UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest event Reported): January 21, 2009 (January 15, 2009)

HENRY COUNTY PLYWOOD CORPORATION

(Exact name of registrant as specified in its charter)

Nevada | 000-53208 | 54-0484915 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

6/F No.947,Qiao Xing Road, Shi Qiao Town

Pan Yu District, Guang Zhou

People's Republic of China

(Address of principal executive offices)

86-20-84890337

(Registrant's telephone number, including area code)

5353 Manhattan Circle Suite 101 Boulder, Colorado 80303

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Our Business,” “Risk Factors,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,� 8; “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

•

our ability to overcome competition in our market;

•

the impact that a downturn or negative changes in the price of our products could have on our business and profitability;

•

our ability to simultaneously fund the implementation of our business plan and invest in new projects;

•

economic, political, regulatory, legal and foreign exchange risks associated with international expansion; or

•

the loss of key members of our senior management.

Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this registration statement and the documents that we reference and filed as exhibits to the registration statement completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF DEFINED TERMS

Except where the context otherwise requires and for the purposes of this report only:

•

“BVI” refers to the British Virgin Islands; and “China,” and the “PRC,” refer to the People's Republic of China;

•

the “Company,” “we,” “us,” and “our” refer to the combined business of Henry County Plywood Corporation and/or its consolidated direct and indirect subsidiaries, Organic Region, Fuji Sunrise, HK Organic, Southern International and Zhuhai Organic; and its variable interest entity, or VIE, Guangzhou Organic;

•

“Fuji Sunrise” refers to Organic Region's wholly-owned subsidiary Fuji Sunrise International Enterprises Limited, a BVI company;

•

“Guangzhou Organic” refers to Organic Region's subsidiary, Guangzhou Organic Region Agriculture Ltd., a PRC company;

•

“HK Organic” refers to Organic Region's wholly-owned subsidiary HK Organic Region Limited, a Hong Kong company;

•

“Organic Region” refers to Organic Region Group Limited, our wholly-owned BVI subsidiary;

•

“Renminbi” and “RMB” refer to the legal currency of China; and “U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States; and

•

“Securities Act” mean the Securities Act of 1933, as amended; and “Exchange Act” mean the Securities Exchange Act of 1934, as amended.

1

•

“Southern International” refers to Organic Region's wholly-owned subsidiary Southern International Develop Limited, a BVI company; and

•

“Zhuhai Organic” refers to Organic Region's wholly-owned subsidiary Zhuhai Organic Region Modern Agriculture Ltd., a PRC company, formerly, Zhuhai Greenland Contemporary Agriculture Ltd.

In this report we are relying on and we refer to information and statistics regarding the fruit industry that we have obtained from various sited public sources. Any such information is publicly available for free and has not been specifically prepared for us for use or incorporation in this registration statement or otherwise.

ITEM 1.01

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On January 15, 2009, we entered into a share exchange agreement, or the Share Exchange Agreement, with Organic Region and its wholly owned subsidiaries, Zhuhai Organic, Guangzhou Organic, Fuji Sunrise, Southern International and HK Organic and the shareholders of Organic Region, or the Organic Region Shareholders. Pursuant to the Share Exchange Agreement, the Organic Region Shareholders transferred all of the shares of the capital stock of Organic Region held by them, constituting all of the issued and outstanding capital stock of Organic Region, in exchange for 81,648,554 newly issued shares of our common stock, which, after giving effect to the Redemption Agreement disclosed herein, constituted 98% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange A greement.

On January 15, 2009, in connection with the Share Exchange Agreement, we entered into a piggyback registration rights agreement, or the Registration Rights Agreement, with Michael Friess and Sanford Schwartz, or the Majority Stockholders, pursuant to which we granted piggyback registration rights to the Majority Stockholders with respect to all shares of our common stock held by them.

On January 15, 2009, we also entered into a redemption agreement, or the Redemption Agreement, with the Majority Stockholders, whereby the Majority Stockholders surrendered an aggregate of 1,666,298 shares of our common stock for redemption in exchange for our issuance of a convertible promissory note to each, or the Notes, in the aggregate principal amount of five hundred thousand dollars $500,000 in favor of the Majority Stockholders. The Notes bear interest at an annual rate equal to the short term applicable federal rate as published by the United States Internal Revenue Service for avoidance of imputed interest from the date thereof, computed on the basis of a 360 day year. The principal and accrued interest of the Notes is payable on the earlier of the consummation of a financing with gross proceeds of at least $2,000,000 or March 31, 2009, provided that the principal is subject to setoff and holdback rights to secure the Majority Stockholders' indemnification obligations under the Indemnification Agreement described below. If we receive a notice of claim under the Indemnification Agreement and are required to use funds to defend against any such claim, the principal shall be reduced by such corresponding amount. In addition, so long as any claim remains unresolved against the Company, no further interest will accrue under the Notes with regard to such portion of the principal that is equal to the amount of such claim.

If the Notes are not paid off at maturity, the Majority Stockholders may, at their sole option, choose to either (i) extend the maturity date by three months and increase the aggregate principal amount of the notes to $750,000, or (ii) convert the Notes into a number of shares of our common stock such that, following conversion, the Majority Stockholders, together will all other stockholders of the Company immediately prior to the consummation of the Share Exchange Agreement, will own, in the aggregate, 49% of our outstanding capital stock; provided that if the Majority Stockholders choose to convert their Notes at such time, we will have the right, within six months of the date of conversion, to repurchase all such shares for an aggregate purchase price of $825,000. If the Majority Stockholders choose to extend the ma turity date as described above, and the Notes are not paid by the extended maturity date, the Majority Stockholders will have the option to either (i) further extend the maturity date by an additional three months and increase the aggregate principal amount of the notes to $1,000,000, or (ii) convert the Notes into a number of shares of our common stock such that, following conversion, the Majority Stockholders, together will all other stockholders of the Company immediately prior to the consummation of the Share Exchange Agreement, will own, in the aggregate, 49% of our outstanding capital stock; provided that if the Majority Stockholders choose to convert their Notes at such time, we will have the right, within six months of the date of conversion, to repurchase all such shares for an aggregate purchase price of $1,100,000. If the Majority Stockholders convert the Notes as described above and we do not repurchase all such shares issued upon conversion, following the expiration of the applicable period allowing for the repurchase of such shares, the Majority Stockholders will receive demand registration rights with respect to all shares of our common stock then owned by them.

