Fiscal Year 2019 Fourth Quarter and Full Year Results Earnings Presentation - May 29, 2019

Today’s Speakers Mario Giannini Erik Hirsch Randy Stilman Jackie Rantanen Chief Executive Officer Vice Chairman Chief Financial Officer Head of Product Management Hamilton Lane | Global Leader in the Private Markets Page 2

Period Highlights Business Performance • Total asset footprint (assets under management/advisement) reached approximately $484 billion, growing 7% compared to March 31, 2018 • Assets under management and fee-earning assets under management were approximately $61 billion and $34 billion, respectively, as of March, 2019, increases of 14% and 9%, respectively, compared to March 31, 2018 Financial Results USD in millions except per share amounts Q4 FY19 FY19 vs. FY18 Management and advisory fees $57.9 $217.8 12% GAAP net income $8.0 $33.6 94% GAAP EPS $0.31 $1.40 50% Non-GAAP EPS1 $0.36 $1.91 16% Fee Related Earnings1 $24.1 $89.9 11% Adjusted EBITDA1 $31.3 $117.7 (11)% Dividend • Declared a quarterly dividend of $0.275 per share of Class A common stock to record holders at the close of business on June 14, 2019, which represents a 29% increase from the prior dividend 1 Non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures, see pages 15 and 21 of this presentation. Hamilton Lane | Global Leader in the Private Markets Page 3

Growing Asset Footprint & Influence 1 ����B Total Assets Under Management/Advisement ($B) AUM � AUA ���� Y-o-Y Growth ��� ��� AUA: 6% AUM: 14% ��� ���� ���� ���� ���� ��� ���� CAGR: 20� ��� ���� ��� ���� ��� ���� ��� ���� ��� ���� ���� ��� ��� ���� ���� ��� ��� ��� �� ��� ��� �� ��� ��� ��� �� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ������� �otal ��� �otal ��M � �ata as o� �alendar �ear end ������ ��mbers ma� not tie d�e to ro�ndin�� Hamilton Lane | Global Leader in the Private Markets Page 4

