QuickLinks -- Click here to rapidly navigate through this document | | | | |

| | | New York

Menlo Park

Washington DC

London

Paris | | Madrid

Tokyo

Beijing

Hong Kong |

| | | | |

| Joseph A. Hall | | | | |

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017 |

|

212 450 4565 tel

212 701 5565 fax

joseph.hall@davispolk.com |

|

|

September 9, 2010

- Re:

- First Wind Holdings Inc.

Registration Statement on Form S-1

File No. 333-152671

Mail Stop 3561

Mr. H. Christopher Owings

Assistant Director

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington D.C. 20549

Dear Mr. Owings:

This letter is being furnished on behalf of First Wind Holdings Inc. (the "Company") with respect to the above-referenced Registration Statement on Form S-1 as amended through Amendment No. 7 on August 18, 2010. To assist the Staff of the Division of Corporation Finance in its evaluation of stock compensation and other matters, the Company advises the Staff that, considering information currently available, the Company currently estimates a price of $20.00 per share for the proposed public offering of its Class A common stock, $0.001 par value per share (the "Offering"), based on an assumed 20,000,0000 shares of Class A common stock offered to the public in connection with the Offering and 39,286,627 and 35,413,373 shares of the Company's Class A and Class B common stock, respectively, to be outstanding upon completion of the Offering. This estimated price is not based on the Company's discussions with its underwriters. Attached as Exhibit A to this letter are relevant pages of the Registration Statement which are marked to show the changes that would be made to Amendment No. 7 for inclusion in the Company's preliminary prospectus relating to the Offering, including completed draft pro forma financial statements, based on the foregoing expectations.

The Company advises that Staff that, given the volatility of the public trading markets and the uncertainty of the timing of the Offering, the Company and the underwriters have not yet agreed to a valuation and related price range for the Offering and the information provided in this letter and the selected pages included in Exhibit A hereto is provided for illustrative purposes only and may differ in the actual preliminary prospectus for the Offering.

Please direct any comments on the foregoing to the undersigned at (212) 450-4565 or to Jeff Ramsay at (212) 450-4243.

Very truly yours,

Joseph A. Hall

Enclosures

| | |

cc w/ enc: |

|

Catherine Brown

Staff Attorney

Brigitte Lippmann

Special Counsel

James Allegretto

Senior Assistant Chief Accountant

Adam Phippen

Staff Accountant

Division of Corporation Finance

U.S. Securities and Exchange Commission

Paul Gaynor

Paul H. Wilson, Jr.

First Wind Holdings Inc.

Elisabeth M. Martin

Kirkland & Ellis LLP

|

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to this prospectus filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 18, 2010

20,000,000 Shares

First Wind Holdings Inc.

Class A Common Stock

We are offering 20,000,000 shares of our Class A common stock and we intend to use the net proceeds of this offering to fund capital expenditures and for general corporate purposes.

We will be a holding company and our sole asset will be approximately 52.6% of the aggregate Membership Interests of First Wind Holdings, LLC. Concurrently with the completion of this offering, we will issue 19,286,627 and 35,413,373 shares of Class A and Class B common stock, respectively, to members of First Wind Holdings, LLC.

Before this offering there has been no public market for our Class A common stock. The initial public offering price of our Class A common stock is expected to be between and per share. We have applied to list our Class A common stock on the Nasdaq Global Market under the symbol "WIND."

The underwriters have an option to purchase up to 3,000,000 additional shares from us to cover over-allotments, if any.

Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page 15.

| | | | | | | | | | |

| | Price to

Public | | Underwriting

Discounts and

Commissions | | Proceeds to First

Wind Holdings

Inc. | |

|---|

| Per share | | $ | 20.00 | | $ | 1.19 | | $ | 18.81 | |

| Total | | $ | 400,000,000 | | $ | 25,000,000 | | $ | 375,000,000 | |

Delivery of the shares of Class A common stock will be made on or about .

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | |

| Credit Suisse | | Morgan Stanley | | Goldman, Sachs & Co. | | Deutsche Bank Securities |

RBS

| | | | | | | | |

| Citi | | Macquarie Capital | | Piper Jaffray | | KeyBanc Capital Markets | | SOCIETE GENERALE |

The date of this prospectus is .

Risk Factors

Our business is subject to numerous risks and uncertainties, including:

- •

- those relating to our ability to build our pipeline of projects under development or acquire wind energy assets and turn them into operating projects;

- •

- the impact of schedule delays, cost overruns, revenue shortfalls and lower-than-expected capacity for those projects we do place into operation;

- •

- our substantial net losses and negative operating cash flows;

- •

- government policies supporting renewable energy development;

- •

- our dependence on suitable wind conditions;

- •

- our ability to locate and obtain control of suitable operating sites;

- •

- the need for ongoing access to capital to support our growth;

- •

- our substantial indebtedness and its short-term maturities, which could limit our flexibility in operating our business and to plan for and react to unexpected events; and

- •

- the potential for mechanical breakdowns.

You should carefully consider all of the information in this prospectus and, in particular, the information under "Risk Factors," prior to making an investment in our Class A common stock.

Class A Common Stock and Class B Common Stock

After completion of this offering, our outstanding capital stock will consist of Class A common stock and Class B common stock. Investors in this offering will hold shares of Class A common stock. See "Description of Capital Stock."

The Reorganization and Our Holding Company Structure

First Wind Holdings Inc. was formed for purposes of this offering and has only engaged in activities in contemplation of this offering. Upon completion of the offering, all of our business will continue to be conducted through First Wind Holdings, LLC, which is the holding company that has conducted all of our business to date. First Wind Holdings Inc. will be a holding company, whose principal asset will be its interest in First Wind Holdings, LLC. That interest will represent approximately 52.6% of the economic interests in our business, assuming the underwriters do not exercise their over-allotment option. First Wind Holdings Inc. will be the sole managing member of First Wind Holdings, LLC and will therefore control First Wind Holdings, LLC. Entities in the D. E. Shaw group and Madison Dearborn Capital Partners IV, L.P., will collectively own substantially all of the balance of the economic interests in our business. As a holding company, our only source of cash flow from operations will be distributions from First Wind Holdings, LLC. See "The Reorganization and Our Holding Company Structure." After completion of this offering, First Wind Holdings Inc. will be a "controlled company" under the listing rules of the Nasdaq Stock Market ("Nasdaq").

7

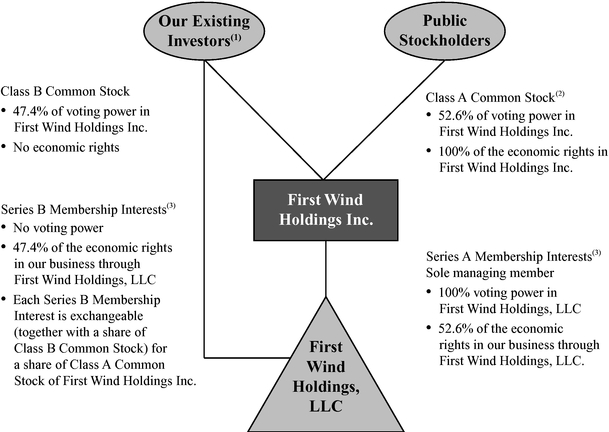

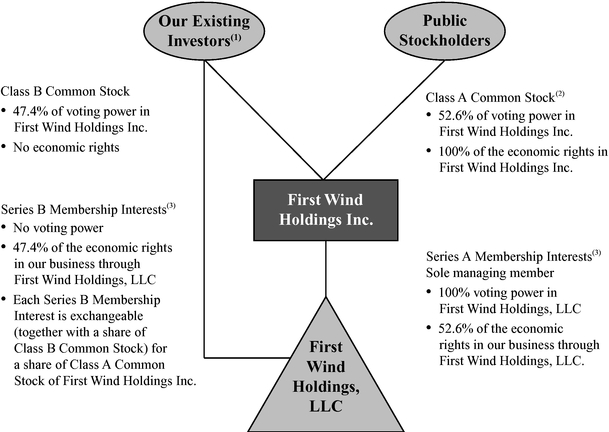

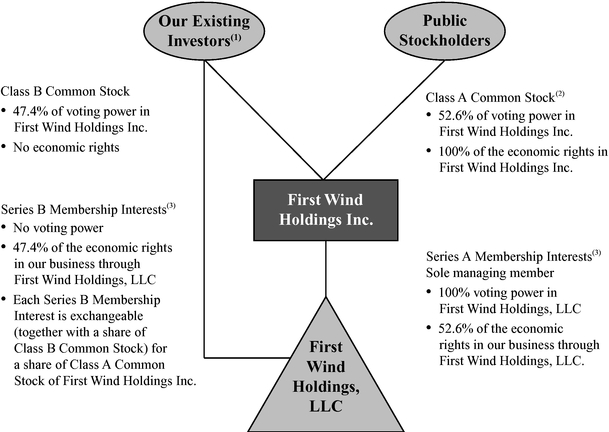

The diagram below shows our organizational structure immediately after consummation of this offering and related transactions, assuming no exercise of the underwriters' over-allotment option.

