Cassidy & Associates

Attorneys at Law

9454 Wilshire Boulevard

Beverly Hills, California 90212

Email: CassidyLaw@aol.com

| Telephone: 202/387-5400 | Fax: 949/673-4525 |

February 13, 2012

Securities and Exchange Commission

Division of Corporation Finance

Attn: John Reynolds, Assistant Director

Washington, D.C. 20549

| RE: | Powerdyne International, Inc. |

| | Amendment No. 5 to Registration Statement on Form S-1 |

Dear Mr. Reynolds:

Attached for filing with the Securities and Exchange Commission (the “Commission”) is Amendment No. 5 to the Powerdyne International, Inc. (the “Company”) registration statement on Form S-1. The following responses address the comments of the reviewing staff of the Commission as set forth in a comment letter dated December 22, 2011 (the “Comment Letter”). The comments in the Comment Letter are sequentially numbered and the answers set forth herein refer to each of the comments by number and by citing the location of each response (if applicable) thereto in the Registration Statement. For your convenience and ease of reading, in our responses below we have set forth the text of the actual comment made by the Commission immediately above each response that we are providing in reply thereof.

Form S-1

Prospectus Cover Page

1. Please revise your cover page to be consistent with your offering. We note, for example, the reference to shares “[o]ffered by Company.”

Response: We have revised the cover page of the Form S-1 to be consistent with the offering and have made the noted revision therein.

2. We note your response to prior comment five from our letter dated September 30, 2011. Your cover page continues to state that the selling shareholders will sell at a price of $.15 per share, “or at prevailing market or privately negotiated prices.” It is still unclear if you have set a fixed price for the offering. Please revise to clarify. We will not object if you include language stating that selling shareholders will sell at a price of $x.xx (or a range) per share until the shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices.

Response: We have revised the cover page to provide additional disclosure with respect to the selling price for the offering. In addition, we have made applicable conforming revisions throughout the document.

The applicable offering selling price disclosure now states the following: “The selling shareholders will offer their shares at a price of $0.15 per share, until (i) the offering of shares by the Company is closed, or (ii) the Company's common stock is listed on a national securities exchange or is quoted on the OTC Bulletin Board (or a successor) or a national quotation platform; after which, the selling shareholders may sell their shares at prevailing market or privately negotiated prices, including (without limitation) in one or more transactions that may take place by ordinary broker's transactions, privately-negotiated transactions or through sales to one or more dealers for resale.”

The Business

3. We note your disclosure in response to prior comment six and your existing disclosure under Background, Summary, The Business: Power Generation and Supply, and Products. On page 17 you state your PDIGenset “produces 1-megawatt of power 24 hours a day, 7 days a week, all year round …” However, it appears that your previous tests focused on fuel and oil consumption as well as torque and not power generation. Please advise. In addition, please revise to provide context for the amount of power generated – for example, enough to power a certain number of homes or a similar, commonly used referent.

Response: The Company was not concerned with the ability of the generator to produce power, because when these generators are manufactured they are already certified by the manufacturer at the factory to produce a specified amount of current (electricity) at a specific RPM. Every generator comes from the manufacturer with a stamped metal plate attached to the generator that specifies the performance thresholds of that generator. Therefore,any engine turning a generator shaft at the specific RPM will typically create electricity at the specified performance that has been identified by the manufacturer.

