UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

Registration Statement under the Securities Act of 1933

RESOURCE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1090 | 80-0154562 |

| (State or jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

600 Parker Road Fairfield, California 94533

(707) 208-6368

(Address and telephone number of principal executive offices and place of business)

Delaware Business Incorporators Inc

Capitol Office Center

3422 Old Capital Trail, Suite 700

Wilmington, DE 19808-6192

(302) 996 5819

(Name, address and telephone number of agent for service)

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its

effective date until the registrant shall file a further amendment that specifically states that this Registration

Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as

amended, or until the Registration Statement shall become effective on such date as the Commission, acting

pursuant to said Section 8(a), may determine.

Approximate date of proposed sale to the public: The proposed date of sale will be as soon as practicable after

the Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant

to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities

Act, please check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. [ ]

If delivery of the Prospectus is expected to be made pursuant to Rule 434, please check the following box. [ ]

F-1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-

accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| | | | |

| Non-accelerated filer (Do not check if a smaller reporting Company) | [ ] | Smaller reporting Company | [X] |

CALCULATION OF REGISTRATION FEE (3)

| | | Proposed | Proposed | |

| | | Maximum | Maximum | |

| Title of each class of | Amount of | offering | Aggregate | Amount of |

| Securities to be | Shares to be | Price per | offering | Registration |

| Registered | Registered | share | Price (2) | Fee (1) |

| Common Stock | 600,000 | $0.10 | $60,000 | $ 2.36 |

| Total | 600,000 | $0.10 | $60,000 | $ 2.36 |

(1) Registration Fee (to be paid).

(2) The offering price was arbitrarily determined by Resource Group, Inc.

(3) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended (the "Securities Act").

PROSPECTUS

The date of this Prospectus is April - --, 2008.

Our existing shareholders are offering for sale 600,000 shares of common stock. There are no underwriters.

By means of this prospectus a number of our shareholders are offering to sell up to 600,000 shares of our common stock at a price of $0.10 per share. If and when our stock becomes quoted on the OTC Bulletin Board or listed on a securities exchange, the shares owned by the selling shareholders may be sold in the over-the-counter market, or otherwise, or at prices and terms then prevailing or at prices related to the then current market price, or in negotiated transactions.

As of the date of this prospectus there was no public market for our common stock. Although we plan to have our shares listed on the OTC Bulletin Board or any other public market. We may not be successful in establishing any public market for our common stock because the many variables that will determine our success are uncertain and subject to change based upon circumstances that are not foreseen in the market place, etc.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. FOR A DESCRIPTION OF CERTAIN IMPORTANT FACTORS THAT SHOULD BE CONSIDERED BY PROSPECTIVE INVESTORS. SEE “RISK FACTORS” STARTING ON PAGE 6 OF THIS PROSPECTUS.

There are no underwriters, discounts or commissions.

All proceeds will be distributed to the existing selling shareholders.

This prospectus will not be used before the effective date of the registration statement.

Information in this prospectus will be amended or completed as needed.

This registration statement has been filed with the securities exchange commission.

These securities will not be sold until the registration statement becomes effective.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

| | Per Share | | Total |

| Public offering price | $ 0.10 | | $ 60,000 |

| | | | |

| Possible Proceeds to the selling shareholder | $ 0.10 | | $ 60,000 |

The information in this Prospectus is not complete and may be changed. The Selling Security Holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such state.

TABLE OF CONTENTS

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information provided by this Prospectus is accurate as of any date other than the date on the front cover page of this Prospectus.

PROSPECTUS SUMMARY

Overview

The following is only a summary of the information, financial statements and the notes included in this Prospectus. You should read the entire Prospectus carefully, including “Risk Factors” and our Financial Statements and the notes to the Financial Statements before making any investment decision. Unless the context indicates or suggests otherwise, the terms “”Company, “we,” “our” and “us” means Resource Group, Inc.

Our Business

Resource Group, Inc. (the "Company") was incorporated in the State of Delaware on April 2, 2007 to engage in the acquisition, exploration and development of natural resource properties. We are an exploration stage

Company with no revenues and a limited operating history. The principal executive offices are located at, 600 Parker Road Fairfield, California 94533.

As of the date of this prospectus, we have not had any revenues, have not begun operations and we have one mining property asset and cash. Our Company has no employees at the present time with the general administration being performed at no cost by our President and Director James P. Geiskopf and our Treasurer Ken Greenlaw. We do not expect to commence earning revenues for at least three year after this registration statement becomes effective.

Our mineral claim has been prospected, sampled and staked and we have engaged the services of Edward Kruchkowski, a professional geologist, to prepare a geological report. We have commenced no other exploration activities on the claim. Our property is without known reserves and there is the possibility that the Strohn Creek claims on the Meziadin Project does not contain any reserves and funds that we spend on exploration will be lost. Even if we complete our current exploration program and are successful in identifying a molybdenum, gold or other metals deposit we will be required to expend substantial funds to bring our claim to production.

There is no current public market for our securities. As our stock is not publicly traded, investors should be aware they probably will be unable to sell their shares and their investment in our securities is not liquid.

Common Stock Outstanding and Related Stockholder Matters

In December 2007 we issued 1,500,000 @ $0.001 to each of our two Directors, in aggregate 3,000,000

Common Stock was issued in February 2008 in accordance with a Section 4(2) offering under the Securities Act of 1933, as amended and Rule 506 promulgated thereunder

In February 2008 the Company offered up to 600,000 shares offered for sale for cash at $0.10 per share. The offering was fully subscribed, the Company realized a total of $60,000. The sales were made to friends and family of the Officers and Directors.

Total shares issued and outstanding as of February 29, 2008 - 3,600,000 shares.

Following this offering the total issued and outstanding common stock of the Company was 3,600,000

SUMMARY FINANCIAL INFORMATION

The following is a summary of our financial information and is qualified in its entirety by our audited consolidated financial statements as of February 29, 2008

Consolidated Balance Sheet Data

| | | February 29, 2008 | |

| Current Assets | $ | 122,351 | |

| Current Liabilities | | 77,852 | |

| Stockholders Equity | $ | 44,499 | |

| | | | |

| Revenue | | 0 | |

| Net Loss | | (18,501 | ) |

OTC BULLETIN BOARD SYMBOL

A trading symbol has not been applied for at this time.

