UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

| | | | | |

| Check the appropriate box: |

| | |

| x | | Preliminary Information Statement |

| | |

| ¨ | | Confidential, for Use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

| | |

| ¨ | | Definitive Information Statement |

| |

| CIG WIRELESS CORP. |

| (Name of Registrant as Specified in Its Charter) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required. |

| | |

| | | Fee computed on the table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| | | | | |

| | | (5) | | Total fee paid: |

| | | |

| | | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount previously paid: |

| | | |

| | | |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | |

| | | | | |

| | | (3) | | Filing Party: |

| | | |

| | | | | |

| | | (4) | | Date Filed: |

| | | |

| | | | | |

| | | | | | | |

CIG WIRELESS CORP.

11120 South Crown Way, Suite 1

Wellington, Florida 33414

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

To Our Stockholders:

We are delivering this Notice and the accompanying Information Statement to inform the stockholders of CIG Wireless Corp. (the “Company”) that on December 29, 2014, the beneficial owners of all of the shares of the Company’s Series A-2 Convertible Preferred Stock, $.00001 par value per share (the “Series A-2 Preferred Stock”), which holders also exercise voting rights over certain shares of our restricted common stock, constituting a majority of the Company’s outstanding voting capital, adopted resolutions by written consent, in lieu of a meeting of stockholders, to amend our Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase the number of authorized shares of the Company’s common stock, $.00001 par value per share (the “Common Stock”), from 100,000,000 to 300,000,000, and increase the number of authorized shares of the Company’s preferred stock (“Preferred Stock”) from 100,000,000 to 205,000,000 (together, the “Authorized Capital Increase”). In addition, Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC approved an amendment to the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock (the “Certificate of Designation”) in accordance with its terms to increase the number of authorized shares of our Series A-2 Preferred Stock from 95,000,000 to 200,000,000 (the “Series A-2 Increase”).

The Certificate of Amendment amending the Articles of Incorporation is attached hereto as Annex A (the “Charter Amendment”) and was approved by stockholder written consent pursuant to Section 78.320 of the Nevada Revised Statutes (“NRS”), which permits any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of the number of shares of voting stock required to approve the action at a meeting. The Certificate of Amendment amending the Certificate of Designation (the “Certificate of Designation Amendment,” and together with the Charter Amendment, the “Amendments”) is attached hereto as Annex B and, in accordance with the terms of the Certificate of Designation, was approved by Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC. All necessary corporate approvals in connection with the matters referred to in the Information Statement have been obtained.

The Information Statement is being furnished to the holders of the Company’s Common Stock and Series B 6% 2012 Convertible Redeemable Preferred Stock (the “Series B Preferred Stock”) pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and the rules thereunder, solely for the purpose of informing our stockholders of these corporate actions before they take effect. In accordance with Rule 14c-2 under the Exchange Act, we plan to file the Amendments, and thereby implement the Authorized Capital Increase and the Series A-2 Increase, twenty calendar days following the mailing of this Notice and the accompanying Information Statement, or as soon thereafter as is reasonably practicable.

The Charter Amendment was approved by the board of directors of the Company prior to the stockholder action by written consent described in this Information Statement. The Certificate of Designation Amendment was approved by the board of directors of the Company prior to the stockholder action by written consent described in this Information Statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

| | | |

| | | By order of the Board of Directors |

| | | |

| | | /s/ Paul McGinn |

| | | |

| | | Paul McGinn |

| December 30, 2014 | | President and Chief Executive Officer |

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

CIG WIRELESS CORP.

11120 South Crown Way, Suite 1

Wellington, Florida 33414

INFORMATION STATEMENT

General

In this Information Statement, unless the context otherwise requires, “CIG Wireless,” “we,” “our,” “us,” the “Company” and similar expressions refer to CIG Wireless Corp., a Nevada corporation.

This Information Statement is being sent to advise our stockholders that on December 29, 2014, the beneficial owners of all of the shares of the Company’s Series A-2 Convertible Preferred Stock, $.00001 par value per share (the “Series A-2 Preferred Stock”), which holders also exercise voting rights over certain shares of our restricted common stock (“Restricted Stock”), constituting a majority of the Company’s outstanding voting capital, adopted resolutions by written consent, in lieu of a meeting of stockholders, to amend our Articles of Incorporation, as amended (the “Articles of Incorporation”), to increase the number of authorized shares of the Company’s common stock, $.00001 par value per share (the “Common Stock”), from 100,000,000 to 300,000,000, and increase the number of authorized shares of the Company’s preferred stock (“Preferred Stock”) from 100,000,000 to 205,000,000 (together, the “Authorized Capital Increase”). In addition, Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC approved an amendment to the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock (the “Certificate of Designation”) in accordance with its terms to increase the number of authorized shares of our Series A-2 Preferred Stock from 95,000,000 to 200,000,000 (the “Series A-2 Increase”).

The Certificate of Amendment amending the Articles of Incorporation is attached hereto as Annex A (the “Charter Amendment”) and was approved by stockholder written consent pursuant to Section 78.320 of the Nevada Revised Statutes (“NRS”), which permits any action that may be taken at a meeting of the stockholders to be taken by written consent by the holders of the number of shares of voting stock required to approve the action at a meeting. The Certificate of Amendment amending the Certificate of Designation (the “Certificate of Designation Amendment,” and together with the Charter Amendment, the “Amendments”) is attached hereto as Annex B and, in accordance with the terms of the Certificate of Designation, was approved by Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC. All necessary corporate approvals in connection with the matters referred to in the Information Statement have been obtained.

