Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-179534

SUPERFUND GOLD, L.P.

$79,665,429 SERIES A AND $84,482,522 SERIES B

UNITS OF LIMITED PARTNERSHIP INTEREST

The Offering

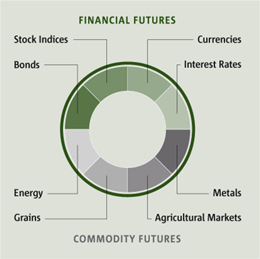

Superfund Gold, L.P., a Delaware limited partnership (the “Fund”), is offering two separate series of limited partnership units (“Units”), designated Series A and Series B. The primary objective of Superfund Gold, L.P. is to maintain the approximate equivalent of a dollar for dollar investment in gold while seeking appreciation of its assets over time by trading and investing in a portfolio of futures and forward contracts on stock indices, currencies, bonds, grains, energies, metals (including gold), agricultural markets and livestock. The two Series are traded and managed the same way except for the degree of leverage, and the assets and liabilities of each Series are segregated from the assets and liabilities of the other Series.

Superfund USA, Inc., and additional selling agents, which serve as underwriters, are offering the Units on the last day of each month at a price of month-end net asset value per Unit. As of February 29, 2012, the net asset value per Unit of Series A-1 was $1,667.76, the net asset value per Unit of Series A-2 was $1,818.08, the net asset value per Unit of Series B-1 was $1,399.06, and the net asset value per Unit of Series B-2 was $1,470.74. Units are continuously offered as of the last day of each month at their net asset value, stated in dollars, for transaction purposes, and ounces of gold for reference. Regardless of the net asset value at which Units are issued, the initial aggregate net asset value of an investor’s Units will equal the dollar amount of the investor’s subscription, and no up-front underwriting discount or commission will be taken, although, as described herein, certain Units will pay an installment selling commission of up to 10% of the gross offering proceeds of the Units in monthly installments of 1/12 of 2% of the month-end net asset value of such Units. There is no scheduled termination date for the offering of the Units. If the total amount offered pursuant to this Prospectus is sold, the proceeds to Superfund Gold, L.P. will be $164,147,951. Subscription proceeds are held in escrow at HSBC Bank USA until released to Superfund Gold, L.P. at the end of each month, and there is no minimum number or dollar amount of Units that must be sold for Units to be issued as of the end of any month. Subscriptions for Units become irrevocable five business days after submission to your selling agent.

The General Partner

Superfund Capital Management, Inc., a professional futures trading advisor and member of the Superfund group of affiliated companies, serves as the general partner and trading advisor of Superfund Gold, L.P.

Minimum Investment

The minimum initial investment in a Series is $10,000; $1,000 for existing investors in such Series.

The Risks

These are speculative securities. You could lose all or substantially all of your investment in a Series. Before you decide whether to invest, read this entire Prospectus carefully and consider “THE RISKS YOU FACE” on page 11.

| • | Each Series has only a limited performance history. |

| • | The Fund is speculative and highly leveraged. The Series acquire positions with face amounts substantially greater than their total equity. Leverage magnifies the impact of both gains and losses. |

| • | Performance is expected to be volatile; the net asset value per Unit may fluctuate significantly in a single month. |

| • | Superfund Capital Management, Inc. is the sole trading advisor for the Fund. The use of a single advisor could mean lack of diversification and, consequently, higher risk. |

| • | There is no secondary market for the Units. You may redeem your Units only as of a month-end. Transfers of Units are subject to limitations. |

| • | A Series’ trading operations may be successful and yet the Series may still sustain losses if the value of the Series’ gold position declines by more than the amount of profits generated by the Series’ trading operations. Likewise, a Series’ gains, if any, from its gold position may be offset by losses incurred in its futures and forward trading. |

| • | A Series may fail to achieve its objective of maintaining a dollar for dollar investment in gold if gold futures margins increase substantially, in which case the Series may reduce its gold position and continue its futures and forward trading activities. |

| • | You will sustain losses if the substantial expenses of a Series are not offset by trading and/or gold investment profits and interest income. |

To invest, you will be required to represent and warrant, among other things, that you have received a copy of this Prospectus and that you satisfy the minimum net worth and income requirements for residents of your state to invest in a Series. You are encouraged to discuss your investment decision with your individual financial, tax and legal advisors.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

SUPERFUND CAPITAL MANAGEMENT, INC.

General Partner

Prospectus dated May 11, 2012

Table of Contents

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 4 THROUGH 6 AND 48 THROUGH 51 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 6 THROUGH 8.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 11.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

SWAPS TRANSACTIONS, LIKE OTHER FINANCIAL TRANSACTIONS, INVOLVE A VARIETY OF SIGNIFICANT RISKS. THE SPECIFIC RISKS PRESENTED BY A PARTICULAR SWAP TRANSACTION NECESSARILY DEPEND UPON THE TERMS OF THE TRANSACTION AND YOUR CIRCUMSTANCES. IN GENERAL, HOWEVER, ALL SWAPS TRANSACTIONS INVOLVE SOME COMBINATION OF MARKET RISK, CREDIT RISK, COUNTERPARTY CREDIT RISK, FUNDING RISK, LIQUIDITY RISK, AND OPERATIONAL RISK.

HIGHLY CUSTOMIZED SWAPS TRANSACTIONS IN PARTICULAR MAY INCREASE LIQUIDITY RISK, WHICH MAY RESULT IN A SUSPENSION OF REDEMPTIONS. HIGHLY LEVERAGED TRANSACTIONS MAY EXPERIENCE SUBSTANTIAL GAINS OR LOSSES IN VALUE AS A RESULT OF RELATIVELY SMALL CHANGES IN THE VALUE OR LEVEL OF AN UNDERLYING OR RELATED MARKET FACTOR.

IN EVALUATING THE RISKS AND CONTRACTUAL OBLIGATIONS ASSOCIATED WITH A PARTICULAR SWAP TRANSACTION, IT IS IMPORTANT TO CONSIDER THAT A SWAP TRANSACTION MAY BE MODIFIED OR TERMINATED ONLY BY MUTUAL CONSENT OF THE ORIGINAL PARTIES AND SUBJECT TO AGREEMENT ON INDIVIDUALLY NEGOTIATED TERMS. THEREFORE, IT MAY NOT BE POSSIBLE FOR THE COMMODITY POOL OPERATOR TO MODIFY, TERMINATE, OR OFFSET THE POOL’S OBLIGATIONS OR THE POOL’S EXPOSURE TO THE RISKS ASSOCIATED WITH A TRANSACTION PRIOR TO ITS SCHEDULED TERMINATION DATE.

ii

Table of Contents

This Prospectus does not include all of the information or exhibits in Superfund Gold, L.P.’s Registration Statement. You can read and copy the entire Registration Statement at the Public Reference Facilities maintained by the Securities and Exchange Commission (“SEC”) in Washington, D.C.

Superfund Gold, L.P. will file quarterly and annual reports with the SEC. You can read and copy these reports at the SEC Public Reference Facility in Washington, D.C. Please call the SEC at 1-800-SEC-0330 for further information.

Superfund Gold, L.P.’s filings will be posted at the SEC website athttp://www.sec.gov.

SUPERFUND CAPITAL MANAGEMENT, INC.

