As filed with the Commission on June 2, 2008 File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SWEETWATER RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 1099 | 71-1050559 |

| (State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Cod Number) | (I.R.S. Employee Identification No.) |

Madappilly House, Elenjipra, P.O. Chalakudy, Via 680271 Kerala, India (Telephone: 011-91-480-320-8192) |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

Action Stock Transfer Corp., 7069 S. Highland Drive, Suite 300, Salt Lake City, Utah, 84121 Telephone (801) 274-1088 – Fax: (801) 244-1099 |

| (Name, address and telephone number of agent of service) |

Copies to: Lawler & Associates 29377 Rancho California Road, Suite 204, Temecula, California, 92591 |

| Telephone: 951-676-4900 Fax: 951-676-4988 |

As soon as practicable after the registration statement become effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [X]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is filed a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is filed a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Large accelerated filer Accelerated filer

Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box [ ]

CALCULATION OF REGISTRATION FEE

| Securities to be Registered | Amount to be Registered | Offering Price Per Share | Aggregate Offering Price | Registration Fee (1) |

| Common | 1,166,000 | $ 0.05 | $ 58,300 | $7.50 |

[1] Estimated solely for purposes of calculating the registration fee under Rule 457.

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8 (a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON DATES AS THE COMMISSION, ACTING UNDER SAID SECTION 8 (a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE , 2008

PROSPECTUS

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell securities.

SWEETWATER RESOURCES, INC.

Shares of Common Stock

1,166,000 shares

Sweetwater Resources, Inc.’s selling shareholders, including are directors and officers, named in this prospectus offering a total of 1,166,000 common shares at a price of $0.05 per share or whatever the market value of the shares are, if and when, we are quoted on the Over-the-Counter Bulletin Board (the “OTCBB”). We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

Our selling shareholders may sell all or part of their shares in one or more transactions on the OTCBB or in a private transaction if it occurs. There is no assurance we will be able to find a market maker to sponsor our shares on the OTCBB and if we are successful at identifying a market maker that our application will ever be approved by the Financial Industry Regulatory Authorities (the “FINRA”).

INVESTING IN OUR COMMON STOCK INVOLVES RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

DEALER PROSPECTUS DELIVERY INSTRUCTIONS

Until 2008, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The Date of this Prospectus is June , 2008

TABLE OF CONTENTS

Item No. | | Description | Page |

| | | | |

| Item 3. | | Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges | 3 |

| | | | |

| Item 4. | | Use of Proceeds | 10 |

| | | | |

| Item 5. | | Determination of Offering Price | 10 |

| | | | |

| Item 6. | | Dilution | 11 |

| | | | |

| Item 7. | | Selling Securities Holders | 11 |

| | | | |

| Item 8. | | Plan of Distribution | 13 |

| | | | |

| Item 9. | | Description of Securities to be Registered | 15 |

| | | | |

| Item 10. | | Interests in name Experts and Counsel | 17 |

| | | | |

| Item 11. | | Information with Respects to the Registrant | 18 |

| | | | |

| Item 11A. | | Material Changes | 40 |

| | | | |

| Item 12. | | Incorporation of Certain Information by Reference | 49 |

| | | | |

| Item 12A. | | Disclosure of Commissions Position of Indemnification for Securities Act Liabilities | 49 |

| | | | |

| ITEM 3. | SUMMARY OF INFORMATION, RISK FACTORS AND RATIO OF EARNINGS TO FIXED CHARGES |

Overview:

Sweetwater Resources, Inc. was incorporated on the 24th day of July, 2007, under the laws of the State of Nevada for the purpose of acquiring, exploring and developing mineral properties. Our principal offices are located at Madappilly House, Elenjipra, P.O. Chalakudey, Via 680271, Kerala, India. Our telephone number is 011-91-480-320-8192.

The following is a summary of the information, financial statements and notes contained in this prospectus.

The information in this prospectus is not complete and may be changed. Our selling shareholders cannot sell their shares until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective.

The following is merely a summary of the information, including financial statements and the commentary included herein. You should read the entire Prospectus carefully, including “Risk Factors” and our financial statements and the notes appended thereto prior to your making any investment in the shares of our Company. Unless the context otherwise dictates or suggests, the terms “the Company”, “we”, “our” and “us” refers to Sweetwater Resources, Inc.

Currently we are in the pre-exploration stage. To date, we have had no revenues, no operating history beyond the initial set up of our Company. Our sole asset is a mining claim called the Bhavnagar Gold Claim (the “Bhavnagar”) located in the Republic of India which is more fully described elsewhere in this prospectus. We have incurred losses since inception and to remain as a going concern we must raise additional capital, through the sale of securities, in order to fund our operations. There is no assurance we will be able to raise this capital and if we do not our Company may no longer be a going concern.

We own no other mineral property other than the Bhavnagar and are not engaged in the exploration of any other mineral properties. There can be no assurance that a commercially viable mineral deposit, an ore reserve, exits on the Bhavnagar or can be shown to exist unless and until sufficient and appropriate exploration work is carried out and a comprehensive evaluation of such work concludes economic and legal feasibility. Such work may take many years and there is no assurance that we will have available the working capital to bring an ore deposit into production.

There is no current public market for our securities as our stock is not publicly traded on any exchange and as such investors face the prospect that they will be unable to sell their shares and hence their investment does not have liquidity.

We have no fulltime employees and the management of the Company, all of whom are in the Republic of India, devote a very little percentage of their working day to the affairs of our Company. Presently our directors and officers are not directors and officers of other public companies but this might not be the case in the future. If this happens there might be a conflict of interest on their part.

On October 31, 2007 we completed a private placement pursuant to Regulation S of the Securities Act of 1933, of 3,750,000 shares of common stock sold to our two officers and directors at the price of $0.001 per share to raise $3,750. On January 31, 2008 we completed a further private placement pursuant to Regulation S of the Securities Act of 1933, whereby 791,000 common shares were sold at the price of $0.05 per share to raise $39,550. The total cash raised from the sale of shares was $43,300. Cash on hand totaled $10,996 as of April 30, 2008. The amount of $32,304, being the balance spent since the funds were received, was spent as follows:

| Accounting fees for the examination of the March 31, 2008 financial statements | $ 2,500 |

| Consulting for identifying Bhavnagar ($5,000) and preparation of this prospectus ($10,000) | 15,000 |

| Exploration – geology report ($5,000), exploration work ($5,000) and licenses ($1,321) | 11,321 |

| Legal | 2,983 |

| Office | 500 |

| | |

| Cash paid from proceeds as of April 30, 2008 | $ 32,304 |

The following financial information summarizes the more complete historical financial information found in our audited financial statements contained elsewhere in this prospectus:

| | Since inception to March 31, 2008 |

| Statement of Expenses Information | |

| | |

| Revenue | $ - |

| Net losses | 43,183 |

| Net operating expenses | 43,183 |

| Exploration costs | 11,321 |

| General and administrative | 31,862 |

| | |

| | As at March 31, 2008 |

| Balance Sheet Information | |

| | |

| Cash | $ 13,496 |

| Total assets | 13,496 |

| Total liabilities | 6,879 |

| Shareholders’ equity | 6,617 |

| | |

The Offering

This offering relates to the offer and sale of our common share by the selling security holders identified in this prospectus. The selling security holders will determine when they will sell their shares, and in all cases, will sell their shares at the current market price or at negotiated prices at the time of the sale. Although we have agreed to pay the expenses related to the registration of the shares being offered, we will not receive any proceeds from the sale of the shares by the selling security holders.

