Iron Horse Holdings, LLC Report on Financial Statements For the nine months ended September 30, 2016 and 2015 Exhibit 99.3

Iron Horse Holdings, LLC Contents Page Financial Statements Balance Sheets ............................................................................................................................................1 Statements of Operations and Members’ Equity (Deficit) .........................................................................2 Statements of Cash Flows ...........................................................................................................................3 Notes to Financial Statements ...............................................................................................................4 - 8 Page

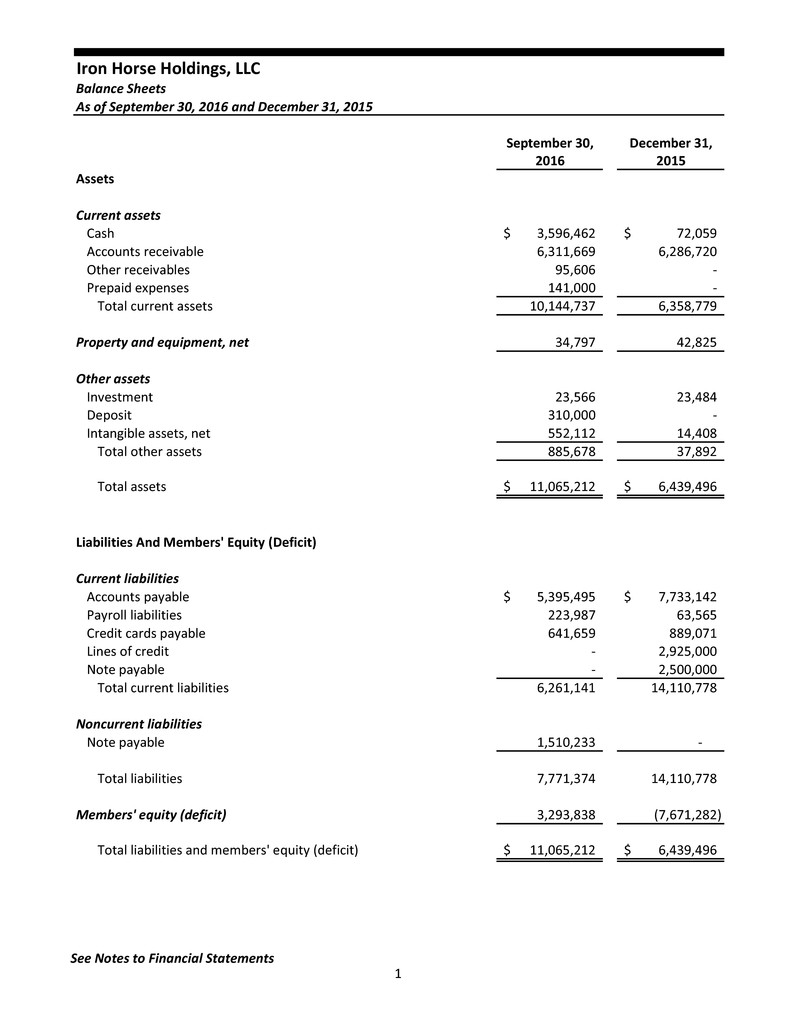

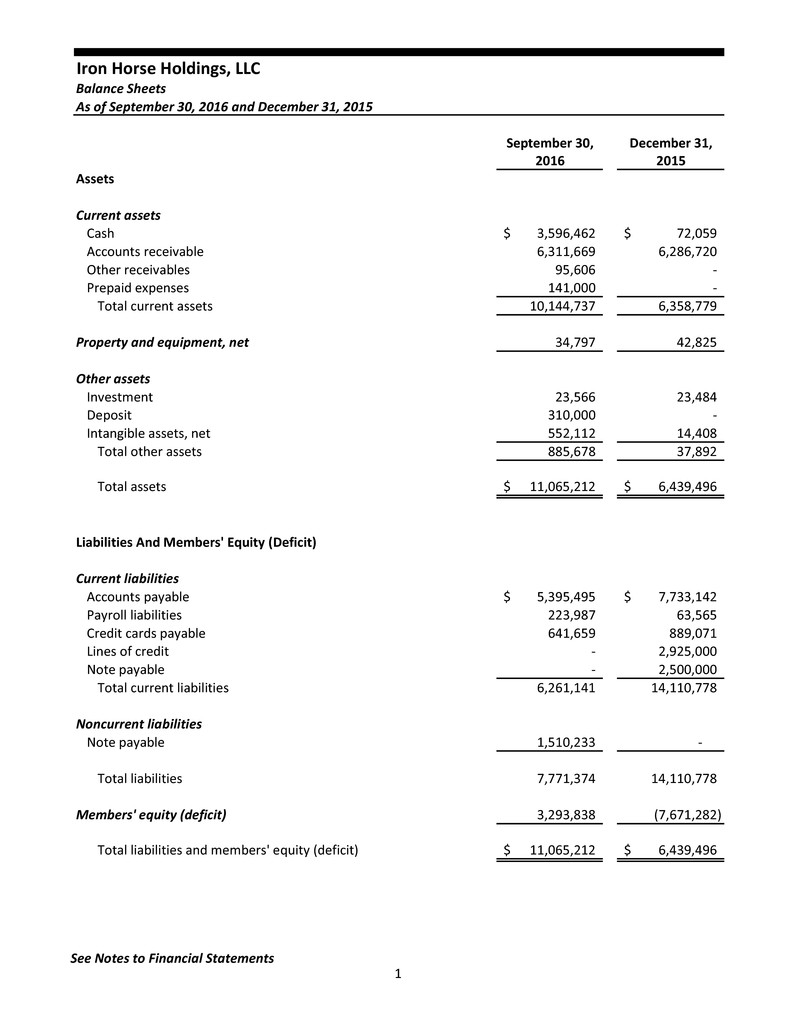

See Notes to Financial Statements 3 Iron Horse Holdings, LLC Balance SheetsAs of September 30, 2016 and December 31, 2015 September 30, December 31,2016 2015Assets Current assetsCash 3,596,462$ 72,059$ Accounts receivable 6,311,669 6,286,720 Other receivables 95,606 - Prepaid expenses 141,000 - Total current assets 10,144,737 6,358,779 Property and equipment, net 34,797 42,825 Other assetsInvestment 23,566 23,484 Deposit 310,000 - Intangible assets, net 552,112 14,408 Total other assets 885,678 37,892 Total assets 11,065,212$ 6,439,496$ Liabilities And Members' Equity (Deficit) Current liabilitiesAccounts payable 5,395,495$ 7,733,142$ Payroll liabilities 223,987 63,565 Credit cards payable 641,659 889,071 Lines of credit - 2,925,000 Note payable - 2,500,000 Total current liabilities 6,261,141 14,110,778 Noncurrent liabilitiesNote payable 1,510,233 - Total liabilities 7,771,374 14,110,778 Members' equity (deficit) 3,293,838 (7,671,282) Total liabilities and members' equity (deficit) 11,065,212$ 6,439,496$ 1