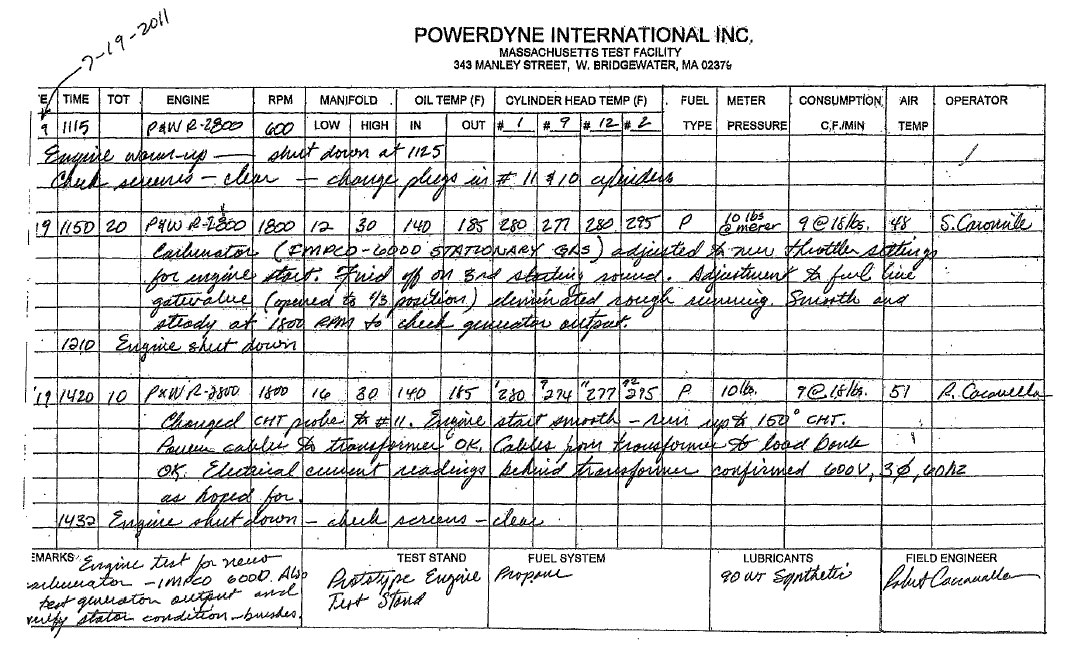

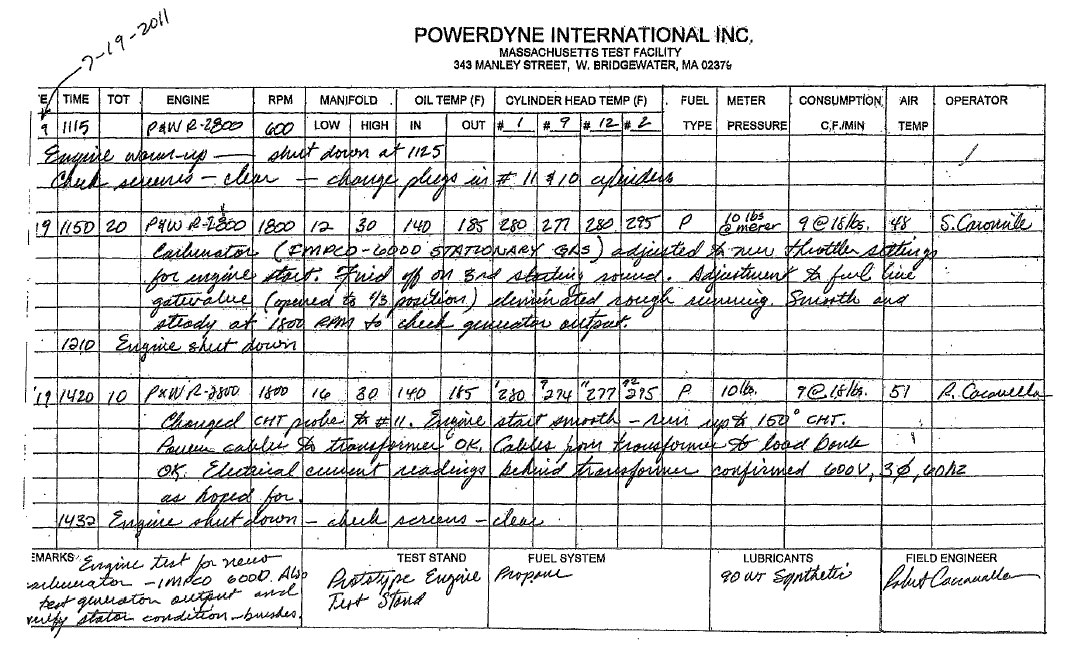

The Company has run this test on its PDIGenset. The unit was run at the specified shaft speed of 1800 RPM. Electrodes attached to the generator buss terminals were fed into a universal step-down transformer and then into a load bank to absorb the electricity. Using a Chance Heavy Duty Electric Meter, the voltage was recorded at 600V, 3 phase, @ 60 Hz. This reading confirmed that the power produced by the generator is at least 1,000kw (1-Megawatt). For comparison, a typical residential home uses 20kw of power daily (or about 0.83kw per hour averaged over 24 hours).

We have revised the disclosure to provide the comparison of the power generated by the PDIGenset to a commonly use referent (the power used by a typical residential home.) We trust that the explanation above and the inclusion of the reference metric (to homes) in the Form S-1 adequately address this comment from the Commission.

4. Also, please provide a supplemental copy of the report underlying the disclosed findings.

Response: We have included the report underlying these findings as an attachment to this correspondence. Please note that the report is only being provided to the Commission per its request and the Company does not intend at the present time to publicly release or file the report as an exhibit to the Form S-1.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

5. We note your response to prior comment 11 and the revised disclosure on page 26. Please revise to remove this and similar projections from your document as you do not appear to have a basis for them. In this respect your attention is directed to Item 10(b) of Regulation S-K.

Response: We have revised the Form S-1 to remove references to the projected sale during the fourth quarter and concomitant $750,000 in revenue and $100,000 in net income.

Executive Compensation, page 29

6. Please summarize your employment agreement with Mr. Euga.

Response: We have summarized the employment agreement with Mr. Euga in the Form S-1 and also filed the same as an exhibit to the document.

Powerdyne International, Inc.

Financial Statements for the period ended September 30, 2011

Statement of Changes in Stockholders’ Equity (Deficit)

7. We note the header for your statement of changes in Stockholders’ equity (deficit) states it is for the period from February 2, 2010 (Inception) to June 30, 2011. However, this schedule presents information for the period ended September 30, 2011. Please revise.

