SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BABY FOX INTERNATIONAL, INC.(Exact name of registrant as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | 5621 (Primary Standard Industrial Classification Code Number) | 26-0775642 (I.R.S. Employer Identification Number) |

Shanghai Minhang, District, 89 Xinbang Road, Suite 305-B5, PRC 86 21 5415 3855 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

Jieming Huang President and Chief Executive Officer Minhang District 89 Xinbang Road, Suite 305-B5 Shanghai, P.R. China 86 21 5415 3855 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to: Kristina L. Trauger, Esq. Anslow + Jaclin, LLP 195 Route 9 South, Suite 204 Manalapan, New Jersey 07726 (732) 409-1212 |

Approximate Date of Commencement of Proposed Sale to the Public: from time to time after the effective date of this Registration Statement as determined by market conditions and other factors.If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | |

CALCULATION OF REGISTRATION FEE

Title Of Each Class of Securities to be Registered | | Amount To Be Registered | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| | | | | | | | | | | | | |

| Common Stock, par value $.001 | | | | 868,262 | | | $ | 0.20 | | | $ | 173,653 | | | $ | 6.78 | |

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c). Our common stock is not traded and any national exchange and in accordance with Rule 457, the offering price was determined by the price shareholders were sold to our shareholders in a private placement memorandum. The price of $0.20 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

SUBJECT TO COMPLETION February 6, 2009

PROSPECTUS

868,262 shares of Common Stock

BABY FOX INTERNATIONAL, INC.

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. Our common stock is presently not traded on any market or securities exchange. The 868,262 shares of our common stock can be sold by selling security holders at a fixed price of $.20 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. We will receive no proceeds from the sale or other disposition of the shares, or interests therein, by the selling stockholders.

An investment in shares of our common stock involves a high degree of risk. We urge you to carefully consider the Risk Factors beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and neither we nor the selling stockholders are soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

February 6, 2009

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements, before making an investment decision .

THE COMPANY

Background

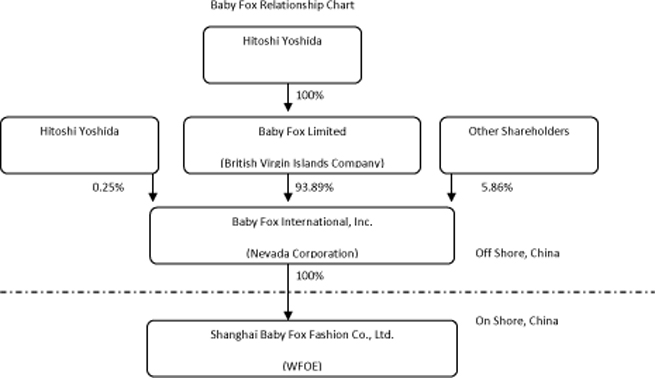

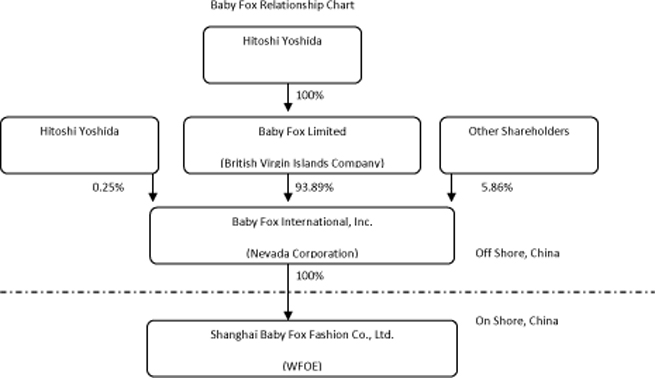

Baby Fox International, Inc. (“Baby Fox”) is a Nevada corporation organized on August 13, 2007 by Hitoshi Yoshida, a Japanese citizen, as a listing vehicle to acquire Shanghai Baby Fox Fashion Co., Ltd. (“Shanghai Baby Fox”) and to be quoted on the Over-The-Counter Bulletin Board (OTCBB). Shanghai Baby Fox, a wholly owned China-based subsidiary of Baby Fox, was originally founded by our board director, Fengling Wang, in March 2006 under Chinese laws. On September 20, 2007, we entered into an Equity Share Acquisition Agreement with Fengling Wang through an arm’s length transaction. Pursuant to the Equity Share Acquisition Agreement, we purchased 100% of the equity shares of Shanghai Baby Fox in exchange for 5.72 million RMB, approximately equivalent to $806,608, which was subsequently contributed to equity. Since this transaction is deemed between entities under common control, the financial statements in this registration statement are those of Shanghai Baby Fox. Baby Fox’s management team is experienced with fashion design, operations management, apparel sales and marketing backgrounds.

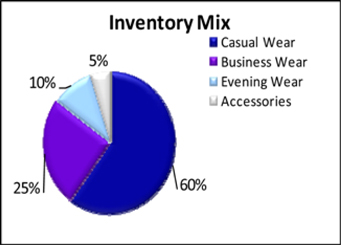

Baby Fox is a growing specialty retailer, developer, and designer of fashionable, value-priced women’s apparel and accessories. Our products are aimed to target women aged 20 to 40 in China. Unlike other mall stores, Baby Fox continuously updates its fashions and clothing designs to stay in sync with the latest fashions and trends in Korea, Japan, & Europe. Baby Fox has been a success story in China’s fashion industry, since the launch of its first retail mall store in July 2006. As of December 31, 2007, the brand has gained exposure in leading women’s magazines, which has helped us open 123 stores in over 30 cities.

The Baby Fox brand was initially registered in Italy in May of 2003 and it is promoted as an international brand in China (i.e. designs based on current fashions in Europe, Japan, etc.). Foreign apparel brands from France, Italy, U.S, Japan, and the U.K have traditionally dominated the high end fashion scene in China. We lease our offices and distribution facilities, and utilize strategic relationships with leading manufactures in China. Baby Fox’s flexible organizational structure, strong relationships and core focus on design enables us to launch a garment from concept to distribution in just weeks.

