Exhibit 99.1 JBT 2018 Technology Day September 13, 2018

Forward-Looking Statements These slides and the accompanying presentation contain “forward-looking” statements, including statements about management’s expectations regarding trends in the food markets, strategic initiatives, acquisition strategies and long- term goals, which represent management’s best judgment as of the date hereof, based on currently available information. Actual results may differ materially from those contained in such forward-looking statements. JBT Corporation’s (the “Company”) most recent filings with the Securities and Exchange Commission include information concerning factors, including the factors set forth under “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 28, 2018 that may cause actual results to differ from those anticipated by these forward-looking statements. The Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. 2 2018 Technology Day

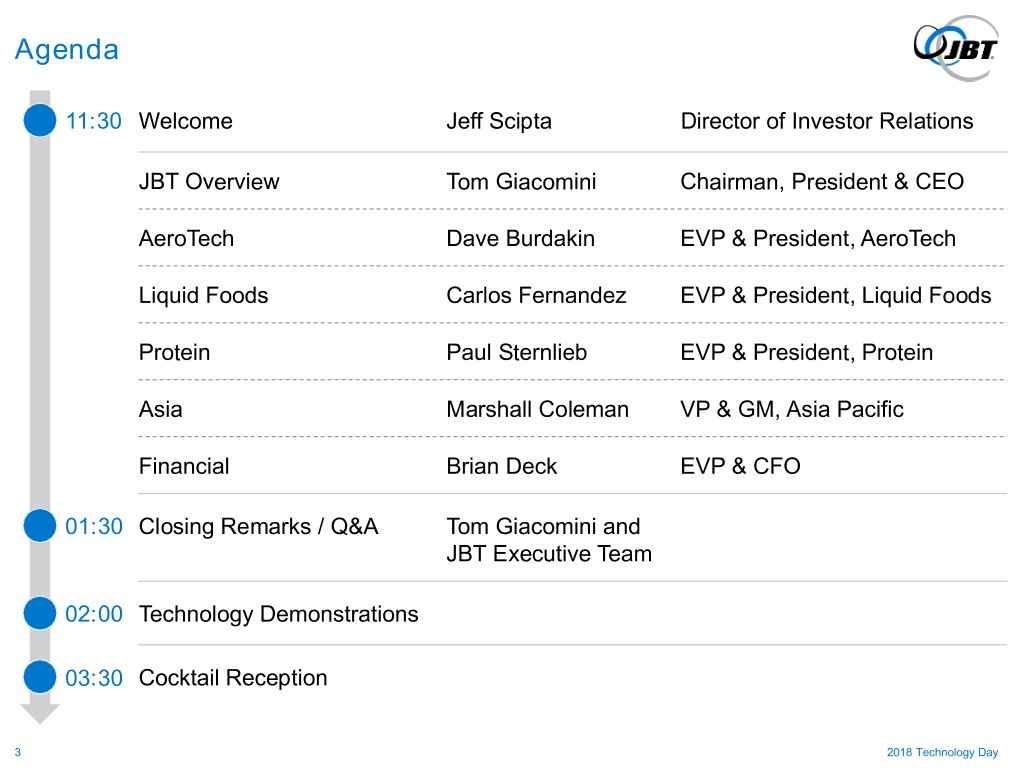

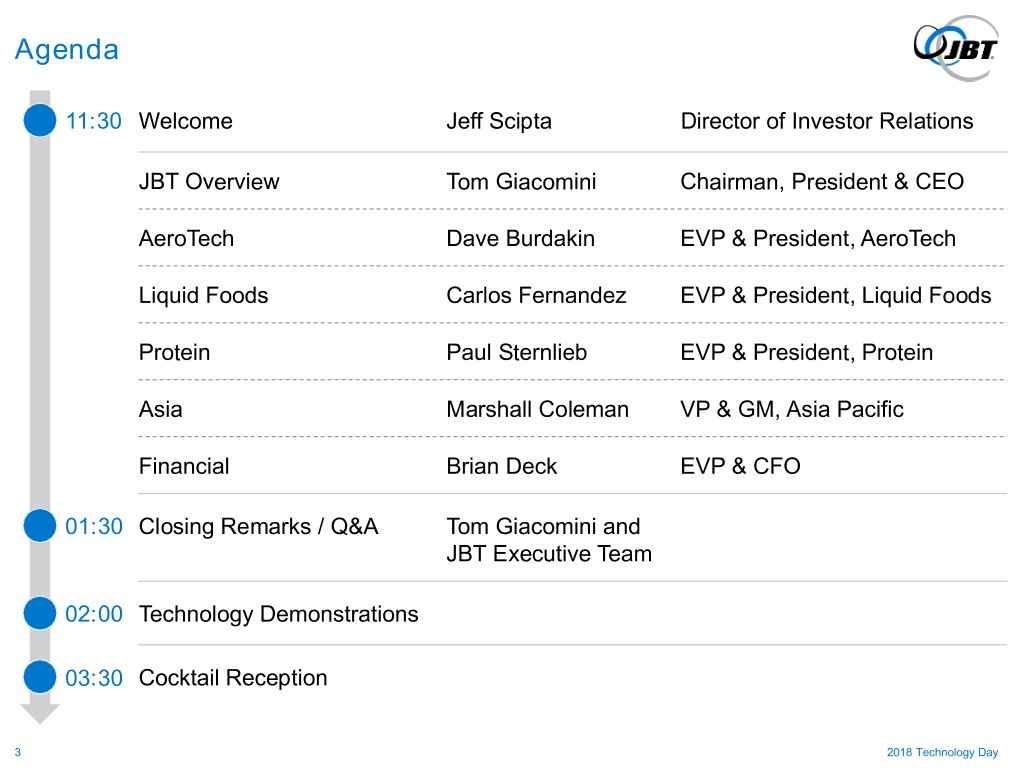

Agenda 11:30 Welcome Jeff Scipta Director of Investor Relations JBT Overview Tom Giacomini Chairman, President & CEO AeroTech Dave Burdakin EVP & President, AeroTech Liquid Foods Carlos Fernandez EVP & President, Liquid Foods Protein Paul Sternlieb EVP & President, Protein Asia Marshall Coleman VP & GM, Asia Pacific Financial Brian Deck EVP & CFO 01:30 Closing Remarks / Q&A Tom Giacomini and JBT Executive Team 02:00 Technology Demonstrations 03:30 Cocktail Reception 3 2018 Technology Day

JBT Overview Tom Giacomini Chairman, President & CEO 4 2018 Technology Day

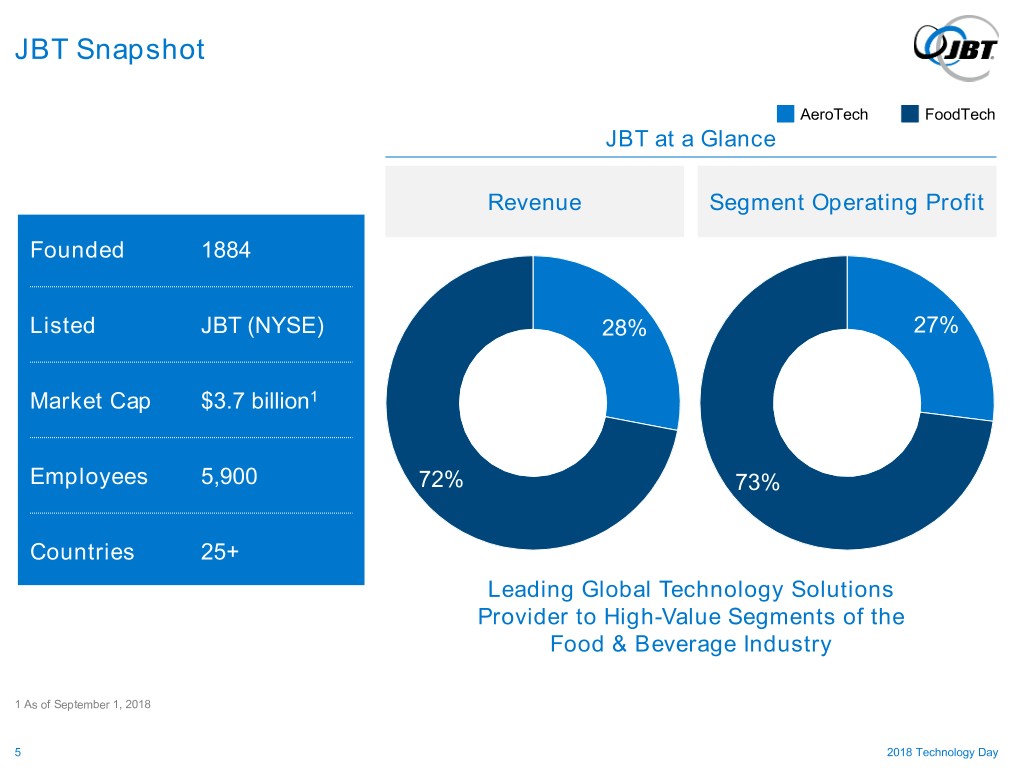

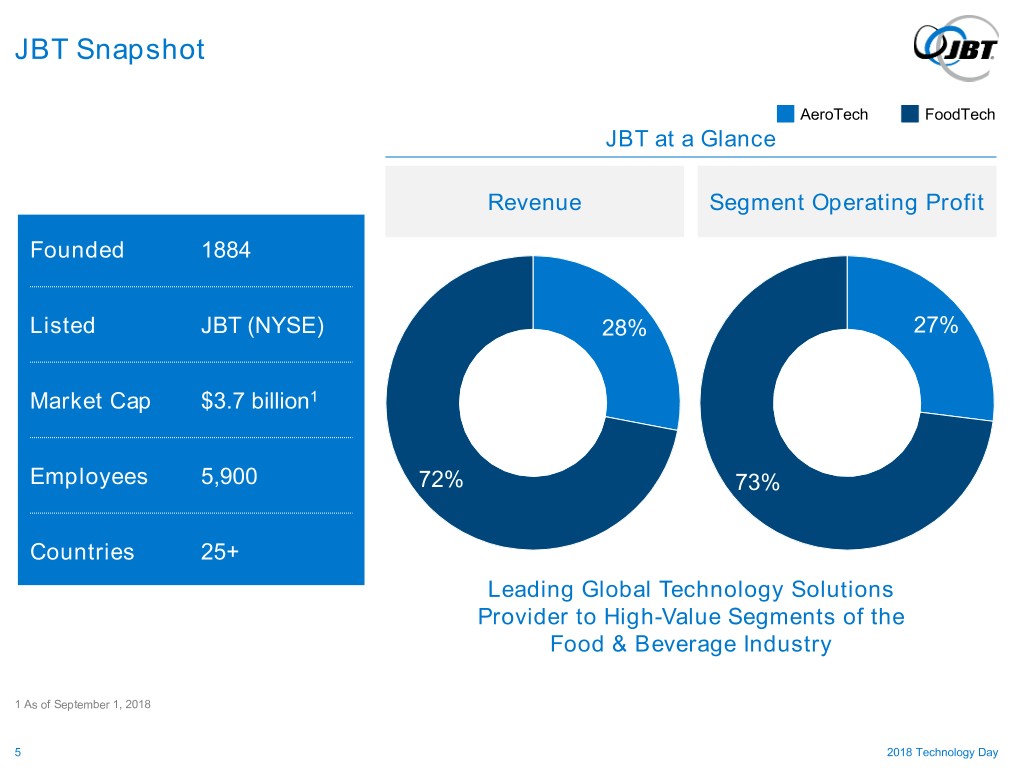

JBT Snapshot AeroTech FoodTech JBT at a Glance Revenue Segment Operating Profit Founded 1884 Listed JBT (NYSE) 28% 27% Market Cap $3.7 billion1 Employees 5,900 72% 73% Countries 25+ Leading Global Technology Solutions Provider to High-Value Segments of the Food & Beverage Industry 1 As of September 1, 2018 5 2018 Technology Day

One JBT: A Sustainable Growth Culture ONE Purpose and Set of Values Across the Entire Organization 6 2018 Technology Day

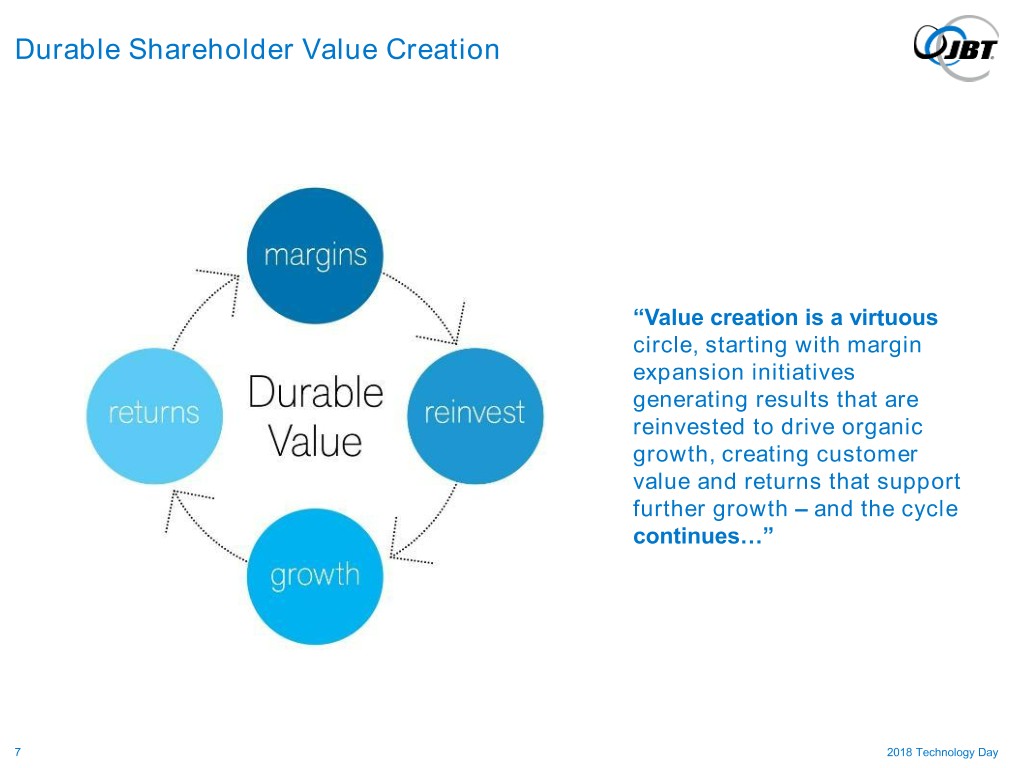

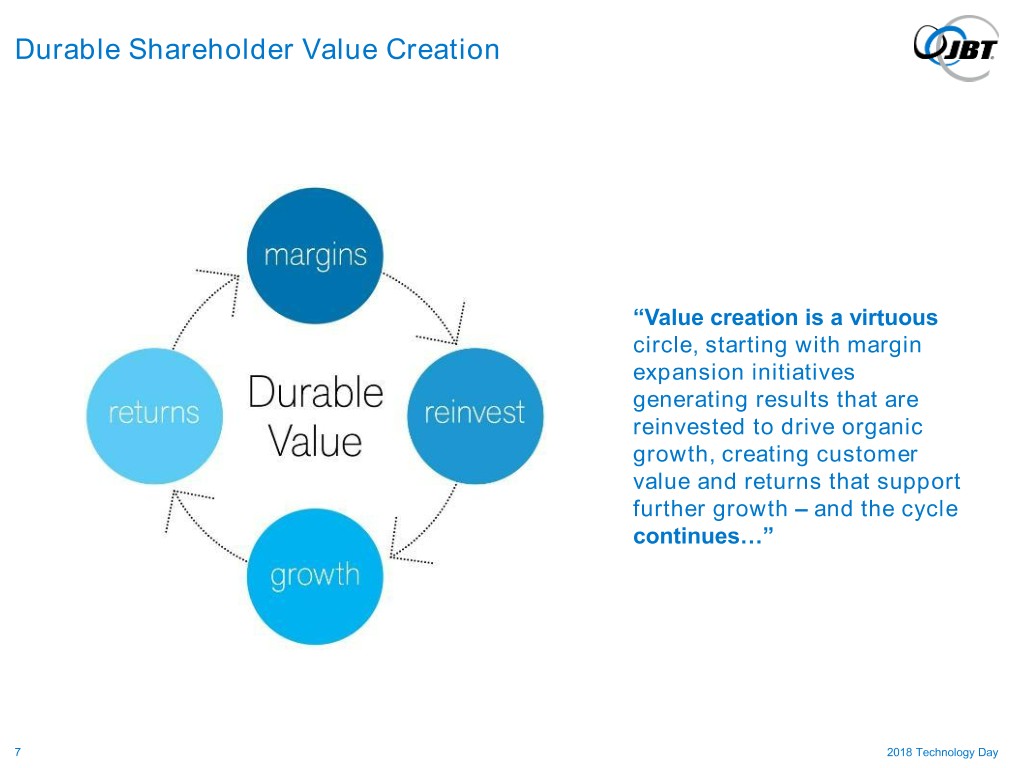

Durable Shareholder Value Creation “Value creation is a virtuous circle, starting with margin expansion initiatives generating results that are Returns reinvested to drive organic growth, creating customer value and returns that support further growth – and the cycle continues…” 7 2018 Technology Day

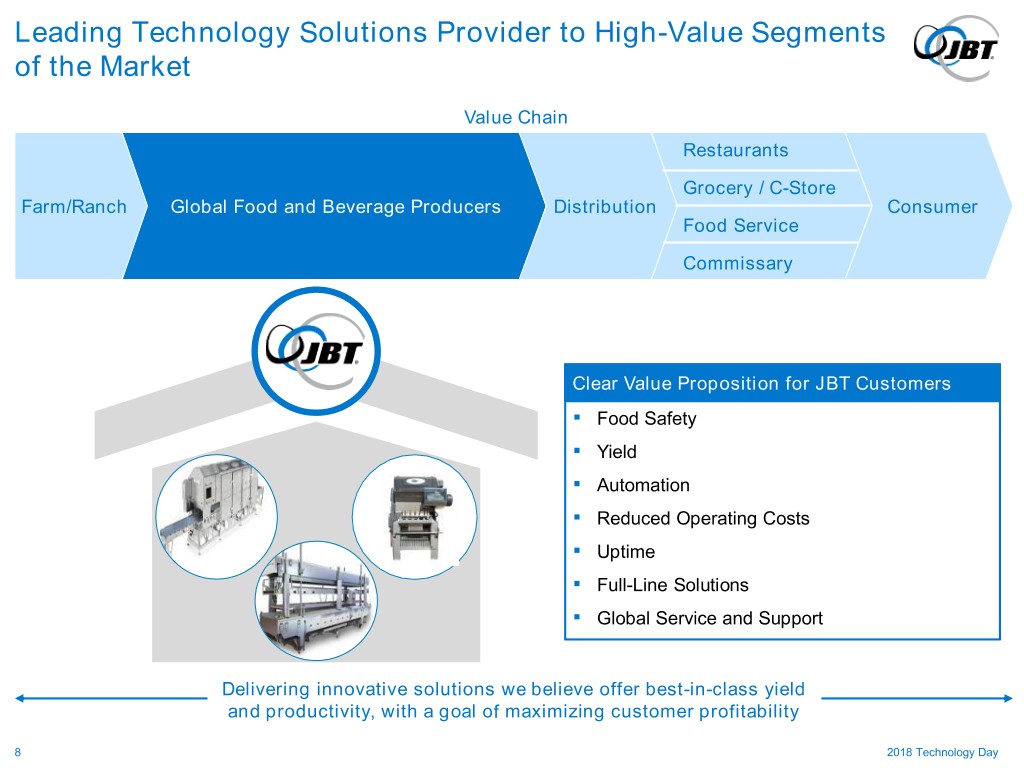

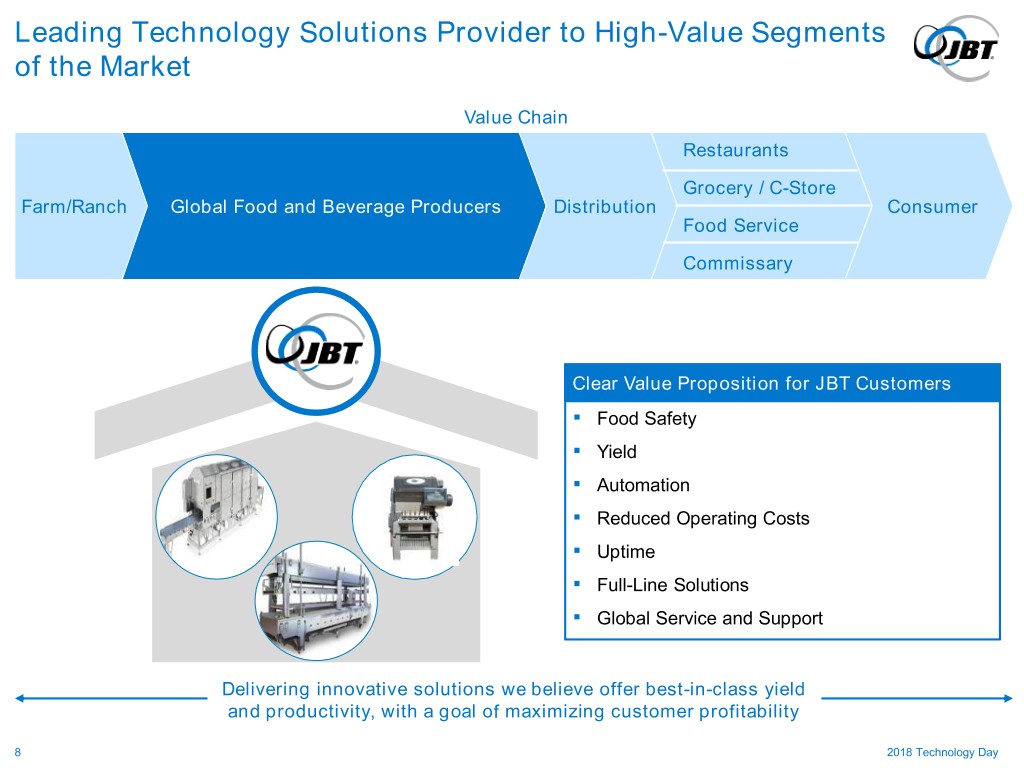

Leading Technology Solutions Provider to High-Value Segments of the Market Value Chain Restaurants Grocery / C-Store Farm/Ranch Global Food and Beverage Producers Distribution Consumer Food Service Commissary Clear Value Proposition for JBT Customers ▪ Food Safety ▪ Yield ▪ Automation ▪ Reduced Operating Costs ▪ Uptime ▪ Full-Line Solutions ▪ Global Service and Support Delivering innovative solutions we believe offer best-in-class yield and productivity, with a goal of maximizing customer profitability 8 2018 Technology Day

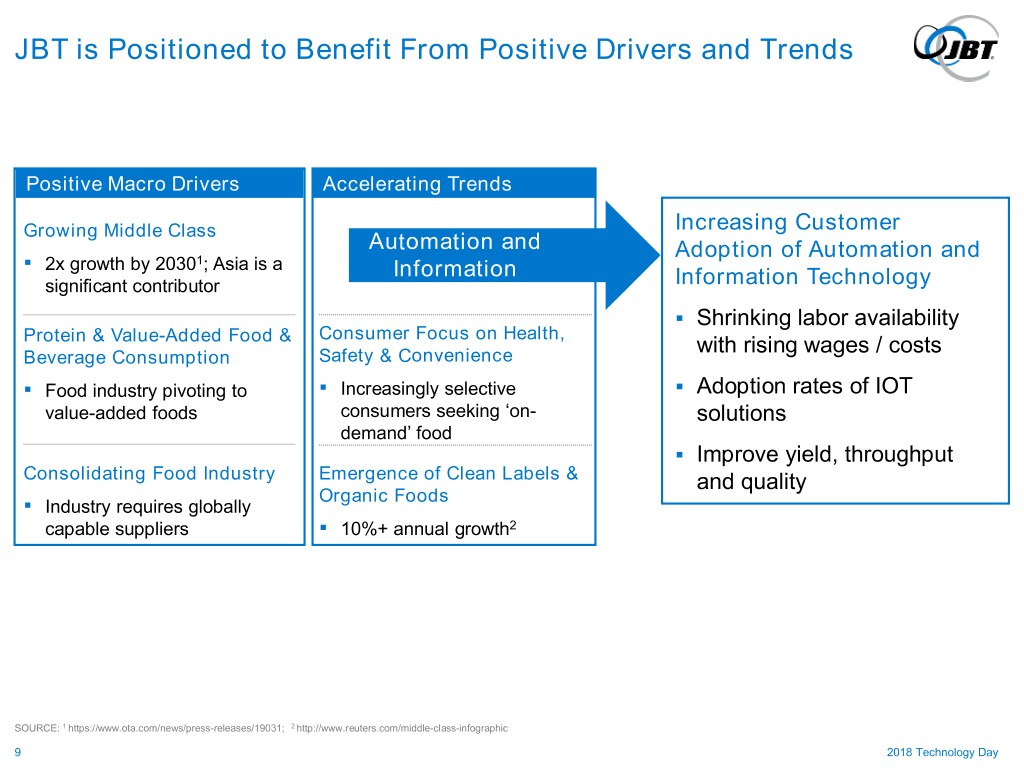

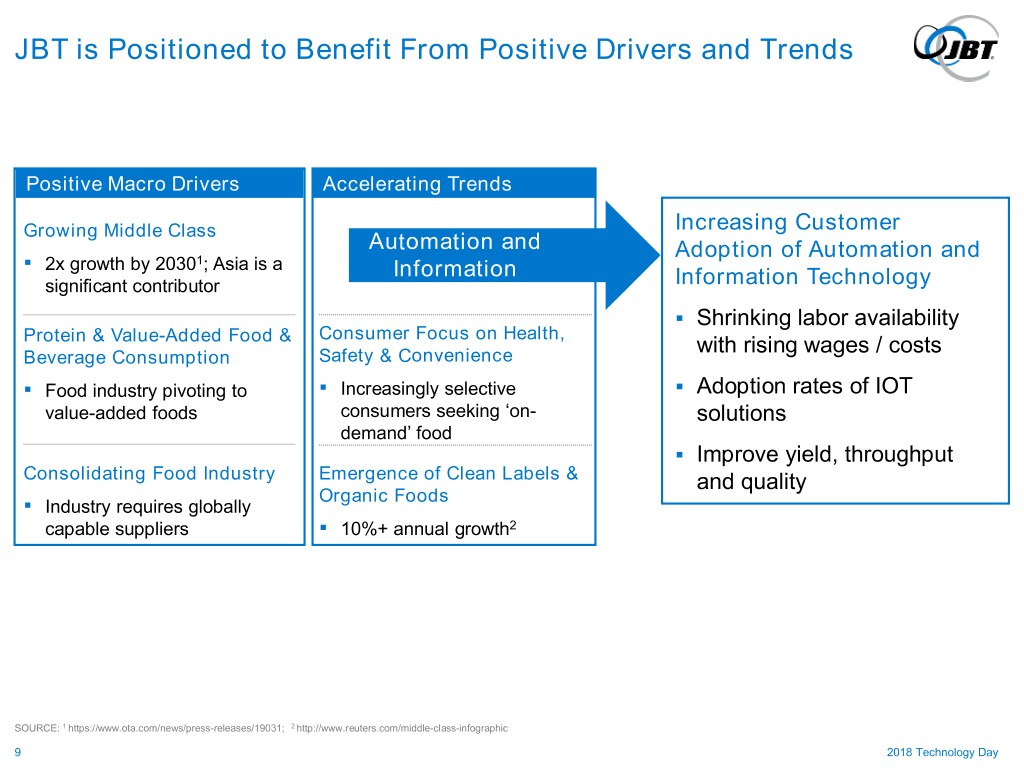

JBT is Positioned to Benefit From Positive Drivers and Trends Positive Macro Drivers Accelerating Trends Growing Middle Class Increasing Customer Automation and Adoption of Automation and ▪ 2x growth by 20301; Asia is a Information significant contributor Information Technology . Shrinking labor availability Consumer Focus on Health, Protein & Value-Added Food & with rising wages / costs Beverage Consumption Safety & Convenience . ▪ Food industry pivoting to ▪ Increasingly selective Adoption rates of IOT value-added foods consumers seeking ‘on- solutions demand’ food . Improve yield, throughput Consolidating Food Industry Emergence of Clean Labels & and quality Organic Foods ▪ Industry requires globally capable suppliers ▪ 10%+ annual growth2 SOURCE: 1 https://www.ota.com/news/press-releases/19031; 2 http://www.reuters.com/middle-class-infographic 9 2018 Technology Day

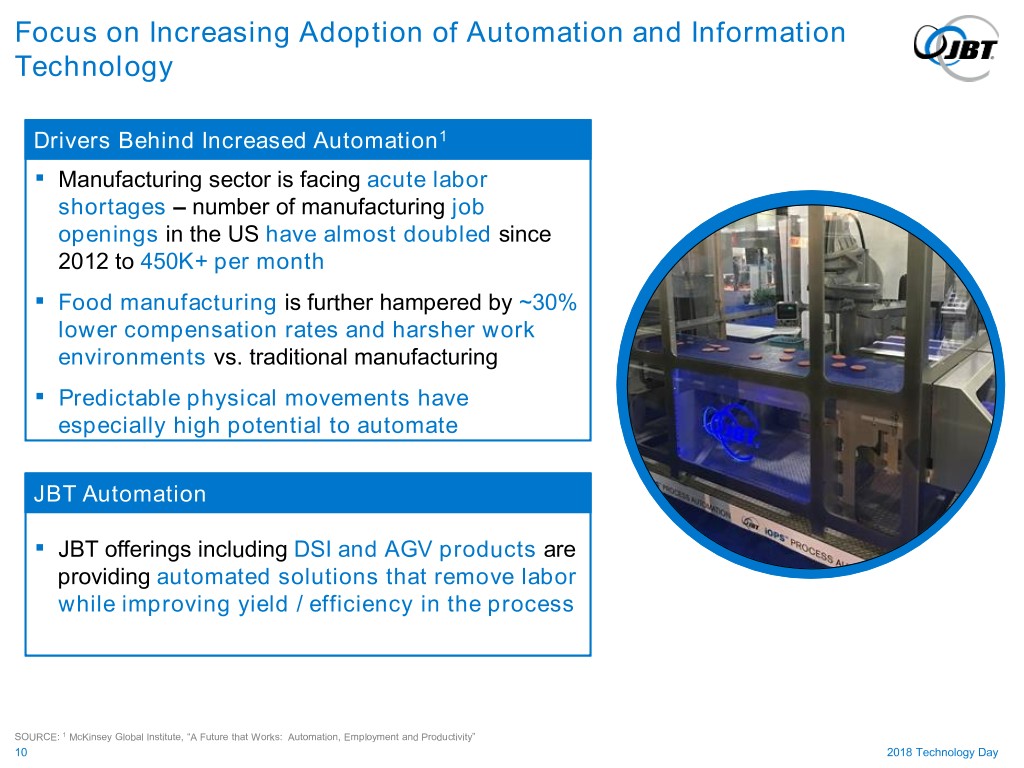

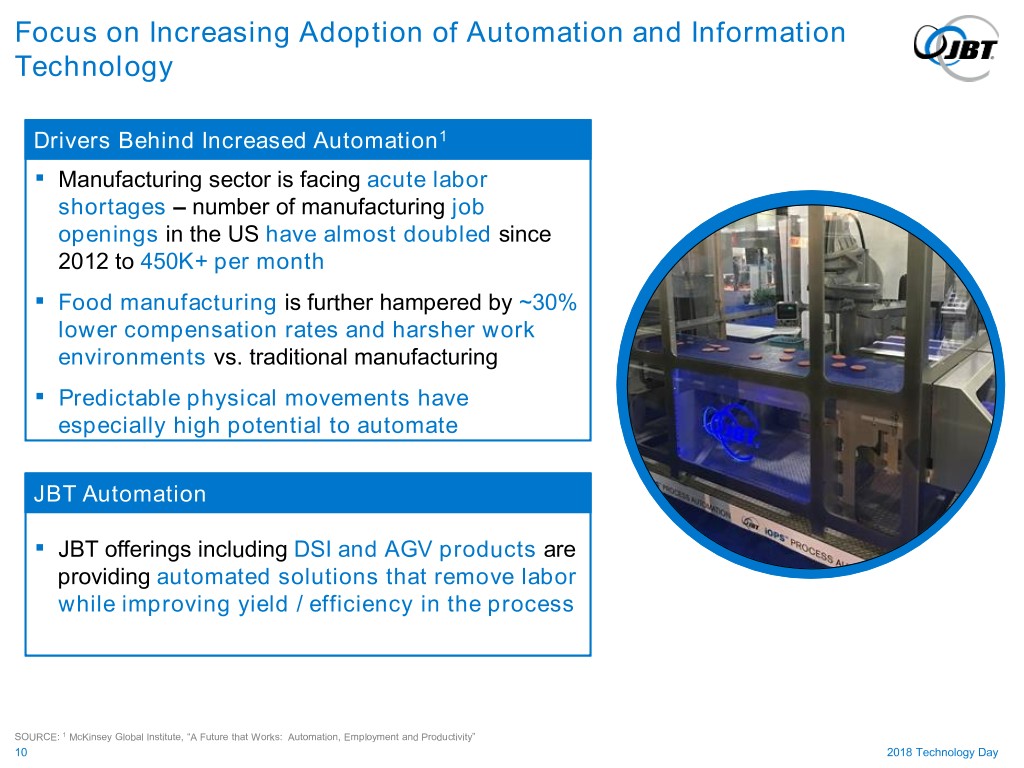

Focus on Increasing Adoption of Automation and Information Technology Drivers Behind Increased Automation1 ▪ Manufacturing sector is facing acute labor shortages – number of manufacturing job openings in the US have almost doubled since 2012 to 450K+ per month ▪ Food manufacturing is further hampered by ~30% lower compensation rates and harsher work environments vs. traditional manufacturing ▪ Predictable physical movements have especially high potential to automate JBT Automation ▪ JBT offerings including DSI and AGV products are providing automated solutions that remove labor while improving yield / efficiency in the process SOURCE: 1 McKinsey Global Institute, “A Future that Works: Automation, Employment and Productivity” 10 2018 Technology Day