2

On January 15, 2009, we also entered into an indemnification agreement, or the Indemnification Agreement, with the Majority Stockholders whereby the Majority Stockholders agreed to indemnify us and our stockholders, for a period of twenty-four months, for any liabilities or causes of action that arise from actions or omissions on the part of the Majority Stockholders with respect to the transactions contemplated by the Share Exchange Agreement or any liabilities based on any matter relating to the Company that occurred on or prior to the date of the Indemnification Agreement. Pursuant to the Indemnification Agreement, the Majority Stockholders pledged and delivered to us an aggregate of 499,889 shares of our common stock held by them, to be held in escrow by us until December 31, 2009 to secure the Majority Stockholders' obligations under the Indemnific ation Agreement.

The foregoing description of the terms of the Share Exchange Agreement, the Piggyback Registration Rights Agreement, the Redemption Agreement, the Notes and the Indemnification Agreement is qualified in its entirety by reference to the provisions of those documents filed as Exhibits 2.1, 4.1, 4.2, 4.3 and 10.1 to this report, which are incorporated by reference herein.

ITEM 2.01

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On January 15, 2009, we completed the acquisition of Organic Region pursuant to the Share Exchange Agreement described in Item 1.01 hereof. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein Organic Region is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, on January 15, 2009, we acquired Organic Region in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company as we were immediately prior to the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

Please note that the information provided below relates to the combined enterprises after the acquisition of Organic Region, except that information relating to periods prior to the date of the reverse acquisition only relate to Henry County Plywood Corporation unless otherwise specifically indicated.

OUR BUSINESS

Overview of Our Business

We are a Nevada holding company whose PRC-based operating subsidiaries, Zhuhai Organic and Guangzhou Organic, are primarily engaged in the wholesale distribution, marketing and sales of high-value fruits and vegetables to wholesale centers and supermarkets in China. Our main products include Fuji Apples, Emperor Bananas and Tangerine Oranges. Our products are sourced directly from farming cooperative groups on leased plantations throughout China to whom we provide varying degrees of farming, harvesting and marketing services. We distribute our products through our established distribution network and trading agents who sell our products to customers throughout China.

Our Corporate History and Structure

We were incorporated under the laws of the State of Virginia in May 1948 as Henry County Plywood Corporation. We were originally formed for the purchase, sale, lease and manufacture of lumber, and other wood products. On March 3, 2008, our stockholders approved our reincorporation to the State of Nevada and the Amendment of our Articles of Incorporation to increase our authorized capital stock to 780,000,000 shares of common stock and 20,000,000 shares of preferred stock, and we became a Nevada corporation on March 18, 2008. From July 2004 through to the date of our reverse acquisition, discussed below, we were a shell company with no operations and our sole purpose was to locate and consummate a merger or acquisition with a private entity. As a result of the reverse acquisition transaction, discussed elsewhere herein, we now conduct our operations i n the PRC through our wholly owned PRC subsidiaries, Zhuhai Organic and Guangzhou Organic.

3

The following chart reflects our organizational structure as of the date of this report:

Our corporate headquarters are located at 6/F No. 947, Qiao Xing Road, Shi Qiao Town, Pan Yu District, Guang Zhou, China. Our telephone number is +86-20-84890337.

Consulting Services Agreement

On January 1, 2005, Organic Region and Mr. Xiong Luo, our Chief Operating Officer, entered into an exclusive arrangement, whereby Organic Region agreed to provide consulting services, including business operations, human resources and research and development services, to Mr. Luo, the holder of licenses necessary to operate the fruit trading business in China, an entity owned and controlled by him. In exchange for such services, Mr. Luo agreed to pay a consulting services fee to Organic Region equal to all of the revenues obtained by Guangzhou Greenland, and the Company obtained the ability to substantially influence Guangzhou Greenland's daily operations and financial affairs, appoint its senior executives and approval all matters requiring shareholder approval. Mr. Luo also irrevocably granted the Company an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in Guangzhou Greenland and agrees to entrust all the rights to exercise their voting power to the person appointed by the Company. As a result of this arrangement, we consolidate the financial results of Guangzhou Greenland is our variable interest entity, pursuant to Financial Interpretation No. 46R, Consolidation of Variable Interest Entities, or FIN 46R.

4

Reverse Acquisition of Organic Region

Prior to January 15, 2009, we were a shell company and had no operations. On January 15, 2009, we completed a reverse acquisition transaction through a share exchange with Organic Region, whereby we issued to the shareholders of Organic Region 81,648,554 shares of our common stock, par value $0.001, in exchange for 100% of the issued and outstanding capital stock of Organic Region. Organic Region thereby became our wholly owned subsidiary and its subsidiaries, Fuji Sunrise, Southern International, HK Organic, Zhuhai Organic and Guangzhou Organic, became our subsidiaries.

