[***] - Confidential portions of this document have been redacted and filed separately with the Commission.

PURCHASE AND SALE CONTRACT

This Purchase and Sale Contract (this "Contract") is made between REXFORD PARK INVESTORS, LLC, a Delaware limited liability company ("Seller"), and LENDINGTREE, LLC, a Delaware limited liability company ("Purchaser").

For and in consideration of the mutual covenants and agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, Seller hereby agrees to sell and convey to Purchaser, and Purchaser hereby agrees to purchase and take from Seller, subject to and in accordance with all of terms and conditions of this Contract, all of the Seller's right, title, and interest in and to all of the following described property including any and all rights to oil, gas and other minerals, the royalties, bonuses, rentals and all other rights in connection with the same (collectively, the "Property"):

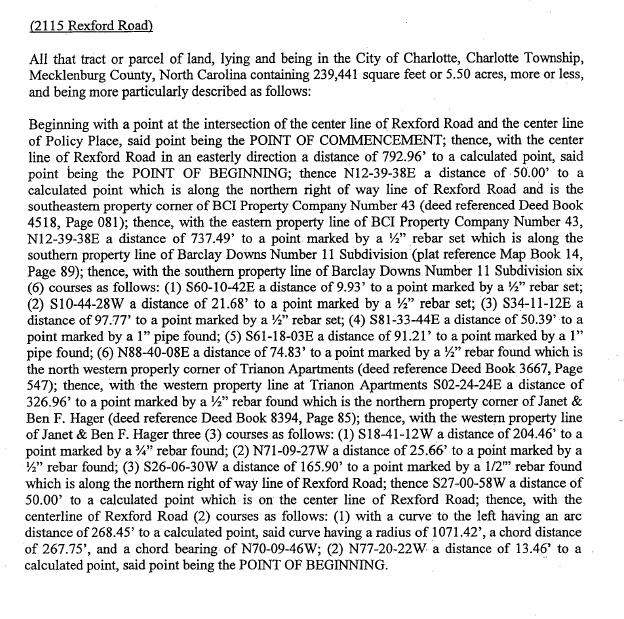

2.1 Land. The land more particularly described in Exhibit "A" attached hereto and incorporated herein by reference (the "Land") commonly known as Rexford Park I & II located at 2100 and 2115 Rexford Road, Charlotte, North Carolina, together with all of Seller's right, title and interest in and to all easements and other appurtenances (if any) to the Land.

2.2 Improvements. All buildings, structures and other improvements located on the Land and equipment serving the same (collectively, the "Improvements"). The Land and Improvements are collectively referred to herein as the "Real Property".

2.3 Leases. The Seller’s interest as landlord in, to and under all leases relating to the Property, or any portion thereof, as amended from time to time, and in effect on the date of Closing, as hereinafter defined (collectively, the "Leases") and all guaranties (if any) relating to the Leases.

2.4 Contracts. The Seller’s interest as the owner of the Property in, to and under the contracts and agreements relating to the Property with the parties identified in Exhibit "B" or are hereafter executed by Seller in accordance with Section 7.1.3 of this Contract, which in either case remain in effect on the date of Closing (collectively, the "Property Agreements"), excluding the existing management and leasing agreements which will be terminated at or prior to the Closing.

2.5 Tangible Property. All tangible personal property used by Seller in connection with the ownership or operation of the Improvements, provided the same are now owned or are acquired by Seller prior to the Closing (collectively, the "Tangible Property").

2.6 Intangible Property. To the extent assignable or transferable, all plans and specifications for the Improvements and any permits, approvals, licenses, warranties and intangible personal property, if any, relating to the Property (collectively, the "Intangible Property").

3.CONSIDERATION.

3.1 Purchase Price; Earnest Money. The purchase price for the Property shall be Twenty-Four Million Nine Hundred Thousand and No/100 Dollars ($24,900,000.00) (the "Purchase Price"), which shall be paid as follows:

| |

| (a) | Five Hundred Thousand Dollars ($500,000.00) (the "First Deposit") shall be deposited by Purchaser into escrow with Chicago Title Insurance Company, 200 S. Tryon Street, Suite 800, Charlotte, NC 28202, Attention: Scott Mansfield ("Escrow Agent") in immediately available funds no later than three (3) Business Days (as defined below) after the execution of this Contract by Purchaser and Seller (the date on which the later of Seller or Purchaser executes this Contract and delivers a copy to the counterparty is called the "Effective Date"); |

| |

| (b) | An additional Five Hundred Thousand Dollars ($500,000.00) (the "Second Deposit") in immediately available funds shall be deposited by Purchaser into escrow with Escrow Agent no later than three (3) Business Days after the expiration of the Due Diligence Period (as defined below); and |

| |

| (c) | The balance of the Purchase Price, subject to the adjustments, credits and prorations provided in this Contract, shall be deposited by Purchaser into escrow with the Escrow Agent in immediately available funds on or prior to the Closing Date as required by Section 9.3 to allow for the consummation of the Closing pursuant to this Contract on the Closing Date. |

The First Deposit and Second Deposit shall, upon receipt, be deposited by the Escrow Agent into a non-interest bearing account or, if elected by Purchaser, in an interest-bearing account, with such interest reportable as interest earned by Purchaser. If the Purchaser fails to make the First Deposit as required under Section 3.1(a) above, then this Contract shall automatically terminate and become null and void, and neither party shall have any further rights or obligations under this Contract. The First Deposit and the Second Deposit, when made, and all accrued interest, if any, on such deposits are collectively called the "Earnest Money." All fees or costs charged by Escrow Agent for depositing the Earnest Money in an interest bearing account shall be paid by Purchaser. Seller and Purchaser shall execute all documents reasonably required by Escrow Agent in connection with the Earnest Money.

3.2 Further Application of Earnest Money. In the event that the Closing is consummated, all Earnest Money will be applied in partial satisfaction of the Purchase Price. If, however, the Closing is not consummated, the Earnest Money will be delivered to Seller as liquidated damages as provided in Section 12.2 or returned to Purchaser by the Escrow Agent as elsewhere expressly provided in this Contract.

3.3 Dispute as to Earnest Money. The Escrow Agent shall hold in and disburse from escrow any monies and documents held by it under this Contract in accordance with the terms and provisions of this Contract. The Escrow Agent shall not be liable for any actions taken by it in good faith, but only for its breach of its obligations under this Contract, negligence or willful misconduct. Each party agrees to indemnify and hold the Escrow Agent harmless from and against any and all claims, demands, losses, liabilities, damages, fees, costs and expenses (including reasonable attorneys’ fees and costs through all trial, appellate and post-judgment levels and proceedings) which the Escrow Agent may incur in its capacity as escrow agent under this Contract, except for any such claim, demand, loss, liability, damage, fee, cost and/or expense incurred as a result of the Escrow Agent’s breach of its obligations under this Contract, negligence or willful misconduct. In the event of a dispute with respect to the right to receive the Earnest Money, the Escrow Agent may interplead the Earnest Money into a court of competent jurisdiction. All reasonable attorneys' fees and costs and Escrow Agent's costs and expenses incurred in connection with such interpleader will be assessed against the party that is not awarded the Earnest Money or, if the Earnest Money is distributed in part to both parties, then in the inverse proportion of such distribution.

3.4 Independent Consideration. Notwithstanding anything to the contrary contained herein, One Hundred and No/100 Dollars ($100.00) of the Earnest Money shall be paid to Seller as independent consideration for entering into this Contract (the “Independent Consideration”), and shall be non-refundable to Purchaser in all events, and Seller acknowledges that said amount is adequate consideration therefor. In the event that the Earnest Money is returned to Purchaser for any reason, the Independent Consideration shall be paid to Seller.

4.1 Title Commitment and Documents. Purchaser acknowledges that Seller has made available to Purchaser copies of the following: (a) the Owner's Policy of Title Insurance issued in connection with Seller's acquisition of the Land, and (b) Seller’s survey of the Land (such survey and any updated survey obtained by Purchaser at Purchaser expense are collectively called the "Survey"). Promptly after the Effective Date, Purchaser shall order from Chicago Title Insurance Company (the "Title Company") for delivery to Purchaser with a copy to Seller, a current commitment for title insurance for the Real Property (the "Title Commitment") to be issued by the Title Company to Purchaser in the amount of the Purchase Price, setting forth the matters (the "Title Exceptions") that the Title Company determines affect title to the Real Property. Purchaser shall be entitled to obtain an updated Survey of the Land and Improvements and certified to Seller, Purchaser and Purchaser’s lender (if any). The updated Survey shall be obtained by Purchaser at Purchaser's expense, but Seller shall provide a $600 credit to Purchaser at Closing to defray a portion of the surveying costs.