Iron Horse Holdings, LLC Statements of Operations and Members' Equity (Deficit)For the nine months ended September 30, 2016 and 2015 Nine Months Ended Nine Months EndedSeptember 30, 2016 September 30, 2015 Sales 54,070,789$ 40,262,078$ Selling and marketing expenses 40,241,276 38,117,300 Operating expensesSalaries 1,140,933 697,433Commissions 613,333 103,021Professional fees 357,598 634,230Dues and subscriptions 225,532 17,476Rent 58,130 62,620Employee benefits and insurance 36,225 14,288Website maintenance and related costs 45,580 33,053Payroll taxes 42,046 37,976Travel 22,089 23,291Office supplies and postage 19,380 14,633Profit sharing 17,631 3,296Charitable contributions and scholarship 14,000 3,482Miscellaneous 12,488 38,400Depreciation and amortization 9,324 5,916Entertainment and meals 3,503 1,284Utilities 2,618 3,311Automobile 748 143State license and filing fees 164 555Storage 2,822Total operating expenses 2,621,322 1,697,230 Operating income 11,208,191 447,548 Other income (expense)Guaranteed payments (208,000)Interest expense (155,387) (65,771)Other income, net 108,309 21,478Total other income (expense) (47,078) (252,293) Net income 11,161,113 195,255 Beginning members' deficit (7,671,282) (1,701,881)Member distributions (523,493) (3,279,488)Member contributions 327,500Ending members' equity (deficit) 3,293,838$ (4,786,114)$ See Notes to Financial Statements 42