The following sets forth the number and percentage of outstanding shares of common stock that will be sold by:

| | 1. | Selling securities holders other than our two officers and directors and members of their immediate family: |

Number Percentage

791,000 17.4%

| | 2. | Our two officers and directors and members of their immediate families who are among the selling securities holders. |

Number Percentage

375,000 8.3%

3. All selling securities holders including our two officers and members of their immediate families:

Number Percentage

1,166,000 25.7%

| | 4. | You should carefully consider all the information in this prospectus. In particular, you should evaluate the information set forth in the section of the prospectus entitled “Risk Factors” beginning on page 6 before deciding whether to invest in our common shares. |

| | 5. | There is a lack of liquidity in our common shares due it not presently being quoted or traded on any securities exchange or automated quotation system and we have not yet applied for listing on any public market. We can provide no assurance that there will ever be an established public trading market for our common shares. |

Cautionary Statement Concerning Forward-Looking Statements

This prospectus contains written statements regarding our business and prospectus, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements. Statements containing the words or phases such as “is anticipated”, “estimates”, “believes”, “expects”, “anticipates”, “plans”, “objective”, “should” or similar expressions identify forward-looking statements, which may appear in this prospectus.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communication and other information from government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement, or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following:

RISK FACTORS

An investment in our securities involves an exceptionally high degree of risk and is extremely speculative. In addition to the other information regarding Sweetwater Resources Inc., contained in this prospectus, you should consider many important factors in considering whether you should purchase the shares being offered. The following risk factors reflect the potential and substantial material risks which could be involved if you consider purchasing shares in this offering.

Risks Associated With Our Company

Even though we recently raised capital through the sale of our common shares our financial position is not favorable.

Presently we have accumulated losses of $43,183 since our inception on July 24, 2007 and our working capital position is $6,879. This working capital position could easily, and no doubt will do so, over the next few months be reduced to a deficiency in working capital. This will mean we will either have to raise funds through a sale of our common shares, ask our directors and officers to offer personally guarantees for debt financing from a lending institution or else the officers and directors will have to advance money to us so that we can continue in operations. In short, our current cash position will not last us for more than a few months.

The probability of any given property having any provable reserves is very remote. In all likelihood our property does not contain any reserves, and any funds spent on exploration will be lost.

As the probability of finding provable reserves on any given property is extremely unlikely, the same applies to prospects on our only property, the Bhavnagar Gold Claim, with the result being that funds spent on exploration will be lost. Following upon that, if we are unable to raise further funds for our operations, we may have to suspend or cease our operations resulting in loss of your investment.

We lack an operating history and have losses which we expect will continue into the future. As a result we may have to suspend or cease exploration and cease operations.

We are an exploration stage company which is undertaking limited exploration, at this time, on the Bhavnagar. Accordingly, we anticipate incurring operating losses into the foreseeable future.

Our Company was incorporated in 2007, and has not undertaken any exploration, nor has it generated any revenues. We do not have an exploration history against which one can assess the future prospects of our Company. To March 31, 2008, we have incurred a loss of $43,183. Whether we will generate income or a positive cash flow will be dependent upon our capacity to find economically viable reserves on the Bhavnagar and control of our operating costs.

Our present prospects are that we anticipate incurring further operating losses in future operating quarters, given that we will be facing research and exploration costs in exploring the Bhavnagar. There is no certainty that we will be able to produce income in which case our business will cease or be suspended indefinitely. Our prospects for success must be weighed in light of the problems, expenses, complications, difficulties and delays commonly associated with exploring a mineral property. There is a high rate of failure in ventures such as ours.

We have never had profitable operations since our inception.

Even though we have been incorporated for only a short period of time, we have never had profitable operations and if the situation continues as it is today we might never have profitable operations. This would mean that our shareholders would never be able to realize any dividends and/or increase in the value of their initial investment.

We have no known reserves. Without ore reserves we cannot generate income and if we cannot generate income we will have to cease exploration activity, which will result in the loss of your investment. Reserve estimates are very speculative and unreliable as indicators of success. Regardless of how much money is spent on the Bhavnagar, there is risk that we may never identify a commercially viable ore reserve. Even with positive results during exploration, the Bhavnagar may never be put into commercial production due to inadequate tonnage, low metal prices or high extraction costs.

Currently we have no known reserves. Without actual ore reserves we will be unable to generate income, in which case exploration operations will cease resulting in a loss of your investment. Typically reserves in regard to mining claims are referred to as “proven reserves” or “probable reserves”. At present, we have neither proven nor probable reserves. Ore reserve figures are merely estimates and are not guarantees that the amounts so estimated would be recovered. The Company would engage private, independent contractors to conduct sampling and testing of the mining claim and from the results of such sampling and testing estimates of potential reserves are made. Such estimates are inherently imprecise in that they are based upon statistical analysis of geological data requiring the interpretation of the professionals involved. As such they are likely to be unreliable as indicators of the extent of reserves.

As production proceeds, existing reserves are diminished. Reserves may be reduced as a result of the grade and volume being recovered being lower than anticipated.

As reserve estimates are calculated using assumptions about metal prices, they are subject to a great degree of uncertainty in that metal prices can fluctuate considerably. Falling metal prices, rising production costs, capital costs, declining recovery rates, can render reserve estimates commercially unviable. Material declines in our reserves may result in reduced cash flow, net losses, asset write downs, and other such adverse financial consequences to our operation and the financial wherewithal of our Company. Reserves are not assurances of future revenues or the profitability of the mining operation, nor can they be utilized to predict the life of a particular mining venture. Reserves are no assurance of the amount of metal, if any that might be produced, nor that any given level of production will be achieved.

If we do not have enough funds for exploration, we will have to delay exploration or go out of business which will result in the loss of your investment.

If we are unable to raise funds for exploration, our proposed exploration plan will be delayed. This may result in cessation or suspension of operations. If we cease operations or if operations are suspended for indefinitely, we will go out of business and your investment will be lost.

Because we are small and do not have much capital, we must delay conduct of any exploration and as a result may not find an ore body. Without an ore body, we cannot generate revenues and you will lose your investment.

As our Company is small with little capital, there will delays in the conduct of exploration and we may not find an ore body. If we do not find an ore body, we cannot generate revenues and you will lose your investment.

We may not have access to all the materials and supplies we need to begin exploration which could cause us to delay or suspend exploration activity.

Due to our own financial condition or due to extraneous factors relating to costs and market forces, we may not be able to have access to the materials and supplies required to commence exploration. Without such basics of exploration, we would be forced to delay, suspend or even cancel exploration activity in which case your investment may be lost.

Because mineral exploration and development activities are inherently risky, we may be subject to various hazards including environmental liabilities, adverse weather conditions, floods, cave-ins, and the like. If such an event were to occur it may result in loss of your investment.