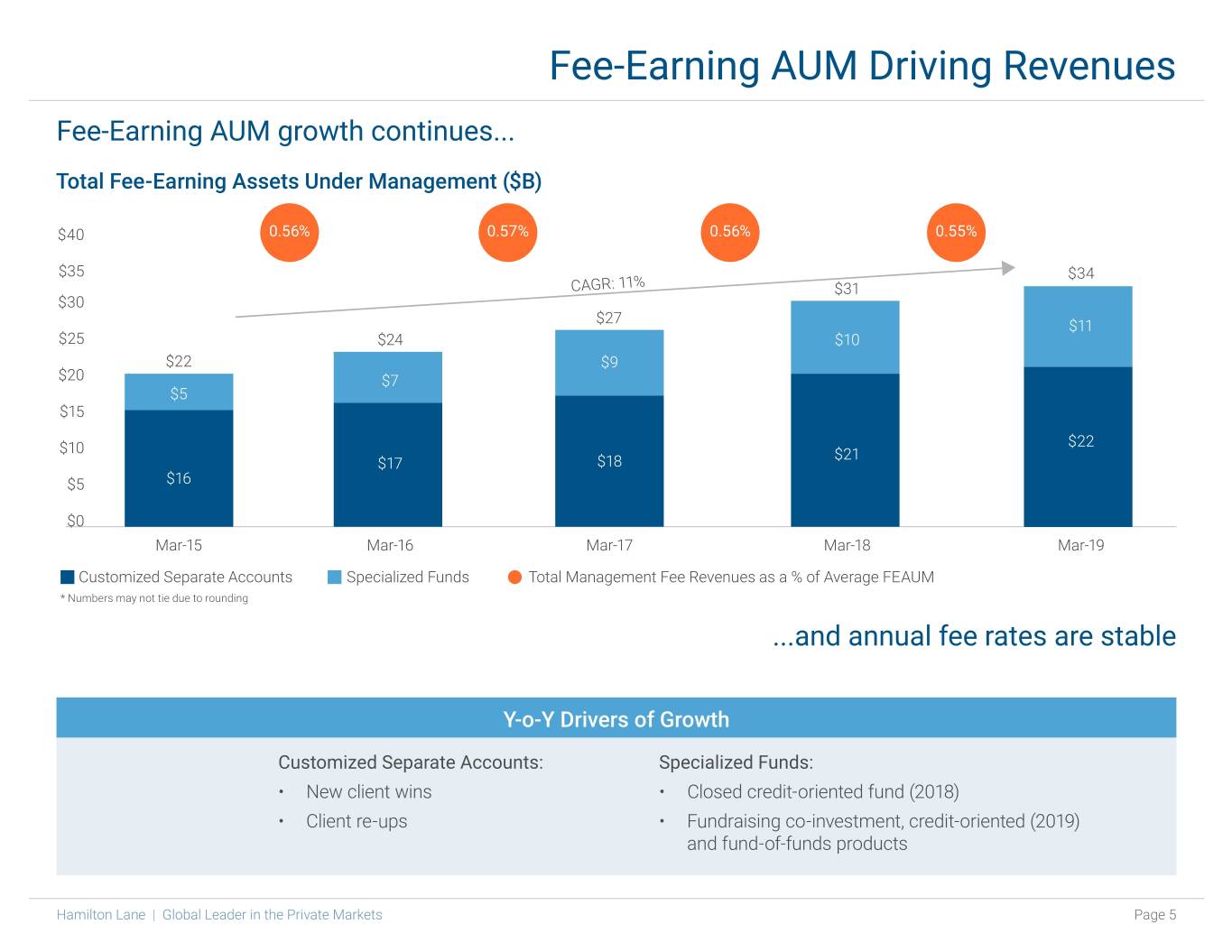

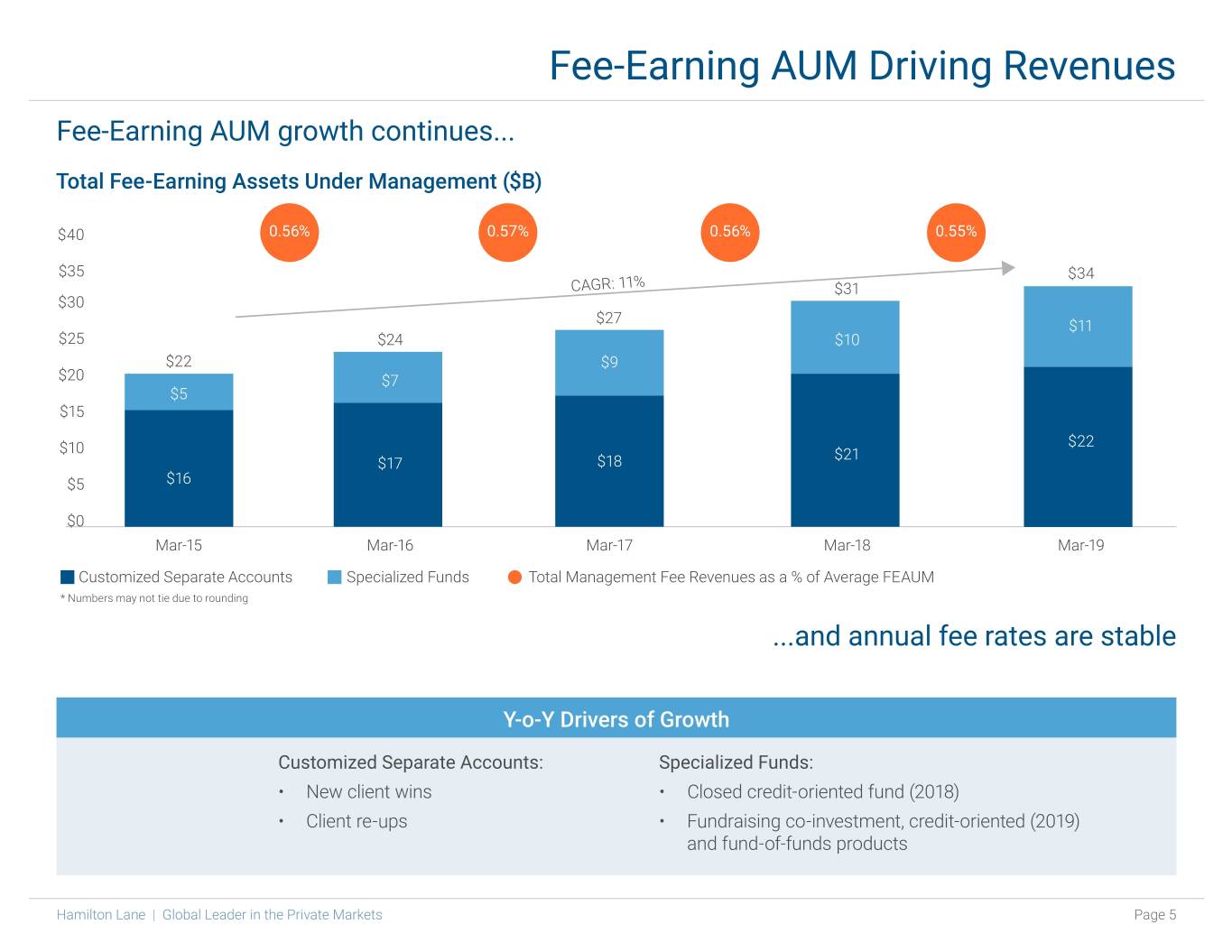

Fee-Earning AUM Driving Revenues Fee-Earning AUM growth continues... Total Fee-Earning Assets Under Management ($B) ��� 0.��� 0.��� 0.��� 0.��� ��� ��� ��G�� ��� ��� ��� ��� ��� ��� ��� ��� ��� �� ��� �� �� ��� ��� ��� ��� ��� ��� �� ��� �� Mar��� Mar��� Mar��� Mar��� Mar��� ��stomi�ed �e�arate ���o�nts ��e�iali�ed ��nds �otal Mana�ement �ee �even�es as a � o� �vera�e ����M � ��mbers ma� not tie d�e to ro�ndin� ...and annual fee rates are stable Y-o-Y Drivers of Growth Customized Separate Accounts: Specialized Funds: • New client wins • Closed credit-oriented fund (2018) • Client re-ups • Fundraising co-investment, credit-oriented (2019) and fund-of-funds products Hamilton Lane | Global Leader in the Private Markets Page 5

Separate Account Re-ups • A total of 20 existing clients elected to allocate an additional tranche of capital in FY19 (a “re-up”) • The average size of those re-ups was over $130 million and the average age of clients re-upping was 6 years • Re-upping clients represented 9 different countries and included pensions, sovereign wealth funds, insurance companies, endowments, and white labels Number of Times FY19 Allocations Have Re-Upped � � � � � � � � � ��� ��� ��� �� Hamilton Lane | Global Leader in the Private Markets Page 6

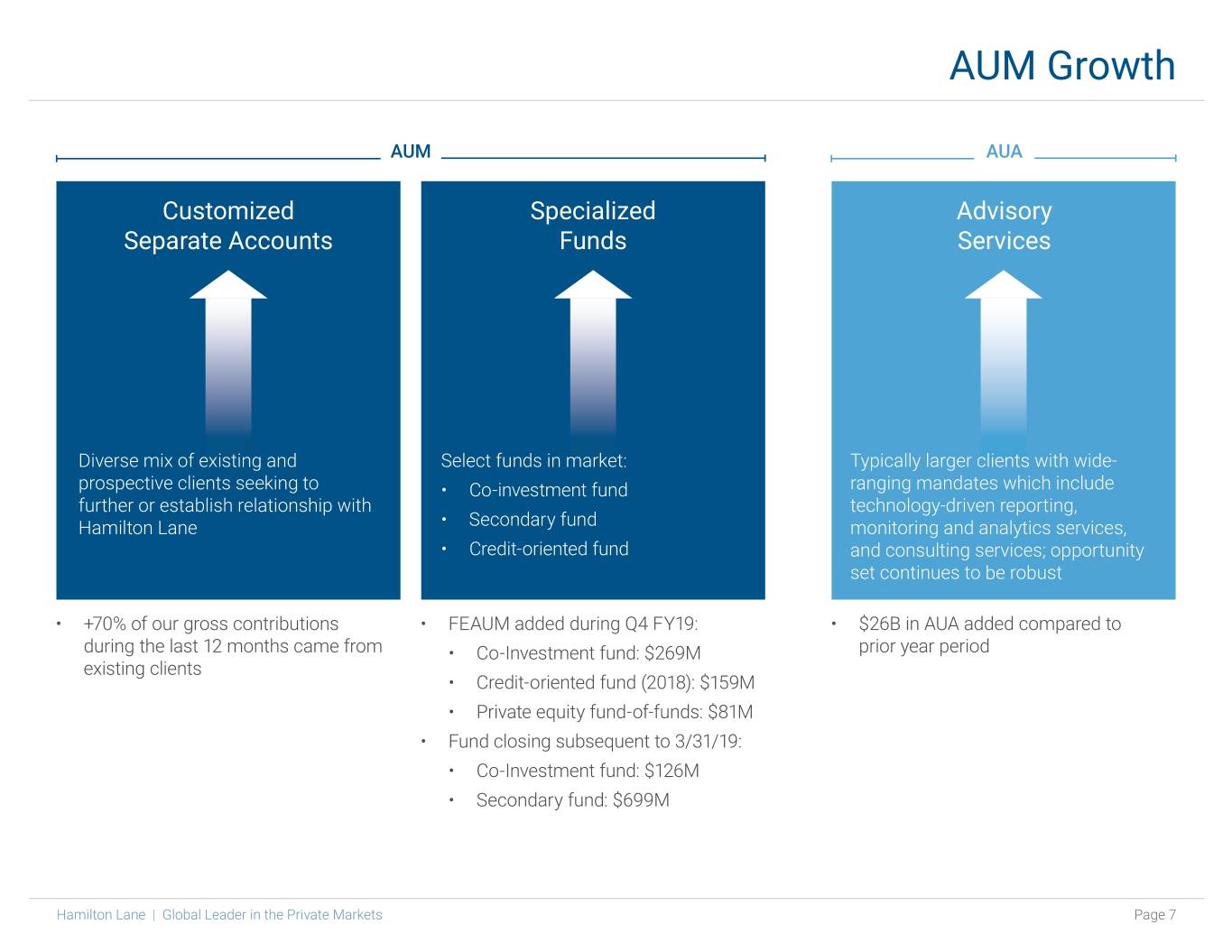

AUM Growth AUM AUA Customized Specialized Advisory Separate Accounts Funds Services Diverse mix of existing and Select funds in market: Typically larger clients with wide- prospective clients seeking to • Co-investment fund ranging mandates which include further or establish relationship with technology-driven reporting, Hamilton Lane • Secondary fund monitoring and analytics services, • Credit-oriented fund and consulting services; opportunity set continues to be robust • +70% of our gross contributions • FEAUM added during Q4 FY19: • $26B in AUA added compared to during the last 12 months came from • Co-Investment fund: $269M prior year period existing clients • Credit-oriented fund (2018): $159M • Private equity fund-of-funds: $81M • Fund closing subsequent to 3/31/19: • Co-Investment fund: $126M • Secondary fund: $699M Hamilton Lane | Global Leader in the Private Markets Page 7

Financial Highlights

Consolidated Revenue Strong revenue growth across management and advisory fees and incentive fees Management and Advisory Fees YTD Long-Term Growth Y-o-Y Growth: 12� CAGR: 11� • Represented an average of just under 90% of total revenues over the 220 ���� ���� past five fiscal years ���� 165 • Y-o-Y increase of 12% 110 ���� • $2.6M in retroactive fees from our latest co-investment fund in the ��� in Millions 55 quarter 0 ���� ���� ���� ���� Incentive Fees YTD Long-Term Growth • Incentive fees derived from a highly diversified pool of assets and Y-o-Y Growth: (�0)� 200 CAGR: �0� funds 150 • Allocated carried interest of $326M as of 3/31/19 diversified across +3,000 assets and +50 funds 100 ��� in Millions • $38.9M and $2.5M recognition of deferred carried interest from 50 ��� Coinvestment Fund II in FY18 and FY19, respectively ��� �� ��� 0 ���� ���� ���� ���� Total Revenues YTD Long-Term Growth Y-o-Y Growth: �� CAGR: 1�� 300 300 • Total revenues increased by 3%, driven by recurring management and 250 250 ���� ���� ���� 200 200 advisory fee growth across core offerings 150 150 100 100 ���� ��� in Millions 50 50 0 0 ���� ���� ���� ���� Hamilton Lane | Global Leader in the Private Markets Page 9

Consolidated Earnings Profitability stable and growing Net Income Attributable to HLI YTD Long-Term Growth Y-o-Y Growth: 9�� • $8M in net income attributable to HLI for the quarter ��� in Millions ��� ��� ��� ��� ���� ���� ���� ���� Adjusted EBITDA1 YTD Long-Term Growth Y-o-Y Growth: (11)� CAGR: 1�� • Y-o-Y decrease of 11% driven by $38.9M recognition of deferred carried interest from Co-investment Fund II in FY18 ���� ���� ���� • Margins decreased Y-o-Y due to deferred carry recognition without corresponding expense in the prior year period ��� in Millions ��� ���� ���� ���� ���� Fee Related Earnings1 YTD Long-Term Growth • Y-o-Y growth of 11% Y-o-Y Growth: 11� CAGR: 11� • Long-term double digit growth in Fee Related Earnings ��� ��� ��� ��� ��� in Millions ���� ���� ���� ���� 1 Adjusted EBITDA and Fee Related-Earnings are non-GAAP financial measures. For a reconciliation from GAAP financial measures to non- GAAP financial measures, see pages 15 and 21 of this presentation. Hamilton Lane | Global Leader in the Private Markets Page 10

