represented by proxy and entitled to vote is required to ratify the appointment of Pricewaterhouse Coopers LLP as our independent registered public accounting firm. Abstentions will not be voted and will have the effect of a vote against this proposal. Broker non-votes will not be counted in determining the number of shares necessary for approval and will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THIS PROPOSAL NO. 2.

16

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The audit committee oversees our financial reporting process on behalf of the Company’s board of directors, but management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed and discussed with PricewaterhouseCoopers LLP, which is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including Auditing Standard No. 16, “Communication with Audit Committees” (which superseded Statement on Auditing Standards No. 61 for fiscal years beginning after December 15, 2012) of the Public Company Accounting Oversight Board. In addition, the audit committee has discussed with PricewaterhouseCoopers LLP, its independence from management and the Company, has received from PricewaterhouseCoopers LLP the written disclosures and the letter required by Public Company Accounting Oversight Board Rule 3526 (Independence Discussions with Audit Committees), and has considered the compatibility of non-audit services with the auditors’ independence.

We have met with PricewaterhouseCoopers LLP to discuss the overall scope of its services, the results of its audit and reviews and the overall quality of the Company’s financial reporting. PricewaterhouseCoopers LLP, as the Company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the Company’s reporting. Our meetings with PricewaterhouseCoopers LLP were held with and without management present. Members of the audit committee are not employed by the Company, nor does the audit committee provide any expert assurance or professional certification regarding the Company’s financial statements. We rely, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, we recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. We and the Company’s board of directors also recommended, subject to stockholder approval, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015.

This report of the audit committee is not “soliciting material,” and shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Audit Committee

Daniel J. Moore

Jake R. Nunn

James P. Scopa

17

EXECUTIVE OFFICERS

The following sets forth certain information regarding our current executive officers. Information regarding Mr. Chavez, who is both a director and an executive officer of the Company, can be found in the section entitled “Proposal No. 1—Election of Directors—Nominees for Election of Directors at the Annual Meeting.”

| | | | | | |

Name | | Age | | | Position(s) |

Christopher G. Chavez | | 59 | | | | President, Chief Executive Officer and Chairman |

Michael R. Kramer | | 39 | | | | Chief Financial Officer |

Michael V. Chobotov, Ph.D. | | 54 | | | | Chief Technology Officer; Co-founder |

Robert G. Whirley, Ph.D. | | 54 | | | | Vice President, Research and Development; Co-founder |

Kimberley A. Elting | | 50 | | | | Vice President, Corporate Affairs, General Counsel, Chief Compliance Officer and Secretary |

Vivek K. Jayaraman | | 40 | | | | Vice President, Global Sales and Marketing |

Louis J. Molinari | | 53 | | | | Vice President, Manufacturing Operations |

Shari L. O’Quinn | | 41 | | | | Vice President, Clinical/Regulatory Affairs and Quality |

Michael R. Kramer joined us as Chief Financial Officer in September 2010. Prior to joining us, Mr. Kramer served as Chief Financial Officer at ATS Medical, Inc., or ATS, a publicly traded cardiovascular device company, from July 2007 to September 2010. From October 2006 to July 2007 Mr. Kramer served as Senior Director of Finance and acting Chief Financial Officer of ATS. Prior to ATS, Mr. Kramer served as Controller at CABG Medical, Inc., a cardiovascular device manufacturer and as Corporate Finance Manager at Ecolab, Inc., a developer and marketer of products and services to the hospital, foodservice, healthcare and industrial markets. Prior to Ecolab, Inc., Mr. Kramer was a manager in the assurance and advisory services practice at the professional services firm of Ernst & Young LLP. Mr. Kramer received his Bachelors of Accountancy from the University of North Dakota. Mr. Kramer is a certified public accountant (inactive).

Michael V. Chobotov, Ph.D. co-founded TriVascular as President and CEO in 1998, and led its spin-off from Boston Scientific Corporation in 2008, serving as President and CEO until 2012. He currently serves as our Chief Technology Officer and served as a member of our Board until April 2014. Prior to co-founding TriVascular in 1998, Dr. Chobotov co-founded TransMotive Technologies, an engineering and product development consulting company. Previously, Dr. Chobotov served as Senior Vice President of R&D and board member of U.S. Electricar, and Senior Systems Engineer at Hughes Space and Communications. He also led the design of the Lunar Prospector, which was subsequently implemented as the first NASA Discovery mission. Dr. Chobotov received his Ph.D. in Mechanical Engineering, his M.S. in Mechanical Engineering and his B.S. in Engineering and Applied Science, all from the California Institute of Technology.