We lease our store space from mall operators generally for an initial term of one year. The lease generally includes provisions providing that the mall operator can cancel or modify the lease if the sales of the store are below the mall operator’s expected levels for any three consecutive months. Approximately 20% of the store leases require payment of a fixed minimum rental plus percentage rentals if sales of such stores exceed certain levels. The remaining 75% of the leases require payment of percentage rentals with no minimum fixed rental. The percentage of sales paid as rent ranges from 16% to 39% depending upon, among other things, the location of the store, with rentals being higher in large cities. As of the date of this registration statement, none of our corporate stores has been closed by mall operators due to its lower than expected sales.

We are focusing our near-term efforts on further expanding our reach with the goal of having over 200 stores launched and open for business by the end of June of 2009 (FY09). In addition, we are in the process of launching a “Baby Fox Membership Rewards” club. These initiatives are intended to strengthen our reach, brand image, and customer loyalty. Management believes these efforts will allow us to develop and secure a strong and powerful presence within China’s apparel industry.

Our long-term plans include expanding to over 1,000 stores, developing and launching of Baby Fox Outlet Centers, and the launching of Baby Fox Active – sport and active apparel stores.

We began generating revenue in August 2006. We generated sales of $ 15,055,727, and a net loss of $ 1,459,435 for the fiscal year ended June 30, 2008.

Pursuant to the Chinese Company Law, Shanghai Baby Fox is a Wholly Foreign Owned Enterprise (WFOE). WFOE is a limited liability company wholly owned by foreign investor(s). In China, WFOEs were originally conceived in order to encourage manufacturing activities that were either export oriented or related to the introduction of advanced technology. However, with China's entry into the WTO, these conditions were gradually abolished and WFOE is increasingly being adopted by service providers such as a variety of consulting and management services, software development, retail and trading as well.

When we acquired Shanghai Baby Fox on September 20, 2007, we received the Certificate of Approval from Shanghai Foreign Economic Relation & Trade Commission and the approval from the State Administration of Foreign Exchange (SFAE) Shanghai local branch. These approvals gave us the permission to change our entity status from a domestic enterprise to a WFOE, and to continue our business in the women apparel industry in China as a WFOE without being subject to any restrictions.

The advantages of establishing a WFOE include, but are not limited to:

| | 1. | Independence and freedom to implement the worldwide strategies of its parent company without having to consider the involvement of Chinese partner(s); |

| | 2. | Ability to formally carry out business rather than just function as a representative office and being able to issue invoices to their customers in RMB and receive revenues in RMB; |

| | 3. | Capability of converting RMB profits into US dollars for remittance to its parent company outside of China; |

| | 4. | Protection of intellectual know-how and technology; |

| | 5. | No requirement for Import / Export license for its own products; |

| | 6. | Full control of human resources |

| | 7. | Greater efficiency in operations, management and future development. |

Since January 2008, China began to implement its new corporate tax rates ranging from 15% to 25%. The actual tax rate depends on where a company is registered and the industry that such company engages in. Our subsidiary, Shanghai Baby Fox, is currently subject to a corporate tax rate of 25%.

The Chinese government allows Foreign Invested Enterprises to remit their profits out of the country and such remittances do not require any prior approval of the SAFE Dividends cannot be distributed and repatriated overseas if the losses of previous years have not been covered, but dividends that were not distributed in previous years may be distributed together with those of the current year. Repatriating registered capital to home countries is forbidden during the term of business operation.

Under Chinese laws and regulations, an industry is considered a “key industry” if the acquisition of the industry by an foreign entity may have an impact on “national economic security” or result in a transfer of actual control of a domestic enterprise that owns a well-known trademark or historic Chinese brand name. The women's apparel industry is not considered as a “key industry” in China. Accordingly, Chinese laws and regulations do not restrict foreign investment in China’s women apparel industry.

Summary of the Offering

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The selling stockholders are selling shares of common stock covered by this prospectus for their own account.

We will not receive any of the proceeds from the sale of these shares. The offering price of $.20 was determined by the price shares were sold to our shareholders in a private placement offering. The offering price of $.20 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board, at which time the shares may be sold at prevailing market prices or privately negotiated prices. We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

There is currently no public market for our securities and you may not be able to liquidate your investment since there is no assurance that a public market will develop for our common stock or that our common stock will ever be approved for trading on a recognized exchange. After this document is declared effective by the Securities and Exchange Commission, we intend to seek a market maker to apply for a quotation on the OTC BB in the United States. Our shares are not and have not been listed or quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the OTC BB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment.

We intend to apply for quoting of our common stock on the OTCBB, which we estimate will cost around $470,000. The breakdown of such costs is estimated as following:

| Legal Counsel | | $ | 100,000 | |

| | | | | |

| Auditor | | $ | 110,000 | |

| | | | | |

| Other consultants | | $ | 260,000 | |

| | | | | |

| Total: | | $ | 470,000 | |

We estimate that to maintain a quoting status will cost us $200,000 to $300,000 annually which will include legal, auditing and Chief Financial Officer’s salary expenses.

We will rely on professional services to carry out this plan, which includes, but is not limited to, a U.S. law firm with corporate and securities practice, a PCAOB registered auditor and consultants. In addition, we also expect to employ a Chief Financial Officer (CFO) who is familiar with US generally accepted accounting principles and the requirements related to public company listing. We have already started searching for a CFO with such qualification, but as of the date of this registration statement, we have not located such a CFO. We engaged Anslow & Jaclin LLP as our U.S. legal counsel on June 7, 2007, and Paritz & Company, P.A. as our auditor on June 4, 2007. We filed our initial registration statement on May 12, 2008, and estimate that it will take additional six (6) to twelve (12) months until our registration statement is declared effective.

