XG SCIENCES, INC.

3101 Grand Oak Drive

Lansing, MI 48911

March 1, 2016

Via E-Mail

Pamela A. Long

Assistant Director

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549-4631

Registration Statement on Form S-1

Filed January 27, 2016

File No. 333-209131

Dear Ms. Long:

XG Sciences, Inc. (the “Company”) confirms receipt of the letter dated February 11, 2016 from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) with respect to the above-referenced filing (the “Registration Statement”). We are responding to the Staff’s comments as set forth below. The Company’s responses to the Staff’s comments are in identical numerical sequence. For the convenience of the Staff, each comment is repeated verbatim with the Company’s response immediately following.

General

| COMMENT 1: | Disclosure in the fee table and throughout the registration statement indicates that the selling securityholders will sell their shares of common stock at a fixed price of $8.00 per share until your common stock is quoted on the OTC Bulletin Board or OTC Markets. Note that issuers of securities on the OTC Bulletin Board may rely upon certain staff accommodations for issuers where a public or existing market is necessary. For example, selling securityholders of an issuer of securities on the OTC Bulletin Board may sell at prices set by that market once the issuer’s securities are quoted on the OTC Bulletin Board. This position, however, does not extend to certain other OTC Markets’ marketplaces such as OTCPink. Please revise, therefore, your reference to other OTC Markets on the prospectus’ outside front cover page and throughout the registration statement to clarify that you are referring to the OTC Bulletin Board. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 2

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the Company has modified its disclosure accordingly. |

| COMMENT 2: | Throughout the registration statement, it remains unclear how you determined the number of shares you are registering for resale where those shares relate to outstanding shares of Series A or B Preferred Stock or units. It appears that both the Series A and Series B Preferred convert either at the election of the stockholder or automatically upon your becoming listed on a market other than OTCBB. You disclose the number of shares of common stock that each Series will convert into automatically; however, we understand that the quotation of your common stock on OTCBB will not trigger the automatic conversion feature. Therefore, it appears that you are registering shares for resale that the selling stockholders would obtain by converting their Series A or B Preferred at their own election under the terms of and according to the conversion rates applicable to those elections under the respective certificates of designation. Wherever you discuss the shares of common stock issuable in connection with the Series A and B Preferred, and wherever you discuss the amounts of shares of common stock offered for resale in this prospectus, please also discuss, with equal prominence, the conversions or exchanges that you anticipate taking place to produce the shares of common stock you are registering for resale, and clarify how you arrived at the amount of shares of common stock underlying the Series A and B Preferred. |

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the Company has modified its disclosure accordingly. |

| COMMENT 3: | With respect to the Series B Preferred and unit exchange, you state that “holders of Series B Preferred Stock have the right to exchange each Series B Unit” for two shares of common stock. Please clarify whether all Series B Preferred holders own their shares as part of a Series B Unit, and also clarify what other securities make up a Series B Unit in the context of your discussion of the number of shares you are registering. If the Series B Units include warrants or other securities that are exchangeable or exercisable for shares of common stock, please clarify whether it is your intention to register those shares as well. Please also disclose whether holders of Series B Preferred Stock who do not participate in the exchange will have the right to convert the Series B Preferred Stock according to Section 4(a) of the certificate of designation for the Series B Preferred, and if so, whether you are registering the resale of shares of common stock that are issued upon such a conversion, or only shares that may be issued in the unit exchange. |

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the Company has modified its disclosure accordingly. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 3

Our Shareholder Agreement contains certain negative covenants and restrictions on transfer, page 17

| COMMENT 4: | It appears that you intend to require purchasers in the primary offering, but not the resale offering, to enter into the Shareholder Agreement. The terms of the Shareholder Agreement, including non-competition covenants that extend even after an investor disposes of the shares purchased in the offering, as well as restrictions on transfer and other provisions, seem inconsistent with the idea that all of the shares are of a single class, and that your shares of common stock will be owned by public shareholders and quoted for trading on OTCBB. Please describe the purpose of binding investors in the public primary offering to this agreement, and also discuss clearly whether investors purchasing from selling shareholders would also be bound. |

| RESPONSE: | On February 26, 2016, the Shareholder Agreement was amended to provide that holders of “Excluded Stock” are not subject to the terms of the Shareholder Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective, including, without limitation, shares being offered in the primary offering in the Registration Statement. The Company has summarized this amendment to the Shareholder Agreement throughout and has attached a copy of the amendment as an Exhibit to the Registration Statement. |

| COMMENT 5: | It is not clear how investors, the OTCBB, or other market participants would distinguish the shares of common stock that are subject to the Shareholder Agreement from those that are not. We also note that you intend for the agreement to bind investors who purchase from the company but, presumably, not those who purchase from other investors, yet Dr. Rose is expected to offer shares on behalf of the company and is also a selling stockholder with respect to the shares he personally owns. Please clarify how an investor would determine whether it is necessary to adopt the Shareholder Agreement if purchasing shares from Dr. Rose. |

| RESPONSE: | On February 26, 2016, the Shareholder Agreement was amended to provide that holders of “Excluded Stock” are not subject to the terms of the Shareholder Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective, including, without limitation, shares being offered in the primary offering in the Registration Statement. The Company has summarized this amendment to the Shareholder Agreement throughout and has attached a copy of the amendment as an Exhibit to the Registration Statement. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 4

| COMMENT 6: | If you intend to bind new holders of the common stock to the Shareholder Agreement, please clearly explain this in the summary and describe all material terms of the shareholder agreement, including terms giving larger shareholders special voting and nomination rights, and the non-competition covenants in the “Description of Securities” section. Please also address the impact of preemptive rights under the Shareholder Agreement on holders of common stock who are parties to the agreement versus holders of common stock who are not parties to the agreement. We may have further comment upon review of your response. |

| RESPONSE: | On February 26, 2016, the Shareholder Agreement was amended to provide that holders of “Excluded Stock” are not subject to the terms of the Shareholder Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective, including, without limitation, shares being offered in the primary offering in the Registration Statement. The Company has summarized this amendment to the Shareholder Agreement throughout and has attached a copy of the amendment as an Exhibit to the Registration Statement. |

Going Concern, page 30

| COMMENT 7: | Refer to your response to comment 2 in our December 4, 2015. We are unable to locate the disclosures: “we believe we will need approximately $4 2 million to sustain us for the next twelve months,” and “although we do not have firm commitments, we believe we will raise an anticipated $15,000,000 from certain investors that have expressed an interest in investing and which are currently conducting due diligence.” Please revise. |

| RESPONSE: | The Company has further revised its disclosures in the subsections “Going Concern”, “Liquidity and Capital Resources” in Management’s Discussion and Analysis of Financial Condition section of the Registration Statement to reflect management’s current estimates. |

Shareholder Agreement, page 78

| COMMENT 8: | We note the paragraph in this section that describes preemptive rights that are granted to shareholders who are parties to the Shareholder Agreement. Please disclose whether these parties have waived their rights with respect to this offering, or whether you intend to offer the shares registered in the primary offering to these parties. If you intend to offer registered shares, please provide your analysis as to why this is appropriate since the parties entered into this agreement privately. Note that an agreement or offer to sell shares that is made privately must generally be completed privately. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 5

| RESPONSE: | On February 26, 2016, the Shareholder Agreement was amended to provide that holders of “Excluded Stock” are not subject to the terms of the Shareholder Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective, including, without limitation, shares being offered in the primary offering in the Registration Statement. The Company has summarized this amendment to the Shareholder Agreement throughout and has attached a copy of the amendment as an Exhibit to the Registration Statement. |

| COMMENT 9: | Please clarify whether investors who purchase shares in the resale offering will be required to execute an adoption agreement to the Shareholder Agreement. Please also clarify whether the shares offered for resale are subject to any right of first refusal under the Shareholder Agreement, and if so, please disclose whether there has been a waiver of this right by the company and other shareholders who are parties to this agreement. |

| RESPONSE: | On February 26, 2016, the Shareholder Agreement was amended to provide that holders of “Excluded Stock” are not subject to the terms of the Shareholder Agreement. Excluded Stock means shares of common stock that are subject to a registration statement that has been filed with the SEC and has been declared effective, including, without limitation, shares being offered in the primary offering in the Registration Statement. The Company has summarized this amendment to the Shareholder Agreement throughout and has attached a copy of the amendment as an Exhibit to the Registration Statement. |

Security Ownership of Certain Beneficial Owners and Management ...., page 80

| COMMENT 10: | Please tell us why you have excluded shares of common stock issuable upon conversion of the Series A Preferred Stock at a ratio of 1.875 to 1 and the shares of common stock issuable upon exchange of the Series B Units. If the holders of the Series A Preferred Stock and Series B Units can exercise their rights to receive common stock within 60 days, please explain why they would be deemed to beneficially own those shares. |

| RESPONSE: | The Company has revised the security ownership table to include common stock issuable upon the conversion of Series A Preferred Stock and the shares of common stock issuable upon the exchange of Series B Units in the Registration Statement in response to the Staff’s comment above. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 6

Selling Securityholders, page 83

| COMMENT 11: | Please clarify that the percentages of shares owned by the selling stockholders after the offering takes into account the sale of the 2 million shares by the company in the primary offering. If necessary, please revise the percentages in the table accordingly. |

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the Company has modified its disclosure accordingly. |

Plan of Distribution for Primary Offering, page 99

| COMMENT 12: | We note the risk factor disclosure on page 18 that your chief executive officer, Dr. Philip L. Rose, will conduct the primary offering on your behalf if you determine not to engage a sales agent. Expand the disclosure in the plan of distribution section to indicate how Dr. Rose would be able to rely on the safe harbor from broker-dealer registration.See Rule 3a-41 under the Exchange Act. Additionally, please elaborate on the manner in which Dr. Rose would offer the shares of common stock on your behalf and how investors would learn about the offering. For example, would Dr. Rose solicit investors through direct mailings and/or personal contacts? How would Dr. Rose identify those who might have an interest in purchasing shares of common stock? How will Dr. Rose determine whether to sell on behalf of the company or to sell the shares he owns and is registering for resale in this offering? Please provide us copies of any materials that Dr. Rose would intend to use in conducting the primary offering on your behalf. |

| RESPONSE: | In response to the Staff’s comment, we have expanded our Plan of Distribution discussion to include the fact that certain officers and directors will conduct the primary offering on our behalf and how such officers and directors will be able to rely on the safe harbor from broker-dealer registration. We have also clarified that such officers and directors will offer the shares solely by means of this prospectus and the investor presentation materials which are attached as Exhibit 99.1 to the Registration Statement to friends, family members, business acquaintances and other contacts, and by direct mail to investors who have indicated an interest in the Company. Such investor presentation materials are also attached to this response letter at the request of the Commission. |

Plan of Distribution for Secondary Offering, page 101

| COMMENT 13: | Please clarify your reference to the NASDAQ Capital Market. We understand that you are not listed or quoted on any market currently, and that you intend to seek quotation on the OTCBB. |

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the Company has modified its disclosure accordingly. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 7

Signatures, page II-8

| COMMENT 14: | Refer to comment 7 in our December 4, 2015 letter. The registration statement must be signed also by your controller or principal accounting officer. Further, any person who occupies more than one of the specified positions, for example, principal financial officer and controller or principal accounting officer, must indicate each capacity in which he signs the registration statement. See Instructions 1 and 2 to “Signatures” on Form S-1, and revise. |

| RESPONSE: | The Company has revised the Registration Statement to include Phil Rose as signatory in his capacity also as our Principal Financial Officer. Mr. Rose has also signed as attorney in fact on behalf of Corinne Lyon as Controller, pursuant to a power of attorney attached as Exhibit 24.2 to the Registration Statement. |

Exhibit 5.1

| COMMENT 15: | Remove the word “DRAFT” from each page of the exhibit. Additionally, specify the registration statement’s file number in the first paragraph. |

| RESPONSE: | The Company has filed a revised legal opinion to include the Staff’s comments above and has filed the same as Exhibit 5.1 to the Registration Statement. |

| COMMENT 16: | Please revise to clarify that the “Selling Shareholder Series A Shares” and “Selling Shareholders Series B Shares” that counsel is opining on are in fact shares of common stock. Additionally, the reference to “conversion of the underlying” shares of Series A and B Preferred stock in enumerated paragraphs (4) and (5) on page 4 of the opinion is confusing. It appears that you mean to refer to shares of common stock that underlie the Series A and B Preferred. |

| RESPONSE: | The Company has revised the Registration Statement throughout to eliminate the secondary offering and therefore, the legal opinion also reflects the elimination of all secondary shares. |

Exhibits 10.5, 10.7, 10.9, 10.15, 10.19 and 10.21

| COMMENT 17: | It appears that not all attachments or not all attachments in their entirety to these exhibits were filed. Unlike Item 601(b)(2) of Regulation S-K, there is no provision in Item 601(b)(10) of Regulation S-K for omitting attachments to exhibits. Please refile the exhibits, including all attachments, in their entirety. |

| RESPONSE: | The Company has provided the missing exhibits and has refiled the exhibits in their entirety, except as follows: (1) after consultation with Dart, the lessor for the leases, the Company has concluded that Exhibits 10.5 and 10.7 were executed without exhibits E and F thereto; (2) Annex VI to Exhibit 10.19 refers to a Landlord Consent which the Company has been unable to locate. The remaining exhibits identified as incomplete are being refiled with Amendment No. 1 with all exhibits and annexes thereto that the Company has determined were incorporated with the executed copies of the exhibits. |

Pamela A. Long

U.S. Securities and Exchange Commission

March 1, 2016

Page 8

| COMMENT 18: | We note that the exhibit list refers to Exhibit 10.31 as the “Sales Agency Agreement,” while the agreement you have filed here is a “Distribution Agreement.” Please reconcile. |

| RESPONSE: | The Company has revised the description of the referenced exhibit to accurately reflect that it is a Distribution Agreement. |

Exhibit 21

| COMMENT 19: | Include the state or other jurisdiction of incorporation or organization of the subsidiary.See Item 601(b)(21) of Regulation S-K. |

| RESPONSE: | The Company has refiled Exhibit 21 to name the state of organization in response to the Commission’s comment. |

Closing

The Company acknowledges that:

| · | should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| · | the action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| · | the Company may not assert Staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We trust that this response satisfactorily responds to your request. Should you require further information, please contact Clayton E. Parker at (305) 539-3306 or Matthew Ogurick at (305) 539-3352.

| | Very truly yours, |

| | |

| | /s/ Dr. Philip L. Rose |

| | |

| | Chief Executive Officer |

| | XG Sciences, Inc. |

| | 3101 Grand Oak Drive |

| | Lansing, MI 48911 |

| cc: | Clayton Parker, Esq., of K&L Gates LLP |

Jeff Bauman, CPA, of Frazier & Deeter

Exhibit 99.1

Company

XG Sciences, Inc. (“XGS”), formed in May 2006, is a first mover and market leader in the design and manufacture of graphene nanoplatelets. Graphene nanoplatelets are particles consisting of multiple layers of graphene and are considered a game changer for numerous industries. XGS’ graphene nanoplatelets, trademarked under the name xGnP®, have demonstrated performance impacting multi-billion dollar markets and have unique capabilities for energy storage, thermal conductivity, electrical conductivity, barrier properties and the ability to impart strength when incorporated into plastics or other matrices. XGS has sold products to over 1,000 customers in 47 countries who are in various stages of trialing its products for numerous applications. XGS has also licensed elements of its technology to leading supply chain and distribution partners, such as Cabot Corp and POSCO. Headquartered in Lansing, Michigan, the Company has raised $32 million to date and has 23 full-time employees.

