Fiscal Year 2025 Third Quarter Results February 4, 2025

2Hamilton Lane | Global Leader in the Private Markets Today's Speakers Erik Hirsch Co-CEO Jeff Armbrister Chief Financial Officer John Oh Head of Shareholder Relations

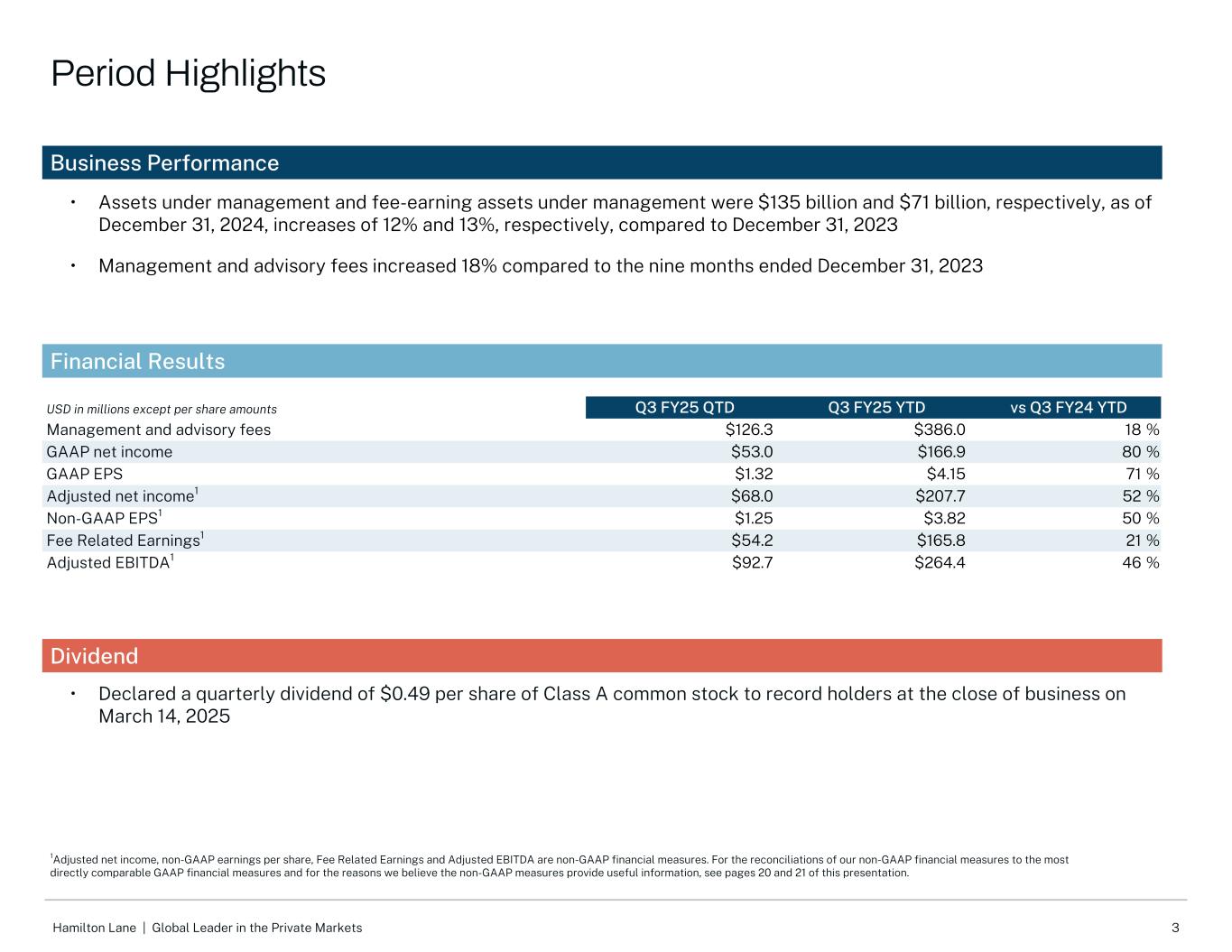

3Hamilton Lane | Global Leader in the Private Markets Business Performance Financial Results Dividend • Assets under management and fee-earning assets under management were $135 billion and $71 billion, respectively, as of December 31, 2024, increases of 12% and 13%, respectively, compared to December 31, 2023 • Management and advisory fees increased 18% compared to the nine months ended December 31, 2023 USD in millions except per share amounts Q3 FY25 QTD Q3 FY25 YTD vs Q3 FY24 YTD Management and advisory fees $126.3 $386.0 18 % GAAP net income $53.0 $166.9 80 % GAAP EPS $1.32 $4.15 71 % Adjusted net income1 $68.0 $207.7 52 % Non-GAAP EPS1 $1.25 $3.82 50 % Fee Related Earnings1 $54.2 $165.8 21 % Adjusted EBITDA1 $92.7 $264.4 46 % • Declared a quarterly dividend of $0.49 per share of Class A common stock to record holders at the close of business on March 14, 2025 1Adjusted net income, non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see pages 20 and 21 of this presentation. Period Highlights

4Hamilton Lane | Global Leader in the Private Markets Total Assets Under Management/Advisement ($B) Total AUA Total AUM 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $0 $200 $400 $600 $800 $1,000 Y-o-Y Growth AUM: 12 % AUA: 5 % $956B AUM & AUA 1 CAGR: 18% $6 $7 $11 $13 $16 $19 $22 $24 $30 $32 $35 $40 $50 $59 $66 $76 $98 $108 $36 $51 $77 $79 $95 $81 $129 $147 $147 $189 $205 $292 $374 $410 $422 $581 $753 $724 $783 $120 Growing Asset Footprint & Influence 1Data as of calendar year end 12/31 unless otherwise noted. Numbers may not tie due to rounding. $135 $821

