UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2 to

Form S-4

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

AUTO SEARCH CARS, INC.

(Exact name of registrant as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | | 5599 (Primary Standard Industrial Classification Code Number) | | 26-1919261 (I.R.S. Employer Identification No.) |

164 Eleven Levels Road

Ridgefield, CT 06877

(203) 216-9991

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Business Filings Incorporated

6100 Neil Road, Suite 500

Reno, NV 89511

(608) 827-5300

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

Joseph M. Lucosky, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

Tel: (732) 409-1212

Fax: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement and the satisfaction or waiver of all other conditions to the Merger Agreement described herein.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

| | | | | Proposed Maximum | | Proposed Maximum | | |

| Title of Each Class of | | Amount to be | | Offering | | Aggregate | | Amount of |

| Securities to be Registered (1) | | Registered | | Price per Share (2) | | Offering Price (3) | | Registration Fee (4) |

| Common Stock, $0.0001 par value per share | | 63,964,202 | | $0.10 | | $6,396,420.20 | | $456.06 |

| (1) | | This registration statement relates to common stock, $0.0001 par value per share, of Auto Search Cars, Inc. (“Auto Search”) issuable to holders of shares of Curaxis Pharmaceutical Corporation (“Curaxis”), in the proposed merger of Curaxis with and into Auto Search Cars, Inc. |

| | | |

| (2) | | The Proposed Maximum Offering price per share is based on the Company’s original resale registration statement filed on Form S-1 May 15, 2008. |

| | | |

| (3) | | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and (o) of the Securities Act of 1933, as amended. |

| | | |

| (4) | | The Company has previously paid this fee. |

The registrant hereby amends the registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that the registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this information statement/prospectus is not complete and may be changed. Auto Search may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”), of which this document is a part, is declared effective. This information statement/prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any representation to the contrary is a criminal offense.

CURAXIS PHARMACEUTICAL CORPORATION

12600 Deerfield Parkway, suite 100

Alpharetta, GA 30004

NOTICE OF ACTION BY WRITTEN CONSENT

TO THE STOCKHOLDERS OF CURAXIS PHARMACEUTICAL CORPORATION:

NOTICE IS HEREBY GIVEN that on February 5, 2010, Curaxis Pharmaceutical Corporation, a Delaware corporation (“Curaxis”), obtained written consent from stockholders holding a majority of the outstanding shares of common stock of Curaxis entitled to vote on the following actions:

1. To ratify and approve the merger agreement (the “Merger Agreement”) by and among Curaxis, Auto Search Cars Acquisition Corp. and Auto Search Cars, Inc. (“Auto Search”) and the transactions contemplated thereby.

The details of the foregoing action and other important information are set forth in the accompanying information statement and a copy of the Merger Agreement is attached as Exhibit 2.1. The board of directors of Curaxis has unanimously approved the above action.

Under Section 228 of the Delaware General Corporation Law (“DGCL”), action by stockholders may be taken without a meeting, without prior notice, without a vote, by written consent of the holders of outstanding capital stock having not less than the minimum number of votes that would be necessary to authorize the action at a meeting at which all shares entitled to vote thereon were present and voted. On that basis, the stockholders holding a majority of the outstanding shares of capital stock entitled to vote approved the foregoing actions. No other vote or stockholder action is required. Under Delaware law, appraisal rights are afforded to stockholders who properly dissent with the merger and comply with the requirements set forth herein. If you do not comply with the procedures governing appraisal rights set forth under De laware law and explained elsewhere in this information statement, you may not be entitled to payment for your shares.

Please read this information statement carefully and in its entirety. Although you will not have an opportunity to vote on the approval of the Merger Agreement and the merger, this information statement contains important information about these actions.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND CURAXIS A PROXY

This information statement is being mailed on or about February 20, 2010 to all stockholders of record as of February 5, 2010.

| | | | By Order of the Board of Directors | |

| | | | /s/ Patrick S. Smith | |

| | | | | |

Auto Search Cars, Inc.

Common Stock

PRELIMINARY INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND CURAXIS A PROXY

GENERAL INFORMATION

Jonathan Martin, the sole director of Auto Search Cars, Inc., (“Auto Search”), and the board of directors Curaxis Pharmaceutical Corporation, (“Curaxis”) have each approved the merger of Curaxis with a wholly-owned subsidiary of Auto Search. If the proposed merger is completed, the holders of common stock of Curaxis (the “Curaxis Common Stock”) are expected to receive one (1) share of Auto Search common stock (the “Auto Search Common Stock”) for each share of Curaxis Common Stock they own immediately prior to completion of the merger.

This information statement is being furnished to Curaxis stockholders in connection with the actions taken by the board of directors of Curaxis (the “Curaxis Board of Directors”) and the written consent of the holders of a majority of Curaxis’ outstanding voting securities with respect to the actions described below. On January 18, 2010, the Curaxis Board of Directors unanimously approved these actions, subject to stockholder approval. In accordance with Section 228 of the DGCL, on or about February 5, 2010, Curaxis received written consents in lieu of a meeting from stockholders (the “Majority Stockholders”) holding 43,966,182 shares of Curaxis Common Stock, representing approximately 70% of the 62,962,604 total shares of common stock issued and outstanding as of Janua ry 18, 2010, the record date. This information statement is being sent to Curaxis’ stockholders to comply with the requirements of Delaware General Corporations Law and shall constitute notice to Curaxis’ stockholders of action taken by written stockholder consent.

Pursuant to the Merger Agreement dated as of February 8, 2010, by and between Curaxis, Auto Search Cars Acquisition Corp. (“Acquisition Corp.”) and Auto Search, Acquisition Corp. will merge with and into Curaxis, with Curaxis being the surviving corporation (the “Surviving Corporation”) and a wholly-owned subsidiary of Auto Search. The merger will become effective as of the date and at such time as the Certificate of Merger is filed with the Secretary of State of the State of Delaware with respect to the merger (the “Effective Time”). In accordance with the terms of the Merger Agreement, at the Effective Time, each share of Curaxis Common Stock outstanding immediately prior to the Effective Time will be converted into the right to receive one share, par value $0.0001 per share, of Auto Search Co mmon Stock. Auto Search Common Stock currently trades with limited volume on the Over-the-Counter Bulletin Board (the “OTCBB”) under the symbol ASCH. At the Effective Time, the Curaxis Common Stock will no longer be outstanding and shall automatically be cancelled and retired and cease to exist, and each holder of Curaxis Common Stock shall cease to have any rights with respect to the shares of Curaxis Common Stock, except the right to receive the shares of Auto Search common stock as described above. No fractions of a share of Auto Search Common Stock will be issued, and in lieu of such issuance, a holder of Curaxis Common Stock who would otherwise be entitled to a fraction of a share of Auto Search Common Stock as a result of the exchange of shares contemplated by the Merger Agreement will receive a whole share for any fractional share interest equal to or in excess of $0 .50 of a share and will receive no share or payment for any fractional share inte rest less than .50 per share.

We encourage you to read carefully this information statement/prospectus including the section entitled “Risk Factors” beginning on page 15 .

IN CONNECTION WITH THE MERGER, YOU HAVE THE RIGHT TO EXERCISE DISSENTERS’ RIGHTS UNDER THE DELAWARE GENERAL CORPORATION LAW AND OBTAIN THE “FAIR VALUE” OF YOUR SHARES OF AUTO SEARCH’S COMMON STOCK, PROVIDED THAT YOU COMPLY WITH THE CONDITIONS ESTABLISHED UNDER APPLICABLE DELAWARE LAW. IF YOU DO NOT COMPLY WITH THE PROCEDURES GOVERNING APPRAISAL RIGHTS SET FORTH UNDER DELAWARE LAW AND EXPLAINED ELSEWHERE IN THIS INFORMATION STATEMENT, YOU MAY NOT BE ENTITLED TO PAYMENT FOR YOUR SHARES.

FOR A DISCUSSION REGARDING YOUR APPRAISAL RIGHTS, SEE THE SECTION TITLED “APPRAISAL RIGHTS.”