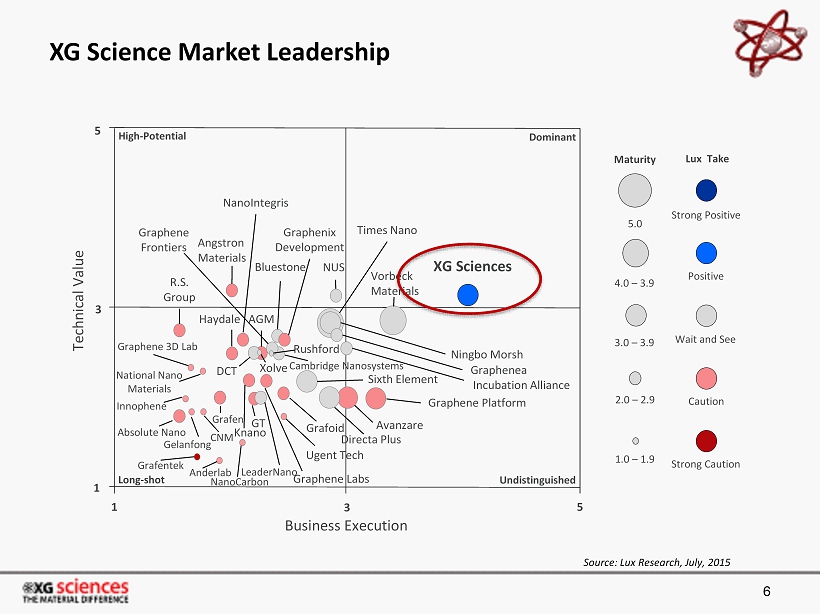

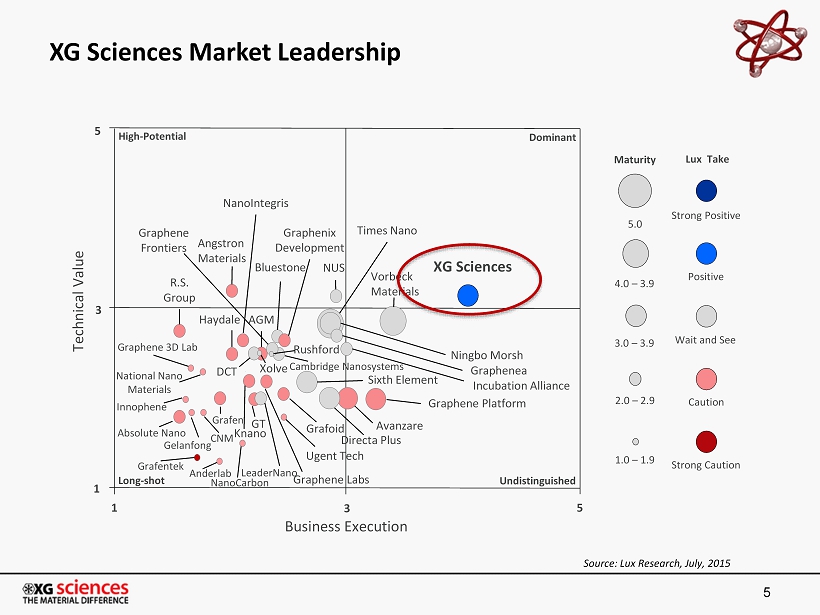

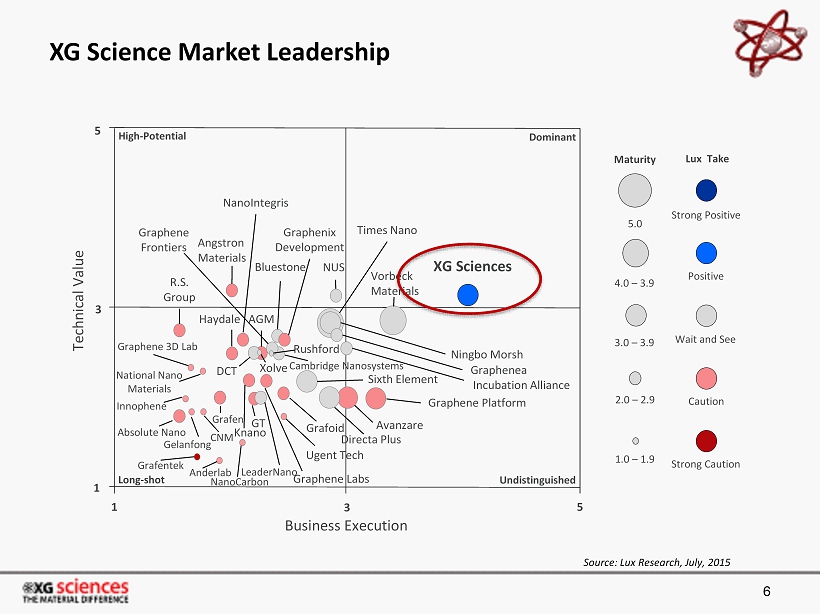

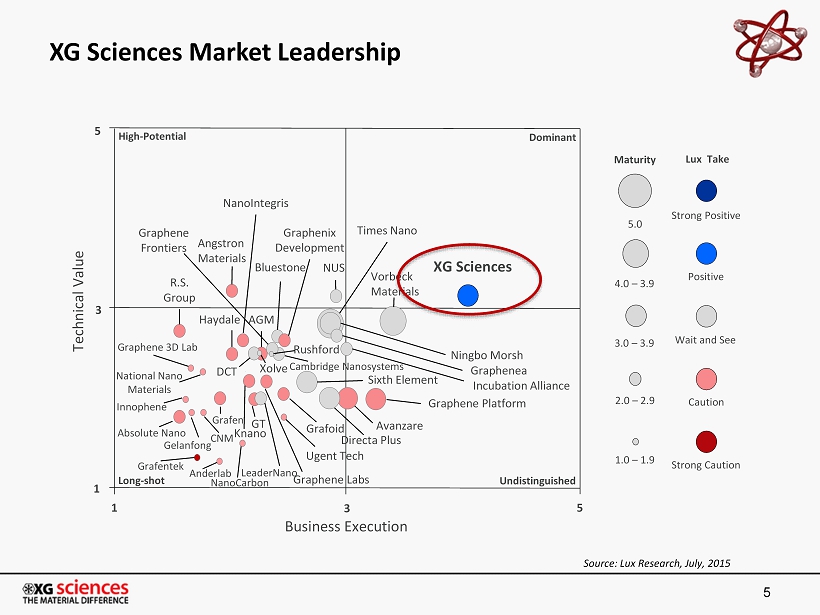

Lux Research says:

XG Sciences – Positive – Advanced Materials. Top Ten Innovative Companies.

“Despite increasing competition from a handful of new entrants to the graphene space, XG remains the low cost leader and also boasts the most impressive business execution to date.”

XG Sciences Well Positioned for Success

| | - | Significant Customer Traction: 1,000+ in 40+ countries since inception.Strong portfolio of customer engagementsin end-use markets ranging from polymer composites, energy storage, electrically conductive films and thermal management. |

| | - | Revenue Traction: Commercial sales started in multiple applications and gaining momentum. $5-10 million in forecasted 2016 revenue. |

| | - | Proven Technology:Significant IP in the form of patents, trade secrets and know-how. XG SiG™ Composite with4x the storage capacity versus today’s LiB anode technology. XG Leaf® with one-third the density of copper films,50% more thermally conductive than copper and more than 2x that of aluminum. Formulated water- and solvent-based inks with conductivity approaching 1W/oat 1 mil thickness.Industry-leading performance available in bulk powders and dispersions. |

| | - | Positioned To Grow: Technology, partners and management positions XG for substantial growth.Proven manufacturing technology and strong customer channel to deliver on success. Moved beyond proof of concept intocommercialization phase. |

| | - | Strategic Partners: Well positioned withworld class strategic partners, Investors and licensees. Investors:Aspen Advanced Opportunity Fund, Hanwha, POSCO and Samsung Ventures. Licensees: Cabot and POSCO. |

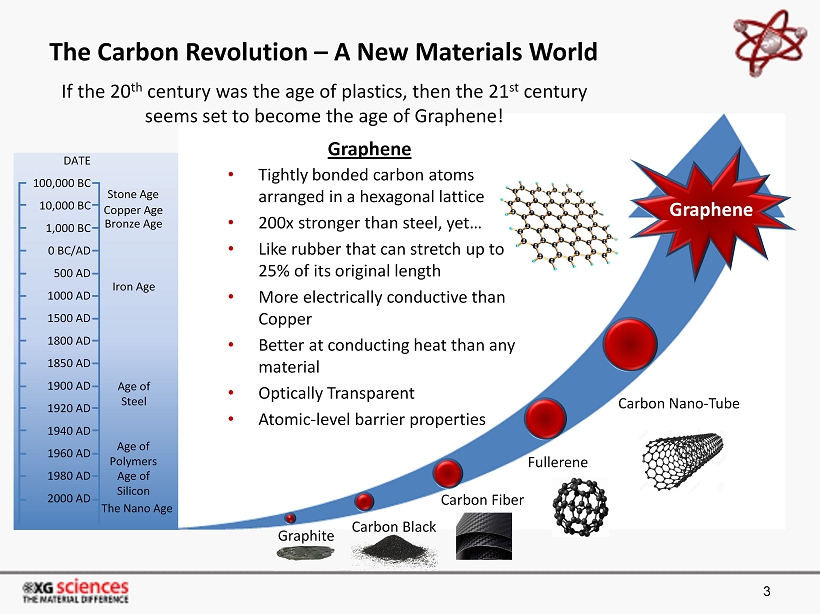

Graphene: The “Miracle Material”

First discovered in 2004, graphene is the thinnest material known - a single layer of carbon atoms configured in an atomic-scale honeycomb lattice, and is noted for its strength, density, impermeability, light weight, and both electrical and thermal conductivity. Among many noted properties, graphene is harder than diamonds, lighter than steel but significantly stronger, conducts electricity better than copper and one of the most thermally conductive materials available today.

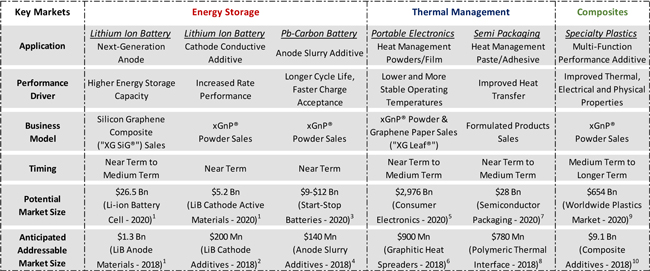

Markets

XGS is a “platform play” in advanced materials where the Company’s proprietary processes produce varying grades of graphene nanoplatelets which can be mapped to a variety of applications in many market segments. The Company’s primary focus markets are Energy Storage and Thermal Management where they currently have a portfolio of products undergoing design-in with a range of marquee customers. They also target the Inks & Coatings market with products in development and are engaged in commercial and development activities for the Composites market.

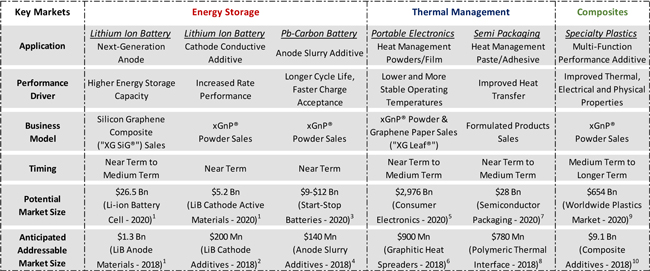

XGS Market/Application Focus Areas & 2018 Market Size

XG SiG™ in Lithium-ion Battery Markets

The global LiB market is large and growing rapidly. According to Avicenne Energy1, the 2014 LiB market is $12.5B and growing to $21.5B in 2016, driven by the rapid proliferation of tablets, smart phones, electric vehicles, and grid storage applications. The portion of the market that XGS addresses is the anode materials segment, which Avicenne values at about $850 million in 2014 and expects to grow to $1.3-1.4B by 2018.

1Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015.

2Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015 & Internal Estimates.

3ArcActive via Nanalyze, April 3, 2015.

4ArcActive via Nanalyze, April 3, 2015 & Internal Estimates.

5Future Markets Insights, "Consumer Electronics Market: Global Industry Analysis and opportunity Assessment 2015 - 2020", May 8, 2015.

6Prismark, "Market Assessment: Thin Carbon-Based Heat Spreaders", August 2014.

7Reporterlink.com, "Semiconductor & IC Packaging Materials Market…", May 2014.

8Prismark, 2015.

9Grand View Research, "Global Plastics Market Analysis…", August 2014.

10From (9) and internal estimates: 2018 = 305 million tons of plastic, if 10% of the market adopted xGnP to enhance their properties, and at only 1% by weight as an additive, then in 2018 305,000 tons or 305,000,000 kilos of xGnP would be required. At $30 a Kg - the value is $9.1 Bn per year.

XG Leaf®in Portable Electronics

XG Leaf® can be used for a variety of applications such as heat dissipation in electronics, electromagnetic interference (EMI) shielding, and resistive heating. Among these, thermal application has the biggest apparent market potential especially in consumer electronics. According to a private client study by Prismark Partners, LLC, a leading electronics industry consulting firm specializing in advanced materials, the 2014 market for finished graphitic heat spreaders as sold to the OEM and EMS companies with adhesive, PET, and/or copper backing for selected portable applications, is $600 million, and is expected to reach $900 million in 2018. The market is currently in a significant expansion period driven by the demand for portable devices.

Other Markets

| | - | Energy Storage: lead acid batteries, supercapacitor electrodes, lithium-ion battery cathodes, lithium-ion anodes; |

| | - | Thermal Management: circuit boards, portable electronic devices, such as cell phones and tablets, thermal management systems for battery packs used in electric vehicles; inks, coatings, polymer composites and greases; cooling liquids / fluids; |

| | - | Electrical Conductivity: aqueous and solvent-based formulations to print conductive circuits using flexo, gravure, off-set and screen-printing processes on flexible and rigid substrates; |

| | - | Composites: polymers (urethanes, polycarbonate, Teflon, rubber, polypropylene, thermoplastic polyolefin and nylon), polymer processes (e.g., thermoset, solvent cast and thermoplastic) and cement; and |

| | - | Lubricity: oil and grease additives. |

XGS Products

xGnP® Graphene Nanoplatelets

xGnP® graphene nanoplatelets consist of ultrathin particles of graphite that are short stacks of graphene. They are produced in various grades, which vary by average particle thickness, and average particle diameters. xGnP® graphene nanoplatelets are especially applicable for use as additives in polymeric or metallic composites, or in coatings or other formulations where particular electrical, thermal or barrier applications are desired by our customers.