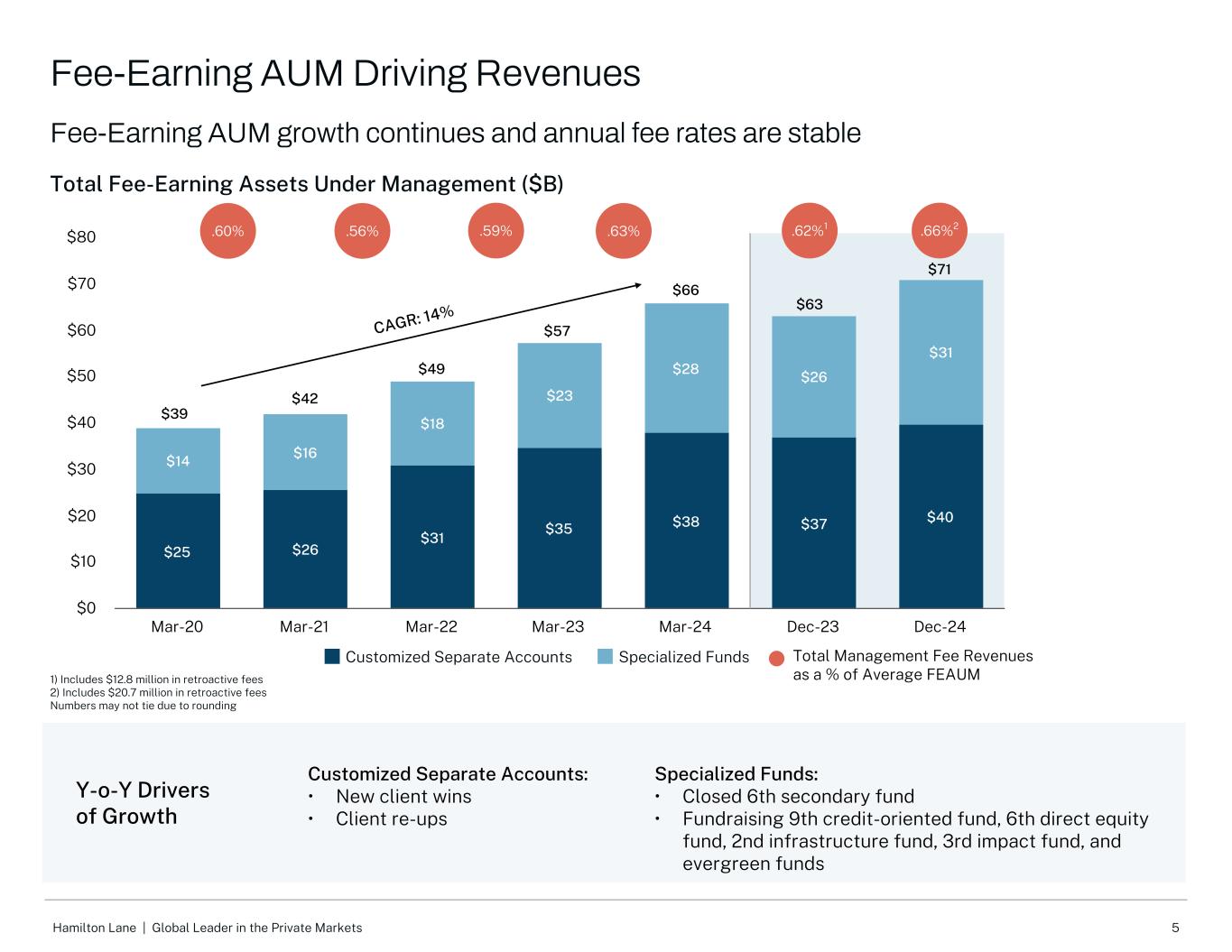

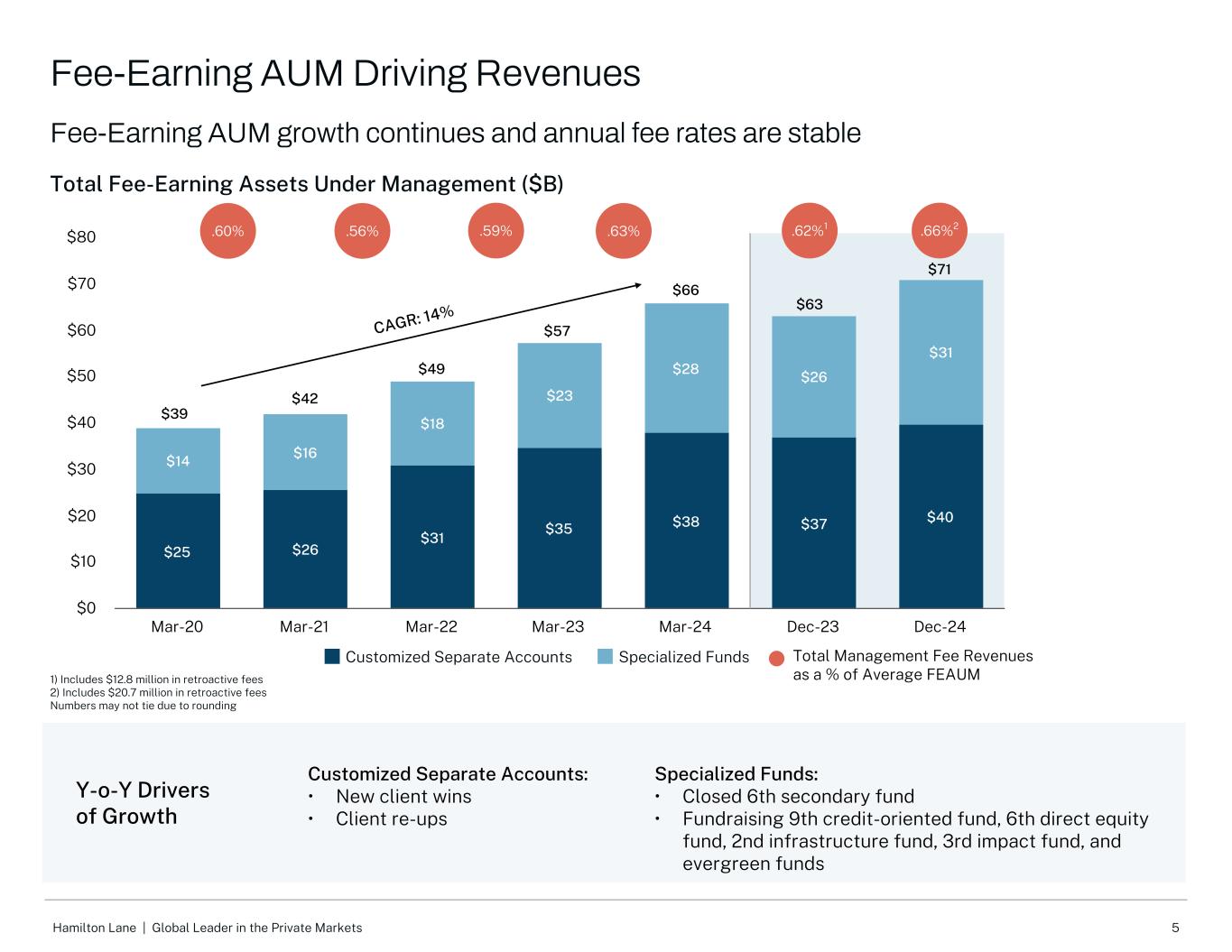

5Hamilton Lane | Global Leader in the Private Markets Y-o-Y Drivers of Growth Total Fee-Earning Assets Under Management ($B) $25 $26 $31 $35 $38 $37 $40 $14 $16 $18 $23 $28 $26 $31 Customized Separate Accounts Specialized Funds Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Dec-23 Dec-24 $0 $10 $20 $30 $40 $50 $60 $70 $80 Fee-Earning AUM growth continues and annual fee rates are stable CAGR: 14% Total Management Fee Revenues as a % of Average FEAUM Customized Separate Accounts: • New client wins • Client re-ups Specialized Funds: • Closed 6th secondary fund • Fundraising 9th credit-oriented fund, 6th direct equity fund, 2nd infrastructure fund, 3rd impact fund, and evergreen funds .60% $49 $63 $66 $39 $42 $57 $71 Fee-Earning AUM Driving Revenues .56% .59% .63% .62%1 .66%2 1) Includes $12.8 million in retroactive fees 2) Includes $20.7 million in retroactive fees Numbers may not tie due to rounding

6Hamilton Lane | Global Leader in the Private Markets Customized Separate Accounts Specialized Funds Advisory Services Diverse mix of existing and prospective clients seeking to further or establish relationships with Hamilton Lane • $2.9 billion year-over-year increase in FEAUM • +80% of our gross contributions during the last 12 months came from existing clients AUM AUM & AUA Drivers AUA Select funds in market: • Direct equity fund • Credit-oriented fund • Infrastructure fund • Impact fund • Evergreen funds • $5.0 billion year-over-year increase in FEAUM • Closings during Q3 FY25: ◦ Direct equity fund: $478M Typically larger clients with wide-ranging mandates which include technology-driven reporting, monitoring and analytics services and consulting services; opportunity set continues to be robust • $38.3 billion year-over-year increase in AUA

Financial Highlights

8Hamilton Lane | Global Leader in the Private Markets U S D in M ill io ns $377 $515 Q3 FY24 Q3 FY25 U S D in M ill io ns $49 $129 Q3 FY24 Q3 FY25 U S D in M ill io ns $328 $386 Q3 FY24 Q3 FY25 Management and Advisory Fees Incentive Fees Total Revenues YTD YTD Y-o-Y Change: 18% YTD Y-o-Y Change: 37% Y-o-Y Change: 163% • Recurring management and advisory fees represented an average of over 80% of total revenues over the past five fiscal years • Y-o-Y increase of 18% • $0.1 million in retroactive fees from our latest direct equity fund in the quarter • Incentive fees derived from a highly diversified pool of assets and funds • Unrealized carried interest of $1.3 billion as of 12/31/24 diversified across 3,000+ assets and over 110 funds • Timing of realizations unpredictable • Total revenues increased by 37%, driven by both incentive fees and management and advisory fees U S D in M ill io ns $218 $452 FY19 FY24 Long-Term Growth U S D in M ill io ns $34 $102 FY19 FY24 Long-Term Growth CAGR: 16% U S D in M ill io ns $252 $554 FY19 FY24 Long-Term Growth CAGR: 17% CAGR: 24% Consolidated Revenue Strong growth across management and advisory fees

9Hamilton Lane | Global Leader in the Private Markets Period Ending V eh ic le s U S D in M illions Unrealized Carried Interest $952 $1,126 $1,293 91 99 113 Unrealized Carried Interest Vehicles in Unrealized Carry Position Dec-22 Dec-23 Dec-24 0 20 40 60 80 100 120 $0 $250 $500 $750 $1,000 $1,250 $1,500 Unrealized Carry by Age < 5 years 26% 5-8 years 52% 8-12 years 18% > 12 years 4% Unrealized Carried Interest

10Hamilton Lane | Global Leader in the Private Markets U S D in M ill io ns $34 $141 FY19 FY24 Net Income Attributable to HLI Adjusted EBITDA1 Fee Related Earnings1 U S D in M ill io ns $181 $264 Q3 FY24 Q3 FY25 U S D in M ill io ns $92 $167 Q3 FY24 Q3 FY25 U S D in M ill io ns $118 $273 FY19 FY24 U S D in M ill io ns $137 $166 Q3 FY24 Q3 FY25 U S D in M ill io ns $90 $193 FY19 FY24 Y-o-Y Change: 80% 1Adjusted EBITDA and Fee Related Earnings are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see pages 20 and 21 of this presentation. Y-o-Y Change: 46% Y-o-Y Change: 21% CAGR: 17% CAGR: 18% Consolidated Earnings Stable long-term growth YTD YTD YTD Long-Term Growth Long-Term Growth Long-Term Growth • $53M in net income attributable to HLI for the quarter • Y-o-Y increase of 46% driven by increase in revenue • Y-o-Y growth of 21% • Long-term double digit growth in Fee Related Earnings CAGR: 32%

11Hamilton Lane | Global Leader in the Private Markets U S D in M ill io ns Investments $208 $374 $514 $588 $632 $716 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Dec-24 $0 $200 $400 $600 $800 • For December 31, 2024, the total investment balance consisted primarily of: ◦ ~$459M in investments in our funds ◦ ~$257M in technology related and other investments • Modest leverage • $292M of debt as of December 31, 2024 • Issued $100M private placement senior notes in the quarter U S D in M ill io ns Leverage $197 $196 $292 Dec-23 Mar-24 Dec-24 $0 $100 $200 $300 $400 Other Key Items Strong balance sheet with investments in our own products and a modest amount of leverage...