Neither of the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this information statement/prospectus. Any representation to the contrary is a criminal offense.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary Prospectus Subject to completion _________, 2010

TABLE OF CONTENTS

| | Page |

| SUMMARY TERM SHEET | 7 |

| QUESTIONS AND ANSWERS ABOUT THE MERGER | 8 |

| SUMMARY | 10 |

| AUTO SEARCH SUMMARY FINANCIAL DATA | 13 |

| RISK FACTORS | 15 |

| CAUTIONARY INFORMATION REGARDING FORWARD LOOKING STATEMENTS | 34 |

| THE MERGER | 35 |

| APPRAISAL RIGHTS | 37 |

| THE MERGER AGREEMENT | 40 |

| MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES | 42 |

| COMPARISON OF RIGHTS OF AUTO SEARCH STOCKHOLDERS AND CURAXIS STOCKHOLDERS | 43 |

| AUTO SEARCH DESCRIPTION OF BUSINESS | 48 |

| AUTO SEARCH DESCRIPTION OF PROPERTY | 49 |

| AUTO SEARCH DIRECTORS, OFFICERS, AND CORPORATE GOVERNANCE | 50 |

| AUTO SEARCH EXECUTIVE COMPENSATION | 51 |

| AUTO SEARCH OUTSTANDING EQUITY AWARDS AT 2009 FISCAL YEAR END | 51 |

| AUTO SEARCH BENEFICIAL OWNERSHIP | 51 |

| AUTO SEARCH TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS | 52 |

| AUTO SEARCH MARKET FOR COMMON STOCK | 52 |

| AUTO SEARCH DESCRIPTION OF SECURITIES | 52 |

| AUTO SEARCH EXPERTS | 52 |

| AUTO SEARCH LEGAL MATTERS | 53 |

| AUTO SEARCH MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 53 |

| AUTO SEARCH FINANICAL STATEMENTS | 56 |

| AUTO SEARCH NOTES TO FINANCIAL STATEMENTS | 62 |

| CURAXIS DESCRIPTION OF BUSINESS | 66 |

| CURAXIS DESCRIPTION OF PROPERTY | 88 |

| CURAXIS LEGAL PROCEEDINGS | 88 |

| CURAXIS DIRECTORS, OFFICERS, PROMOTERS AND CONTROL PERSONS | 88 |

| CURAXIS EXECUTIVE COMPENSATION | 90 |

| CURAXIS DIRECTOR COMPENSATION | 92 |

| CURAXIS OUTSTANDING EQUITY AWARDS AT 2009 FISCAL YEAR END | 93 |

| CURAXIS BENEFICIAL OWNERSHIP | 94 |

| BENEFICIAL OWNERSHIP OF THE COMBINED COMPANY | 96 |

| CURAXIS TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS | 97 |

| CURAXIS MARKET FOR COMMON STOCK | 97 |

| CURAXIS DESCRIPTION OF SECURITIES | 97 |

| CURAXIS EXPERTS | 98 |

| CURAXIS MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 98 |

| CURAXIS FINANCIAL STATEMENTS | F-1 |

| CURAXIS NOTES TO FINANCIAL STATEMENTS | F-8 |

| SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL DATA OF AUTO SEARCH AND CURAXIS | PF-1 |

| NOTES TO SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL DATA OF AUTO SEARCH AND CURAXIS | PF-4 |

| PART II – INFORMATION NOT REQUIRED IN PROSPECTUS | 109 |

| SIGNATURES | 111 |

| EXHIBITS | Attached |

SUMMARY TERM SHEET FOR THE MERGER

The following is a summary of the principal terms of the merger. This summary does not contain all information that may be important to you. Auto Search and Curaxis encourage you to read carefully this information statement, including the appendices, in their entirety.

On February 8, 2010, Curaxis Pharmaceutical Corporation entered into the Merger Agreement with Auto Search Cars, Inc. In connection with the merger:

● | each share of common stock, par value $0.001 per share, of the Acquisition Corp. that shall be outstanding immediately prior to the Effective Time shall, by virtue of the Merger and without any action on the part of the holder thereof, be converted into the right to receive one share of common stock, par value $0.001, of the Surviving Corporation, so that at the Effective Time, Auto Search shall be the holder of all of the issued and outstanding shares of the Surviving Corporation. |

| | |

| each issued and outstanding share of Curaxis Common Stock shall be converted into the right to receive one (1) share of Auto Search Common Stock. |

| | |

| Each issued Company Warrant (as defined in the Merger Agreement) shall be converted into warrants to purchase an equal number of shares of Auto Search Common Stock at the Exercise Price defined in the Company Warrants. |

| | |

| each share of Auto Search Common Stock issued to Curaxis shareholders pursuant to the Merger Agreement shall be restricted from trading or resale for a period of one (1) year commencing on the Effective Date, provided that such restriction shall not apply to the Auto Search Common Stock issued in exchange for Curaxis Common Stock issued in the Company’s Bridge Financing (as defined in the Merger Agreement); |

| | |

| each share of Curaxis Common Stock held in the treasury of Curaxis immediately prior to the Effective Time shall be cancelled in the Merger and cease to exist; and |

| | |

| the Certificate of Incorporation and By-laws of Curaxis shall be the Certificate of Incorporation and By-laws of the Surviving Corporation. |

Auto Search Common Stock trades on the OTC Bulletin Board with limited volume under the symbol “ASCH.” On February 5, 2010, the last reported sales price of Auto Search Common Stock at the end of regular trading hours, as reported on the OTCBB, was $0.00.

The Auto Search stockholders are not required to vote on the Merger. The obligations of Auto Search and Curaxis to complete the Merger are also subject to the satisfaction or waiver of several other conditions to the Merger. More information about Auto Search, Curaxis and the Merger is contained in this information statement/prospectus.

| Sincerely, | | | | |

| /s/ Jonathan Martin | | | | |

Jonathan Martin Chief Executive Officer Auto Search Cars, Inc. | | | Patrick S. Smith Chief Executive Officer Curaxis Pharmaceutical Corporation | |

This information statement/prospectus is dated February 10, 2010, and is being mailed to stockholders of Curaxis on or about February 20, 2010.

QUESTIONS AND ANSWERS ABOUT THE MERGER

Following are questions and related answers that address some of the questions you may have regarding the pending merger (the “Merger”) transaction between Curaxis Pharmaceutical Corporation (“Curaxis”), Auto Search Cars Acquisition Corp. (“Acquisition Corp.”) and Auto Search Cars, Inc. (“Auto Search”). These questions and answers may not contain all of the information relevant to you, do not purport to summarize all material information relating to the Merger Agreement, or any of the other matters discussed in this information statement, and are subject to, and are qualified in their entirety by, the more detailed information contained in or attached to this information statement. Therefore, please carefully read this information statement, including the attached appe ndices, in its entirety.

Q. WHY DID I RECEIVE THIS INFORMATION STATEMENT?

A. Applicable requirements of Delaware law and the federal securities laws require Curaxis to provide you with information regarding the Merger. As explained more fully elsewhere in this information statement, since Curaxis has adopted the Merger Agreement and the Merger has been approved by the written consent of the holders of a majority of Curaxis’ outstanding capital stock, your consent to the Merger or the other actions in connection therewith, is not required and is not requested. Nevertheless, this information statement contains important information about the Merger, and the other actions contemplated thereby.

Q. WHY AM I NOT BEING ASKED TO VOTE ON THE MERGER?

A. Curaxis’ stockholders, who currently own in the aggregate approximately 70% of the voting power of outstanding shares of Curaxis’ capital stock, have executed a written consent dated February 5, 2010, approving the Merger and the transactions contemplated by the Merger Agreement. This consent of stockholders is sufficient to approve entering into the transactions. Accordingly, the actions will not be submitted to our other stockholders for a vote.

Q. WHEN IS IT EXPECTED THAT THE MERGER WILL BE COMPLETE?

A. Curaxis and Auto Search signed the Merger Agreement on February 8, 2010. The holders of a majority of Curaxis’ capital stock approved the merger by written consent dated February 5, 2010. The parties are working toward completing the Merger as quickly as possible, and hope to complete the Merger during the first quarter of 2010; however, the exact timing cannot be predicted. In order to complete the Merger, several conditions set forth in the Merger Agreement must be met or waived. The Merger will become effective when a certificate of merger is filed with the Secretary of State of the State of Delaware.

Q. WHAT WILL I RECEIVE IN THE MERGER?

A. The holders of Curaxis Common Stock will receive shares of Auto Search common stock. This means that each share of Curaxis Common Stock will convert into the right to receive one (1) share of Auto Search Common Stock. After the Merger is completed, it is expected that Curaxis’ pre-merger stockholders and warrant holders will own approximately 63,964,202 shares of Auto Search Common Stock, or approximately 89% of the outstanding shares of Auto Search on an as converted basis, subject to adjustment under the terms of the Merger Agreement.

Q. HAS SOMEONE DETERMINED THAT THE MERGER IS ADVISABLE FOR THE CURAXIS STOCKHOLDERS AND AUTO SEARCH STOCKHOLDERS?

A. Yes. The Curaxis Board of Directors and Mr. Martin, the sole director of Auto Search (the “Sole Director of Auto Search”), have independently determined that the Merger is advisable for their stockholders, respectively. The Curaxis Board of Directors and the Sole Director of Auto Search have approved the Merger and the Merger Agreement, and the Sole Director of Auto Search has approved the issuance of Auto Search’s common stock in the Merger, as well as the other actions contemplated in connection with the Merger. The number of shares of Auto Search Common Stock to be issued pursuant to the Merger Agreement was determined by negotiation between Curaxis and Auto Search. This consideration does not necessarily bear any relationship to our asset value, net worth or other established criteria of value and sh ould not be considered indicative of the actual value of Curaxis. Furthermore, neither Curaxis nor Auto Search has obtained an opinion from any third party that the merger is fair from a financial perspective.

Q. DO I HAVE APPRAISAL OR DISSENTER’S RIGHTS?

A. Yes. Under Delaware law, holders of Curaxis Common Stock who do not consent to the Merger are entitled to appraisal rights in connection with the Merger. You are urged to read the discussion of appraisal rights commencing on page 38 for a more complete discussion of appraisal rights. If you do not comply with the procedures governing appraisal rights set forth under Delaware law and explained elsewhere in this information statement, you may not be entitled to payment for your shares.

