September 4, 2019 KP415/KP484 License Agreement with Gurnet Point Capital Exhibit 99.2

Cautionary Note Regarding Presentation Information This presentation contains forward-looking statements, including statements about any royalty or milestone payments under our license agreement, the exchange of any future principal under our exchange agreement, our plans to develop and commercialize our product candidates, our planned clinical trials for our prodrug product candidates, the timing of and our ability to obtain and maintain regulatory approvals for our product candidates, including expectations about our ability to use the 505(b)(2) pathway and expedited FDA review, the clinical utility of our product candidates and our intellectual property position. These statements involve substantial known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements in this presentation represent our views as of the date of this presentation. These and other risks concerning our business are described in additional detail in our Quarterly Report on Form 10-Q filed with the SEC on August 13, 2019, and our other Periodic and Current Reports filed with the SEC. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Further, the information contained in this presentation speaks only as the date hereof. While we may elect to update the information in this presentation in the future, we disclaim any obligation to do so except to the extent required by applicable law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

Travis Mickle, Ph.D. – President & Chief Executive Officer R. LaDuane Clifton, CPA – Chief Financial Officer, Secretary & Treasurer Gordon K. “Rusty” Johnson – Chief Business Officer KP415/KP484 License Agreement Call Participants

KP415/KP484 Collaboration and License Agreement KemPharm has entered into a definitive collaboration and license agreement with an affiliate of Gurnet Point Capital (GPC) Up to a total of $493M in upfront, regulatory, development and sales milestone payments; plus royalty percentages of up to mid-20s of net sales Licensee granted exclusive worldwide licenses for KP415 and KP484, plus options to add KP879 and product candidates based on KP922, a new prodrug of amphetamine KemPharm to manage all development activities and Licensee responsible for development costs under the license agreement Licensee responsible for commercialization and manufacturing activities, seeking to build a best-in-class CNS sales and managed markets team, with KP415 as its leading product candidate This collaboration is a unique opportunity to bring innovative products to ADHD patients and their families