Appendix

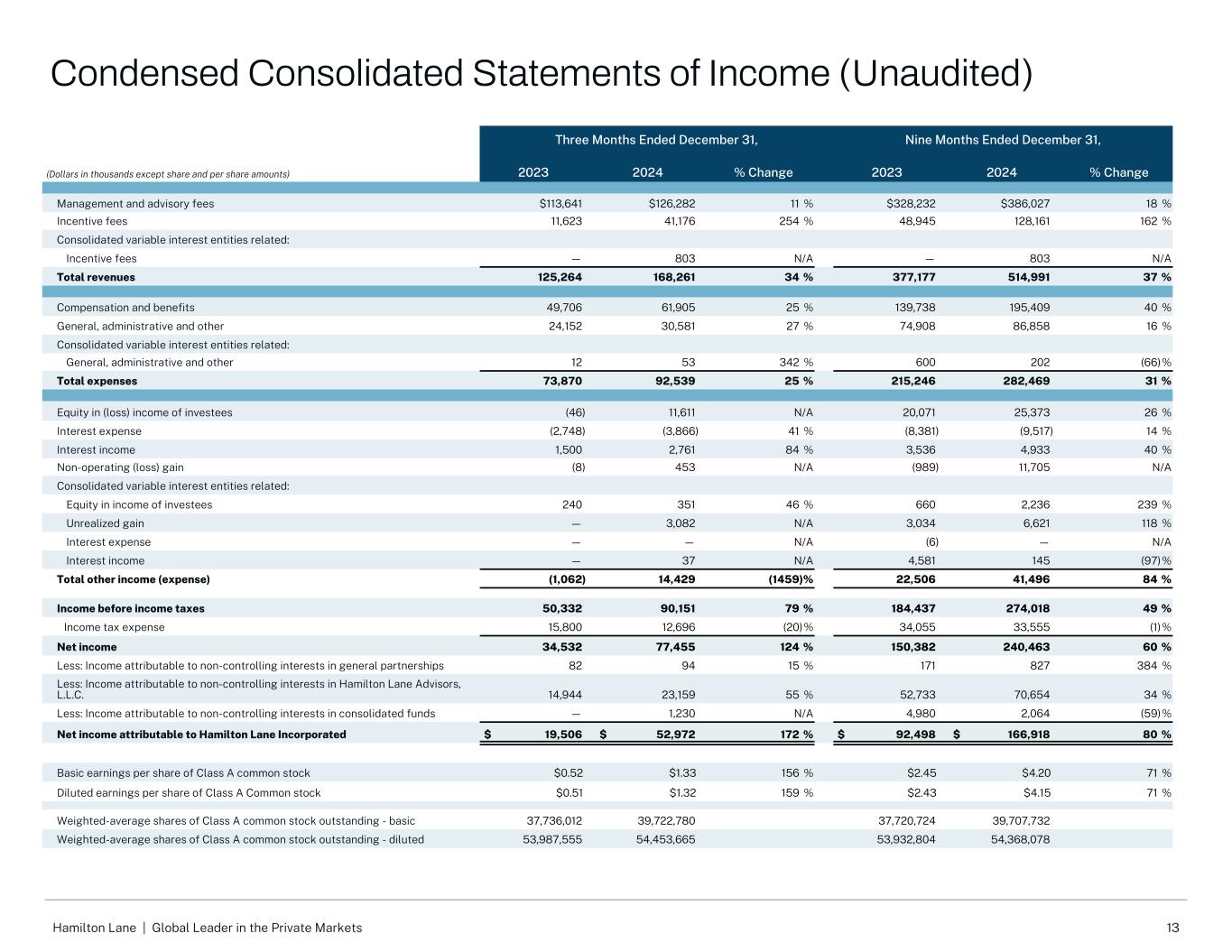

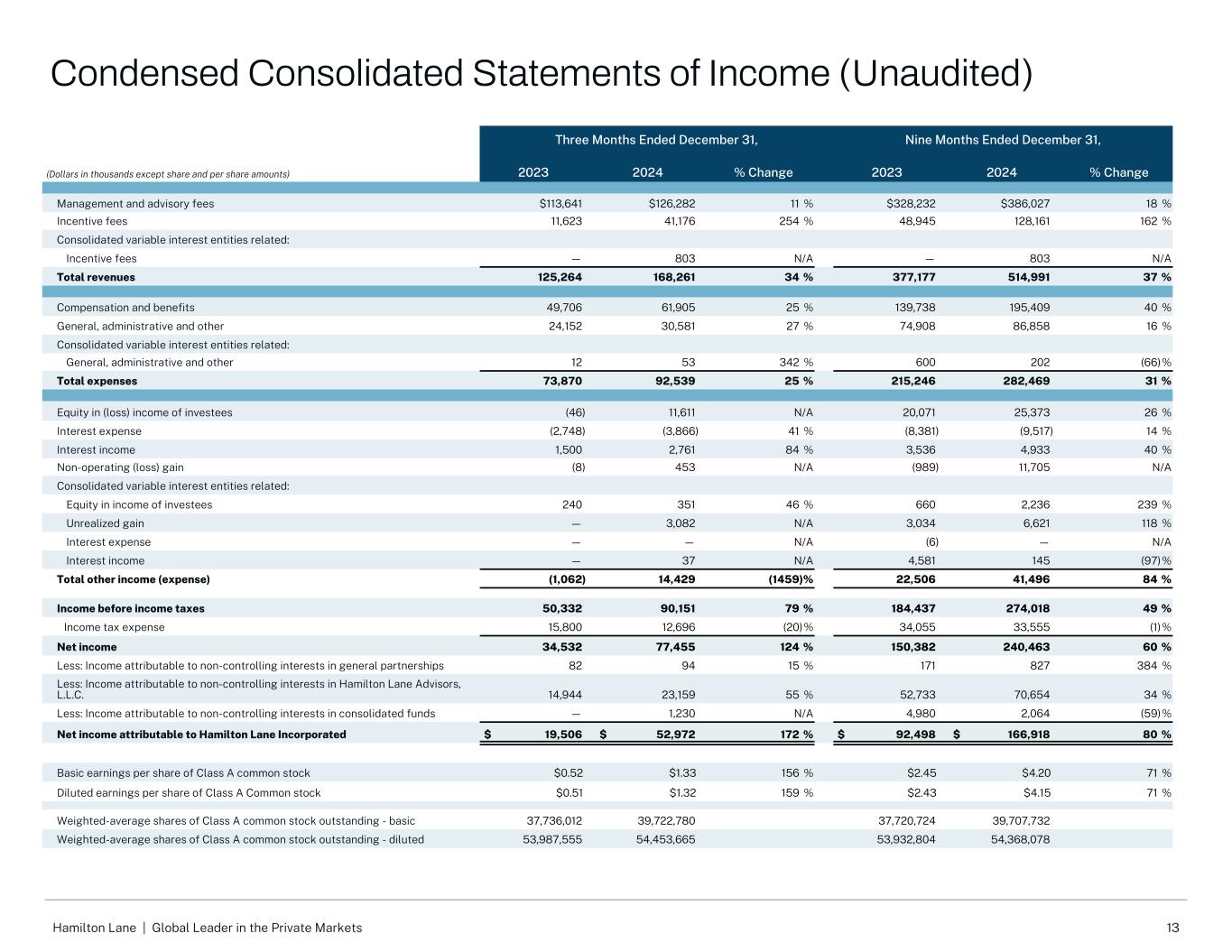

13Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands except share and per share amounts) 2023 2024 % Change 2023 2024 % Change Management and advisory fees $113,641 $126,282 11 % $328,232 $386,027 18 % Incentive fees 11,623 41,176 254 % 48,945 128,161 162 % Consolidated variable interest entities related: Incentive fees — 803 N/A — 803 N/A Total revenues 125,264 168,261 34 % 377,177 514,991 37 % Compensation and benefits 49,706 61,905 25 % 139,738 195,409 40 % General, administrative and other 24,152 30,581 27 % 74,908 86,858 16 % Consolidated variable interest entities related: General, administrative and other 12 53 342 % 600 202 (66) % Total expenses 73,870 92,539 25 % 215,246 282,469 31 % Equity in (loss) income of investees (46) 11,611 N/A 20,071 25,373 26 % Interest expense (2,748) (3,866) 41 % (8,381) (9,517) 14 % Interest income 1,500 2,761 84 % 3,536 4,933 40 % Non-operating (loss) gain (8) 453 N/A (989) 11,705 N/A Consolidated variable interest entities related: Equity in income of investees 240 351 46 % 660 2,236 239 % Unrealized gain — 3,082 N/A 3,034 6,621 118 % Interest expense — — N/A (6) — N/A Interest income — 37 N/A 4,581 145 (97) % Total other income (expense) (1,062) 14,429 (1459) % 22,506 41,496 84 % Income before income taxes 50,332 90,151 79 % 184,437 274,018 49 % Income tax expense 15,800 12,696 (20) % 34,055 33,555 (1) % Net income 34,532 77,455 124 % 150,382 240,463 60 % Less: Income attributable to non-controlling interests in general partnerships 82 94 15 % 171 827 384 % Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 14,944 23,159 55 % 52,733 70,654 34 % Less: Income attributable to non-controlling interests in consolidated funds — 1,230 N/A 4,980 2,064 (59) % Net income attributable to Hamilton Lane Incorporated $ 19,506 $ 52,972 172 % $ 92,498 $ 166,918 80 % Basic earnings per share of Class A common stock $0.52 $1.33 156 % $2.45 $4.20 71 % Diluted earnings per share of Class A Common stock $0.51 $1.32 159 % $2.43 $4.15 71 % Weighted-average shares of Class A common stock outstanding - basic 37,736,012 39,722,780 37,720,724 39,707,732 Weighted-average shares of Class A common stock outstanding - diluted 53,987,555 54,453,665 53,932,804 54,368,078 Condensed Consolidated Statements of Income (Unaudited)

