UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

| Diligent Board Member Services, Inc. |

| (Name of Registrant as Specified In Its Charter) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

39 West 37th Street, 8thFloor

New York, New York

PROXY STATEMENT

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 25, 2013

Dear Shareholders:

Diligent Board Member Services, Inc., a Delaware corporation (the “Company”), will hold its Annual Meeting of Shareholders on Tuesday, June 25, 2013, at 11:00 a.m., New Zealand local time, at the Pullman Hotel, Corner of Princes and Waterloo Quadrant, Auckland, New Zealand (the “Annual Meeting”), to consider and, if thought fit, pass the following resolutions:

| · | To elect the Board’s nominees, Rick Bettle and Greg B. Petersen, as Class I directors (“Proposal 1”); |

| · | To ratify Mark Weldon’s appointment as a Class II director (“Proposal 2”); |

| · | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2013 (“Proposal 3”); |

| | | |

| · | To ratify the total remuneration paid by the Company to its non-executive directors for each calendar year or part year since our listing on the New Zealand Stock Exchange (“NZSX”) (“Proposal 4”), which amounted to: |

| E. | U.S. $60,000 in 2011; and |

| · | To approve the total remuneration payable by the Company to all non-executive directors for the 2013 and subsequent calendar years in an amount equal to U.S. $856,000, all or any portion of which may be payable through the issuance of equity securities, provided the issuance occurs in compliance with New Zealand Stock Exchange Rule (“NZSX Rule”) 3.5.1 and NZSX Rule 7.3.7. This is an increase of U.S. $646,000 from the amount paid to non-executive directors in the 2012 calendar year (“Proposal 5”); |

| · | To approve the Company’s 2013 Incentive Plan (the “2013 Plan”) (“Proposal 6”); |

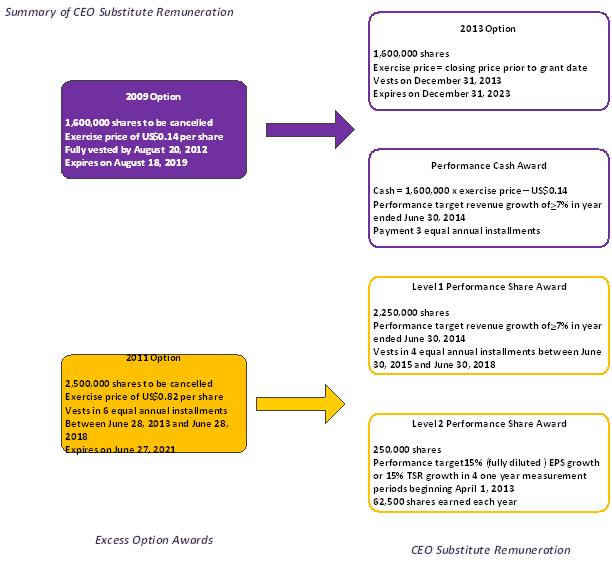

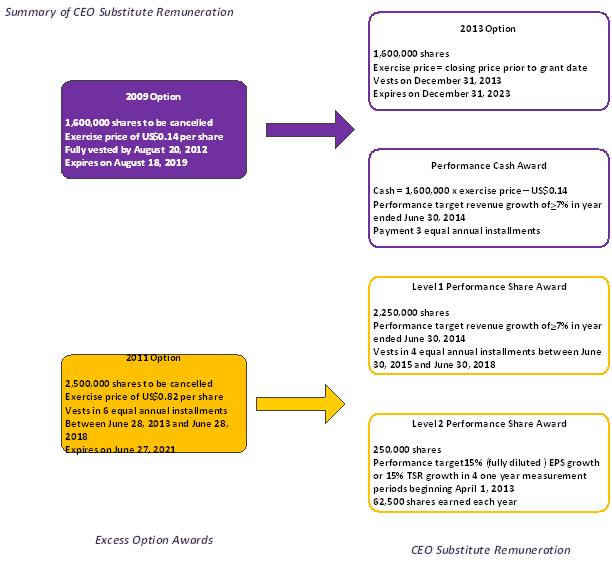

| · | To approve, conditional on Proposals 6 and 8 being approved, the issuance to our Chief Executive Officer, Alessandro Sodi, of options to purchase 1,600,000 shares of our common stock with an exercise price per share equal to the U.S. dollar equivalent closing price of our common stock on the NZSX on the last trading day immediately prior to the grant and the issuance of up to 2,500,000 shares of our common stock on the terms described in Proposals 7 and 8 as part of his substitute remuneration package (the “CEO Substitute Remuneration”) pursuant to NZSX Rule 7.3.1(a) (“Proposal 7”); and |

| · | To approve, conditional on Proposals 6 and 7 being approved, the substitute remuneration package of our Chief Executive Officer, Alessandro Sodi as a related party pursuant to NZSX Rule 9.2.1 (“Proposal 8”). |

Following the consideration of the foregoing resolutions the Company will transact any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

This proxy statement is first being delivered to shareholders on or about June 11, 2013 (New Zealand time). The matters listed in this notice of meeting are described in the accompanying proxy statement. Our Board of Directors has fixed the close of business on May 1, 2013 (New York time) and immediately prior to the open of market on May 2, 2013 (New Zealand time) as the record date for the 2013 Annual Meeting of Shareholders. You must be a shareholder of record at that time to be entitled to receive the Notice of the Annual Meeting and to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on June 25, 2013: In accordance with the rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a notice of annual meeting, proxy statement, proxy card (which also serves as an admission card for our Annual Meeting) and our Annual Report, if you have not received it previously, for the year ended December 31, 2012, and by notifying you of the availability of our proxy materials on the internet at http://www.boardbooks.com/diligentbooks/downloads/2013AnnualMeetingProxy.pdf.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, please submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares by fax, email, online on the registry website, mail (or by telephone for our U.S. shareholders), please refer to the enclosed proxy card. Any shareholder may revoke a submitted proxy at any time before the meeting by written notice addressed to the Corporate Secretary, by submitting a subsequently dated proxy, or by attending the Annual Meeting and voting in person. If you choose to submit a proxy over the internet at the website below, you may also revoke your proxy by voting in person at the annual meeting or by submitting your proxy at a later time on the website.

YOU MAY SUBMIT YOUR PROXY ON THE INTERNET BY GOING TO THE WEBSITE OF OUR SHARE REGISTRY, LINK MARKET SERVICES, ATHTTPS://INVESTORCENTRE.LINKMARKETSERVICES.CO.NZ/VOTING/DIL.ASPX. YOU WILL REQUIRE YOUR CSN (HOLDER NUMBER) AND FIN FOR SECURITY PURPOSES. HOWEVER, IF YOUR SHARES ARE HELD BY A BANK, BROKER, FIDUCIARY, TRUSTEE OR OTHER NOMINEE, YOU MAY VOTE BY GOING TO THE WEBSITE OF OUR PROXY ADVISORY FIRM, GEORGESON, INC. AT HTTP://PROXY.GEORGESON.COM/.

If your shares are held in the name of a bank, broker, fiduciary or custodian, follow the voting instructions on the form you received from your record holder. The availability of internet and telephone voting instructions will depend on their procedures.

| | By Order of the Board of Directors, |

| | |

| |  |

| | Jack Van Arsdale |

| | Associate General Counsel |

New York, New York

June 4, 2013

THE MEETING

Date, Time and Place

We are providing this proxy statement (this “proxy statement”) to you in connection with the solicitation on behalf of our Board of Directors (the “Board”) of proxies to be voted at the 2013 Annual Meeting of Shareholders (the “Annual Meeting”) of Diligent Board Member Services, Inc. (the “Company” or “Diligent”) or any postponement or adjournment of the Annual Meeting. The Annual Meeting will be held on Tuesday, June 25, 2013, at 11:00 a.m., New Zealand local time, at the Pullman Hotel, Corner of Princes and Waterloo Quadrant, Auckland, New Zealand.