PRINCIPAL OFFICES

Our principal executive offices are located at 600 Parker Road Fairfield, California 94533, which is also our mailing address. Our telephone number is (707) 208-6368.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus may contains statements that constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. The words “expect,” “estimate,” “anticipate,” “predict,” “believe,” and similar expressions and variations thereof are intended to identify forward-looking statements. Such forward-looking statements may include statements regarding, among other things, (a) our estimates of mineral reserves and mineralized material, (b) our projected sales and profitability, (c) our growth strategies, (d) anticipated trends in our industry, (e) our future financing plans, (f) our anticipated needs for working capital and (g) the benefits related to ownership of our common stock. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements for the reasons, among others, described within the various sections of this Prospectus, specifically the section entitled “Risk Factors”. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Description of Business,” as well as in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Prospectus will in fact occur as projected. We undertake no obligation to release publicly any updated information about forward-looking statements to reflect events or circumstances occurring after the date of this Prospectus or to reflect the occurrence of unanticipated events.

RISK FACTORS

An investment in these securities involves an exceptionally high degree of risk and is extremely speculativein nature. Following are what we believe are all the material risks involved if you decide to purchaseshares in this offering.

The risks described below are the ones we believe are most important for you to consider. These risks are not the only ones that we face. If events anticipated by any of the following risks actually occur, our business, operating results or financial condition could suffer and the price of our common stock could decline.

WE ARE AN EXPLORATION STAGE COMPANY BUT HAVE NOT YET COMMENCED EXPLORATION ACTIVITIES ON OUR CLAIM, WE EXPECT TO INCUR OPERATING LOSSES FOR THE FORESEEABLE FUTURE.

We have not yet commenced exploration on the Strohn Creek Claim. Accordingly, we have no way to evaluate the likelihood that our business will be successful. We were incorporated on April 2, 2007 and to date have been involved primarily in organizational activities and the acquisition of the Strohn Creek Claim. We have not earned any revenues as of the date of this prospectus and have incurred losses of $18,496 to date. Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises.

The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without procuring any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from

development of the Strohn Creek Claim and the production of the targeted Molybdenum and Gold resources from the claim, we will unable to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

BECAUSE MANAGEMENT HAS NO TECHNICAL EXPERIENCE IN MINERAL EXPLORATION, OUR BUSINESS HAS A HIGHER RISK OF FAILURE.

Our directors have no professional training or technical credentials in the field of geology and specifically in the areas of exploring, developing and operating a mine. As a result, we may not be able to recognize and take advantage of potential acquisition and exploration opportunities in the sector without the aid of qualified geological consultants. Management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently our operations, earnings and ultimate financial success may suffer irreparable harm as a result.

OUR INDEPENDENT AUDITOR HAS ISSUED AN AUDIT OPINION FOR RESOURCE GROUP, WHICH INCLUDES A STATEMENT DESCRIBING OUR GOING CONCERN STATUS. OUR FINANCIAL STATUS CREATES A DOUBT WHETHER WE WILL CONTINUE AS A GOING CONCERN.

As described in Note 3 of our accompanying financial statements, our limited exploration to date and our lack of any guaranteed sources of future capital create substantial doubt as to our ability to continue as a going concern. If our business plan does not work, we could remain as a start-up Company with limited operations and revenues.

THE VALIDITY OF OUR UNPATENTED MINING CLAIMS COULD BE CHALLENGED, WHICH COULDFORCE US TO CURTAIL OR CEASE OUR BUSINESS OPERATIONS.

Our property consists of two unpatented mining claims, which we own. These claims are located on Province of British Columbia land and involve mineral rights that are subject to the claims procedures established by the Ministry of Energy, Mines and Petroleum Resources. We must make certain filings with the Ministry of Energy, Mines and Petroleum Resources in the province in which the land or mineral is situated and pay annual fees or exploration work equal to the fees amounting to $2,453.74 for both our claims. If we fail to make the annual holding fee by payment or completion of exploration work, our mining claim will become void and available to others.

ENVIRONMENTAL CONTROLS COULD CURTAIL OR DELAY EXPLORATION AND DEVELOPMENT OFOUR MINE AND IMPOSE SIGNIFICANT COSTS ON US.

During the exploration and mining processes, we are required to comply with numerous environmental laws and regulations imposed by federal and provincial authorities, which impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of exploration, mining and mineral processing.

Many provinces, including British Columbia (where our Strohn Creek Moly/Gold claims are located), have also adopted regulations that establish design, operation, monitoring, and closing requirements for mining operations. Under these regulations, mining companies are required to provide a reclamation plan and financial assurance including cash deposits to ensure that the reclamation plan is implemented upon completion of mining operations. Additionally, British Columbia and other require mining operations to obtain and comply with environmental permits, including permits regarding air emissions and the protection of surface water and groundwater. Although we believe that we are currently in compliance with applicable federal and provincial environmental laws, changes in those laws and regulations may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays

in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

GOVERNMENT REGULATION OR OTHER LEGAL UNCERTAINTIES MAY INCREASE COSTS AND OUR BUSINESS WILL BE NEGATIVELY AFFECTED.

There are several governmental regulations that materially restrict mineral claim exploration and development. Under British Columbia mining law, engaging in certain types of exploration requires work permits, the posting of bonds, and the performance of remediation work for any physical disturbance to the land. While these current laws will not affect specific types of exploration work, if we identify exploitable minerals and proceed to phase two which includes drilling operations on the Strohn Creek Claim, we will incur regulatory compliance costs based upon the size and scope of our operations. In addition, new regulations could increase our costs of doing business and prevent us from exploring for and the exploitation of ore deposits. In addition to new laws and regulations being adopted, existing laws may be applied to mining that have not as yet been applied. These new laws may increase our cost of doing business with the result that our financial condition and operating results may be harmed.

THE DEVELOPMENT AND OPERATION OF OUR MINING PROJECTS INVOLVE NUMEROUSUNCERTAINTIES.

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the exploration and development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

- estimation of reserves;

- anticipated metallurgical recoveries;

- future molybdenum and gold prices; and

- anticipated capital and operating costs of such projects.

Our project has limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

- unanticipated changes in grade and tonnage of material to be mined and processed;

- unanticipated adverse geotechnical conditions;

- incorrect data on which engineering assumptions are made;

- costs of constructing and operating a mine in a specific environment;

- availability and cost of processing and refining facilities;

- availability of economic sources of power;

- adequacy of water supply;

- adequate access to the site;

- unanticipated transportation costs;

- government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

- fluctuations in metal prices; and

- accidents, labor actions and force majeure events.