14Hamilton Lane | Global Leader in the Private Markets 1 Adjusted EBITDA and Non-GAAP earnings per share are non-GAAP financial measures. For the reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures, see page 20. 2 Incentive fee related compensation includes incentive fee compensation expense and bonus related to carried interest that is classified as base compensation. 3 Represents corporate income taxes at our estimated statutory tax rate of 23.4% and 23.6% for the three and nine months ended December 31, 2024 and 2023, respectively, applied to adjusted pre-tax net income. The 23.4% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.4%. The 23.6% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.6%. Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands except share and per share amounts) 2023 2024 % Change 2023 2024 % Change Adjusted EBITDA1 Management and advisory fees $113,641 $126,282 11 % $328,232 $386,027 18 % Revenue related to consolidated funds — — N/A 394 — (100) % Total expenses 73,870 92,539 25 % 215,246 282,469 31 % Less: Incentive fee related compensation2 (5,521) (19,926) 261 % (23,249) (61,244) 163 % Consolidated VIE related general, administrative and other expenses — (54) N/A (566) (203) (64) % Non-operating income related compensation — (507) N/A (59) (784) 1229 % Management fee related expenses 68,349 72,052 5 % 191,372 220,238 15 % Fee Related Earnings $45,292 $54,230 20 % $137,254 $165,789 21 % Fee Related Earnings Margin 40 % 43 % 42 % 43 % Incentive fees 11,623 41,979 261 % 48,945 128,964 163 % Incentive fees attributable to non-controlling interests — (29) N/A — (29) N/A Incentive fee related compensation2 (5,521) (19,926) 261 % (23,249) (61,244) 163 % Non-operating income related compensation — (507) N/A (59) (784) 1229 % Interest income 1,500 2,761 84 % 3,536 4,933 40 % Equity-based compensation 3,264 11,785 261 % 9,227 19,681 113 % Depreciation and amortization 2,037 2,385 17 % 5,774 7,065 22 % Adjusted EBITDA $58,195 $92,678 59 % $181,428 $264,375 46 % Adjusted EBITDA Margin 46 % 55 % 48 % 51 % Non-GAAP earnings per share1 Net income attributable to Hamilton Lane Incorporated $19,506 $52,972 172 % $92,498 $166,918 80 % Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 14,944 23,159 55 % 52,733 70,654 34 % Income tax expense 15,800 12,696 (20) % 34,055 33,555 (1) % Adjusted pre-tax net income 50,250 88,827 77 % 179,286 271,127 51 % Adjusted income taxes3 (11,859) (20,785) 75 % (42,312) (63,444) 50 % Adjusted net income $38,391 $68,042 77 % $136,974 $207,683 52 % Adjusted shares outstanding 53,987,555 54,453,665 53,932,804 54,368,078 Non-GAAP earnings per share $0.71 $1.25 76 % $2.54 $3.82 50 % Non-GAAP Financial Measures

