UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

FOR THE YEAR ENDED March 31, 2009

Commission file number 333-151693

DESTINY MINING INC.

(Exact name of registrant as specified in its charter)

NEVADA | | 98-0579264 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

246 Horsham Avenue

North York, Ontario

Canada M2N 2A6

(Address of principal executive offices, including zip code.)

1-888-512-9124

(telephone number, including area code)

Securities pursuant to section 12(b) of the Act:

NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.02 Par Value (and rights attached thereto)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

Yes [ ] No [X]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day.Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 if the Exchange Act.

Large Accelerated filer | | [ ] | | Accelerated filer | | [ ] |

Non-accelerated filer | | [ ] | | Smaller reporting company | | [X] |

(Do not check if a smaller reporting company) | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as ofMarch 31, 2009 $0.00.

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date:8,000,000 as ofJune 26, 2009.

Number of the registrant's Common Stock outstanding as of June 26, 2009: 8,000,000.

DOCUMENTS INCORPORATED BY REFERENCE

See Exhibit Index.

- 2 -

- 3 -

FORWARD-LOOKING STATEMENTS

The information presented in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements have been made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995. These statements are not historical facts, but rather are based on our current expectations, estimates and projections, and our beliefs and assumptions. We intend words such as "anticipate," "expect," "intend," "plan," "believe," "seek," "estimate," "will" and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. These factors could cause actual results to dif fer materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties are described in the risk factors and elsewhere in this Annual Report on Form 10-K. We caution you not to place undue reliance on these forward-looking statements, which reflect our management's view only as of the date of this Annual Report on Form 10-K. We are not obligated to update these statements or publicly release the result of any revisions to them to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

PART I.

ITEM 1. BUSINESS

General

We were incorporated in the State of Nevada on February 12, 2008. We are an exploration stage corporation. An exploration stage corporation is one engaged in the search from mineral deposits or reserves which are not in either the development or production stage. We intend to conduct exploration activities on one property. We maintain our statutory registered agent's office at National Registered Agents Inc. of NV, located at 1000 East William Street, Suite 204, Carson City, Nevada 89701. Our business office is located at 246 Horsham Avenue, North York, Ontario, Canada M2N 2A6. Our telephone number is (888) 512-9124. This is Mr. Petro's home. We use this space on a rent free basis.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause our plans to change.

Background

In March 2008, we acquired one mineral property containing nine mineral claims located in the province of Quebec, Canada. Quebec allows a mineral explorer to claim a portion of available Crown lands as its exclusive area for exploration by map designation or by staking. Quebec's mining system promotes the development of mineral resources, while taking other possible uses of the territory into consideration. It is based on the "free mining" principle, which allows the broadest possible access to the territory, regardless of means, on a first come, first serve basis, and where the title obtained includes the exclusive right to search for mineral substances and the assurance of being able to obtain, under certain conditions, the right to mine the mineral substance discovered. The property was recorded by David Zamida. Mr. Zamida transferred the property to us in consideration of $5,000 and a 1% net smelter royalty in April 2008. Mr. Zamida is a non-affiliate third party.

A net smelter royalty is a fee paid to a landowner or claimholder that is a percentage of a minerals' value at time of sale. This type of royalty is free of all development, operating and environmental liability costs. Accordingly for every $1 of mineralized material sold, Mr. Zamida will receive $0.01. There is no assurance, however, we will ever discover mineralized material, develop the property and ever sell any mineralized material to anyone.

- 4 -

We have no revenues, have a loss since inception, have minimal operations, have been issued a going concern opinion and rely upon the sale of our securities and loans from our sole officer and director to fund operations.

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause us to change our plans.

In the 19th century the practice of reserving the minerals from fee simple Crown grants was established. Legislation now ensures that minerals are reserved from Crown land dispositions. The result is that the Crown is the largest mineral owner in Canada, both as the fee simple owner of Crown lands and through mineral reservations in Crown grants. Most privately held mineral titles are acquired directly from the Crown. The property is one such acquisition. Accordingly, fee simple title to the property resides with the Crown.

Claims may be recorded in the names of individuals or corporations. Prospecting licenses, however, may only be issued in the name of individuals. Our claims are recorded in our name and Emad Petro, our president holds the prospecting license. We have the exclusive rights to mine and recover all of the minerals contained within the surface boundaries of the lease vertically downward of our property. The Crown could reclaim the property in an eminent domain proceeding, but would have to compensate the lessee for the value of the claim if it exercised the right of eminent domain. It is highly unlikely that the Crown will exercise the power of eminent domain. In general, where eminent domain has been exercised it has been in connection with incorporating the property into a provincial park.