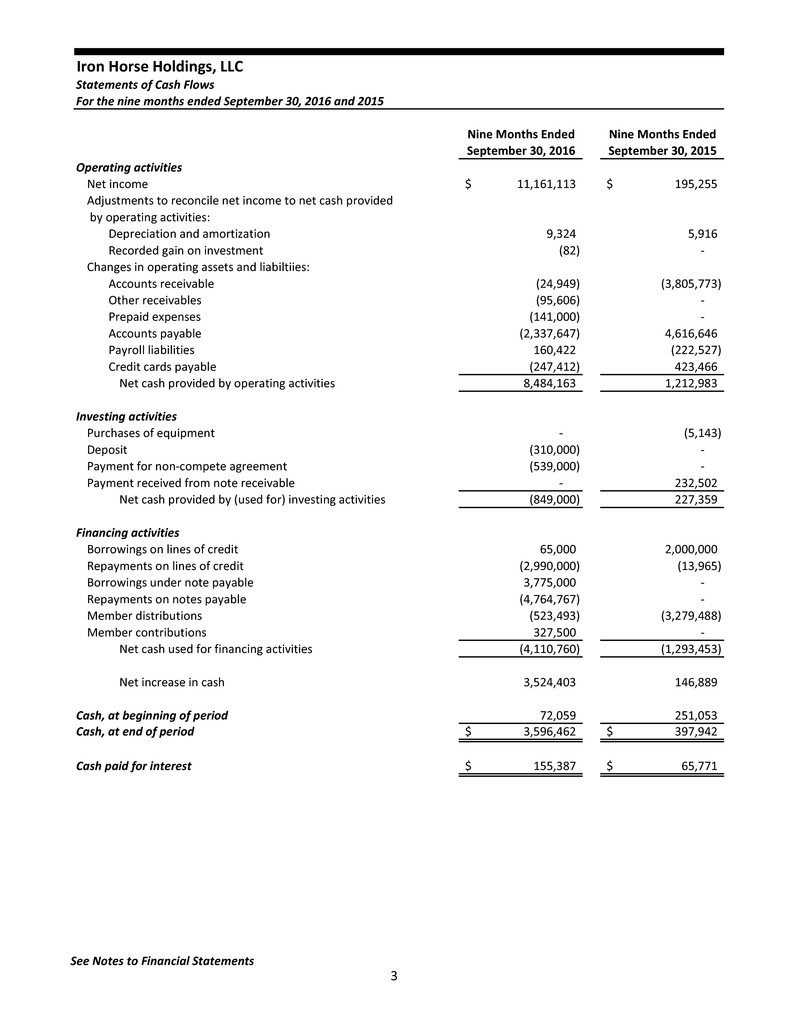

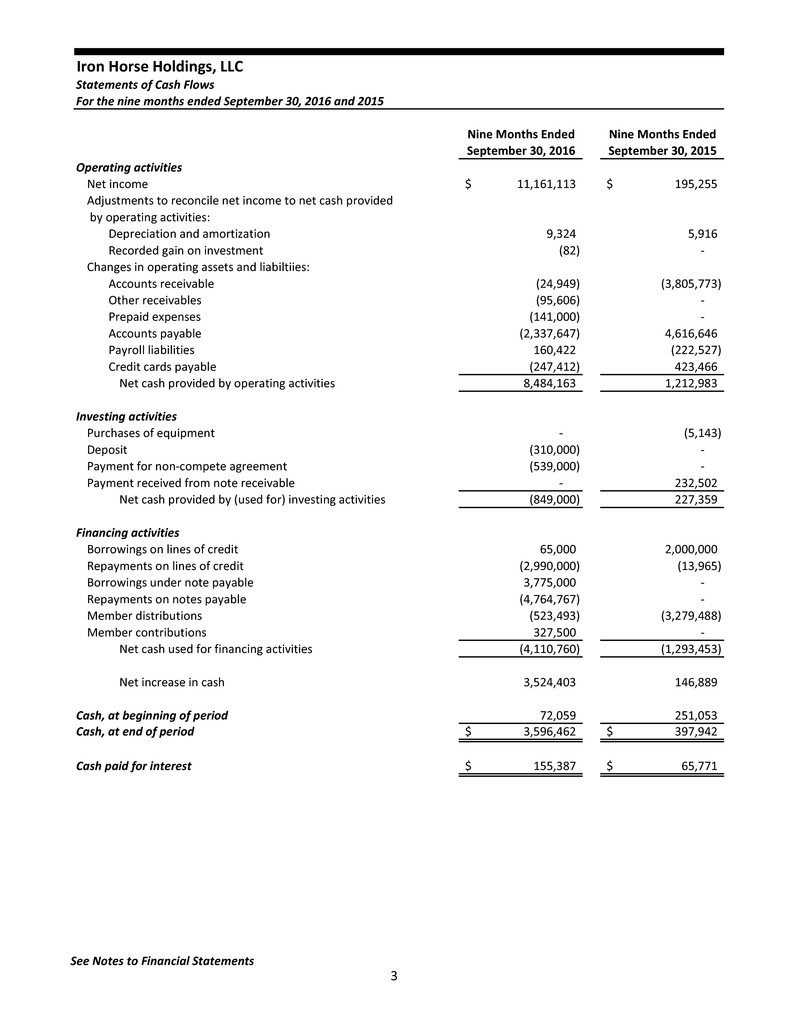

See Notes to Financial Statements 5 Iron Horse Holdings, LLC Statements of Cash FlowsFor the nine months ended September 30, 2016 and 2015 Nine Months Ended Nine Months EndedSeptember 30, 2016 September 30, 2015Operating activitiesNet income 11,161,113$ 195,255$ Adjustments to reconcile net income to net cash provided by operating activities:Depreciation and amortization 9,324 5,916 Recorded gain on investment (82) - Changes in operating assets and liabiltiies:Accounts receivable (24,949) (3,805,773) Other receivables (95,606) - Prepaid expenses (141,000) - Accounts payable (2,337,647) 4,616,646 Payroll liabilities 160,422 (222,527) Credit cards payable (247,412) 423,466 Net cash provided by operating activities 8,484,163 1,212,983 Investing activitiesPurchases of equipment - (5,143) Deposit (310,000) - Payment for non-compete agreement (539,000) - Payment received from note receivable - 232,502 Net cash provided by (used for) investing activities (849,000) 227,359 Financing activitiesBorrowings on lines of credit 65,000 2,000,000 Repayments on lines of credit (2,990,000) (13,965) Borrowings under note payable 3,775,000 - Repayments on notes payable (4,764,767) - Member distributions (523,493) (3,279,488) Member contributions 327,500 - Net cash used for financing activities (4,110,760) (1,293,453) Net increase in cash 3,524,403 146,889 Cash, at beginning of period 72,059 251,053 Cash, at end of period 3,596,462$ 397,942$ Cash paid for interest 155,387$ 65,771$ 3

Iron Horse Holdings, LLC Notes to Financial Statements September 30, 2016 and 2015 6 Note 1. Summary of Significant Accounting Policies Business activity: Iron Horse Holdings, LLC (the “Company”), a Delaware limited liability company, was formed on February 28, 2011. The Company operates a website (comparecards.com) to help people make smarter, more informed, healthier financial decisions based on a deeper knowledge of financial offers. The Company provides easy-to-use, objective tools and educational resources that help consumers do everything from making side-by-side credit