Upon the closing of the reverse acquisition on January 15, 2009, Michael Friess, our Chief Executive Officer, President and director, submitted his resignation letter pursuant to which he resigned as our director and from all offices of the Company that he held effective immediately. Also on such date, David Lilja, our Chief Financial Officer, Treasurer, Secretary and director, submitted his resignation letter pursuant to which he resigned from all offices that he held effective immediately and from his position as our director that will become effective on the tenth day following the mailing by us of an information statement, or the Information Statement, to our stockholders that complies with the requirements of Section 14f-1 of the Exchange Act, which will be mailed out on or about January 23, 2009. Anson Yiu Ming Fong was appointed to our board of directors effective as of the closing of the reverse acquisition on January 15, 2009. In addition, our board of directors on January 15, 2009 increased the size of our board of directors to three (3) and appointed Chi Ming Leung and Xiong Luo to fill the vacancies created by such increase, which appointments will become effective upon the effectiveness of the resignation of Mr. Lilja on the tenth day following the mailing by us of the Information Statement to our stockholders. In addition, our executive officers were replaced by the Organic Region executive officers upon the closing of the reverse acquisition as indicated in more detail below.

Organic Region was incorporated in the BVI on January 30, 2003. It is a vertically integrated agricultural company engaged in the research and development, production, sales and distribution of high-value fruits and vegetables in the China. Since its inception, Organic Region has grown from a small distributor of various produce to become a large producer of high-value fruits such as: Fuji Apples, Emperor Bananas and Tangerine Oranges. In the interim, the Organic-Region brand has become highly recognizable and the Organic Region distribution network stretches across China from North to South. We plan to change our name to Organic Region Group, Inc. to more accurately reflect our new business operations.

For accounting purposes, the share exchange transaction was treated as a reverse acquisition with Organic Region as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Organic Region.

Our Industry and Market Trends

Background

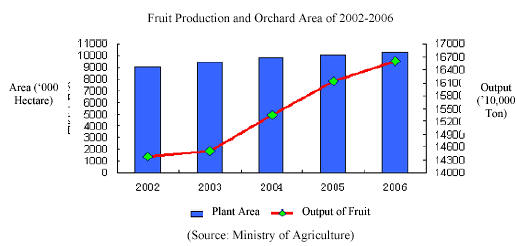

The rapid economic expansion experienced in China in the recent decade brought more income to Chinese consumers and enabled higher consumer spending. We see this trend through the rising number of super markets operating in China and their total sales. Studies have shown that as the living standard of urban populations increases, consumers become more health-conscious and they consume more fruits on a per capital basis. A recent USDA Economic Research study, Consumer Demand for Fruit and Vegetables (WRS-01-1), concluded that fruit and vegetable consumption in high income countries was more than two and one-half times that of low income countries. The latest USDA data, Dietary Assessment of Major Trends in US Food Consumption, 1970–2005 (USDA Research Economic Bulletin Number 33, March 2008), shows that the Chinese urban per capita fruit consumption has reached more than 60kg per year. However, this is still low compared to the level of fruit consumption of 123kg/yr in the US. As such, we believe that there is still much room for growth of fruit consumption in China.

5

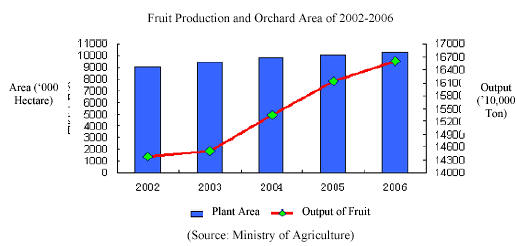

In terms of the absolute size of the market, a 2004 USDA presentation on the World Fresh Food Market estimated that China's total fruit production was 72 million tons in 2003, compared to a global production of 380 million tons for that year. This represents about 20% of world production at the time. Of that production volume, China exported only about 1.5 million tons, implying that the vast majority of this production was consumed domestically.

As such, China was not only the largest consumer of fruits in the world at that time, it was also the largest producer; and for the most part China supplied what it consumed.

Industry Structure

Prior to 1984, the fruit industry in China was subject to state controlled pricing and distribution. Although fruit production developed rapidly and features varied categories and configurations, the PRC's fruit production structure still lagged far behind other industries in the following three aspects:

•

Apples, oranges and pears accounted for a large proportion of total domestic fruit production (at approximately 63.5%), but lacked high-end and rare categories.

•

The domestic fruit harvest period was clustered in the fall months; oranges mature mainly in November and December and a few categories of fruits matured before October. The supply of fruits was therefore too concentrated during this period.

•

Fruit storage methods only allowed for the storage of less than 30% of total fruit production and mechanical processing methods could only store 10% of total production.

6

In 1984 the PRC government began implementing a system of reforms in the industry which transformed the industry from a fully state oriented structure to a market oriented structure, from state oriented pricing to market oriented pricing, and from state controlled distribution to multi channel distribution. These changes not only greatly mobilized and enthused fruit farmers and promoted the development of fruit production, it also increased the income of farmers and varied the vegetable basket of residents.

These reforms led to the development of planting and storage technologies which enabled consumers to purchase their fruits all year round and in small amounts, rather than purchase all their demand at one time and only when fruits were in season. The reforms also led to the introduction of multiple transportation channels and the opening up of new markets across China. As a result, consumers have access to fruits from all regions in China and are no longer limited to locally produced fruits.

In addition, the improvement of people's living standards in the PRC has led to more attention being paid to the link between healthy foods and long lives. This trend has stimulated the consumption of substances that promote health, including fresh fruits and vegetables, and the transition of fresh fruits in China from a luxury to a necessity. We expect that this increase in demand has led to good prospects for the whole fruit and vegetable industry.