4.2 Review of Title Commitment, Survey and Exception Documents. Purchaser will have from the Effective Date until five (5) Business Days prior to the expiration of the Due Diligence Period ("Title Review Period") within which to deliver to Seller written notice specifying Purchaser's objections, if any, to the Title Commitment, Title Exceptions and/or matters reflected on the Survey, provided, however, that in no event shall Purchaser have the right to object to any of the matters described on Exhibit "C" attached hereto (the "Existing Exceptions"). The Purchaser's objections to the Title Commitment, Title Exceptions and/or Survey that are timely raised by Purchaser in compliance with this Section 4.2 are collectively called the "Title Objections."

4.3 Purchaser's Right to Terminate. If Purchaser timely notifies Seller in writing of Title Objections prior to the expiration of the Title Review Period, Seller will, within five (5) Business Days after Seller's receipt of Purchaser's notice (such 5-Business Day period is called the "Seller Notice Period"), notify Purchaser in writing ("Seller's Title Notice") of the Title Objections that Seller will attempt to cure at Seller's sole cost and expense and/or of the Title Objections that Seller cannot or will not cure at Seller's expense; provided, however, that notwithstanding anything to the contrary provided herein, Seller shall be required to take the following actions regarding any Title Objections that are timely raised by Purchaser:

(a) satisfy all mortgages, deeds of trust, liens and similar monetary encumbrances on the Real Property (provided the same are in a liquidated amount) that have been executed by Seller, and satisfy or transfer to bond all liens that arise in connection with any work or services performed or materials, supplies or other property delivered to the Real Property at the request of Seller and all judgments in a liquidated amount against Seller, other than non-delinquent taxes and assessments (collectively, "Seller's Liens");

(b) pay any delinquent taxes or other amounts then due and payable by Seller to any governmental entity and relating to any period prior to the Closing (but Seller shall not be required to pay any such amounts that are payable by any tenant of the Property); and

(c) cure any title matters adversely affecting the marketability of the Property that are timely objected to by Purchaser and may be cured at or prior to the Closing with the expenditure of an aggregate amount of $25,000.00 or less.

The Title Objections that Seller is required to address in accordance with clauses (a), (b) and (c) are collectively called the "Required Cure Items." Failure by Seller to timely respond to the Purchaser's Title Objections shall be deemed Seller's decision not to cure any Title Objections other than the Required Cure Items. If Seller elects within the Seller Notice Period not to attempt to cure any of the Title Objections that have been timely raised by Purchaser other than the Required Cure Items, Purchaser has the option, exercisable by the delivery of written notice to Seller within five (5) Business Days after the earlier to occur of the receipt of Seller's Title Notice or the expiration of the Seller Notice Period (the "Purchaser Notice Period") to either (i) waive the uncured Title Objections, in which event the unsatisfied Title Objections (other than the Required Cure Items) will become Permitted Exceptions (hereinafter defined), or (ii) terminate this Contract, in which event the Earnest Money will be returned to Purchaser and upon such return neither Seller nor Purchaser will have any further obligations under this Contract except under any provisions that survive the termination of this Contract by their express terms. If Purchaser fails to notify Seller in writing before the expiration of the Purchaser Notice Period that Purchaser has elected to terminate this Contract pursuant to clause (ii) above, then Purchaser shall be deemed to have waived and accepted the uncured Title Objections (other than the Required Cure Items) as provided in clause (i) above. If after Purchaser has given its notice of Title Objections to Seller, the Title Company issues continuation reports or other written evidence indicating any new Title Exceptions which are not Permitted Exceptions and Purchaser delivers written notice thereof to Seller prior to the earlier to occur of (x) five (5) Business Days after Purchaser's receipt of such continuation report or other written evidence or (y) the Closing Date, then this Section 4.3 shall apply to such new Title Exceptions.

(d) If Seller shall have elected to attempt to cure the Title Objections (other than the Required Cure Items) and does not cure such Title Objections by the date on which the Closing is to occur, then Purchaser shall have the right (exercisable within five (5) Business Days of Seller's notification of its inability to cure or, if no such notification is delivered by Seller, on or prior to the Closing Date) to terminate this Contract, in which event the Earnest Money will be returned to Purchaser and upon such return neither Seller nor Purchaser will have any further obligations under this Contract except under any provisions that survive the termination of this Contract by their express terms. If Purchaser does not terminate this Contract in accordance with the immediately preceding sentence, then Purchaser shall be deemed to have elected to accept the uncured Title Objections (other than the Required Cure Items) and to purchase the Property subject thereto, with no adjustment, abatement or offset to the Purchase Price as a result of the existence of such uncured Title Objections. Notwithstanding anything to the contrary provided herein, Seller shall be entitled to cure any Title Objections at the Closing through the use of the Closing proceeds or otherwise.

4.4 Permitted Exceptions. For purposes of this Contract the term "Permitted Exceptions" will mean, collectively, the following: (a) all Existing Exceptions, (b) all Title Exceptions to which Purchaser has not timely objected, and (c) all Title Objections which Purchaser has waived, accepted or is deemed to have waived or accepted (other than the Required Cure Items, which Seller shall be obligated to remove at or prior to the Closing) under this Section 4.

5.DUE DILIGENCE PERIOD.

5.1 Items to be Delivered by Seller. Within five (5) Business Days after the Effective Date, Seller shall make available to Purchaser (through a website or any other method) copies of the items described on Exhibit "D" relating to the Property to the extent in Seller’s possession or control (collectively, the "Seller's Deliverables").

5.2 Items Available to Purchaser. Seller shall make available to Purchaser, promptly after Purchaser's request therefor, such other items of information relating to the Property reasonably requested by Purchaser that are in Seller's possession or control and that relate exclusively to the Property; provided, however, in no event shall Seller be required to make available to Purchaser books, records or files (whether in a printed or electronic format) that consist of or contain any of the following except to the extent the same are included in the Seller's Deliverables: appraisals; strategic plans, budgets, forecasts and similar forward-looking information for the Property; internal analyses; information regarding the Property that is embedded in information concerning the business, affairs and/or property of any affiliate of Seller; information related to, or obtained by Seller in connection with, Seller's purchase of the Property or any financing of the Property; communications and information related to the marketing of the Property for sale or any other sales contract relating to the Property; communications and information pertaining to any sale of the Property, including any materials provided to any prospective purchaser by Seller; internal communications among employees of Seller and/or any affiliate of Seller; communications or historical information pertaining to the Leases and the Property Agreements (or the negotiation thereof) excluding (a) any correspondence regarding any default or alleged default by Seller or a Tenant that, in either case, has not been cured or (b) information relating to any open Property expense billings.

5.3 Due Diligence Period. During the period (the "Due Diligence Period") commencing with the Effective Date and ending at 5:00 pm, Eastern time, on the date that is forty (40) days after the Effective Date (the "Termination Date"), Purchaser will have the option and right to conduct such investigations, inspections, analyses, surveys, tests, examinations, studies, and appraisals of the Property and to research and examine all governmental records, zoning, development rights and other public information relating to the Property, as Purchaser deems necessary or desirable, at Purchaser's sole cost and expense, to determine if the Property is suitable for Purchaser's purposes; provided, however, any entry onto, or physical examination, inspection or testing of, the Property (a) must be scheduled in advance with Seller and comply with the provisions of Section 5.4, (b) may be performed only after the delivery by Purchaser of the insurance certificate required under Section 5.4, and (c) shall be subject to, and must be conducted in full compliance with, the terms of the Leases and this Contract. Purchaser shall deliver to Seller copies of all third party inspection reports received by Purchaser or any other written notices received by Purchaser identifying any potential violations of law promptly after receipt by Purchaser of such third party inspection reports or other notices. Upon any termination of this Contract, Purchaser shall deliver to Seller, without recourse to Purchaser, a copy of any third party written reports received by Purchaser as a result of the activities of or on behalf of Purchaser to the extent a copy has not previously been delivered to Seller. Purchaser shall cause to be repaired any physical damage to the Property caused by any entry on the Property and/or any activities performed by, for or on behalf of Purchaser under this Section 5 and shall restore the Property to the condition existing immediately prior to such entry and/or exercise of such activities. The obligations of Purchaser under this Section 5.3 shall survive the Closing or earlier termination of this Contract.

