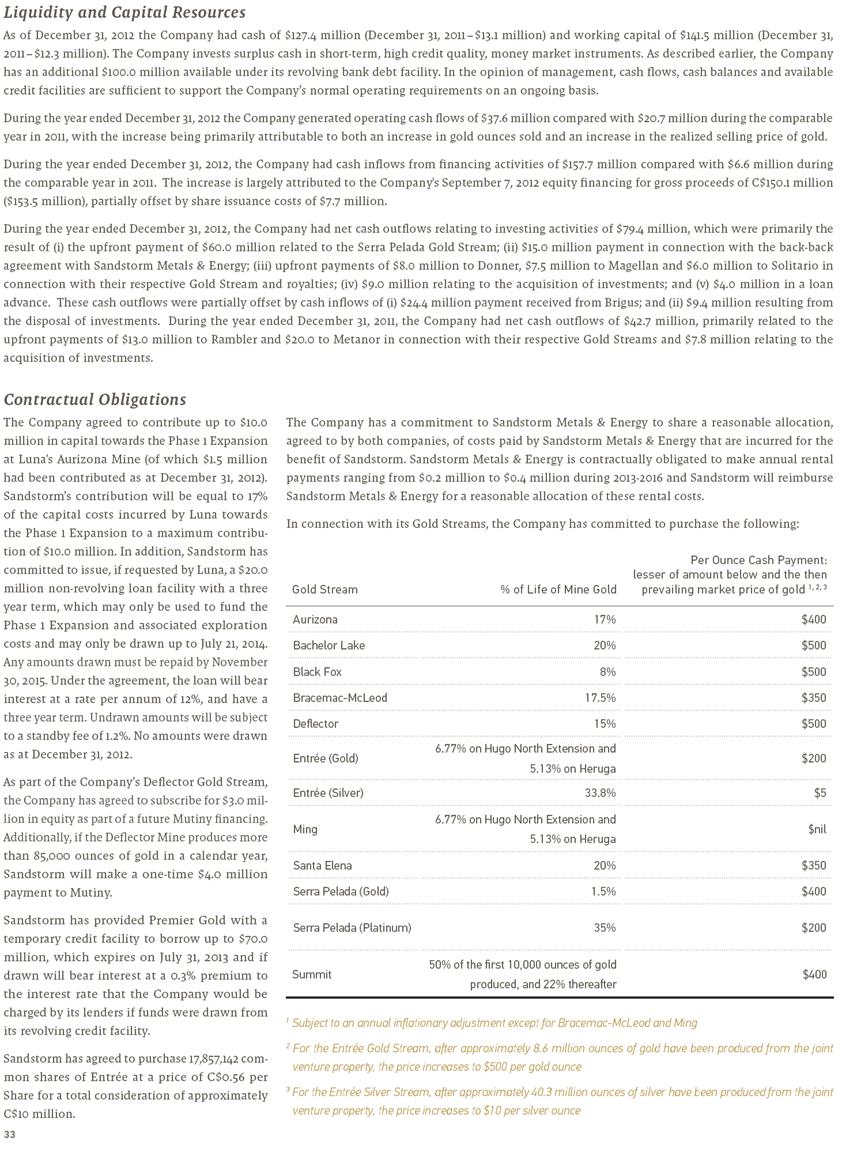

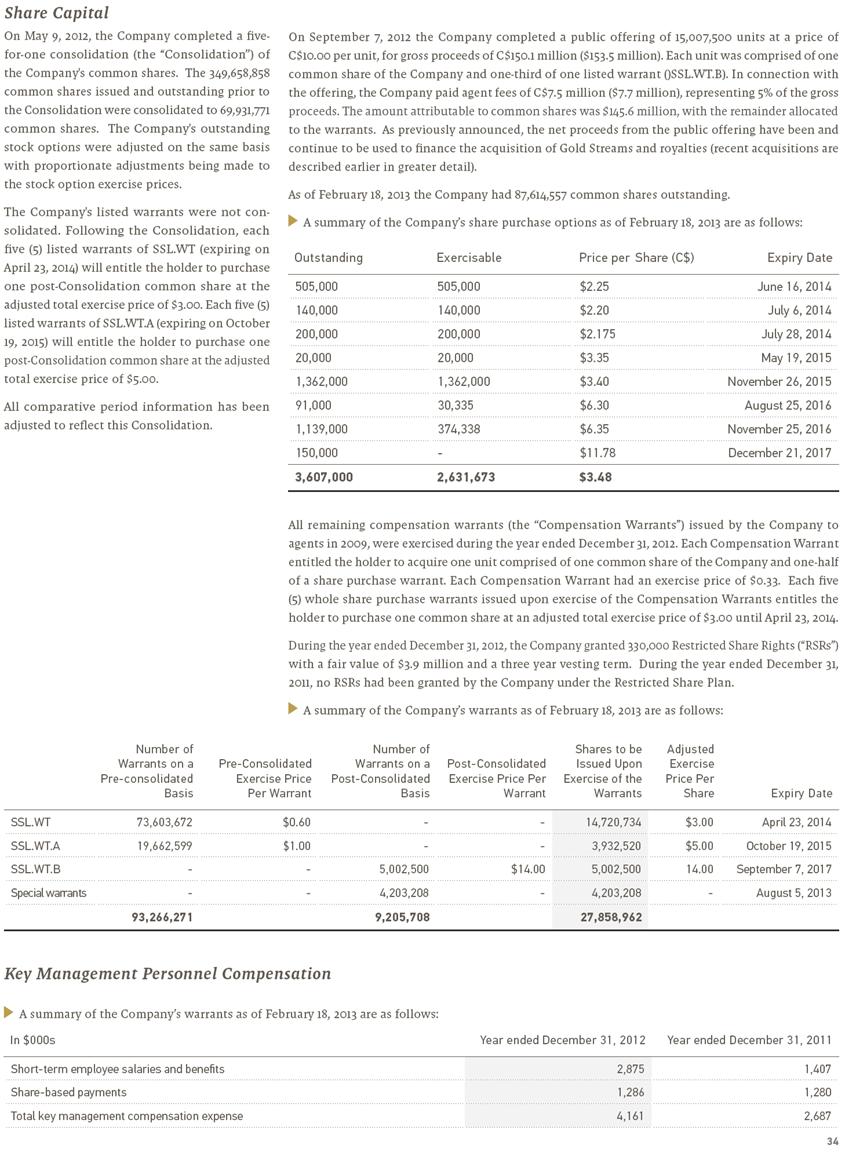

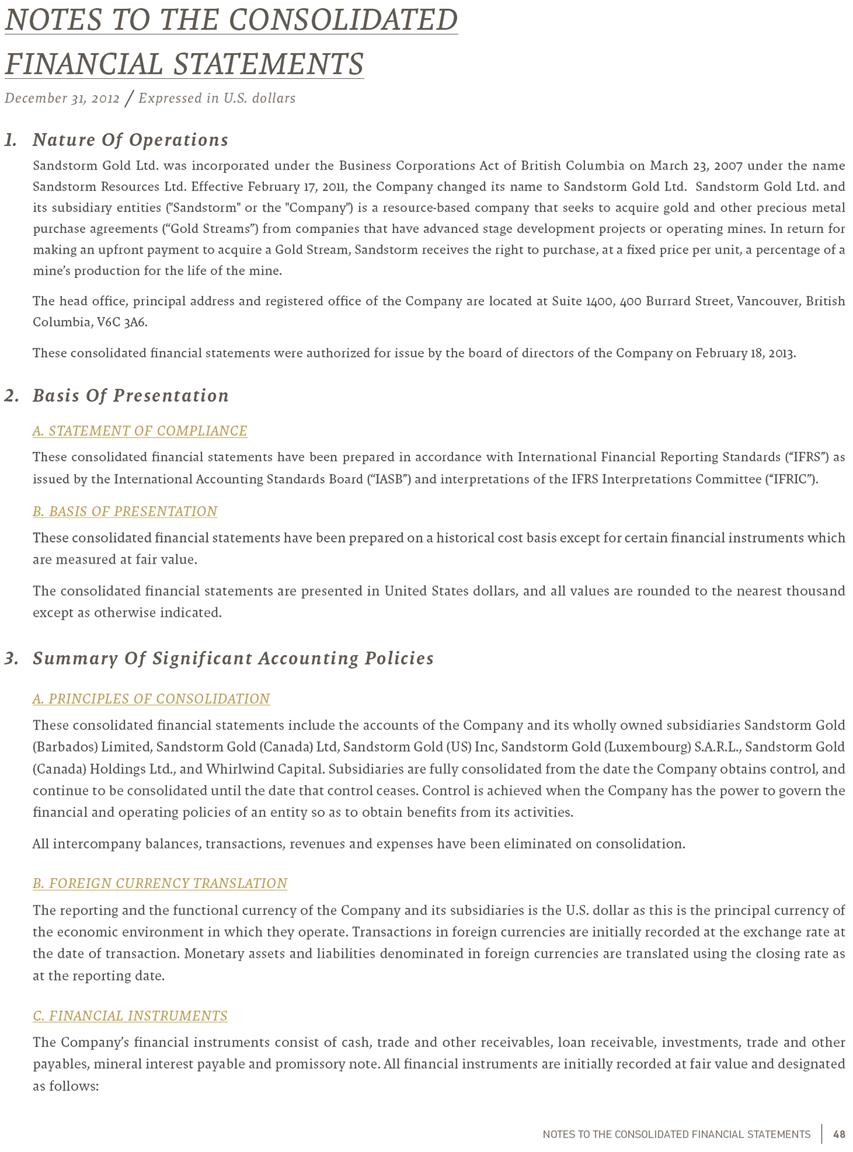

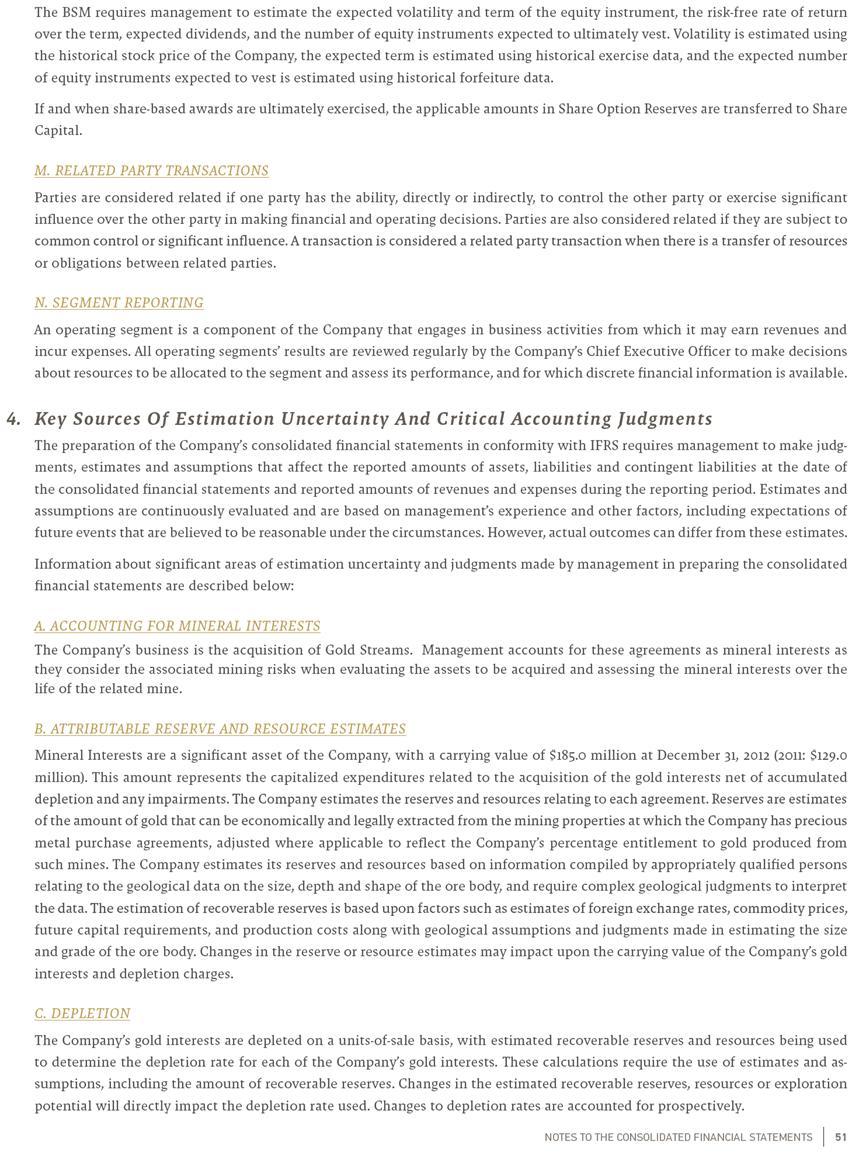

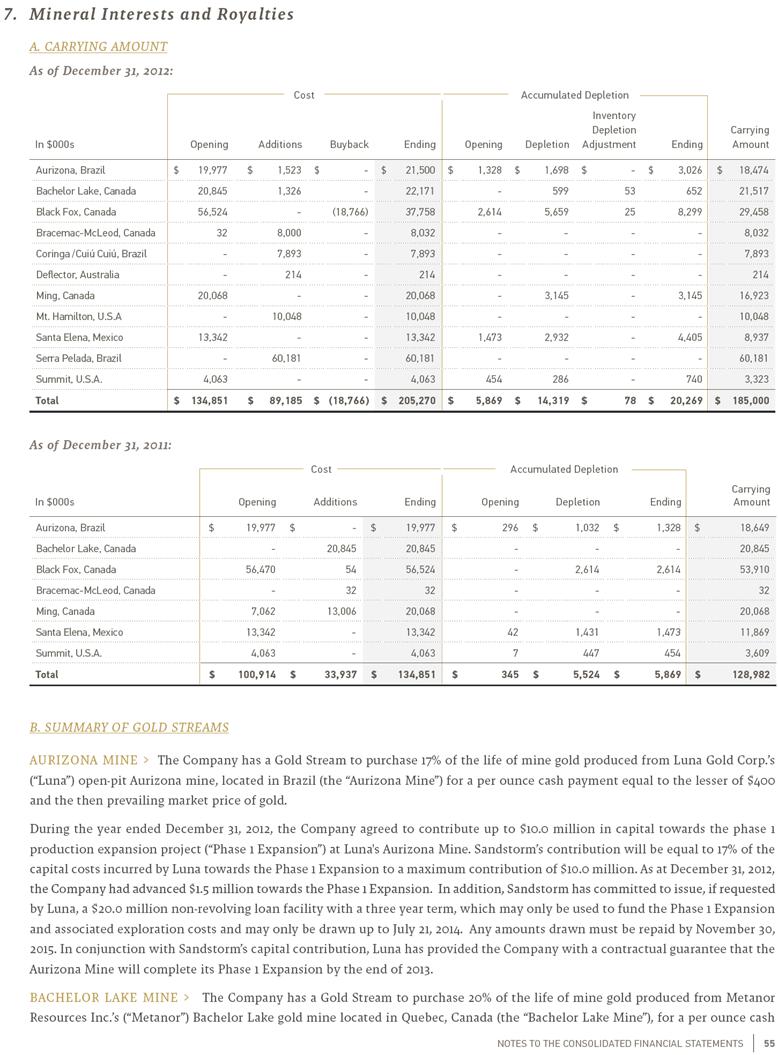

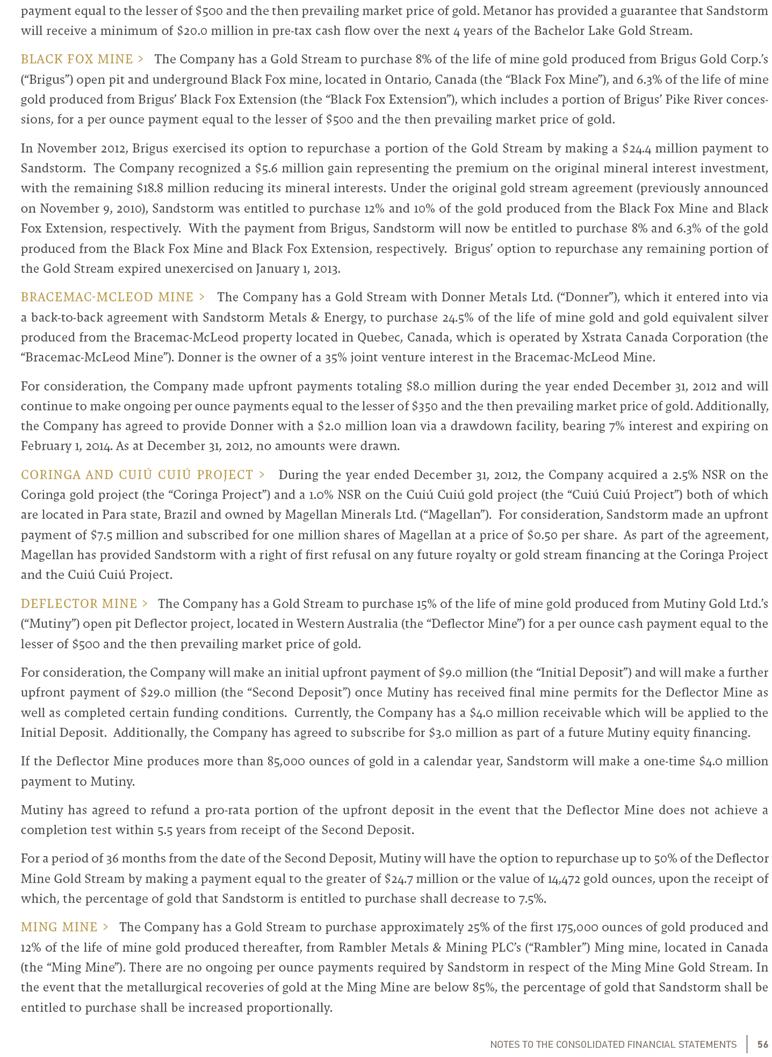

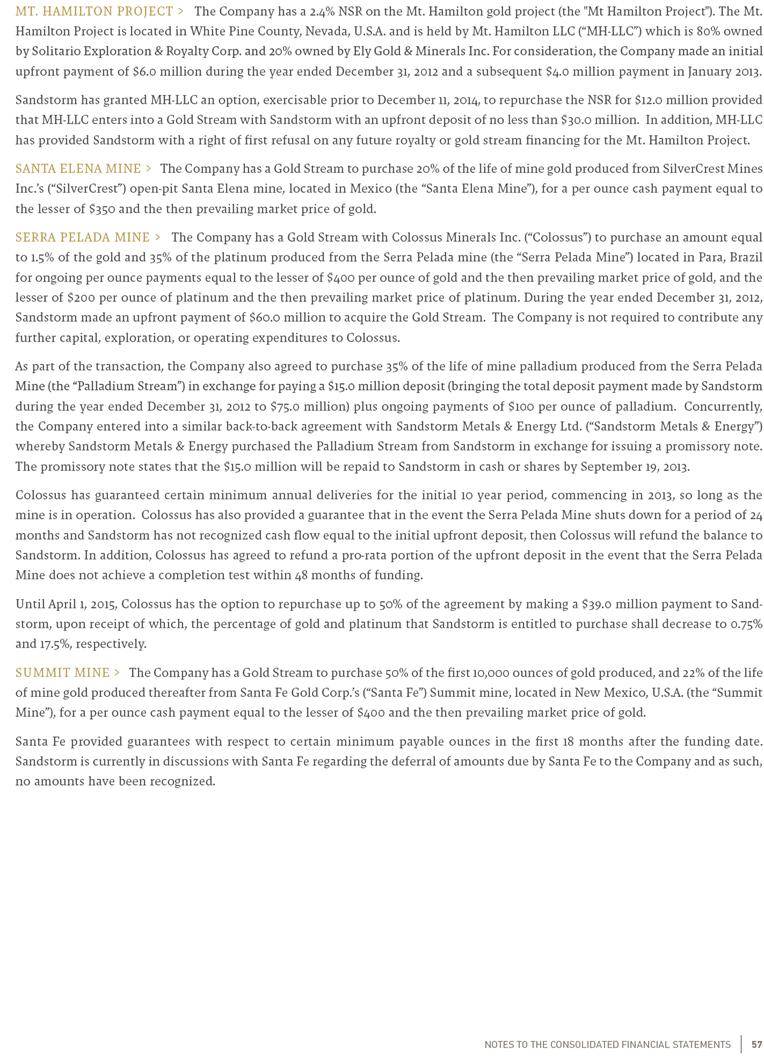

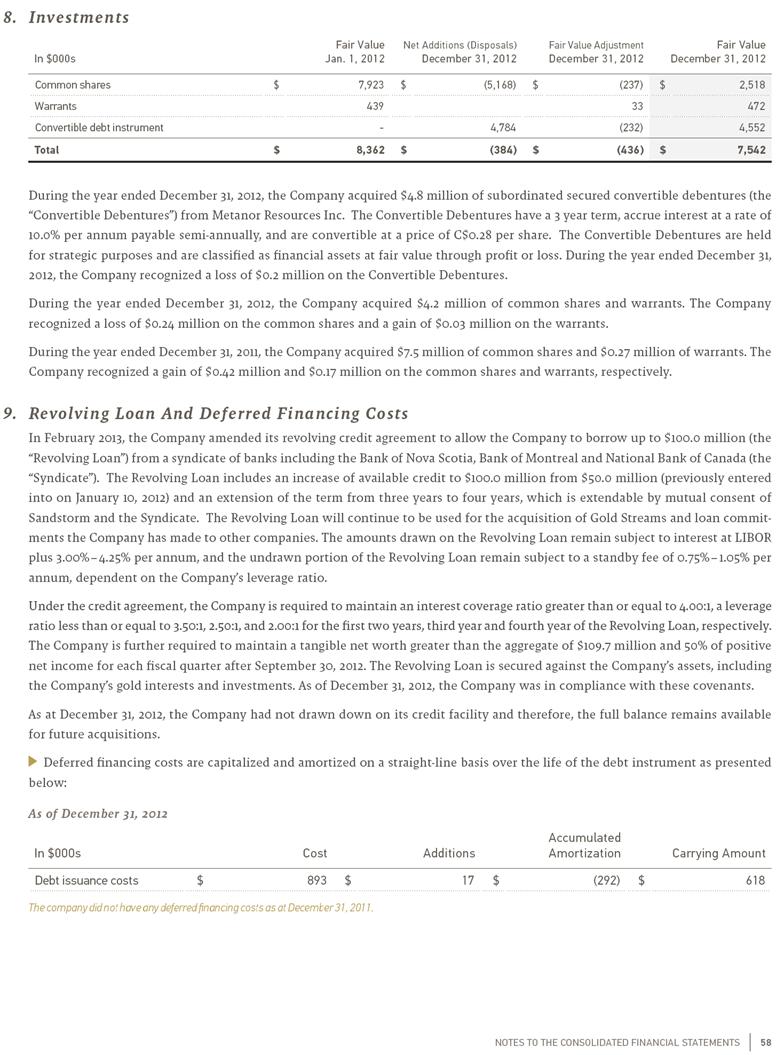

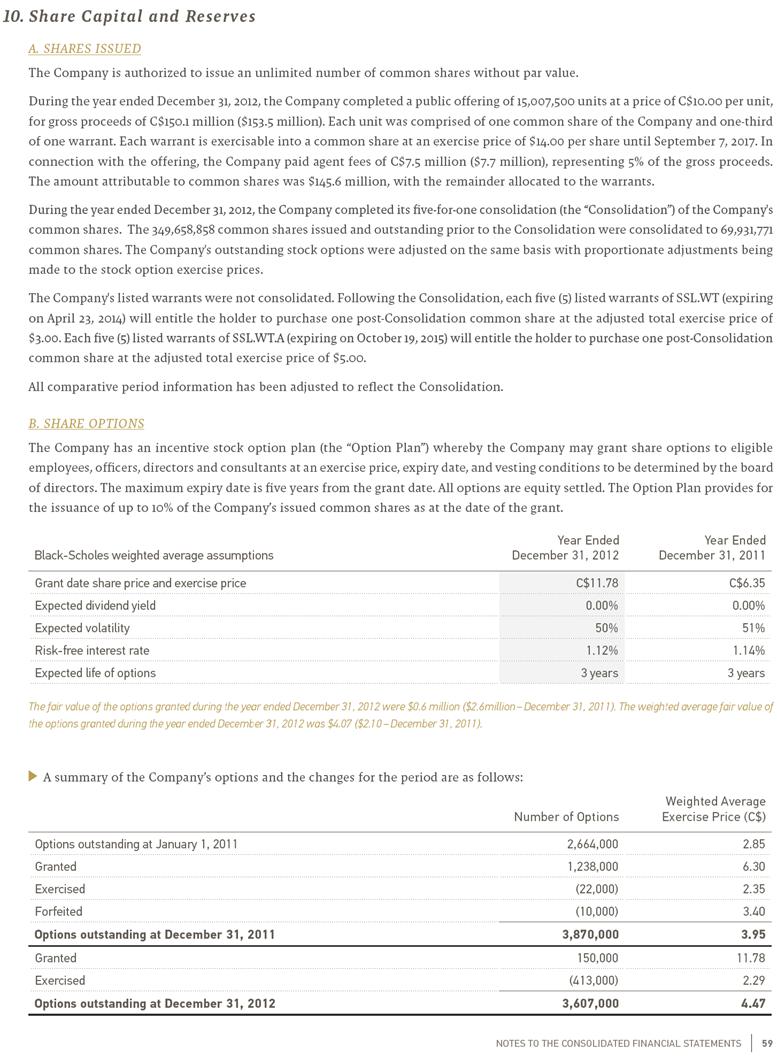

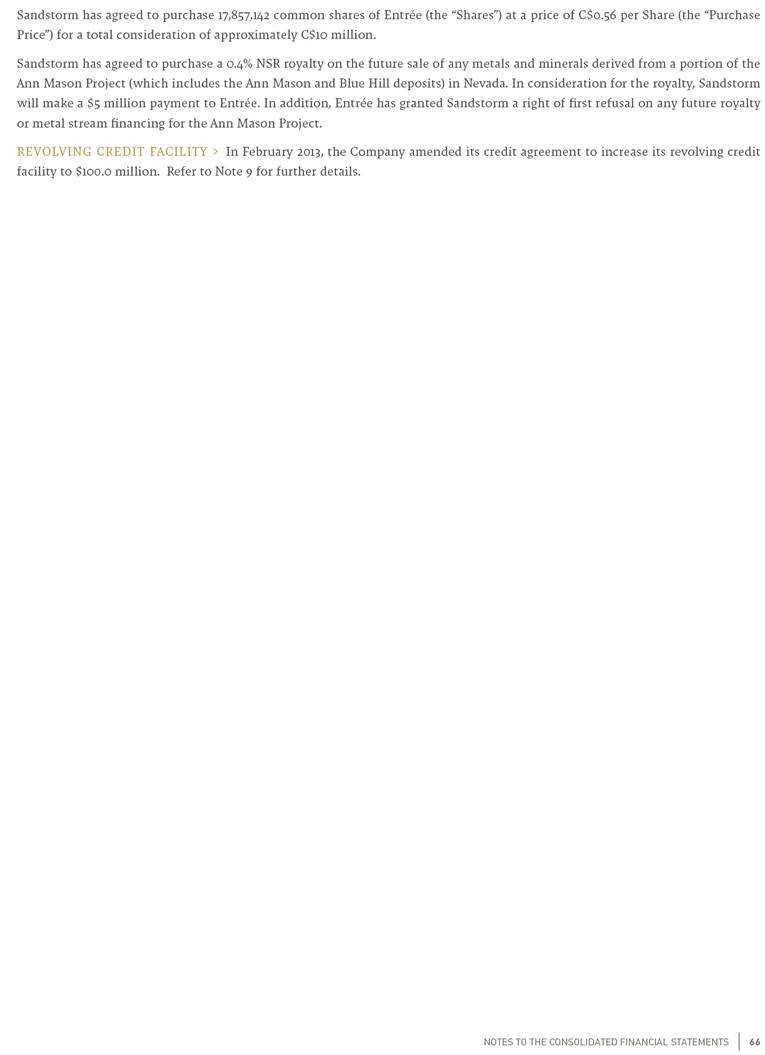