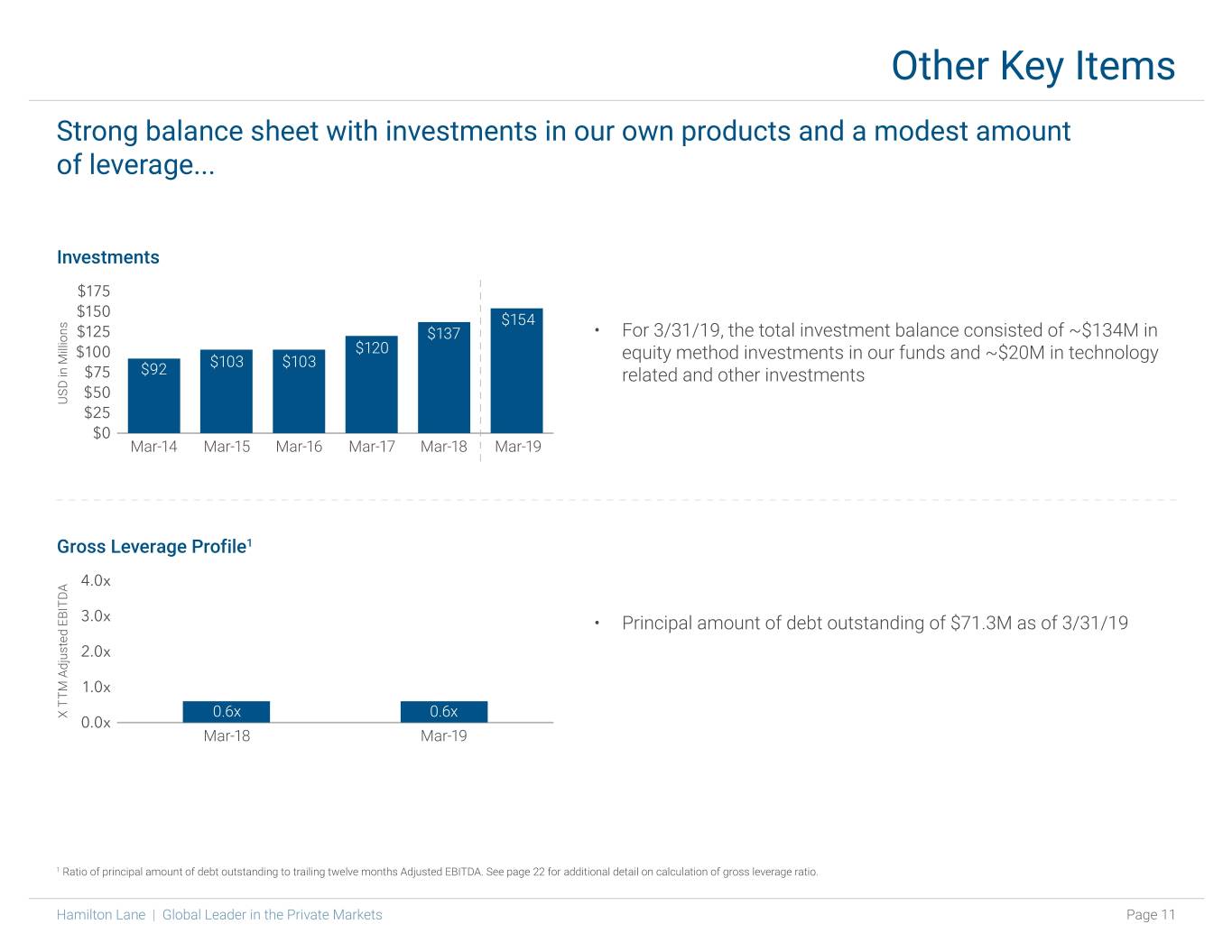

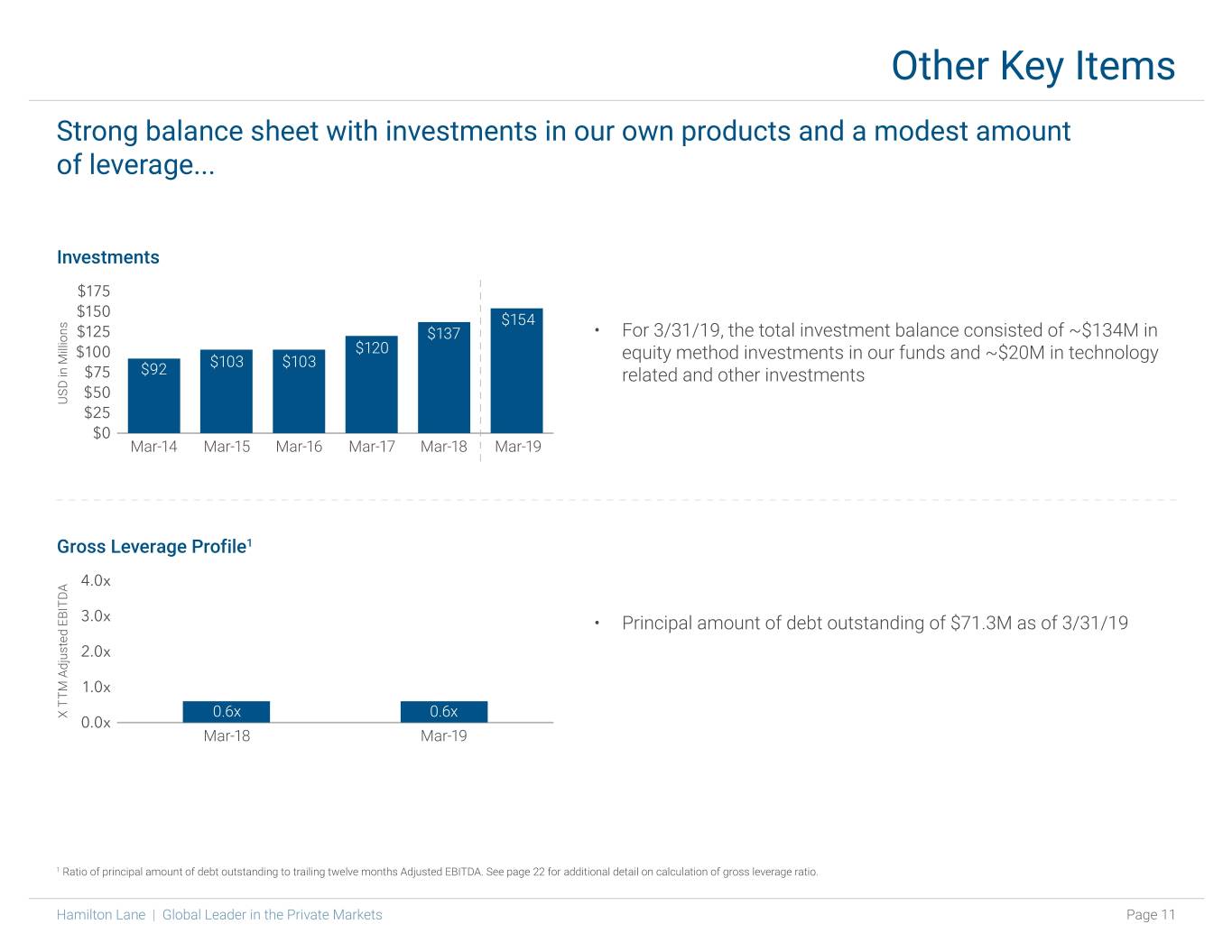

Other Key Items Strong balance sheet with investments in our own products and a modest amount of leverage... Investments $175 $150 ���� $125 ���� • For 3/31/19, the total investment balance consisted of ~$134M in ���� $100 ���� ���� equity method investments in our funds and ~$20M in technology $75 ��� related and other investments $50 ��� in Millions $25 $0 Mar��� Mar��� Mar��� Mar��� Mar��� Mar��� Gross Leverage Profile1 4.0x 3.0x • Principal amount of debt outstanding of $71.3M as of 3/31/19 2.0x 1.0x � ��M �d��sted ������ ���� ���� 0.0x Mar��� Mar��� 1 Ratio of principal amount of debt outstanding to trailing twelve months Adjusted EBITDA. See page 22 for additional detail on calculation of gross leverage ratio. Hamilton Lane | Global Leader in the Private Markets Page 11

Fiscal Year 2019 Fourth Quarter and Full Year Results Earnings Presentation - May 29, 2019