Robert G. Whirley, Ph.D. co-founded TriVascular in 1998, and currently serves as our Vice President, Research and Development. Prior to rejoining TriVascular in March 2008, Dr. Whirley worked as an independent consultant starting in August 2006. Prior to his work as a consultant, Dr. Whirley served as Vice President, Research and Development for Vascular Surgery for Boston Scientific Corporation after it acquired TriVascular in May 2005. Prior to co-founding TriVascular in 1998, Dr. Whirley’s previous experience included co-founder and Vice President, Engineering for TransMotive Technologies, Vice President of Technology R&D for U.S. Electricar, and President of Livermore Research and Engineering Corp. Dr. Whirley received his Ph.D. in Mechanical Engineering from the California Institute of Technology, his M.S. in Applied Mechanics from the California Institute of Technology, and his Bachelors of Mechanical Engineering from Georgia Institute of Technology.

Kimberley A. Elting joined us as General Counsel and Vice President, Corporate Affairs in March 2013. In July 2013 she was appointed our Chief Compliance Officer. In this role, Ms. Elting leads the legal, compliance, human resources and government affairs functions, and also serves as the company’s corporate Secretary. Prior to joining us, Ms. Elting served in various roles of increasing responsibility with St. Jude Medical, most recently as General Counsel and Vice President Human Resources & Health Policy for the Neuromodulation division of St. Jude Medical, from January 2007 to January 2013. Prior to joining St. Jude Medical, Ms. Elting was a partner at the Jones Day law firm where she counseled clients in the health care sector on mergers & acquisitions and regulatory matters. Ms. Elting received her B.A. in Politics from Ithaca College, her J.D. from the University of Denver and her LL.M. in Health Law from Loyola University Chicago.

18

Vivek K. Jayaraman joined us as Vice President, Global Sales and Marketing in October 2009. Mr. Jayaraman previously served in various roles of increasing responsibility at Medtronic, Inc. from 2001 to 2009, most recently as the Vice President of Global Marketing—Endovascular Innovations. Previously, Mr. Jayaraman led Medtronic’s Peripheral Vascular business, worked as a Policy Fellow in Medtronic’s Government Affairs Office in Washington, D.C. and served as an expatriate in Hong Kong and Tokyo in a sales leadership role. Mr. Jayaraman also worked at the Johnson & Johnson Development Corporation, and began his career at The Wilkerson Group, a healthcare focused management consultancy. Mr. Jayaraman received his M.B.A. in Health Care Management from The Wharton School at The University of Pennsylvania and his dual B.S. degree in Biology and History from the University of Michigan.

Louis J. Molinari rejoined us as Vice President, Manufacturing Operations in April 2008. Prior to that, Mr. Molinari served as Director of Operations for Brooks Automation, Inc. from May 2007 to April 2008. Mr. Molinari also previously served as Director of Manufacturing/Process Development Engineering for TriVascular and in the same role for Boston Scientific Corporation. Mr. Molinari received his B.S. in Electrical Engineering from California Polytechnic University, San Luis Obispo.

Shari L. O’Quinn joined us as Vice President, Clinical/Regulatory Affairs and Quality in September 2009. Ms. O’Quinn previously served as the Vice President of Clinical and Regulatory at Aptus Endosystems, Inc. from February 2007 to August 2009. Prior to that, Ms. O’Quinn served as Director of Clinical and Regulatory at Bard Peripheral Vascular. Ms. O’Quinn began her career as a consultant at Quintiles Medical Technology Consultants where she specialized in developing global clinical and regulatory strategies for commercialization of implantable cardiovascular devices. Ms. O’Quinn received her B.A. from the University of Virginia.

19

EXECUTIVE COMPENSATION

This section discusses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in the “Summary Compensation Table” and the material factors relevant to an analysis of these policies and decisions. Our named executive officers for the year ended December 31, 2014 include our principal executive officer and two other officers:

· | Christopher G. Chavez, President, Chief Executive Officer and Chairman; |

· | Michael R. Kramer, Chief Financial Officer |

· | Michael V. Chobotov, Chief Technology Officer; Co-founder |

The primary objective of our compensation policies and programs with respect to executive compensation is to serve our stockholders by attracting, retaining and motivating talented and qualified executives. We focus on providing a competitive compensation package that provides significant short and long-term incentives for the achievement of measurable corporate and individual performance objectives. Decisions regarding executive compensation are the primary responsibility of our compensation committee. Our Board, through the compensation committee, regularly assesses our compensation policies for any practices that are reasonably likely to have a material adverse effect on our company. As of December 31, 2014, our Board concluded that our compensation policies did not present any such risks to the company.