card comparisons and managing their credit health to helping children in primary, middle, and high school learn how to make wise financial decisions. Basis of accounting and presentation: These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The financial statements reflect all adjustments that are necessary for presentation of the financial position, results of operations, and cash flows for the years presented. Use of estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of sales and expenses during the reporting period. Actual results could differ from those estimates. Cash and cash equivalents: The Company considers all highly liquid investments with an initial maturity of three months or less to be cash equivalents. There were no cash equivalents as of September 30, 2016 or December 31, 2015. The Company’s cash balances are maintained with high quality financial institutions. At times, deposits may exceed Federal Deposit Insurance Corporation insurance limits. Accounts receivable and allowance for doubtful accounts: Trade receivables are carried at their estimated collectible amounts and are periodically evaluated for collectability based on management’s assessment of the status of each account. An allowance for doubtful accounts is established as losses are estimated to have occurred through recognition of bad debt expense. When management confirms an account receivable is not collectible, such amount is charged off against the allowance for doubtful accounts. As of September 30, 2016 and December 31, 2015, the Company believes all accounts are collectible and as such has not recorded an allowance for doubtful accounts. Revenue recognition: The Company derives sales from commissions which are earned upon the approval of credit card applications from consumers which were referred to the financial institutions through the Company’s websites. The Company recognizes sales when persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable and collectability is reasonably assured. Delivery is deemed to have occurred at the time that the financial institution generates the consumer’s credit card approval. 4

