Exhibit 99.2 D R A F T January 17, 2019 1/17/2019 9:05 AM Draft #18final CRETIC ENERGY SERVICES, LLC UNAUDITED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2018 AND 2017

CRETIC ENERGY SERVICES, LLC UNAUDITED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2018 AND 2017 Page FINANCIAL STATEMENTS: UNAUDITED BALANCE SHEETS ............................................................................................ 1 UNAUDITED STATEMENTS OF OPERATIONS ......................................................................... 2 UNAUDITED STATEMENTS OF CHANGES IN MEMBERS’ EQUITY ........................................... 3 UNAUDITED STATEMENTS OF CASH FLOWS ......................................................................... 4 UNAUDITED NOTES TO FINANCIAL STATEMENTS................................................................. 5

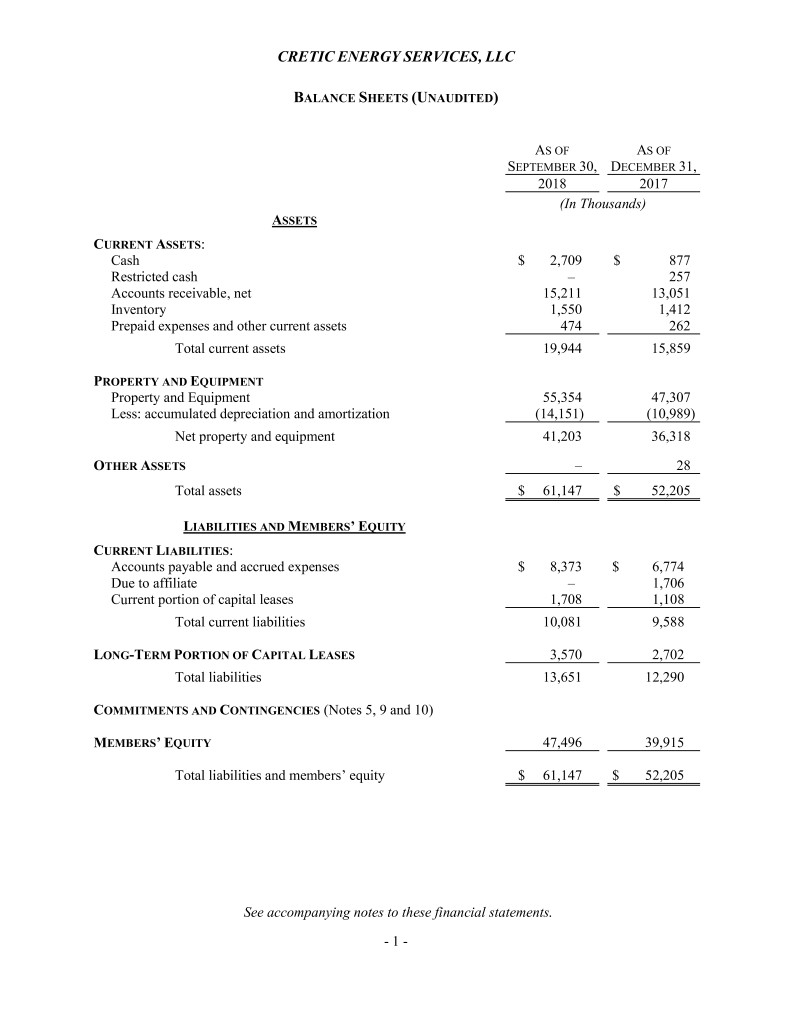

CRETIC ENERGY SERVICES, LLC BALANCE SHEETS (UNAUDITED) AS OF AS OF SEPTEMBER 30, DECEMBER 31, 2018 2017 (In Thousands) ASSETS CURRENT ASSETS: Cash $ 2,709 $ 877 Restricted cash – 257 Accounts receivable, net 15,211 13,051 Inventory 1,550 1,412 Prepaid expenses and other current assets 474 262 Total current assets 19,944 15,859 PROPERTY AND EQUIPMENT Property and Equipment 55,354 47,307 Less: accumulated depreciation and amortization (14,151) (10,989) Net property and equipment 41,203 36,318 OTHER ASSETS – 28 Total assets $ 61,147 $ 52,205 LIABILITIES AND MEMBERS’ EQUITY CURRENT LIABILITIES: Accounts payable and accrued expenses $ 8,373 $ 6,774 Due to affiliate – 1,706 Current portion of capital leases 1,708 1,108 Total current liabilities 10,081 9,588 LONG-TERM PORTION OF CAPITAL LEASES 3,570 2,702 Total liabilities 13,651 12,290 COMMITMENTS AND CONTINGENCIES (Notes 5, 9 and 10) MEMBERS’ EQUITY 47,496 39,915 Total liabilities and members’ equity $ 61,147 $ 52,205 See accompanying notes to these financial statements. - 1 -

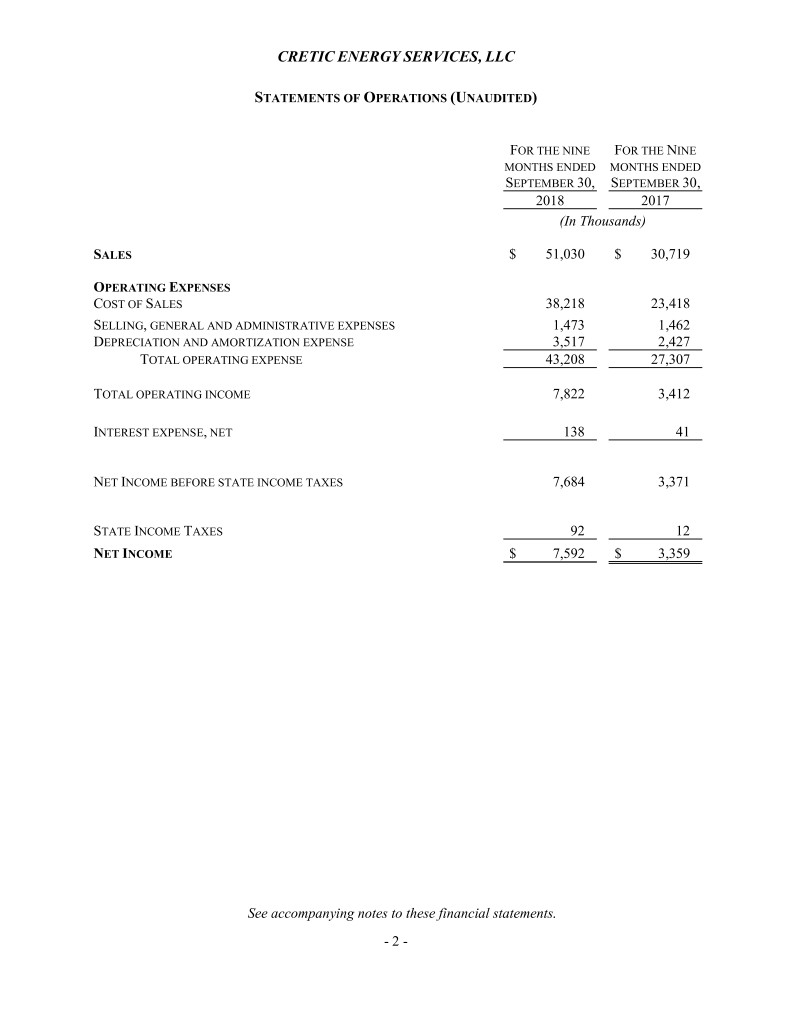

CRETIC ENERGY SERVICES, LLC STATEMENTS OF OPERATIONS (UNAUDITED) FOR THE NINE FOR THE NINE MONTHS ENDED MONTHS ENDED SEPTEMBER 30, SEPTEMBER 30, 2018 2017 (In Thousands) SALES $ 51,030 $ 30,719 OPERATING EXPENSES COST OF SALES 38,218 23,418 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES 1,473 1,462 DEPRECIATION AND AMORTIZATION EXPENSE 3,517 2,427 TOTAL OPERATING EXPENSE 43,208 27,307 TOTAL OPERATING INCOME 7,822 3,412 INTEREST EXPENSE, NET 138 41 NET INCOME BEFORE STATE INCOME TAXES 7,684 3,371 STATE INCOME TAXES 92 12 NET INCOME $ 7,592 $ 3,359 See accompanying notes to these financial statements. - 2 -