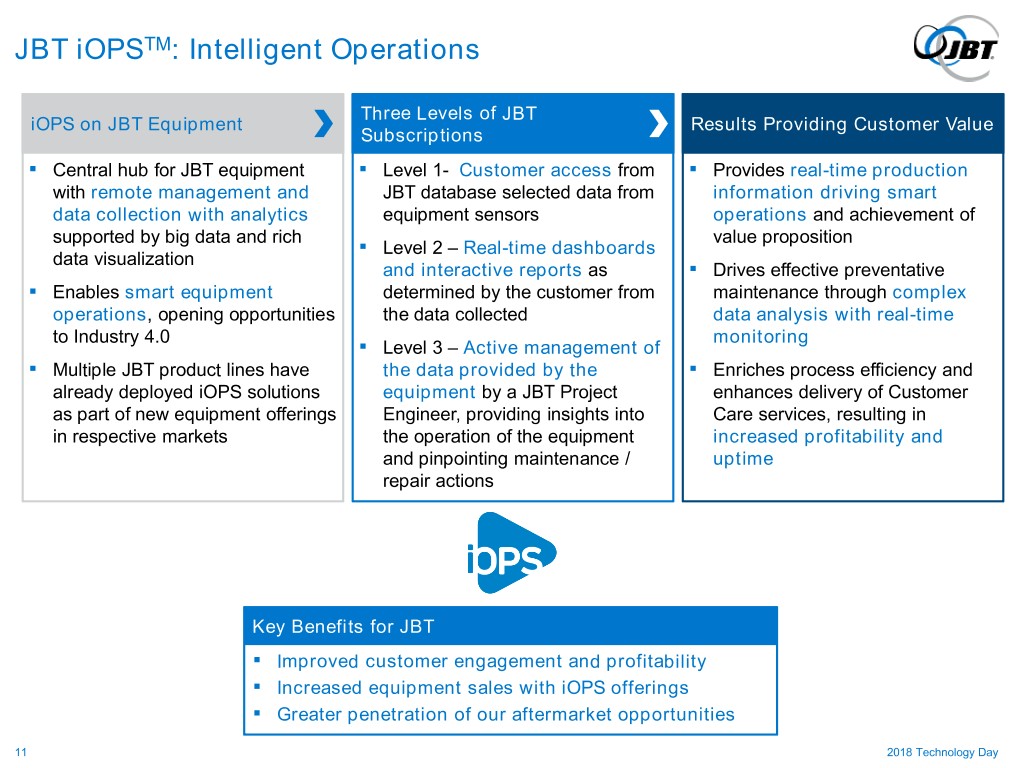

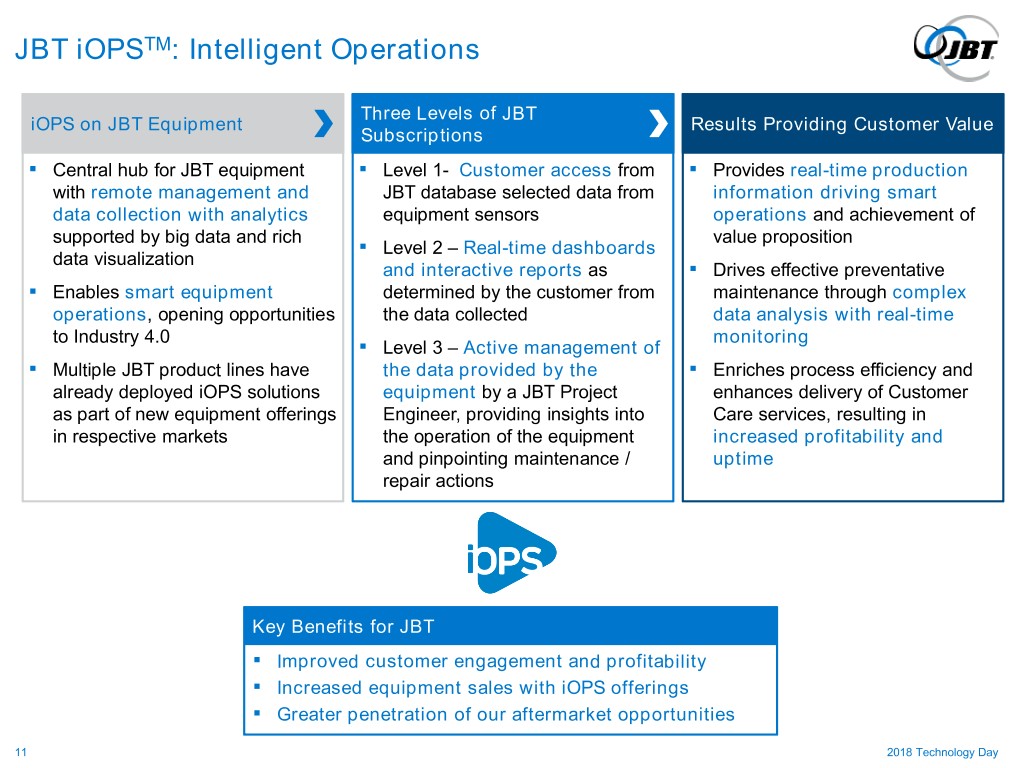

JBT iOPSTM: Intelligent Operations Three Levels of JBT iOPS on JBT Equipment Results Providing Customer Value Subscriptions ▪ Central hub for JBT equipment ▪ Level 1- Customer access from ▪ Provides real-time production with remote management and JBT database selected data from information driving smart data collection with analytics equipment sensors operations and achievement of supported by big data and rich value proposition ▪ Level 2 – Real-time dashboards data visualization and interactive reports as ▪ Drives effective preventative ▪ Enables smart equipment determined by the customer from maintenance through complex operations, opening opportunities the data collected data analysis with real-time to Industry 4.0 monitoring ▪ Level 3 – Active management of ▪ Multiple JBT product lines have the data provided by the ▪ Enriches process efficiency and already deployed iOPS solutions equipment by a JBT Project enhances delivery of Customer as part of new equipment offerings Engineer, providing insights into Care services, resulting in in respective markets the operation of the equipment increased profitability and and pinpointing maintenance / uptime repair actions Key Benefits for JBT ▪ Improved customer engagement and profitability ▪ Increased equipment sales with iOPS offerings ▪ Greater penetration of our aftermarket opportunities 11 2018 Technology Day

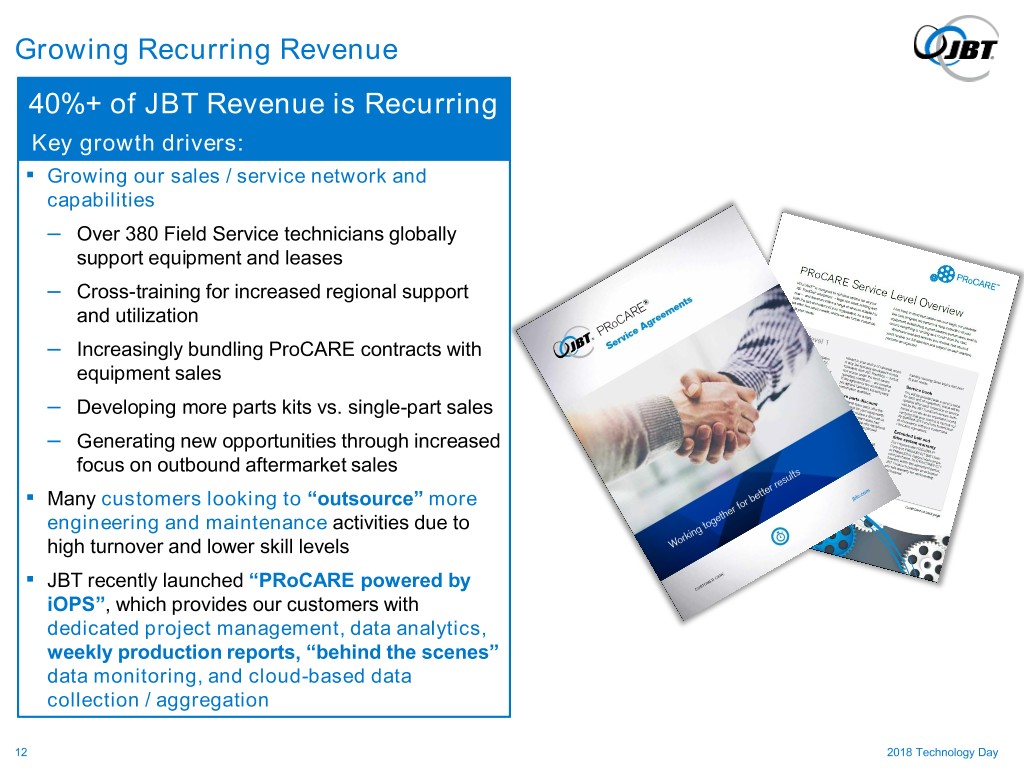

Growing Recurring Revenue 40%+ of JBT Revenue is Recurring Key growth drivers: ▪ Growing our sales / service network and capabilities – Over 380 Field Service technicians globally support equipment and leases – Cross-training for increased regional support and utilization – Increasingly bundling ProCARE contracts with equipment sales – Developing more parts kits vs. single-part sales – Generating new opportunities through increased focus on outbound aftermarket sales ▪ Many customers looking to “outsource” more engineering and maintenance activities due to high turnover and lower skill levels ▪ JBT recently launched “PRoCARE powered by iOPS”, which provides our customers with dedicated project management, data analytics, weekly production reports, “behind the scenes” data monitoring, and cloud-based data collection / aggregation 12 2018 Technology Day

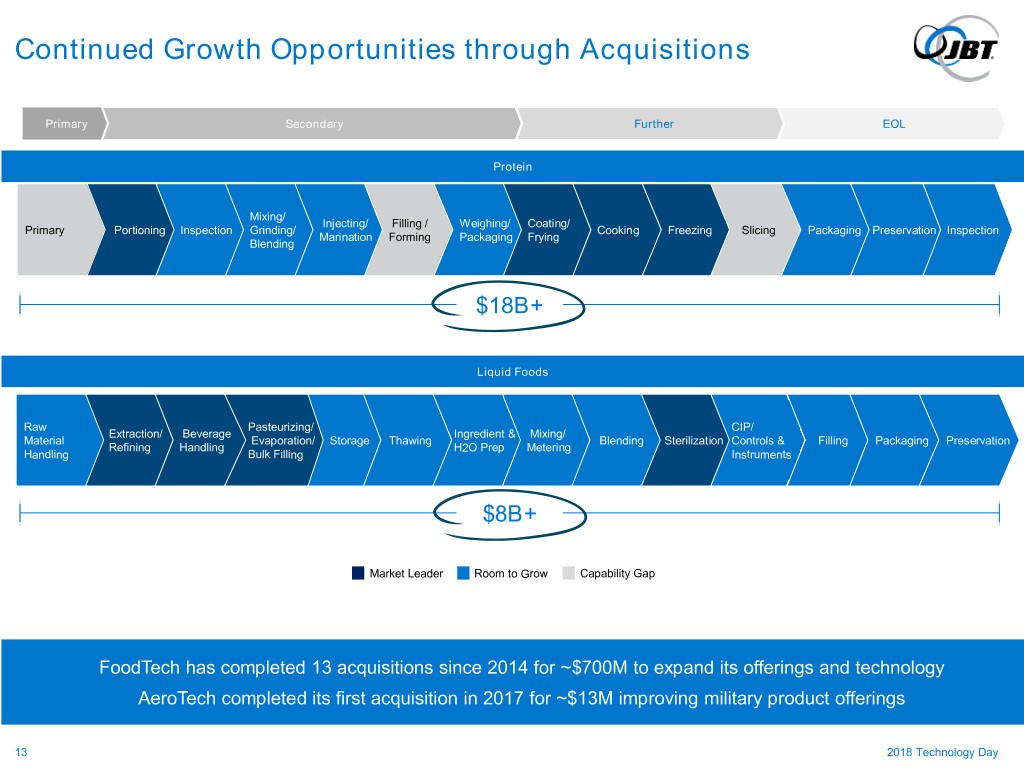

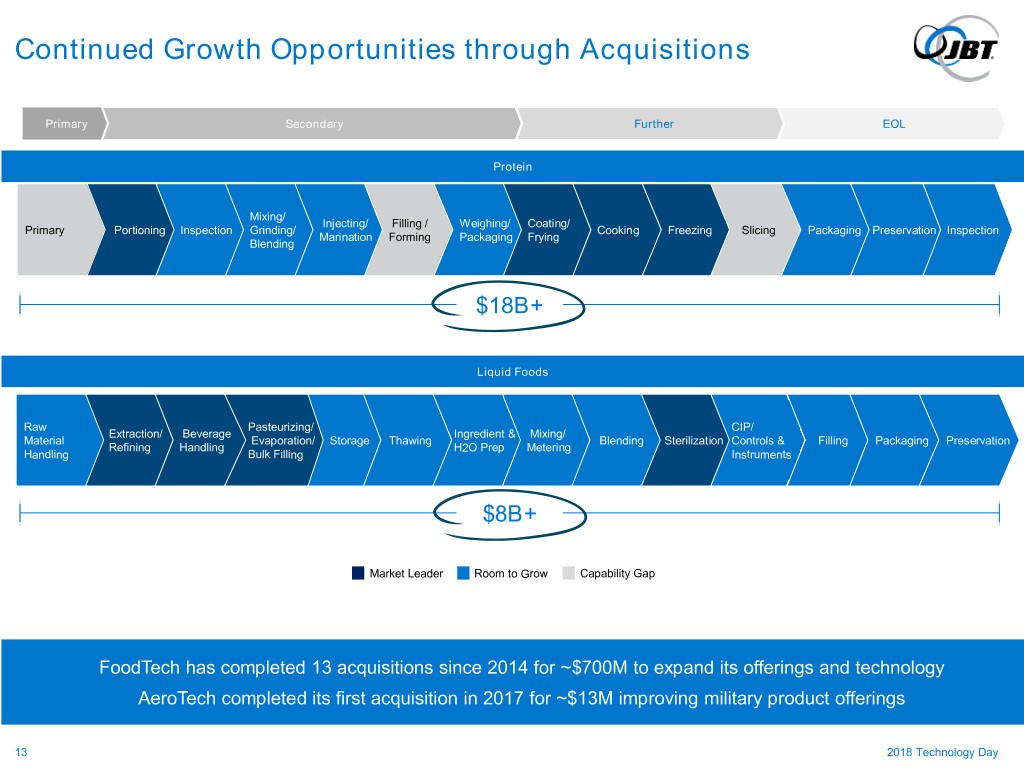

Continued Growth Opportunities through Acquisitions Primary Secondary Further EOL Protein Mixing/ Injecting/ Filling / Weighing/ Coating/ Primary Portioning Inspection Grinding/ Cooking Freezing Slicing Packaging Preservation Inspection Marination Forming Packaging Frying Blending $18B+ Liquid Foods Raw Pasteurizing/ CIP/ Extraction/ Beverage Ingredient & Mixing/ Material Evaporation/ Storage Thawing Blending Sterilization Controls & Filling Packaging Preservation Refining Handling H2O Prep Metering Handling Bulk Filling Instruments $8B+ Market Leader Room to Grow Capability Gap FoodTech has completed 13 acquisitions since 2014 for ~$700M to expand its offerings and technology AeroTech completed its first acquisition in 2017 for ~$13M improving military product offerings 13 2018 Technology Day

AeroTech Dave Burdakin EVP & President, AeroTech 14 2018 Technology Day

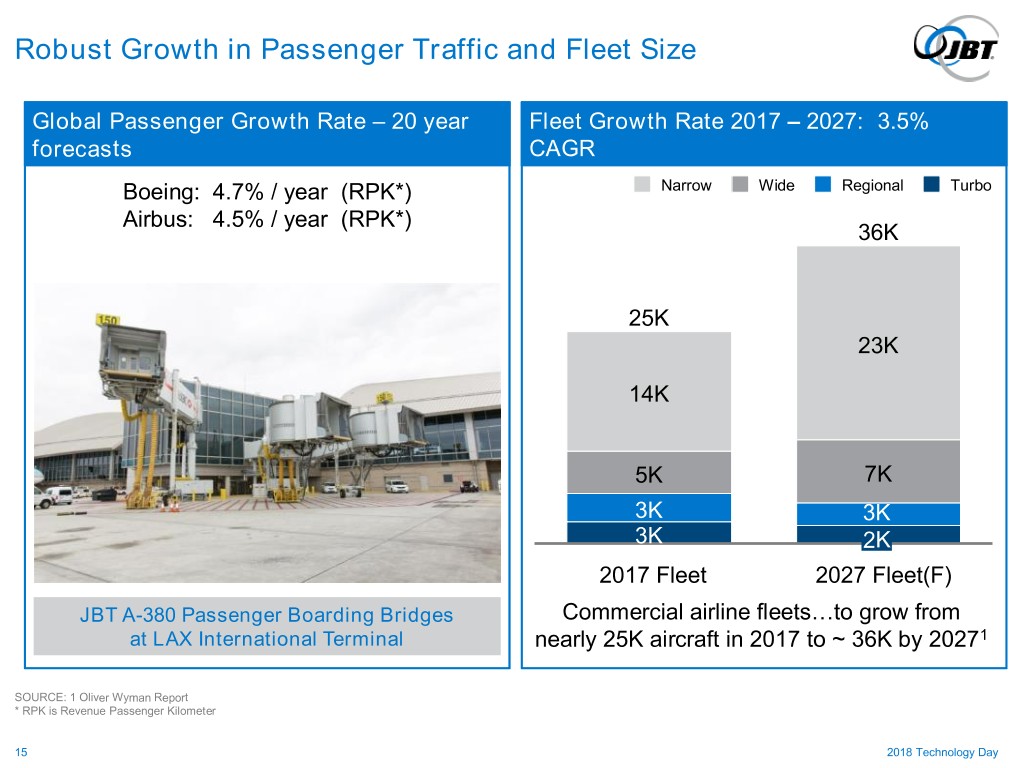

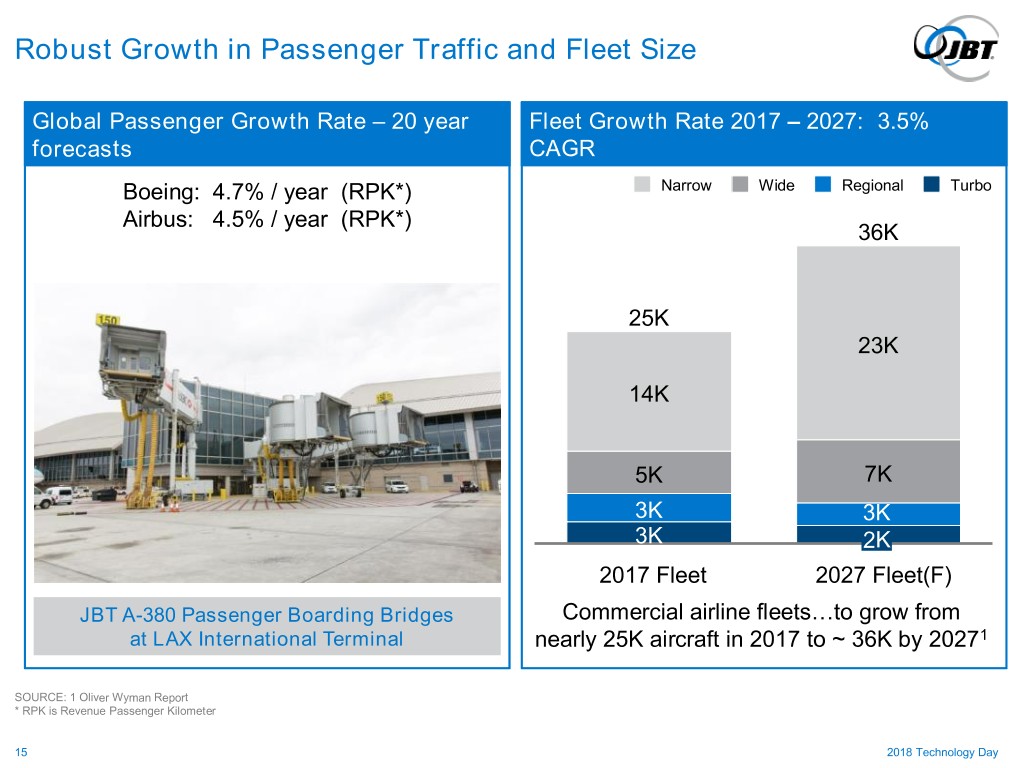

Robust Growth in Passenger Traffic and Fleet Size Global Passenger Growth Rate – 20 year Fleet Growth Rate 2017 – 2027: 3.5% forecasts CAGR Boeing: 4.7% / year (RPK*) Narrow Wide Regional Turbo Airbus: 4.5% / year (RPK*) 36K 25K 23K 14K 5K 7K 3K 3K 3K 2K 2017 Fleet 2027 Fleet(F) JBT A-380 Passenger Boarding Bridges Commercial airline fleets…to grow from at LAX International Terminal nearly 25K aircraft in 2017 to ~ 36K by 20271 SOURCE: 1 Oliver Wyman Report * RPK is Revenue Passenger Kilometer 15 2018 Technology Day

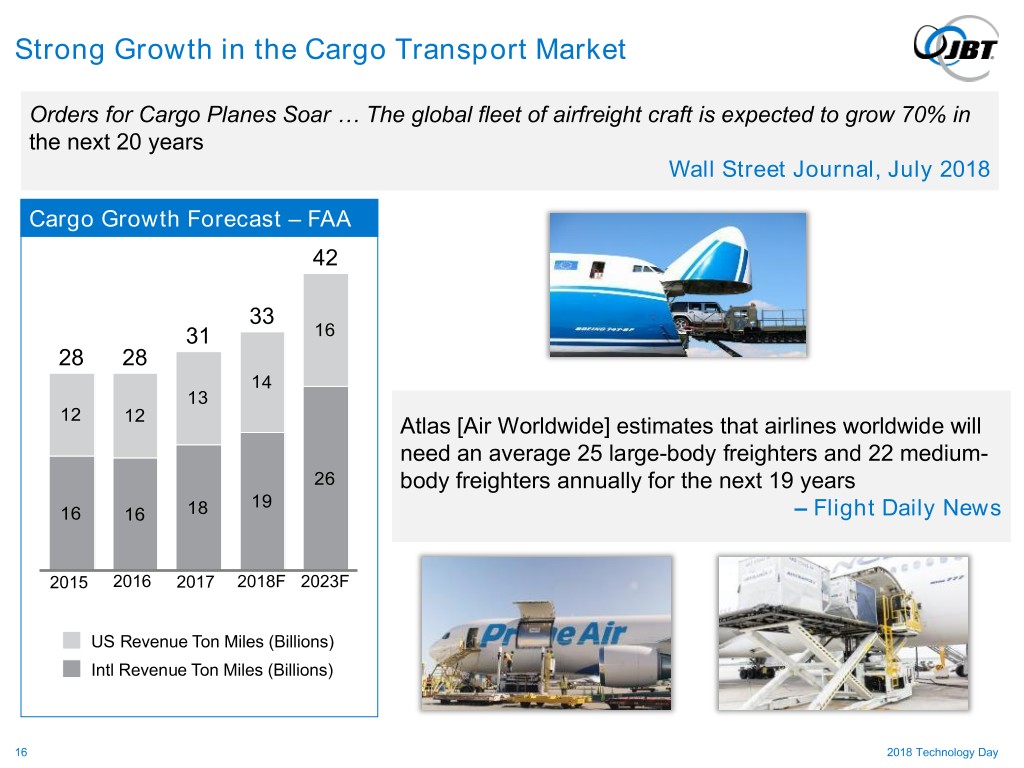

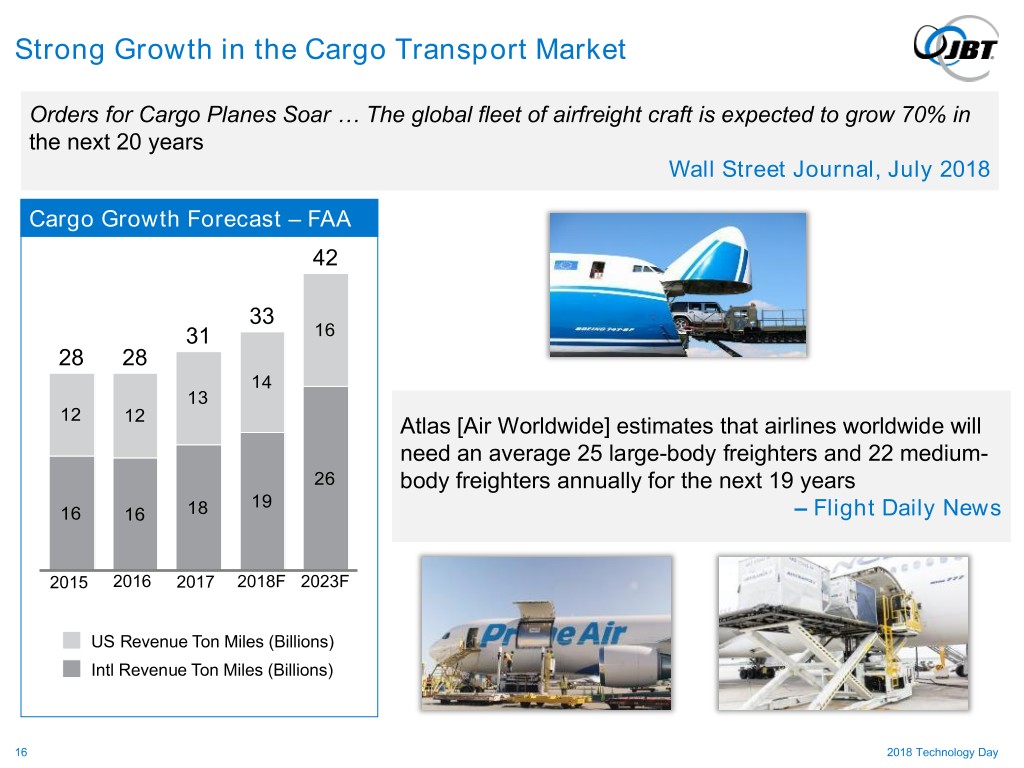

Strong Growth in the Cargo Transport Market Orders for Cargo Planes Soar … The global fleet of airfreight craft is expected to grow 70% in the next 20 years Wall Street Journal, July 2018 Cargo Growth Forecast – FAA 42 33 31 16 28 28 14 13 12 12 Atlas [Air Worldwide] estimates that airlines worldwide will need an average 25 large-body freighters and 22 medium- 26 body freighters annually for the next 19 years 19 16 16 18 – Flight Daily News 2015 2016 2017 2018F 2023F US Revenue Ton Miles (Billions) Intl Revenue Ton Miles (Billions) 16 2018 Technology Day

Other Market Drivers Fixed Equipment Drivers $20B / year needed for airport Airport Infrastructure Spending upgrades1 ▪ Both airlines and airports improving facilities Need to Improve Operational Efficiencies $7.6B / year needed for airport ▪ Reduce turn times terminal upgrades – often includes 1 ▪ Improve asset utilization and productivity new bridges Fixed & Mobile Equipment Drivers Minimizing Aircraft Damage ▪ Automation and aircraft protection Mobile Equipment Drivers Environmental ▪ Battery powered equipment, lower emission diesel engines Outsourcing to Ground Handling Companies ▪ Seeking lower cost, ease of operation & maintenance Military ▪ New programs and replacement of obsolete GSE SOURCE: 1 ACI Airport Survey 17 2018 Technology Day

New Product Development – AgileAirTM Key Features Value Proposition ▪ Provides conditioned air, power and bleed air all-in- ▪ Fuel savings one – replaces 2 - 3 legacy units ▪ Noise reduction ▪ F-16 SERD testing completed in Q1 2018 ▪ Single piece of equipment ▪ Significant IP development effort ▪ Easily deployable 18 2018 Technology Day

New Product Development – Gate Monitoring Powered by iOPSTM iOPS: Systems to remotely monitor all gate activity, providing faster aircraft turns, less downtime and lower maintenance costs 19 2018 Technology Day

Success Story – B-Series Tractor Family Situation Results ▪ Aged product line resulting in loss of JBT share ▪ First new development utilizing lean new product development tools ▪ Need for a more cost effective, differentiated solution ▪ Modular product line with common sub-assemblies ▪ Identified and met customers’ primary needs – Easy to Operate – Easy to Maintain – High Reliability Significant Revenue and Margin Growth 20 2018 Technology Day

Success Story – Military HPC Air Conditioner Situation Results ▪ Global military customers needed highly reliable, ▪ Performance – fast scramble fast cooling solution for a wide range of fighter aircraft in extreme weather conditions ▪ Reliability ▪ Application expertise Worldwide Use in Combat and Non-combat Zones 21 2018 Technology Day

Success Story – Ranger Cargo Loader Situation Results ▪ Growth in ground handler market required different ▪ Productivity – fastest cargo loader features than traditional offering ▪ Easy to operate and maintain ▪ Positioned JBT to win with ground handlers Driving Increased Loader Sales and Margin 22 2018 Technology Day

Future Product Development Trends . Electric GSE is accelerating . Auto-docking – operator assist technologies . Collision avoidance: protect the aircraft . Faster turns: keep the aircraft flying . Expanding iOPS and maintenance services capability 23 2018 Technology Day

AeroTech Summary JBT AeroTech ▪ Seeing strong long term growth forecast for market drivers: >GDP ▪ Investing in R&D with a disciplined, Advancing on our market driven product development Organic Growth process Goal to be the Margin Expansion ▪ Adding value for customers – Leading Aviation matching innovations to market Innovation & RCI needs and enhancing our service Equipment capabilities Provider ▪ Executing on RCI to drive further margin improvements 24 2018 Technology Day

FoodTech – Liquid Foods Carlos Fernandez EVP & President, Liquid Foods 25 2018 Technology Day

