UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________________________

Form 10-Q

__________________________________________________________

(Mark One)

|

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-35281

__________________________________________________________

Forbes Energy Services Ltd.

(Exact name of registrant as specified in its charter)

__________________________________________________________

|

| | |

| Delaware | | 98-0581100 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

3000 South Business Highway 281 Alice, Texas | | 78332 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(361) 664-0549

__________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| | | | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| | | | |

| | | Emerging growth company | ¨ |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ Yes x No

The number of shares of common stock, par value $0.04 per share, of Forbes Energy Services Ltd. outstanding prior to its emergence from bankruptcy on April 13, 2017 was 22,214,855 and after such emergence was zero. The number of shares of common stock, par value $0.01 per share, of Forbes Energy Services Ltd. outstanding as of May 11, 2017 was 5,249,997.

FORBES ENERGY SERVICES LTD.

TABLE OF CONTENTS

|

| | |

| | | Page |

| |

| Item 1. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | Other Information | |

| Item 6. | Exhibits | |

| | Signatures | |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and any oral statements made in connection with it include certain forward-looking statements within the meaning of the federal securities laws. You can generally identify forward-looking statements by the appearance in such a statement of words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or “should” or other comparable words or the negative of these words. When you consider our forward-looking statements, you should keep in mind the risk factors we describe and other cautionary statements we make in this Quarterly Report on Form 10-Q. Our forward-looking statements are only predictions based on expectations that we believe are reasonable. Our actual results could differ materially from those anticipated in, or implied by, these forward-looking statements as a result of known risks and uncertainties set forth below and elsewhere in this Quarterly Report on Form 10-Q. These factors include or relate to the following:

| |

| • | increased advisory costs to execute our reorganization; |

| |

| • | the effect of the industry-wide downturn in energy exploration and development activities; |

| |

| • | continuing incurrence of operating losses due to such downturn; |

| |

| • | oil and natural gas commodity prices; |

| |

| • | market response to global demands to curtail use of oil and natural gas; |

| |

| • | capital budgets and spending by the oil and natural gas industry; |

| |

| • | the ability or willingness of the Organization of Petroleum Exporting Countries, or OPEC, to set and maintain production levels for oil; |

| |

| • | oil and natural gas production levels by non-OPEC countries; |

| |

| • | supply and demand for oilfield services and industry activity levels; |

| |

| • | our ability to maintain stable pricing; |

| |

| • | our level of indebtedness; |

| |

| • | possible impairment of our long-lived assets; |

| |

| • | potential for excess capacity; |

| |

| • | substantial capital requirements; |

| |

| • | significant operating and financial restrictions under our loan and security agreement which provides for a term loan of $50.0 million, or the New Loan Agreement; |

| |

| • | technological obsolescence of operating equipment; |

| |

| • | dependence on certain key employees; |

| |

| • | concentration of customers; |

| |

| • | substantial additional costs of compliance with reporting obligations, the Sarbanes-Oxley Act and New Loan Agreement covenants; |

| |

| • | seasonality of oilfield services activity; |

| |

| • | collection of accounts receivable; |

| |

| • | environmental and other governmental regulation, including potential climate change legislation; |

| |

| • | the potential disruption of business activities caused by the physical effects, if any, of climate change; |

| |

| • | risks inherent in our operations; |

| |

| • | ability to fully integrate future acquisitions; |

| |

| • | variation from projected operating and financial data; |

| |

| • | variation from budgeted and projected capital expenditures; |

| |

| • | volatility of global financial markets; and |

| |

| • | the other factors discussed under “Risk Factors” beginning on page 11 of the Annual Report on Form 10-K for the year ended December 31, 2016. |

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent these risks, uncertainties and assumptions give rise to events that vary from our expectations, the forward-looking events discussed in this Quarterly Report on Form 10-Q may not occur. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

Forbes Energy Services Ltd.

(Debtor-in-Possession through April 12, 2017)

Condensed Consolidated Balance Sheets (unaudited)

(in thousands, except par value amounts)

|

| | | | | | | |

| | March 31,

2017 | | December 31,

2016 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 17,647 |

| | $ | 20,437 |

|

| Cash - restricted | 27,579 |

| | 27,563 |

|

| Accounts receivable - trade, net of allowance for doubtful accounts of $1.5 million and $1.4 million as of March 31, 2017, and December 31, 2016, respectively | 16,889 |

| | 16,962 |

|

| Accounts receivable - other | 664 |

| | 290 |

|

| Prepaid expenses and other | 6,556 |

| | 7,957 |

|

| Other current assets | — |

| | 821 |

|

| Total current assets | 69,335 |

| | 74,030 |

|

| Property and equipment, net | 221,538 |

| | 233,362 |

|

| Intangible assets, net | 3,086 |

| | 3,220 |

|

| Other assets | 2,376 |

| | 2,269 |

|

| Total assets | $ | 296,335 |

| | $ | 312,881 |

|

| Liabilities and Shareholders’ Deficit | | | |

| Current liabilities | | | |

| Current portions of long-term debt | $ | 18,806 |

| | $ | 298,932 |

|

| Accounts payable - trade | 7,424 |

| | 4,505 |

|

| Accounts payable - related parties | — |

| | 18 |

|

| Accrued interest payable | 300 |

| | 26,578 |

|

| Accrued expenses | 9,869 |

| | 8,740 |

|

| Total current liabilities | 36,399 |

| | 338,773 |

|

| Long-term debt, net of current portion | 121 |

| | 240 |

|

| Deferred tax liability | 1,052 |

| | 1,096 |

|

| Liabilities subject to compromise | 308,431 |

| | — |

|

| Total liabilities | 346,003 |

| | 340,109 |

|

| | | | |

| Commitments and contingencies (Note 10) | — |

| | — |

|

| | | | |

| Temporary equity | | | |

| Series B senior convertible preferred shares, 588 shares outstanding at March 31, 2017 and December 31, 2016 | 15,344 |

| | 15,298 |

|

| Shareholders’ deficit | | | |

| Common stock, $.04 par value, 112,500 shares authorized, 22,215 shares issued and outstanding at March 31, 2017 and December 31, 2016 | 889 |

| | 889 |

|

| Additional paid-in capital | 193,431 |

| | 193,477 |

|

| Accumulated deficit | (259,332 | ) | | (236,892 | ) |

| Total shareholders’ deficit | (65,012 | ) | | (42,526 | ) |

| Total liabilities and shareholders’ deficit | $ | 296,335 |

| | $ | 312,881 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forbes Energy Services Ltd.

(Debtor-in-Possession through April 12, 2017)

Condensed Consolidated Statements of Operations (unaudited)

(in thousands, except per share amounts)

|

| | | | | | | | |

| | Three months ended March 31, | |

| | 2017 | | 2016 | |

| Revenues | | | | |

| Well servicing | $ | 17,105 |

| | $ | 18,713 |

| |

| Fluid logistics | 9,942 |

| | 13,218 |

| |

| Total revenues | 27,047 |

|

| 31,931 |

| |

| Expenses | | | | |

| Well servicing | 14,140 |

| | 16,720 |

| |

| Fluid logistics | 9,948 |

| | 13,161 |

| |

| General and administrative | 4,512 |

| | 6,056 |

| |

| Depreciation and amortization | 12,068 |

| | 13,489 |

| |

| Total expenses | 40,668 |

|

| 49,426 |

| |

| Operating loss | (13,621 | ) |

| (17,495 | ) | |

| Other income (expense) | | | | |

| Interest income | 13 |

| | 22 |

| |

| Interest expense (excludes contractual interest of $4.7 million on Prior Senior Notes subject to compromise for the period January 22, 2017 through March 31, 2017) | (2,214 | ) | | (6,946 | ) | |

| Reorganization costs | (6,587 | ) | | — |

| |

| Pre-tax loss | (22,409 | ) |

| (24,419 | ) | |

| Income tax expense | 31 |

| | 49 |

| |

| Net loss | (22,440 | ) |

| (24,468 | ) |

|

| Preferred stock dividends | (46 | ) | | (194 | ) | |

| Net loss attributable to common shareholders | $ | (22,486 | ) |

| $ | (24,662 | ) | |

| Loss per share of common stock | | | | |

| Basic and diluted loss per share | $ | (1.01 | ) | | $ | (1.11 | ) | |

| Weighted average number of shares outstanding | | | | |

| Basic and diluted | 22,215 |

| | 22,210 |

| |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forbes Energy Services Ltd.