We plan to file the Amendments with the Secretary of State of Nevada, and thereby implement the Authorized Capital Increase and the Series A-2 Increase, twenty calendar days after we send this Information Statement to our stockholders, or as soon thereafter as is reasonably practicable. You have the right to receive the enclosed Notice and this Information Statement if you were a holder of record of shares of Common Stock or Series B 6% 2012 Convertible Redeemable Preferred Stock (the “Series B Preferred Stock”) at the close of business on December 29, 2014 (the “Record Date”). In accordance with Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the actions contemplated by the stockholder written consent will not become effective until at least twenty calendar days following the mailing of the enclosed Notice and this Information Statement.

This Information Statement is being mailed on or about January , 2015 to the Company’s holders of record of shares of Common Stock and Series B Preferred Stock as of December 29, 2014. We will pay the costs of preparing and sending out the enclosed Notice and this Information Statement.

The date of this Information Statement is January , 2015.

The Action by Written Consent

The Company is not seeking consents, authorizations or proxies from you. Section 78.320 of the NRS provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for a meeting. Approval of at least a majority of outstanding capital stock entitled to vote thereon was required to approve the Charter Amendment. In accordance with the Certificate of Designation,the approval ofFir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC was required to approve the Certificate of Designation Amendment.

Under the NRS, unless otherwise provided in the articles of incorporation or bylaws, any action that may be taken at an annual or special meeting of stockholders also can be taken without such meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, is signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to take such action at a meeting at which all shares entitled to vote thereon were present and voted. Our Articles of Incorporation and Bylaws, each as amended, do not limit, prohibit, restrict, or otherwise qualify the use of this written consent procedure without a meeting.

Further, unless applicable law, the articles of incorporation, or bylaws of a corporation requires a greater number of votes, matters submitted to stockholders generally require the approval of a majority of the shares at a meeting when a quorum is present. The NRS requires the approval of a majority of the outstanding shares in order to amend a Nevada corporation’s articles of incorporation, unless the articles of incorporation require a greater vote to take such action. Our Articles of Incorporation provide that the holders of Series A-2 Preferred Stock and Series B Preferred Stock shall be entitled to vote on all matters on which the holders of Common Stock shall be entitled to vote, in the same manner and with the same effect as the holders of Common Stock, voting together with the holders of Common Stock as a single class. The holders of Series A-1 Non-Convertible Preferred Stock, par value $.00001 per share (“Series A-1 Preferred Stock”) are not entitled to vote on such matters. The Certificate of Designation, in Section 6(c)(i)(1) thereof, further provides that the approval of Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC is required to amend the Articles of Incorporation to increase the number of authorized shares of Series A-1 Preferred Stock or Series A-2 Preferred Stock. Accordingly, the approval of the Charter Amendment requires the receipt of the written consent of the holders having the power to vote at least a majority of the outstanding shares of the Company’s capital stock, voting as a single class on an as-converted-to-common basis, as of the Record Date, and the Certificate of Designation Amendment requires the receipt of the written consent of Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC.

Fir Tree Inc., Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC (the “Majority Stockholders”) have shared dispositive power and shared voting power with respect to an aggregate of 43,679,348 shares of Series A-2 Preferred Stock which, as of the date of this Information Statement, are convertible on a 1-for-1 basis into an aggregate of 43,679,348 shares of Common Stock. Fir Tree Inc., one of the Majority Stockholders, also has voting power over 7,878,293 shares of Restricted Stock issued to certain officers, directors and employees of the Company pursuant to the 2014 Equity Incentive Plan, which together with the 43,679,348 shares of Series A-2 Preferred Stock, which, as of the date of this Information Statement, are convertible on a 1-for-1 basis into an aggregate of 43,679,348 shares of Common Stock, represent a majority of the Company’s outstanding voting capital. The Majority Stockholders have executed a written consent approving the Charter Amendment effectuating the Authorized Capital Increase and a written consent approving the Certificate of Designation Amendment effectuating the Series A-2 Increase. As of the date of this Information Statement, there were 38,579,416 shares of our Common Stock issued and outstanding and43,679,348 shares of our Series A-2 Preferred Stock were issued and outstanding. No payment was made to any person or entity in consideration of execution of the written consent.

As of the Record Date, the Company had 38,579,416 shares of Common Stock outstanding and entitled to vote, 43,679,348 shares of our Series A-2 Preferred Stock outstanding and entitled to vote and 1,680,492 shares of our Series B Preferred Stock outstanding and entitled to vote. Each share of Common Stock is entitled to one vote per share, each share of Series A-2 Preferred Stock is entitled to one vote per share and each share of Series B Preferred Stock is entitled to one vote per share. On the Record Date, the Majority Stockholders beneficially owned, directly and indirectly, an aggregate of 43,679,348 shares of Series A-2 Preferred Stock which, as of the date of this Information Statement, are convertible on a 1-for-1 basis into an aggregate of 43,679,348 shares of Common Stock and had voting power over 7,878,293 shares of Restricted Stock issued to certain officers, directors and employees of the Company pursuant to the 2014 Equity Incentive Plan, which together represent a majority of the Company’s outstanding voting capital.Accordingly, the written consent executed by the Majority Stockholders pursuant to Section 78.320 of the NRSis sufficient to approve the Charter Amendment effectuating the Authorized Capital Increase and the written consent executed by the Majority Stockholders is sufficient to approve the Certificate of Designation Amendment effectuating the Series A-2 Increase. No further stockholder action is required to approve the Charter Amendment or the Certificate of Designation Amendment.