Iron Horse Holdings, LLC Notes to Financial Statements September 30, 2016 and 2015 7 Note 1. Summary of Significant Accounting Policies, Continued Property and equipment: Property and equipment are stated at original cost less accumulated depreciation. Major renewals and betterments are capitalized while routine maintenance and repair costs which do not extend the original useful lives of the assets are charged to expense as incurred. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. The estimated useful lives are generally as follows: Computers 5 years Furniture and fixtures 5 to 10 years Investment: The Company accounts for its 30% investment in DVDs.com, LLC using the equity method. The Company’s initial interest is recognized at cost, adjusted for the Company’s proportionate share of undistributed earnings or losses at each period end. Other assets: In 2016, the Company began participating in a new captive insurance program. The captive membership required an initial deposit of $310,000. The deposit is carried at cost because of the restrictions on transfer and lack of marketability. In September 2016, the Company entered into a non-compete agreement with an employee in exchange for a one-time payment of $539,000. The cost of the non-compete agreement will be amortized over a period of eighteen months beginning in October 2016. The amount is included in intangible assets in the accompanying Balance Sheets. Other intangible assets are comprised of expenses paid for the Company’s domain name. The domain name is amortized over a period of 15 years. Amortization expense for the nine months ending September 30, 2016 and 2015 was $1,296. Advertising: The Company expenses advertising costs as they are incurred, and reports them as selling and marketing expenses. The Company had advertising costs of $40,241,276 and $38,117,300 for the nine months ended September 30, 2016 and 2015, respectively. 5