(Debtor-in-Possession through April 12, 2017)

Condensed Consolidated Statement of Changes in Shareholders’ Deficit (unaudited)

(in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Temporary Equity | | Permanent Equity |

| | Preferred Shares | | Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Total Shareholders’ Deficit |

| | Shares | | Amount | | Shares | | Amount | | | |

| Balance: December 31, 2016 | 588 |

| | $ | 15,298 |

| | 22,215 |

| | $ | 889 |

| | $ | 193,477 |

| | $ | (236,892 | ) | | $ | (42,526 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | — |

| | (22,440 | ) | | (22,440 | ) |

Preferred shares dividends and accretion | — |

| | 46 |

| | — |

| | — |

| | (46 | ) | | — |

| | (46 | ) |

| Balance: March 31, 2017 | 588 |

| | $ | 15,344 |

| | 22,215 |

| | $ | 889 |

| | $ | 193,431 |

| | $ | (259,332 | ) | | $ | (65,012 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forbes Energy Services Ltd.

(Debtor-in-Possession through April 12, 2017)

Condensed Consolidated Statements of Cash Flows (unaudited)

(in thousands)

|

| | | | | | | |

| | Three months ended March 31, |

| | 2017 | | 2016 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (22,440 | ) | | $ | (24,468 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization | 12,068 |

| | 13,489 |

|

| Share-based compensation | — |

| | 70 |

|

| Reorganization items | 2,104 |

| | — |

|

| Deferred tax (benefit) expense | (44 | ) | | 49 |

|

| (Gain) loss on disposal of assets, net | (700 | ) | | 676 |

|

| Bad debt expense | 175 |

| | 643 |

|

| Amortization of deferred financing cost | 234 |

| | 355 |

|

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (477 | ) | | 7,440 |

|

| Prepaid expenses and other assets | (71 | ) | | 1,032 |

|

| Accounts payable - trade | 3,519 |

| | (282 | ) |

| Accounts payable - related parties | (18 | ) | | (4 | ) |

| Accrued expenses | 1,122 |

| | 2,270 |

|

| Accrued interest payable | 1,546 |

| | 6,242 |

|

| Net cash (used in) provided by operating activities | (2,982 | ) | | 7,512 |

|

| Cash flows from investing activities: | | | |

| Proceeds from sale of property and equipment | 979 |

| | — |

|

| Purchases of property and equipment | (377 | ) | | (3,065 | ) |

| Change in restricted cash | — |

| | 51 |

|

| Net cash provided by (used in) investing activities | 602 |

| | (3,014 | ) |

| Cash flows from financing activities: | | | |

| Change in restricted cash | (16 | ) | | — |

|

| Payments of debt | (394 | ) | | (1,052 | ) |

| Payment of tax withholding obligations related to restricted stock | — |

| | (110 | ) |

| Dividends paid on Series B senior convertible preferred shares | — |

| | (184 | ) |

| Net cash used in financing activities | (410 | ) | | (1,346 | ) |

| Net (decrease) increase in cash and cash equivalents | (2,790 | ) | | 3,152 |

|

| Cash and cash equivalents: | | | |

| Beginning of period | 20,437 |

| | 74,611 |

|

| End of period | $ | 17,647 |

| | $ | 77,763 |

|

| | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forbes Energy Services Ltd.

(Debtor-in-Possession through April 12, 2017)

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Organization and Nature of Operations

Nature of Business

Forbes Energy Services Ltd., or FES Ltd., is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include fluid hauling, fluid disposal, well maintenance, completion services, workovers and re-completions, plugging and abandonment, and tubing testing. Our operations are concentrated in the major onshore oil and natural gas producing regions of Texas, with an additional location in Pennsylvania. We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers' wells. Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

As used in these Consolidated Financial Statements, the “Company,” “we,” and “our” mean FES Ltd. and its direct and indirect subsidiaries, except as otherwise indicated.

Chapter 11 Proceedings

On January 22, 2017, FES Ltd. and its domestic subsidiaries, or collectively, the Debtors, filed voluntary petitions, or the Bankruptcy Petitions, for reorganization under chapter 11 of the United States Bankruptcy Code, or the Bankruptcy Code, in the United States Bankruptcy Court for the Southern District of Texas-Corpus Christi Division, or the Bankruptcy Court, pursuant to the terms of a restructuring support agreement that contemplated the reorganization of the Debtors pursuant to a prepackaged plan of reorganization, as amended and supplemented, the Plan. On March 29, 2017, the Bankruptcy Court entered an order, or the Confirmation Order, confirming the Plan. On April 13, 2017, or the Effective Date, the Plan became effective pursuant to its terms and the Debtors emerged from their chapter 11 cases. Although the Debtors are no longer debtors-in-possession, the Debtors were debtors-in-possession for the entire quarter ended March 31, 2017. As such, certain aspects of the bankruptcy proceedings of the Debtors and related matters are described below in order to provide context and explain part of the Company's financial condition and results of operations for the period presented.

Effect of the Bankruptcy Proceedings

During the bankruptcy proceedings, the Debtors conducted normal business activities and were authorized to pay certain vendor payments, wage payments and tax payments in the ordinary course. In addition, subject to certain specific exceptions under the Bankruptcy Code, the Bankruptcy Petitions automatically stayed most judicial or administrative actions against the Debtors or their property to recover, collect, or secure a prepetition claim. For example, the Bankruptcy Petitions prohibited lenders or note holders from pursuing claims for defaults under the Debtors’ debt agreements during the pendency of the chapter 11 cases.

The Plan

Under the Plan, which was approved by the Bankruptcy Court and became effective on the Effective Date,:

•FES Ltd. converted from a Texas corporation to a Delaware corporation;

•All prior equity interests (which included FES Ltd.’s prior common stock, par value $0.04 per share, or the Old Common Stock, FES Ltd.’s prior preferred stock, awards under FES Ltd.’s prior incentive compensation plans, or the Prior Compensation Plans, and the preferred stock purchase rights under the Rights Agreement dated as of May 19, 2008 and subsequently amended on July 8, 2013, or the Rights Agreement, between FES Ltd. and CIBC Mellon Trust Company, as rights agent) in FES Ltd. were extinguished without recovery;

•FES Ltd. created a new class of common stock, par value $0.01 per share, or the New Common Stock;

•FES Ltd.’s prior 9% senior notes due 2019, or the Prior Senior Notes, were canceled and each holder of the Prior Senior Notes received such holder’s pro rata share of (i) $20.0 million in cash and (ii) 100% of the New Common Stock, subject to dilution only as a result of the shares of New Common Stock issued or available

for issuance in connection with a management incentive plan, or the Management Incentive Plan. A total of 5,249,997 shares of New Common Stock was issued to the holders of the Prior Senior Notes;

•The Debtors entered into the New Loan Agreement, with certain financial institutions party thereto from time to time as lenders, or the Lenders, and Wilmington Trust, National Association, as agent for the Lenders;

•FES Ltd. adopted the Management Incentive Plan, which provides for the issuance of equity-based awards with respect to, in the aggregate, up to 750,000 shares of New Common Stock;

•The Debtors’ loan and security agreement governing their revolving credit facility, or the Prior Loan Agreement, dated as of September 9, 2011 and subsequently amended, with Regions Bank, or Regions, as the sole lender party thereto, or the Lender, was terminated and a new letter of credit facility was entered into with Regions, or the New Regions Letters of Credit Facility, which covers letters of credit and certain bank product obligations. Regions continues to hold the cash pledged to support the New Regions Letters of Credit Facility in the amount of $10.1 million as of May 11, 2017;

•The Debtors paid off the outstanding principal balance of $15 million plus outstanding interest and fees under the Prior Loan Agreement, and the Prior Loan Agreement was terminated in accordance with the Plan;

•Holders of allowed creditor claims, aside from holders of the Prior Senior Notes, received, on account of such claims, either payment in full in cash or otherwise had their rights reinstated; and

•FES Ltd. entered into a registration rights agreement with certain of its stockholders to provide registration rights.

On the Effective Date, the Debtors eliminated approximately $280.0 million in principal amount of the Prior Senior Notes plus accrued interest thereon.

Fresh Start Accounting

In connection with the Debtors' emergence from bankruptcy, the Company will be required to apply fresh start accounting to its financial statements because (i) the holders of Old Common Stock received none of the New Common Stock issued upon the Debtors' emergence from bankruptcy and (ii) the reorganization value of the Company's assets immediately prior to confirmation of the Plan was less than the post-petition liabilities and allowed claims. Fresh start accounting will be applied to the Company’s consolidated financial statements during the quarter ending June 30, 2017.

Financial Statement Classification of Liabilities Subject to Compromise

The Company's financial statements include amounts classified as liabilities subject to compromise, which represent liabilities that have been addressed in the chapter 11 cases. The Plan, as confirmed, provides for the treatment of claims against the Debtors’ bankruptcy estates, including prepetition liabilities. Certain claims were unimpaired under the Plan and remain pending against the Debtors. Such claims may be material and will be addressed in the ordinary course.

The following table summarizes the components of liabilities subject to compromise included on our condensed consolidated balance sheets as of March 31, 2017 and December 31, 2016 (in thousands):

|

| | | | | |

| | | | March 31, 2017 |

| | | | (in thousands) |

| | | | | |

| | Accounts payable and accrued liabilities | | $ | 607 |

|

| | Prior Senior Notes and accrued interest | | | 307,824 |

|

| | | | | |

| | | | $ | 308,431 |

|

Reorganization Items

The Debtors have incurred significant costs associated with the reorganization, principally professional fees. The amount of these costs, which are being expensed as incurred, significantly affect the Company's results of operations.

The following table summarizes the components included in reorganization items in the Company's condensed consolidated statements of operations for the three months ended March 31, 2017 (in thousands):

|

| | | | | | |

| | | | March 31, 2017 | |

| | | | (in thousands) | |

| | | | | | |

| | Reorganization legal and professional fees and expenses | | $ | 4,483 |

| |

| | Deferred loan costs expensed (1) | | | 2,104 |

| |

| | | | | | |

| | Reorganization items | | $ | 6,587 |

| |

(1) The amount shown reflects the deferred financing costs on the Prior Senior Notes that were written off in the

first quarter of 2017.

2. Risk and Uncertainties

As an independent oilfield services contractor that provides a broad range of drilling-related and production-related services to oil and natural gas companies, primarily onshore in Texas, our revenue, profitability, cash flows and future rate of growth are substantially dependent on our ability to (1) maintain adequate equipment utilization, (2) maintain adequate pricing for the services we provide, and (3) maintain a trained work force. Failure to do so could adversely affect our financial position, results of operations, and cash flows.

Because our revenues are generated primarily from customers who are subject to the same factors generally impacting the oil and natural gas industry, our operations are also susceptible to market volatility resulting from economic, cyclical, weather related, or other factors related to such industry. Changes experienced in the level of operating and capital spending in the industry, decreases in oil and natural gas prices, and/or industry perception about future oil and natural gas prices has materially decreased the demand for our services, and has had an adverse effect on our financial position, results of operations and cash flows.

3. Basis of Presentation

Reclassification

Certain prior period amounts have been reclassified to conform to the current year presentation with no material impact on consolidated net income or cash flows.

Interim Financial Information

The unaudited condensed consolidated financial statements of the Company are prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP, for interim financial reporting. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission. Therefore, these condensed consolidated financial statements should be read along with the annual audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2016. In management’s opinion, all adjustments necessary for a fair statement are reflected in the interim periods presented. Interim results for the three months ended March 31, 2017 may not be indicative of results that will be realized for the full year ending December 31, 2017. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated balance sheets and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates.

Recent Accounting Pronouncements

In January 2017, the Financial Accounting Standards Board, or the FASB, issued Accounting Standards Update, or ASU, No. 2017-01, or ASU 2017-01, "Clarifying the Definition of a Business." ASU 2017-01 provides guidance on whether or not an integrated set of assets and activities constitutes a business. ASU 2017-01 is effective for periods beginning after December 15, 2017 including interim periods within those periods, with early adoption permitted in specific instances. We have determined the adoption of this pronouncement will not have a material impact on our consolidated financial statements and related disclosures.

In November 2016, the FASB issued ASU No. 2016-18, "Statement of Cash Flows (Topic 230), Restricted Cash," or ASU 2016-18. ASU 2016-18 provides guidance on the presentation of restricted cash and restricted cash equivalents in the statement of cash flows. Restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period amounts shown on the statement of cash flows. The amendments of ASU 2016-18 should be applied using a retrospective transition method and are effective for reporting periods beginning after December 15, 2017 with early adoption permitted. We believe the adoption of this pronouncement will only change the presentation of the statement of cash flows for restricted cash.

In August 2016, the FASB issued ASU No. 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments,” or ASU 2016-15. ASU 2016-15 will make eight targeted changes to how cash receipts and cash payments are presented and classified in the statement of cash flows. ASU 2016-15 is effective for fiscal years beginning after December 15, 2017. The new standard will require adoption on a retrospective basis unless it is impracticable to apply, in which case, the new standard would apply the amendments prospectively as of the earliest date practicable. We are currently in the process of evaluating the impact of adoption on our consolidated financial statements.

In June 2016, the FASB issued ASU No. 2016-13, "Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments", or ASU 2016-13, which introduces a new impairment model for financial instruments that is based on expected credit losses rather than incurred credit losses. The new impairment model applies to most financial assets, including trade accounts receivable. The amendments in ASU 2016-13 are effective for interim and annual reporting periods beginning after December 15, 2019 with early adoption permitted for annual periods beginning after December 15, 2018. We will be evaluating the impact of adopting this pronouncement on our consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, "Leases (Topic 842)," or ASU 2016-02, which increases the transparency and comparability about leases among entities. The new guidance requires lessees to recognize a lease liability and a corresponding lease asset for operating leases with lease terms greater than 12 months. It also requires additional disclosures about leasing arrangements to help users of financial statements better understand the amount, timing, and uncertainty of cash flows arising from leases. ASU 2016-02 becomes effective for interim and annual periods beginning after December 15, 2018 and requires a modified retrospective approach to adoption. Early adoption is permitted. We have engaged a third party to assist in evaluating the impact of this new standard on our consolidated financial statements and related disclosures.

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606),” or ASU 2014-09, which provides guidance for revenue recognition and which supersedes nearly all existing revenue recognition guidance under ASU 2014-09. This ASU provides guidance that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. Additionally, the guidance permits two methods of transition upon adoption: full retrospective and modified retrospective. Under the full retrospective method, the standard would be applied to each prior reporting period presented. Under the modified retrospective method, the cumulative effect of applying the standard would be recognized at the date of initial application. In August 2015, the FASB issued final revised guidance that defers the effective date of the revenue recognition standard to be for annual and interim periods beginning after December 15, 2017, with early adoption permitted for interim and annual reporting periods beginning after December 15, 2016. We have engaged a third party to assist in evaluating the impact of this new standard on our consolidated financial statements and related disclosures.

Impairment

During the second quarter of 2016, the Company experienced a triggering event resulting from the continuing decline in operating revenues due to an industry-wide slowdown. An impairment loss of $14.5 million was recorded as a component of operating expenses based on the amount that the carrying value of certain intangibles exceeded the fair value of such intangibles during the second quarter of 2016. The Company continues to monitor facts and circumstances for asset impairment indicators for long-term assets. The Company did not experience any triggering events in the first quarter of 2017.

4. Intangible Assets

Our major class of intangible assets subject to amortization consists of trade names. The Company expenses costs associated with extensions or renewals of intangible assets. There were no such extensions or renewals in the three months ended March 31, 2017 and 2016. Amortization expense is calculated using the straight-line method over the period indicated. Amortization expense for the three months ended March 31, 2017 and 2016 was $0.1 million and $0.7 million, respectively. As noted in Note 3, an impairment of certain intangible assets of $14.5 million was recorded in the second quarter of 2016. Based upon our findings during the second quarter of 2016, the recoverable amount of the trade name was in excess of the carrying amount, and no impairment was indicated at that time. We did not experience any triggering events during the first quarter of 2017.

The following sets forth the identified intangible assets by major asset class: |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | As of March 31, 2017 | | As of December 31, 2016 |

| | Useful Life (years) | | Gross Carrying Value | | Accumulated Amortization | | Impairment | | Net Book Value | | Gross Carrying Value | | Accumulated Amortization | | Impairment | | Net Book Value |

| | | | (in thousands) |

| Trade names | 15 | | 8,050 |

| | (4,964 | ) | | — |

| | 3,086 |

| | 8,050 |

| | (4,830 | ) | | — |

| | 3,220 |

|

Estimated amortization expense of the trade names remaining for the years 2017 through 2022 is $0.5 million per year.

5. Share-Based Compensation

Bankruptcy Proceedings

As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, all prior equity interests (which included the Old Common Stock, FES Ltd.’s prior preferred stock, awards under the Prior Compensation Plans and the preferred stock purchase rights under the Rights Agreement) in FES Ltd. were extinguished without recovery.

Incentive Compensation Plans

From time to time, the Company grants stock options, restricted stock units, or other awards to its employees, including executive officers and directors. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, all awards then outstanding under the Prior Compensation Plans were extinguished without recovery and the Prior Compensation Plans were effectively terminated.

Stock Options

There were 602,625 stock options vested and exercisable at March 31, 2017.

For the three months ended March 31, 2017 and 2016, the Company recorded no expenses for share-based compensation related to stock options, as all outstanding options are fully vested. There was no share-based compensation expense capitalized for either of the three months ended March 31, 2017 or 2016. As of March 31, 2017, there was no unrecognized share-based compensation expense for stock options. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, all options then outstanding under the Prior Compensation Plans were extinguished without recovery.

Restricted Stock Units

The following table presents a summary of restricted stock unit grant activity for the three months ended March 31, 2017:

|

| | | | | | | | |

| | Liability Based | | | Grant Date Average Fair Value Per Unit |

| Outstanding at December 31, 2016 | 715,679 |

| | | $ | 1.53 |

| |

| Canceled | (715,679 | ) | | | | 1.53 |

| |

| Outstanding at March 31, 2017 | — |

| | | $ | — |

| |

On March 17, 2017, the outstanding restricted stock units were canceled. There was no share-based compensation expense for restricted stock units for the three months ended March 31, 2017 and $0.1 million for the three months ended March 31, 2016.

6. Property and Equipment

Property and equipment consisted of the following:

|

| | | | | | | | | |

| | Estimated Life in Years | | March 31,

2017 | | December 31,

2016 |

| | | | (in thousands) |

| Well servicing equipment | 9-15 years | | $ | 409,321 |

| | $ | 411,199 |

|

| Autos and trucks | 5-10 years | | 121,347 |

| | 126,580 |

|

| Disposal wells | 5-15 years | | 37,748 |

| | 37,752 |

|

| Building and improvements | 5-30 years | | 14,125 |

| | 14,125 |

|

| Furniture and fixtures | 3-15 years | | 6,836 |

| | 6,779 |

|

| Land | | | 1,524 |

| | 1,524 |

|

| | | | 590,901 |

| | 597,959 |

|

| Accumulated depreciation | | | (369,363 | ) | | (364,597 | ) |

| | | | $ | 221,538 |

| | $ | 233,362 |

|

Depreciation expense was $12.0 million and $12.8 million for the three months ended March 31, 2017, and 2016, respectively.

7. Long-Term Debt

Long-term debt at March 31, 2017 and December 31, 2016 consisted of the following:

|

| | | | | | | |

| | March 31,

2017 | | December 31,

2016 |

| | (in thousands) |

Prior Senior Notes, net of deferred financing costs of $2.3 million as of December 31, 2016 (1) | $ | — |

| | $ | 277,662 |

|

| Revolving credit facility | 15,000 |

| | 15,000 |

|

| Capital leases | 988 |

| | 1,386 |

|

| Insurance notes | 2,939 |

| | 5,124 |

|

| | 18,927 |

| | 299,172 |

|

| Less: Current portion | (18,806 | ) | | (298,932 | ) |

| | $ | 121 |

| | $ | 240 |

|

(1) Classified as Liabilities subject to compromise as of March 31, 2017.

Prior Senior Notes

On June 7, 2011, FES Ltd. issued $280.0 million in principal amount of the Prior Senior Notes, which were guaranteed by Forbes Energy Services LLC, or FES LLC, C.C. Forbes, LLC, or CCF, TX Energy Services, LLC, or TES, and Forbes Energy International, LLC, or FEI. FES Ltd.’s failure to make the semi-annual interest payments on the Prior Senior Notes on June 15, 2016 and December 15, 2016 after the cure periods provided for in the indenture governing the Prior Senior Notes, or the Prior Senior Indenture, and other events of default resulting from technical breaches of covenants under the Prior Senior Indenture, or, collectively, the Prior Indenture Defaults, could have resulted in all outstanding indebtedness due under the Prior Senior Indenture immediately becoming due and payable. However, as discussed in Note 1 - Chapter 11 Proceedings, any efforts to enforce such payment obligations were automatically stayed as a result of the filing of the Bankruptcy Petitions, and the creditors' rights of enforcement in respect of the Prior Senior Indenture were subject to the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the Prior Senior Notes were canceled and each holder of the Prior Senior Notes received such holder’s pro rata share of (i) $20 million in cash and (ii) 100% of the New Common Stock, subject to dilution only as a result of the shares of New Common Stock issued or available for issuance in connection with the Management Incentive Plan.

Revolving Credit Facility

On September 9, 2011, the Debtors entered into the Prior Loan Agreement. Under cross default provisions in the Prior Loan Agreement, an event of default under the Prior Senior Indenture constituted an event of default under the Prior Loan Agreement. As mentioned above, the Debtors experienced the Prior Indenture Defaults under the Prior Senior Indenture and, thus, constituted an event of default under the Prior Loan Agreement, or the Prior Loan Defaults. The Prior Indenture Defaults and the Prior Loan Defaults could have resulted in all outstanding indebtedness due under the Prior Senior Indenture and the Prior Loan Agreement becoming immediately due and payable. However, as discussed in Note 1 - Chapter 11 Proceedings, any efforts to enforce such payment obligations were automatically stayed as a result of the filing of the Bankruptcy Petitions, and the creditors' rights of enforcement in respect of the Prior Senior Indenture and the Prior Loan Agreement were subject to the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the outstanding principal balance of $15.0 million plus outstanding interest and fees under the Prior Loan Agreement was paid off and the Prior Loan Agreement was terminated in accordance with the Plan. Additionally, on the Effective Date, the Debtors entered into the New Regions Letters of Credit Facility to cover letters of credit and certain bank product obligations.

New Loan Agreement

As discussed previously, on the Effective Date, the Company entered into the New Loan Agreement. FES LLC is the borrower, or the Borrower, under the New Loan Agreement. The Borrower’s obligations have been guaranteed by the FES Ltd. and by TES, CCF and FEI, each direct subsidiaries of the Borrower and indirect subsidiaries of FES Ltd. The New Loan Agreement provides for a term loan of $50.0 million. Subject to certain exceptions and permitted encumbrances, the obligations under this loan are secured by a first priority security interest in substantially all the assets of the Company other than cash collateralizing the New Regions Letters of Credit Facility. Such term loan has a stated maturity date of April 13, 2021. The proceeds of such term loan are only permitted to be used for (i) the payment on account of the Prior Senior Notes in an amount equal to $20.0 million; (ii) the payment of costs, expenses and fees incurred on or prior to the Effective Date in connection with the preparation, negotiation, execution and delivery of the New Loan Agreement and documents related thereto; and (iii) subject to satisfaction of certain release conditions set forth in the New Loan Agreement, for general operating, working capital and other general corporate purposes of the Borrower not otherwise prohibited by the terms of the New Loan Agreement.

Borrowings under this term loan bear interest at a rate equal to five percent (5%) per annum payable quarterly in cash, or the Cash Interest Rate, plus (ii) an initial PIK interest rate of seven percent (7%) commencing July 1, 2017 to be capitalized and added to the principal amount of the term loan or, at the election of the Borrower, paid in cash. The PIK interest increases by two percent (2%) twelve months after the Effective Date and every twelve months thereafter until maturity. Upon and after the occurrence of an event of default, the Cash Interest Rate will increase by two percentage points per annum.

The Borrower is also responsible for certain other administrative fees and expenses. In connection with the execution of the New Loan Agreement, the Borrower paid the Lenders a funding fee of $3.0 million, and paid certain Lenders a backstop fee of $2.0 million. The $20.0 million payment referred to above and these fees were funded as draws under the New Loan Agreement.

The Company is able to voluntarily repay the outstanding term loan at any time without premium or penalty. The Company is required to use the net proceeds from certain events, including but not limited to, the disposition of assets, certain judgments, indemnity payments, tax refunds, pension plan refunds, insurance awards and certain incurrences of indebtedness to repay outstanding loans under the New Loan Agreement. The Company may also be required to use cash in excess of $20.0 million to repay outstanding loans under the New Loan Agreement.

The New Loan Agreement includes customary negative covenants for an asset-based term loan, including covenants limiting the ability of the Company to, among other things, (i) effect mergers and consolidations, (ii) sell assets, (iii) create or suffer to exist any lien, (iv) make certain investments, (v) incur debt and (vi) transact with affiliates. In addition, the New Loan Agreement includes customary affirmative covenants for an asset-based term loan, including covenants regarding the delivery of financial statements, reports and notices to the Agent. The New Loan Agreement also contains customary representations and warranties and event of default provisions for a secured term loan.

New Regions Letters of Credit Facility

As discussed previously, on the Effective Date, the outstanding principal balance of $15.0 million plus outstanding interest and fees under the Prior Loan Agreement was paid off and the Prior Loan Agreement was terminated in accordance with the Plan. On the Effective Date, the Company entered into the New Regions Letters of Credit Facility to cover letters of credit and certain bank product obligations existing on the Effective Date and pursuant to which Regions may issue, upon request by the Company, letters of credit and continue to provide charge cards for use by the Company. Amounts available under the New Regions Letters of Credit Facility are subject to customary fees and are secured by a first-priority lien on, and security interest in, a cash collateral account with Regions containing cash equal to at least (i) 105% of the sum of (a) all amounts owing for any drawings under letters of credit, including any reimbursement obligations, (b) the aggregate undrawn amount of all outstanding letters of credit, (c) all sums owing to Regions or any affiliate pursuant to any letter of credit document and (d) all obligations of the Company arising thereunder, including any indemnitees and obligations for reimbursement of expenses and (ii) 120% of the aggregate line of credit for charge cards issued by Regions to the Company. The fees for each letter of credit for the period from and excluding the date of issuance of such letter of credit to and including the date of expiration or termination, are equal to (x) the average daily face amount of each outstanding letter of credit multiplied by (y) a per annum rate determined by Regions from time to time in its discretion based upon such factors as Regions shall determine, including, without limitation, the credit quality and financial performance of the Company. As of the Effective Date, such rate was 3.00%. In the event the Company is unable to repay amounts due under the New Regions Letters of Credit Facility, Regions could proceed against such cash collateral account. Regions has no commitment under the New Regions Letters of Credit Facility to issue letters of credit.

Capital Leases

The Company financed the purchase of certain vehicles and equipment through commercial loans and capital leases with aggregate principal amounts outstanding as of March 31, 2017 and December 31, 2016 of approximately $1.0 million and $1.4 million, respectively. These loans are repayable in a range of 42 to 60 monthly installments with the maturity dates ranging from April 2017 to July 2018. Interest accrues at rates ranging from 3.1% to 8.4% and is payable monthly. The loans are collateralized by equipment purchased with the proceeds of such loans. The Company paid total principal payments of approximately $0.4 million and $1.1 million for the three months ended March 31, 2017 and 2016, respectively.

Following are required principal payments due on notes and capital leases (other than the 9% Senior Notes) existing as of March 31, 2017:

|

| | | | | | | | | | | | | | | | | | |

| | April - December 2017 | | 2018 | | 2019 | | 2020 | 2021 and thereafter |

| | (in thousands) | |

| Capital lease principal payments | $ | 748 |

| | $ | 240 |

| | $ | — |

| | $ | — |

| $ | — |

|

Management has historically acquired all light duty trucks (pickup trucks) through capital leases and may use capital leases or cash to purchase equipment held under operating leases that have reached the end of the lease term. See Note 10 - Commitments and Contingencies.

Insurance Notes

During October of 2016, the Company entered into an insurance promissory note for the payment of insurance premiums at an interest rate of 2.9% with an aggregate principal amount outstanding as of March 31, 2017 and December 31, 2016, of approximately $2.9 million and $5.1 million, respectively.

8. Fair Value of Financial Instruments

Fair value is defined as the amount that would be received for the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The carrying amounts of cash and cash equivalents, accounts receivable-trade, accounts receivable-other, accounts payable-trade, and insurance notes, approximate fair value because of the short maturity of these instruments. The fair values of third party notes and equipment notes approximate their carrying values, based on current market rates at which the Company could borrow funds with similar maturities (Level 2 in the fair value hierarchy).

|

| | | | | | | | | | | | | | | |

| | March 31, 2017 | | December 31, 2016 |

| | Carrying Amount | | Fair Value | | Carrying Amount | | Fair Value |

| | (in thousands) |

| Prior Senior Notes | $ | 280,000 |

| | $ | 95,200 |

| | $ | 277,662 |

| | $ | 98,570 |

|

The fair value of our 9% Senior Notes is a Level 1 input within the fair value hierarchy and is based on the dealer quoted market prices at March 31, 2017 and December 31, 2016, respectively.

Fair Value on a Non-Recurring Basis

The Company has assets measured and recorded at fair value on a non-recurring basis. These nonfinancial assets include property, plant and equipment and intangible assets for which fair value is calculated in connection with impairment testing. These fair value calculations incorporate a market and a cost approach and the inputs include projected revenue, costs, equipment utilization and other assumptions. Given the unobservable inputs, these fair value measurements are classified as Level 3.

9. Related Party Transactions

The Company enters into transactions with related parties in the normal course of conducting business. The following tables represent related party transactions.

|

| | | | | | | | | |

| | | As of | |

| | | March 31,

2017 | | December 31, 2016 | |

| | | (in thousands) | |

| Related parties cash and cash equivalents balances: | | | | | |

Balance at Texas Champion Bank (1) | | $ | 160 |

| | $ | 295 |

| |

| | | | | | |

| Related parties payable: | | | | | |

Texas Quality Gate Guard Services, LLC (2) | | — |

| | 18 |

| |

| | | $ | — |

| | $ | 18 |

| |

| | | | | | |

There were no related party receivables as of March 31, 2017 and December 31, 2016.

There were no related party capital expenditures for the three months ended March 31, 2017 and 2016 .

|

| | | | | | | | | |

| | | | | | |

| | | Three months ended March 31, | |

| | | 2017 | | 2016 | |

| | | (in thousands) | |

| Related parties revenue activity: | | | | | |

Tasco Tool Services, Ltd. (3) | | $ | 1 |

| | $ | — |

| |

| | | $ | 1 |

| | $ | — |

| |

| | | | | | |

|

| | | | | | | | | |

| | | | | | |

| Related parties expense activity: | | | | | |

Alice Environmental Services, LP/Alice Environmental Holdings, LLC (4) | | $ | 223 |

| | $ | 298 |

| |

Tasco Tool Services, Ltd. (3) | | 9 |

| | 7 |

| |

Texas Quality Gate Guard Services, LLC (2) | | 41 |

| | 45 |

| |

Animas Holdings, LLC (5) | | 48 |

| | 40 |

| |

CJW Group, LLC (6) | | 9 |

| | 9 |

| |

| | | $ | 330 |

| | $ | 399 |

| |

|

| | | | | | | | | |

| Other payments to related parties: | | | | | |

SB Factoring, LLC (7) | | $ | 73 |

| | $ | 128 |

| |

| | | $ | 73 |

| | $ | 128 |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)The Company has a deposit relationship with Texas Champion Bank. Travis Burris, who served as a Company director until the Effective Date, is the President, Chief Executive Officer, and director of Texas Champion Bank. John E. Crisp, or Mr. Crisp, an executive officer and director of the Company, serves on the board of directors of Texas Champion Bank.

(2)Texas Quality Gate Guard Services, LLC, or Texas Quality Gate Guard Services, is an entity owned by Mr. Crisp and Charles C. Forbes, Jr., and a son of Mr. Crisp. Texas Quality Gate Guard Services has provided security services to the Company. Mr. Forbes served as a Company director and an executive officer until the Effective Date.

(3)Tasco Tool Services, Ltd., or Tasco, is a down-hole tool company that is partially owned and managed by a company that is partially owned by Mr. Forbes. Tasco rents and sells tools to the Company from time to time.

(4)Messrs. Crisp and Forbes are also owners and managers of Alice Environmental Holdings, LLC, or AEH, and indirect owners and managers of Alice Environmental Services, LP, or AES and Alice Environmental West Texas, LLC, or AEWT. The Company leases or rents land and buildings, and formerly leased aircraft from AES. During January 2015, the Company purchased land from AEWT for an additional operating location. The aircraft leases were terminated during the third quarter of 2015.

(5)Animas Holdings, LLC, or Animas, is owned by the two sons of Mr. Crisp and three children of Mr. Forbes. Animas owns land and property that it leases to the Company.

(6) CJW Group, LLC is an entity that leases office space to the Company and is partially owned by Messrs. Crisp and Forbes.

(7)From time to time, vendors of the Company factor their receivables from the Company and direct that the Company make payment of such factored amounts directly to the applicable factor. One such factor to whom payments have been made by the Company is SB Factoring LLC which is owned in part by each of Mr. Crisp and Mr. Forbes. The nature of these transactions does not result in recording in the Company’s financial records any revenue, any expense or any receivable and does not result in any payable distinct in amount from the amount payable to such vendors as originally incurred.

10. Commitments and Contingencies

Chapter 11 Proceedings

As discussed in Note 1 - Chapter 11 Proceedings, the Bankruptcy Petitions automatically stayed certain actions against the Debtors, including actions to collect prepetition liabilities or to exercise control over the property of the Debtors. The Plan, as confirmed, provides for the treatment of claims against the Debtors’ bankruptcy estates, including prepetition liabilities. Certain claims were unimpaired under the Plan and remain pending against the Debtors. Such claims may be material and will be addressed in the ordinary course.

Concentrations of Credit Risk

FDIC insurance coverage is currently $250,000 per depositor at each financial institution, and our non-interest bearing cash balances typically exceed federally insured limits. The Company restricts investment of temporary cash investments to financial institutions with high credit standings.

The Company's customer base consists primarily of multi-national and independent oil and natural gas producers. The Company does not require collateral on its trade receivables. For the three months ended March 31, 2017 the Company's largest customer, five largest customers, and ten largest customers constituted 14.3%, 45.1% and 56.4% of consolidated revenues, respectively. For the three months ended March 31, 2016 the Company's largest customer, five largest customers, and ten largest customers constituted 23.7%, 60.2% and 76.7% of consolidated revenues, respectively. For the three months ended March 31, 2017 two customers constituted 14.3% and 12.7% of consolidated revenues, respectively. The loss of any one of our top five customers would have a materially adverse effect on the revenues and profits of the Company. Further, our trade accounts receivable are from companies within the oil and natural gas industry and as such the Company is exposed to normal industry credit risks. As of March 31, 2017 the Company's largest customer, five largest customers, and ten largest customers constituted 20.7%, 46.3% and 61.5% of accounts receivable, respectively. As of March 31, 2017 two customers constituted 20.7% and 10.0% of accounts receivable, respectively.

Self-Insurance

The Company is self-insured under its Employee Group Medical Plan for the first $150 thousand per individual. The Company is self-insured with a retention for the first $250 thousand in general liability. The Company also retains the first $1.0 million within the auto liability buffer policy which is in excess of a primary $1.0 million auto liability limit. The Company has an additional premium payable clause under its lead $10.0 million limit excess policy that states in the event losses exceed $0.5 million, a loss additional premium of up to 15% of paid losses in excess of $0.5 million will be due. The loss additional premium is payable at the time when the loss is paid and will be payable over a period agreed by insurers. The Company has accrued liabilities totaling $6.4 million and $7.2 million as of March 31, 2017 and December 31, 2016, respectively, for the projected additional premium and self-insured portion of these insurance claims as of the financial statement dates. This accrual includes claims made as well as an estimate for claims incurred but not reported as of the financial statement dates.

Litigation

The Company is subject to various other claims and legal actions that arise in the ordinary course of business. We do not believe that any of these claims and actions, separately or in the aggregate, will have a material adverse effect on our business, financial condition, results of operations, or cash flows, although we cannot guarantee that a material adverse effect will not occur.

Off-Balance Sheet Arrangements

The Company is often party to certain transactions that constitute off-balance sheet arrangements such as performance bonds, guarantees, operating leases for equipment, and bank guarantees that are not reflected in our condensed consolidated balance sheets. These arrangements are made in our normal course of business and they are not reasonably likely to have a current or future material adverse effect on our financial condition, results of operations, liquidity, or cash flows. The Company's off-balance sheet arrangements include $9.0 million in letters of credit and operating leases for equipment, which are summarized in the table below.

Following are future lease payments on operating leases existing as of March 31, 2017:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | April - December 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 and thereafter |

| | (in thousands) | | | | |

| Lease payments | $ | 1,447 |

| | $ | 953 |

| | $ | 513 |

| | $ | 476 |

| | $ | 417 |

| | $ | 2,167 |

|

11. Supplemental Cash Flow Information

|

| | | | | | | |

| | Three months ended March 31, |

| | 2017 | | 2016 |

| | (in thousands) |

| Cash paid for | | | |

| Interest | $ | 461 |

| | $ | 147 |

|

| Income tax | — |

| | 25 |

|

| Supplemental schedule of non-cash investing and financing activities | | | |

| Changes in accounts payable related to capital expenditures | $ | — |

| | $ | (1,485 | ) |

| Capital leases on equipment | — |

| | 50 |

|

| Preferred stock dividends and accretion costs | 46 |

| | 10 |

|

12. Earnings per Share

Basic earnings (loss) per share, or EPS, is computed by dividing net income (loss) available to common shareholders by the weighted average common stock outstanding during the period. Diluted earnings (loss) per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock, such as options and convertible preferred stock, were exercised and converted into common stock. Potential common stock equivalents relate to outstanding stock options and unvested restricted stock units, which are determined using the treasury stock method, and the prior Series B Senior Convertible Preferred Stock, or the Prior Preferred Stock, which were determined using the "if-converted" method. In applying the if-converted method, conversion is not assumed for purposes of computing diluted EPS if the effect would be antidilutive. As of each of the quarters ended March 31, 2017 and 2016, there were 602,625 and 614,125 options to purchase shares of the Old Common Stock outstanding, respectively, and 588,059 shares of Prior Preferred Stock. The Prior Preferred Stock was convertible at a rate of nine shares of Old Common Stock to one share of Prior Preferred Stock, or 5,292,531 shares of Old Common Stock. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the Old Common Stock, the Prior Preferred Stock and awards then outstanding under the Prior Compensation Plans were extinguished without recovery.

The following table sets forth the computation of basic and diluted loss per share:

|

| | | | | | | |

| | Three months ended March 31, |

| | 2017 | | 2016 |

| | (in thousands, except per share amounts) |

| Basic and diluted: | | | |

| Net loss | $ | (22,440 | ) | | (24,468 | ) |

| Preferred stock dividends and accretion | (46 | ) | | (194 | ) |

| Net loss attributable to common shareholders | $ | (22,486 | ) | | $ | (24,662 | ) |

| Weighted-average common shares | 22,215 |

| | 22,210 |

|

| Basic and diluted net loss per share | $ | (1.01 | ) | | $ | (1.11 | ) |

There were 602,625 stock options and 5,292,531 shares of Old Common Stock equivalents underlying the Prior Preferred Stock outstanding as of March 31, 2017 that were not included in the calculation of diluted EPS for the three months ended March 31, 2017 because their effect would have been antidilutive. There were 614,125 stock options, 779,183 units of unvested restricted stock, and 5,292,531 shares of Old Common Stock equivalents underlying the Prior Preferred Stock outstanding as of March 31, 2016 that were not included in the calculation of diluted EPS for the three months ended March 31, 2016 because their effect would have been antidilutive.

13. Income Taxes

The Company’s effective tax rate for the three months ended March 31, 2017 was (0.1)% based on a pre-tax loss of $22.4 million. The Company's effective tax rate for the three months ended March 31, 2016 was (0.2)% based on a pre-tax loss of $24.4 million. The difference between the effective rate and 35.0% statutory rate is mainly due to the application of a valuation allowance in 2017 and 2016. With respect to the application of a valuation allowance, the management team considered the

likelihood of realizing the future benefits associated with the Company's existing deductible temporary differences and carryforwards. As a result of this analysis, and based on the current year pre-tax loss and a cumulative loss in the prior three fiscal years, management determined that it is not more likely than not that the future benefit associated with all of the Company's existing deductible temporary differences and carryforwards will be realized. As a result, the Company maintained a valuation allowance against all of its net deferred tax assets. Management evaluates the recoverability of the Company's deferred income tax assets by assessing the need for a valuation allowance on a quarterly basis. If the Company determines that it is more likely than not that its deferred tax assets will be recovered, the valuation allowance will be reduced.

14. Business Segment Information

The Company has determined that it has two reportable segments organized based on its products and services—well servicing and fluid logistics. The accounting policies of the segments are the same as those described in the summary of significant accounting policies.

Well Servicing

At March 31, 2017, our well servicing segment utilized our fleet of 172 well servicing rigs, which was comprised of 158 workover rigs and 14 swabbing rigs, six coiled tubing spreads, and other related assets and equipment. These assets are used to provide (i) well maintenance, including remedial repairs and removal and replacement of downhole production equipment, (ii) well workovers, including significant downhole repairs, re-completions and re-perforations, (iii) completion and swabbing activities, (iv) plugging and abandonment services, and (v) pressure testing of oil and natural gas production tubing and scanning tubing for pitting and wall thickness using tubing testing units.

Fluid Logistics

The fluid logistics segment utilizes our fleet of owned or leased fluid transport trucks and related assets, including specialized vacuum, high pressure pump and tank trucks, frac tanks, salt water disposal wells and facilities, and related equipment. These assets are used to transport, store and dispose of a variety of drilling and produced fluids used in and generated by oil and natural gas production activities. These services are required in most workover and completion projects and are routinely used in the daily operation of producing wells.

The following tables set forth certain financial information with respect to the Company’s reportable segments for the three months ended March 31, 2017 and 2016:

|

| | | | | | | | | | | | |

| | Three months ended March 31, | |

| | Well Servicing | | Fluid Logistics | | Consolidated | |

| 2017 | (in thousands) | |

| Operating revenues | $ | 17,105 |

| | $ | 9,942 |

| | $ | 27,047 |

| |

| Direct operating costs | 14,140 |

| | 9,948 |

| | 24,088 |

| |

| Segment operating profit (loss) | $ | 2,965 |

| | $ | (6 | ) | | $ | 2,959 |

| |

| Depreciation and amortization | $ | 6,169 |

| | $ | 5,899 |

| | $ | 12,068 |

| |

Capital expenditures (1) | 274 |

| | 103 |

| | 377 |

| |

| Total assets | 615,696 |

| | 434,304 |

| | 1,050,000 |

| |

| Long-lived assets | 136,435 |

| | 85,103 |

| | 221,538 |

| |

| 2016 | | | | | | |

| Operating revenues | $ | 18,713 |

| | $ | 13,218 |

| | $ | 31,931 |

| |

| Direct operating costs | 16,720 |

| | 13,161 |

| | 29,881 |

| |

| Segment operating profit | $ | 1,993 |

| | $ | 57 |

| | $ | 2,050 |

| |

| Depreciation and amortization | $ | 6,676 |

| | $ | 6,813 |

| | $ | 13,489 |

| |

Capital expenditures (1) | 193 |

| | 1,437 |

| | 1,630 |

| |

| Total assets | 615,449 |

| | 465,242 |

| | 1,080,691 |

| |

| Long-lived assets | 158,257 |

| | 106,952 |

| | 265,209 |

| |

| | | | | | | |

(1) Capital expenditures listed above include all cash and non-cash additions to property and equipment, including capital leases and fixed assets recorded in accounts payable at period end. |

|

| | | | | | | |

| | Three months ended March 31, |

| | 2017 | | 2016 |

| Reconciliation of the Company's Operating Loss As Reported: | (in thousands) |

| Segment operating profits | $ | 2,959 |

| | $ | 2,050 |

|

| General and administrative expense | 4,512 |

| | 6,056 |

|

| Depreciation and amortization | 12,068 |

| | 13,489 |

|

| Operating loss | (13,621 | ) | | (17,495 | ) |

| Other expense, net | (8,788 | ) | | (6,924 | ) |

| Restructuring costs | 6,587 |

| | — |

|

| Pre-tax loss | $ | (22,409 | ) | | $ | (24,419 | ) |

|

| | | | | | | |

| | March 31, 2017 | | December 31, 2016 |

| Reconciliation of the Company's Assets As Reported: | (in thousands) |

| Total reportable segments | $ | 1,050,000 |

| | $ | 1,045,753 |

|

| Elimination of internal transactions | (1,971,596 | ) | | (1,935,640 | ) |

| Parent | 1,217,931 |

| | 1,202,768 |

|

| Total assets | $ | 296,335 |

| | $ | 312,881 |

|

15. Equity Securities

Bankruptcy Proceedings

As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the Old Common Stock or Prior Preferred Stock were extinguished without recovery.

Additionally, on the Effective Date, FES Ltd. created the New Common Stock. The New Common Stock carries the following rights:

•Voting. Holders of the New Common Stock are entitled to one vote per share of New Common Stock owned as of the relevant record date on all matters submitted to a vote of shareholders. Except as otherwise required by Delaware law, holders of New Common Stock (as well as holders of any preferred stock of FES Ltd. entitled to vote with such common shareholders) vote together as a single class on all matters presented to the shareholders for their vote or approval, including the election of directors. The election of directors is determined by a plurality of the votes cast by the shareholders present in person or represented by proxy at the meeting and entitled to vote thereon. All other matters are determined by the vote of a majority of the votes cast by the shareholders present in person or represented by proxy at the meeting and entitled to vote thereon, unless the matter is one upon which, by applicable law, the rules or regulations of any stock exchange applicable to FES Ltd., the Certificate of Incorporation of FES Ltd., or the Certificate of Incorporation, or the Second Amended and Restated Bylaws of FES Ltd., or the Bylaws, a different vote is required, in which case such provision shall govern and control the decision of such matter.

•Dividends. Subject to provisions of applicable law and the Certificate of Incorporation, dividends may be declared by and at the discretion of the board of directors of FES Ltd. at any meeting and may be paid in cash, in property, or in shares of stock of FES Ltd.

•Liquidation, dissolution or winding up. Except as otherwise required by the Certificate of Incorporation or the Bylaws, in the event of the liquidation, dissolution or winding-up of FES Ltd., holders of New Common Stock will have all rights and privileges typically associated with such securities as set forth in the General Corporation Law of the State of Delaware in relation to rights upon liquidation.

•Restrictions on transfer. The New Common Stock is not subject to restrictions on transfer as a result of the Certificate of Incorporation or the Bylaws. Nevertheless, there may be restrictions imposed by applicable securities laws or by the terms of other agreements entered into in the future. The Bylaws permit FES Ltd. to place restrictive legends on its share certificates in order to ensure compliance with these restrictions.

•Other rights. Holders of the New Common Stock have no preemptive, redemption, conversion or sinking fund rights.

The rights, preferences, and privileges of the holders of the New Common Stock will be subject to, and may be adversely affected by, the rights of the holders of any series of preferred stock that may be issued by FES Ltd.

16. Subsequent Events

The Company has evaluated events subsequent to the date of the Company's condensed consolidated financial statements, March 31, 2017. On the Effective Date, the Debtors completed their financial restructuring and emerged from the chapter 11 bankruptcy cases after completing all required actions and satisfying the remaining conditions to the Plan, which was confirmed by the Bankruptcy Court on March 29, 2017. See Note 1 - Chapter 11 Proceedings for more information regarding the Debtor’s emergence from bankruptcy. The Company cannot currently estimate the financial effect of the Debtor’s emergence from bankruptcy on its financial statements, although it expects to record material adjustments in the second quarter of 2017 related to the Plan and due to the application of fresh start accounting upon emergence. There were no other material subsequent events requiring additional disclosure in these financial statements.

| |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the accompanying condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q and with the audited consolidated financial statements for the year ended December 31, 2016 included in our Annual Report on Form 10-K. Any forward-looking statements made by or on our behalf are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that such forward-looking statements involve risks and uncertainties in that the actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ include risks set forth in the Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2016.

Overview

Forbes Energy Services Ltd., or FES Ltd., is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include fluid hauling, fluid disposal, well maintenance, completion services, workovers and re-completions, plugging and abandonment, and tubing testing. Our operations are concentrated in the major onshore oil and natural gas producing regions of Texas, plus one location in Pennsylvania. We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers’ wells. Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

As used in this Quarterly Report on Form 10-Q, the “Company,” “we,” and “our” mean FES Ltd. and its subsidiaries, except as otherwise indicated.

We currently provide a wide range of services to a diverse group of companies. In the three months ended March 31, 2017, we provided services to approximately 280 companies. John E. Crisp and our senior management team, have cultivated deep and ongoing relationships with these customers during their average of over 40 years of experience in the oilfield services industry. For the three months ended March 31, 2017 we generated consolidated revenues of approximately $27.0 million.

We currently conduct our operations through the following two business segments:

| |

| • | Well Servicing. Our well servicing segment comprised 63.2% of consolidated revenues for the three months ended March 31, 2017. At March 31, 2017, our well servicing segment utilized our fleet of 172 well servicing rigs, which was comprised of 158 workover rigs and 14 swabbing rigs, as well as six coiled tubing spreads, and other related assets and equipment. These assets are used to provide (i) well maintenance, including remedial repairs and removal and replacement of downhole production equipment, (ii) well workovers, including significant downhole repairs, re-completions and re-perforations, (iii) completion and swabbing activities, (iv) plugging and abandonment services, and (v) pressure testing of oil and natural gas production tubing and scanning tubing for pitting and wall thickness using tubing testing units. |

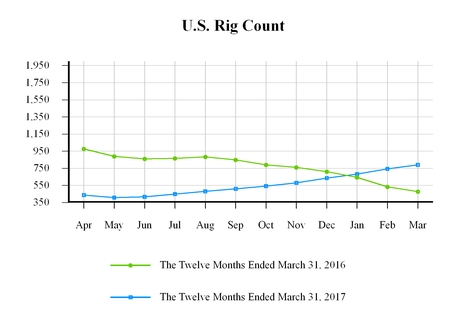

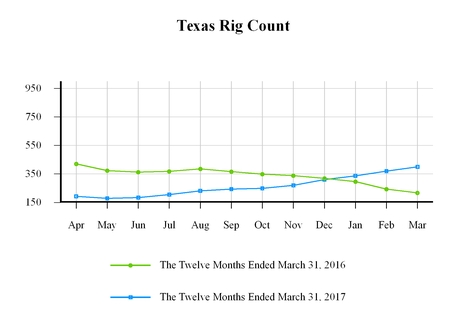

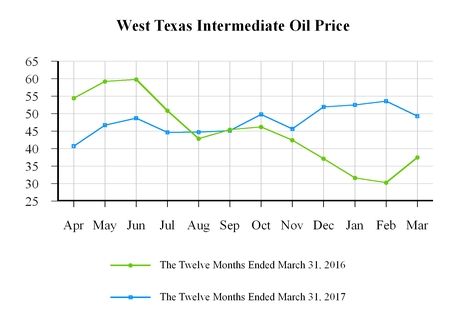

| |