Appendix

Condensed Consolidated Statements of Income (Unaudited) Three Months Ended March 31, Year Ended March 31, (Dollars in thousands except share and per share amounts) 2018 2019 % Change 2018 2019 % Change Revenues Management and advisory fees 48,704 57,929 19% 195,030 217,773 12% Incentive fees 28,905 9,059 (69)% 49,003 34,406 (30)% Total revenues 77,609 66,988 (14)% 244,033 252,179 3% Expenses Compensation and benefits 22,621 24,483 8% 82,868 97,719 18% General, administrative and other 10,626 13,577 28% 38,212 50,236 31% Total expenses 33,247 38,060 14% 121,080 147,955 22% Other income (expense) Equity in income (loss) of investees 4,036 (2,894) (172)% 17,102 7,202 (58)% Interest expense (707) (779) 10% (5,989) (3,039) (49)% Interest income 56 88 57% 528 255 (52)% Non-operating income (loss) 867 (36) (104)% 5,036 20,915 315% Total other income (expense) 4,252 (3,621) (185)% 16,677 25,333 52% Income before income taxes 48,614 25,307 (48)% 139,630 129,557 (7)% Income tax expense 3,996 4,900 23% 33,333 30,560 (8)% Net income 44,618 20,407 (54)% 106,297 98,997 (7)% Less: Income (loss) attributable to non-controlling interests in general partnerships 698 (511) (173)% 2,448 564 (77)% Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 30,422 12,870 (58)% 86,508 64,860 (25)% Net income attributable to Hamilton Lane Incorporated $13,498 $8,048 (40)% $17,341 $33,573 94% Basic earnings per share of Class A common stock $0.69 $0.32 $0.94 $1.41 Diluted earnings per share of Class A common stock $0.68 $0.31 $0.93 $1.40 Weighted-average shares of Class A common stock outstanding - basic 19,504,124 25,386,382 18,414,715 23,836,401 Weighted-average shares of Class A common stock outstanding - diluted 20,216,258 25,852,163 18,990,369 24,298,795 Hamilton Lane | Global Leader in the Private Markets Page 14

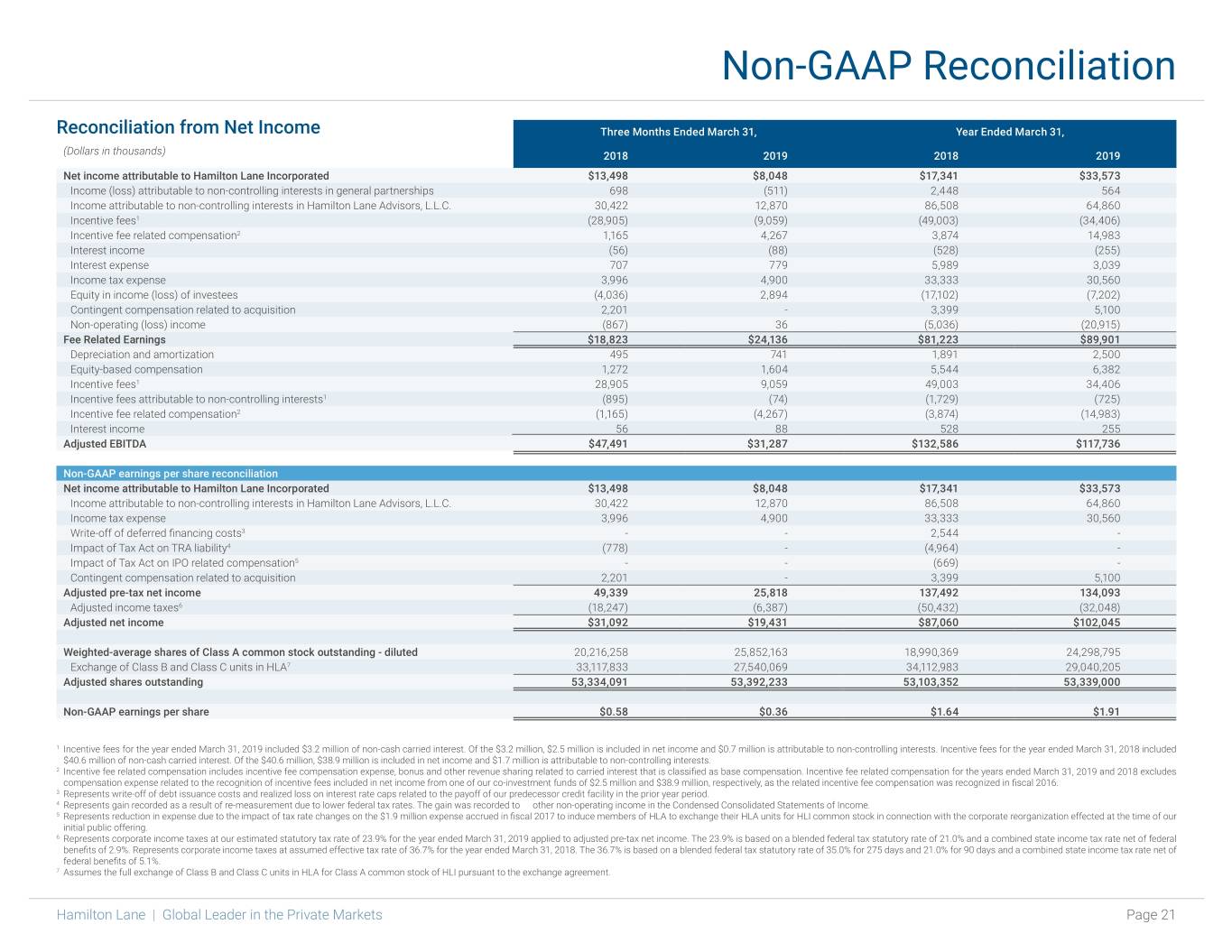

Non-GAAP Financial Measures Three Months Ended March 31, Year Ended March 31, (Dollars in thousands except share and per share amounts) 2018 2019 % Change 2018 2019 % Change Adjusted EBITDA Management and advisory fees $48,704 $57,929 19% $195,030 $217,773 12% Total expenses 33,247 38,060 14% 121,080 147,955 22% Less: Incentive fee related compensation1 (1,165) (4,267) 266% (3,874) (14,983) 287% Contingent compensation related to acquisition (2,201) - (100)% (3,399) (5,100) 50% Management fee related expenses 29,881 33,793 13% 113,807 127,872 12% Fee Related Earnings $18,823 $24,136 28% $81,223 $89,901 11% Incentive fees2 28,905 9,059 (69)% 49,003 34,406 (30)% Incentive fees attributable to non-controlling interests2 (895) (74) (92)% (1,729) (725) (58)% Incentive fee related compensation1 (1,165) (4,267) 266% (3,874) (14,983) 287% Interest income 56 88 57% 528 255 (52)% Equity-based compensation 1,272 1,604 26% 5,544 6,382 15% Depreciation and amortization 495 741 50% 1,891 2,500 32% Adjusted EBITDA $47,491 $31,287 (34)% $132,586 $117,736 (11)% Adjusted EBITDA margin 61% 47% 54% 47% Non-GAAP earnings per share reconciliation Net income attributable to Hamilton Lane Incorporated $13,498 $8,048 (40)% $17,341 $33,573 94% Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 30,422 12,870 (58)% 86,508 64,860 (25)% Income tax expense 3,996 4,900 23% 33,333 30,560 (8)% Write-off of deferred financing costs3 - - 0% 2,544 - (100)% Impact of Tax Act on TRA liability4 (778) - (100)% (4,964) - (100)% Impact of Tax Act on IPO related compensation5 - - 0% (669) - (100)% Contingent compensation related to acquisition 2,201 - (100)% 3,399 5,100 50% Adjusted pre-tax net income $49,339 $25,818 (48)% $137,492 $134,093 (2)% Adjusted income taxes6 (18,247) (6,387) (65)% (50,432) (32,048) (36)% Adjusted net income $31,092 $19,431 (38)% $87,060 $102,045 17% Adjusted shares outstanding7 53,334,091 53,392,233 53,103,352 53,339,000 Non-GAAP earnings per share $0.58 $0.36 (38)% $1.64 $1.91 16% 1 Incentive fee related compensation includes incentive fee compensation expense, bonus and other revenue sharing related to carried interest that is classified as base compensation. Incentive fee related compensation for the years ended March 31, 2019 and 2018 excludes compensation expense related to the recognition of incentive fees included in net income from one of our co-investment funds of $2.5 million and $38.9 million, respectively, as the related incentive fee compensation was recognized in fiscal 2016. 2 Incentive fees for the year ended March 31, 2019 included $3.2 million of non-cash carried interest. Of the $3.2 million, $2.5 million is included in net income and $0.7 million is attributable to non-controlling interests. Incentive fees for the year ended March 31, 2018 included $40.6 million of non-cash carried interest. Of the $40.6 million, $38.9 million is included in net income and $1.7 million is attributable to non-controlling interests. 3 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility in the prior year period. 4 Represents gain recorded as a result of re-measurement due to lower federal tax rates. The gain was recorded to other non-operating income in the Condensed Consolidated Statements of Income. 5 Represents reduction in expense due to the impact of tax rate changes on the $1.9 million expense accrued in fiscal 2017 to induce members of HLA to exchange their HLA units for HLI common stock in connection with the corporate reorganization effected at the time of our initial public offering. 6 Represents corporate income taxes at our estimated statutory tax rate of 23.9% for the year ended March 31, 2019 applied to adjusted pre-tax net income. The 23.9% is based on a blended federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.9%. Represents corporate income taxes at assumed effective tax rate of 36.7% for the year ended March 31, 2018. The 36.7% is based on a blended federal tax statutory rate of 35.0% for 275 days and 21.0% for 90 days and a combined state income tax rate net of federal benefits of 5.1%. 7 Assumes the full exchange of Class B and Class C units in HLA for Class A common stock of HLI pursuant to the exchange agreement Hamilton Lane | Global Leader in the Private Markets Page 15