- (1)

- The members of First Wind Holdings, LLC, other than us, will consist of our Sponsors and certain of our employees and current investors in First Wind Holdings, LLC.

- (2)

- The Class A common stockholders will have the right to receive all distributions made on account of our capital stock. Each share of Class A common stock and Class B common stock is entitled to one vote per share. Certain entities in the D. E. Shaw group will receive Class A common stock rather than Series B Membership Interests (and the corresponding shares of Class B common stock). As a result, the D. E. Shaw group will hold Series B Membership Interests, Class A common stock and Class B common stock.

- (3)

- Series A Membership Interests and Series B Membership Interests will have the same economic rights in First Wind Holdings, LLC.

Corporate Information

We began developing wind energy projects in North America in 2002. First Wind Holdings Inc. was incorporated in Delaware in May 2008. Our principal executive offices are located at 179 Lincoln Street, Suite 500, Boston, Massachusetts 02111, and our telephone number is (617) 960-2888. Our website iswww.firstwind.com. The information contained on or accessible through our website, or any other website referenced in this prospectus, is not part of this prospectus and you should not consider it in making an investment decision.

8

The Offering

| | |

Class A common stock offered by us | | 20,000,000 shares. |

Class A common stock to be outstanding after this offering | | 39,286,627 shares (assuming no exercise of the underwriters' over-allotment option). |

Underwriters' over-allotment option | | 3,000,000 shares. |

Class B common stock to be outstanding after this offering | | 35,413,373 shares. Shares of our Class B common stock will be issued in connection with, and in equal proportion to, issuances of Series B Membership Interests of First Wind Holdings, LLC. Each Series B Membership Interest of First Wind Holdings, LLC, together with a corresponding share of our Class B common stock, will be exchangeable for one share of Class A common stock as described under "The Reorganization and Our Holding Company Structure—Limited Liability Company Agreement of First Wind Holdings, LLC." |

Use of proceeds | | We expect to receive net proceeds from the sale of Class A common stock offered hereby, after deducting estimated underwriting discounts and commissions and estimated offering expenses, of approximately $372.0 million, based on an assumed offering price of $20.00 per share (the midpoint of the range set forth on the cover of this prospectus). We intend to use approximately $ million of such net proceeds to fund a portion of our capital expenditures for 2010–2013 and the remainder for general corporate purposes. |

Voting rights | | Each share of our Class A common stock and Class B common stock will entitle its holder to one vote on all matters to be voted on by stockholders. Holders of Class A common stock and Class B common stock will vote together as a single class on all matters presented to stockholders for their vote or approval, except as otherwise required by law. After completion of this offering, the D. E. Shaw group and Madison Dearborn will own 73.2% (70.4% if the underwriters exercise their over-allotment option in full) and 100%, respectively, of the total number of shares of our outstanding Class A common stock and Class B common stock and will have effective control over the outcome of votes on all matters requiring approval by our stockholders. |

Dividend policy | | We do not anticipate paying dividends. See "Dividend Policy." |

Risk factors | | For a discussion of certain factors you should consider before making an investment, see "Risk Factors." |

Proposed Nasdaq Global Market symbol | | "WIND" |

The number of shares to be outstanding after completion of this offering is based on 19,286,627 shares of Class A common stock and 35,413,373 shares of Class B common stock outstanding as of June 30, 2010 after giving effect to the reorganization described under "The Reorganization and Our

9

Holding Company Structure." The number of shares to be outstanding after this offering excludes additional shares of Class A common stock reserved for issuance under our long-term incentive plan.

Unless we specifically state otherwise, the information in this prospectus assumes:

- •

- the implementation of the reorganization described in "The Reorganization and Our Holding Company Structure;" and

- •

- no exercise of the underwriters' over-allotment option.

10

| | | | | | | | | | | | | | | | | | | | | | | |

| | First Wind

Holdings, LLC | | First Wind

Holdings Inc. | | First Wind

Holdings LLC | | First Wind

Holdings Inc. | |

|---|

| | Year Ended December 31, | | Six Months Ended June 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2009

Pro Forma | | 2009 | | 2010 | | 2010

Pro Forma | |

|---|

| | (Dollars in thousands, except per share/unit amounts)

| |

|---|

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 23,817 | | $ | 28,790 | | $ | 47,136 | | $ | 47,136 | | $ | 20,915 | | $ | 40,747 | | $ | 40,747 | |

Cash settlements of derivatives | | | (1,670 | ) | | (4,072 | ) | | 10,966 | | | 10,966 | | | 6,558 | | | 5,018 | | | 5,018 | |

Fair value changes in derivatives | | | (9,801 | ) | | 14,760 | | | 17,175 | | | 17,175 | | | 12,708 | | | 3,976 | | | 3,976 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 12,346 | | | 39,478 | | | 75,277 | | | 75,277 | | | 40,181 | | | 49,741 | | | 49,741 | |

Cost of revenues: | | | | | | | | | | | | | | | | | | | | | | |

Project operating expenses | | | 9,175 | | | 10,613 | | | 19,709 | | | 19,709 | | | 8,380 | | | 24,121 | | | 24,121 | |

Depreciation and amortization of operating assets | | | 8,800 | | | 10,611 | | | 34,185 | | | 34,185 | | | 15,741 | | | 24,055 | | | 24,055 | |

| | | | | | | | | | | | | | | | |

Total cost of revenues | | | 17,975 | | | 21,224 | | | 53,894 | | | 53,894 | | | 24,121 | | | 48,176 | | | 48,176 | |

| | | | | | | | | | | | | | | | |

Gross income (loss) | | | (5,629 | ) | | 18,254 | | | 21,383 | | | 21,383 | | | 16,060 | | | 1,565 | | | 1,565 | |

Other operating expenses: | | | | | | | | | | | | | | | | | | | | | | |

Project development | | | 25,861 | | | 35,855 | | | 35,895 | | | 35,895 | | | 16,987 | | | 23,337 | | | 23,337 | |

General and administrative | | | 13,308 | | | 44,358 | | | 39,192 | | | 39,192 | | | 19,145 | | | 18,641 | | | 18,641 | |

Depreciation and amortization | | | 1,215 | | | 2,325 | | | 3,381 | | | 3,381 | | | 1,422 | | | 2,285 | | | 2,285 | |

| | | | | | | | | | | | | | | | |

Total other operating expenses | | | 40,384 | | | 82,538 | | | 78,468 | | | 78,468 | | | 37,554 | | | 44,263 | | | 44,263 | |

| | | | | | | | | | | | | | | | |

Income (loss) from operations | | $ | (46,013 | ) | $ | (64,284 | ) | $ | (57,085 | ) | $ | (57,085 | ) | $ | (21,494 | ) | $ | (42,698 | ) | $ | (42,698 | ) |

| | | | | | | | | | | | | | | | |

Risk management activities related to non-operating projects | | $ | (21,141 | ) | $ | 42,138 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

| | | | | | | | | | | | | | | | |

| | Net loss attributable per common unit (basic and diluted)(1) | | $ | (0.36 | ) | $ | (0.05 | ) | $ | (0.09 | ) | | | | $ | (0.03 | ) | $ | (0.06 | ) | | | |

| | | | | | | | | | | | | | | | | | |

| | Weighted average number of common units (basic and diluted)(1) | | | 189,161,855 | | | 278,288,518 | | | 649,681,382 | | | | | | 649,681,382 | | | 649,681,382 | | | | |

| | | | | | | | | | | | | | | | | | |

| | Pro forma net loss per share—basic and diluted(1) | | | | | | | | | | | $ | (0.80 | ) | | | | | | | $ | (0.56 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | Shares used in computing pro forma net loss per share—basic and diluted(1) | | | | | | | | | | | | 39,286,627 | | | | | | | | | 39,286,627 | |

| | | | | | | | | | | | | | | | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | |

| | Net cash provided by (used in): | | | | | | | | | | | | | | | | | | | | | | |

| | Operating activities(2) | | $ | (26,370 | ) | $ | (41,589 | ) | $ | (54,478 | ) | $ | (54,478 | ) | $ | (23,590 | ) | $ | 217,032 | | $ | 217,032 | |

| | Investing activities | | | (334,007 | ) | | (477,268 | ) | | (253,533 | ) | | (253,533 | ) | | (116,745 | ) | | (37,081 | ) | | (37,081 | ) |

| | Financing activities | | | 358,107 | | | 556,059 | | | 298,749 | | | 298,749 | | | 113,939 | | | (167,344 | ) | | (167,344 | ) |