XG Leaf®

XG Leaf® is a family of sheet products suited for use in industrial, electronics, and automotive markets. These sheets are made using special formulations of xGnP® graphene nanoplatelets as precursors, along with other materials for specific applications. There are several different types of XG Leaf™ available in various thicknesses (30 to 250 microns), depending on the end-use requirements for thermal conductivity, electrical conductivity, or resistive heating.

XG SiG™ Li-ion Battery Anode Materials

XG SiG™ is a composite of silicon and graphene nanoplatelets designed to deliver 3-4 times the storage capacity of today’s graphite-based LiB anodes. Anode capacity is a key driver for extended battery runtime in applications such as portable electronics, power tools and electric vehicles (“EV”). Silicon has 10x the storage capacity of graphite and has been targeted as the next-generation material to replace graphite. However, silicon suffers from poor cyclability limiting its adoption in LiB anodes. XGS’ breakthrough is the creation of a SiG composite that allows the use of silicon as an active component in anodes, delivering on the industry need for long battery cycle life, high efficiency and at a cost and scale that meets industry targets. Product design-in is underway with battery manufacturers targeting early commercialization performance requirements. The combination of performance, cost and manufacturability positions XG SiG™ and XGS as a leader in high energy density LiB materials.

Strategic Investors and License Agreements

The Company has partnered with leading global companies as manufacturing, technology and distribution partners as a way to accelerate XGS’ customer and manufacturing reach. Each of these partners has spent significant time with XGS to validate the technology and market need.

Mar 2014 | POSCO | $1.2M investment exercising certain pre-emptive rights |

| Jan 2014 | Samsung Ventures | $3M investment + Joint Development Program ongoing with Samsung SDI for next gen Li-Ion batteries |

| Nov 2011 | Cabot Corp | $4M licensing agreement + royalties |

| Jun 2011 | POSCO | $4M investment with licensing agreement + royalties |

| Dec 2010 | Hanwha Chemical | $3M investment |

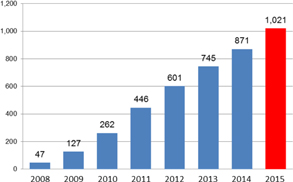

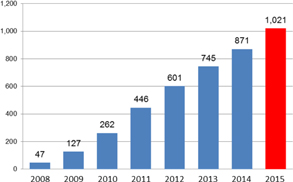

Customer Traction

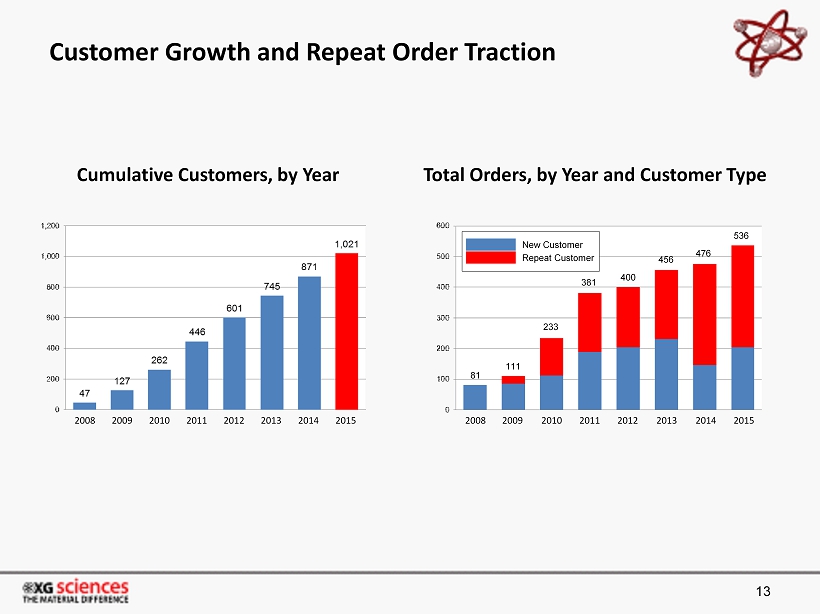

| | - | Year-on-year addition of new customers in a range of end-use applications. |

| | - | Track record of annual order growth as well as repeat customers underlying commercial traction with multiple customers and markets. |

| Cumulative Customers, by Year | | Total Orders, by year and Customer Type |

| | | |

| |  |

Management Team

Dr. Philip Rose, CEO

| | - | President, Hitech, Sigma Aldrich (2010 to 2013) |

| | - | General Management, M&A, Business Development and Marketing, Rohm and Haas (1989-2010) |

Dr. Liya Wang, VP R&D

| | - | Renowned expert in the field of batteries and advanced materials |

| | - | Former Principal Scientific Director for Spain’s CIC Energigune and Director for emerging technologies at A123 |

Rob Privette, VP Energy Markets

| | - | 25 years of experience in technology development and commercialization of fuel cells, batteries, and other energy related devices |

| | - | Former Director for Product Development at Energy Conversion Devices and Director of US Fuel Cell Development at Umicore with experience at the US DOE, DARPA, the US Army and US Navy. |

Dr. Hiroyuki Fukushima, Technical Director

| | - | Founding shareholder and inventor of xGnP® production processes |

Scott Murray, VP Operations

| | - | Seasoned professional with 30 years as a senior operations executive |

| | - | Formerly Founder and CEO of Uretech International Inc., Director of Development for McKechnie Automotive and various positions with Motor Wheel Corporation |

Board of Directors

Dr. Philip Rose, CEO, President, Treasurer and Director

Arnold A. Allemang, Director, Chairman and Audit Committee member. Retired Board member, Dow Chemical, former Operating Officer of Dow

Ravi Shanker, General Manager, Lightweighting Platform, Dow Chemical

Steven C. Jones, Director and Audit Committee Chairman. Chairman, Aspen Capital Group LLC. President, Aspen Capital Advisors, LLC

Wonil Kim, Director. Advanced Materials Investment & Technology Group, POSCO

Michael Pachos, Director and Audit Committee member. Principal, Samsung Ventures

Dave Pendell, Director. Owns and operates AdvancedStage Capital LLC, ASC Lease Income, and is a general partner in Veterans Capital Fund.

Company Overview Presentation 1

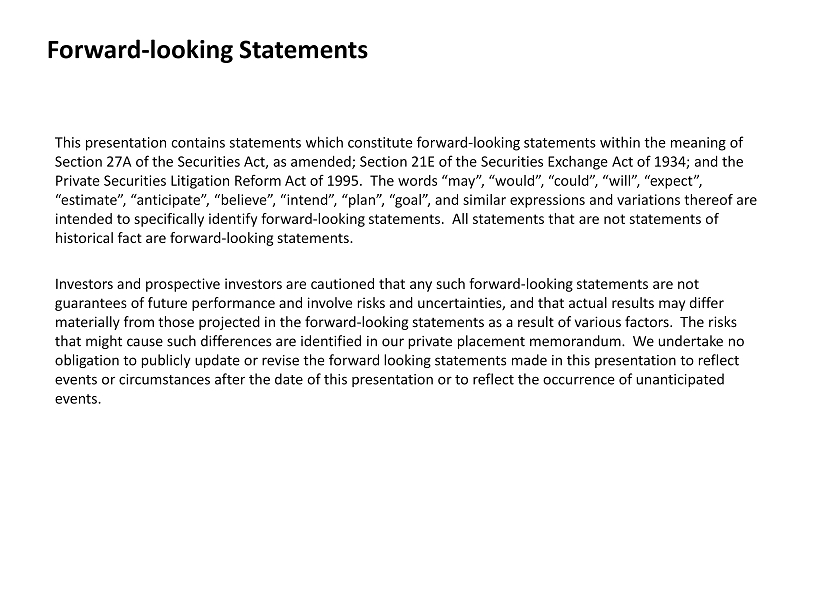

Forward - looking Statements This presentation contains statements which constitute forward - looking statements within the meaning of Section 27A of the Securities Act, as amended; Section 21E of the Securities Exchange Act of 1934; and the Private Securities Litigation Reform Act of 1995. The words “may”, “would”, “could”, “will”, “expect”, “estimate”, “anticipate”, “believe”, “intend”, “plan”, “goal”, and similar expressions and variations thereof are intended to specifically identify forward - looking statements. All statements that are not statements of historical fact are forward - looking statements. Investors and prospective investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward - looking statements as a result of various factors. The risks that might cause such differences are identified in our private placement memorandum. We undertake no obligation to publicly update or revise the forward looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events.

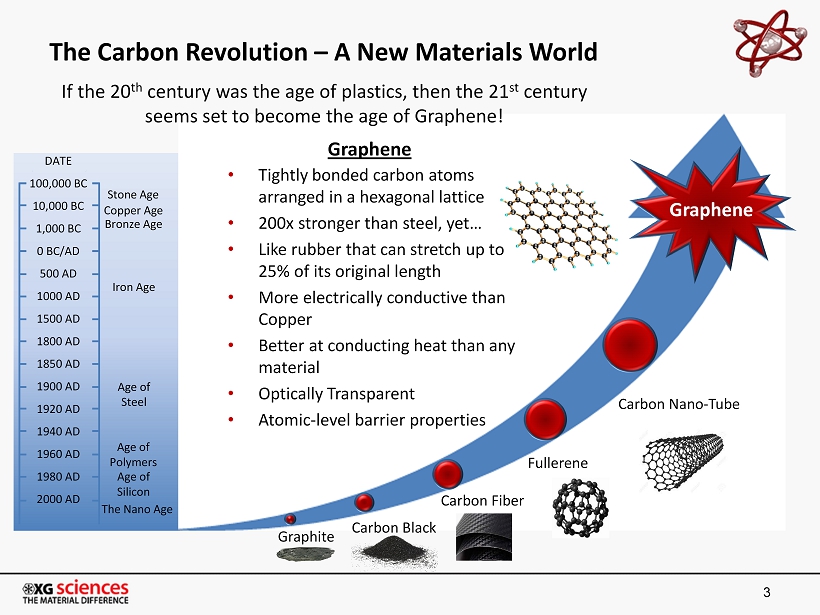

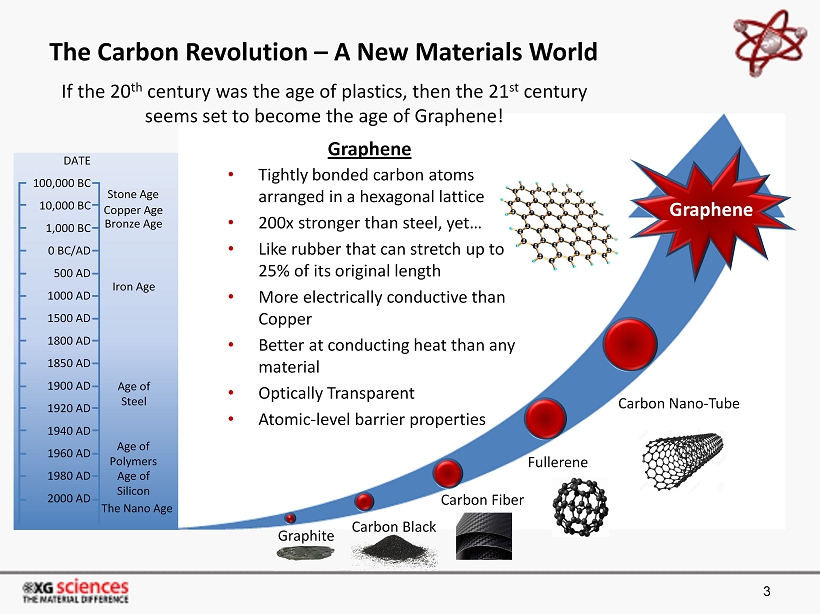

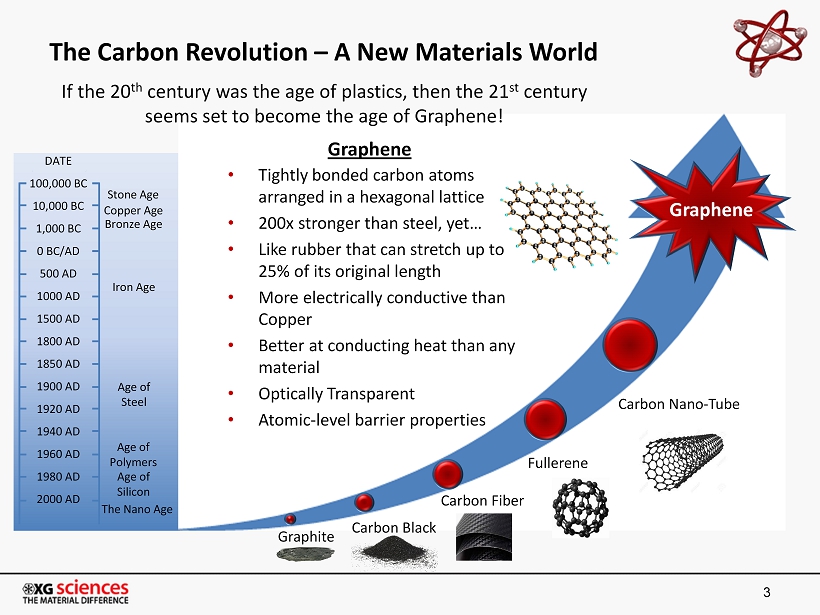

The Carbon Revolution – A New Materials World 3 DATE 100,000 BC 10,000 BC 1,000 BC 0 BC/AD 500 AD 1000 AD 1500 AD 1800 AD 1850 AD 1900 AD 1920 AD 1940 AD 1960 AD 1980 AD 2000 AD Stone Age Copper Age Bronze Age Iron Age Age of Steel Age of Polymers Age of Silicon The Nano Age Carbon Black Carbon Fiber Fullerene Carbon Nano - Tube Graphite • Tightly bonded carbon atoms arranged in a hexagonal lattice • 2 00x stronger than steel, yet… • Like rubber that can stretch up to 25% of its original length • More electrically conductive than Copper • Better at conducting heat than any material • Optically Transparent • Atomic - level barrier properties Graphene If the 20 th century was the age of plastics, then the 21 st century seems set to become the age of Graphene! Graphene

Potential Future is Endless? 4 It is currently only limited based on your imagination! • Flexible, wearable electronics • Stronger and lighter airplanes • More efficient solar panels • Energy Savings power systems • Longer battery life time • More storage memory in portable electronics • Supercapacitors charged in seconds • Desalination