To be quoted on the OTCBB, we must engage a market maker to file an application for a trading symbol on our behalf with the Financial Industry Regulatory Authority (FINRA). This process can take between three (3) to six (6) months. We plan to engage a market maker after our registration statement is declared effective by SEC.

Where You Can Find Us

We presently maintain our principal office at Minhang District, 89 Xinbang Road, Suite 305-B5, Shanghai, P.R. China. Our telephone number is +86 21 5415 3855. We maintain a website at www.babyfoxstyle.com.

RISK FACTORS

See “RISK FACTORS” for a discussion of the above factors and certain additional factors that should be considered in evaluating an investment in the common stock.

SUMMARY FINANCIAL AND OPERATING INFORMATION

The following selected financial information is derived from the Consolidated Financial Statements appearing elsewhere in this prospectus and should be read in conjunction with the Consolidated Financial Statements, including the notes thereto, appearing elsewhere in this prospectus.

| | | For Three Months Ended | |

| | | September 30, 2008 | | | September 30, 2007 | |

| | | Unaudited | | | Unaudited | |

| Summary of Operations | | | | | | |

| Total sales | | $ | 4,891,140 | | | $ | 2,481,642 | |

| Net income (loss) | | $ | (349,129 | ) | | $ | | |

| Basic and diluted income (loss) per common share | | $ | (0.01 | ) | | $ | - | |

| Weighted average common shares outstanding, basic and diluted | | | 40,427,499 | | | | 38,057,487 | |

| | | As of September 30, | |

| Statement of Financial Position | | 2008 | |

| Cash and cash equivalents | | $ | 225,286 | |

| Total assets | | $ | 11,685,481 | |

| Total current liabilities | | $ | 12,474,650 | |

| Long-term debt | | $ | 1,644,070 | |

| Stockholders’ deficiency | | $ | (2,433,239 | ) |

| Summary of Operations | | Year Ended June 30, 2008 | | | Year Ended June 30, 2007 | |

| Total sales | | $ | 15,055,727 | | | $ | 6,964,012 | |

| Net income (loss) | | $ | (1,459,435 | ) | | $ | 252,799 | |

| Net income (loss) per common share (basic and diluted) | | $ | (0.04 | ) | | $ | 0.01 | |

| Weighted average common shares outstanding, basic and diluted | | | 39,068,722 | | | | 38,057,487 | |

| Statement of Financial Position | | As of June 30, 2008 | | | As of June 30, 2007 | |

| | | | | | | |

| Cash and cash equivalents | | $ | 110,140 | | | $ | 321,879 | |

| Total assets | | $ | 9,239,943 | | | $ | 3,450,699 | |

| Current Liabilities | | $ | 9,679,883 | | | $ | 2,535,107 | |

| Long-term debt | | $ | 1,642,075 | | | $ | - | |

| Stockholders’ equity (deficiency) | | $ | (2,082,015 | ) | | $ | 915,592 | |

RISK FACTORS

The shares of our common stock being offered for resale by the selling stockholders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline and you may lose all or part of your investment. This Risk Factors section has addressed all material risks that should be considered in evaluating an investment in the common stock.

Risks Relating to Our Business

| | · | WE MUST SUCCESSFULLY GAUGE FASHION TRENDS AND CHANGING CONSUMER PREFERENCES, AND PROVIDE MERCHANDISE THAT SATISFIES CUSTOMER DEMAND IN A TIMELY MANNER TO INCREASE OUR SALE VOLUME AND IMPROVE OUR OPERATING RESULTS. |

Our success is largely dependent upon our ability to gauge the fashion tastes of our customers and to provide merchandise that satisfies customer demand in a timely manner. The global specialty retail business fluctuates according to changes in consumer preferences dictated, in part, by fashion and season. To the extent we misjudge the market for our merchandise or the products suitable for local markets, our sales will be adversely affected and the markdowns required to move the resulting excess inventory will adversely affect our operating results. Some of our past product offerings have not been well received by our broad and diverse customer base. Merchandise misjudgments could have a material adverse effect on our operating results.

Our ability to anticipate and effectively respond to changing fashion trends depends in part on our ability to attract and retain key personnel in our design, merchandising, marketing and other functions. Competition for this personnel is intense, and we cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods.

Fluctuations in the global specialty retail business especially affect the inventory owned by apparel retailers, since merchandise usually must be ordered well in advance of the season and frequently before fashion trends are evidenced by customer purchases. In addition, the cyclical nature of the global specialty retail business requires us to carry a significant amount of inventory, especially prior to peak back-to-school and holiday selling seasons when we build up our inventory levels. We must enter into contracts for the purchase and manufacture of merchandise well in advance of the applicable selling season. As a result, we are vulnerable to demand and pricing shifts and to suboptimal selection and timing of merchandise purchases. In the past, we have not always predicted our customers’ preferences and acceptance levels of our fashion items with accuracy. In addition, lead times for many of our purchases are long, which may make it more difficult for us to respond to new or changing fashion trends or consumer acceptance for our products. If sales do not meet expectations, too much inventory may cause excessive markdowns and, therefore, lower than planned margins.

| | · | OUR BUSINESS IS HIGHLY COMPETITIVE AND DEPENDS ON CONSUMER SPENDING PATTERNS. DECLINES IN CONSUMER SPENDING ON APPAREL AND ACCESSORIES COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR OPERATING RESULTS. |

The global specialty apparel retail industry is highly competitive. In Chinese market, we compete with China’s national and local department stores, specialty and discount store chains, independent retail stores and internet businesses that market similar lines of merchandise. We face a variety of competitive challenges including:

| • | | anticipating and quickly responding to changing consumer demands; |

| | | |

| • | | maintaining favorable brand recognition and effectively marketing our products to consumers in several diverse market segments; |

| • | | developing innovative, high-quality products in sizes, colors and styles that appeal to consumers of varying age groups and tastes; |

| • | | sourcing merchandise efficiently; |

| • | | competitively pricing our products and achieving customer perception of value; |

| • | | providing strong and effective marketing support; and |

| • | | attracting consumer traffic. |

Our business is sensitive to a number of factors that influence the levels of consumer spending, including political and economic conditions such as recessionary environments, the levels of disposable consumer income, consumer debt, interest rates and consumer confidence. Declines in consumer spending on apparel and accessories could have a material adverse effect on our operating results.