Selected Operating Data | | | | | | | | | | | | | | | | | | | | | | |

| | Rated capacity (end of period) | | | 92 MW | | | 92 MW | | | 478 MW | | | 478 MW | | | 274 MW | | | 504 MW | | | 504 MW | |

| | Electricity generated | | | 239,940 MWh | | | 275,024 MWh | | | 656,365 MWh | | | 656,365 MWh | | | 304,803 MWh | | | 568,724 MWh | | | 568,724 MWh | |

| | Average realized energy price(3) | | $ | 103/MWh | | $ | 97/MWh | | $ | 85/MWh | | $ | 85/MWh | | $ | 78/MWh | | $ | 81/MWh | | $ | 81/MWh | |

| | Project EBITDA(4) | | $ | 14,945 | | $ | 15,589 | | $ | 35,867 | | $ | 35,867 | | $ | 15,198 | | $ | 23,154 | | $ | 23,154 | |

- (1)

- The basic net loss attributable per common unit for each of the annual periods ended December 31, 2007, 2008 and 2009 and the six month periods ended June 30, 2009 and 2010 has been presented for informational and historical purposes only. After completion of this offering, as a result of the reorganization events that have taken place or that will take place immediately prior to completion of the offering as described in "The Reorganization and Our Holding Company Structure," the shares used in computing net earnings or loss per share will bear no relationship to these historical common units.

- Pro forma basic and diluted net loss per share was computed by dividing the pro forma net loss attributable to our Class A common stockholders by the shares of Class A common stock that we will issue and sell in this offering, plus shares issued in connection with our initial capitalization, assuming that these shares of Class A common stock were outstanding for the entirety of each of the historical periods presented on a pro forma basis. No pro forma effect was given to the future potential exchanges of the Series B Membership Interests of our subsidiary, First Wind Holdings, LLC (and the equal number of shares of our Class B common stock), that will be outstanding immediately after the completion of this offering and the reorganization transactions for an equal number of shares of our Class A common stock because the issuance of shares of Class A common stock upon these exchanges would not be dilutive.

- (2)

- Operating cash flows for the six months ended June 30, 2010 include a prepayment for energy for our Milford I project of approximately $232 million.

- (3)

- Average realized energy price per MWh of energy generated is a metric that allows us to compare revenues from period to period, or on a project by project basis, regardless of whether the revenues are generated under a PPA, from sales at market prices with a financial swap, from sales at market prices or a combination of the three. Although average realized energy price is based, in part, on revenues recognized

12

income or expense that does not correspond to actual energy production in a given period, and we believe it is useful for investors to consider a measure that does not include project-related depreciation and amortization. Because lenders and providers of tax equity financing frequently disregard the non-cash charges and GAAP timing differences noted above when determining the financeability of a project, we believe that presenting information in this manner can help give investors an understanding of our ability to secure financing for our projects. Project EBITDA can be reconciled to gross income (loss), which we believe to be the most directly comparable financial measure calculated and presented in accordance with GAAP, as follows (in thousands):

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Six Months

Ended

June 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2009 | | 2010 | |

|---|

Gross income (loss) | | $ | (5,629 | ) | $ | 18,254 | | $ | 21,383 | | $ | 16,060 | | $ | 1,565 | |

| | Add (subtract): | | | | | | | | | | | | | | | | |

| | | | Depreciation and amortization of operating assets | | | 8,800 | | | 10,611 | | | 34,185 | | | 15,741 | | | 24,055 | |

| | | | New England REC timing | | | 2,461 | | | 1,947 | | | 2,060 | | | 472 | | | 120 | |

| | | | Mark-to-market adjustments(a) | | | 9,801 | | | (14,760 | ) | | (21,322 | ) | | (16,855 | ) | | (3,976 | ) |

| | | | KWP I property tax assessment(b) | | | (488 | ) | | (463 | ) | | (439 | ) | | (220 | ) | | 1,390 | |

| | | | | | | | | | | | |

| | | Project EBITDA | | $ | 14,945 | | $ | 15,589 | | $ | 35,867 | | $ | 15,198 | | $ | 23,154 | |

| | | | | | | | | | | | |

- (a)

- The mark-to-market adjustments for the 2009 periods include the effect of a financial hedge modification fee of $4,147 in addition to market adjustments of $17,175 and $12,708, for the year and the six months, respectively.

- (b)

- In June 2010, the County of Maui, Hawaii retroactively assessed property taxes for our KWP I project totaling approximately $1.4 million plus penalties and interest for 2007, 2008 and 2009. We have appealed these retroactive assessments as well as the amount then billed by the county for 2010. The KWP I property tax assessment adjustment reflects these retroactive assessments in the periods to which they relate.

Project EBITDA does not represent funds available for our discretionary use and is not intended to represent or to be used as a substitute for gross income (loss), net income or cash flow from operations data as measured under GAAP. We use Project EBITDA to assess the performance of our operating projects and not as a measure of our liquidity. Investors should consider cash flow from operations, and not Project EBITDA, when evaluating our liquidity and capital resources. The items excluded from Project EBITDA are significant components of our statement of operations and must be considered in performing a comprehensive assessment of our overall financial performance. Project EBITDA and the associated period-to-period trends should not be considered in isolation.

The following table presents summary consolidated balance sheet data as of the dates indicated:

- •

- on an actual basis;

- •

- on a pro forma basis as of June 30, 2010 to give effect to all of the reorganization transactions described in "The Reorganization and Our Holding Company Structure"; and

- •

- on a pro forma as adjusted basis as of June 30, 2010 to give further effect to our sale of shares of common stock in this offering at an assumed initial public offering price of $20.00 per share, the midpoint of the range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses.

| | | | | | | | | | | | | | | | | | | | |

| | First Wind Holdings, LLC | | First Wind Holdings Inc. | |

|---|

| | As of December 31, | |

| | Pro Forma

As of

June 30,

2010 | | Pro Forma

As Adjusted

June 30,

2010 | |

|---|

| | As of

June 30,

2010 | |

|---|

| | 2007 | | 2008 | | 2009 | |

|---|

| | (in thousands)

| |

|---|

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

| | Property, plant and equipment, net | | $ | 192,076 | | $ | 187,316 | | $ | 950,610 | | $ | 848,739 | | $ | 848,739 | | $ | 848,739 | |

| | Construction in progress | | | 346,320 | | | 571,586 | | | 472,526 | | | 450,536 | | | 450,536 | | | 450,536 | |

| | Total assets | | | 770,666 | | | 1,311,591 | | | 1,698,154 | | | 1,615,439 | | | 1,625,439 | | | 1,982,739 | |

| | Long-term debt, including debt with maturities less than one year | | | 465,449 | | | 532,441 | | | 632,046 | | | 495,338 | | | 495,338 | | | 480,638 | |

| | Members' capital/ stockholders' equity | | | 147,876 | | | 653,092 | | | 849,373 | | | 794,352 | | | 808,702 | | | 1,180,702 | |

14

Our substantial amount of indebtedness maturing in less than one year may adversely affect our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness.

As of June 30, 2010, we had gross outstanding indebtedness of approximately $516.9 million, which represented approximately 31.1% of our total debt and equity capitalization of $1,661.3 million (after giving effect to this offering and giving effect to the pro forma as adjusted assumptions set forth under "Capitalization"), including:

- •

- $171.8 million of debt under turbine supply loans;

- •

- $339.6 million of holding company and project term debt; and

- •

- $5.5 million of other debt used to fund development, construction and general and administrative expenses.

Of this amount, approximately $184.1 million matures prior to July 1, 2011. We do not have available cash or short-term liquid investments sufficient to repay all of this indebtedness and we have not obtained commitments for refinancing all of this debt. Therefore, we may not be able to extend the maturity of this indebtedness or to otherwise successfully refinance current maturities. If we are unable to repay or further extend the maturity on the $171.8 million of turbine supply loans included in this current indebtedness, we would be in default on these loans. In that event, we may be forced to sell the collateral securing the loans or surrender the collateral to the lender, which would result in a loss for financial reporting purposes and could have an adverse effect on our longer term operations, including a potential delay in completion of one or more of our Tier 1 projects.

The initial report of our independent registered public accounting firm, dated April 30, 2009, on our consolidated financial statements as of and for the year ended December 31, 2008, contained an explanatory paragraph regarding our ability to continue as a going concern. After April 30, 2009, we obtained additional funding that removed the substantial doubt about whether we would continue as a going concern through December 31, 2009. The report of our independent registered public accounting firm dated March 24, 2010, on our consolidated financial statements as of and for the year ended December 31, 2009, does not contain such an explanatory paragraph; however, there may be in the future circumstances that raise substantial doubt about our ability to continue as a going concern. If doubts about our ability to continue as a going concern are raised in the future notwithstanding the additional funding we have obtained and the funding we will obtain from this offering, our stock price could drop and our ability to raise additional funds, to obtain credit on commercially reasonable terms or to remain in compliance with our covenants with lenders may be adversely affected.

In addition, the assets of some of our subsidiaries collateralize their indebtedness, and in certain cases the assets of certain subsidiaries collateralize the indebtedness of other subsidiaries. This cross-collateralization means that a default by one subsidiary could trigger adverse consequences for other subsidiaries, including possible defaults under their debt agreements, which could have a material adverse effect on our business, financial condition and results of operations.

Our substantial indebtedness could have important consequences. For example, it could:

- •

- make it difficult for us to satisfy our obligations with respect to our indebtedness, and failure to comply with these obligations could result in an event of default under those agreements, which could be difficult to cure, or result in our bankruptcy;

- •

- require us to dedicate an even greater portion of our cash flow to pay principal and interest on our debt, reducing the funds available to us and our ability to borrow to operate and grow our business;

- •

- limit our flexibility to plan for and react to unexpected opportunities;

27

receivable agreement could be substantial for periods in which we generate taxable income. However, because we have not generated taxable income to date and do not expect to generate taxable income in the near-term, it is difficult to predict when and if we will make payments under the tax receivable agreement. Assuming no material changes in the relevant tax law and based on our current operating plan and other assumptions, including our estimate of the tax basis of our assets as of December 31, 2009, if all of the Series B Membership Interests were acquired by us in taxable transactions at the time of the closing of this offering for a price of $20.00 (the midpoint of the range on the cover of this prospectus) per Series B Membership Interest, we estimate that the amount that we would be required to pay under the tax receivable agreement could be approximately $ million. The actual amount may materially differ from this hypothetical amount, as potential future payments will be calculated using the market value of our Class A shares and the prevailing tax rates at the time of relevant exchange and will be dependent on us generating sufficient future taxable income to realize the benefit.

If the Internal Revenue Service successfully challenges the tax basis increases described above, we will not be reimbursed for any payments made under the tax receivable agreement. As a result, in certain circumstances, we could be required to make payments under the tax receivable agreement in excess of our cash tax savings.

If we are deemed to be an investment company under the Investment Company Act, our business would be subject to applicable restrictions under that Act, which could make it impracticable for us to continue our business as contemplated.

We believe our company is not an investment company under the Investment Company Act because we are the managing member of First Wind Holdings, LLC and we are primarily engaged in a non-investment company business. We intend to conduct our operations so that we will not be an investment company. However, if we are deemed an investment company, restrictions imposed by the Investment Company Act, including limitations on our capital structure and our ability to transact with affiliates, and changes in financial reporting and regulatory disclosure requirements as a result of being an investment company, could make it impractical for us to continue operating our business as contemplated.

Risks Related to this Offering and Our Class A Common Stock

We will continue to be controlled by our Sponsors after the completion of this offering, which will limit your ability to influence corporate activities and may adversely affect the market price of our Class A common stock.

Upon completion of the offering, the D. E. Shaw group and Madison Dearborn will own or control outstanding common stock representing an approximately 34.3% and 34.3% voting interest in us, respectively, or approximately 33.0% and 33.0%, respectively, if the underwriters exercise their over-allotment option in full. As a result of this ownership, our Sponsors will have effective control over the outcome of votes on all matters requiring approval by our stockholders, including the election of directors, the adoption of amendments to our certificate of incorporation and bylaws and approval of a sale of the company and other significant corporate transactions. Our Sponsors can also take actions that have the effect of delaying or preventing a change in control of us or discouraging others from making tender offers for our shares, which could prevent stockholders from receiving a premium for their shares. These actions may be taken even if other stockholders oppose them. Concurrently with the completion of this offering we and our Sponsors will enter into a nominating agreement pursuant to which we will agree to nominate individuals designated by our Sponsors to the board of directors and the Sponsors will agree to vote all of the shares of Class A common stock and Class B common stock held by them together on certain matters submitted to a

32

fullest extent permitted by law. These protections may result in the indemnified parties' tolerating greater risks when making investment-related decisions than otherwise would be the case, for example when determining whether to use leverage in connection with investments. The indemnification arrangements may also give rise to legal claims for indemnification that are adverse to us and holders of our common stock.

We will be a "controlled company" within the meaning of Nasdaq rules and, as a result, will qualify for, and rely on, applicable exemptions from certain corporate governance requirements.

After completion of this offering we will be a "controlled company" under Nasdaq rules. Under these rules, a company of which more than 50% of the voting power is held by a group is a "controlled company" and may elect not to comply with certain Nasdaq corporate governance requirements, including (1) the requirement that a majority of the board of directors consist of independent directors, (2) the requirement that the nominating committee be composed entirely of independent directors, (3) the requirement that the compensation committee be composed entirely of independent directors and (4) the requirement for an annual performance evaluation of the nominating and corporate governance and compensation committees. We intend to rely on this exemption to the extent it is applicable, and therefore we will not have a majority of independent directors or nominating and compensation committees consisting entirely of independent directors. Accordingly, you will not have the same protections afforded to stockholders of companies that are not deemed "controlled companies."

The market price of our Class A common stock could decline due to the large number of shares of Class A common stock eligible for future sale upon the exchange of Series B Membership Interests.

The market price of our Class A common stock could decline as a result of sales of a large number of shares of our Class A common stock eligible for future sale upon the exchange of Series B Membership Interests (together with an equal number of shares of our Class B common stock), or the perception that such sales could occur. These sales, or the possibility that these sales may occur, also may make it more difficult for us to raise additional capital by selling equity securities in the future, at a time and price that we deem appropriate.

After completion of this offering, approximately 35,413,373 Series B Membership Interests of First Wind Holdings, LLC will be outstanding. Each Series B Membership Interest, together with a share of Class B common stock, will be exchangeable for one share of Class A common stock as described under "The Reorganization and Our Holding Company Structure—Limited Liability Company Agreement of First Wind Holdings, LLC." We will enter into a registration rights agreement with our current investors pursuant to which we will grant such investors registration rights with respect to shares of Class A common stock.

Requirements associated with being a public company will increase our costs significantly, as well as divert significant company resources and management attention.

Before this offering, we have not been subject to the reporting requirements of the Exchange Act or the other rules and regulations of the SEC or any stock exchange relating to publicly-held companies. We are working with our legal, independent auditing and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and fulfill our obligations as a public company. These areas include corporate governance, corporate controls, internal audit, disclosure controls and procedures, financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas. However, the expenses that will be required in order to prepare adequately for being a public company could be material. Compliance with the various reporting and other requirements applicable to public companies will also require considerable management time and attention.

34

prove to be a relevant indicator of future earnings. These factors may harm our business, financial condition and results of operations and may cause our stock price to decline.

We currently do not intend to pay dividends on our Class A common stock. As a result, your only opportunity to achieve a return on your investment is if the price of our Class A common stock appreciates.

We currently do not expect to declare or pay dividends on our Class A common stock. Our debt agreements currently limit our ability to pay dividends on our Class A common stock, and we may also enter into other agreements in the future that prohibit or restrict our ability to declare or pay dividends on our Class A common stock. As a result, your only opportunity to achieve a return on your investment will be if the market price of our Class A common stock appreciates and you sell your shares at a profit.

You may experience dilution of your ownership interest due to the future issuance of additional shares of our Class A common stock.

We are in a capital intensive business and we do not have sufficient funds to finance the growth of our business or the construction costs of our development projects or to support our projected capital expenditures. As a result, we will require additional funds from further equity or debt financings, including tax equity financing transactions or sales of preferred shares or convertible debt to complete the development of new projects and pay the general and administrative costs of our business. We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of purchasers of Class A common stock offered hereby. We are currently authorized to issue shares of common stock and shares of preferred stock with preferences and rights as determined by our board of directors. The potential issuance of such additional shares of common stock or preferred stock or convertible debt may create downward pressure on the trading price of our Class A common stock. We may also issue additional shares of Class A common stock or other securities that are convertible into or exercisable for Class A common stock in future public offerings or private placements for capital raising purposes or for other business purposes, potentially at an offering price or conversion price that is below the offering price for Class A common stock in this offering.

You will suffer immediate and substantial dilution in the book value per share of your Class A common stock as a result of this offering.

The initial public offering price of our Class A common stock is considerably more than the pro forma net tangible book value per share of our outstanding Class A common stock, as adjusted to reflect completion of this offering. This reduction in the book value of your equity is known as dilution. This dilution occurs in large part because our earlier investors paid substantially less than the initial public offering price when they purchased their shares. Investors purchasing Class A common stock in this offering will incur immediate dilution of $4.19 in pro forma net tangible book value per share of Class A common stock, as adjusted to reflect completion of this offering and giving effect to the pro forma as adjusted assumptions set forth under "Capitalization."

36

MARKET AND INDUSTRY DATA

This prospectus includes market and industry data that we have developed from independent consultant reports, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Our internal data, estimates and forecasts are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management's understanding of industry conditions.

USE OF PROCEEDS

We estimate that the net proceeds to us from the sale of Class A common stock in this offering will be approximately $372.0 million, based on an offering price of $20.00 per share, the midpoint of the range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses.

We intend to use approximately $ million of our net proceeds from this offering to fund a portion of our capital expenditures for 2010-2013 and the remainder for general corporate purposes.

A $1.00 increase or decrease in the assumed initial public offering price of $20.00 would increase or decrease net proceeds to us from this offering by approximately $20.0 million after deducting estimated underwriting discounts and commissions and estimated offering expenses.

DIVIDEND POLICY

We do not expect to declare or pay any cash or other dividends on our Class A common stock, as we intend to reinvest cash flow generated by operations in our business. Our debt agreements effectively limit our ability to pay dividends on our Class A common stock, and we may also enter into credit agreements or other arrangements in the future that prohibit or restrict our ability to declare or pay dividends on our Class A common stock. Class B common stock will not be entitled to any dividend payments.

39

CAPITALIZATION

The following table sets forth the consolidated capitalization of:

- •

- First Wind Holdings, LLC on an actual basis as of June 30, 2010;

- •

- First Wind Holdings Inc. on a pro forma basis as of June 30, 2010 to give effect to all of the reorganization transactions described in "The Reorganization and Our Holding Company Structure;" and

- •

- First Wind Holdings Inc. on a pro forma as adjusted basis as of June 30, 2010 to give further effect to our sale of shares of common stock in this offering at an assumed initial public offering price of $20.00 per share, the midpoint of the range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses.

You should read this table together with the information under "Unaudited Pro Forma Financial Information," "Selected Historical Financial and Operating Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "The Reorganization and Our Holding Company Structure," "Description of Capital Stock" and in the consolidated financial statements included elsewhere in this prospectus and application of the proceeds therefrom.

| | | | | | | | | | | |

| | As of June 30, 2010 | |

|---|

| | First Wind

Holdings,

LLC Actual | | First Wind

Holdings Inc.

Pro Forma | | First Wind

Holdings Inc.

Pro Forma As

Adjusted(2) | |

|---|

| | (unaudited)

(in thousands, except share amounts)

| |

|---|

Long-term debt, including debt with maturities less than one year(1) | | $ | 495,338 | | $ | 495,338 | | $ | 480,638 | |

| | | | | | | | |

Members' capital/stockholders' equity: | | | | | | | | | | |

| | Members' capital | | | 846,666 | | | N/A | | | N/A | |

| | | | | | | | | | |

| | Class A common stock, $0.001 par value, no shares authorized, issued and outstanding, actual; shares authorized and 19,286,627 shares issued and outstanding, pro forma; shares authorized and 39,286,627 shares issued and outstanding, pro forma as adjusted | | | N/A | | | 19 | | | 39 | |

| | Class B common stock, $0.001 par value, no shares authorized, issued and outstanding, actual; shares authorized and 35,413,373 shares issued and outstanding pro forma; shares authorized and 35,413,373 shares issued and outstanding, pro forma as adjusted | | | N/A | | | 35 | | | 35 | |

Additional paid-in capital | | | N/A | | | 303,920 | | | 608,147 | |

Accumulated deficit | | | (233,409 | ) | | (82,393 | ) | | (82,393 | ) |

Noncontrolling interests in subsidiaries | | | 181,095 | | | 587,121 | | | 654,874 | |

| | | | | | | | |

| | Total members' capital/stockholders' equity | | | 794,352 | | | 808,702 | | | 1,180,702 | |

| | | | | | | | |

Total capitalization | | $ | 1,289,690 | | $ | 1,304,040 | | $ | 1,661,340 | |

| | | | | | | | |

- (1)

- Approximately $184.1 million of our outstanding indebtedness had a maturity of less than one year as of June 30, 2010.

- (2)

- A $1.00 increase (decrease) in the assumed initial public offering price of $20.00 per share would increase (decrease) pro forma as adjusted stockholders' equity by $20.0 million, based on the assumptions set forth above. The pro forma as adjusted information set forth above is illustrative only and upon completion of this offering will be adjusted based on the actual offering price and other terms of this offering determined at pricing.

40

DILUTION

At June 30, 2010 after giving effect to the reorganization described under "The Reorganization and Our Holding Company Structure," the net tangible book value per share of our Class A and Class B common stock was $14.78. Net tangible book value per share is determined by dividing our tangible net worth (tangible assets less total liabilities) by the total number of outstanding shares of Class A common stock. After giving effect to the sale of shares in this offering at an assumed offering price of $20.00 per share, the midpoint of the range set forth on the cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses, and assuming all Series B Membership Interests that will be outstanding immediately after the reorganization are, together with an equal number of shares of our Class B common stock, exchanged for an equal number of shares of Class A common stock, our net tangible book value at June 30, 2010 would have been approximately $15.81 per share. This represents an immediate dilution of $6.54 per share to new investors purchasing Class A common stock in this offering, resulting from the difference between the offering price and the net tangible book value after this offering. The following table illustrates the per share dilution to new investors purchasing Class A common stock in this offering:

| | | | | | | |

Assumed initial public offering price per share | | | | | $ | 20.00 | |

Net tangible book value per share at June 30, 2010 (pro forma) | | $ | 14.78 | | | | |

Increase in net tangible book value per share attributable to new investors | | | 1.03 | | | | |

| | | | | | | |

As adjusted net tangible book value per share after this offering | | | | | | 15.81 | |

| | | | | | | |

Dilution per share to new investors | | | | | $ | 4.19 | |

| | | | | | | |

The following table sets forth at June 30, 2010 after giving effect to the reorganization, the total number of shares of Class A common stock purchased from us, and the total consideration and average price per share paid by existing equity holders and by new investors purchasing Class A common stock in this offering, assuming all Series B Membership Interests that will be outstanding immediately after the completion of the reorganization are, together with an equal number of shares of Class B common stock, exchanged for an equal number of shares of Class A common stock, at an assumed initial public offering price of $20.00 per share, the midpoint of the range set forth on the cover of this prospectus.

| | | | | | | | | | | | | | | | | |

| |

| |

| | Total

Consideration | |

| |

|---|

| | Shares Issued | |

| |

|---|

| | Average

Consideration

Per Share | |

|---|

| | Number | | Percent | | Amount | | Percent | |

|---|

Existing stockholders | | | 54,700,000 | | | 73.2 | % | $ | 871,582,835 | | | 68.5 | % | $ | 15.93 | |

| | | | | | | | | | | | |

New investors | | | 20,000,000 | | | 26.8 | % | | 400,000,000 | | | 31.5 | % | | 20.00 | |

| | | | | | | | | | | | |

| | Total | | | 74,700,000 | | | 100.0 | % | $ | 1,271,582,835 | | | 100.0 | % | $ | 17.02 | |

| | | | | | | | | | | | |

If the underwriters' over-allotment option is exercised in full, the number of shares held by existing stockholders after this offering would decrease to 45.6% of the total number of shares of Class A common stock outstanding immediately following this offering, and the number of shares held by new investors would increase to 23,000,000 or approximately 54.4% of the total number of shares of Class A common stock outstanding immediately following this offering.

A $1.00 increase (decrease) in the assumed initial public offering price of $20.00 per share would increase (decrease) total consideration paid by new investors in this offering and by all investors by $20.0 million and dilution per share for new investors by approximately $0.26.

41

FIRST WIND HOLDINGS INC.

Unaudited Pro Forma Consolidated Balance Sheet

As of June 30, 2010

(in thousands, except share amounts)

| | | | | | | | | | | | | | | | | | |

| | First Wind

Holdings, LLC

Historical | | Reorganization

Adjustments | | First Wind

Holdings Inc.(1)

Pro Forma | | Offering

Adjustments | | First Wind

Holdings, Inc.(1)

Pro Forma as

Adjusted | |

|---|

Assets | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | 44,074 | | $ | 10,000 | (6) | $ | 54,074 | | $ | 372,000 | (4) | $ | 411,374 | |

| | | | | | | | | | | | (14,700 | ) (5) | | | |

| | Restricted cash | | | 47,432 | | | — | | | 47,432 | | | — | | | 47,432 | |

| | Accounts receivable | | | 6,618 | | | — | | | 6,618 | | | — | | | 6,618 | |

| | Prepaid expenses and other current assets | | | 8,930 | | | — | | | 8,930 | | | — | | | 8,930 | |

| | Derivative assets | | | 10,132 | | | — | | | 10,132 | | | — | | | 10,132 | |

| | | | | | | | | | | | |

| | | Total current assets | | | 117,186 | | | 10,000 | | | 127,186 | | | 357,300 | | | 484,486 | |

Property, plant and equipment, net | | | 848,739 | | | — | | | 848,739 | | | — | | | 848,739 | |

Construction in progress | | | 450,536 | | | — | | | 450,536 | | | — | | | 450,536 | |

Turbine deposits | | | 116,909 | | | — | | | 116,909 | | | — | | | 116,909 | |

Long-term derivative assets | | | 37,703 | | | — | | | 37,703 | | | — | | | 37,703 | |

Other non-current assets | | | 25,467 | | | — | | | 25,467 | | | — | | | 25,467 | |

Deferred financing costs | | | 18,899 | | | — | | | 18,899 | | | — | | | 18,899 | |

| | | | | | | | | | | | |

| | | Total assets | | $ | 1,615,439 | | $ | 10,000 | | $ | 1,625,439 | | $ | 357,300 | | $ | 1,982,739 | |

| | | | | | | | | | | | |

Liabilities and Stockholders' Equity | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | |

| | Accrued capital expenditures | | $ | 36,067 | | $ | — | | $ | 36,067 | | $ | — | | $ | 36,067 | |

| | Accounts payable and accrued expenses | | | 30,797 | | | — | | | 30,797 | | | — | | | 30,797 | |

| | Derivative liabilities | | | 3,274 | | | — | | | 3,274 | | | — | | | 3,274 | |

| | Deferred tax liability | | | — | | | — | | | — | | | — | | | — | |

| | Other current liabilities | | | — | | | — | | | — | | | — | | | — | |

| | Deferred revenue | | | 11,562 | | | — | | | 11,562 | | | — | | | 11,562 | |

| | Current portion of long-term debt | | | 184,052 | | | — | | | 184,052 | | | (14,700 | ) (5) | | 169,352 | |

| | | | | | | | | | | | |

| | | Total current liabilities | | | 265,752 | | | — | | | 265,752 | | | (14,700 | ) | | 251,052 | |

Long-term debt, net of current portion | | | 311,286 | | | — | | | 311,286 | | | — | | | 311,286 | |

Long-term derivative liabilities | | | 10,150 | | | — | | | 10,150 | | | — | | | 10,150 | |

Deferred income tax liability(3) | | | 5,845 | | | — | | | 5,845 | | | — | | | 5,845 | |

Deferred revenue | | | 210,348 | | | — | | | 210,348 | | | — | | | 210,348 | |

Other liabilities | | | 7,687 | | | (4,350 | ) (6) | | 3,337 | | | — | | | 3,337 | |

Asset retirement obligations | | | 10,019 | | | — | | | 10,019 | | | — | | | 10,019 | |

| | | | | | | | | | | | |

| | | Total liabilities | | | 821,087 | | | (4,350 | ) | | 816,737 | | | (14,700 | ) | | 802,037 | |

Commitments and contingencies | | | | | | | | | | | | | | | | |

Members' capital/stockholders' equity | | | | | | | | | | | | | | | | |

| | | | | | 14,350 | (6) | | | | | | | | | |

| | First Wind Holdings, LLC members' capital | | | 846,666 | | | (861,016 | ) (2) | | — | | | — | | | — | |

| | First Wind Holdings Inc. | | | | | | | | | | | | | | | | |

| | | Class A common stock, $0.001 par value | | | — | | | 19 | (2) | | 19 | | | 20 | (4) | | 39 | |

| | | Class B common stock, $0.001 par value | | | — | | | 35 | (2) | | 35 | | | — | | | 35 | |

| | Additional paid-in capital | | | — | | | 303,920 | (2) | | 303,920 | | | 304,227 | (4) | | 608,147 | |

| | Accumulated deficit | | | (233,409 | ) | | 151,016 | (2) | | (82,393 | ) | | — | | | (82,393 | ) |

| | | | | | | | | | | | |

| | | Total First Wind Holdings members' capital/stockholders' equity | | | 613,257 | | | (391,676 | ) | | 221,581 | | | 304,247 | | | 525,828 | |

| | | Noncontrolling interests in subsidiaries | | | 181,095 | | | 406,026 | (2) | | 587,121 | | | 67,753 | (4) | | 654,874 | |

| | | | | | | | | | | | |

| | | Total members' capital/stockholders' equity | | | 794,352 | | | 14,350 | | | 808,702 | | | 372,000 | | | 1,180,702 | |

| | | | | | | | | | | | |

| | | Total liabilities and members' capital/stockholders' equity | | $ | 1,615,439 | | $ | 10,000 | | $ | 1,625,439 | | $ | 357,300 | | $ | 1,982,739 | |

| | | | | | | | | | | | |

- (1)

- As a newly formed entity, First Wind Holdings Inc. will have no assets or results of operations until the completion of this offering.

43

- (2)

- Represents adjustments to reflect exchange of existing members' ownership interest in First Wind Holdings LLC for approximately 49.1% of our Class A common stock and 100% of our Class B common stock along with the Series B Membership Interests in First Wind Holdings, LLC. As described in "The Reorganization and Our Holding Company Structure," after this offering and the reorganization transactions that we are undertaking in connection therewith, our only material asset will be our ownership of approximately 52.6% of the Membership Interests of First Wind Holdings, LLC and our only business will be to act as the sole managing member of First Wind Holdings, LLC. As such, we will operate and control all of its business and affairs and will consolidate its financial results into our financial statements. The ownership interests of the other members of First Wind Holdings, LLC will be accounted for as a noncontrolling interest in our consolidated financial statements after this offering. The exchange of shares of our Class B common stock (or Class A common stock, as the case may be) for membership units of First Wind Holdings, LLC as part of our reorganization will be accounted for as a transfer of carrying value in a recapitalization without consideration.

- (3)

- This offering and the reorganization transactions do not result in an immediate step-up in the value of our assets. However, future exchanges of Series B Membership Interests for shares of our Class A common stock are expected to increase the tax basis in the tangible and intangible assets of First Wind Holdings, LLC. The step-up in tax basis is initially depreciable and amortizable for tax purposes over a 15-year period. We will enter into a tax receivable agreement with certain holders of Series B Membership Interests after giving effect to the reorganization and certain future holders of Series B Membership Interests that will require us to pay such holders 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we actually realize (or are deemed to realize in the case of an early termination payment by us, or a change in control, as discussed below) as a result of the increases in tax basis and of certain other tax benefits related to entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement.

- (4)

- We expect to receive net proceeds from this offering of $372.0 million based on an aggregate underwriting discount of $25.0 million and estimated offering expenses of $3.0 million. We intend to use approximately $ million of our net proceeds from this offering to fund a portion of our capital expenditures for 2010–2013 and the remainder for general corporate purposes. Upon completion of the offering, outstanding Series B Membership Interests in First Wind Holdings, LLC will be reflected as noncontrolling interests.

- (5)

- Reflects payment of our Wind Acquisition Loan in accordance with the amortization schedule for such loan that contains a provision requiring payment upon completion of this offering. Also, the Company anticipates that it will make a discretionary payment of $ million to retire the First Wind Term Loan in March 2011; however, this payment is not a direct result of the offering or reorganization and has been excluded from the pro forma presentation.

- (6)

- Reflects assumed exercise of warrant to purchase 10.0 million Series A-1 units of First Wind Holdings, LLC at $1.00 per unit.

44

FIRST WIND HOLDINGS INC.

Unaudited Pro Forma Consolidated Statement of Operations

Year Ended December 31, 2009

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | |

| | First Wind

Holdings, LLC

Historical | | Reorganization

Adjustments | | First Wind

Holdings Inc.(1)

Pro Forma | | Offering

Adjustments | | First Wind

Holdings Inc.(1)

Pro Forma as

Adjusted | |

|---|

Revenues: | | | | | | | | | | | | | | | | |

| | Revenues | | $ | 47,136 | | $ | — | | $ | 47,136 | | $ | — | | $ | 47,136 | |

| | Cash settlements of derivatives | | | 10,966 | | | — | | | 10,966 | | | — | | | 10,966 | |

| | Fair value changes in derivatives | | | 17,175 | | | — | | | 17,175 | | | — | | | 17,175 | |

| | | | | | | | | | | | |

| | | Total revenues | | | 75,277 | | | — | | | 75,277 | | | — | | | 75,277 | |

Cost of revenues: | | | | | | | | | | | | | | | | |

| | Project operating expenses(2) | | | 19,709 | | | — | | | 19,709 | | | — | | | 19,709 | |

| | Depreciation and amortization | | | 34,185 | | | — | | | 34,185 | | | — | | | 34,185 | |

| | | | | | | | | | | | |

| | | Total cost of revenues | | | 53,894 | | | — | | | 53,894 | | | — | | | 53,894 | |

| | | | | | | | | | | | |

| | | Gross income | | | 21,383 | | | — | | | 21,383 | | | — | | | 21,383 | |

| | | | | | | | | | | | |

Other operating expenses: | | | | | | | | | | | | | | | | |

| | Project development(2) | | | 35,895 | | | — | | | 35,895 | | | — | | | 35,895 | |

| | General and administrative(2) | | | 39,192 | | | — | | | 39,192 | | | — | | | 39,192 | |

| | Depreciation and amortization | | | 3,381 | | | — | | | 3,381 | | | — | | | 3,381 | |

| | | | | | | | | | | | |

| | | Total other operating expenses | | | 78,468 | | | — | | | 78,468 | | | — | | | 78,468 | |

| | | | | | | | | | | | |

| | | Loss from operations | | | (57,085 | ) | | — | | | (57,085 | ) | | — | | | (57,085 | ) |

| | | | | | | | | | | | |

Other expense(3) | | | (1,915 | ) | | — | | | (1,915 | ) | | — | | | (1,915 | ) |

| | | | | | | | | | | | |

Loss before provision for income taxes | | | (59,000 | ) | | — | | | (59,000 | ) | | — | | | (59,000 | ) |

| | Provision for income taxes | | | 2,010 | | | — | | | 2,010 | | | — | | | 2,010 | |

| | | | | | | | | | | | |

Net loss | | | (61,010 | ) | | — | | | (61,010 | ) | | — | | | (61,010 | ) |

| | Less: net loss attributable to noncontrolling int. | | | 1,391 | | | 38,573 | (4) | | 39,964 | | | (10,314 | ) (4) | | 29,650 | |

| | | | | | | | | | | | |

| | Net loss attributable to members of First Wind Holdings(5) | | $ | (59,619 | ) | $ | 38,573 | | $ | (21,046 | ) | $ | (10,314 | ) | $ | (31,360 | ) |

| | | | | | | | | | | | |

Pro forma net loss per share (basic)(6) | | $ | (0.09 | ) | | | | $ | (1.09 | ) | | | | $ | (0.80 | ) |

| | | | | | | | | | | | | | |

Shares used in computing pro forma net loss per share (basic)(6) | | | 649,681,382 | | | (630,394,755 | ) (6) | | 19,286,627 | | | (20,000,000 | ) (6) | | 39,286,627 | |

| | | | | | | | | | | | |

- (1)

- As a newly formed entity, First Wind Holdings Inc. will have no assets or results of operations until the completion of this offering.

- (2)

- Historical amounts include stock-based compensation expense for our Series B Unit Awards. We anticipate issuing to employees options to purchase shares of our Class A common stock concurrently with the offering. These stock option awards will have an exercise price equal to the offering price of $20.00 per share and will generally vest over the average remaining vesting period of an employee's unvested Series B Unit Awards. Since this award is discretionary, no pro forma adjustment has been made. We anticipate that this award will result in approximately $ million of incremental stock-based compensation expense in the year following the offering over the $ that would have been recorded for the outstanding Series B Unit Awards.

- (3)

- Interest on anticipated cash proceeds from this offering is excluded from the pro forma presentation. We expect to receive net proceeds from this offering of $372.0 million based on an aggregate underwriting discount of $25.0 million and estimated offering expenses of $3.0 million. We intend to use approximately $ million of our net proceeds from this offering to fund a portion of our capital expenditures for 2010–2013 and the remainder for general corporate purposes. We expect that interest income on the net proceeds at current market rates would total approximately $ million on an annual basis.

- (4)

- As described in "The Reorganization and Our Holding Company Structure," following this offering, and the reorganization transactions that we are undertaking in connection therewith, our only material asset will be our ownership of approximately 52.6% of the membership units of First Wind Holdings, LLC and our only business will be to act as the sole managing member of First Wind Holdings, LLC. As such, we will operate and control all of its business and affairs and will consolidate its financial results into our financial statements. The ownership interests of the other members of First Wind Holdings, LLC will be accounted for as a noncontrolling interest in our consolidated financial statements after this offering.

45

Represents adjustments to reflect noncontrolling interest resulting from the existing members' ownership interest of approximately 100% of the Series B Units of First Wind Holdings, LLC.

- (5)

- First Wind Holdings, LLC is currently taxed as a partnership for federal income tax purposes. Therefore, First Wind Holdings, LLC is not subject to entity-level federal income taxation, with the exception of certain subsidiaries that have elected to be treated as corporations under the Internal Revenue Code, and taxes with respect to income of First Wind Holdings, LLC are payable by First Wind Holdings, LLC's equity holders at rates applicable to them. Following this offering, and the reorganization that we are undertaking in connection therewith, earnings recorded by us will be subject to federal income taxation. For the period presented, our loss before provision for income taxes would have resulted in a net income tax benefit. This net income tax benefit is not recognized in the pro forma presentation since it would be offset by a valuation allowance.

- (6)

- Basic and diluted net income per share was computed by dividing the pro forma net income attributable to our Class A stockholders by the 20,000,000 shares of Class A common stock that we will issue and sell in this offering (assuming that the underwriters do not exercise their option to purchase an additional 3,000,000 shares of Class A common stock to cover over-allotments), plus 19,286,627 shares issued in connection with our initial capitalization, assuming that these 39,286,627 shares of Class A common stock were outstanding for the entirety of each of the historical periods presented on a pro forma basis. No pro forma effect was given to the future potential exchanges of the 35,413,373 Series B Membership Interests of our subsidiary, First Wind Holdings, LLC, together with an equal number of shares of our Class B common stock, that will be outstanding immediately after the completion of this offering and the reorganization transactions for the equal number of shares of our Class A common stock because the issuance of shares of Class A common stock upon these exchanges would not be dilutive.

A $1.00 increase (decrease) in the assumed initial public offering price of $20.00 per share would increase (decrease) each of the pro forma as adjusted cash and cash equivalents and stockholders' equity by $20.0 million, after deducting estimated underwriting discounts and commissions and estimated offering expenses. The pro forma as adjusted information discussed above is illustrative only and following completion of this offering will be adjusted based on the actual offering price and other terms of this offering determined at pricing.

46

FIRST WIND HOLDINGS INC.

Unaudited Pro Forma Consolidated Statement of Operations

Six months Ended June 30, 2010

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | |

| | First Wind

Holdings, LLC

Historical | | Reorganization

Adjustments | | First Wind

Holdings Inc.(1)

Pro Forma | | Offering

Adjustments | | First Wind

Holdings Inc.(1)

Pro Forma as

Adjusted | |

|---|

Revenues: | | | | | | | | | | | | | | | | |

| | Revenues | | $ | 40,747 | | $ | — | | $ | 40,747 | | $ | — | | $ | 40,747 | |

| | Cash settlements of derivatives | | | 5,018 | | | — | | | 5,018 | | | — | | | 5,018 | |

| | Fair value changes in derivatives | | | 3,976 | | | — | | | 3,976 | | | — | | | 3,976 | |

| | | | | | | | | | | | |

| | | Total revenues | | | 49,741 | | | — | | | 49,741 | | | — | | | 49,741 | |

Cost of revenues: | | | | | | | | | | | | | | | | |

| | Project operating expenses(2) | | | 24,121 | | | — | | | 24,121 | | | — | | | 24,121 | |

| | Depreciation and amortization | | | 24,055 | | | — | | | 24,055 | | | — | | | 24,055 | |

| | | | | | | | | | | | |

| | | Total cost of revenues | | | 48,176 | | | — | | | 48,176 | | | — | | | 48,176 | |

| | | | | | | | | | | | |

| | | Gross income (loss) | | | 1,565 | | | — | | | 1,565 | | | — | | | 1,565 | |

| | | | | | | | | | | | |

Other operating expenses: | | | | | | | | | | | | | | | | |

| | Project development(2) | | | 23,337 | | | — | | | 23,337 | | | — | | | 23,337 | |

| | General and administrative(2) | | | 18,641 | | | — | | | 18,641 | | | — | | | 18,641 | |

| | Depreciation and amortization | | | 2,285 | | | — | | | 2,285 | | | — | | | 2,285 | |

| | | | | | | | | | | | |

| | | Total other operating expenses | | | 44,263 | | | — | | | 44,263 | | | — | | | 44,263 | |

| | | | | | | | | | | | |

| | | Loss from operations | | | (42,698 | ) | | — | | | (42,698 | ) | | — | | | (42,698 | ) |

| | | | | | | | | | | | |

Other income (expense)(3) | | | (5,153 | ) | | — | | | (5,153 | ) | | — | | | (5,153 | ) |

| | | | | | | | | | | | |

Loss before provision for income taxes | | | (47,851 | ) | | — | | | (47,851 | ) | | — | | | (47,851 | ) |

| | Provision for income taxes | | | 3,835 | | | — | | | 3,835 | | | — | | | 3,835 | |

| | | | | | | | | | | | |

Net loss | | | (51,686 | ) | | — | | | (51,686 | ) | | — | | | (51,686 | ) |

| | Less: net loss attributable to noncontrolling int. | | | 9,506 | | | 27,290 | (4) | | 36,796 | | | (7,297) | (4) | | 29,499 | |

| | | | | | | | | | | | |

| | Net loss attributable to members of First Wind Holdings(5) | | $ | (42,180 | ) | $ | 27,290 | | $ | (14,890 | ) | $ | (7,297 | ) | $ | (22,187 | ) |

| | | | | | | | | | | | |

Pro forma net loss per share (basic)(6) | | $ | (0.06 | ) | | | | $ | (0.77 | ) | | | | $ | (0.56 | ) |

| | | | | | | | | | | | | | |

Shares used in computing pro forma net loss per share (basic)(6) | | | 649,681,382 | | | (630,394,755) | (6) | | 19,286,627 | | | 20,000,000 | (6) | | 39,286,627 | |

| | | | | | | | | | | | |

- (1)

- As a newly formed entity, First Wind Holdings Inc. will have no assets or results of operations until the completion of this offering.

- (2)

- Historical amounts include stock-based compensation expense for our Series B Unit Awards. We anticipate issuing to employees options to purchase shares of our Class A common stock concurrently with the offering. These stock option awards will have an exercise price equal to the offering price of $20.00 per share and will generally vest over the average remaining vesting period of an employee's unvested Series B Unit Awards. Since this award is discretionary, no pro forma adjustment has been made. We anticipate that this award will result in approximately $ million of incremental stock-based compensation expense in the year following the offering over the $ that would have been recorded for the outstanding Series B Unit Awards.

- (3)

- Interest on anticipated cash proceeds from this offering is excluded from the pro forma presentation. We expect to receive net proceeds from this offering of $372.0 million based on an aggregate underwriting discount of $25.0 million and estimated offering expenses of $3.0 million. We intend to use approximately $ million of our net proceeds from this offering to fund a portion of our capital expenditures for 2010–2013 and the remainder for general corporate purposes. We expect that interest income on the net proceeds at current market rates would total approximately $ million on an annual basis.

- (4)

- As described in "The Reorganization and Our Holding Company Structure," following this offering, and the reorganization transactions that we are undertaking in connection therewith, our only material asset will be our ownership of approximately 52.6% of the membership units of First Wind Holdings, LLC and our only business will be to act as the sole managing member of First Wind Holdings, LLC. As such, we will operate and control all of its business and affairs and will consolidate its financial results into our financial statements. The ownership interests of the other members of First Wind Holdings, LLC will be accounted for as a noncontrolling interest in our consolidated financial statements after this offering.

47

Represents adjustments to reflect noncontrolling interest resulting from the existing members' ownership interest of 100% of the Series B Units of First Wind Holdings, LLC.

- (5)

- First Wind Holdings, LLC is currently taxed as a partnership for federal income tax purposes. Therefore, First Wind Holdings, LLC is not subject to entity-level federal income taxation, with the exception of certain subsidiaries that have elected to be treated as corporations under the Internal Revenue Code, and taxes with respect to income of First Wind Holdings, LLC are payable by First Wind Holdings, LLC's equity holders at rates applicable to them. Following this offering, and the reorganization that we are undertaking in connection therewith, earnings recorded by us will be subject to federal income taxation. For the period presented, our loss before provision for income taxes would have resulted in a net income tax benefit. This net income tax benefit is not recognized in the pro forma presentation since it would be offset by a valuation allowance.

- (6)

- Basic and diluted net income per share was computed by dividing the pro forma net income attributable to our Class A stockholders by the 20,000,000 shares of Class A common stock that we will issue and sell in this offering (assuming that the underwriters do not exercise their option to purchase an additional 3,000,000 shares of Class A common stock to cover over-allotments), plus 19,286,627 shares issued in connection with our initial capitalization, assuming that these 39,286,627 shares of Class A common stock were outstanding for the entirety of each of the historical periods presented on a pro forma basis. No pro forma effect was given to the future potential exchanges of the 35,413,373 Series B Membership Interests of our subsidiary, First Wind Holdings, LLC, together with an equal number of shares of our Class B common stock, that will be outstanding immediately after the completion of this offering and the reorganization transactions for the equal number of shares of our Class A common stock because the issuance of shares of Class A common stock upon these exchanges would not be dilutive.

A $1.00 increase (decrease) in the assumed initial public offering price of $20.0 per share would increase (decrease) each of the pro forma as adjusted cash and cash equivalents and stockholders' equity by $20.0 million, after deducting estimated underwriting discounts and commissions and estimated offering expenses. The pro forma as adjusted information discussed above is illustrative only and following completion of this offering will be adjusted based on the actual offering price and other terms of this offering determined at pricing.

48

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of our Class A common stock and Class B common stock as of , by (i) each person who, to our knowledge, beneficially owns more than 5% of our Class A common stock or our Class B common stock; (ii) each of our directors and named executive officers; and (iii) all of our executive officers and directors as a group. The information set forth below gives effect to our reorganization and assumes the sale of 20,000,000 shares of our Class A common stock in this offering at an assumed initial public offering price of $20.00 per share (the midpoint of the range set forth on the cover of this prospectus). The information in the following table may change based on the actual initial public offering price. See "The Reorganization and Our Holding Company Structure." The information set forth below after this offering assumes the sale of 20,000,000 shares of our Class A common stock in this offering and no exercise of the underwriters' over-allotment option.

The number of shares beneficially owned by each stockholder is determined under SEC rules. Under these rules, beneficial ownership includes any shares as to which the stockholder has sole or shared voting power or investment power. Each of the stockholders listed below has sole voting and investment power with respect to the stockholder's shares unless noted otherwise, subject to community property laws where applicable. Shares of common stock that may be acquired by a stockholder within 60 days following pursuant to the exercise of options are deemed to be outstanding for the purpose of computing the percentage ownership of such stockholder but are not deemed to be outstanding for computing the percentage ownership of any other stockholder.

| | | | | | | | | | | | | | | | | | | | |

| |

| | Percentage of

Shares of

Class A Common

Stock

Beneficially

Owned(1) | |

| | Percentage of

Shares of

Class B Common

Stock

Beneficially

Owned(1) | |

|---|

| | Shares of

Class A

Common

Stock

Beneficially

Owned(1) | | Shares of

Class B

Common

Stock

Beneficially

Owned(1) | |

|---|

Name | | Before

Offering | | After

Offering | | Before

Offering | | After

Offering | |

|---|

Stockholders owning 5% or more: | | | | | | | | | | | | | | | | | | | |

| | The D. E. Shaw group(2) | | | 19,286,627 | | | 100 | % | | 49.1 | % | | 6,329,373 | | | 17.9 | % | | 17.9 | % |

| | Madison Dearborn(3) | | | — | | | — | | | — | | | 25,615,600 | | | 72.3 | % | | 72.3 | % |

Directors and executive officers: | | | | | | | | | | | | | | | | | | | |

| | Paul Gaynor(4) | | | — | | | — | | | — | | | 320,300 | | | * | | | * | |