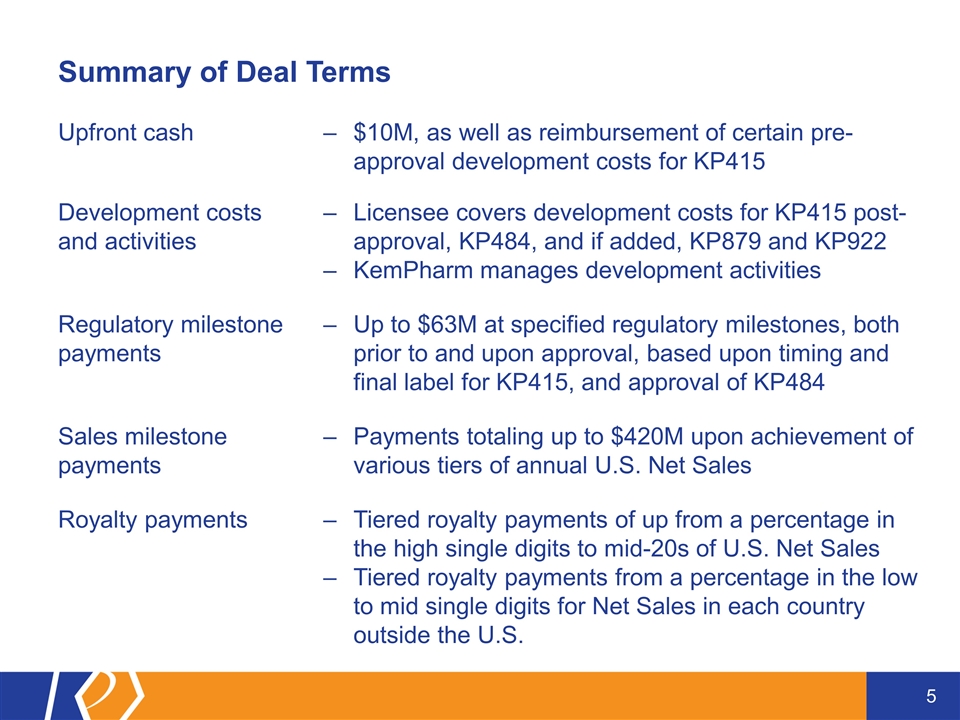

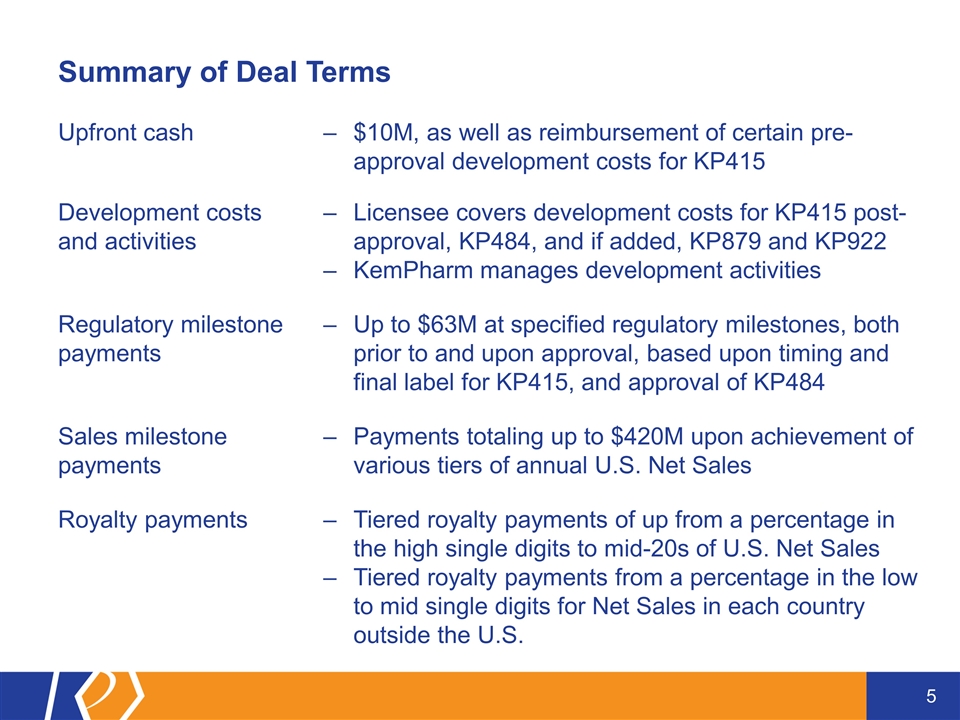

Summary of Deal Terms Upfront cash $10M, as well as reimbursement of certain pre-approval development costs for KP415 Development costs and activities Licensee covers development costs for KP415 post-approval, KP484, and if added, KP879 and KP922 KemPharm manages development activities Regulatory milestone payments Up to $63M at specified regulatory milestones, both prior to and upon approval, based upon timing and final label for KP415, and approval of KP484 Sales milestone payments Payments totaling up to $420M upon achievement of various tiers of annual U.S. Net Sales Royalty payments Tiered royalty payments of up from a percentage in the high single digits to mid-20s of U.S. Net Sales Tiered royalty payments from a percentage in the low to mid single digits for Net Sales in each country outside the U.S.

Gurnet Point Capital GPC is a healthcare fund that invests long-term capital into life sciences and medical technology companies across all stages of project development Founded by Ernesto Bertarelli, former CEO of Serono, SA, and led by Christopher Viehbacher, Managing Partner and former CEO and board member of Sanofi, who together bring decades of expertise in an industry for which they share a passion GPC brings significant experience at guiding novel drugs through development and commercialization, aided by its unique long-term investment horizon, which helps ensure development and commercial success GPC’s investment portfolio includes: Auregen BioTherapeutics, Axcella Health, Before Brands, Boston Pharmaceuticals, Corium International, Innocoll Holdings and Zikani Therapeutics