Management and Advisory Fees Three Months Ended March 31, Year Ended March 31, (Dollars in thousands) 2018 2019 % Change 2018 2019 % Change Management and advisory fees Customized separate accounts $20,891 $22,158 6% $79,144 $85,245 8% Specialized funds 19,569 25,892 32% 83,151 93,056 12% Advisory and reporting 7,401 8,275 12% 28,359 32,935 16% Distribution management 843 752 (11)% 4,376 4,525 3% Fund reimbursement revenue - 852 N/A - 2,012 N/A Total management and advisory fees $48,704 $57,929 19% $195,030 $217,773 12% �ther �dvisor� �� and re�ortin� ��� ��stomi�ed se�arate a��o�nts ��� Year Ended March �1� 2019 ��e�iali�ed ��nds ��� Hamilton Lane | Global Leader in the Private Markets Page 16

Incentive Fees Three Months Ended March 31, Year Ended March 31, (Dollars in thousands) 2018 2019 % Change 2018 2019 % Change Incentive fees Secondary Fund II $- $204 N/A $2,239 $1,529 (32)% Co-investment Fund II 26,072 1,790 (93)% 40,650 16,748 (59)% Other specialized funds 150 5,657 3667% 1,012 7,410 632% Customized separate accounts 2,683 1,408 (48)% 5,101 8,719 71% Incentive fees $28,905 $9,059 (69)% $49,003 $34,406 (30)% As of March 31, 2018 December 31, 2018 March 31, 2019 YoY % Change QoQ % Change Allocated carried interest Secondary Fund II $6,305 $4,838 $3,874 (39)% (20)% Secondary Fund III 36,335 39,066 36,697 1% (6)% Secondary Fund IV 16,818 31,033 30,587 82% (1)% Co-investment Fund II 68,431 62,361 54,374 (21)% (13)% Co-investment Fund III 35,635 49,520 39,435 11% (20)% Co-investment Fund IV - - 746 N/A N/A Other specialized funds 32,520 47,375 40,204 24% (15)% Customized separate accounts 107,722 121,275 120,549 12% (1)% Total allocated carried interest $303,766 $355,468 $326,466 7% (8)% Hamilton Lane | Global Leader in the Private Markets Page 17

