Filed pursuant to Rule 424(b)(5)

Registration No. 333-245722

PROSPECTUS SUPPLEMENT

(To prospectus dated September 8, 2020)

1,000,000 Shares

Common Stock

We are offering 1,000,000 shares of our common stock in this offering.

Our common stock is listed on the NASDAQ Global Market under the symbol “GWRS.” On July 26, 2022, the last reported sale price of our common stock on the NASDAQ Global Market was $13.75 per share.

We have granted the underwriter an option to buy up to an additional 150,000 shares of common stock from us to cover over-allotments. The underwriter may exercise this option at any time and from time to time during the 30-day period from the date of this prospectus supplement.

| | | | | | | | | | | | | | |

| | No Exercise of Over-Allotment | Full Exercise of Over-Allotment |

| | Per Share | Total | Per Share | Total |

| Public offering price | $ | 13.50 | | $ | 13,500,000 | | $ | 13.50 | | $ | 15,525,000 | |

Underwriting discounts and commissions(1) | $ | 0.675 | | $ | 675,000 | | $ | 0.675 | | $ | 776,250 | |

| Proceeds to us, before expenses | $ | 12.825 | | $ | 12,825,000 | | $ | 12.825 | | $ | 14,748,750 | |

_______________________

(1)The underwriter will not receive any underwriting discount or commissions for the sale of shares of our common stock to existing stockholders, including certain directors and/or their affiliates. See “Underwriting” for additional information regarding underwriting compensation and expense reimbursement.

YOU SHOULD READ THIS PROSPECTUS SUPPLEMENT, THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN, AND THE ACCOMPANYING PROSPECTUS CAREFULLY BEFORE YOU INVEST IN OUR COMMON STOCK. INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE S-7 OF THIS PROSPECTUS SUPPLEMENT.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares on or about August 1, 2022, subject to customary closing conditions.

Roth Capital Partners

July 28, 2022

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| | | | | |

| ABOUT THIS PROSPECTUS SUPPLEMENT | |

| PROSPECTUS SUPPLEMENT SUMMARY | |

| THE OFFERING | |

| RISK FACTORS | |

| FORWARD-LOOKING STATEMENTS | |

| USE OF PROCEEDS | |

| DIVIDEND POLICY | |

| UNDERWRITING | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | |

| LEGAL MATTERS | |

| EXPERTS | |

PROSPECTUS

| | | | | |

| ABOUT THIS PROSPECTUS | |

| OUR COMPANY | |

| RISK FACTORS | |

| FORWARD-LOOKING STATEMENTS | |

| USE OF PROCEEDS | |

| DESCRIPTION OF CAPITAL STOCK | |

| DESCRIPTION OF DEBT SECURITIES | |

| GLOBAL SECURITIES | |

| PLAN OF DISTRIBUTION | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | |

| LEGAL MATTERS | |

| EXPERTS | |

We have not, and the underwriter has not, authorized anyone to provide you with information different than or inconsistent with the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. We and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, dated September 8, 2020, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the United States Securities and Exchange Commission (the “SEC”) before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents, regardless of the time of delivery of those respective documents. Our business, financial condition, results of operations, and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference contain statistical data, market research, and industry forecasts that were obtained from government or independent industry publications and reports or were based on estimates derived from such publications or reports and management’s knowledge of, and experience in, the markets in which we operate. Government and industry publications and reports generally indicate that they have obtained their information from sources believed to be reliable, but do not guarantee the accuracy and completeness of their information. None of the third-party sources cited have provided any form of consultation, advice or counsel regarding any aspect of, or is in any way whatsoever associated with, or consenting to this prospectus supplement, the accompanying prospectus and the documents incorporated by reference. While we believe the data to be reliable, market and industry data is subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Neither we nor the underwriter have independently verified any of the data from third party sources or ascertained the underlying assumptions relied upon by such sources. While we are not aware of any misstatements regarding any information presented in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference, estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed in “Risk Factors” and in our other filings with the SEC incorporated by reference herein.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information contained in greater detail elsewhere in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein or therein. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. You should carefully read this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized for use in connection with this offering and the documents incorporated by reference, including the information referred to under the heading “Risk Factors” in this prospectus supplement. Unless the context requires otherwise, references in this prospectus to the “Company”, “we”, “us”, and “our” refer to Global Water Resources, Inc., a Delaware corporation, and its consolidated subsidiaries.

Our Company

We are a water resource management company that owns, operates, and manages water, wastewater, and recycled water utilities in strategically located communities, principally in metropolitan Phoenix, Arizona. We seek to deploy an integrated approach, which we refer to as “Total Water Management.” Total Water Management is a comprehensive approach to water utility management that reduces demand on scarce non-renewable water sources and costly renewable water supplies, in a manner that ensures sustainability and greatly benefits communities both environmentally and economically. This approach employs a series of principles and practices that can be tailored to each community:

•Reuse of recycled water, either directly or to non-potable uses, through aquifer recharge, or direct potable reuse;

•Regional planning;

•Use of advanced technology and data;

•Employing the best subject matter experts and retaining thought and application leaders;

•Leading outreach and educational initiatives to ensure all stakeholders including customers, development partners, regulators, and utility staff are knowledgeable on the principles and practices of our Total Water Management approach; and

•Establishing partnerships with communities, developers, and industry stakeholders to gain support of our Total Water Management principles and practices.