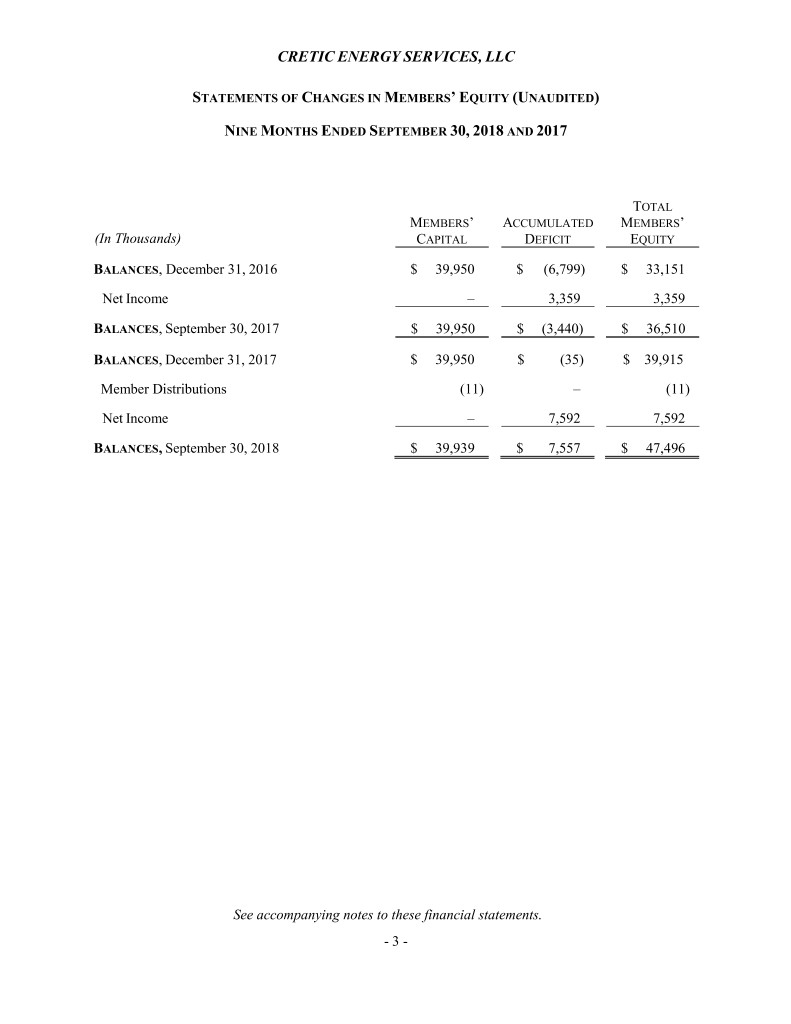

CRETIC ENERGY SERVICES, LLC STATEMENTS OF CHANGES IN MEMBERS’ EQUITY (UNAUDITED) NINE MONTHS ENDED SEPTEMBER 30, 2018 AND 2017 TOTAL MEMBERS’ ACCUMULATED MEMBERS’ (In Thousands) CAPITAL DEFICIT EQUITY BALANCES, December 31, 2016 $ 39,950 $ (6,799) $ 33,151 Net Income – 3,359 3,359 BALANCES, September 30, 2017 $ 39,950 $ (3,440) $ 36,510 BALANCES, December 31, 2017 $ 39,950 $ (35) $ 39,915 Member Distributions (11) – (11) Net Income – 7,592 7,592 BALANCES, September 30, 2018 $ 39,939 $ 7,557 $ 47,496 See accompanying notes to these financial statements. - 3 -

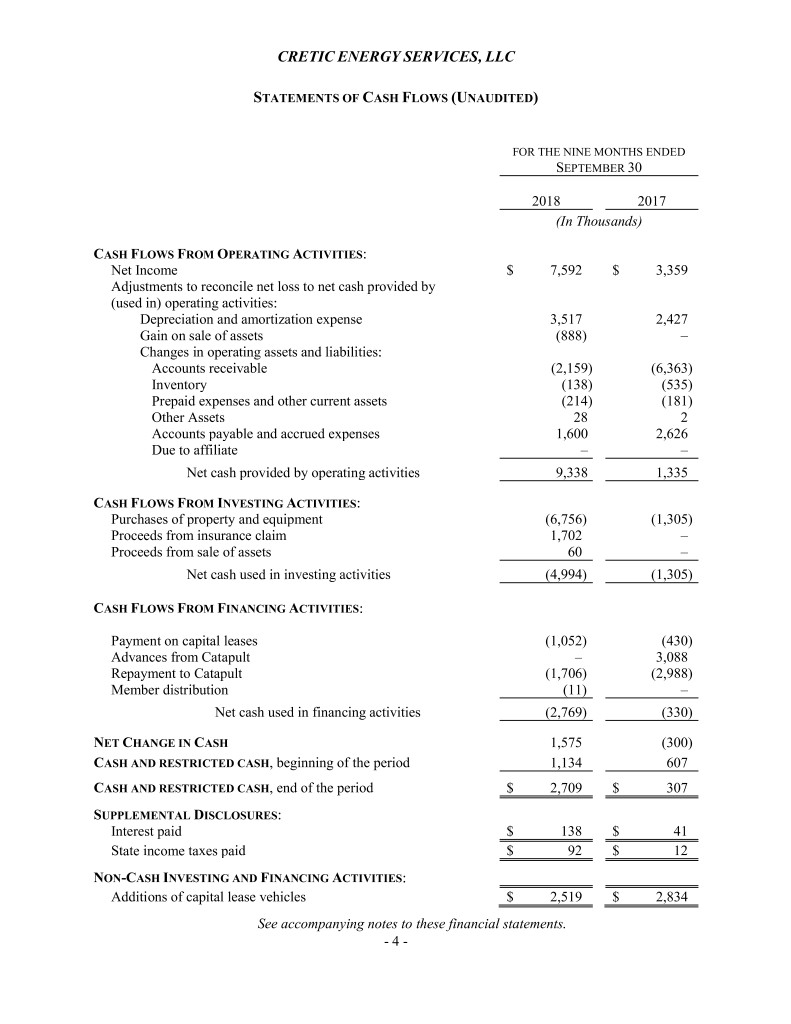

CRETIC ENERGY SERVICES, LLC STATEMENTS OF CASH FLOWS (UNAUDITED) FOR THE NINE MONTHS ENDED SEPTEMBER 30 2018 2017 (In Thousands) CASH FLOWS FROM OPERATING ACTIVITIES: Net Income $ 7,592 $ 3,359 Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization expense 3,517 2,427 Gain on sale of assets (888) – Changes in operating assets and liabilities: Accounts receivable (2,159) (6,363) Inventory (138) (535) Prepaid expenses and other current assets (214) (181) Other Assets 28 2 Accounts payable and accrued expenses 1,600 2,626 Due to affiliate – – Net cash provided by operating activities 9,338 1,335 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property and equipment (6,756) (1,305) Proceeds from insurance claim 1,702 – Proceeds from sale of assets 60 – Net cash used in investing activities (4,994) (1,305) CASH FLOWS FROM FINANCING ACTIVITIES: Payment on capital leases (1,052) (430) Advances from Catapult – 3,088 Repayment to Catapult (1,706) (2,988) Member distribution (11) – Net cash used in financing activities (2,769) (330) NET CHANGE IN CASH 1,575 (300) CASH AND RESTRICTED CASH, beginning of the period 1,134 607 CASH AND RESTRICTED CASH, end of the period $ 2,709 $ 307 SUPPLEMENTAL DISCLOSURES: Interest paid $ 138 $ 41 State income taxes paid $ 92 $ 12 NON-CASH INVESTING AND FINANCING ACTIVITIES: Additions of capital lease vehicles $ 2,519 $ 2,834 See accompanying notes to these financial statements. - 4 -