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended

exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

MINERAL EXPLORATION IS HIGHLY SPECULATIVE, INVOLVES SUBSTANTIAL EXPENDITURES,AND IS FREQUENTLY NON-PRODUCTIVE.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

- The identification of potential economic mineralization based on superficial analysis;

- the quality of our management and our geological and technical expertise; and

- the capital available for exploration and development.

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

THE PRICE OF MOLYBDENUM AND GOLD ARE HIGHLY VOLATILE AND A DECREASE IN THEPRICE OF MOLYBDENUM OR GOLD WOULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop one or more of our mines at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

RESERVE ESTIMATES ARE POTENTIALLY INACCURATE.

Estimate of reserves on property is either “proven reserves” or “probable reserves.” At this time we have no proven reserves or probable reserves. Ore reserve figures and costs are primarily estimates and are not guarantees that we will recover the indicated quantities of these metals. Estimated proven reserve quantities based on sampling and testing of sites conducted by the Company or by independent companies hired by the Company. Probable reserves are based on information similar to that used for proven reserves, but the sites for sampling are less extensive, and the degree of certainty is less. Reserve estimation is an interpretive process based upon available geological data and statistical inferences and is inherently imprecise and may prove to be unreliable.

Reserves are reduced as existing reserves are depleted through production. Reserves may be reduced due to lower than anticipated volume and grade of reserves mined and processed and recovery rates.

Reserve estimates are calculated using assumptions regarding metals prices. These prices have fluctuated widely in the past. Declines in the market price of metals, as well as increased production costs, capital costs and reduced recovery rates, may render reserves uneconomic to exploit. Any material reduction in our reserves may lead to increased net losses, reduced cash flow, asset write-downs and other adverse effects on our results of operations and financial condition. Reserves should not be interpreted as assurances of mine life or of the

profitability of current or future operations. No assurance can be given that the amount of metal estimated will be produced or the indicated level of recovery of these metals will be realized.

MINING RISKS AND INSURANCE COULD HAVE AN ADVERSE EFFECT ON OUR PROFITABILITY.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Insurance is available to ameliorate some of these risks, however such insurance may not continue to be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

NO MARKET CURRENTLY EXISTS FOR OUR SECURITIES AND WE CANNOT ASSURE YOU THAT SUCH A MARKET WILL EVER DEVELOP, OR IF DEVELOPED, WILL BE SUSTAINED.

Our common stock is not currently eligible for trading on any stock exchange and there can be no assurance that our common stock will be listed on any stock exchange in the future. We intend to apply for listing on the NASD OTC Bulletin Board trading system pursuant to Rule 15c2-11 of the Securities Exchange Act of 1934, but there can be no assurance we will obtain such a listing. The bulletin board tends to be highly illiquid, in part because there is no national quotation system by which potential investors can track the market price of shares except through information received or generated by a limited number of broker-dealers that make a market in particular stocks. There is a greater chance of market volatility for securities that trade on the bulletin board as opposed to a national exchange or quotation system. This volatility may be caused by a variety of factors, including: the lack of readily available price quotations; the absence of consistent administrative supervision of "bid" and "ask" quotations; lower trading volume; and general market conditions. If no market for our shares materializes, you may not be able to sell your shares or may have to sell your shares at a significantly lower price.

IF OUR SHARES OF COMMON STOCK ARE ACTIVELY TRADED ON A PUBLIC MARKET, THEY WILL IN ALL LIKELIHOOD BE PENNY STOCKS.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price per share of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules..

WE WILL INCUR ONGOING COSTS AND EXPENSES FOR SEC REPORTING AND COMPLIANCE WITHOUT REVENUE WE MAY NOT BE ABLE TO REMAIN IN COMPLIANCE, MAKING IT DIFFICULT FOR INVESTORS TO SELL THEIR SHARES, IF AT ALL.

We plan to contact a market maker immediately following the close of the offering and apply to have the shares quoted on the OTC Electronic Bulletin Board. To be eligible for quotation, issuers must remain current in their filings with the SEC. In order for us to remain in compliance we will require future revenues to cover the cost of

these filings, which could comprise a substantial portion of our available cash resources. If we are unable to generate sufficient revenues to remain in compliance it may be difficult for you to resell any shares you may purchase, if at all.

USE OF PROCEEDS

The selling shareholder will retain the proceeds from any sales of common stock. The Company does not share in the proceeds.

DETERMINATION OF OFFERING PRICE

The selling security holders will sell 600,000 common shares at prevailing market prices or privately negotiated prices. Each selling security holder will determine the number of common shares that may actually be sold by a selling security holder. The selling security holders are under no obligation to sell all or any portion of the common shares offered, nor are the selling security holders obligated to sell such shares immediately under this Prospectus. A shareholder may sell common stock at any price depending on privately negotiated factors such as a shareholder's own cash requirements, or objective criteria of value such as the market value of our assets.

DILUTION

All 600,000 issued common shares to be sold by the selling security holders are common shares that are currently issued and outstanding. Accordingly, they will not cause dilution to our existing shareholders.

SELLING SECURITY HOLDERS

The following table sets forth the Common Stock ownership and other information relating to the Selling Stockholders as of March 14, 2008. The Selling Stockholders acquired their shares through private transactions with the Registrant pursuant to an exemption provided under Section 4(2) of the Securities Act of 1933.

Name and Address

Of Selling Stockholder

| Number Of

Shares

Beneficially

Owned

Prior To

Offering | Percentage

of

Outstanding

Shares

Owned Prior

To Offering | Number Of

Shares

Offered

Pursuant To

This

Prospectus | Number Of

Shares

Beneficially

Owned

After The

Offering | Percentage

of

Outstanding

Shares To Be

Owned After

The Offering |

| | | | | | |

John Muntrim

14428 113 PL NE, Kirkland, WA 98034, |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Lori Tiemann