Our Growth Strategy

As a leading premium specialty fruit based product company in China, we believe we are well positioned to capitalize on future industry growth in China. We are dedicated to providing healthy and high nutritional premium specialty fruit based products. We will implement the following strategic plans to take advantage of industry opportunities and our competitive strengths:

•

Further strengthen and expand our supply sources. We believe that a steady supply of premium specialty fruits is crucial to our future success. Currently, we have built strong relationships with three plantation bases in Shaanxi, Guangdong, and Guangxi Provinces. We intend to further strengthen our existing cooperative relationships with our plantation bases and look forward to expanding our supply sources by securing more first priority purchase rights with suppliers across China.

•

Further expand our distribution network to increase the prevalence of our products nationwide. Our current sales depend heavily on our regional distributors and their network. To support our rapid growth in sales, we plan to further expand our distribution network by leveraging our steady and expanding supply sources and capture the higher margin business of sales to retail stores and super markets.

•

Continue to expand our product portfolio to satisfy different customer preferences. We currently focus on apples, bananas and oranges because they are the best selling fruits in the world. However, we constantly evaluate our product line and seek to adapt to changing market conditions by updating our products to fulfill market needs. Currently, we are testing a few new fruit product lines, such as pears.

7

Our Products

Our main products are Fuji Apples, Emperor Bananas and Tangerine Oranges, which are high-quality variations of apples, oranges and bananas. We are also engaged in wholesale distribution of a variety of vegetables.

Fuji Apples –Fuji Apples are very popular in China because of their crispness and taste. They are also treated as a high-end product. The output for the Fuji Apple in China is about 17 million tons in 2006. Fuji Apples have a long storage period and are easy to transport. We lease more than 15 thousand acres of Fuji Apple plantations now and plan to expand our land base in the near future. During 2007, our 7,400 acre Fuji Apple plantation base in Yan'an, Shaanxi Province, had an output of 50,000 tons.

Emperor Bananas –The Emperor Banana derives its name from its appealing outer appearance and delicious taste. It is considered to be a high-end item in China and is priced about two to two and a half times the price for normal bananas. The Emperor Banana originates in Thailand and is new to China. Historically, Wanqingsha Town, Nansha District, Guangzhou in Guangdong Province, has been a production base of traditional bananas. In 2003, banana production drastically declined due to the spread of the “Panama Virus,” which stunted the growth and cultivation of traditional bananas. To address this agricultural problem, we launched a collaborative effort with Nansha's local government to find alternative fruits to grow in Nansha district. Pilot projects for Hawaiian papaya, Taiwan pearl guava, Thai Emperor Banana and the Chinese dragon fruit were pursued. Of the four fruits tested, the Emperor Banana from Thailand proved to be the most economically viable fruit to cultivate. Aside from the Emperor Banana's compatibility with Nansha's agricultural landscape and local farming knowledge, profitability from the production of Emperor Bananas was determined to be 100% to 250% higher than that of traditional bananas.We have developed a special method for cultivating seedlings for this species in our research laboratories. Our seedlings mature and are ready for planting in approximately 3 months and are harvested between 7 and 9 months later. Our Guangzhou plantation is now one of the only two Chinese growers of this special kind of banana. During 2007, our farmers produced 4,700 tons of these bananas on 330 acres of land.

Tangerine Orange –Tangerine Orange trees are created by grafting the Japanese Tangerine Orange tree onto an Orange tree stem when both are one year old. The resulting tree contains a number of desirable characteristics including: (a) a yield that is approximately two and half times higher than a regular orange tree; (b) sweeter juice than regular oranges; and (c) a meatier body than an orange. Tangerine Oranges can be stored for approximately 90 days, which is a relatively long storage period. This characteristic makes it well suited for transportation. Our Tangerine Orange plantation is roughly 1,300 acres in size and is located in Liuzhou in Guangxi Province. Our Tangerine Orange output in 2007 was over 7,000 tons.

Production

Production Facilities

We currently operate our production facilities from three main plantation bases: the Luochuan Apple Plant Base in Yan'an, Shaanxi Province; the Nansha Wanqingsha “Emperor” Banana plantation base in Guangzhou, Guangdong Province and the Rong'an Tangerine Orange plantation base in Liuzhou, Guangxi Province.

Production Process

Each of our farming cooperatives enter into our 25 year Land Lease Agreement, pursuant to which we lease the land from farming cooperatives and then grant farming rights back to the farming cooperatives. In exchange, we have first priority on purchasing the farming cooperatives' production at prevailing wholesale prices. This provides us with a guaranteed annual supply which we can resell at wholesale centers with a margin. In addition, our sales and distribution team manage our inventories with the primary objective of controlling our inventory levels in the wholesale centers to balance our inventory against market need and minimize spoilage rates as well as our stock holding and handling costs.

8

We believe that our cooperative relationships with farming cooperatives allows us to reduce our financial and operating risks and avoid the substantial capital required to maintain and finance agricultural production while making a significant contribution to regional development.

Quality Control

In 2006, we successfully passed both the ISO9001:2000 quality management system and the HACCP-EC-01 food security management system granted by the National Business Inspection Bureau.

We have also established our own Quality Control system for all our fresh fruits and vegetables and have adopted a very high quality standard which may be adopted by the industry and the government.

For the Tangerine Oranges and Emperor Bananas, our field Quality Control teams check and inspect all products before they are dispatched to the wholesale markets and to our customers. In addition, our own Quality Control team in Shannxi Province is on hand to closely monitor all shipments of Fuji Apples and ensure that each and every truck load is in complete compliance with our standards.