5.4 Access. To facilitate the Purchaser's physical inspections under Section 5.3 but subject to the rights of the tenants under the Leases and the full compliance with all terms and conditions of the Leases, from the later to occur of the Effective Date or the delivery of the insurance certificate required below until the Closing or the earlier termination of this Contract, Seller will provide Purchaser and Purchaser's agents, consultants, inspectors and representatives reasonable access to the Real Property upon at least one (1) Business Day's prior written or email notice from Purchaser to Seller (but in no event less than 24 hours' advance notice); provided, however, that (a) Seller shall have the right to accompany any person entering the Real Property for or on behalf of Purchaser, (b) Purchaser shall have no right to conduct any physical testing, boring, sampling or removal without the specific prior written consent of Seller after the submission by Purchaser to Seller of a work plan, which work plan Seller may modify, limit or disapprove in its reasonable discretion within three (3) Business Days following receipt of Purchaser’s request, failing which Seller shall be deemed to have approved the work plan, (c) prior to any entry onto the Real Property, Purchaser must provide to Seller an insurance certificate evidencing that Purchaser has at least $1,000,000 of public liability insurance that names Seller as an additional insured with respect to the Property, (d) during the Due Diligence Period, Purchaser shall have the right to conduct tenant interviews with any of the current tenants leasing 3,000 square feet or more of the Property, subject to at least three (3) Business Days' advance written or email notice by Purchaser to Seller and, at Seller’s request, Seller’s participation in any such interview, (e) notwithstanding the foregoing, the parties acknowledge that Purchaser’s broker has a relationship with the tenant Campus Crest (which tenant is currently attempting to sublease its premises or assign its lease) and that Purchaser desires to relocate or terminate Campus Crest’s lease following Closing, and that Purchaser’s broker shall have the right to communicate and negotiate with Campus Crest without prior notice to Seller, provided any offer or agreement that Purchaser makes or enters into with Campus Crest shall be conditioned upon Purchaser acquiring the Property at Closing and shall not affect in any way any obligations or liabilities of Campus Crest or the lease guarantor to Seller (whether such obligations or liabilities arise before or after the Closing), and (f) except as provided in the foregoing subparagraphs (d) and (e), Purchaser shall not have the right to communicate with any of the tenants of the Property without the specific prior written or email consent of Seller, and Seller shall have the right to participate in any communications allowed by Seller. All requests for any entry on the Real Property shall be made to Mr. Bradley Safchik, 786-464-8327 (office); 305-951-1134 (mobile), or such other representative of Seller that may hereafter be designated by Seller. Purchaser will use all commercially reasonable efforts to minimize interference with the tenants under the Leases or their operations at the Real Property.

5.5 Indemnity. Purchaser agrees to indemnify, defend and hold Seller and its affiliates and their respective agents, members, partners, shareholders, directors, officers, employees and representatives, harmless from and against any liens, claims, demands, damages, losses and/or expenses (including, without limitation, reasonable attorneys' fees), suffered or incurred by Seller or its affiliates or their respective agents, members, partners, shareholders, directors, officers, employees and representatives, as a result of, arising out of, or in connection with, Purchaser or Purchaser's agents or representatives exercising any rights set forth in this Section 5 or arising from Purchaser or its agents or representatives otherwise entering upon the Real Property, except to the extent arising from the negligence or willful misconduct of Seller or its agents, members, partners, directors, officers or representatives; provided, however, that the foregoing indemnity shall not be applicable to any liens, claims, demands, damages, losses or expenses resulting solely from the discovery of any existing condition on, or information relating to, the Property. Purchaser will repair or cause to be repaired any damage caused by Purchaser or Purchaser's agents or representatives in the conduct of the review and/or inspection contemplated hereunder. The indemnification and other obligations of Purchaser in this Section 5.5 will survive the Closing or earlier termination of this Contract.

5.6 Option to Terminate. If Purchaser is not satisfied, in Purchaser's sole and absolute discretion, with the condition of the Property, or if Purchaser determines, in Purchaser's sole and absolute discretion, that the Property is unsuitable for Purchaser's purposes, or if Purchaser, in Purchaser's sole and absolute discretion, elects not to proceed with the transaction contemplated by this Contract, then Purchaser may terminate this Contract by giving written notice to Seller before 5 pm, Eastern time, on the Termination Date. In the event that Purchaser terminates this Contract in strict compliance with the provisions of this Section 5.6, the Earnest Money will be returned to Purchaser (except that the Independent Consideration shall be paid to Seller) and the parties will have no further obligations under this Contract except for return of the Earnest Money and any obligations that expressly survive the termination of this Contract. If Purchaser fails to notify Seller in writing before 5 pm, Eastern time, on the Termination Date that Purchaser has elected to terminate this Contract, then Purchaser shall no longer have any termination rights under this Section 5.6, the Earnest Money shall be nonrefundable except as otherwise expressly provided in this Contract, and the parties shall proceed to close the transaction contemplated hereby subject to and in accordance with the terms of this Contract.

Seller acknowledges that Purchaser is seeking certain Incentives (defined below) in connection with its acquisition of the Property and operation of its business therein, and that Purchaser is not obligated to acquire the Property without such Incentives. If such Incentives are not finally approved by Purchaser during the Due Diligence Period, then Purchaser may elect to terminate this Contract in accordance with the foregoing provisions of this Section 5.6. For the purposes hereof, “Incentives” shall mean any state, local and other economic incentives or other benefits from various state, local, utility and non-profit agencies that Purchaser or any other person, agency, or entity may seek to obtain for Purchaser’s benefit, including but not limited to property tax rebates, credits, abatements, and cash grants.

5.7 Property Agreements. Purchaser shall notify Seller in writing prior to the expiration of the Due Diligence Period of those Property Agreements that Purchaser elects to assume at the Closing; provided that any Property Agreements which cannot be terminated by their terms or cannot be terminated without a penalty shall be required to be assumed by Purchaser at Closing. Seller shall terminate all Property Agreements (insofar as they affect the Property) other than Property Agreements that Purchaser elects to assume or is required to assume under this Contract. Seller shall not be required to pay any termination fee or penalty in connection with the termination of any Property Agreement.

| |

| 6. | REPRESENTATIONS AND WARRANTIES. |

6.1 Seller's Representations and Warranties. Seller makes the following warranties and representations to Purchaser as of the Effective Date, and such representations and warranties will be updated at Closing as provided in Section 6.2 below:

6.1.1 Organization. Seller is duly formed, validly existing and in good standing under the laws of the state of its organization.

6.1.2 Authority. Seller has the requisite power and authority, has taken all actions required by its organizational documents and applicable law, and has obtained all necessary consents, to execute and deliver this Contract and to consummate the transactions contemplated in this Contract. The person signing this Contract on behalf of Seller is authorized to do so. The performance of this Contract by Seller will not result in any breach of, or constitute any default under, any agreement, document, instrument, or other obligation to which Seller is a party or by which Seller or the Property is bound.

6.1.3 Pending Actions. To Seller's Knowledge (as defined below), there are no pending or threatened actions, suits, arbitrations or government investigations or any unsatisfied orders or judgments against Seller, which, if adversely determined, could individually or in the aggregate (a) materially interfere with the consummation of the transaction contemplated by this Contract, or (b) have a material adverse impact on the Property. To Seller's Knowledge, Seller has

not received notice of any pending or threatened condemnation or similar proceeding affecting the Property or any part thereof.

6.1.4 Leases. (a) The only Leases in effect as of the Effective Date are with the tenants identified on Exhibit "B"; (b) except as set forth on Exhibit "B", (i) all tenant improvements required under all Leases in existence on the Effective Date and the Additional Leases (as defined below) to be constructed by Seller have been completed, and (ii) all brokerage commissions payable under the Leases in existence on the Effective Date and the Additional Leases have been paid, (c) except as set forth in the Campus Crest Lease, no Tenant under any of the Leases (each, a "Tenant") has any option or right of first offer to purchase the Property; (d) except as set forth in the Leases, no Tenant has any right or option to lease additional space in the Property, extend the term of such Lease, put back to the landlord any space currently subject to such Tenant's Lease or terminate any Lease, (e) no written notice of default has been given or received by Seller with respect to any Lease that in either case remains uncured; (f) except as set forth on Exhibit "B", no Tenant has paid rent for more than one month in advance; (g) Seller has provided or will provide in accordance with Section 5.1 or Section 7.1.3, as applicable, of this Contract true and correct copies of the Leases to Purchaser; (h) except as set forth in Exhibit "B", Seller has not released or discharged in writing any guarantor under any lease guaranty pertaining to the Leases except as set forth in the Leases; (i) attached to this Contract as Exhibit “M” is a rent roll for the Leases (the “Rent Roll”), but Seller only represents that the Rent Roll consists of the rent roll used by Seller in its management of the Property supplemented by information on two (2) additional Leases (one with Medflow Holdings, LLC and the other with Blacka Jessup & Henderson LLP) that have been circulated for execution but have not been fully executed on the Effective Date (the "Additional Leases"), and Seller makes no further representations regarding the accuracy of the Rent Roll; and (j) attached to this Contract as Exhibit "N" is a list of security deposits currently held by Seller under the Leases.