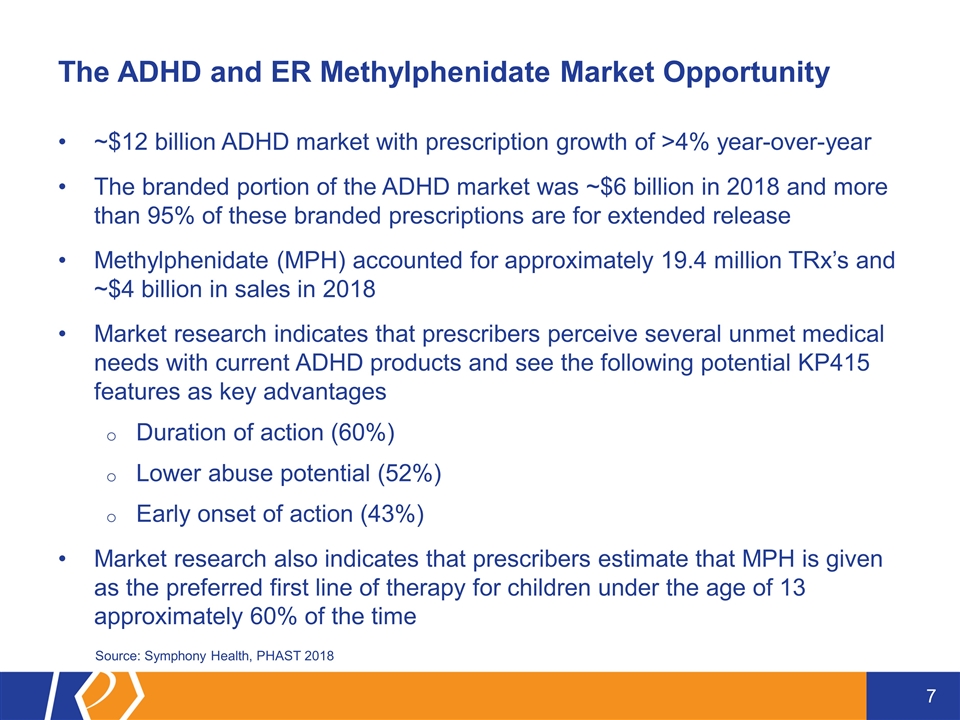

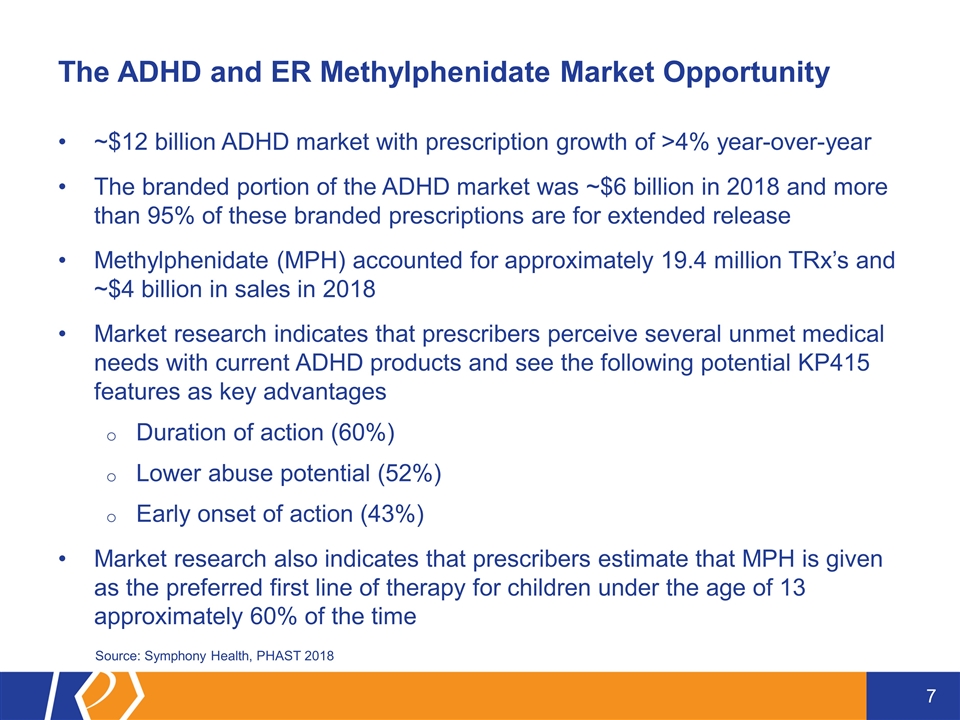

The ADHD and ER Methylphenidate Market Opportunity ~$12 billion ADHD market with prescription growth of >4% year-over-year The branded portion of the ADHD market was ~$6 billion in 2018 and more than 95% of these branded prescriptions are for extended release Methylphenidate (MPH) accounted for approximately 19.4 million TRx’s and ~$4 billion in sales in 2018 Market research indicates that prescribers perceive several unmet medical needs with current ADHD products and see the following potential KP415 features as key advantages Duration of action (60%) Lower abuse potential (52%) Early onset of action (43%) Market research also indicates that prescribers estimate that MPH is given as the preferred first line of therapy for children under the age of 13 approximately 60% of the time Source: Symphony Health, PHAST 2018