We also face competition with European, American, Japanese and Canadian manufacturers with established regional and national chains in China. Our success in China’s domestic markets depends on our ability to determine a sustainable profit formula to build brand loyalty and gain market share in these challenging retail environments. If we cannot effectively take advantage of international growth opportunities, our results of operations could be adversely affected.

· WE EXPECT THAT STORE OPENING COSTS WILL REDUCE NET INCOME IN FUTURE PERIODS.

Due to the initial term of the leases with mall operators and the cancellation provisions in the store leases, the cost of leasehold improvements and store fixtures averaging $21,750 per store are charged to expense as incurred. In addition, we incur additional costs related to hiring and training new employees averaging $3,000 per store. The effect of store openings could potentially reduce reported net income in the period of store openings.

| · | WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE. |

In order to maximize potential growth in our current and potential markets, we believe that we must expand our sourcing of apparel and accessories and marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the above mentioned targets, our general strategies are to maintain and search for hard-working employees who have innovative initiatives; on the other hands, we will also keep a close eye on expanding opportunities, for example, acquisition of state-owned enterprises.

| · | SUBSTANTIALLY ALL OF OUR BUSINESS, ASSETS AND OPERATIONS ARE LOCATED IN CHINA. THE CHINESE GOVERNMENT MAY TAKE MEASURES THAT BENEFIT THE OVERALL ECONOMY OF CHINA, BUT MAY HAVE AN ADVERSE EFFECT ON OUR OPERATIONS. |

Substantially all of our business, assets and operations are located in China. The economy of China differs from the economies of most developed countries in many respects. The economy of China has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of China, but may have a negative effect on us.

· | WE CANNOT ASSURE YOU THAT WE CAN SUCCEED IN OUR STRATEGY TO GROW ORGANICALLY THROUGH INCREASING THE DISTRIBUTION AND SALES OF OUR PRODUCTS BY PENETRATING EXISTING MARKETS IN PRC AND ENTERING NEW GEOGRAPHIC MARKETS IN PRC AS WELL AS OTHER PARTS OF ASIA AND THE UNITED STATES. OUR FAILURE TO IMPLEMENT THIS STRATEGY MAY RESULT IN A NEGATIVE IMPACT ON OUR GROWTH, FINANCIAL CONDITION, RESULTS OF OPERATIONS AND CASH FLOW. |

One of our strategies is to grow organically through increasing the distribution and sales of our products by penetrating existing markets in PRC and entering new geographic markets in PRC as well as other parts of Asia and the United States. However, many obstacles to entering such new markets exist, including, but not limited to, international trade and tariff barriers, shipping and delivery costs, costs associated with marketing efforts abroad and maintaining attractive foreign exchange ratios. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

· | IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS. |

If adequate additional financing is not available on acceptable terms, we may not be able to undertake store expansion, purchase additional machinery and purchase equipment for our operations and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) our research and development expenses; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies has experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of common stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding, the market fluctuations affecting our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our store expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures.

Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

BABY FOX LIMITED IS OUR PARENT COMPANY AND COULD TAKE ACTIONS THAT ARE DETRIMENTAL TO YOUR INVESTMENT FOR WHICH YOU WOULD HAVE NO REMEDY.

Baby Fox Limited beneficially owns the majority of our outstanding common stock as of the date of this filing. It has the ability to substantially influence our management, policies, and business operations. It will have the ability to control all matters submitted to the stockholders for approval, including the election and removal of directors and the approval of any merger and consolidation, or sale of all or substantially all of our assets. It could take actions detrimental to your investment in the future for which you would have no remedy.

WE SOURCED 49% OF OUR PRODUCT MANUFACTURING FROM A RELATED PARTY, CHANGZHOU CTS FASHION CO., LTD, PURSUANT TO A PURCHASE AGREEMENT. IF THE RELATED PARTY CANCELS THE PURCHASE AGREEMENT, IT WILL TAKE US CONSIDERABLE TIME AND EFFORT TO LOCATE NEW QUALIFIED SUPPLIERS.

In the fiscal year ended June 30, 2008, we sourced 49% of our product from a related party, Changzhou CTS Fashion Co., Ltd. (the “Changzhou CTS”). Pursuant to the purchase agreement with Changzhou CTS (as attached herein as Exhibit 10.2), we pay 30% of the total price of the value as down payment upon placing an order, pay 60% upon our receipt of the order, and pay the remaining balance within 25 days following the receipt of the products. Should such a purchase agreement be cancelled, it will take us considerable time and effort to locate new qualified suppliers.

| • | NEED FOR ADDITIONAL EMPLOYEES. |

Our future success also depends upon our continuing ability to attract and retain highly qualified personnel. Our business expansion, management and operation will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. Competition for such personnel is intense. There can be no assurance that we will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the fashion industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees. Our inability to attract skilled management personnel and other employees as needed could have a material adverse effect on our business, operating results and financial condition. Our arrangement with our current employees is at will, meaning its employees may voluntarily terminate their employment at any time. We anticipate that the use of stock options, restricted stock grants, stock appreciation rights, and phantom stock awards will be valuable in attracting and retaining qualified personnel. However, there is no assurance that this plan can achieve such effect.