Q. WHAT WILL HAPPEN IF THE MERGER IS NOT COMPLETED?

A. If the Merger is not completed for any reason, Curaxis may be subject to a number of other risks. Curaxis will have no access to the public markets for its common stock and will have incurred the expenses associated with attempting to effectuate the Merger and the transactions contemplated by the Merger. The failure to consummate the Merger would have an adverse impact on the financial condition of Curaxis and the value of its equity interests.

Q. WHO CAN ANSWER QUESTIONS REGARDING THE MERGER?

A. If you would like additional copies of this information statement, or if you have questions about the Merger, amendments or the other matters discussed in this document, you should contact:

| Curaxis Pharmaceutical Corporation |

| 12600 Deerfield Parkway, Suite 100 |

| Alpharetta, GA 30004 |

| Attn: David Corcoran |

SUMMARY

The following is a summary that highlights information contained in this information statement/prospectus. This summary may not contain all of the information that may be important to you. For a more complete description of the Merger Agreement and the Merger contemplated by the Merger Agreement, we encourage you to read carefully this entire information statement/prospectus, including the attached appendices.

The Companies

Auto Search Cars, Inc.

164 Eleven Levels Road

Ridgefield, CT 06877

(203) 216-9991

Auto Search Cars, Inc.’s Business

Auto Search has been engaged in the development of a web-based e-commerce site designed to be a price leader in the online vehicle sales and service market. Inclusive in the business plan is to develop the website as a platform to provide information, not just for the sale of vehicles but also for information such as vehicle financing and warranties. Auto Search has created a platform that is local, regional and national in nature. By providing such a platform, Auto Search can bring vehicle sellers and other industry participants, such as vendors of automotive services and advertisers, together with consumers actively engaged in a search for a vehicle or vehicle-related products.

Since inception, Auto Search has been engaged in business activities, including the launch of the preliminary website, website development, market research, developing economic models and financial forecasts, performing due diligence regarding e-commerce marketing, identifying future sources of capital and most notably the launch of the fully operational website.

Auto Search has been offering free listings on its website though the date of this filing as an incentive for consumers to use its product.

Auto Search has implemented a full set of features including geographic search criteria, pictures and make/model search options.

In 2009, Auto Search redesigned the general look and feel of its website while not changing its functionality. Notwithstanding this development, there have been no significant activities related to website development.

Curaxis Pharmaceutical Corporation

12600 Deerfield Parkway, Suite 100

Alpharetta, GA 30004

(678) 566-3750

Curaxis’ Business

We were incorporated on February 27, 2001, under the laws of the state of Delaware. Our executive offices are located at 12600 Deerfield Parkway, Suite 100, Alpharetta, Georgia 30004. Our fiscal year end is December 31. Curaxis is a development stage company and to date, we have not (i) received FDA approval for any of our products; and (ii) generated any commercial revenue through the sale of our products.

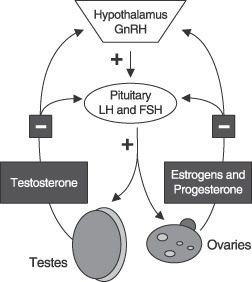

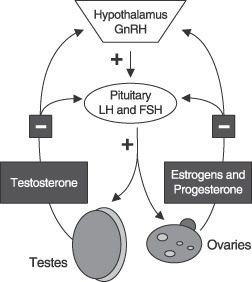

We are an emerging specialty pharmaceutical company with a hormone drug product candidate for the treatment of Alzheimer’s disease and multiple cancers. Our therapeutic platform is based on the hypothesis that many diseases of aging may be caused by age-related changes in the function of the hypothalamic-pituitary-gonadal (HPG) axis. The HPG axis is a hormonal endocrine feedback loop that controls development, reproduction and aging in animals. This drug development platform is built on the premise that hormones associated with this feedback loop are beneficial early in life, when they promote growth and development, but are harmful later in life when the mechanism for feedback is compromised, thereby leading to disease processes, including pathologies associated with Alzheimer’s disease and various c ancers. We believe our discovery of similar hormonal signaling mechanisms at the cellular level in brain tissue from Alzheimer’s patients and in multiple tumors will enable us to develop significant new treatments for Alzheimer’s disease as well as many cancers.

Curaxis does not plan to pursue the current business plan of Auto Search after the merger is effectuated. We plan to concentrate our efforts during the next several years on the development of our candidate for the treatment of Alzheimer’s disease. We have previously conducted several clinical trials for this indication, the most recent of which we were forced to terminate in 2006 due to financial constraints. Since terminating those trials, we have been unable to advance the clinical development of our Alzheimer’s disease candidate due to a lack of financial resources. Upon completion of our merger with Auto Search, we anticipate that we will be able to raise the funds necessary to restart the clinical development of our Alzheimer’s disease candidate, but there can be no assurance that we will be able to do so.

Our Alzheimer’s Disease Program

Leuprolide acetate, a hormone analogue of naturally occurring gonadotropin-releasing hormone (GnRH), has been widely used over the past twenty years for the treatment of a number of hormone-related disorders, most notably prostate cancer and endometriosis and precocious puberty, and has a well-established safety profile. Curaxis has conducted extensive preclinical and clinical studies exploring the use of leuprolide acetate for the treatment of Alzheimer’s disease in mild-to-moderate patients. The results to date are encouraging and point especially to a potentially significant new treatment for women with Alzheimer’s disease. Women represent approximately two-thirds of Alzheimer’s patients.

Men present greater challenges in the use of leuprolide to treat Alzheimer’s disease because leuprolide suppresses their production of testosterone, which could necessitate patient self-administration of supplemental testosterone and which can lead to wide swings in testosterone blood serum levels. Therefore, in the near-term, we plan to concentrate our development efforts on the use of leuprolide acetate to treat women, although we will continue our efforts to better understand mechanisms that might lead to optimum outcomes in men.

Auto Search Cars Acquisition Corp.

164 Eleven Levels Road

Ridgefield, CT 06877

(203) 216-9991

Auto Search Cars Acquisition Corp.’s Business

Auto Search Cars Acquisition Corp. was formed in December 2009, in the state of Delaware, as an acquisition subsidiary of Auto Search, for the purpose of merging with Curaxis, pursuant to the terms of the Merger Agreement.

The Merger

Auto Search and Curaxis have agreed to the acquisition of Curaxis by Auto Search under the terms of the Merger Agreement that is described in this information statement/prospectus. In the Merger, Acquisition Corp., a wholly-owned subsidiary of Auto Search will merge with Curaxis, with Curaxis surviving as a wholly-owned subsidiary of Auto Search (the “Surviving Corporation”). We have attached the Merger Agreement to this information statement/prospectus as Exhibit 2.1. We encourage you to carefully read the Merger Agreement in its entirety because it is the legal document that governs the Merger.

Merger Consideration

If the proposed Merger is completed, the holders of Curaxis Common Stock are expected to receive one (1) share of Auto Search Common Stock for each share of Curaxis Common Stock they own immediately prior to completion of the Merger. For a full description of a comparison of the rights of the Auto Search Common Stock to the rights of the Curaxis Common Stock, see “Comparison of Rights of Auto Search Stockholders and Curaxis Stockholders” beginning on page 43. The merger is expected to qualify as a “reorganization” under the Internal Revenue Code. See “Risk Factors – Risks Related to the Merger” beginning on page 15.

Ownership of Auto Search after the Merger

As a result of the merger, Curaxis common stockholders will become holders of Auto Search common stock. Auto Search is a Nevada corporation and Curaxis is a Delaware corporation. The rights of Auto Search stockholders are currently governed by the certificate of incorporation of Auto Search, or the Auto Search charter, the amended and restated bylaws of Auto Search, or the Auto Search bylaws, and the laws of the State of Nevada. The rights of Curaxis stockholders are currently governed by the articles of incorporation of Curaxis, or the Curaxis articles, the bylaws of Curaxis and the laws of the State of Delaware. At the effective time of the merger, holders of Curaxis common stock will become holders of Auto Search common stock and, as such, the rights of such holders will be governed by Nevada law, the Auto Search charter and the Au to Search bylaws. Please see the “Comparison of Rights of Auto Search Stockholders and Curaxis Stockholders” on page 43.

Based on the number of shares of Auto Search Common Stock and Curaxis Common Stock outstanding on April 30, 2010, and without giving effect to any further issuances of shares of stock by Auto Search, holders of Curaxis common stock are expected to hold approximately 89% of the outstanding shares of Auto Search Common Stock on an as converted basis immediately after the Merger. In the event that the merger becomes effective, the capitalization of Auto Search will consist of 480,000,000 common shares authorized, 20,000,000 preferred shares authorized, 71,667,902 common shares issued, 13,720,597 common shares reserved for issuance, and 394,611,501 common shares authorized and unissued but not reserved. Upon the exercise of all options and warrants, the Company may be required to issue up to 13,541,501 restr icted shares of common stock.

Auto Search stockholders will continue to own their existing shares, which will not be affected by the Merger.