6.1.5 Property Agreements. The only contracts and agreements pertaining to the Real Property in effect as of the Effective Date that will continue to be in effect after the Closing are with the parties identified in Exhibit "B". To Seller's Knowledge, Seller has received no written notice of default from any service provider that remains uncured, no written notice of default has been sent by Seller to a service provider and, to Seller’s knowledge, all Property Agreements are in full force and effect. Seller has provided, or will provide in accordance with Section 5.1 or Section 7.1.3, as applicable, of this Contract, true and correct copies of the Property Agreements to Purchaser.

6.1.6 Bankruptcy. There are no attachments, executions, assignments for the benefit of creditors or proceedings under any bankruptcy or other debtor relief laws pending, or to Seller's Knowledge threatened, against Seller or its interest in the Property nor are any of the foregoing contemplated by Seller.

6.1.7 FIRPTA. Seller is not a "foreign person" within the meaning of Section 1445(f)(3) of the Internal Revenue Code, as amended.

6.1.8 Terrorist Organizations Lists. Seller is not, and is not acting, directly or indirectly, for or on behalf of, any person named by the United States Treasury Department as a Specifically Designated National and Blocked Person, or for or on behalf of any person designated in Executive Order 13224 as a person who commits, threatens to commit, or supports terrorism. Seller is not engaged in the transaction contemplated by this Contract directly or indirectly on behalf of, or facilitating such transaction directly or indirectly on behalf of, any such person.

6.1.9 Violations. To Seller's Knowledge as of the Effective Date, Seller has not received any written notices from any governmental authority of any uncured zoning, building, environmental protection, clean air, pollution, fire or health code violations with respect to the Property or uncured violations of any federal, state or local law pertaining to the Property.

6.1.10 Possessory Rights. Except as granted under the Leases or the Permitted Exceptions, Seller has not granted to any person or entity any possessory interest in or right to use any portion of the Property.

6.1.11 Third Party Commitments. Except for the Permitted Exceptions, Leases and Property Agreements and as otherwise expressly permitted hereunder, Seller has not made any commitment to any governmental authority, utility company, Tenant, or to any other entity, organization, group or individual, that in any instance would be binding upon the Property or the Purchaser after Closing.

6.1.12 Tangible Property. Seller owns the Tangible Property free and clear of mortgages, pledges, liens, security interests or other encumbrances other than those that will be satisfied or released at Closing and all claims or rights of others other than the rights of Tenants and their successors and assigns under the Leases.

As used in this Contract, the term "Seller's Knowledge" means the actual knowledge of Bradley Safchik, without imposing any duty of investigation or personal liability on such individual, and shall not include any imputed, implied or constructive knowledge of such individual. Seller represents and warrants that the foregoing individual is the representative of Seller that is most likely to have knowledge concerning the matters represented by Seller in this Section 6.1.

6.2 Survival of Seller's Representations and Warranties. Seller shall promptly notify Purchaser in writing if, to Seller's Knowledge, any facts, circumstances or events occur after the Effective Date that would make any of the representations or warranties contained in Section 6.1 untrue at the Closing. If any of the representations or warranties of Seller contained in this Contract, as updated as permitted under this Contract, are not made accurate by Seller on or prior to the Closing, Purchaser may elect, as its sole remedy (unless the same were made inaccurate by a willful act of Seller in violation of this Contract by Seller, in which case Section 12.1 shall be applicable), to terminate this Contract prior to the Closing, in which event the Earnest Money shall be returned to Purchaser and the parties shall have no further obligations under this Contract except for those obligations that survive termination by their express terms. If Purchaser does not elect to terminate this Contract, then the representations and warranties of Seller shall be updated at Closing to reflect all matters disclosed by Seller. The representations and warranties of Seller set forth in Section 6.1, as they may be updated at Closing, (i) shall survive Closing and expire two hundred seventy (270) days after the Closing Date (the "Survival Period") except to the extent, and only to the extent, if any, that Purchaser shall have given Seller written notice during such Survival Period which describes in reasonable detail the breach or alleged breach of such representations and warranties by Seller and, if curable, the curative actions requested by Purchaser, and which provides Seller with a reasonable period of time, not less than thirty (30) days, in which to resolve such matters to the reasonable satisfaction of Purchaser; and (ii) shall expire and be of no further force and effect two (2) years after the day the cause of action accrues (which the parties agree will be the Closing Date) with respect to any matters timely disclosed in a written notice delivered by Purchaser to Seller under subsection (i) hereof. Seller shall have no liability to Purchaser for a breach of any representation or warranty unless written notice containing a description of the specific nature of such breach shall have been given by Purchaser to Seller prior to the expiration of the Survival Period. Furthermore, notwithstanding anything to the contrary contained in this Contract, if the Closing shall have occurred: (a) Seller shall have no liability (and Purchaser shall make no claim against Seller) for a breach of any representation or warranty or any other obligation of Seller under this Contract or any document executed by Seller in connection with this Contract, unless the valid claims for actual damages incurred due to such breaches collectively exceed $25,000.00; (b) the liability of Seller for a breach of a representation or warranty under Section 6.1 or the Seller Bringdown Certificate (as defined in Section 9.2.1 below) shall in no event exceed, in the aggregate, the amount of Seven Hundred Fifty Thousand and No/100 Dollars ($750,000.00); and (c) in no event shall Seller be liable for any consequential or punitive damages, except in the case of fraud. Seller covenants and agrees that from and after the Closing until the last day of the Survival Period, Seller shall maintain a minimum net worth as determined in accordance with generally accepted accounting principles of not less than Seven Hundred Fifty Thousand and No/100 Dollars ($750,000.00); provided, however, that if any written claim is made and delivered to Seller prior to the last day of the Survival Period, Seller shall continue to maintain, until such claim has been finally adjudicated or settled and paid to the extent required by such judgment or settlement, a net worth of not less than the lesser of (i) $750,000 or (ii) 125% of the reasonable amount required to satisfy such claim. Seller’s obligations under this Section 6.2 shall survive the Closing.

6.3 Purchaser's Representations and Warranties. Purchaser makes the following warranties and representations to Seller, which warranties and representations shall be deemed to have been remade by Purchaser at the Closing and shall survive the Closing for the Survival Period:

6.3.1 Organization. Purchaser is duly organized, validly existing and in good standing under the laws of the state of its organization.

6.3.2 Authority. Purchaser has the requisite power and authority, has taken all actions required by its organizational documents and applicable law, and has obtained all necessary consents, to execute and deliver this Contract and to consummate the transactions contemplated in this Contract. The person signing this Contract on behalf of Purchaser is authorized to do so. Performance of this Contract by Purchaser will not result in any breach of, or constitute any default under, any agreement or other instrument to which Purchaser is a party or by which Purchaser is bound.

6.3.3 Bankruptcy. There are no attachments, executions, assignments for the benefit of creditors or proceedings under any bankruptcy or other debtor relief laws pending, or to the actual knowledge of Purchaser threatened, against Purchaser nor are any of the foregoing contemplated by Purchaser.

6.3.4 Terrorist Organizations Lists. Purchaser is not acting, directly or indirectly, for or on behalf of any person named by the United States Treasury Department as a Specifically Designated National and Blocked Person, or for or on behalf of any person designated in Executive Order 13224 as a person who commits, threatens to commit, or

supports terrorism. Purchaser is not engaged in the transaction contemplated by this Contract directly or indirectly on behalf of, or facilitating such transaction directly or indirectly on behalf of, any such person.

6.3.5 No Litigation. There is no litigation pending or, to Purchaser’s knowledge, threatened against Purchaser, which if adversely determined would materially adversely affect Purchaser’s ability to enter into or perform this Contract.

7.SELLER’S COVENANTS.

7.1 Covenants regarding Property. Between the Effective Date and the Closing, Seller shall:

7.1.1 Maintain Property. Maintain the portions of the Property that Seller is required to maintain under the Leases in the ordinary course of business consistent with the practices and procedures of Seller in effect as of the Effective Date, ordinary wear and tear and damage from casualty or condemnation excepted; provided, however, that notwithstanding the foregoing, Seller shall have no obligation to cure any violation of any law, ordinance or other governmental requirement or any physical condition that would give rise to a violation of any law, ordinance or other governmental requirement, whether the same exists as of the Effective Date or prior to Closing (each a "Violation") except for any Violations that, in the reasonable determination of Seller, can be cured prior to the Closing by an aggregate expenditure of $100,000 or less and for which Seller has received, prior to the Closing, written notice from the relevant governmental authority that the Violation exists. Seller shall promptly send to Purchaser a copy of all written notices of a Violation it receives from relevant governmental authorities. If (a) any written notice of a Violation is received by Purchaser after the expiration of the Due Diligence Period that (i) does not result from any communications by the Purchaser or its agents or representatives with the relevant governmental authority and (ii) does not relate to a matter that Purchaser knew constituted a violation of law prior to the expiration the Due Diligence Period as a result of the identification of such matter in a third party report or a written notice received by Purchaser, and (b) Seller is not obligated to cure such noticed Violation in accordance with the foregoing provisions, then Purchaser shall have the right to terminate this Contract by delivering written notice thereof to Seller within five (5) Business Days following Purchaser’s receipt of the written notice of the Violation if Seller does not, at Seller's option, agree either (i) to cure the violation at Seller's cost and, if the cure has not been completed by Closing, deposit in escrow with the Title Company the reasonably estimated unpaid cost therefor for disbursement in payment of the costs of Seller's curative action (with any undisbursed sums be disbursed to Seller upon the completion of the curative action), or (ii) to provide a credit to Purchaser at Closing in an amount equal to the reasonably unpaid estimated cost to cure the violation. If Seller elects to provide a credit pursuant to clause (ii) above, then Seller shall have no further obligation in connection with the Violation and Purchaser shall be responsible for the cure thereof.