Response: We have corrected this typographical error in the header to clarify that the information presented is for the period ended September 30, 2011.

Part II

Item 14

8. Please update your disclosure concerning the means by which these investors were solicited and the exemptions claimed to fully reflect your response to prior comment 22. In this respect your attention is directed to Item 701(d) of Regulation S-K.

Response: We have incorporated our response to prior comment 22 into the disclosure in the Form S-1. The disclosure in this section now contains the additional information that was previously included in our comment responses.

Item 17

9. Please advise us why you have not provided the undertakings requested by Item 512(h) of Regulation S-K.

Response: We are not requesting acceleration of the Registration Statement, and accordingly, the undertaking requested by Item 512(h) has not been included. Please advise us if there is some other reason or need to include this undertaking at the present time.

Signatures

10. We note your response to prior comment 29. Please note that your Form S-1 should be signed by the Registrant, by at least a majority of the board, and your Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer in their capacities as such. Please revise as appropriate.

Response: We have clarified the titles of the signatories of the officers of the Company to the Form S-1 to indicate that they are signing in their respective capacities asPrincipal Executive Officer, Principal Financial Officer, and Principal Accounting Officer. In addition, we have noted on the signature page that all of the members (there being only two) of the board of directors are signing the document.We trust that these changes in the Form S-1 adequately address this comment from the Commission.

Form 10-K for the Fiscal Year Ended December 31, 2010

11. Please note the continuing applicability of prior comment 30.

Response: The previous amendment to the Form S-1 was filed on December 9, 2011. As indicated in the accompanying comment responses that were then submitted with such amendment, the Company endeavored to file its conforming revisions to its Form 10-K and other Exchange Act reports (in order to comply with its comment responses and Form S-1 amendments) by December 23, 2011. In the interim, the Commission issued its comments to the Form S-1 filed December 9, 2011 on December 22, 2011. The Company filed its amended Form 10-K and other Exchange Act reports on December 23, 2011. Thus, it appears that the most recent comments from the Commission were issued just prior to the filing of the amendments to the Form 10-K and other Exchange Act reports being filed.

We will continue to update and revise the 10-K and other Exchange Act reports based on correspondence and comments/responses as related to the Form S-1. Due to the limited number of outstanding comments at this time, we assume that there may be only one final comment letter forthcoming from the Commission following our submission of these responses. Accordingly, we will plan to review the Form 10-K and other Exchange Act reports again at such time to confirm (at the time when we submit our presumably final comment responses to the Form S-1) that the Form 10-K and other Exchange Act reports are duly conformed (where applicable) to the final version of the Registration Statement.

Form 10-Q for the Three Months Ended March 31, 2011

12. Please note the continuing applicability of prior comments 31 and 32.

Response: We incorporate our response above to comment 11. We believe that the amendments to the Form 10-K and other Exchange Act reports filed December 23, 2011 adequately address prior comments 31 and 32. Please advise us if our understanding is in error or further clarification or response is needed.

Form 10-Q for the Six Months Ended June 30, 2011

13. Please note the continuing applicability of prior comment 33.

Response: We incorporate our responses above to comments 11 and 12. We believe that the amendments to the Form 10-K and other Exchange Act reports filed December 23, 2011 adequately address prior comments 31 and 32. Please advise us if our understanding is in error or further clarification or response is needed.

Other

14. Please advise if your updated articles of incorporation and by-laws refer to you as Greenlight Acquisition or Powerdyne.

Response: The name of the Company was changed to Powerdyne International, Inc. following the merger of Powerdyne, Inc. with Greenmark Acquisition Corporation. In this regard, please also see the certificate of merger (please see Exhibit 3.3 previously filed as an exhibit to the Form S-1.) Greenlight Acquisition Corporation was the original name of the Company. However, the name was changed to Greenmark Acquisition Corporation in July 2008 (please see Form 8-K filed by the Company in 2008 to note that this change had been made and filed in the State of Delaware).

We trust that the responses above and revised Form S-1 filed herewith together address the recent comments from the Commission that were issued to the Company. Finally, as a related matter to the comments above, we have revised the Form S-1 to reflect recent private sales of common stock of the Company. In addition, please note that, as previously discussed in our earlier comment response letter, following the effectiveness of the registration statement, the Company anticipates potentially completing a primary public offering of securities in order to raise capital (i.e a subsequent registration statement will be duly filed at such time).

We look forward to receiving any additional comments following your review and evaluation of the registration statement. If you have any questions or concerns in the interim, please do not hesitate to contact Lee Cassidy, Esq. at (202) 387-5400 or the undersigned at (310) 709-4338. In addition, we would request in the future that electronic copies of any comment letters or other correspondence from the Commission on behalf of the Company to be copied to lwcassidy@aol.com and tony@tonypatel.com.

| | Sincerely, |

| | |

| | /s/ Anthony A. Patel |

| | |

| | Anthony A. Patel, Esq. |

| | Cassidy & Associates |