Our Suppliers and Supply Arrangements

Fuji Apples

Organic Region currently sources 100% of its Fuji Apples from a network of 7,400 acres of apple plantation bases located in Luochuan County, Yan'an, Shaanxi Province. Our average annual production output is between 50,000 to 60,000 tons. Since 1947, various varieties of apples have been successfully cultivated in Luochuan County and in 2000, Luochuan County was designated as the apple growing region in China. To date, around 60 varieties of apples are being grown in Luochuan County, covering a total plantation area of close to 100,000 acres, 76% of which is dedicated to Fuji Apple production. In 2007, total apple production reached about 1,000,000 tons in Luochuan County alone.

We have entered into a 25 year Land Lease Agreement with the Luochuan County farming cooperative, pursuant to which we have first priority on purchasing the farming cooperative's apple production at prevailing market wholesale prices, thereby creating a guaranteed annual supply. The farming cooperative benefits from guaranteed sale of their harvest and the ability to use our advanced cultivation techniques. We believe that this is a win-win situation for both parties and to the best of our knowledge, we are the only company that has successfully established and implemented the Cooperative Supply Chain model.

Our farming cooperative arranges for the packaging and transportation of their harvested apples to our designated wholesale centers where we can resell to our customers. This requires an efficient logistical process in loading, unloading, transporting and delivering fruit from the plantation base to the wholesale centers. On a weekly basis, our sales and distribution team coordinates with the Luochuan plantation base to schedule deliveries to either Yun Cheng or Xin Fadi wholesale centers. In addition, our sales and distribution team monitors our Fuji Apple inventories with the primary objective of controlling inventory levels in the wholesale centers to balance our inventory level against market need and minimize spoilage rates as well as stock holding and handling costs.

Emperor Bananas

We source our supply of Emperor Bananas from Wanqingsha, Town, Nansha District, Guangzhou in Guangdong Province. The Emperor Banana is a high-value product, but like the traditional banana, it is highly perishable and should be brought to market and sold generally within 3 to 4 weeks after harvest. In the same manner that the wholesale Fuji Apples are carried out, our sales teams in each of the wholesale centers coordinate with the Emperor Banana plantation base to facilitate deliveries and effectively manage inventories.

Nansha's local government intends to allocate a total of 16,457 acres of land for the cultivation of the Emperor Bananas and the local cooperative has leased the land to us for a term of 25 years. We intend to develop this parcel of 16,457 acres of land in phases. In 2007, we started our first phase of Emperor Banana cultivation covering 330 acres. For 2008 and 2009, we expect that 2,5001 acres and 1,000 acres of land, respectively, will be further developed for Emperor Banana plantations. A seedling facility has also been established with a target to produce 1,000,000 seedlings by 2009.

9

Encouraged by our success in instituting the Cooperative Supply Chain model in our Luochuan apple plantations, we intend to replicate this business model in the Nansha district. We are coordinating with Nansha's farming cooperative to increase the membership of our farming cooperative and encourage them to participate in our Emperor Banana cultivation program. We regularly conduct Emperor Banana cultivation seminars and training in local areas to educate and persuade farmers to join our cooperative arrangement. We transfer the seedlings we produce in our facilities to the farmers, which they can cultivate and sell back to us when the fruit matures. We believe that our agricultural practices contribute to the quality of the Emperor Bananas that we distribute.

Tangerine Oranges

In contrast with our use of the cooperative supply chain model with Fuji Apples, we source our Tangerine Oranges pursuant to a 25 year lease agreement with the Rongan Wan Shanhong Fruit Company, which owns a 1,268-acre Tangerine Orange plantation base. Pursuant to this agreement, we have first priority rights on purchasing the company's Tangerine Orange production at prevailing market wholesale prices. We expect that annual output for the Rongan Wan Shanhong Fruit Company will reach approximately 7,000 tons for 2008.

Marketing, Sales And Distribution

Fuji Apple

We distribute our Fuji Apples in the Guangdong Yun Cheng Wholesale Market and the Beijing Xin Fadi Agricultural Products Wholesale Market. The Guangdong Yun Cheng Wholesale Marketis one of the major wholesale centers for apples and tangerine oranges in Southern China, with an annual apple sales volume of over 250,000 tons. This wholesale market covers an area of approximately 43 million people within a 200 kilometer radius. In 2007, our annual turnover in the Yun Cheng wholesale market was approximately 35,850 tons, representing approximately 72% of our total apple production. We believe that we are the largest apple wholesaler in Yun Cheng, accounting for a 14.34% of Yung Cheng's annual apple turnover in 2007. The second largest apple seller at Yung Cheng has only 2.34% of Yun Cheng's total annual turnover. We expect to continue make in-roads at Y un Cheng and capture 25% of Yun Cheng's total turn-over by 2009.

The Beijing Xin Fadi Agricultural Products Wholesale Market is one of the largest agricultural wholesale centers in China with an annual apple turnover of approximately 300,000 tons. This wholesale market covers a market of approximately 24 million people within a 200 kilometer radius. In 2007, we sold approximately 13,650 tons of apples in Xin Fadi, representing approximately 4.55% of Xin Fadi's total annual turnover.

Emperor Bananas and Tangerine Oranges

We take advantage of our developed wholesale distribution network to distribute our Emperor Bananas and our Tangerine Oranges to wholesale centers such as the Guangdong Yun Cheng Wholesale Market in Southern China and the Beijing Xin Fadi Agricultural Products Wholesale Market in Northern China.

Our Competition and Competitive Strengths

Due to land reforms over the past 20-years, orchards in China are generally small and the average farmer only owns somewhere between 0.4 to 0.5 acres (or 2.5 to 3 mu in Chinese unit, 1 acre=6 mu) of land. As a result, there are very few large marketing and distribution enterprises in the Chinese fruit industry. The marketing and distribution system for Chinese apples is primarily accomplished through small fruit brokers who buy apples from farmers for cash in the orchards or at a broker collection points. The brokers sort and pack the fruit and resell it at fresh fruit markets or package it for delivery to processors.