1108 Nancy Court, Suison, CA 94585 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Tony Tiemann

1108 Nancy Court, Suison, CA 94585 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Cindy R. Schubert

1005 Almaden Ct, Fairfield, CA 94533 |

21,000 |

0.583% |

21,000 |

21,000 |

0.583% |

Jeffrey L. Schubert

1005 Almaden Ct, Fairfield, CA 94533 |

19,000 |

0.528% |

19,000 |

19,000 |

0.528% |

Sharon E. Hanson

1005 Almaden CT, Fairfield, CA 94533 |

18,000 |

0.500% |

18,000 |

18,000 |

0.500% |

John E. Hanson

1005 Almaden CT, Fairfield, CA 94533 |

22,000 |

0.611% |

22,000 |

22,000 |

0.611% |

John M. Barry

1108 Nancy CT, Suison, CA 94585 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Janice K. Barry

1108 Nancy CT, Suison, CA 94585 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Kevin M. Kleinsmith

7288 E Fir ST, Port Orchard, WA 98366 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Richard Miller

20906 Hwy 141, Helmville, MT

59843 |

20,000

|

0.556%

|

20,000

|

20,000

|

0.556%

|

David Berry

4902 Norpoint Way NE, Tacoma, WA

98422 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Oktay Yildiz

16918 NE 38thPL, Belleview WA 98008 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Christina M. Irwin

26510 NE Anderson St, Duvall, WA

98019 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Bill R. Vucurevich

2131 Rockville Rd. Fairfield, CA 94534 |

22,500 |

0.625% |

22,500 |

22,500 |

0.625% |

Judy A. Vucurevich

2131 Rockville Rd. Fairfield, CA 94534 |

17,500 |

0.486% |

17,500 |

17,500 |

0.486% |

Joseph A. Polk

1090 Soda Canyon Road. NAPA, CA

94558 |

20,000

|

0.556%

|

20,000

|

20,000

|

.556%

|

Gretchen L. Polk

1090 Soda Canyon Road. NAPA, CA

94558 |

20,000

|

0.556%

|

20,000

|

20,000

|

0.556%

|

Rachel L. Wurzbach

3253 Seminole Circle. Fairfield, CA

94534 |

25,000

|

0.694%

|

25,000

|

25,000

|

0.694%

|

Karl A. Wurzbach

3253 Seminole Circle. Fairfield, CA

94534 |

15,000

|

0.417%

|

15,000

|

15,000

|

0.417%

|

Alisa Overby

708 Mustang CT. Fairfield, CA 94533 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Daniel Overby

708 Mustang CT. Fairfield, CA 94533 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Veronica L. Thomas

114 Tartan Way. Fairfield, CA 94534 |

19,000 |

0.528% |

19,000 |

19,000 |

0.528% |

Scott B. Thomas

114 Tartan Way. Fairfield, CA 94534 |

21,000 |

0.583% |

21,000 |

21,000 |

0.583% |

Rebekah L. Fisher

16526 Campesina LN. Huntington

Beach, CA 92649 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Nicholas W. Fisher

16526 Campesina LN. Huntington

Beach, CA 92649 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Carla M. Ackermann

766 Lakeshore CT. Fairfield, CA 94534 |

25,000 |

0.694% |

25,000 |

25,000 |

0.694% |

Eric Ackermann

766 Lakeshore CT. Fairfield, CA 94534 |

15,000 |

0.417% |

15,000 |

15,000 |

0.417% |

Christopher Ackermann

3532 Glenwood Drive. Fairfield, CA

94534 |

18,000 |

0.500% |

18,000 |

18,000 |

0.500% |

Valerie Ackermann

3532 Glenwood Drive. Fairfield, CA

94534 |

22,000

|

0.611%

|

22,000

|

22,000

|

0.611%

|

| Jacob A. Polk | | | | | |

2189 Cedarbrook Dr. Fairfield, CA

94534 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Paulina A. Polk

2189 Cedarbrook Dr. Fairfield, CA

94534 |

20,000 |

0.556% |

20,000 |

20,000 |

0.556% |

Deanna R. Deckard

1799 Nephi Drive. Fairfield, CA 94534 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

Daniel L. Deckard

1799 Nephi Drive. Fairfield, CA 94534 |

10,000 |

0.278% |

10,000 |

10,000 |

0.278% |

PLAN OF DISTRIBUTION

Following this registration statement becoming effective, the selling stockholders may from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

Our shares of common stock offered hereby by the selling stockholders may be sold from time to time by such stockholders, or by pledges, donees, transferees and other successors in interest thereto. These pledgees, donees, transferees and other successors in interest will be deemed “selling stockholders” for the purposes of this prospectus. Our shares of common stock may be sold:

- on one or more exchanges or in the over-the-counter market (including the OTC Bulletin Board); or

- in privately negotiated transactions.

Rule 144 Shares.

A total of 600,000 shares of the common stock will be available for resale to the public after the effective date of this prospectus; a total of 3,600,000 shares of the common stock will be available for resale to the public after December 1, 2008 in accordance with the applicable holding period, volume and manner of sale limitations of Rule 144 of the Act.

In accordance with the volume and trading limitations of Rule 144 of the Act, in general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least twelve (12) month if the Company is not subject to the reporting requirements of the Securities Act of 1934 or six (6) months, provided that the company has been subject to the reporting requirements of the Securities Act of 1934 for a minimum of 90 days, is entitled to sell within any three month period a number of shares that does not exceed the greater of: 1% of the number of shares of common stock then outstanding which, in this case, will equal approximately 36,000 shares as of the date of this prospectus; or the average weekly trading volume of common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale.

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the Company. Under Rule 144(k), a person who is not one of the Company’s affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least twelve (12) month if the Company is not subject to the reporting requirements of the Securities Act of 1934, or six months, provided that the company has been subject to the reporting requirements of the Securities Act of 1934 is entitled to sell shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

The selling stockholders may also sell their shares directly to market makers acting as principals or brokers or dealers, who may act as agents or acquire the common stock as principals.

Any broker or dealer participating in such transactions as agent may receive a commission from the selling stockholders, or if they act as agent for the purchaser of such common stock, from such purchaser. The selling stockholders will likely pay the usual and customary brokerage fees for such services. Brokers or dealers may agree with the selling stockholders to sell a specified number of shares at a stipulated price per share and, to the extent such broker or dealer is unable to do so acting as agent for the selling stockholders, to purchase, as principal, any unsold shares at the price required to fulfill the respective broker’s or dealer’s commitment to the selling stockholders. Brokers or dealers who acquire shares as principals may thereafter resell such shares from time to time in transactions in a market or on an exchange, in negotiated transactions or otherwise, at market prices prevailing at the time of sale or at negotiated prices, and in connection with such re-sales may pay or receive commissions to or from the purchasers of such shares. These transactions may involve cross and block transactions that may involve sales to and through other brokers or dealers. If applicable, the selling stockholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above. We can provide no assurance that all or any of the common stock offered will be sold by the selling stockholders.