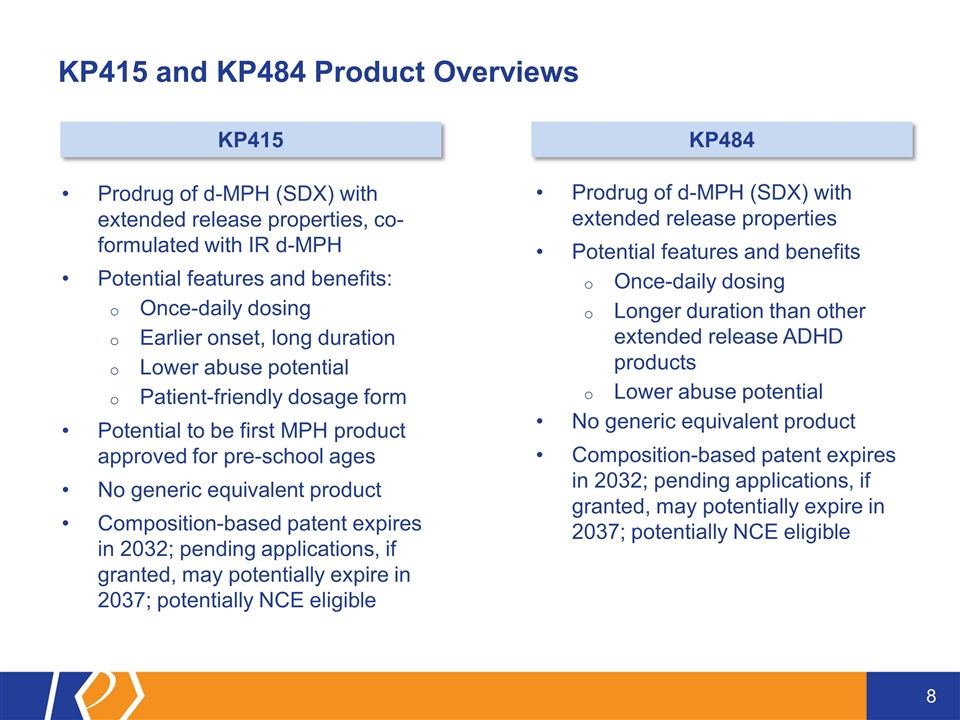

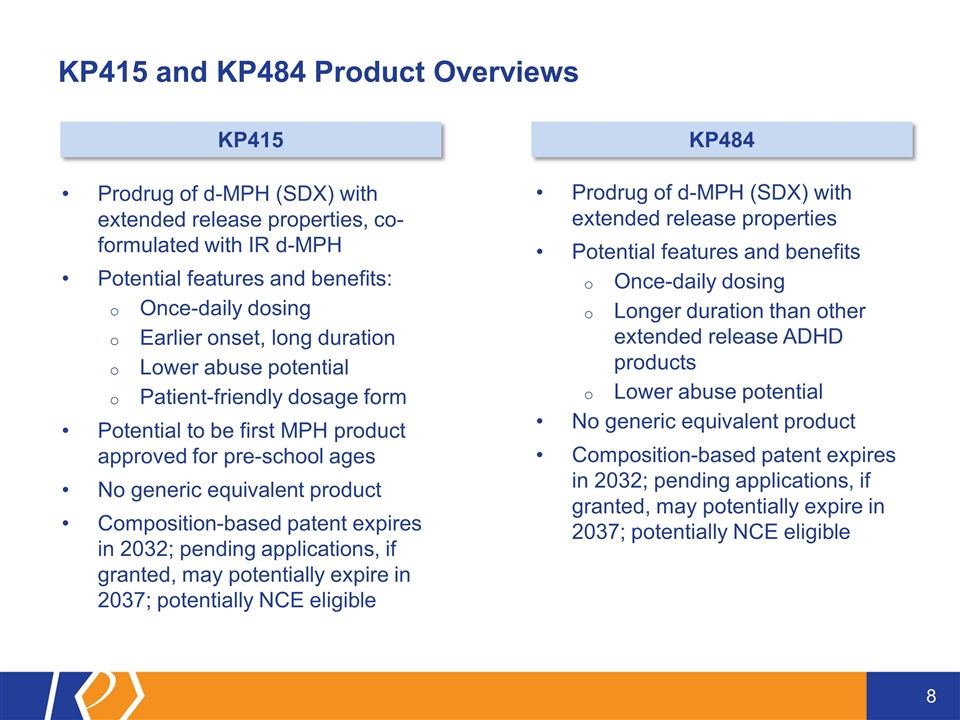

KP415 and KP484 Product Overviews Prodrug of d-MPH (SDX) with extended release properties, co-formulated with IR d-MPH Potential features and benefits: Once-daily dosing Earlier onset, long duration Lower abuse potential Patient-friendly dosage form Potential to be first MPH product approved for pre-school ages No generic equivalent product Composition-based patent expires in 2032; pending applications, if granted, may potentially expire in 2037; potentially NCE eligible Prodrug of d-MPH (SDX) with extended release properties Potential features and benefits Once-daily dosing Longer duration than other extended release ADHD products Lower abuse potential No generic equivalent product Composition-based patent expires in 2032; pending applications, if granted, may potentially expire in 2037; potentially NCE eligible KP415 KP484