7.1.2 Insurance. Maintain all casualty, liability, and hazard insurance currently in force with respect to the Property or other replacement insurance that is reasonably comparable to the existing insurance; and

7.1.3 Property Operation. Between the Effective Date and the date which is five (5) Business Days prior to the expiration of the Due Diligence Period (the “Seller Discretion Period”), Seller may lease, operate, manage, and enter into contracts with respect to the Property in the ordinary course of business consistent with the practices and procedures of Seller prior to the date hereof, subject to the limitations contained below in this Section 7.1.3. During the Seller Discretion Period, Seller shall (i) promptly notify Purchaser in writing of the commencement of any negotiations pertaining to the modification of any existing Leases or Property Agreements or the execution of any new Leases or Property Agreements that will affect the Property after the Closing, (ii) promptly send to Purchaser a copy of all written offers, letters of intent, leases, lease amendments, contracts and contract amendments, in each case, that pertain to the modification of any existing Lease or Property Agreement or any new Lease or Property Agreement that are received from or sent to Seller, other than any such documents sent between Seller and any of its affiliates or any employees, counsel, agents or advisors of Seller or any of its affiliates, and (iii) prior to the expiration of the Seller Discretion Period, send Purchaser a true and complete copy of any modifications of any Lease or Property Agreement or new Leases or Property Agreements that Seller enters into accompanied by a statement of all Purchaser Leasing Costs (as defined in Section 10.3.4) that Purchaser would be responsible for under Section 10.3.4 hereof. Seller hereby notifies Purchaser that the Additional Leases have been sent to the tenants thereunder for execution. Following the expiration of the Seller Discretion Period, Seller shall not enter into any new lease, Lease modification, Property Agreement modification or contract that cannot be terminated prior to the Closing without the prior written approval of Purchaser (which approval may be given or withheld in Purchaser’s sole discretion). Notwithstanding the foregoing, in no event (even during the Seller Discretion Period) shall Seller (a) apply any tenant security deposits unless the applicable lease is terminated and the tenant thereunder has vacated its premises, (b) initiate any zoning reclassification of the Property or seek any variance under existing zoning ordinances applicable to the Property, or (c) impose any additional restrictive covenants or

encumbrances on the Property (other than exceptions to be removed by Closing) or execute or file any subdivision plat affecting the Property. If Purchaser fails to give Seller notice of its approval or disapproval, together with the reason for any disapproval, of any proposed action requiring its approval under this Section 7.1.3 within three (3) Business Days after Seller notifies Purchaser in writing of the proposed action, then Purchaser shall be deemed to have given its disapproval. The representations and warranties of Seller shall be updated at Closing to reflect any leases and contracts executed by Seller as permitted by the provisions of this Section 7.1.3. Seller shall promptly provide to Purchaser copies of all documents executed by Seller pursuant to this Section 7.1.3.

7.2 Marketing of Property. Between the Effective Date and the Closing, Seller shall not market the Property for sale and shall not accept or negotiate any letter of intent to sell the Property or sales agreement with respect to the Property (other than this Contract).

7.3 Estoppels and SNDAs.

7.3.1 After the expiration of the Due Diligence Period, Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser, prior to Closing, an estoppel letter in substantially the form attached hereto as Exhibit "E" executed by each of the Tenants; provided, however, that if any Tenant is permitted under the terms of its Lease to provide less information or to otherwise make different statements or provide a different form of estoppel certification, then if the tenant refuses to provide an estoppel letter in the form of Exhibit "E", Seller shall use commercially reasonable efforts to obtain an estoppel certificate in accordance with the relevant Lease. Any estoppel letter in substantially the form of Exhibit "E" or that complies with the provisions of the relevant Lease is called a "Tenant Estoppel". Commercially reasonable efforts shall not include the payment of any sums by Seller to any Tenant, the incurrence of any other liability to any Tenant, or the granting of any other concession to any Tenant.

7.3.2 Within five (5) days after the delivery by Purchaser to Seller of a completed subordination, non-disturbance and subordination form for any Lease, Seller shall send to the Tenants under any Leases identified by Purchaser, for execution by each of the relevant Tenants, a subordination, non-disturbance and attornment agreement ("SNDA") in favor of Purchaser's lender on Purchaser's lender's standard form; provided, however, that notwithstanding the foregoing (a) in no event shall Seller be required to send an SNDA to any Tenant prior to the expiration of the Due Diligence Period, and (b) the failure of any such Tenant to execute and deliver an SNDA shall not affect any of the obligations of the Purchaser under this Contract or be a condition to Purchaser's obligation to close the purchase of the Property. Purchaser acknowledges and agrees that this Contract and the Purchaser's obligations hereunder are not contingent upon the receipt by Purchaser of loan or other financing in connection with the Property regardless of the provisions of this Section 7.3.2 or any reference in this Contract to any lender of or loan to Purchaser.

8."AS IS" SALE.

8.1 Seller's Deliveries. Except as otherwise expressly provided in this Contract or in the Seller Documents (defined in Section 8.2 below), any and all materials, reports, studies or other items furnished by Seller or on Seller's behalf, whether or not required by the terms of this Contract (including but not limited to the Seller's Deliverables) are delivered without representation or warranty, express or implied, by Seller as to the truth, accuracy and completeness thereof, and any reliance thereon by the Purchaser shall be at Purchaser's own risk, without any recourse against Seller and subject to Purchaser's independent examination.

8.2 AS-IS SALE. PURCHASER HEREBY ACKNOWLEDGES AND AGREES THAT THE SALE OF THE PROPERTY HEREUNDER IS AND WILL BE MADE ON AN "AS IS, WHERE IS AND WITH ALL FAULTS" BASIS SUBJECT, HOWEVER, TO THE EXPRESS REPRESENTATIONS OF SELLER CONTAINED IN THIS CONTRACT OR THE DEED (AS DEFINED BELOW) OR OTHER CLOSING DOCUMENTS. THE OCCURRENCE OF CLOSING SHALL CONSTITUTE AN ACKNOWLEDGMENT BY PURCHASER THAT THE PROPERTY WAS ACCEPTED WITHOUT PRESENTATION OR WARRANTY, EXPRESS OR IMPLIED EXCEPT FOR THE REPRESENTATIONS CONTAINED IN THIS CONTRACT OR THE DEED OR OTHER CLOSING DOCUMENTS EXECUTED BY SELLER (THE DEED AND SUCH OTHER CLOSING DOCUMENTS ARE COLLECTIVELY CALLED THE "SELLER DOCUMENTS"). EXCEPT FOR THE WRITTEN REPRESENTATIONS SPECIFICALLY SET FORTH IN THIS CONTRACT OR THE SELLER DOCUMENTS, SELLER HEREBY SPECIFICALLY NEGATES AND DISCLAIMS ANY REPRESENTATIONS, WARRANTIES OR GUARANTEES OF ANY KIND OR CHARACHTER, WHETHER EXPRESS OR IMPLIED, ORAL OR WRITTEN, PAST, PRESENT, FUTURE OR OTHERWISE, AS TO, CONCERNING OR WITH REPSECT TO THE PROPERTY, ITS CONDITION (PHYSICAL, FINANCIAL OR OTHERWISE), THE OPERAITON OF, ACCESS TO, OR THE FITNESS FOR ANY SPECIFIC PURPOSE OR USE, MERCHANTABILITY, HABITABILITY, OR THE LIE AND TOPOGRAPHY, OF ALL OR ANY PORTION OF THE PROPERTY, THE EXISTENCE, LOCATION OR AVAILABILITY OF UTILITY LINES FOR WATER, SEWER, DRAINAGE, ELECTRICITY OR ANY OTHER UTILITY, THE INCOME-PRODUCING POTENTIAL OF THE PROPERTY, THE LAWS,