Dissenters’ Rights of Appraisal

The NRS does not provide dissenters’ rights to the Company’s stockholders in connection with the adoption of the Charter Amendment.

AMENDMENT TO ARTICLES OF INCORPORATION TO INCREASE AUTHORIZED SHARES OF COMMON

STOCK AND PREFERRED STOCK AND AMENDMENT TO CERTIFICATE OF DESIGNATION TO

INCREASE AUTHORIZED SHARES OF SERIES A-2 PREFERRED STOCK

Background

The resolutions adopted by our Majority Stockholders by written consent give us the authority to amend our Articles of Incorporation to increase the number of authorized shares of our Common Stock from 100,000,000 to 300,000,000 shares and increase the number of authorized shares of our Preferred Stock from 100,000,000 to 205,000,000 (the “Authorized Capital Increase”). In addition, the resolutions adopted by the Majority Stockholders by written consent give us the authority to amend the Certificate of Designation to increase the number of authorized shares of our Series A-2 Preferred Stock from 95,000,000 to 200,000,000 (the “Series A-2 Increase”). As of the Record Date, the Company had 38,579,416 shares of Common Stock outstanding and entitled to vote.The form of the Charter Amendment is attached to this Information Statement as Annex A and the form of the Certificate of Designation Amendment is attached to this Information Statement as Annex B.

Principal Reasons for the Amendments

The purpose of the Authorized Capital Increase is to increase the number of shares of Common Stock and Preferred Stock available for issuance to our stockholders to satisfy the requirements of our Certificate of Designation and the Amended and Restated Limited Liability Company Operating Agreement, as amended, dated June 30, 2012 (“CIG LLC Agreement”), of our subsidiary Communications Infrastructure Group, LLC (“CIG LLC”). The purpose of the Series A-2 Increase is to increase the number of shares of our Series A-2 Preferred Stock available for issuance to our stockholders to satisfy the requirements of our Certificate of Designation and CIG LLC Agreement.

On December 31, 2014, in accordance with the terms of the CIG LLC Agreement, the outstanding Class A-IT2 Interests and Class A-IT5 Interests (together, “Class A Interests”) in CIG LLC will automatically convert into shares of Common Stock. On March 31, 2015, the outstanding Class A-IT9 Interests of CIG LLC will automatically convert into shares of Common Stock. In accordance with the Certificate of Designation, the Majority Stockholders are entitled to receive shares of Series A-2 Preferred Stock upon each conversion of the Class A-IT2 Interests, Class A-IT5 Interests and Class A-IT9 Interests, in an amount necessary so that the Series A-2 Preferred Stock represents immediately after such conversion the same voting percentage, on a fully diluted basis, as the voting percentage it equaled immediately before such conversion. The Certificate of Designation also requires that the Company maintain sufficient authorized shares of Series A-2 Preferred Stock and Common Stock to permit the issuances of each such class upon operation of the provisions of the Certificate of Designation, namely the issuance of the incremental anti-dilution shares in respect of the Class A Interests and conversion of the Series A-2 Preferred Stock. We intend to effect the Authorized Capital Increase and the Series A-2 Increase in order to have a sufficient number of authorized shares of Common Stock and Series A-2 Preferred Stock to make such issuances to the Class A Interest holders and the Majority Stockholders, respectively. We also intend to effect the Authorized Capital Increase to ensure, as required by the Certificate of Designation, that we have sufficient shares of Common Stock authorized and reserved for issuance in the event that all outstanding shares of Series A-2 Preferred Stock are converted.

Although the increase in the authorized number of shares of Common Stock will not, in and of itself, have any immediate effect on the rights of our stockholders, any future issuance of additional shares of Common Stock could affect our stockholders in a number of respects, including by diluting the voting power of the then holders of our Common Stock, and by diluting the earnings per share and book value per share of outstanding shares of our Common Stock at such time. The issuance of shares of Series A-2 Preferred Stock to any person other than the Majority Stockholders, who currently own all of the issued and outstanding shares of Series A-2 Preferred Stock, could dilute the voting power of the Majority Stockholders. In addition, the issuance of additional shares of Common Stock, or shares of Preferred Stock (including Series A-2 Preferred Stock) or other securities that are convertible into, or exercisable for, Common Stock, could adversely affect the market price of our Common Stock.

Our board of directors (the “Board”) believes that it is in the best interests of the Company and its stockholders to have sufficient authorized capital stock to permit issuances, on an as-needed basis without the delay or expense of seeking stockholder approval (except as may be required by applicable laws or the rules of any stock exchange or national securities association trading system on which our securities may be listed or traded, including the OTC Bulletin Board), for future tower asset acquisitions, related financing and other matters that may arise from time to time, which the Board considers appropriate to issue capital stock. Except as described above and with respect to issuances of Restricted Stock pursuant to the 2014 Equity Incentive Plan, at present the Board has no specific plans to issue the additional shares of Common Stock or Series A-2 Preferred Stock that would be available as a result of the Authorized Capital Increase and the Series A-2 Increase. However, we frequently explore the acquisition of additional towers assets and related financing, which may involve the issuance of shares of our capital stock. This creates the need to maintain sufficient available authorized capital stock for purposes of effectuating such issuances. Stockholders should note that no assurance can be given that any such transactions will or will not occur.