Mining operations are subject to a myriad of risks inherent to its nature. These include the presentation of unusual geological formations, environmental pollution issues, mine collapses, injury to personnel, flooding, changing and adverse weather conditions, and other such uncontrollable events. In some cases, the risk might be ameliorated by way of insurance, however, all such risks are not necessarily covered by insurance and the cost of insurance may in any event become prohibitive. Any one or a combination of such events could render the operation subject to delay, suspension or cancellation having become either too difficult or impossible to continue or uneconomical to carry on.

Because we have not put a mineral deposit into production before, we will have to acquire outside expertise. If we are unable to acquire such expertise we may be unable to put Bhavnagar into production and you may lose your investment. Management has no technical experience mineral exploration or production.

Our directors do not have technical training or proficiency in geology or engineering, specifically as such relates to exploration, development and operation of a mine. Consequently, they may not exploit opportunities in acquisition and exploration of claims without hired professionals. Management may not appreciate the usual and common approaches necessary in the industry to commercially exploit or investigate a claim. Such a deficiency may severely, permanently and adversely affect the financial viability of our business.

Risks Associated With This Offering:

Without a public market there is no liquidity for our shares and our shareholders may never be able to sell their shares which would result in a total loss of their investment.

Our common shares are not list on any exchange or quotation system and we do not have a market maker who will assist us in having our shares quoted on the OTCBB. At the present, time none of our selling security holders are able to sell their shares other than through private transactions and only after this prospectus becomes effective. Selling shares privately might result in our selling security holders not receiving the price per share that they might have obtained if the shares were quoted on the OTCBB. Management will seek out a market maker when this registration statement becomes effective. This will occur as follows:

| ● | | We will have to identify a market maker who will file a Form 211 for us which will start the process with the FINRA and hopefully eventually obtaining a quotation on the OTCBB; and |

| | | |

| ● | | We will have to be current in our financial statements to be quoted on the OTCBB and hence we will be responsible for filing Forms 10K-SB and 10Q-SB on a periodic bases as required. |

We do not know how long this process will take for our Company to become effective with the SEC but estimate a period of between six to twelve months. Once our registration statement is effective, we will identify a market maker and commence the process of being quoted on the OTCBB. The length of time this will take is unknown to us but we estimate approximately six to twelve months again. There is the distinct possibility that our Company will never be quoted on the OTCBB.

If we are fortunate enough to be quoted on the OTCBB our shares might be thinly traded resulting in our shareholders not having the opportunity to easily liquidate their investment in our shares.

If our shares our quoted on the OTCBB we might experience a lack of buying or selling which will not allow our selling security holders to sell their shares when they want and at prices they desire. Reasons for the lack of buying or selling could be the result of investors not desiring to purchase our shares, the stock markets overall are unfavorable to purchasing or selling shares or our Company cannot identify an ore body on the Bhavnagar. On the other hand, our share prices might be volatile with wide fluctuations in response to the previous mentioned circumstances. This also might restrict our shareholders from selling their investment in our shares at the price they wish.

We might in the future have to sell shares by way of private placements or through a public offering which will have the effect of diluting our shareholders’ current percentage ownership in our Company.

If, in the future, we decide to sell shares to raise additional capital for operations, our shareholders current percentage ownership in our Company will be diluted unless they participate in the purchase of shares equivalent to their present ownership in our Company. If they do not participate in either a future private placement or public offering their percentage interest in our Company will be diluted.

Without a public market there is no liquidity for our share and our shareholders may never be able to sell their shares which could result in a total loss of our shareholders’ investment.

Our common shares are not listed on any exchange or quotation system and we do not have a market maker which might results in no market for our shares. Therefore, our shareholders will not be able to sell their shares in an organized market place unless they sell their shares privately. If this happens, our shareholders may not receive a price per share which they might have received had there been a public market for our shares. If we are ever quoted on the OTCBB our shares will be considered “penny stock” and our market maker will have to adhere to the “penny stock” rules:

Our shares will be considered “penny stocks” and therefore are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practices requirements on broker dealers who sell our securities including the delivery of standardized disclosure document: disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker/dealer must make a special suitability determination and receive from his customers a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder’s ability to dispose of his/her stock.

Because our officers and directors have other outside business activities and may not be in a position to devote a majority of their time to our planned exploration activity, our exploration activity may be sporadic which may result in periodic interruptions or suspensions of exploration

Our directors and officers have other business interests which take a large percentage of their time. Our president spends approximately 10 hours a month attending to the affairs of our Company whereas our Secretary Treasurer spends only 5 hours per month. If our business and exploration activities expand in the near future our directors and officers will have to devote more time to the affairs of our Company or they will have to hire professional personnel to undertake these duties. This will result in an increase in costs to the Company.

Ratio of Earnings to Fixed Charges

We have no registered debt securities nor any fixed charges in the way of interest expense or preference security dividends.

The Conversion of Indian Rupees to United States Dollars and Vise Versa.

The Bhavnagar is located in the Republic of India, and costs expressed in the geological report prepared by Raman Mistry, Professional Geologist, are expressed in Indian Rupees. For purposes of consistency and to express United States Dollars throughout this registration statement, Indian Rupee have been converted into United States currency at the rate of US $1.00 being approximately equal to Indian Rupee 40.51 or 1 Indian Rupee being approximately equal US $0.02460 which is the approximate average exchange rate during recent months and which is consistent with the incorporated financial statements.

ITEM 4. USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling security holders. We will not receive any proceeds from the sale of shares of common stock in this offering. Nevertheless, there is cost to the Company for preparing this prospectus which will be borne by the Company and not the selling security holders. We have estimated the cost to as follows:

| Description of Expenses | Paid to date | Future payments | Total Amount |

| | | | |

| Internal Accountant – preparation of financial statements as required (1) | $ - | $ 2,363 | $ 2,363 |

| Independent accountant’s examination of financial statements (2) | 2,500 | 1,000 | 3,500 |

| Fees for preparation of this prospectus | 10,000 | - | 10,000 |

| Legal opinion | - | 1,500 | 1,500 |

| Photocopying and delivery expenses | - | 150 | 150 |

| SEC filing fees | - | 7 | 7 |

Estimated offering costs | $ 12,500 | $ 5,020 | $ 17,520 |

| (1) | The accountant has prepared the working papers for the March 31, 2008 financial statements and will prepare the financial statements as at June 30, 2008. |

| | (2) | The auditors have given an opinion of the March 31, 2008 financial statements included herein and will review of the financial statements as at June 30, 2008. |

| ITEM 5. | DETERMINATION OF OFFERING PRICE |

There is no public market for the shares being offered by our selling security holders. The price of the offering shares should not be considered as an indicator of either current or future value of the shares themselves.

The facts we took into consideration in determining the offering price of our selling security holders shares is our Company’s financial condition and future prospects, our lack of any operating history and the general conditions of the securities markets. The offering price is not an indicator of any actual value of our shares and it does not bear any relation to our assets or earnings. It is merely an arbitrary figure we have used.

Our selling security holders can offer to sell their shares at what price they wish or when they want. It might be a negotiated transaction or one which is done through the facilities of the securities market. Until our shares are quoted, if they are ever quoted, our selling security holders are expected to sell their shares at the offering price of $0.05 per share. We have been advised by our selling security holders that none of them have entered into any agreement, undertaking or arrangement to sell their shares. The selling security holders do not have an underwriter or coordinating broker acting in connection with the proposed sale of the common shares they hold. Our Company will pay all the expenses of this prospectus but it is up to the individual selling security holders to pay any future commissions to any brokers in assisting them in selling their shares.