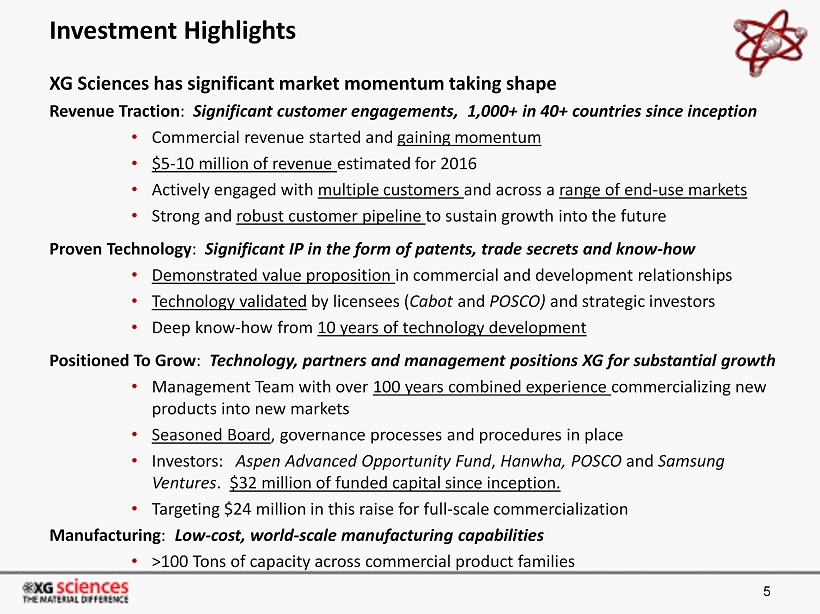

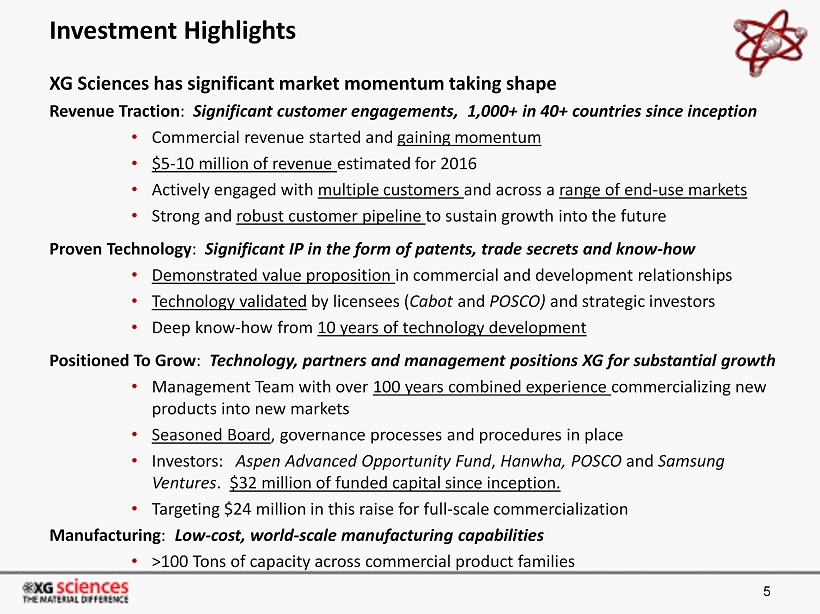

Investment Highlights XG Sciences has significant market momentum taking shape Revenue Traction : Significant customer engagements, 1,000+ in 40+ countries since inception • C ommercial revenue started and gaining momentum • $5 - 10 million of revenue estimated for 2016 • Actively engaged with multiple customers and across a range of end - use markets • S trong and robust customer pipeline to sustain growth into the future Proven Technology : Significant IP in the form of patents, trade secrets and know - how • Demonstrated value proposition in commercial and development relationships • Technology validated by licensees ( Cabot and POSCO) and strategic investors • Deep know - how from 10 years of technology development Positioned To Grow : Technology, partners and management positions XG for substantial growth • Management Team with over 100 years combined experience commercializing new products into new markets • Seasoned Board , governance processes and procedures in place • Investors: Aspen Advanced Opportunity Fund , Hanwha, POSCO and Samsung Ventures . $32 million of funded capital since inception. • Targeting $24 million in this raise for full - scale commercialization Manufacturing : Low - cost, world - scale manufacturing capabilities • > 100 Tons of capacity across commercial product families 5

6 Source: Lux Research, July, 2015 1.0 – 1.9 2.0 – 2.9 3.0 – 3.9 4.0 – 3.9 5.0 Maturity Lux Take Strong Positive Positive Wait and See Caution Strong Caution Dominant Undistinguished Long - shot Technical Value 1 1 5 XG Sciences Vorbeck Materials Sixth Element Angstron Materials Incubation Alliance Grafoid Graphenix Development Ningbo Morsh Xolve Avanzare Grafen Graphene Platform Haydale R.S. Group Knano Graphenea Times N ano NUS Bluestone AGM DCT Rushford Cambridge Nanosystems Graphene Frontiers NanoIntegris Directa Plus Graphene Labs G T LeaderNano Ugent Tech NanoCarbon CNM Anderlab Grafentek Gelanfong Absolute Nano National Nano Materials Graphene 3D Lab Innophene Business Execution 3 3 5 High - Potential XG Science Market Leadership

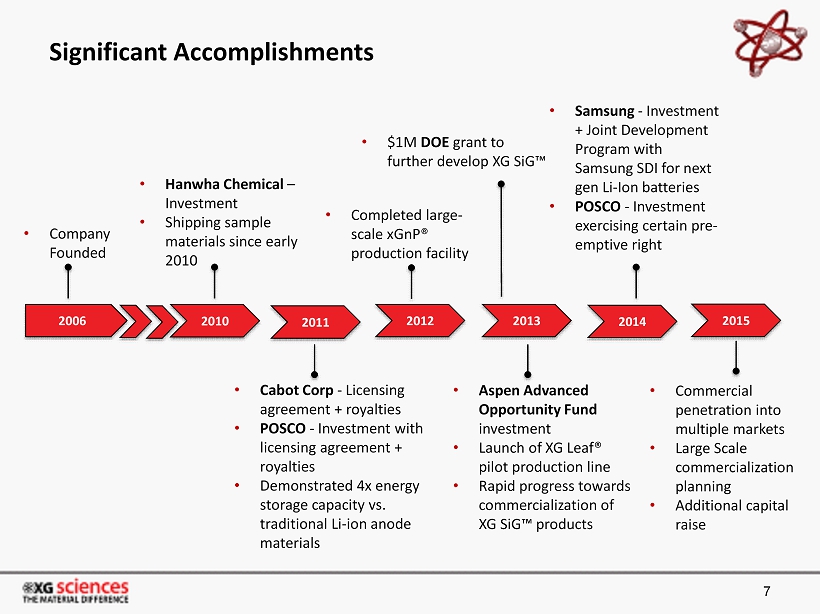

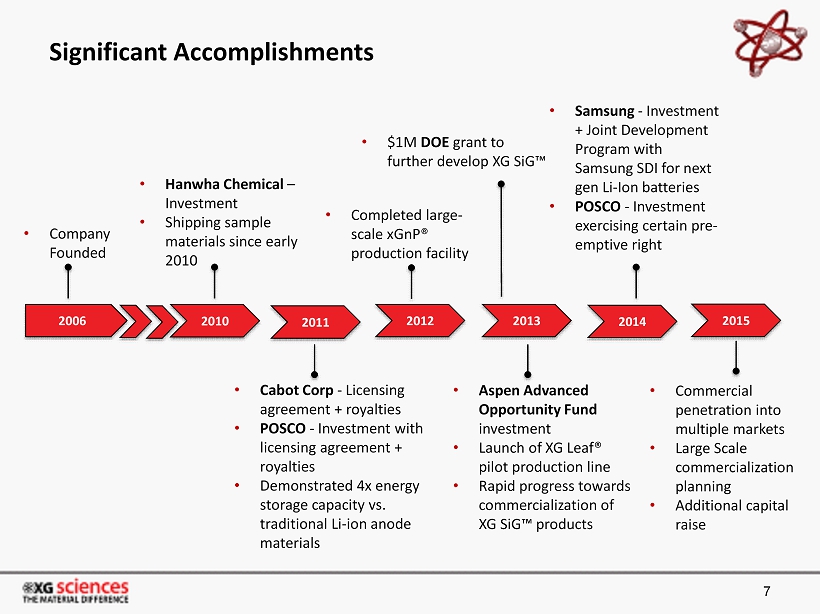

Significant Accomplishments 7 2006 2010 2011 2012 2013 • Hanwha Chemical – Investment • Shipping sample materials since early 2010 • Cabot Corp - L icensing agreement + royalties • POSCO - I nvestment with licensing agreement + royalties • Demonstrated 4x energy storage capacity vs. traditional Li - ion anode materials • Samsung - I nvestment + Joint Development Program with Samsung SDI for next gen Li - Ion batteries • POSCO - I nvestment exercising certain pre - emptive right 2014 • Company Founded • Aspen Advanced Opportunity Fund investment • Launch of XG Leaf® pilot production line • Rapid progress towards commercialization of XG SiG™ products • $1M DOE grant to further develop XG SiG™ • Completed large - scale xGnP® production facility 2015 • Commercial penetration into multiple markets • Large Scale commercialization planning • Additional capital raise

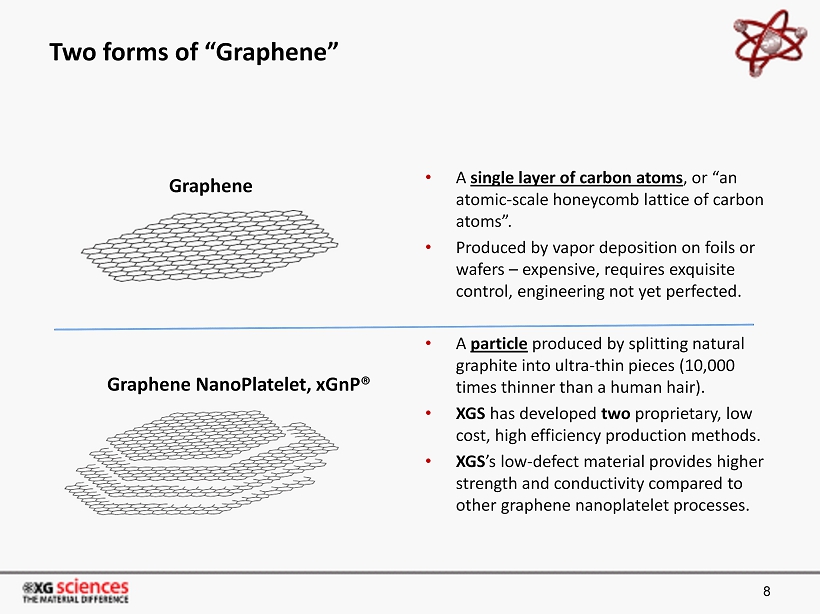

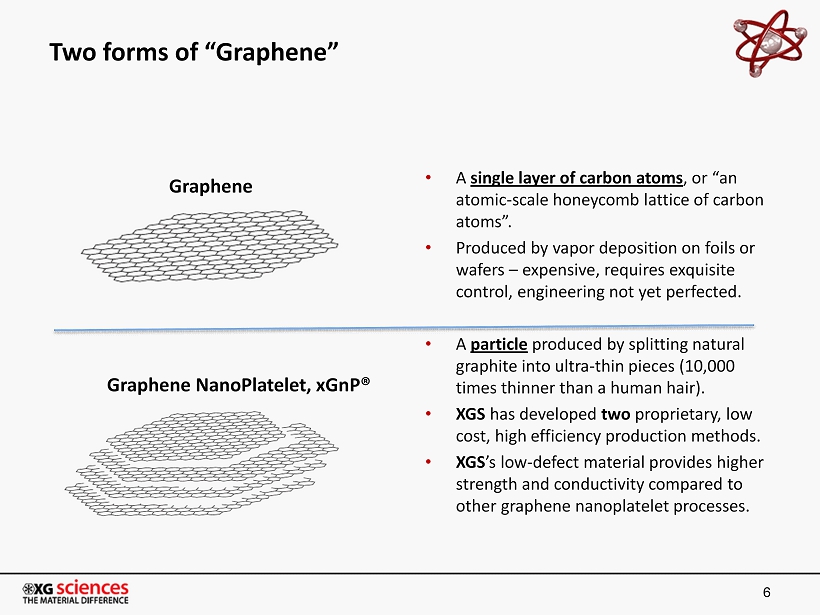

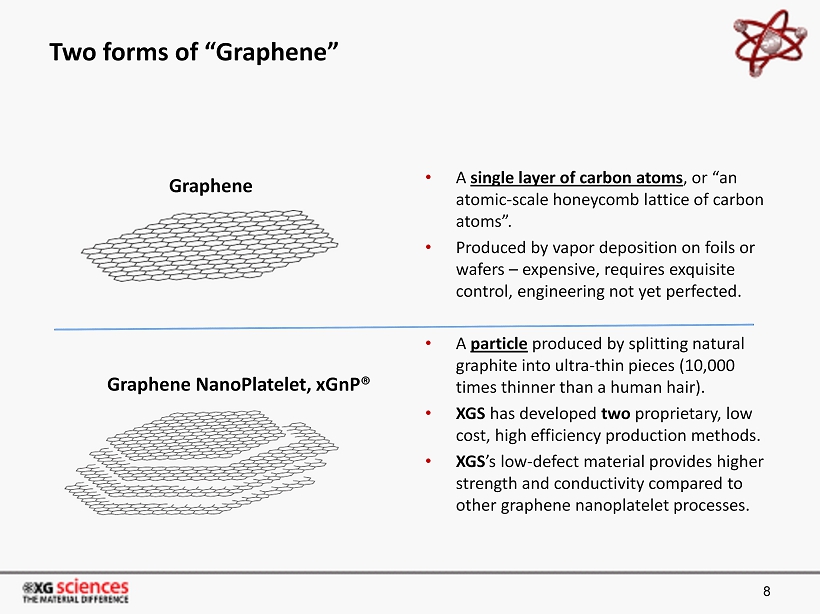

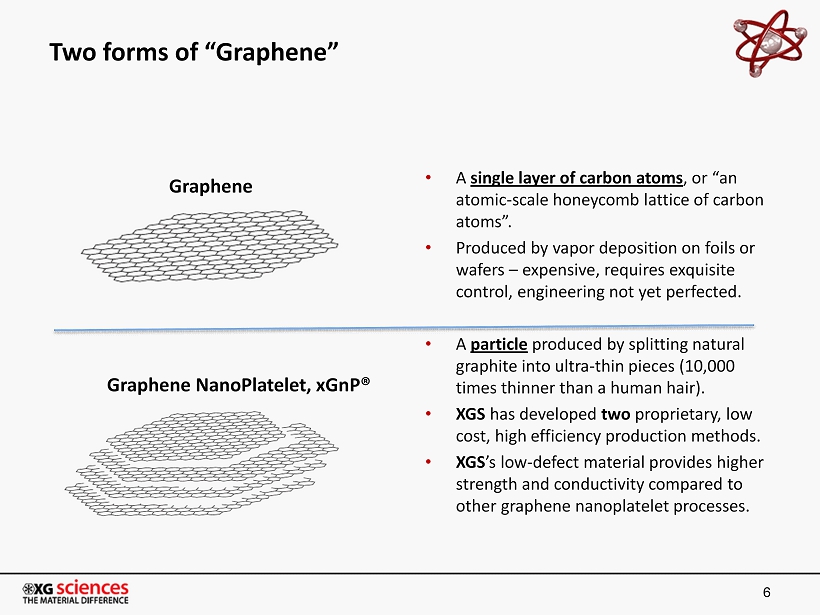

Two forms of “Graphene” • A single layer of carbon atoms , or “an atomic - scale honeycomb lattice of carbon atoms”. • Produced by vapor deposition on foils or wafers – expensive, requires exquisite control, engineering not yet perfected. • A particle produced by splitting natural graphite into ultra - thin pieces (10,000 times thinner than a human hair). • XGS has developed two proprietary, low cost, high efficiency production methods. • XGS ’s low - defect material provides higher strength and conductivity compared to other graphene nanoplatelet processes. 8 Graphene Graphene NanoPlatelet, xGnP ®