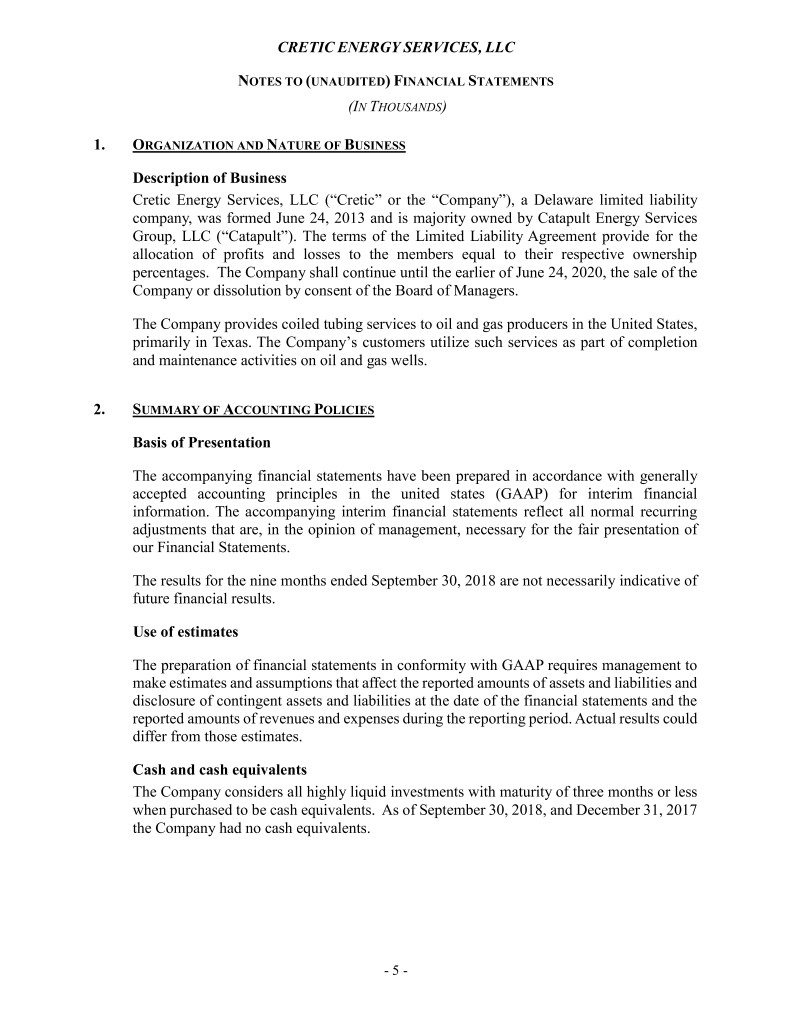

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 1. ORGANIZATION AND NATURE OF BUSINESS Description of Business Cretic Energy Services, LLC (“Cretic” or the “Company”), a Delaware limited liability company, was formed June 24, 2013 and is majority owned by Catapult Energy Services Group, LLC (“Catapult”). The terms of the Limited Liability Agreement provide for the allocation of profits and losses to the members equal to their respective ownership percentages. The Company shall continue until the earlier of June 24, 2020, the sale of the Company or dissolution by consent of the Board of Managers. The Company provides coiled tubing services to oil and gas producers in the United States, primarily in Texas. The Company’s customers utilize such services as part of completion and maintenance activities on oil and gas wells. 2. SUMMARY OF ACCOUNTING POLICIES Basis of Presentation The accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the united states (GAAP) for interim financial information. The accompanying interim financial statements reflect all normal recurring adjustments that are, in the opinion of management, necessary for the fair presentation of our Financial Statements. The results for the nine months ended September 30, 2018 are not necessarily indicative of future financial results. Use of estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash and cash equivalents The Company considers all highly liquid investments with maturity of three months or less when purchased to be cash equivalents. As of September 30, 2018, and December 31, 2017 the Company had no cash equivalents. - 5 -

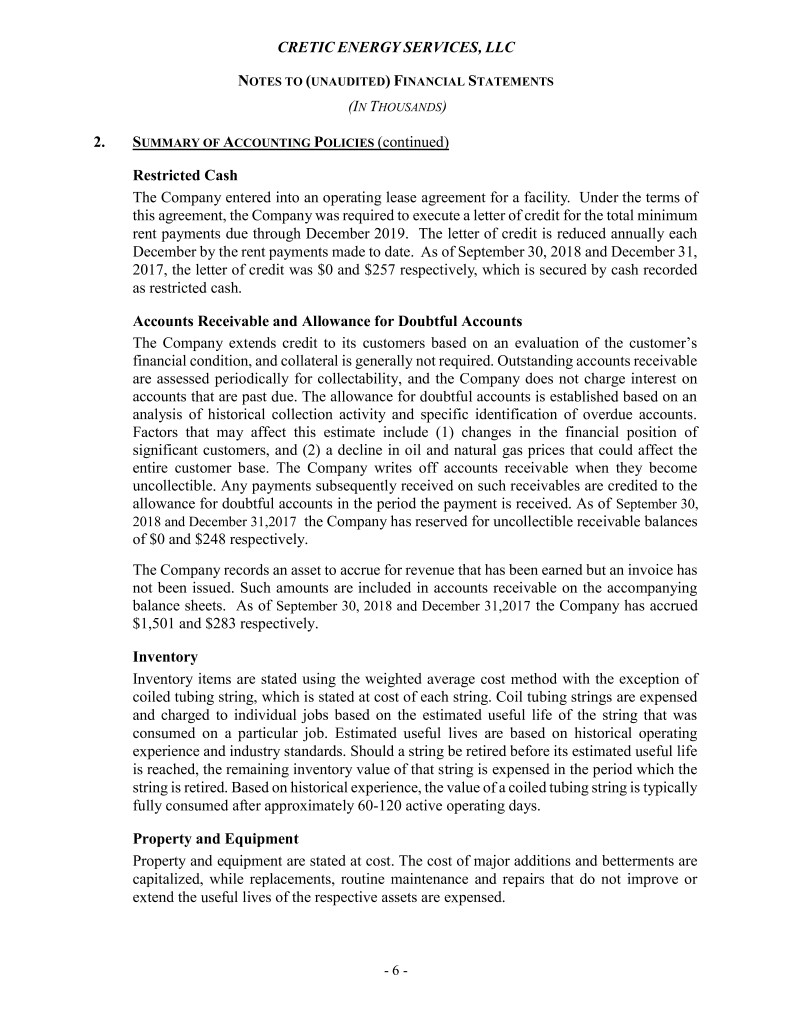

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 2. SUMMARY OF ACCOUNTING POLICIES (continued) Restricted Cash The Company entered into an operating lease agreement for a facility. Under the terms of this agreement, the Company was required to execute a letter of credit for the total minimum rent payments due through December 2019. The letter of credit is reduced annually each December by the rent payments made to date. As of September 30, 2018 and December 31, 2017, the letter of credit was $0 and $257 respectively, which is secured by cash recorded as restricted cash. Accounts Receivable and Allowance for Doubtful Accounts The Company extends credit to its customers based on an evaluation of the customer’s financial condition, and collateral is generally not required. Outstanding accounts receivable are assessed periodically for collectability, and the Company does not charge interest on accounts that are past due. The allowance for doubtful accounts is established based on an analysis of historical collection activity and specific identification of overdue accounts. Factors that may affect this estimate include (1) changes in the financial position of significant customers, and (2) a decline in oil and natural gas prices that could affect the entire customer base. The Company writes off accounts receivable when they become uncollectible. Any payments subsequently received on such receivables are credited to the allowance for doubtful accounts in the period the payment is received. As of September 30, 2018 and December 31,2017 the Company has reserved for uncollectible receivable balances of $0 and $248 respectively. The Company records an asset to accrue for revenue that has been earned but an invoice has not been issued. Such amounts are included in accounts receivable on the accompanying balance sheets. As of September 30, 2018 and December 31,2017 the Company has accrued $1,501 and $283 respectively. Inventory Inventory items are stated using the weighted average cost method with the exception of coiled tubing string, which is stated at cost of each string. Coil tubing strings are expensed and charged to individual jobs based on the estimated useful life of the string that was consumed on a particular job. Estimated useful lives are based on historical operating experience and industry standards. Should a string be retired before its estimated useful life is reached, the remaining inventory value of that string is expensed in the period which the string is retired. Based on historical experience, the value of a coiled tubing string is typically fully consumed after approximately 60-120 active operating days. Property and Equipment Property and equipment are stated at cost. The cost of major additions and betterments are capitalized, while replacements, routine maintenance and repairs that do not improve or extend the useful lives of the respective assets are expensed. - 6 -