General Partner

SUPERFUND OFFICE BUILDING

PO BOX 1479

GRAND ANSE

ST. GEORGE’S, GRENADA

WEST INDIES

(473) 439-2418

iii

Table of Contents

Part One — Disclosure Document | ||||

| 1 | ||||

| 11 | ||||

The Fund Is Speculative; You Could Lose All or Substantially All of Your Investment in a Series | 11 | |||

| 11 | ||||

The Fund Is Highly Leveraged; Leverage Magnifies Losses as Well as Gains | 11 | |||

| 11 | ||||

The Fund’s Forward Transactions Are Not Currently Regulated and Are Subject to Credit Risk | 11 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

iv

Table of Contents

v

Table of Contents

| 68 | ||||

| 69 | ||||

| 119 | ||||

| 120 | ||||

| 121 | ||||

| 122 | ||||

| 122 | ||||

Exhibit A: Form of Limited Partnership Agreement | A-1 | |||

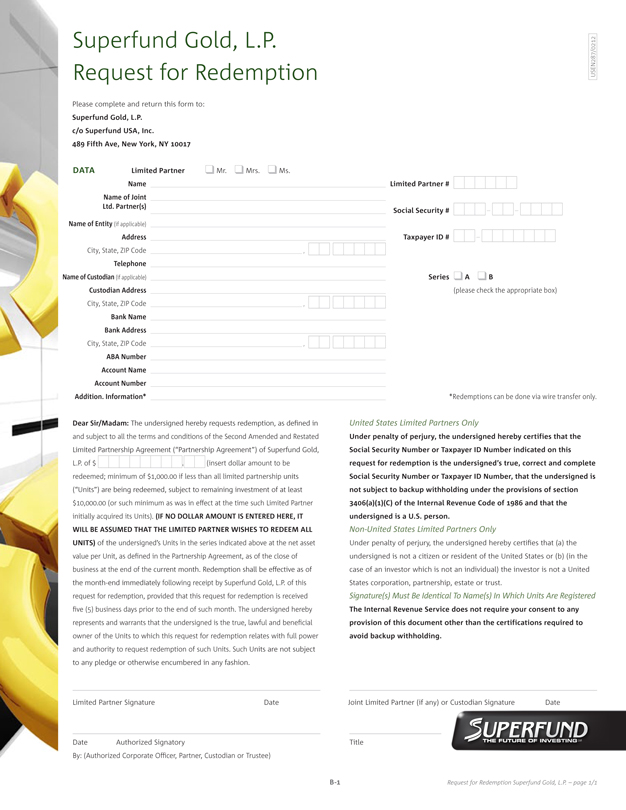

Exhibit B: Request for Redemption | B-1 | |||

Exhibit C: Subscription Representations | C-1 | |||

Exhibit D: Subscription Agreement | D-1 | |||

Exhibit E: Request for Transfer Form | E-1 | |||

Exhibit F: Subscription Agreement for Additional Investment | F-1 | |||

Exhibit G: Series Exchange Subscription Agreement | G-1 | |||

An electronic version of this Prospectus is available on a special web site (http://www.superfund.net) being maintained by Superfund USA, Inc.

vi

Table of Contents

General

Superfund Gold, L.P., a Delaware limited partnership formed in March 2008 (the “Fund”), is offering two series of limited partnership units (“Units”): Superfund Gold, L.P. Series A and Superfund Gold, L.P. Series B (each, a “Series”). Each Series is designed to maintain a long position in gold futures with a notional, or face, value approximately equal to the net asset value of the Series while seeking appreciation of its assets through trading a diversified, systematic, primarily trend-following, futures and forward trading program operated by Superfund Capital Management, Inc., the general partner and trading advisor of the Fund (the “General Partner”). This long gold position is referred to in this Prospectus as a Series’ gold position or the “dollar for dollar” gold position. The net asset value of each Series’ Units will be quoted in ounces of gold, as described below under “Summary — The Offering,” as well as in dollars. You should note, however, that the Series are not “gold funds,” and Series performance will not necessarily track the price of gold. Likewise, the net asset value of the Series will not be determined solely by the price of gold.

To obtain its dollar for dollar gold position, the Series enter into futures contracts to purchase gold in a dollar amount approximately equal to the amount of capital invested in each Series. Prior to November 1, 2011 the General Partner adjusted each Series’ gold position at the beginning of each month to reflect additions to and redemptions of Series capital, as well as to reflect profits and losses from the Series’ futures and forward trading activities and interest income, as of the end of the preceding month so as to maintain a gold futures position with a notional, or face, value approximately equal to the Series’ net asset value at the beginning of each month. Commencing November 1, 2011, the General Partner began adjusting each Series’ dollar for dollar gold position periodically throughout the month to reflect profits and losses from the Series’ futures and forward trading activities and interest income, so as to maintain a long gold futures position with a nominal, or face, value approximately equal to the Series’ net asset value throughout the month. These adjustments are in addition to the adjustments made to the dollar for dollar gold position by the General Partner at the beginning of each month to reflect additions to and redemptions of Series capital. The General Partner may in the future determine to adjust the Series’ dollar for dollar gold position on a more or less frequent basis but in no event will such adjustment take place less frequently than monthly. You should note, however, that because the Series’ gold positions are not adjusted on a real-time basis to account for the Series’ net asset value, profits or losses incurred on a Series’ gold position or from a Series’ speculative futures and forward trading and interest income earned by a Series between any such adjustment may cause the notional, or face, value of a Series’ gold position at any time during a month to be greater than or less than the Series’ net asset value at that time.

In addition to maintaining an investment in gold, each Series trades speculatively in the U.S. and international futures and currency forward markets using Superfund’s automated computerized trading systems. The Superfund trading systems generate buy and sell trading signals and monitor relevant technical indicators on over 120 markets traded in the United States, Canada, Europe and Asia. The primary sectors in which each Series trades are: stock indices, currencies, bonds, grains, energies, metals (including gold), agricultural markets and livestock, and trades are entered on U.S. and, to a substantial extent, non-U.S. markets. Each Series attempts to emphasize instruments with low correlation to each other and high liquidity for trade order execution. Series B implements the Fund’s futures and forward trading program at a leverage level equal to approximately 1.5 times that implemented on behalf of Series A, and, accordingly, is expected to have more volatile performance than Series A.

Effective July 1, 2010, the General Partner integrated a systematic, technical short-term trading strategy into the Fund’s primary trend-following methodology. This short-term strategy seeks trading opportunities arising out of short term changes in futures and forward market prices, with trades lasting from less than a day to more than a week, and has exhibited low correlation to the trend-following methodology historically utilized by the Fund.

The General Partner

Superfund Capital Management, Inc., a Grenada corporation, serves as the general partner and trading advisor of the Fund and each Series and is responsible for the trading and administration of each Series. The General Partner’s offices, and the office of the Fund where its books and records are kept, are located at Superfund Office Building, P.O. Box 1479, Grand Anse, St. George’s, Grenada, West Indies.

1

Table of Contents

The General Partner is a professional futures trading advisor and a member of the Superfund group of affiliated companies. As of February 29, 2012, the General Partner and its affiliates had approximately $800 million in assets under management in the futures and forward markets. The General Partner has delegated certain administrative functions, including calculation of the Series’ net asset values and distribution of reports to investors, to SS&C Fund Services, Inc. (“SS&C”), a leading fund administration services provider and a business unit of SS&C Technologies, Inc. Certain Fund records are located at the offices of SS&C at 80 Lamberton Road, Windsor, CT 06095.

The General Partner contributed $1,000,000 to the capital of each Series prior to the commencement of trading and will maintain an investment in each Series of not less than the greater of $25,000 or 1% of the net asset value of the Series, including the General Partner’s investment; provided, however, that the General Partner may withdraw any excess above such level in a Series at any month-end if the aggregate net asset value of the outstanding Units of the Series exceeds $2,000,000. As of February 29, 2012, the value of the General Partner’s investment in Series A-1 was $858,763.07, in Series A-2 was $0.00, in Series B-1 was $607,550.60 and in Series B-2 was $0.00.

The Offering

Superfund USA, Inc., an affiliate of the General Partner, and additional selling agents, which serve as underwriters, are offering the Units as of the end of each month at the then current net asset value per Unit which will be stated both in ounces of gold, reflecting the U.S. dollar price per ounce of gold established at the London A.M. fixing on the last business day of the month, and in dollars. For example, assume the net asset value per Unit stated in dollars is $1,500 and further assume that the U.S. dollar price per ounce of gold, established at the London A.M. fixing, is $1,400. The net asset value per Unit stated in gold would be 1.07 ounces of gold (1,500 ÷ 1,400).The foregoing example is for illustrative purposes only. There can be no assurance that the U.S. dollar price of gold will rise or not decline or that a Series will not incur losses from its futures and forward trading. The U.S. dollar price for gold established at the London A.M. fixing, and the closing price for the gold futures contracts to be traded by the Series will normally be different from each other, although the differences are expected to be insignificant as a percentage of the per ounce price of gold.