Opinion of Financial Advisor

Curaxis

The Curaxis Board of Directors did not engage a financial advisor to assist in the sale of Curaxis or to render a financial opinion as to the fairness, from a financial point of view, of the consideration to be paid to the Curaxis stockholders in the merger. The Curaxis Board of Directors determined that the factors which weighed in favor of the Merger, as discussed below, were substantial in relation to the factors which weighed against the Merger. The Curaxis Board of Directors also considered the cost of obtaining a fairness opinion as prohibitively expensive in light of Curaxis’ financial condition.

Share Ownership of Directors and Executive Officers

At the close of business on February 5, 2010, the Curaxis record date, directors and executive officers of Curaxis and their affiliates beneficially owned and were entitled to vote approximately 16,422,064 shares of Curaxis Common Stock, collectively representing approximately 26% of the shares of Curaxis Common Stock outstanding on that date. Curaxis has received written consent from certain Curaxis stockholders representing approximately 70% of Curaxis Common Stock under which the parties, subject to certain limited exceptions, have voted their shares in favor of the Merger.

Dissenters’ or Appraisal Rights

Holders of shares of Curaxis Common Stock who do not vote in favor of approval and adoption of the Merger Agreement and approval of the Merger and who properly demand appraisal of their shares will be entitled to appraisal rights in connection with the Merger under Section 262 of the Delaware General Corporate Law (“DGCL”). Under the Nevada Revised Statutes, holders of shares of Auto Search Common Stock are not entitled to appraisal rights in connection with the merger.

Conditions to Completion of the Merger

A number of conditions must be satisfied before the Merger will be completed. These include among others:

| The Form S-4 shall have become effective under the Securities Act of 1993, as amended; |

| The representations and warranties made by Curaxis in the Merger Agreement are true and correct; |

| Curaxis has performed, in all material respects, all obligations and complied with all covenants required by the Merger Agreement to be performed or complied with, in all material respects, by Curaxis prior to the Effective Time; |

| The representations and warranties made by Auto Search and/or Acquisition Corp. in the Merger Agreement are true and correct; and |

| Auto Search has performed, in all material respects, all obligations and complied with all covenants required by the Merger Agreement to be performed or complied with, in all material respects, by it prior to the Effective Time. |

Each of Auto Search, Acquisition Corp. and Curaxis may waive the conditions to the performance of its respective obligations under the merger agreement and complete the merger even though one or more of these conditions has not been met.

Regulatory Matters

The merger is not subject to antitrust laws or any federal or state regulatory requirements.

Reasonable Best Efforts to Complete the Merger

Each of Auto Search and Curaxis has agreed to cooperate fully with the other party and use its reasonable best efforts to take, or cause to be taken, all actions necessary, proper or advisable under applicable law and regulations to complete the Merger as promptly as practicable.

Material United States Federal Income Tax Consequences of the Merger

Curaxis expects the Merger to qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code. If the Merger qualifies as a “reorganization,” Curaxis stockholders generally will not recognize a gain or loss for federal income tax purposes. No gain or loss will be recognized for federal income tax purposes by Curaxis, Auto Search, or Auto Search stockholders as a result of the Merger.

Tax matters are complicated, and the tax consequences of the Merger to each Curaxis stockholder will depend on the facts of each stockholder’s situation. Curaxis stockholders are urged to read carefully the discussion in the section entitled “The Merger—Material United States Federal Income Tax Consequences of the Merger” and to consult their tax advisors for a full understanding of the tax consequences of their participation in the merger.

Accounting Treatment

The merger transaction will be accounted for as a reverse acquisition and recapitalization. Auto Search is the issuer. For accounting purposes, Curaxis will be considered the acquirer. Accordingly, the historical financial statements prior to the merger will become those of Curaxis retroactively restated for the equivalent number of shares received in the merger. Earnings per share for the periods prior to the merger will be restated to reflect the equivalent number of shares outstanding.

Risk Factors

In evaluating the Merger Agreement and the Merger, in the case of Curaxis stockholders, or the issuance of shares of Auto Search Common Stock in the Merger, you should carefully read this information statement/prospectus and especially consider the factors discussed in the section entitled “Risk Factors” beginning on page 15.

Summary Selected Historical Financial Data

Auto Search and Curaxis are providing the following information to aid you in your analysis of the financial aspects of the Merger.

Summary Financial Data of Auto Search

The following statement of operations and balance sheet summary of Auto Search should be read in conjunction with the financial statements and the notes thereto included elsewhere in this Prospectus and in the information set forth in the section titled “Auto Search Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | For the Period from February 1, 2008 (Inception) to March 31, 2010 (unaudited) | | | For the Period from February 1, 2008 (Inception) to December 31, 2009 | |

| STATEMENT OF OPERATIONS | | |

| Revenues | | $ | 0 | | | $ | 0 | |

| Total Operating Expenses | | $ | 29,084 | | | $ | 25,512 | |

| | | | | | | | | |

| Other Income | | $ | 200 | | | $ | 200 | |

| Net Loss | | $ | (28,884 | ) | | $ | (25,312 | ) |

| | | | As of March 31, 2010 (unaudited) | | | | As of December 31, 2009 | |

BALANCE SHEET DATA | | | | | | | | |

| Cash | | $ | 280 | | | $ | 277 | |

| Total Assets | | $ | 480 | | | $ | 477 | |

| Total Liabilities | | $ | 21,494 | | | $ | 17,918 | |

| Stockholders’ (Deficiency) | | $ | (21,014 | ) | | $ | (17,442 | ) |

Summary Financial Data of Curaxis

The following statement of operations and balance sheet summary of Curaxis Pharmaceutical Corporation should be read in conjunction with the financial statements and the notes thereto included elsewhere in this Prospectus and in the information set forth in the section titled “Curaxis Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| | | For the Period from February 27, 2001 (Inception) to March 31, 2010 (unaudited) | | | For the Period from February 27, 2001 (Inception) to December 31, 2009 (unaudited) | |

| | | (in thousands) | |

| STATEMENT OF OPERATIONS | | | | | | |

| Revenues | | $ | 0 | | | $ | 0 | |

| Total Operating Expenses | | $ | 93,726 | | | $ | 93,195 | |

| | | | | | | | | |

| Other Income (expense) | | $ | (970 | ) | | $ | (917 | ) |

| Gain on debt restructuring | | $ | 6,766 | | | $ | 6,562 | |

| | | | | | | | | |

| Net Income (Loss) | | $ | (9,582 | ) | | $ | (87,550 | ) |

| | | | As of March 31, 2010 (unaudited) | | | | As of December 31, 2009 (audited) | |

| | | | (in thousands) | |

BALANCE SHEET DATA | | | | | | | | |

| Cash | | $ | 418 | | | $ | 631 | |

| Total Assets | | $ | 478 | | | $ | 781 | |

| Total Liabilities | | $ | 10,060 | | | | 10,371 | |

| Stockholders’ (Deficiency) | | $ | (87,930 | ) | | $ | (9,590 | ) |

RISK FACTORS

The following risk factors should be considered carefully in addition to the other information in this Registration Statement, before purchasing any of the Company’s securities.

RISKS RELATED TO THE MERGER

IF THE PROPOSED MERGER WITH CURAXIS IS CONSUMMATED, AUTO SEARCH WILL FACE THE RISKS ASSOCIATED WITH CURAXIS’ BUSINESS.

Auto Search is targeting a closing of the Merger during the first quarter of 2010. If the proposed Merger is consummated, Auto Search may be subject to a number of material risks associated with Curaxis’ business, including the following:

| ● | Curaxis’ business is capital intensive and, after the Merger, Auto Search may not be able to raise sufficient funds to proceed with clinical development of Curaxis’ therapeutic candidates. |

| ● | Curaxis’ business is subject to numerous uncertainties, including the possibility that none of its therapeutic candidates will obtain FDA approval or achieve commercialization. |

OWNERSHIP OF AUTO SEARCH COMMON STOCK MAY BE HIGHLY CONCENTRATED AFTER CONSUMMATION OF THE MERGER.

After consummation of the Merger, certain stockholders will have beneficial ownership of significant blocks of Auto Search’s outstanding common stock. Such stockholders, acting individually or as a group, will have substantial influence over the outcome of a corporate action of Auto Search requiring stockholder approval, including the election of directors, any approval of a merger, consolidation or sale of all or substantially all of Auto Search’s assets or any other significant corporate transaction, even if the outcome sought by such stockholders is not in the interest of Auto Search’s other stockholders. These stockholders, acting as a group, may also delay or prevent a change in control of Auto Search, even if such change in control would benefit the other stockholders of Auto Search.

AUTO SEARCH’S AND CURAXIS’ SHAREHOLDERS MAY NOT REALIZE A BENEFIT FROM THE MERGER COMMENSURATE WITH THE OWNERSHIP DILUTION THEY WILL EXPERIENCE IN CONNECTION WITH THE MERGER.

If the combined company is unable to realize the strategic and financial benefits currently anticipated from the Merger, Auto Search’s and Curaxis’ stockholders will have experienced substantial dilution of their ownership interest in connection with the Merger without receiving any commensurate benefit.