We do not believe that there are any fruit distributors that handle more overall annual tonnage than we do, and if there are, we believe that our focus on high-end fruits and our guaranteed supply chain set us apart. In the Chinese market, we believe that only the Yan'an Apple Group and the Qixia Apple Group are our closest competitors. However, since both of these entities are state-owned enterprises, they are very inefficient in management and production.

10

We believe that our success to date and potential for future growth can be attributed to a combination of our strengths, including the following:

•

Guaranteed Supply andStrong Supplier Relationships – We implement a cooperative (collaborative) supply chain model, under which we have total control of the production cycle of our high value fruits and of our resale at wholesale centers. We acquire first priority purchase rights from the best plantation bases, provide farming cooperatives with technological support to ensure high yields and ensure that they have a ready market for their produce through our multi-channel marketing network. Under this mutually beneficial arrangement, we are assured of a steady supply of our high value fruits and vegetables. The result of our cooperative model is that our suppliers, the small orchard farmers, are as motivated as we are. In 2007, we became qualified for bidding as a United Nation's supplier, which means that we are recognized as subscribing to the UN Supplier Code of Conduct in the conduct of our business and operations.

•

Production Line Processing Technology– Our production line processing technology (for which we have a patent application pending) provides standardized procedures for inspection, grading, cleansing and packaging of our fruits and vegetables. Only our company utilizes this “deep cleansing” technology which ensures healthy, fresh and high-quality produce with the Organic Region brand name. In 2006, our Organic Region brand was granted the National “3.15” China Famous Brand Authentication award, and in 2006, we received the Guangzhou Nansha District Agricultural Technology Breakthrough Support Prize Certificate for introducing Emperor Banana cultivation technology.

•

High Product Quality – Our products are viewed as high quality products by our customers, and in the past three years we have established a reliable reputation in wholesale centers in China. We have chosen to focus on the high-end fruit and vegetable sector of the industry and we will always strive for better quality. We believe that with respect to our products, “the best is yet to come.” We do not compete in low-end markets. We believe that only by providing unparalleled quality and adhering to high-end market standards can we outsell our competitors and remain successful. In 2006, we received both the ISO9001:2000 quality management system certificate and the HACCP-EC-01 food security management system certificate from the National Business Inspect ion Bureau.

We believe that our advantages in quality, brand name, price and service of products with the complete structure of the industrial chain—planting, picking, preservation, storage, transportation with cold chains and marketing—will keep us ahead of current and future competitors.

Research and Development

Our research and development programs concentrate on sustaining the productivity of our agricultural lands, product quality, value-added product development and packaging design. Agronomic research is directed toward sustaining and improving product yields and product quality by examining and improving agricultural practices in all phases of production (such as development of specifically adapted fruit varieties, land preparation, fertilization, cultural practices, pest and disease control, post-harvesting, handling, packing and shipping procedures). Our R&D department also provides on-site technical services to our suppliers and is also responsible for the implementation and monitoring of recommended agricultural practices.

The Fuji Apple variety originated from Japan. Production efficiency for Fuji Apple production in Japan is approximately 4 tons per mu. In the next 2 years, we expect to increase the current production efficiency of our Fuji Apples 1.5 tons per mu by 10-15%. We also plan to hire a Japanese Fuji Apple expert to help us increase our current production yields.

11

We are on target to produce 1 million Emperor Banana seedlings by 2009. In the next 2 to 3 years, we plan to produce up to 10 million Emperor Banana seedlings to cater to the planned expansion of our plantations.

Our Intellectual Property

Our application for an invention patent for “cleaning, freshening and sterilizing method and device for fruit and vegetable” (Application No. 2005100888659) is still in progress. The foregoing patent application right is held in the names of Mr. Xiong Luo and Mr. Anson Yiu Ming Fong, who are in the process of transferring the application right to the Company for no consideration, pursuant to a patent transfer agreement, among Mr. Luo, Mr. Fong and the Company, dated January 10, 2009.

We also made the following 16 trademark applications.

Trademark | Application Date | Application No. | Class | Status |

| January 16, 2008 | 6512335 through 6512338 | 35, 31, 30 and 29 | Patent application pending |

| January 16, 2008 | 6512339; 6512340; 6512365 and 6512366 | 35, 31, 30 and 29 | Patent application pending |

| January 16, 2008 | 6512374; 6512368; 6512369; 6512370 | 29, 31, 30 | Patent application pending |

| January 16, 2008 | 6512371 through 6512374 | 31, 35, 30 and 29 | Patent application pending |

In addition, we protect our technological know-how through confidentiality agreements entered into with the employees in our production department.

Regulation

The food industry is subject to extensive regulation in China. The following summarizes the most significant PRC regulations governing our business in China.

Food Hygiene and Safety Laws and Regulations

As a distributor and producer of food products in China, we are subject to a number of PRC laws and regulations governing food safety and hygiene, including:

•

the PRC Product Quality Law;

•

the PRC Food Hygiene Law;

•

the Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises (trail implementation);

•

the Regulation on the Administration of Production Licenses for Industrial Products;

12

•

the General Measure on Food Quality Safety Market Access Examination;

•

the General Standards for the Labeling of Prepackaged Foods;

•

the Standardization Law;

•

the Regulation on Hygiene Administration of Food Additive;

•

the Regulation on Administration of Bar Code of Merchandise; and

•

the PRC Metrology Law.

These laws and regulations set out safety and hygiene standards and requirements for various aspects of food production, such as the use of additives, production, packaging, handling, labeling and storage, as well as facilities and equipment. Failure to comply with these laws and regulations may result in confiscation of our products and proceeds from the sales of non-compliant products, destruction of our products and inventory, fines, suspension of production and operation, product recalls, revocation of licenses, and, in extreme cases, criminal liability.

