As filed with the Securities and Exchange Commission on May 7, 2018

Registration No. 333-185212

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 6

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PLASTEC TECHNOLOGIES, LTD.

(Exact name of registrant as specified in its constitutional documents)

| Cayman Islands | | 3089 | | N/A |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

c/o Unit 01, 21/F

Aitken Vanson Centre

61 Hoi Yuen Road

Kwun Tong

Kowloon, Hong Kong

852-21917155

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Kin Sun Sze-To, Chief Executive Officer

Plastec Technologies, Ltd.

c/o Unit 01, 21/F

Aitken Vanson Centre

61 Hoi Yuen Road

Kwun Tong

Kowloon, Hong Kong

852-21917155

Graubard Miller

405 Lexington Avenue

New York, New York 10174

(212) 818-8800

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

David Alan Miller, Esq.

Jeffrey M. Gallant, Esq.

Graubard Miller

The Chrysler Building

405 Lexington Avenue

New York, New York 10174

(212) 818-8800

(212) 818-8881 — Facsimile

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus included in this Post-Effective Amendment No. 6 to Form F-1 (“Registration Statement”) is a combined prospectus also relating to Registration Statement No. 333-162547 previously filed by the registrant on Form F-1 and declared effective November 19, 2009. This Registration Statement also constitutes a Post-Effective Amendment to Form F-1 to such Registration Statement No. 333-162547, and such post-effective amendment shall hereafter become effective concurrently with the effectiveness of this Registration Statement in accordance with Section 8(c) of the Securities Act of 1933.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

On November 30, 2012, the Registrant filed a registration statement on Form F-1 (Registration No. 333-185212), which was subsequently declared effective by the Securities and Exchange Commission on July 29, 2013 (“2013 Registration Statement”), registering the resale of an aggregate of 13,935,057 ordinary shares of the Registrant and 1,181,122 warrants of the Registrant and the issuance upon exercise of warrants and unit purchase options of 5,280,372 ordinary shares of the Registrant and 289,625 warrants of the Registrant. The 2013 Registration Statement also constituted a Post-Effective Amendment No. 1 to Form F-1 to the Registrant’s Registration Statement No. 333-162547 declared effective on November 19, 2009 (“2009 Registration Statement”).

This Post-Effective Amendment is being filed pursuant to Section 10(a)(3) of the Securities Act of 1933, as amended, to update the 2013 Registration Statement and 2009 Registration Statement to include the audited consolidated financial statements and the notes thereto included in the Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2017, filed with the SEC on April 30, 2018 (“2017 Annual Report”), and certain other information in such Registration Statements.

No additional securities are being registered under this Post-Effective Amendment. All applicable registration fees were paid at the time of the original filing of such 2013 Registration Statement and 2009 Registration Statement, as applicable.

| The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION, DATED MAY 7, 2018

PROSPECTUS

Plastec Technologies, Ltd.

12,093,935 Ordinary Shares (for Resale)

This prospectus relates to 12,093,935 ordinary shares of Plastec Technologies, Ltd., a Cayman Islands exempted company, that may be sold from time to time by the Selling Securityholders set forth in this prospectus under the heading “Selling Securityholders” beginning on page 40. This represents (i) 382,507 ordinary shares that were issued in connection with our initial public offering, or “IPO,” held or purchased in privately negotiated transactions by certain of the Selling Securityholders and (ii) an aggregate of 11,711,428 ordinary shares that were issued to the former shareholders of Plastec International Holdings Limited (formerly our direct wholly owned subsidiary until October 11, 2016), or “Plastec,” in connection with our merger with Plastec.

We will not receive any proceeds from the sale of the securities under this prospectus.

The securities are being registered to permit the Selling Securityholders to sell the securities from time to time in the public market at prices determined by the prevailing market prices or in privately negotiated transactions. Information regarding the Selling Securityholders, the amounts of ordinary shares that may be sold by them and the times and manner in which they may offer and sell the ordinary shares under this prospectus is provided under the sections titled “Selling Securityholders” and “Plan of Distribution,” respectively, in this prospectus. We do not know when or in what amount the Selling Securityholders may offer the securities for sale. The Selling Securityholders may sell any, all, or none of the securities offered by this prospectus.

The Selling Securityholders and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended, with respect to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation. We have agreed to indemnify the Selling Securityholders against certain liabilities, including liabilities under the Securities Act.

Our ordinary shares are quoted on the OTC Bulletin Board under the symbol “PLTYF”. As of May 3, 2018, the closing sale price of our ordinary shares was $7.0001 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 7 to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state or foreign securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2018.

PLASTEC TECHNOLOGIES, LTD

TABLE OF CONTENTS

This prospectus is not an offer to sell any securities other than the shares offered hereby. This prospectus is not an offer to sell securities in any circumstances in which such an offer is unlawful.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

PROSPECTUS SUMMARY

This summary highlights key information contained in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere herein. It may not contain all of the information that is important to you. You should read the entire prospectus, including “Risk Factors,” our consolidated financial statements and the related notes, the information incorporated by reference in this prospectus, and the other documents to which this prospectus refers, before making an investment decision.

Unless the context indicates otherwise:

·“we,” “us,” “our company” and “our” refer to Plastec Technologies, Ltd., a Cayman Islands exempted company, its predecessor entities and direct and indirect subsidiaries;

·“Plastec” refers to Plastec International Holdings Limited, formerly our direct wholly owned subsidiary until October 11, 2016;

·“HK$” or “Hong Kong dollar” refer to the lawful currency of the Hong Kong Special Administrative Region, People’s Republic of China; if not otherwise indicated, all financial information presented in HK$/RMB may be converted to U.S.$ or $ using the exchange rates of 7.8 HK$ and 6.3 RMB, respectively, for every 1 U.S.$ or $;

·“China” or the “PRC” refer to the People’s Republic of China.

·“Renminbi” or “RMB” refer to the lawful currency of China; and

·“U.S.$” or “$” or “U.S. dollar” refer to the lawful currency of the United States of America

Overview

Until October 11, 2016, we were a vertically integrated plastic manufacturing services provider providing comprehensive precision plastic manufacturing services through our former wholly owned subsidiary, Plastec, from mold design and fabrication and plastic injection manufacturing to secondary-process finishing as well as parts assembly to leading international OEMs, ODMs and OBMs of consumer electronics, electrical home appliances, telecommunication devices, computer peripherals and precision plastic toys.

On October 11, 2016, we completed the divestment of our shareholdings in Plastec as described below. Following consummation of the divestment transactions on October 11, 2016, we no longer own Plastec with the result that our only operations have generally been, or will be, to (i) complete the construction of our manufacturing plant in Kai Ping, China which was disposed of to SYB prior to its official operation as described below, (ii) collect rental income from certain property we own and that is being leased to one of Plastec’s subsidiaries, (iii) collect the payments upon Plastec achieving the performance targets for the years ended December 31, 2016, 2017 (which Plastec already did) and 2018 as described in the Agreement and below; and (iv) to explore other investment opportunities.

Corporate History and Developments

We are a Cayman Islands exempted company incorporated under the Companies Law (2018 Revision) of the Cayman Islands (as the same may be supplemented or amended from time to time), or the “Companies Law,” on March 27, 2008 as an exempted company with limited liability. We were originally incorporated under the name “GSME Acquisition Partners I” for the purpose of acquiring, through a merger, share exchange, asset acquisition, plan of arrangement, recapitalization, reorganization or similar business combination, an operating business, or control of such operating business through contractual arrangements, that had its principal operations located in the PRC.