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 55 Mineral Interests and Royalties A. CARRYING AMOUNT As of December 31, 2012: Cost Accumulated Depletion In $000s Opening Additions Buyback Ending Opening Depletion Inventory Depletion Adjustment Ending Carrying Amount Aurizona, Brazil $ 19,977 $ 1,523 $ - $ 21,500 $ 1,328 $ 1,698 $ - $ 3,026 $ 18,474 Bachelor Lake, Canada 20,845 1,326 - 22,171 - 599 53 652 21,517 Black Fox, Canada 56,524 - (18,766) 37,758 2,614 5,659 25 8,299 29,458 Bracemac-McLeod, Canada 32 8,000 - 8,032 - - - - 8,032 Coringa /Cuiú Cuiú, Brazil - 7,893 - 7,893 - - - - 7,893 Deflector, Australia - 214 - 214 - - - - 214 Ming, Canada 20,068 - - 20,068 - 3,145 - 3,145 16,923 Mt. Hamilton, U.S.A - 10,048 - 10,048 - - - - 10,048 Santa Elena, Mexico 13,342 - - 13,342 1,473 2,932 - 4,405 8,937 Serra Pelada, Brazil - 60,181 - 60,181 - - - - 60,181 Summit, U.S.A. 4,063 - - 4,063 454 286 - 740 3,323 Total $ 134,851 $ 89,185 $ (18,766) $ 205,270 $ 5,869 $ 14,319 $ 78 $ 20,269 $ 185,000 As of December 31, 2011: Cost Accumulated Depletion In $000s Opening Additions Ending Opening Depletion Ending Carrying Amount Aurizona, Brazil $ 19,977 $ - $ 19,977 $ 296 $ 1,032 $ 1,328 $ 18,649 Bachelor Lake, Canada - 20,845 20,845 - - - 20,845 Black Fox, Canada 56,470 54 56,524 - 2,614 2,614 53,910 Bracemac-McLeod, Canada - 