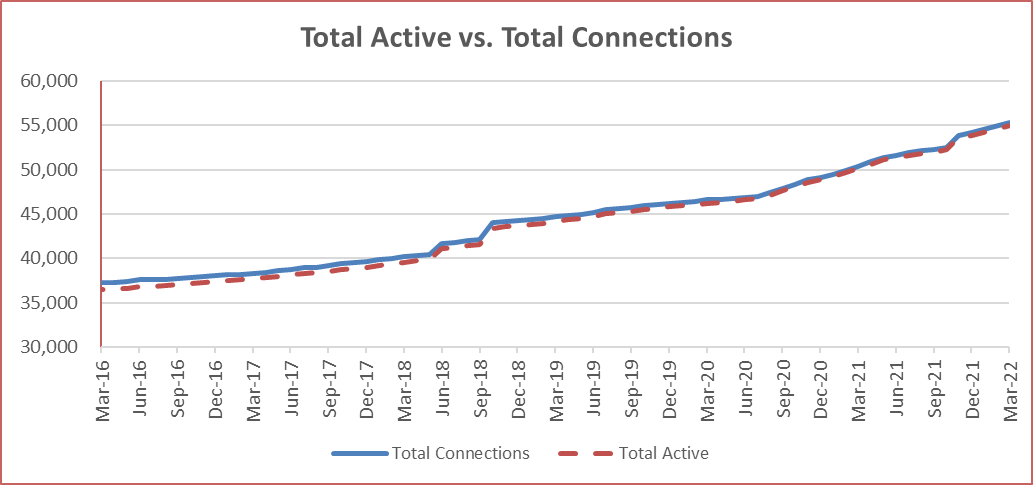

We currently own and operate 25 water and wastewater systems in strategically targeted communities in metropolitan Phoenix. We currently serve more than 74,048 people in approximately 27,630 homes within our 376 square miles of certificated service areas. As of March 31, 2022, approximately 90.8% of our active service connections are customers of our Global Water - Santa Cruz Water Company, Inc. (“Santa Cruz”) and Global Water - Palo Verde Utilities Company, Inc. (“Palo Verde”) utilities, which are located within a single service area. At present, we have obtained a Designation of Assured Water Supply in the Maricopa/Casa Grande service territory (Santa Cruz) for approximately 22,900 acre-feet of water use and are only using approximately 7,700 acre feet per year. We have grown significantly since our formation in 2003, with total revenues increasing from $4.9 million in 2004 to $41.9 million in 2021, and total service connections increasing from 8,113 as of December 31, 2004 to 55,303 as of March 31, 2022, with regionally planned areas large enough to serve approximately two million service connections.

The graph below presents the historical change in active and total connections for our ongoing operations over the past six years.

Business Outlook

2021 and the first quarter of 2022 continued the trend of positive growth in new connections. According to the 2020 U.S. Census Data, the Phoenix metropolitan statistical area (“MSA”) is the 11th largest MSA in the U.S. and had a population of 4.8 million, an increase of 14% over the 4.2 million people reported in the 2010 Census. Metropolitan Phoenix continues to grow due to its affordable housing, excellent weather, large and growing universities, a diverse employment base, and low taxes. The Employment and Population Statistics Department of the State of Arizona predicts that the Phoenix metropolitan area will have a population of 5.7 million people by 2030 and 6.5 million by 2040. During the three months ended March 31, 2022, Arizona’s employment rate increased by 3.7%, ranking the state in the top 20 nationally for job growth.

According to the W.P. Carey School of Business Greater Phoenix Blue Chip Real Estate Consensus Panel (the “Greater Phoenix Blue Chip Panel”), the single family housing market experienced a period of very rapid growth in 2021 with approximately 31,000 building permits issued. Strong underlying demand and an extreme shortage of existing inventory pushed prices up rapidly. The Greater Phoenix Blue Chip Panel expects this to continue but at a slower pace as lack of product and affordability issues slow demand. Building permits are forecasted to increase to 35,000 and 36,000 in 2022 and 2023, respectively.

We believe that our utilities and service areas are directly in the anticipated path of growth primarily in the Phoenix metropolitan area. Management believes that we are well-positioned to benefit from the near-term growth in the Phoenix metropolitan area due to the availability of lots and existing infrastructure in place within our services areas.

Our Growth Strategy

Our long-term goal is to become one of the largest investor-owned operators of integrated water and wastewater utilities in areas of the arid western U.S. where water scarcity management is necessary for long-term economic sustainability and growth.

Our growth strategy involves the elements listed below:

•acquiring or forming utilities in the path of prospective population growth;

•expanding our service areas geographically and organically growing our customer base within those areas; and

•deploying our Total Water Management approach into these utilities and service areas.

We believe this plan can be executed in our current service areas and in other geographic areas where water scarcity management is necessary to support long-term growth and in which regulatory authorities recognize the need for water conservation through water recycling.

In April 2022, we signed a definitive agreement to acquire Farmers Water Co., a subsidiary of Farmers Investment Co., located in Pima County. The acquisition is expected to add approximately 3,300 active water service connections, approximately $1.5 million in annual revenue and 21.1 square miles of Certificate of Convenience and Necessity service area in Sahuarita, Arizona.

Our Competitive Strengths

Our Utilities Are Located in Areas of Strong Population Growth Where We Have Contracted Service Areas

We have three regional planning areas located in the metropolitan Phoenix area with area-wide permits and contractual service rights relating to over 500 square miles of territory. Our Maricopa regional planning area and Sun Corridor regional planning area are located in Pinal County, Arizona. Pinal County is rapidly changing from primarily rural to an area of suburbanization. According to the U.S. Census, Pinal County grew by approximately 20% from a population of 375,770 in 2010 to an estimated population of 449,557 in 2021.

Our West Valley regional planning area is located in Maricopa County. Maricopa County grew by approximately 18% from a population of 3,817,117 in 2010 to an estimated population of 4,496,588 in 2021 according to the U.S. Census. From 2020 to 2021, Maricopa County was the fastest growing county in the U.S., with a population increase of 58,246 persons. Maricopa County is the fourth largest county in the U.S. with approximately 4.5 million residents.

Modern Infrastructure Provides Foundation for Future Growth with Low Future Maintenance Capital Expenditures

We believe that as demand for new homes continues to increase in the regions we serve, there will be opportunities for growth, particularly in the Maricopa Planning Area, where our local utilities have considerable infrastructure already in place. As of April 2022, Maricopa’s median home price of approximately $410,000 was a 19% discount to the average median home price of approximately $507,000 for the rest of the metropolitan Phoenix area. As a result of our investment in modern infrastructure, we expect our regulated utilities business in our current service areas to have relatively low maintenance capital expenditures because greater than 90% of our infrastructure was built in the last 17 years compared to most U.S. drinking water infrastructure, which was built 50 or more years ago. This allows for the majority of future capital expenditure to be focused on growth areas and acquisitions. Additionally, our current infrastructure has built-in capacity to support substantial growth in total connections.

Leader in Utilization of Technology and Innovation

We use technology to reduce costs, increase revenues, and save water. We focus on technological innovations that allow us to deliver high-quality water and customer service with lower potential for human error, delays, and inefficiencies. Our comprehensive technology platform includes customer information systems, automated meter reading and geographical information system technologies, along with supervisory control and data acquisition systems, which we use to map and monitor our physical assets and water resources on an automated, real-time basis with fewer employees than the standard water utility model requires. Our innovative approaches to utility planning, water conservation, and technology utilization have led to our development of strong relationships with key regulatory bodies.