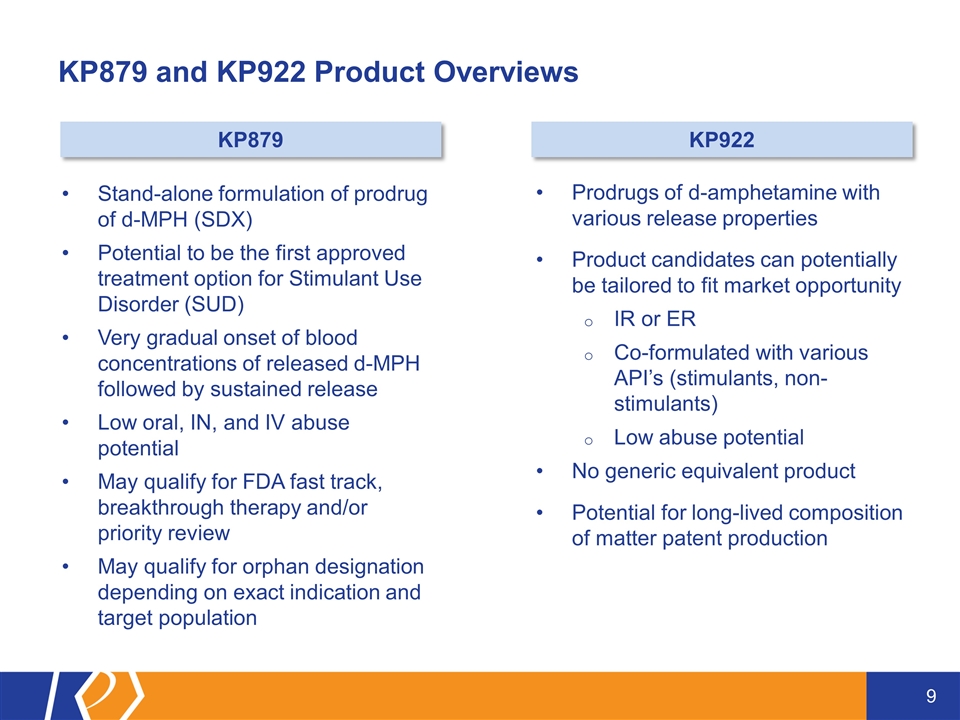

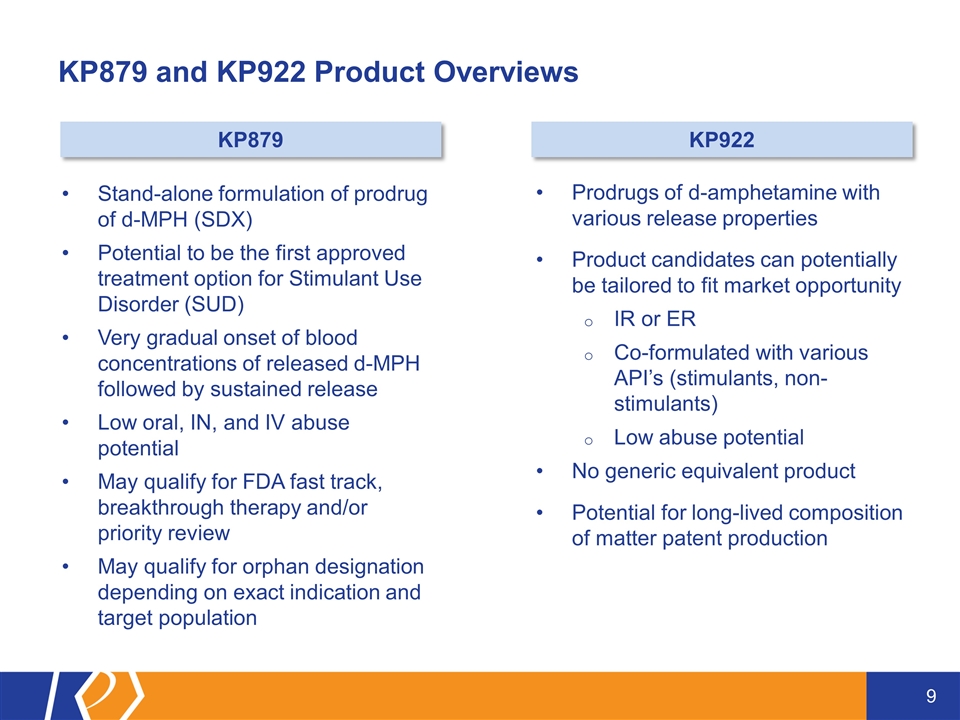

KP879 and KP922 Product Overviews Stand-alone formulation of prodrug of d-MPH (SDX) Potential to be the first approved treatment option for Stimulant Use Disorder (SUD) Very gradual onset of blood concentrations of released d-MPH followed by sustained release Low oral, IN, and IV abuse potential May qualify for FDA fast track, breakthrough therapy and/or priority review May qualify for orphan designation depending on exact indication and target population Prodrugs of d-amphetamine with various release properties Product candidates can potentially be tailored to fit market opportunity IR or ER Co-formulated with various API’s (stimulants, non-stimulants) Low abuse potential No generic equivalent product Potential for long-lived composition of matter patent production KP879 KP922