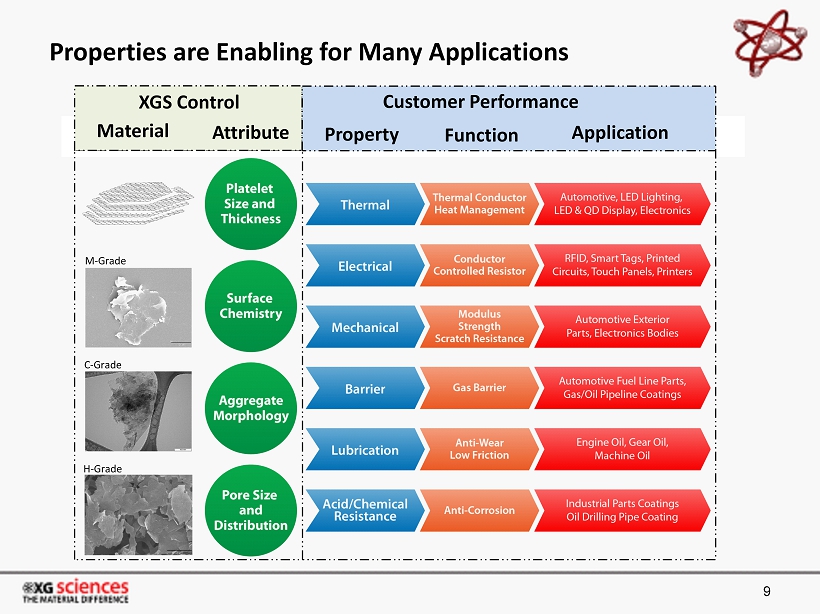

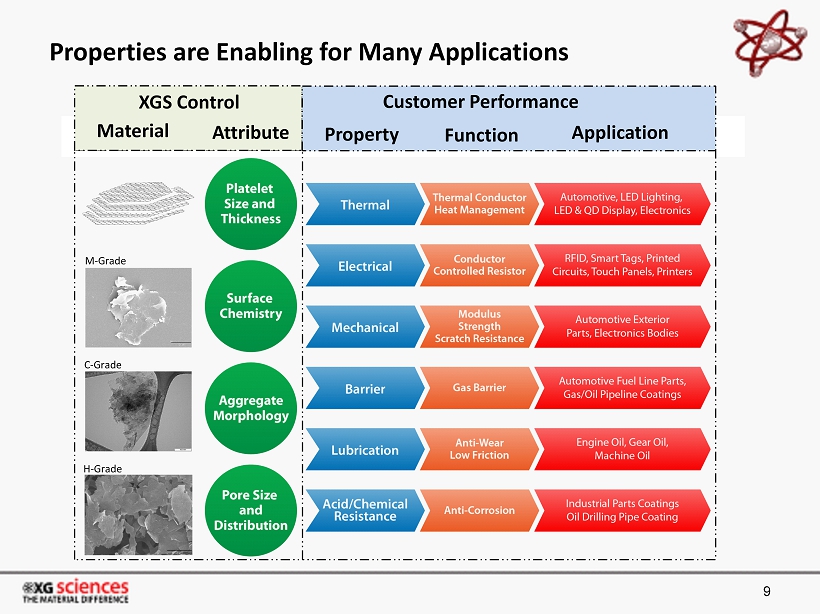

Properties are Enabling for Many Applications 9 M - Grade C - Grade H - Grade XGS Control Material Attribute Property Function Application Customer Performance

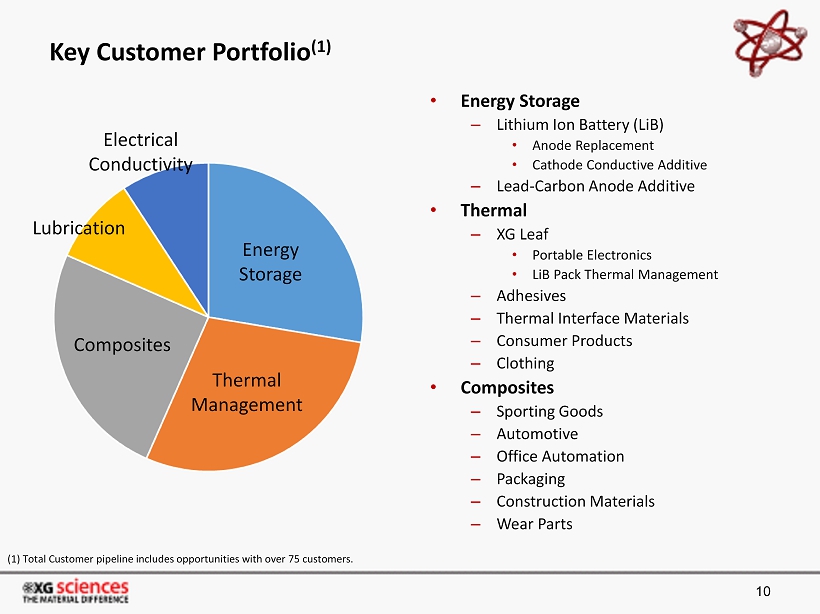

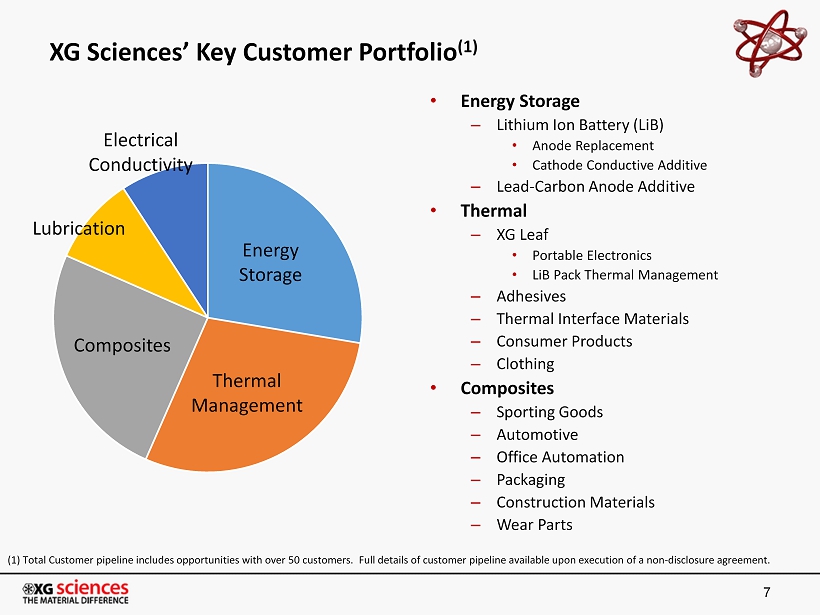

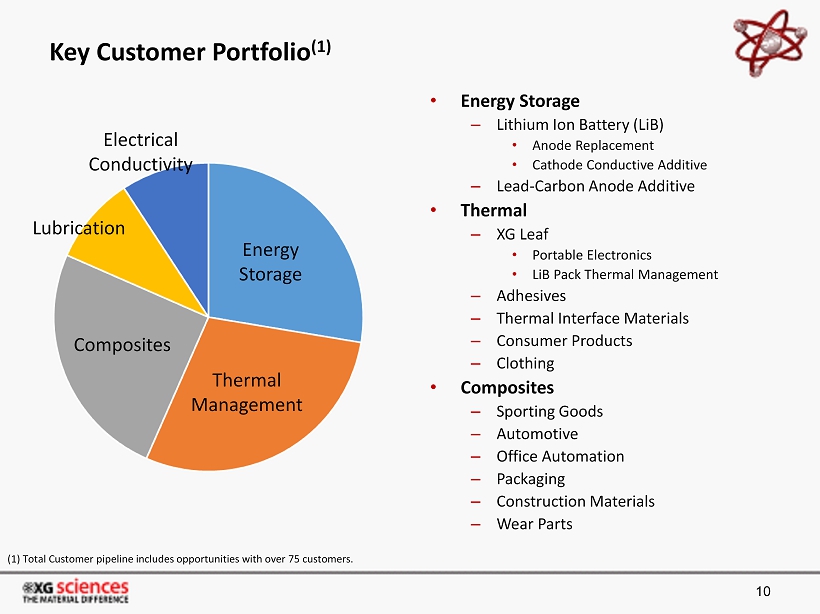

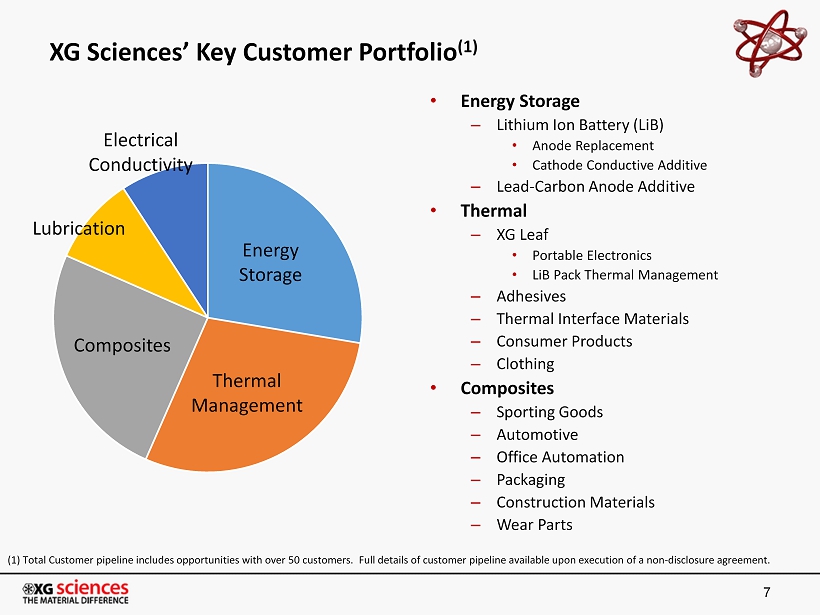

Key Customer Portfolio (1) • Energy Storage – Lithium Ion Battery (LiB) • Anode Replacement • Cathode Conductive Additive – Lead - Carbon Anode Additive • Thermal – XG Leaf • Portable Electronics • LiB Pack Thermal Management – Adhesives – Thermal Interface Materials – Consumer Products – Clothing • Composites – Sporting Goods – Automotive – Office Automation – Packaging – Construction Materials – Wear Parts 10 Energy Storage Thermal Management Composites Lubrication Electrical Conductivity (1) Total Customer pipeline includes opportunities with over 75 customers.