The property is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the property and we believe that no insurance is necessary since the property is unimproved and contains no buildings or improvements.

There are no native land claims that affect title to the property. We have no plans to try interest other companies in the property if mineralization is found. If mineralization is found, we will try to develop the property ourselves.

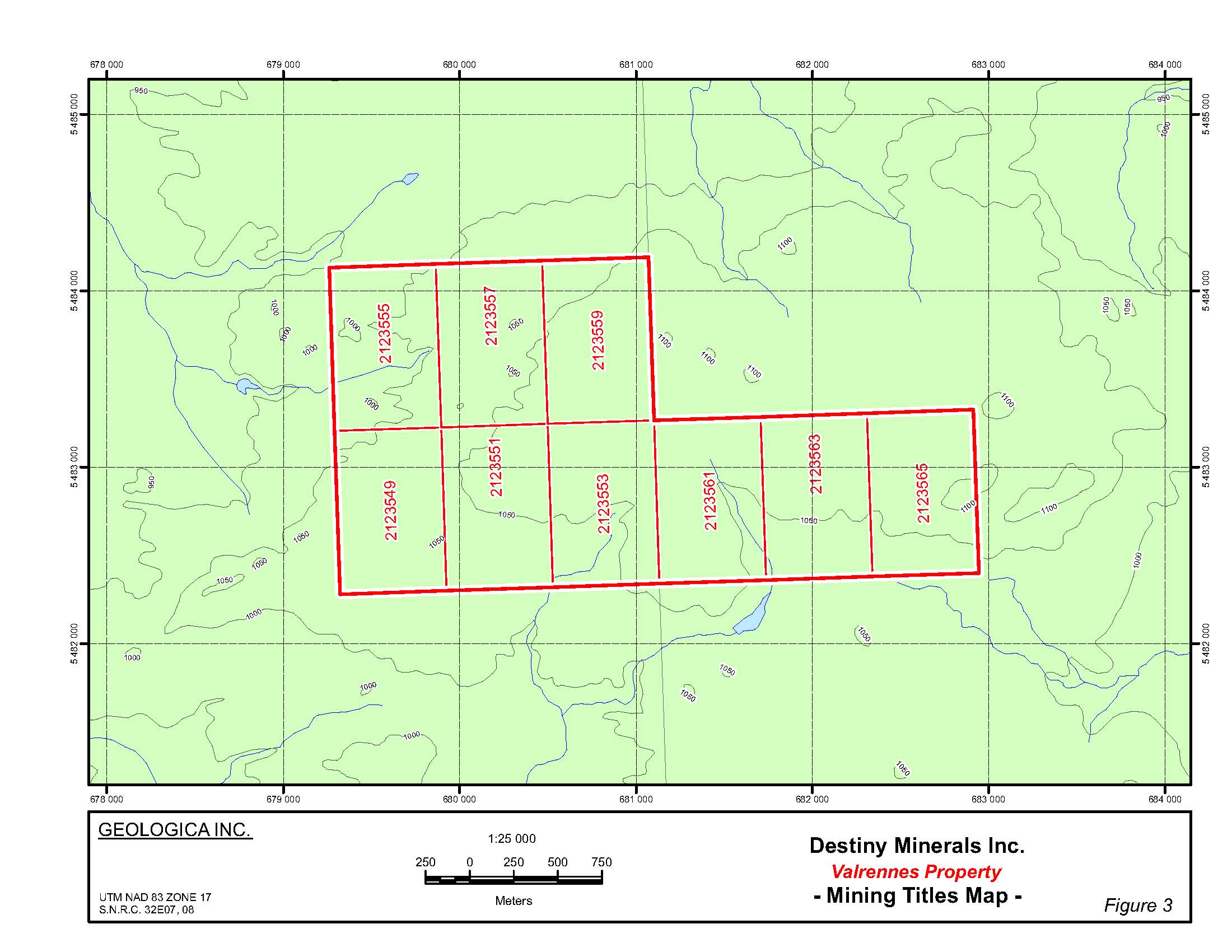

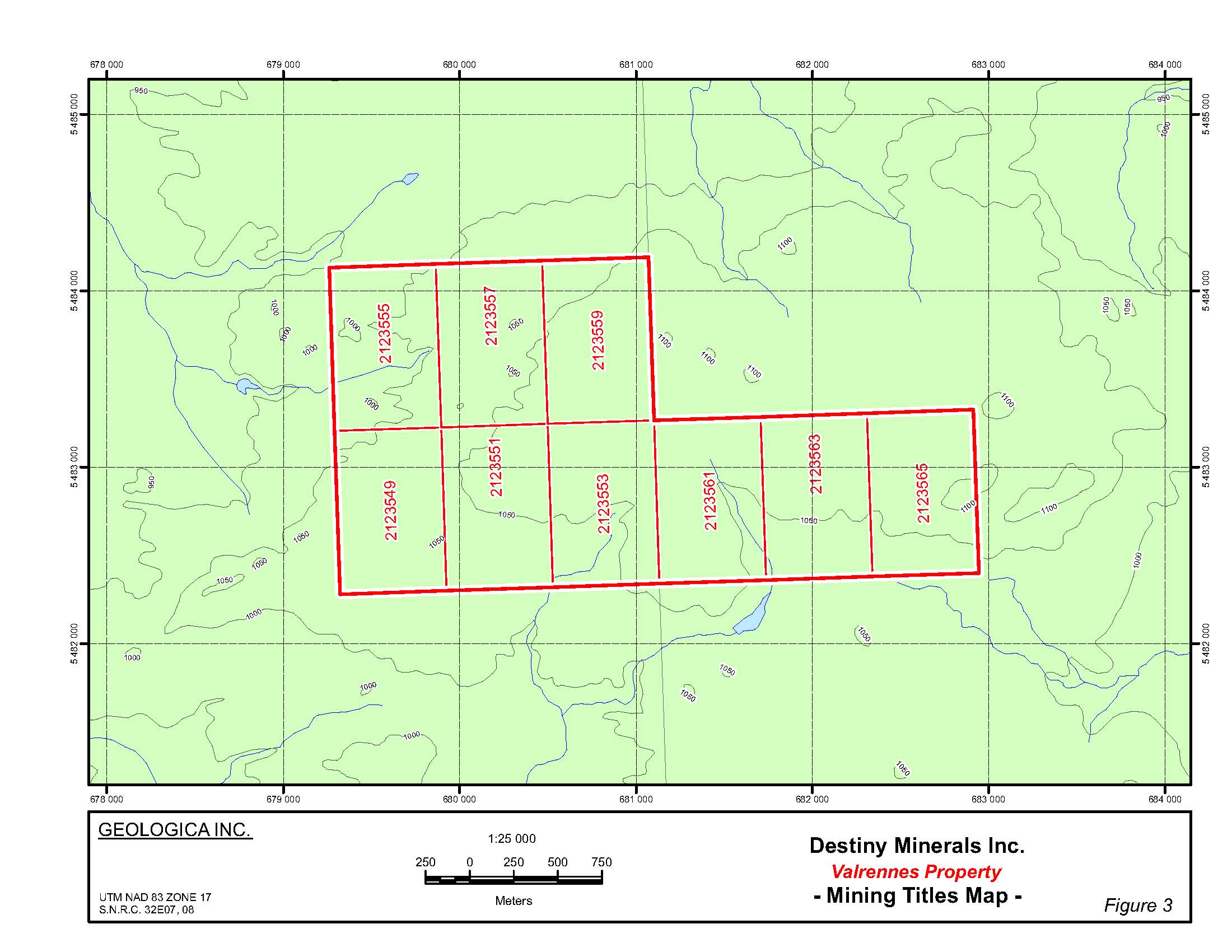

Claims

The following is a list of claims and expiration dates:

| Date of |

Claim No. | Expiration |

NTSC 32E07-CDC 123549 | September 25, 2009 |

NTSC 32E07 CDC 123551 | September 25, 2009 |

NTSC 32E07 CDC 123553 | September 25, 2009 |

NTSC 32E07 CDC 123555 | September 25, 2009 |

NTSC 32E07 CDC 123557 | September 25, 2009 |

NTSC 32E07 CDC 123559 | September 25, 2009 |

NTSC 32E08 CDC 123561 | September 25, 2009 |

NTSC 32E08 CDC 123563 | September 25, 2009 |

NTSC 32E08 CDC 123565 | September 25, 2009 |

- 5 -

In order to maintain these claims we must complete work on the property or pay a fee of approximately CND$1,250 per claim.