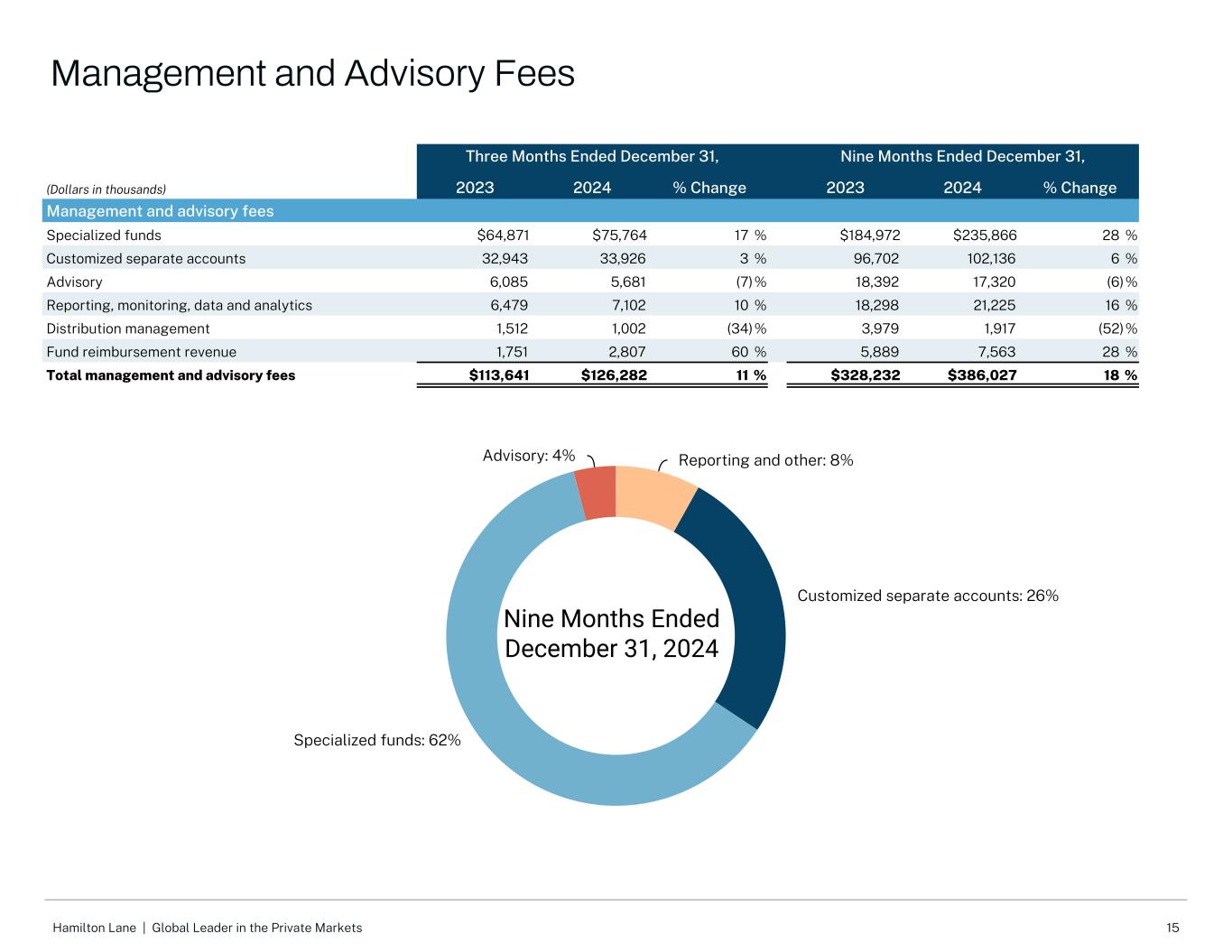

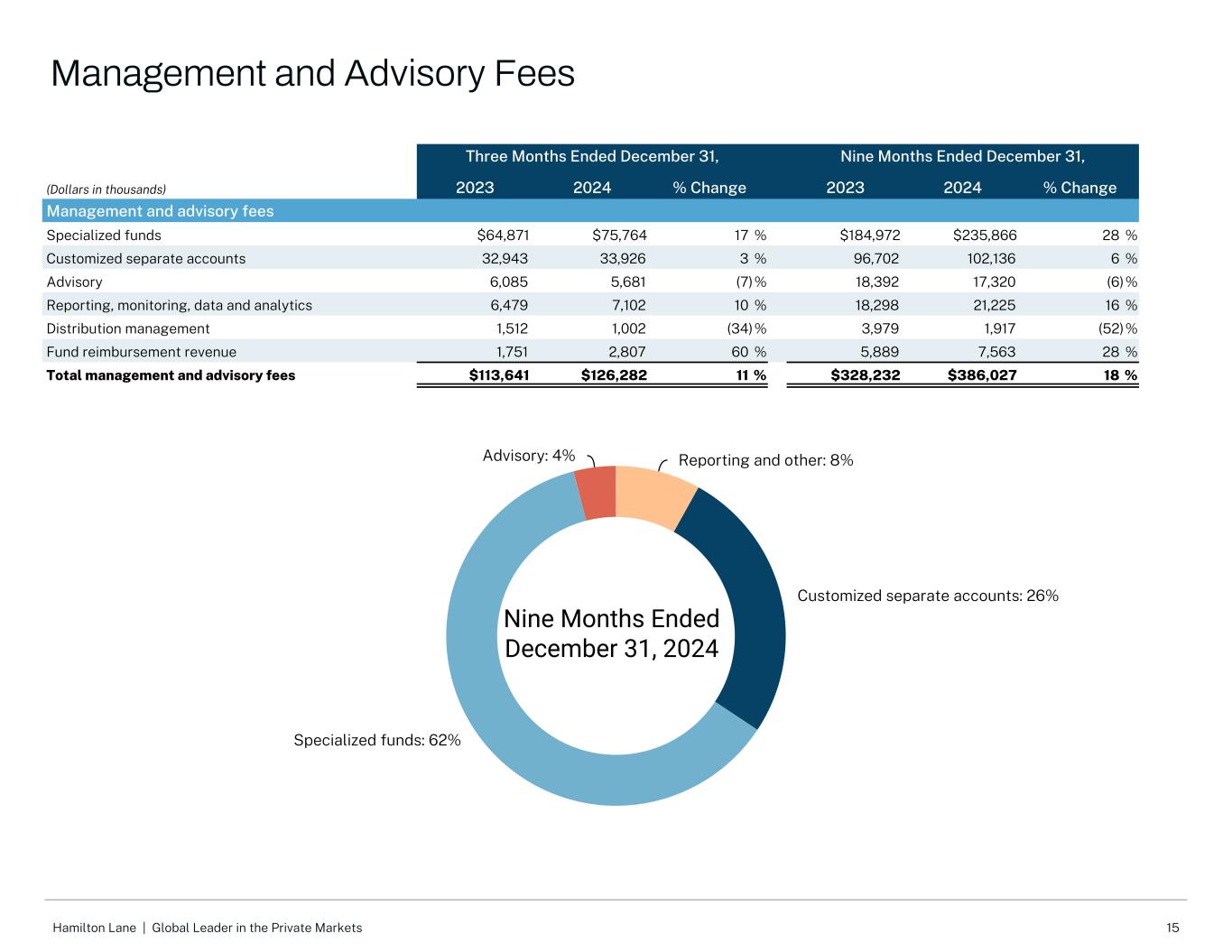

15Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2023 2024 % Change 2023 2024 % Change Management and advisory fees Specialized funds $64,871 $75,764 17 % $184,972 $235,866 28 % Customized separate accounts 32,943 33,926 3 % 96,702 102,136 6 % Advisory 6,085 5,681 (7) % 18,392 17,320 (6) % Reporting, monitoring, data and analytics 6,479 7,102 10 % 18,298 21,225 16 % Distribution management 1,512 1,002 (34) % 3,979 1,917 (52) % Fund reimbursement revenue 1,751 2,807 60 % 5,889 7,563 28 % Total management and advisory fees $113,641 $126,282 11 % $328,232 $386,027 18 % Reporting and other: 8% Customized separate accounts: 26% Specialized funds: 62% Advisory: 4% Nine Months Ended December 31, 2024 Management and Advisory Fees