The holders of the Series A-1 Preferred Stock do not have general voting rights, however, as long as any shares of the Series A-1 Preferred Stock remain outstanding, the holders of a majority of the outstanding shares of the Series A-1 Preferred Stock, voting as a separate class, are entitled to elect two directors of the Company, or upon the occurrence of certain events of default set forth in the securities purchase agreement entered into between the Company and the Majority Stockholders, dated as of August 1, 2013, four directors of the Company, whereupon the size of the Board shall automatically increase from five to seven. Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC have elected Messrs. Scott Troeller and Jarret Cohen, both executives of Fir Tree Inc., to the Board.

In the event that the Majority Stockholders become entitled to elect four directors to the Board, the Majority Stockholders’ ability to control the Board could have the effect of discouraging or impeding a takeover of CIG Wireless and attempts by a third party to seek control of the Company. This could have a detrimental effect on the interests of any stockholder who wanted to tender his or her shares to the party seeking control or who would favor a future change in control. The future issuance of additional shares of Common Stock or shares of Preferred Stock (including Series A-2 Preferred Stock) could increase the number of shares necessary to acquire control of the Board or to meet the voting requirements imposed by Nevada law with respect to a merger or other business combination involving us. Issuance of additional shares unrelated to any takeover attempt could also have these effects.

Effect of the Amendments

The Charter Amendment will increase the number of authorized shares of the Company’s Common Stock from 100,000,000 to 300,000,000 shares and increase the number of authorized shares of Preferred Stock from 100,000,000 to 205,000,000. The Certificate of Designation Amendment will increase the number of authorized shares of our Series A-2 Preferred Stock from 95,000,000 to 200,000,000. The percentage ownership of the holders of the Company’s issued and outstanding Common Stock, Series A-1 Preferred Stock, Series A-2 Preferred Stock or Series B Preferred Stock will not change as a result of the Amendments. The Amendments will not change the terms of our Common Stock or Series A-2 Preferred Stock. After the Authorized Capital Increase and the Series A-2 Increase, our Common Stock and Series A-2 Preferred Stock will have the same voting rights and will be identical in all respects to the Common Stock and Series A-2 Preferred Stock currently authorized.

The increase in the number of authorized shares of our Common Stock and Series A-2 Preferred Stock will permit the Board to issue authorized and unissued shares without further stockholder action (except as may be required by applicable laws or the rules of any stock exchange or national securities association trading system on which our securities may be listed or traded or the Certificate of Designation, including the OTC Bulletin Board). The issuance in the future of additional authorized shares may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights, of the then outstanding shares of our Common Stock and Series B Preferred Stock. At this time, except as described above and with respect to issuances of Restricted Stock pursuant to the 2014 Equity Incentive Plan, the Company does not have any specific plans to issue additional shares of the Company’s Common Stock or Series A-2 Preferred Stock. However, we frequently explore the acquisition of additional towers assets and related financing, which may involve the issuance of shares of our capital stock. This creates the need to maintain sufficient available authorized capital stock for purposes of effectuating such issuances. Stockholders should note that no assurance can be given that any such transactions will or will not occur.

EFFECTIVE DATE OF THE AMENDMENTS

The Board and the Majority Stockholders have approved the Authorized Capital Increase to be effective concurrent with the filing of the Charter Amendment and have approved the Series A-2 Increase to be effective concurrent with the filing of the Certificate of Designation Amendment. We anticipate the Amendments will be filed and become effective on the twentieth day following the date on which this Information Statement is first sent or given to our stockholders, or as soon thereafter as reasonably practicable.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Messrs. Troeller and Cohen are directors of the Company and are executives of Fir Tree Inc. Fir Tree Inc. is the investment manager to Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC, and has the authority to cause them to purchase securities issued by the Company and to exercise any and all voting rights associated with such securities. The Majority Stockholders hold all of the outstanding shares of Series A-2 Preferred Stock. The Authorized Capital Increase is necessary, among other reasons, to ensure sufficient shares of Common Stock are available to effect the full conversion of the Series A-2 Preferred Stock, as required by the Certificate of Designation. The Series A-2 Increase is necessary to satisfy the requirements of our Certificate of Designation and CIG LLC Agreement. Other than as set forth above, no director or executive officer, other than in his role as director or executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect by security holdings or otherwise, in the matters described herein which, to the extent such director, executive officer or associate of such director or executive officer is a stockholder of the Company, is not shared by all other stockholders pro-rata and in accordance with their respective stock ownership interests.