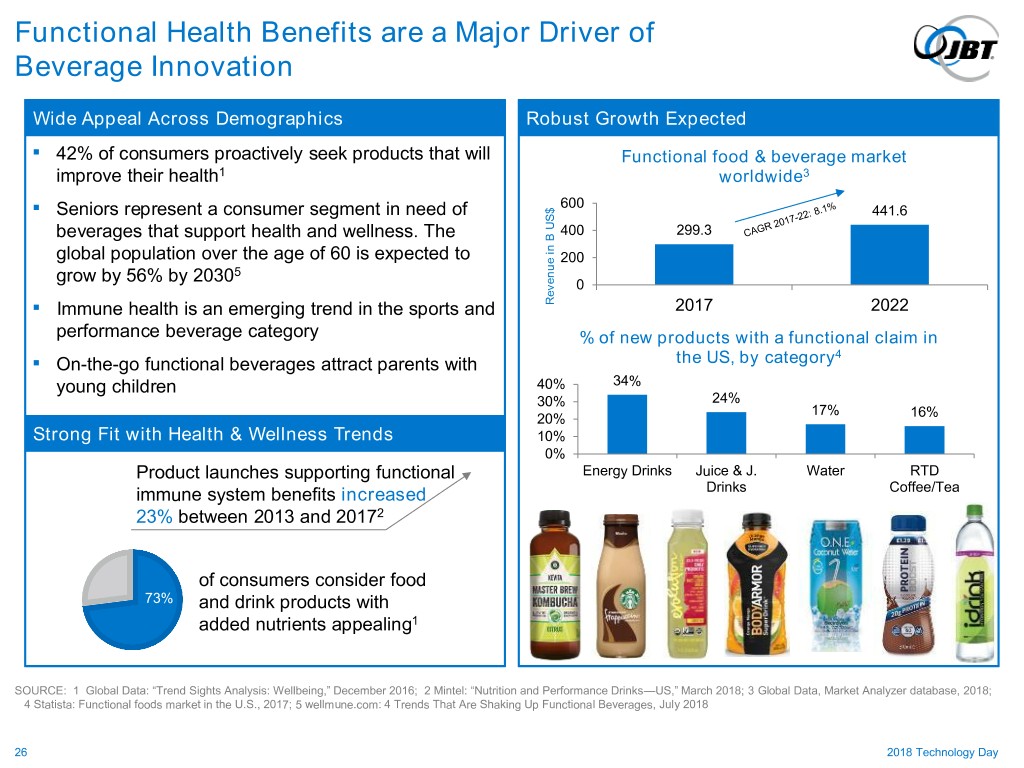

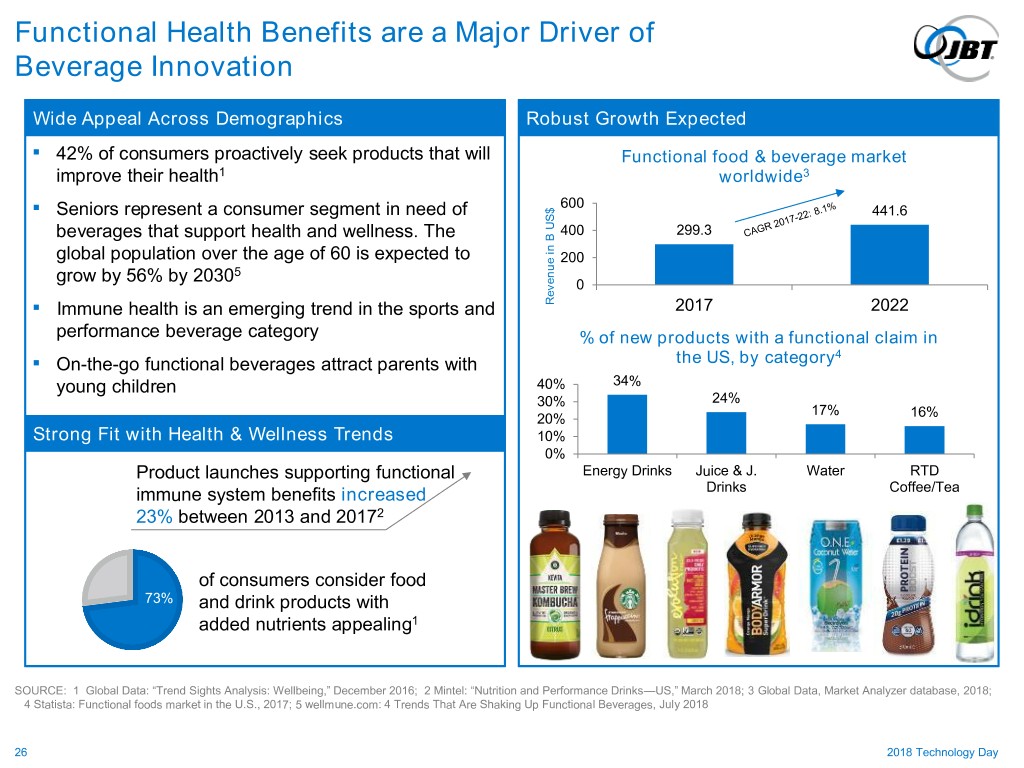

Functional Health Benefits are a Major Driver of Beverage Innovation Wide Appeal Across Demographics Robust Growth Expected ▪ 42% of consumers proactively seek products that will Functional food & beverage market improve their health1 worldwide3 600 ▪ Seniors represent a consumer segment in need of 441.6 beverages that support health and wellness. The 400 299.3 global population over the age of 60 is expected to 200 5 grow by 56% by 2030 0 ▪ Immune health is an emerging trend in the sports and US$ B in Revenue 2017 2022 performance beverage category % of new products with a functional claim in 4 ▪ On-the-go functional beverages attract parents with the US, by category young children 73% of con 40% 34% 30% 24% 17% 20% 16% Strong Fit with Health & Wellness Trends 10% 0% 3K Product launches supporting functional Energy Drinks Juice & J. Water 3KRTD 3K immune system benefits increased Drinks Coffee/Tea 23% between 2013 and 20172 of consumers consider food 73% and drink products with added nutrients appealing1 SOURCE: 1 Global Data: “Trend Sights Analysis: Wellbeing,” December 2016; 2 Mintel: “Nutrition and Performance Drinks—US,” March 2018; 3 Global Data, Market Analyzer database, 2018; 4 Statista: Functional foods market in the U.S., 2017; 5 wellmune.com: 4 Trends That Are Shaking Up Functional Beverages, July 2018 26 2018 Technology Day

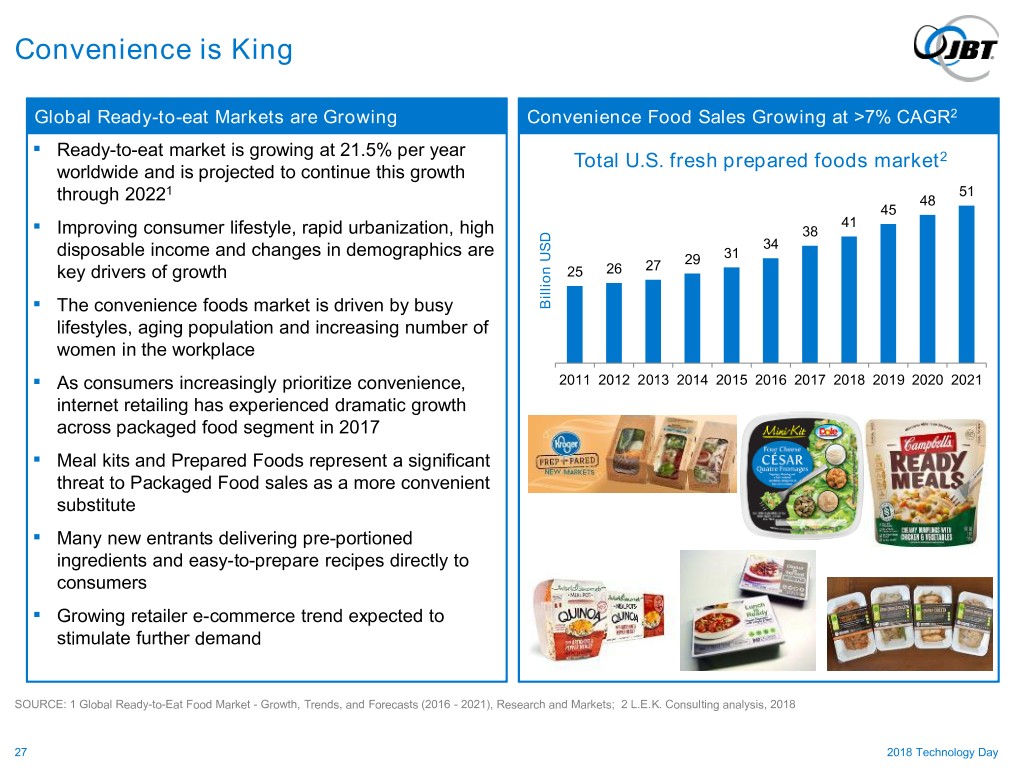

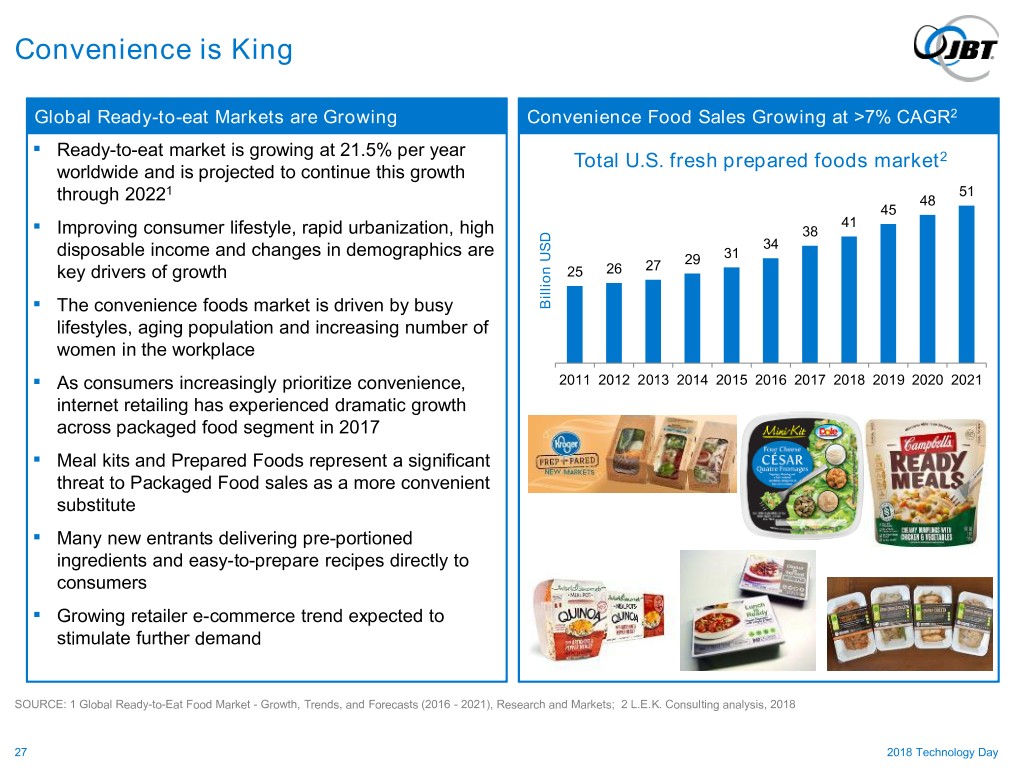

Convenience is King Global Ready-to-eat Markets are Growing Convenience Food Sales Growing at >7% CAGR2 ▪ Ready-to-eat market is growing at 21.5% per year Total U.S. fresh prepared foods market2 worldwide and is projected to continue this growth 1 51 through 2022 48 45 41 ▪ Improving consumer lifestyle, rapid urbanization, high 38 disposable income and changes in demographics are 34 29 31 key drivers of growth 25 26 27 ▪ The convenience foods market is driven by busy Billion USD lifestyles, aging population and increasing number of women in the workplace ▪ As consumers increasingly prioritize convenience, 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 internet retailing has experienced dramatic growth across packaged food segment in 2017 ▪ Meal kits and Prepared Foods represent a significant threat to Packaged Food sales as a more convenient substitute ▪ Many new entrants delivering pre-portioned ingredients and easy-to-prepare recipes directly to consumers ▪ Growing retailer e-commerce trend expected to stimulate further demand SOURCE: 1 Global Ready-to-Eat Food Market - Growth, Trends, and Forecasts (2016 - 2021), Research and Markets; 2 L.E.K. Consulting analysis, 2018 27 2018 Technology Day

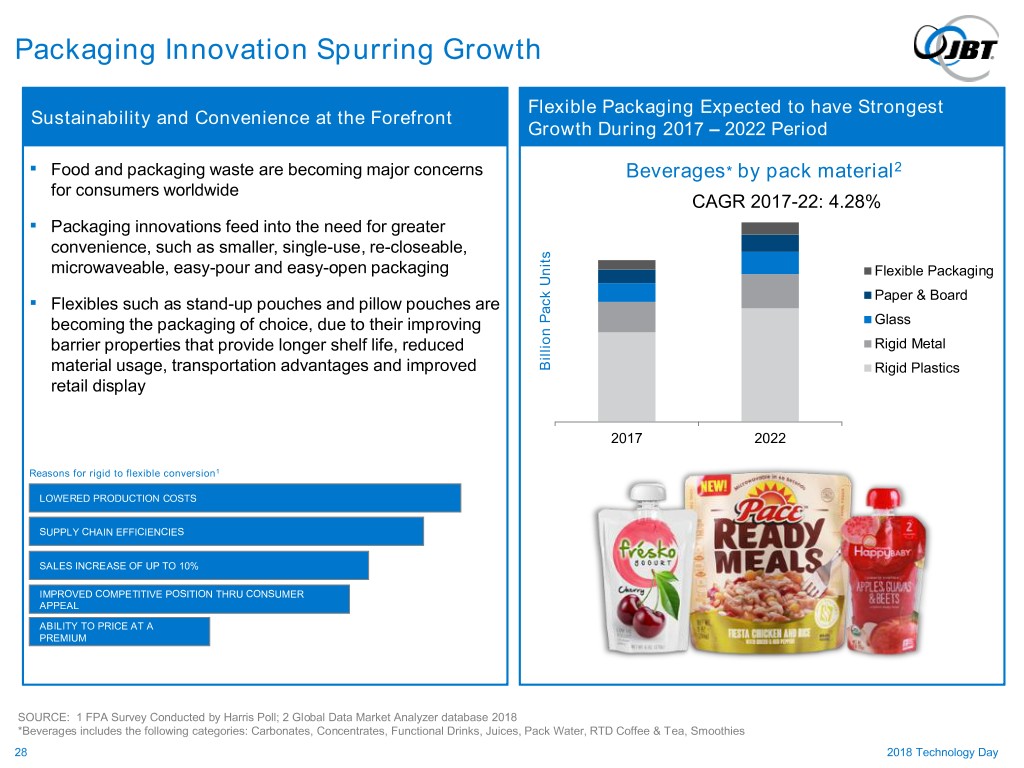

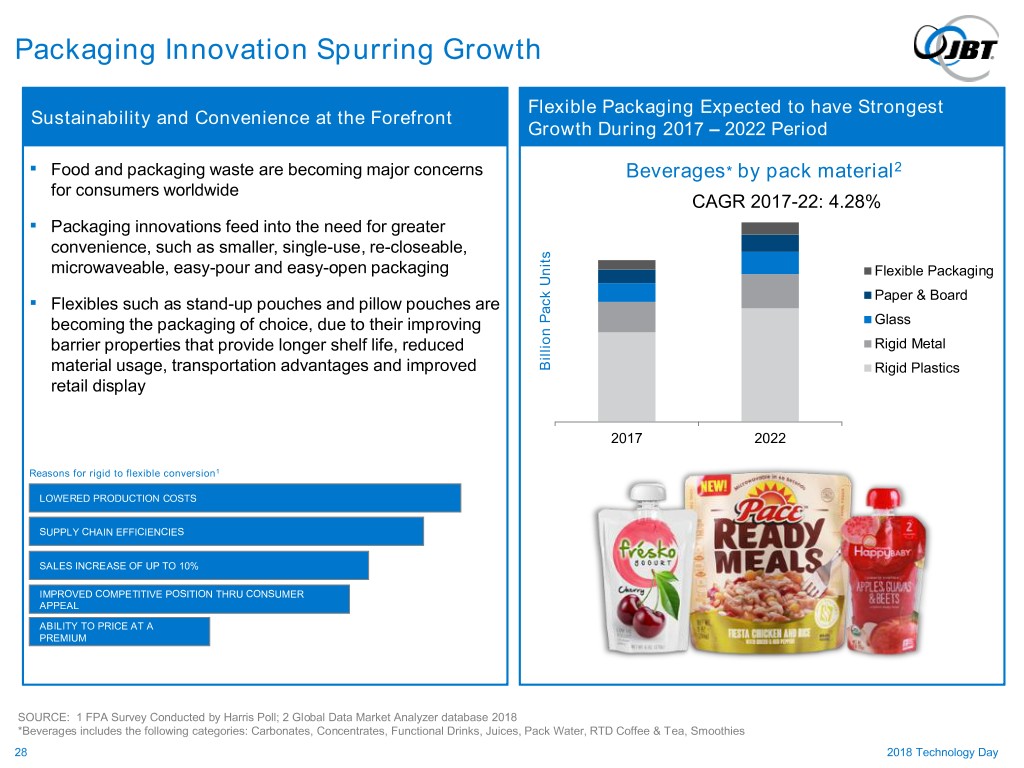

Packaging Innovation Spurring Growth Flexible Packaging Expected to have Strongest Sustainability and Convenience at the Forefront Growth During 2017 – 2022 Period ▪ Food and packaging waste are becoming major concerns Beverages* by pack material2 for consumers worldwide CAGR 2017-22: 4.28% ▪ Packaging innovations feed into the need for greater convenience, such as smaller, single-use, re-closeable, microwaveable, easy-pour and easy-open packaging Flexible Packaging Paper & Board ▪ Flexibles such as stand-up pouches and pillow pouches are becoming the packaging of choice, due to their improving Glass barrier properties that provide longer shelf life, reduced Rigid Metal material usage, transportation advantages and improved Billion Pack Units Rigid Plastics retail display 2017 2022 Reasons for rigid to flexible conversion1 LOWERED PRODUCTION COSTS SUPPLY CHAIN EFFICIENCIES SALES INCREASE OF UP TO 10% IMPROVED COMPETITIVE POSITION THRU CONSUMER APPEAL ABILITY TO PRICE AT A PREMIUM SOURCE: 1 FPA Survey Conducted by Harris Poll; 2 Global Data Market Analyzer database 2018 *Beverages includes the following categories: Carbonates, Concentrates, Functional Drinks, Juices, Pack Water, RTD Coffee & Tea, Smoothies 28 2018 Technology Day

New Product Development – READYGo d-LIMONENE 33 Key Features Value Proposition ▪ Low capital investment alternative leads to quick ▪ Targeted development for mid / small juice IRR investment processors ▪ Recovers valuable ingredients that would otherwise ▪ Major revenue / profit driver for processors go to waste ▪ Reduced labor, improved uptime and yield ▪ Compact footprint for easier installation in existing facilities ▪ Lower capacity solution meets need for large part of the market segment 29 2018 Technology Day

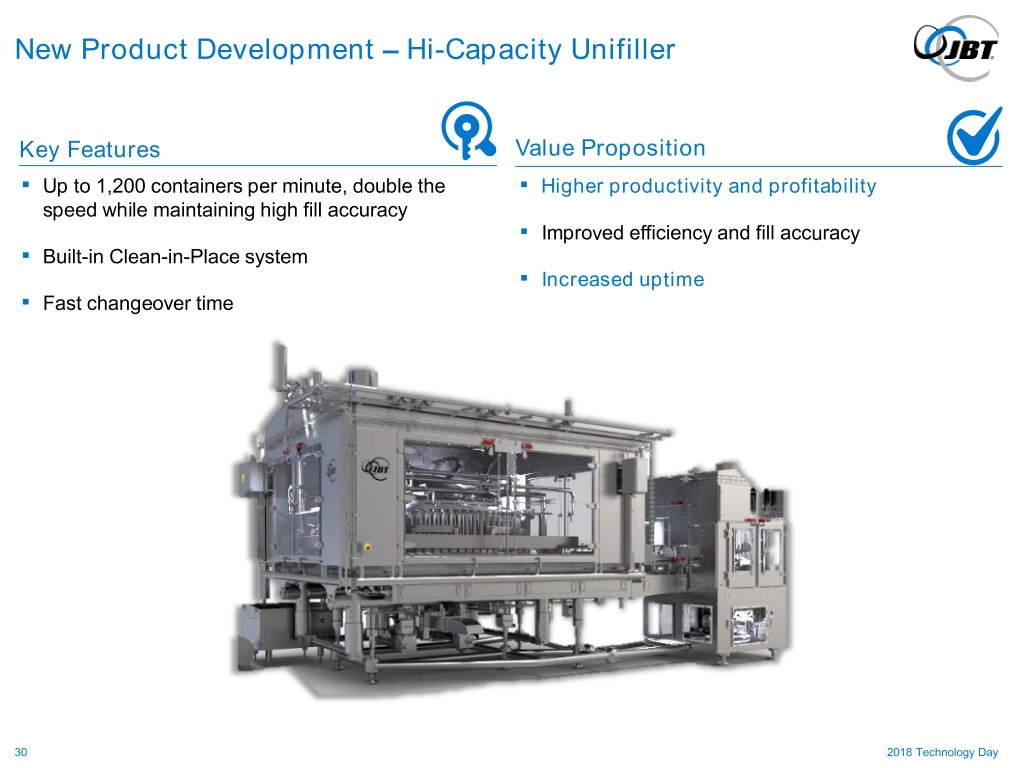

New Product Development – Hi-Capacity Unifiller Key Features Value Proposition ▪ Up to 1,200 containers per minute, double the ▪ Higher productivity and profitability speed while maintaining high fill accuracy ▪ Improved efficiency and fill accuracy ▪ Built-in Clean-in-Place system ▪ Increased uptime ▪ Fast changeover time 30 2018 Technology Day

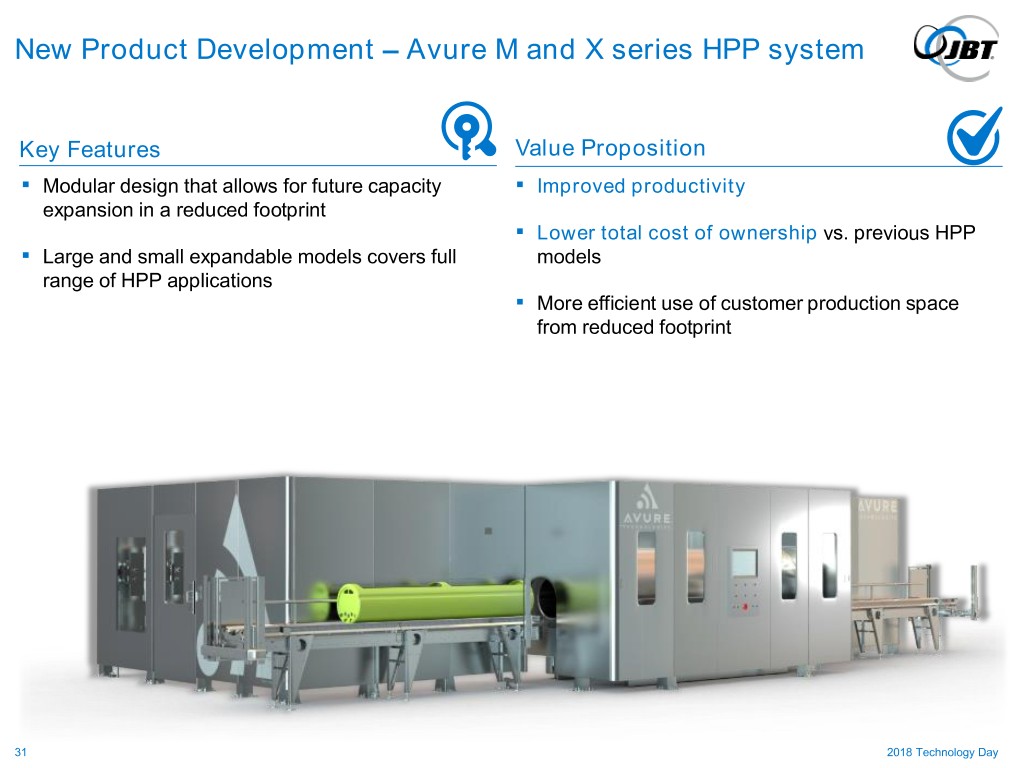

New Product Development – Avure M and X series HPP system Key Features Value Proposition ▪ Modular design that allows for future capacity ▪ Improved productivity expansion in a reduced footprint ▪ Lower total cost of ownership vs. previous HPP ▪ Large and small expandable models covers full models range of HPP applications ▪ More efficient use of customer production space from reduced footprint 31 2018 Technology Day

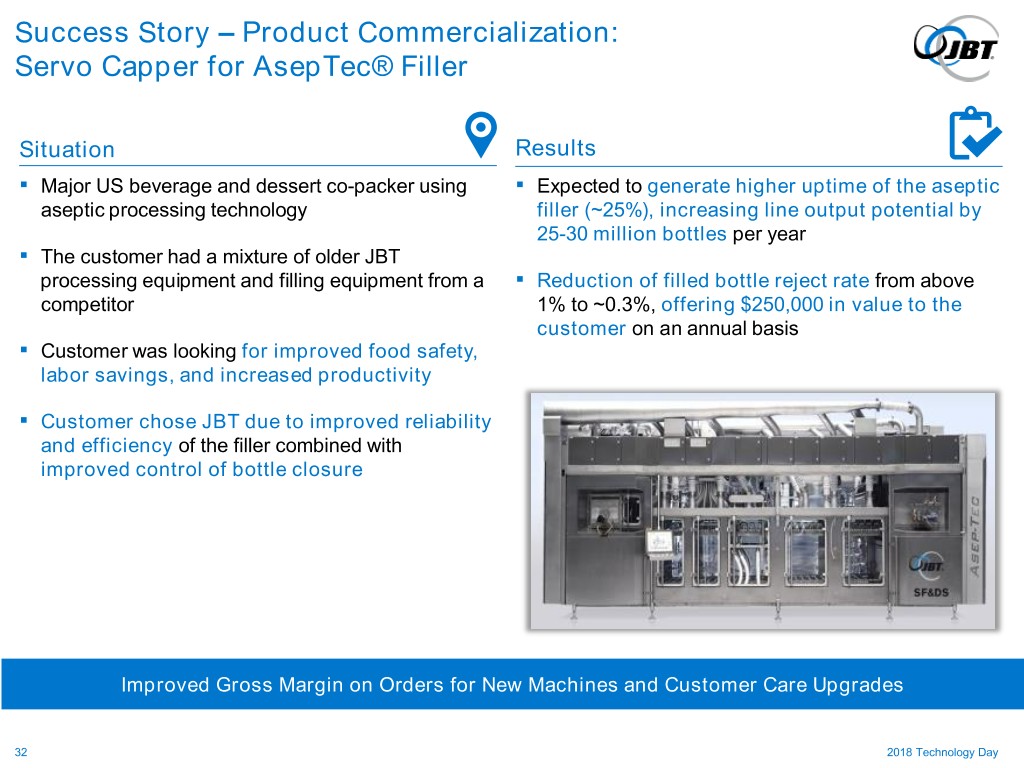

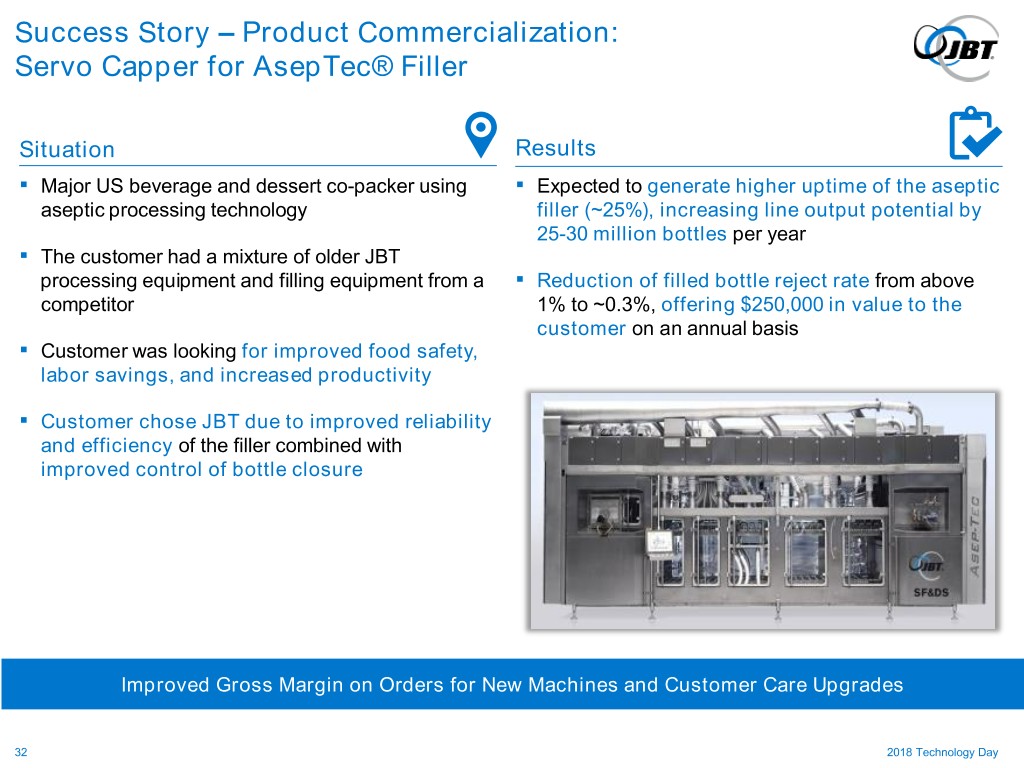

Success Story – Product Commercialization: Servo Capper for AsepTec® Filler Situation Results ▪ Major US beverage and dessert co-packer using ▪ Expected to generate higher uptime of the aseptic aseptic processing technology filler (~25%), increasing line output potential by 25-30 million bottles per year ▪ The customer had a mixture of older JBT processing equipment and filling equipment from a ▪ Reduction of filled bottle reject rate from above competitor 1% to ~0.3%, offering $250,000 in value to the customer on an annual basis ▪ Customer was looking for improved food safety, labor savings, and increased productivity ▪ Customer chose JBT due to improved reliability and efficiency of the filler combined with improved control of bottle closure Improved Gross Margin on Orders for New Machines and Customer Care Upgrades 32 2018 Technology Day

Success Story – Product Commercialization: SeamTecTM for Powder Applications Situation Results ▪ Major dairy producers with global operations are ▪ Resulted in higher capacity of 2.5 - 5.0 million cans expanding their offering of powdered infant formula per year per machine in cans ▪ New process provides gentler can handling which ▪ A customer’s change in their can design placing the minimizes product loss and maximizes overall scoop outside the seal required a significant re- quality for the consumer design of the equipment ▪ Unique six-spindle design achieves higher ▪ JBT used this opportunity to design an entirely new capacities with improved efficiency seamer specifically adapted for the powder industry ▪ Hygienic design reduces risk of contamination while requiring less time to clean New Market Segment Leader 33 2018 Technology Day