We are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

Regulation M

During such time as the selling security holders may be engaged in a distribution of any of the shares being registered by this registration statement, the selling security holders are required to comply with Regulation M. In general, Regulation M precludes any selling security holder, any affiliated purchasers and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete.

Regulation M defines a“distribution”as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a“distribution participant”as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M under the Securities Exchange Act of 1934 prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed the selling security holders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this Prospectus, and we have also advised the selling security holders of the requirements for delivery of this Prospectus in connection with any sales of the common stock offered by this Prospectus.

In regards to short sells, the selling security holders cannot cover their short sales with shares from this offering. In addition, if such short sale is deemed to be a stabilizing activity, then the selling security holders will not be permitted to engage in a short sale of our common stock. All of these limitations may affect the marketability of the shares

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common Stock

We are authorized by our Articles of Incorporation to issue 50,000,000 shares of common stock, par value $0.001 per share. As of March 14, 2008, there were 3,600,000 shares of common stock issued and outstanding. Holders of shares of common stock have full voting rights, one vote for each share held of record. Stockholders are entitled to receive dividends as may be declared by the Board out of funds legally available therefore and share pro rata in any distributions to stockholders upon liquidation. Stockholders have no conversion, preemptive or subscription rights. All outstanding shares of common stock are fully paid and nonassessable.

TRANSFER AGENT AND REGISTRAR

The transfer agent and registrar for our common stock is Holladay Stock Transfer Inc., having an office situated at 2939 North 67th Place, Scottsdale, AZ 85251, USA.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The financial statements of Resource Group, Inc., a Delaware corporation have been included in this Prospectus and elsewhere in the registration statement in reliance on the report of Moore & Associates Chartered, an independent registered public accounting firm, given on the authority of that firm as experts in auditing and accounting.

Edward Kruchkowski P. Geo., is our consulting geologist. Mr. Edward Kruchkowski received a Bachelor of Science degree in Geology from the University of Alberta in 1972 and is registered as a Professional Geoscientist (P.Geo.) with the Association of Professional Engineers and Geoscientists in British Columbia, Canada. Mr. Kruchkowski’s geological report on the Strohn Creek Claims is attached as Exhibit 99.2

Mr. Kruchkowski consent is attached to this prospectus as an Exhibit.

All legal matters of Resource Group, Inc. linked to the filing of this prospectus and on going legal matters that may arise will be handled by Mr. Aaron McGeary of The McGeary Law Firm, P.C.

None of the named experts hold common stock nor rights to acquire common stock in the future

Financial Statements

Our fiscal year end is February 2008. We will provide audited financial statements to our stockholders on an annual basis. Our consolidated audited financial statements for the fiscal years ended February 29, 2008, the first year following incorporation on April 2, 2007 follow beginning at next page.

Resource Group Inc.

(A Development Stage Company)

Financial Statements

with

Report of Independent Registered Public Accounting Firm

February 29, 2008

F-1

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORS

PCAOB REGISTERED

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Resource Group, Inc.

(An Exploration Stage Company)

We have audited the accompanying balance sheet of Resource Group, Inc. (A Exploration Stage Company) as of February 29, 2008, and the related statements of operations, stockholders’ equity and cash flow for the year ended February 29, 2008 and since inception on April 2, 2007 through February 29, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Resource Group, Inc. (A Exploration Stage Company) as of February 29, 2008, and the related statements of operations, stockholders’ equity and cash flow for the year ended February 29, 2008 and since inception on April 2, 2007 through February 29, 2008, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has had no business operations to date and must secure additional financing to commence the Company’s plan of operations, which raises substantial doubt about its ability to continue as a going concern. Management’s plans concerning these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Moore & Associates, Chartered

Moore & Associates Chartered

Las Vegas, Nevada

April 5, 2008

2675 S. Jones Blvd. Suite 109, Las Vegas, NV 89146 (702) 253-7499 Fax (702) 253-7501

F-2

Resource Group, Inc

(An Exploration Stage Company)

Balance Sheet

| | | At February | |

| | | 29, 2008 | |

| | | $ | |

| ASSETS | |

| | | | |

| Current Assets | | | |

| Cash | | 97,098 | |

| | | | |

| Total Current Assets | | 97,098 | |

| Other Assets | | | |

| Mining Claims – at cost (Note 4) | | 25,253 | |

| | | | |

| Total Other Assets | | 25,253 | |

| Total Assets | | 122,351 | |

| | | | |

| LIABILITIES & STOCKHOLDERS EQUITY | |

| Current | | | |

| Loans Payable Related Parties (Note 5) | | 77,852 | |

| Total Liabilities | | 77,852 | |

| | | | |

| STOCKHOLDERS’ EQUITY | | | |

| | | | |

| Capital Stock | | | |

| Authorized: | | | |

| 75,000,000 common shares, par value $0.001 per share | | | |

| Issued and outstanding: | | | |

| 3,600,000 common shares | | 3,600 | |

| | | | |

| Additional paid-in capital | | 59,400 | |

| | | | |

| Deficit Accumulated During The Development Stage | | (18,501 | ) |

| Total Shareholders’ Equity | | 44,499 | |

| | | | |

| Total Liabilities and Stockholders’ Equity | | 122,351 | |

The accompanying notes are an integral part of these Financial Statements

F-3

Resource Group, Inc

(An Exploration Stage Company)

Statement of Operations

Period From Inception,

(April 2, 2007 to February 29, 2008)

| | | Cumulative | |

| | | amounts from Date | |

| | | of Incorporation | |

| | | April 2, 2007 to | |

| | | February 29, 2008 | |

| | | $ | |

| Revenue | | - | |

| | | | |

| Expenses | | | |

| Organizational costs | | 5,000 | |

| Office and Administration | | 2,649 | |

| Legal and Consulting Fees | | 10,000 | |

| | | 17,649 | |

| | | | |

| Net Loss from Operations | | (17,649 | ) |

| | | | |

| Other Income | | | |

| Interest Income | | - | |

| Other Expense | | 852 | |

| Interest | | - | |

| | | | |

| Net Loss For The Period | | (18,501 | ) |

| | | | |

| | | | |

| Basic And Diluted Loss Per Common Share | | (0.001 | ) |

| | | | |

| Weighted Average Number of Common Shares Outstanding | | 3,600,000 | |

The accompanying notes are an integral part of these Financial Statements

F-4

Resource Group, Inc

(An Exploration Stage Company)