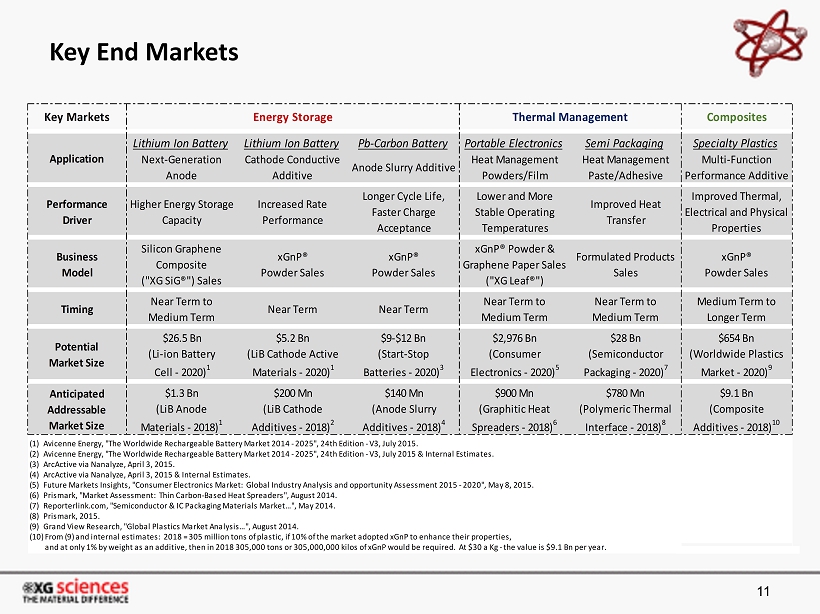

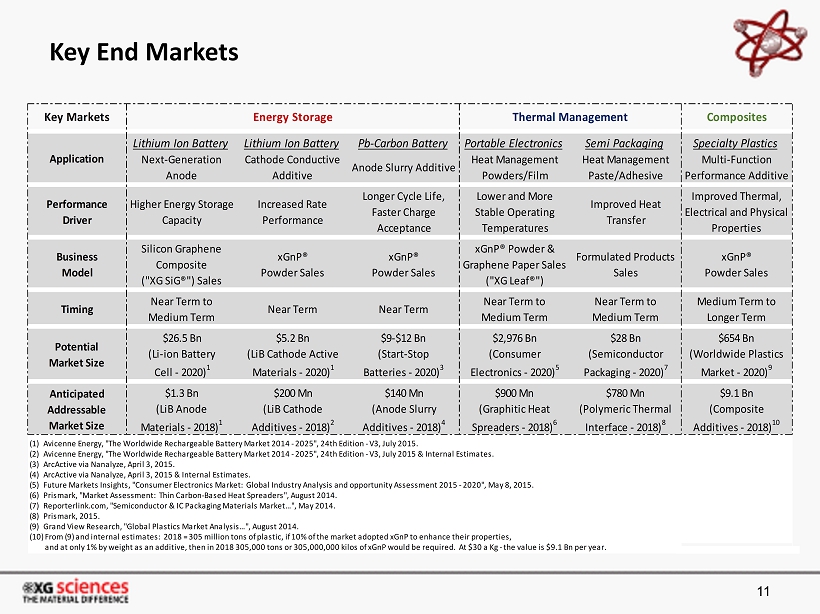

Key End Markets 11 Key Markets Composites Lithium Ion Battery Lithium Ion Battery Pb-Carbon Battery Portable Electronics Semi Packaging Specialty Plastics Next-Generation Anode Cathode Conductive Additive Anode Slurry Additive Heat Management Powders/Film Heat Management Paste/Adhesive Multi-Function Performance Additive Performance Driver Higher Energy Storage Capacity Increased Rate Performance Longer Cycle Life, Faster Charge Acceptance Lower and More Stable Operating Temperatures Improved Heat Transfer Improved Thermal, Electrical and Physical Properties Business Model Silicon Graphene Composite ("XG SiG®") Sales xGnP® Powder Sales xGnP® Powder Sales xGnP® Powder & Graphene Paper Sales ("XG Leaf®") Formulated Products Sales xGnP® Powder Sales Timing Near Term to Medium Term Near Term Near Term Near Term to Medium Term Near Term to Medium Term Medium Term to Longer Term Potential Market Size $26.5 Bn (Li-ion Battery Cell - 2020) 1 $5.2 Bn (LiB Cathode Active Materials - 2020) 1 $9-$12 Bn (Start-Stop Batteries - 2020) 3 $2,976 Bn (Consumer Electronics - 2020) 5 $28 Bn (Semiconductor Packaging - 2020) 7 $654 Bn (Worldwide Plastics Market - 2020) 9 Anticipated Addressable Market Size $1.3 Bn (LiB Anode Materials - 2018) 1 $200 Mn (LiB Cathode Additives - 2018) 2 $140 Mn (Anode Slurry Additives - 2018) 4 $900 Mn (Graphitic Heat Spreaders - 2018) 6 $780 Mn (Polymeric Thermal Interface - 2018) 8 $9.1 Bn (Composite Additives - 2018) 10 (1) Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015. (2) Avicenne Energy, "The Worldwide Rechargeable Battery Market 2014 - 2025", 24th Edition - V3, July 2015 & Internal Estimates. (3) ArcActive via Nanalyze, April 3, 2015. (4) ArcActive via Nanalyze, April 3, 2015 & Internal Estimates. (5) Future Markets Insights, "Consumer Electronics Market: Global Industry Analysis and opportunity Assessment 2015 - 2020", May 8, 2015. (6) Prismark, "Market Assessment: Thin Carbon-Based Heat Spreaders", August 2014. (7) Reporterlink.com, "Semiconductor & IC Packaging Materials Market…", May 2014. (8) Prismark, 2015. (9) Grand View Research, "Global Plastics Market Analysis…", August 2014. (10) From (9) and internal estimates: 2018 = 305 million tons of plastic, if 10% of the market adopted xGnP to enhance their properties, and at only 1% by weight as an additive, then in 2018 305,000 tons or 305,000,000 kilos of xGnP would be required. At $30 a Kg - the value is $9.1 Bn per year. Application Energy Storage Thermal Management

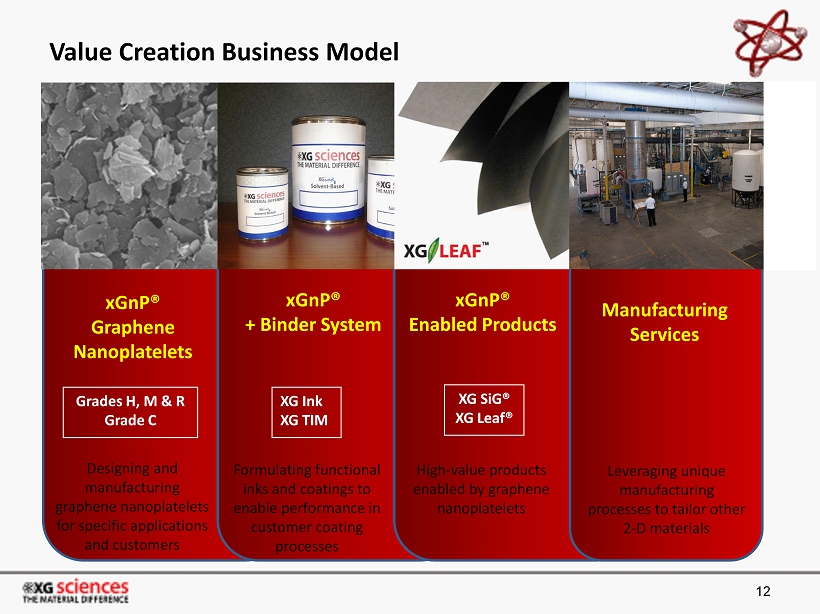

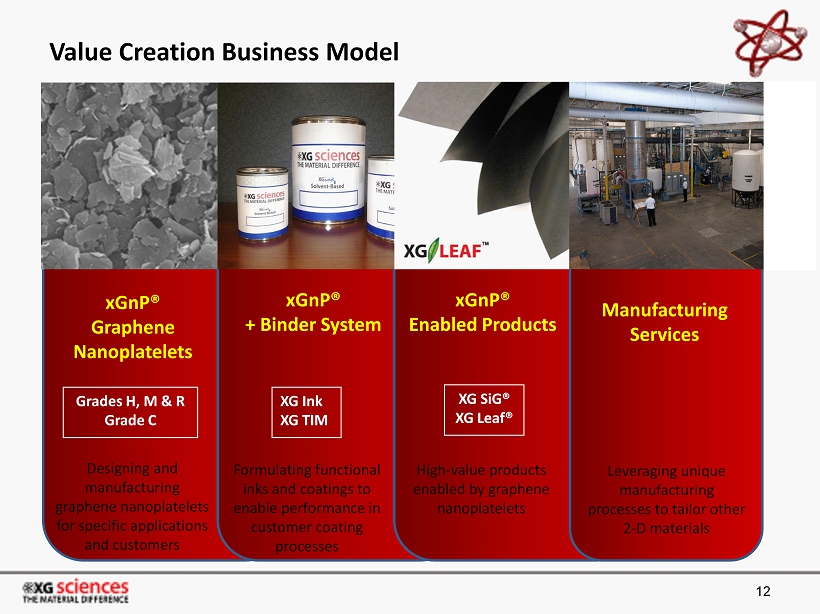

Value Creation Business Model xGnP® Graphene Nanoplatelets Designing and manufacturing graphene nanoplatelets for specific applications and customers xGnP® + Binder System Formulating functional inks and coatings to enable performance in customer coating processes xGnP® Enabled Products High - value products enabled by graphene nanoplatelets Manufacturing Services Leveraging unique manufacturing processes to tailor other 2 - D materials XG Ink XG TIM XG SiG® XG Leaf® Grades H, M & R Grade C 12

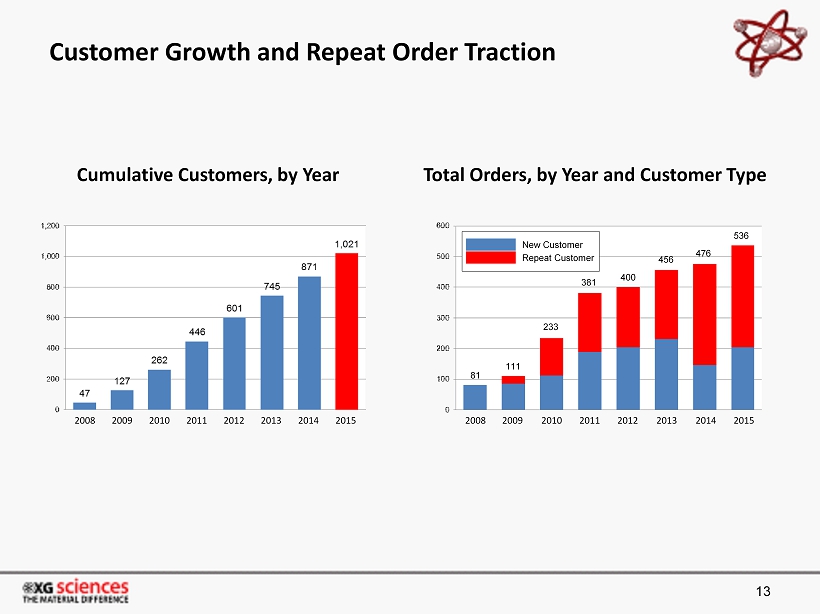

Customer Growth and Repeat Order Traction 13 Cumulative Customers, by Year Total Orders, by Year and Customer Type 81 111 233 381 400 456 476 536 New Customer Repeat Customer 2008 2009 2010 2011 2012 2013 2014 2015 2008 2009 2010 2011 2012 2013 2014 2015

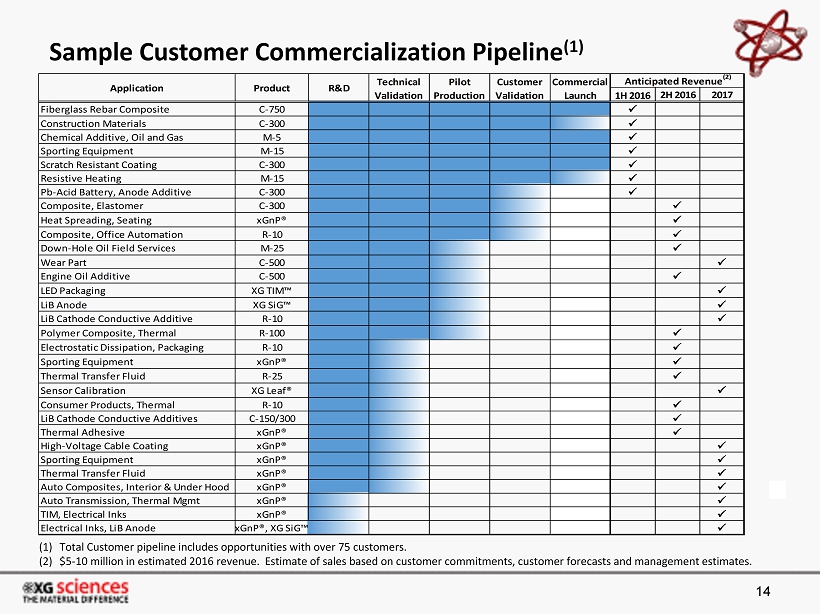

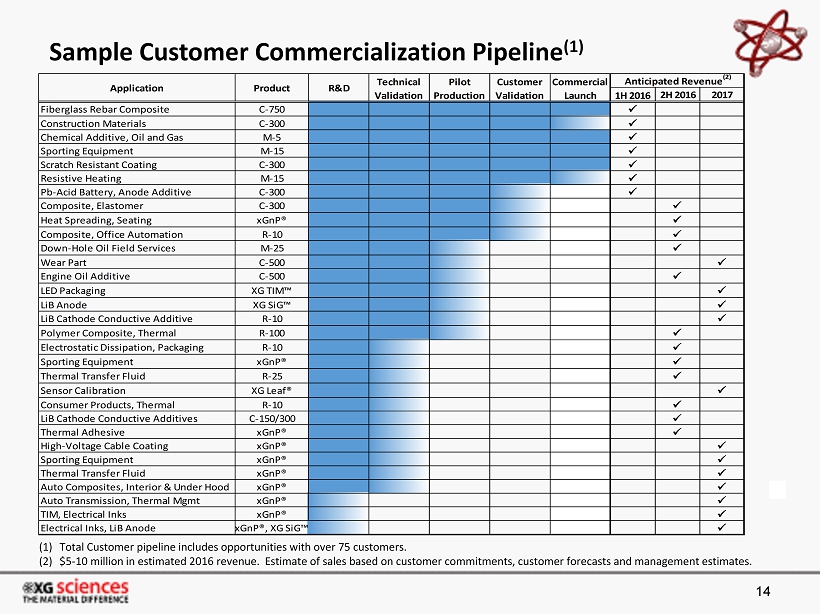

Sample Customer Commercialization Pipeline (1) 14 (1) Total Customer pipeline includes opportunities with over 75 customers. (2) $5 - 10 million in estimated 2016 revenue. Estimate of sales based on customer commitments, customer forecasts and management es timates. 1H 2016 2H 2016 2017 Fiberglass Rebar Composite C-750 x Construction Materials C-300 x Chemical Additive, Oil and Gas M-5 x Sporting Equipment M-15 x Scratch Resistant Coating C-300 x Resistive Heating M-15 x Pb-Acid Battery, Anode Additive C-300 x Composite, Elastomer C-300 x Heat Spreading, Seating xGnP® x Composite, Office Automation R-10 x Down-Hole Oil Field Services M-25 x Wear Part C-500 x Engine Oil Additive C-500 x LED Packaging XG TIM™ x LiB Anode XG SiG™ x LiB Cathode Conductive Additive R-10 x Polymer Composite, Thermal R-100 x Electrostatic Dissipation, Packaging R-10 x Sporting Equipment xGnP® x Thermal Transfer Fluid R-25 x Sensor Calibration XG Leaf® x Consumer Products, Thermal R-10 x LiB Cathode Conductive Additives C-150/300 x Thermal Adhesive xGnP® x High-Voltage Cable Coating xGnP® x Sporting Equipment xGnP® x Thermal Transfer Fluid xGnP® x Auto Composites, Interior & Under Hood xGnP® x Auto Transmission, Thermal Mgmt xGnP® x TIM, Electrical Inks xGnP® x Electrical Inks, LiB Anode xGnP®, XG SiG™ x Customer Validation Commercial Launch Anticipated Revenue (2)Application Product R&D Technical Validation Pilot Production

Management Team Board of Directors Dr. Philip Rose, CEO: More than 20 years managing and growing businesses based on advanced materials in technical applications and markets – lived in Japan/Korea for ~8 years . Dr . Liya Wang, VP R&D: Renowned expert in the field of batteries and advanced materials. Former Principal Scientific Director for Spain’s CIC Energigune and Director for emerging technologies at A123 . Rob Privette, VP Energy Markets: 25 years of experience in technology development and commercialization of fuel cells, batteries, and other energy related devices . Dr. Hiroyuki Fukushima, Technical Director : Founding shareholder and inventor of xGnP® production processes .. Scott Murray, VP Operations: Seasoned professional with 30 years as a senior operations executive . 15 Dr. Philip Rose , CEO, President, Treasurer & Director Arnold A. Allemang , Director, Chairman and Audit Committee Member: Former member , Board of Directors, Dow Chemical Company (NYSE: DOW); former Chief Operating Officer of Dow. Dr. Ravi Shanker , Director: General Manager, Lightweighting Platform, Dow Chemical Company. Steven C. Jones , Director and Audit Committee Member : Chairman of Aspen Capital Group, Member Board of Directors, NeoGenomics (NASDAQ: NEO) and various other private companies. Wonil Kim , Director : Director of the Advanced Materials Investment & Technology Group, POSCO. Michael Pachos , Director and Audit Committee Member : Principal, Samsung Ventures focused on Consumer, Display and Energy related investments. Dave Pendell , Director: Owns and operates AdvancedStage Capital LLC, ASC Lease Income, and is a general partner in Veterans Capital Fund.