· | INTERNATIONAL OPERATIONS REQUIRE US TO COMPLY WITH A NUMBER OF UNITED STATES AND INTERNATIONAL REGULATIONS WHICH MAY INCREASE OUR OPERATING COSTS, LIMIT THE SCOPE OF OUR TRANSACTIONS AND REDUCE OUR ABILITY TO CONTINUOUSLY INCREASE OUR PROFITS. |

We are required to comply with a number of international regulations in countries outside of the United States, which may increase our operating costs. In addition, we must comply with the Foreign Corrupt Practices Act, or FCPA, which prohibits U.S. companies or their agents and employees from providing anything of value to a foreign official for the purposes of influencing any act or decision of these individuals in their official capacity to help obtain or retain business, direct business to any person or corporate entity or obtain any unfair advantage. Any failure by us to adopt appropriate compliance procedures and ensure that our employees and agents comply with the FCPA and applicable laws and regulations in foreign jurisdictions could result in substantial penalties and/or restrictions in our ability to conduct business in certain foreign jurisdictions. We believe we are currently in compliance with such regulations. The U.S. Department of The Treasury's Office of Foreign Asset Control, or OFAC, administers and enforces economic and trade sanctions against targeted foreign countries, entities and individuals based on U.S. foreign policy and national security goals. As a result, we are restricted from entering into transactions with certain targeted foreign countries, entities and individuals except as permitted by OFAC which may reduce our ability to increase our profits.

· | WE MAY INCUR SIGNIFICANT COSTS TO ENSURE COMPLIANCE WITH UNITED STATES CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS. |

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Relating to the People's Republic of China

| · | FAILURE TO COMPLY WITH PRC REGULATIONS RELATED TO THE ESTABLISHMENT OF OFFSHORE SPECIAL PURPOSE COMPANIES BY PRC RESIDENTS MAY SUBJECT OUR PRC RESIDENT STOCKHOLDERS TO PERSONAL LIABILITY, LIMIT OUR ABILITY TO ACQUIRE PRC COMPANIES OR TO INJECT CAPITAL INTO OUR PRC SUBSIDIARIES, AND LIMIT OUR PRC SUBSIDIARIES’ ABILITY TO DISTRIBUTE PROFITS TO US. |

In October 2005, the SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control of an offshore special purpose company (SPV), for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006. Failure to comply with the requirements of Circular 75, as applied by SAFE, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We believe our controlling stockholder, Hitoshi Yoshida, a Japanese national, who is not a PRC resident as defined in Circular 75. We believe that there is no need for Hitoshi Yoshida to register with the relevant branch of SAFE, as currently required, in connection with his equity interests in us and our acquisitions of equity interests in our PRC subsidiary. We further believe other PRC individuals, who are either purchasers of our March 2008 private placement or individuals and controlling shareholders of certain BVI companies in receiving our January 18, 2008 share issue, are not required to register with the relevant branch of SAFE in connection with their equity interest in us and with our acquisitions of equity interests in our PRC subsidiary, because they hold total less than five percent (5%) of our issued and outstanding shares.

However, we cannot provide any assurances that they, their existing registrations, and their amendments to their registrations have fully complied with all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

| · | EVEN THOUGH WE HAVE OBTAINED THE GOVERMENTAL APPROVALS WHICH ALLOW US TO CHANGE OUR ENTITY FROM A CHINESE DOMESTIC ENTERPRISE TO A WHOLLY FOREIGN OWNED ENTERPRISE AND TO CONTINUE OUR BUSINESS IN CHINESE WOMEN APPAREL INDUSTRY AS A WHOLLY FOREIGN OWNED ENTERPRISE WITHOUT ANY RESTRICTIONS, THERE IS SUBSTANTIAL UNCERTAINTY WITH RESPECT TO THE FUTURE INTERPRETATION AND APPLICATION OF THE RELEVANT LAWS AND REGULATIONS. |

Under PRC laws and regulations, an industry is considered a “key industry” if the acquisition of the industry by an foreign entity may have an impact on “national economic security” or result in a transfer of actual control of a domestic enterprise that owns a well-known trademark or historic Chinese brand name. The women's apparel industry is not considered as a “key industry” in China. Accordingly, PRC laws and regulations do not restrict foreign investment in China’s women apparel industry.

When we acquired Shanghai Baby Fox on September 20, 2007, we received the Certificate of Approval from Shanghai Foreign Economic Relation & Trade Commission and the approval from SAFE Shanghai local branch. The approvals gave us the permission to change our entity from a domestic enterprise to a WFOE, and to continue our business in the women apparel industry in China as a WFOE without being subject to any restrictions.

Although we believe that our operations are in compliance with current, applicable PRC regulations in all material aspects, many PRC laws and regulations are subject to extensive interpretive power of governmental agencies and commissions, and there is substantial uncertainty regarding the future interpretation and application of these laws or regulations.

· | CERTAIN POLITICAL AND ECONOMIC CONSIDERATIONS RELATING TO THE PRC COULD ADVERSELY AFFECT OUR OPERATIONS. OUR OPERATING RESULTS MAY BE ADVERSELY AFFECTED BY CHANGES IN THE PRC’S ECONOMIC AND SOCIAL CONDITIONS AS WELL AS BY CHANGES IN THE POLICES OF THE PRC GOVERNMENT. |

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC's economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

| · | IF THE CHINA SECURITIES REGULATORY COMMISSION, OR CSRC, OR ANOTHER PRC REGULATORY AGENCY, DETERMINES THAT CSRC APPROVAL IS REQUIRED IN CONNECTION WITH THIS OFFERING, THIS OFFERING MAY BE DELAYED OR CANCELLED, OR WE MAY BECOME SUBJECT TO PENALTIES. |

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, has certain provisions that require SPVs formed for the purpose of acquiring PRC domestic companies and controlled by PRC individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock market. In our case, the formation on August 13, 2007 by Hitoshi Yoshida, a Japanese national, of Baby Fox International, Inc., a Nevada State corporation and subsequent acquisition of Shanghai Baby Fox Fashion Co., Ltd. from Fengling Wang, should not be seen as a PRC individual’ acquisition of a PRC domestic company as contemplated by the new regulation and we therefore have not applied to the CSRC for approval under this regulation. Nonetheless, if the CSRC or another PRC regulatory agency subsequently determines that the CSRC’s approval is required for this offering, we may face sanctions by the CSRC or another PRC regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of the proceeds from this offering into the PRC, restrict or prohibit payment or remittance of dividends to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our shares. The CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, to delay or cancel this offering before settlement and delivery of the shares being offered by us.”