CURAXIS DID NOT OBTAIN AN INVESTMENT BANKER’S OPINION PRIOR TO ENTERING INTO THE MERGER AGREEMENT.

Curaxis did not obtain a fairness opinion with respect to the merger transaction. If the Curaxis Board of Directors erred in concluding that the Merger and the Merger Agreement is in the best interest of the Curaxis stockholders, then the Curaxis stockholders will suffer adverse consequences associated with the consummation of the transaction. In the event of litigation over Curaxis’ Board of Directors’ exercise of its fiduciary duties, Curaxis may be required to indemnify its directors. At a minimum, any litigation would divert management’s time and attention from completing the transactions described herein, and would likely also involve the expenditure of substantial amounts for l egal fees.

IF ANY OF THE EVENTS DESCRIBED IN “RISKS RELATED TO AUTO SEARCH,” “RISKS RELATED TO CURAXIS” OR RISKS RELATED TO AUTO SEARCH AND THE COMBINED COMPANY AND THE INDUSTRY IN WHICH THEY WILL OPERATE OCCUR, THOSE EVENTS COULD CAUSE THE POTENTIAL BENEFITS OF THE MERGER NOT TO BE REALIZED.

Following the effective time of the Merger, the combined company will be susceptible to many of the risks described in the sections herein entitled “Risks Related to Auto Search,” and “Risks Related to Curaxis.” To the extent any of the events in the risks described in those sections occur, those events could cause the potential benefits of the Merger not to be realized and the market price of the combined company’s common stock to suffer.

RISKS RELATED TO AUTO SEARCH

RISKS ASSOCIATED WITH AUTO SEARCH’S BUSINESS

Assuming the Merger is consummated, Auto Search intends to discontinue any efforts relating to development of a website for online vehicle classified advertising and to concentrate its focus exclusively on Curaxis’ drug research and development business. Therefore, the risks described below, relating to Auto Search’s current website business, will continue to be relevant to its business only if the Merger is not consummated. However, if the Merger is consummated, the risks associated with Curaxis’ drug research and development business will be important to Auto Search’s business.

AUTO SEARCH’S INDEPENDENT ACCOUNTANTS HAVE EXPRESSED DOUBT ABOUT ITS ABILITY TO CONTINUE AS A GOING CONCERN.

Auto Search’s business condition, as indicated in its independent accountant’s audit report, raises substantial doubt as to Auto Search’s ability to continue as a going concern. To date, Auto Search has completed only part of its business plan and it can provide no assurance that it will be able to generate enough revenue to achieve profitability. It is not possible at this time to predict with any assurance the potential success of Auto Search’s business.

RISKS RELATED TO AUTO SEARCH COMMON STOCK

ANY ADDITIONAL FUNDING AUTO SEARCH ARRANGES THROUGH THE SALE OF ITS COMMON STOCK WILL RESULT IN DILUTION TO EXISTING SECURITY HOLDERS.

Auto Search may have to raise additional capital in order for its business plan to succeed. Its most likely source of additional capital will be through the sale of additional shares of common stock. Such issuances will cause security holders’ interests in Auto Search to be diluted, which may negatively affect the value of their shares.

CURRENTLY, THERE IS NO PUBLIC MARKET FOR AUTO SEARCH’S COMMON STOCK, AND THERE CAN BE NO ASSURANCE THAT ANY PUBLIC MARKET WILL EVER DEVELOP OR THAT AUTO SEARCH’S COMMON STOCK WILL BE QUOTED FOR TRADING. FURTHER, EVEN IF QUOTED, IT IS LIKELY TO BE SUBJECT TO SIGNIFICANT PRICE FLUCTUATIONS.

Auto Search’s common stock is listed on the Over-the-Counter Bulletin Board under the symbol “ASCH,” however; there is a limited trading market for its common stock. Even if Auto Search is successful in developing a public market, there may not be enough liquidity in such market to enable security holders to sell their stock. If a public market for Auto Search’s common stock does not develop, investors may not be able to re-sell the shares of its common stock, rendering their shares effectively worthless and resulting in a complete loss of their investment. Auto Search cannot predict the extent to which investor interest in Auto Search will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

ANY TRADING MARKET THAT MAY DEVELOP MAY BE RESTRICTED BY VIRTUE OF STATE SECURITIES “BLUE SKY” LAWS WHICH PROHIBIT TRADING ABSENT COMPLIANCE WITH INDIVIDUAL STATE LAWS. THESE RESTRICTIONS MAY MAKE IT DIFFICULT OR IMPOSSIBLE FOR AUTO SEARCH SECURITY HOLDERS TO SELL SHARES OF ITS COMMON STOCK IN THOSE STATES.

There is a limited public market for Auto Search’s common stock, and there can be no assurance that any public market will develop in the foreseeable future. Transfer of Auto Search’s common stock may also be restricted under the securities regulations and laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, Auto Search’s common stock may not be traded in such jurisdictions.

BECAUSE AUTO SEARCH IS SUBJECT TO THE “PENNY STOCK” RULES, THE LEVEL OF TRADING ACTIVITY IN ITS COMMON STOCK MAY BE REDUCED.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the b roker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in Auto Search’s common stock may find it difficult to sell their shares.

IN THE EVENT THAT A PUBLIC MARKET DEVELOPS, THE PRICE OF AUTO SEARCH’S COMMON STOCK WILL BE SUBJECT TO SIGNIFICANT PRICE FLUCTUATIONS.

Until an orderly market develops in Auto Search’s common stock, if ever, the price at which its common stock trades is likely to fluctuate significantly. Prices for Auto Search’s common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of its common stock, developments affecting its business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of Auto Search and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of Auto Search common stock.

In addition, Auto Search common stock may not be followed by any market analysts, and there may be few institutions acting as market makers for its common stock. Currently, there are 5 institutions acting as market makers but there can be no guarantee that they will continue to do so or that any other institutions in the future will act as a market make for the Company’s common stock. Either of these factors could (i) adversely affect the trading price of Auto Search’s common stock and (ii) severely limit the liquidity of Auto Search’s common stock.

AUTO SEARCH DOES NOT EXPECT TO PAY DIVIDENDS TO HOLDERS OF ITS COMMON STOCK IN THE FORESEEABLE FUTURE. AS A RESULT, HOLDERS OF ITS COMMON STOCK MUST RELY ON STOCK APPRECIATION FOR ANY RETURN ON THEIR INVESTMENT.

Auto Search has not declared any dividends since its inception, and it does not plan to declare any dividends in the foreseeable future. Accordingly, holders of Auto Search common stock will have to rely on capital appreciation, if any, to earn a return on their investment in Auto Search common stock.

RISKS RELATED TO CURAXIS

DUE TO A LACK OF FINANCIAL RESOURCES, WE HAVE BEEN UNABLE TO ADVANCE THE CLINICAL DEVELOPMENT OF OUR LEAD PRODUCT CANDIDATE SINCE 2006 AND THERE IS NO ASSURANCE THAT THE COMPLETION OF THE MERGER WILL ENABLE US TO DO SO.

Our lead product candidate is a hormone for the treatment of Alzheimer’s disease. We have previously conducted several clinical trials for this indication, the most recent of which we were forced to terminate in 2006 due to financial constraints. Since terminating those trials, we have been unable to advance the clinical development of our Alzheimer’s disease candidate due to a lack of financial resources. Upon completion of our merger with Auto Search, we anticipate that we will be able to raise the funds necessary to restart the clinical development of our Alzheimer’s disease candidate, but there can be no assurance that we will be able to do so. Furthermore, even if we are successful in raising the funds necessary to restart the clinical development of our Alzheimer’s disease candidate, there can be no assur ance that we will be able to successfully complete all phases of such clinical development. Drug development is extremely costly and complex and requires multiple clinical trials and we may be unable to obtain suitable financing for all such trials and, even if we are successful in obtaining suitable financing, we may be unable to complete all required clinical trials, due to an inability to recruit an adequate number of clinical trial sites or an adequate number of patients to participate in those trials or other reasons.

RISKS RELATED TO CURAXIS’ FINANCIAL POSITION AND NEED FOR ADDITIONAL CAPITAL.

CURAXIS HAS INCURRED SIGNIFICANT LOSSES SINCE ITS INCEPTION, AND CURAXIS EXPECTS TO INCUR LOSSES AT LEAST FOR THE FORESEEABLE FUTURE AND MAY NEVER ACHIEVE OR MAINTAIN PROFITABILITY.

Since inception Curaxis has incurred significant operating losses. To date, Curaxis has financed its operations primarily through the sale of its common stock and warrants to private investors. Curaxis expects to incur operating losses at least for the foreseeable future. If Curaxis is unable to raise the funds necessary to pay its expenses, including expenses accumulated in its clinical trial activities to date, Curaxis may be unable to continue operations.

To become and remain profitable, Curaxis must succeed in developing and commercializing drugs with significant market potential. This will require Curaxis to be successful in a range of challenging activities for which it is only in the preliminary stages: developing drugs, obtaining regulatory approval for them, and manufacturing, marketing and selling them. Curaxis may never succeed in these activities and may never generate revenues that are significant or large enough to achieve profitability. Even if Curaxis does achieve profitability, it may not be able to sustain or increase profitability on a quarterly or annual basis. Curaxis’ failure to become and remain profitable could impair its ability to raise capital, expand its business, diversify its product offerings or continue its operations.

CURAXIS WILL NEED SUBSTANTIAL ADDITIONAL FUNDING AND MAY BE UNABLE TO RAISE CAPITAL WHEN NEEDED, WHICH WOULD FORCE IT TO DELAY, REDUCE OR ELIMINATE ITS PRODUCT DEVELOPMENT PROGRAMS OR COMMERCIALIZATION EFFORTS.

Curaxis expects its research and development expenses to increase in connection with its ongoing activities, particularly as it conducts clinical trials for its candidate for the treatment of mild to moderate Alzheimer’s disease. In addition, subject to regulatory approval of any of its product candidates, Curaxis expects to incur significant commercialization expenses for product sales, marketing, securing commercial quantities of product from its manufacturers and distribution. Curaxis will need substantial additional funding to complete clinical trials and fund initial commercialization costs of its therapeutic candidates and to advance its earlier stage preclinical programs, and may be unable to raise capital when needed or on attractive terms, which would force Curaxis to delay, reduce or eliminate its research and development programs or commercialization efforts. The management of Curaxis believes that it has sufficient funds to continue operations through June 2010.

Curaxis’ future capital requirements will depend on many factors, including:

the progress and results of clinical trials of its lead candidate, VP4896, for mild to moderate Alzheimer’s disease;

the costs of establishing sales and marketing functions, outsourcing manufacturing needs and obtaining pre-launch inventory of VP4896;

the scope, progress, results and cost of preclinical development and laboratory testing and clinical trials for its other product candidates;

the costs, timing and outcome of regulatory review of VP4896 for mild to moderate Alzheimer’s disease and of its other product candidates;

the number and development requirements of other product candidates;

the costs of preparing, filing and prosecuting patent applications and maintaining, enforcing and defending intellectual property-related claims;

Curaxis’ success in entering into collaboration agreements with leading pharmaceutical and biotechnology companies to assist in furthering the development of product candidates; and

The timing, receipt and amount of sales or royalties, if any, from VP4896 and other potential products.

Until such time, if ever, as Curaxis can generate substantial product revenues, Curaxis expect to finance its cash needs through public or private equity offerings, debt financings and possibly corporate collaboration and licensing arrangements. If Curaxis raises additional funds by issuing equity securities, its stockholders may experience dilution. Debt financing, if available, may involve agreements that include covenants limiting or restricting its ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. Any debt financing or additional equity that Curaxis raises may contain terms, such as liquidation and other preferences that are not favorable to Curaxis or its stockholders. If Curaxis raises additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to Curaxis.

CURAXIS’ SHORT OPERATING HISTORY MAY MAKE IT DIFFICULT FOR YOU TO EVALUATE THE SUCCESS OF OUR BUSINESS TO DATE AND TO ASSESS ITS FUTURE VIABILITY.

Curaxis is a development-stage company. Its operations to date have been limited to organizing and staffing the company, acquiring, developing and securing its technology and undertaking preclinical studies and limited clinical trials of its most advanced product candidate, VP4896. Curaxis has not yet demonstrated its ability to successfully complete large-scale, pivotal clinical trials, obtain regulatory approval, manufacture a commercial scale product or arrange for a third party to do so on its behalf or conduct sales and marketing activities necessary for successful product commercialization.

In addition, Curaxis may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors. Curaxis will need to transition from a company with a research focus to a company capable of supporting commercial activities and it may not be successful in such transition.

CURAXIS DEPENDS HEAVILY ON THE SUCCESS OF ITS MOST ADVANCED PRODUCT CANDIDATE, VP4896 FOR MILD TO MODERATE ALZHEIMER’S DISEASE, WHICH IS STILL IN CLINICAL DEVELOPMENT. IF CURAXIS IS UNABLE TO COMMERCIALIZE VP4896 FOR THIS INDICATION, OR EXPERIENCES SIGNIFICANT DELAYS IN DOING SO, ITS BUSINESS WILL BE MATERIALLY HARMED.

Curaxis has invested a significant portion of its efforts and financial resources in the development of its most advanced product candidate, VP4896, for mild to moderate Alzheimer’s disease. The success of its VP4896 Alzheimer’s disease program will depend on several factors, including the following:

successful patient enrollment in, and completion of, clinical trials;

receipt of marketing approvals from the FDA and similar foreign regulatory authorities;

obtaining commercial quantities of leuprolide acetate, the active ingredient of VP4896;

obtaining commercial quantities of VP4896 from its supplier, Durect Corporation;

establishing a sales and marketing infrastructure to market and sell VP4896 in the United States and internationally, whether alone or in collaboration with others; and

acceptance of the product by patients, the medical community and third party payors.

Curaxis’ ability to generate product revenues, which Curaxis does not expect will occur for at least the next several years, if ever, will depend heavily on the successful development and commercialization of VP4896. If Curaxis is unable to commercialize VP4896 for mild to moderate Alzheimer’s disease, or experience significant delays in doing so, its business will be materially harmed.

IF CURAXIS IS UNABLE TO ACHIEVE STATISTICAL SIGNIFICANCE ON THE PRIMARY EFFICACY ENDPOINTS IN CLINICAL TRIALS OF VP4896 FOR THE TREATMENT OF MILD TO MODERATE ALZHEIMER’S DISEASE, IT MAY NOT BE SUCCESSFUL IN OBTAINING FDA APPROVAL FOR VP4896, WHICH WOULD MATERIALLY HARM ITS BUSINESS.

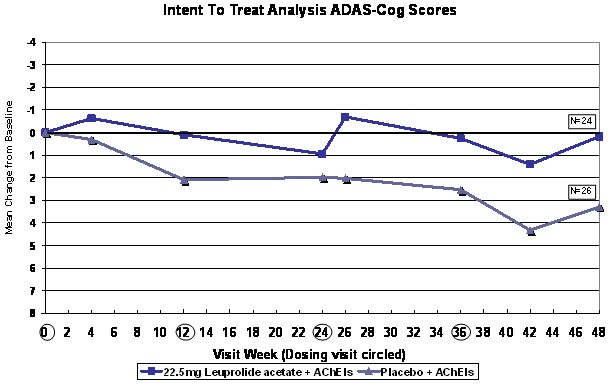

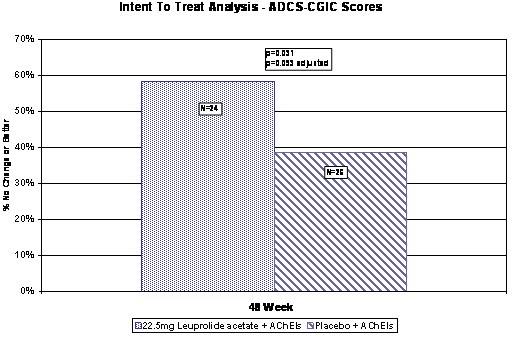

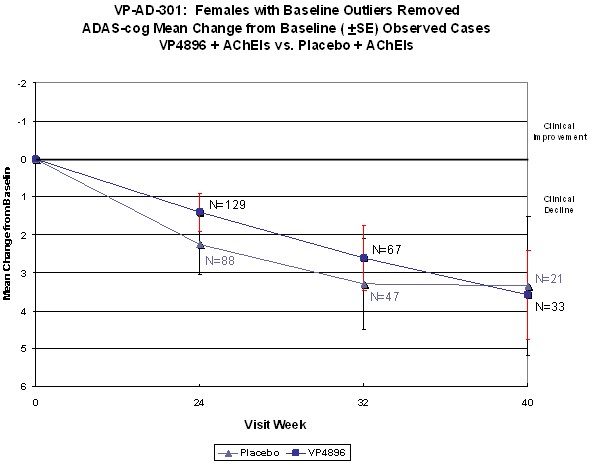

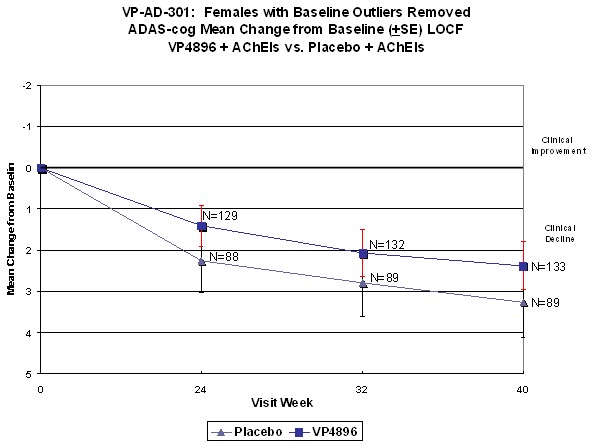

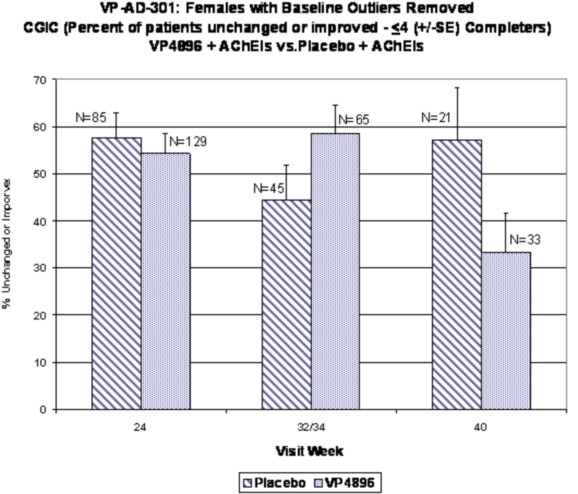

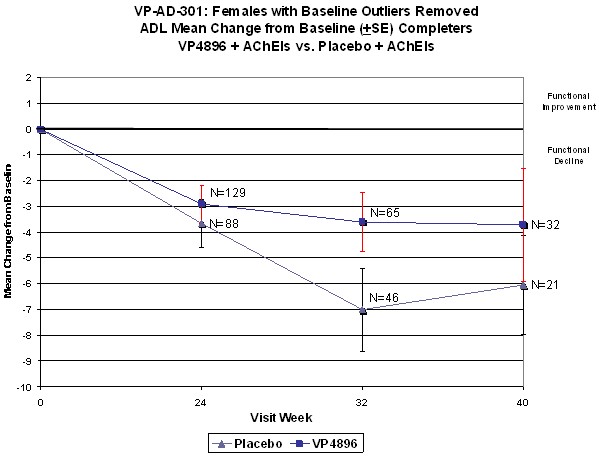

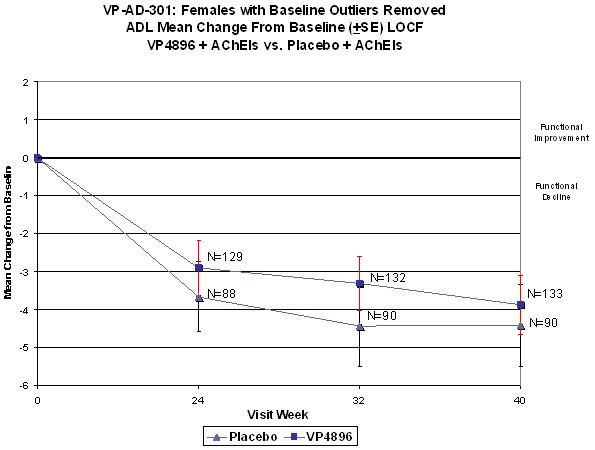

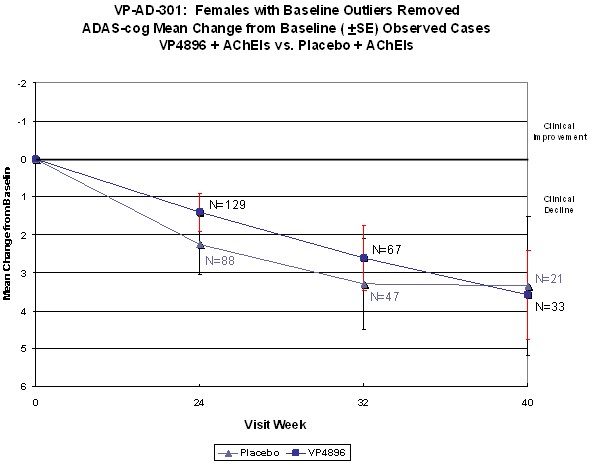

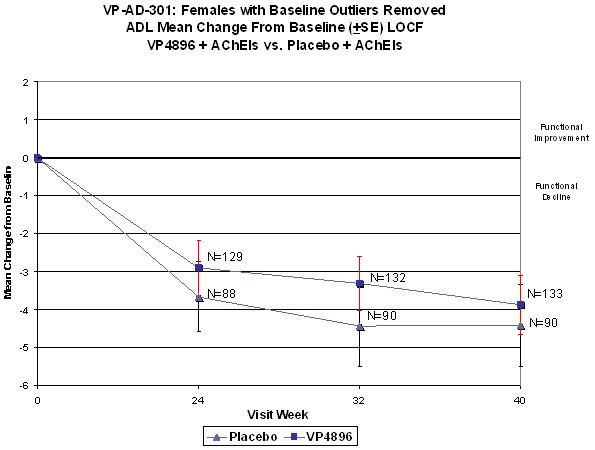

In ALADDIN I, Curaxis’ Phase II clinical trial for women with mild to moderate Alzheimer’s disease involving an injectable formulation of leuprolide acetate, Curaxis identified a trend in favor of the high dose leuprolide acetate group versus placebo, but it did not achieve statistical significance on the primary efficacy endpoints or any of the secondary efficacy endpoints in this clinical trial. The primary efficacy endpoints of the trial were a patient’s score on each of the ADAS-cog, a test of memory and cognition, and the ADCS-CGIC, a global measure of a subject’s change in condition, at 48 weeks compared to baseline. There were various secondary efficacy endpoints, including a patient’s score on the ADCS-ADL, a measurement of a patient’s capacity to perform activities of daily living, at 48 wee ks compared to baseline. Analysis of the same primary efficacy endpoints at the completion of the 48-week men’s Phase II study, ALADDIN II, also did not demonstrate statistical significance.

Curaxis performed a preplanned subgroup analysis of 78 women out of the 108 women who participated in ALADDIN I, the Phase II clinical trial in women. Of this subgroup of 78 women, which included all of the patients who were taking an acetylcholinesterase inhibitor (AChEI) and excluded the 30 patients who were not taking an AChEI, 28 patients were taking an AChEI plus 11.25 mg of leuprolide acetate, 24 patients were taking an AChEI plus 22.5 mg of leuprolide acetate and 26 patients were taking an AChEI plus placebo. The results for the group of 28 patients that received an AChEI plus the 11.25 mg dose of leuprolide acetate were not statistically significantly different from the results for the group that received an AChEI plus placebo. The results for the group of 24 patients that received an AChEI plus the 22.5 mg of leuprolide aceta te compared to the group of 26 patients that received an AChEI plus placebo were statistically significant with respect to the patients’ scores on both primary endpoints, the ADAS-cog and ADCS-CGIC as well as on the ADCS-ADL, a secondary endpoint, prior to applying any statistical adjustment. However, because Curaxis performed several comparisons, it was required to adjust the p-values (a mathematical calculation used to determine the likelihood that the measured result was obtained by chance) of the results to account for multiple comparisons. This was done by using what is referred to as the Bonferroni correction which applies an estimated statistical penalty to account for the number of comparisons made. Specifically, the unadjusted p-values for this subgroup were 0.026 for the ADAS-cog, 0.031 for the ADCS-CGIC and 0.015 for ADCS-ADL. The adjusted p-values for this subgroup were 0.078 for the ADAS-cog, 0.093 for the ADCS-CGIC and 0.044 for ADCS-ADL. Therefore, after apply ing the Bonferroni correction, Curaxis was only able to demonstrate statistical significance with respect to the ADCS-ADL.

Curaxis likewise performed an analysis of 90 men out of 119 men who participated in ALADDIN II, the Phase II clinical trial in men. Of this subgroup of 90 men, which included all of the patients who were taking an AChEI and excluded the 29 patients who were not taking an AChEI, 27 patients were taking an AChEI plus a 22.5 mg dose of leuprolide acetate, 34 patients were taking an AChEI plus a 33.75 mg dose of leuprolide acetate and 29 patients were taking an AChEI plus placebo. The results for both leuprolide-treated groups were not significantly different from the results for the group that received an AChEI plus placebo. The treated groups of 27 and 34 patients given 22.5 mg and 33.75 mg of leuprolide acetate, respectively, demonstrated a slight positive signal on the ADAS-cog assessment compared to pl acebo at 48 weeks. Results on the ADCS-CGIC rating demonstrated that 44% of the men who received 22.5 mg of leuprolide acetate plus AChEIs, and 47% of the men who received 33.75 mg of leuprolide acetate plus AChEIs, were either improved or showed no change compared to 31% of the men who received placebo plus AChEIs.

In addition, Curaxis used a commercially available formulation of leuprolide acetate administered by injection in its Phase II trials for the treatment of mild to moderate Alzheimer’s disease, while Curaxis’ planned clinical trials will test VP4896, a biodegradable polymeric implant formulation of leuprolide acetate, for this indication. Leuprolide acetate administered through an implant may not have the same effect as leuprolide acetate injections had in Curaxis’ earlier Phase II clinical trials and may cause side effects not seen in those Phase II clinical trials. ALADDIN 105 was a Phase I trial performed by Curaxis to test the safety and tolerability of the VP4896 implant and the implantation procedure as well as the pharmacokinetics (absorption, distribution, metabolism, and elimination), of leuprolide delivery f rom the implant. The results of that study suggest that the VP4896 implant is safe and well tolerated. ALADDIN 105 also demonstrated that the VP4896 implant releases leuprolide acetate in a steady and sustained way over the 8-week dosing period. In addition, Curaxis’ planned clinical trials may be at dosing levels that are higher than the doses of leuprolide acetate used in ALADDIN I and ALADDIN II. The differences in dosing levels and methods of administration, as well as other factors, may have unexpected effects on the outcome of Curaxis’ clinical trials. If Curaxis is unable to achieve statistical significance on the primary efficacy endpoints in pivotal Phase III clinical trials, it may be not be successful in obtaining FDA approval for VP4896, which would materially harm its business.

CURAXIS’ PROGRAM FOR VP4896 IS BASED ON THE LH HYPOTHESIS, WHICH IS NOT VIEWED AS THE PREDOMINANT HYPOTHESIS REGARDING THE POSSIBLE CAUSES OF ALZHEIMER’S DISEASE. THIS ADDS TO THE RISK OF CURAXIS’ DEVELOPMENT EFFORT AND MAY AFFECT PHYSICIAN AND PATIENT ACCEPTANCE AND USE OF VP4896 AND THE WILLINGNESS OF THIRD PARTIES TO PROVIDE REIMBURSEMENT.

Curaxis’ program for VP4896 is based on the LH hypothesis which is not the predominant view regarding the possible causes of Alzheimer’s disease. The LH hypothesis proposes that the known neurological and biochemical changes associated with Alzheimer’s disease are caused by elevated levels of the pituitary hormone, leuteinizing hormone (LH). This hypothesis suggests that when LH levels increase as the body ages, the neurological changes seen in Alzheimer’s disease result. The beta amyloid hypothesis, however, proposes that amyloid beta protein, which makes up the plaques present in the brains of Alzheimer’s disease patients, is toxic, and is the causative agent of the disease. Under this hypothesis, inhibiting the production of, and enhancing the clearance of, amyloid beta protein plaques may prevent or t reat Alzheimer’s disease. The beta amyloid hypothesis is the predominant view. While preclinical data now support the notion that the LH hypothesis may be interrelated with the amyloid hypothesis and other hypotheses of Alzheimer’s disease pathology, the unproven nature of the LH hypothesis adds to the risk that Curaxis’ development effort may not be successful. In particular, no drugs for the treatment of Alzheimer’s disease have been successfully developed based on the LH hypothesis. Moreover, the predominant status of the beta amyloid hypothesis may impede Curaxis’ development and commercialization efforts. For example, the predominant status of the beta amyloid hypothesis in the medical community may adversely affect Curaxis’ ability to recruit patients for its clinical trials or, if Curaxis successfully completes clinical development of this product candidate and obtains regulatory approval, may adversely affect its ability to recruit sales and marketing personnel, ma y affect physician and patient acceptance and use of the product and the willingness of third parties to provide reimbursement, any of which could materially harm Curaxis’ business.

IF CURAXIS’ PRECLINICAL STUDIES DO NOT PRODUCE SUCCESSFUL RESULTS OR ITS CLINICAL TRIALS DO NOT DEMONSTRATE SAFETY AND EFFICACY IN HUMANS, CURAXIS WILL NOT BE ABLE TO COMMERCIALIZE ITS PRODUCT CANDIDATES.

Before obtaining regulatory approval for the sale of its product candidates, Curaxis must conduct, at its own expense, extensive preclinical tests and clinical trials to demonstrate the safety and efficacy in humans of its product candidates. Preclinical and clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. Success in preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and interim results of a clinical trial do not necessarily predict final results. Specifically, the results of Curaxis’ Phase II trials were collected from a limited number of subjects and may not be indicative of results that it will obtain in later studies which are expected to be of greater size and scope.

A failure of one or more of Curaxis’ clinical trials can occur at any stage of testing. Curaxis may experience numerous unforeseen events during, or as a result of, the clinical trial process that could delay or prevent its ability to receive regulatory approval or commercialize VP4896 or its other product candidates, including:

regulatory authorities, institutional review boards, or ethics committees may not authorize Curaxis to commence a clinical trial or conduct a clinical trial at a prospective trial site;

Curaxis’ clinical trials may produce negative or inconclusive results, and it may decide, or regulatory authorities may require it, to conduct additional clinical trials or it may abandon projects that it expects to be promising;

enrollment in Curaxis’ clinical trials may be slower than it currently anticipates, resulting in significant delays. Additionally, participants may drop out of our clinical trials at a higher rate than we anticipate;

our third party contractors may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner;

we might have to suspend or terminate our clinical trials if the participants are being exposed to unacceptable health risks;

regulatory authorities, institutional review boards, or ethics committees may require that we hold, suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements;

the cost of our clinical trials may be greater than we anticipate;

the supply or quality of our product candidates or other materials necessary to conduct our clinical trials may be insufficient or inadequate;

the effects of our product candidates may not be the desired effects or may include undesirable side effects or the product candidates may have other unexpected characteristics.

If we are required to conduct additional clinical trials or other testing of VP4896 or our other product candidates beyond those that we currently contemplate, if we are unable to successfully complete our clinical trials or other testing or if the results of these trials or tests are not positive or are only modestly positive, we may:

be delayed in obtaining marketing approval for our product candidates;

not be able to obtain marketing approval; or

obtain approval for indications that are not as broad as intended.

Curaxis’ product development costs will also increase if we experience delays in testing or approvals. We do not know whether any clinical trials will begin as planned, need to be restructured or will be completed on schedule, if at all. Significant clinical trial delays also could shorten the patent protection period during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do and impair our ability to commercialize our products or product candidates.

USE OF THIRD PARTIES TO MANUFACTURE OUR PRODUCT CANDIDATES, INCLUDING VP4896, MAY INCREASE THE RISK THAT WE WILL NOT HAVE SUFFICIENT QUANTITIES OF OUR PRODUCT CANDIDATES OR SUCH QUANTITIES AT AN ACCEPTABLE COST, AND CLINICAL DEVELOPMENT AND COMMERCIALIZATION OF OUR PRODUCT CANDIDATES COULD BE DELAYED, PREVENTED OR IMPAIRED.

Curaxis does not own or operate manufacturing facilities for clinical or commercial production of our product candidates. We have limited personnel with experience in drug manufacturing and we lack the resources and the capabilities to manufacture any of our product candidates on a clinical or commercial scale. Our strategy is to outsource all manufacturing of our product candidates and products, including VP4896, to third parties.

Reliance on third party manufacturers entails risks to which we would not be subject if we manufactured product candidates or products ourselves, including:

reliance on the third party for regulatory compliance and quality assurance;

the possible breach of the manufacturing agreement by the third party because of factors beyond our control; and

the possible termination or nonrenewal of the agreement by the third party, based on its own business priorities, at a time that is costly or inconvenient for us.

Curaxis’ manufacturers may not be able to comply with current Good Manufacturing Practice, or cGMP, regulations or other regulatory requirements or similar regulatory requirements outside the United States. Our failure, or the failure of our third party manufacturers to comply with applicable regulations could result in sanctions being imposed on us, including fines, injunctions, civil penalties, failure of regulatory authorities to grant marketing approval of our product candidates, delays, suspension or withdrawal of approvals, license revocation, seizures or recalls of product candidates or products, operating restrictions and criminal prosecutions, any of which could significantly and adversely affect supplies of our product candidates.

Curaxis’ product candidates and any products that we may develop may compete with other product candidates and products for Auto Search to manufacturing facilities. There are a limited number of manufacturers that operate under cGMP regulations that are both capable of manufacturing for us and willing to do so. If the third parties that we engage to manufacture product for our clinical trials should cease to continue to do so for any reason, we likely would experience delays in advancing these trials while we identify and qualify replacement suppliers and we may be unable to obtain replacement supplies on terms that are favorable to us. In addition, if we are not able to obtain adequate supplies of our product candidates or the drug substances used to manufacture them, it will be more difficult for us to develop our product candi dates and compete effectively.

Curaxis’ current and anticipated future dependence upon others for the manufacture of our product candidates may adversely affect our future profit margins and our ability to develop product candidates and commercialize any products that receive regulatory approval on a timely and competitive basis.

CURAXIS RELIES ON DURECT CORPORATION, OUR SOLE SOURCE PROVIDER OF VP4896, TO PRODUCE VP4896 FOR OUR CLINICAL TRIALS AND WILL RELY ON DURECT TO PRODUCE COMMERCIAL DRUG SUPPLIES OF VP4896. DURECT HAS LIMITED EXPERIENCE PRODUCING BIODEGRADABLE IMPLANTS AND MAY NOT BE ABLE TO PROVIDE VP4896 TO SATISFY OUR REQUIREMENTS.

We rely on Durect Corporation, or Durect, as our sole source provider of VP4896 for use in our clinical trials and, if we receive marketing approval, will rely on Durect as our sole source provider for commercial supply of VP4896. VP4896 requires precise, high quality manufacturing. Durect’s failure to achieve and maintain satisfactory standards could result in patient injury or death, product recalls or withdrawals, delays or failures in product testing or delivery, cost overruns or other problems that could materially harm our business. Durect may encounter manufacturing difficulties involving production yields, quality control and quality assurance. Durect is subject to ongoing periodic unannounced inspection by the FDA and corresponding state and foreign agencies to ensure strict compliance with cGMP and other government regu lations and corresponding foreign standards. We do not control Durect’s compliance with these regulations and standards.