In 2014, we compensated our named executive officers through a mix of base salary, bonus and equity compensation at levels that we believed were comparable to those of executives at companies of similar size and stage of development. Our named executive officers were awarded stock option grants under our 2008 Equity Incentive Plan, as amended, or 2008 Plan, and our 2014 Equity Incentive Plan, or 2014 Plan, and received bonuses, both discretionary and based on our achievement of corporate performance targets that were set during the year.

We have not yet established a formal policy with respect to our allocations between long-term equity compensation and short-term incentive compensation. Historically, our compensation plans and the amount of each compensation element to pay our named executive officers were generally developed by our management and approved by our Board or the compensation committee on an individual, case-by-case basis utilizing a number of factors, including publicly available data and our general business conditions and objectives, as well as our subjective determination with respect to each executive’s individual contributions to such objectives.

2014 Summary Compensation Table

The following table presents the compensation awarded to, earned by or paid in 2014 and 2013 to each of our named executive officers for the years ended December 31, 2014 and 2013, respectively:

Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | | Stock Awards ($) | | Option Awards ($) (1) | | | Nonequity Incentive Plan Compensation | | | | All Other Compensation ($) | | | | Total ($) | |

Christopher G. Chavez | | 2014 | | | 450,000 | | | — | | | | | | | 873,716 | | | | 432,315 | | (2) | | | 737 | | (3) | | | 1,756,768 | |

President and Chief Executive Officer | | 2013 | | | 450,000 | | | | | | | | | | | 852,797 | | | | | | | | | 2,974 | | (3) | | | 1,305,771 | |

Michael R. Kramer | | 2014 | | | 301,616 | | | | 54,621 | | (5) | | | | | 375,844 | | | | 100,302 | | | | | 558 | | (4) | | | 832,941 | |

Chief Financial Officer | | 2013 | | | 275,000 | | | | | | | | | | | 152,100 | | | | | | | | | 558 | | (4) | | | 427,658 | |

Michael V. Chobotov | | 2014 | | | 264,000 | | | | 32,280 | | | | | | | 441,427 | | | | 87,793 | | | | | 81,458 | | (6) | | | 906,958 | |

Chief Technology Officer | | 2013 | | | 264,000 | | | | | | | | | | | 387,735 | | | | | | | | | 558 | | (4) | | | 652,293 | |

20

(1) | The amounts in this column reflect the aggregate grant date fair value of the stock options granted in the year indicated computed in accordance with FASB ASC Topic 718. In 2014, this was determined using the Black-Scholes Method with an option value of $6.31 per share, except for an option to purchase 29,720 shares of common stock granted to Mr. Chavez with an option value of $6.93 per share. In 2013, this was determined using the Black-Scholes Method with an option value of $4.75 per share, except for an option to purchase 29,720 shares of common stock granted to Mr. Chavez with an option value of $1.72 per share. The assumptions in both years are as set forth in Note 13 of our Annual Report on Form 10-K for the year ended December 31, 2014 and filed with the SEC on March 9, 2015. |

(2) | The amount reported in this column does not reflect a cash amount actually received by Mr. Chavez. Instead, this amount was paid in the form of a fully vested restricted stock unit, or RSU, grant with certain settlement deferral features pursuant to the terms of Mr. Chavez’s employment agreement. The grant date for the RSU was March 2, 2015 but because it constitutes Mr. Chavez’s nonequity incentive award for performance in the year 2014, it is included in this column. |

(3) | This amount represents reimbursement to Mr. Chavez for company-paid term life insurance premiums in the amount of $558 and $179 of travel benefits in 2014 and (i) $479 of travel benefits; (ii) $1,937 of supplemental health insurance; and (iii) company-paid term life insurance premiums in the amount of $558 in 2013. |

(4) | This amount represents company-paid term life insurance premiums in the amount of $558. |

(5) | This amount includes $10,000 earned in 2014 and paid in March 2015. |

(6) | This amount represents deemed income of $80,900 associated with the termination of a loan in early 2014, and company-paid term life insurance premiums in the amount of $558. |

Narrative Disclosure to Summary Compensation Table

Annual Salary