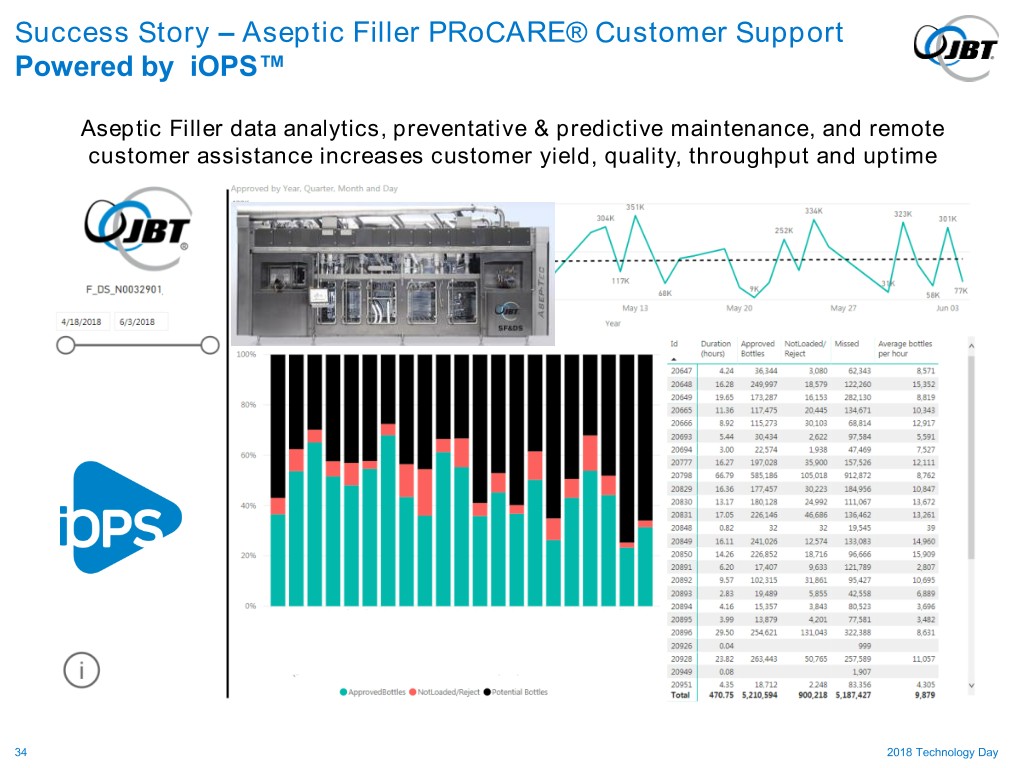

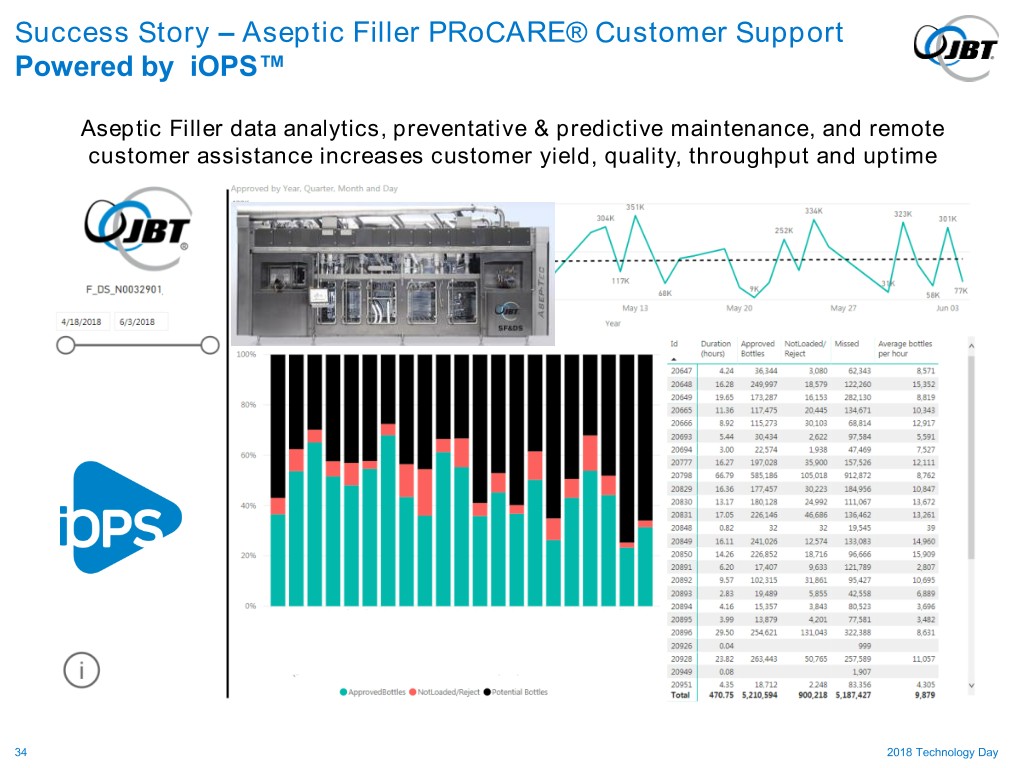

Success Story – Aseptic Filler PRoCARE® Customer Support Powered by iOPS™ Aseptic Filler data analytics, preventative & predictive maintenance, and remote customer assistance increases customer yield, quality, throughput and uptime 34 2018 Technology Day

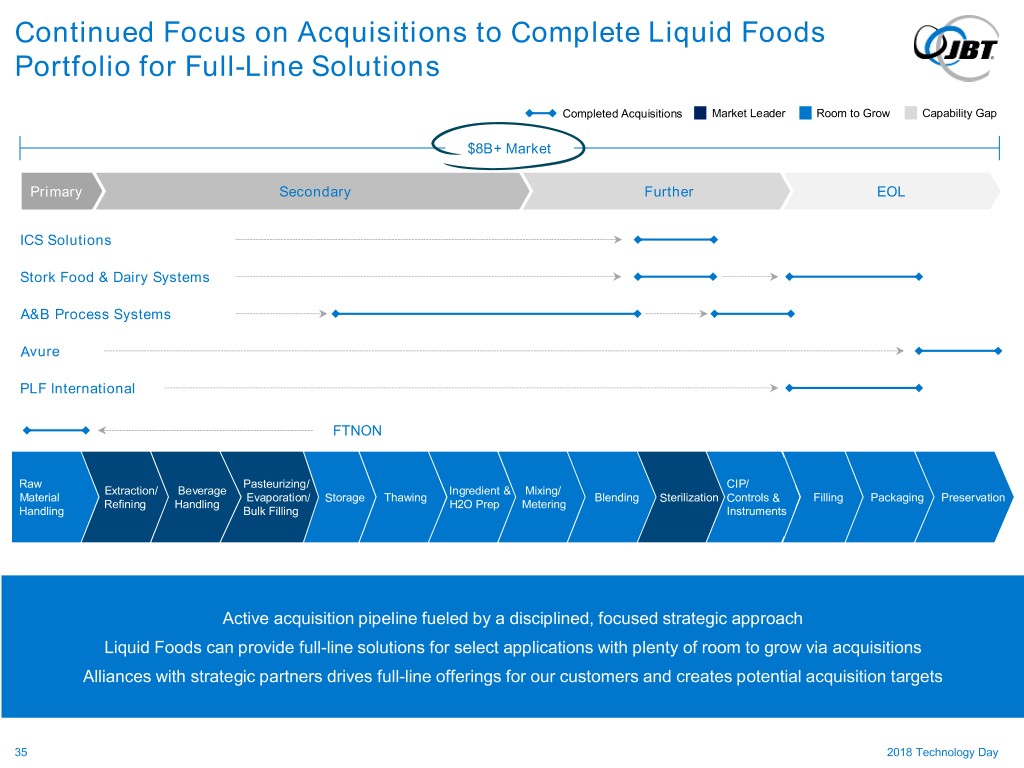

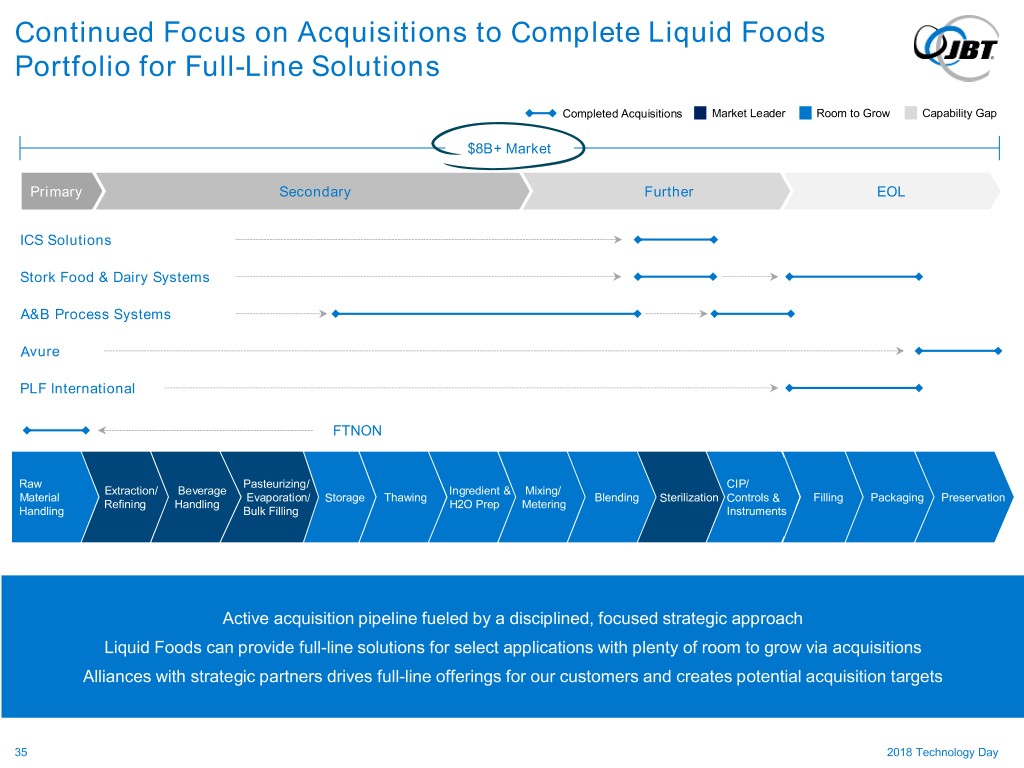

Continued Focus on Acquisitions to Complete Liquid Foods Portfolio for Full-Line Solutions Completed Acquisitions Market Leader Room to Grow Capability Gap $8B+ Market Primary Secondary Further EOL ICS Solutions Stork Food & Dairy Systems A&B Process Systems Avure PLF International FTNON Raw Pasteurizing/ CIP/ Extraction/ Beverage Ingredient & Mixing/ Material Evaporation/ Storage Thawing Blending Sterilization Controls & Filling Packaging Preservation Refining Handling H2O Prep Metering Handling Bulk Filling Instruments Active acquisition pipeline fueled by a disciplined, focused strategic approach Liquid Foods can provide full-line solutions for select applications with plenty of room to grow via acquisitions Alliances with strategic partners drives full-line offerings for our customers and creates potential acquisition targets 35 2018 Technology Day

FoodTech – Protein Paul Sternlieb EVP & President, Protein 36 2018 Technology Day

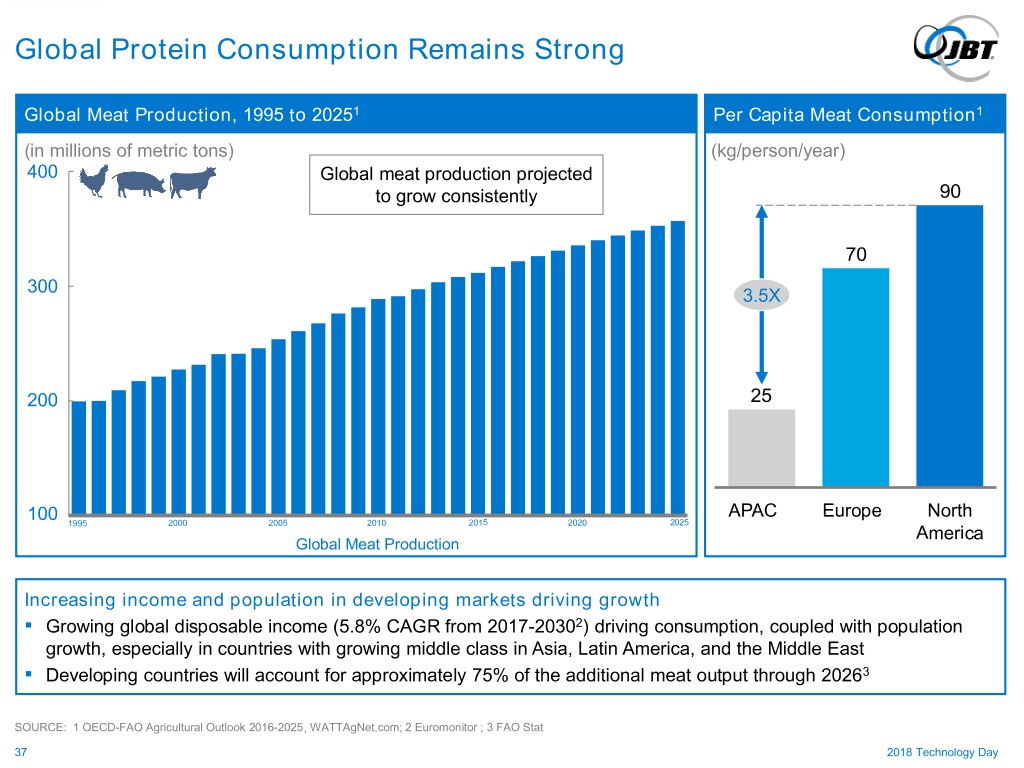

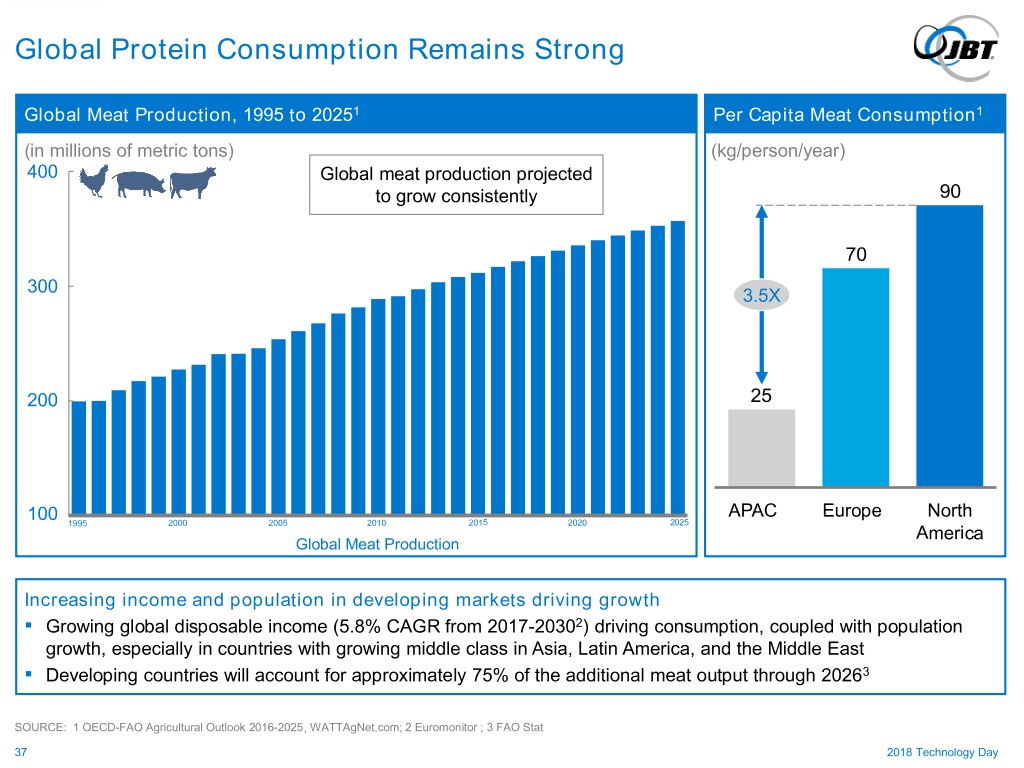

Global Protein Consumption Remains Strong Global Meat Production, 1995 to 20251 Per Capita Meat Consumption1 (in millions of metric tons) (kg/person/year) 400 Global meat production projected to grow consistently 90 70 300 3.5X 200 25 APAC Europe North 100 1995 2000 2005 2010 2015 2020 2025 America Global Meat Production Increasing income and population in developing markets driving growth ▪ Growing global disposable income (5.8% CAGR from 2017-20302) driving consumption, coupled with population growth, especially in countries with growing middle class in Asia, Latin America, and the Middle East ▪ Developing countries will account for approximately 75% of the additional meat output through 20263 SOURCE: 1 OECD-FAO Agricultural Outlook 2016-2025, WATTAgNet.com; 2 Euromonitor ; 3 FAO Stat 37 2018 Technology Day

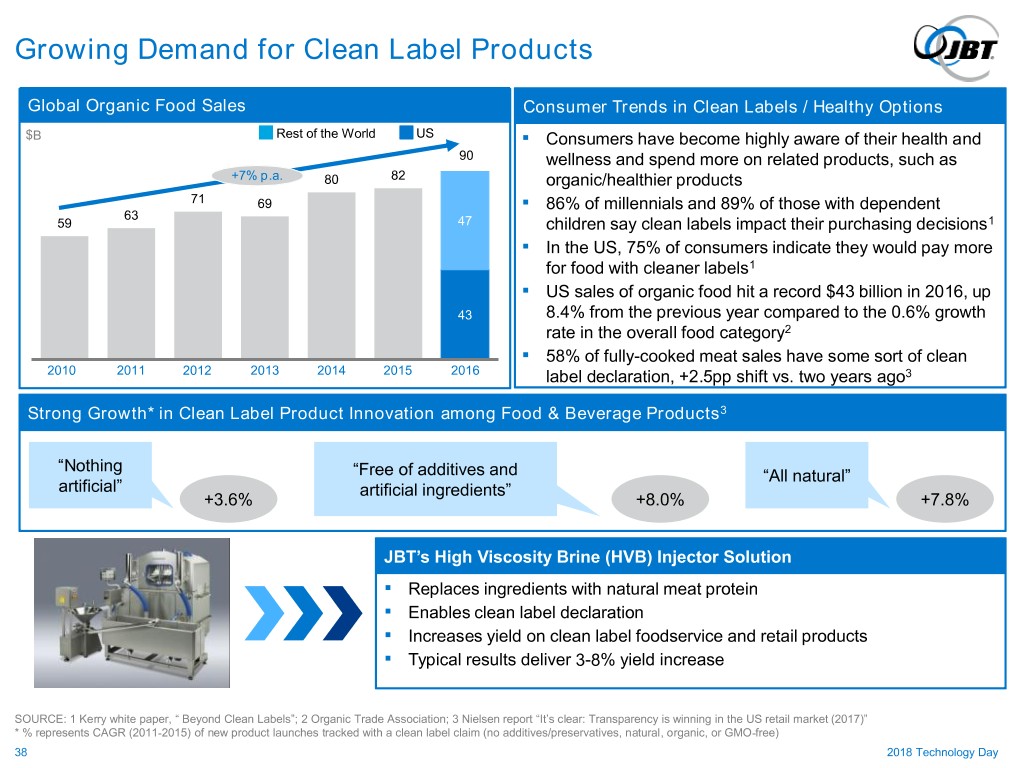

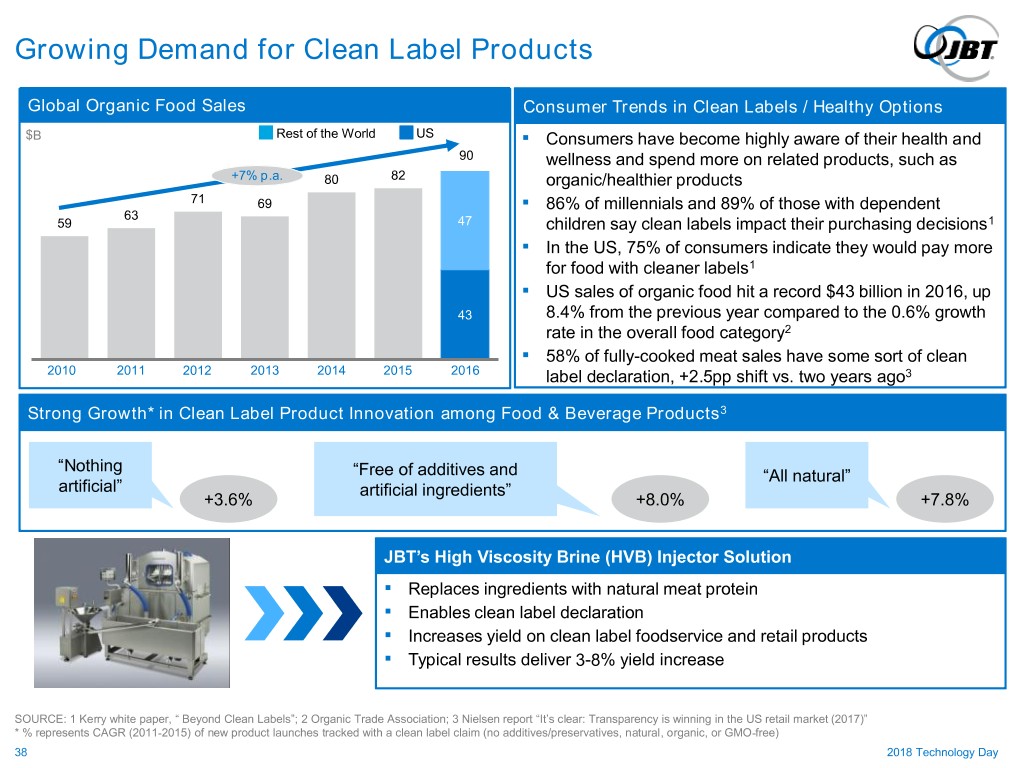

Growing Demand for Clean Label Products Global Organic Food Sales Consumer Trends in Clean Labels / Healthy Options $B Rest of the World US ▪ Consumers have become highly aware of their health and 90 wellness and spend more on related products, such as +7% p.a. 80 82 organic/healthier products 71 69 ▪ 86% of millennials and 89% of those with dependent 63 59 47 children say clean labels impact their purchasing decisions1 ▪ In the US, 75% of consumers indicate they would pay more for food with cleaner labels1 ▪ US sales of organic food hit a record $43 billion in 2016, up 43 8.4% from the previous year compared to the 0.6% growth rate in the overall food category2 ▪ 58% of fully-cooked meat sales have some sort of clean 2010 2011 2012 2013 2014 2015 2016 label declaration, +2.5pp shift vs. two years ago3 Strong Growth* in Clean Label Product Innovation among Food & Beverage Products3 “Nothing “Free of additives and “All natural” artificial” artificial ingredients” +3.6% +8.0% +7.8% JBT’s High Viscosity Brine (HVB) Injector Solution ▪ Replaces ingredients with natural meat protein ▪ Enables clean label declaration ▪ Increases yield on clean label foodservice and retail products ▪ Typical results deliver 3-8% yield increase SOURCE: 1 Kerry white paper, “ Beyond Clean Labels”; 2 Organic Trade Association; 3 Nielsen report “It’s clear: Transparency is winning in the US retail market (2017)” * % represents CAGR (2011-2015) of new product launches tracked with a clean label claim (no additives/preservatives, natural, organic, or GMO-free) 38 2018 Technology Day

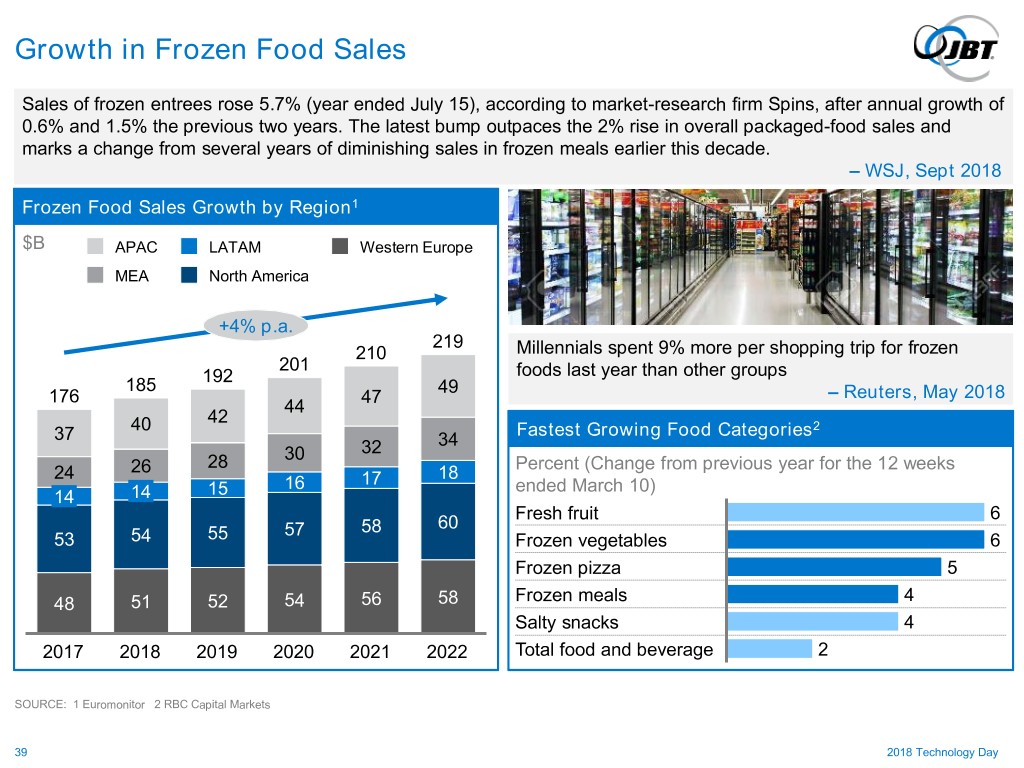

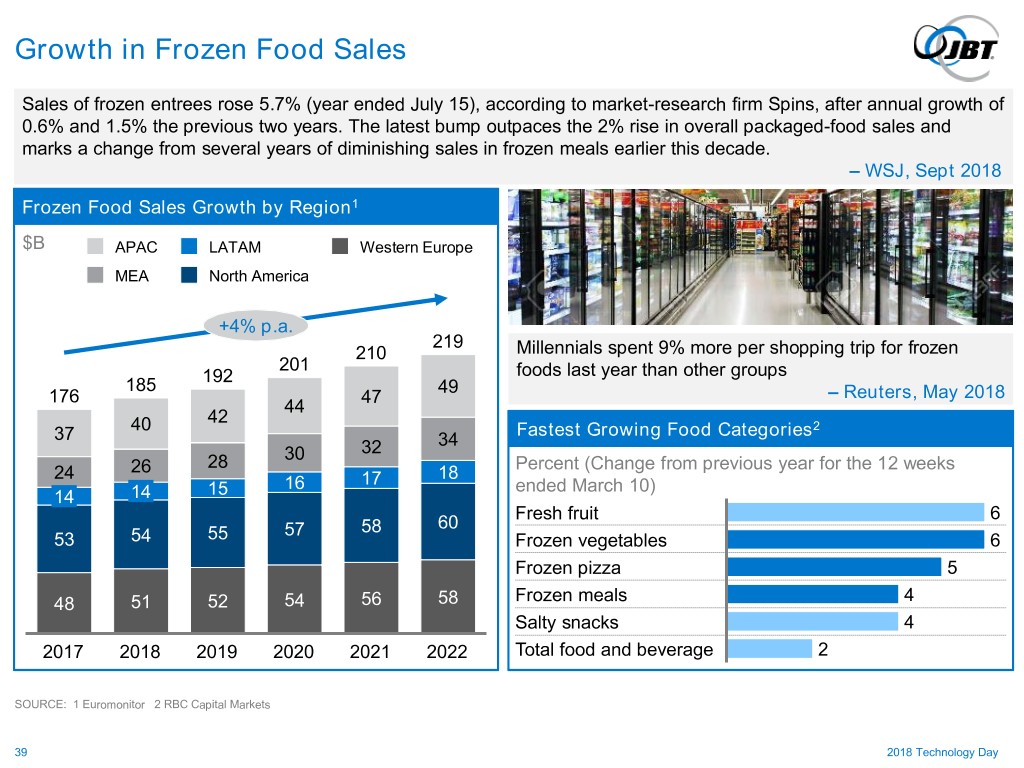

Growth in Frozen Food Sales Sales of frozen entrees rose 5.7% (year ended July 15), according to market-research firm Spins, after annual growth of 0.6% and 1.5% the previous two years. The latest bump outpaces the 2% rise in overall packaged-food sales and marks a change from several years of diminishing sales in frozen meals earlier this decade. – WSJ, Sept 2018 Frozen Food Sales Growth by Region1 $B APAC LATAM Western Europe MEA North America +4% p.a. 219 210 Millennials spent 9% more per shopping trip for frozen 201 192 foods last year than other groups 185 49 176 47 – Reuters, May 2018 44 42 40 Fastest Growing Food Categories2 37 34 30 32 28 Percent (Change from previous year for the 12 weeks 24 26 18 16 17 ended March 10) 14 14 15 Fresh fruit 6 57 58 60 53 54 55 Frozen vegetables 6 Frozen pizza 5 48 51 52 54 56 58 Frozen meals 4 Salty snacks 4 2017 2018 2019 2020 2021 2022 Total food and beverage 2 SOURCE: 1 Euromonitor 2 RBC Capital Markets 39 2018 Technology Day

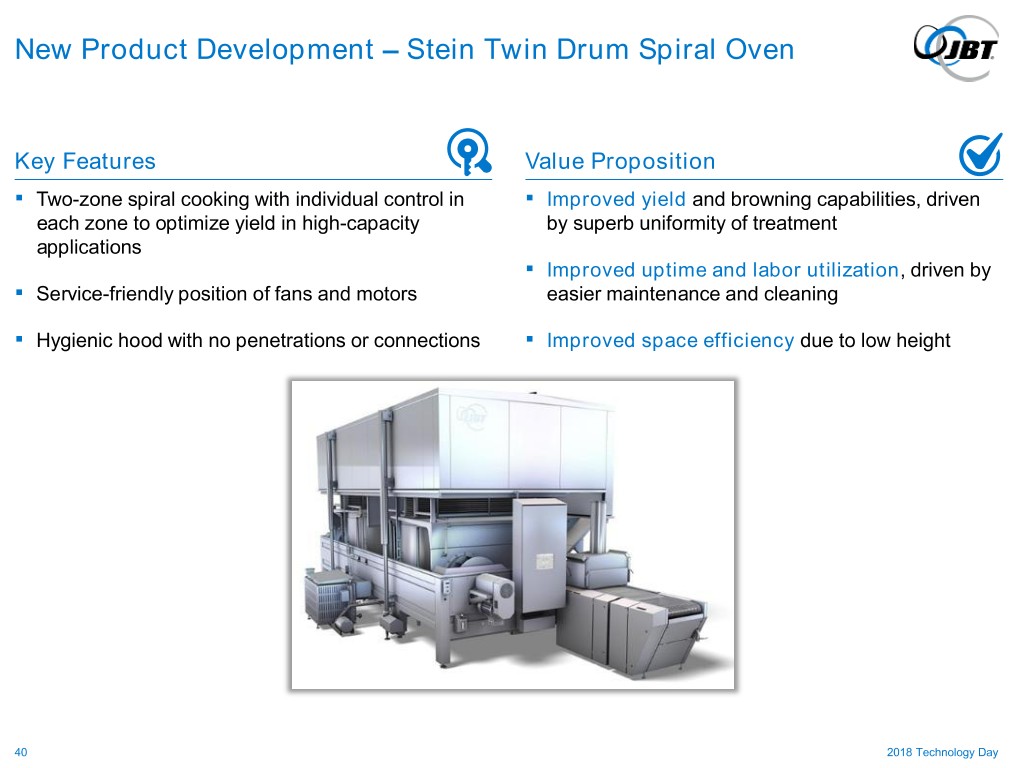

New Product Development – Stein Twin Drum Spiral Oven Key Features Value Proposition ▪ Two-zone spiral cooking with individual control in ▪ Improved yield and browning capabilities, driven each zone to optimize yield in high-capacity by superb uniformity of treatment applications ▪ Improved uptime and labor utilization, driven by ▪ Service-friendly position of fans and motors easier maintenance and cleaning ▪ Hygienic hood with no penetrations or connections ▪ Improved space efficiency due to low height 40 2018 Technology Day

New Product Development – Frigoscandia GYRoCOMPACT 40 Key Features Value Proposition ▪ Incredibly compact, hygienic, and efficient spiral ▪ Improved uptime and reduced running costs, freezer due to Frigodrive system which enables easier cleaning and lower maintenance ▪ High capacity freezing in compact footprint (>1 ton/hour freezing capacity) ▪ Improved plant efficiency due to design that allows for quick installation & easy relocation ▪ Unrivalled energy efficiency 41 2018 Technology Day

New Product Development – Dual-mode Automated Guided Vehicles (AGVs) Key Features Value Proposition ▪ Automation of manual forklifts ▪ Increased facility utilization and productivity ▪ Flexibility of manual & automatic operation ▪ Reduced labor & product damage ▪ High reach for warehousing ▪ Improved plant safety ▪ Towing for horizontal moves 42 2018 Technology Day

Success Story – Product Commercialization: Enterprise-Wide Implementation of AGVs Situation Results ▪ USA-based building materials supplier approached ▪ Resulted in reduction of 58 forklifts and JBT to reduce costs 120 operators, generating annual savings of $6 million ▪ JBT recognized with unique ability to integrate complex AGV automation systems ▪ Benefits for customer included labor savings, productivity increase, reduction in product ▪ Partnership created to initially automate damage, and improved safety four facilities ▪ Customer’s experience with JBT resulted in the opportunity to automate an additional 20 facilities over the next year four years, with five facilities coming within the next twelve months JBT Strength in AGV Technology Driving Strong Growth with Enterprise Customers 43 2018 Technology Day