Our shareholders will suffer no dilution of their percentage interest in our Company since we are not undertaking an offering of our shares from Treasury. In other words, no new shares are being sold. If our selling security holders sell their shares, the shares will become the property of the purchasing shareholders and those new shareholders will have the identical interest in our Company as our original selling security holders had.

| ITEM 7. | SELLING SECURITY HOLDERS |

This prospectus relates to the offering and sale, from time to time, of up to 1,166,000 shares of our common shares held by the selling security holders named in the table below, which amount includes 375,000 common shares to be sold by our officers and directors. All of the selling security holders named below acquired their shares of our common stock directly from us in private transactions.

The selling security holders have furnished all information with respect to share ownership. The shares being offered are being registered to permit public secondary trading of the shares and each selling security holder may offer all or part of the shares owned for resale from time to time. A selling security holder is under no obligation, however, to sell any shares immediately pursuant to this prospectus, nor are the selling security holders obligated to sell all or any portion of the shares at any time. Therefore, no assurance can be given by our Company as to the number of shares of common stock that will be sold pursuant to this prospectus or the number of shares that will be owned by the selling security holders upon termination of the offering.

None of the selling security holders named in this prospectus are residents of the United States. All are residents of the Republic of India. They are offering for sale a total of 1,166,000 shares of common stock of the Company.

The following table provides, as of the date of this prospectus, information regarding the beneficial ownership of our common stock held by each of the selling security holders, including:

| ● | The number of shares owned by each prior to this offering; |

| ● | The total number of shares that are to be offered for each; |

| ● | The total number of shares that will be owned by each upon completion of the offering; and |

| ● | The percentage owned by each upon completion of the offering assuming such selling security holders sell all of their common stock offered in this registration statement. |

To the best of our knowledge, the named parties in the table beneficially own and have sole voting and investment power over all shares or rights to their shares. We have based the percentage owned by each on our 4,541,000 shares of common stock outstanding as of the date of this prospectus.

Name of Shareholder | Common Stock Beneficially Owned Prior to Offering | Number of Common stock Offered Hereby | Common Stock Beneficially Owned Following the Offering (1) |

| | No. of Shares % | No. of Shares % | No. of Shares % |

| Shina Joseph | 40,000 | .0088 | 40,000 | Nil | Nil |

| Manoj Kuttappan | 37,500 | .0083 | 37,500 | Nil | Nil |

| Gopalan Achari | 36,000 | .0079 | 36,000 | Nil | Nil |

| Ranjith P. Poul | 35,000 | .0077 | 35,000 | Nil | Nil |

| Rekha Rajan | 35,000 | .0077 | 35,000 | Nil | Nil |

| Lissy Thomas | 33,000 | .0073 | 33,000 | Nil | Nil |

| Mary Thomas | 30,000 | .0066 | 30,000 | Nil | Nil |

| Annop Vasudevan | 30,000 | .0066 | 30,000 | Nil | Nil |

| Balakrishnan Appakkunhi | 27,000 | .0059 | 27,000 | Nil | Nil |

| Preethanjuj Preethalavan | 26,000 | .0057 | 26,000 | Nil | Nil |

| Lissy James | 25,000 | .0055 | 25,000 | Nil | Nil |

| Augusthy Ouseph | 25,000 | .0055 | 25,000 | Nil | Nil |

| Leena George | 25,000 | .0055 | 25,000 | Nil | Nil |

| Suneesh Joseph | 25,000 | .0055 | 25,000 | Nil | Nil |

| Jose Kunjuvareeth | 25,000 | .0055 | 25,000 | Nil | Nil |

| Abdul Rehman | 23,000 | .0050 | 23,000 | Nil | Nil |

| Johnson Lonappan | 22,000 | .0048 | 22,000 | Nil | Nil |

| Subran Chendan | 21,000 | .0046 | 21,000 | Nil | Nil |

| Lissy Jose | 20,000 | .0044 | 20,000 | Nil | Nil |

| Koran Chathan | 20,000 | .0044 | 20,000 | Nil | Nil |

| Unnikrishnan Kanna Nair | 20,000 | .0044 | 20,000 | Nil | Nil |

| Varghese Pailoth | 20,000 | .0044 | 20,000 | Nil | Nil |

| Vasudevan Raghavan | 20,000 | .0044 | 20,000 | Nil | Nil |

| Krishnakamar Appa Nair | 18,000 | .0040 | 18,000 | Nil | Nil |

| Baby Subran | 17,500 | .0039 | 17,500 | Nil | Nil |

| Ravendran Velayudham | 15,000 | .0033 | 15,000 | Nil | Nil |

| Midunkumar Unnikrishnan | 15,000 | .0033 | 15,000 | Nil | Nil |

| Rosily Augusthy | 15,000 | .0033 | 15,000 | Nil | Nil |

| Kunjuvareeth Ouseph | 15,000 | .0033 | 15,000 | Nil | Nil |

| Kochannamma Kunjuvareeth | 10,000 | .0022 | 10,000 | Nil | Nil |

| Omana Gopolan | 10,000 | .0022 | 10,000 | Nil | Nil |

| Sarada Gopolan | 10,000 | .0022 | 10,000 | Nil | Nil |

| Devaki Narayanan | 10,000 | .0022 | 10,000 | Nil | Nil |

| Kalikuty Koran | 5,000 | .0011 | 5,000 | Nil | Nil |

| Joicy Johnson | 5,000 | .0011 | 5,000 | Nil | Nil |

| Annam Augusthy | 5,000 | .0011 | 5,000 | Nil | Nil |

| Seethadevi Unnikrishnan | 5,000 | .0011 | 5,000 | Nil | Nil |

| Mary Varghese | 5,000 | .0011 | 5,000 | Nil | Nil |

| Indira Vasudevaqn | 5,000 | .0011 | 5,000 | Nil | Nil |

| Vinod MD | 5,000 | .0011 | 5,000 | Nil | Nil |

| Jose Madappilly | 2,000,000 | .4400 | 200,000 | 1,800,000 | .3960 |

| Jaiiju Maliakai | 1,750,000 | .3860 | 175,000 | 1,575,000 | .3470 |

| | | | | | |

| | 4,541,000 | 1.0000 | 1,166,000 | 3,375,000 | .7440 |

(1) These figures assume all shares offered by selling security holders are in fact sold.

(2) Jose Madappilly is our President, Chief Executive Officer and a Director.

(3) Jaiiju Maliakai is our Secretary Treasurer, Chief Financial Officer and a Director.

Except for Jose Madappilly and Jaiiju Maliakai, whose relationship with our Company is detailed in the footnotes immediately above, to our knowledge, none of the selling security holders has had a material relationship with our Company other than as a shareholder.