REGULATIONS AND RULES APPLICABLE TO THE PROPERY OR THE COMPLIANCE (OR NON-COMPLIANCE) OF THE PROPERTY THEREWITH, ANY ENVIRONMENTAL LAWS, REGULATIONS AND RULES (OR OTHER LAWS RELATIVE TO HAZARDOUS MATERIALS) APPLICABLE TO THE PROPERTY OR THE COMPLIANCE (OR NON-COMPLIANCE) OF THE PROPERTY THEREWITH, THE QUANITY, QUALITY OR CONDITION OF THE ARTICLES OF PERSONAL PROPERTY INCLUDED IN THE TRANSACTIONS CONTEMPLATED HEREBY, THE PERMITTED USE OF THE PROPERTY OR ANY PART THEREOF OR ANY OTHER AMTTER OR THING AFFECTING OR RELATING TO THE PROPERTY OR THE TRANSACTIONS CONTEMPLATED HEREBY. PURCHASER ACKNOWLEDGES THAT PURCHASER HAS NOT RELIED ON SELLER'S SKILL OR JUDGMENT TO SELECT OR FURNISH THE PROPERTY FOR ANY PARTICULAR PURPOSE, AND THAT SELLER MAKES NO WARRANTY THAT THE PROPERTY IS FIT FOR ANY PARTICULAR PURPOSE. WITHOUT LIMITING ANY EXPRESS REPRESENTATIONS CONTAINED IN THIS CONTRACT OR THE SELLER DOCUMENTS, PURCHASE FUTHER ACKNOWLEDGES AND AGREES THAT (1) ALL INFORMATION PROVIDED OR TO BE PROVIDED WITH RESPECT TO THE PROPERTY (INCLUDING, WITHOUT LIMITATION, THE SELLER'S DELIVERABLES) WAS OR WILL BE OBTAINED FROM A VARIETY OF SOURCES AND (A) SUCH INFORMAITON HAS BEEN AND WILL BE PROVIDED WITHOUT ANY RECOURSE TO OR LIABILITY OF SELLER OR THE PREPARES THEREOF, AND (B) SELLER (I) HAS NOT MADE ANY INDEPENDENT INVESTIGATION OR VERIFICATION OF SUCH INFORMATION AND )II) HAS NOT MADE ANY EXPRESS OR IMPLIED, ORAL OR WRITTEN, REPRESENTATIONS AS TO ANY SUCH INFORMATION OR THE ACCURACY, COMPLETENESS, FORM OR CONTENT OF SUCH INFORMATION, (2) THE PURCHASE PRICE REFLECTS THE "AS-IS" NATURE OF THIS SALE AND ANY FAULTS, LIABILTIES, DEFECTS OR OTHER ADVERSE MATTERS THAT MAY BE ASSOCIATED WITH THE PROPERTY, (3) PURCHASER'S DECISION TO PURCHASE THE PROPERTY SHALL BE BASED SOLELY ON THE TERMS OF THIS CONTRACT AND PURCHASER'S INDEPENDENT EVALUATION OF THE PROPERTY, AND (4) ANY INFORMATION (INCLUDING, WITHOUT LIMITAITONS, THE SELLER'S DELIVERABLES) HERETOFORE OR HEREAFTER PROVIDED BY SELLER TO PURCHASER SHALL BE FOR INFORMATIONAL PURPOSES ONLY, AND PURCHSER SHALL NOT RELY UPON ANY SUCH INFORMATION. PURCHASER HEREBY RELEASES SELLER AND ITS AFFILIATES AND THEIR RESPECTIVE EMPLOYEES, AGENTS AND ATTORNEYS FROM ALL OBLIGATIONS AND LIABILITIES WITH RESPECT TO ALL SUCH INFORMATION (INCLUDING, WITHOUT LIMITAITON, THE SELLER'S DELIVERABLES) EXCEPT AS OTHERWISE EXPRESSLY PROVIDED IN THIS CONTRACT, AND THE CLOSING STATEMENT SHALL INCLUDE A RATIFICATION AND CONFIRMATION OF SUCH RELEASE AS OF THE CLOSING DATE. PURCHASER ACKNOWLEDGES AND AGREES THAT, EXCEPT AS EXPRESSLY PROVIDED IN THIS CONTRACT, SELLER SHALL BE UNDER NO DUTY TO MAKE ANY AFFIRMATIVE DISCLOSURE REGARDING ANY MATTER WHICH MAY BE KNOWN TO SELLER, OR ITS OFFICERS, DIRECTORS, CONTRACTORS, AGENTS OR EMPLOYEES.

8.3 NOTWITHSTANDING THE FOREGOING, THE PURCHASER’S RELEASE OF SELLER AND WAIVER AS SET FORTH IN SECTION 8.2 SHALL NOT CONSTITUTE A RELEASE OR WAIVER BY PURCHASER NOR PERTAIN TO ANY CLAIM OR CAUSE OF ACTION BY PURCHASER AGAINST SELLER, TO THE EXTENT THAT SUCH A CLAIM OR CAUSE OF ACTION BY PURCHASER OTHERWISE EXISTS, FOR (A) FRAUD OR WILLFUL MISrEPRESENTATION, OR (B) A BREACH BY SELLER OF THIS CONTRACT OR ANY SELLER DOCUMENTS, INCLUDING A BREACH OF ANY REPRESENTATION OR WARRANTY EXPRESSLY SET FORTH IN THIS CONTRACT, OR (C) ANY TORT CLAIMS MADE OR BROUGHT BY A THIRD PARTY UNRELATED TO PURCHASER WHICH ARISE ON ACCOUNT OF EVENTS THAT OCCURRED AT THE PROPERTY PRIOR TO CLOSING, OR (D) ANY CLAIMS MADE OR CAUSES OF ACTION BROUGHT BY ANY GOVERNMENTAL AUTHORITY OR OTHER THIRD-PARTY (UNAFFILIATED WITH THE PURCHASER) WITH RESPECT TO HAZARDOUS MATERIALS DEPOSITED OR PLACED IN, AT, OR UNDER THE PROPERTY BY SELLER, OR (E) ANY CLAIMS MADE OR CAUSES OF ACTION BROUGHT BY ANY THIRD PARTY UNRELATED TO PURCHASER ALLEGING A DEFAULT OR BREACH BY SELLER WHICH IS ALLEGED TO HAVE OCCURRED PRIOR TO THE CLOSING DATE UNDER ANY CONTRACT, AGREEMENT OR LEASE TO WHICH SELLER AND ANY SUCH CLAIMANT WERE PARTIES. NOTHING CONTAINED IN THIS SECTION 8.3 SHALL IMPLY THAT PURCHASER HAS ANY RIGHT TO ANY CLAIM OR CAUSE OF ACTION FOR ANY OF THE MATTERS DESCRIBED IN THIS SECTION 8.3.

8.4 SURVIVAL. THE PROVISIONS OF THIS SECTION 8 SHALL SURVIVE THE CLOSING OR EARLIER TERMINATION OF THIS CONTRACT.

9.CLOSING.

9.1 Closing Date. The consummation of this transaction (the "Closing") will take place through an escrow with the Title Company on that date that is thirty (30) days after the expiration of the Due Diligence Period or such earlier date to which the parties may agree in writing; provided, however, that if all conditions to Purchaser's obligations to fund and close the purchase contemplated hereby have been satisfied or waived in writing by Purchaser, then Purchaser upon at least five (5) Business Days'

written notice to Seller shall be entitled to accelerate the Closing to such earlier Business Day as may be mutually acceptable to Seller and Purchaser. The date on which the Closing is required to occur (or if the Closing occurs, the date on which the Closing occurs) is called the "Closing Date." The Closing shall be accomplished through the delivery of the closing documents and funds in escrow to the Title Company, without the need for either Seller or Purchaser to be present at the Closing. All documents delivered in escrow to the Title Company by Seller and Purchaser shall be released from escrow and delivered to the other party at the Closing.

9.2 Seller's Closing Obligations. At or prior to the Closing, Seller will do, or cause to be done, the following:

9.2.1 Seller will execute, acknowledge (if necessary), and deliver in escrow to the Title Company, for delivery to Purchaser at the Closing, the following documents:

(a) a Special Warranty Deed conveying the Land and the Improvements in the form and substance of Exhibit "G" (the "Deed");

(b) an Assignment and Assumption of Lessor's Interest in Leases in the form and substance of Exhibit "H";

(c) a Bill of Sale and General Assignment in the form and substance of Exhibit "I";

(d) a Certificate of Non-Foreign Status in the form and substance of Exhibit "J";

(e) a notification of change of ownership in the form and substance of Exhibit "K";

(f) an affidavit in the form of Exhibit "L";

(g) any form required from the Seller by law in connection with the delivery of the Deed and the payment of any transfer taxes;

(h) a document pursuant to which Seller confirms its liability for all unpaid amounts of the Seller Leasing Costs pursuant to Section 10.3.4 and indemnifies Purchaser with respect thereto;

(i) a certificate of Seller confirming that its representations and warranties set forth in this Contract, as updated in accordance with this Contract, are correct in all material respects as if made on the Closing Date or noting any exceptions, but such certificate shall expressly provide that the representations and warranties are subject to the provisions of Section 6.2 hereof (the "Seller Bringdown Certificate");

(j) a closing statement setting forth the Purchase Price, the costs payable in connection with the transaction contemplated hereby, the disbursements hereunder and otherwise conforming to the requirements of this Contract; and

(k) all such additional documents as may be reasonably required by the Title Company and consistent with this Contract to consummate the sale of the Property pursuant to this Contract.