On November 25, 2009, we closed our initial public offering, or “IPO,” of 3,600,000 units with each unit consisting of one ordinary share and one warrant, or “public warrants,” each to purchase one ordinary share at an exercise price of $11.50 per share. The units were sold at an offering price of $10.00 per unit, generating gross proceeds of $36,000,000. We also issued to the underwriters in the IPO an aggregate of 360,000 unit purchase options, each to purchase a unit identical to the units sold in the IPO, at an exercise price of $15.00 per unit, of which 70,375 unit purchase options were subsequently repurchased by us in April 2012. Simultaneously with the consummation of the IPO, we consummated the private sale of 3,600,000 warrants, or “insider warrants,” at a price of $0.50 per warrant, generating total proceeds of $1,800,000. In connection with the IPO, our initial shareholders placed a total of 1,200,000 ordinary shares, or “initial shares,” in escrow pursuant to an escrow agreement with Continental Stock Transfer & Trust Company, as escrow agent.

From the consummation of our IPO until August 6, 2010, we were searching for a suitable target business to acquire. On August 6, 2010, we entered into an agreement and plan of reorganization, or “Merger Agreement,” with Plastec, each of the former Plastec shareholders and our merger subsidiary, which provided, among other things, that our wholly owned subsidiary would merge with and into Plastec, with Plastec surviving as a wholly owned subsidiary of ours then. The Merger Agreement was subsequently amended in September 2010 and December 2010 but continued to provide for our wholly owned subsidiary to merge with and into Plastec, with Plastec surviving as a wholly owned subsidiary of ours then. On December 10, 2010, we held an extraordinary general meeting of our shareholders, at which our shareholders approved the merger and other related proposals. On December 16, 2010, we closed the merger. At the closing, we issued to the former shareholders of Plastec an aggregate of 7,054,583 ordinary shares and agreed to issue the former Plastec shareholders an aggregate of 9,723,988 earnout shares additionally upon the achievement by Plastec of certain net income targets. Also at the closing, 2,615,732 of the public shares sold in our IPO were converted into cash and cancelled based on the election of the holders to exercise their conversion rights. In connection with the merger, our business then became the business of Plastec and we changed our name to “Plastec Technologies, Ltd.” On April 30, 2011, we further amended the Merger Agreement to remove certain earnout provisions contained within it and to issue an aggregate of 7,486,845 ordinary shares to the former Plastec shareholders. We subsequently repurchased from one of the former Plastec shareholders an aggregate of 1,570,000 shares.

In connection with the merger with Plastec, we amended the terms of the escrow agreement with the initial shareholders to include in escrow an aggregate of 2,418,878 of the insider warrants and to provide additional restrictions on the release from escrow of all of the securities, including the requirement to raise certain financing by December 16, 2011. On December 16, 2011, the escrow agreement was again amended and the date on which the required financing was needed by was extended to March 16, 2012. No funds were ultimately raised and as a result, a total of 806,293 initial shares and the entire 2,418,878 insider warrants held in escrow were automatically repurchased by us at an aggregate consideration of $0.01 and cancelled.

We announced the establishment of a repurchase program in December 2011, under which and as the program was subsequently extended and expanded, we were allowed to repurchase up to $5 million of our ordinary shares and public warrants in both open market and privately negotiated transactions at the discretion of our management and as market conditions allowed, or “2011 Repurchase Program.” At the completion of the 2011 Repurchase Program on September 25, 2013, we had repurchased 832,765 ordinary shares and 85,000 public warrants thereunder.

On September 25, 2013, we also announced a new repurchase program, under which and as the program was subsequently extended and expanded, we are allowed to repurchase up to $5 million of our units, ordinary shares and public warrants in both open market and privately negotiated transactions at the discretion of our management and as market conditions allowed, or “2013 Repurchase Program.” The 2013 Repurchase Program (as extended) is currently valid through September 25, 2018 and so far we have repurchased 586,010 ordinary shares and 547,600 public warrants thereunder.

On November 18, 2014, all issued and outstanding public warrants, insider warrants and unit purchase options expired and were cancelled accordingly.

On November 14, 2015, we entered into a Share Transfer Agreement (the “Agreement”) with Shanghai Yongli Belting Co., Ltd. (“SYB”) and its wholly-owned subsidiary, Shanghai Yongjing Investment Management Co., Ltd. (“SYIM”). Pursuant to the Agreement, SYIM was to purchase, through a wholly-owned Hong Kong subsidiary, the entirety of our shareholding interests in Plastec for an aggregate purchase price of RMB 1,250,000,000 (or US$198,412,698), in cash (the “Transfer Price”). Of the Transfer Price, RMB 875,000,000 (or US$138,888,889) was payable within 60 days after the China Securities Regulatory Commission approved of the Issuance (as defined in the Agreement) and SYB’s receipt of the funds raised through the Issuance, the latter of which was confirmed by SYB to have happened by July 29, 2016. Accordingly, payment of the initial portion of the Transfer Price was made to us on September 21, 2016.

The remaining RMB 375,000,000 (or US$59,523,810) of the Transfer Price (the “Remaining Amount”) was deposited into a bank account designated solely for the purpose of the transaction, supervised and administered by SYB and us jointly, with tranches of which made payable to us upon Plastec achieving certain performance targets for the years ended December 31, 2016, 2017 and 2018 (the “Performance Commitments”) as described below:

| Year ending December 31, | | Net Profit Target | | Payment Amount |

| 2016 | | HK$161,211,000 | | RMB 113,250,000 (US$17,976,190) |

| 2017 | | HK$177,088,000 | | RMB 124,380,000 (US$19,742,857) |

| 2018 | | HK$195,408,000 | | RMB 137,370,000 (US$21,804,762) |

On October 11, 2016, the parties consummated the transactions contemplated by the Agreement after the fulfillment of certain other conditions, as described in the Agreement. As a result, we no longer own Plastec.

By a letter dated May 10, 2017, SYB confirmed and acknowledged to us that Plastec’s audited net profit (on a consolidated basis, after deducting non-current gains and losses) for the year ended December 31, 2016 was HK$183,958,100, which is in excess of the performance target for the year ended December 31, 2016, set at HK$161,211,000 in the Agreement, by HK$22,747,100 or approximately 14.1%. Accordingly, we were paid a further sum of RMB 113,250,000 (or US$17,976,190) of the Remaining Amount on June 1, 2017 and in accordance with the terms of the Agreement.

By a letter dated March 28, 2018, SYB confirmed and acknowledged to us that Plastec’s audited net profit (on a consolidated basis, after deducting non-current gains and losses) for the year ended December 31, 2017 was HK$183,124,000, which was in excess of the performance target for the year ended December 31, 2017, set at HK$177,088,000 in the Agreement, by HK$6,036,000 or approximately 3.4%. Accordingly, we shall be paid a further sum of RMB 124,380,000 (or US$19,742,857) of the Remaining Amount in due course and in accordance with the terms of the Agreement.

If the Performance Commitment for the year ending December 31, 2018 is met, the Remaining Amount payable for fiscal 2018 shall be paid in full. If the actual net profit of Plastec in fiscal 2018 is less than the Performance Commitment of 2018 but more than or equal to 80% thereof, then the corresponding Remaining Amount payable for fiscal 2018 shall be adjusted proportionately at that same rate. If the actual net profit of Plastec in fiscal 2018 is less than 80% of the Performance Commitment of 2018, then the corresponding Remaining Amount payable for fiscal 2018, or any part thereof, will not be paid.

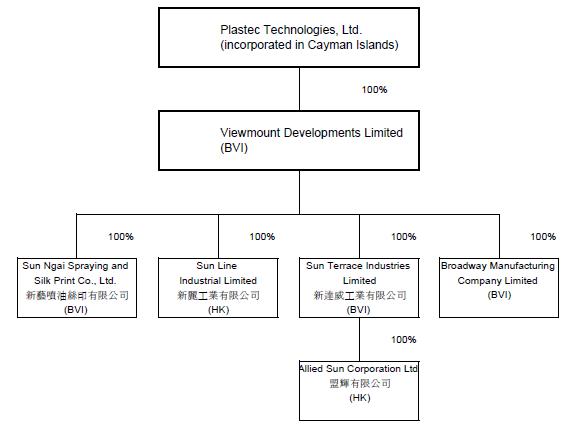

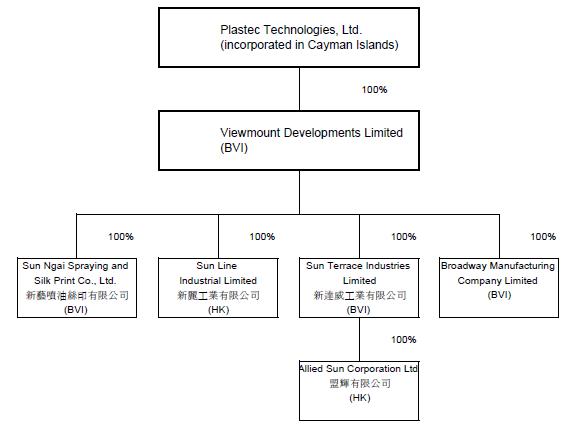

In accordance with the terms and spirits of the Agreement, we caused Viewmount Developments Limited, a wholly owned subsidiary of ours (“Viewmount”), to enter into a Share Transfer Agreement with Plastec (a wholly owned subsidiary of SYB since October 11, 2016) on March 30, 2018 (the “Manufacturing Plant Transfer Agreement”), pursuant to the terms and conditions of which Viewmount was to transfer the ownership interests in the subsidiaries of Viewmount holding our newly established manufacturing plant in Kai Ping, China through their PRC subsidiaries, Kai Ping Broadway Mold Tech Co., Limited and Yong Xie Precision Tech (Kai Ping) Co., Limited, to Plastec for a total consideration of approximately HK$70,000 (or US$8,974), representing the actual registered capital injected by Viewmount into the relevant subsidiaries.

On April 20, 2018, the parties consummated the transactions contemplated by the Manufacturing Plant Transfer Agreement. The parties also settled all account payables owed by the relevant subsidiaries to Viewmount at the closing, totaling HK$258,910,000 (or US$33,193,590).

Office Location

Our principal executive offices are located at c/o Unit 01, 21/F, Aitken Vanson Centre, 61 Hoi Yuen Road, Kwun Tong, Kowloon, Hong Kong and our telephone number at that location is 852-21917155. Our registered office is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands and our registered agent is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our agent for service of process in the United States is Graubard Miller, our U.S. counsel, located at 405 Lexington Avenue, New York, New York 10174. We maintain a website athttp://www.plastec.com.hk that contains information about our company, but that information is not part of this prospectus.

Risks Affecting Our Company

In evaluating an investment in our securities, you should carefully read this prospectus and especially consider the factors discussed in the section titled“Risk Factors” commencing on page 7.

The Offering

| Shares offered by the Selling Securityholders | | 12,093,935 shares |

| | | |

| Shares outstanding | | 12,938,128 shares |

| | | |

| Trading Symbol | | Our shares are quoted on the OTC Bulletin Board under the symbol “PLTYF.” |

| | | |

| Use of proceeds | | We will not receive any proceeds from the sale of the securities under this prospectus. |

| | | |

| Risk factors | | Prospective investors should carefully consider the “Risk Factors” beginning on page 7 before buying the ordinary shares offered hereby. |

Summary Financial Information

The selected financial information set forth below has been derived from our audited financial statements for the years ended December 31, 2017, 2016, 2015, 2014 and 2013.

The disposal of Plastec represented a strategic shift and had a major effect on our results of operations. Accordingly, assets and liabilities, revenues and expenses, and cash flows related to the disposed business lines have been reclassified as discontinued operations in the consolidated financial statements for the years ended December 2017, 2016 and 2015. The consolidated balance sheets as of December 31, 2016, the consolidated statements of operations and comprehensive income and the consolidated statements of cash flows for the years ended December 2016 and 2015 have been adjusted retrospectively to reflect this strategic shift.

The selected financial information below is only a summary and should be read in conjunction with our audited financial statements and notes thereto contained elsewhere herein. The selected consolidated statements of operations data for the years ended December 31, 2017, 2016 and 2015 and the consolidated balance sheet data as of December 31, 2017 and 2016 have been derived from our audited consolidated financial statements prepared and presented in accordance with U.S. GAAP, which are included in this prospectus. The selected consolidated statements of operations data for the years ended December 31, 2014 and the consolidated balance sheet data as of December 31, 2015, 2014 and 2013 have been derived from our audited consolidated financial statements prepared and presented in accordance with U.S. GAAP, which are not included in this prospectus. The selected consolidated statements of operations data for the year ended December 31, 2013 have been derived from our financial statements for the relevant period, which are not included in this prospectus. The financial results should not be construed as indicative of financial results for subsequent periods.

Our results of operations in any period may not necessarily be indicative of the results that may be expected for any future period. See“Risk Factors” beginning on page 7 of this prospectus.

| | | For the year ended | |

| | | ended December 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (HK$’000, except for per share data) | |

| | | (Audited) | | | (Audited) | | | (Audited) | | | (Audited) | | | (Unaudited) | |

| Revenues | | | - | | | | - | | | | - | | | | - | | | | 16,407 | |

| Cost of revenues | | | - | | | | - | | | | - | | | | - | | | | (14,060 | ) |

| Gross profit/(loss) | | | - | | | | - | | | | - | | | | - | | | | 2,347 | |

| Selling, general and administrative expenses | | | (19,593 | ) | | | (18,946 | ) | | | (27,812 | ) | | | (20,022 | ) | | | (31,649 | ) |

| Other income | | | 16,413 | | | | 23,874 | | | | 25,161 | | | | 23,907 | | | | 27,919 | |

| Write-off of property, plant and equipment | | | - | | | | - | | | | - | | | | - | | | | (14,920 | ) |

| Gain/(loss) on disposal of property, plant and equipment | | | - | | | | 545 | | | | - | | | | 122 | | | | (3,481 | ) |

| Gain on disposal of subsidiary | | | - | | | | - | | | | - | | | | 29,125 | | | | - | |

| Income/(loss) from operations | | | (3,180 | ) | | | 5,473 | | | | (2,651 | ) | | | 33,132 | | | | (19,784 | ) |

| Interest income | | | 2,258 | | | | 1,276 | | | | 1,028 | | | | 963 | | | | 52 | |

| Interest expense | | | - | | | | - | | | | - | | | | - | | | | (163 | ) |

| Income/(loss) before income tax expense | | | (922 | ) | | | 6,749 | | | | (1,623 | ) | | | 34,095 | | | | (19,895 | ) |

| Income tax (expense)/benefits | | | (524 | ) | | | (1,241 | ) | | | (294 | ) | | | (3,169 | ) | | | 5,240 | |

| Net income/(loss) from continuing operations | | | (1,446 | ) | | | 5,508 | | | | (1,917 | ) | | | 30,926 | | | | (14,655 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

| Net income from discontinued operations (including gain of HK$540,921 upon the disposal in the year ended December 31, 2016) | | | 141,341 | | | | 717,721 | | | | 163,204 | | | | 157,206 | | | | 104,509 | |

| Income tax expenses from discontinued operations | | | - | | | | (31,187 | ) | | | (29,952 | ) | | | (20,311 | ) | | | (8,974 | ) |

| Net income from discontinued operations attributable to the Company’s shareholders | | | 141,341 | | | | 686,534 | | | | 133,252 | | | | 136,895 | | | | 95,535 | |

| Net income attributable to the Company’s shareholders | | | 139,895 | | | | 692,042 | | | | 131,335 | | | | 167,821 | | | | 80,880 | |

| Net income per share | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of ordinary shares | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| - Discontinued operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of diluted ordinary shares | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| - Discontinued operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic income per share attributable from | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | HK$ | (0.11 | ) | | HK$ | 0.44 | | | HK$ | (0.15 | ) | | HK$ | 2.39 | | | HK$ | (1.09 | ) |

| - Discontinued operations | | HK$ | 10.92 | | | HK$ | 53.06 | | | HK$ | 10.35 | | | HK$ | 10.61 | | | HK$ | 7.09 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted income per share attributable from | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | HK$ | (0.11 | ) | | HK$ | 0.44 | | | HK$ | (0.15 | ) | | HK$ | 2.39 | | | HK$ | (1.09 | ) |

| - Discontinued operations | | HK$ | 10.92 | | | HK$ | 53.06 | | | HK$ | 10.35 | | | HK$ | 10.61 | | | HK$ | 7.09 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | December 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (HK$’000) | |

| | | (Audited) | | | (Audited) | | | (Audited) | | | (Audited) | | | (Audited) | |

| Total assets | | | 780,263 | | | | 793,599 | | | | 1,302,872 | | | | 1,271,156 | | | | 1,154,821 | |

| Total liabilities | | | 10,933 | | | | 11,975 | | | | 362,186 | | | | 338,166 | | | | 351,207 | |

| Total shareholders’ equity | | | 769,330 | | | | 781,624 | | | | 940,686 | | | | 932,990 | | | | 803,614 | |

RISK FACTORS

You should carefully consider the following risk factors, before you decide to buy our securities. You should also consider the other information in this prospectus. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this prospectus.

Risks Relating to Our Business

We have limited scope of operation after divestment of our ownership interest in Plastec and, accordingly, you will have no or little basis on which to evaluate our prospect as a going concern.

Following divestment of our ownership interest in Plastec, our only operations have generally been, or will be, to (i) complete the construction of our manufacturing plant in Kai Ping, China which was disposed of to SYB prior to its official operation in April 2018, (ii) collect rental income from certain property we own and that is being leased to one of Plastec’s subsidiaries, (iii) collect the payments upon Plastec achieving the performance targets for the years ended December 31, 2016, 2017 (which Plastec already did) and 2018 as described in the Agreement; and (iv) explore other investment opportunities. As of the date hereof, we have no plans, arrangements or understandings of what long term, if at all, operations in which we might be engaged or business objective by which we might adopt and, accordingly, you will have no or little basis on which to evaluate our prospect as a going concern.

We have limited sources of revenues, the extent to which are contingent upon third parties’ performances and contractual commitments.

Currently, our only sources of revenues are receiving lease payments from one of Plastec’s subsidiaries. We also may receive a contingent payment upon Plastec achieving the prospective performance target for the year ended December 31, 2018 pursuant to the terms of the Agreement. If SYB fails to cause Plastec’s subsidiary to continue to make lease payments when and as due, or if it determines to cancel the lease as provided for therein, or if Plastec does not achieve the prospective performance target for the year ended December 31, 2018 as provided for in the Agreement, we would not have any sources of revenue. As a result, there would be substantial doubt regarding our ability to remain as a going concern from a long-term perspective.

If lessee of the land and premises under which our recurring rental income have been derived from terminates the underlying lease agreements prior to their stated maturities or not to renew them for another term upon their usual expiry for want of relevant land and building title certificates, we could incur significant losses of revenues.

Although our wholly-owned subsidiary, Broadway Manufacturing Company Limited, has the right to use the parcels of land in Shenzhen together with premises built thereon (with an aggregate site area and gross floor area of approximately 47,190 square meters and 108,180 square meters, respectively) which have been leased to a lessee for industrial manufacturing activities in return for recurring rental income, it has not obtained the relevant land and building title certificates due to historical reasons as of the date of this prospectus. It is therefore unclear whether Broadway Manufacturing Company Limited has the proper rights to lease the relevant parcels of land and to make the relevant premises built thereon available to the lessee for industrial manufacturing activities. In addition, the parcels of land in question are situated on collectively-owned land. Under the PRC laws and regulations, if the collectively-owned land does not belong to the collectively-owned land for non-agricultural use category, before such piece of land can be leased for industrial use, prior approval must be granted by competent governmental authorities. To date, Broadway Manufacturing Company Limited has not been able to complete the relevant governmental procedures to obtain the relevant land and building title certificates and regularize the leasing of such land and premises to the relevant lessee for manufacturing use as contemplated under the underlying lease agreements. As a result, the relevant lease agreements may not be legally valid and enforceable, as a matter of PRC laws and regulations due to lack of proper government approvals or title certificates. Accordingly, it is possible that the relevant lease agreements could be terminated or invalidated prior to their stated maturities.

If the lessee of the above mentioned land and premises terminates the relevant leases prior to their stated maturities or not to renew them for another term upon their usual expiry for want of proper title certificates, we would incur significant losses of revenues and we might experience significant difficulties in securing replacement lessee for the above mentioned land and premises, or if at all, on best available terms; in which case our business prospects and financial condition could be materially and adversely affected.

We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Pursuant to the Notice on Strengthening Administration of Enterprise Income Tax for Share Transfers by Non-PRC Resident Enterprises (“SAT Circular 698”), issued by the PRC State Administration of Taxation, or SAT, on December 10, 2009 with retroactive effect from January 1, 2008, except for the purchase and sale of equity through a public securities market where a non-resident enterprise transfers the equity interests of a PRC resident enterprise indirectly via disposing the equity interests of an overseas holding company, or an “Indirect Transfer,” the non-resident enterprise, being the transferor, shall report to the relevant tax authority of the PRC resident enterprise such Indirect Transfer. As a result, gains derived from such Indirect Transfer may be subject to PRC withholding tax at a rate of up to 10%. SAT Circular 698 also provides that, where a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its related parties at a price lower than the fair market value, the relevant tax authority has the power to make a reasonable adjustment to the taxable income of the transaction. On February 03, 2015, the SAT issued the Announcement of the State Administration of Taxation on Several Issues concerning the Enterprise Income Tax Deriving from the Indirect Transfers of Properties among Non-Resident Enterprises, or “Announcement 7”, which was further amended on December 1, 2017 and December 29, 2017. Announcement 7 repealed relevant provisions in Circular 698 with respect to Indirect Transfer, and stipulates more detailed rules for tax treatment of indirect transfer of equity interest in PRC resident enterprises and other assets situated in China. Announcement 7 has broadened the scope of the Indirect Transfer under Circular 698 to non-resident enterprises’ indirect transfer of (i) the assets of an "establishment or place" situated in the PRC; (ii) real property situated in the PRC; and (iii) equity interest in Chinese resident enterprises. The Announcement 7 has also elaborated how to determine that an Indirect Transfer has “a reasonable commercial purpose” and specified the legal consequences for failing to withhold and pay tax. We may conduct acquisitions involving changes in corporate structures in the future and Circular 698 and Announcement 7 may be interpreted by the relevant tax authorities to be applicable if such future acquisitions are considered by the relevant tax authorities to be devoid of “a reasonable commercial purpose.” As a result, we may be required to expend valuable resources to comply with Circular 698 or other related tax rules, which may have a material adverse effect on our business, results of operations and financial condition in the future.

We are vulnerable to foreign currency exchange risk exposure.

Currently, our revenues are all denominated in Renminbi, which is not a freely convertible currency. The PRC government regulates conversion between Renminbi and foreign currencies. Changes in PRC laws and regulations on foreign exchange may result in uncertainties in our operation, albeit limited, in China. Our foreign currency exchange risk also arises from the fact that our financial statements are expressed in Hong Kong dollars. Our balance sheet uses the relevant prevailing period end exchange rate to convert all foreign currency amounts into Hong Kong dollars and our income statement records various payments and receipts using the relevant prevailing exchange rate on the date of each transaction. The different exchange rates prevailing at different times will give rise to foreign currency exchange exposures. In addition, the current peg of the exchange rate between the Hong Kong dollar and the U.S. dollar may be de-pegged or subject to an increased band of fluctuation. Fluctuations in the Hong Kong dollar exchange rates against other currencies may negatively impact our financial condition.

We intend to explore other currently unidentified investment opportunities and, accordingly, we are unable to currently ascertain the merits or risks of any such investment opportunity.

We intend to explore other currently unidentified investment opportunities to supplement our current minimal operations. Accordingly, there is no current basis for you to evaluate the possible merits or risks of any investment opportunity we may ultimately pursue. Although our management will endeavor to evaluate the risks inherent in any particular investment opportunity, we cannot assure you that we will properly ascertain or assess all of the significant risk factors or not be exposed to potential risks which could have a material and adverse effect on ability to manage our business. Further, as a result of our current minimal operations, limited sources of revenues and the need to maintain adequate control of our costs and expenses, we may not be able to attract, train, motivate and recruit suitably qualified personnel to explore or effect any investment opportunity thereby making it difficult for you to evaluate our long term business, financial performance and prospects. If we do not succeed in launching new business upon any investment opportunity to supplement our current minimal operations, our future results of operations and growth prospects may be materially and adversely affected.

Risks Related to Us and Our Securities

Because we are incorporated under the laws of the Cayman Islands, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. Federal courts may be limited.

We are a company incorporated under the laws of the Cayman Islands, and substantially all of our assets are located outside the United States. In addition, our directors and officers are nationals or residents of jurisdictions other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon our directors or executive officers, or enforce judgments obtained in the United States courts against our directors or officers.

Our corporate affairs are governed by our second amended and restated memorandum and articles of association, the Companies Law and the common law of the Cayman Islands. The rights of shareholders to take action against the directors, actions by minority shareholders and the fiduciary responsibilities of our directors to us under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from English common law, the decisions of whose courts are of persuasive authority, but are not binding on a court in the Cayman Islands. The rights of our shareholders and the fiduciary responsibilities of our directors under Cayman Islands law are not as clearly established as they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less developed body of securities laws as compared to the United States, and certain states, such as Delaware, have more fully developed and judicially interpreted bodies of corporate law. In addition, Cayman Islands companies may not have standing to initiate a shareholders derivative action in a Federal court of the United States.

There is also uncertainty as to whether the courts of the Cayman Islands would:

| · | recognize or enforce judgments of United States courts obtained against us or our directors or officers predicated upon the civil liability provisions of the securities laws of the United States or any state in the United States; or |

| · | entertain original actions brought in each respective jurisdiction against us or our directors or officers predicated upon the securities laws of the United States or any state in the United States. |

The uncertainty relates to whether a judgment obtained from the U.S. courts under civil liability provisions of U.S. securities laws will be determined by the courts of the Cayman Islands as penal or punitive in nature. If such a determination is made, the courts of the Cayman Islands will not recognize or enforce the judgment against a Cayman Islands company, such as our company. As the courts of the Cayman Islands have yet to rule on making such a determination in relation to judgments obtained from U.S. courts under civil liability provisions of U.S. securities laws, it is uncertain whether such judgments would be enforceable in the Cayman Islands. The courts of the Cayman Islands would recognize as a valid judgment a final and conclusive judgment in personam obtained in the federal or state courts in the United States under which a sum of money is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of a fine or other penalty) and would give a judgment based thereon provided that: (a) such courts had proper jurisdiction over the parties subject to such judgment; (b) such courts did not contravene the rules of natural justice of the Cayman Islands; (c) such judgment was not obtained by fraud; (d) the enforcement of the judgment would not be contrary to the public policy of the Cayman Islands; (e) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of the Cayman Islands; and (f) there is due compliance with the correct procedures under the laws of the Cayman Islands.

As a result of all of the above, shareholders may have more difficulty in protecting their interests in the face of actions taken by management, members of the board of directors or controlling shareholders than they would as public shareholders of a United States company.

We may be treated as a passive foreign investment company (“PFIC”), which could result in adverse U.S. federal income tax consequences to U.S. investors.

In general, we would be treated as a PFIC for any taxable year in which either (1) at least 75% of our gross income (looking through certain 25% or more-owned corporate subsidiaries) is passive income or (2) at least 50% of the average value of our assets (looking through certain 25% or more-owned corporate subsidiaries) is attributable to assets that produce, or are held for the production of, passive income. Passive income generally includes, without limitation, dividends, interest, rents, royalties, and gains from the disposition of passive assets. If we are determined to be a PFIC for any taxable year (or portion thereof) that is included in the holding period of a U.S. holder of our ordinary shares, the U.S. holder may be subject to increased U.S. federal income tax liability and may be subject to additional reporting requirements. As a result of the disposition of all of our shareholdings in Plastec in October 2016 and based on the expected composition (and estimated values) of the assets and the nature of the income of us and our subsidiaries and our current plans of operation, we are expected to be treated as a PFIC in the near future. However, our actual PFIC status for any taxable year will not be determinable until after the end of such taxable year. Accordingly, there can be no assurance with respect to our status as a PFIC for our current taxable year or any subsequent taxable year. We urge U.S. investors to consult their own tax advisors regarding the possible application of the PFIC rules.

A national securities exchange may not list our securities, or if a national securities exchange does grant such listing, it could thereafter delist our securities, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions.

We may consider applying to have our ordinary shares listed on a national securities exchange if circumstances permit. However, there is no assurance that such an application will be made or that we will be successful in our efforts to have our securities listed. If a national securities exchange does not list our securities or if it grants such listing and thereafter delists our securities, we could face significant material adverse consequences, including:

| · | A limited availability of market quotations for our securities; |

| · | A reduced liquidity with respect to our securities; |

| · | A determination that our ordinary shares are “penny stocks” which will require brokers trading in our shares to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for our shares; |

| · | A limited amount of news and analyst coverage for us; and |

| · | A decreased ability to issue additional securities or obtain additional financing in the future. |

If our ordinary shares become subject to the SEC’s penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.

If at any time we have net tangible assets of $5,000,000 or less and our ordinary shares have a market price per share of less than $5.00, transactions in our ordinary shares may be subject to the “penny stock” rules promulgated under the Securities Exchange Act of 1934. Under these rules, broker-dealers who recommend such securities to persons other than institutional accredited investors must:

| · | make a special written suitability determination for the purchaser; |

| · | receive the purchaser’s written agreement to the transaction prior to sale; |

| · | provide the purchaser with risk disclosure documents which identify certain risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and |

| · | obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed. |

If our ordinary shares become subject to these rules, broker-dealers may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected. As a result, the market price of our securities may be depressed, and you may find it more difficult to sell our securities.

If we fail to maintain an effective system of internal controls, we may be unable to accurately report our financial results or prevent fraud, and investor confidence and the market price of our ordinary shares may be adversely affected.

Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We are a relatively young company with limited accounting personnel and other resources with which to address our internal controls and procedures. In addition, we must implement financial and disclosure control procedures and corporate governance practices that enable us to comply, on a stand-alone basis, with the Sarbanes-Oxley Act of 2002 and related Securities and Exchange Commission, or the SEC, rules. For example, we will need to further develop accounting and financial capabilities, including the establishment of an internal audit function and development of documentation related to internal control policies and procedures. Failure to quickly establish the necessary controls and procedures would make it difficult to comply with SEC rules and regulations with respect to internal control and financial reporting. We will need to take further actions to continue to improve our internal controls. If we are unable to implement solutions to any weaknesses in our existing internal controls and procedures, or if we fail to maintain an effective system of internal controls in the future, we may be unable to accurately report our financial results or prevent fraud and investor confidence and the market price of our ordinary shares may be adversely impacted.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to perform an evaluation of our internal controls over financial reporting and file annual management assessments of their effectiveness with the SEC. The management assessment to be filed is required to include a certification of our internal controls by our chief executive officer and chief financial officer. In addition to satisfying requirements of Section 404, we may also make improvements to our management information system to computerize certain manual controls, establish a comprehensive procedures manual for US GAAP financial reporting, and increase the headcount in the accounting and internal audit functions with professional qualifications and experience in accounting, financial reporting and auditing under US GAAP.

If we become an “accelerated filer” or a “large accelerated filer” as those terms are defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), our auditors will be required to attest to our evaluation of internal controls over financial reporting. Unless we successfully design and implement changes to our internal controls and management systems, or if we fail to maintain the adequacy of these controls as such standards are modified or amended from time to time, we may not be able to comply with Section 404 of the Sarbanes-Oxley Act of 2002. As a result, our auditors may be unable to attest to the effectiveness of our internal controls over financial reporting. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management, which could, among other things, adversely affect the price of our ordinary shares and our ability to raise additional capital.

Our executive officers have limited experience managing a public company subject to United States securities laws and preparing financial statements in U.S. GAAP.

Our chief executive officer and chief financial officer, who are primarily responsible for the disclosure contained in our annual reports and financial statements filed with the SEC, have limited experience as officers of a public company subject to United States securities laws since we are the first United States public company they have managed. As a result, our executive officers chiefly in charge of our disclosure have limited experience with United States securities laws and U.S. GAAP. Accordingly, they may not have sufficient knowledge to properly interpret the extensive SEC financial reporting and disclosure rules or all relevant U.S. GAAP accounting standards and guidance, and may have to rely on third party advisers for compliance. If we are unable to engage knowledgeable third party advisers or our executive officers improperly interpret SEC financial reporting and disclosure rules and U.S. GAAP accounting standards and guidance, investor confidence and the market price of our securities may be adversely impacted.

One of our directors and officers controls a significant amount of our ordinary shares and his interests may not align with the interests of our other shareholders.

Kin Sun Sze-To, our Chairman of the Board of Directors, currently has beneficial ownership of approximately 78.3% of our issued and outstanding ordinary shares. This significant concentration of share ownership may adversely affect or reduce the trading price of our ordinary shares because investors often perceive a disadvantage in owning shares in a company with one or several controlling shareholders. Furthermore, our directors and officers, as a group, have the ability to significantly influence or control the outcome of all matters requiring shareholders’ approvals, including electing directors and approving mergers or other business combination transactions. These actions may be taken even if they are opposed by our other shareholders. This concentration of ownership and voting power may also discourage, delay or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company.

Our executive officers have become affiliated with SYB following divestment of our shareholdings in Plastec and have thereafter allocated their time in pursuit of businesses of Plastec thereby causing conflicts of interest in their determination as to how much time to devote to our affairs. This conflict of interest could have a negative impact on our ability to remain as a going concern.

Our executive officers are not required to commit their full time to our affairs, which could create a conflict of interest when allocating their time between our operations (albeit limited currently) and their commitments vis-à-vis Plastec as part and parcel of our divestment of our shareholdings in Plastec to SYB. None of our executive officers is obligated to devote any specific number of hours to our affairs. If their other business affairs vis-à-vis Plastec require them to devote more substantial amounts of time to such affairs, it could limit their ability to devote time to our affairs and could have a negative impact on our ability to remain as a going concern from a long-term perspective. Additionally, our executive officers may become aware of business opportunities which may be appropriate for presentation to us and SYB/Plastec to which they owe fiduciary duties. Accordingly, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. As a result, a potential business opportunity may preferentially be presented to SYB/Plastec ahead, or instead, of to us and we may not be afforded a realistic chance of exploring any business opportunity.

Our ability to consummate any investment opportunity will be dependent on the efforts of our key personnel.

Our ability to successfully effect any investment opportunity will be dependent upon the efforts of our key personnel. As indicated above, our executive officers are not required to commit their full time efforts to our affairs. Accordingly, there is no assurance that they will spend sufficient time to our locating any potential investment opportunity. Further, the unexpected loss of our executives could have a detrimental effect on us and our ability to realize any potential investment opportunity.

Because of our limited resources, other companies may have a competitive advantage in locating and consummating investment opportunities.

We expect to encounter competition from entities having a business objective similar to ours, including venture capital funds, leveraged buyout funds and operating businesses competing for investment opportunities. Many of these entities are well established and have extensive experience in identifying and effecting investment opportunities directly or through affiliates. Many of these competitors possess greater technical, human and other resources than we do and our financial resources will be relatively limited when contrasted with those of many of these competitors. The foregoing may place us at a competitive disadvantage in successfully locating and consummating any investment opportunity.

The market price for our shares may be volatile.

The market price for our shares is likely to be highly volatile and subject to wide fluctuations in response to factors including the following:

| · | actual or anticipated fluctuations in our operating results and changes or revisions of our expected results; |

| · | changes in financial estimates by securities research analysts; |

| · | fluctuations of exchange rates between the RMB, the Hong Kong dollar and the U.S. dollar. |

Volatility in the price of our shares may result in shareholder litigation that could in turn result in substantial costs and a diversion of our management’s attention and resources.

The financial markets in the United States and other countries have experienced significant price and volume fluctuations, and market prices have been and continue to be extremely volatile. Volatility in the price of our shares may be caused by factors outside of our control and may be unrelated or disproportionate to our results of operations. In the past, following periods of volatility in the market price of a public company’s securities, shareholders have frequently instituted securities class action litigation against such company. Litigation of this kind could result in substantial costs and a diversion of our management’s attention and resources.

If we do not pay dividends on our shares, shareholders may be forced to benefit from an investment in our shares only if those shares appreciate in value.

The payment of dividends in the future will be entirely within the sole discretion of our board of directors. Whether future dividends will be declared will largely be contingent upon Plastec’s ability to achieve the prospective performance target for the year ended December 31, 2018 pursuant to the terms of the Agreement, of which there can be no assurance, and our cash flow needs for future development; all of which may be adversely affected by one or more of the factors described herein. Accordingly, we may not declare or pay additional dividends in the future. Even if the board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board may deem relevant. If we determine not to pay any dividends in future, realization of a gain on shareholders’ investments will depend on the appreciation of the price of our shares, and there is no guarantee that our shares will appreciate in value.

We may need additional capital, and the sale of additional shares or equity or debt securities could result in additional dilution to our shareholders.

We believe that our current cash and cash equivalents will be sufficient to meet our anticipated cash needs at least for the next twelve month. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain one or more additional credit facilities. The sale of additional equity securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. It is uncertain whether financing will be available in amounts or on terms acceptable to us, if at all.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The following factors, among others, could cause actual results to materially differ from those set forth in the forward-looking statements:

| · | continued compliance with government regulations; |

| · | changing legislation or regulatory environments; |

| · | requirements or changes affecting the businesses in which we are engaged; |

| · | changing interpretations of accounting principles; |

| · | general economic conditions; and |

| · | other relevant risks detailed in our filings with the Securities and Exchange Commission. |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in this prospectus in the section titled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws and/or if and when management knows or has a reasonable basis on which to conclude that previously disclosed projections are no longer reasonably attainable.

PER SHARE MARKET INFORMATION

Our ordinary shares are quoted on the OTC Bulletin Board under the symbols “PLTYF”. The following table sets forth the range of high and low closing sale prices for the shares for the periods indicated.

| | | Ordinary Shares | | | Units | |

| Period | | High | | | Low | | | High | | | Low | |

| April 2018 | | $ | 24.80 | | | $ | 10.00 | | | $ | 6.00 | | | $ | 6.00 | |

| March 2018 | | $ | 24.80 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| February 2018 | | $ | 4.00 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| January 2018 | | $ | 4.00 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| December 2017 | | $ | 4.20 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| November 2017 | | $ | 4.20 | | | $ | 4.20 | | | $ | 6.00 | | | $ | 6.00 | |

| October 2017 | | $ | 4.20 | | | $ | 4.20 | | | $ | 6.00 | | | $ | 6.00 | |

| | | | | | | | | | | | | | | | | |

| Fiscal Quarter for | | | | | | | | | | | | | | | | |

| FY Ending Dec. 31, 2018: | | | | | | | | | | | | | | | | |

| First Quarter | | $ | 24.80 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| | | | | | | | | | | | | | | | | |

| Fiscal Quarter for | | | | | | | | | | | | | | | | |

| FY Ended Dec. 31, 2017: | | | | | | | | | | | | | | | | |

| Fourth Quarter | | $ | 4.20 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| Third Quarter | | $ | 6.50 | | | $ | 4.20 | | | $ | 6.00 | | | $ | 6.00 | |

| Second Quarter | | $ | 8.00 | | | $ | 4.50 | | | $ | 6.00 | | | $ | 6.00 | |

| First Quarter | | $ | 8.00 | | | $ | 4.38 | | | $ | 6.00 | | | $ | 6.00 | |

| | | | | | | | | | | | | | | | | |

| Fiscal Quarter for | | | | | | | | | | | | | | | | |

| FY Ended Dec. 31, 2016: | | | | | | | | | | | | | | | | |

| Fourth Quarter | | $ | 12.00 | | | $ | 2.50 | | | $ | 6.00 | | | $ | 6.00 | |

| Third Quarter | | $ | 9.50 | | | $ | 9.50 | | | $ | 6.00 | | | $ | 6.00 | |

| Second Quarter | | $ | 9.50 | | | $ | 9.00 | | | $ | 6.00 | | | $ | 6.00 | |

| First Quarter | | $ | 9.50 | | | $ | 7.80 | | | $ | 6.00 | | | $ | 6.00 | |

| FY Ended Dec. 31, 2015: | | | | | | | | | | | | | | | | |

| Fourth Quarter | | $ | 8.01 | | | $ | 7.80 | | | $ | 6.00 | | | $ | 6.00 | |

| Third Quarter | | $ | 8.00 | | | $ | 6.50 | | | $ | 6.00 | | | $ | 6.00 | |

| Second Quarter | | $ | 6.50 | | | $ | 6.50 | | | $ | 6.00 | | | $ | 6.00 | |

| First Quarter | | $ | 6.50 | | | $ | 6.50 | | | $ | 6.00 | | | $ | 6.00 | |

| | | | | | | | | | | | | | | | | |

| FY Ended Dec 31, | | | | | | | | | | | | | | | | |

| 2017 | | $ | 4.20 | | | $ | 4.00 | | | $ | 6.00 | | | $ | 6.00 | |

| 2016 | | $ | 12.00 | | | $ | 2.50 | | | $ | 6.00 | | | $ | 6.00 | |

| 2015 | | $ | 8.01 | | | $ | 6.50 | | | $ | 7.50 | | | $ | 3.00 | |

| 2014 | | $ | 7.00 | | | $ | 5.00 | | | $ | 7.50 | | | $ | 3.00 | |

| 2013 | | $ | 9.00 | | | $ | 5.50 | | | $ | 7.50 | | | $ | 3.00 | |

Approximate Number of Holders of Securities

As of April 26, 2018, there were 17 shareholders of record holding a total of 12,938,128 of our ordinary shares.

CAPITALIZATION

The following table sets forth our capitalization, as of March 31, 2018, on an actual basis:

You should read this table in conjunction with “Management Discussion and Analysis of Financial Condition and Results of Operations”, our consolidated financial statements and related notes included elsewhere in this prospectus. The information presented in the capitalization table below is unaudited.

| | | As of March 31,

2018 | |

| | | Actual | |

| (in HK$’000, except per share data) | | (unaudited) | |

| Bank borrowings | | | - | |

| | | | | |

| Equity: | | | | |

| Preferred shares (US$0.001 par value; 1,000,000 share authorized, none issued and outstanding) | | | - | |

| Ordinary shares (US$0.001 par value; 100,000,000 shares authorized, 12,938,128 shares issued and | | | 101 | |

| outstanding as of April 30, 2017) | | | | |

| | | | | |

| Additional paid-in capital | | | 26,050 | |

| | | | | |

| Accumulated other comprehensive income | | | (31 | ) |

| | | | | |

| Retained earnings | | | 746,880 | |

| | | | | |

| Total shareholders’ equity | | | 773,000 | |

| | | | | |

| Total capitalization | | | 773,000 | |

USE OF PROCEEDS

We will not receive any proceeds from the sale of the securities under this prospectus.

DIVIDEND POLICY

The payment of dividends in the future will be entirely within the sole discretion of our board of directors. Whether future dividends will be declared will depend upon our future growth and earnings, of which there can be no assurance, and our cash flow needs for future development; all of which may be adversely affected by one or more of the factors discussed in “Risk Factors.” Accordingly, we may not declare or pay any additional dividends in the future. Even if the board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board may deem relevant.

EXCHANGE RATE INFORMATION

Unless otherwise noted, all translations from Hong Kong dollars to U.S. dollars in this prospectus were made at the noon buying rate in the City of New York for cable transfers of Hong Kong dollars as certified for customs purposes by the Federal Reserve Bank of New York on April 20, 2018, which was HK$7.8448 to U.S.$1.00. We make no representation that any Hong Kong dollars or U.S. dollar amounts could have been, or could be, converted into U.S. dollar or Hong Kong dollars, as the case may be, at any particular rate, at the rates stated below, or at all.

The following table sets forth information concerning exchange rates between the Hong Kong dollar and the U.S. dollar for the periods indicated, in Hong Kong dollars per U.S. dollar. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in the prospectus or will use in the preparation of our periodic reports or any other information to be provided to you.

| Period | | Period End | | | Average (1) | | | Maximum | | | Minimum | |

| April 2018 | | | 7.8483 | | | | 7.8482 | | | | 7.8499 | | | | 7.8432 | |

| March 2018 | | | 7.8484 | | | | 7.8413 | | | | 7.8486 | | | | 7.8310 | |

| February 2018 | | | 7.8262 | | | | 7.8222 | | | | 7.8267 | | | | 7.8194 | |

| January 2018 | | | 7.8210 | | | | 7.8190 | | | | 7.8230 | | | | 7.8161 | |

| December 2017 | | | 7.8128 | | | | 7.8128 | | | | 7.8228 | | | | 7.8050 | |

| November 2017 | | | 7.8093 | | | | 7.8052 | | | | 7.8118 | | | | 7.7955 | |

| October 2017 | | | 7.8015 | | | | 7.8053 | | | | 7.8106 | | | | 7.7996 | |

| | | | | | | | | | | | | | | | | |

| FY Ended Dec. 31, 2017 | | | 7.8128 | | | | 7.7926 | | | | 7.8267 | | | | 7.7540 | |

| FY Ended Dec. 31, 2016 | | | 7.7534 | | | | 7.7618 | | | | 7.8270 | | | | 7.7505 | |

| FY Ended Dec. 31, 2015 | | | 7.7507 | | | | 7.7525 | | | | 7.7685 | | | | 7.7495 | |

| FY Ended Dec. 31, 2014 | | | 7.7531 | | | | 7.7554 | | | | 7.7648 | | | | 7.7497 | |

| FY Ended Dec. 31, 2013 | | | 7.7539 | | | | 7.7565 | | | | 7.7629 | | | | 7.7526 | |

Source: The exchange rate refers to the noon buying rate as set forth in the weekly H.10 statistical release of the Federal Reserve Board.

| (1) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

SELECTED CONSOLIDATED FINANCIAL DATA

The selected financial information set forth below has been derived from our audited financial statements for the years ended December 31, 2017, 2016, 2015, 2014 and 2013.

The disposal of Plastec represented a strategic shift and had a major effect on our results of operations. Accordingly, assets and liabilities, revenues and expenses, and cash flows related to the disposed business lines have been reclassified as discontinued operations in the consolidated financial statements for the years ended December 2017, 2016 and 2015. The consolidated balance sheets as of December 31, 2016, the consolidated statements of operations and comprehensive income and the consolidated statements of cash flows for the years ended December, 2016 and 2015 have been adjusted retrospectively to reflect this strategic shift.

The selected financial information below is only a summary and should be read in conjunction with our audited financial statements and notes thereto contained elsewhere herein. The selected consolidated statements of operations data for the years ended December 31, 2017, 2016 and 2015 and the consolidated balance sheet data as of December 31, 2017 and 2016 have been derived from our audited consolidated financial statements prepared and presented in accordance with U.S. GAAP, which are included in this prospectus. The selected consolidated statements of operations data for the years ended December 31, 2014 and the consolidated balance sheet data as of December 31, 2015, 2014 and 2013 have been derived from our audited consolidated financial statements prepared and presented in accordance with U.S. GAAP, which are not included in this prospectus. The selected consolidated statements of operations data for the year ended December 31, 2013 have been derived from our financial statements for the relevant period, which are not included in this prospectus. The financial results should not be construed as indicative of financial results for subsequent periods.

Our results of operations in any period may not necessarily be indicative of the results that may be expected for any future period. See“Risk Factors” beginning on page 7 of this prospectus.

| | | For the year ended | |

| | | ended December 31, | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | (HK$’000, except for per share data) | |

| | | (Audited) | | | (Audited) | | | (Audited) | | | (Audited) | | | (Unaudited) | |

| Revenues | | | - | | | | - | | | | - | | | | - | | | | 16,407 | |

| Cost of revenues | | | - | | | | - | | | | - | | | | - | | | | (14,060 | ) |

| Gross profit/(loss) | | | - | | | | - | | | | - | | | | - | | | | 2,347 | |

| Selling, general and administrative expenses | | | (19,593 | ) | | | (18,946 | ) | | | (27,812 | ) | | | (20,022 | ) | | | (31,649 | ) |

| Other income | | | 16,413 | | | | 23,874 | | | | 25,161 | | | | 23,907 | | | | 27,919 | |

| Write-off of property, plant and equipment | | | - | | | | - | | | | - | | | | - | | | | (14,920 | ) |

| Gain/(loss) on disposal of property, plant and equipment | | | - | | | | 545 | | | | - | | | | 122 | | | | (3,481 | ) |

| Gain on disposal of subsidiary | | | - | | | | - | | | | - | | | | 29,125 | | | | - | |

| Income/(loss) from operations | | | (3,180 | ) | | | 5,473 | | | | (2,651 | ) | | | 33,132 | | | | (19,784 | ) |

| Interest income | | | 2,258 | | | | 1,276 | | | | 1,028 | | | | 963 | | | | 52 | |

| Interest expense | | | - | | | | - | | | | - | | | | - | | | | (163 | ) |

| Income/(loss) before income tax expense | | | (922 | ) | | | 6,749 | | | | (1,623 | ) | | | 34,095 | | | | (19,895 | ) |

| Income tax (expense)/benefits | | | (524 | ) | | | (1,241 | ) | | | (294 | ) | | | (3,169 | ) | | | 5,240 | |

| Net income/(loss) from continuing operations | | | (1,446 | ) | | | 5,508 | | | | (1,917 | ) | | | 30,926 | | | | (14,655 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

| Net income from discontinued operations (including gain of HK$540,921 upon the disposal in the year ended December 31, 2016) | | | 141,341 | | | | 717,721 | | | | 163,204 | | | | 157,206 | | | | 104,509 | |

| Income tax expenses from discontinued operations | | | - | | | | (31,187 | ) | | | (29,952 | ) | | | (20,311 | ) | | | (8,974 | ) |

| Net income from discontinued operations attributable to the Company’s shareholders | | | 141,341 | | | | 686,534 | | | | 133,252 | | | | 136,895 | | | | 95,535 | |

| Net income attributable to the Company’s shareholders | | | 139,895 | | | | 692,042 | | | | 131,335 | | | | 167,821 | | | | 80,880 | |

| Net income per share | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of ordinary shares | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| - Discontinued operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of diluted ordinary shares | | | | | | | | | | | | | | | | | | | | |

| - Continuing operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| - Discontinued operations | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 12,938,128 | | | | 13,503,623 | |

| | | | | | | | | | | | | | | | | | | | | |