ITEM 8. PLAN OF DISTRIBUTION

Each selling security holder and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on the OTCBB or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling security holder may use any one or more of the following methods when selling shares:

| ● | | Using a brokerage house wherein a broker-dealer will solicit purchaser; |

| | | |

| ● | | The broker-dealer, as principal, purchases the shares for his/her own account; |

| | | |

| ● | | Selling the shares in a private transaction negotiated by the selling security holder; |

| | | |

| ● | | The broker-dealer attempts to sell a block of shares as agent for the selling security holders and he acts as a principal in this transaction; |

| | | |

| ● | | An exchange distribution in accordance with the rules of the applicable exchange; |

| | | |

| ● | | Settlement of short sales entered into after the effective date of this prospectus; |

| | | |

| ● | | The broker-dealer and the selling security holder agreed to sell a specific number of shares at a stipulated price per share; |

| | | |

| ● | | Through the writing or settlement of options or other hedging transactions, whether through an option exchange or otherwise; |

| | | |

| ● | | A combination of any such methods of sale; or |

| | | |

| ● | | Any other method permitted pursuant to applicable law. |

The selling security holders may also sell shares under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the selling security holders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling security holders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with NASDR Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with NASDR IM-2440.

In connection with the sale of the common stock or interests therein, the selling security holders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our common shares in the course of hedging the positions they assume. The selling security holders may also sell shares of the common shares short and deliver these shares to close out their short positions, or loan or pledge the common shares to broker-dealers that in turn may sell their shares. The selling security holders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling security holders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling security holder has informed our Company that he/she does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute our common shares. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

We are required to pay certain fees and expenses incurred by our Company incident to the registration of the shares. Our Company has agreed to indemnify the selling security holders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by our selling security holders without registration and without regard to any volume limitations by reason of Rule 144(k) under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the common shares for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, our selling security holders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the common stock by the selling security holders or any other person. We will make copies of this prospectus available to the selling security holders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

Any FINRA member participating in the distribution of the shares offered under this prospectus will be subject to compliance with FINRA rules and regulations, including rules governing the timely filing of documents and

disclosures with the Corporate Finance Department of the FINRA.

ITEM 9. DESCRIPTION OF SECURITIES TO BE REGISTERED

Capital Stock

Our authorized share capital consists of 450,000,000 common shares with a par value of $0.001 per share. We have issued 4,451,000 common shares. We have no other class of shares other than our common shares.

Rights of Our Shareholders

Our shareholders are entitled to receive dividends as may be declared periodically by our Board of Directors. Each of our shareholders is entitled to share ratably in all of our assets available for distribution upon winding up of the affairs of our Company. They are each entitled to one non-cumulative vote per share on all matters on which our shareholders may be asked to vote up either at an Annual General Meeting of Stockholders or by way of Shareholders’ Resolutions.

Our shareholders are not entitled to:

| ● | | Preference as to dividends or interest; |

| | | |

| ● | | Preemptive rights to purchase issuance of new shares in future public or private offerings; |

| | | |

| ● | | Preference upon liquidation of our Company; and |

| | | |

| ● | | Any other special rights or preferences. |

Non-Cumulative Voting

Our shareholders do not have cumulative voting rights. What this means is that the holders of more than 50% of our outstanding shares can ensure the election of the directors that they vote for. This being the case, the holders of the remaining shares are not able to elect any directors of their personal choice.

Debt Securities

We have no debt securities.

Market Information

Presently our shares are not quoted on any exchange or quotation system. Upon having this registration statement become effective it is our intention to seek out a market maker who will sponsor our shares for trading on the OTCBB. This will entail making an application to FINRA under a Form 211. Until we are accepted for a quotation on the OTCBB there is no established market for the shares of our Company. Even if we make an application to FINRA there is no assurance our shares will ever be quoted on the OTCBB. The OTCBB does not have any listing requirements but to remain quoted on it requires that we will have to be current with our filings with the SEC. This means that we will have to file quarterly financial statements reviewed by our independent accountants, filed under a Form 10Q, and have our annual financial statements examined by our independent accountants, filed under a Form 10K. If we are not current in our filing the market makers will not be able to quote our shares. If we do not keep our filings current then after 30 to 60 day grace period our shares will no longer be quoted on the OTCBB. This will have two effects; first, our shareholders will not be able to dispose of their shares when they want to, and second, our share price could be adversely affected. In other words, there might not be a secondary market for our shares. If there is a secondary market there might be wide fluctuations in our share price which would not give confidence to the investment community. In the fluctuation in our share price is extreme there might be the situation where class action litigation is brought against our Company. Such litigation, if started against us, even if not successful, could cost our Company a great deal of money; money which we currently do not have and would prefer not to spend since it might impair our working capital to such an extent that we could not longer be considered a going concern.

“Penny Stock” Requirements

Our common shares are not quoted on any stock exchange or quotation system in North America or elsewhere in the world. The SEC has adopted a rule that defines a “penny stock”, for purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| ● | | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| | | |

| ● | | that the broker or dealer receives from the investor a written agreement to thetransactions setting forth the identity and quantity of the penny stock to bepurchased. |

To approve a person’s account transactions in penny stock, the broker or dealer must:

| ● | | obtaining financial information and investment experience and objectives of theperson; and |

| | | |

| ● | | make reasonable determination that the transactions in penny stock are suitable forthat person and that person has sufficient knowledge and experience infinancial matters to be capable of evaluating the risks of transactions inpenny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form:

| ● | | sets forth the basis on which the broker or dealer made the suitability determination;and |

| | | |

| ● | | that the broker or dealer received a signed, written agreement from the investor priorto the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks and about commission payable by both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling shares and may cause the price of our shares to decline.

Transfer Agent

Our transfer agent is Action Stock Transfer Corp., Suite 300 – 7069 S. Highland Drive, Salt Lake City, Utah, USA, 84121.

ITEM 10. INTEREST IN NAME EXPERTS AND COUNSEL

We wish to state that no named expert or counsel in this prospectus has any interest in our Company. There are no contractual agreements with our experts or counsel whereby they would received from our Company, either directly or indirectly, an interest in us. None of them is a promoter, underwriter, voting trustee, officer or director of our Company. The definition of an “expert” is a person who is named as preparing or certifying all or part of our prospector or a report or valuation for use in connection with the prospectus. The definition of “counsel” is any counsel named in the prospectus as having given an opinion on the validity of the securities being registered or upon other legal matters concerning the registration or offering of securities.

Madsen & Associates CPA’s Inc., Certified Public Accountants, Unit #3 – 684 East Vine Street, Murray, Utah, 84197 (Tel: 801-268-2632), have audited, as set forth in their report dated May 2, 2008 which appear elsewhere in this prospectus, our financial statements for the period from July 24, 2007 (date of inception) to March 31, 2008. We have included our financial statements in this prospectus in reliance on Madsen & Associates CPA’s Inc.’s report, given on their authority as experts in accounting and auditing.

The geological report on the Bhavnagar claim dated November 22, 2007 titled “Summary of Exploration on the Bhavnagar Property” was authored by Raman Mistry, Professional Geologist, 42 Darjiwala Apartments, Baroda, India.

The legal opinion rendered by Lawler & Associates, Attorney at Law, 29377 Rancho California Road, Suite 204, Temecula, California, 92591 regarding our common shares registered in this prospectus is set forth in his opinion letter dated May 13, 2008

ITEM 11. INFORMATION WITH RESPECTS TO THE REGISTRANT

Description of the Business

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

General Development of the Business

We are a start up, pre-exploration stage company and have not yet generated or realized any revenues from our business operations. We were incorporate under the laws of the State of Nevada on July 24, 2007. We do not have any subsidiaries or affiliate companies. We have never been bankrupt, been under the control of a receiver or similar proceedings with respect to ourselves. We have never had a material reclassification, merger or consolidation of our Company. Since inception we have not disposed of any material amount of assets other than in the ordinary course of business and have had no material changes in the method of conducting our business.

Our present address is Madappilly House, Elenjhipra, P.O. Chalakudy, Via 680271 Kerala, India. Our telephone number is 011-91-480-320-8192.

We are filing this registration statement on Form S-1 under the Securities Act. We are not subject to the reporting requirements of section 13(a) or 15(d) of the Exchange Act immediately before filing this registration statement.

Our Company has made no revenue since its inception on July 24, 2007. During the next fiscal year we will be conducting research in the form of exploration on our Bhavnagar claim located in the Republic of India. We have a 100% interest in the mineral rights on the Bhavnagar claim which we acquired from Bhindi Mines LLC, an unrelated limited liability company having its registered office at Bhopal, India for $5,000, on November 1, 2007.

In order to determine a work program on the Bhavnagar claim we commissioned Raman Mistry, Professional Geologist, to prepare a report on it.

The professional background of Mr. Mistry is that he graduated from the University of New Delhi, India with a Bachelor of Science degree in Geology in 1974 and a Masters of Science degree in 1979 from the same university. He worked as a consulting geologist for 25 years for such companies as Pradesh Mining, Gusain Ventures and Porbqander Explorations where he was commissioned to write reports on their geological structures. He is currently a member in good standing of the Geological Society of India.

In order to write his report, Mr. Mistry reviewed historical and current geological reports of the area and of the Bhavnagar claim and visited to the area between November 17 and19, 2007 for the purpose of evaluating the exploration potential of the Bhavnagar. The reports by previous qualified persons as presented from a literature search of the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of India in its annual reports, papers, Geological Survey maps and assessment reports provide most of the technical basis for his report. His report, dated November 22, 2007, is summarized below:

Description of the Bhavnagar and its location

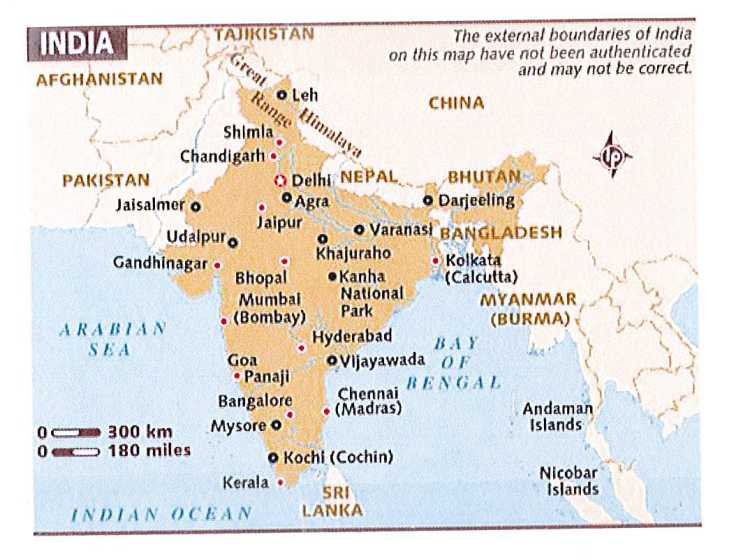

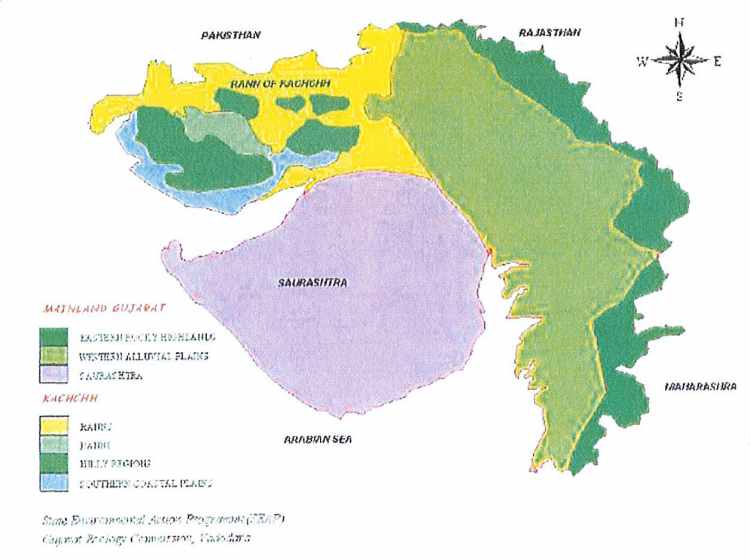

Bhavnagar claim consists of 1 unpatented mineral claim, located 42 km East of Surat, and 79 km Northwest of Amreli at UTM co-ordinates Latitude 21°46’00”North and Longitude 072°14’00”East. A 100% of the Bhavnagar claim was assigned to our Company by Bhindi Mines LLC. and the assignment was filed with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of India.

There are no known environmental concerns or parks designated for any area contained within the Bhavnagar claim. The property has no encumbrances. As advanced exploration proceeds there may be bonding requirements for reclamation.

Accessibility, climate, local resources, infrastructure and topography

The Bhavnagar claim is accessible from Gujarat. It is connected to Mumbai by air and railway. Daily flights operated by Jet Airways and Air Deccan. It was one of the first cities in Gujarat to have an airport. The city is well connected to other major cities of Gujarat such as Valadara, Ahmedabad, Rajkot, Jamnagar, Surat and more by road, with bus services operating by private and state-owned transport corporations. The city is also connected to Ahmedabad and some major cities of Saurashtra by rail road. Intercity bus service is operated by VITCOs. Private auto-rikshaw is other mode of transport. The city of Bhavnagar has an experienced work force and will provide all the necessary services needed for an exploration and development operation, including police, hospitals, groceries, fuel, transportation services, hardware and other necessary items. Drilling companies and assay facilities are present in Gujurat.

Natural resources play an important role in industrial development. Gujarat is endowed with important resources like minerals, marine, agriculture; besides animal wealth and human resources. The state government has taken several measures to explore and exploit these resources for industrial development.

Tropical mountain forests grow at lower elevations in the northeast corner of the claim and good rock exposure is found along the peaks and ridges in the western portion of the claim. The area has a tropical and humid climate, with an oppressive summer and plentiful seasonal rainfall. The summer season, from March to May, is followed by the south west monsoon from June to September. The north east monsoon lasts from October to November.

History

Gold is available in acid and basic volcanic rocks of Archaean age, the oldest known rocks in India ranging in age from more than 3000 million years to 2000 million years.

India has a large number of economically useful minerals and they constitute one-quarter of the world's known mineral resources. India is a country rich in mineral resources. A major portion of the country is composed of Precambrian rocks which have hosted major gold discoveries worldwide. There were over a hundred gold mining centers in the early part of last century. Today India’s annual primary gold mine output is only between 2 and 3 tones. India is the land of the world famous Kolar Gold Fields and the largest consumer of gold.

Numerous showings of mineralization have been discovered in the area and six prospects have achieved significant production, with the nearby Dayal Gold Mine (36 kilometers away) producing 175,000 ounces of gold annually.

During the 1990’s several properties east of Bhavnagar claim were drilled by junior mineral exploration companies.

Our Company is preparing to conduct preliminary exploration work on the Bhavnagar since we have advanced part of the money required to start Phase I of the Mistry report.

Geological Setting

Regional Geology of the Area

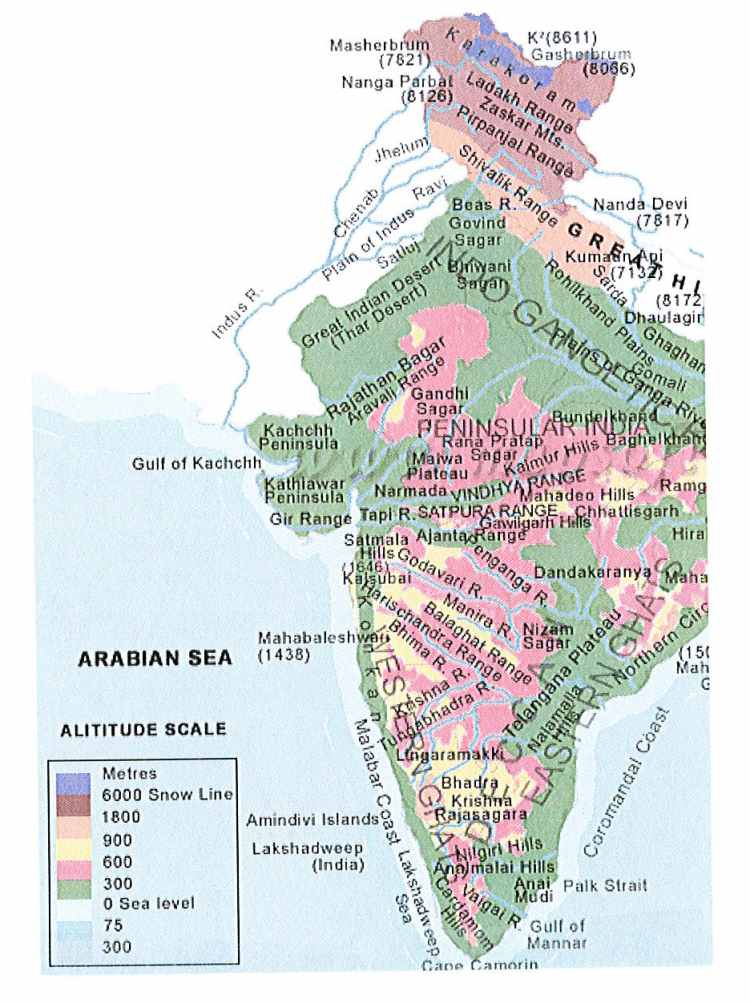

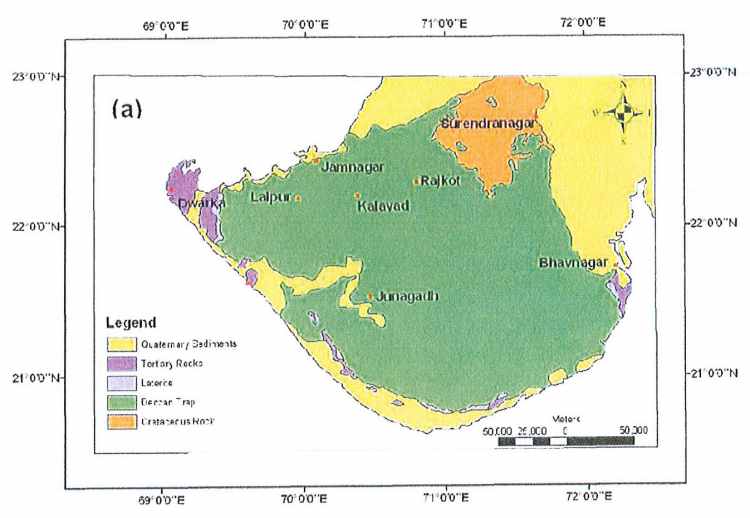

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusive such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

Stratigraphy

The principal bedded rocks for the area of Bhavnagar claim (and for most of India for that matter) are Precambrian rocks which are exposed along a wide axial zone of a broad complex.

Gold at the Dayal Gold Mine (which is in close proximity to the Bhavnagar claim) is generally concentrated within extrusive Precambrian rocks in the walls of large volcanic caldera.

Intrusive

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

Recent exploration result for gold occurrence in Gujarat is highly encouraging. Gold belt in sheared gneissic rocks is found in three sub parallel auriferous load zones where some blocks having 250 to 500 meter length and 1.5 to 2 meter width could be identified as most promising ones.

Structure

Capsule Description: Graphite veins currently mined are from few centimeters to a meter thick. Typically they cut amphibolite to granulite grade metamorphic rocks and/or associated intrusive rocks.

Tectonic Setting(s): Katazone (relatively deep, high-grade metamorphic environments associated with igneous activity; conditions that are common in the shield areas).

Depositional Environment / geological setting: Veins form in high-grade, dynamothermal metamorphic environment where met sedimentary belts are invaded by igneous rocks.

Age of Mineralization: Any age; most commonly Precambrian.

Host / Associated Rock Type: Hosted by paragneisses, quartzites, clinopyroxenites, wollastonite-rich rocks, pegmatites. Other associated rocks are charnockites, granitic and intermediate intrusive rocks, quartz-mica schists, granulites, aplites, marbles, amphibolites, magnetite-graphite iron formations and anorthosites.

Deposit Types

Deposits are from a few millimeters to over a meter thick in places, although usually less than 0.3 meter thick. Individual veins display a variety of forms, including saddle-, pod- or lens-shaped, tabular or irregular bodies; frequently forming anatomizing or stock work patterns.

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of 2 km and are mostly within 400m of the surface. Lodes occur in three main structural settings:

(i) steeply dipping northweststriking shears;

(ii) flatdipping (1040) fractures (flatmakes); and

(iii) shatter blocks between shears.

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Mineralization

No mineralization has been reported for the area of the Bhavnagar claim but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

Exploration

Previous exploration work has not to Mr. Mistry’s knowledge included any attempt to drill the structure on Bhavnagar claim. Records indicate that no detailed exploration has been completed on the property.

Property Geology

To the east of Bhavnagar claim is intrusive consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is underlain by sediments and volcanic. The intrusive also consist of a large mass of granodiorite towards the western most point of the property.

Drilling Summary

No drilling is reported on Bhavnagar claim.

Sampling Method; Sample Preparation; Data Verification

All the exploration conducted to date has been conducted according to generally accepted exploration procedures with methods and preparation that are consistent with generally accepted exploration practices. No opinion as to the quality of the samples to be taken can be presented.

Adjacent Properties

The adjacent properties are cited as examples of the type of deposit that has been discovered in the area and are not major facets to Mr. Mistry’s report.

Interpretations and Conclusions

The area is well known for numerous productive mineral occurrences including the Dayal Gold Claim.

The locale of the Bhavnagar claim is underlain by the units of the Precambrian rocks that are found at those mineral occurrence sites. These rocks consisting of cherts and argillites (sediments) and andesitic to basaltic volcanic have been intruded by granodiorite. Structures and mineralization probably related to this intrusion are found throughout the region and occur on the claim. They are associated with all the major mineral occurrences and deposits in the area.