Success Story – Product Commercialization: DSI 888 Waterjet Portioning System Situation Results ▪ Major US poultry customer producing weight and ▪ Generated $315,000 labor savings shape controlled poultry portions and nuggets from whole breast ▪ Increased capacity in a smaller space, generating $390,000/year more value to customer ▪ The customer had a mixture of old DSI equipment and competitor equipment ▪ Enabled higher production (+2.4 million more pounds/year) than competing alternatives ▪ Customer was looking for yield improvement, labor savings, and space savings ▪ Generated nearly $250,000 in annual yield savings ▪ JBT’s DSI won this recent order by demonstrating labor reduction, higher capacity, and yield ▪ Enabled investment payback <18 months for the improvement on an 8-cutter customer waterjet system Strong Customer Payback Continues to Drive Growth in DSI 44 2018 Technology Day

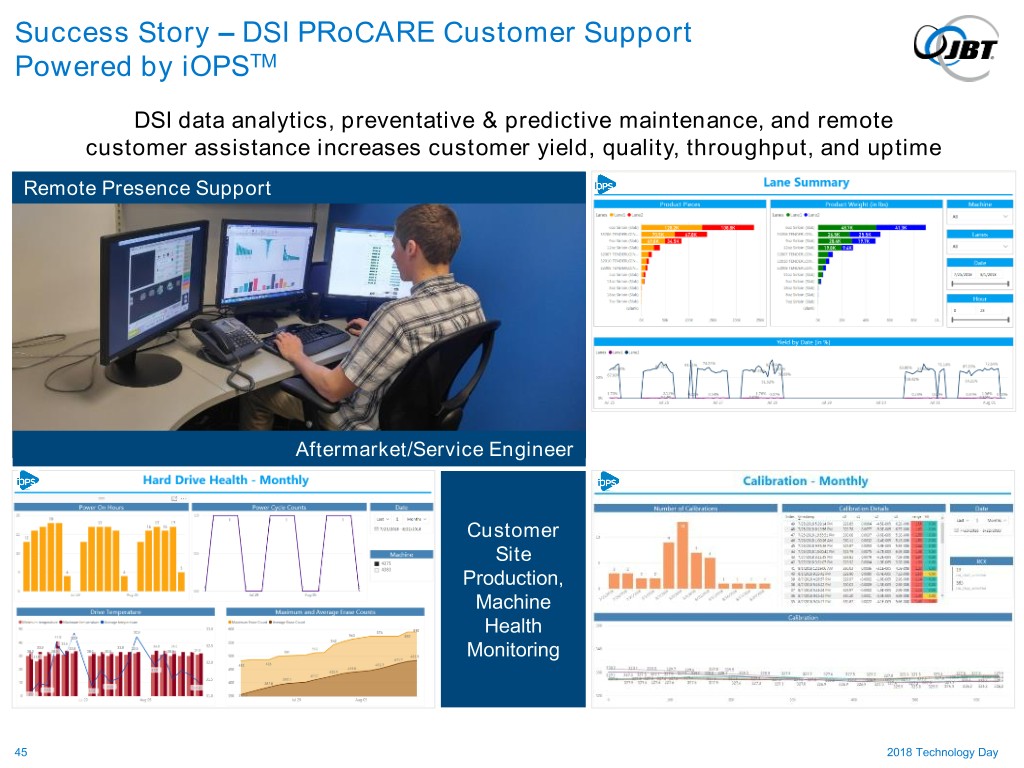

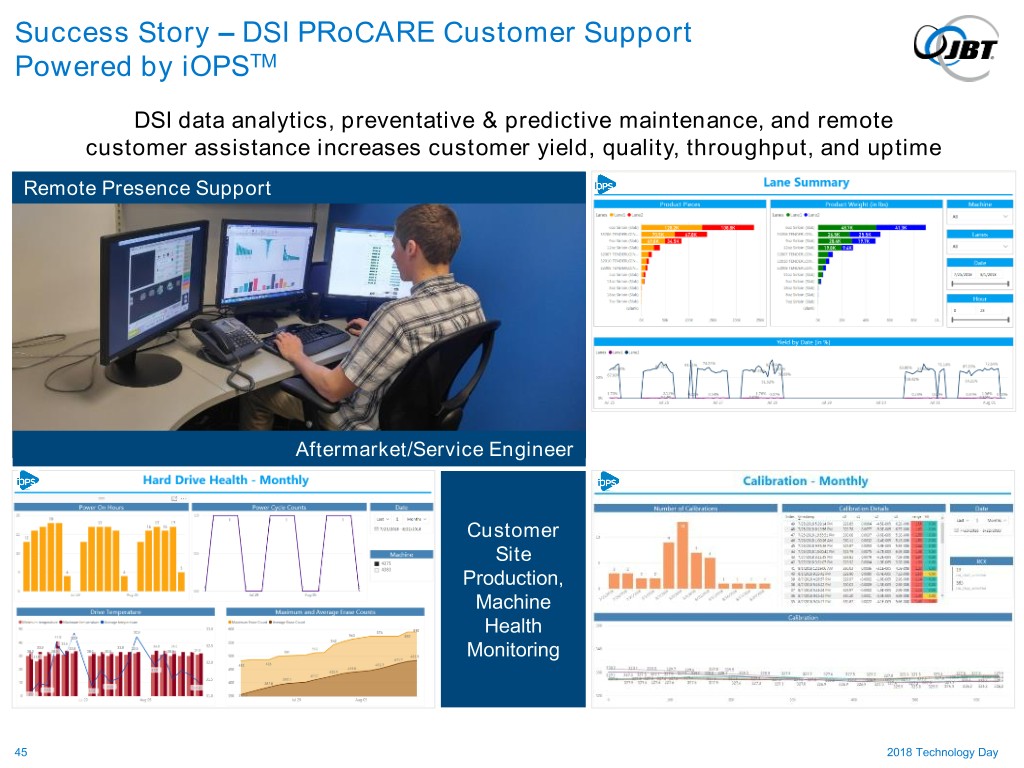

Success Story – DSI PRoCARE Customer Support Powered by iOPSTM DSI data analytics, preventative & predictive maintenance, and remote customer assistance increases customer yield, quality, throughput, and uptime Remote Presence Support Aftermarket/Service Engineer Customer Site Production, Machine Health Monitoring 45 2018 Technology Day

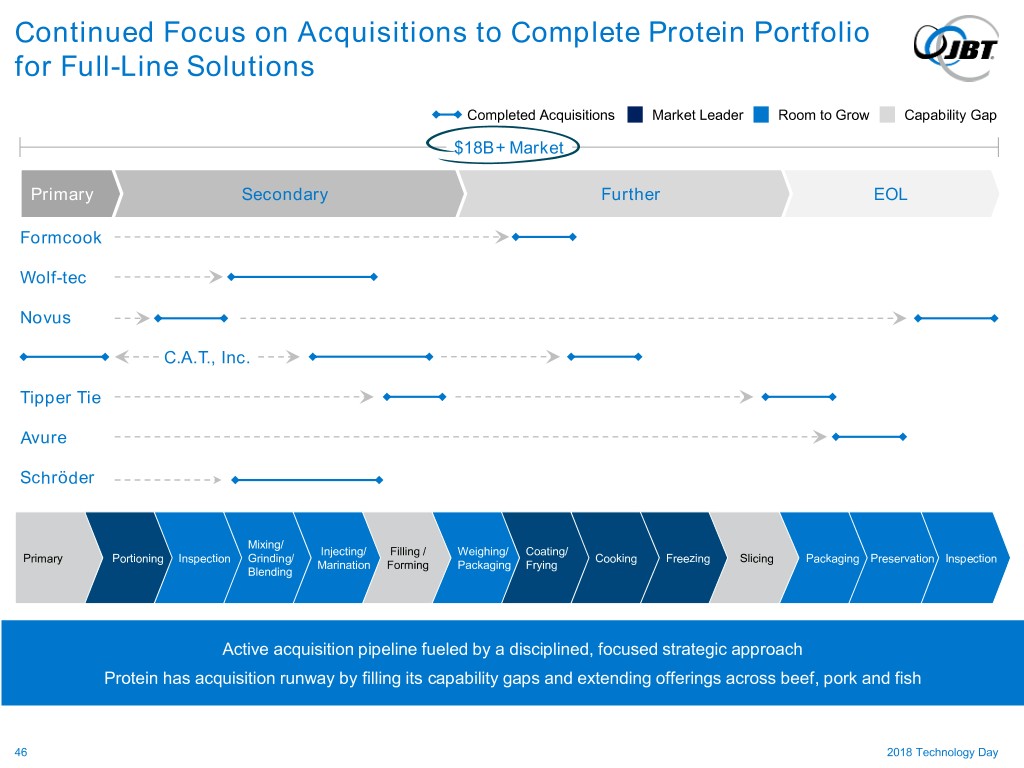

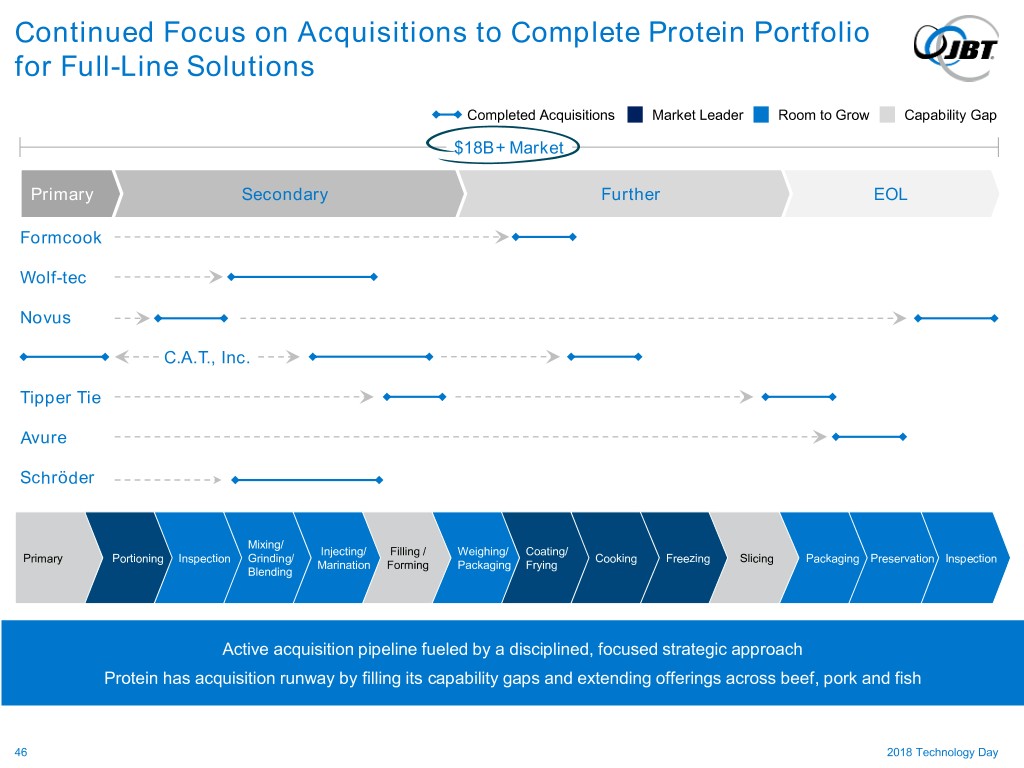

Continued Focus on Acquisitions to Complete Protein Portfolio for Full-Line Solutions Completed Acquisitions Market Leader Room to Grow Capability Gap $18B+ Market Primary Secondary Further EOL Formcook Wolf-tec Novus C.A.T., Inc. Tipper Tie Avure Schröder Mixing/ Injecting/ Filling / Weighing/ Coating/ Primary Portioning Inspection Grinding/ Cooking Freezing Slicing Packaging Preservation Inspection Marination Forming Packaging Frying Blending Active acquisition pipeline fueled by a disciplined, focused strategic approach Protein has acquisition runway by filling its capability gaps and extending offerings across beef, pork and fish 46 2018 Technology Day

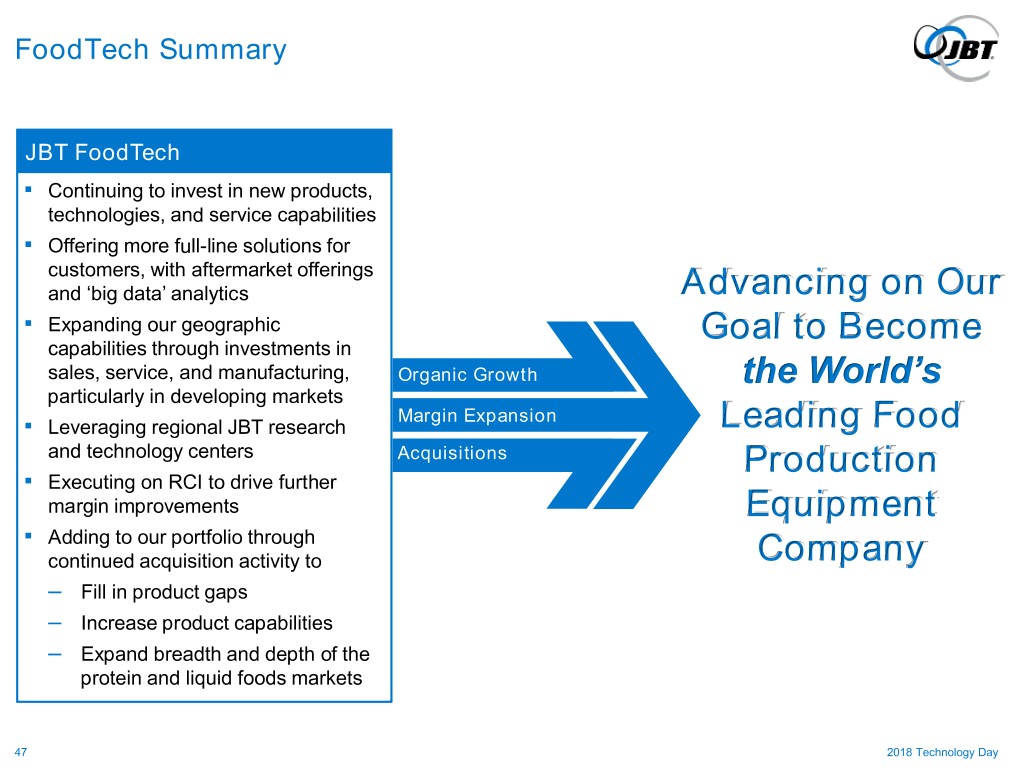

FoodTech Summary JBT FoodTech ▪ Continuing to invest in new products, technologies, and service capabilities ▪ Offering more full-line solutions for customers, with aftermarket offerings and ‘big data’ analytics Advancing on Our ▪ Expanding our geographic Goal to Become capabilities through investments in sales, service, and manufacturing, Organic Growth the World’s particularly in developing markets Margin Expansion ▪ Leveraging regional JBT research Leading Food and technology centers Acquisitions Production ▪ Executing on RCI to drive further margin improvements Equipment ▪ Adding to our portfolio through continued acquisition activity to Company – Fill in product gaps – Increase product capabilities – Expand breadth and depth of the protein and liquid foods markets 47 2018 Technology Day

Asia Marshall Coleman VP & General Manager, Asia 48 2018 Technology Day

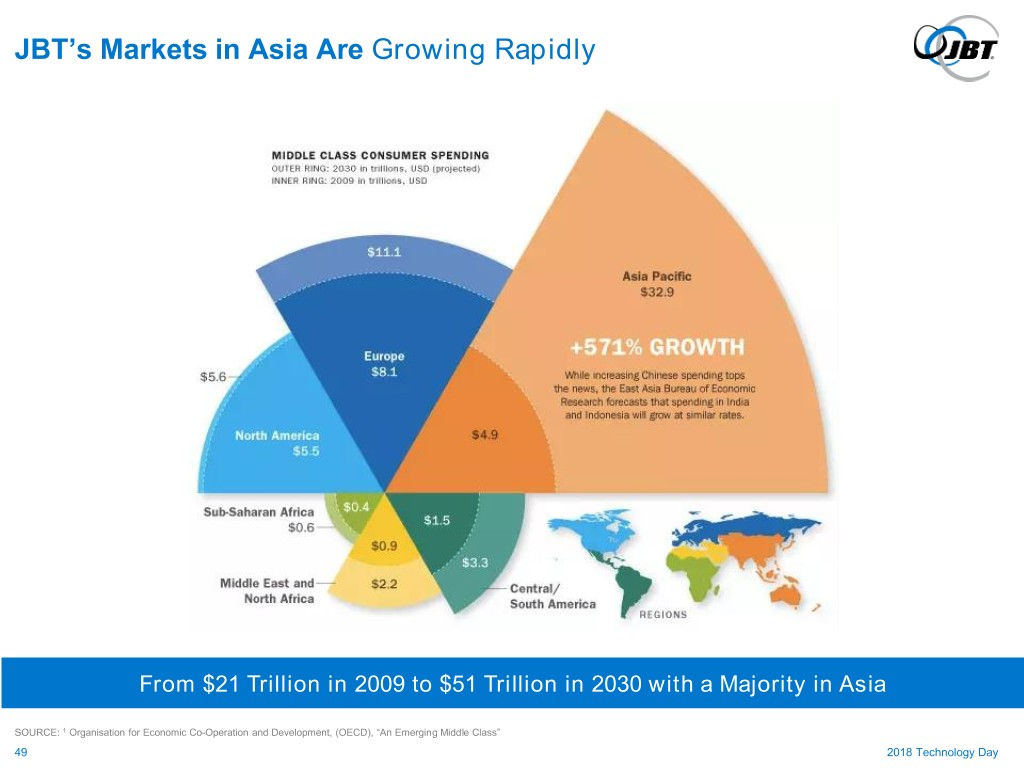

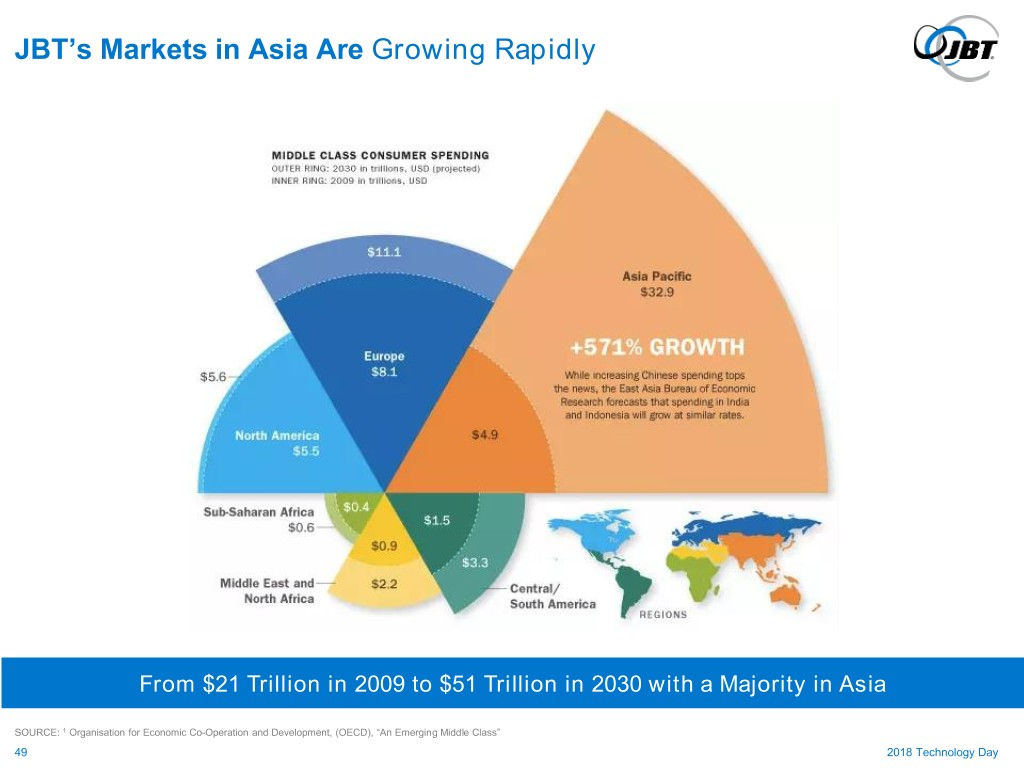

JBT’s Markets in Asia Are Growing Rapidly From $21 Trillion in 2009 to $51 Trillion in 2030 with a Majority in Asia SOURCE: 1 Organisation for Economic Co-Operation and Development, (OECD), “An Emerging Middle Class” 49 2018 Technology Day

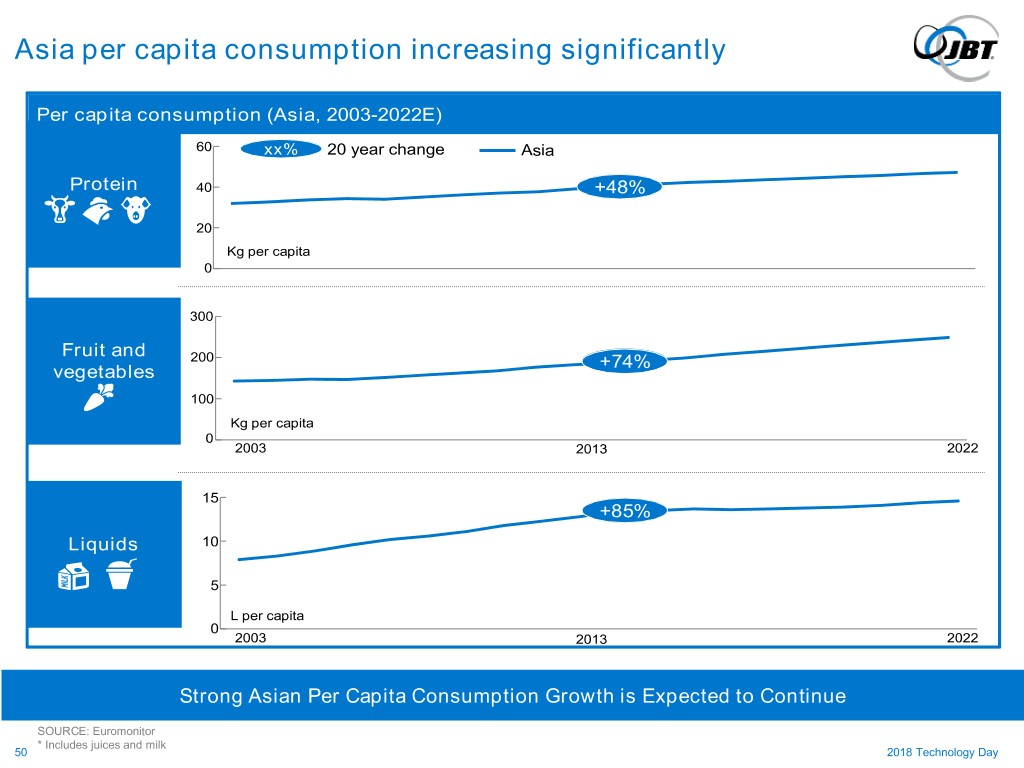

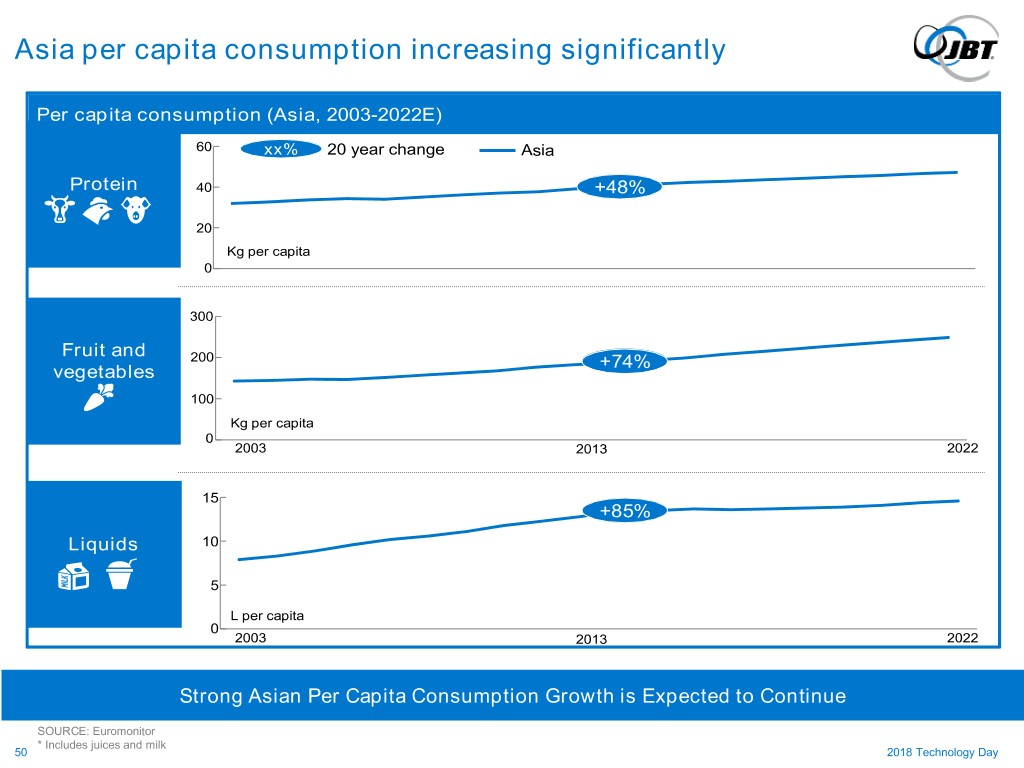

Asia per capita consumption increasing significantly Per capita consumption (Asia, 2003-2022E)) 60 xx% 20 year change Asia Protein 40 +48% 20 Kg per capita 0 300 Fruit and 200 +74% vegetables 100 Kg per capita 0 2003 2013 2022 15 +85% Liquids 10 5 L per capita 0 2003 2013 2022 Strong Asian Per Capita Consumption Growth is Expected to Continue SOURCE: Euromonitor * Includes juices and milk 50 2018 Technology Day

JBT Asia has a Diverse Customer Base Major multinationals Regional food companies Emerging companies Leveraging Breadth of JBT Offerings to Provide Solutions for our Customers Large, Medium and Small 51 2018 Technology Day

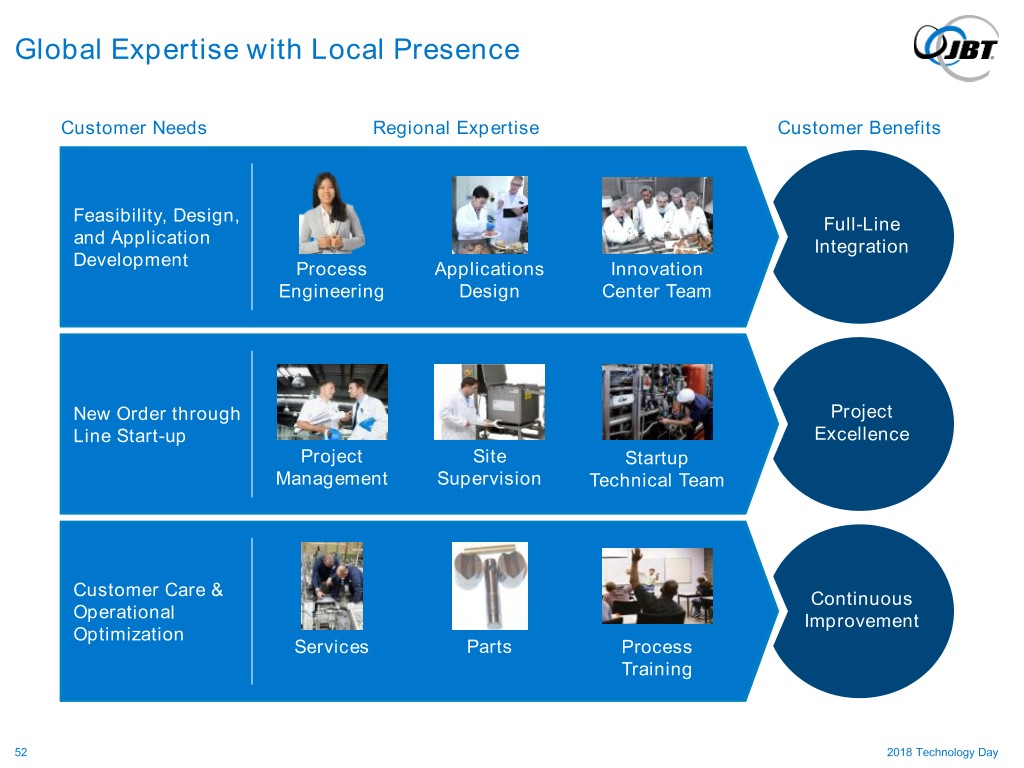

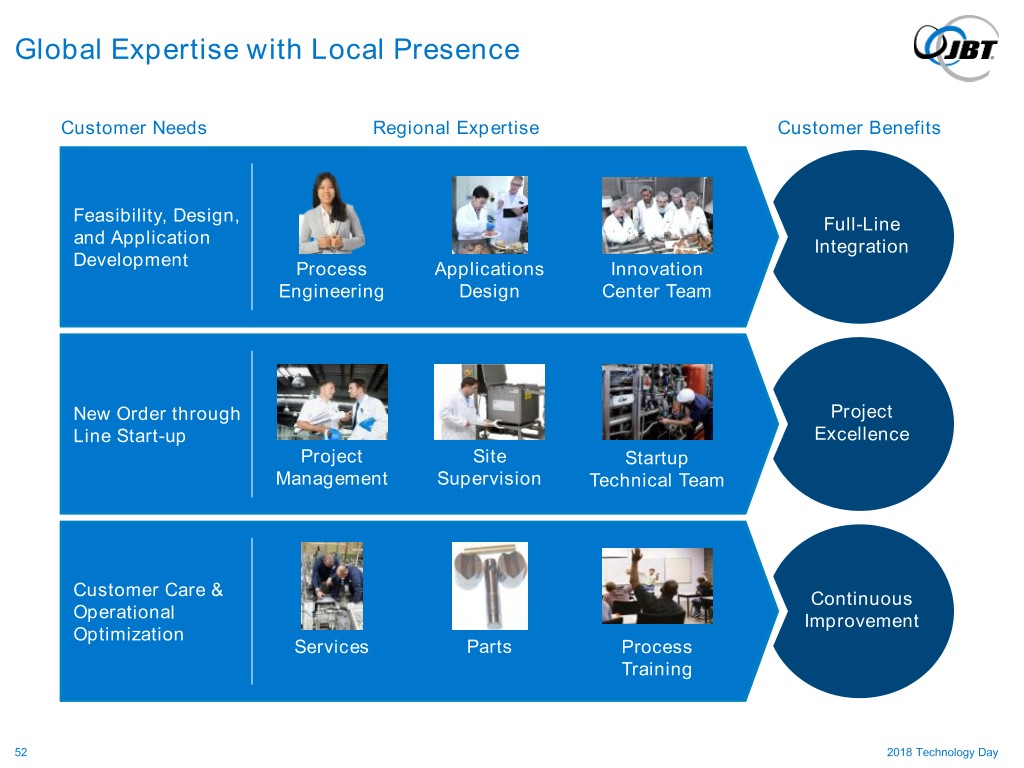

Global Expertise with Local Presence Customer Needs Regional Expertise Customer Benefits Feasibility, Design, Full-Line and Application Integration Development Process Applications Innovation Engineering Design Center Team New Order through Project Line Start-up Excellence Project Site Startup Management Supervision Technical Team Customer Care & Continuous Operational Improvement Optimization Services Parts Process Training 52 2018 Technology Day

Locally Made with the Same JBT Quality Kunshan, China Project Management Localization JBT Innovation & IP Sourcing Assembly & Test Pune, India 53 2018 Technology Day

Success Story – Ready Meals Turnkey Solution in Korea Situation Results ▪ Creating a state of the art factory with an ▪ Reduced labor costs by $500K annually automated process line ▪ Reduced energy consumption versus competitive ▪ Customer was looking for a full-line integrated systems by 25% solution ▪ 4x as many SKU’s given the flexibility of the ▪ Required flexible production for various ready meal integrated loading/unloading system products JBT Asia Provided: 6x - SuperAgi | 3x - AGV | 1x - static retort Full-line Integrated Solutions are a Key Differentiator for Growing Customers in Asia 54 2018 Technology Day