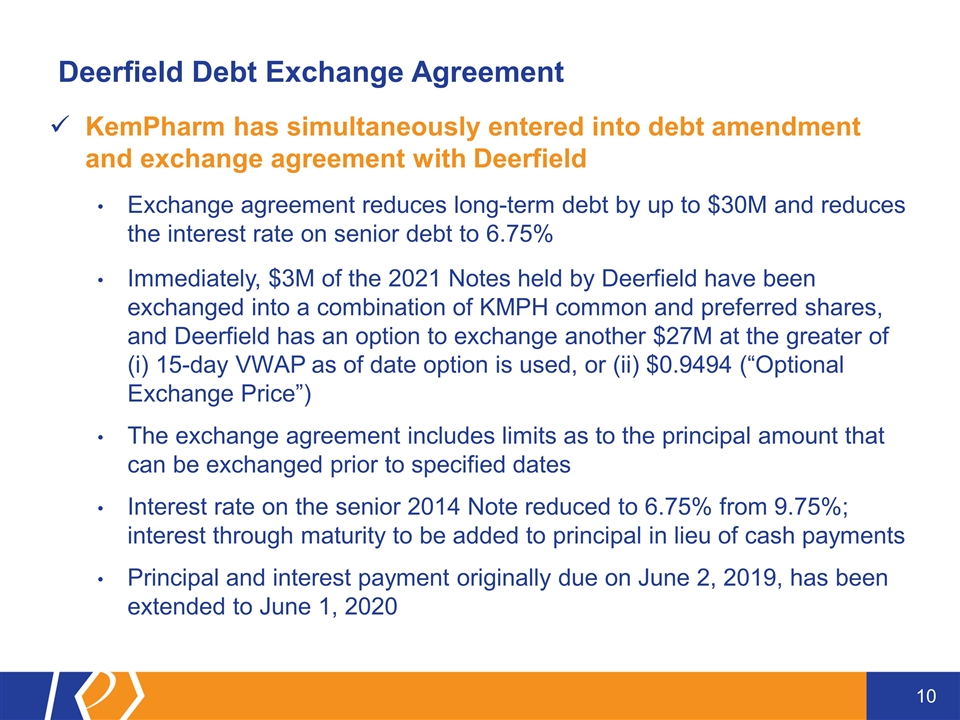

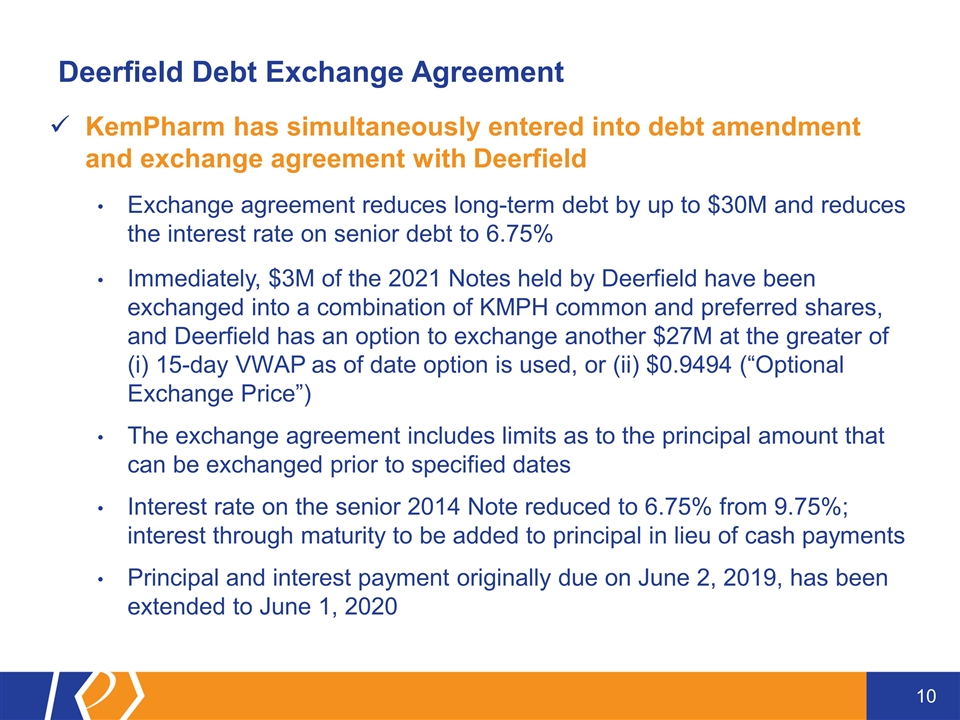

Deerfield Debt Exchange Agreement KemPharm has simultaneously entered into debt amendment and exchange agreement with Deerfield Exchange agreement reduces long-term debt by up to $30M and reduces the interest rate on senior debt to 6.75% Immediately, $3M of the 2021 Notes held by Deerfield have been exchanged into a combination of KMPH common and preferred shares, and Deerfield has an option to exchange another $27M at the greater of (i) 15-day VWAP as of date option is used, or (ii) $0.9494 (“Optional Exchange Price”) The exchange agreement includes limits as to the principal amount that can be exchanged prior to specified dates Interest rate on the senior 2014 Note reduced to 6.75% from 9.75%; interest through maturity to be added to principal in lieu of cash payments Principal and interest payment originally due on June 2, 2019, has been extended to June 1, 2020