Matters to be Considered

At the Annual Meeting, the shareholders will be asked:

| · | To elect the Board’s nominees, Rick Bettle and Greg B. Petersen, as Class I directors (“Proposal 1”); |

| · | To ratify Mark Weldon’s appointment as a Class II director (“Proposal 2”); |

| · | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2013 (“Proposal 3”); |

| | | |

| · | To ratify the total remuneration paid by the Company to our non-executive directors for each calendar year or part year since our listing on the New Zealand Stock Exchange (“NZSX”) (“Proposal 4”), which amounted to: |

| E. | U.S. $60,000 in 2011; and |

| · | To approve the total remuneration payable by the Company to all non-executive directors for the 2013 and subsequent calendar years in an amount equal to U.S. $856,000, all or any portion of which may be payable through the issuance of equity securities, provided the issuance occurs in compliance with New Zealand Stock Exchange Rule (“NZSX Rule”) 3.5.1 and NZSX Rule 7.3.7. This is an increase of U.S. $646,000 from the amount paid to non-executive directors in the 2012 calendar year (“Proposal 5”); |

| · | To approve the Company’s 2013 Incentive Plan (the “2013 Plan”) (“Proposal 6”); |

| · | To approve, conditional on Proposals 6 and 8 being approved, the issuance to our Chief Executive Officer, Alessandro Sodi, of options to purchase 1,600,000 shares of our common stock with an exercise price per share equal to the U.S. dollar equivalent closing price of our common stock on the NZSX on the last trading day immediately prior to the grant and the issuance of up to 2,500,000 shares of our common stock on the terms described in Proposals 7 and 8 as part of his substitute remuneration package (the “CEO Substitute Remuneration”) pursuant to NZSX Rule 7.3.1(a) (“Proposal 7”); and |

| · | To approve, conditional on Proposals 6 and 7 being approved, the substitute remuneration package of our Chief Executive Officer, Alessandro Sodi, as a related party transaction pursuant to NZSX Rule 9.2.1 (“Proposal 8”). |

Following the consideration of the foregoing resolutions we will transact any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

Attending the Annual Meeting

If you are a shareholder of record, you may attend the Annual Meeting and vote in person, or you may submit your proxy for your shares to be voted at the Annual Meeting. If you are a beneficial owner of common stock and your shares are held in the name of a broker, bank, fiduciary, trustee or other nominee, your nominee will be required to advise Link Market Services in writing at P.O. Box Auckland 1142 New Zealand (to be received 48 hours before the start of the Annual Meeting). For clarification, the terms “common stock” and “common shares” are the equivalent U.S. terminology for the term “ordinary shares” used in New Zealand.

If you are attending the meeting, you must bring your proxy card with you as the barcode will assist in your registration at the meeting. All shareholders must register before entering the meeting.

If you wish to obtain directions to the location of the Annual Meeting to attend and vote in person, contact Sonya Joyce, Diligent Board Member Services, Inc. on +64 4 894 6912.

Notice of Internet Availability of Proxy Materials

In accordance with the rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a notice of annual meeting, proxy statement, proxy card (which also serves as an admission card for our Annual Meeting) and our Annual Report, unless you have received it previously, for the year ended December 31, 2012 (the “Annual Report”), and by notifying you of the availability of our proxy materials on the internet at http://www.boardbooks.com/diligentbooks/downloads/2013AnnualMeetingProxy.pdf.

Shareholders may sign up to receive future proxy statements, notices of internet availability of proxy materials and other shareholder communications electronically instead of by mail by contacting the Company’s share registry, Link Market Services in any way as stated on the reverse of the proxy card. In order to receive your investor communications electronically, you must have an e-mail account, access to the internet through an internet service provider and web browser that supports secure connections.

Record Date; Shares Outstanding and Entitled to Vote

You are entitled, subject to the NZSX Rules, to vote your shares at the Annual Meeting only if our records show that you held your shares as of the close of business on the record date, which is May 1, 2013 (New York time) and immediately prior to the open of market on May 2, 2013 (New Zealand time). On the record date, there were 83,776,155 shares of our common stock outstanding and entitled to vote. In addition, on the record date, there were 32,667,123 shares of our Series A Preferred Stock outstanding and entitled to vote as one class with the common stock on all matters other than the election of directors generally, for a total of 116,443,278 shares entitled to vote on Proposals 2 through 6 and 8. The holders of our Series A Preferred Stock are not entitled to vote on Proposals 1 and 7. Further to NZSX Rule 9.3.1, Mr. Alessandro Sodi and his associated persons are not entitled to vote on Proposals 7 and 8.

Quorum; Required Vote

Holders of our common stock and Series A Preferred Stock are entitled to one vote per share on all matters presented at the Annual Meeting, and shall vote as one class except that holders of our Series A Preferred Stock will not be entitled to vote on Proposals 1 or 7. Only the holders of our common stock will be entitled to vote on Proposals 1 and 7. The presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of common stock and Series A Preferred Stock will constitute a quorum for the transaction of business at the Annual Meeting.

With respect to Proposal 1, under Delaware law and our Amended and Restated Certificate of Incorporation, the affirmative vote of a plurality of the votes cast by the holders of our shares of common stock is required to elect each director. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality.

The approval of Proposals 2 through 8 will require the affirmative vote of a majority in voting power of the shares of stock entitled to vote and present in person or by proxy at the Annual Meeting.

If any other matters are properly presented at the Annual Meeting for action, including a question of adjourning or postponing the meeting from time to time, the persons named in the proxies and acting thereunder will have discretion to vote, unless prohibited by the NZSX Rules, on such matters in accordance with their best judgment.

Effect of Abstentions and Broker Non-Votes

Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. A broker non-vote occurs when a shareholder fails to provide voting instructions to the shareholder’s broker for shares held in street name. Under these circumstances, the broker may be authorized to vote the shares on routine items. In the case of the Annual Meeting, such routine items are limited to the ratification of the appointment of our auditors. Brokers are prohibited from voting on other matters to be presented at the Annual Meeting. Abstentions and broker non-votes will have the effect of a vote against the proposals herein.

Voting and Revocation of Proxy

If at the close of business on May 1, 2013 (New York time) and immediately prior to the open of market on May 2, 2013 (New Zealand time), you were a shareholder of record or held shares through a broker, bank, fiduciary, trustee or other nominee, you may vote your shares as described below or you may vote in person at the Annual Meeting. The instructions for voting your shares appear below. Please follow the instructions below and on your proxy card accordingly.

| · | By FAX – Complete your proxy form and FAX to Link Market Services at +64 9 375 5990 |

| · | By email – Complete your proxy form and scan and email to Link Market Services at: meetings@linkmarketservices.co.nz |

| · | By internet (online) – Visit the Link Market Services website indicated on your proxy card and follow the on-screen instructions. If you received your annual meeting documentation electronically, you can click on the express ID in the email, enter your FIN and this will take you directly to the voting page on the Link Market Services website; or |

| · | By mail – You can date, sign and promptly return your proxy card by mail. |

| o | New Zealand holders - use the enclosed postage prepaid envelope. |

| o | Overseas holders – affix required postage before mailing your proxy |

The contact information for Link Market Services is available below.

Link Market Services

P.O. Box 91976

Auckland 1142

New Zealand

Or

Level 16 Brookfield House

19 Victoria Street

Auckland, New Zealand

+64-9-375 5998

meetings@linkmarketservices.com

The contact information for Georgeson, Inc. is available below:

Georgeson, Inc.

480 Washington Boulevard

26th Floor

Jersey City, NJ 07310

Attn: Proxy Services

1-800-457-0759

Voting instructions are provided on the proxy card provided to U.S. shareholders of record that are banks, brokers, fiduciaries, trustees or other similar nominees. The proxy voting procedures are designed to authenticate shareholder identities, to allow shareholders to give voting instructions and to confirm that the shareholders’ instructions have been recorded properly. These U.S. shareholders will have a control number, located on the proxy card, which will identify shareholders and allow them to submit their proxies and confirm that their voting instructions have been properly recorded. The remaining shareholders will require a FIN and shareholder number for secure access.