INFORMATION ABOUT MAJORITY STOCKHOLDERS

As of the Record Date, the Majority Stockholders beneficially owned a majority of the voting capital stock of the Company, and have consented to the Charter Amendment effectuating the Authorized Capital Increase. In addition, in accordance with the Certificate of Designation, the requisite Majority Stockholders have consented to the Certificate of Designation Amendment effectuating the Series A-2 Increase. The number of shares which the Majority Stockholders are entitled to vote as of the Record Date is set forth below.

| Name and Address: | | Title of Capital Stock | | Number of Shares

entitled to Vote | | | Percentage of

Outstanding Stock

entitled to Vote

(by class) (1) | | | Percentage of

Outstanding

Stock Entitled to

Vote(2) | |

| Fir Tree Inc. | | Common Stock | | | 7,878,293 | | | | 20.4 | % | | | 9.4 | % |

| Fir Tree Capital Opportunity (LN) Master Fund, L.P. | | Series A-2 Preferred Stock | | | 21,839,674 | | | | 50.0 | % | | | 26.0 | % |

| Fir Tree REF III Tower LLC | | Series A-2 Preferred Stock | | | 21,839,674 | | | | 50.0 | % | | | 26.0 | % |

| | | | | | | | | | | | | | Total: 61.4 | % |

| (1) | The percentage of outstanding stock entitled to vote by class was calculated based upon (i) 38,579,416 shares of Common Stock outstanding and entitled to vote, (ii) 43,679,348 shares of our Series A-2 Preferred Stock outstanding and entitled to vote and (iii) 1,680,492 shares of our Series B Preferred Stock outstanding and entitled to vote, each as of the Record Date. |

| (2) | The percentage of outstanding stock entitled to vote was calculated on an as-converted-to-common basis. |

INFORMATION ABOUT CIG WIRELESS SECURITY BENEFICIAL OWNERSHIP

The following table shows, as of the Record Date, (a) all persons we know to be “beneficial owners” of more than five percent of the outstanding Common Stock of CIG Wireless, and (b) the Common Stock owned beneficially by the Company’s directors and named executive officers and all executive officers and directors as a group. Each person has sole voting and sole investment power with respect to the shares shown, except as noted.

| Name of beneficial owners | | Number of

Shares

Beneficially

Owned | | | | Percentage

Ownership | |

| Five Percent Stockholders: | | | | | | | |

Fir Tree Inc.

Fir Tree Capital Opportunity (LN) Master Fund, L.P.

Fir Tree REF III Tower LLC

505 Fifth Avenue, 23rd Floor

New York, New York 10017 | | | 51,557,641 | | (1 | ) | | | 62.7 | % |

Housatonic Equity Partners IV, L.L.C.

Housatonic Equity Investors IV, L.P.

Housatonic Equity Affiliates IV, L.P.

One Post Street, Suite 2600

San Francisco, California 94140 | | | 8,073,949 | | (2 | ) | | | 20.9 | % |

Wireless Investment Fund AG

Seestrasse 1, CH-6330 Cham

Switzerland | | | 10,000,000 | | | | | | 25.9 | % |

Compartment IT2, LP

Five Concourse Parkway, Suite 3100

Atlanta, Georgia 30328 | | | 25,109,726 | | (3 | ) | | | 39.4 | % |

Compartment IT5, LP

Five Concourse Parkway, Suite 3100

Atlanta, Georgia 30328 | | | 14,099,423 | | (4 | ) | | | 26.8 | % |

| Executive Officers and Directors: | | | | | | | | | | |

| Paul McGinn, Chief Executive Officer, President and Director | | | 6,248,498 | | (5 | ) | | | 16.2 | % |

| Grant Barber, Director | | | 185,956 | | (6 | ) | | | * | |

| Gabriel Margent, Director | | | 185,956 | | (7 | ) | | | * | |

| Jarret Cohen, Director (8) | | | - | | | | | | - | |

| Scott Troeller, Director (8) | | | - | | | | | | - | |

| Romain Gay-Crosier, Chief Financial Officer and Treasurer | | | 626,046 | | (9 | ) | | | 1.6 | % |

| All Executive Officers and Directors as a Group | | | 7,246,456 | | (10 | ) | | | 18.8 | % |

* Represents less than 1%.

| | (1) | As reported on its Form 4 filed with the Securities and Exchange Commission (“SEC”) on October 1, 2014, Fir Tree Inc. has shared dispositive power and shared voting power with respect to 43,679,348 shares of Series A-2 Preferred Stock which, as of the date of this Information Statement, is convertible on a 1-for-1 basis into 43,679,348 shares of Common Stock. Each of Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC have shared dispositive power and shared voting power with respect to 21,839,674 shares of Series A-2 Preferred Stock which, as of the date of this Information Statement, are convertible on a 1-for-1 basis into 21,839,674 shares of Common Stock. Fir Tree Inc. is the investment manager to Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC and has the power to exercise all voting rights with respect to the securities. In addition, as of the date of this Information Statement, Fir Tree Inc. has voting power over 7,878,293 shares of Restricted Stock issued to certain officers, directors and employees of the Company pursuant to the 2014 Equity Incentive Plan. |

| | | |

| | (2) | As reported on its Schedule 13D filed with the SEC on August 9, 2013, Housatonic Equity Partners IV, L.L.C. serves as the sole general partner of each of Housatonic Equity Investors IV, L.P. and Housatonic Equity Affiliates IV, L.P. and has voting and investment control over the 7,718,143 shares of Common Stock owned by Housatonic Equity Investors IV, L.P. and the 355,806 shares of Common Stock owned by Housatonic Equity Affiliates IV, L.P. |