Series and Sub-Series of Units

Within each Series, Units are issued in two sub-Series (each a “Sub-Series”). Series A-1 Units and Series B-1 Units are subject to the selling commissions described below under “Summary — Charges to Each Series.” Series A-2 Units and Series B-2 Units are not subject to selling commissions but are available exclusively to: (i) investors participating in selling agent asset-based or fixed-fee investment programs or a registered investment adviser’s asset-based fee or fixed-fee advisory program through which an investment adviser recommends a portfolio allocation to the Fund and for which Superfund USA, Inc. serves as selling agent, (ii) investors who purchased the Units through Superfund USA, Inc. or an affiliated broker and who are commodity pools operated by commodity pool operators registered as such with the Commodity Futures Trading Commission (“CFTC”), and (iii) investors who have paid the maximum selling commission on their Series A-1 or Series B-1 Units (by redesignation of such Units as Series A-2 Units or Series B-2 Units as described herein).

Minimum Investment

The minimum initial investment is $10,000 per Series; existing investors in a Series may make additional investments in $1,000 minimums. Fractional Units will be issued calculated to three decimal places.

Major Risks of the Fund

| • | An investment in a Series is a speculative investment. You must be prepared to lose all or substantially all of your investment. |

2

Table of Contents

| • | The Fund is recently formed and thus has only a limited performance history. The past performance of gold or of the General Partner’s trading program is not necessarily indicative of the future results of either Series. |

| • | The Fund is speculative and leveraged. The Series acquire positions with face amounts substantially greater than their total equity. Leverage magnifies the impact of both gains and losses. |

| • | Performance is expected to be volatile; the net asset value per Unit may fluctuate significantly in a single month. |

| • | The General Partner is the sole trading advisor for the Fund. The use of a single advisor could mean lack of diversification and, consequently, higher risk. |

| • | There is no secondary market for the Units. You may redeem your Units only as of a month-end. Transfers of Units are subject to limitations. |

| • | A Series’ trading operations may be successful and yet the Series may still sustain losses if the value of the Series’ gold position declines by more than the amount of profits generated by the Series’ trading operations and interest income. Likewise, a Series’ gains, if any, from its gold position may be offset by losses incurred in its futures and forward trading. |

| • | A Series may fail to achieve its objective of maintaining a dollar for dollar investment in gold or may reduce its normal level of futures and forward trading activities if gold futures margins increase substantially, in which case the Series may reduce its gold position and maintain its normal level of futures and forward trading activities or maintain its gold position and reduce its futures and forward trading activities, depending on the General Partner’s assessment of market conditions at that time. |

| • | You will sustain losses if the substantial expenses of a Series are not offset by trading and/or gold investment profits and interest income. |

| • | Each Series is subject to numerous conflicts of interest. |

Investment Considerations

| • | The Fund is designed to maintain a long position in gold in a U.S. dollar amount approximately equal to the total capital of each Series as of the beginning of each month and as periodically readjusted during each month to reflect profits and losses from the Series’ futures and forward trading activities and interest income during the month. The gold investment of each Series is intended to de-link the Series’ net asset value, which is denominated in U.S. dollars, from the value of the U.S. dollar relative to gold, essentially denominating the Series’ net asset value in terms of gold.However, if the U.S. dollar value of gold declines resulting in dollar losses for the Series, there can be no assurance that there will be a corresponding increase in the value or purchasing power of the U.S. dollar for goods (other than gold) or services priced in dollars. Further, there can be no assurance that trading losses incurred in the Fund’s speculative futures and forward trading will not result in overall losses for the Series or that the Series will not reduce its gold position if gold futures margin requirements increase significantly. |

| • | The Fund is a leveraged investment fund, managed by an experienced, professional trading advisor, which trades in a wide range of futures and forward markets. |

3

Table of Contents

| • | The General Partner utilizes a proprietary, systematic trading system for each Series. Trading decisions are not discretionary and thus do not involve human emotional responses to changing market conditions. |

| • | An investment in the Units has the potential to help diversify traditional securities portfolios. A diverse portfolio consisting of assets that perform in an unrelated manner, or non-correlated assets, may increase overall return and/or reduce the volatility (a widely used measure of risk) of a traditional portfolio of stocks and bonds. However, for a non-correlated asset to increase a traditional portfolio’s overall returns, the non-correlated asset must outperform either stocks or bonds over the period being measured.There can be no assurance that a Series will outperform other sectors of an investor’s portfolio over any given time period or not produce losses. |

| • | The Fund holds substantially all of its assets (including those assets used as margin deposits for trading activities) in U.S. government securities and/or non-interest bearing deposit accounts, segregated by Series. Accordingly, each Series, in addition to its potential to profit from its gold investment and active trading operations, earns interest on all or almost all of its assets. However, as interest rates on U.S. government securities and interest bearing deposit accounts are at historically low levels, it is possible that any interest earned by each Series from such securities or accounts could be nominal. |

| • | The Series in which you invest must experience certain levels of trading profits in order for you to break even on your investment. Based on an initial investment of $10,000 (and assuming no changes in net asset value and interest income of 0.05%), the break even points for each Series are as follows: Series A-1 — 6.95% ($695.00); Series A-2 — 4.95% ($495.00); Series B-1 — 7.95% ($795.00); Series B-2 — 5.95% ($595.00). A more detailed break even analysis begins at page 6. |

Limited Liability

Investors cannot lose more than the amount of their investments and undistributed profits, if any. Thus, investors receive the advantage of limited liability in a highly leveraged trading vehicle.

Redemptions, Distributions, Transfers and Exchanges

The Fund is intended to be a medium- to long-term, i.e., 3- to 5-year, investment. However, monthly redemptions are permitted, without penalty or any redemption charge, upon five (5) business days’ written notice to the General Partner. Redemption proceeds will be paid in U.S. dollars. Due to the availability of monthly redemptions, the General Partner does not intend to make any distributions, and the trading profits of a Series, if any, will be reinvested in the Series. Upon written request, an investment in either Series may be exchanged for an investment in the other Series by a simultaneous redemption and reinvestment at the then applicable respective net asset values of each Series. Units are transferable with the consent of the General Partner.

Charges to Each Series

The Fund’s charges are substantial and must be offset by trading gains and/or gold investment profits and interest income in order to avoid depletion of each Series’ assets. The fees and expenses applicable to each Series are as follows:

The General Partner

| • | 2.25% of net assets annual management fee (1/12 of 2.25% payable monthly) for each Series. |

| • | A performance fee of 25% of new appreciation (if any) in each Series’ net assets, computed on a monthly basis, excluding interest income and changes in the value of the Series’ dollar for dollar investment in gold and adjusted for subscriptions and redemptions. New appreciation is the |

4

Table of Contents

increase in a Series’ net asset value since the last time a performance fee was paid. Please see “Charges to Each Series — Performance Fee” for a more detailed discussion of new appreciation and the performance fee. |

Selling Agents and Others

| • | Within each Series, Units will be issued in two Sub-Series. Series A-1 Units and Series B-1 Units are subject to, and will pay Superfund USA, Inc., a selling commission of up to 10% of the gross offering proceeds of the Units by paying 2% of the average month-end net asset value of such Units in monthly installments of 1/12 of 2% of the month-end net asset value of such Units. Thus, the Series A-1 Units and Series B-1 Units are charged a commission of 2% of the average month-end net asset value per Unit in the initial year after purchase. These Units are charged additional selling commissions of 2% per annum of the average month-end net asset value per Unit thereafter; provided, however, that the maximum cumulative selling commission per Unit is limited to 10% of the gross offering proceeds for such Unit. Superfund USA, Inc. may retain additional selling agents to assist with the placement of the Units and will pay all or a portion of the annual selling commission it receives in respect of the Units sold by the additional selling agents to the additional selling agents effecting the sales. |

Series A-2 Units and Series B-2 Units are not subject to selling commissions but are available exclusively to: (i) investors participating in selling agent asset-based or fixed-fee investment programs or a registered investment adviser’s asset-based fee or fixed-fee advisory program through which an investment adviser recommends a portfolio allocation to the Fund and for which Superfund USA, Inc. serves as selling agent, (ii) investors who purchased the Units through Superfund USA, Inc. or an affiliated broker and who are commodity pools operated by commodity pool operators registered as such with the CFTC, and (iii) investors who have paid the maximum selling commission on their Series A-1 or Series B-1 Units (by redesignation of such Units as Series A-2 Units or Series B-2 Units).