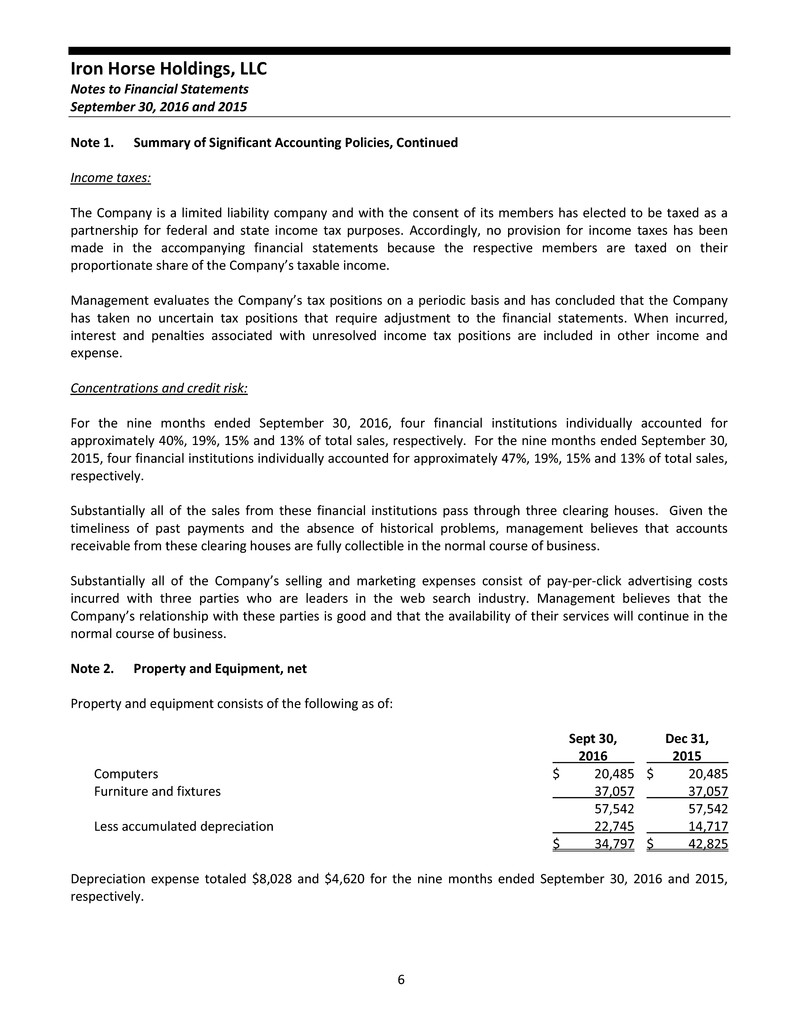

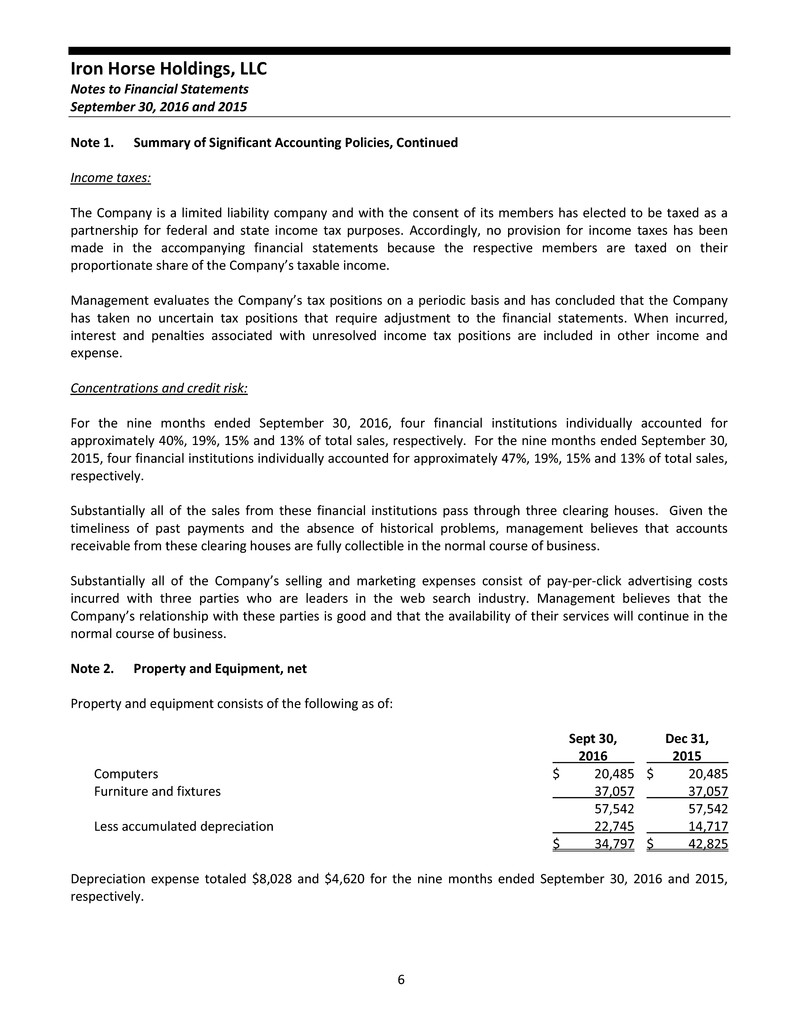

Iron Horse Holdings, LLC Notes to Financial Statements September 30, 2016 and 2015 8 Note 1. Summary of Significant Accounting Policies, Continued Income taxes: The Company is a limited liability company and with the consent of its members has elected to be taxed as a partnership for federal and state income tax purposes. Accordingly, no provision for income taxes has been made in the accompanying financial statements because the respective members are taxed on their proportionate share of the Company’s taxable income. Management evaluates the Company’s tax positions on a periodic basis and has concluded that the Company has taken no uncertain tax positions that require adjustment to the financial statements. When incurred, interest and penalties associated with unresolved income tax positions are included in other income and expense. Concentrations and credit risk: For the nine months ended September 30, 2016, four financial institutions individually accounted for approximately 40%, 19%, 15% and 13% of total sales, respectively. For the nine months ended September 30, 2015, four financial institutions individually accounted for approximately 47%, 19%, 15% and 13% of total sales, respectively. Substantially all of the sales from these financial institutions pass through three clearing houses. Given the timeliness of past payments and the absence of historical problems, management believes that accounts receivable from these clearing houses are fully collectible in the normal course of business. Substantially all of the Company’s selling and marketing expenses consist of pay-per-click advertising costs incurred with three parties who are leaders in the web search industry. Management believes that the Company’s relationship with these parties is good and that the availability of their services will continue in the normal course of business. Note 2. Property and Equipment, net Property and equipment consists of the following as of: Sept 30, Dec 31, 2016 2015 Computers $ 20,485 $ 20,485 Furniture and fixtures 37,057 37,057 57,542 57,542 Less accumulated depreciation 22,745 14,717 $ 34,797 $ 42,825 Depreciation expense totaled $8,028 and $4,620 for the nine months ended September 30, 2016 and 2015, respectively. 6