32 32 - - - 32 Ming, Canada 7,062 13,006 20,068 - - - 20,068 Santa Elena, Mexico 13,342 - 13,342 42 1,431 1,473 11,869 Summit, U.S.A. 4,063 - 4,063 7 447 454 3,609 Total $ 100,914 $ 33,937 $ 134,851 $ 345 $ 5,524 $ 5,869 $ 128,982 B. SUMMARY OF GOLD STREAMS AURIZONA MINE ¯ The Company has a Gold Stream to purchase 17% of the life of mine gold produced from Luna Gold Corp.’s (“Luna”) open-pit Aurizona mine, located in Brazil (the “Aurizona Mine”) for a per ounce cash payment equal to the lesser of $400 and the then prevailing market price of gold. During the year ended December 31, 2012, the Company agreed to contribute up to $10.0 million in capital towards the phase 1 production expansion project (“Phase 1 Expansion”) at Luna's Aurizona Mine. Sandstorm’s contribution will be equal to 17% of the capital costs incurred by Luna towards the Phase 1 Expansion to a maximum contribution of $10.0 million. As at December 31, 2012, the Company had advanced $1.5 million towards the Phase 1 Expansion. In addition, Sandstorm has committed to issue, if requested by Luna, a $20.0 million non-revolving loan facility with a three year term, which may only be used to fund the Phase 1 Expansion and associated exploration costs and may only be drawn up to July 21, 2014. Any amounts drawn must be repaid by November 30, 2015. In conjunction with Sandstorm’s capital contribution, Luna has provided the Company with a contractual guarantee that the Aurizona Mine will complete its Phase 1 Expansion by the end of 2013. BACHELOR LAKE MINE ¯ The Company has a Gold Stream to purchase 20% of the life of mine gold produced from Metanor Resources Inc.’s (“Metanor”) Bachelor Lake gold mine located in Quebec, Canada (the “Bachelor Lake Mine”), for a per ounce cash |