Despite the aforementioned Food Hygiene and Food Quality Laws and Regulations, our exposure to these risks is limited since our business model and our agreements with our suppliers provide a cushion which shields us from product liability exposure and we control food hygiene and food quality by implementing a strict quality control system.

Environmental Regulations

We are subject to various governmental regulations related to environmental protection. The major environmental regulations applicable to us include:

•

the Environmental Protection Law of the PRC;

•

the Law of PRC on the Prevention and Control of Water Pollution;

•

Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution;

•

the Law of PRC on the Prevention and Control of Air Pollution;

•

Implementation Rules of the Law of PRC on the Prevention and Control of Air Pollution;

•

the Law of PRC on the Prevention and Control of Solid Waste Pollution; and

•

the Law of PRC on the Prevention and Control of Noise Pollution.

We have obtained all permits and licenses required for production of our products and believe that we are in material compliance with all applicable laws and regulations.

Environmental Matters

Our packaging facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating subsidiary has received certifications from the relevant PRC government agencies in charge of environmental protection, indicating that our business operations are in material compliance with relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Our Employees

As of September 30, 2008, we employed a total of 135 full-time employees. The following table sets forth the number of our employees by function.

13

Function | | Number of Employees |

Senior Management | | 5 |

Human resource & Administration. | | 10 |

Production | | 25 |

Procurement | | 6 |

Marketing | | 2 |

Sales | | 24 |

Logistic | | 40 |

Research & Development | | 3 |

Quality Control | | 10 |

Accounting | | 10 |

Total | | 135 |

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages.

We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the after-tax profit. In addition, we are required by the PRC law to cover employees in China with various types of social benefits. We believe that we are in material compliance with the relevant PRC laws.

Seasonality

Naturally, our fresh fruits business is highly seasonal. Our Fuji Apples and Tangerine Oranges are harvested mainly during September and November every year, while our Emperor Bananas grow in an eight month cycle. We plan to invest in a bigger and better processing line and packing house, including our own cold storage facilities in our base in Luo Chuan, Shaanxi in order to avoid unnecessary fluctuations in seasonality.

Insurance

Our business model and our agreements with our suppliers provide a cushion which shields our company from product liability exposure and business interruption. We purchase on C.O.D. terms and almost all of our current sales are on a cash basis. In addition, our business in the two wholesales centers are cash sales. Therefore, the limited insurance coverage available in China for Agriculture products in relation to marketing and sales of fresh fruits does not materially affect our business. However, we do have adequate insurance for all of our workers on our processing lines, at our wholesale centers and on our plantation bases in Luo Chuan and Wanqingsha.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Notes Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

RISKS RELATED TO OUR BUSINESS

Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular fruits we sell, our products or our industry in general could harm our sales and cause consumers to avoid our products.

The food industry is subject to risks posed by food spoilage and contamination, product tampering, product recall, and consumer product liability claims. Although we only take delivery from our suppliers at wholesale markets on a C.O.D. basis and are somewhat cushioned from such risks, the decrease in our product supplies that could result from such events could harm our product sales.

14

Our operations could be impacted by both genuine and fictitious claims regarding our and our competitors' products. In the event of product contamination or tampering, we may need to recall some of our products. A widespread product recall could result in significant loss due to the cost of conducting a product recall including destruction of inventory and the loss of sales resulting from the unavailability of the product for a period of time.

In addition, any adverse publicity or negative public perception regarding our products, our actions relating to our products, or our industry in general could result in a substantial drop in demand for our products. This negative public perception may include publicity regarding the safety or quality of our products in general, of other companies or of our products specifically. Negative public perception may also arise from regulatory investigations or product liability claims, regardless of whether those investigations involve us or whether any product liability claim is successful against us. We could also suffer losses from a significant product liability judgment against us. Either a significant product recall or a product liability judgment, involving either our company or our competitors, could also result in a loss of consumer confidence in our pr oducts or the food category, and an actual or perceived loss of value of our brands, materially impacting consumer demand.

We compete in an industry that is brand-conscious, and unless we are able to establish and maintain brand name recognition our sales may be negatively impacted.

Our company has established two separate brands, one for our processed vegetables and the other for our fresh fruits. In the current wholesale fresh fruits business in China, brand-consciousness has not reached such a level that would impact on sales. Nevertheless, we are striving to build our two brands in the market and targeting to make Organic Region as famous as Sunkist in so far as apple sales are concerned in China within five years.

Our business is substantially dependent upon awareness and market acceptance of our products and brand by our targeted consumers. In addition, our business depends on acceptance by our independent distributors and consumers of our brand. Although we believe that we have made progress towards establishing market recognition for our brand “Organic-Region™” in the Chinese wholesale industry, it is too early in the product life cycle of the brand to determine whether our products and brand will achieve and maintain satisfactory levels of acceptance by independent distributors and retail consumers.

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate and our annual performance will depend largely on results from two quarters.

Our business is seasonal, reflecting the harvest season of our primary source foods during the months from mid September to mid November. Typically, a substantial portion of our revenues are earned during our third and fourth fiscal quarters. We generally experience lowest revenues during our second fiscal quarter. Sales in the third and fourth fiscal quarters accounted for approximately 52% of our revenues for fiscal year ended December 31, 2007. If sales in these quarters are lower than expected, our operating results would be adversely affected, and it would have a disproportionately large impact on our annual operating results.

Changes in weather conditions and natural disasters could affect our crop supplies and disrupt our operations, which couldadversely affect our operations and our results of operations.