Proven Ability to Acquire and Consolidate

We have acquired or formed 27 regulated water and wastewater utilities, some of which have subsequently been divested or combined with other utilities. We have successfully consolidated the operations, management, technology and employees of these utilities. We believe that our success to date engenders positive relationships and credibility with regulators, municipalities, developers and customers in both existing and prospective service areas. As part of our acquisition strategy, we are currently seeking additional utility acquisitions, but we currently do not have any agreements or understandings as to any particular acquisition other than as disclosed in our filings with the SEC.

Recent Developments

Arizona Corporation Commission (“ACC”) Rate Case

On August 28, 2020, 12 of our 18 regulated utilities each filed a rate case application with the ACC for water,

wastewater, and recycled water rates based on a 2019 test year. In addition to a rate increase, we requested, among other things, the consolidation of water and/or wastewater rates for certain of our utilities, including our Red Rock, Santa Cruz, Palo Verde, Picacho Water, and Picacho Utilities located in Pinal County. Of our utilities filing a rate case, these utilities make up approximately 96% of our active service connections; provide or will provide water, wastewater and recycled water services; and are expected to create economies of scale that are beneficial to all customers if consolidated.

On July 12, 2022, the ACC voted in an open meeting to approve the recommended order and opinion in the rate case with certain amendments, subject to a final signed decision. Pursuant to the vote, the ACC approved a collective annual revenue requirement increase of approximately $2.2 million (including the acquisition premiums discussed below) based on 2019 test year service connections, phased-in over time, as follows:

| | | | | | | | | | | | | | |

| | Incremental | | Cumulative |

| August 1, 2022 | $ | 1,457,462 | $ | 1,457,462 |

| January 1, 2023 | | 675,814 | | 2,133,277 |

| January 1, 2024 | | 98,585 | | 2,231,861 |

Whereas this phase-in of additional revenues was determined using a 2019 test year, to the extent that the number of active service connections has increased and continues to increase from 2019 levels, the additional revenues may be greater than the amounts set forth above. On the other hand, if active connections decrease or we experience declining usage per customer, we may not realize all of the anticipated revenues.

Additionally, the ACC approved, among other things, (i) the consolidation of water and/or wastewater rates to create economies of scale that are beneficial to all customers when rates are consolidated; (ii) acquisition premiums relating to our acquisitions of our Red Rock and Turner Ranches utilities, which increase the rate base for such utilities and result in an increase in the annual collective revenue requirement included in the table above; (iii) our ability to annually adjust rates to flow through changes in property tax expense and/or changes in income tax expense, without the necessity of a rate case proceeding; and (iv) a sustainable water surcharge, which will allow semiannual surcharges to be added to customer bills based on verified costs of new water resources.

Finally, the order and opinion requires us to work with ACC staff and the Residential Utility Consumer Office to prepare a Private Letter Ruling request to the Internal Revenue Service (“IRS”) to clarify whether the failure to eliminate the deferred taxes attributable to assets condemned in a transaction governed by Section 1033 of the Internal Revenue Code (“Code”) would violate the normalization provisions of Section 168(i)(9) of the Code. If the IRS accepts the request and issues its ruling, a copy must be provided to the ACC. Within 90 days after providing the ruling to the ACC, ACC Staff shall prepare, for ACC consideration, a memorandum and proposed order regarding guidance issued within the Private Letter Ruling. This may result in further action by the ACC, which we are unable to predict due to the uncertainties involved, that could have an adverse impact on our financial condition, results of operations and cash flows.

Revolving Line of Credit Amendment

On July 26, 2022, we entered into a second amendment (the “Second Modification Agreement”) to our loan agreement with The Northern Trust Company, an Illinois banking corporation, relating to our revolving line of credit. Pursuant to the Second Modification Agreement, the terms and conditions set forth in the loan agreement were further amended to, among other things, (i) extend the scheduled maturity date from April 30, 2024 to July 1, 2024; (ii) increase the maximum principal amount available for borrowing under the revolving line of credit from $10.0 million to $15.0 million; and (iii) replace the London Interbank Offered Rate (LIBOR) interest rate provisions with provisions based on the secured overnight financing rate (SOFR). As of the date of this prospectus supplement, no amount was drawn under the revolving line of credit.

Corporate Information

Global Water Resources, Inc. was incorporated as a Delaware corporation on May 2, 2008. Our principal executive offices are located at 21410 N 19th Avenue #220, Phoenix, AZ 85027, and our telephone number is (480) 360-7775. Our website address is www.gwresources.com. The information contained on, or accessible through, our website is not incorporated in, and shall not be part of, this prospectus supplement.

THE OFFERING

| | | | | |

| Common stock offered by us | 1,000,000 shares |

| |

| Option to purchase additional shares | We have granted the underwriter an over-allotment option for a period of thirty (30) days to purchase up to an aggregate of 150,000 additional shares of common stock at a purchase price of $13.50 per share to cover over-allotments, if any, of the shares offered by this prospectus supplement. See “Underwriting” on page S-12. |

| |

Common stock to be outstanding after this offering(1) | 23,716,609 shares |

| |

| Use of proceeds | We estimate that the net proceeds to us from this offering after deducting underwriting discounts and commissions and estimated offering expenses payable by us will be approximately $13.0 million. We intend to use the proceeds from this offering to fund acquisitions and for working capital and other general corporate purposes. See “Use of Proceeds.” |

| |

| Dividend policy | We currently intend to continue to pay a regular monthly dividend of $0.02458 per share ($0.29496 per share annually); however, dividend payments are not mandatory or guaranteed, and there can be no assurance that we will continue to pay a dividend in the future. See “Dividend Policy.” |

| |

| Risk factors | See “Risk Factors” beginning on page S-7 (and under similar headings in the documents incorporated by reference herein) and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| |

| NASDAQ Global Market symbol | GWRS |

_______________________

(1)The number of shares of our common stock outstanding is based on 22,716,609 shares of our common stock outstanding as of June 30, 2022 and excludes the following:

•179,805 shares of our common stock issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $10.20 per share; and

•102,493 shares of our common stock reserved for future issuance under our 2020 Omnibus Incentive Plan.