Costs associated with electronic access, such as usage charges from internet access providers and telephone companies, must be borne by the shareholder. If you submit your proxy by internet, it will not be necessary to return your proxy card. For all other shareholders voting instructions are provided on the proxy card. The internet (online) proxy facility is designed to authenticate shareholder identities, to allow shareholders to give voting instructions and to confirm that the shareholders’ instructions have been recorded properly. You will require your FIN and shareholder number for secure access. If you submit your proxy by internet, it will not be necessary to return your proxy card.

If a shareholder does not return a signed proxy card or submit a proxy by the internet, and does not attend the meeting and vote in person, his or her shares will not be voted. Shares of our common stock represented by properly executed proxies that are received by us and are not revoked will be voted at the meeting in accordance with the instructions contained therein. If you sign and return a proxy but fail to submit instructions, such proxy will be voted “FOR” the proposals set forth in this proxy statement, unless either the proxy or the shareholder are not permitted to vote under the NZSX Rules. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by the Company in its sole discretion and consistently with the NZSX Rules, on any matters brought before the Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the SEC.

If your shares are held in the name of a bank, broker, fiduciary, trustee or other nominee, follow the voting instructions on the proxy card you receive from your record holder. The availability of internet and telephone (in the case of U.S. shareholders) proxies will depend on voting procedures of the record holder.

Any proxy signed and returned by a shareholder or submitted through the internet may be revoked at any time before it is exercised by giving written notice of revocation to the Corporate Secretary of the Company, at our address set forth herein (or the Company’s share registry, Link Market Services or the Company’s proxy advisory firm, Georgeson, Inc., as applicable), by executing and delivering a later-dated proxy (either in writing or through the internet) or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not, in and of itself, constitute a revocation of a proxy.

Proxy Solicitation

We will bear the costs of such solicitation of proxies for the Annual Meeting, including the cost of preparing and mailing this Proxy Statement and the enclosed form of proxy. Copies of the Company’s proxy statement and related materials will be furnished to banks, brokerage houses, fiduciaries, trustees or other nominees holding shares of common stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of common stock for their costs of forwarding solicitation material to such beneficial owners. The Company will also bear the cost of maintaining a website compliant with regulations promulgated by the SEC to provide internet availability of this proxy statement, Annual Report and proxy card. Solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services. In addition, the Company has retained Georgeson, Inc. to act as our proxy advisory firm in the United States in conjunction with Link Market Services in New Zealand, our share registry.

Householding

The SEC’s rules permit us to deliver a single proxy statement and Annual Report to one address shared by two or more of ourshareholders. This delivery method is referred to as “householding” and can result in significant cost savings. The “householding” delivery method will only be an option for the Company with respect to U.S. shareholders to the extent such delivery method is utilized by us. We would deliver only one proxy statement and Annual Report to multipleshareholders who share an address unless we received contrary instructions from the impactedshareholders prior to the mailing date. We agree to deliver promptly, upon written request, a separate copy of the proxy statement and Annual Report, to anyshareholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy statement and Annual Report, contact, with respect to holders in the United States (“U.S.”), Georgeson, Inc. at 1-800-457-0759 or in writing at 480 Washington Boulevard, 26th Floor, Jersey City, NJ 07310, Attn: Proxy Services.

Dissenters’ Rights of Appraisal

The Delaware General Corporation Law (“DGCL”) does not provide dissenters’ rights of appraisal to the Company’s shareholders in connection with the proposals described in this proxy statement.

Interest of Certain Persons in Matters to Be Acted Upon

Except as otherwise disclosed herein or other than in his role as a director, nominee or executive officer or associate of any director, nominee or executive officer, no person has any substantial interest, direct or indirect, in the matters to be acted upon at the Annual Meeting. For the purpose of this paragraph, “person” shall include each person: (a) who has been a director or executive officer of the Company at any time since the commencement of the Company’s last fiscal year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is an associate or affiliate of a person included in subparagraphs (a) or (b).

Independent U.S. Registered Public Accounting Firm

We have been advised that representatives of Holtz Rubenstein Reminick LLP, our U.S. independent registered public accounting firm for the fiscal year ended December 31, 2012, will attend the meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions. In addition, we have been advised that representatives of Deloitte & Touche LLP, our independent U.S. registered public accounting firm for the fiscal year ended December 31, 2013, will attend the meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

PROPOSAL ONE

ELECTION OF NOMINEES AS CLASS I DIRECTORS

At the 2012 Annual Meeting, the Company's shareholders approved the adoption of a classified board as permitted by Section 141(d) of the DGCL, by adopting an Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) providing for such classes.

The Certificate of Incorporation provides that the classes will be as nearly equal in number as possible. The Company currently has two directors in Class I, two in Class II and two in Class III.

Pursuant to the Certificate of Incorporation and the DGCL, at each Annual Meeting only two out of six directors divided into classes (out of the seven member board) will stand for election. The seventh director, Mr. Liptak, is elected by the holders of our Series A Preferred Stock, and is, therefore, not subject to rotation under the NZSX Rules, the DGCL or the Certificate of Incorporation. The DGCL and the Certificate of Incorporation do not permit the Company to require any directors whose terms are classified to stand for election more frequently than the term of the class to which he or she was elected or appointed.

Pursuant to our Certificate of Incorporation, the term of Class I directors will expire at the 2013 Annual Meeting. The nominees to be elected as Class I directors pursuant to Proposal 1, each with a three-year term expiring at the 2016 annual meeting of shareholders, subject to the valid election and qualification of their respective successors, are described below. The Board has nominated each of the candidates for election and expects that each of the nominees will be available for election as a director. However, if by reason of an unexpected occurrence, one or more nominees are not available for election, the persons named in the form of proxy have advised that they will vote for such substitute nominees as the Board deems appropriate.

All the nominees have consented to being named in this proxy statement and to serve as a director if elected.

Nominees for Election

Name, age and present

position, if any, with the

Company | | Period served as director, other business experience |

| | | |

Rick Bettle, 66 (Class I) | | Mr. Bettle has served on our Board since September 2007. Mr. Bettle is a professional director and an Accredited Fellow and a past President of the New Zealand Institute of Directors. He is also a Graduate Fellow of the Australian Institute of Company Directors. From 1995 to 1998, Mr. Bettle was the Chief Executive Officer of the New Zealand law firm Kensington Swan. Mr. Bettle was the Chief Executive Officer of Alliance Group from 1991 to 1995 and the Managing Director of Wrightson from 1987 to 1991. He is currently the Chairman of Powerco New Zealand, Business Mentors NZ, and Ovita. He is also a director of Revera Ltd, RVNZ Investments Limited and Solid Wood Innovation. Mr. Bettle was previously the Chairman of the Civil Aviation Authority of New Zealand and Aviation Security, the New Zealand Totalisator Agency Board, The Racing Industry Board, NZ Lamb Co., Capital Coast Health and Wrightson Finance. He was also a director of Dominion Finance Holdings Limited and its related entities North South Finance and Dominion Finance Group Limited (all now in receivership and/or liquidation). Mr. Bettle’s wide business experience is seen as an asset to the Board along with his knowledge of the Company and having served for six years as a director of the Company, including through a period of turbulence for the Company during the global financial crisis. |

| | | It has been determined by the Board that Mr. Bettle is an independent director for the purposes of the NZSX Rules and the marketplace rules of the NASDAQ Stock Market LLC (the “NASDAQ Rules”). |

| | | |

Greg B. Petersen, 50 (Class I) | | Mr. Petersen has served on our Board since April 2013. Mr. Petersen is currently a private investor and serves as a director and a member of the audit committee of PROS Holdings, Inc. and KIT digital, Inc. Mr. Petersen has an extensive background as a technology company chief financial officer, and significant experience in financial planning, reporting and internal controls. From 2001 through 2012, he was the Executive Vice President and Chief Financial Officer of several technology companies including Activant Solutions, an enterprise software provider to the automotive, hardware, lumber and wholesale verticals; Lombardi Software, a business process management software company sold to IBM; CBG Holdings, Inc., a provider of banking software and services and CSIdentity, Inc., a provider of identity monitoring software and services. Mr. Petersen started his career after business school at American Airlines where he worked in corporate development and finance from 1989 to 1997. Mr. Petersen holds a B.A. degree in Economics from Boston College and an M.B.A. from the Fuqua School of Business at Duke University. Mr. Petersen was selected as a director due to his experience as a Chief Financial Officer of several U.S.-based software companies and as a director and audit committee member of two U.S. publicly listed companies. Mr. Petersen currently serves as the Company’s audit committee financial expert and his experience in financial planning, reporting and internal controls is a substantial asset to the Company. |

| | |

It has been determined by the Board that Mr. Petersen is an independent director for the purposes of the NZSX Rules and the NASDAQ Rules. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES AS A CLASS I DIRECTOR.

PROPOSAL TWO

RATIFICATION OF CLASS II DIRECTOR

Because Mr. Weldon was originally appointed to the Board in May 2012 by the Board to fill a vacancy, and has not previously been elected as a director under the NZSX Rules, his appointment to the Board must be submitted to a vote of shareholders at the Annual Meeting. This is required notwithstanding that Mr. Weldon is not required to stand for re-election at this Annual Meeting pursuant to the Company’s Certificate of Incorporation and the DGCL. In order to comply with the NZSX Rules, the Company therefore asks shareholders to ratify Mr. Weldon’s appointment to the Board as a Class II director. Mr. Weldon will cease to be a Class II director if this proposal is not passed.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF MR. WELDON’S APPOINTMENT AS A CLASS II DIRECTOR.

Other Members of the Board

The Board currently consists of 7 directors, each of whom, other than the nominees for election, is described below. The terms of the Class II directors shall expire at the 2014 annual meeting of shareholders, subject to the valid election and qualification of their respective successors. The terms of the Class III directors shall expire at the 2015 annual meeting of shareholders, subject to the valid election and qualification of their respective successors. The Series A Director will serve in office until his successor is validly elected and qualified or until such time that he is removed by the holders of our Series A Preferred Stock.

Name, age and

present position, if

any, with the

Company | | Period served as director, other business experience |

| | | |

Joseph Carrabino, Jr., 51 (Class II) | | Mr. Carrabino has served on our Board since April 2012. Mr. Carrabino has been a Partner of AEA Investors LP since 2004 and is Head of the Private Debt Group, which focuses on mezzanine and senior debt investing in the middle market. From 1999 to 2003, Mr. Carrabino was a Partner at a private equity firm, J. H. Whitney & Co. His responsibilities included serving as co-head of the mezzanine debt and structured products groups and a member of their credit and investment committees. Mr. Carrabino also spent considerable time on J. H. Whitney’s private equity activities. From 1987 to 1999, Mr. Carrabino worked in the Investment Banking Department of Credit Suisse First Boston, attaining the position of Managing Director. His areas of focus included leveraged finance and private equity sponsor coverage, high yield finance, and corporate restructurings and reorganizations. Mr. Carrabino is currently a member of the board of directors of Ramsey Industries LLC and has served on other boards in his various capacities at AEA and J. H. Whitney. Mr. Carrabino is a graduate of Harvard College, with an A.B. in economics. Mr. Carrabino was selected as a director because of his experience with financings and capital raising, his financial expertise and his experience as a director. |

| | | |

| | | It has been determined by the Board that Mr. Carrabino is an independent director for the purposes of the NZSX Rules and the NASDAQ Rules. |

| | | |

Mark Weldon, 45 (Class II) | | Mr. Weldon has served on our Board since May 2012. Mr. Weldon currently owns and operates Terra Sancta Vineyards. From 2002 to 2012, Mr. Weldon served as a Chief Executive Officer of the New Zealand Stock Exchange (NZSX). Prior to that, Mr. Weldon was an attorney at Skadden, Arps, Slade, Meagher & Flom and then became a Senior Engagement Manager at McKinsey & Company. Mr. Weldon graduated from Auckland University with a Masters degree in Economics (First Class Honours), a Bachelor of Commerce and a Bachelor of Arts. He then studied at Columbia University School of Law, graduating in 1997 with a law degree and a diploma in International Law. Mr. Weldon’s experience in working in both the United States and New Zealand with listed companies, including as CEO of NZSX, is seen as an asset to the Board. |

| | | |

| | | It has been determined by the Board that Mr. Weldon is an independent director for the purposes of the NZSX Rules and the NASDAQ Rules. |

| | | |

Mark Russell, 56 (Class III) | | Mr. Russell has served on our Board since September 2007. Mr. Russell is a senior commercial partner of the New Zealand law firm Buddle Findlay, acting for a wide range of public and private companies and has extensive experience in corporate finance and structuring, and banking and insolvency. He acts for a number of companies listed on the NZSX and NZX Alternative Market, with particular emphasis on the NZSX Rules, compliance advice, initial listing and IPOs. He gives banking and securities advice to New Zealand and overseas banks and overseas law firms, and he also provides advice to trustee companies and issuers on public securities issues and managed funds. He is ranked as a leading individual in banking and finance in Asia Pacific Legal 500 2010. Mr. Russell is Chairman of the Company’s Audit and Compliance Committee. Mr. Russell was selected as a director because of his familiarity with our Company as a result of having served as a director since our initial public offering in New Zealand, and his broad legal experience is seen as an asset to the Company. |

| | | |

| | | It has been determined by the Board that Mr. Russell is an independent director for the purposes of the NZSX Rules and the NASDAQ Rules. |

Name, age and

present position, if

any, with the

Company | | Period served as director, other business experience |

| | | |

Alessandro Sodi, 53 (Class III) | | Mr. Sodi serves as our Chief Executive Officer and President and a director of the Board. Before our founding in 1998, Mr. Sodi served as an officer of our predecessor entity, Diligent Board Member Services, LLC (“DBMS LLC”), which was previously known as Manhattan Creative Partners, LLC (“MCP”), a consulting firm specializing in software development and the internet. Subsequently, in 2003, MCP switched its focus to corporate governance service delivery. From 2001 to 2003, Mr. Sodi managed the development of software that would become the Diligent Boardbooks system. Mr. Sodi was selected as a director because as the Company’s Chief Executive Officer and President, he has in-depth knowledge of the Company’s operations, strategy and competitive position. |

| | | |

| | | It has been determined by the Board that Mr. Sodi is not an independent director for the purposes of the NZSX Rules or the NASDAQ Rules. |

| | | |

David Liptak, 54 (Series A Director) | | Mr. Liptak was elected Chairman of our Board in March 2010 and was elected as a director by the holders of our Series A Preferred Stock in April 2009. Mr. Liptak is the founder and Managing Partner of Spring Street Partners, L.P., which he formed in 1995. Mr. Liptak was the founder and President of West Broadway Partners, Inc., an investment partnership that ultimately managed more than U.S. $700 million in investor capital in the West Broadway Partners group of funds until March 2005. At that time, Mr. Liptak left the firm and began managing Spring Street Partners on a full-time basis. Spring Street Partners is the holder of approximately 22 million shares of the Company’s Series A Preferred Stock (representing a majority of the outstanding Series A Preferred Stock), and also holds approximately 4.17 million shares of the Company’s common stock, representing beneficial ownership of approximately 25% of our common stock in the aggregate. Mr. Liptak was selected as a director by the holders of our Series A Preferred Stock due to Spring Street Partners substantial investment in our capital stock, as well as due to Mr. Liptak’s extensive financial and investment experience. |

| | | |

| | | It has been determined by the Board that Mr. Liptak is not an independent director for the purposes of the NZSX Rules, but is an independent director for the purposes of the NASDAQ Rules. |

CORPORATE GOVERNANCE

Independence Standards for Directors

As our common stock is not listed on a U.S. national securities exchange, the Board has elected to evaluate the independence of our directors using the NASDAQ Rules. A majority of our board members are independent directors based on the definition of independence in the NASDAQ Rules, specifically, Rick Bettle, Mark Russell, Mark Weldon, Greg B. Petersen, Joseph Carrabino, Jr. and David Liptak. Under the NZSX Rules, Rick Bettle, Mark Russell, Mark Weldon, Greg B. Petersen and Joseph Carrabino are independent directors. Further, given that Rick Bettle, Mark Russell and Mark Weldon are New Zealand residents, the Company satisfies the requirement under the NZSX Rules that at least two directors must be resident in New Zealand.

None of the nominees, nor any other member of our Board or executive officers, has been involved in any legal proceeding enumerated in Securities and Exchange Commission Regulation S−K, Item 401, within the time periods described in that regulation, except as described in the following paragraph.

Rick Bettle serves as one of our independent directors. As previously disclosed,the New Zealand Securities Commission (the functions of which are now undertaken by the Financial Markets Authority) laid criminal and civil charges against all of the directors of Dominion Finance Holding Ltd. and its wholly owned subsidiary North South Finance (four executive and two independent directors, one of whom is Mr. Bettle). Two directors, Ann Butler and Robert Barry Whale, have pleaded guilty and will be sentenced on June 14, 2013 in New Zealand.The Financial Markets Authority (the “FMA”) alleges that Dominion Finance Group's offer documents and advertisements misled investors. In particular, the FMA alleges that the directors made false statements in the Dominion Finance Group registered prospectus dated September 13, 2007 in New Zealand, as amended by an extension certificate dated December 20, 2007 in New Zealand and the North South Finance registered prospectus dated September 11, 2007 in New Zealand, as amended by an extension certificate dated December 20, 2007 in New Zealand. In addition, the FMA alleges that a quarterly newsletter of Dominion Finance Group and a letter to the investors of both Dominion Finance Group and North South Finance distributed during 2008 contained similar untrue statements. Mr. Bettle, who was the Independent Chairman of Dominion Finance Holdings Ltd. and North South Finance, has denied the allegations made. The Serious Fraud Office of New Zealand (the “SFO”), in addition to the FMA, also investigated the companies. As a result of its investigation, the SFO determined that criminal charges should be laid. Four persons associated with Dominion and North South Finance (two directors, the CEO and a fourth person who has name suppression) were subsequently charged. Mr. Bettle was not one of those charged by the SFO. On April 12, 2013 in New Zealand, the CEO was found guilty of the charges against him. The FMA case has been set for hearing on June 17, 2013 in New Zealand.

Board Committees

Our Board has three standing committees: an Audit and Compliance Committee, a Compensation Committee, and a Nominations Committee. Our Board has adopted charters for each of its standing committees. Copies of our committee charters are available on our website at www.boardbooks.com.

Audit and Compliance Committee. The Audit and Compliance Committee assists the Board in fulfilling its oversight responsibilities by reviewing the integrity of the Company’s financial statements and financial reporting process; the qualifications, independence and performance of the Company’s independent U.S. registered public accounting firm; and compliance with legal and regulatory requirements. The main responsibilities of the Audit and Compliance Committee are to:

| · | Review and discuss with management and the independent U.S. registered public accounting firm the Company’s annual and quarterly financial statements (and the results of the independent U.S. registered public accounting firm’s reviews of the quarterly financial statements), including reviewing specific disclosures made in management’s discussion and analysis. |

| · | Review and discuss with management and the independent U.S. registered public accounting firm: |

| o | Significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements; |

| o | Management’s internal control assessment, including any significant deficiencies in the design or operation of internal controls or material weaknesses therein, and any fraud involving management or other employees who have a significant role in the Company’s internal controls (as well as any special steps adopted in light of such control issues); and |

| o | Matters (including correspondence or inquiries from regulators or governmental agencies, complaints or legal matters) that raise material issues regarding the Company’s financial statements or accounting policies. |

| · | Discuss with the independent U.S. registered public accounting firm: |

| o | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to requested information, and any significant disagreements with management; and |

| o | Material written communications with management, such as management letter provided by the independent U.S. registered public accounting firm and the Company’s response to that letter, and any accounting adjustments that were noted or proposed by the independent U.S. registered public accounting firm. |

| · | Recommend to the Board whether the audited financial statements fairly and adequately present the financial position of the Company and that they should be included in the Company’s Form 10-K that is filed with the SEC. |

| · | Periodically review with management the form of presentation and types of information to be included in the Company’s earnings releases. |

| · | Obtain and review annually a report by the independent U.S. registered public accounting firm describing: |

| o | The firm’s internal quality control procedures; |

| o | All relationships between the independent U.S. registered public accounting firm and the Company, consistent with PCAOB Rule 3526, Communication with Audit Committees Concerning Independence. |

| · | Evaluate the qualifications, performance and independence of the independent U.S. registered public accounting firm (in its evaluation, the Audit and Compliance Committee may take into account the reports of the independent U.S. registered public accounting firm and the opinions of management). |

| · | Discuss with management the Company’s major risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. |

The independent U.S. registered public accounting firm attends Committee meetings when requested.

Pursuant to the Audit and Compliance Committee Charter, membership of the Committee consists of at least three directors, all of whom shall meet independence and experience requirements in accordance with the U.S. Securities Exchange Act (the “Exchange Act”) and the regulations thereto and the NZSX Rules. At least one member of the Committee shall be an “audit committee financial expert” as defined in the Exchange Act and its regulations and have the required “accounting or financial background” as defined by the NZSX Rules.

The Board has determined that all three current members of the Audit and Compliance Committee, Mark Russell, Greg B. Petersen and Joseph Carrabino, Jr., are independent in accordance with the NASDAQ Rules and the NZSX Rules. Mr. Russell is the Chairman of the Audit and Compliance Committee. Prior to 2013, the Company paid the law firm Buddle Findlay, of which Mr. Russell is a partner, fees in an amount which would not require disclosure under the rules of the Exchange Act. The Company has determined not to retain Buddle Findlay on a going forward basis to avoid any conflict with the NASDAQ Rules governing audit committee independence. The Board has determined that Mr. Petersen qualifies as an “audit committee financial expert,” and has the required “accounting or financial background” in accordance with the applicable rules of the Exchange Act and the NZSX Rules.

Compensation Committee. The Compensation Committee assists the Board in discharging its responsibilities relating to compensation of the Chief Executive Officer and the Company’s other executive officers. The Compensation Committee is also responsible for the policy for compensation for senior management and the granting of stock options and other equity and incentive awards to employees. The main responsibilities of the Compensation Committee are to:

| · | Adopt and maintain in effect a compensation philosophy which shall apply to activities undertaken pursuant to the charter of the Compensation Committee. |

| · | Annually review and approve the Chief Executive Officer’s compensation. |

| · | Annually evaluate the performance of the executive officers in consultation with the Chief Executive Officer and, based upon such evaluation, approve the base salaries, annual salary increases, annual cash incentive and equity based awards for each of the executive officers. |

| · | Periodically and as and when appropriate, review and make recommendations to the Board regarding the following: (a) all equity incentive awards and opportunities to employees; and (b) any special or supplemental compensation and benefits as they affect the Chief Executive Officer and/or the executive officers. |

| · | Be responsible for reviewing and making a recommendation to the Board with regard to the structure, terms and conditions of any proposed cash or equity based incentive plan. |

| · | Have the sole authority to retain and terminate any advisers to assist it in the performance of its duties and shall have sole authority to approve the adviser’s fees and the other terms and conditions of the adviser’s retention, which fees shall be borne by the Company. |

The Compensation Committee has the exclusive authority to retain or terminate compensation consultants to be used to assist the Compensation Committee in the evaluation and determination of the Company’s compensation for its CEO and other executive officers. The Compensation Committee did not engage a compensation consultant for the fiscal year ended December 31, 2012.

The Board has determined that all three current members of the Compensation Committee, Mr. Petersen, Mr. Carrabino, Jr. and Mr. Weldon, are independent in accordance with the NASDAQ Rules and the NZSX Rules and also qualify as “outside directors” within the meaning of the U.S. Internal Revenue Code Section 162(m). Mr. Petersen serves as Chairman of our Compensation Committee.

Nominations Committee. The Nominations Committee assists the Board in fulfilling its oversight responsibilities by identifying individuals qualified to serve on the Board, recommending nominees to serve on the Board and Board Committees and reviewing directors’ fees. The main responsibilities of the Nominations Committee are to:

| · | Identify and evaluate candidates to recommend to the Board for election as directors. |

| · | Recommend to the Board a slate of nominees for election or reelection as directors by the Company’s shareholders at the annual meeting. |

| · | Review and evaluate director nominees proposed by shareholders of the Company. |

| · | Report the results of its deliberations and its recommendations to the Board regarding any Board candidate considered by the Committee. |

| · | Review the structure, authority and responsibilities of Board committees and make annual recommendations regarding the membership of Board committees. |

The Board has determined that all three current members of the Nominations Committee, Mr. Liptak, Mr. Bettle and Mr. Russell, are independent in accordance with the NASDAQ Rules. Mr. Liptak is not regarded as independent under the NZSX Rules. Mr. Liptak serves as Chairman of our Nominations Committee.

Director Nomination Process

The Company’s goal is to assemble a Board that brings to the Company a variety of perspectives and skills derived from business and professional experience. The Board considers a variety of criteria when evaluating potential Board members, as described below, and expects that its candidates be of the highest ethical character, share the values of the Company, be capable of discharging his or her fiduciary duties to the shareholders of the Company, have reputations, both personal and professional, consistent with the image and reputation of the Company, be highly accomplished in their respective field, and possess the relevant expertise and experience necessary to assist the Company with enhancing shareholder value.

The Board considers nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. The Nominations Committee seeks new nominees for election to the Board, when necessary, through a variety of channels, including informal recommendations through business and personal contacts. Current members of the Board and the CEO are polled for suggestions. Research also may be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify, evaluate, or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third party search firm, if necessary.

Pursuant to NZSX Rule 3.3.5, shareholders of the Company have the right to propose nominees for directors of the Company to be elected at each annual meeting of shareholders in accordance with the opening date and closing date for nominations announced by the Company for each applicable annual meeting. Under the U.S. federal securities laws, shareholders who submit a nomination pursuant to NZSX Rule 3.3.5 are also required to submit a filing with the SEC containing the information required by Schedule 14N. The Board will evaluate any candidate recommended for nomination as a director, whether proposed by a shareholder, or identified through the Board’s own search processes, about whom it is provided appropriate information in a timely manner.

All new candidates for election to the Board and all Board members eligible for nomination for re-election to the Board are evaluated based upon a variety of criteria, including the following:

| · | whether the candidate has the highest level of personal and business integrity and a reputation for integrity, honesty and fair dealing in the business community and such candidate’s local community; |

| · | whether the candidate has the requisite senior level executive experience that management responsibilities or has such candidate been engaged extensively in advising corporations as either an accountant or lawyer; |

| · | whether the candidate’s personality is conducive to working effectively and on a collaborative basis with the other directors on Board matters; |

| · | the absence of conflicts of interest; |

| · | whether the candidate has expertise or skill set which is needed on the Board; |

| · | whether the candidate has a level of financial literacy as would be appropriate for evaluating budgets and financial statements; and |

| · | consideration of whether the candidate has experience in the software service industry or exposure to the board portal business. |

The Nominations Committee does not have a policy with respect to the consideration of diversity in identifying director nominees. While the Nominations Committee focuses on obtaining a diversity of professional expertise on the Board rather than a diversity of personal characteristics, it recognizes the desirability of racial, ethnic and gender diversity and considers it an additional benefit when a new director can also increase the personal diversity of the Board as a whole. The Nominations Committee and the Board may also consider such other factors as it may deem to be in the best interests of the Company and its shareholders.

Board Leadership Structure and Role in Risk Oversight

Mr. Liptak serves as the Chairman of the Board and Mr. Sodi serves as the Chief Executive Officer. The Board believes that separate Chairman and Chief Executive Officer roles are appropriate for the Company at this time and is consistent with NZSX’s Corporate Governance Best Practise Code. The Company has not designated a lead independent director.

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational and strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. As disclosed in Item 9A of the Company’s Annual Report on Form 10-K filed with the SEC on March 18, 2013 (the “Annual Report on Form 10-K”), the Board has adopted resolutions relating to the improvement of the Company’s internal controls and governance. In implementing these resolutions, the Board and its Committees will seek to address the risks relating to the Company’s need to comply with dual regulatory regimes including U.S. securities laws as a reporting company and New Zealand securities and financial reporting laws and exchange listing requirements. The Company will include at every Board meeting (other than meetings on an ad hoc basis or dealing with special items) reporting on compliance as a standard agenda item.

Various committees of the Board also have responsibility for risk management. The Audit and Compliance Committee, in connection with its quarterly and annual review of the Company’s financial statements, receives reports from the Company’s Chief Financial Officer and the Company’s independent U.S. registered public accounting firm regarding significant risks and exposures and will assess management’s steps to minimize them. In addition, the Board will task the Audit and Compliance Committee to take additional express responsibilities for regulatory compliance and internal controls and procedures, and will appoint an independent director to serve as the Board’s point person on compliance issues. In setting compensation, the Compensation Committee will work with management to create incentives that encourage a level of risk-taking that is consistent with the Company’s business strategy and the goal of maximizing value.

Attendance at Board and Committee Meetings

During the fiscal year ended December 31, 2012, (a) the Board held eleven meetings and acted once by written consent and (b) the Audit and Compliance Committee held five meetings and acted once by written consent. Historically, the Board had a Remuneration and Nominations Committee. On June 7, 2012, the Board restructured its committees by replacing the Remuneration and Nominations Committee with the Board’s Compensation Committee and Nominations Committee. During the fiscal year ended December 31, 2012, (x) the Remuneration and Nominations Committee held two meetings and held one joint session with the Board and (y) the Compensation Committee held three meetings and held one joint session with the Board. Each director attended at least 75% of the meetings of the Board and the meetings of the committees of which such director was a member during the fiscal year ended December 31, 2012. The Company’s policy is to ask directors to attend, in person or by video conference, the annual meeting of shareholders, and all of our current directors who were directors at the time did attend the 2012 Annual Meeting of Shareholders.

COMMUNICATIONS FROM SHAREHOLDERS

Although the Company does not have a formal policy concerning shareholders communicating with the Board or individual directors, shareholders may send communications to the Board at the Company’s business address at39 West 37th St., 8th Floor, New York, New York 10018, attention Office of the Secretary.

Upon receipt of a communication for the Board or an individual director, the Secretary will promptly forward any such communication to all the members of the Board or the individual director, as appropriate. If a communication to an individual director deals with a matter regarding the Company, the Secretary or appropriate officer will forward the communication to the entire Board, as well as the individual director.

If the communication involves material non-public information, the Board or individual director will not provide a response to the shareholder. The Company may, however, publicly provide information responsive to such communication if (following consultation with the office of the Corporate Secretary or other advisors, as the Board determines appropriate) the Board determines disclosure is appropriate. In any case, the responsive information will be provided in compliance with Regulation FD, our Regulation FD Policy and other applicable laws and regulations, including the NZSX Rules, if at all.

Executive Officers

The following persons currently serve as our executive officers in the capacities indicated below. Our executive officers are responsible for the management of our operations, subject to the oversight of the Board.

| Name | | Position & Other Business Experience |

Alessandro Sodi, 53 Director, CEO, President | | Please see biographical information under Alessandro Sodi “Other Members of the Board” on page 13. |

Carl D. Blandino, 61 Chief Financial Officer, EVP | | Mr. Blandino serves as our Executive Vice President and Chief Financial Officer (“CFO”). Prior to his employment with the Company on May 15, 2013, Mr. Blandino served as Senior Vice President and Chief Financial Officer at CashEdge, Inc., a U.S. software-as-a-service (SaaS) provider of a mobile and online payments network and risk management services to financial institutions. Prior to his service at CashEdge, Inc., Mr. Blandino served as Chief Financial Officer at several U.S. public and private high technology and software companies, including most recently Open Solutions, Inc., a provider of technology solutions to the financial services marketplace. He also spent over 10 years in public accounting in various management positions with Coopers and Lybrand and Deloitte Haskings & Sells, both international public accounting firms. |

Michael Flickman, 52 Chief Technology Officer, EVP | | Mr. Flickman serves as our Executive Vice President and Chief Technology Officer. Prior to joining the Company in September 2011, Mr. Flickman served as Chief Technology Officer at Survey Sampling International from July 2008 to August 2011. Prior to that time, Mr. Flickman served as Chief Technology Officer at CYA Technologies, Inc. since November 2004. Mr. Flickman has been working in the technology field for nearly 30 years, specializing in commercial software development, infrastructure architecture and management, enterprise software, product management, development process improvement and project management. |

| | | |

Jeffrey Hilk, 48 Director of Client Services, SVP | | Mr. Hilk serves as Senior Vice President and Director of Client Services, and has global responsibility for Account Management and worldwide Client Support. Prior to joining the Company in March 2011, Mr. Hilk held senior-level sales positions with IT consulting firms, specifically Shore Group, Inc. from November 2009 to March 2011 and Presidio Networked Solutions from July 2007 to November 2009. Mr. Hilk has more than twenty-five years of experience in the technology industry, having led teams in account management, sales, product management and engineering, during his career at large multi-national companies such as NCR, AT&T, McDonnell-Douglas Aerospace Corp., and Boundless Corporation. |

Don Meisner, 58 Treasurer | | Mr. Meisner has served as our Controller and Treasurer since 2007. Mr. Meisner has a broad range of business experience including accounting, forecasting, budgeting, business analysis and systems implementation. Prior to joining us in 2007, Mr. Meisner served as the Controller of the Lebermuth Company, Inc. from February 2002 through 2007, where he was responsible for all aspects of accounting, as well as legal and insurance issues. |

| Name | | Position & Other Business Experience |

Robert Norton, 70 General Counsel, Corporate Secretary | | Mr. Nortonserves as our General Counsel and Corporate Secretary, in which capacity he has served since 2008. Mr. Norton has been a practicing attorney for over 35 years, commencing his career at the law firm of Shearman & Sterling LLP in New York City. Mr. Norton served as General Counsel of MasterCard International for over 15 years, where he was the head of the law department and was responsible for all legal matters addressed by the corporation. For the five years before he joined us in 2008, Mr. Norton was engaged as a sole practitioner in private practice and at times as a contract attorney. |

Code of Conduct

We have a written Code of Conduct that applies to all employees, including our Chief Executive Officer, Chief Financial Officer and Treasurer. The full text of our Code of Conduct is published on our website at www.boardbooks.com under the “Investor Center-Corporate Governance” caption. We will disclose any future amendments to, or waivers from, certain provisions of the Code of Conduct applicable to our Chief Executive Officer, Chief Financial Officer and Treasurer on our website within four business days following the date of any such amendment or waiver.

Compensation Committee Interlocks and Insider Participation

David Liptak, Joseph Carrabino, Jr. and Mark Weldon each served on the Compensation Committee for the fiscal year ended December 31, 2012. There are no Compensation Committee interlocks between the Company and other entities involving the Company’s executive officers and directors required to be reported under the rules and regulations of the Exchange Act. None of the Compensation Committee members were involved in any transactions requiring disclosure as a related party transaction under the rules of the Exchange Act.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and officers, and persons who beneficially own more than 10% of a registered class of the Company’s equity securities, to file reports of beneficial ownership and changes in beneficial ownership of the Company’s securities with the SEC on Forms 3, 4 and 5. Officers, directors and greater than 10% shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. As part of the Company’s program to improve internal controls and governance, as discussed in Item 9A of our Annual Report on Form 10-K, the Company has reviewed past Section 16 filings by its officers and directors. The Company found that it had not historically provided customary support to its officers and directors in achieving compliance with Section 16(a) obligations and resolved to assist its officers and directors in completing any outstanding filings and in remaining compliant on a going-forward basis. Based on its review, the Company became aware of several untimely filings required by Section 16(a) of the Exchange Act by persons who serve as directors and officers, specifically: (i) two reports, one covering the initial filing obligation and one reporting a purchase from the Company, were filed late by Joseph Carrabino Jr.; (ii) two reports, one covering the initial filing obligation and one reporting a stock option grant, were filed late by Michael Flickman; (iii) three reports, one covering the initial filing obligation, one reporting a stock option grant, and one reporting a transaction, were filed late by Jeffrey Hilk; (iv) five reports, one covering the initial filing obligation, one covering a stock option grant, one covering one transaction, and two covering two transactions each, were filed late by Don Meisner; (v) four reports, one covering the initial filing obligation, one covering a stock option grant, one covering a stock option exercise and one covering a transaction, were filed late by Robert Norton; (vi) five reports, one covering the initial filing obligation, one reporting a stock option grant and three reporting transactions, were filed late by Steven Ruse; and (vii) seven reports, one covering the initial filing obligation and six reporting transactions, were filed late by Mark Russell; (viii) fifteen reports, one covering the initial filing obligation, two reporting stock option grants and twelve reporting transactions, were filed late by Alessandro Sodi; and (ix) one report, covering the initial filing obligation, was filed late by Mark Weldon.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

The following table provides information concerning beneficial ownership of our common stock as of May 1, 2013 by:

| · | Each person who is known to us to be the beneficial owner of 5% or more of our common stock; |

| · | Each of our directors and nominees; |

| · | Each of our executive officers; and |

| · | All of our directors and executive officers as a group. |

Except as indicated in the footnotes to this table, the persons or entities named have sole voting and investment power with respect to all shares of our common stock and preferred stock shown as beneficially owned by them. Beneficial ownership representing less than one percent is denoted with an asterisk (“*”).

Unless otherwise indicated, the principal address of each of the persons below is c/o Diligent Board Member Services, Inc., 39 West 37 St. 8th Floor, New York, NY 10018.

| Name of Beneficial Owner | | Number of Shares

Beneficially Owned

(1) | | | Percentage of

Outstanding Shares

(2) | |

| Officers and Directors | | | | | | | | |

| Alessandro Sodi, Director, CEO, President (3) | | | 4,567,915 | | | | 5.3 | % |

| David Liptak, Chairman; Director (4) | | | 25,950,307 | | | | 24.6 | % |

| Rick Bettle, Director | | | 50,000 | | | | * | |

| Joseph Carrabino, Director | | | 4,983 | | | | * | |

| Mark Russell, Director | | | 85,957 | | | | * | |

| Mark Weldon, Director | | | 75,000 | | | | * | |

| Michael Flickman, Chief Technology Officer, EVP | | | 0 | | | | * | |

| Jeffrey Hilk, Director of Client Services, SVP | | | 10,000 | | | | * | |

| Don Meisner, Treasurer (5) | | | 295,000 | | | | * | |

| Robert Norton, GC, Corporate Secretary | | | 165,500 | | | | * | |

| Greg B. Petersen, Director | | | 0 | | | | * | |

| Steven P. Ruse, Chief Financial Officer, EVP (6) | | | 673,350 | | | | * | |

All directors and named officers as a group (12 persons) | | | 31,878,012 | | | | 29.6 | % |

| | | | | | | | | |

| 5% Security Holders | | | | | | | | |

| Spring Street Partners, L.P.(4) | | | 25,950,307 | | | | 24.6 | % |

| Carroll Capital Holdings, LLC (7) | | | 14,994,860 | | | | 15.8 | % |

| Milford Asset Management Limited (8) | | | 4,445,430 | | | | 5.31 | % |

| Accident Compensation Corporation (9) | | | 5,216,984 | | | | 6.23 | % |

| Peter Karl Christopher Huljich (10) | | | 5,823,697 | | | | 6.95 | % |

| (1) | Includes (i) stock held in joint tenancy, (ii) stock owned as tenants in common, (iii) stock owned or held by spouse or other members of the individual’s household, and (iv) stock in which the individual either has or shares voting and/or investment power, even though the individual disclaims any beneficial interest in such stock. |

| (2) | Shares of common stock subject to options currently exercisable or exercisable within 60 days of May 1, 2013, and shares of common stock issuable upon conversion of the Series A Preferred Stock, are deemed outstanding and beneficially owned by the person holding such options or Series A Preferred Stock for purposes of computing the number of shares and percentage beneficially owned by such person, but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person. |

| (3) | Includes 2,400,000 shares subject to options exercisable within 60 days of May 1, 2013. As more fully discussed under Proposals 7 and 8, it is anticipated that these options will be cancelled as to 1,600,000 shares of common stock as part of Mr. Sodi’s replacement incentive compensation subject to approval by shareholders at the Annual Meeting. |

| (4) | Includes shares of common stock beneficially owned by Spring Street Partners, L.P., with a principal address at 488 Madison Avenue, 21st Floor, NY, NY 10022. David Liptak is the sole manager and member of West Broadway Advisors, L.L.C., which is the sole general partner of Spring Street, L.P. Spring Street Partners, L.P. is the beneficial owner of 25,950,207 shares of common stock, which include (i) 21,777,904 shares of Series A Preferred Stock that are convertible into common stock on a one of one basis and (ii) 4,172,403 shares of common stock. |

| (5) | Includes (i) 150,000 shares of common stock owned by the Cantaluppi Family Trust and (ii) 45,000 shares of common stock that may be acquired upon the exercise of currently exercisable options. |

| | |

| (6) | On May 15, 2013, Mr. Ruse resigned from his position as Executive Vice President and Chief Financial Officer of the Company effective as of that date and continues to remain employed by the Company as its Executive Vice President of Finance. |

| (7) | Includes (i) 10,889,219 shares of Series A Preferred Stock and 2,506,641 shares of common stock owned by Carroll Capital Holdings LLC; (ii) 600,000 shares owned by Kenneth Carroll, Trustee, the Elizabeth Carroll 2012 Descendants Trust; and (iii) 1,000,000 shares owned by the Kenneth Carroll 2012 Family Trust. Carroll Capital Holdings, LLC’s principal address is 94 Long Pond Road, Hewitt, New Jersey 07421. |

| (8) | Based on the disclosures set forth in the Substantial Security Holder Notice (“SSH Notice”) filed in New Zealand by Milford Asset Management Limited (“MAML”) on April 30, 2013. MAML’s principal address is Level 9, 70 Shortland Street, Auckland 1140, New Zealand. As of May 16, 2013, MAML is no longer a beneficial owner of 5% or more of our common stock based on a subsequent SSH Notice, dated May 16, 2013, disclosing a reduction in shares beneficially owned to 4,105,116 or 4.90%. |

| (9) | Based on an SSH Notice filed in New Zealand by Accident Compensation Corporation (“ACC”) on March 11, 2013, Nicholas Bagnall, Blair Tallot, Paul Robertshawe and Blair cooper are employees and portfolio managers or equity analysts for ACC. Under current ACC investment policies, they have the discretion to exercise control over some or all of the rights to vote and the power to acquire or dispose of some or all of the securities of which ACC is the beneficial owner. ACC’s principal address is Vogel Centre, 19 Aitken Street, P.O. Box 242, Wellington, NZ. As of May 27, 2013, ACC reduced the number of shares beneficially owned to 4,376,984 or 5.225% based on a subsequent SSH Notice, dated May 27, 2013. |

| (10) | Based on the SSH Notice filed in New Zealand by Mr. Huljich on March 28, 2012. Mr. Huljich’s percentage ownership of the Company’s outstanding shares has been updated to reflect his percentage ownership based on the outstanding number of shares of common stock as of the record date. Mr. Huljich’s principal address is P.O. Box 328, Shortland Street, Auckland 1140. |

We are not aware of any arrangements involving our shareholders, the operation of which would result in a change of control.

EXECUTIVE COMPENSATION

The summary compensation table below summarizes information concerning compensation for the twelve months ended December 31, 2012 and the twelve months ended December 31, 2011, of our Chief Executive Officer and our two other most highly compensated executive officers during our 2012 fiscal year. We refer to these individuals as the “Named Executive Officers.”

SUMMARY COMPENSATION TABLE

The following table sets forth information with respect to the compensation of our Named Executive Officers for services in all capacities to us and our subsidiaries.

Name and Principal

Position | | Year | | Salary

($) | | | Bonus

($) | | | Nonequity

Incentive Plan

Compensation

($)(1) | | | Option

awards

($)(2) | | | All other

compensation

($)(3) | | | Total

($) | |

| | | | | | | | | | | | | | | | | | | | | |

| Alessandro Sodi | | 2012 | | | 549,133 | | | | 750,000 | (4) | | | 0 | | | | 0 | | | | 14,633 | | | | 1,313,766 | |

| Chief Executive Officer (CEO) | | 2011 | | | 437,177 | | | | 0 | | | | | | | | 2,370,000 | (5) | | | 3,900 | | | | 2,811,077 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jeff Hilk | | 2012 | | | 150,000 | | | | 35,000 | (6) | | | 294,396 | | | | 260,000 | | | | 10,000 | | | | 749,396 | |

| Director of Client Services | | 2011 | | | 113,654 | | | | 0 | | | | 33,751 | | | | 0 | | | | 0 | | | | 147,405 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Michael Flickman | | 2012 | | | 225,000 | | | | 80,000 | (6) | | | 0 | | | | 260,000 | | | | 13,658 | | | | 578,658 | |

| Chief Technology Officer | | 2011 | | | 69,086 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 69,086 | |

(1) The amount reported represents incentive compensation paid to Mr. Hilk pursuant to the terms of his March 2011 offer letter in the amounts of U.S. $294,396 and U.S. $33,751 in 2012 and 2011, respectively.

(2) The amounts reported in this column represent the aggregate grant date fair value of the stock option awards granted to the Named Executive Officers in 2011 and 2012, respectively. We estimate the fair value of awards on the grant date using the Black-Scholes option pricing model. The assumptions made in calculating the grant date fair value amounts for stock option awards are incorporated herein by reference to the discussion of those assumptions in footnote 16 to the financial statements contained in the Company’s Annual Report on Form 10-K. Note that the amounts reported in this column reflect the Company’s accounting cost for the stock option awards, and do not correspond to the actual economic value that will be received by the Named Executive Officers from the awards.

(3) The amounts reported in this column represent amounts paid for health benefits and the matching funds the Company provides in connection with the Named Executive Officers’ contributions to the Company’s 401(k) savings plan.

(4) The amount reported represents a discretionary bonus approved by the Board on April 12, 2012. The bonus was payable in three equal installments on each of April 30, 2012, July 31, 2012 and October 31, 2012.