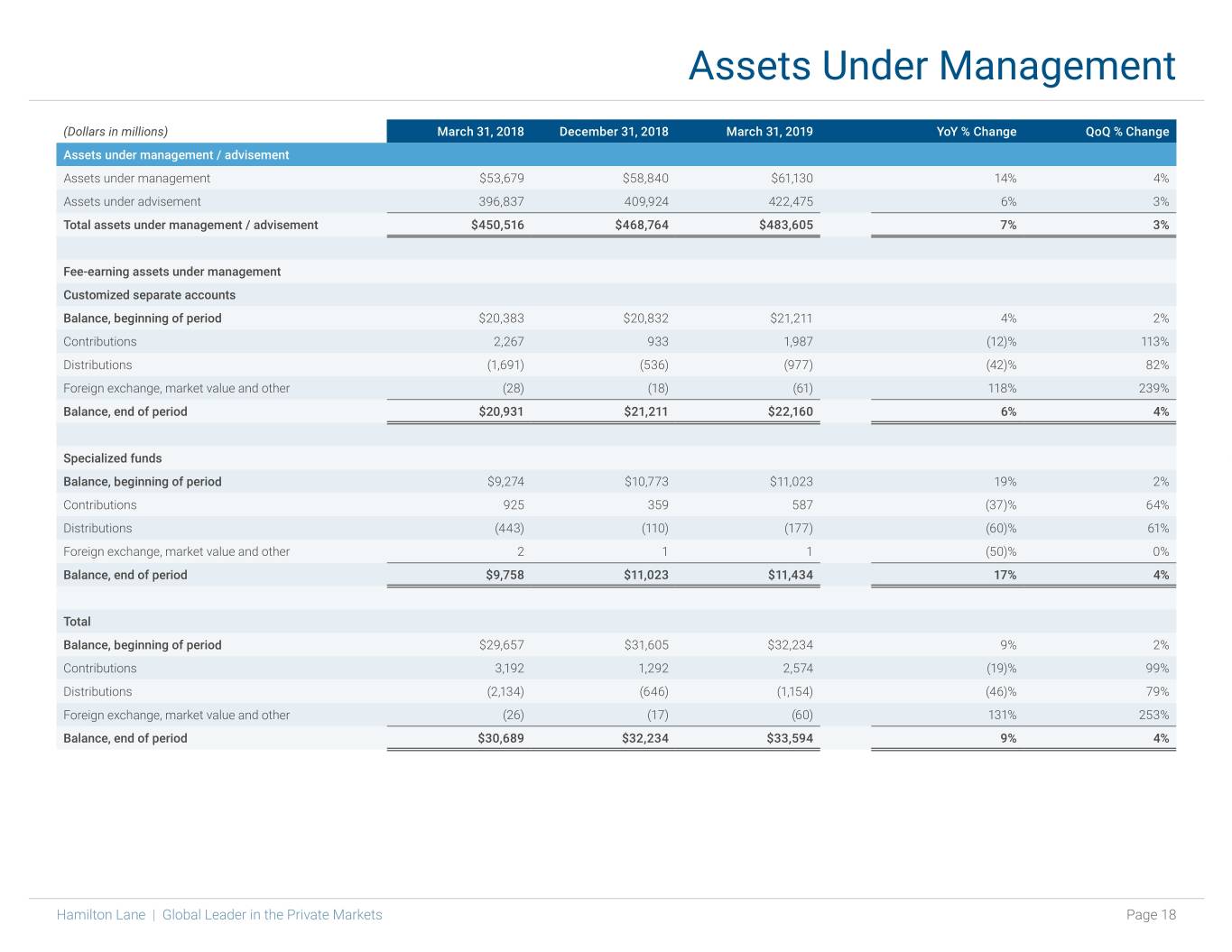

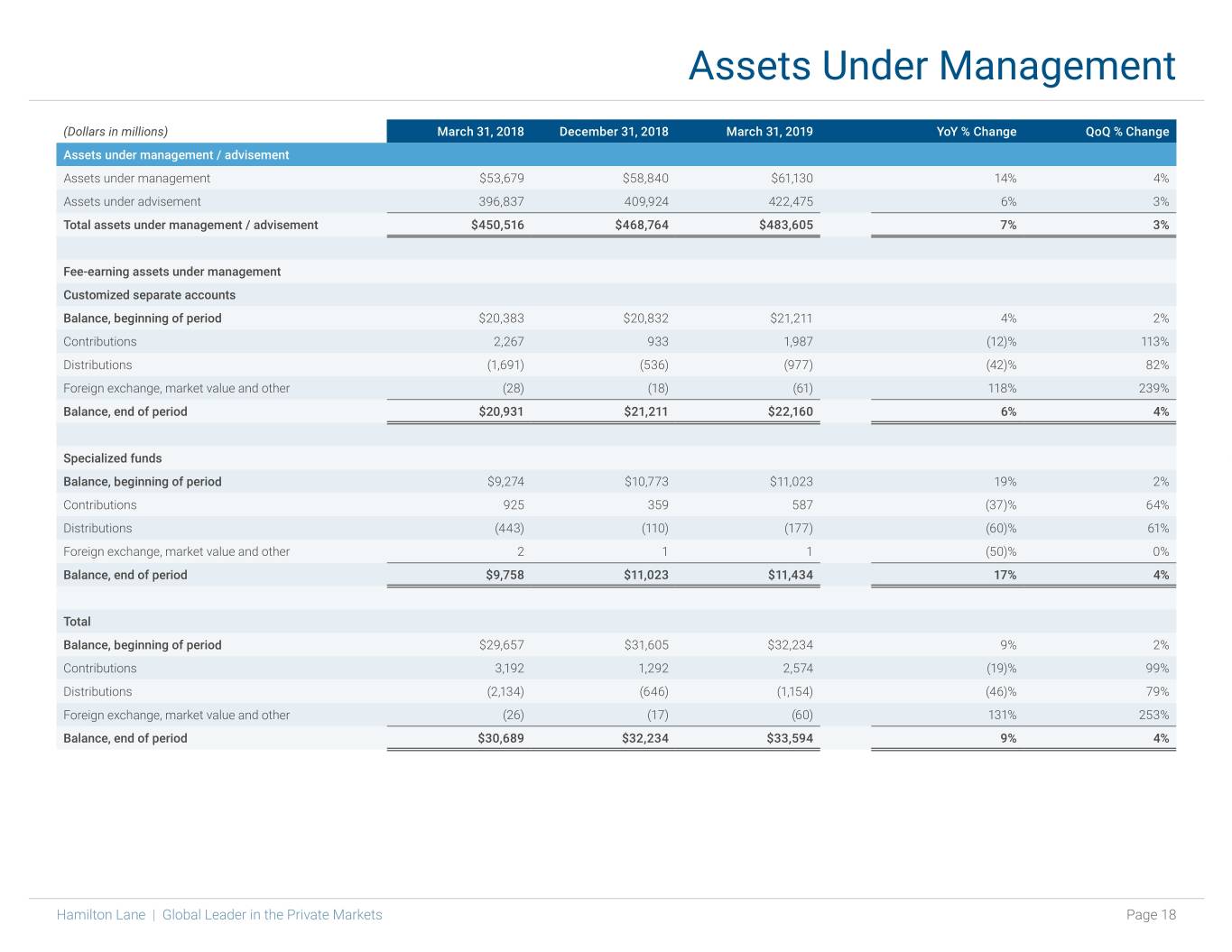

Assets Under Management (Dollars in millions) March 31, 2018 December 31, 2018 March 31, 2019 YoY % Change QoQ % Change Assets under management / advisement Assets under management $53,679 $58,840 $61,130 14% 4% Assets under advisement 396,837 409,924 422,475 6% 3% Total assets under management / advisement $450,516 $468,764 $483,605 7% 3% Fee-earning assets under management Customized separate accounts Balance, beginning of period $20,383 $20,832 $21,211 4% 2% Contributions 2,267 933 1,987 (12)% 113% Distributions (1,691) (536) (977) (42)% 82% Foreign exchange, market value and other (28) (18) (61) 118% 239% Balance, end of period $20,931 $21,211 $22,160 6% 4% Specialized funds Balance, beginning of period $9,274 $10,773 $11,023 19% 2% Contributions 925 359 587 (37)% 64% Distributions (443) (110) (177) (60)% 61% Foreign exchange, market value and other 2 1 1 (50)% 0% Balance, end of period $9,758 $11,023 $11,434 17% 4% Total Balance, beginning of period $29,657 $31,605 $32,234 9% 2% Contributions 3,192 1,292 2,574 (19)% 99% Distributions (2,134) (646) (1,154) (46)% 79% Foreign exchange, market value and other (26) (17) (60) 131% 253% Balance, end of period $30,689 $32,234 $33,594 9% 4% Hamilton Lane | Global Leader in the Private Markets Page 18