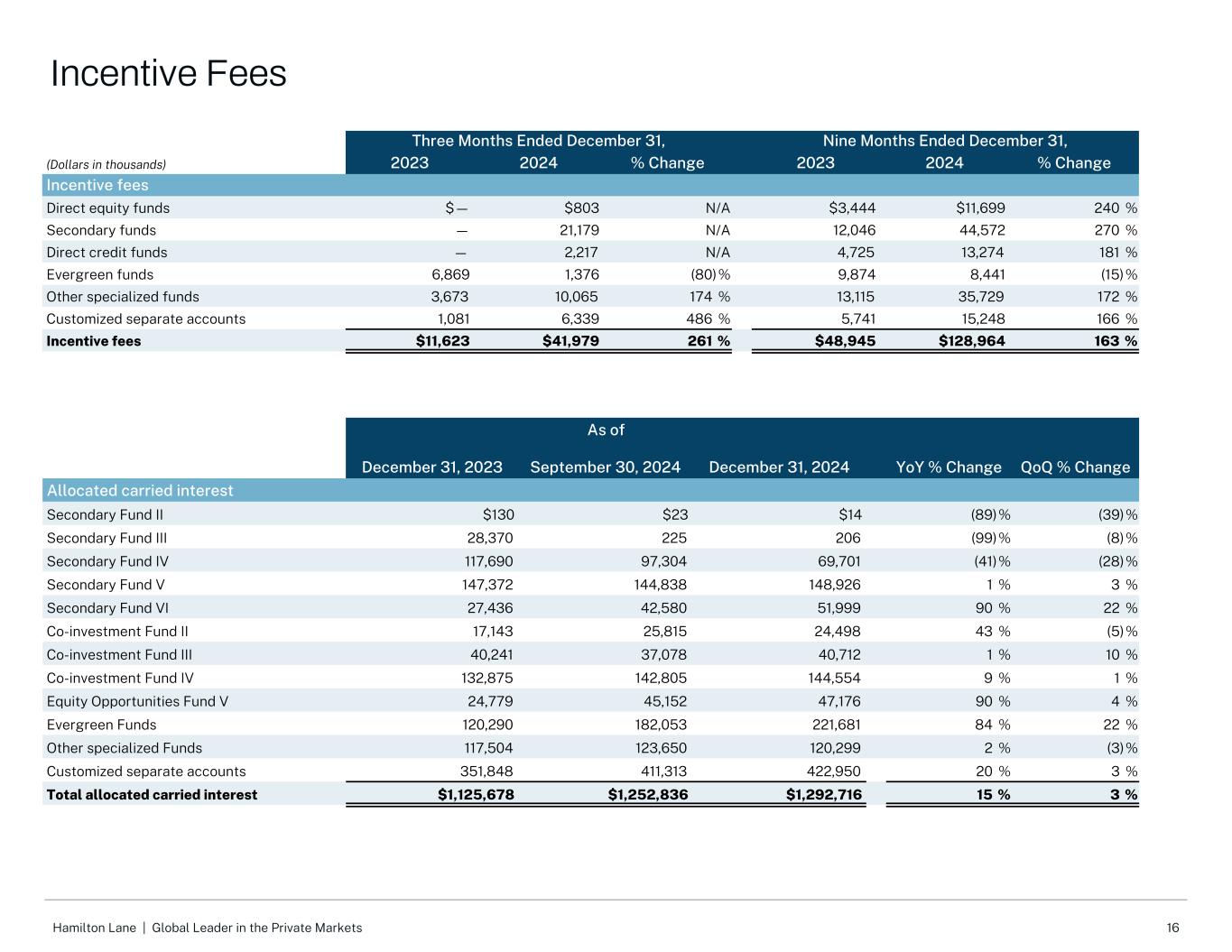

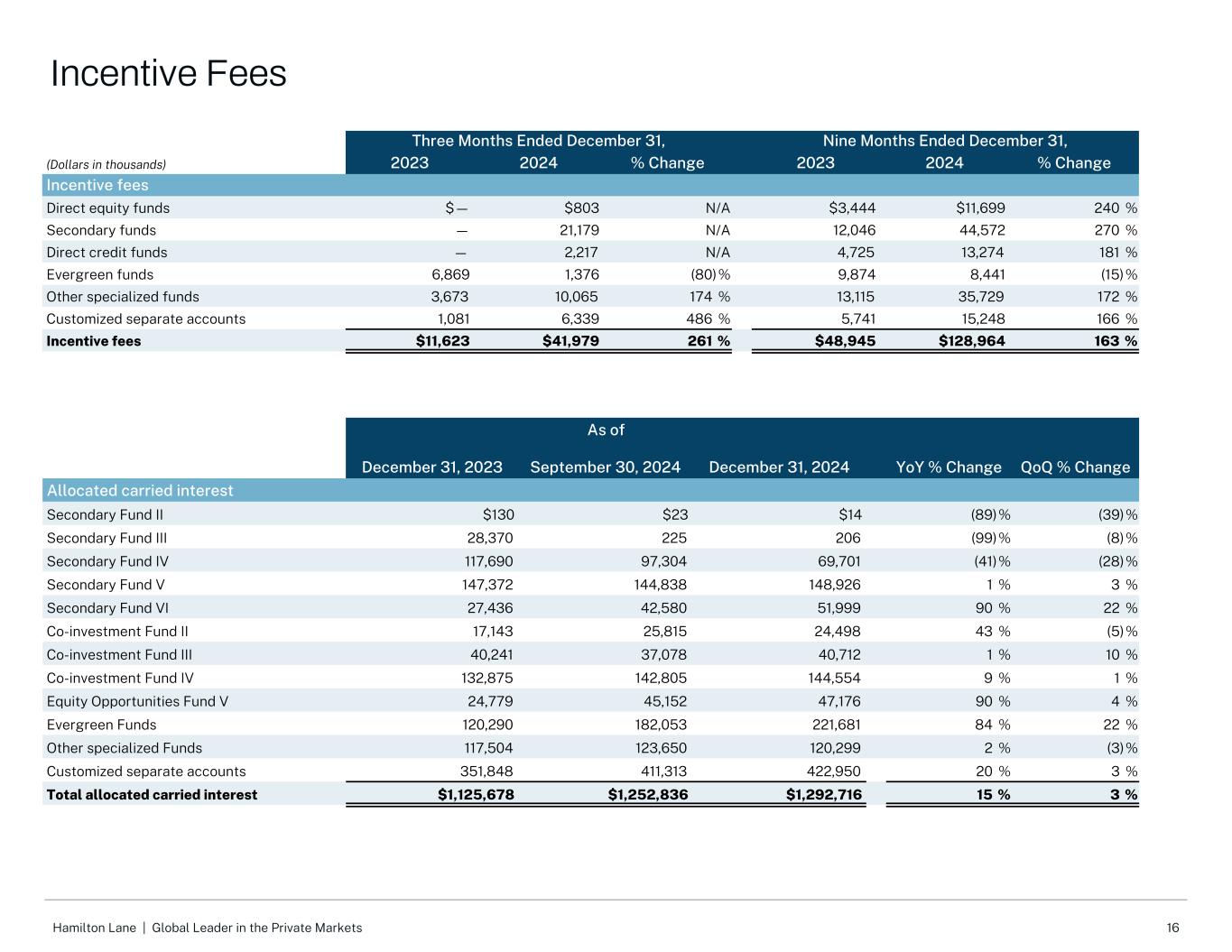

16Hamilton Lane | Global Leader in the Private Markets Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands) 2023 2024 % Change 2023 2024 % Change Incentive fees Direct equity funds $— $803 N/A $3,444 $11,699 240 % Secondary funds — 21,179 N/A 12,046 44,572 270 % Direct credit funds — 2,217 N/A 4,725 13,274 181 % Evergreen funds 6,869 1,376 (80) % 9,874 8,441 (15) % Other specialized funds 3,673 10,065 174 % 13,115 35,729 172 % Customized separate accounts 1,081 6,339 486 % 5,741 15,248 166 % Incentive fees $11,623 $41,979 261 % $48,945 $128,964 163 % As of December 31, 2023 September 30, 2024 December 31, 2024 YoY % Change QoQ % Change Allocated carried interest Secondary Fund II $130 $23 $14 (89) % (39) % Secondary Fund III 28,370 225 206 (99) % (8) % Secondary Fund IV 117,690 97,304 69,701 (41) % (28) % Secondary Fund V 147,372 144,838 148,926 1 % 3 % Secondary Fund VI 27,436 42,580 51,999 90 % 22 % Co-investment Fund II 17,143 25,815 24,498 43 % (5) % Co-investment Fund III 40,241 37,078 40,712 1 % 10 % Co-investment Fund IV 132,875 142,805 144,554 9 % 1 % Equity Opportunities Fund V 24,779 45,152 47,176 90 % 4 % Evergreen Funds 120,290 182,053 221,681 84 % 22 % Other specialized Funds 117,504 123,650 120,299 2 % (3) % Customized separate accounts 351,848 411,313 422,950 20 % 3 % Total allocated carried interest $1,125,678 $1,252,836 $1,292,716 15 % 3 % Incentive Fees

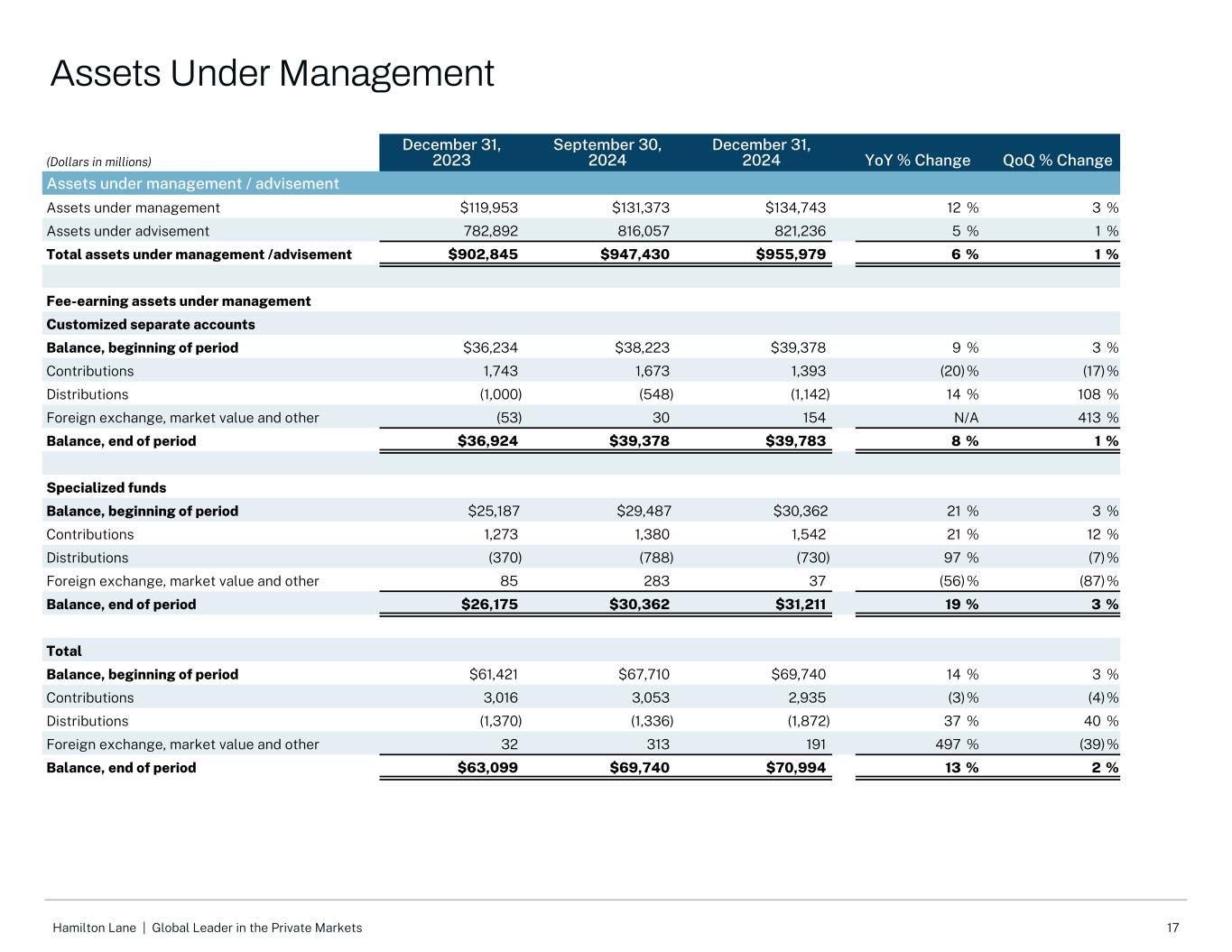

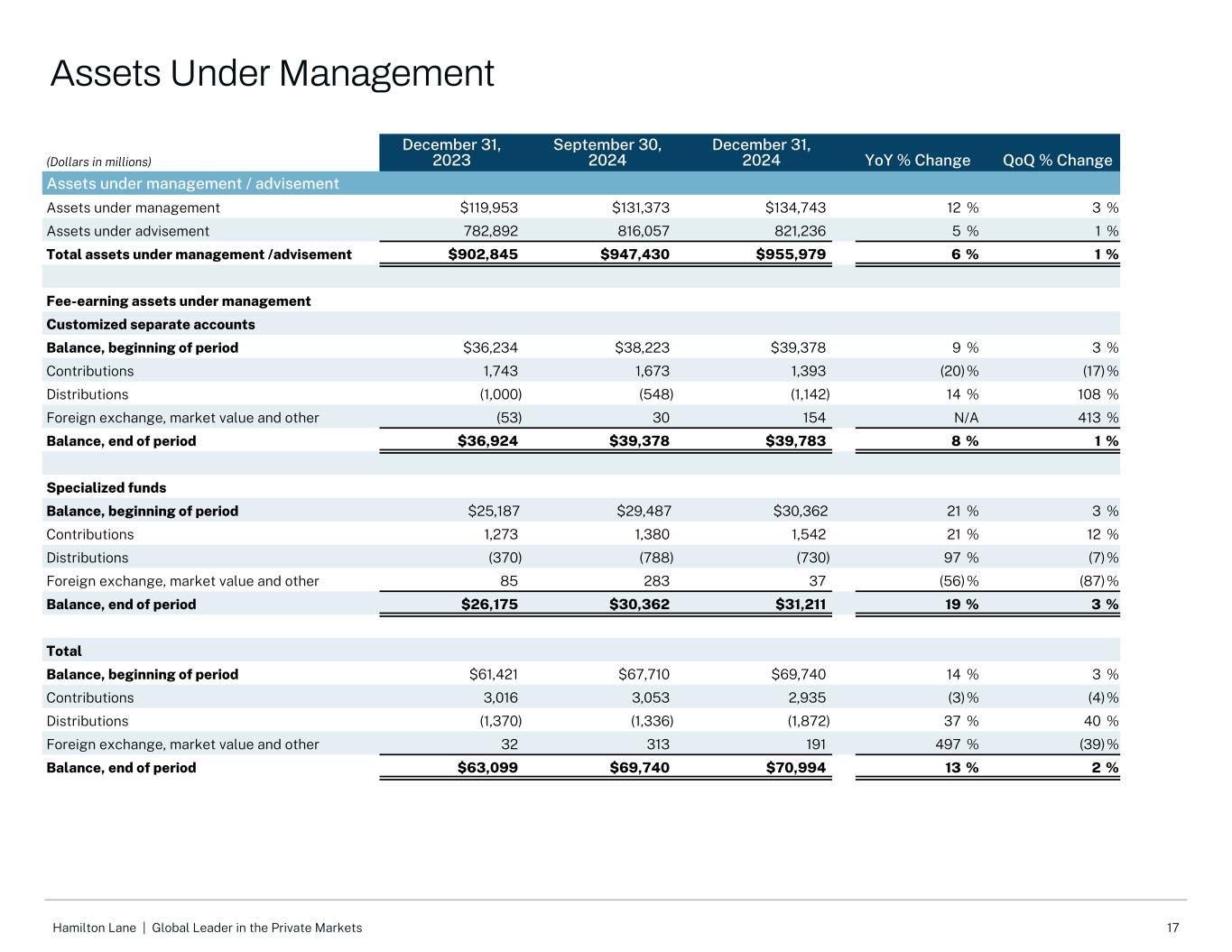

17Hamilton Lane | Global Leader in the Private Markets (Dollars in millions) December 31, 2023 September 30, 2024 December 31, 2024 YoY % Change QoQ % Change Assets under management / advisement Assets under management $119,953 $131,373 $134,743 12 % 3 % Assets under advisement 782,892 816,057 821,236 5 % 1 % Total assets under management /advisement $902,845 $947,430 $955,979 6 % 1 % Fee-earning assets under management Customized separate accounts Balance, beginning of period $36,234 $38,223 $39,378 9 % 3 % Contributions 1,743 1,673 1,393 (20) % (17) % Distributions (1,000) (548) (1,142) 14 % 108 % Foreign exchange, market value and other (53) 30 154 N/A 413 % Balance, end of period $36,924 $39,378 $39,783 8 % 1 % Specialized funds Balance, beginning of period $25,187 $29,487 $30,362 21 % 3 % Contributions 1,273 1,380 1,542 21 % 12 % Distributions (370) (788) (730) 97 % (7) % Foreign exchange, market value and other 85 283 37 (56) % (87) % Balance, end of period $26,175 $30,362 $31,211 19 % 3 % Total Balance, beginning of period $61,421 $67,710 $69,740 14 % 3 % Contributions 3,016 3,053 2,935 (3) % (4) % Distributions (1,370) (1,336) (1,872) 37 % 40 % Foreign exchange, market value and other 32 313 191 497 % (39) % Balance, end of period $63,099 $69,740 $70,994 13 % 2 % Assets Under Management