| | (3) | Compartment IT2, LP has dispositive power and voting power with respect to certain Class A Interests in CIG LLC, which, as of December 26, 2014, are convertible into approximately 25,109,726 shares of Common Stock. Such Class A Interests will automatically convert into shares of Common Stock on December 31, 2014 at a terminating conversion price calculated by reference to the twenty trading days’ volume weighted average price of the Common Stock prior to the effective date of such conversion. As of December 26, 2014, the conversion rate would be 0.2808, which is assumed for purposes of this Information Statement. |

| | | |

| | (4) | Compartment IT5, LP has dispositive power and voting power with respect to certain Class A Interests in CIG LLC, which, as of December 26, 2014, are convertible into approximately 14,099,423 shares of Common Stock. Such Class A Interests will automatically convert into shares of Common Stock on December 31, 2014 at a terminating conversion price calculated by reference to the twenty trading days’ volume weighted average price of the Common Stock prior to the effective date of such conversion. As of December 26, 2014, the conversion rate would be 0.2808, which is assumed for purposes of this Information Statement. |

| | | |

| | (5) | Mr. Paul McGinn has sole voting power over 50,000 shares of Common Stock purchased during 2013 at $2 per share, and owns 6,198,498 shares of Restricted Stock. Under the terms of the Restricted Stock Awards pursuant to which Mr. McGinn received the Restricted Stock, Mr. McGinn has appointed Fir Tree Inc. to act as his proxy and attorney-in-fact to vote all of his shares of Restricted Stock with respect to all matters to which he is entitled to vote. The shares of Restricted Stock awarded to Mr. McGinn are subject to the vesting and other provisions set forth in the 2014 Equity Incentive Plan and Restricted Stock Awards pursuant to which such shares of Restricted Stock were awarded to Mr. McGinn. |

| | | |

| | (6) | Mr. Grant Barber owns 185,956 shares of Restricted Stock. Under the terms of the Restricted Stock Awards pursuant to which Mr. Barber received the Restricted Stock, Mr. Barber has appointed Fir Tree Inc. to act as his proxy and attorney-in-fact to vote all of his shares of Restricted Stock with respect to all matters to which he is entitled to vote. The shares of Restricted Stock awarded to Mr. Barber are subject to the vesting and other provisions set forth in the 2014 Equity Incentive Plan and Restricted Stock Awards pursuant to which such shares of Restricted Stock were awarded to Mr. Barber. |

| | | |

| | (7) | Mr. Gabriel Margent owns 185,956 shares of Restricted Stock. Under the terms of the Restricted Stock Awards pursuant to which Mr. Margent received the Restricted Stock, Mr. Margent has appointed Fir Tree Inc. to act as his proxy and attorney-in-fact to vote all of his shares of Restricted Stock with respect to all matters to which he is entitled to vote. The shares of Restricted Stock awarded to Mr. Margent are subject to the vesting and other provisions set forth in the 2014 Equity Incentive Plan and Restricted Stock Awards pursuant to which such shares of Restricted Stock were awarded to Mr. Margent. |

| | | |

| | (8) | Each of Messrs. Cohen and Troeller serves as an employee of Fir Tree Inc., which is the investment manager to Fir Tree Capital Opportunity (LN) Master Fund, L.P. and Fir Tree REF III Tower LLC. However, neither Messrs. Cohen nor Troeller has any sole or shared power to vote or control the disposition of any shares of the Company. |

| | | |

| | (9) | Mr. Romain Gay-Crosier is deemed to beneficially own 626,046 shares of Restricted Stock. Mr. Gay-Crosier was granted 619,847 shares of Restricted Stock under the 2014 Equity Incentive Plan and Mr. Gay-Crosier’s wife, Ms. Kristin O’Connor, was granted 6,199 shares of Restricted Stock under the 2014 Equity Incentive Plan. Under the terms of the Restricted Stock Awards pursuant to which Mr. Gay-Crosier and his wife received the Restricted Stock, Mr. Gay-Crosier and his wife have each appointed Fir Tree Inc. to act as his/her proxy and attorney-in-fact to vote all of his/her shares of Restricted Stock with respect to all matters to which he/she is entitled to vote. The shares of Restricted Stock awarded to Mr. Gay-Crosier and his wife are subject to the vesting and other provisions set forth in the 2014 Equity Incentive Plan and Restricted Stock Awards pursuant to which such shares of Restricted Stock were awarded to Mr. Gay-Crosier and Ms. O’Connor. Mr. Gay-Crosier disclaims beneficial ownership with respect to any shares other than the shares owned of record by him. |

| | | |

| | (10) | The 7,246,456 shares beneficially owned by all executive officers and directors as a group includes shares owned by Paul McGinn, Romain Gay-Crosier (including shares held by his wife, for which he disclaims beneficial ownership), Gabriel Margent and Grant Barber. 7,196,456 shares of Restricted Stock owned by each of the Company’s officers and directors are included three times in the table in accordance with the rules governing disclosure of beneficial ownership (this figure includes 6,198,498 shares of Restricted Stock owned by Paul McGinn, but does not include 50,000 shares of Common Stock owned by Mr. McGinn, which do not represent Restricted Stock, but rather were purchased by Mr. McGinn and which appear twice in the table). In addition to being shown as owned by the respective officer or director individually, shares owned by each officer and director are also included within the 7,246,456 shares beneficially owned by all executive officers and directors as a group. Of the 7,246,456 shares owned by the executive officers and directors as a group, 7,196,456 (including shares the shares owned by Mr. Gay-Crosier’s wife) are Restricted Stock, and are therefore also included within the 7,878,293 shares of Restricted Stock over which Fir Tree Inc. has voting power. The 7,878,293 shares of Restricted Stock over which Fir Tree Inc. has voting power include 7,196,456 shares owned by the Company’s officers and directors (including the shares owned by Mr. Gay-Crosier’s wife) and 681,837 shares of Restricted Stock owned by other employees of the Company. Fir Tree Inc. has beneficial ownership of a total of 51,557,641 shares. |