Once a Series A-1 Unit or Series B-1 Unit has been charged selling commissions totaling 10% of the sale price of such Unit, the Unit will not be charged any further selling commissions and the net asset value of such Unit will be recalculated, and the Unit will be redesignated, in terms of Series A-2 Units or Series B-2 Units, as applicable, against which selling commissions are not charged. The redesignation of Series A-1 Units to Series A-2 or Series B-1 Units to Series B-2 will have no impact on the net asset value of an investor’s investment in the Fund at the time of such redesignation.

| • | $9.00 brokerage commission per round-turn futures transaction (i.e., purchase and sale or sale and purchase) plus applicable regulatory and exchange fees will be charged, where brokerage commissions are charged in U.S. dollars, a portion of which will be paid to the clearing brokers for execution and clearing costs and the balance of which will be paid to Superfund Asset Management, Inc., which will serve as introducing broker for each Series. Brokerage commissions for certain foreign futures contracts to be traded by the Fund are charged in currencies other than the U.S. dollar. Commission rates for brokerage commissions charged in foreign currencies will be reset on the first business day of each calendar month to the foreign currency equivalent of 9.00 based on the then current U.S. dollar exchange rate for the applicable foreign currencies. Daily fluctuations in foreign currency exchange rates will, however, cause the actual commissions charged to the Fund for certain foreign futures contracts to be more or less than 9.00 per round-turn. |

| • | Actual operating and ongoing offering expenses (including the costs of updating this Prospectus and registering additional Units for sale to the public), such as legal, auditing, administration, escrow, printing and postage costs. Ongoing offering expenses will not exceed 0.4999% of the gross offering proceeds of the Units registered pursuant to the Registration Statement of which the Prospectus is part. Operating expenses are not expected to exceed 0.70% of the average month-end |

5

Table of Contents

net assets each year of each Series. The General Partner will assume liability for ongoing offering and operating expenses, when considered together, in excess of 0.75% of average month-end net assets per year of each Series. |

Break-Even Analysis

The following tables show the fees and expenses that an investor would incur on an initial investment of $10,000 in the Fund and the amount that such investment must earn to break even after one year. The break-even analysis is an approximation only.

SERIES A-1 Units

Routine Expenses | Percentage Return Required Initial Twelve Months of Investment | Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment | ||||||

Management Fees | 2.25 | % | $ | 225.00 | ||||

General Partner Performance Fees(1) | 0.00 | % | $ | 0.00 | ||||

Selling Commissions(2) | 2.00 | % | $ | 200.00 | ||||

Operating and Ongoing Offering Expenses(3) | 0.75 | % | $ | 75.00 | ||||

Brokerage Fees(4) | 2.00 | % | $ | 200.00 | ||||

Less Interest Income(5) | 0.05 | % | $ | 5.00 | ||||

TWELVE-MONTH BREAKEVEN | 6.95 | % | $ | 695.00 | ||||

SERIES A-2 Units

Routine Expenses | Percentage Return Required Initial Twelve Months of Investment | Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment | ||||||

Management Fees | 2.25 | % | $ | 225.00 | ||||

General Partner Performance Fees(1) | 0.00 | % | $ | 0.00 | ||||

Selling Commissions(2) | 0.00 | % | $ | 0.00 | ||||

Operating and Ongoing Offering Expenses(3) | 0.75 | % | $ | 75.00 | ||||

Brokerage Fees(4) | 2.00 | % | $ | 200.00 | ||||

Less Interest Income(5) | 0.05 | % | $ | 5.00 | ||||

TWELVE-MONTH BREAKEVEN | 4.95 | % | $ | 495.00 | ||||

SERIES B-1 Units

Routine Expenses | Percentage Return Required Initial Twelve Months of Investment | Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment | ||||||

Management Fees | 2.25 | % | $ | 225.00 | ||||

General Partner Performance Fees(1) | 0.00 | % | $ | 0.00 | ||||

Selling Commissions(2) | 2.00 | % | $ | 200.00 | ||||

Operating and Ongoing Offering Expenses(3) | 0.75 | % | $ | 75.00 | ||||

Brokerage Fees(4) | 3.00 | % | $ | 300.00 | ||||

Less Interest Income(5) | 0.05 | % | $ | 5.00 | ||||

TWELVE-MONTH BREAKEVEN | 7.95 | % | $ | 795.00 | ||||

6

Table of Contents

SERIES B-2 Units

Routine Expenses | Percentage Return Required Initial Twelve Months of Investment | Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment | ||||||

Management Fees | 2.25 | % | $ | 225.00 | ||||

General Partner Performance Fees(1) | 0.00 | % | $ | 0.00 | ||||

Selling Commissions(2) | 0.00 | % | $ | 0.00 | ||||

Operating and Ongoing Offering Expenses(3) | 0.75 | % | $ | 75.00 | ||||

Brokerage Fees(4) | 3.00 | % | $ | 300.00 | ||||

Less Interest Income(5) | 0.05 | % | $ | 5.00 | ||||

TWELVE-MONTH BREAKEVEN | 5.95 | % | $ | 595.00 | ||||

The foregoing break-even analyses are approximations only and assume a constant $10,000 net asset value and break-even months during the first year of an investor’s investment in a Series.

| (1) | No performance fees will be charged until break-even costs are met. However, because the General Partner’s performance fee is payable monthly, and the General Partner is not obligated to return performance fees once earned, it is possible for the General Partner to earn a performance fee during a break-even or losing year if, after payment of a performance fee, the Fund incurs losses resulting in a break-even or losing year. It is impossible to predict what performance fee, if any, could be paid during a break-even or losing year, thus none is shown. |

| (2) | The maximum cumulative selling commission per Series A-1 and Series B-1 Unit sold pursuant to this Prospectus is capped at 10% of the gross offering proceeds for each such Unit. Series A-2 Units and Series B-2 Units are not subject to selling commissions. |

| (3) | Ongoing offering expenses will not exceed 0.4999% of the gross offering proceeds of the Units registered pursuant to the Registration Statement of which the Prospectus is part. Operating expenses are not expected to exceed 0.70% of the average month-end net assets each year of each Series. The General Partner will assume liability for ongoing offering and operating expenses, when considered together, in excess of 0.75% of average month-end net assets per year of each Series. |

| (4) | Assumes 1,720 round-turn transactions for Series A and 2,585 round-turn transactions for Series B per million dollars per year at a rate of $9 per round-turn transaction. These assumptions are based on the average number of round-turn transactions per million dollars per year traded on behalf of each Series since the Fund’s inception and the average risk capital of each Series allocated to the Fund’s short-term systematic, technical trading strategy since July 1, 2010. The Fund’s Third Amended and Restated Limited Partnership Agreement (the “Partnership Agreement”) provides that brokerage commission costs borne by the Fund shall not exceed 5% (Series A) and 7% (Series B) annually of the average annual net assets of the Series. |

7

Table of Contents

| (5) | Estimated. Interest income reflects an assumed interest rate of 0.10% per annum based on current cash market information and the fact that less than half of the Fund’s assets are currently held in interest bearing accounts. |

The twelve-month break-even points shown are based on interest income of 0.05% per annum. Actual interest to be earned by the Fund will be at the prevailing rates for the period being measured which may be greater than 0.05% over any twelve month period.

Federal Income Tax Aspects

Each Series will be classified as a partnership for federal income tax purposes. As such, you will be taxed each year on the income attributable to the Series in which you invest whether or not you redeem Units or receive distributions from the Series.