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriter of its over-allotment option.

Existing stockholders, including certain directors and/or their affiliates, have agreed to purchase an aggregate of 652,000 shares of our common stock offered hereby at the public offering price of $13.50 per share. The shares sold to such stockholders will be subject to the lock-up agreement described under “Underwriting.” The underwriter will not receive any underwriting discount or commissions on the shares of our common stock purchased by such stockholders in this offering.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks described below and all other information in this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized for use in connection with this offering, and the documents incorporated by reference, including our Annual Report on Form 10-K for the year ended December 31, 2021 and our subsequently filed Quarterly Report on Form 10-Q, each of which is incorporated by reference in this prospectus supplement and which may be amended, supplemented, or superseded from time to time by other reports that we subsequently file with the SEC. If any of these risks actually occur, our business, financial condition, results of operations, or cash flows could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section entitled “Forward-Looking Statements” in this prospectus supplement.

Risks Related to this Offering

Management will have broad discretion in determining how to use the proceeds of this offering.

Our management will have broad discretion over the use of proceeds from this offering, and we could use the proceeds from this offering in ways our stockholders may not agree with or that do not yield a favorable return, if at all. We intend to use the proceeds from this offering for any of the purposes described in the section entitled “Use of Proceeds” in this prospectus supplement. However, our use of these proceeds may differ substantially from our current plans. If we do not invest or apply the proceeds of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could have an adverse effect on the market price of our common stock.

If you purchase shares of our common stock in this offering, you will incur immediate and substantial dilution.

The public offering price of our common stock offered pursuant to this prospectus supplement is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase shares of common stock in this offering, you will incur immediate and substantial dilution in the pro forma net tangible book value per share of common stock from the price per share that you pay for the common stock. Furthermore, we expect that we will seek to raise additional capital from time to time in the future. Such financings may involve the issuance of equity and/or securities convertible into or exercisable or exchangeable for our equity securities. We also expect to continue to utilize equity-based compensation. To the extent that stock options are exercised, or we issue common stock, preferred stock, or securities, such as warrants that are convertible into, exercisable or exchangeable for, our common stock or preferred stock in the future, you may experience further dilution.

Substantial future sales of our common stock, or the perception in the public markets that these sales may occur, may depress our stock price.

Shares of our common stock sold in this offering may be freely tradable without restriction or further registration under the Securities Act except for any shares of our common stock that may be held or acquired by our directors, executive officers, and other affiliates, as that term is defined in the Securities Act, which may not be sold in the public market unless the sale is registered under the Securities Act or an exemption from registration is available. Moreover, from time to time, certain of our stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market or otherwise. As a result, the market price of our common stock may decline if our stockholders sell a large number of shares of our common stock in the public market or the market perceives that such sales may occur.

Fluctuations in the price of our common stock may make our common stock more difficult to resell.

The market price and trading volume of our common stock have been and may continue to be subject to significant fluctuations due not only to general stock market conditions, but also to a change in sentiment in the market regarding the industry in which we operate, our operations, business prospects or liquidity or this offering. Stock markets in general may experience extreme volatility that is unrelated to the operating performance of listed companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our operating results. As a result, these fluctuations in the market price and trading volume of our common stock may make it difficult to predict the market price of our common stock in the future, cause the value of your investment to decline and make it more difficult to resell our common stock.

Our common stock is an equity security and is subordinate to our existing and future indebtedness.

The shares of common stock being offered by this prospectus supplement and the accompanying prospectus are equity interests and do not constitute indebtedness. As such, the shares of common stock rank junior to all of our indebtedness and any non-equity claims on us and our assets that would be available to satisfy claims on us, including claims in a bankruptcy, liquidation or similar proceeding.

Additionally, unlike indebtedness, where principal and interest customarily are payable on specified due dates, in the case of our common stock, (i) dividends are payable only when and if declared by our board of directors or a duly authorized committee of the board, and (ii) as a corporation, we are restricted to only making dividend payments and redemption payments out of legally available assets. For additional information, see “Dividend Policy.” Further, our common stock places no restrictions on our business or operations or on our ability to incur indebtedness or engage in any transactions, subject only to the voting rights available to stockholders generally.

FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized for use in connection with this offering and the documents incorporated by reference contain forward-looking statements within the meaning of federal securities laws and which are subject to certain risks, trends, and uncertainties. We use words such as “could”, “would”, “may”, “might”, “will”, “expect”, “likely”, “believe”, “continue”, “anticipate”, “estimate”, “intend”, “plan”, “objective”, “goal”, “focus”, “aim”, “should”, “project”, and other similar expressions to identify some forward-looking statements, but not all forward-looking statements include these words. These forward-looking statements include, but are not limited to, statements about our strategies; expectations about future business plans, prospective performance, and opportunities; future financial performance; regulatory and ACC proceedings and approvals; the anticipated benefits resulting from our approved rate application, including our expected collective revenue increase due to new water and wastewater rates and benefits from consolidation of rates; our contemplated Private Letter Ruling request in connection with our recent rate case and possible further action that may be taken by the ACC following such request; acquisition plans and our ability to complete additional acquisitions, including the acquisition of Farmers Water Co. and the expected timing and future benefits, such as expected increases in active water service connections, annual revenue and miles of Certificate of Convenience and Necessity service area; population and growth projections; technologies; revenues; metrics; operating expenses; trends relating to our industry, market, population growth, and housing permits; liquidity; cash flows and uses of cash; dividends; expectations that our regulated utilities business in our current service areas will have relatively low maintenance capital expenditures; depreciation and amortization; tax payments; our ability to repay indebtedness and invest in initiatives; impact and resolutions of legal matters; the impact of tax changes; the impact of accounting changes and other pronouncements; the anticipated impacts from the COVID-19 pandemic on the Company, including to our business operations, results of operations, cash flows, and financial position; our future responses to the COVID-19 pandemic; and the intended use of the net proceeds from this offering.