| | | By order of the Board of Directors |

| | | |

| | | /s/ Paul McGinn |

| | | Paul McGinn |

| December 30, 2014 | | President and Chief Executive Officer |

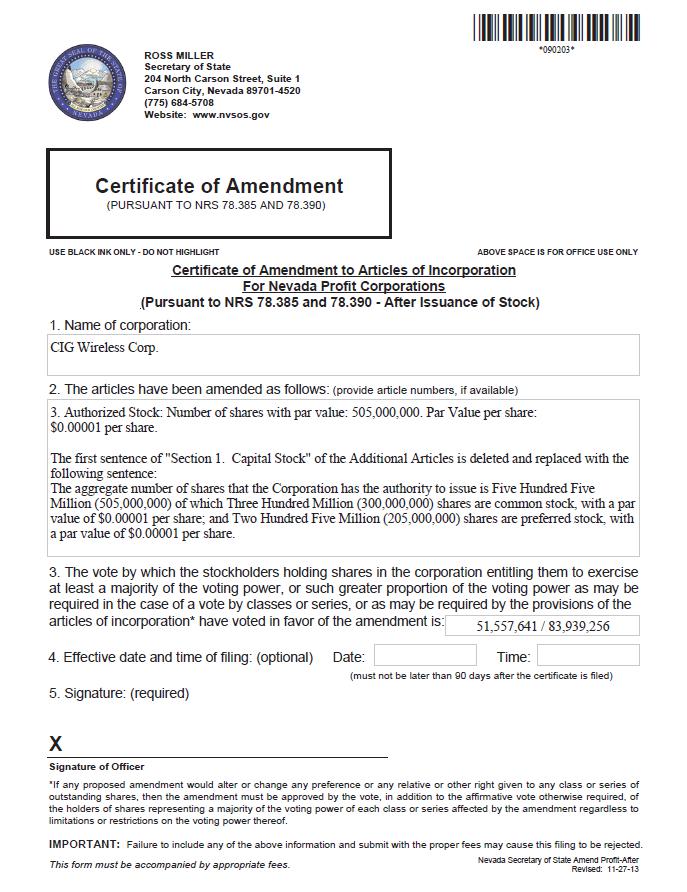

ANNEX A

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov Certificate of Amendment (PURSUANT TO NRS 78.385 AND 78.390) USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY Certificate of Amendment to Articles of Incorporation For Nevada Profit Corporations (Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock) 1. Name of corporation: 2. The articles have been amended as follows: (provide article numbers, if available) 3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: 4. Effective date and time of filing: (optional) (must not be later than 90 days after the certificate is filed) Date: Time: 5. Signature: (required) Signature of Officer *If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof. IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected. This form must be accompanied by appropriate fees. Nevada Secretary of State Amend Profit-After Revised: 11-27-13 X *090203* *090203* CIG Wireless Corp. 3. Authorized Stock: Number of shares with par value: 505,000,000. Par Value per share: $0.00001 per share. The first sentence of "Section 1. Capital Stock" of the Additional Articles is deleted and replaced with the following sentence: The aggregate number of shares that the Corporation has the authority to issue is Five Hundred Five Million (505,000,000) of which Three Hundred Million (300,000,000) shares are common stock, with a par value of $0.00001 per share; and Two Hundred Five Million (205,000,000) shares are preferred stock, with a par value of $0.00001 per share. 51,557,641 / 83,939,256