To the extent the Fund invests in futures and other commodity contracts, gain or loss on such investments will, depending on the contracts traded, consist of a mixture of: (1) ordinary income or loss; and/or (2) capital gain or loss. Forty percent (40%) of trading profits, if any, on U.S. exchange-traded futures contracts and certain foreign currency forward contracts are taxed as short-term capital gains at ordinary income rates and the remaining sixty percent (60%) is taxed as long-term capital gains at a lower maximum rate for non-corporate investors. Trading gains or losses from other contracts will be primarily short-term capital gains or losses, and interest income is taxed at ordinary income rates.

For non-corporate investors, capital losses on the Units may be deducted against capital gains but may only be deducted against ordinary income to the extent of $3,000 per year. Therefore, you could pay tax on a Series’ interest income even though your overall investment in the Fund has been unprofitable.

Is Superfund Gold, L.P. a Suitable Investment for You?

The primary objective of the Fund is to maintain its dollar for dollar gold position while seeking appreciation of its assets over time by trading a diversified portfolio of futures and forward contracts. An investment in Units may fit within your portfolio allocation strategy if you are interested in the Fund’s potential to produce returns generally unrelated to traditional securities investments and the de-linking of the Fund’s net asset value from the value of the U.S. dollar relative to gold resulting from the maintenance of the dollar for dollar gold position.

An investment in Units is speculative and involves a high degree of risk. The Series are not complete investment programs. The General Partner offers the Units as a diversification opportunity for an investor’s entire investment portfolio, and therefore an investment in Units should only be a limited portion of the investor’s portfolio. To invest, you must, at a minimum, have:

| (1) | a net worth of at least $250,000, exclusive of home, furnishings and automobiles; or |

| (2) | a net worth, similarly calculated, of at least $70,000 and an annual gross income of at least $70,000. |

Some jurisdictions in which the Units are offered impose higher minimum suitability standards on prospective investors. These suitability standards are, in each case, regulatory minimums only, and merely because you meet such standards does not mean that an investment in the Units is suitable for you. See Exhibit C to this Prospectus — “Subscription Representations.”

You may not invest more than 10% of your net worth, exclusive of home, furnishings and automobiles, in the Fund.

8

Table of Contents

Subscription Procedure

To Subscribe for Units, you must complete and sign the subscription documents that accompany this Prospectus and deliver them to your selling agent at least five business days prior to the applicable month-end closing date. Payment instructions are included with the subscription documents. Subscription documents deemed valid and complete by the General Partner will be accepted, within five business days of receipt of a subscription, once subscription payments have been received and cleared. Investors’ purchases will be confirmed by their selling agents, generally within five business days after the applicable month-end closing. The General Partner will notify investors of, and will return, rejected subscriptions within five business days following the applicable month-end closing or sooner if practicable. No interest is earned while subscriptions are being processed. See “Plan of Distribution.”

Reports

Within 30 calendar days after the end of each month, the General Partner will distribute to investors a monthly report of the Fund. The General Partner will also distribute an annual report of the Fund within 90 calendar days after the end of the Fund’s fiscal year and will provide investors with federal income tax information for the Fund by March 15 of each year.

The General Partner will calculate the approximate net asset value per Unit of each Series on a daily basis, both in U.S. dollars and in ounces of gold, and will furnish such information upon request to any Limited Partner.

CFTC Rules require that this Prospectus be accompanied by summary financial information, which may be a recent monthly report of the Fund, current within 60 calendar days.

9

Table of Contents

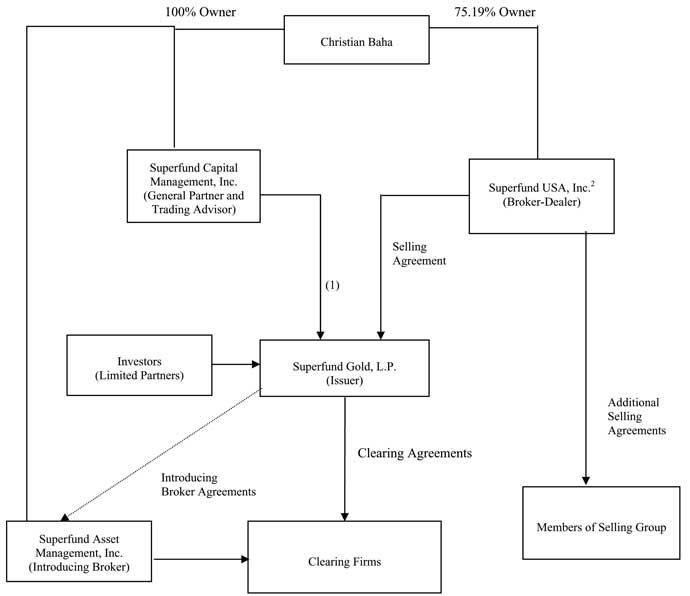

Organizational Chart

The organizational chart below illustrates the relationships among the various service providers of this offering. Superfund Capital Management, Inc. is both the general partner and trading advisor for the Fund. The selling agents (other than Superfund USA, Inc.) and clearing brokers are not affiliated with Superfund Capital Management, Inc. or Superfund Gold, L.P.

| (1) | Superfund Capital Management, Inc. will maintain an investment in each Series of Superfund Gold, L.P. of at least 1% of the net asset value of each such Series (including Superfund Capital Management, Inc.’s investment). |

| (2) | The remaining 24.81% of Superfund USA, Inc. is owned by Superfund Asset Management, Inc. |

Descriptions of the dealings between Superfund Capital Management, Inc. and its affiliates and the Fund are set forth below under “Conflicts of Interest” and “Charges to Each Series.”

10

Table of Contents

The Fund Is Speculative; You Could Lose All or Substantially All of Your Investment in a Series

An investment in the Fund is a speculative investment. You will be relying on the General Partner to trade profitably and on the price of gold to rise or not to decrease substantially, neither of which can be assured. Consequently, you could lose all or substantially all of your investment in a Series.

The Fund Has Only a Limited Performance History for You to Evaluate When Making a Decision Whether or Not to Invest in a Series

The Fund has a limited performance history for you to evaluate when making your investment decision. Although past performance is not necessarily indicative of future performance, a longer performance history might provide you with potentially valuable information about the rate of return experience of the Series in various market conditions. However, as the Fund has only a limited performance history, you will have to make your investment decision without the benefit of more performance information.The past performance of the Fund, the General Partner or the General Partner’s affiliates is not necessarily indicative of the future results of either Series.

The Fund Is Highly Leveraged; Leverage Magnifies Losses as Well as Gains

Because the amount of margin funds necessary to enter into a futures or forward contract position is typically about 2% to 10% of the total value of the contract, the Series are able to hold positions with notional, or face, values far greater than each Series’ net assets.

The General Partner anticipates that, with respect to its speculative futures and forward contract trading, Series A will acquire futures and forward contracts with a notional, or face, value of approximately four to seven times Series A’s net assets and that Series B will acquire futures and forward contracts with a notional, or face, value of approximately six to nine times Series B’s net assets, although, at any given time, the notional value of a Series’ futures and forward contracts may be greater than or less than the limits of these anticipated ranges. As a result of this leveraging, even a small adverse movement in the price of a contract can cause major losses.

The Performance of the Fund Is Expected To Be Volatile; Volatile Performances Can Result in Sudden Large Losses.

The General Partner expects the performance of each Series to be volatile. Futures and forward contract prices have a high degree of variability and are subject to occasional rapid and substantial changes, and the value of the Units may suffer substantial loss from time to time. The net asset value per Unit may change substantially between the date on which you subscribe for Units and the date on which your Units are issued or the date on which you request a redemption and the month-end redemption date. Since it commenced trading operations in April 2009 through February 2012, monthly returns in the Fund have ranged from up 20.03% to down 13.49% for its Series A-1 Units, from up 20.15% to down 13.35% for its Series A-2 Units, from up 33.75% to down 20.62% for its Series B-1 Units and from up 33.97% to down 20.48% for its Series B-2 Units.