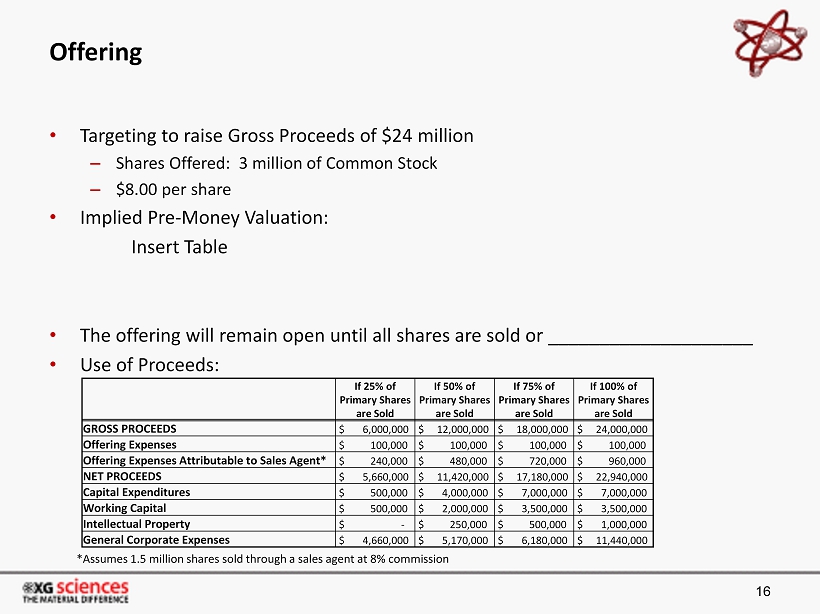

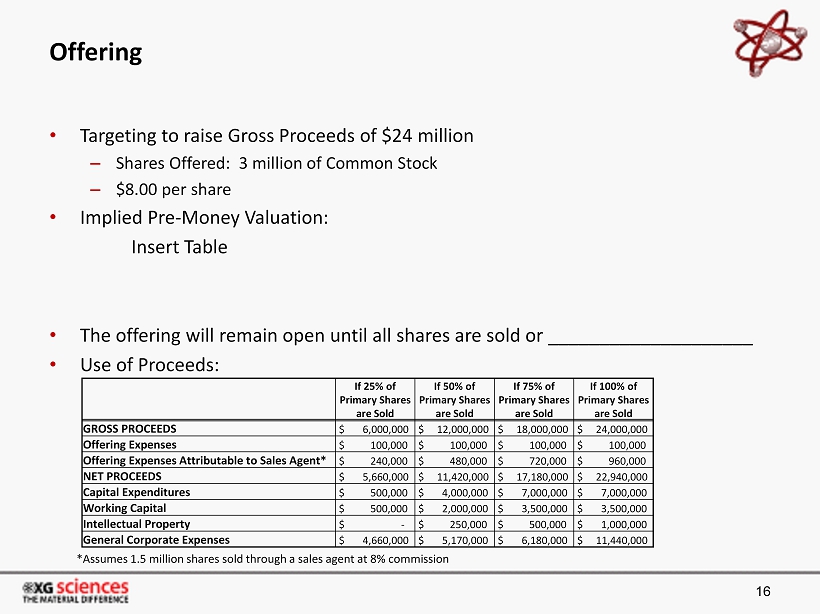

Offering • Targeting to raise Gross Proceeds of $24 million – Shares Offered: 3 million of Common Stock – $8.00 per share • Implied Pre - Money Valuation: Insert Table • The offering will remain open until all shares are sold or ____________________ • Use of Proceeds: 16 *Assumes 1.5 million shares sold through a sales agent at 8% commission If 25% of Primary Shares are Sold If 50% of Primary Shares are Sold If 75% of Primary Shares are Sold If 100% of Primary Shares are Sold GROSS PROCEEDS $ 6,000,000 $ 12,000,000 $ 18,000,000 $ 24,000,000 Offering Expenses $ 100,000 $ 100,000 $ 100,000 $ 100,000 Offering Expenses Attributable to Sales Agent* $ 240,000 $ 480,000 $ 720,000 $ 960,000 NET PROCEEDS $ 5,660,000 $ 11,420,000 $ 17,180,000 $ 22,940,000 Capital Expenditures $ 500,000 $ 4,000,000 $ 7,000,000 $ 7,000,000 Working Capital $ 500,000 $ 2,000,000 $ 3,500,000 $ 3,500,000 Intellectual Property $ - $ 250,000 $ 500,000 $ 1,000,000 General Corporate Expenses $ 4,660,000 $ 5,170,000 $ 6,180,000 $ 11,440,000

Summary • Recognized leader in disruptive, emerging advanced materials • Robust competitive advantages with diverse applications • Broad customer base with multiple design - in relationships • Revenue ramp starting • World class investors and licensees • Significant IP position • Low cost, scalable manufacturing capabilities • Strong Management Team with outstanding industry experience 17

Thank You Philip Rose, Ph.D. Chief Executive Officer +1 517 999 5453 p.rose@xgsciences.com 18

Introduction to Graphene a nd XG Sciences 1

Forward - looking Statements This presentation contains statements which constitute forward - looking statements within the meaning of Section 27A of the Securities Act, as amended; Section 21E of the Securities Exchange Act of 1934; and the Private Securities Litigation Reform Act of 1995. The words “may”, “would”, “could”, “will”, “expect”, “estimate”, “anticipate”, “believe”, “intend”, “plan”, “goal”, and similar expressions and variations thereof are intended to specifically identify forward - looking statements. All statements that are not statements of historical fact are forward - looking statements. Investors and prospective investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward - looking statements as a result of various factors. The risks that might cause such differences are identified in our private placement memorandum. We undertake no obligation to publicly update or revise the forward looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events.

The Carbon Revolution – A New Materials World 3 DATE 100,000 BC 10,000 BC 1,000 BC 0 BC/AD 500 AD 1000 AD 1500 AD 1800 AD 1850 AD 1900 AD 1920 AD 1940 AD 1960 AD 1980 AD 2000 AD Stone Age Copper Age Bronze Age Iron Age Age of Steel Age of Polymers Age of Silicon The Nano Age Carbon Black Carbon Fiber Fullerene Carbon Nano - Tube Graphite • Tightly bonded carbon atoms arranged in a hexagonal lattice • 2 00x stronger than steel, yet… • Like rubber that can stretch up to 25% of its original length • More electrically conductive than Copper • Better at conducting heat than any material • Optically Transparent • Atomic - level barrier properties Graphene If the 20 th century was the age of plastics, then the 21 st century seems set to become the age of Graphene! Graphene

Potential Future is Endless? 4 It is currently only limited based on your imagination! • Flexible, wearable electronics • Stronger and lighter airplanes • More efficient solar panels • Energy Savings power systems • Longer battery life time • More storage memory in portable electronics • Supercapacitors charged in seconds • Desalination

5 Source: Lux Research, July, 2015 1.0 – 1.9 2.0 – 2.9 3.0 – 3.9 4.0 – 3.9 5.0 Maturity Lux Take Strong Positive Positive Wait and See Caution Strong Caution Dominant Undistinguished Long - shot Technical Value 1 1 5 XG Sciences Vorbeck Materials Sixth Element Angstron Materials Incubation Alliance Grafoid Graphenix Development Ningbo Morsh Xolve Avanzare Grafen Graphene Platform Haydale R.S. Group Knano Graphenea Times N ano NUS Bluestone AGM DCT Rushford Cambridge Nanosystems Graphene Frontiers NanoIntegris Directa Plus Graphene Labs G T LeaderNano Ugent Tech NanoCarbon CNM Anderlab Grafentek Gelanfong Absolute Nano National Nano Materials Graphene 3D Lab Innophene Business Execution 3 3 5 High - Potential XG Sciences Market Leadership

Two forms of “Graphene” • A single layer of carbon atoms , or “an atomic - scale honeycomb lattice of carbon atoms”. • Produced by vapor deposition on foils or wafers – expensive, requires exquisite control, engineering not yet perfected. • A particle produced by splitting natural graphite into ultra - thin pieces (10,000 times thinner than a human hair). • XGS has developed two proprietary, low cost, high efficiency production methods. • XGS ’s low - defect material provides higher strength and conductivity compared to other graphene nanoplatelet processes. 6 Graphene Graphene NanoPlatelet, xGnP ®

XG Sciences’ Key Customer Portfolio (1) • Energy Storage – Lithium Ion Battery (LiB) • Anode Replacement • Cathode Conductive Additive – Lead - Carbon Anode Additive • Thermal – XG Leaf • Portable Electronics • LiB Pack Thermal Management – Adhesives – Thermal Interface Materials – Consumer Products – Clothing • Composites – Sporting Goods – Automotive – Office Automation – Packaging – Construction Materials – Wear Parts 7 Energy Storage Thermal Management Composites Lubrication Electrical Conductivity (1) Total Customer pipeline includes opportunities with over 50 customers. Full details of customer pipeline available upon exe cution of a non - disclosure agreement.

Summary • Recognized leader in disruptive, emerging advanced materials • Robust competitive advantages with diverse applications • Broad customer base with multiple design - in relationships • Revenue ramp starting • World class investors and licensees • Significant IP position • Low cost, scalable manufacturing capabilities • Strong Management Team with outstanding industry experience 8

Thank You Philip Rose, Ph.D. Chief Executive Officer +1 517 999 5453 p.rose@xgsciences.com 9

Sample Customer Pipeline Summaries

On the Ramp

The following customers represent a sub-set of our portfolio where XG Sciences (‘XGS”) value proposition as it relates to price and performance is clear, our customer has developed a product concept in response to their customer’s need, our customer has confirmed they can manufacture such a product, there are no technical barriers to the commercial launch of their product and they have started to market their product to one or more customers.

| | 1. | Sporting goods equipment manufacturer with an emphasis in netball, cricket, rugby and field hockey. Introduced XGS’ product in late 2015 in composite for field hockey sticks. Top of the line models are priced at £400 and are described as: “Graphene fibre matrix construction formulae with fully integrated carbon, aramid & graphene resin system”, “Improved control performance provided by energy absorbing basalt” and “Excellent energy transfer when hitting”. Initial production order of 30Kg filled and waiting on customer response before providing further 2016 estimates. Informed customer intends to extend to two additional product families within their portfolio. |

| | 2. | Custom-tailored formulations and oilfield chemicals company. Stock item for oilfield chemicals incorporating XGS’ graphene nanoplatelets. Introduced in late 2014. Ordered in 2015 to refill inventory as needed. Expect to see increased demand in 2016. Estimate 100-200 Kgs in 2016. |

| | 3. | European construction materials company specializing in composites for rebar, road signs, pipes and seawalls. Introduced XGS’ C-series product into their fiberglass rebar product in late 2014. Improved flexural strength. Ordered regular quantities throughout 2015. Introduced XGS’ C-series product into a second application in late 2015. Estimate 5 to 10 Tons in 2016. First order received. Looking for additional opportunities to extend into other parts of their product portfolio. |

| | 4. | European technology company based in Spain. Developed a novel scratch-resistant coating incorporating C-300 and targeted to protect the screens of portable electronics, watches, sunglasses and in automotive applications. Demonstrated the technology in late 2014, filed IP and finalized the formulation(s) in 2015. Actively marketing beginning in January, 2016. Waiting to see response before providing “volume” estimate. |

| | 5. | Korean specialty chemical company specializing in unique metal composites and metal forming processing. Licensed formulation and use IP from the Korean Electronics Technology Institute for resistive heating where XGS’ graphene nanoplatelets are an enabling component of the composition. Marketing activities starting in late 2014. Target markets include office automation, automotive (seat heating, steering wheel heating), in-floor heating and other consumer and industrial heating applications. The office automation opportunity has demonstrated shorter startup time, 30% energy savings and improved lifetime for laser printers. The company has quoted multiple customers in multiple markets. Expects adoption in the first half of 2016 and ramping into the second half and into 2017. Estimate 500Kg to 1T in 2016. |

| | 6. | US-based, international specialty material company with broad product offering for specialty carbon-based materials with a strategic interest in graphene nanoplatelets and XGS licensee. Have been working with XGS materials for over 5 years. Focus on energy storage (lead acid anode additive and lithium ion cathode conductive additive) and elastomers. Demonstrated performance for lead-acid batteries in auto and telecommunications applications and delivering improved cycle life and dynamic charge acceptance. Multiple customers in major scale testing. Demonstrated performance for both LiB cathode conductive additives and elastomeric composites meeting customer needs to win the business. Estimate is 10-50T in 2016 for the lead acid application, 5-10T in elastomers and if the LiB testing proceeds according to plan, it represents a 200-400T/yr industry-wide opportunity, about 1/3 of which is coming from one lead customer. However, no 2016 estimate has been provided for this application. |

| | 7. | US-based, international oilfield services company. Demonstrated efficacy for target performance in a down-hole testing application. Customer has told us that they have run every test they can think of and the fluid with XGS graphene nanoplatelets outperforms their existing fluid and they cannot make it fail in any of their tests. Stated desire to move to field testing in 2016 with demand for field trials between 5 and 15 Tons. Currently targeting completing of an intermediate yard test by the end of Q1 before deciding how to move forward. Oil prices negatively impacting adoption timing. Risk for delays in product qualification. |

| | 8. | UK-based, international supplier of engineered materials for applications ranging from medical instruments, aerospace, power generation and satellite communications, to body armor, trains and fire protection systems. Demonstrated efficacy for improved wear resistance of carbon-based wear components when incorporating XGS graphene nanoplatelets. Intent to commercialize in the second half of 2016. No estimate at this time. |

Product Confirmation Pending

The following customers represent a sub-set of our portfolio where XG Sciences value proposition as it relates to price and performance is clear, our customer has developed a product concept in response to their customer’s need and our customer has confirmed they can manufacture such a product. However, they have not finalized the product formulation and are completing engineering work and expect to launch commercially in 2016.