18Hamilton Lane | Global Leader in the Private Markets (Dollars in thousands) March 31, 2024 December 31, 2024 Assets Cash and cash equivalents $114,634 $285,553 Restricted cash 4,985 5,858 Fees receivable 108,291 135,622 Prepaid expenses 11,073 9,446 Due from related parties 8,150 21,339 Furniture, fixtures and equipment, net 33,013 35,937 Lease right-of-use assets, net 62,425 61,436 Investments 603,697 664,275 Deferred income taxes 261,887 255,001 Other assets 34,435 28,076 Assets of consolidated variable interest entities: Cash and cash equivalents — 35,902 Investments 28,575 52,175 Other assets 35 408 Total assets $1,271,200 $1,591,028 Liabilities and equity Accounts payable $4,505 $5,250 Accrued compensation and benefits 35,979 77,771 Accrued members' distributions 23,815 14,377 Accrued dividend 17,628 19,464 Debt 196,159 292,024 Payable to related parties pursuant to tax receivable agreement 201,422 200,025 Lease liabilities 79,033 77,842 Other liabilities (includes $13,071 and $12,792 at fair value) 36,700 41,327 Liabilities of consolidated variable interest entities: Other liabilities 1 923 Total liabilities 595,242 729,003 Total equity 675,958 862,025 Total liabilities and equity $1,271,200 $1,591,028 Condensed Consolidated Balance Sheets (Unaudited)

19Hamilton Lane | Global Leader in the Private Markets Nine Months Ended December 31, (Dollars in thousands) 2023 2024 Operating activities Net income $150,382 $240,463 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 5,774 7,065 Change in deferred income taxes 7,990 6,886 Change in payable to related parties pursuant to tax receivable agreement (884) (1,397) Equity-based compensation 9,227 19,681 Equity income of investees (20,071) (25,373) Net realized loss (gain) on sale of investments 288 (654) Fair value adjustment of other investments 45 (9,852) Proceeds received from Partnerships 22,160 39,463 Non-cash lease expense 6,796 6,608 Other 511 582 Changes in operating assets and liabilities 21,142 2,059 Consolidated variable interest entities related (104,220) (23,992) Net cash provided by operating activities $99,140 $261,539 Investing activities Purchase of furniture, fixtures and equipment $(9,463) $(8,713) Purchase of investments (6,352) (5,794) Proceeds from sale of investments 1,343 6,948 Proceeds from sale of intangible assets 2,562 1,786 Distributions received from Partnerships 10,730 16,481 Contributions to Partnerships (34,985) (53,087) Consolidated variable interest entities related (57,832) (25,570) Net cash used in investing activities $(93,997) $(67,949) Financing activities Private placement of senior notes, net of deferred financing cost $— $97,658 Repayments of long term debt (1,875) (1,875) Draw-down on revolver 10,000 — Repayment of revolver (25,000) — Repurchase of Class A shares for employee tax withholding (269) (990) Proceeds received from issuance of shares under Employee Share Purchase Plan 1,666 2,031 Dividends paid (48,613) (56,533) Members' distributions paid (31,817) (36,310) Consolidated variable interest entities related 143,648 10,123 Net cash provided by financing activities $47,740 $14,104 Increase in cash and cash equivalents, restricted cash, and cash and cash equivalents held at consolidated variable interest entities 52,883 207,694 Cash and cash equivalents, restricted cash, and cash and cash equivalents held at consolidated variable interest entities at beginning of the period 116,552 119,619 Cash and cash equivalents, restricted cash, and cash and cash equivalents held at consolidated variable interest entities at end of the period $169,435 $327,313 Condensed Consolidated Statements of Cash Flows (Unaudited)