Various factors may influence the price movements of commodity interests, such as: changing supply and demand relationships; weather; agricultural, trade, fiscal, monetary and exchange control programs and policies of governments; United States and foreign political and economic events and policies; changes in national and international interest rates and rates of inflation; currency devaluations and revaluations; and emotions of the marketplace. None of these factors can be controlled by the General Partner and no assurance can be given that the General Partner’s advice will result in profitable trades for a participating customer or that a customer will not incur substantial losses.

The Fund’s Forward Transactions Are Not Currently Regulated and Are Subject to Credit Risk

The Fund, as an eligible contract participant, trades forward contracts in foreign currencies through the over-the-counter (“OTC”) dealer market which is dominated by major money center banks and is currently

11

Table of Contents

substantially unregulated. Thus, you do not receive the same protection as provided to futures traders in United States markets by the CFTC regulatory scheme or the statutory scheme of the Commodity Exchange Act. Each Series faces the risk of non-performance by the counterparties to the forward contracts and such non-performance may cause some or all of a Series’ gain, if any, on its forward trading to be unrealized.

The interbank currency markets may in the near future become subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”), a development Act which may entail increased costs and result in burdensome reporting requirements. The imposition of credit controls by governmental authorities or the implementation of regulations pursuant to the Reform Act might limit such forward trading to less than that which the General Partner would otherwise recommend, to the possible detriment of the Fund. In its forward trading, the Fund will be subject to the risk of the failure of, or the inability or refusal to perform with respect to its forward contracts by, the principals with which the Fund trades. Assets on deposit with such principals will also generally not be protected by the same segregation requirements imposed on CFTC-regulated commodity brokers in respect of customer funds on deposit with them. Accordingly, the insolvency or bankruptcy of such parties could also subject the Fund to the risk of loss.

Currency forward markets are substantially unregulated and price movements in such markets are caused by many unpredictable factors including general economic and financial conditions, governmental policies, national and international political and economic events, and changes in interest rates. Such factors combined with the lack of regulation could expose each Series to significant losses which they might otherwise have avoided.

Currency forward positions can be established using less margin than is typical for futures contracts. Thus, a small movement in the price of the underlying currency can result in a substantial price movement relative to the margin deposit. In addition, cash foreign currencies are traded through a dealer market and not on an exchange. This presents the risks of both counterparty creditworthiness and possible default or bankruptcy by the counterparty.

Fees and Commissions Are Charged Regardless of Profitability and Will Cause Losses If Not Offset by Profits and Interest Income; If Profitable, a Series Will Pay Substantial Performance Fees

The Fund is subject to substantial charges payable irrespective of profitability in addition to performance fees which are payable based on each Series’ profitability. Each Series must have profits from its trading and/or gold investment and interest income to avoid losses. In order to break-even during the first twelve months of investment, the Units must return approximately 6.95% (Series A-1 Units), 7.95% (Series B-1 Units), 4.95% (Series A-2 Units) and 5.95% (Series B-2 Units). If profitable, given the rate at which the management fee is charged, a Series will pay a performance fee that is approximately 2.7% greater than that recommended by the North American Securities Administrators Association, in the Association’s guidelines for public commodity pools, resulting in somewhat lower profits for investors in the Series than would be the case if the performance fee were less.

An Investment in the Fund is Not a Liquid Investment; Investors Remain Liable for Fund Liabilities Incurred After Submitting Redemption Notices but Before the Month-End Redemption Date, and You Will Not be Able to Limit Your Losses or Realize Accrued Profits Except at a Month-End

There is no secondary market for the Units. While the Units have redemption rights, redemptions are permitted only at the end of a month upon five (5) business days’ prior written notice to the Fund, and redeeming

12

Table of Contents

investors remain liable for the liabilities of the Series in which they invest until they are redeemed at month-end. Transfers of the Units are permitted only upon 30 days’ advance written notice to the Fund. Because Units cannot be readily liquidated, it will not be possible for you to limit losses or realize accrued profits, if any, except at a month-end in accordance with the Fund’s redemption provisions.

Lack of Liquidity in the Markets in Which the Fund Trades Could Make It Impossible to Realize Profits or Limit Losses

Futures and forward positions cannot always be liquidated at the desired price. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. A market disruption, such as when foreign governments may take or be subject to political actions which disrupt the markets in their currency or major exports, can also make it difficult to liquidate a position.

Unexpected market illiquidity has caused major losses in the recent past in such sectors as emerging markets, mortgage-backed securities and other credit related instruments. There can be no assurance that the same will not happen in the futures markets generally, or in certain futures markets, at any time or from time to time. The large size of the positions the Series may take increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

United States commodity exchanges impose limits over the amount the price of some, but not all, futures contracts may change on any day. If a market has moved adversely to a Series’ position and has reached the daily price limit, it may be impossible for the Series to liquidate its position until the limit is expanded by the exchange or the contract begins to trade away from the limit price. In addition, even if futures prices have not reached the daily price limit, the Fund may not be able to execute futures trades at favorable prices if little trading in such contracts is taking place.

The Fund Trades Extensively in Foreign Markets Which May Not Be Subject to the Same Level of Regulatory Oversight as Trading in Domestic Markets

A substantial portion of the Fund’s trades take place on markets or exchanges outside the United States. The risk of loss in trading foreign futures contracts and foreign options can be substantial. Non-U.S. markets may not be subject to the same degree of regulation as their U.S. counterparts. None of the CFTC, National Futures Association (“NFA”) or any domestic exchange regulates activities of any foreign boards of trade or has the power to compel enforcement of the rules of a foreign board of trade or any applicable foreign laws. In addition, some foreign exchanges are “principals’ markets” in which performance is the responsibility only of the individual exchange member counterparty, not of the exchange or a clearing facility. In such cases, the Fund will be subject to the risk that the member with whom the Fund has traded is unable or unwilling to perform its obligations under the transaction.

Trading on foreign exchanges also presents the risk of loss due to the possible imposition of exchange controls (making it difficult or impossible for the Fund to repatriate some or all of the Series’ assets held by foreign counterparties), government expropriation of assets, taxation, government intervention in markets, limited rights in the event of bankruptcy of a foreign counterparty or exchange and variances in foreign exchange rates between the time a position is entered and the time it is exited.

If the Series Do Not Perform in a Manner Non-Correlated with the General Financial Markets or Do Not Perform Successfully, You Will Not Obtain Any Diversification Benefits by Investing in the Units and You May Have No Gains to Offset Your Losses from Other Investments

Historically, managed futures have been generally non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is no statistically valid relationship between the past performance of futures and forward contracts on the one hand and stocks or bonds on the other hand. Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be opposite each other. Because of this non-correlation, the Series cannot be expected to be automatically profitable during unfavorable periods for the stock or bond markets, or vice versa. If the Series do not perform in a manner

13

Table of Contents

non-correlated with the general financial markets or do not perform successfully, you will not obtain any diversification benefits by investing in the Units and you may have no gains to offset your losses from other investments.

A Series May Be Subject to a Performance Fee Despite the Units Having Declined in Value Further Depressing the Value of Such Units

Series performance fees are calculated on the basis of the new appreciation in the net asset value of each Sub-Series due to futures and forward trading performance, excluding interest income and changes in the value of the Series’ dollar for dollar gold position. Consequently, the General Partner may earn a performance fee for its trading performance even though the dollar value of the Units held by an investor has declined due to a decrease in the dollar value of gold. Additionally, Units may incur losses generating a loss carryforward for purposes of calculating subsequent performance fees payable by a Series. The benefit of any such loss carryforward will be diluted by the admission of new Limited Partners to such Series, and the differential between any loss carryforwards attributable to the Sub-Series within each Series will be eliminated with respect to Series 1 Units redesignated as Series 2 Units after selling commissions are no longer chargeable to such Series 1 Units.