| | 9. | Korean specialty chemical company focusing on electronic materials and with a commercial presence in other industrial markets and applications. Introduced in late 2014 an electrostatic dissipation coating for consumer electronics and automotive packaging. In late stage qualification and expect orders in late Q1/early Q2. Estimate from 100 to 200 Kg in 2016. |

| | 10. | Korean specialty chemical company specializing in oil additives. Demonstrated improvement in wear properties for lubrication application when incorporating XGS’ graphene nanoplatelets. Targeting improved dispersion and 2016 product launch. |

| | 11. | Sporting goods equipment manufacturer with emphasis in lacrosse, ice hockey and field hockey. Desire to incorporate graphene nanoplatelets in lacrosse stick heads to improve strength at lower weight. Samples under testing within customers manufacturing infrastructure. First target application at 400,000 pieces. Market reputation for innovation leader and stated desire to move quickly. Lab testing expected to be complete in Q1, followed by 4-6 month field trial and then commercial launch. |

| | 12. | US-based manufacturer of refrigeration equipment. Actively working towards validation of the value of XGS’ products in heat transfer fluids in their equipment. Independent verification of the efficacy of XGS’ technology from Argonne National Labs. Further validation within XGS laboratories. Active engagement with this customer and extending to two other customers. Expecting target insertion within 2016 but no firm timeline established until after product validation – expected within first half 2016. |

| | 13. | World leader in the development, design, manufacture and distribution of manual and powered wheelchairs, mobility scooters and both standard and customized seating and positioning systems. Use of XGS’ product in gel packs in seat cushions achieved 30% improvement in distribution of heat, although some developmental work will likely be required to optimize the chemistry of customer’s gel packs. Tentative implementation timing. Targeting second half of 2016. |

| | 14. | US-based leader in the development of wet friction technology used in powertrain components and system solutions. Seeking improved thermal performance for a friction component of a transmission part. Have manufactured prototype composite films including XGS’ graphene nanoplatelets. Exploring coated solutions to down-select to the best option. Revenue likely to begin in 2017. |

| | 15. | The global leader in lighting technology solutions. The company develops, manufactures and distributes groundbreaking LEDs and automotive lighting products. Sampled thermal interface grease in China for use in LED packaging. Feedback indicates initial samples are close to the best they are using in production and they will recommend our product to their suppliers. XGS will need to engage with their suppliers but having validation and a recommendation from the customer is a very positive development. No timing yet established for commercial adoption. |

| | 16. | Japanese company involved in the manufacture of composite plastic parts for multiple industries (among other initiatives). Interested in improved thermal stability for PEEK plastics for office automation parts. Demonstrated efficacy using XGS’ products. Will begin in late 2016 at 100Kg per quarter and ramp to 2 Tons per year. Very performance driven, not highly price sensitive. |

| | 17. | Family-owned business of high-end professional styling equipment. Use of XGS’ coating provides more uniform temperature than the standard material. Customer is motivated to move quickly and has involved their supply chain in the evaluation. Getting volume estimates and confirming manufacturing parameters in Korean plant. Expect to ramp in mid 2016. |

Development Engagements

The following customers represent a sub-set of our portfolio where XG Sciences value proposition as it relates to price and performance is defined, our customer has identified a product concept in response to their customer’s need and are highly motivated to work with XG Sciences to define a solution.

| | 18. | Specialty materials company operating worldwide with leading brands and technologies in three business areas: Laundry & Home Care, Beauty Care and Adhesive Technologies. Engaged with 2 groups in their Electronic Materials unit interested in conductive inks, thermal interface materials and heat spreaders. XGS has demonstrated value propositions in each area and the customer is eager to reproduce the results in their labs. No commercial timing established at this phase. |

| | 19. | One of the world's leading suppliers in the additives and instruments for the quality control of color, appearance and physical properties. Have identified numerous areas of synergy (dispersion of nanomaterials, coatings, rheology modification, composites and lithium ion battery conductive additives). The customer’s key coating accounts have graphene projects that they are interested in pursuing and are encouraging the customer to get involved in graphene. Began brainstorming session in February to define specific customer and product targets. |

| | 20. | Boston Power: Formal joint development agreement signed in December targeting customizing XG Sciences’ silicon-graphene anode materials for use in Boston-Power’s lithium-ion battery products. Work statement details plans to optimize electrochemical and microstructural electrode performance, as well as developing electrode and battery manufacturing techniques using the two companies’ proprietary materials. The companies see a real synergy between Boston-Power’s battery engineering and design capabilities and the new XG-SiG anode materials. Boston-Power has the ability to design and manufacture the battery, while XG Sciences has the ability to customize the anode materials to best fit the Boston-Power system. |

| | 21. | Large Korean LiB manufacturer. Formerly working under joint development agreement targeting next-generation lithium ion batteries for consumer electronics and other devices. Currently engaged on meeting their needs for lithium ion battery cathode and anode conductive additives. Not expected to commercialize in 2016. |

| | 22. | China-based lithium ion battery manufacturer. Eager to adopt graphene nanoplatelets for use as conductive additives in cathode formulations. Currently using carbon nanotubes (CNT). XGS internal data demonstrates that a significant portion of the CNT can be replaced with xGnP and retain the high rate discharge capacity from 100% CNT and with the benefits of low cost, reduced spring back and high pressed density. Current CNT costs of $125/Kg on a dry powder basis. Customer has agreed to fast-track 25Ah battery tests using our materials. Potential demand in the multiple tons per month. |

| | 23. | Korean specialty chemical company focusing on electronic materials and with a commercial presence in other industrial markets and applications. Business model to sell resin loaded XGS’ graphene nanoplatelets. Demonstrated good dispersion and performance acceptable for market entry. CEO is positioning the company as leading manufacturer of graphene-based composites. Targeting initially camera housing and CD-Disc covers with eventual target of automotive parts. Estimate 10-30 Kg per month through first 3 quarters of 2016 as they progress toward late 2016 commercial launch. |

| | 24. | Large consumer electronics company not wishing to be identified. Working closely to develop thermal heat spreading solution using XGS’ proprietary XG Leaf technology. Estimate low 1,000’s of sheets in 2016. |

| | 25. | Carbon nanotube company based in the US with production and R&D in China. Demonstrated efficacy for use of XGS’ products in combination with customer’s carbon nanotubes for use as a cathode conductive additive in lithium ion batteries. Improved energy density and process yield using XGS products. Marketing formulations to customers in China. Estimating the potential for up to 5T in 2016 but do not currently have orders. Successful adoption up to 5T per month. |

| | 26. | Korean-based lead acid battery manufacturer. Engaged in two programs to use our materials to improve performance for 1) start stop application and 2) high temperature geographies. Successful demonstration of target 1) but need improvement in water loss performance. Active sample for target 2) with initial positive feedback. Customer would like to scale up in 2016 pending completion of development efforts. No firm volume commitments at this time. First application likely 1 to 2T per year and can grow to 5T within 2 years. Volume for second application dependent upon nature of product offering (dry powder versus formulated coating). |

| | 27. | Korean-based specialty tape and adhesive supplier. Their customer in need of improved thermal adhesive for high-brightness LED TV. Wishes to work with mid-tier, Korean-based supplier. XGS working with our customer to supply XGS precursors for use in a thermal adhesive tape and for supply to their customer. Targeting late Q1/early Q2 for qualification and initial production in late 2016. Initial coating results validating value proposition. No volume estimates at this time. |

| | 28. | Large Korean-based supplier of PET films and specialty chemicals. Working to define product and technical solutions using XGS’ product portfolio. Initially target thermally conductive adhesives and coatings. Also pursuing options for XG Leaf integration. |

| | 29. | Korean-based specialty materials provider. Working closely with cable companies in Korea to develop semi-conductive coating materials for ultra-high voltage cables. Incorporation of XGS’ product improves the coating mechanical performance and the mechanical stability during heat shock and shrinkage in the ultra-high voltage cable application. Commercial timing is mid to late 2017. Potential volume is given to XGS as 1 to 20T per year. |

| | 30. | World leader in rolled aluminum products, delivering unique solutions for the most demanding global applications, such as beverage cans, automobiles, architecture and consumer electronics. Applying XGS technology to aluminum processing and expecting results in Q1. No timing yet defined for commercial launch. Unlikely to be in 2016. |

| | 31. | Recognized as the world's leading provider of lubricant solutions offering a range of advanced automotive motor oil, including synthetic, synthetic blend, high mileage, conventional and diesel oils. Engaged for well over a year on use of XGS products as an oil additive to improve friction and wear, particularly for gear box applications. Demonstrated benefits for high gear load applications (i.e., drivetrains). Also interested in nanofluid with thermal transfer properties for cooling of cutting tools. Exploring options to better move these projects forward. |

| | 32. | Technology and innovation leader specializing in defense, civil and cybersecurity markets throughout the world. Specified use of XGS product for sensor calibration in multi-layered system. Have validated efficacy for thermal heat transfer and are completing integration design efforts. Small volume application. |

Sampling Examples

An additional >30 customers represent a sub-set of our portfolio where XG Sciences value proposition as it relates to price and performance is theorized but not yet demonstrated and where we are sampling products and formulations against a defined market need but have not yet entered into a collaborative development effort.

Transformational Customers

The following customers represent a sub-set of our portfolio where success can drive significant commercial volume and subsequent value for XGS shareholders. These customers are specifically managed at the account level while we actively engage in development and commercialization efforts.

| | 33. | International auto manufacturer. Actively engaged with the group having a mandate to explore opportunities for graphene. Currently focusing on two applications that we are not at liberty to disclose. They have demonstrated a compelling value proposition in the lab and we have started working with their supply chain partners, upon the request of our customer, in multiple applications. Target is to have graphene in a car on the road in 2017. They have alignment up to the VP of R&D and out into the relevant business groups. They have indicated that they believe XGS is the only commercially viable supplier of graphene nanoplatelets. Specific feedback on the value proposition includes “substantial property enhancements at much lower loadings” compared to other types of additives for composite applications and “increased both tensile and flexural moduli and strength” and “enhanced thermal stability”. Only estimated data thus far is for a target application requiring 25T of XGS’ product starting in 2018. |

| | 34. | US-based coatings company. Engaged with multiple businesses to exploit the properties of graphene nanoplatelets for barrier, thermal transfer and structural components in paint. Initial samples weren’t compelling but customer admits were cursory and not likely definitive with regard to the potential for performance. Held a technical face-to-face to define next steps in collaboration. Initial dispersions were prepared without knowledge of the customer’s chemistry. Knowledge of the chemistry will allow for tailored formulations. Engagement supported at program director level. Strong desire on the part of the customer to see graphene nanoplatelets adopted and have represented their view of XGS as a leading supplier in the industry. |

| | 35. | Global sporting goods manufacturer. Engaged in multiple projects being sponsored by the golf division. One such project is an injection molded composite for a club head, targeting improved strength and modulus. Working directly with customer’s supplier. A second project is for club shafts and we are working directly with the customer’s supplier. We are expecting an on-going engagement to validate efficacy. Success would support brand recognition efforts and provide additional validation of our broad value proposition. |

| | 36. | International chemical company. Engaged in multiple R&D efforts. XGS technology has broad appeal within the customer’s business units. Two projects are progressing through their stage gage process: thermal transfer fluids and composites. Customer is projecting up to 2,000 Tons of annual demand for XGS’ product by 2020, assuming successful product development and market launch efforts. Broader success would drive significant demand for XGS’ products and commensurate shareholder value. |

Lithium Ion Battery Anode Replacement

XG Sciences has developed an advanced Silicon-based anode that, as a critical battery component, can potentially enable high energy cells for future generation batteries, enabling longer battery life and/or more functional performance for portable electronics. Silicon (Si) is considered the most promising anode material due to its high capacity and proper working voltage. Theoretically, Si can provide up to 4,200 mAh/g of Lithium storage capacity, which is more than 10 times that of graphite. It can be lithiated in the potential range of 0.0 ~ 0.4 V, which enables a high energy density battery when paired with an appropriate cathode. The global market for lithium ion anode materials is estimated to be $1.3 Billion in 2018.

Two major barriers have hindered the development of Si-based anodes for commercial applications, especially for use in EV batteries: poor cycle life and high synthesis costs. XGS’ Si/graphene (SiG) composite anode is based on a unique nano-structure design and an innovative compositing process that utilizes graphene to mitigate cycling stability issues of Si particles during cycling. Graphene creation and SiG compositing is achieved in a single unit process using an existing manufacturing process and low cost industrial precursors. Unlike other Si/graphene based materials where graphene is often produced separately and Si is deposited onto the graphene using exotic methods, XGS’ one-pot process allows to produce the SiG material at high volume and low cost.

XG Sciences technology is widely considered as a leading candidate for next generation anode materials. XGS received a $1.2 Million grant from the Department of Energy to further develop this technology. Samsung Ventures invested in XGS and we entered into a joint development program with Samsung SDI, the world’s leading lithium ion battery manufacturer. The company developed its technology to a level that allows it to aggressively pursue commercial efforts in applications requiring high energy storage and with cycle life up to 250 cycles. The company is pursuing commercialization in those applications. In parallel, the company has formed, and are seeking additional development relationships that will advance its technology, making it more amenable to a broad industry adoption. The company announced in December a joint development relationship with Boston Power. The company was recently awarded a funded development contract under which it will work with a cell manufacturer and a cathode material supplier to pair its silicon graphene composite and demonstrate performance against a commercial need. The customer funding the work wishes to not be named. The company is currently in active discussions with a other parties to form additional joint development arrangements targeting both technology development and specific commercial implementation. It is anticipated that these efforts may result in up to $1 million of development revenue in 2016 and target product revenue in 2017 and beyond.

Frequently Asked Questions

1. Who are XG Sciences competitors?

Graphene suppliers are first segmented on whether they are a producer of graphene monolayer or of graphene nanoplatelets. XG Sciences does not manufacture graphene monolayer. Furthermore, the applications for each form of graphene do not compete, for the vast majority of projected applications, with one another. Therefore, XGS does not compete with graphene monolayer developers or manufacturers. Graphene nanoplatelet manufacturers will begin to segment by the process(es) used to manufacture graphene nanoplatelets. In the US, there are at least two companies producing graphene nanoplatelets. One leverages their nanoplatelet know-how to make conductive inks and sensors and is considered by many to be a sensor company. XGS is not actively targeting the sensor market. A second follows a technology license model and will typically work under development and license agreements for specific applications. XGS is a solutions provider and produces graphene nanoplatelets and products containing graphene nanoplatelets, principally for end-market needs in Energy Storage, Thermal Management, Composites, Lubrication and Electrically Conductive Coatings. There are also emerging producers in the United States, Europe and China that are likely to become more active as time progress.

2. What are XG Sciences competitive Advantages?

Our strategy is to compete with other companies on the basis of our intellectual property, our business model, our manufacturing techniques, our management team, our scientific credibility, and our customer relationships. Recognizing that the worldwide market for products and materials similar to ours is developing very rapidly and will be quite large, we intend to compete vigorously on a worldwide basis by:

| | · | Implementing strategic partnerships with customers and other partners in many different geographic localities as well as specialized markets. |

| | · | Focusing our resources on remaining a low-cost supplier of high-quality materials with sufficient production capacity to meet the needs of large, global customers. |

| | · | Developing “value-added” products like XG Leaf®, XG SiG™ battery anode materials, inks and coatings, and similar specialized products for specific markets. |

| | · | Investing in intellectual property, especially in areas covering novel formulations of our products and use of our products in end-use applications. |

3. What are XG Sciences competitive strengths?

We believe that we are a world leader in the emerging global market for graphene nanoplatelets. The following competitive strengths distinguish us in our industry: