UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedApril 30, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

| Commission file number: | 000-53826 |

| PLASTEC TECHNOLOGIES, LTD. |

| (Exact Name of Registrant as Specified in Its Charter) |

| N/A |

| (Translation of Registrant’s Name Into English) |

| Cayman Islands |

| (Jurisdiction of Incorporation or Organization) |

| Unit 01, 21/F, Aitken Vanson Centre, 61 Hoi Yuen Road, Kwun Tong, Kowloon, Hong Kong |

| (Address of Principal Executive Offices) |

Kin Sun Sze-To, Chief Executive Officer, Plastec Technologies, Ltd. Unit 01, 21/F, Aitken Vanson Centre, 61 Hoi Yuen Road, Kwun Tong, Kowloon, Hong Kong Tel.: 852-21917155, Fax: 852-27796001 |

| (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange on Which Registered |

| | | |

| | | |

| | | |

| | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Units consisting of one Ordinary Share, par value U.S.$0.001 per share, and one Warrant |

| (Title of Class) |

| Ordinary Shares, par value U.S.$0.001 per share |

| (Title of Class) |

| Warrants to purchase Ordinary Shares |

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report:14,352,903 Ordinary Shares, par value U.S.$0.001 per share, as of April 30, 2012

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨ Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer¨ | Accelerated filer¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAPx | International Financial Reporting Standards as issued | Other¨ |

| | by the International Accounting Standards Board¨ | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

TABLE OF CONTENTS

| INTRODUCTION | 1 |

| PART I | 2 |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS. | 2 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE. | 2 |

| ITEM 3. | KEY INFORMATION. | 2 |

| ITEM 4. | INFORMATION ON THE COMPANY. | 20 |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS. | 32 |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS. | 32 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES. | 42 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS. | 48 |

| ITEM 8. | FINANCIAL INFORMATION. | 52 |

| ITEM 9. | THE OFFER AND LISTING | 53 |

| ITEM 10. | ADDITIONAL INFORMATION. | 54 |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. | 64 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES. | 64 |

| PART II | 65 |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES. | 65 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS. | 65 |

| ITEM 15. | CONTROLS AND PROCEDURES. | 65 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT. | 66 |

| ITEM 16B. | CODE OF ETHICS. | 67 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. | 67 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES. | 68 |

| ITEM 16E. | PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS. | 68 |

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT. | 69 |

| ITEM 16G. | CORPORATE GOVERNANCE. | 69 |

| PART III | 70 |

| ITEM 17. | FINANCIAL STATEMENTS. | 70 |

| ITEM 18. | FINANCIAL STATEMENTS. | 71 |

| ITEM 19. | EXHIBITS. | 72 |

| SIGNATURES | 73 |

| EXHIBIT INDEX | 74 |

INTRODUCTION

Definitions

Unless the context indicates otherwise:

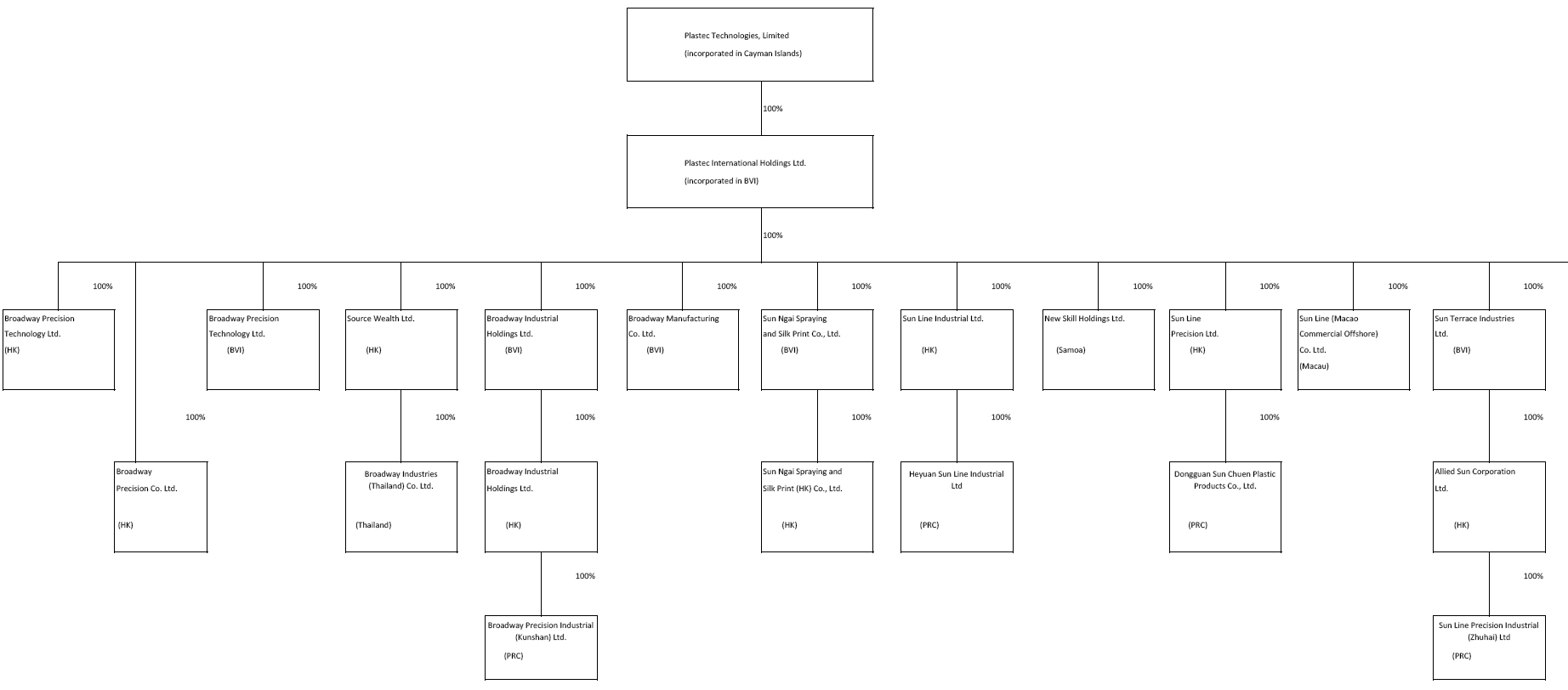

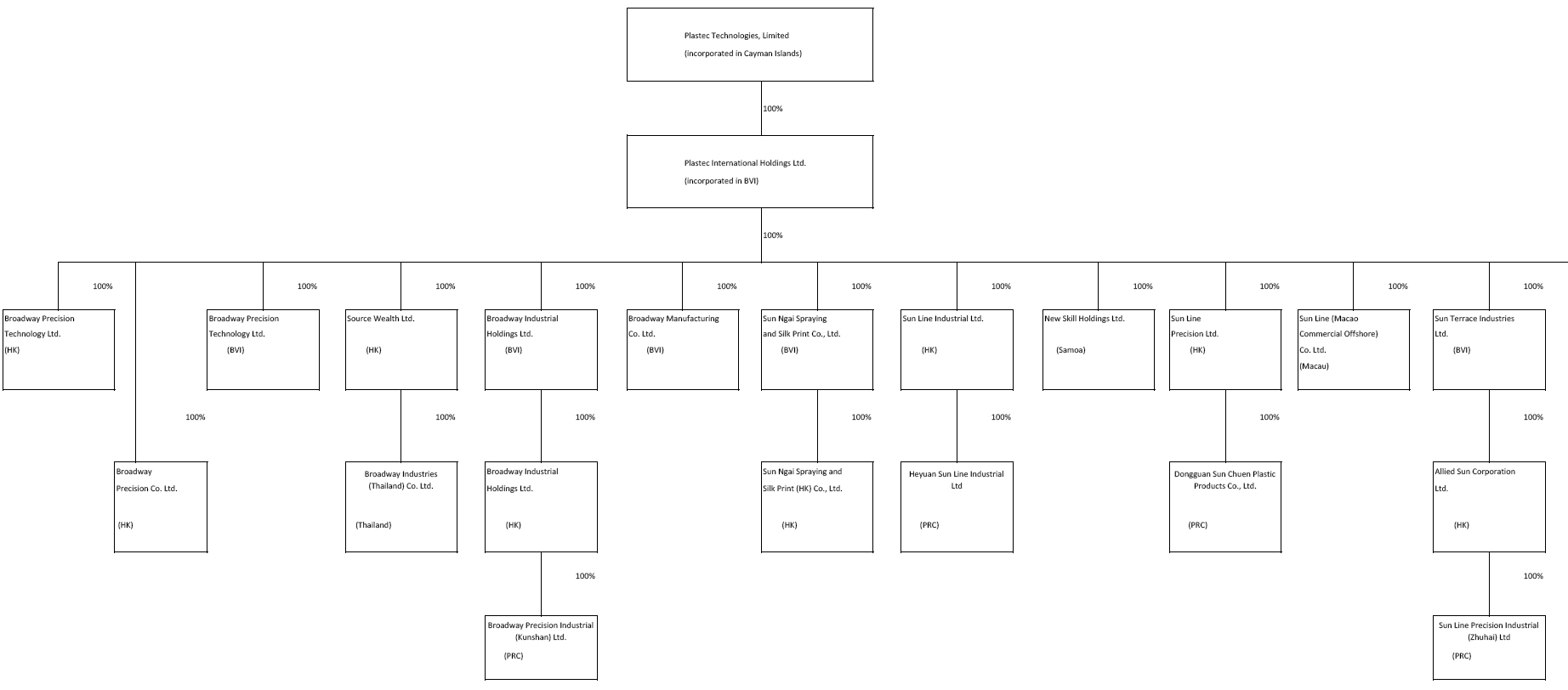

| · | “we,” “us,” “our” and “our company” refer to Plastec Technologies, Ltd., a Cayman Islands exempted company, its predecessor entities and direct and indirect subsidiaries; |

| · | “Plastec” refers to Plastec International Holdings Limited, a British Virgin Islands company, our direct wholly owned subsidiary; |

| · | “BVI” refers to the British Virgin Islands; |

| · | “PRC subsidiaries” refers to our indirect owned subsidiaries operating in the PRC; |

| · | “China” or the “PRC” refer to the People’s Republic of China; |

| · | “HK$” or “Hong Kong dollar” refer to the lawful currency of the Hong Kong Special Administrative Region, People’s Republic of China; if not otherwise indicated, all financial information presented in HK$ may be converted to U.S.$ or $ using the exchange rate of 7.8 HK$ for every 1 U.S.$ or $; |

| · | “Renminbi” or “RMB” refer to the lawful currency of China; and |

| · | “U.S.$” or “$” or “U.S. dollar” refer to the lawful currency of the United States of America. |

Forward-Looking Statements

This Annual Report on Form 20-F (this “Form 20-F”) contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements contained in this Form 20-F, or the documents to which we refer you in this Form 20-F, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances on which any statement is based.

This report should be read in conjunction with our audited consolidated financial statements and the accompanying notes thereto for the fiscal year ended April 30, 2012, which are included in Item 18 to this Form 20-F.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS.

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

Not Applicable.

ITEM 3. KEY INFORMATION.

A. Selected Financial Data

The selected financial information set forth below has been derived from our audited financial statements for the years ended as of April 30, 2012, 2011, 2010 and 2009.

The information is only a summary and should be read in conjunction with our audited financial statements and notes thereto contained elsewhere herein. The financial results should not be construed as indicative of financial results for subsequent periods. See Item 5 of this Form 20-F and the financial statements and the accompanying notes thereto included under Item 18 of this Form 20-F for further information about our financial results and condition.

| | | For the year ended

April 30 | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | (in HK$’000, except for per share data) | |

| | | | |

| Revenues | | | 1,291,223 | | | | 1,323,533 | | | | 966,755 | | | | 913,444 | |

| Cost of revenues | | | (1,142,653 | ) | | | (1,074,880 | ) | | | (810,187 | ) | | | (749,649 | ) |

| Gross profit | | | 148,570 | | | | 248,653 | | | | 156,568 | | | | 163,795 | |

| Selling, general and administrative expenses | | | (81,557 | ) | | | (83,584 | ) | | | (63,824 | ) | | | (69,241 | ) |

| Other income | | | 2,431 | | | | 4,711 | | | | 4,364 | | | | 2,102 | |

| Write-off of property, plant and equipment | | | (690 | ) | | | (1,791 | ) | | | (40,348 | ) | | | — | |

| Gain/(loss) on disposal of property, plant and equipment | | | 938 | | | | 1,315 | | | | 1,077 | | | | (29,031 | ) |

| Income from operations | | | 69,692 | | | | 169,304 | | | | 57,837 | | | | 67,625 | |

| Interest income | | | 218 | | | | 124 | | | | 60 | | | | 240 | |

| Interest expense | | | (2,695 | ) | | | (3,008 | ) | | | (2,733 | ) | | | (5,355 | ) |

| Income before income tax expense | | | 67,215 | | | | 166,420 | | | | 55,164 | | | | 62,510 | |

| Income tax expense | | | (16,811 | ) | | | (33,106 | ) | | | (10,857 | ) | | | (772 | ) |

| Net income | | | 50,404 | | | | 133,314 | | | | 44,307 | | | | 61,738 | |

| Net income per share | | | | | | | | | | | | | | | | |

| Basic and diluted income per ordinary share | | HK$ | 3.2 | | | HK$ | 16.9 | | | HK$ | 6.3 | | | HK$ | 8.8 | |

| Basic and diluted weighted average number of ordinary shares | | | 15,944,233 | | | | 7,891,754 | | | | 7,054,583 | | | | 7,054,583 | |

| | | | |

| | | April 30 | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

| Total assets | | | 1,193,729 | | | | 1,201,927 | | | | 977,492 | | | | 844,097 | |

| Total liabilities | | | 481,682 | | | | 455,667 | | | | 411,400 | | | | 294,068 | |

| Total shareholders’ equity | | | 712,047 | | | | 746,260 | | | | 566,092 | | | | 550,029 | |

We have omitted the selected financial data as of and for the year ended April 30, 2008, as such information is not available on a basis that is consistent with the consolidated financial data as of and for the years ended April 30, 2012, 2011, 2010 and 2009 and cannot be provided on a U.S. GAAP basis without unreasonable effort and expense.

Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars in this Form 20-F were made at the noon buying rate in the City of New York for cable transfers of Hong Kong dollars as certified for customs purposes by the Federal Reserve Bank of New York on July 20, 2012, which was HK$7.7566 to U.S.$1.00. We make no representation that any Hong Kong dollars or U.S. dollar amounts could have been, or could be, converted into U.S. dollar or Hong Kong dollars, as the case may be, at any particular rate, at the rates stated below, or at all.

The following table sets forth information concerning exchange rates between the Hong Kong dollar and the U.S. dollar for the periods indicated, in Hong Kong dollars per U.S. dollar. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this Form 20-F or will use in the preparation of our periodic reports or any other information to be provided to you.

| Period(1) | | Period End | | | Average(2) | | | Maximum | | | Minimum | |

| July 20, 2012 | | | 7.7566 | | | | — | | | | — | | | | — | |

| June 2012 | | | 7.7572 | | | | 7.7590 | | | | 7.7610 | | | | 7.7572 | |

| May 2012 | | | 7.7616 | | | | 7.7640 | | | | 7.7699 | | | | 7.7583 | |

| April 2012 | | | 7.7587 | | | | 7.7621 | | | | 7.7660 | | | | 7.7580 | |

| March 2012 | | | 7.7656 | | | | 7.7620 | | | | 7.7678 | | | | 7.7551 | |

| February 2012 | | | 7.7551 | | | | 7.7544 | | | | 7.7559 | | | | 7.7532 | |

| January 2012 | | | 7.7555 | | | | 7.7622 | | | | 7.7674 | | | | 7.7538 | |

| | | | | | | | | | | | | | | | | |

| FY 2012 | | | 7.7587 | | | | 7.7719 | | | | 7.7942 | | | | 7.7551 | |

| FY 2011 | | | 7.7673 | | | | 7.7748 | | | | 7.7926 | | | | 7.7515 | |

| FY 2010 | | | 7.7637 | | | | 7.7552 | | | | 7.7665 | | | | 7.7497 | |

| FY 2009 | | | 7.7500 | | | | 7.7693 | | | | 7.8041 | | | | 7.7499 | |

| FY 2008 | | | 7.7950 | | | | 7.7924 | | | | 7.8264 | | | | 7.7502 | |

_________________________

| (1) | For all periods prior to January 1, 2009, the exchange rate refers to the noon buying rate as reported by the Federal Reserve Bank of New York. For periods beginning on or after January 1, 2009, the exchange rate refers to the noon buying rate as set forth in the weekly H.10 statistical release of the Federal Reserve Board. |

| (2) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described below, together with the other information contained in this Form 20-F before making a decision to invest in our securities.

Risks Relating to Plastec’s Industry and Business

Plastec relies on third parties for significant portions of its business and, in the event that such parties do not properly manage those portions of the business, our production would be materially adversely affected.

Although Plastec owns all manufacturing equipment at the processing factories owned by third party PRC counterparties, which together we refer to throughout this Form 20-F as the “Processing Factories,” we do not own the Processing Factories or directly hire the employees to operate the production lines. Plastec is entirely dependent on contractual arrangements for manufacturing premises and manufacturing labor services pursuant to our processing agreements referred to below. Plastec also relies on third party PRC counterparties for utilities and supplemental supplies pursuant to our processing agreements. Although our management team controls the overall manufacturing process, other parties are contractually entitled to designate the plant manager, finance officer and customs liaison officer and have overall responsibility to manage the plant premises. Accordingly, if such parties do not manage the plant premises properly and hire appropriate individuals to supervise such premises, it could have a material adverse effect on our business, financial condition and results of operations.

Suitable plant facilities may not be available to us.

Plastec’s processing agreement, dated November 5, 2002, as amended and supplemented, between and among a third party PRC counterparty and our subsidiary that governs our processing arrangement for the processing factory we operate in Dongguan City is currently scheduled to expire in November 2012. Plastec’s processing agreement, dated December 18, 1996, as amended and supplemented, between and among another third party PRC counterparty and another subsidiary of ours that governs our processing arrangement for the processing factory we operate in Shenzhen City, is currently scheduled to expire in December 2012, which processing agreements shall individually and collectively be referred throughout this Form 20-F as the “Processing Agreements”. We are currently in the process of transforming the Processing Factories into two wholly foreign-owned enterprises going forward. We anticipate relevant approvals and licenses will be granted by and obtained from relevant PRC authorities on or before December 2012, failing which, a timely application for an extension of the respective terms of the Processing Agreements will have to be made prior to their expiry but an extension may not be obtained timely or upon similar terms or at all. In the event that we are not able to transform the Processing Factories into two wholly foreign-owned enterprises in time and/or any or all of the Processing Agreements expire or are not extended, and we are unable to locate an alternative facility site or enter into an alternative processing arrangement, our production would be materially adversely affected. This could result in a potential loss of customers and a material adverse effect on our results of operations, business prospects and financial condition.

Plastec does not control the third parties that actually own the Processing Factories.

Plastec does not have control over the third party PRC counterparties who own the Processing Factories. To the extent such third parties fail to renew the licenses necessary for their operations, or fail to comply with the various PRC laws and regulations, such as environmental and legal qualification matters, Plastec may not be able to continue to use the Processing Factories and our operations will be materially and adversely affected. In the event that we have to vacate the Processing Factories due to such failures, we would incur significant losses of revenue, we would have significant difficulty in performing our obligations under the contracts with our customers to supply our products and services, and we would experience significant delays in our attempt to find alternative manufacturing premises and to relocate our production facilities. We would also have to commit significant financial and other resources, including time of senior management members, to complete such relocation. Should this happen on a significant scale, our business and prospects would be materially adversely affected. In the event that we have to relocate our manufacturing operations from any of the current Processing Factories to another manufacturing facility in either Dongguan or Shenzhen, while maintaining our relationship with the relevant PRC counterparty to the respective Processing Agreement, the relevant Processing Factory will have to update its business license to reflect a change of address at the relevant local Administration of Industry and Commerce. If we have to engage a new PRC counterparty for such relocation, we will have to enter into a new processing agreement (which will need to be approved by the relevant governmental authority) and the new PRC counterparty will have to apply for the licenses. The relevant PRC counterparties may not cooperate with us diligently in respect of the application process and may not proceed with such applications in a timely manner so as to allow the business licenses to be approved, issued or updated promptly in order to minimize any interruption to our operations. This could have a material and adverse effect on our financial condition and results of operations.

Our manufacturing activities are dependent upon the availability of skilled and unskilled labor. If we are unable to retain skilled and unskilled labor, or if labor costs rise, we could experience reduction in profits.

Our manufacturing activities are relatively labor intensive and dependent on availability of skilled and unskilled labor in large numbers. Large labor intensive operations call for good monitoring and maintenance of cordial relations. Non-availability of labor and/or any disputes between the labor and management may result in a reduction in profits. Further, we sometimes rely on contractors who engage on-site laborers for performance of many of our unskilled operations. The scarcity or unavailability of contract laborers may affect our operations and financial performance.

Labor costs in China have been increasing in recent years, as have our labor costs. As a percentage of cost of products sold, our labor costs for the years ended April 30, 2012 and 2011 were 24.2% and 21.1%, respectively. Such costs could continue to increase in the future. If labor costs in the PRC continue to increase, our production costs will likely increase, which may in turn affect the selling prices of our products. We may not be able to pass on these increased costs to customers by increasing the selling prices of our products in light of competitive pressure in the markets where we operate. In such circumstances, our profit margin may decrease.

If the proper certificates of land use rights and building ownership certificates are not obtained or renewed, we could incur significant losses of revenue and have significant difficulty in performing the contracts with our customers to supply our products and services.

Certain of our manufacturing plants in Guangdong Province and Jiangsu Province rely on tenancy agreements (the “Tenancy Agreements”) for the use of land and premises that are necessary for the operation of our business. As of the date of this Form 20-F, the lessors of certain of those plants have not obtained the required land use rights certificates or building ownership certificates. Although we rely on third party PRC counterparties to ensure that we may properly use the underlying land and have the proper land use rights to lease such land, it is unclear whether such third party PRC counterparties have the right to make the premises available to us for use. Although the Processing Agreements and the Tenancy Agreements constitute separate agreements, termination or invalidity of any Tenancy Agreement could also impact the term or validity of the relevant Processing Agreement.

In addition, certain of the land used by us in our operations is situated on collectively-owned land. Under the PRC laws and regulations, if the collectively-owned land does not belong to the collectively-owned land for industrial use category, before such piece of land can be leased for industrial use, prior approval must be granted by competent governmental authorities. The third party PRC counterparties are responsible for completing the relevant governmental procedures to enable them to lease such land and premises. To this date, the relevant governmental procedures have not been completed in order to lease such land and premises to us for our manufacturing use as contemplated under the Tenancy Agreements. As a result, the Tenancy Agreements may not be legally valid and enforceable, as a matter of PRC laws and regulations. Accordingly, it is possible that any of the Tenancy Agreements could be terminated or invalidated prior to its stated maturity. If we have to vacate some or all of our production facilities because of the foregoing, we would incur significant losses of revenue, we would have significant difficulty in performing the contracts with our customers to supply our products and services, and we would experience significant delays in our attempt to find alternative manufacturing premises and to relocate our production facilities. We would also have to commit significant financial and other resources, including time of senior management members, to complete such relocation. Should this happen on a significant scale, our results of operations, business prospects and financial condition could be materially and adversely affected.

Potential government restrictions and changes in the availability of PRC government support and incentives could have a negative effect on our business and results of operations.

Plastec is an export-oriented processing manufacturer in China. As an export-oriented processing manufacturer, Plastec is currently substantially exempted from the value added tax because it imports approximately 95.1% of the raw materials needed for the manufacturing of its products and exports approximately 93.2% of its products for incorporation into goods sold outside China. Recent PRC measures have reduced or attempted to reduce or eliminate certain existing economic support and incentives for export-oriented processing businesses. Any additional reduction or elimination by the PRC government of the various existing economic support and incentives accorded to export-oriented processing enterprises, or imposition by the PRC government of any additional restrictions or operational barriers with respect to export-oriented processing enterprises for political, financial or other reasons, may adversely affect our business prospects and results of operations.

The selling prices of our products tend to decline over time and, if we do not receive orders for new products in a timely manner, our results of operations would be negatively impacted.

A majority of our customers are manufacturers of consumer electronics, electrical home appliances, telecommunication products and computer equipment. As is typical in these industries, the selling prices of the end products tend to decline significantly over time. As a result, our customers have also placed pricing pressure on our products over the life of their end products. We believe the selling prices of each of our products will continue to decline over time for the foreseeable future. To offset the declining selling prices, we must receive orders for new products that command higher initial selling prices in a timely manner. If we do not receive orders for new products over time and cannot otherwise increase the selling prices of our products, our gross margins will decline.

We depend on existing major customers and are exposed to the risk of delays, claims, reductions or cancellations of orders from customers in general.

We depend on approximately five major customers, who collectively accounted for approximately 66.2%, 75.2% and 77.1% of our revenues for the years ended April 30, 2010, 2011 and 2012, respectively. Historically, our largest customer accounted for approximately 32.5%, 33.3% and 35.6% of our revenues for the years ended April 30, 2010, 2011 and 2012, respectively. We believe that we will continue to be dependent upon these customers for a significant portion of our business. Our ability to retain these customers, as well as other customers, and to add new customers is important to our ongoing success. The loss of one or more of our major customers, or delayed, reduced or cancelled orders or claims from any of our major customers, could have a material adverse impact on our business, financial condition and results of operations.

We sell our products to manufacturers to incorporate them into their consumer electronic products. We are therefore dependent on our customers to compete effectively.

We do not sell our products directly to the mass consumer market. Instead, we sell products, largely plastic components, to leading international OEM, ODM and OBM manufacturers for them to incorporate into their consumer electronics products, electrical home appliances, telecommunication devices and computer peripherals. Market demand for our products is, therefore, derived from the demand for the products of our customers. Our customers market their products globally and any significant change in the global demand or preference for these consumer electronics products, electrical home appliances, telecommunication devices and computer peripherals will affect our revenue. The ability of our customers to compete successfully to increase their market share will indirectly affect our business prospects and results of operations.

We do not own any legally protected intellectual property. Any infringement claim by third parties may require us to spend significant resources to defend our rights and interests.

As a manufacturing service provider to OBM, ODM and OEM manufacturers, we do not own any legally protected intellectual property. We rely on our customers to ensure that they actually have the right to share that intellectual property with us. However, such intellectual property may be in violation of intellectual property belonging to other parties. Accordingly, we are subject to claims from the ultimate owners of the intellectual property that is being infringed on. In the event of an infringement claim, we may be required to spend a significant amount of resources, financial and otherwise, to defend against such claim. Additionally, our customers may have to develop a non-infringing alternative or obtain licenses for us to continue to manufacture the products for them using the existing intellectual property. Such customers may not be successful in developing an alternative or obtaining a license on reasonable terms, if at all. Additionally, our customers may not fully indemnify us for losses in such cases. Substantial costs and diversion of our resources resulting from any such litigation may adversely affect our business, financial condition and results of operations.

The consumer electronics and electrical home appliance industries are characterized by rapid technological changes and changing consumer preferences. If we do not respond to such changes in tandem, our operations would be adversely affected.

A majority of our customers make and sell consumer electronics and electrical home appliances, which are characterized by rapid technological changes and changing consumer preferences. As a result, a majority of the products that use our plastic components tend to have short product life cycles, faster technological obsolescence and are subject to constantly evolving industry standards. In order to meet our customers’ demand for new products and to ensure operational efficiency, we need to continually invest in new machines and technologies to upgrade and expand our manufacturing capacity and capabilities, including our know-how and skills. If we are unable to cope with such advances in technology and correspondingly respond to our customers’ requirements on a timely basis, demand for our services may decline and our business, financial condition and results of operations would be adversely affected.

We may not be able to upgrade our machinery when and as needed which could adversely affect our operations and profitability.

We need to regularly upgrade the machinery used in our operations in order to keep pace with various technological changes and changing consumer preferences. Such machinery is imported from other countries into China and then delivered to our local manufacturing facilities. Approvals from various governmental agencies in the PRC are required to import such machinery due to its high precision and hi-tech nature. If we are unable to obtain the necessary approvals, and therefore are unable to import new machinery, our business, results of operations and profitability would be adversely affected.

Our business depends on the continued services of our executive officers and key personnel, the loss of which could adversely affect our business.

Our success depends on the continued services of our executive officers and key personnel, in particular Mr. Sze-To, who founded Plastec and is now our Chairman and Chief Executive Officer. Mr. Sze-To, together with Plastec’s other executive directors and senior management, have been instrumental in Plastec’s growth and success. We do not maintain key-man life insurance on any of our executive officers and key personnel. If one or more of our executive officers and key personnel are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. As a result, our business may be severely disrupted and we may have to incur additional expenses in order to recruit and retain new personnel. In addition, if any of our executives joins a competitor or forms a competing company, we may lose some of our customers.

We may fail to implement our expansion strategy successfully.

We intend to expand our existing production capacity and capability by establishing new production bases and offering plastic products to industries other than consumer electronics and electrical home appliances. Our ability to obtain adequate funds to finance our expansion plans will depend on our financial condition and results of operations, as well as other factors outside our control, such as general market conditions, demand for the types of products we offer, success of our competitors and political and economic conditions in China. If additional capital is unavailable, we may be forced to abandon some or all of our expansion plans, as a result of which our business, financial condition and results of operations could be adversely affected.

We are vulnerable to foreign currency exchange risk exposure.

Currently, Renminbi is not a freely convertible currency. The PRC government regulates conversion between Renminbi and foreign currencies. Changes in PRC laws and regulations on foreign exchange may result in uncertainties in Plastec’s financing and operating plans in China. Over the years, China has significantly reduced the government’s control over routine foreign exchange transactions under current accounts, including trade and service related foreign exchange transactions, payment of dividends and service of foreign debts. In accordance with the existing foreign exchange regulations in China, our PRC subsidiaries are able to pay dividends and service debts in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, the current PRC foreign exchange policies regarding debt service and payment of dividends in foreign currencies may not continue in the future. Changes in PRC foreign exchange policies may have a negative impact on the ability of our PRC subsidiaries to service their foreign currency-denominated indebtedness and to distribute dividends to us in foreign currencies. In addition, transfer of funds to our subsidiaries in China is subject to approval by PRC governmental authorities in case of an increase in our registered capital in these subsidiaries, or subject to registration with PRC governmental authorities in case of a shareholder loan to them. These limitations on the flow of funds between us and our PRC subsidiaries could restrict our ability to act in response to changing market conditions.

During the years ended April 30, 2010, 2011 and 2012, approximately 63.8%, 61.0% and 56.9% of our sales were denominated in Hong Kong dollars, respectively, and approximately 28.6%, 30.3% and 36.2% of our sales were denominated in U.S. dollars, respectively. The remaining 7.6%, 8.7% and 6.9% were denominated in Renminbi during the same periods. In contrast, approximately 61.5%, 64.3% and 62.2% of our purchases were denominated in Hong Kong dollars during the same time periods, and approximately 32.6%, 30.2% and 32.9% of our purchases were denominated in U.S. dollars, respectively. The remaining 5.9%, 5.5% and 4.9% were denominated in Renminbi during the same periods. All of our direct labor costs and factory overheads, including electricity and utility costs, were also denominated in Renminbi. Our foreign currency exchange risk also arises from the mismatch between the currency of our sales and the currency of our costs of goods sold. In addition, our financial statements are expressed in Hong Kong dollars. Our balance sheet uses the relevant prevailing period end exchange rate to convert all foreign currency amounts into Hong Kong dollars and our income statement records various payments and receipts using the relevant prevailing exchange rate on the date of each transaction. The different exchange rates prevailing at different times will give rise to foreign currency exchange exposures. Our net foreign exchange gain during the year ended April 30, 2010 was approximately HK$1.0 million, an exchange loss for the year ended April 30, 2011 was approximately HK$1.2 million and an exchange gain for the year ended April 30, 2012 was HK$10.1 million, respectively. In addition, the current peg of the exchange rate between the Hong Kong dollar and the U.S. dollar may be de-pegged or subject to an increased band of fluctuation. Fluctuations in the Hong Kong dollar exchange rates against other currencies may negatively impact our business, financial condition and results of operations.

We face intense competition in our industry with respect to technical and manufacturing capabilities, resources and production scale, range of product offering and pricing, product quality, delivery efficiencies and overall capability of management.

We operate in a competitive environment and are subject to competition from both existing competitors and new market entrants. Competitive factors in our industry include technical and manufacturing capabilities, resources and production scale, range of product offering and pricing, product quality, delivery efficiencies, and overall capability of management. Many of our current and potential competitors have a longer operating history, better name recognition, greater resources, larger customer base, better access to raw materials and greater economies of scale than we do. In addition, the entry barriers to the general plastic injection and molding business are moderate since no specialized knowledge is needed. In fact, numerous small-scale enterprises are producing plastic products in China. Our success depends on our ability to generate and nurture customer patronage and loyalty mainly through consistent offering of quality products and services at competitive prices and reliable delivery times. Should our competitors offer any better-quality products or services, better pricing and/or shorter delivery times, our sales and market share will be adversely affected. Stiff competition and overall decline in demand for our products and services may also exert a downward pressure on our prices and erode our profit margins. Consequently, our business, financial condition and results of operations could be adversely affected.

We are exposed to credit risks of our customers and defaults in payment by our customers may adversely affect our business, financial condition and results of operations.

We are exposed to credit risks of our customers. Our trade receivables balances as at April 30, 2010, 2011 and 2012 were approximately HK$242.1 million, HK$270.8 million and HK$282.9 million, respectively. These accounted for approximately 50.5%, 43.9% and 44.8% of our current asset balances as at April 30, 2010, 2011 and 2012, respectively. Our trade receivables turnover days for the three years ended April 30, 2010, 2011 and 2012 were 91 days, 75 days and 80 days, respectively. We calculate our trade receivables turnover day by dividing our trade receivables balances at the end of the period by the turnover during the period, multiplied by actual days in the period (365 days for each year). We made no provisions for doubtful trade receivables as at April 30, 2010, 2011 and 2012 and bad debts written off in the years ended April 30, 2010, 2011 and 2012 amounted to HK$0 million, HK$0 million and HK$0 million, respectively. Our customers’ payments may not be made timely and they may not be able to fulfill their payment obligations. Defaults in payment by our customers may adversely affect our business, financial condition and results of operations.

We may be exposed to product liability claims.

The products we manufacture for our customers must meet their stringent quality standards. Although we have put in place strict quality control procedures, our products may not always satisfy our customers’ quality standards. In addition, as a manufacturing service provider, we do not control the design and structure of the plastic parts and components we manufacture for our customers. Nor do we control the design or structure of the final products containing our parts and components that our customers market to end-users. In our manufacturing, we strictly follow the chemical formulae provided by our customers and source our principal raw materials from vendors as designated and required by our customers. If there are any quality defects in the products that contain our parts and components, we may face claims from our customers or end-users for the damages suffered by them arising from such defects. It may be difficult or impossible to determine who is responsible for such defects or the extent of responsibility each party should bear for such defects. In addition, we do not maintain any product liability insurance except for a $5 million policy on a particular customer’s products. In the event that we become subject to valid product liability claims, we will be liable for them and, as a result, our business, financial condition and results of operations may be adversely affected.

Electricity disruptions may adversely impact our production.

Our manufacturing processes consume substantial amounts of electricity. We depend on the PRC power grid to supply our electricity needs. With the rapid development of the PRC economy, however, demand for electricity has continued to increase. There have been electricity shortages in various regions across China, especially during peak seasons. As a result, we have in the past experienced interruptions of, or limitations on, our electricity supply. To prevent similar occurrences, we have installed backup power generators to provide electricity to our production lines in case of electricity supply interruptions. However, there still may be interruptions or shortages in our electricity supply and we may need more electricity in the future to support our requirements at such time. Interruptions or shortages in power supply or increases in electricity costs may disrupt our normal operations and adversely affect our profitability.

We are exposed to risk of loss from fire, theft and natural disasters.

We face the risk of loss or damage to our properties, machinery and inventories due to fire, theft and natural disasters such as earthquakes and floods. Although we have not experienced any such disasters, such events have caused disruptions or cessations in the operations in some of the foreign-owned manufacturing facilities in China in the past and have adversely affected their business, financial condition and results of operations. While our insurance policies cover some losses in respect of damage or loss of our properties, machinery and inventories, our insurance may not be sufficient to cover all such potential losses. In the event that such loss exceeds our insurance coverage or is not covered by our insurance policies, we will be liable for the excess in losses. In addition, even if such losses are fully covered by our insurance policies, such fire, theft or natural disaster may cause disruptions or cessations in its operations and adversely affect our financial condition and results of operations.

Changes in global manufacturing outsourcing trends may adversely affect our business and prospects.

The electronic manufacturing services, or “EMS,” industry has undergone rapid change and growth over the last two decades as the capabilities of EMS providers continued to expand. More consumer electronics manufacturers have adopted, and have become more dependent on, manufacturing outsourcing strategies to remain competitive. We believe that the EMS industry has the potential for further growth as many consumer electronics manufacturers continue to favor outsourcing and the market for outsourcing, as a whole, continues to flourish. In recent years, manufacturing outsourcing has been quickly adopted by, and adapted for, other industries involving electrical home appliances, computers and automobiles. However, these trends of adopting manufacturing outsourcing strategies by consumer electronics and other manufacturers may not continue to grow. If the outsourcing trends change, our business, financial condition and results of operations could be adversely affected.

We may be subject to potential tax penalty and surcharge for the enterprise income tax payable in PRC following our assessment for uncertainty in income taxes.

During the year, we had engaged an independent tax advisor to assess for uncertainty in income taxes for all open years subject to any statute of limitations. We may have uncertainty over non-taxable income benefit in the business of certain of our subsidiaries under their processing arrangement in the PRC. Based on the processing factories operation of the relevant subsidiaries, the PRC tax bureau may take the position that they have permanent establishment in the PRC. In this regard, the relevant subsidiaries may be subject to enterprise income tax at a rate of 25% on the net profits attributable to their permanent establishment in the PRC. While we have made provision for additional tax payable plus interest thereon, if the PRC tax bureau were to deem the relevant subsidiaries to have failed to pay enterprise income tax within the prescribed time limit, a tax penalty equivalent to 0.5 to 3 times of the tax undercharged might be imposed subject to the PRC tax bureau’s discretion plus an additional daily surcharge might be levied at 0.05% of the overdue payment from the date on which the obligation to pay the enterprise income tax first arose.

Risks Relating to Operations in China

Changes in PRC political and economic policies and conditions could adversely affect our business and prospects.

China has been, and will continue to be, our primary production base and currently a majority of our assets are located in China. While the PRC government has been pursuing economic reforms to transform its economy from a planned economy to a market-oriented economy since 1978, a substantial part of the PRC economy is still being operated under various controls of the PRC government. By imposing industrial policies and other economic measures, such as control of foreign exchange, taxation and foreign investment, the PRC government exerts considerable direct and indirect influence on the development of the PRC economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental and are expected to be refined and improved over time. Other political, economic and social factors may also lead to further adjustments of the PRC reform measures. This refining and adjustment process may not necessarily have a positive effect on our operations and our future business development. Our business, financial condition and results of operations may be materially and adversely affected by changes in the PRC economic and social conditions and by changes in the policies of the PRC government, such as austerity measures or measures to control inflation, changes in the rates or method of taxation and the imposition of additional restrictions on currency conversion.

The PRC economy has been experiencing significant growth, leading to inflation and increased labor costs which in turn could lead to increases in our costs of doing business.

Inflation in China soared for a large part of fiscal year ended April 30, 2012, exacerbated by rising wages and increasing minimum wage levels and factory overhead including utilities. As a result, we may experience material increases in our cost of labor which will likely increase our operating costs and will adversely affect our financial results unless we pass on such increases to our customers by increasing the prices of our products and services. The effect of increases in the prices of our products and services would make our products more expensive in global markets, such as the United States and the European Union. This could result in the loss of customers, who may seek, and be able to obtain, products and services comparable to those we offer in lower-cost regions of the world. If we do not increase our prices to pass on the effect of increases in our labor costs, our margins and profitability would suffer.

The uncertain legal environment in China could limit the legal protections available to shareholders.

Plastec’s operating subsidiaries are wholly foreign-owned enterprises in China and are subject to laws and regulations applicable to foreign investments in China in general and laws and regulations applicable to wholly foreign-owned enterprises in particular. The PRC legal system is a civil law system based on written statutes. Unlike the common law system, the civil law system is a system in which decided legal cases have little precedential value. When the PRC government started its economic reform in 1978, it began to formulate and promulgate a comprehensive system of laws and regulations to provide general guidance on economic and business practices in China and to regulate foreign investments. China has made significant progress in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, the promulgation of new laws, changes in existing laws and abrogation of local regulations by national laws may have a negative impact on our business, financial condition and results of operations. In addition, as these laws, regulations and legal requirements are relatively recent and because of the limited volume of published cases and their non-binding nature, the interpretation and enforcement of these laws, regulations and legal requirements involve significant uncertainties. These uncertainties could limit the legal protections available to foreign investors and shareholders.

Plastec’s primary source of funds (in the form of dividends and other distributions from its operating subsidiaries in China) is subject to various legal and contractual restrictions and uncertainties.

Plastec is a holding company established in the British Virgin Islands and it conducts its core business operations through its operating subsidiaries in China. As a result, our ultimate profits available for distribution to shareholders are dependent on the profits available for distribution from Plastec’s PRC operating subsidiaries. If these subsidiaries in China incur debt on their own behalf, the debt instruments may restrict their ability to pay dividends or make other distributions, which in turn would limit our ability to pay dividends. Under the current PRC laws, because Plastec is incorporated in the British Virgin Islands, its PRC subsidiaries are regarded as wholly foreign-owned enterprises in China. Under the new Enterprise Income Tax Law of the PRC effective from January 1, 2008, dividends paid by foreign-invested enterprises, such as wholly foreign-owned enterprises, are currently subject to a 10% PRC corporate withholding tax, unless any such foreign investor’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. The PRC laws permit payment of dividends only out of net income as determined in accordance with PRC accounting standards and regulations. Determination of net income under PRC accounting standards and regulations may differ from determination under U.S. GAAP in significant aspects, such as the use of different principles for recognition of revenue and expenses. In addition, distribution of additional equity interests by Plastec’s PRC subsidiaries to Plastec which are credited as fully paid through capitalizing their undistributed profits requires additional approval of the PRC government due to an increase in the registered capital and total investment in its subsidiaries in China. Under the PRC laws, Plastec’s PRC subsidiaries must allocate at least 10% of their respective after-tax profit to their statutory general reserve funds until the balance of the fund reaches 50% of their registered capital. They also have discretion in allocating their after-tax profits to their statutory employee welfare reserve funds. These reserve funds are not distributable as cash dividends. As a result, Plastec’s primary internal source of funds for dividend payments from its PRC subsidiaries is subject to these and other legal and contractual restrictions and uncertainties.

PRC regulation of loans to, and direct investment in, PRC entities by offshore holding companies and governmental control of currency conversion may limit our ability to fund our expansion or operations.

As an offshore holding company with PRC subsidiaries, we may (i) make additional capital contributions to our PRC operating subsidiaries, (ii) establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, (iii) make loans to our PRC operating subsidiaries or (iv) acquire offshore entities with business operations in China in an offshore transaction. However, most of these actions are subject to PRC regulations and approvals. For example:

| · | capital contributions to our PRC operating subsidiaries, whether existing ones or newly established ones, must be approved by the PRC Ministry of Commerce or its local counterparts; and |

| · | loans by us to our PRC operating subsidiaries, each of which is a foreign-invested enterprise, to finance their activities cannot exceed statutory limit, which is the difference between the registered capital and the amount of total investment as approved by the Ministry of Commerce or its local counterparts and must be registered with the PRC State Administration of Foreign Exchange, or SAFE, or its local branches. |

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues Concerning the Improvement of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign Invested Enterprises, or “SAFE Circular 142”, regulating the conversion by a foreign-invested enterprise of foreign currency registered capital into Renminbi by restricting how the converted Renminbi may be used. SAFE Circular 142 provides that the Renminbi capital converted from foreign currency registered capital of a foreign-invested enterprise may only be used for purposes within the business scope approved by the applicable governmental authority and may not be used for equity investments within the PRC, unless it is provided for otherwise. In addition, SAFE strengthened its oversight of the flow and use of the Renminbi capital converted from foreign currency registered capital of a foreign-invested company. The use of such Renminbi capital may not be altered without SAFE approval, and such Renminbi capital may not in any case be used to repay Renminbi loans if the proceeds of such loans have not been used. Violations of SAFE Circular 142 could result in severe monetary or other penalties. We expect that if we convert any of our funds into Renminbi pursuant to SAFE Circular 142, our use of Renminbi funds will be for purposes within the approved business scope of our PRC subsidiaries. However, we may not be able to use such Renminbi funds to make equity investments in the PRC through our PRC subsidiaries.

Expiration of, or changes to, current PRC tax incentives that Plastec’s business enjoys could have a material adverse effect on its results of operations.

Our PRC subsidiaries are subject to various PRC taxes and enjoy various PRC tax incentives. The rate of income tax chargeable on companies in China may vary depending on the availability of preferential tax treatment or subsidies based on their industry or location. If Plastec’s current tax benefits expire or otherwise become unavailable to it for any reason, our profitability may be materially and adversely affected.

We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Pursuant to the Notice on Strengthening Administration of Enterprise Income Tax for Share Transfers by Non-PRC Resident Enterprises (“SAT Circular 698”), issued by the SAT, on December 10, 2009 with retroactive effect from January 1, 2008, except for the purchase and sale of equity through a public securities market where a non-resident enterprise transfers the equity interests of a PRC resident enterprise indirectly via disposing the equity interests of an overseas holding company, or an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that (i) has an effective tax rate less than 12.5% or (ii) does not tax foreign income of its residents, the non-resident enterprise, being the transferor, shall report to the relevant tax authority of the PRC resident enterprise such Indirect Transfer. Using a “substance over form” principle, the PRC tax authority may disregard the existence of the overseas holding company if it lacks a reasonable commercial purpose and was established for the purpose of reducing, avoiding or deferring PRC tax. As a result, gains derived from such Indirect Transfer may be subject to PRC withholding tax at a rate of up to 10%. SAT Circular 698 also provides that, where a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its related parties at a price lower than the fair market value, the relevant tax authority has the power to make a reasonable adjustment to the taxable income of the transaction. There is uncertainty as to the application of SAT Circular 698. For example, while the term “Indirect Transfer” is not clearly defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax rates in foreign tax jurisdictions, and the process and format of the reporting of an Indirect Transfer to the relevant tax authority of the PRC resident enterprise. In addition, there has not been any formal declaration by the relevant authority with regard to how to determine whether a foreign investor has adopted an abusive arrangement in order to reduce, avoid or defer PRC tax. SAT Circular 698 may be determined by the tax authorities to be applicable to our offshore restructuring transactions and any future overseas equity transfers which indirectly involve the transfer of equity interests in PRC resident enterprises, if any of such transactions were determined by the tax authorities to be devoid of reasonable commercial purpose, we and our non-resident investors in such transactions may become at risk of being taxed under SAT Circular 698 as a result and we may be required to expend valuable resources to comply with SAT Circular 698 or to establish that we should not be taxed under the general anti-avoidance rule of the PRC Enterprise Income Tax Law, which may have a material adverse effect on our financial condition and results of operations or such non-resident investors’ investments in us.

Compliance with environmental regulations can be expensive, and noncompliance may result in adverse publicity and potentially significant monetary damages and fines or suspension of our business operations.

We are required to comply with all national and local regulations regarding protection of the environment in China. Compliance with environmental regulations is expensive. In addition, if more stringent regulations are adopted by the PRC government in the future, the costs of compliance with PRC environmental protection regulations could increase. If we fail to comply with present or future environmental regulations, we may be subject to substantial fines or damages or suspension of our business operations, and our reputation may be harmed.

The enforcement of the Labor Contract Law and other labor-related regulations in the PRC may adversely affect our business and results of operations.

In June 2007, the National People’s Congress of China enacted the Labor Contract Law, which became effective on January 1, 2008, to impose more stringent requirements on employers for entering into labor contracts and dismissal of employees. Further, under the newly promulgated Regulations on Paid Annual Leave for Employees, which became effective on January 1, 2008, employees who have served more than one year with an employer are entitled to a paid vacation ranging from five to fifteen days, depending on their length of service. Employees who waive such vacation entitlement at the request of the employer shall be compensated at three times their normal salaries for each waived vacation day. As a result of these new protective labor measures, our labor costs may increase and our future operations may be adversely affected.

In addition, as required by the relevant PRC laws and regulations, our PRC subsidiaries must provide their employees in the PRC with welfare schemes covering pension insurance, unemployment insurance, maternity insurance, injury insurance, medical insurance and a housing accumulation fund. Our PRC subsidiaries are in material compliance with all applicable labor laws and regulations in the PRC and have provided their employees in the PRC with welfare schemes covering above-mentioned insurances. However, the housing accumulation fund scheme has not been fully implemented in a timely manner in certain parts of the PRC, including the places where some of our PRC subsidiaries are located. As of the date of this Form 20-F, where the housing accumulation fund scheme has been implemented in places our PRC subsidiaries are located, full contributions thereto have been made and where the housing accumulation fund scheme has not been implemented in places our PRC subsidiaries are located, full provisions thereto have been made for contributions once the implementation is carried out. Should any of our PRC subsidiaries be considered by relevant local authorities as not in compliance with the requirements in respect of those insurances and the housing accumulation fund scheme, our PRC subsidiaries may be ordered by the relevant authorities to make the unpaid contributions or be fined and thus, our future operations may be adversely affected.

Risks Related to Us and Our Securities

Because we are incorporated under the laws of the Cayman Islands, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. Federal courts may be limited.

We are a company incorporated under the laws of the Cayman Islands, and substantially all of our assets are located outside the United States. In addition, a majority of our directors and officers are nationals or residents of jurisdictions other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon our directors or executive officers, or enforce judgments obtained in the United States courts against our directors or officers.

Our corporate affairs are governed by our second amended and restated memorandum and articles of association, the Companies Law (as the same may be supplemented or amended from time to time) and the common law of the Cayman Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from English common law, the decisions of whose courts are of persuasive authority, but are not binding on a court in the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less developed body of securities laws as compared to the United States, and certain states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law. In addition, Cayman Islands companies may not have standing to initiate a shareholders derivative action in a Federal court of the United States.

There is also uncertainty as to whether the courts of the Cayman Islands would:

| · | recognize or enforce judgments of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States; or |

| · | entertain original actions brought in each respective jurisdiction against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

The uncertainty relates to whether a judgment obtained from the U.S. courts under civil liability provisions of U.S. securities laws will be determined by the courts of the Cayman Islands as penal or punitive in nature. If such a determination is made, the courts of the Cayman Islands will not recognize or enforce the judgment against a Cayman Islands company, such as our company. As the courts of the Cayman Islands have yet to rule on making such a determination in relation to judgments obtained from U.S. courts under civil liability provisions of U.S. securities laws, it is uncertain whether such judgments would be enforceable in the Cayman Islands. The courts of the Cayman Islands would recognize as a valid judgment a final and conclusive judgment in personam obtained in the federal or state courts in the United States under which a sum of money is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of a fine or other penalty) and would give a judgment based thereon provided that: (a) such courts had proper jurisdiction over the parties subject to such judgment; (b) such courts did not contravene the rules of natural justice of the Cayman Islands; (c) such judgment was not obtained by fraud; (d) the enforcement of the judgment would not be contrary to the public policy of the Cayman Islands; (e) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of the Cayman Islands; and (f) there is due compliance with the correct procedures under the laws of the Cayman Islands.

As a result of all of the above, shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders than they would as public shareholders of a United States company.

We may be treated as a passive foreign investment company (“PFIC”), which could result in adverse U.S. federal income tax consequences to U.S. investors.

In general, we would be treated as a PFIC for any taxable year in which either (1) at least 75% of our gross income (looking through certain 25% or more-owned corporate subsidiaries) is passive income or (2) at least 50% of the average value of our assets (looking through certain 25% or more-owned corporate subsidiaries) is attributable to assets that produce, or are held for the production of, passive income. Passive income generally includes, without limitation, dividends, interest, rents, royalties, and gains from the disposition of passive assets. If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. Holder (as defined in Item 11.E of this Form 20-F) of our ordinary shares, the U.S. Holder may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements. Based on the expected composition (and estimated values) of the assets and the nature of the income of us and our subsidiaries and our current plans of operation, we do not expect to be treated as a PFIC for the current taxable year or in the near future. However, our actual PFIC status for any taxable year will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance with respect to our status as a PFIC for our current taxable year or any subsequent taxable year. We urge U.S. investors to consult their own tax advisors regarding the possible application of the PFIC rules.

We may not declare and/or distribute any dividends.

We intend to declare regular annual cash dividends equal to 30% of Plastec’s yearly net income commencing with the fiscal year ending April 30, 2012. However, the actual payment of such future dividends will be entirely within the sole discretion of our board of directors at such times. Accordingly, we may never declare or pay any dividend in the future. Even if the board of directors decides to pay dividends, the form, frequency and amount will depend upon Plastec’s future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board may deem relevant.

An effective registration statement may not be in place when an investor desires to exercise warrants, thus precluding such investor from being able to exercise warrants and causing the warrants to expire worthless.

Public warrants may not be exercisable and we will not be obligated to issue any ordinary shares thereunder unless, at the time a holder seeks to exercise a warrant, we have a registration statement under the Securities Act of 1933, as amended (“Securities Act”), in effect covering the shares issuable upon the exercise of such warrants and a current prospectus relating to such shares. Under the terms of the warrant agreement governing the warrants, we are obligated to use our best efforts to have a registration statement in effect covering shares issuable upon exercise of the warrants as soon as practicable and following such effectiveness to maintain a current and effective prospectus relating to the shares issuable upon exercise of the warrants until the expiration of the warrants. We may not be able to do so. We will not be required to net cash settle the warrants if we do not maintain a current prospectus. In such event, the warrants held by public investors may have no value, the market for such warrants may be limited and such warrants may expire worthless.

An investor will only be able to exercise a warrant if the issuance of shares upon the exercise of such warrant has been registered or qualified or is deemed exempt under the securities laws of the state of residence of the holder of the warrants.

No public warrants will be exercisable and we will not be obligated to issue any ordinary shares thereunder unless, at the time a holder seeks to exercise a warrant, the shares issuable upon an exercise thereof have been registered or qualified or deemed to be exempt under the securities laws of the state of residence of the holder of the warrants. If the shares issuable upon exercise of the warrants are not qualified or exempt from qualification in the jurisdictions in which the holders of the warrants reside, the warrants may be deprived of any value, the market for the warrants may be limited and they may expire worthless if they cannot be sold.

A national securities exchange may not list our securities, or if a national securities exchange does grant such listing, it could thereafter delist our securities, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

We intend to apply to have our ordinary shares and warrants listed on a national securities exchange at an opportune time. However, there is no assurance that we will be successful in our efforts to have our securities listed. If a national securities exchange does not list our securities or if it grants such listing and thereafter delists our securities, we could face significant material adverse consequences, including:

| · | A limited availability of market quotations for our securities; |

| · | A reduced liquidity with respect to our securities; |

| · | A determination that our ordinary shares are “penny stocks” which will require brokers trading in our shares to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our shares; |

| · | A limited amount of news and analyst coverage for us; and |

| · | A decreased ability to issue additional securities or obtain additional financing in the future. |

If our shareholders exercise their registration rights with respect to their securities, it may have an adverse effect on the market price of our securities.

The holders of the ordinary shares issued by us prior to our IPO, which we sometimes refer to as the “initial shares” and the holders thereof as our “initial shareholders,” and the holders of the insider warrants purchased in connection with our IPO are entitled to demand that we register the resale of their initial shares and insider warrants (and the ordinary shares underlying the insider warrants) at any time. We also granted the former Plastec shareholders registration rights with respect to the securities they were issued in the Merger. We will bear the cost of registering these securities. The presence of these additional securities trading in the public market may have an adverse effect on the market price of our securities.

Our warrants and unit purchase options may be exercised, which would increase the number of shares eligible for future resale in the public market and result in dilution to our shareholders.

Our warrants are currently exercisable. There are warrants outstanding to purchase 4,781,122 ordinary shares. In addition, in connection with our IPO, we granted Cohen & Company Securities, LLC (and its designees) options to purchase, at $15.00 per unit, an aggregate of 360,000 units, each consisting of one ordinary share and one warrant (exercisable at $11.50 per share). There are currently 289,625 unit purchase options outstanding, which options and underlying warrants, if fully exercised, would result in an additional 579,250 ordinary shares being outstanding. To the extent such securities are exercised, additional ordinary shares of ours will be issued, which will result in dilution to the holders of our ordinary shares and increase the number of shares eligible for resale in the public market. Sales of substantial numbers of such shares in the public market could adversely affect the market price of our ordinary shares.

If we fail to maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our ordinary shares may be adversely affected.

Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We are a relatively young company with limited accounting personnel and other resources with which to address our internal controls and procedures. In addition, we must implement financial and disclosure control procedures and corporate governance practices that enable us to comply, on a stand-alone basis, with the Sarbanes-Oxley Act of 2002 and related Securities and Exchange Commission, or the SEC, rules. For example, we will need to further develop accounting and financial capabilities, including the establishment of an internal audit function and development of documentation related to internal control policies and procedures. Failure to quickly establish the necessary controls and procedures would make it difficult to comply with SEC rules and regulations with respect to internal control and financial reporting. We will need to take further actions to continue to improve our internal controls. If we are unable to implement solutions to any weaknesses in our existing internal controls and procedures, or if we fail to maintain an effective system of internal controls in the future, we may be unable to accurately report our financial results or prevent fraud and investor confidence and the market price of our ordinary shares may be adversely impacted.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to perform an evaluation of our internal controls over financial reporting and file annual management assessments of their effectiveness with the SEC. The management assessment to be filed is required to include a certification of our internal controls by our chief executive officer and chief financial officer. In addition to satisfying requirements of Section 404, we may also make improvements to our management information system to computerize certain manual controls, establish a comprehensive procedures manual for U.S. GAAP financial reporting, and increase the headcount in the accounting and internal audit functions with professional qualifications and experience in accounting, financial reporting and auditing under U.S. GAAP.