Gains, If Any, From a Series’ Futures and Forward Trading May Be Offset by Losses on Its Gold Position, and Gains, If Any, on Its Gold Position May be Offset by Losses From Its Futures and Forward Trading, Resulting in No Gains or Aggregate Losses for the Series

An investment in a Series is not equivalent to an investment in gold. Rather, it is an investment in a product that combines a gold investment with a systematic, primarily trend-following, futures and forward trading program. The gold investment is intended to de-link each Series’ net asset value, which is denominated in U.S. dollars, from the value of the U.S. dollar relative to gold, essentially denominating the Series’ net asset value in terms of gold. Consequently, if the U.S. dollar value of gold declines, gains, if any, from the Series’ futures and forward trading may not be sufficient for the Series to avoid a decline in the net asset value of its Units expressed in U.S. dollars, the currency in which Units are redeemed. Likewise, losses from a Series’ futures and forward trading may be greater than any increase in the U.S. dollar value of gold resulting in a decline in the net asset value of the Units. Additionally, there can be no assurance that, if the value of gold declines relative to the U.S. dollar, there will be any corresponding increase in the value or purchasing power of the U.S. dollar for goods (other than gold) or services priced in U.S. dollars.

The Series May Reduce Their Gold Positions or Their Futures and Forward Trading Activity If Gold Margin Requirements Increase Substantially, Thereby Changing the Nature of Your Investment in a Series

If the margin requirements for a Series’ gold futures position should increase substantially, the General Partner, in its discretion, may reduce, or eliminate, the Series’ gold position so as to be able to continue the Series’ futures and forward trading. If the General Partner reduces a Series’ gold position, the Series will not achieve its objective of maintaining a gold investment approximately equal to the net asset value of the Series, possibly resulting in a lost profit opportunity if the value of gold should thereafter appreciate relative to the U.S. dollar and possibly resulting in a decline in purchasing power of the net asset value of the Series, expressed in U.S. dollars, if the appreciation in the U.S. dollar value of gold is the result of inflation in the U.S. dollar price of goods and services. Conversely, the General Partner, in its discretion, may reduce, or eliminate, the Series’ futures and forward trading activities so as to be able to maintain the Series’ gold investments. If the General Partner reduces a Series’ futures and forward trading activity, the Series’ capital appreciation objective through trading and investing in a portfolio of futures and forward contracts will be impaired and the performance of the Fund will become more similar to the performance of an unleveraged investment in gold.

The U.S. Dollar Price of Gold Has Fluctuated Widely over the Past Several Years. A Decline in the Price of Gold May Result in a Decline in the Value of the Units, Possibly Resulting in an Overall Loss on Your Investment

While generally advancing, the price of gold has fluctuated widely over the past several years. Several factors may affect the price of gold, including: global gold supply and demand, which is influenced by such factors as forward selling by producers, purchases made by producers to unwind hedge positions, central bank purchases

14

Table of Contents

and sales, and production and cost levels in major gold producing countries such as South Africa, the United States and Australia; investors’ expectations with respect to the rate of inflation; currency exchange rates; interest rates; investment and trading activities of investment funds; and global or regional political, economic or financial events and situations.You should be aware that there is no assurance that gold will maintain its value against the U.S. dollar in terms of purchasing power. There can be no assurance that the price of gold will continue to advance or not decline. Unless offset by trading profits and interest income, a decline in the price of gold will result in a decline in the net asset value of the Units expressed in U.S. dollars, the currency in which Units are redeemed, possibly resulting in an overall loss on your investment.

Large-Scale Sales of Gold May Lead to a Decline in the Price of Gold and a Decline in the Value of the Units, Possibly Resulting in an Overall Loss on Your Investment

The possibility of large-scale distress sales of gold in times of crisis may have a short-term negative impact on the price of gold and adversely affect the value of the Units. For example, the 1997 Asian financial crisis resulted in significant sales of gold by individuals which depressed the price of gold. Crises in the future may impair gold’s price performance which would, in turn, adversely affect an investment in the Units. Moreover, substantial sales of gold by the official sector could adversely affect an investment in the Units. The official sector consists of central banks, other governmental agencies and multilateral institutions that buy, sell and hold gold as part of their reserve assets. Since 1999, most gold sales by the official sector have been made in a coordinated manner under the terms of the Central Bank Gold Agreement. In the event that future economic, political or social conditions or pressures result in members of the official sector liquidating their gold assets all at once or in an uncoordinated manner, the demand for gold might not be sufficient to accommodate the sudden increase in supply. Consequently, the price of gold could decline significantly, which would adversely affect the value of the Units expressed in U.S. dollars, the currency in which Units are redeemed, possibly resulting in an overall loss on your investment.

Widening Interest Rate Differentials Between the Cost of Money and the Cost of Borrowing Gold Could Result in Increased Sales and a Decline in the Price of Gold, Possibly Resulting in a Decline in the Value of the Units and a Loss on Your Investment in a Series

A combination of rising interest rates and a continuation of the current low cost of borrowing gold (the gold lease rate) could improve the economics of selling gold forward. This could result in increased hedging by gold mining companies and short selling by speculators, which could adversely affect the price of gold and thus the value of the Units expressed in U.S. dollars, the currency in which Units are redeemed, possibly resulting in an overall loss on your investment.

The General Partner Analyzes Only Technical Market Data, Not Any Economic Factors External to Market Prices; Thus External Factors That Dominate Prices Could Result in Losses

The General Partner’s trading systems are developed on the basis of a statistical analysis of market prices. Consequently, any factor external to the market itself that dominates prices may cause major losses. For example, a pending political or economic event may be very likely to cause a major price movement, but the General Partner would continue to maintain positions indicated by its trading systems that would incur major losses if the event proved to be adverse.

The General Partner Is Primarily a Trend-Following Trader; An Absence of Price Trends in the Markets to be Traded by the Series Will Likely Result in Losses

The trading systems used by the General Partner for each Series are primarily technical, trend-following methods developed on the basis of statistical analysis of market price behavior, not on the basis of fundamental economic factors. The profitability of trading under these systems depends on, among other things, the occurrence of significant and sustained price trends, up or down, in at least some of the futures and forward markets traded by the Series. Such trends may not develop. There have been periods in the past without price trends in some of the markets traded by the Series. An absence of price trends in the markets traded by the Series will result in losses.

15

Table of Contents

The General Partner’s Trading Methodology is Subject to Change Over Time

The General Partner may periodically modify its trading methodology without approval by or notice to Limited Partners, provided, however, that Limited Partners will be notified within 21 calendar days of any material changes in the General Partner’s trading methodology in accordance with applicable regulations. Modifications may include changes in or substitution of technical trading systems, risk control overlays, money management principles and markets traded as well as the incorporation of non-trend-following systems within the General Partner’s primary trend-following methodology and the inclusion of non-technical methods of analysis. For example, in July 2010 the General Partner integrated a systematic, technical short-term trading strategy into the Fund’s primary trend-following methodology. Although the General Partner believes this modification of the Fund’s trading strategy will be beneficial to the Fund, there can be no assurance that this particular trading strategy will not increase the volatility of Fund returns or not result in losses.

Speculative Position Limits May Alter Trading Decisions for Each Series Possibly Resulting in Loss

The CFTC has established limits on the maximum net long or net short positions which any person may hold or control in certain futures contracts. Exchanges also have established such limits, including limits on gold which may have an impact on the ability of the Fund to acquire its dollar for dollar gold position or may limit the Fund’s ability to issue new Units. In November 2011, the CFTC adopted a new position limits regime for 28 so-called “exempt” (i.e., metals and energy) and agricultural futures and options contracts and their economically equivalent swap contracts. These position limits are not yet effective and there is considerable uncertainty surrounding their application. All accounts controlled by the General Partner, including the accounts of the Series, are combined for speculative position limit purposes. If positions in those accounts were to approach the level of the particular speculative position limit, the General Partner may modify the trading decisions for the Fund or be forced to liquidate certain futures positions, possibly resulting in losses.