· | THE RECENT NATURE AND UNCERTAIN APPLICATION OF MANY PRC LAWS APPLICABLE TO US CREATE AN UNCERTAIN ENVIRONMENT FOR BUSINESS OPERATIONS AND THEY COULD HAVE A NEGATIVE EFFECT ON US. |

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects.

· | CURRENCY CONVERSION AND EXCHANGE RATE VOLATILITY COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION. |

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People's Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day's dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which requires foreign exchange for transactions relating to current account items, may, without approval of the SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, foreign invested enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Reminbi into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

Since 1994, the exchange rate for Renminbi against the United States dollar has remained relatively stable, most of the time in the region of approximately RMB8.28 to $1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. dollar and, the exchange rate for the Renminbi against the U.S. dollar became RMB8.02 to $1.00. As our operations are primarily in PRC, any significant revaluation or devaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. We may not be able to hedge effectively against in any such case. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced. There can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition. Our operating companies are FIEs to which the Foreign Exchange Control Regulations are applicable. There can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

· | IT MAY BE DIFFICULT TO AFFECT SERVICE OF PROCESS AND ENFORCEMENT OF LEGAL JUDGMENTS UPON US AND OUR OFFICERS AND DIRECTORS BECAUSE THEY RESIDE OUTSIDE THE UNITED STATES. |

As our operations are presently based in PRC and a majority of our directors and all of our officers reside in PRC, our service of process and such directors and officers may be difficult to effect within the United States. Also, our main assets are located in PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

· | SINCE ALL OF OUR OPERATIONS ARE IN PRC. ANY FUTURE OUTBREAK OF PATHOGENIC ASIAN BIRD FLU IN CHICKENS AND DUCKS, OR ANY OTHER EPIDEMIC IN PRC COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS OPERATIONS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Since mid-December 2003, a number of Asian countries have reported outbreaks of highly pathogenic avian bird flu in chickens and ducks. Since all of our operations are in PRC, an outbreak of the Asian Bird Flu in PRC in the future may disrupt our business operations and have a material adverse effect on our financial condition and results of operations. For example, a new outbreak of Asian Bird Flu, or any other epidemic, may reduce the level of economic activity in affected areas, which may lead to a reduction in our revenue if our clients cancel existing contracts or defer future expenditures. In addition, health or other government regulations may require temporary closure of our offices, or the offices of our customers or partners, which will severely disrupt our business operations and have a material adverse effect on our financial condition and results of operations.

· | WE MAY EXPERIENCE CURRENCY FLUCTUATION AND LONGER EXCHANGE RATE PAYMENT CYCLES WHICH WILL NEGATIVELY AFFECT THE COSTS OF OUR PRODUCTS SOLD AND THE VALUE OF OUR LOCAL CURRENCY. |

The local currencies in the countries in which we sell our products may fluctuate in value in relation to other currencies. Such fluctuations may affect the costs of our products sold and the value of our local currency profits. While we are not conducting any meaningful operations in countries other than PRC at the present time, we may expand to other countries and may then have an increased risk of exposure of our business to currency fluctuation.

WE HAVE NO PLAN TO DECLARE ANY DIVIDENDS TO SHAREHOLDERS IN THE NEAR FUTURE.

We currently intend to retain our future earnings, if any, to support our operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Although in the fiscal year of 2008, our wholly-owned subsidiary Shanghai Baby Fox declared cash dividends on August 8, 2007 and December 10, 2007 in the amount of $401,973 and $433,757, respectively, there is no intent to make the payment in the foreseeable future. The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

· | SINCE MOST OF OUR ASSETS ARE LOCATED IN PRC, ANY DIVIDENDS OF PROCEEDS FROM LIQUIDATION IS SUBJECT TO THE APPROVAL OF THE RELEVANT CHINESE GOVERNMENT AGENCIES. |

Our assets are predominantly located inside PRC. Under the laws governing foreign invested enterprises in PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency's approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

Risks Associated with Our Shares of Common Stock

· | YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT SINCE THERE IS NO ASSURANCE THAT A PUBLIC MARKET WILL DEVELOP FOR OUR COMMON STOCK OR THAT OUR COMMON STOCK WILL EVER BE APPROVED FOR TRADING ON A RECOGNIZED EXCHANGE. |

There is no established public trading market for our securities. After this document is declared effective by the Securities and Exchange Commission, we intend to seek a market maker to apply for a quotation on the OTC BB in the United States. Our shares are not and have not been listed or quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the OTC BB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment, which will result in the loss of your investment.

· | THE OFFERING PRICE OF THE SHARES WAS ARBITRARILY DETERMINED, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO OUR ACTUAL VALUE, AND MAY MAKE OUR SHARES DIFFICULT TO SELL. |

The offering price of $.20 for the shares of common stock was based upon the sale price in our recent private placement. The sale price in the private placement was arbitrarily determined. The facts considered in determining the sale price were our financial condition and prospects, our limited operating history and the general condition of the securities market. Therefore, the offering price is not an indication of and is not based upon our actual value. The offering price bears no relationship to our book value, assets or earnings or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

��

· | FUTURE SALES BY OUR STOCKHOLDERS MAY NEGATIVELY AFFECT OUR STOCK PRICE AND OUR ABILITY TO RAISE FUNDS IN NEW STOCK OFFERINGS. |

Sales of our common stock in the public market could lower the market price of our common stock. Sales may also make it more difficult for us to sell equity securities or equity-related securities in the future at a time and price that our management deems acceptable or at all. Of the 40,427,500 shares of common stock outstanding as of May 9, 2008, 868,262 shares are, or will be, freely tradable without restriction upon the effective date of this registration statement, unless held by our “affiliates”. The remaining 39,559,238 shares of common stock, which will be held by existing stockholders, including the officers and directors, are “restricted securities” and may be resold in the public market only if registered or pursuant to an exemption from registration. Some of these shares may be resold under Rule 144.