Iron Horse Holdings, LLC Notes to Financial Statements September 30, 2016 and 2015 9 Note 3. Intangible Assets, net Intangible assets consist of the following as of: Sept 30, Dec 31, 2016 2015 Domain name $ 29,705 $ 29,705 Non-compete agreement 539,000 - 568,705 29,705 Less accumulated amortization 16,593 15,297 $ 552,112 $ 14,408 Amortization expense totaled $1,296 for the nine months ended September 30, 2016 and 2015. Note 4. Debt Note payable: On March 23, 2016, the Company entered into a promissory note agreement for $3,775,000 with a financial institution. The loan carries interest at 4.5%. Principal payments of $86,200 were due beginning April 23, 2016, with the final payment due on March 23, 2020. The balance on the note as of September 30, 2016 was $1,510,233. Due to pre-payments on the note, there is no current portion due as of September 30, 2016. Lines of credit: On September 29, 2014, the Company opened a line of credit with a financial institution. The maximum amount the Company can draw on this line of credit is $1,000,000. The line of credit matured on September 29, 2015 and was renewed on November 17, 2015, with an extended maturity date of November 16, 2016. The line of credit incurs interest at an annual rate of 3.25%. The balance on the line of credit was $925,000 as of December 31, 2015. The line of credit was paid in full during 2016. On February 27, 2015, the Company opened an additional line of credit with a different financial institution. The maximum amount the Company can draw is $2,000,000. The line of credit incurs interest at the U.S. Prime Rate (3.25% as of December 31, 2015). As of December 31, 2015, the outstanding balance was $2,000,000. The revolver matured on February 27, 2016 and was paid in full. Note 5. Leases The Company leases office space in Illinois under an operating lease that expires on November 30, 2016 and office space in Charleston under an operating lease that expires on March 31, 2017. Rent expense totaled $58,130 and $62,620 for the nine months ended September 30, 2016 and 2015, respectively. Future minimum lease payments under operating leases as of September 30, 2016 are as follows: 2016 $ 17,731 2017 12,731 Total minimum lease payments $ 30,462 7

Iron Horse Holdings, LLC Notes to Financial Statements September 30, 2016 and 2015 10 Note 6. Related Parties Beginning January 1, 2013, the Company had a consulting agreement which provided the consultant with a 12.5% return on the taxable income of the Company (corresponding to a 12.5% membership interest in the Company), as further defined in the respective consulting agreement. Distributions paid to the consultant relating to the period ended September 30, 2015 are included in guaranteed payments as taxable income was not sufficient to generate a return on the membership interests. The relationship with the consultant ceased in April 2016 and remaining obligations were paid in a settlement in October 2016, the details of which are subject to a confidentiality agreement. Such payments, however, had no significant impact on the overall financial position of the Company. The Company subleases space in its Charleston office on a month-to-month basis to a limited liability company that is partially owned by a member of the Company. Rental income related to this lease totaled $3,325 and $2,600 for the nine months ended September 30, 2016 and 2015. Note 7. Profit Sharing Plan The Company has a profit sharing plan that covers substantially all employees, with the exception of union, nonresident aliens, and leased employees, who meet certain age and length of service requirements. Eligible employees may make salary deferral contributions to the plan. The Company's contribution was equal to up to three percent of the participants' eligible compensation for the plan year. The Company may also make discretionary profit sharing contributions. The Company’s contribution expense totaled approximately $17,631 and $3,296 for the nine months ended September 30, 2016 and 2015, respectively. Note 8. Subsequent Events Management has evaluated events and transactions for potential recognition and/or disclosure through November 14, 2016, which is the date these financial statements were available to be issued. All outstanding lines of credit and notes payable were paid in full in October 2016. The Company has received a letter of intent in connection with the potential sale of all of the business. Assuming approval by all parties, the sale is scheduled to occur by the end of 2016. 8