Mineralization found on the Bhavnagar claim is consistent with that found associated with zones of extensive mineralization. Past work however has been limited and sporadic and has not tested the potential of the property.

Mr. Mistry concludes that potential for significant amounts of mineralization to be found exists on the Bhavnagar claim and it merits intensive exploration.

Recommendations

A two phased exploration program to further delineate the mineralized system currently recognized on Bhavnagar claim is recommended. The program would consist of air photo interpretation of the structures, geological mapping, both regionally and detailed on the area of the main showings, geophysical survey using both magnetic and electromagnetic

instrumentation in detail over the area of the showings and in a regional reconnaissance survey and geochemical soil sample surveying regionally to identify other areas on the claim that are mineralized and in detail on the known areas of mineralization. The effort of this exploration work is to define and enable interpretation of a follow-up diamond drill program, so that the known mineralization and the whole property can be thoroughly evaluated with the most up to date exploration techniques.

Budget

The proposed budget for the recommended work in US dollars is $38,376 (INR 1,560,000) is as follows:

Phase I

| | U.S Dollars | Indian Rupee |

| | | |

| Geological mapping | $ 6,519 | 265,000 |

| | | |

| Geophysical surveying | 7,380 | 300,000 |

| | | |

| Total Phase I | 13,899 | 565,000 |

Phase II

| Geochemical surveying and surface sampling (including sample collection and assaying) | 24,477 | 995,000 |

| | | |

| Total of Phases I and II | $ 38,376 | 1,560,000 |

| | | |

Glossary of Geological Definitions used in the Raman Mistry Report

| Word | Definition |

| | |

| Anorthosite | A plutonic rock composed almost entirely of a mixture of sodium and calcium feldspars. |

| | |

| Aplite | A light-colored igneous rock characterized by a fine-grained sand texture. |

| | |

| Bauxite | An off-white, grayish, brown, yellow or reddish brown rock which is the chief ore of aluminum. |

| | |

| Bentonite | A type of clay formed by the alternation of volcanic ash. |

| | |

| Clinopyroxene | A group name for monoclinic magnesium-iron minerals. |

| | |

| Deposit | Mineral deposit or ore deposit is used to designate a natural occurrence of a useful mineral, or an ore, in sufficient extent and degree of concentration to invite exploration. |

| | |

| Dolerite | A term used in the United States for a fine-grained character of the rock which makes it difficult to identify. |

| | |

| Dolomite | Usually referred to as a bed of limestone. |

| | |

| Feldspar | Comprises 60% of the Earths’ surface and is conceived under high-temperatures. |

| | |

| Gneiss | A rock formed by regional metamorphism in which there are bands or layers of other rock types. |

| | |

| Gypsum | Commonly associated with rock salt, limestone, share and clay and often found in large beds of colorless to white rock. |

| | |

| Laterite | Red residual soil developed in humid, tropical and subtropical regions of good drainage. |

| | |

| Leptynites | A rock containing mica, quartz and feldspar. |

| | |

| Limestone | A general term used commercially for a class of rock containing at least 80% of the carbonates of calcium or magnesium and which, when calcined, gives a product that slakes upon the addition of water. |

| | |

| Mineralization | Potential economic concentration of commercial metals occurring in nature. |

| | |

| Nodules | A small, irregularly rounded knot, mass, or lump of a mineral or mineral aggregate, normally having a warty or knobby surface and no internal structure, and usually exhibiting a contrasting composition from the enclosing sediment or rock. |

| | |

| Ore | The natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or political objectives. |

| | |

| Paragneill | A gneiss formed by metamorphism of a sedimentary rock. |

| | |

| Pegmatite | An exceptionally course-grained igneous rock, with interlocking crystals, usually as irregular dikes, lenses, or veins. |

| | |

| Reserve | (1) That part of a mineral deposit which could be economically and legally extracted or produced at the time the reserve is determined. (2) Proven: Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the site for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. (3) Probable: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Wollastonite | It is found in contact-metamorphosed limestone, and occurs usually in cleavable masses or sometimes in tabular twinned crystals. |

Management’s Discussion and Analysis of Financial Conditions and Results of Operations

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the Bhavnagar claim contains reserves. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we do not find mineralized material or we cannot

remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and our shareholders will loss their entire investment.

In addition, we may not have enough money to complete our exploration of the Bhavnagar claim. If it turns out that we have not raised enough money to complete our exploration program, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and cannot raise it, we will have to suspend or cease operations.

We must conduct exploration to determine what amount of minerals, if any, exist on our claim and if any minerals which are found can be economically extracted and profitably processed.

The Bhavnagar is undeveloped raw land. We are in the process of exploring the Bhavnagar but have not had any results there from to date. If we encounter satisfactory results from our current exploration program we will extend our test to determine if a mineral body exists. The chances of ever identifying a mineral body which can be commercially put into production is extremely remote.

Before minerals retrieval can begin, it is imperative that we explore thoroughly the Bhavnagar and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We cannot predict what that will be until we find mineralized material.

We do not know if we will find mineralized material. We believe that activities occurring on adjoining properties are not material to our activities. The reason is that whatever is located on adjoining property may or may not be located on the Bhavnagar.

We do not claim to have any minerals or reserves whatsoever at this time on any part of the Bhavnagar claim.

We intend to implement an exploration program which consists of geochemical soil and rock sampling along with prospecting, geological mapping and geophysical surveys. Work will focus on prospecting the numerous new roads and clear cuts which may have exposed previously covered bedrock. Areas of alteration, fault zones and especially quartz veining (float or in situ) will be explored by establishing grids along which soil sampling will be conducted. Streams should be sampled by collecting silt and heavy mineral concentrates. The soil samples will be analyzed to determine if elevated amounts of minerals are present. The results will be plotted on a map to determine where the elevated areas of mineralization occur. Rock samples and geological mapping and prospecting will be done by competent professionals. Preliminary geophysical surveying will also be done to try and locate anomalies which may be caused by mineralization which is not evident on the surface. Based upon the results of the exploration we will determine, in consultation with our consultants, if the Bhavnagar is to be dropped or further exploration work is warranted and is to be done.

We estimate the cost of the Phase I work program to be $13,899 (INR 565,000). This is composed of $6,519 (INR 265,000) for geological mapping, $7,380 (INR 300,000) geophysical surveying, which work we have already commenced with an advancement of $5,000. We do not expect to receive any results until late June or July 2008.

If we receive some results from Phase I, we will consider raising money to do Phase II as recommended by Raman Minsty, which will comprise geochemical surveying and surface sampling including sample collection and assaying at an estimated cost of $24,477 (INR 995,000). We do not have sufficient funds to undertake this portion of the work and will have to raise additional capital by subsequent issuance of our securities, attracting a joint venture partner to undertake work on our claim (presumably in exchange for an interest in the Bhavnagar) or through advances from our directors. If we are unable to complete any element of Phase I exploration because we do not have enough money, we will cease operations until we raise more money. If we cannot or do not raise more money, we will cease operations. If we cease operations, we do not have any plans to do anything else.

We do not intend to hire any employees at this time. All of the work on the property will be conducted by unaffiliated independent contactors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility or removing any mineralized material we may find.