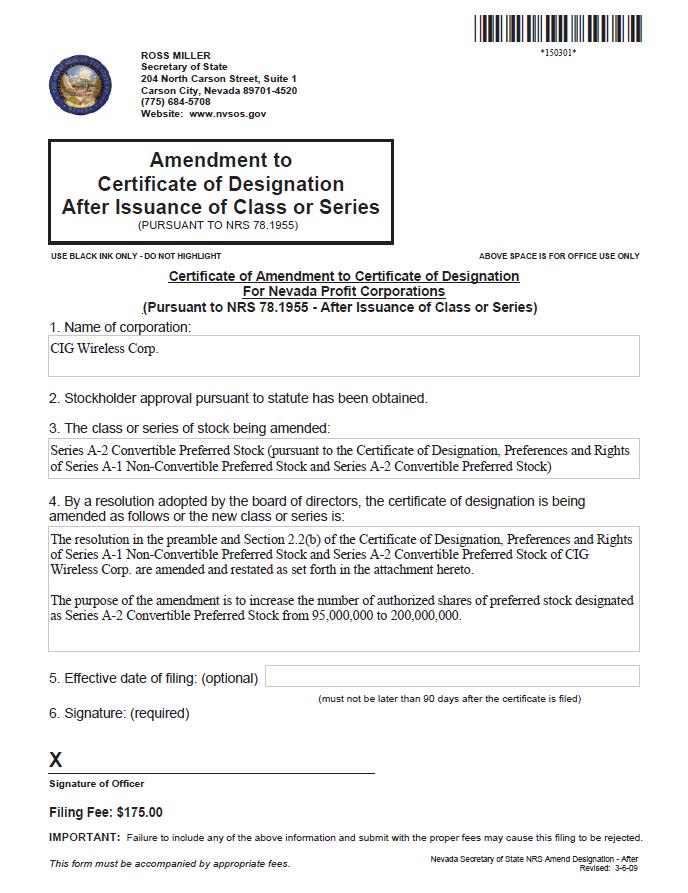

ANNEX B

ROSS MILLER Secretary of State 204 North Carson Street, Suite 1 Carson City, Nevada 89701-4520 (775) 684-5708 Website: www.nvsos.gov Amendment to Certificate of Designation After Issuance of Class or Series (PURSUANT TO NRS 78.1955) USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY Certificate of Amendment to Certificate of Designation For Nevada Profit Corporations (Pursuant to NRS 78.1955 - After Issuance of Class or Series) 1. Name of corporation: 2. Stockholder approval pursuant to statute has been obtained. 3. The class or series of stock being amended: 4. By a resolution adopted by the board of directors, the certificate of designation is being amended as follows or the new class or series is: 5. Effective date of filing: (optional) (must not be later than 90 days after the certificate is filed) 6. Signature: (required) Signature of Officer Filing Fee: $175.00 IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected. This form must be accompanied by appropriate fees. Nevada Secretary of State NRS Amend Designation - After Revised: 3-6-09 X *150301* *150301* CIG Wireless Corp. Series A-2 Convertible Preferred Stock (pursuant to the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock) The resolution in the preamble and Section 2.2(b) of the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock of CIG Wireless Corp. are amended and restated as set forth in the attachment hereto. The purpose of the amendment is to increase the number of authorized shares of preferred stock designated as Series A-2 Convertible Preferred Stock from 95,000,000 to 200,000,000.

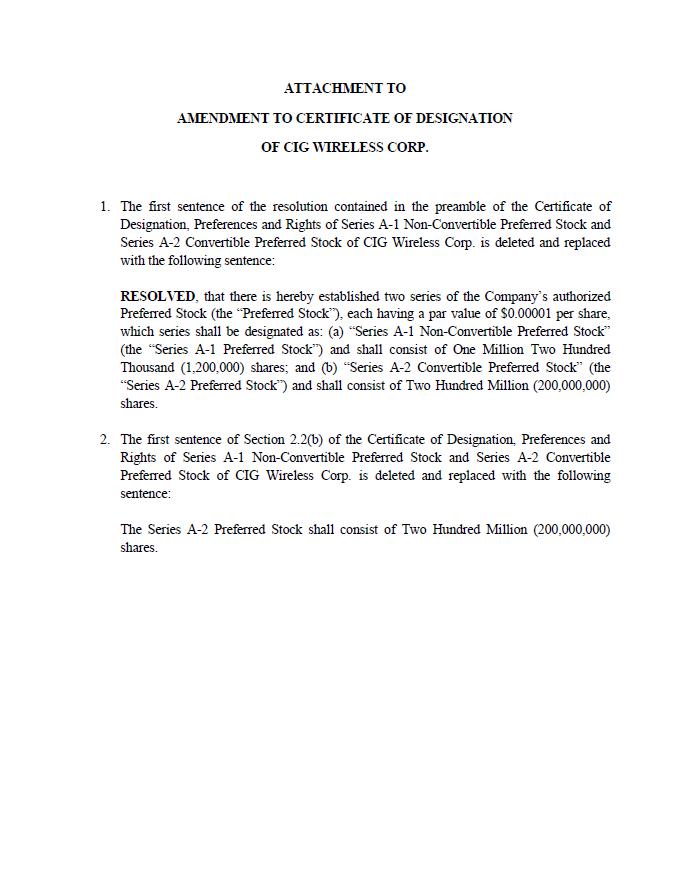

ATTACHMENT TO AMENDMENT TO CERTIFICATE OF DESIGNATION OF CIG WIRELESS CORP. 1. The first sentence of the resolution contained in the preamble of the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock of CIG Wireless Corp. is deleted and replaced with the following sentence: RESOLVED, that there is hereby established two series of the Company’s authorized Preferred Stock (the “Preferred Stock”), each having a par value of $0.00001 per share, which series shall be designated as: (a) “Series A-1 Non-Convertible Preferred Stock” (the “Series A-1 Preferred Stock”) and shall consist of One Million Two Hundred Thousand (1,200,000) shares; and (b) “Series A-2 Convertible Preferred Stock” (the “Series A-2 Preferred Stock”) and shall consist of Two Hundred Million (200,000,000) shares. 2. The first sentence of Section 2.2(b) of the Certificate of Designation, Preferences and Rights of Series A-1 Non-Convertible Preferred Stock and Series A-2 Convertible Preferred Stock of CIG Wireless Corp. is deleted and replaced with the following sentence: The Series A-2 Preferred Stock shall consist of Two Hundred Million (200,000,000) shares.