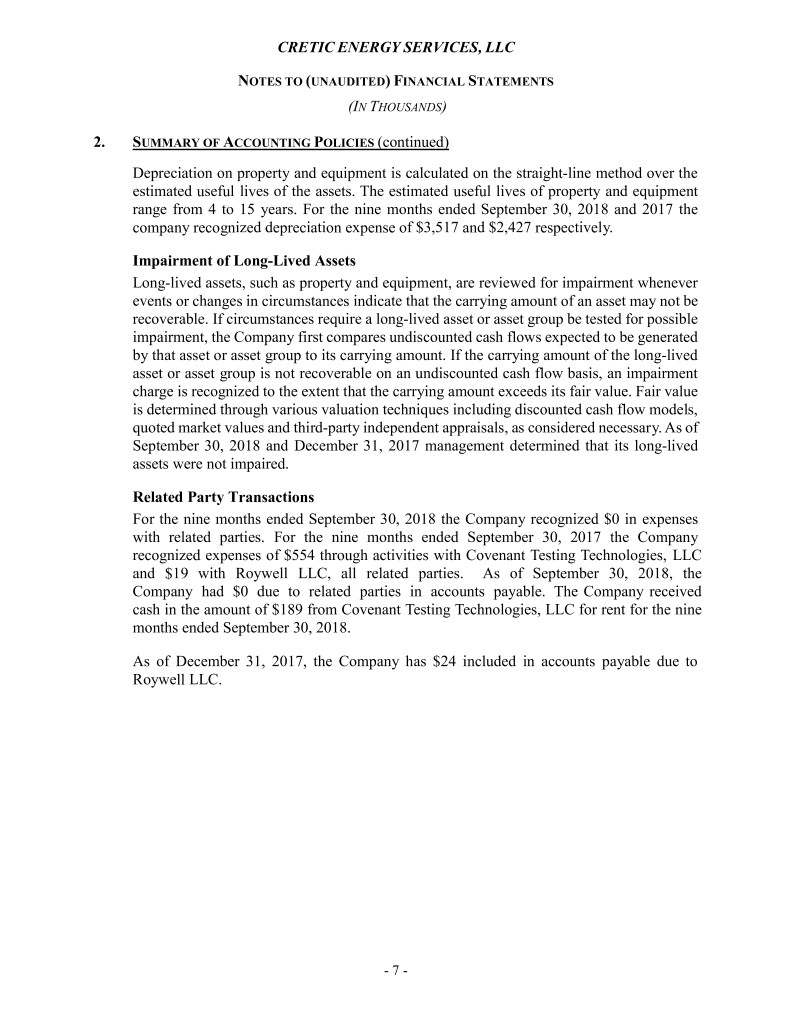

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 2. SUMMARY OF ACCOUNTING POLICIES (continued) Depreciation on property and equipment is calculated on the straight-line method over the estimated useful lives of the assets. The estimated useful lives of property and equipment range from 4 to 15 years. For the nine months ended September 30, 2018 and 2017 the company recognized depreciation expense of $3,517 and $2,427 respectively. Impairment of Long-Lived Assets Long-lived assets, such as property and equipment, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset or asset group be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying amount. If the carrying amount of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment charge is recognized to the extent that the carrying amount exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. As of September 30, 2018 and December 31, 2017 management determined that its long-lived assets were not impaired. Related Party Transactions For the nine months ended September 30, 2018 the Company recognized $0 in expenses with related parties. For the nine months ended September 30, 2017 the Company recognized expenses of $554 through activities with Covenant Testing Technologies, LLC and $19 with Roywell LLC, all related parties. As of September 30, 2018, the Company had $0 due to related parties in accounts payable. The Company received cash in the amount of $189 from Covenant Testing Technologies, LLC for rent for the nine months ended September 30, 2018. As of December 31, 2017, the Company has $24 included in accounts payable due to Roywell LLC. - 7 -