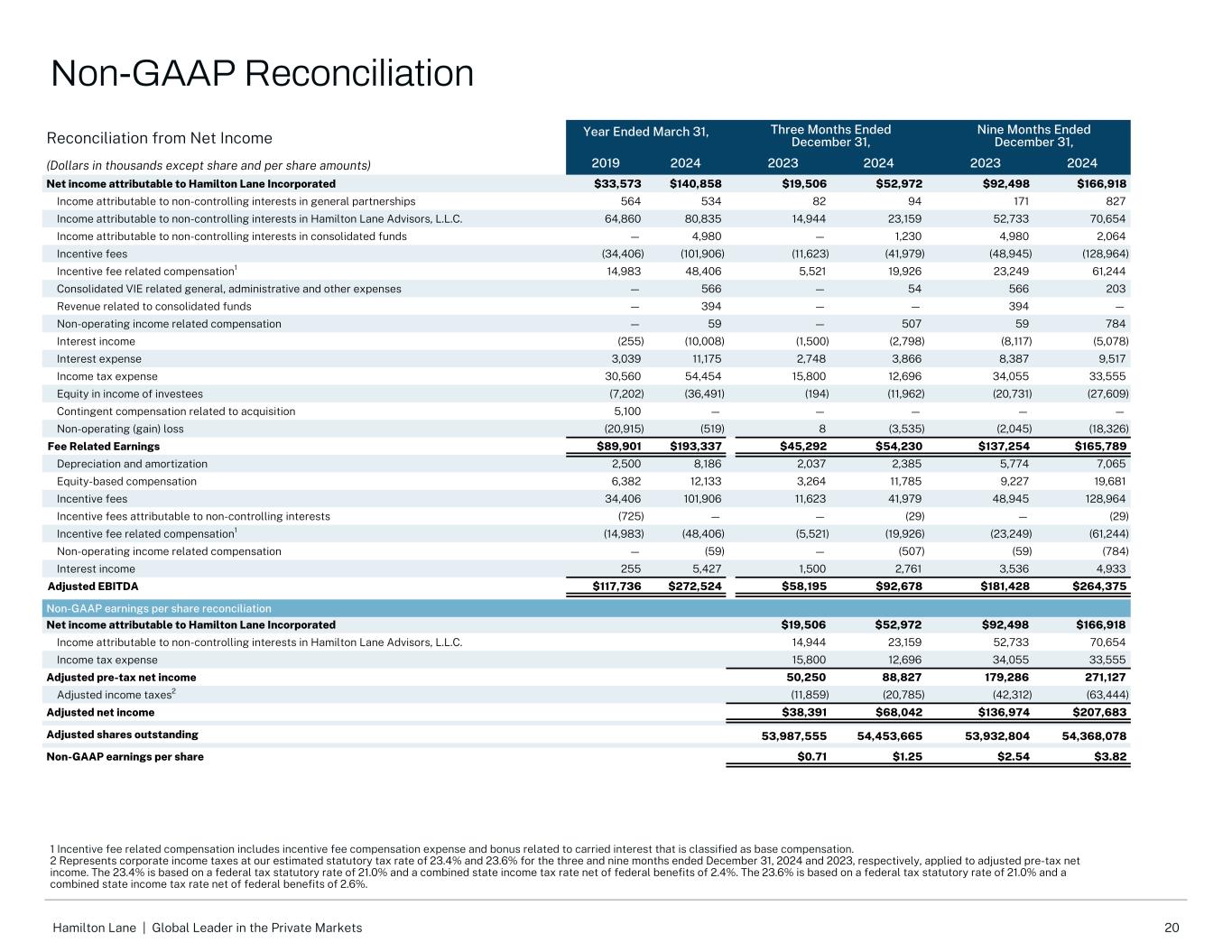

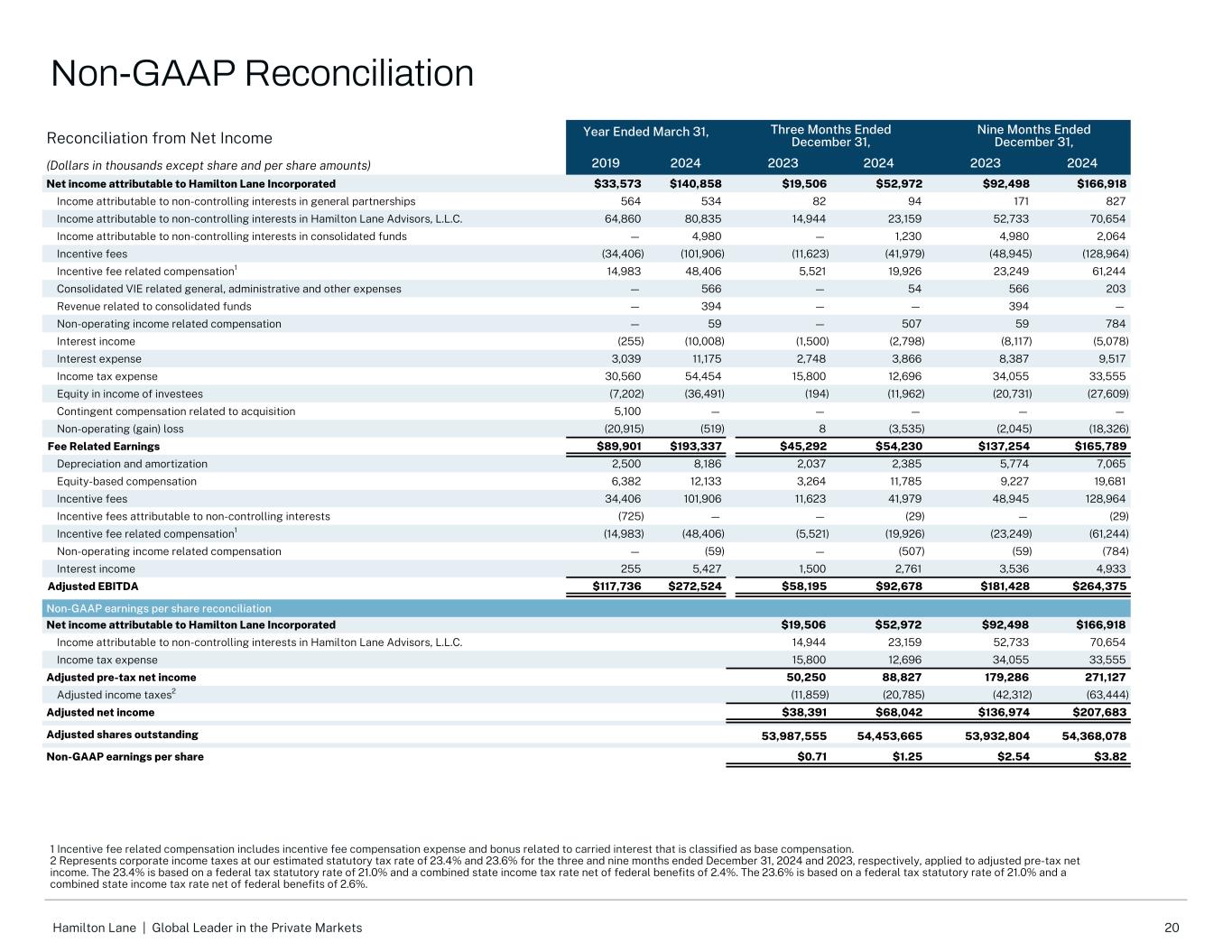

20Hamilton Lane | Global Leader in the Private Markets Reconciliation from Net Income Year Ended March 31, Three Months Ended December 31, Nine Months Ended December 31, (Dollars in thousands except share and per share amounts) 2019 2024 2023 2024 2023 2024 Net income attributable to Hamilton Lane Incorporated $33,573 $140,858 $19,506 $52,972 $92,498 $166,918 Income attributable to non-controlling interests in general partnerships 564 534 82 94 171 827 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 64,860 80,835 14,944 23,159 52,733 70,654 Income attributable to non-controlling interests in consolidated funds — 4,980 — 1,230 4,980 2,064 Incentive fees (34,406) (101,906) (11,623) (41,979) (48,945) (128,964) Incentive fee related compensation1 14,983 48,406 5,521 19,926 23,249 61,244 Consolidated VIE related general, administrative and other expenses — 566 — 54 566 203 Revenue related to consolidated funds — 394 — — 394 — Non-operating income related compensation — 59 — 507 59 784 Interest income (255) (10,008) (1,500) (2,798) (8,117) (5,078) Interest expense 3,039 11,175 2,748 3,866 8,387 9,517 Income tax expense 30,560 54,454 15,800 12,696 34,055 33,555 Equity in income of investees (7,202) (36,491) (194) (11,962) (20,731) (27,609) Contingent compensation related to acquisition 5,100 — — — — — Non-operating (gain) loss (20,915) (519) 8 (3,535) (2,045) (18,326) Fee Related Earnings $89,901 $193,337 $45,292 $54,230 $137,254 $165,789 Depreciation and amortization 2,500 8,186 2,037 2,385 5,774 7,065 Equity-based compensation 6,382 12,133 3,264 11,785 9,227 19,681 Incentive fees 34,406 101,906 11,623 41,979 48,945 128,964 Incentive fees attributable to non-controlling interests (725) — — (29) — (29) Incentive fee related compensation1 (14,983) (48,406) (5,521) (19,926) (23,249) (61,244) Non-operating income related compensation — (59) — (507) (59) (784) Interest income 255 5,427 1,500 2,761 3,536 4,933 Adjusted EBITDA $117,736 $272,524 $58,195 $92,678 $181,428 $264,375 Non-GAAP earnings per share reconciliation Net income attributable to Hamilton Lane Incorporated $19,506 $52,972 $92,498 $166,918 Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 14,944 23,159 52,733 70,654 Income tax expense 15,800 12,696 34,055 33,555 Adjusted pre-tax net income 50,250 88,827 179,286 271,127 Adjusted income taxes2 (11,859) (20,785) (42,312) (63,444) Adjusted net income $38,391 $68,042 $136,974 $207,683 Adjusted shares outstanding 53,987,555 54,453,665 53,932,804 54,368,078 Non-GAAP earnings per share $0.71 $1.25 $2.54 $3.82 1 Incentive fee related compensation includes incentive fee compensation expense and bonus related to carried interest that is classified as base compensation. 2 Represents corporate income taxes at our estimated statutory tax rate of 23.4% and 23.6% for the three and nine months ended December 31, 2024 and 2023, respectively, applied to adjusted pre-tax net income. The 23.4% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.4%. The 23.6% is based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 2.6%. Non-GAAP Reconciliation

21Hamilton Lane | Global Leader in the Private Markets Adjusted EBITDA is an internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our outstanding debt, (b) income tax expense, (c) depreciation and amortization expense, (d) equity-based compensation expense, (e) non-operating gain (loss) and (f) certain other significant items that we believe are not indicative of our core performance. Fee Related Earnings ("FRE") is used to highlight earnings from recurring management fees. FRE represents net income excluding (a) incentive fees and related compensation, (b) interest income and expense, (c) income tax expense, (d) equity in income of investees, (e) non-operating gain (loss) and (f) certain other significant items that we believe are not indicative of our core performance. We believe FRE is useful to investors because it provides additional insight into the operating profitability of our business. FRE is presented before income taxes. Non-GAAP earnings per share measures our per-share earnings excluding certain significant items that we believe are not indicative of our core performance and assuming all Class B and Class C units in HLA were exchanged for Class A common stock in HLI. Non-GAAP earnings per share is calculated as adjusted net income divided by adjusted shares outstanding. Adjusted net income is income before taxes fully taxed at our estimated statutory tax rate and excludes any impact of changes in carrying amount of our redeemable non-controlling interest. Adjusted shares outstanding for the three and nine months ended December 31, 2023 and 2024 and March 31, 2024 are equal to weighted-average shares of Class A common stock outstanding - diluted. We believe adjusted net income and non-GAAP earnings per share are useful to investors because they enable them to better evaluate total and per-share operating performance across reporting periods. Our assets under management ("AUM"), as presented in these materials, comprise the assets associated with our customized separate accounts and specialized funds. AUM does not include the assets associated with our distribution management services. We classify assets as AUM if we have full discretion over the investment decisions in an account. We calculate our AUM as the sum of: (1) the net asset value of our clients' and funds' underlying investments; (2) the unfunded commitments to our clients' and funds' underlying investments; and (3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment. Management fee revenue is based on a variety of factors and is not linearly correlated with AUM. However, we believe AUM is a useful metric for assessing the relative size and scope of our asset management business. Our assets under advisement ("AUA") comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee basis on our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services provided and other factors. Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues. However, we view AUA growth as a meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers. Fee-earning assets under management (Fee-earning "AUM" or "FEAUM") is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our customized separate accounts and specialized funds from which we derive management fees that are generally derived from applying a certain percentage to the appropriate fee base. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital commitments, net invested capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. The vast majority of our customized separate accounts and specialized funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Therefore, revenues and fee-earning AUM are not significantly affected by changes in market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Hamilton Lane Incorporated (or "HLI"), a Delaware corporation, was formed for the purpose of completing an initial public offering ("IPO") and related transactions in order to carry on the business of Hamilton Lane Advisors, L.L.C. ("HLA") as a publicly-traded entity. As of the closing of our IPO on March 6, 2017, HLI became the sole managing member of HLA. Terms

22Hamilton Lane | Global Leader in the Private Markets Some of the statements in this presentation may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as "will", "expect", "believe", "estimate", "continue", "anticipate", "intend", "plan", and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management's current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to: our ability to manage growth, fund performance, competition in our industry, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to fund commitments; our exposure and that of our clients and investors to the credit risks of financial institutions at which we and they hold accounts; our ability to comply with investment guidelines set by our clients; our ability to successfully integrate acquired businesses with ours; our ability to manage risks associated with introducing new types of investment structures, products or services or entering into strategic partnerships; our ability to manage redemption or repurchase rights in certain of our funds; our ability to manage, identify and anticipate risks we face; our ability to manage the effects of events outside of our control; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses. The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks we face, you should refer to the "Risk Factors" detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this presentation are made only as of the date presented. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law. Values appearing in this presentation that are whole numbers are rounded approximations. As of February 4, 2025 Disclosures