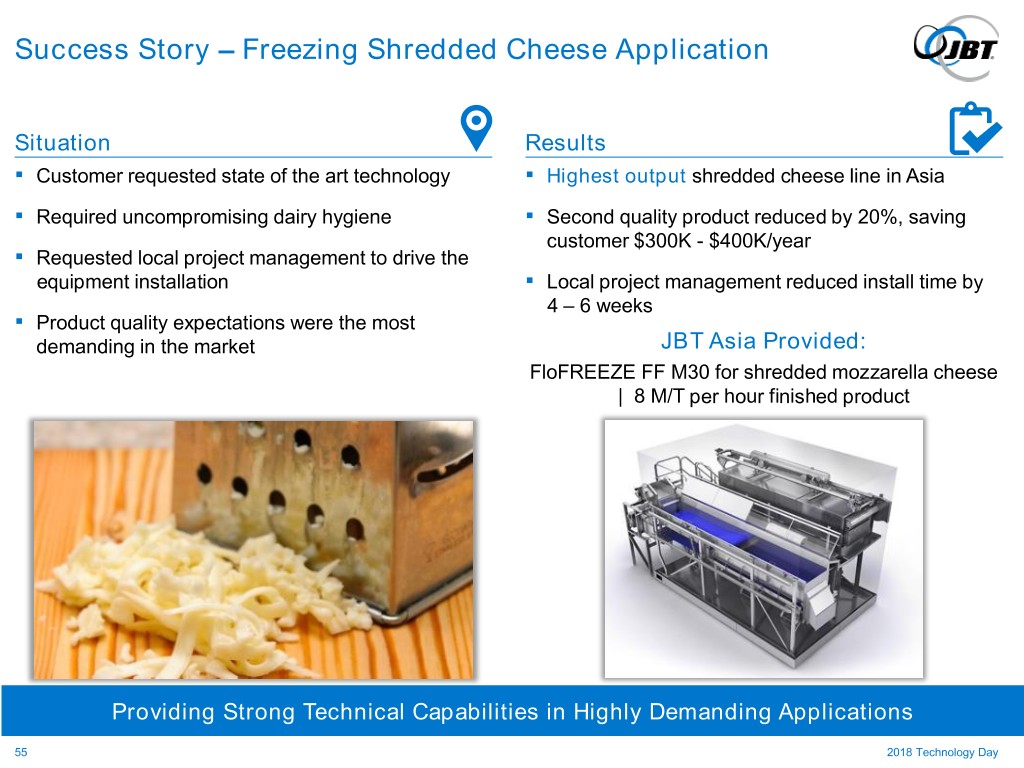

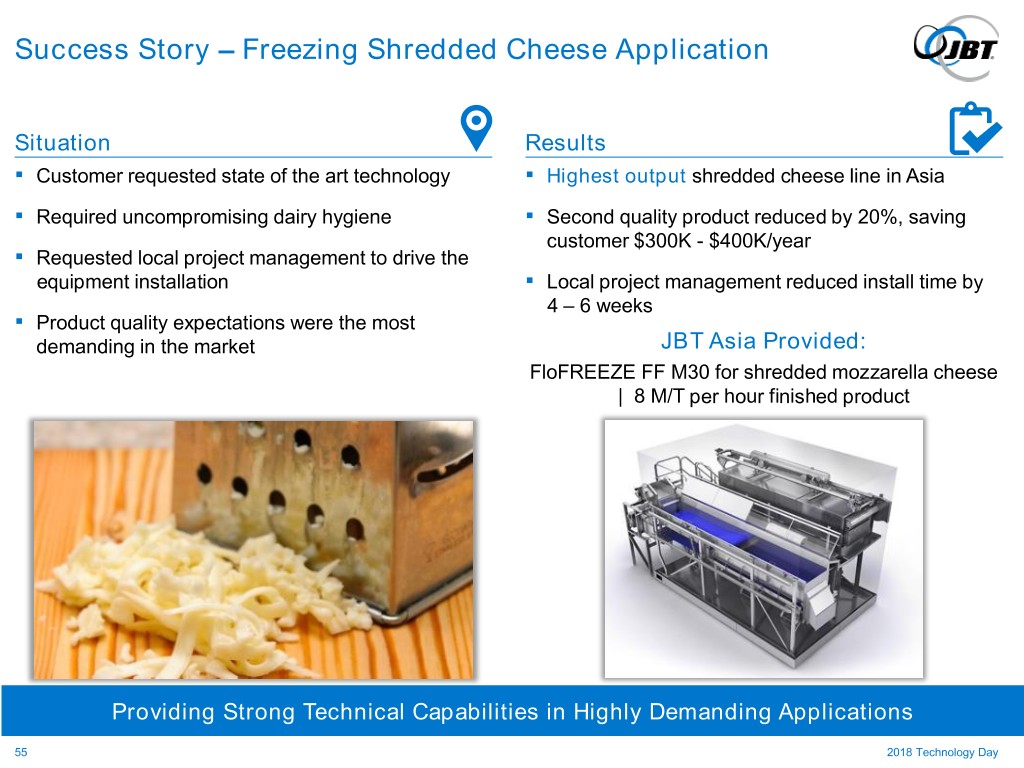

Success Story – Freezing Shredded Cheese Application Situation Results ▪ Customer requested state of the art technology ▪ Highest output shredded cheese line in Asia ▪ Required uncompromising dairy hygiene ▪ Second quality product reduced by 20%, saving customer $300K - $400K/year ▪ Requested local project management to drive the equipment installation ▪ Local project management reduced install time by 4 – 6 weeks ▪ Product quality expectations were the most demanding in the market JBT Asia Provided: FloFREEZE FF M30 for shredded mozzarella cheese | 8 M/T per hour finished product Providing Strong Technical Capabilities in Highly Demanding Applications 55 2018 Technology Day

Success Story – India/Vietnam Farm Raised Shrimp Situation Results ▪ Customers export high quality shrimp and require ▪ Reduced energy and freezing losses driving $65K freezing and high pressure pasteurization of their of annual savings products ▪ HPP process opened up a new market for the ▪ Desired low cost of ownership and quick return on customer with additional food safety without heat investment or chemical treatment ▪ Required local service support ▪ Customer is planning further expansion in 2019 JBT Asia Provided: Avure HPP | Advantec Impingement Freezer Leveraging New Acquisitions (Avure) to Support New Customer Applications 56 2018 Technology Day

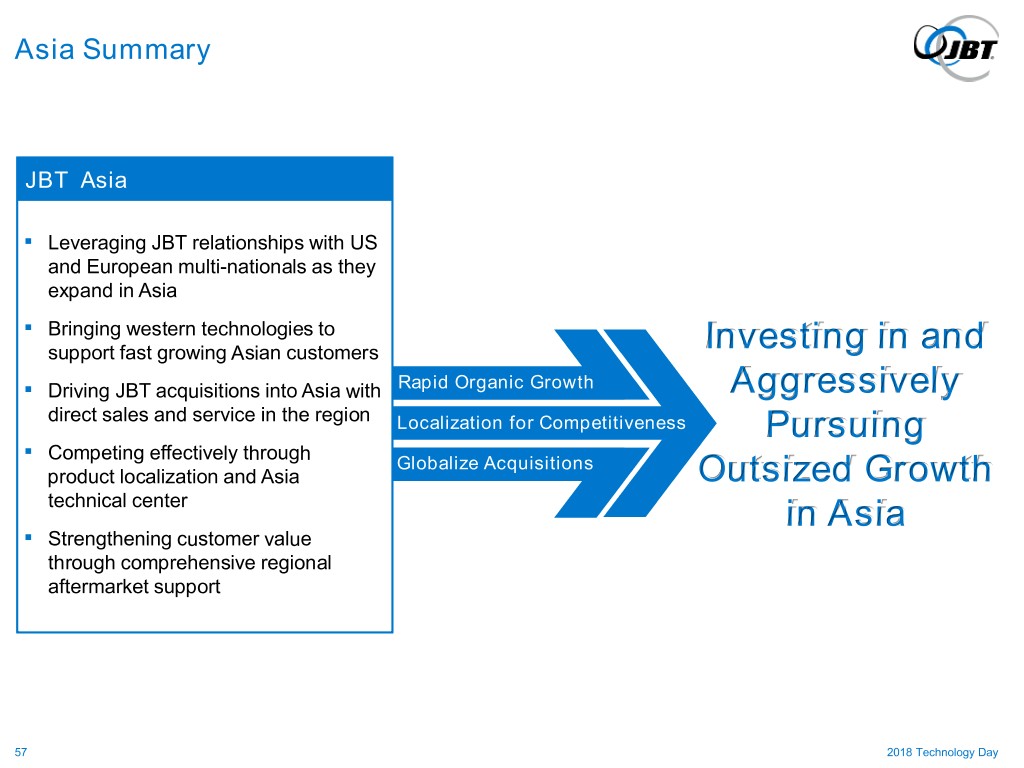

Asia Summary JBT Asia ▪ Leveraging JBT relationships with US and European multi-nationals as they expand in Asia ▪ Bringing western technologies to support fast growing Asian customers Investing in and ▪ Driving JBT acquisitions into Asia with Rapid Organic Growth Aggressively direct sales and service in the region Localization for Competitiveness Pursuing Competing effectively through ▪ Globalize Acquisitions product localization and Asia Outsized Growth technical center in Asia ▪ Strengthening customer value through comprehensive regional aftermarket support 57 2018 Technology Day

Financial Update Brian Deck EVP & CFO 58 2018 Technology Day

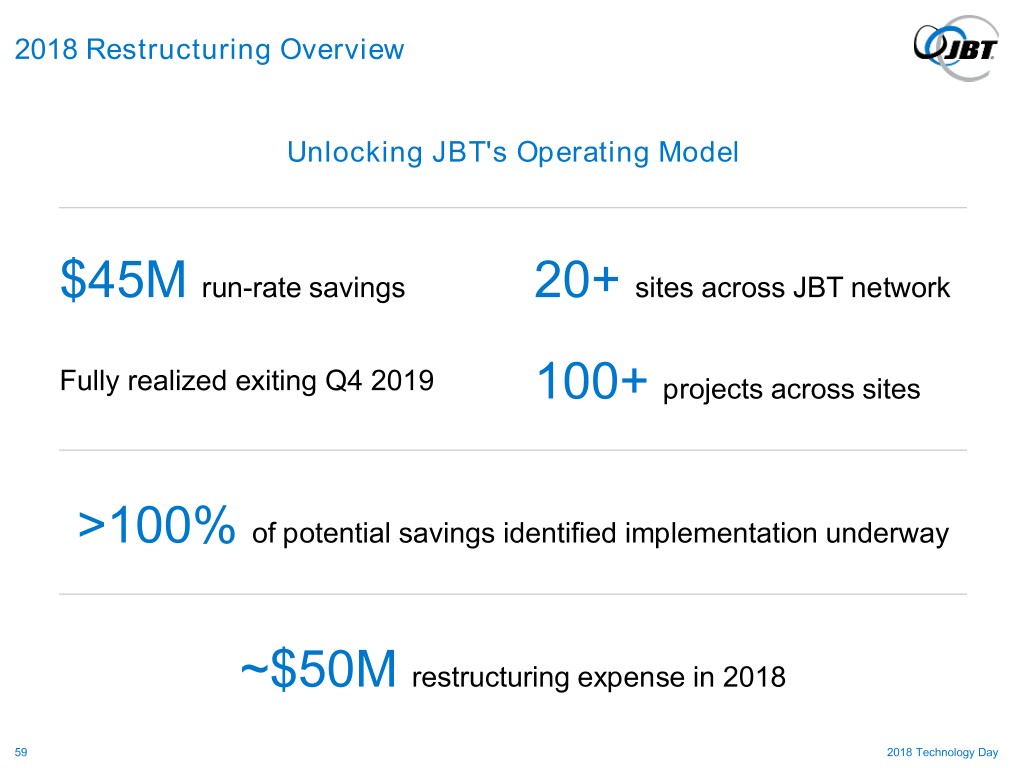

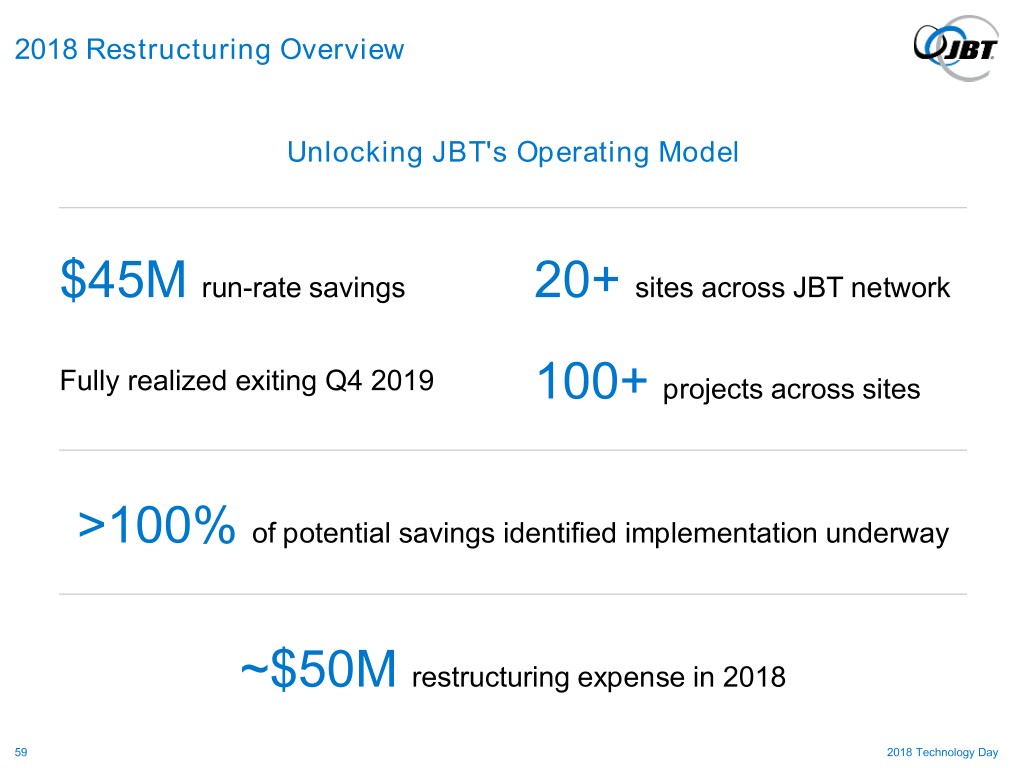

2018 Restructuring Overview Unlocking JBT's Operating Model $45M run-rate savings 20+ sites across JBT network Fully realized exiting Q4 2019 100+ projects across sites >100% of potential savings identified implementation underway ~$50M restructuring expense in 2018 59 2018 Technology Day

2018 Restructuring Savings by Category Portion of Total Category Savings ▪ Improving the availability of parts for assembly Direct labor ▪ Improving application of RCI in welding & assembly ▪ Automating manual processes SG&A ▪ Optimizing the quotation process ▪ Consolidating roles across sites ▪ Optimizing freight modality Indirect spend ▪ Consolidating third party vendor spend across sites ▪ Optimizing warehouse logistics and shipping Indirect labor processes ▪ Automating process flow to improve productivity ▪ Improving scheduling / routing for higher utilization Service Labor ▪ Retooling internal training and automating our admin processes ▪ Automating BOM / product configurators Engineering ▪ Implementing creation of 3D drawings for major sub-assemblies ▪ Reducing wasted time during installation work External Install Costs ▪ Deploying lean construction management 60 2018 Technology Day

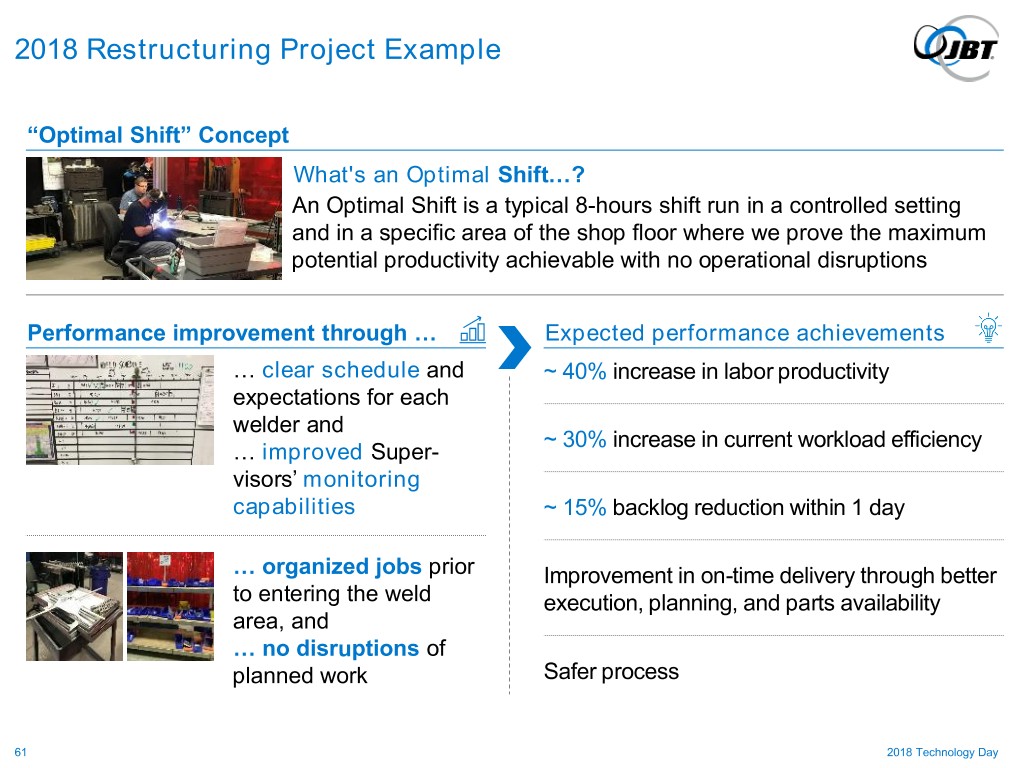

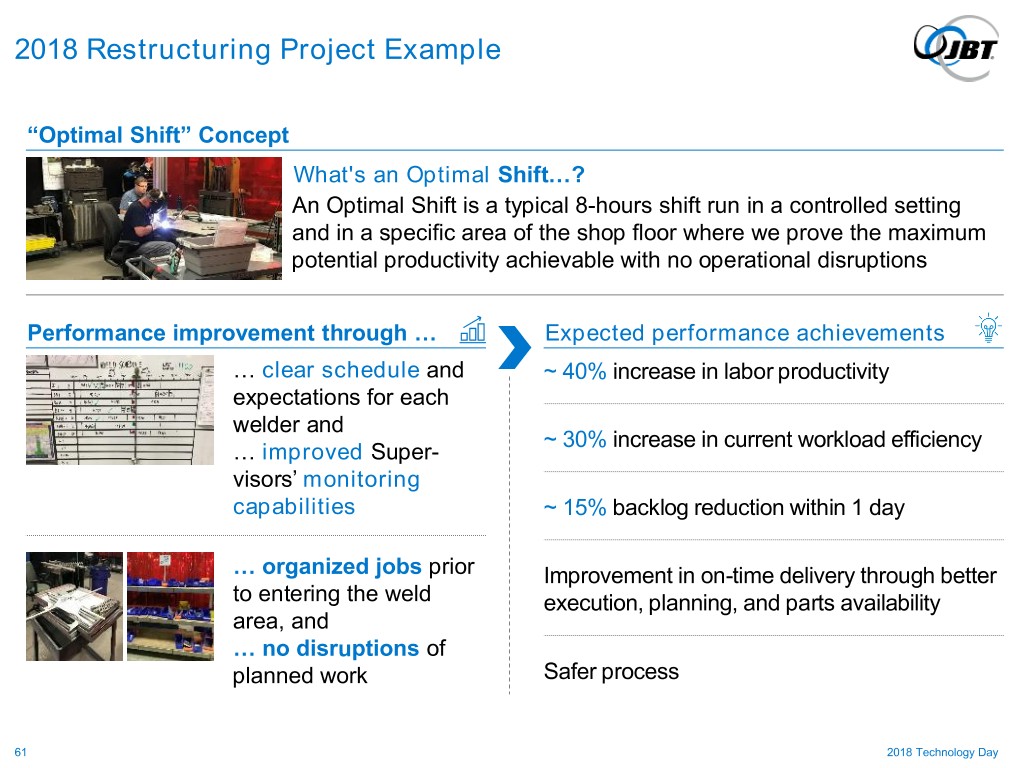

2018 Restructuring Project Example “Optimal Shift” Concept What's an Optimal Shift…? An Optimal Shift is a typical 8-hours shift run in a controlled setting and in a specific area of the shop floor where we prove the maximum potential productivity achievable with no operational disruptions Performance improvement through … Expected performance achievements … clear schedule and ~ 40% increase in labor productivity expectations for each welder and ~ 30% increase in current workload efficiency … improved Super- visors’ monitoring capabilities ~ 15% backlog reduction within 1 day … organized jobs prior Improvement in on-time delivery through better to entering the weld execution, planning, and parts availability area, and … no disruptions of planned work Safer process 61 2018 Technology Day

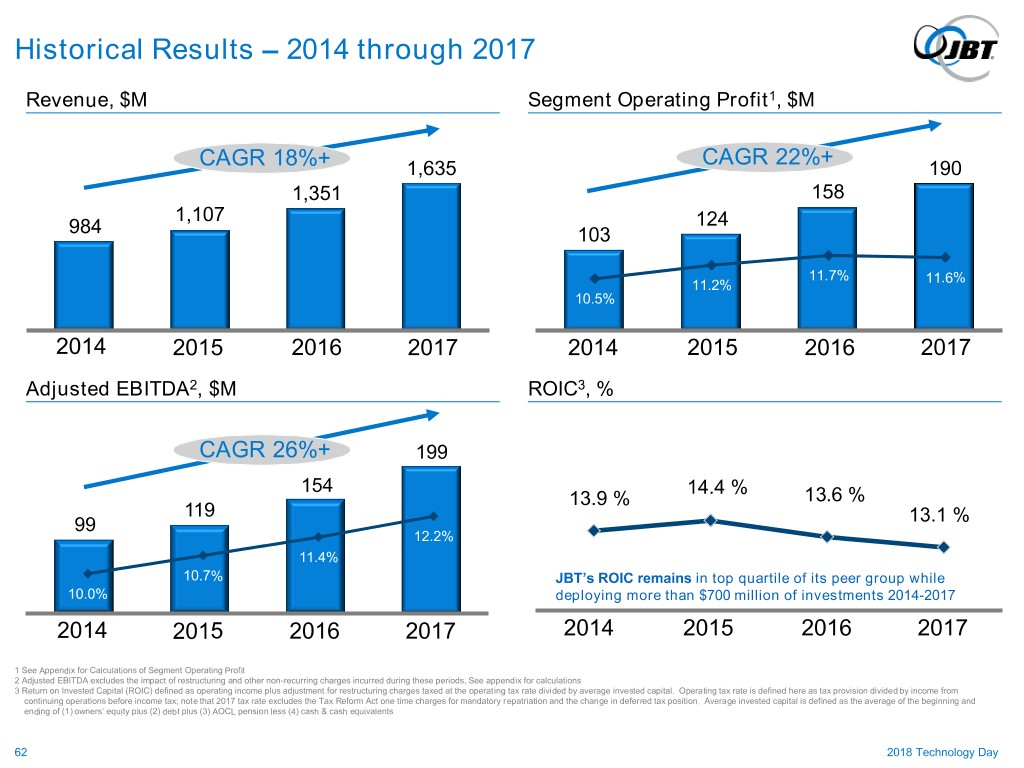

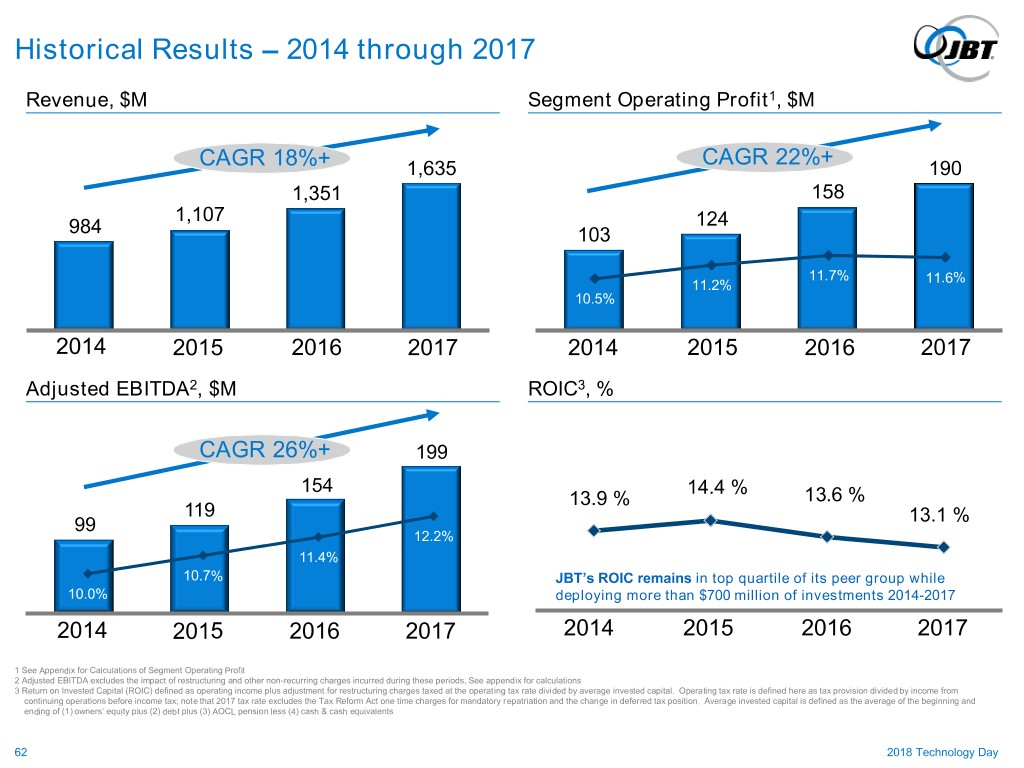

Historical Results – 2014 through 2017 Revenue, $M Segment Operating Profit1, $M CAGR 22%+ CAGR 18%+ 1,635 190 1,351 158 1,107 124 984 103 11.7% 11.6% 11.2% 10.5% 2014 2015 2016 2017 2014 2015 2016 2017 Adjusted EBITDA2, $M ROIC3, % CAGR 26%+ 199 154 14.4 % 13.9 % 13.6 % 119 99 13.1 % 12.2% 11.4% 10.7% JBT’s ROIC remains in top quartile of its peer group while 10.0% deploying more than $700 million of investments 2014-2017 2014 2015 2016 2017 2014 2015 2016 2017 1 See Appendix for Calculations of Segment Operating Profit 2 Adjusted EBITDA excludes the impact of restructuring and other non-recurring charges incurred during these periods, See appendix for calculations 3 Return on Invested Capital (ROIC) defined as operating income plus adjustment for restructuring charges taxed at the operating tax rate divided by average invested capital. Operating tax rate is defined here as tax provision divided by income from continuing operations before income tax; note that 2017 tax rate excludes the Tax Reform Act one time charges for mandatory repatriation and the change in deferred tax position. Average invested capital is defined as the average of the beginning and ending of (1) owners’ equity plus (2) debt plus (3) AOCL pension less (4) cash & cash equivalents 62 2018 Technology Day

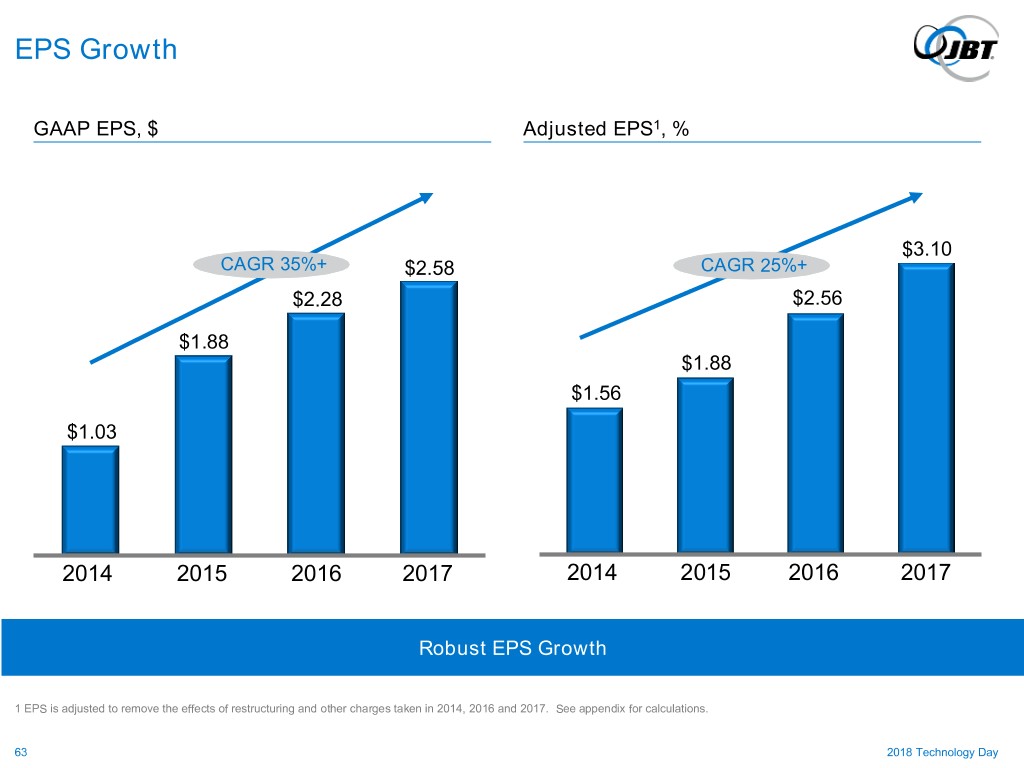

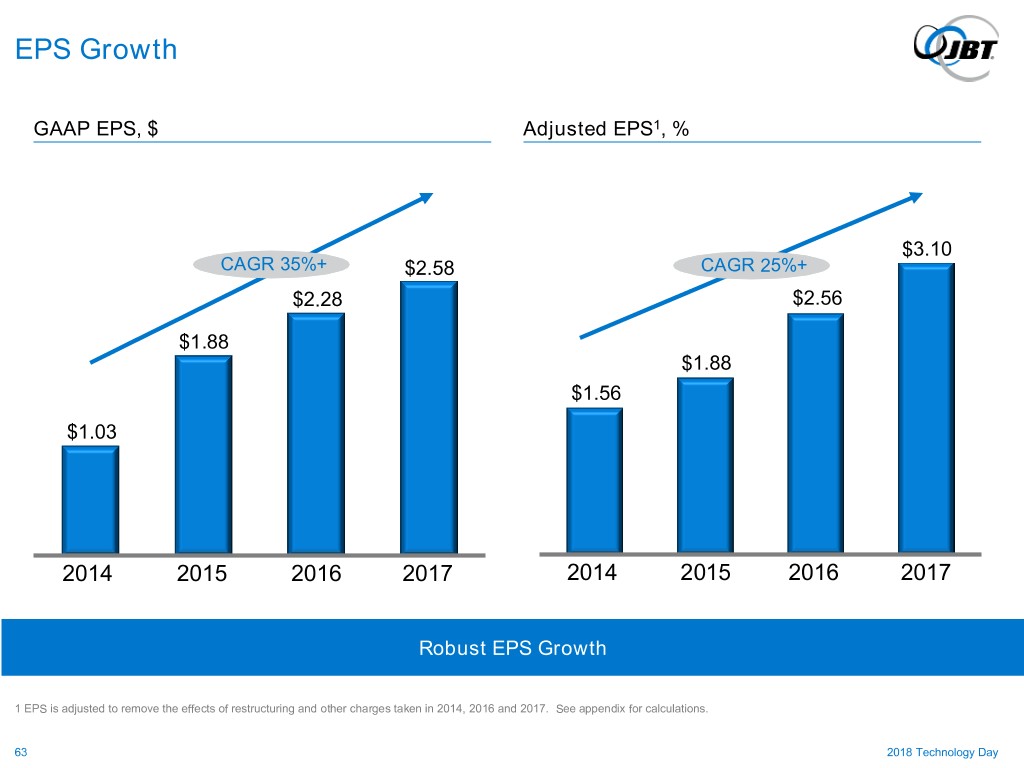

EPS Growth GAAP EPS, $ Adjusted EPS1, % $3.10 CAGR 35%+ $2.58 CAGR 25%+ $2.28 $2.56 $1.88 $1.88 $1.56 $1.03 2014 2015 2016 2017 2014 2015 2016 2017 Robust EPS Growth 1 EPS is adjusted to remove the effects of restructuring and other charges taken in 2014, 2016 and 2017. See appendix for calculations. 63 2018 Technology Day