· | “PENNY STOCK” RULES MAY MAKE BUYING OR SELLING OUR COMMON STOCK DIFFICULT. |

Trading in our securities will be subject to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that any broker-dealer who recommends our securities to persons other than prior customers and accredited investors, must, prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker- dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. Broker-dealers who sell penny stocks to certain types of investors are required to comply with the Commission’s regulations concerning the transfer of penny stocks. These regulations require broker- dealers to:

| o | Make a suitability determination prior to selling a penny stock to the purchaser; |

o | Receive the purchaser’s written consent to the transaction; and |

o | Provide certain written disclosures to the purchaser. |

These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

FORWARD LOOKING STATEMENTS

Information included or incorporated by reference in this prospectus may contain forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

This prospectus contains forward-looking statements, including statements regarding, among other things, (a) our projected sales and profitability, (b) our technology, (c) our manufacturing, (d) the regulation to which we are subject, (e) anticipated trends in our industry and (f) our needs for working capital. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Business,” as well as in this prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur.

Except as otherwise required by applicable laws, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in the prospectus, whether as a result of new information, future events, changed circumstances or any other reason after the date of this prospectus.

USE OF PROCEEDS

The selling stockholders are selling shares of common stock covered by this prospectus for their own account. We will not receive any portion of the proceeds from the sale or other disposition of the shares of common stock covered hereby, or interests therein, by the selling stockholders.

We have agreed to bear the expenses of the registration of the shares. We anticipate that these expenses will be out $52,507.

DIVIDEND POLICY

In the fiscal year of 2008, our wholly-owned subsidiary, Shanghai Baby Fox, declared cash dividends payable to its sole shareholder, Fengling Wang, on August 8, 2007 and December 10, 2007 in the amount of $401,973 and $433,757, respectively. The dividends have not been paid to Fengling Wang as of the date of this registration statement. In the three months ended September 30, 2008, we did not declare any cash dividend. We do not plan to declare any dividend in the foreseeable future.

DETERMINATION OF OFFERING PRICE

No market currently exists for our common stock. Therefore, the offering price of $.20 was based on the offering price of shares sold pursuant to our Regulation D, Rule 506 offering completed in March, 2008 in which we issued a total of 427,500 shares of our common stock to 32 shareholders at a price per share of $.20 for an aggregate offering price of $85,500.

DILUTION

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

PENNY STOCK CONSIDERATIONS

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules.

MARKET FOR OUR COMMON STOCK

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate applying for trading of our common stock on the Over the Counter Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the Bulletin Board or, if traded, that a public market will materialize.

Holders of Our Common Stock

As of the date of this registration statement, we had 42 registered shareholders.

Registration Rights

We have not granted registration rights to the selling shareholders or to any other persons.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto and the other financial information appearing elsewhere in this prospectus. In addition to historical information contained herein, the following discussion and other parts of this prospectus contain certain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed in the forward-looking statements due to factors discussed under “Risk Factors”, as well as factors discussed elsewhere in this prospectus. The cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements wherever they appear in this prospectus.

Overview

Our retail stores are located predominantly in well-positioned mall locations with space of approximately 1,000 square feet on average. The stores are designed to create an environment that accentuates our fashion, breadth, and value in merchandise selection.

We lease our store space from mall operators generally for an initial term of one (1) year. The lease generally includes provisions providing that the mall operator can cancel or modify the lease if the sales of the store are below the expected levels for any three consecutive months. Approximately 20% of the store leases require payment of a fixed minimum rental plus percentage rentals if sales of such stores exceed certain levels. The remaining 75% of the leases require payment of percentage rentals only with no minimum fixed rental. The percentage of sales paid as rent ranges from 16% to 39% depending upon, among other things, the location of the store with rentals being higher in large cities. As of the date of this registration statement, none of our corporate stores has been closed by mall operators due to its lower than expected sales.

Both corporate owned stores and non-corporate owned stores use bold, exaggerated colors, such as eye-catching gold, noble black or passionate red. The settings and decors create an atmosphere of nobility. The key is to achieve the functionality and balance between color and material. Our merchandise planning and distribution team works closely with both corporate and non-corporate store personnel to sufficiently distribute merchandise that can meet each individual store’s particular merchandise requirement. This team is also responsible for managing inventory levels, distributing merchandise, and replenishing inventory.

Our management team monitors and tracks the store sales via our Enterprise Resource Planning (ERP) computer system store by store on both daily and monthly basis. In addition, the ERP system can also sort our sales and inventory geographically, city by city and province by province, on both a monthly and yearly base. A typical sales metric is included in Exhibit 99.4 attached hereto, which can track the monthly sales by store and by per square meter.

Factors Relevant to Evaluating Our Business and Financial Performance

In order to expand our business, our goal is to obtain market share initially. To comply with this marketing strategy, we evaluate our business results by examining the monthly gross sales of each store as stated in Exhibit 99.4. With respect to our corporate stores that are located in several malls with common mall operator, we evaluate our business results based upon the average monthly gross sales of such corporate stores. We also receive different brand revenue ranking reports from each mall operator. From these ranking reports, we can easily evaluate the condition of Baby Fox sale volumes compared with the sale volumes of our competitors.