9.2.2 Seller will terminate, as of the Closing Date, all management and leasing agreements relating to the Real Property and all Property Agreements which Purchaser does not elect to assume (except for those which Purchaser is required to assume pursuant to the terms of this Contract);

9.2.3 Seller shall deliver to the Title Company all documents that may be reasonably required by the Title Company to evidence the due organization and good standing of Seller, the power and authority of Seller to convey the Property, and the authority of each signatory for Seller to execute this Contract, the Deed and the other closing documents.

9.2.4 Seller will deliver possession of the Property to Purchaser upon the consummation of the Closing free and clear of all possessory rights other than the tenants and other occupants under the Leases, but subject to the Permitted Exceptions.

9.2.5 Seller will deliver to Purchaser within two (2) Business Days after the Closing, the following to the extent in Seller's possession or control: original Leases, original Property Agreements, Seller's lease files, and any transferable permits held by Seller pertaining to the operation of the Property.

9.2.6 Seller will pay all costs required to be paid by Seller pursuant to Section 10.1 of this Contract.

All documents required to be delivered by Seller must be delivered in escrow to the Title Company no later than 5:00 p.m. (local time at the closing office of the Title Company) on the Business Day immediately preceding the Closing Date.

9.3 Purchaser's Closing Obligations. At or prior to the Closing, Purchaser will do, or cause to be done, the following:

9.3.1 Purchaser will pay to Seller the Purchase Price, as adjusted in accordance with the express provisions of this Contract;

9.3.2 Purchaser will execute and deliver to the Title Company in escrow, for delivery to Seller at Closing, the following: (a) counterparts of the documents described in Section 9.2 requiring Purchaser's signature, (b) a closing statement setting forth the Purchase Price, the costs payable in connection with the transaction contemplated hereby, the disbursements hereunder and otherwise conforming to the requirements of this Contract, (c) a certificate, duly executed by Purchaser, confirming that its representations and warranties set forth in this Contract are correct as if made on the Closing Date, (d) a document pursuant to which Purchaser assumes liability for all unpaid amounts of the Purchaser Leasing Costs pursuant to Section 10.3.4 and indemnifies Seller with respect thereto, and (e) any instruments reasonably necessary to consummate the sale of the Property pursuant to this Contract (including, by way of example, evidence of the authority of the signatory for Purchaser to consummate the Closing).

9.3.3 Purchaser will pay all costs required to be paid by Purchaser pursuant to Section 10.1 of this Contract.

All documents required to be delivered by Purchaser must be delivered in escrow to the Title Company no later than 5:00 p.m. (local time at the closing office of the Title Company) on the Business Day immediately preceding the Closing Date. All funds required to be paid by Purchaser pursuant to this Contract must be delivered in escrow, in immediately available funds, no later than 2:00 p.m. (local time at the Title Company) on the Closing Date.

| |

| 10. | COSTS, PRORATIONS AND ADJUSTMENTS. |

10.1 Expenses. Seller will pay for one-half of the escrow fees charged by the Title Company for the purchase/sale transaction (but not any fees relating to any Exchange, as defined below), any curative title action required of Seller under this Contract, the commission of Brokers due pursuant to Seller’s separate agreement with Brokers, Seller's attorneys' fees to prepare the Deed, a $600 credit in connection with the updated Survey pursuant to Section 4.1, and any transfer taxes or revenue stamps in connection with the recording of the Deed. Purchaser will pay for the costs charged by the Title Company for the issuance of the owner's title policy contemplated thereby (the "Owner’s Title Policy"), all of the costs charged by the Title Company for extended coverage, any title insurance coverage for any lender, and all endorsements to the Owner’s Title Policy or any loan policy, all fees, costs, expenses and other sums relating to any loan applied for and/or obtained by Purchaser, all fees and costs relating to the Purchaser's examination and investigation of the Property, all fees of Escrow Agent relating to placing the deposit in an interest-bearing account, all recording fees, one-half (1/2) of the escrow fees charged by the Title Company for the purchase/sale transaction, the cost of any updated Survey obtained by Purchaser and all revisions thereto, and all of the fees charged by the Title Company for handling any Exchange or any loan transaction. Seller and Purchaser will be responsible for the fees and expenses of their respective attorneys, consultants and advisors.

10.2 Taxes and Assessments. Seller will pay all installments of real estate taxes that are due and payable prior to the Closing. Purchaser shall be responsible for the payment of all general real estate taxes that become due after the Closing. Taxes shall be prorated as of the Apportionment Time (as defined below) on a calendar year basis (i.e., based on any tax bill issued by the governing authority issued during the calendar year in which Closing occurs despite the fact that such tax bill may be for a fiscal year and not such calendar year). "Apportionment Time" shall mean the Closing Date. Purchaser shall not receive a credit for any special assessments, or installments thereof, that are levied or are first due and payable after the Closing and Purchaser shall be responsible for all such special assessments or installments thereof.

10.3 Prorations and Adjustments. The prorations and adjustments to the Purchase Price set forth in this Section 10.3 shall be made between Seller and Purchaser and included in the closing statement. All prorations shall be made on a per diem basis as of the Apportionment Time (as defined above).

10.3.1 Current rents, advance rentals, operating expenses, additional rent and other charges actually paid by tenants under the Leases, and charges under the Property Agreements to be assumed by Purchaser shall be prorated as of the Apportionment Time.

10.3.2 The parties shall use commercially reasonable efforts to cause all utility providers to perform a meter reading as close to the Closing Date as is practicable. Purchaser shall arrange for the provision of all utility services in Purchaser's name from and after the Closing, so that such utility services are no longer provided in Seller's name. Seller shall be entitled to a refund of all utility deposits made by or on behalf Seller, and Purchaser shall make its own deposits directly with the utility provider. Seller shall receive a credit for all deposits made by or on behalf of Seller to the extent the same remain on deposit for the benefit of Purchaser.

10.3.3 Unapplied security deposits existing under the Leases as of the Closing shall be credited to Purchaser at Closing.

10.3.4 Subject to the last sentence of this Section 10.3.4, any tenant improvements, allowances, third party leasing commissions and all costs and reimbursements payable by the landlord to or on behalf of the tenant that are paid or incurred by Seller after the Effective Date of this Contract with respect to leases, lease renewals, lease expansions, lease modifications or other rental agreements executed after the Effective Date in accordance with Section 7.1.3, excluding the Additional Leases, shall be paid by Purchaser at or after Closing. All of the foregoing amounts are called the "Purchaser Leasing Costs." The Purchaser Leasing Costs shall not include any tenant improvements, allowances or third party leasing commissions that, in each case, relate to the primary term of the Additional Leases or of the Lease with Peachtree Providence Partners, LLC (the "Peachtree Lease"), all of which shall be Seller Leasing Costs (but the Purchaser Leasing Costs shall include any and all costs, fees or expenses that are payable under or in connection with any of the Leases (including, without limitation, the Additional Leases and the Peachtree Lease) after the Closing that relate to any election by the landlord under any Lease to move the tenant or that relate to any extension or renewal option under such Leases). Seller shall receive a credit at Closing for such Purchaser Leasing Costs paid by Seller on or prior to the Closing Date. At the Closing, Purchaser shall execute and deliver to Seller a document pursuant to which Purchaser assumes liability for all unpaid amounts of the Purchaser Leasing Costs and indemnifies Seller with respect thereto. Any tenant improvements, allowances and third party leasing commissions that relate to Leases executed prior to the Effective Date (as the same may have been modified by any lease renewals, lease expansions, lease modifications or other rental agreements executed prior to the Effective Date) and the Additional Leases, exclusive of the Purchaser Leasing Costs and any costs, fees or expenses relating to extensions or renewal terms not exercised prior to the Effective Date, shall be paid for by Seller at or prior to the Closing. All of the foregoing amounts payable by Seller are called the "Seller Leasing Costs." At the Closing, Seller shall execute and deliver to Purchaser a document pursuant to which Purchaser confirms it liability for all unpaid amounts of the Seller Leasing Costs and indemnifies Purchaser with respect thereto. The terms of this Section 10.3.4 shall survive Closing.