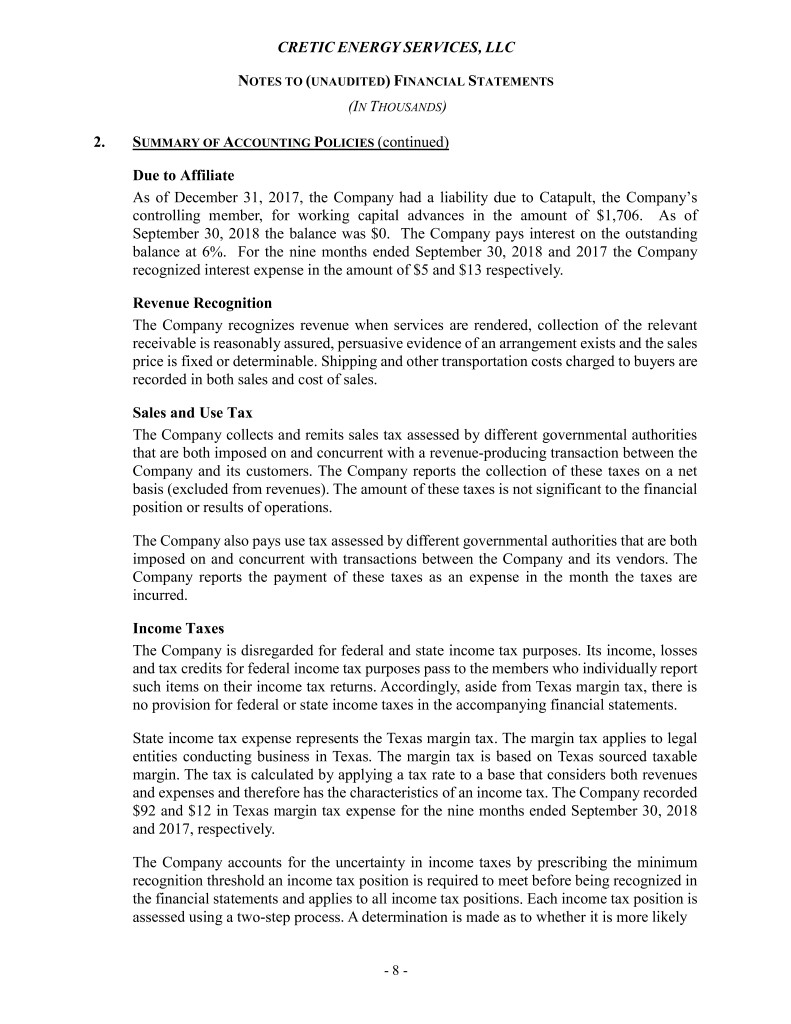

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 2. SUMMARY OF ACCOUNTING POLICIES (continued) Due to Affiliate As of December 31, 2017, the Company had a liability due to Catapult, the Company’s controlling member, for working capital advances in the amount of $1,706. As of September 30, 2018 the balance was $0. The Company pays interest on the outstanding balance at 6%. For the nine months ended September 30, 2018 and 2017 the Company recognized interest expense in the amount of $5 and $13 respectively. Revenue Recognition The Company recognizes revenue when services are rendered, collection of the relevant receivable is reasonably assured, persuasive evidence of an arrangement exists and the sales price is fixed or determinable. Shipping and other transportation costs charged to buyers are recorded in both sales and cost of sales. Sales and Use Tax The Company collects and remits sales tax assessed by different governmental authorities that are both imposed on and concurrent with a revenue-producing transaction between the Company and its customers. The Company reports the collection of these taxes on a net basis (excluded from revenues). The amount of these taxes is not significant to the financial position or results of operations. The Company also pays use tax assessed by different governmental authorities that are both imposed on and concurrent with transactions between the Company and its vendors. The Company reports the payment of these taxes as an expense in the month the taxes are incurred. Income Taxes The Company is disregarded for federal and state income tax purposes. Its income, losses and tax credits for federal income tax purposes pass to the members who individually report such items on their income tax returns. Accordingly, aside from Texas margin tax, there is no provision for federal or state income taxes in the accompanying financial statements. State income tax expense represents the Texas margin tax. The margin tax applies to legal entities conducting business in Texas. The margin tax is based on Texas sourced taxable margin. The tax is calculated by applying a tax rate to a base that considers both revenues and expenses and therefore has the characteristics of an income tax. The Company recorded $92 and $12 in Texas margin tax expense for the nine months ended September 30, 2018 and 2017, respectively. The Company accounts for the uncertainty in income taxes by prescribing the minimum recognition threshold an income tax position is required to meet before being recognized in the financial statements and applies to all income tax positions. Each income tax position is assessed using a two-step process. A determination is made as to whether it is more likely - 8 -

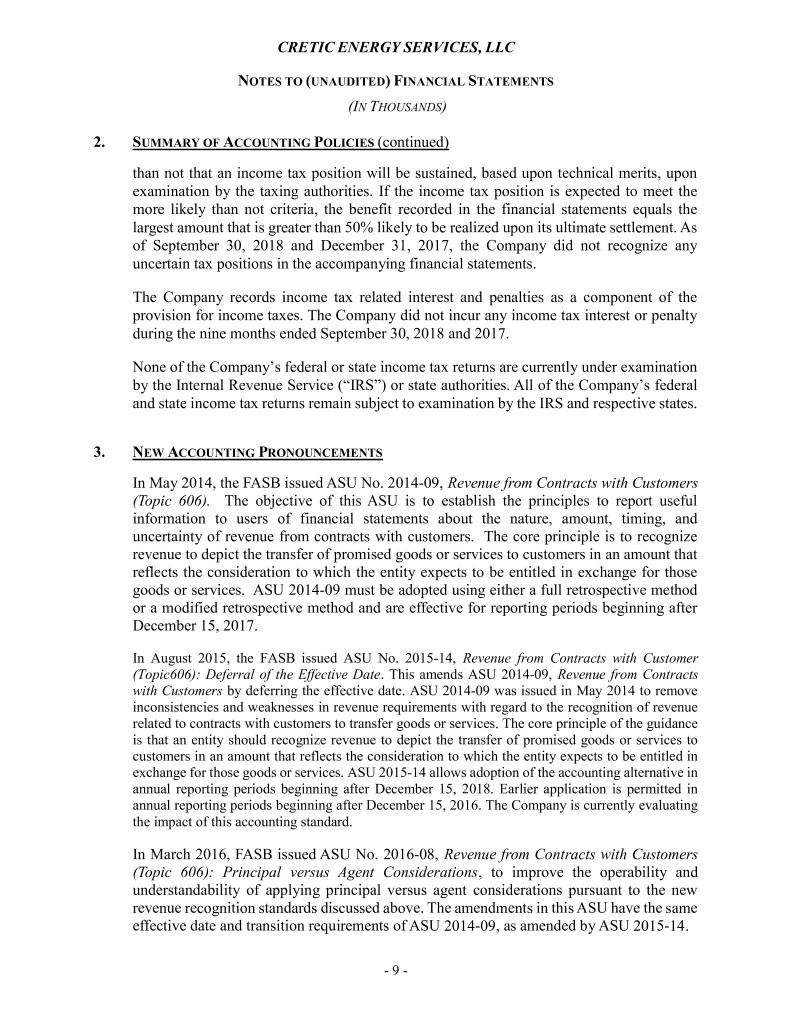

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 2. SUMMARY OF ACCOUNTING POLICIES (continued) than not that an income tax position will be sustained, based upon technical merits, upon examination by the taxing authorities. If the income tax position is expected to meet the more likely than not criteria, the benefit recorded in the financial statements equals the largest amount that is greater than 50% likely to be realized upon its ultimate settlement. As of September 30, 2018 and December 31, 2017, the Company did not recognize any uncertain tax positions in the accompanying financial statements. The Company records income tax related interest and penalties as a component of the provision for income taxes. The Company did not incur any income tax interest or penalty during the nine months ended September 30, 2018 and 2017. None of the Company’s federal or state income tax returns are currently under examination by the Internal Revenue Service (“IRS”) or state authorities. All of the Company’s federal and state income tax returns remain subject to examination by the IRS and respective states. 3. NEW ACCOUNTING PRONOUNCEMENTS In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606). The objective of this ASU is to establish the principles to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue from contracts with customers. The core principle is to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 must be adopted using either a full retrospective method or a modified retrospective method and are effective for reporting periods beginning after December 15, 2017. In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customer (Topic606): Deferral of the Effective Date. This amends ASU 2014-09, Revenue from Contracts with Customers by deferring the effective date. ASU 2014-09 was issued in May 2014 to remove inconsistencies and weaknesses in revenue requirements with regard to the recognition of revenue related to contracts with customers to transfer goods or services. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2015-14 allows adoption of the accounting alternative in annual reporting periods beginning after December 15, 2018. Earlier application is permitted in annual reporting periods beginning after December 15, 2016. The Company is currently evaluating the impact of this accounting standard. In March 2016, FASB issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations, to improve the operability and understandability of applying principal versus agent considerations pursuant to the new revenue recognition standards discussed above. The amendments in this ASU have the same effective date and transition requirements of ASU 2014-09, as amended by ASU 2015-14. - 9 -