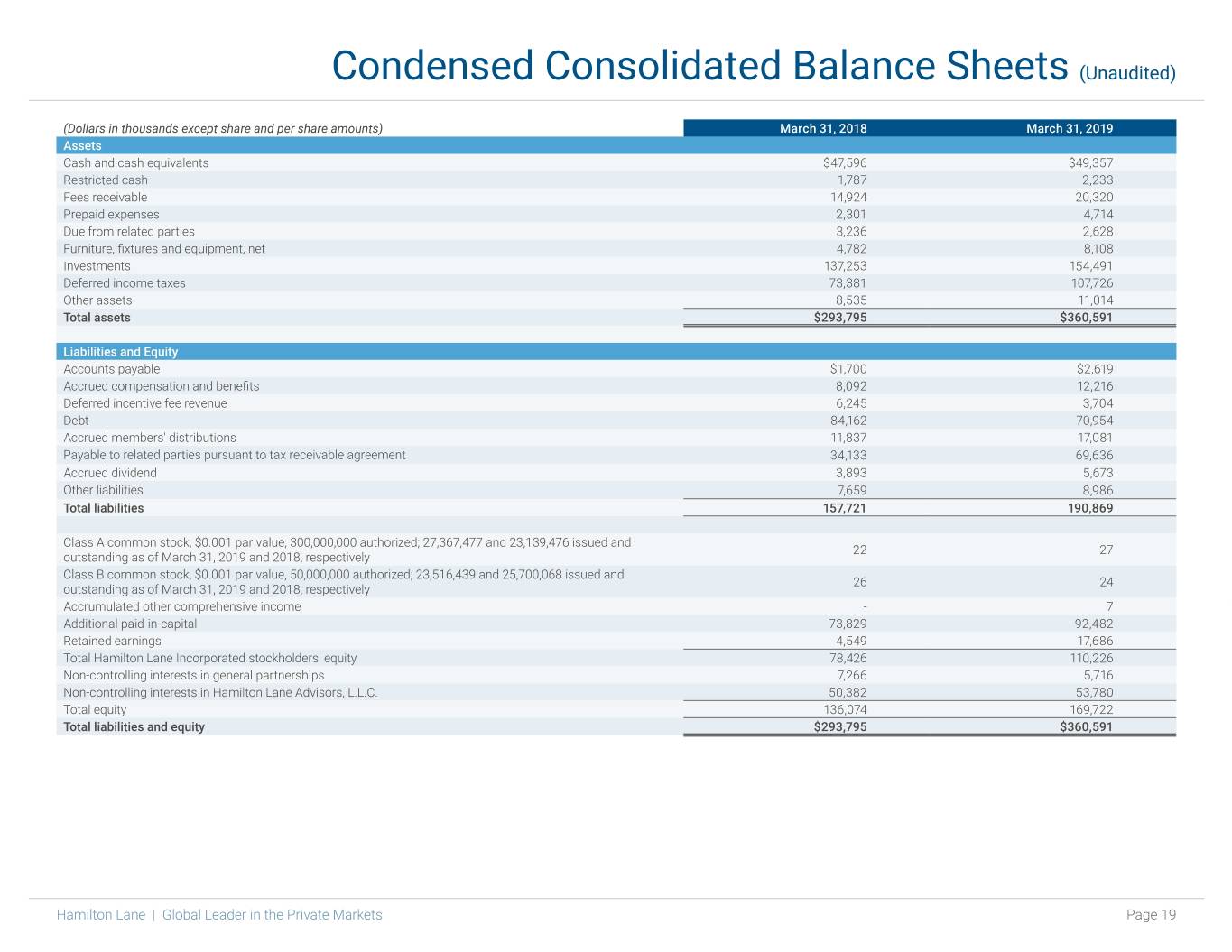

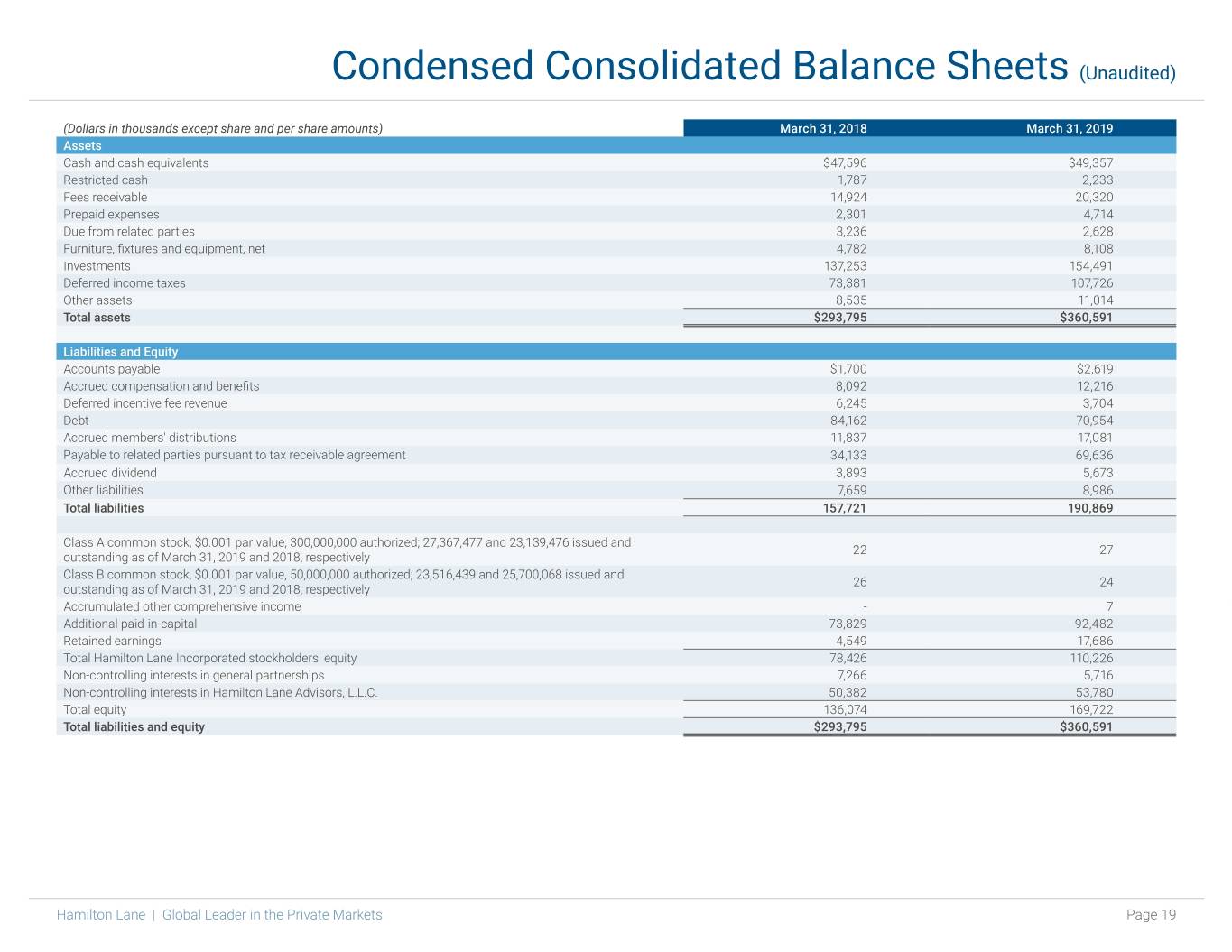

Condensed Consolidated Balance Sheets (Unaudited) (Dollars in thousands except share and per share amounts) March 31, 2018 March 31, 2019 Assets Cash and cash equivalents $47,596 $49,357 Restricted cash 1,787 2,233 Fees receivable 14,924 20,320 Prepaid expenses 2,301 4,714 Due from related parties 3,236 2,628 Furniture, fixtures and equipment, net 4,782 8,108 Investments 137,253 154,491 Deferred income taxes 73,381 107,726 Other assets 8,535 11,014 Total assets $293,795 $360,591 Liabilities and Equity Accounts payable $1,700 $2,619 Accrued compensation and benefits 8,092 12,216 Deferred incentive fee revenue 6,245 3,704 Debt 84,162 70,954 Accrued members' distributions 11,837 17,081 Payable to related parties pursuant to tax receivable agreement 34,133 69,636 Accrued dividend 3,893 5,673 Other liabilities 7,659 8,986 Total liabilities 157,721 190,869 Class A common stock, $0.001 par value, 300,000,000 authorized; 27,367,477 and 23,139,476 issued and 22 27 outstanding as of March 31, 2019 and 2018, respectively Class B common stock, $0.001 par value, 50,000,000 authorized; 23,516,439 and 25,700,068 issued and 26 24 outstanding as of March 31, 2019 and 2018, respectively Accrumulated other comprehensive income - 7 Additional paid-in-capital 73,829 92,482 Retained earnings 4,549 17,686 Total Hamilton Lane Incorporated stockholders’ equity 78,426 110,226 Non-controlling interests in general partnerships 7,266 5,716 Non-controlling interests in Hamilton Lane Advisors, L.L.C. 50,382 53,780 Total equity 136,074 169,722 Total liabilities and equity $293,795 $360,591 Hamilton Lane | Global Leader in the Private Markets Page 19

Condensed Consolidated Statements of Cash Flows (Unaudited) Year Ended March 31, (Dollars in thousands) 2017 2018 2019 Operating activities Net income $74,438 $106,297 $98,997 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 1,915 1,891 2,979 Change in deferred income taxes 26 22,983 21,665 Change in payable to related parties pursuant to tax receivable agreement - (5,076) (9,778) Write-off of deferred financing costs 3,359 1,657 - Equity-based compensation 4,681 5,544 6,382 Equity in income of investees (12,801) (17,102) (7,202) Gain on sale of investments valued at the measurement alternative - - (11,133) Proceeds received from investments 10,843 14,391 14,077 Other 922 1,411 190 Changes in operating assets and liabilities (1,704) (35,304) (4,555) Net cash provided by operating activities $81,679 $96,692 $111,622 Investing activities Purchase of furniture, fixtures and equipment $(1,275) $(2,254) $(5,366) Proceeds from sales of investments valued at the measurement alternative - - 22,531 Cash paid for acquisition of business - (5,228) - Loan to investee - - (944) Distributions received from investments 8,782 16,055 10,614 Contributions to investments (24,222) (30,346) (46,048) Net cash used in investing activities $(16,715) $(21,773) $(19,213) Financing activities Proceeds from offerings $- $125,200 $193,504 Purchase of membership interests (55,983) (125,200) (193,504) Repayments of debt (162,600) (87,038) (13,263) Borrowings of debt, net of deferred financing costs - 85,066 - Contributions from non-controlling interest in Partnerships 532 276 81 Distributions to non-controlling interest in Partnerships (3,191) (5,359) (2,195) Proceeds from IPO, net of underwriting discount 203,205 - - Payment of deterred offering costs (5,844) - - Sale of membership interests 4,669 - - (Repurchase) issuance of Class B common stock 28 (2) (2) Purchase of restricted stock for tax withholding (2,151) (6,473) (5,387) Proceeds received from issuance of shares under employee stock plans 1,192 313 264 Dividends paid - (9,511) (18,676) Members’ distributions paid (80,457) (36,943) (50,649) Other (611) - (383) Net cash used in financing activities $(101,211) $(59,671) $(90,210) Effect of exchange rate changes on cash and cash equivalents - - 8 Increase (decrease) in cash, cash equivalents, and restricted cash (36,247) 15,248 2,207 Cash, cash equivalents, and restricted cash at beginning of the year 70,382 34,135 49,383 Cash, cash equivalents, and restricted cash at end of the year $34,135 $49,383 $51,590 Hamilton Lane | Global Leader in the Private Markets Page 20