Increase in Assets Under Management May Affect the General Partner’s Trading Decisions to the Detriment of Your Investment in a Series

The General Partner has not agreed to limit the amount of money it may manage and it and its affiliates are actively seeking to raise additional capital for the investment products they manage. The more assets the General Partner and its affiliates manage, the more difficult it may be for the Series to trade profitably because of the difficulty of trading larger positions without adversely affecting prices and performance. Accordingly, increases in capital under management may require the General Partner to modify its trading decisions for the Series which could have a detrimental effect on your investment such as decreasing profits or increasing losses.

Investors Are Taxed Each Year Based on Their Share of Profits Attributable to the Series in Which They Invest; Investors Must Either Redeem Units to Pay Taxes or Have Other Assets Available to Do So

Investors are taxed each year on their share of Fund profits, if any, attributable to the Series in which they invest (including any profits arising out of the Series’ gold investment) irrespective of whether they redeem any Units or receive any cash distributions from a Series. All performance information included in this Prospectus is presented on a pre-tax basis; investors who experienced such performance may have had to redeem a portion of their investments or, otherwise, paid the related taxes from other sources.

You Could Owe Taxes on Your Share of Ordinary Income Attributable to a Series Despite Having Suffered an Overall Loss

Investors may be required to pay tax on their share of ordinary income, from interest and gain on some foreign futures contracts, attributable to the Series in which they invest, even though such Series incurs overall losses. For non-corporate investors, capital losses can be used only to offset capital gains and up to $3,000 of ordinary income each year. Consequently, if a non-corporate investor were allocated $5,000 of ordinary income and $10,000 of capital losses, the investor would owe tax on $2,000 of ordinary income even though the investor would have a $5,000 loss for the year. The remaining $7,000 capital loss may be carried forward and used in subsequent years to offset capital gain and ordinary income, but would be subject to the same annual limitation on its deductibility against ordinary income.

16

Table of Contents

Recharacterization of the Fund’s Ordinary Expenses as “Investment Advisory Fees” Could Result in an Investor Owing Increased Taxes

The General Partner does not intend to treat the ordinary expenses of the Fund as “investment advisory fees” for federal income tax purposes. The General Partner believes that this is the position adopted by virtually all United States futures fund sponsors. However, were the ordinary expenses of the Fund characterized as “investment advisory fees,” non-corporate taxpayers would be subject to substantial restrictions on the deductibility of those expenses, would pay increased taxes in respect of an investment in the Units and could actually recognize taxable income despite having incurred a financial loss.

Accounting for Uncertainty in Income Taxes May Have Effects on the Periodic Calculations of Net Asset Value

Accounting Standards Codification Topic No. 740, “Income Taxes” (in part formerly known as “FIN 48”) (“ASC 740”), provides guidance on the recognition of uncertain tax positions. ASC 740 prescribes the minimum recognition threshold that a tax position is required to meet before being recognized in an entity’s financial statements. It also provides guidance on recognition, measurement, classification and interest and penalties with respect to tax positions. A prospective investor should be aware that, among other things, ASC 740 could have a material adverse effect on the periodic calculations of the net asset value of the Fund, including reducing the net asset value of the Fund to reflect reserves for income taxes, such as foreign withholding taxes, that may be payable by the Fund. This could cause benefits or detriments to certain investors, depending upon the timing of their entry and exit from the Fund.

The Failure of a Clearing Broker or Currency Dealer Could Result in Losses

The Commodity Exchange Act requires a clearing broker to segregate all funds received from customers from such broker’s proprietary assets. If any of the clearing brokers fails to do so, the assets of the Fund might not be fully protected in the event of the bankruptcy of the clearing broker. Furthermore, in the event of any clearing broker’s bankruptcy, the Fund would be limited to recovering only a pro rata share, which may be zero, of all available funds segregated on behalf of the clearing broker’s combined customer accounts. The Fund’s trading in currency forward contracts is generally conducted in the dealer market, which is dominated by major money center banks, currently not subject to the provision of the Commodity Exchange Act. As a result, you do not have the protections provided by the Commodity Exchange Act in the event of the bankruptcy of a Fund currency dealer.

MF Global Exposure; Could Result in Additional Losses

On October 31, 2011, MF Global Inc. (“MF Global”) one of the Fund’s clearing brokers at the time, reported to the Securities and Exchange Commission (“SEC”) and CFTC possible deficiencies in customer segregated accounts held at the firm. As a result, the SEC and CFTC determined that a liquidation led by SIPC would be the safest and most prudent course of action to protect customer accounts and assets, and SIPC initiated the liquidation of MF Global under the Securities Investor Protection Act.

The Fund held assets on deposit in accounts at MF Global as of October 31, 2011, the date that the liquidation proceedings commenced with respect to MF Global. As a result of such liquidation proceedings, customer accounts at MF Global were, and continue to be as of the date hereof, frozen, at least in part, including accounts belonging to the Fund. On November 2, 2011, the CFTC reported an estimated 11.6% shortfall in the customer segregated funds account of MF Global. On November 21, 2011, the SIPC liquidation Trustee announced that the shortfall in the customer segregated funds account could be as much as 22% or more. After consideration of the Fund’s exposure, the General Partner caused the Fund to take a reserve to account for the Fund’s estimated exposure to such 22% shortfall as of October 31, 2011. The foregoing reserve was based upon information available at the time such reserve was taken and is in accordance with generally accepted accounting principles, although there can be no assurance that any actual shortfall will not be greater than the General Partner’s estimate (or that

17

Table of Contents

customer funds will not be located reducing the estimated shortfall). As additional information becomes available, additional reserves may be taken or prior reserves reversed, which will be accounted for in accordance with generally accepted accounting principles as of the time that such information is then available (and not as of the date that the liquidation proceedings commenced with respect to MF Global). As a result, all Limited Partners will participate in any future reserves taken (resulting in decreases in the Fund’s net asset value) or any reversal of prior reserves (resulting in increases in the Fund’s net asset value) to the extent that such Limited Partner holds Units at the time that such reserve is taken or reversed. Were the entirety of the Fund’s assets held at MF Global unrecoverable, the Series A-1 Units would incur a further loss, based on Net Asset Value at February 29, 2012 of 1.80%, the Series A-2 Units would experience a loss of 1.80%, the Series B-1 Units would experience a loss of 3.26% and the Series B-2 Units would experience a loss of 3.26%.

The Fund Is Subject to Actual and Potential Conflicts of Interest That Could Result in Losses for the Fund

The Fund is subject to numerous actual and potential conflicts of interest, including: (1) the General Partner will not select any other trading advisor for the Fund even if doing so would be beneficial to the Fund; (2) the affiliation between the General Partner and Superfund Asset Management, Inc. creates an incentive for the General Partner to trade more frequently than it otherwise might absent the affiliation; (3) the proprietary trading of the General Partner or its principals or of the Fund’s clearing brokers and their affiliates and personnel may increase competition for positions sought to be entered by the Fund making it more difficult for the Fund to enter positions at favorable prices; and (4) the compensation that the selling agents, including Superfund USA, Inc., receive gives them an incentive to promote the sale of Units as well as to discourage redemptions. See “Conflicts of Interest.”

Because the General Partner has not established any formal procedures for resolving conflicts of interest and because there is no independent control over how conflicts of interest are resolved, you will be dependent on the good faith of the parties with conflicts to resolve the conflicts equitably. The General Partner cannot assure that conflicts of interest will not result in losses for the Fund.

No Independent Experts Represented the Interests of Investors; You Must Rely on Your Own Professional Advisors with Respect to an Investment in a Series

The General Partner has consulted with counsel, accountants and other experts regarding the formation and operation of the Fund. No counsel has been appointed to represent the Limited Partners in connection with the offering of the Units. Accordingly, each prospective investor should consult his own legal, tax and financial advisors with respect to an investment in a Series.

You Will Be Relying on the General Partner Alone to Direct the Fund’s Trading

The Fund is structured as a single-advisor managed futures fund. Many managed futures funds are structured as multi-advisor funds to attempt to control risk and reduce volatility through combining advisors whose historical performance records have exhibited a significant degree of non-correlation with each other. As a single-advisor managed futures fund, the Series may have greater volatility and a higher risk of loss than investment vehicles employing multiple advisors.