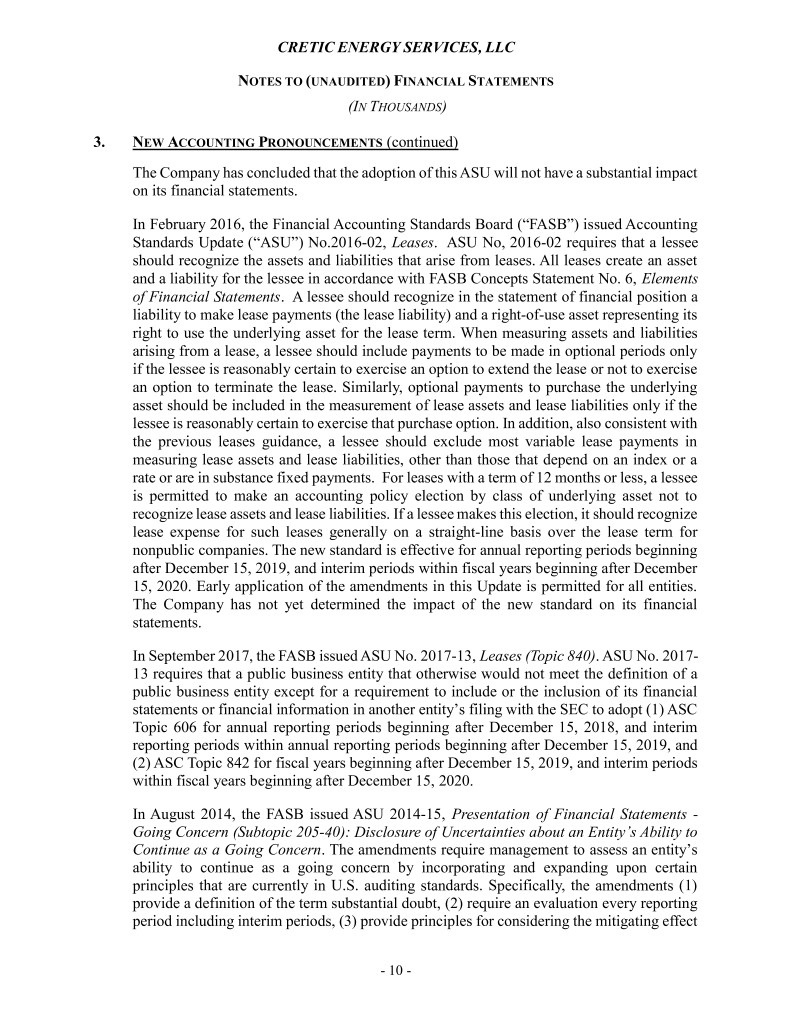

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 3. NEW ACCOUNTING PRONOUNCEMENTS (continued) The Company has concluded that the adoption of this ASU will not have a substantial impact on its financial statements. In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No.2016-02, Leases. ASU No, 2016-02 requires that a lessee should recognize the assets and liabilities that arise from leases. All leases create an asset and a liability for the lessee in accordance with FASB Concepts Statement No. 6, Elements of Financial Statements. A lessee should recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. When measuring assets and liabilities arising from a lease, a lessee should include payments to be made in optional periods only if the lessee is reasonably certain to exercise an option to extend the lease or not to exercise an option to terminate the lease. Similarly, optional payments to purchase the underlying asset should be included in the measurement of lease assets and lease liabilities only if the lessee is reasonably certain to exercise that purchase option. In addition, also consistent with the previous leases guidance, a lessee should exclude most variable lease payments in measuring lease assets and lease liabilities, other than those that depend on an index or a rate or are in substance fixed payments. For leases with a term of 12 months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term for nonpublic companies. The new standard is effective for annual reporting periods beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early application of the amendments in this Update is permitted for all entities. The Company has not yet determined the impact of the new standard on its financial statements. In September 2017, the FASB issued ASU No. 2017-13, Leases (Topic 840). ASU No. 2017- 13 requires that a public business entity that otherwise would not meet the definition of a public business entity except for a requirement to include or the inclusion of its financial statements or financial information in another entity’s filing with the SEC to adopt (1) ASC Topic 606 for annual reporting periods beginning after December 15, 2018, and interim reporting periods within annual reporting periods beginning after December 15, 2019, and (2) ASC Topic 842 for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements - Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. The amendments require management to assess an entity’s ability to continue as a going concern by incorporating and expanding upon certain principles that are currently in U.S. auditing standards. Specifically, the amendments (1) provide a definition of the term substantial doubt, (2) require an evaluation every reporting period including interim periods, (3) provide principles for considering the mitigating effect - 10 -

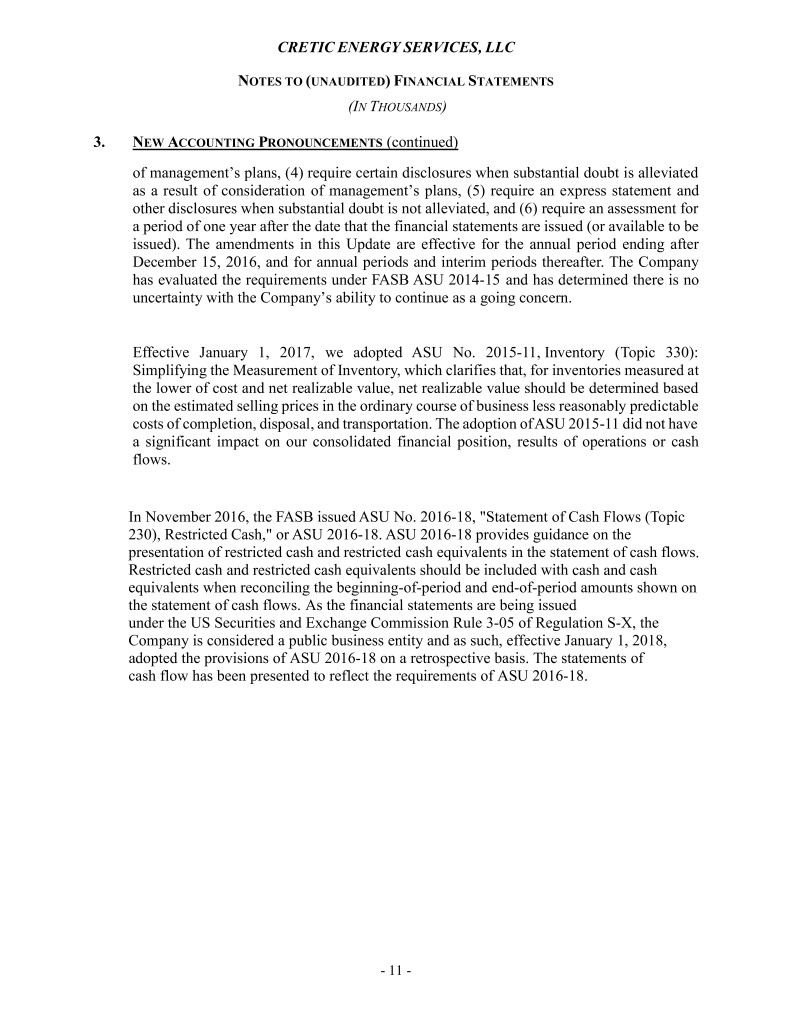

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 3. NEW ACCOUNTING PRONOUNCEMENTS (continued) of management’s plans, (4) require certain disclosures when substantial doubt is alleviated as a result of consideration of management’s plans, (5) require an express statement and other disclosures when substantial doubt is not alleviated, and (6) require an assessment for a period of one year after the date that the financial statements are issued (or available to be issued). The amendments in this Update are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. The Company has evaluated the requirements under FASB ASU 2014-15 and has determined there is no uncertainty with the Company’s ability to continue as a going concern. Effective January 1, 2017, we adopted ASU No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory, which clarifies that, for inventories measured at the lower of cost and net realizable value, net realizable value should be determined based on the estimated selling prices in the ordinary course of business less reasonably predictable costs of completion, disposal, and transportation. The adoption of ASU 2015-11 did not have a significant impact on our consolidated financial position, results of operations or cash flows. In November 2016, the FASB issued ASU No. 2016-18, "Statement of Cash Flows (Topic 230), Restricted Cash," or ASU 2016-18. ASU 2016-18 provides guidance on the presentation of restricted cash and restricted cash equivalents in the statement of cash flows. Restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period amounts shown on the statement of cash flows. As the financial statements are being issued under the US Securities and Exchange Commission Rule 3-05 of Regulation S-X, the Company is considered a public business entity and as such, effective January 1, 2018, adopted the provisions of ASU 2016-18 on a retrospective basis. The statements of cash flow has been presented to reflect the requirements of ASU 2016-18. - 11 -