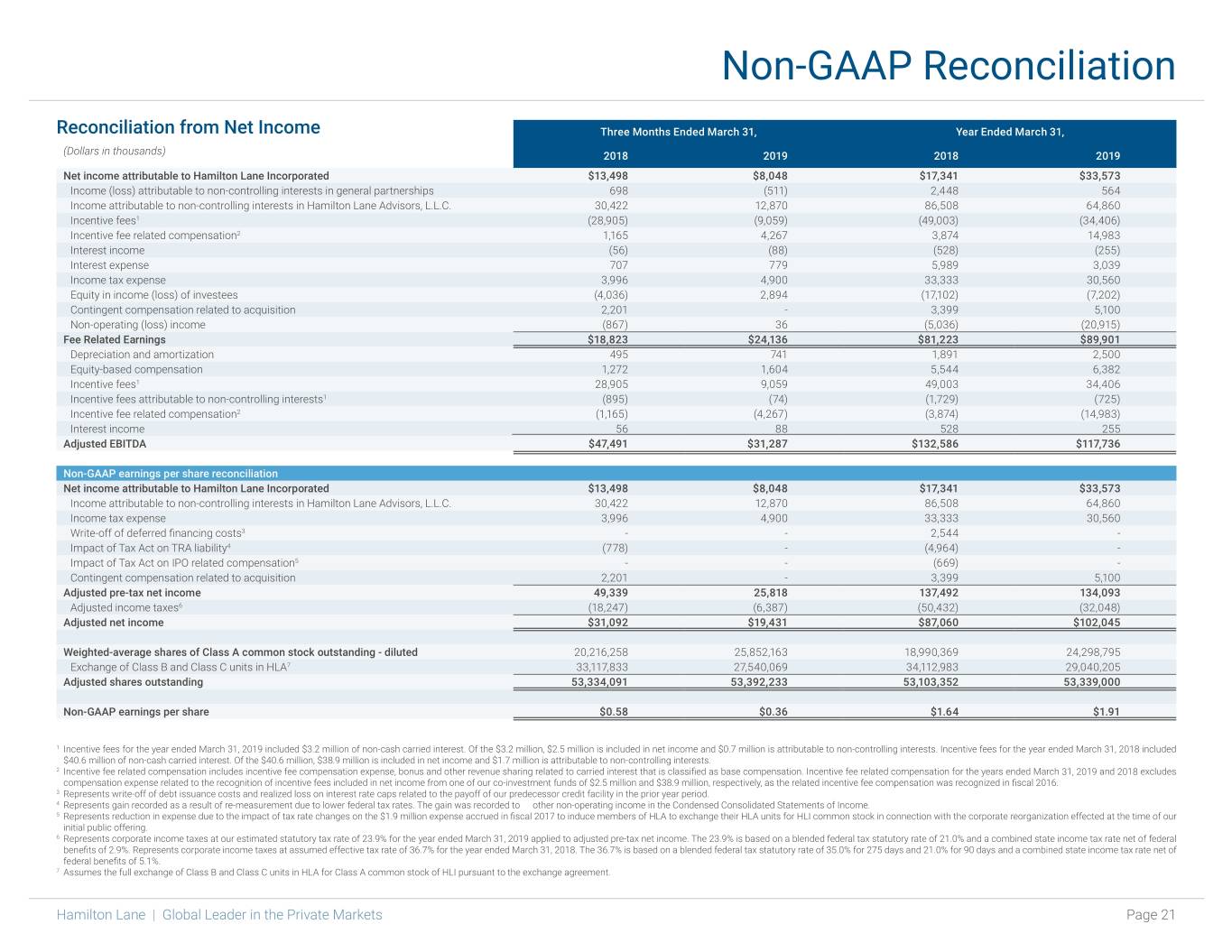

Non-GAAP Reconciliation Reconciliation from Net Income Three Months Ended March 31, Year Ended March 31, (Dollars in thousands) 2018 2019 2018 2019 Net income attributable to Hamilton Lane Incorporated $13,498 $8,048 $17,341 $33,573 Income (loss) attributable to non-controlling interests in general partnerships 698 (511) 2,448 564 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 30,422 12,870 86,508 64,860 Incentive fees1 (28,905) (9,059) (49,003) (34,406) Incentive fee related compensation2 1,165 4,267 3,874 14,983 Interest income (56) (88) (528) (255) Interest expense 707 779 5,989 3,039 Income tax expense 3,996 4,900 33,333 30,560 Equity in income (loss) of investees (4,036) 2,894 (17,102) (7,202) Contingent compensation related to acquisition 2,201 - 3,399 5,100 Non-operating (loss) income (867) 36 (5,036) (20,915) Fee Related Earnings $18,823 $24,136 $81,223 $89,901 Depreciation and amortization 495 741 1,891 2,500 Equity-based compensation 1,272 1,604 5,544 6,382 Incentive fees1 28,905 9,059 49,003 34,406 Incentive fees attributable to non-controlling interests1 (895) (74) (1,729) (725) Incentive fee related compensation2 (1,165) (4,267) (3,874) (14,983) Interest income 56 88 528 255 Adjusted EBITDA $47,491 $31,287 $132,586 $117,736 Non-GAAP earnings per share reconciliation Net income attributable to Hamilton Lane Incorporated $13,498 $8,048 $17,341 $33,573 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 30,422 12,870 86,508 64,860 Income tax expense 3,996 4,900 33,333 30,560 Write-off of deferred financing costs3 - - 2,544 - Impact of Tax Act on TRA liability4 (778) - (4,964) - Impact of Tax Act on IPO related compensation5 - - (669) - Contingent compensation related to acquisition 2,201 - 3,399 5,100 Adjusted pre-tax net income 49,339 25,818 137,492 134,093 Adjusted income taxes6 (18,247) (6,387) (50,432) (32,048) Adjusted net income $31,092 $19,431 $87,060 $102,045 Weighted-average shares of Class A common stock outstanding - diluted 20,216,258 25,852,163 18,990,369 24,298,795 Exchange of Class B and Class C units in HLA7 33,117,833 27,540,069 34,112,983 29,040,205 Adjusted shares outstanding 53,334,091 53,392,233 53,103,352 53,339,000 Non-GAAP earnings per share $0.58 $0.36 $1.64 $1.91 1 Incentive fees for the year ended March 31, 2019 included $3.2 million of non-cash carried interest. Of the $3.2 million, $2.5 million is included in net income and $0.7 million is attributable to non-controlling interests. Incentive fees for the year ended March 31, 2018 included $40.6 million of non-cash carried interest. Of the $40.6 million, $38.9 million is included in net income and $1.7 million is attributable to non-controlling interests. 2 Incentive fee related compensation includes incentive fee compensation expense, bonus and other revenue sharing related to carried interest that is classified as base compensation. Incentive fee related compensation for the years ended March 31, 2019 and 2018 excludes compensation expense related to the recognition of incentive fees included in net income from one of our co-investment funds of $2.5 million and $38.9 million, respectively, as the related incentive fee compensation was recognized in fiscal 2016. 3 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility in the prior year period. 4 Represents gain recorded as a result of re-measurement due to lower federal tax rates. The gain was recorded to to other non-operating income in the Condensed Consolidated Statements of Income. 5 Represents reduction in expense due to the impact of tax rate changes on the $1.9 million expense accrued in fiscal 2017 to induce members of HLA to exchange their HLA units for HLI common stock in connection with the corporate reorganization effected at the time of our initial public offering. 6 Represents corporate income taxes at our estimated statutory tax rate of 23.9% for the year ended March 31, 2019 applied to adjusted pre-tax net income. The 23.9% is based on a blended federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.9%. Represents corporate income taxes at assumed effective tax rate of 36.7% for the year ended March 31, 2018. The 36.7% is based on a blended federal tax statutory rate of 35.0% for 275 days and 21.0% for 90 days and a combined state income tax rate net of federal benefits of 5.1%. 7 Assumes the full exchange of Class B and Class C units in HLA for Class A common stock of HLI pursuant to the exchange agreement. Hamilton Lane | Global Leader in the Private Markets Page 21

Gross Leverage Ratio Twelve Months Ended (Dollars in thousands) March 31, 2018 March 31, 2019 Principal amount of debt outstanding $84,513 $71,250 Adjusted EBITDA 132,586 117,736 Gross leverage ratio 0.6x 0.6x Hamilton Lane | Global Leader in the Private Markets Page 22

Terms Adjusted EBITDA is our primary internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our outstanding debt, (b) income tax expense, (c) depreciation and amortization expense, (d) equity-based compensation expense, (e) other non-operating income and (f) certain other significant items that we believe are not indicative of our core performance. Fee Related Earnings (“FRE”) is used to highlight earnings of the Company from recurring management fees. FRE represents net income excluding (a) incentive fees and related compensation, (b) interest income and expense, (c) income tax expense, (d) equity in income of investees, (e) other non-operating income and (f) certain other significant items that we believe are not indicative of our core performance. We believe FRE is useful to investors because it provides additional insight into the operating profitability of our business. FRE is presented before income taxes. Non-GAAP earnings per share measures our per-share earnings excluding certain items that we believe are not indicative of our core performance and assuming all Class B and Class C units in HLA were exchanged for Class A common stock in HLI. Non-GAAP earnings per share is calculated as adjusted net income divided by adjusted shares outstanding. Adjusted net income is income before taxes fully taxed at our estimated statutory tax rate. We believe Non-GAAP earnings per share is useful to investors because it enables them to better evaluate per-share operating performance across reporting periods. Our assets under management (“AUM”) comprise primarily the assets associated with our customized separate accounts and specialized funds. We classify assets as AUM if we have full discretion over the investment decisions in an account. We calculate our AUM as the sum of: (1) the net asset value of our clients’ and funds’ underlying investments; (2) the unfunded commitments to our clients’ and funds’ underlying investments; and (3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment. Management fee revenue is based on a variety of factors and is not linearly correlated with AUM. However, we believe AUM is a useful metric for assessing the relative size and scope of our asset management business. Our assets under advisement (“AUA”) comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee basis on our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, legal negotiations, monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services provided and other factors. Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues. However, we view AUA growth as a meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers. Fee-earning assets under management (Fee-earning "AUM" or "FEAUM"), is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our cus- tomized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital commitments, net invested capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. Substantially all of our customized separate accounts and specialized funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Therefore, revenues and fee-earning AUM are not significantly affected by changes in market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Hamilton Lane Incorporated (or “HLI”) was incorporated in the State of Delaware on December 31, 2007. HLI was formed for the purpose of completing an initial public offering (“IPO”) and related transactions (“Reorganization”) in order to carry on the business of Hamilton Lane Advisors, L.L.C. (“HLA”) as a publicly-traded entity. As of March 6, 2017, HLI became the sole managing member of HLA. Hamilton Lane | Global Leader in the Private Markets Page 23

Disclosures Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe,” "estimate," "continue," "anticipate," "intend," "plan," and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses. The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2018, and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this presentation are made only as of the date presented. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law. As of May 29, 2019 Hamilton Lane | Global Leader in the Private Markets Page 24