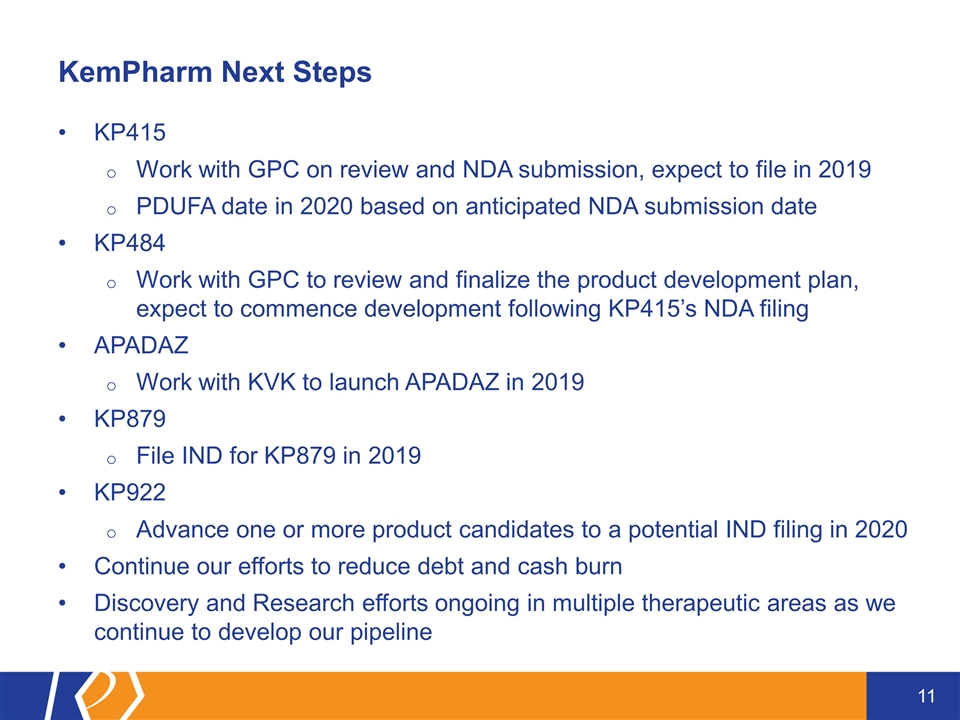

KemPharm Next Steps KP415 Work with GPC on review and NDA submission, expect to file in 2019 PDUFA date in 2020 based on anticipated NDA submission date KP484 Work with GPC to review and finalize the product development plan, expect to commence development following KP415’s NDA filing APADAZ Work with KVK to launch APADAZ in 2019 KP879 File IND for KP879 in 2019 KP922 Advance one or more product candidates to a potential IND filing in 2020 Continue our efforts to reduce debt and cash burn Discovery and Research efforts ongoing in multiple therapeutic areas as we continue to develop our pipeline

September 4, 2019 KP415/KP484 License Agreement with Gurnet Point Capital