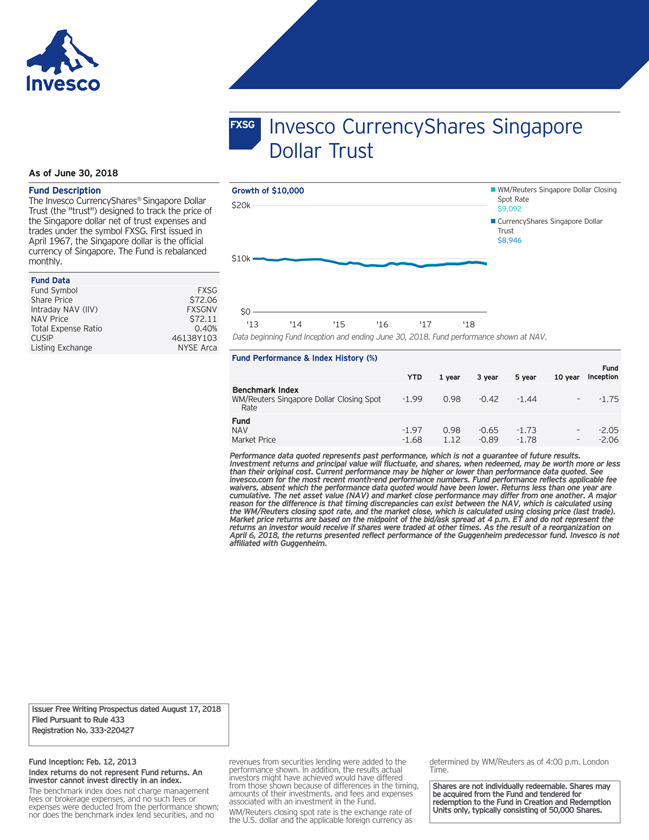

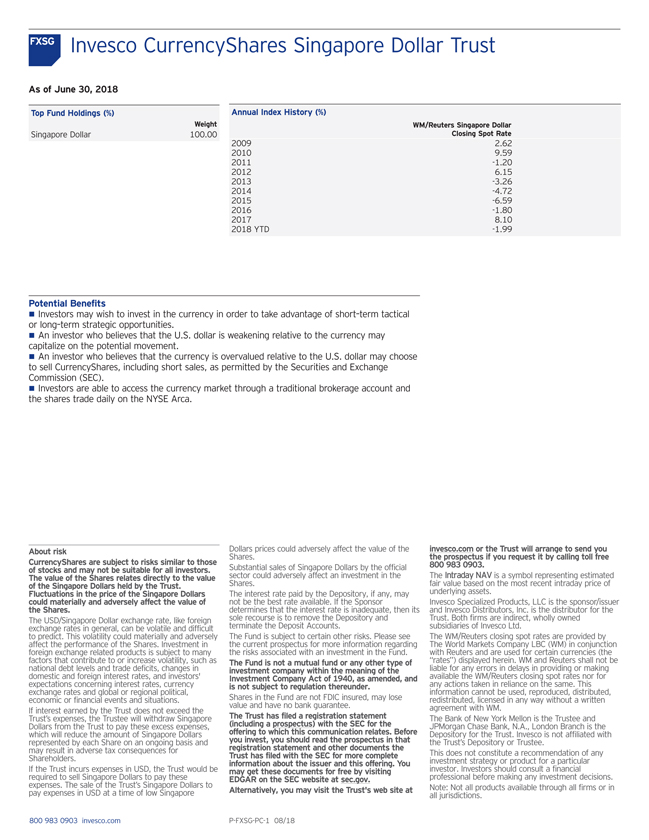

FXSG Invesco CurrencyShares Singapore Dollar Trust As of June 30, 2018 Top Fund Holdings (%) Annual Index History (%) Weight WM/Reuters Singapore Dollar Singapore Dollar 100.00 Closing Spot Rate 2009 2.62 2010 9.59 2011 -1.20 2012 6.15 2013 -3.26 2014 -4.72 2015 -6.59 2016 -1.80 2017 8.10 2018 YTD -1.99 Potential Benefits Investors may wish to invest in the currency in order to take advantage of short–term tactical or long–term strategic opportunities. An investor who believes that the U.S. dollar is weakening relative to the currency may capitalize on the potential movement. An investor who believes that the currency is overvalued relative to the U.S. dollar may choose to sell CurrencyShares, including short sales, as permitted by the Securities and Exchange Commission (SEC). Investors are able to access the currency market through a traditional brokerage account and the shares trade daily on the NYSE Arca. About risk Dollars prices could adversely affect the value of the invesco.com or the Trust will arrange to send you CurrencyShares are subject to risks similar to those Shares. the prospectus if you request it by calling toll free of stocks and may not be suitable for all investors. Substantial sales of Singapore Dollars by the official 800 983 0903. The value of the Shares relates directly to the value sector could adversely affect an investment in the The Intraday NAV is a symbol representing estimated of the Singapore Dollars held by the Trust. Shares. fair value based on the most recent intraday price of Fluctuations in the price of the Singapore Dollars The interest rate paid by the Depository, if any, may underlying assets. could materially and adversely affect the value of not be the best rate available. If the Sponsor Invesco Specialized Products, LLC is the sponsor/issuer the Shares. determines that the interest rate is inadequate, then its and Invesco Distributors, Inc. is the distributor for the The USD/Singapore Dollar exchange rate, like foreign sole recourse is to remove the Depository and Trust. Both firms are indirect, wholly owned exchange rates in general, can be volatile and difficult terminate the Deposit Accounts. subsidiaries of Invesco Ltd. to predict. This volatility could materially and adversely The Fund is subject to certain other risks. Please see The WM/Reuters closing spot rates are provided by affect the performance of the Shares. Investment in the current prospectus for more information regarding The World Markets Company LBC (WM) in conjunction foreign exchange related products is subject to many the risks associated with an investment in the Fund. with Reuters and are used for certain currencies (the factors that contribute to or increase volatility, such as The Fund is not a mutual fund or any other type of “rates”) displayed herein. WM and Reuters shall not be national debt levels and trade deficits, changes in investment company within the meaning of the liable for any errors in delays in providing or making domestic and foreign interest rates, and investors’ Investment Company Act of 1940, as amended, and available the WM/Reuters closing spot rates nor for expectations concerning interest rates, currency is not subject to regulation thereunder. any actions taken in reliance on the same. This exchange rates and global or regional political, information cannot be used, reproduced, distributed, economic or financial events and situations. Shares in the Fund are not FDIC insured, may lose redistributed, licensed in any way without a written If interest earned by the Trust does not exceed the value and have no bank guarantee. agreement with WM. Trust’s expenses, the Trustee will withdraw Singapore The Trust has filed a registration statement The Bank of New York Mellon is the Trustee and Dollars from the Trust to pay these excess expenses, (including a prospectus) with the SEC for the JPMorgan Chase Bank, N.A., London Branch is the which will reduce the amount of Singapore Dollars offering to which this communication relates. Before Depository for the Trust. Invesco is not affiliated with represented by each Share on an ongoing basis and you invest, you should read the prospectus in that the Trust’s Depository or Trustee. may result in adverse tax consequences for registration statement and other documents the Shareholders. Trust has filed with the SEC for more complete This does not constitute a recommendation of any information about the issuer and this offering. You investment strategy or product for a particular If the Trust incurs expenses in USD, the Trust would be may get these documents for free by visiting investor. Investors should consult a financial required to sell Singapore Dollars to pay these EDGAR on the SEC website at sec.gov. professional before making any investment decisions. expenses. The sale of the Trust’s Singapore Dollars to Note: Not all products available through all firms or in pay expenses in USD at a time of low Singapore Alternatively, you may visit the Trust’s web site at all jurisdictions. 800 983 0903 invesco.com P-FXSG-PC-1 08/18