For corporate store, we make a “keep” or “close” decision based on the following one single criterion:

Since October 1, 2008, all corporate stores were categorized in Class A and Class B. Class A stores only sell our new products and Class B stores sell leave-over inventories from the Class A stores at a discount. If the monthly sales of a Class A store fall below 80,000 RMB, approximately $11,765, such Class A store will downgrade into Class B. If a Class B store fails to generate gross sales in the amount less than 40,000 RMB, approximately equivalent to $5,800, such store will be closed.

For non corporate store, we do not have any criteria to decide whether or not to “keep” or “close.” As long as our non corporate store continues to order products from us, we continue our sale to them.

Plan of Operation

Baby Fox Store Footprint – As of June 30, 2008

Since the launch of our first retail mall store in July 2006, the Baby Fox business has been growing in China. The brand has gained exposure in leading women’s magazines and we opened 153 store locations as of June 30, 2008. There were 106 corporate stores and 47 non corporate stores then. As of September 30, 2008, there were 163 stores consisting of 115 corporate stores and 48 non corporate stores. We plan to increase our total store number from 163 to 200 with a total of 143 corporate store and 57 non corporate stores by June 30, 2009. Store opening expenses, including fixture, store build-out, employee training, employee hiring and related expenses, are charged to operations in the year incurred, and are not subject to amortization over years. Because we plan to increase the number of our corporate stores from 106 to 143 in fiscal year 2009, we are expected to generate more store opening expenses in 2009, which will cause more net loss on our financial statements.

Corporate Owned Stores

As of September 30, 2008, we had 115 corporate stores in China. We also test new markets with seasonal stores in additional locations during peak apparel shopping months. We seek to instill enthusiasm and dedication in our corporate owned store management personnel and sales associates through incentive programs and regular communication with the stores. Sales associates receive commissions on sales with a guaranteed minimum hourly compensation. Store managers receive base compensation plus incentive compensation based on sales and inventory control.

We lease our store space from mall operators generally for an initial term of one (1) year. The lease generally includes provisions providing that the mall operator can cancel or modify the lease if the sales of the store are below the expected levels for any three consecutive months. Approximately 20% of the store leases require payment of a fixed minimum rental plus percentage rentals if sales of such stores exceed certain levels. The remaining 75% of the leases require payment of percentage rentals only with no minimum fixed rental. The percentage of sales paid as rent ranges from 16% to 39% depending upon, among other things, the location of the store with rentals being higher in large cities. As of the date of this registration statement, none of our corporate stores has been closed by mall operators due to its lower than expected sales.

In the fiscal year of 2008, our corporate store counts for 91.97% of our total sales. In the fiscal year of 2009, our main capital investment activities are new corporate store expansion.

For corporate store, the average cost associated with opening a new store is approximately $75,000, approximately equivalent to 520,000 RMB. It is mainly spent on the following items:

| Store Build-out: | | | 29 | % | | $ | 21,750 | |

| | | | | | | | | |

| Inventory; | | | 67 | % | | $ | 50,250 | |

| | | | | | | | | |

| Hiring | | | 4 | % | | $ | 3,000 | |

Non-Corporate Stores

As of September 30, 2008, we had 48 non-corporate stores in China. Currently we are able to use our point-of-sale systems to track non-corporate owned sales.

Typically, all licensed non-corporate retail stores must only carry the Baby Fox brand merchandise, the store floor must be designed according to corporate standards, and all employees must represent the Baby Fox brand image via their customer service attitude, attire, and other relevant procedures. The licensee is a business entity independent from us, but we maintain authority and approval rights with respect to store locations, store designs, license renewals, merchandise orders, and the right to conduct random store audits.

Upon agreeing to open a non-corporate Baby Fox store, the licensee must open the store within a limited time frame, otherwise the contract will terminate. The licensee must have the same computer management software installed and operating before the first day of operations. The licensee must use our set prices on all the merchandise sold. It cannot mark up or down the prices. The licensee must follow all ordering and returning merchandise guidelines. During our random audits, we have the right to dismiss any store employee we consider unqualified. The number of employees working during operations must also abide by our company policies. If the licensee violates any of the regulations, it shall be subject to a monetary penalty. The contract with such licensee can also be terminated whenever we consider necessary.

The term of the agreement with non-corporate stores is normally of two years. Non-corporate store owners usually pay 30% down payment to order our products, and the balance of 70% anytime before we ship our products to them. The payments are subject to negotiations between us and our non-corporate stores. We do not collect any license fee from non-corporate stores owners. A sample of our non-corporate store agreement is attached hereto as Exhibit 10.3.

In the fiscal year of 2008, our non-corporate stores account for 9% of our total sales. We do not generate any substantial cost in connection with opening a new non corporate store. We sell our products to individual non corporate store owners who are responsible for their own inventory costs.

Based on our initial success and the assessment of the future opportunity, Baby Fox is positioned for continued growth over the next several years. We plan to grow to over 200 stores by June 30, 2009. Corporate stores will primarily be opened in major metropolitan areas and non-corporate or “licensed” stores will be established in suburban communities.

Specialty stores are popular in China because the store owners have good control over operations, store decorations, and the products and services offered. Furthermore, smaller focused stores can well adapt to China’s growing demand for “fast fashion” and changing fashion trends (i.e. shorter product lifecycles and shifting demand for designs). Baby Fox is currently focusing on expanding in larger cities via corporate owned stores. Smaller cities are ideal targets for non-corporate or “licensed” stores. There is huge market potential for women's apparel in less developed cities in China where disposable income is rising. Owner operated stores in less developed cities are ideal as local managers have a good understanding of malls and locations with high foot traffic patterns and are highly incentivized to capture the growing purchasing power of emerging cities while also benefiting from the lower operating costs of these areas.

While Baby Fox could scale non-corporate stores with minimal capital, management’s preference is to expand via corporate owned stores in major cities and use licensed stores in less metropolitan areas. The economics of this strategy help us better manage overall cash flow and inventory levels and scale the business in a measured manner.

Corporate Owned Stores

| Pros: | | Cons: |

| | | |

| | | |