Statement of Cash Flows

Period From Inception,

(April 2, 2007 to February 29, 2008

| | | Cumulative amounts | |

| | | from Date of | |

| | | Incorporation April 2, | |

| | | 2007 to | |

| | | February 29, 2008 | |

| Operating Activities | | $ | |

| | | | |

| Net Income (Loss) | | (18,501 | ) |

| Less: Net Income (Loss) from Discontinued Operations | | | |

| Net Income (Loss) from Continued Operations | | (18.501 | ) |

| Adjustments To Reconcile Net Loss To Net Cash | | | |

| Provided by Operations | | - | |

| Stock Issued for services | | - | |

| Gain on settlement of debt | | - | |

| Change in Assets and Liabilities | | | |

| (Increase) decrease in accounts receivable | | - | |

| (Increase) decrease in deposits | | - | |

| (Increase) decrease in accounts payable | | - | |

| (Increase) decrease in accrued expenses | | - | |

| Net Cash Provided (Used) by Continuing Operating Activities | | (18,501 | ) |

| Investing Activities | | | |

| Cash paid for Mining Property | | (25,253 | ) |

| Net Cash Provided (Used) by Investing Activities | | (25,253 | ) |

| Financing Activities | | | |

| Cash paid for notes payable - related parties | | 77,852 | |

| Cash Received from issuance of stock | | 63,000 | |

| Net Cash Provided (Used) by Financing Activities | | 140,852 | |

| Increase (Decrease) in Cash from Continuing Operations | | 97,098 | |

| Cash and Cash Equivalents at Beginning of Period | | - | |

| Cash and Cash Equivalents at End of Period | | 97,098 | |

| Supplemental Information | | | |

| Cash Paid For: | | | |

| Interest | | - | |

| Income Taxes | | - | |

The accompanying notes are an integral part of these Financial Statements

F-5

Resource Group, Inc.

(An Exploration Stage Company)

Statement of Stockholders’ Equity

February 29, 2008

| | | | | | | | | | | | Deficit | | | | |

| | | | | | Capital Stock | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | | During the | | | | |

| | | | | | | | | Paid-In | | | Exploration | | | | |

| | | Shares | | | Amount | | | Capital | | | Stage | | | Total | |

| | | | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | |

| Balance Forward | | 0 | | | | | | | | | | | | 0 | |

| December 2007 | | | | | | | | | | | | | | | |

| Shares issued for cash at $0.10 | | 3,000,000 | | | 3,000 | | | - | | | | | | 3,000 | |

| February 2008 | | | | | | | | | | | | | | | |

| Shares issued for cash at $0.10 | | 600,000 | | | 600 | | | 59,600 | | | | | | 60,000 | |

| | | 3,600,000 | | | 3,600 | | | 59,600 | | | | | | 63,000 | |

| Deficit for Period | | | | | | | | | | | (18,501 | ) | | (18,501 | ) |

| Balance, | | | | | | | | | | | | | | | |

| February 29, 2008 | | 3,600,000 | | | 3,600 | | | 59,600 | | | (18,501 | ) | | 44,499 | |

The accompanying notes are an integral part of these Financial Statements

F-6

Resource Group, Inc.

(An Exploration Stage Company)

Notes To Financial Statements

February 29, 2007

1. NATURE AND CONTINUANCE OF OPERATIONS

a) Organization

The Company was incorporated in the State of Delaware, United States of America on April 2, 2007. The Company’s year-end is February 2008.

b) Development Stage Activities

The Company is in the development stage and has not yet realized any revenues from its planned operations. The Company’s business plan is to acquire mining properties in Canada while remaining open to the acquisition of other base and precious metal property opportunities worldwide. During this period the Company has acquired a Molybdenum – Gold property located at Strohn Creek, British Columbia, Canada, further described as the Meziadin Lake Project

Based upon the Company's business plan, it is a development stage enterprise. Accordingly, the Company presents its financial statements in conformity with generally accepted accounting principles (GAAP) in the United States of America that apply in establishing operating enterprises. As a development stage enterprise, the Company discloses the deficit accumulated during the development stage and the cumulative statements of operations and cash flows from inception to the current balance sheet date.

2. SIGNIFICANT ACCOUNTING POLICIES

This summary of significant accounting policies is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management who is responsible for their integrity and objectivity. These accounting policies conform to generally accepted accounting principles in the United States of America and have been consistently applied in the preparation of the financial statements. The financial statements are stated in United States of America dollars.

a) Organizational and Start-up Costs

Costs of start-up activities, including organizational costs, are expensed as incurred in accordance with SOP 98-5.

b) Income Taxes

The Company has adopted the Statement of Financial Accounting Standards No. 109 – “Accounting for Income Taxes” (SFAS 109). SFAS 109 requires the use of the asset and liability method of accounting of income taxes. Under the asset and liability method of SFAS 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

c) Basic and Diluted Loss Per Share

In accordance with SFAS No. 128 – “Earnings Per Share”, the basic loss per common share is computed by

F-7

dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted loss per common share is computed similar to basic loss per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. At February 29, 2007 the Company had no stock equivalents that were anti-dilutive and excluded in the earnings per share computation.

d) Estimated Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments, consisting of accounts payable and accrued liabilities approximate their fair value due to the short-term maturity of such instruments. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial statements.

e) Revenue Recognition

The company has had no revenues to date. It is the Company’s policy that revenues will be recognized in accordance with SEC Staff Accounting Bulletin (SAB) No. 104, "Revenue Recognition." Under SAB 104, product revenues (or service revenues) are recognized when persuasive evidence of an arrangement exists, delivery has occurred (or service has been performed), the sales price is fixed and determinable and collectibility is reasonably assured.

f) Currency

The functional currency of the Company is the United States Dollar.

g) Use of Estimates

The preparation of the Company’s financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual results could differ from those estimates.

h) Cash and Cash Equivalents

The Company considers all highly liquid debt instruments with an original maturity of three months or less to be cash equivalents.

i) Earnings (Loss) Per Share

Earnings (loss) per share of common stock is computed by dividing the net earnings (loss) by the weighted average number of common shares outstanding during the period. Diluted earnings per share is not shown for periods in which the Company incurs a loss because it would be anti-dilutive.

j) Recent Accounting Pronouncements

In April 2003, the FASB issued SFAS No. 149 "Amendment of Statement 133 on Derivative Instruments and Hedging Activities", which amends and clarifies the accounting guidance on certain derivative instruments and hedging activities. SFAS 149 is generally effective for contracts entered into or modified after June 30, 2003 and hedging relationships designated after June 30, 2003. The adoption of this statement did not impact the Company's financial position, results of operations, or cash flows. In May 2003, the FASB issued SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity." SFAS 150 establishes standards for how an issuer of equity (including the equity shares of any entity whose financial statements are included in the consolidated financial statements) classifies and measures on its balance sheet

F-8

certain financial instruments with characteristics of both liabilities and equity. SFAS 150 is effective for financial instruments entered into or modified after May 31, 2003 and for existing financial instruments after July 1, 2003. The adoption of this statement did not impact the Company's financial position, results of operations, or cash flows.

In January 2003, the FASB issued FIN No. 46, "Consolidation of Variable Interest Entities," and a revised interpretation of FIN 46 ("FIN 46-R") in December 2003. FIN 46 requires certain variable interest entities ("VIEs") to be consolidated by the primary beneficiary of the entity if the equity investors in the entity do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The provisions of FIN 46 are effective immediately for all arrangements entered into after January 31, 2003. Since January 31, 2003, the Company has not invested in any entities it believes are variable interest entities for which the Company is the primary beneficiary. For all arrangements entered into after January 31, 2003, the Company was required to continue to apply FIN 46 through April 30, 2004. The Company was required to adopt the provisions of FIN 46-R for those arrangements on May 1, 2004. For arrangements entered into prior to February 1, 2003, the Company was required to adopt the provisions of FIN 46-R on May 1, 2004. The adoption of this statement did not impact the Company's financial position, results of operations, or cash flows.

k) Other

The Company consists of one reportable business segment. The Company paid no dividends during the periods presented.

3. BASIS OF PRESENTATION – GOING CONCERN

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America, which contemplates continuation of the Company as a going concern. However, the Company has no business operations to date and must secure additional financing to commence the Company’s plan of operations. The Company intends to acquire additional operating capital through equity offerings to the public to fund its business plan. There is no assurance that the equity offerings will be successful in raising sufficient funds to commence operations or to assure the eventual profitability of the Company.

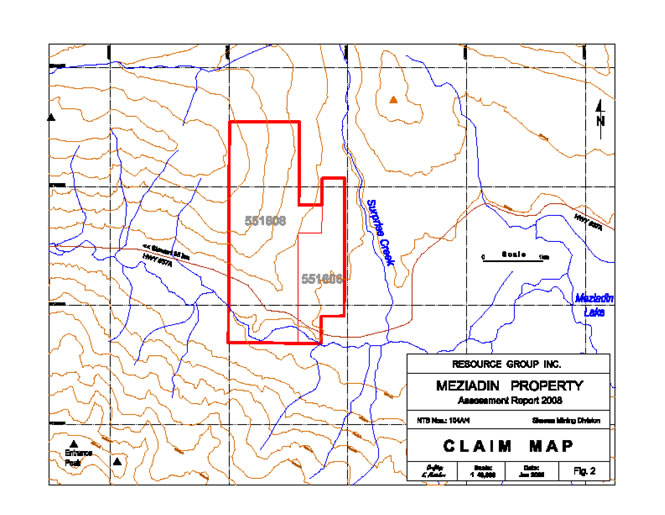

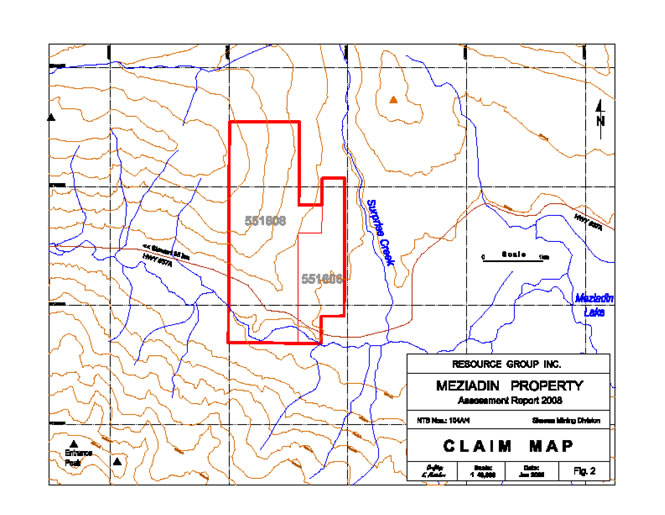

4. MINING PROPERTY

The Company owns a Molybdenum-Gold mining property located at Strohn Creek, further described as the Meziadin Lake Project, which is located approximately 35 kilometres east of Stewart, British Columbia. One hundred percent (100%) of the property has been acquired by the Company from the previous owner. The property is comprised of 2 claims, tenure number 551606 and 551608 covering approximately 613.5 hectares (1,516 Acres). The claim extends from just west of the confluence of Surprise Creek and Strohn Creek for approximately 2 kilometres east-west and 3 kilometres north-south. A geologist was engaged by the Company to prepare a Geological Report. This report was completed January 4, 2008 in accordance with the requirements of National Instrument 43-101

Standards for Disclosure for Mineral Projects.

5. PROMISSORY NOTES PAYABLE - RELATED PARTIES

The Company has sold to two officers/director of the Company, secured one year, 10% Promissory Notes (the “Notes), amounting to in aggregate $80,000.00, due November 12, 2008 pursuant to a Purchase Agreement and Section 4(2) of the Securities Act of 1933, as amended, and Rule 506 promulgated thereunder,. Subsequent to the making of the Notes, on December 1, 2007, the note holders agreed to convert, in aggregate $3,000 of the face value of the Notes into common stock of the Company leaving $77,000 Notes Payable plus $852 accrued interest payable for the period from date of advance, January 18, 2008 to February 29, 2008.

F-9

6. INCOME TAXES

The Company is subject to US federal income taxes. The Company has had no income, and therefore has paid no income tax.

Deferred income taxes arise from temporary timing differences in the recognition of income and expenses for financial reporting and tax purposes. The Company’s has no deferred tax assets at this time.

Income taxes at the statutory rate will be re reconciled to the Company’s actual income taxes as follows:

| Income tax benefit at statutory rate resulting from net operating | (15%) |

| loss carry forward | |

| Deferred income tax valuation allowance | 15% |

| Actual tax rate | 0% |

7. SUBSEQUENT EVENTS

None

F-10

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements, including the notes thereto, appearing elsewhere in this Prospectus. The discussions of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future.

FORWARD LOOKING STATEMENTS

Except for historical information, the following Management’s Discussion and Analysis contains forward-looking statements based upon current expectations that involve certain risks and uncertainties. Such forward-looking statements include statements regarding, among other things, (a) our estimates of mineral reserves and mineralized material, (b) our projected sales and profitability, (c) our growth strategies, (d) anticipated trends in our industry, (e) our future financing plans, (f) our anticipated needs for working capital, (g) our lack of operational experience and (h) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” ��expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Description of Business,” as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Prospectus will in fact occur as projected.

OVERVIEW

Resource Group, Inc. is a mineral exploration, development and production Company specializing in acquiring and consolidating mineral properties with potential production and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, molybdenum and other strategic minerals that present low political and financial risk and exceptional upside potential. Our main focus is currently in British Columbia, Canada.

We were formed in the State of Delaware on April 2, 2007. Presently our primary mining property assets are the Strohn Creek mineral claims on the Meziadin Property (“Strohn Creek”) located near Stewart, British Columbia, Canada, of which we currently own 100% (Figure 1). Management’s near-term goal is to continue to sample the Strohn Creek claims for molybdenum, gold and other mineral deposits.

GOING CONCERN

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our consolidated financial statements for the period ended February 29, 2007 and 2005 with respect to their doubt about our ability to continue The Company has incurred operating losses since its inception in 2007, and has an accumulated deficit of $(18,501) at February 29, 2008, which together raises doubt about the Company’s ability to continue as a going concern. Our ability to continue as a going concern will be determined by our ability to sustain a successful level of operations and to continue to raise capital from debt, equity and other sources. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

LIQUIDITY AND CAPITAL RESOURCES

Our cash balance is $97,098 as of February 29, 2008. We believe our cash balance is sufficient to fund our limited levels of operations until August 2008. We are an exploration stage company and have generated no revenue to date. We have sold $63,000 in equity securities and have notes payable to our officers and directors amounting to $77,852 due November 2008. We expect that we have adequate funds available to pay for our minimum level of operations.

Our auditor has issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated revenues and no revenues are anticipated until we begin removing and selling minerals. There is no assurance we will ever reach that stage.

PLAN OF OPERATION

We will conduct mineral exploration activities on the Strohn Creek Claims in order to assess whether the property contains mineral reserves capable of commercial extraction. Our exploration program is designed to explore for commercially viable deposits of molybdenum, gold and other minerals. We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals at Strohn Creek.

For the twelve months following the date of this prospectus we plan to complete the first phase of the exploration program on our claims consisting of geological prospecting and assaying, (Phase I), trenching and detailed sampling of historic zones (Phase II). We estimate the cost to be about $21,000 for the Phase I and II Exploration program as outlined below. In addition to this $21,000 we anticipate spending an additional $17,200 on professional and administrative fees, including fees payable in connection with the filing of this registration statement and complying with reporting obligations. Total expenditures over the next 12 months are therefore expected to be approximately $38,200, which is covered by the cash on hand. We do not expect to commence work on Phase III until spring 2009, subject to information obtained during the 2008 work program and available funds to complete the outlined program.

Prior to the Company purchasing the Strohn Creek mineral claim, the vendor was required to have prepared at Company cost a geological evaluation report on the Strohn Creek mineral claims. This report was prepared by Mr. Edward Kruchkowski, P. Geo., and was completed on January 4, 2008. Mr. Kruchkowski’s report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of prior exploration on the claims and in the claim areas.

The geological report also gives conclusions regarding mineralization of the mineral claims and recommends a further exploration program on the mineral claims. The exploration program is as follows:

| Phase | Exploration Program | Cost | Status |

| | | | |

| Phase 1 | Prospecting, assay and evaluation of information | $6,000 | Expected to be completed by June 2008, (dependent on geologist schedule). |

| Phase II | Localized soil surveys, trenching and sampling zones identified in historical information & Phase 1 | $15,000 | Expected to be completed by September 2008 (subject to consulting geologist's schedule). |

| Phase III | Test Diamond drilling outlined by Phase 1 and 2 programs. | $130,000 | Planned for spring 2009(Depending on the results of Phase 2, consulting geologist's schedule.) |

| Estimated Cost | | $151,000 | |

We plan to commence Phase I of the exploration program on the claim in June 2008. We expect this phase to take 30 days to complete and an additional month for the consulting geologist to receive the results of the assay lab and prepare his report.

Following Phase I of the exploration program, if it proves successful in identifying mineral deposits, we intend to proceed with the Phase II program in August 2008. The estimated cost of the Phase II program is $15,000 and will take approximately 45 days to complete and an additional two months for the consulting geologist to receive the results from the assay lab and prepare his report.

Following Phase II of the exploration program, if it proves successful in identifying mineral deposits, we intend to proceed with Phase III of our exploration program subject to raising the funds. The estimated cost of this program is $130,000 and will take approximately 4 to 5 weeks to complete and an additional two months for the consulting geologist to receive the results from the assay lab and prepare his report.

The above program costs are management's estimates based upon the recommendations of the professional consulting geologist's report and the actual project costs may exceed our estimates. To date, we have not commenced exploration.

Edward Kruchkowski, P. Geo, the consulting geologist who prepared the geology report on our claim, will be retained for our planned exploration programs. We will however, require additional funding to proceed with Phase III and any subsequent work on the claim, we have no current plans on how to raise the additional funding. We cannot provide investors with any assurance that we will be able to raise sufficient funds to proceed with any work after the first two phases of the exploration program.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Since inception, we have had no changes in or disagreements with our accountants. Our audited financial statements for the fiscal year ended February 29, 2008 have been included in this Prospectus in reliance upon Moore and Associates, Chartered, Independent Registered Public Accounting Firm, as experts in accounting and auditing.

LIMITED OPERATING HISTORY; NEED FOR ADDITIONAL CAPITAL

There is no historical financial information about us on which to base an evaluation of our performance. We are an exploration stage company and have not generated revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our property, and possible cost overruns due to increases in the cost of services.

To become profitable and competitive, we must conduct the exploration of our properties before we start into production of any minerals we may find. Following the completion of Phase I and II we will be seeking funds from convertible loans and private placements of common stock to provide the capital required additional ongoing exploration program. We have no assurance that future financing will materialize. If that financing is not available to use for the third phase of our exploration program we may be unable to continue.

CRITICAL ACCOUNTING POLICIES