Changes in weather conditions and natural disasters, such as floods, droughts, frosts, earthquakes or pestilence, may affect the cost and supply of commodities, ingredients and raw materials, including fruits and vegetables. Additionally, these events can result in reduced supplies of raw materials, lower recoveries of usable raw materials, higher costs of cold storage if harvests are accelerated and processing capacity is unavailable or interruptions in our production schedules if harvests are delayed. Our competitors may be affected differently by weather conditions and natural disasters depending on the location of their supplies or operations. If our supplies of raw materials are reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations. If our operations are damaged by a natural disaster, we may be subject to supply interruptions or other business disruption, which could adversely affect our business and results of operations.

15

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company's internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company's financial statements must also attest to the operating effectiveness of the company's internal controls. Since we just completed the acquisition of Organic Region on January 15, 2009, we have not evaluated Organic Region and its consolidated subsidiaries' internal control systems in order to allow our management to report on, and our independent auditors to attest to, our internal controls on a consolidated basis as required by these requirements of SOX 404. Under current law, we were subject to these requirements b eginning with our annual report for the fiscal year ending December 31, 2008, although the auditor attestation is not required until our annual report for the fiscal year ending December 31, 2009 assuming our filing status remains as a smaller reporting company. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no positive assurance that we will receive a positive attestation from our independent auditors. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

•

a higher level of government involvement;

•

a early stage of development of the market-oriented sector of the economy;

•

a rapid growth rate;

•

a higher level of control over foreign exchange; and

•

the allocation of resources.

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

PRC food hygiene and safety laws may become more onerous, which may adversely affect our operations and financial performance and lead to an increase in our costs which we may be unable to pass on to our customers.

Operators within the PRC food processing industry are subject to compliance with PRC food hygiene and safety laws and regulations. Such laws and regulations require all enterprises engaged in the production of fruit based products to obtain a hygiene license. They also set out hygiene standards with respect to food and food additives, packaging and containers, labeling on packaging as well as hygiene requirements for food production and sites, facilities and equipment used for the transportation and the sale of food. Failure to comply with PRC food hygiene and safety laws may result in fines, suspension of operations, loss of hygiene license and, in certain cases, criminal proceedings against an enterprise and its management. Although we are in compliance with current PRC food hygiene and safety laws and regulations, in the event that such laws and regulat ions become more stringent or widen in scope, we may fail to comply with such laws, or if we comply, our production and distribution costs may increase, and we may be unable to pass these additional costs on to our customers.

16

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and all of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

If we are found to have failed to comply with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties.

Our operations are subject to PRC laws and regulations applicable to us. However, many PRC laws and regulations are uncertain in their scope, and the implementation of such laws and regulations in different localities could have significant differences. In certain instances, local implementation rules and/or the actual implementation are not necessarily consistent with the regulations at the national level. Although we strive to comply with all the applicable PRC laws and regulations, we cannot assure you that the relevant PRC government authorities will not later determine that we have not been in compliance with certain laws or regulations.

In addition, our facilities and products are subject to many laws and regulations administered by the PRC State Administration for Industry and Commerce, the PRC State Administration of Taxation, the PRC Ministry of Health and Hygiene Permitting Office, the PRC General Administration of Quality Supervision, Inspection and Quarantine, and the PRC State Food and Drug Administration Bureau relating to the processing, packaging, storage, distribution, advertising, labeling, quality, and safety of food products. Our failure to comply with these and other applicable laws and regulations in China could subject us to administrative penalties and injunctive relief, as well as civil remedies, including fines, injunctions and recalls of our products. It is possible that changes to such laws or more rigorous enforcement of such laws or with respect to our current or past pr actices could have a material adverse effect on our business, operating results and financial condition. Further, additional environmental, health or safety issues relating to matters that are not currently known to management may result in unanticipated liabilities and expenditures.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

17

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restricti ons on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People's Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Currently, some of our raw materials and major equipment are imported. In the event that the U.S. dollars appreciate against RMB, our costs will increase. If we cannot pass the resulting cost increases on to our customers, our profitability and operating results will suffer. In addition, if our sales to international customers grow, we will be increasingly subject to the risk of foreign currency depreciation.

18

Restrictions under PRC law on our PRC subsidiaries' ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Under the New EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorit ies will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that HCP is a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing o f outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2008 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

If the China Securities Regulatory Commission, or CSRC, or another PRC regulatory agency determines that CSRC approval is required in connection with the reverse acquisition of Organic Region, the reverse acquisition may be unwound, or we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company's equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company's securities on an overseas stock exchange. In addition, when an offshore company acquires a PRC domestic company, the offshore company is generally required to pay the acquisition consideration within three months after the issuance of the foreign-invested company license unless certain ratification from the relevant PRC regulatory agency is obtained. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

19

In the opinion of our PRC counsel, the De Heng Law Firm, the M&A Rule concerning the CSRC approval for acquisition of a PRC domestic company by an offshore company controlled by PRC companies or individuals does not apply to our reverse acquisition of Organic Region because none of HCP, Organic Region or its subsidiaries is a “Special Purpose Vehicle” or an “offshore company controlled by PRC companies or individuals” as defined in the M&A Rule. If the CSRC or another PRC governmental agency subsequently determines that we must obtain CSRC approval prior to the completion of the reverse acquisition, the reverse acquisition may be unwound and we may face regulatory actions or other sanctions from the CSRC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China and limit our operat ing privileges in China, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our shares.

The M&A Rule establishes more complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the PRC Ministry of Commerce be notified in advance of any change-of-control transaction and in some situations, require approval of the PRC Ministry of Commerce when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses, although we do not have any plans to do so at this time. The M&A Rule also requires PRC Ministry of Commerce anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, an d any required approval processes, including obtaining approval from the PRC Ministry of Commerce, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

You may have difficulty enforcing judgments against us.