10.3.5 If on the Closing Date, any Tenant is delinquent in the payment of rent, including any additional rent billed but unpaid at the time of Closing, said delinquent rent shall remain the property of Seller and no proration with respect thereto shall be made at Closing. Purchaser will use its reasonable efforts to collect such delinquent rent; provided, however, that Purchaser shall not be required to commence any legal action to collect such sums. If Purchaser does not elect to file a lawsuit on Seller's behalf (in which event all matters in such lawsuit relating to any sums due to Seller will be controlled solely by Seller), then Seller reserves the right to file a lawsuit for damages against the applicable tenant for any delinquent rent, and Purchaser shall reasonably cooperate with Seller in connection therewith at no expense to Purchaser. For a period of six (6) months following the Closing (or such additional period of time during which Seller is pursuing a claim in court against the applicable tenant, if such claim is commenced during the 6 month period), Purchaser shall not modify any Lease in any way that affects any sums that may be due to Seller. Seller shall have the right to contact tenants to request payment of delinquent rentals after the Closing Date and to institute legal proceedings, at Seller’s sole expense, to collect and retain such delinquent rentals. If Purchaser collects any sums from Tenants, following the application of any sums collected from any Tenant to the monthly rental obligations accruing on or after the Closing Date, Purchaser shall remit the balance thereof, if any, to Seller, less all reasonable direct out-of-pocket costs of collection actually incurred by Purchaser in connection with the collection of the sums due to Seller. All sums received by Purchaser after Closing from any tenants attributable to the period prior to the Closing Date shall be deemed to be held in trust by Purchaser for Seller for application as provided in this Section.

10.3.6 Purchaser will obtain its own insurance from and after the Closing. Seller shall be entitled to cancel its insurance at Closing and shall be entitled to all unearned premiums thereon.

10.4 Adjustment. To the extent that errors are discovered in, or additional information becomes available with respect to, the prorations and allocations made at Closing, Seller and Purchaser agree to make such post-Closing adjustments as may be necessary to correct any inaccuracy; however, all prorations will be final thirty (30) days after Closing except as otherwise

provided in Section 10.5 below, and except that if the tax bill issued in the year in which Closing occurs is not available prior to the Closing, then post-Closing adjustments for such tax bill will be final ninety (90) days after the tax bill is issued.

10.5 Additional Rent. Reconciliations of taxes, insurance charges and other expenses owed by tenants of the Property for the calendar year (or fiscal year if different from the calendar year) in which Closing occurs shall be prepared by Purchaser with the cooperation of Seller within ninety (90) days following the end of such year in accordance with the requirements set forth in the Leases and as provided in this Section 10.5. The proration between the parties of income received from tenants from reconciliations of expenses under the Leases shall be calculated based on the expenses for such year, the sums collected from tenants (inclusive of payments made by each tenant after any reconciliation statements are delivered to the tenants) and the expenses paid by each party with respect to each party’s period of ownership of Property. Purchaser shall provide to Seller an accounting of the reconciliations and receipts from tenants. Any sums due to either party as a result of any reconciliation shall be promptly paid to the other party, but in no event shall any sums due to Seller be paid later than ten (10) Business Days after receipt of the reconciliation payment from relevant tenant.

10.6 Disputes with Respect to Adjustments. If Seller and Purchaser, each acting reasonably and in good faith, cannot resolve any issue with respect to the adjustments described in this Section 10, they shall submit such issue for binding resolution by a nationally recognized accounting firm mutually acceptable to both parties (the "Accounting Firm"). The parties shall bear equally all fees and expenses of the Accounting Firm in connection with the resolution of such issue, and each party shall bear its own legal, accounting and other fees and expenses incurred in connection with the resolution of the issue by the Accounting Firm. Such resolution shall be final and binding on the parties and judgment may be entered upon such resolution in any court having jurisdiction thereof. Seller and Purchaser agree that the proceeding described in this Section 10.6 shall be conducted in Charlotte, North Carolina.

10.7 Survival. The provisions of this Section 10 will survive Closing.

11.CONDITIONS TO PURCHASER'S AND SELLER'S CLOSING OBLIGATIONS.

11.1 Conditions to Purchaser's Obligations. In addition to any other conditions to Closing set forth in this Contract, Purchaser's obligation to fund the Purchase Price and close this transaction is subject to the satisfaction or waiver by Purchaser, in its sole and absolute discretion, of the following conditions:

11.1.1 As of Closing, the representations and warranties of Seller in Section 6.1, subject to the updates and exceptions thereto permitted under this Contract, shall be true and correct in all material respects; and

11.1.2 Seller shall have performed, observed and complied with all covenants, agreements and conditions required by this Contract to be performed, observed and complied with by Seller prior to, or as of, the Closing.

11.1.3 Seller shall have delivered to Purchaser, at least five (5) Business Days prior to the Closing, Acceptable Tenant Estoppels (as defined below) from tenants leasing at least seventy percent (70%) of the space in the Property that is subject to a Lease, which must include Acceptable Tenant Estoppels from the following Tenants (the "Required Tenants"): (a) Campus Crest Lease, LLC, (b) Medflow Holdings, LLC, (c) Wells Fargo Bank, N.A., (d) Dickey McCamey, (e) KSQ Architects, PC, and (f) Edwin M. Rollins Company. An “Acceptable Tenant Estoppel” means a Tenant Estoppel executed by a Tenant that is (i) is dated not more than thirty (30) days prior to the Closing Date, (ii) states that the Lease is in effect, (iii) does not indicate that a default exists under the relevant Lease on the part of the landlord, and (iv) does not contain any information that deviates in any material respect from the information contained in the rent roll delivered by Seller to Purchaser as a part of Seller's Deliverables. Notwithstanding the foregoing, in the event Seller delivers the Acceptable Tenant Estoppels from the Required Tenants but cannot for any reason obtain a sufficient number of Acceptable Tenant Estoppels from other Tenants so as to meet the foregoing condition, then Seller may, at its option, elect to deliver to Purchaser at or prior to the Closing a certificate or certificates of Seller in the form of Exhibit "F" (the “Seller Estoppel”) with respect to Tenants leasing up to fifteen percent (15%) of the space in the Property that is subject to a Lease and thereupon the foregoing precedent condition in this Section 11.1.3 shall be deemed satisfied; provided, however, in no event may Seller provide a Seller Estoppel on behalf of a Required Tenant. Seller’s liability under each such Seller’s certificate delivered in order to meet the condition set forth in this Section 11.1.3 shall expire and be of no further force or effect on the earlier of (A) two hundred seventy (270) days following the Closing Date except to the extent, and only to the extent, if any, that Purchaser shall have delivered to Seller written notice during such 270‑period that describes in reasonable detail a breach or alleged breach by Seller of such Seller Estoppel, and (B) the date that Purchaser receives an Acceptable Tenant Estoppel from the applicable Tenant.

11.1.4 The Title Company has committed to issue the Owner’s Title Policy upon the delivery of all documents required to be delivered by Purchaser, payment of all costs required to be paid by Purchaser, and the satisfaction of all conditions required to be satisfied by the Purchaser.

If any of the conditions set forth in this Section are not satisfied as of the Closing Date, then Purchaser shall have the option, in its sole and absolute discretion, to (i) waive the condition and proceed to close the purchase of the Property contemplated herein and accept the Property without the satisfaction of such conditions with no reduction in the Purchase Price or (ii) (A) if the failure to satisfy the condition results from the default of Seller, exercise an available remedy for default as provided in Section 12.1 below, or (B) if the failure to satisfy the condition does not result from the default of Seller, terminate this Contract, in which event the Earnest Money will be returned to Purchaser, and the parties will have no further obligations under this Contract except for any obligations that survive termination of this Contract by their express terms. If Purchaser fails to deliver written notice of its election prior to the Closing, then Purchaser shall be deemed to have elected to proceed under clause (i) above.

11.2 Conditions to Seller's Obligations. In addition to any other conditions to Closing set forth in this Contract, Seller's obligation to close this transaction is subject to the satisfaction or waiver by Seller, in its sole and absolute discretion, of the following conditions:

11.2.1 As of Closing, the representations and warranties of Purchaser contained in Section 6.3 shall be true and correct; and

11.2.2 Purchaser shall have performed, observed and complied with all covenants, agreements and conditions required by this Contract to be performed, observed and complied with by Purchaser prior to, or as of, the Closing.

If any of such conditions are not satisfied as of the Closing Date, then Seller shall have the option, in its sole and absolute discretion, to (i) exercise its remedies under Section 12.2, or (ii) waive the condition and proceed to close the sale of the Property contemplated herein. If Seller fails to deliver written notice of its election prior at or prior to the Closing, then Seller shall be deemed to have elected to proceed under clause (ii) above.