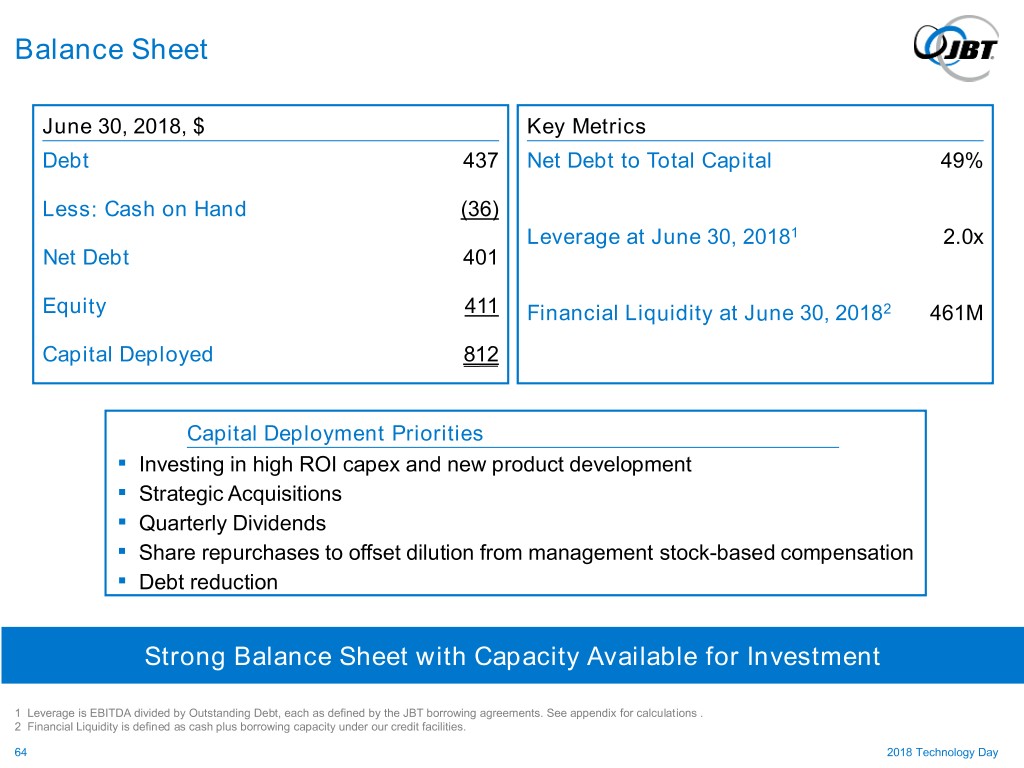

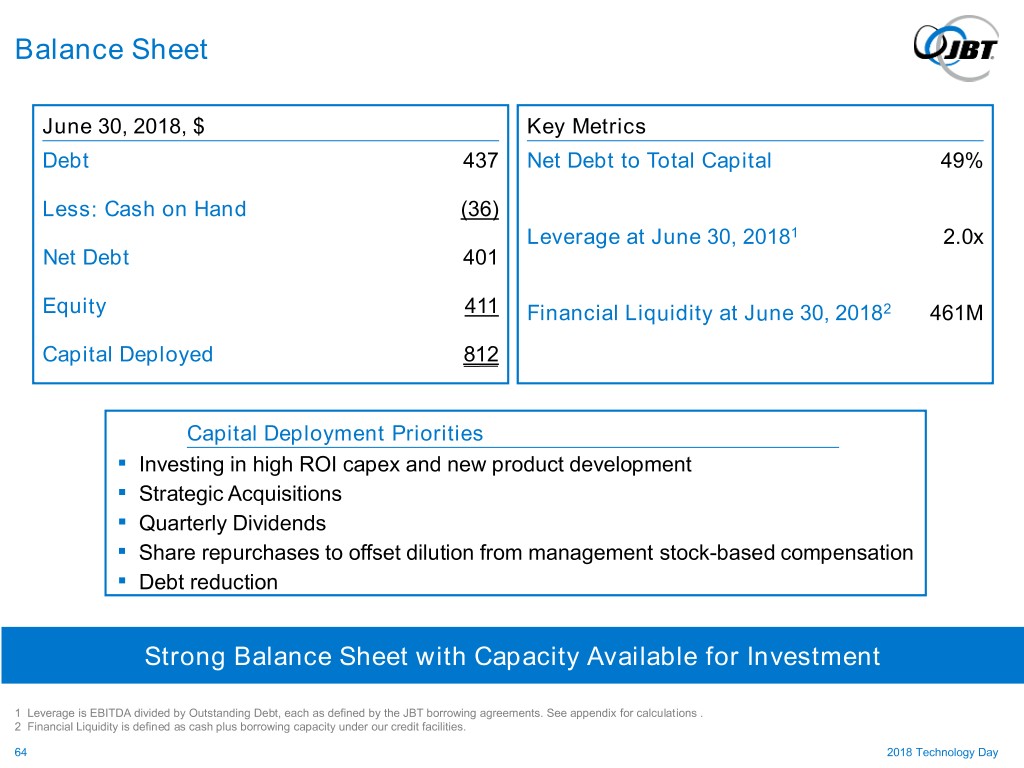

Balance Sheet June 30, 2018, $ Key Metrics Debt 437 Net Debt to Total Capital 49% Less: Cash on Hand (36) Leverage at June 30, 20181 2.0x Net Debt 401 Equity 411 Financial Liquidity at June 30, 20182 461M Capital Deployed 812 Capital Deployment Priorities ▪ Investing in high ROI capex and new product development ▪ Strategic Acquisitions ▪ Quarterly Dividends ▪ Share repurchases to offset dilution from management stock-based compensation ▪ Debt reduction Strong Balance Sheet with Capacity Available for Investment 1 Leverage is EBITDA divided by Outstanding Debt, each as defined by the JBT borrowing agreements. See appendix for calculations . 2 Financial Liquidity is defined as cash plus borrowing capacity under our credit facilities. 64 2018 Technology Day

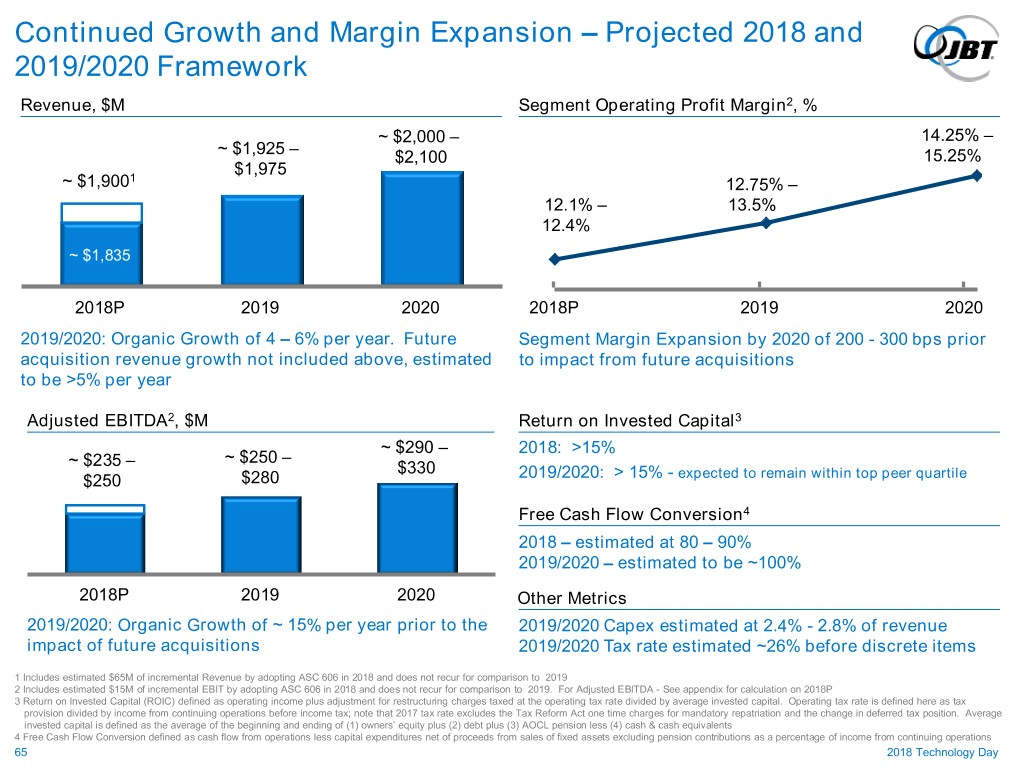

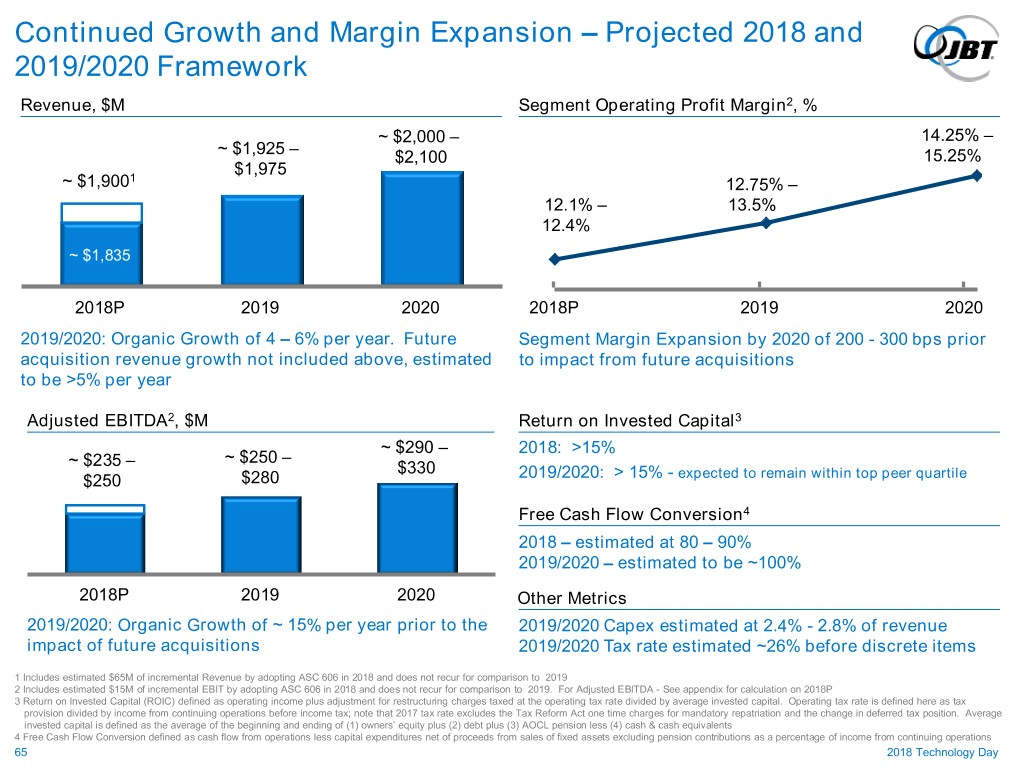

Continued Growth and Margin Expansion – Projected 2018 and 2019/2020 Framework Revenue, $M Segment Operating Profit Margin2, % ~ $2,000 – 14.25% – ~ $1,925 – $2,100 15.25% $1,975 ~ $1,9001 12.75% – 12.1% – 13.5% 12.4% ~ $1,835 2018P 2019 2020 2018P 2019 2020 2019/2020: Organic Growth of 4 – 6% per year. Future Segment Margin Expansion by 2020 of 200 - 300 bps prior acquisition revenue growth not included above, estimated to impact from future acquisitions to be >5% per year Adjusted EBITDA2, $M Return on Invested Capital3 ~ $290 – 2018: >15% ~ $235 – ~ $250 – $330 2019/2020: > 15% - expected to remain within top peer quartile $250 $280 Free Cash Flow Conversion4 2018 – estimated at 80 – 90% 2019/2020 – estimated to be ~100% 2018P 2019 2020 Other Metrics 2019/2020: Organic Growth of ~ 15% per year prior to the 2019/2020 Capex estimated at 2.4% - 2.8% of revenue impact of future acquisitions 2019/2020 Tax rate estimated ~26% before discrete items 1 Includes estimated $65M of incremental Revenue by adopting ASC 606 in 2018 and does not recur for comparison to 2019 2 Includes estimated $15M of incremental EBIT by adopting ASC 606 in 2018 and does not recur for comparison to 2019. For Adjusted EBITDA - See appendix for calculation on 2018P 3 Return on Invested Capital (ROIC) defined as operating income plus adjustment for restructuring charges taxed at the operating tax rate divided by average invested capital. Operating tax rate is defined here as tax provision divided by income from continuing operations before income tax; note that 2017 tax rate excludes the Tax Reform Act one time charges for mandatory repatriation and the change in deferred tax position. Average invested capital is defined as the average of the beginning and ending of (1) owners’ equity plus (2) debt plus (3) AOCL pension less (4) cash & cash equivalents 4 Free Cash Flow Conversion defined as cash flow from operations less capital expenditures net of proceeds from sales of fixed assets excluding pension contributions as a percentage of income from continuing operations 65 2018 Technology Day

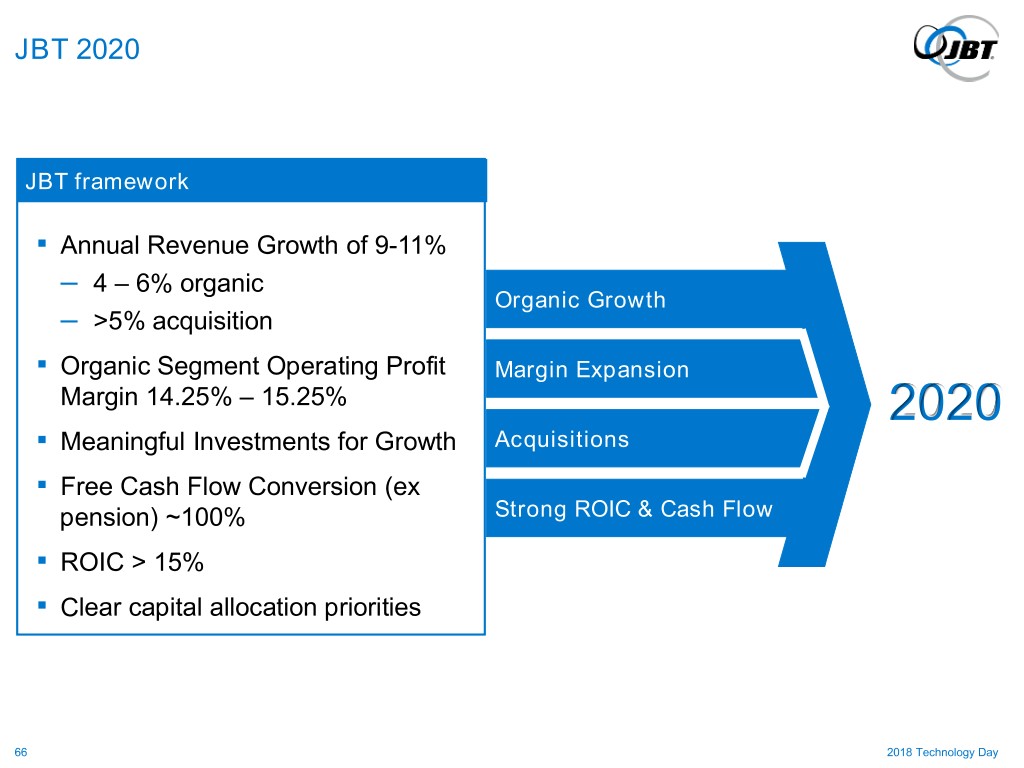

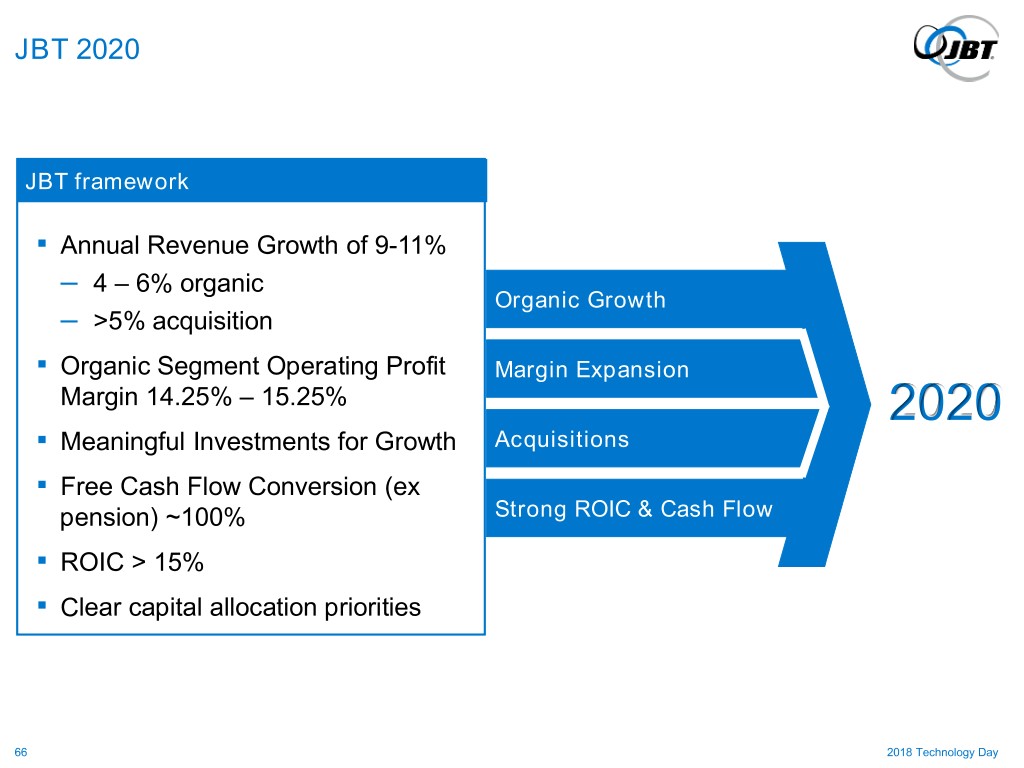

JBT 2020 JBT framework ▪ Annual Revenue Growth of 9-11% – 4 – 6% organic Organic Growth – >5% acquisition ▪ Organic Segment Operating Profit Margin Expansion Margin 14.25% – 15.25% 2020 ▪ Meaningful Investments for Growth Acquisitions ▪ Free Cash Flow Conversion (ex pension) ~100% Strong ROIC & Cash Flow ▪ ROIC > 15% ▪ Clear capital allocation priorities 66 2018 Technology Day

Q&A 67 2018 Technology Day

Appendix September 13, 2018

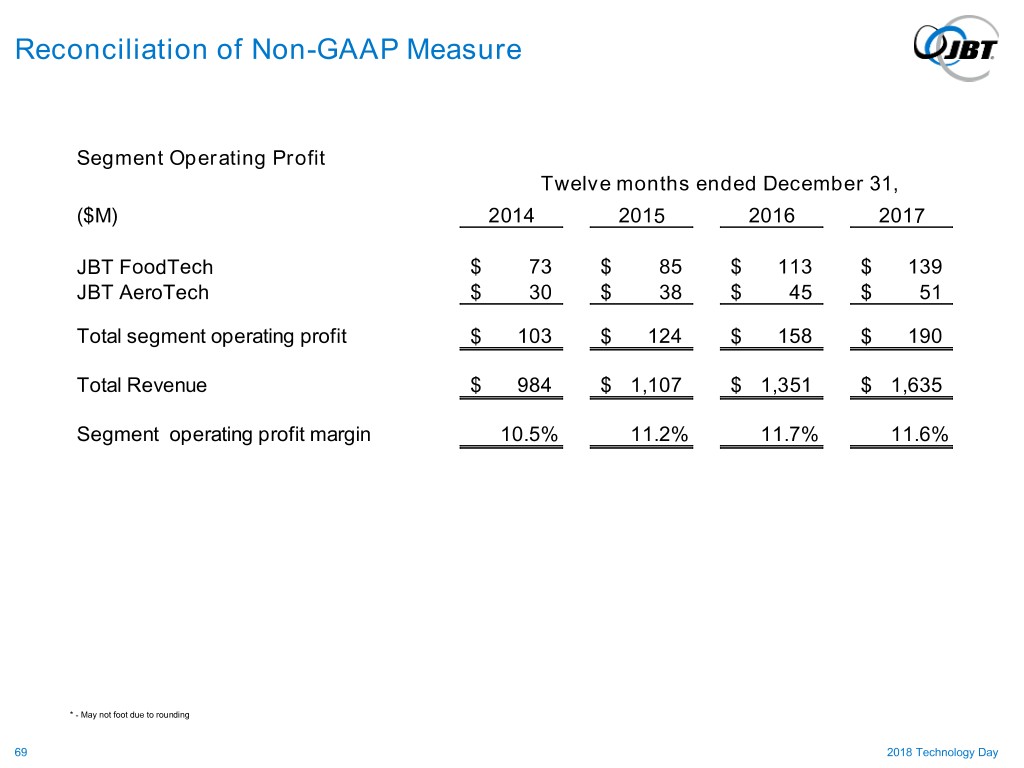

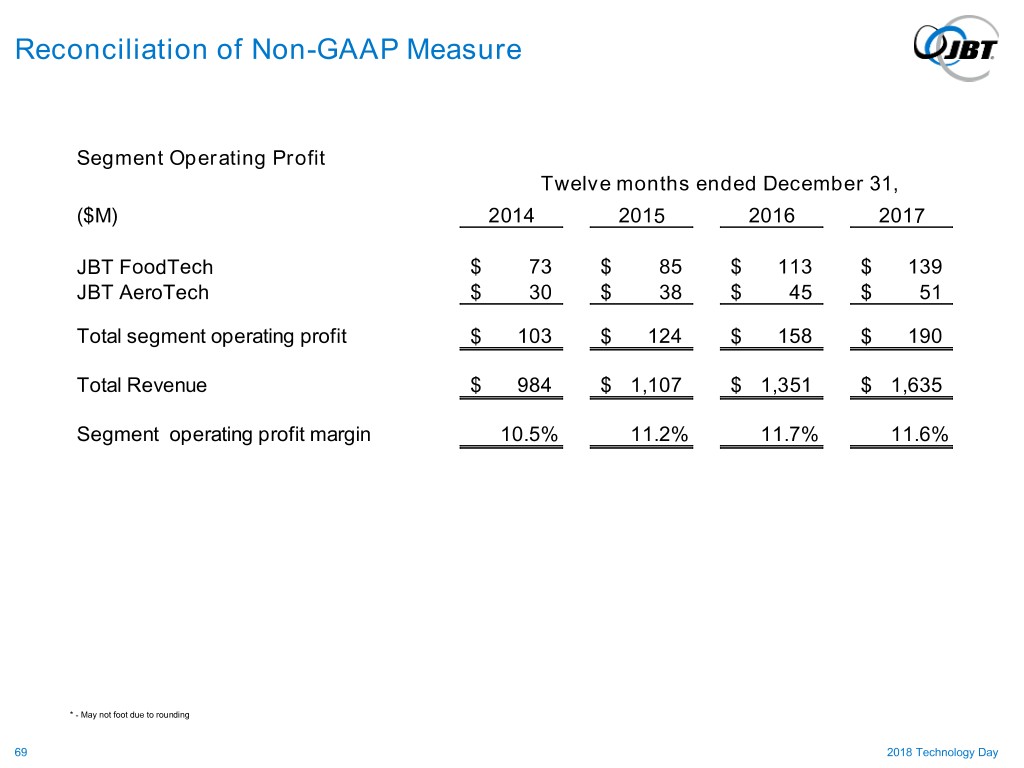

Reconciliation of Non-GAAP Measure Segment Operating Profit Twelve months ended December 31, ($M) 2014 2015 2016 2017 JBT FoodTech $ 73 $ 85 $ 113 $ 139 JBT AeroTech $ 30 $ 38 $ 45 $ 51 Total segment operating profit $ 103 $ 124 $ 158 $ 190 Total Revenue $ 984 $ 1,107 $ 1,351 $ 1,635 Segment operating profit margin 10.5% 11.2% 11.7% 11.6% * - May not foot due to rounding 69 2018 Technology Day

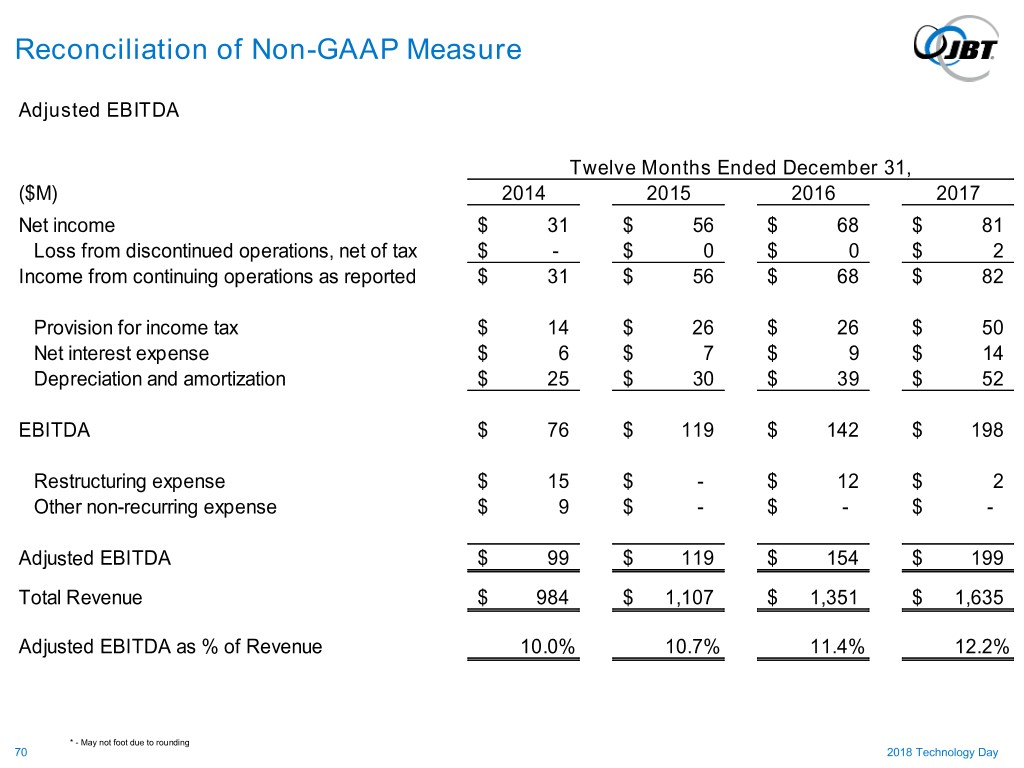

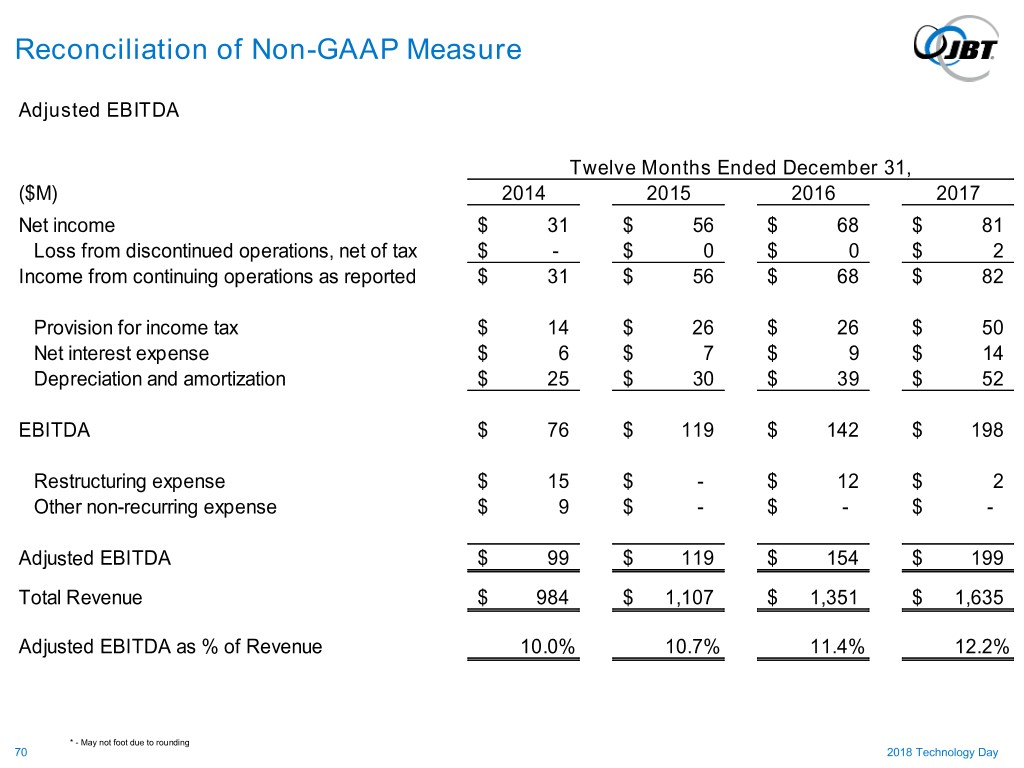

Reconciliation of Non-GAAP Measure Adjusted EBITDA Twelve Months Ended December 31, ($M) 2014 2015 2016 2017 Net income $ 31 $ 56 $ 68 $ 81 Loss from discontinued operations, net of tax $ - $ 0 $ 0 $ 2 Income from continuing operations as reported $ 31 $ 56 $ 68 $ 82 Provision for income tax $ 14 $ 26 $ 26 $ 50 Net interest expense $ 6 $ 7 $ 9 $ 14 Depreciation and amortization $ 25 $ 30 $ 39 $ 52 EBITDA $ 76 $ 119 $ 142 $ 198 Restructuring expense $ 15 $ - $ 12 $ 2 Other non-recurring expense $ 9 $ - $ - $ - Adjusted EBITDA $ 99 $ 119 $ 154 $ 199 Total Revenue $ 984 $ 1,107 $ 1,351 $ 1,635 Adjusted EBITDA as % of Revenue 10.0% 10.7% 11.4% 12.2% * - May not foot due to rounding 70 2018 Technology Day

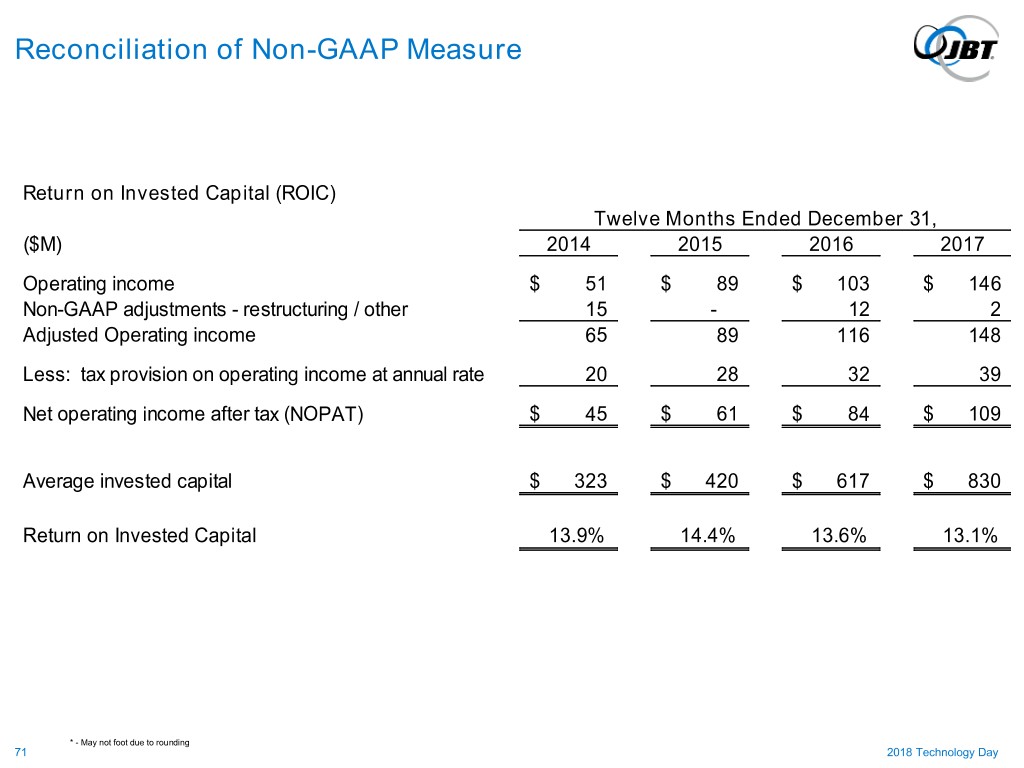

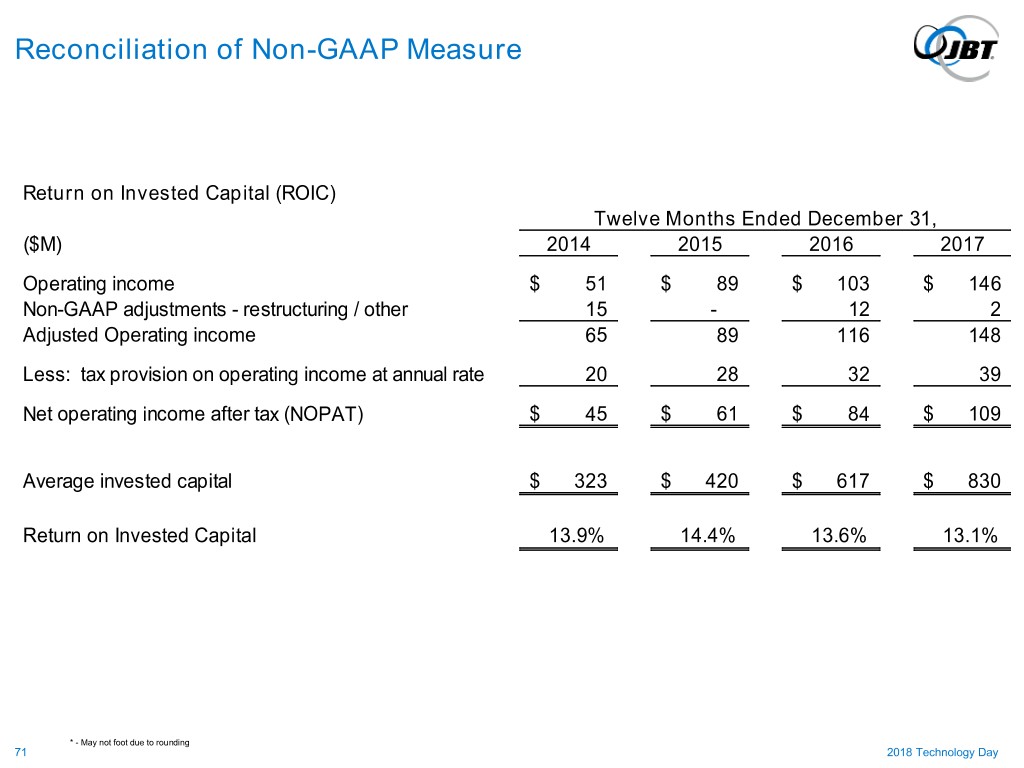

Reconciliation of Non-GAAP Measure Return on Invested Capital (ROIC) Twelve Months Ended December 31, ($M) 2014 2015 2016 2017 Operating income $ 51 $ 89 $ 103 $ 146 Non-GAAP adjustments - restructuring / other 15 - 12 2 Adjusted Operating income 65 89 116 148 Less: tax provision on operating income at annual rate 20 28 32 39 Net operating income after tax (NOPAT) $ 45 $ 61 $ 84 $ 109 Average invested capital $ 323 $ 420 $ 617 $ 830 Return on Invested Capital 13.9% 14.4% 13.6% 13.1% * - May not foot due to rounding 71 2018 Technology Day

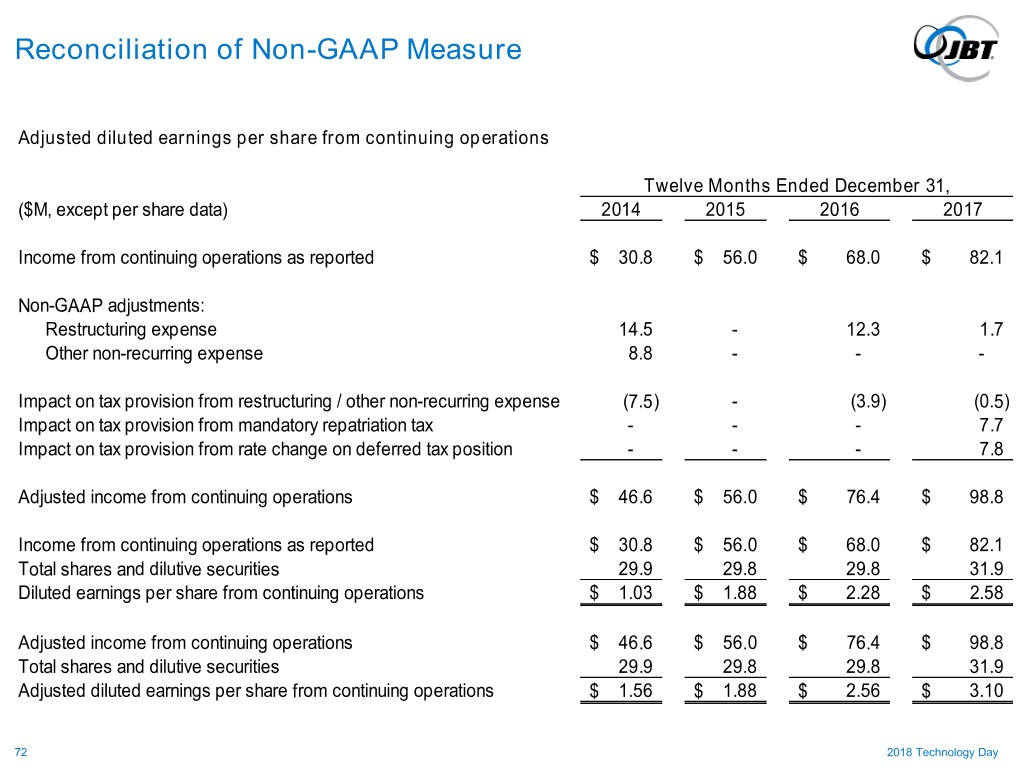

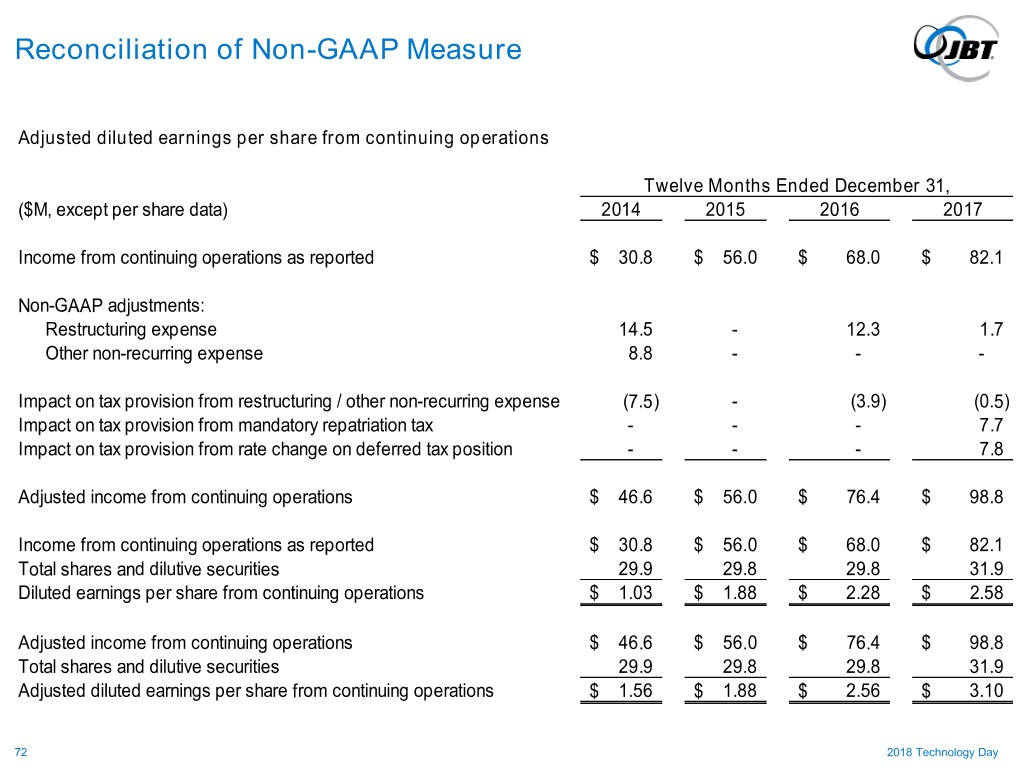

Reconciliation of Non-GAAP Measure Adjusted diluted earnings per share from continuing operations Twelve Months Ended December 31, ($M, except per share data) 2014 2015 2016 2017 Income from continuing operations as reported $ 30.8 $ 56.0 $ 68.0 $ 82.1 Non-GAAP adjustments: Restructuring expense 14.5 - 12.3 1.7 Other non-recurring expense 8.8 - - - Impact on tax provision from restructuring / other non-recurring expense (7.5) - (3.9) (0.5) Impact on tax provision from mandatory repatriation tax - - - 7.7 Impact on tax provision from rate change on deferred tax position - - - 7.8 Adjusted income from continuing operations $ 46.6 $ 56.0 $ 76.4 $ 98.8 Income from continuing operations as reported $ 30.8 $ 56.0 $ 68.0 $ 82.1 Total shares and dilutive securities 29.9 29.8 29.8 31.9 Diluted earnings per share from continuing operations $ 1.03 $ 1.88 $ 2.28 $ 2.58 Adjusted income from continuing operations $ 46.6 $ 56.0 $ 76.4 $ 98.8 Total shares and dilutive securities 29.9 29.8 29.8 31.9 Adjusted diluted earnings per share from continuing operations $ 1.56 $ 1.88 $ 2.56 $ 3.10 72 2018 Technology Day

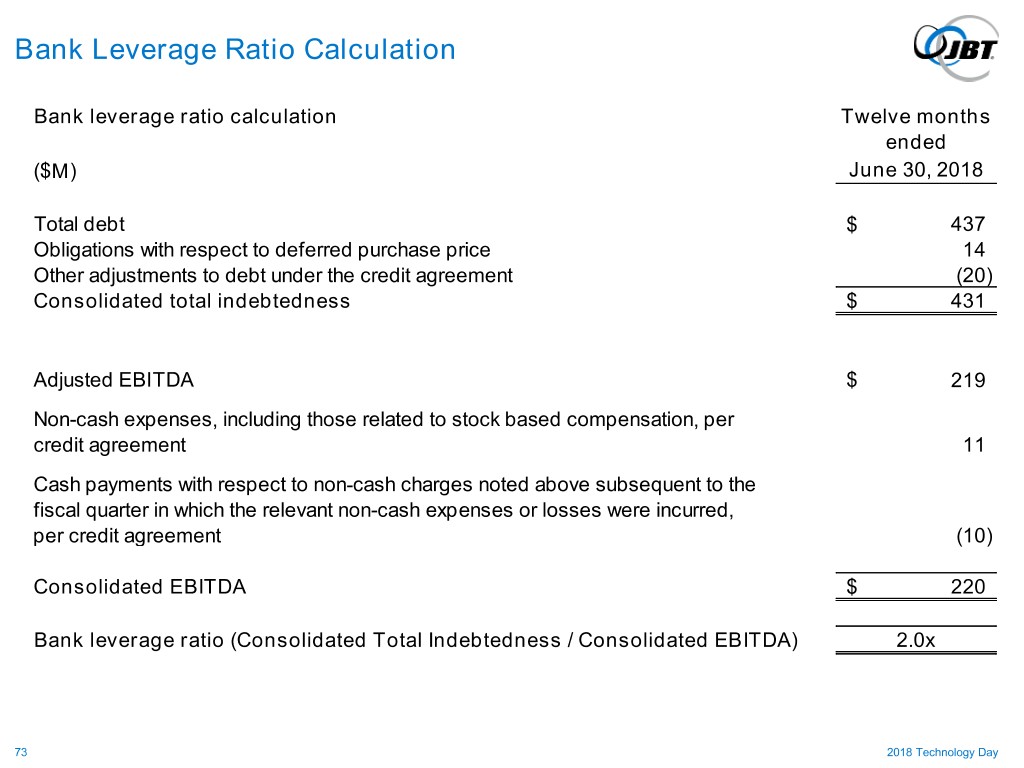

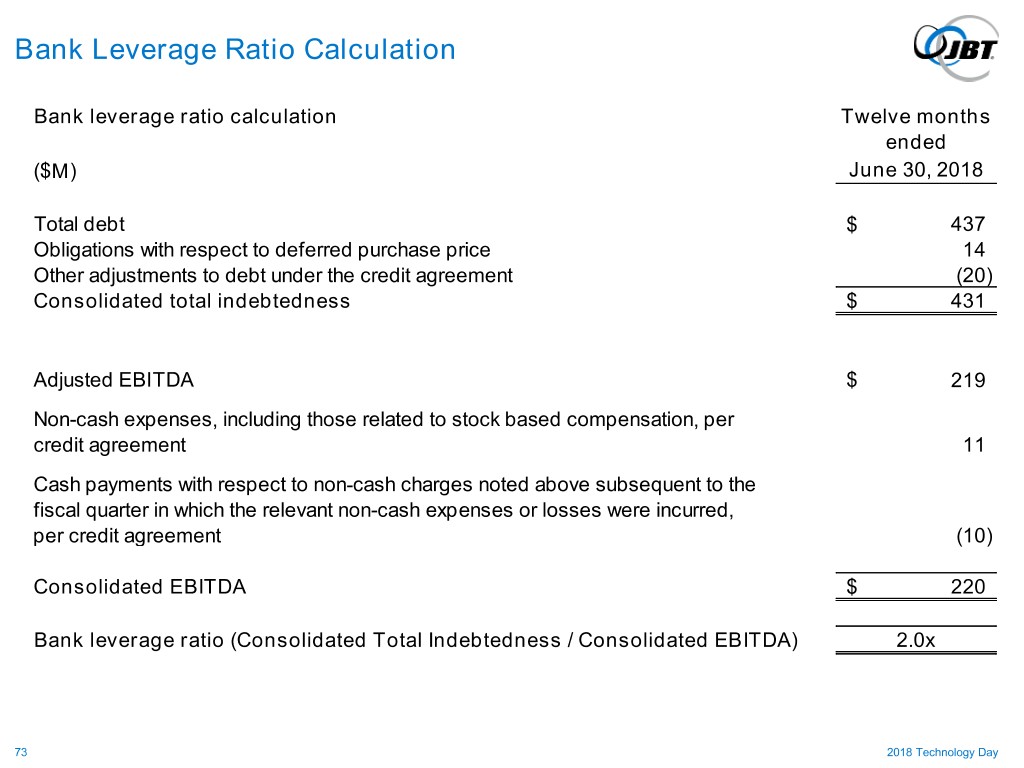

Bank Leverage Ratio Calculation Bank leverage ratio calculation Twelve months ended ($M) June 30, 2018 Total debt $ 437 Obligations with respect to deferred purchase price 14 Other adjustments to debt under the credit agreement (20) Consolidated total indebtedness $ 431 Adjusted EBITDA $ 219 Non-cash expenses, including those related to stock based compensation, per credit agreement 11 Cash payments with respect to non-cash charges noted above subsequent to the fiscal quarter in which the relevant non-cash expenses or losses were incurred, per credit agreement (10) Consolidated EBITDA $ 220 Bank leverage ratio (Consolidated Total Indebtedness / Consolidated EBITDA) 2.0x 73 2018 Technology Day

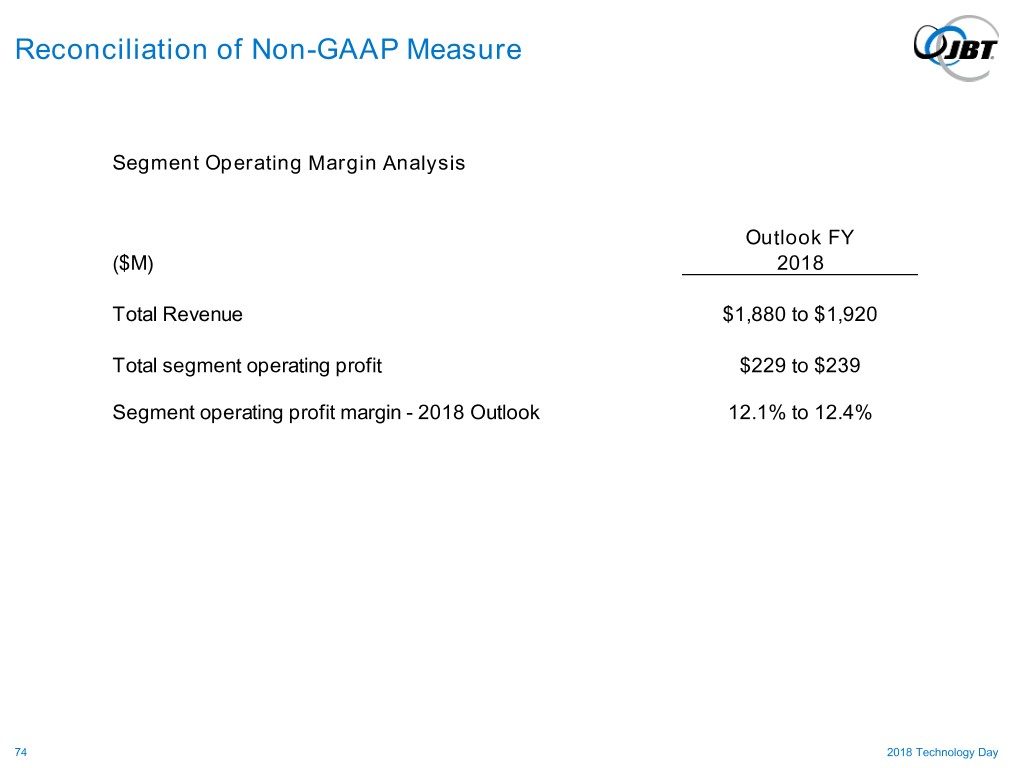

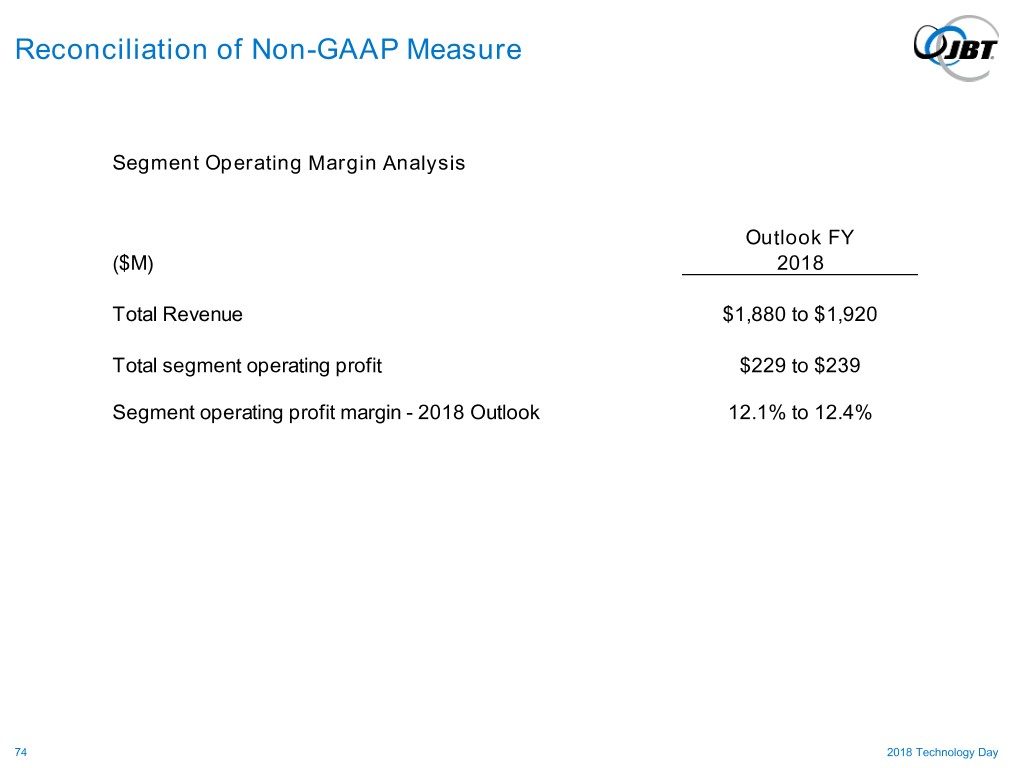

Reconciliation of Non-GAAP Measure Segment Operating Margin Analysis Outlook FY ($M) 2018 Total Revenue $1,880 to $1,920 Total segment operating profit $229 to $239 Segment operating profit margin - 2018 Outlook 12.1% to 12.4% 74 2018 Technology Day

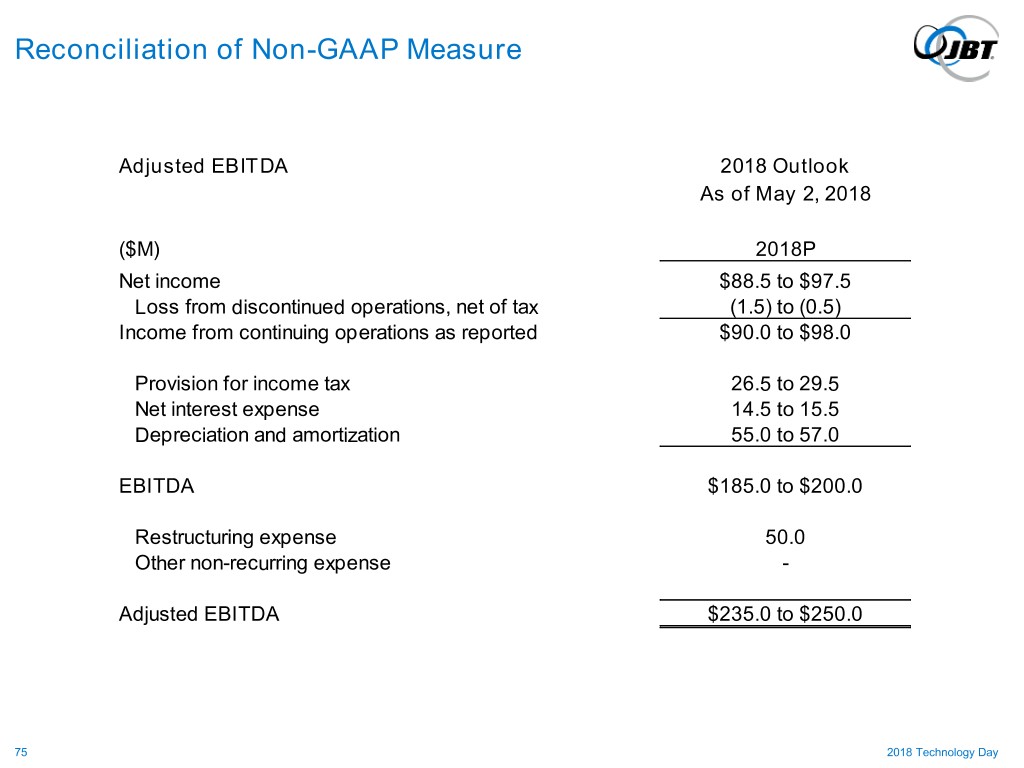

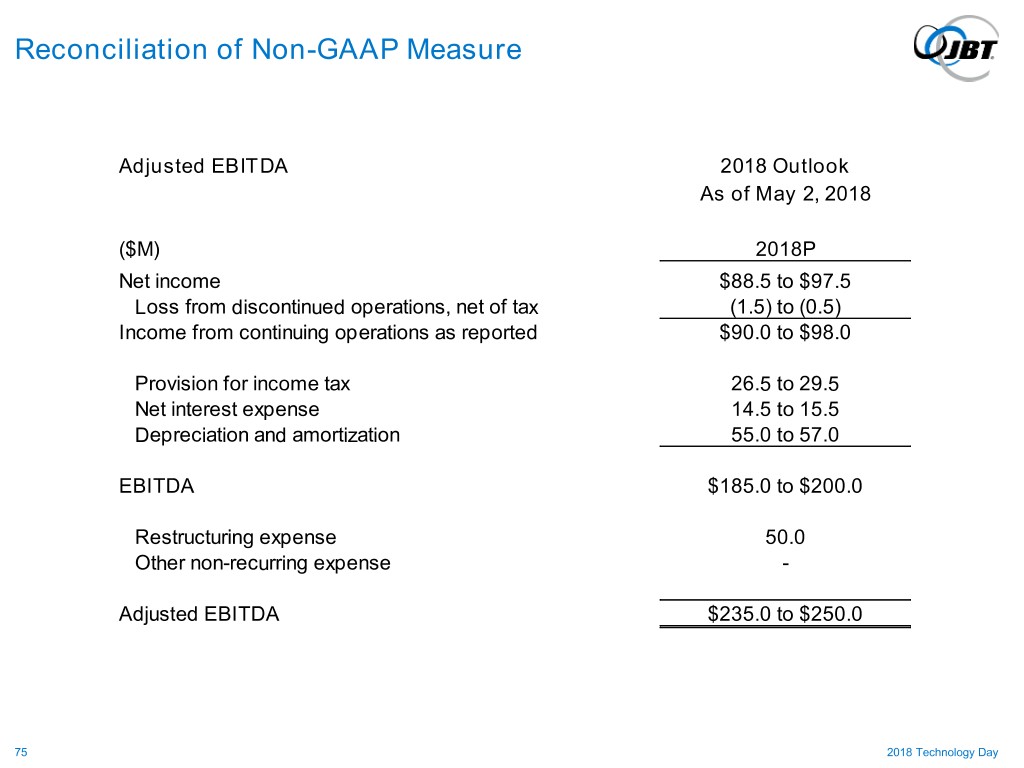

Reconciliation of Non-GAAP Measure Adjusted EBITDA 2018 Outlook As of May 2, 2018 ($M) 2018P Net income $88.5 to $97.5 Loss from discontinued operations, net of tax (1.5) to (0.5) Income from continuing operations as reported $90.0 to $98.0 Provision for income tax 26.5 to 29.5 Net interest expense 14.5 to 15.5 Depreciation and amortization 55.0 to 57.0 EBITDA $185.0 to $200.0 Restructuring expense 50.0 Other non-recurring expense - Adjusted EBITDA $235.0 to $250.0 75 2018 Technology Day

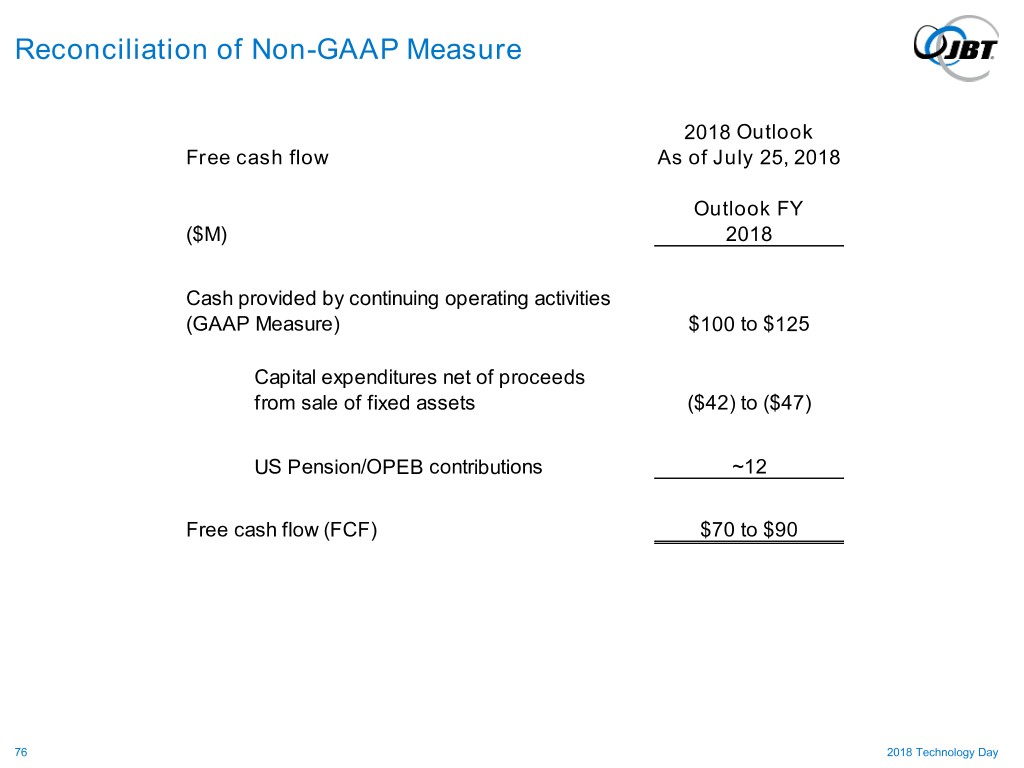

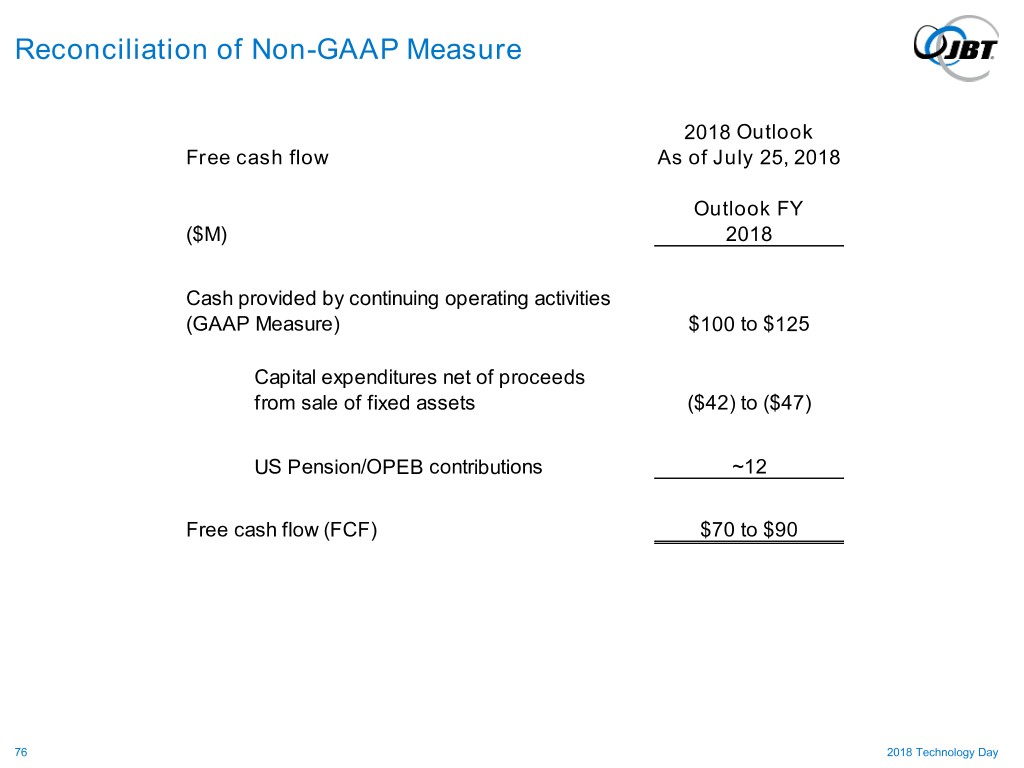

Reconciliation of Non-GAAP Measure 2018 Outlook Free cash flow As of July 25, 2018 Outlook FY ($M) 2018 Cash provided by continuing operating activities (GAAP Measure) $100 to $125 Capital expenditures net of proceeds from sale of fixed assets ($42) to ($47) US Pension/OPEB contributions ~12 Free cash flow (FCF) $70 to $90 76 2018 Technology Day