Forward-looking statements are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments, and other factors we believe are appropriate under the circumstances. As you read and consider this prospectus supplement, the accompanying prospectus, any related free writing prospectus that we have authorized for use in connection with this offering, and the documents incorporated by reference, you should understand that forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not, or the times at or by which, such performance or results will be achieved. Investors are cautioned not to place undue reliance on forward-looking information. They involve risks, uncertainties (many of which are beyond our control) and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. We believe these factors include, but are not limited to, those described under the section entitled “Risk Factors” in this prospectus supplement and in our other filings with the SEC incorporated by reference herein. Additional risks and uncertainties include, but are not limited to, whether all conditions precedent in the definitive agreement to acquire Farmers Water Company will be satisfied, including the receipt of ACC approval, and other risks to consummation of the acquisition, including circumstances that could give rise to the termination of the definitive agreement and the risk that the transaction will not be consummated without undue delay, cost or expense, or at all; and whether the IRS will rule in favor of us in connection with the contemplated Private Letter Ruling request. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement contained herein to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors that could cause our business not to develop as we expect emerge from time to time, and it is not possible for us to predict all of them. Further, we cannot assess the impact of each currently known or new factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering after deducting underwriting discounts and commissions and estimated offering expenses payable by us will be approximately $13.0 million (or approximately $14.9 million if the underwriter exercises its over-allotment option in full).

We intend to use the proceeds from this offering to fund acquisitions and for working capital and other general corporate purposes. We have broad discretion in determining how the proceeds from this offering will be used, and our discretion is not limited by the aforementioned possible uses. See “Risk Factors—Risks Related to this Offering—Management will have broad discretion in determining how to use the proceeds of this offering.”

DIVIDEND POLICY

We paid a monthly cash dividend of $0.02434 per share ($0.29208 per share annually) to holders of our common stock from January 2021 through November 2021. On November 30, 2021, we announced a monthly dividend increase to $0.02458 per share ($0.29496 per share annually).

For the year ended December 31, 2021, we paid cash dividends to holders of our common stock totaling $6.6 million, which included: from January 2021 through November 2021, a monthly dividend of $0.02434 per share; and a monthly dividend of $0.02458 per share for December 2021.

For the year ended December 31, 2020, we paid cash dividends to holders of our common stock totaling $6.5 million, which included: from January 2020 through November 2020, a monthly dividend of $0.0241 per share; and a monthly dividend of $0.02434 per share for December 2020.

We currently intend to continue to pay a regular monthly dividend of $0.02458 per share ($0.29496 per share annually). However, our future dividend policy is subject to our compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, restrictions in our debt agreements and in any preferred stock we may issue in the future, business prospects, and other factors that our board of directors may deem relevant. Dividend payments are not mandatory or guaranteed; there can be no assurance that we will continue to pay a dividend in the future.

UNDERWRITING

We have entered into an underwriting agreement with the Roth Capital Partners, LLC as the underwriter. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriter, and the underwriter has agreed to purchase from us, shares of our common stock. Our common stock trades on the Nasdaq Global Market under the symbol “GWRS.”

Pursuant to the terms and subject to the conditions contained in the underwriting agreement, we have agreed to sell to the underwriter named below, and the underwriter has agreed to purchase from us, the number of shares of common stock set forth below:

| | | | | |

| Underwriter | Number of Shares |

| Roth Capital Partners, LLC | 1,000,000 |

| Total | 1,000,000 |

The underwriting agreement provides that the obligation of the underwriter to purchase the shares of common stock offered by this prospectus supplement and the accompanying base prospectus is subject to certain conditions. The underwriter is obligated to purchase all of the shares of common stock offered hereby if any of the shares are purchased. As described below, existing stockholders, including certain directors and/or their affiliates, have indicated an interested in purchasing shares of common stock sold in this offering at the public offering price.

We have granted the underwriter an option to buy up to 150,000 additional shares of our common stock at the public offering price, less the underwriting discounts and commissions set forth on the cover page of this prospectus supplement, to cover over-allotments, if any. The underwriter may exercise this option at any time, in whole or in part, during the 30-day period after the date of this prospectus supplement. If any additional shares of common stock are purchased, the underwriter will offer the additional shares on the same terms as those on which the shares are being offered.

Discounts, Commissions, and Expenses

The underwriter proposes to offer the shares of common stock purchased pursuant to the underwriting agreement to the public at the public offering price set forth on the cover page of this prospectus supplement and to certain dealers at that price less a concession not in excess of $0.3375 per share. After this offering, the public offering price and concession may be changed by the underwriter. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus supplement.

In connection with the sale of the common stock to be purchased by the underwriter, the underwriter will be deemed to have received compensation in the form of underwriting commissions and discounts. The underwriter’s commissions and discounts will be five percent (5%) of the gross proceeds of this offering, or $0.675 per share of common stock, based on the public offering price per share set forth on the cover page of this prospectus supplement, with an additional 1% payable at the Company’s discretion.

We have also agreed to reimburse Roth Capital Partners at closing for legal expenses incurred by it in connection with the offering up to a maximum of $80,000.

Existing stockholders, including certain directors and/or their affiliates, have agreed to purchase an aggregate of 652,000 shares of our common stock offered hereby at the public offering price of $13.50 per share. The shares sold to such stockholders will be subject to the lock-up agreement described below. The underwriter will not receive any underwriting discount or commissions on the shares of our common stock purchased by such stockholders in this offering.

The following table shows the underwriting discounts and commissions payable to the underwriter by us in connection with this offering (assuming both the exercise and non-exercise of the over-allotment option to purchase additional shares of common stock we have granted to the underwriter):

| | | | | | | | | | | | | | |

| | Per Share | Total |

| | Without Over-allotment | With Over-allotment | Without Over-allotment | With Over-allotment |

| Public offering price | $ | 13.50 | | $ | 13.50 | | $ | 13,500,000 | | $ | 15,525,000 | |

Underwriting discounts and commissions paid by us(1) | $ | 0.675 | | $ | 0.675 | | $ | 675,000 | | $ | 776,250 | |

_______________________

(1)The underwriter will not receive any underwriting discount or commissions on the sale of an aggregate of 652,000 shares of our common stock to existing stockholders.

Indemnification

Pursuant to the underwriting agreement, we have agreed to indemnify the underwriter against certain liabilities, including liabilities under the Securities Act, or to contribute to payments that the underwriter or such other indemnified parties may be required to make in respect of those liabilities.

Lock-Up Agreements

We have agreed not to (i) offer, pledge, issue, sell, contract to sell, purchase, contract to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares of our common stock or any securities convertible into or exercisable or exchangeable for our common stock; (ii) enter into any swap or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of shares of common stock; or (iii) file any registration statement with the SEC relating to the offering of any shares of our common stock or any securities convertible into or exercisable or exchangeable for shares of our common stock, without the prior written consent of Roth Capital Partners for a period of 90 days following the date of this prospectus supplement (the “Lock-up Period”). This consent may be given at any time without public notice. These restrictions on future issuances are subject to exceptions for (1) the issuance of shares of our common stock sold in this offering, (2) the issuance of shares of our common stock upon the exercise of outstanding options or warrants, (3) the issuance of employee stock options not exercisable during the Lock-up Period and the grant of restricted stock awards or settlement in cash of restricted stock units pursuant to our equity incentive plans, (4) the issuance of common stock or warrants to purchase common stock in connection with mergers, acquisitions of securities, businesses, property or other assets, joint ventures, strategic alliances, equipment leasing arrangements or debt financing, or (5) the filing of a registration statement on Form S-8 or any successor form thereto.

In addition, each of our directors and executive officers and certain of our stockholders expect to enter into a lock-up agreement with the underwriter. Under the lock-up agreements, our directors and executive officers and certain of our stockholders may not, directly or indirectly, (i) offer, pledge, announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, or file (or participate in the filing of) a registration statement with the SEC, in respect of any shares of our common stock or any securities convertible into, or exercisable or exchangeable for, shares of our common stock, (ii) enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the shares of our common stock, (iii) make any demand for, or exercise any right with respect to, the registration of any shares of our common stock or any security convertible into, or exercisable or exchangeable for, shares of our common stock, or (iv) publicly announce an intention to effect any of the foregoing, in each case, without the prior written consent of Roth Capital Partners, during the Lock-up Period. This consent may be given at any time without public notice. These restrictions on future dispositions are subject to certain exceptions, as applicable, for (1) transfers as a bona fide gift or gifts (so long as the donee or donees agree to be bound in writing by the lock-up restrictions), (2) transfers to any trust for the direct or indirect benefit of the covered person or the immediate family of the covered person (so long as the trustee of the trust agrees to be bound in writing by the lock-up restrictions and any such transfer does not involve a disposition for value), (3) the acquisition or exercise of any stock option issued pursuant to our existing stock option plan, (4) the purchase or sale of our securities pursuant to a plan, contract or instruction that satisfies all of the requirements of Rule 10b5-1(c)(1)(i)(B) that was in effect prior to the date of this prospectus supplement, or (5) transfers to us upon the vesting of stock-based awards outstanding as of the date of this prospectus supplement under our equity compensation plans to cover applicable withholding taxes due upon such vesting.

Electronic Distribution

This prospectus supplement and the accompanying base prospectus may be made available in electronic format on websites or through other online services maintained by the underwriter or by its affiliates. In those cases, prospective investors may view offering terms online and prospective investors may be allowed to place orders online. Other than this prospectus supplement and the accompanying base prospectus in electronic format, the information on the underwriter’s websites or our website and any information contained in any other websites maintained by the underwriter or by us is not part of this prospectus supplement, the accompanying base prospectus or the registration statement of which this prospectus supplement and the accompanying base prospectus forms a part, has not been approved and/or endorsed by us or the underwriter in its capacity as underwriter, and should not be relied upon by investors.

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering the underwriter may engage in stabilizing transactions, over-allotment transactions, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act:

•Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

•Over-allotment involves sales by the underwriter of shares in excess of the number of shares the underwriter is obligated to purchase, which creates a syndicate short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of shares over-allotted by the underwriter is not greater than the number of shares that they may purchase in the over-allotment option. In a naked short position, the number of shares involved is greater than the number of shares in the over-allotment option. The underwriter may close out any covered short position by either exercising their over-allotment option and/or purchasing shares in the open market.

•Syndicate covering transactions involve purchases of the common stock in the open market after the distribution has been completed in order to cover syndicate short positions. In determining the source of shares to close out the short position, the underwriter will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the over-allotment option. A naked short position occurs if the underwriter sells more shares than could be covered by the over-allotment option. This position can only be closed out by buying shares in the open market. A naked short position is more likely to be created if the underwriter is concerned that there could be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering.

•Penalty bids permit the underwriter to reclaim a selling concession from a syndicate member when the common stock originally sold by the syndicate member is purchased in a stabilizing or syndicate covering transaction to cover syndicate short positions

These stabilizing transactions, syndicate covering transactions and penalty bids may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of the common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. These transactions may be discontinued at any time.

Neither we nor the underwriter makes any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of our shares of common stock. In addition, neither we nor the underwriter makes any representation that the underwriter will engage in these transactions or that any transaction, if commenced, will not be discontinued without notice.

Offer restrictions outside the United States

Other than in the United States, no action has been taken by us or the underwriter that would permit a public offering of the securities offered by this prospectus in any jurisdiction where action for that purpose is required. The securities offered by this prospectus may not be offered or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus comes are advised to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in any jurisdiction in which such an offer or a solicitation is unlawful.

Australia

This prospectus is not a disclosure document under Chapter 6D of the Australian Corporations Act, has not been lodged with the Australian Securities and Investments Commission and does not purport to include the information required of a disclosure document under Chapter 6D of the Australian Corporations Act. Accordingly, (i) the offer of the securities under this prospectus is only made to persons to whom it is lawful to offer the securities without disclosure under Chapter 6D of the Australian Corporations Act under one or more exemptions set out in section 708 of the Australian Corporations Act, (ii) this prospectus is made available in Australia only to those persons as set forth in clause (i) above, and (iii) the offeree must be sent a notice stating in substance that by accepting this offer, the offeree represents that the offeree is such a person as set forth in clause (i) above, and, unless permitted under the Australian Corporations Act, agrees not to sell or offer for sale within Australia any of the securities sold to the offeree within 12 months after its transfer to the offeree under this prospectus.

Canada

The securities may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws. Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

China

The information in this document does not constitute a public offer of the securities, whether by way of sale or subscription, in the People’s Republic of China (excluding, for purposes of this paragraph, Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan). The securities may not be offered or sold directly or indirectly in the PRC to legal or natural persons other than directly to “qualified domestic institutional investors.”

European Economic Area — Belgium, Germany, Luxembourg and Netherlands

The information in this document has been prepared on the basis that all offers of securities will be made pursuant to an exemption under the Directive 2003/71/EC (“Prospectus Directive”), as implemented in Member States of the European Economic Area (each, a “Relevant Member State”), from the requirement to produce a prospectus for offers of securities.

An offer to the public of securities has not been made, and may not be made, in a Relevant Member State except pursuant to one of the following exemptions under the Prospectus Directive as implemented in that Relevant Member State:

•to legal entities that are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities;

•to any legal entity that has two or more of (i) an average of at least 250 employees during its last fiscal year; (ii) a total balance sheet of more than €43,000,000 (as shown on its last annual unconsolidated or consolidated financial statements) and (iii) an annual net turnover of more than €50,000,000 (as shown on its last annual unconsolidated or consolidated financial statements);

•to fewer than 100 natural or legal persons (other than qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive) subject to obtaining our prior consent or any underwriter for any such offer; or

•in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of securities shall require us to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

France

This document is not being distributed in the context of a public offering of financial securities (offre au public de titres financiers) in France within the meaning of Article L.411-1 of the French Monetary and Financial Code (Code monétaire et financier) and Articles 211-1 et seq. of the General Regulation of the French Autorité des marchés financiers (“AMF”). The securities have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France.

This document and any other offering material relating to the securities have not been, and will not be, submitted to the AMF for approval in France and, accordingly, may not be distributed or caused to distributed, directly or indirectly, to the public in France.

Such offers, sales and distributions have been and shall only be made in France to (i) qualified investors (investisseurs qualifiés) acting for their own account, as defined in and in accordance with Articles L.411-2-II-2 and D.411-1 to D.411-3, D. 744-1, D.754-1 and D.764-1 of the French Monetary and Financial Code and any implementing regulation and/or (ii) a restricted number of non-qualified investors (cercle restreint d’investisseurs) acting for their own account, as defined in and in accordance with Articles L.411-2-II-2° and D.411-4, D.744-1, D.754-1 and D.764-1 of the French Monetary and Financial Code and any implementing regulation.

Pursuant to Article 211-3 of the General Regulation of the AMF, investors in France are informed that the securities cannot be distributed (directly or indirectly) to the public by the investors otherwise than in accordance with Articles L.411-1, L.411-2, L.412-1 and L.621-8 to L.621-8-3 of the French Monetary and Financial Code.

Ireland

The information in this document does not constitute a prospectus under any Irish laws or regulations and this document has not been filed with or approved by any Irish regulatory authority as the information has not been prepared in the context of a public offering of securities in Ireland within the meaning of the Irish Prospectus (Directive 2003/71/EC) Regulations 2005 (the “Prospectus Regulations”). The securities have not been offered or sold, and will not be offered, sold or delivered directly or indirectly in Ireland by way of a public offering, except to (i) qualified investors as defined in Regulation 2(l) of the Prospectus Regulations and (ii) fewer than 100 natural or legal persons who are not qualified investors.

Israel

The securities offered by this prospectus have not been approved or disapproved by the Israeli Securities Authority (the ISA), or ISA, nor have such securities been registered for sale in Israel. The shares may not be offered or sold, directly or indirectly, to the public in Israel, absent the publication of a prospectus. The ISA has not issued permits, approvals or licenses in connection with this offering or publishing the prospectus; nor has it authenticated the details included herein, confirmed their reliability or completeness, or rendered an opinion as to the quality of the securities being offered. Any resale in Israel, directly or indirectly, to the public of the securities offered by this prospectus is subject to restrictions on transferability and must be effected only in compliance with the Israeli securities laws and regulations.

Italy

The offering of the securities in the Republic of Italy has not been authorized by the Italian Securities and Exchange Commission (Commissione Nazionale per le Società e la Borsa, “CONSOB” pursuant to the Italian securities legislation and, accordingly, no offering material relating to the securities may be distributed in Italy and such securities may not be offered or sold in Italy in a public offer within the meaning of Article 1.1(t) of Legislative Decree No. 58 of 24 February 1998 (“Decree No. 58”), other than:

•to Italian qualified investors, as defined in Article 100 of Decree no. 58 by reference to Article 34-ter of CONSOB Regulation no. 11971 of 14 May 1999 (“Regulation no. 1197l”) as amended (“Qualified Investors”); and

•in other circumstances that are exempt from the rules on public offer pursuant to Article 100 of Decree No. 58 and Article 34-ter of Regulation No. 11971 as amended.

Any offer, sale or delivery of the securities or distribution of any offer document relating to the securities in Italy (excluding placements where a Qualified Investor solicits an offer from the issuer) under the paragraphs above must be:

•made by investment firms, banks or financial intermediaries permitted to conduct such activities in Italy in accordance with Legislative Decree No. 385 of 1 September 1993 (as amended), Decree No. 58, CONSOB Regulation No. 16190 of 29 October 2007 and any other applicable laws; and

•in compliance with all relevant Italian securities, tax and exchange controls and any other applicable laws.

Any subsequent distribution of the securities in Italy must be made in compliance with the public offer and prospectus requirement rules provided under Decree No. 58 and the Regulation No. 11971 as amended, unless an exception from those rules applies. Failure to comply with such rules may result in the sale of such securities being declared null and void and in the liability of the entity transferring the securities for any damages suffered by the investors.

Japan

The securities have not been and will not be registered under Article 4, paragraph 1 of the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948), as amended (the “FIEL”) pursuant to an exemption from the registration requirements applicable to a private placement of securities to Qualified Institutional Investors (as defined in and in accordance with Article 2, paragraph 3 of the FIEL and the regulations promulgated thereunder). Accordingly, the securities may not be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan other than Qualified Institutional Investors. Any Qualified Institutional Investor who acquires securities may not resell them to any person in Japan that is not a Qualified Institutional Investor, and acquisition by any such person of securities is conditional upon the execution of an agreement to that effect.

New Zealand

The shares of common stock offered hereby have not been offered or sold, and will not be offered or sold, directly or indirectly in New Zealand and no offering materials or advertisements have been or will be distributed in relation to any offer of shares in New Zealand, in each case other than:

•to persons whose principal business is the investment of money or who, in the course of and for the purposes of their business, habitually invest money;

•to persons who in all the circumstances can properly be regarded as having been selected otherwise than as members of the public;

•to persons who are each required to pay a minimum subscription price of at least NZ$500,000 for the shares before the allotment of those shares (disregarding any amounts payable, or paid, out of money lent by the issuer or any associated person of the issuer); or

•in other circumstances where there is no contravention of the Securities Act 1978 of New Zealand (or any statutory modification or reenactment of, or statutory substitution for, the Securities Act 1978 of New Zealand).

Portugal

This document is not being distributed in the context of a public offer of financial securities (oferta pública de valores mobiliários) in Portugal, within the meaning of Article 109 of the Portuguese Securities Code (Código dos Valores Mobiliários). The securities have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in Portugal. This document and any other offering material relating to the securities have not been, and will not be, submitted to the Portuguese Securities Market Commission (Comissăo do Mercado de Valores Mobiliários) for approval in Portugal and, accordingly, may not be distributed or caused to distributed, directly or indirectly, to the public in Portugal, other than under circumstances that are deemed not to qualify as a public offer under the Portuguese Securities Code. Such offers, sales and distributions of securities in Portugal are limited to persons who are “qualified investors” (as defined in the Portuguese Securities Code). Only such investors may receive this document and they may not distribute it or the information contained in it to any other person.

Sweden

This document has not been, and will not be, registered with or approved by Finansinspektionen (the Swedish Financial Supervisory Authority). Accordingly, this document may not be made available, nor may the securities be offered for sale in Sweden, other than under circumstances that are deemed not to require a prospectus under the Swedish Financial Instruments Trading Act (1991:980) (Sw. lag (1991:980) om handel med finansiella instrument). Any offering of securities in Sweden is limited to persons who are “qualified investors” (as defined in the Financial Instruments Trading Act). Only such investors may receive this document and they may not distribute it or the information contained in it to any other person.

Switzerland

The securities may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or

regulated trading facility in Switzerland. Neither this document nor any other offering material relating to the securities may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering material relating to the securities have been or will be filed with or approved by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of securities will not be supervised by, the Swiss Financial Market Supervisory Authority (FINMA).

This document is personal to the recipient only and not for general circulation in Switzerland.

United Arab Emirates

Neither this document nor the securities have been approved, disapproved or passed on in any way by the Central Bank of the United Arab Emirates or any other governmental authority in the United Arab Emirates, nor have we received authorization or licensing from the Central Bank of the United Arab Emirates or any other governmental authority in the United Arab Emirates to market or sell the securities within the United Arab Emirates. This document does not constitute and may not be used for the purpose of an offer or invitation. We may not render services relating to the securities within the United Arab Emirates, including the receipt of applications and/or the allotment or redemption of such shares.

No offer or invitation to subscribe for securities is valid or permitted in the Dubai International Financial Centre.

United Kingdom

Neither the information in this document nor any other document relating to the offer has been delivered for approval to the Financial Services Authority in the United Kingdom and no prospectus (within the meaning of section 85 of the Financial Services and Markets Act 2000, as amended (“FSMA”)) has been published or is intended to be published in respect of the securities. This document is issued on a confidential basis to “qualified investors” (within the meaning of section 86(7) of FSMA) in the United Kingdom, and the securities may not be offered or sold in the United Kingdom by means of this document, any accompanying letter or any other document, except in circumstances which do not require the publication of a prospectus pursuant to section 86(1) FSMA. This document should not be distributed, published or reproduced, in whole or in part, nor may its contents be disclosed by recipients to any other person in the United Kingdom.

Any invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) received in connection with the issue or sale of the securities has only been communicated or caused to be communicated and will only be communicated or caused to be communicated in the United Kingdom in circumstances in which section 21(1) of FSMA does not apply us.

In the United Kingdom, this document is being distributed only to, and is directed at, persons (i) who have professional experience in matters relating to investments falling within Article 19(5) (investment professionals) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 (“FPO”), (ii) who fall within the categories of persons referred to in Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the FPO or (iii) to whom it may otherwise be lawfully communicated (together “relevant persons”). The investments to which this document relates are available only to, and any invitation, offer or agreement to purchase will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

Transfer Agent

Our transfer agent is Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, NY 10004, and its telephone number is 212-509-4000.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements, and other information with the SEC. We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of common stock we are offering under this prospectus supplement. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement and the exhibits to the registration statement. The SEC maintains a website that contains reports, proxy and information statements, and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information and reports we file with it, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus. Information in this prospectus supplement supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus supplement, while information that we file later with the SEC will automatically update and supersede the information in this prospectus supplement and the accompanying prospectus. We incorporate by reference the documents listed below and any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended, after the date of this prospectus supplement and prior to the termination of the offering of the common stock covered by this prospectus supplement:

•Our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 10, 2022.

•Our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 25, 2022 (solely to the extent specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2021).

•Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 4, 2022.

•Our Current Reports on Form 8-K, filed with the SEC on May 6, 2022, July 14, 2022, and July 27, 2022.

•The description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on April 26, 2016 (File No. 001-37756), including any amendment or report filed for the purpose of updating such description.

You may request a free copy of any of the documents incorporated by reference in this prospectus supplement by writing or telephoning us at:

Global Water Resources, Inc.

21410 N. 19th Avenue #220

Phoenix, Arizona 85027

(480) 360-7775

Attention: Corporate Secretary

LEGAL MATTERS

The validity of the shares of our common stock offered hereby will be passed upon for us by Snell & Wilmer L.L.P., Phoenix, Arizona. The underwriter is being represented by Dorsey & Whitney LLP, Seattle, Washington.

EXPERTS

The financial statements incorporated in this Prospectus Supplement by reference from the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

Prospectus

$100,000,000

Common Stock

Debt Securities

We may offer and sell up to $100,000,000 in the aggregate of shares of our common stock and debt securities from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering, as well as the amounts, prices and terms of the securities being offered. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

Our common stock is listed on the NASDAQ Global Market under the symbol “GWRS.” On September 4, 2020, the last reported sale price of our common stock on the NASDAQ Global Market was $11.27 per share.

As of the date of this prospectus, we are an “emerging growth company” as the term is used in the Jumpstart Our Business Act of 2012 and are subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE RISK FACTORS DESCRIBED IN THIS PROSPECTUS BEGINNING ON PAGE 2, ANY ACCOMPANYING PROSPECTUS SUPPLEMENT, AND IN THE DOCUMENTS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS AND THE APPLICABLE PROSPECTUS SUPPLEMENT.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 8, 2020.

ABOUT THIS PROSPECTUS