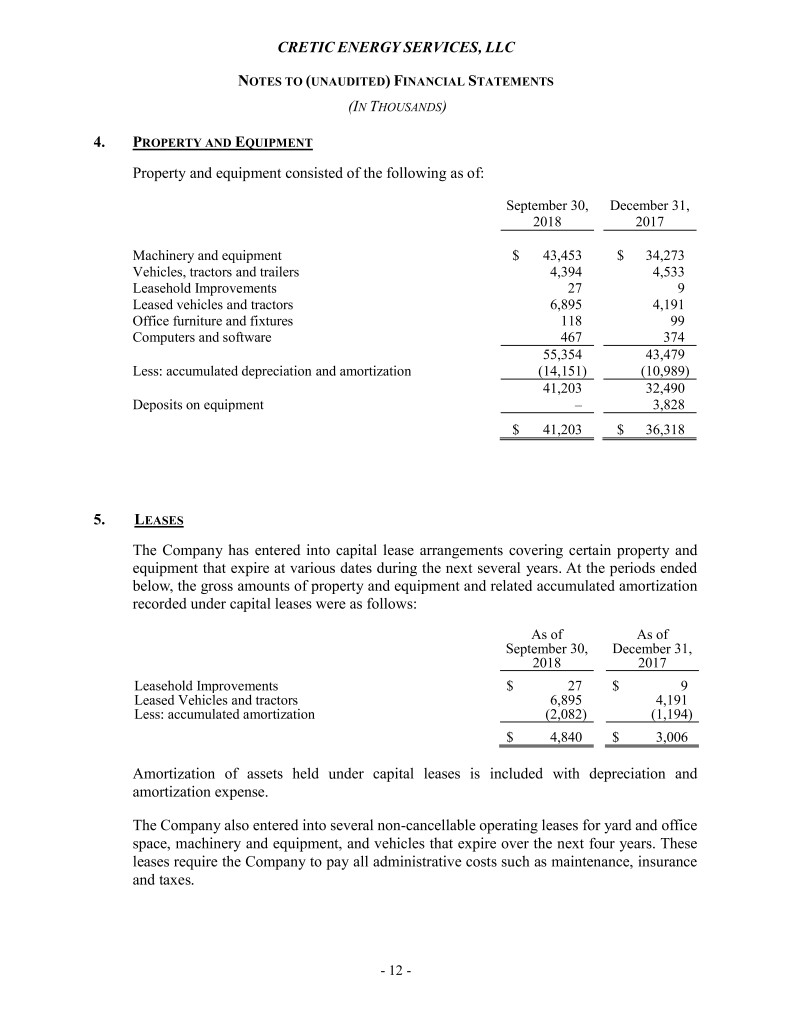

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 4. PROPERTY AND EQUIPMENT Property and equipment consisted of the following as of: September 30, December 31, 2018 2017 Machinery and equipment $ 43,453 $ 34,273 Vehicles, tractors and trailers 4,394 4,533 Leasehold Improvements 27 9 Leased vehicles and tractors 6,895 4,191 Office furniture and fixtures 118 99 Computers and software 467 374 55,354 43,479 Less: accumulated depreciation and amortization (14,151) (10,989) 41,203 32,490 Deposits on equipment – 3,828 $ 41,203 $ 36,318 5. LEASES The Company has entered into capital lease arrangements covering certain property and equipment that expire at various dates during the next several years. At the periods ended below, the gross amounts of property and equipment and related accumulated amortization recorded under capital leases were as follows: As of As of September 30, December 31, 2018 2017 Leasehold Improvements $ 27 $ 9 Leased Vehicles and tractors 6,895 4,191 Less: accumulated amortization (2,082) (1,194) $ 4,840 $ 3,006 Amortization of assets held under capital leases is included with depreciation and amortization expense. The Company also entered into several non-cancellable operating leases for yard and office space, machinery and equipment, and vehicles that expire over the next four years. These leases require the Company to pay all administrative costs such as maintenance, insurance and taxes. - 12 -

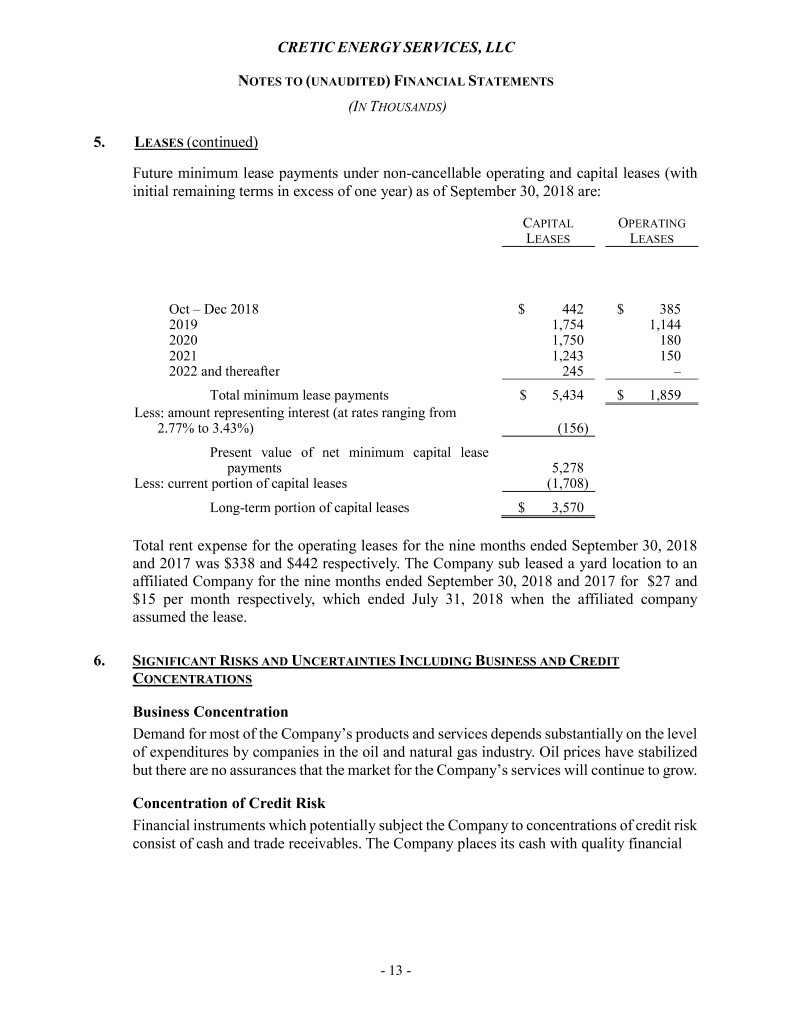

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 5. LEASES (continued) Future minimum lease payments under non-cancellable operating and capital leases (with initial remaining terms in excess of one year) as of September 30, 2018 are: CAPITAL OPERATING LEASES LEASES Oct – Dec 2018 $ 442 $ 385 2019 1,754 1,144 2020 1,750 180 2021 1,243 150 2022 and thereafter 245 – Total minimum lease payments $ 5,434 $ 1,859 Less: amount representing interest (at rates ranging from 2.77% to 3.43%) (156) Present value of net minimum capital lease payments 5,278 Less: current portion of capital leases (1,708) Long-term portion of capital leases $ 3,570 Total rent expense for the operating leases for the nine months ended September 30, 2018 and 2017 was $338 and $442 respectively. The Company sub leased a yard location to an affiliated Company for the nine months ended September 30, 2018 and 2017 for $27 and $15 per month respectively, which ended July 31, 2018 when the affiliated company assumed the lease. 6. SIGNIFICANT RISKS AND UNCERTAINTIES INCLUDING BUSINESS AND CREDIT CONCENTRATIONS Business Concentration Demand for most of the Company’s products and services depends substantially on the level of expenditures by companies in the oil and natural gas industry. Oil prices have stabilized but there are no assurances that the market for the Company’s services will continue to grow. Concentration of Credit Risk Financial instruments which potentially subject the Company to concentrations of credit risk consist of cash and trade receivables. The Company places its cash with quality financial - 13 -

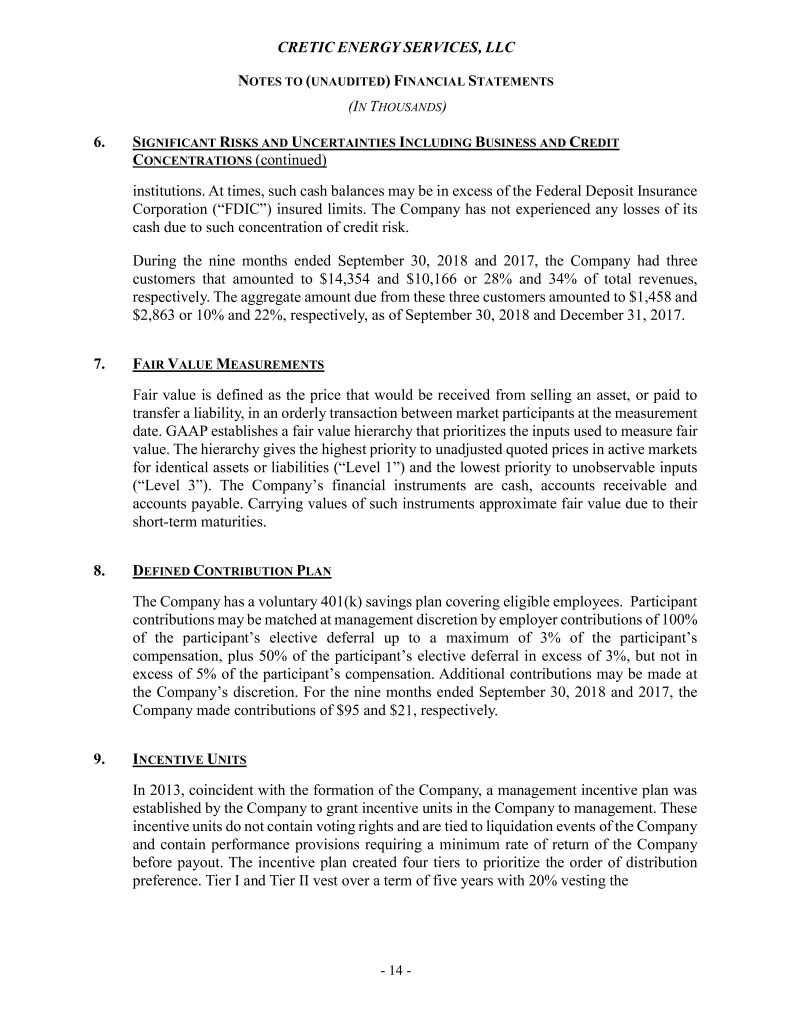

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 6. SIGNIFICANT RISKS AND UNCERTAINTIES INCLUDING BUSINESS AND CREDIT CONCENTRATIONS (continued) institutions. At times, such cash balances may be in excess of the Federal Deposit Insurance Corporation (“FDIC”) insured limits. The Company has not experienced any losses of its cash due to such concentration of credit risk. During the nine months ended September 30, 2018 and 2017, the Company had three customers that amounted to $14,354 and $10,166 or 28% and 34% of total revenues, respectively. The aggregate amount due from these three customers amounted to $1,458 and $2,863 or 10% and 22%, respectively, as of September 30, 2018 and December 31, 2017. 7. FAIR VALUE MEASUREMENTS Fair value is defined as the price that would be received from selling an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. GAAP establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (“Level 1”) and the lowest priority to unobservable inputs (“Level 3”). The Company’s financial instruments are cash, accounts receivable and accounts payable. Carrying values of such instruments approximate fair value due to their short-term maturities. 8. DEFINED CONTRIBUTION PLAN The Company has a voluntary 401(k) savings plan covering eligible employees. Participant contributions may be matched at management discretion by employer contributions of 100% of the participant’s elective deferral up to a maximum of 3% of the participant’s compensation, plus 50% of the participant’s elective deferral in excess of 3%, but not in excess of 5% of the participant’s compensation. Additional contributions may be made at the Company’s discretion. For the nine months ended September 30, 2018 and 2017, the Company made contributions of $95 and $21, respectively. 9. INCENTIVE UNITS In 2013, coincident with the formation of the Company, a management incentive plan was established by the Company to grant incentive units in the Company to management. These incentive units do not contain voting rights and are tied to liquidation events of the Company and contain performance provisions requiring a minimum rate of return of the Company before payout. The incentive plan created four tiers to prioritize the order of distribution preference. Tier I and Tier II vest over a term of five years with 20% vesting the - 14 -

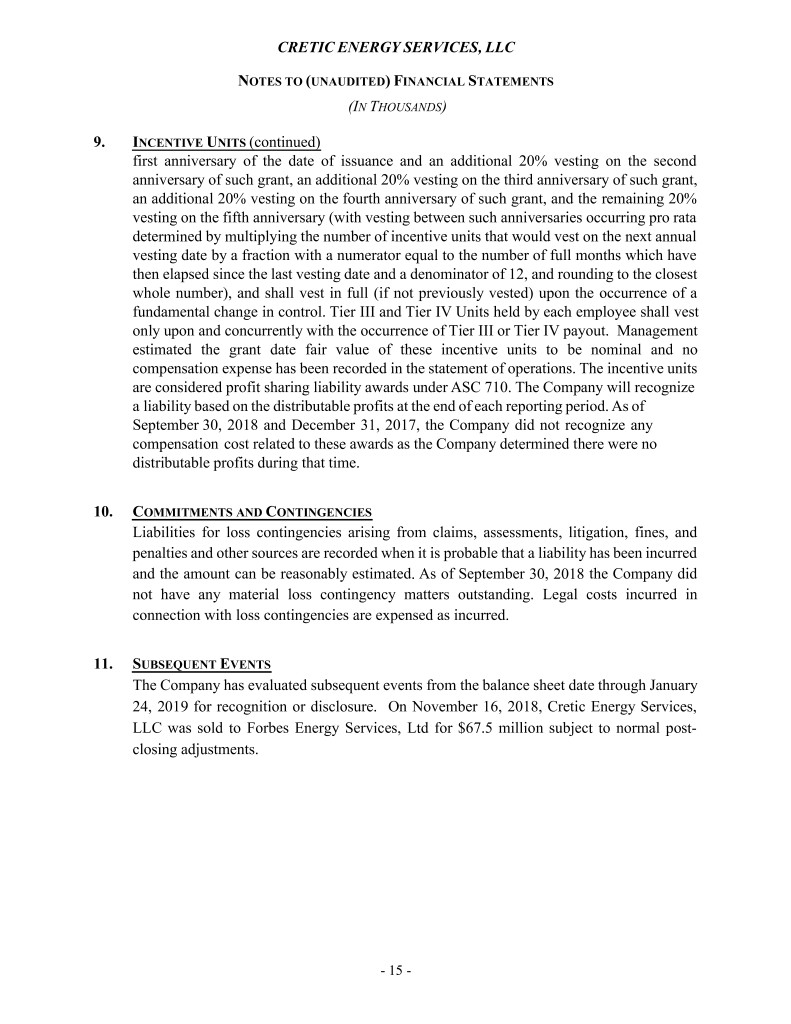

CRETIC ENERGY SERVICES, LLC NOTES TO (UNAUDITED) FINANCIAL STATEMENTS (IN THOUSANDS) 9. INCENTIVE UNITS (continued) first anniversary of the date of issuance and an additional 20% vesting on the second anniversary of such grant, an additional 20% vesting on the third anniversary of such grant, an additional 20% vesting on the fourth anniversary of such grant, and the remaining 20% vesting on the fifth anniversary (with vesting between such anniversaries occurring pro rata determined by multiplying the number of incentive units that would vest on the next annual vesting date by a fraction with a numerator equal to the number of full months which have then elapsed since the last vesting date and a denominator of 12, and rounding to the closest whole number), and shall vest in full (if not previously vested) upon the occurrence of a fundamental change in control. Tier III and Tier IV Units held by each employee shall vest only upon and concurrently with the occurrence of Tier III or Tier IV payout. Management estimated the grant date fair value of these incentive units to be nominal and no compensation expense has been recorded in the statement of operations. The incentive units are considered profit sharing liability awards under ASC 710. The Company will recognize a liability based on the distributable profits at the end of each reporting period. As of September 30, 2018 and December 31, 2017, the Company did not recognize any compensation cost related to these awards as the Company determined there were no distributable profits during that time. 10. COMMITMENTS AND CONTINGENCIES Liabilities for loss contingencies arising from claims, assessments, litigation, fines, and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount can be reasonably estimated. As of September 30, 2018 the Company did not have any material loss contingency matters outstanding. Legal costs incurred in connection with loss contingencies are expensed as incurred. 11. SUBSEQUENT EVENTS The Company has evaluated subsequent events from the balance sheet date through January 24, 2019 for recognition or disclosure. On November 16, 2018, Cretic Energy Services, LLC was sold to Forbes Energy Services, Ltd for $67.5 million subject to normal post- closing adjustments. - 15 -