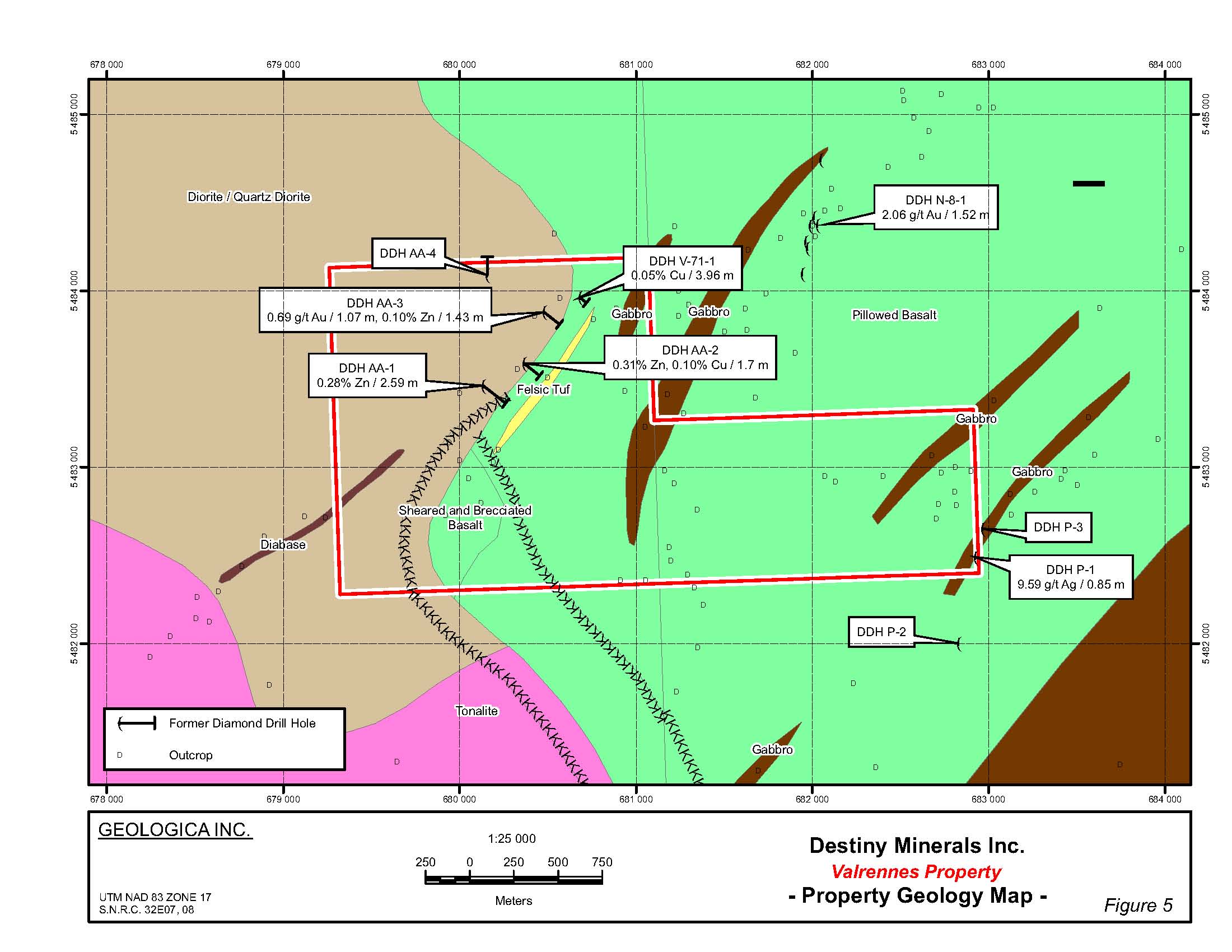

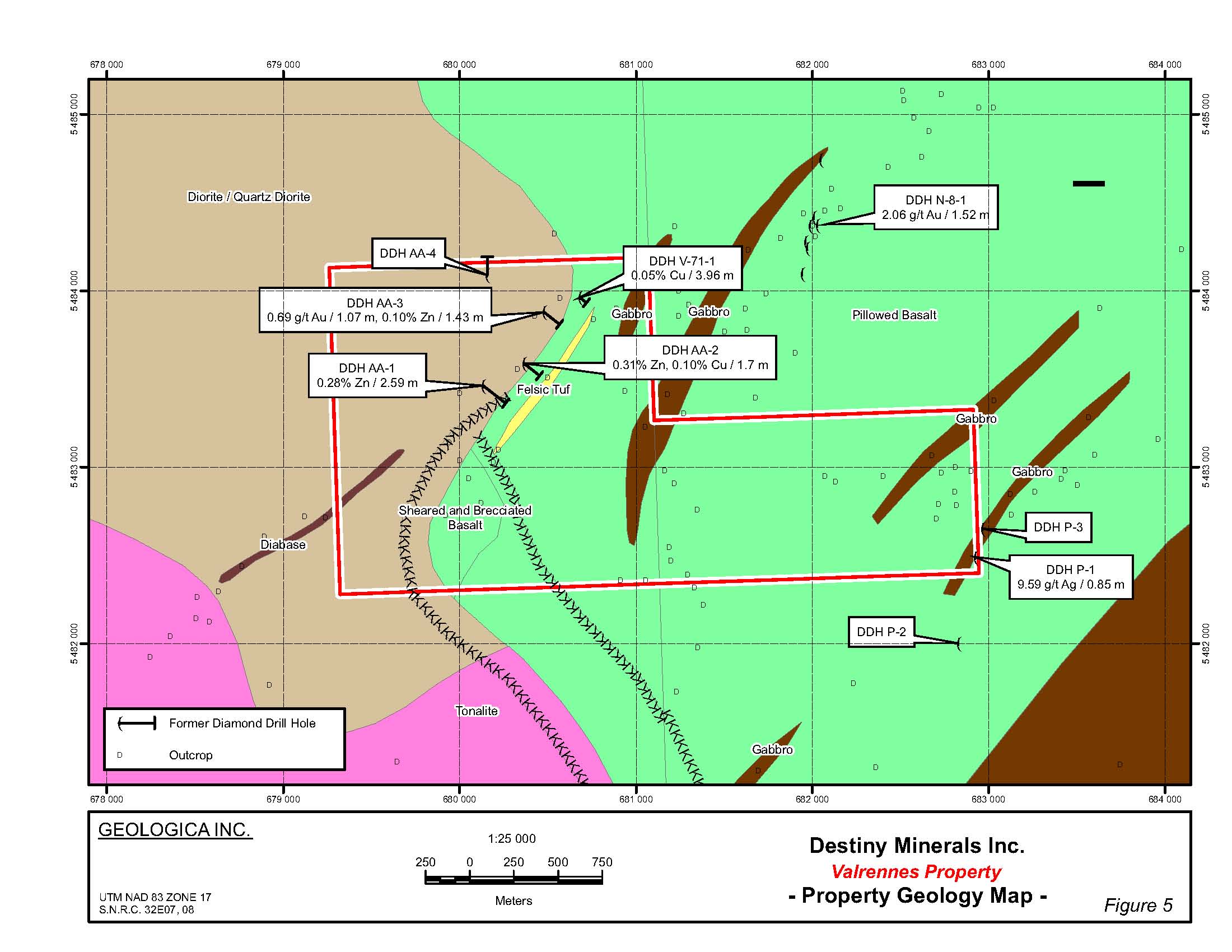

Map 1

- 6 -

Map 2

- 7 -

Map 3

Location and Access

The Valrennes property is located in the north part of the Abitibi Greenstone Belt, approximately 80 kilometres southwest of the town of Matagami in the Abitibi region in Quebec, Canada. The property is easily accessible by several trails, tertiary and secondary roads near the property.

The property consists of 9 claims respectively located in Valrennes Township covering a surface area of 503.79 hectares. We own 100% interest of the mineral rights, subject to a 1% smelter royalty. There are no native land claims that affect the title to the property. The property was selected due to the presence of silver, gold and copper in the area.

The property is easily accessible by several trails, tertiary and secondary roads near the property.

- 8 -

Physiography

The topography is of low relief, which rarely exceeds 100 meters, locally swampy, while spruce forest and mixed birch deciduous, and coniferous forest (tamarack spruce, jackpine) cover the area. Where eskers and glacial deposits are found, the relief makes gently The local climate is that of the Canadian Shield at this latitude, that is to say typically continental, with hard winters extending from October to April, snow which can reach several meters and of total precipitation of 80 centimeters per year. The summers are relatively hot and fairly wet. Qualified manpower and infrastructure are available in the area.

History

There is evidence of previous exploration activity on the property.

Property Geology

The local geology consists of hornoclinal basaltic flows with interflows of cherts, minor felsic volcanics and altered mineralized rhyolites.

Supplies

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as dynamite, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

Other Property

Other than our interest in the property, we own no plants or other property.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

- 9 -

ITEM 2. DESCRIPTION OF PROPERTY

Our business office is located at 246 Horsham Avenue, North York, Ontario, Canada M2N 2A6.

ITEM 3. LEGAL PROCEEDINGS

We are currently not involved in any litigation that we believe could have a material adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries' officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fourth quarter, there were no matters submitted to a vote of our shareholders.

PART II

ITEM 5. MARKET FOR COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our shares are traded on the Bulletin Board operated by the Federal Industry Regulatory Authority under the symbol "DSYM."A summary of trading by quarter for the last two fiscal years is as follows:

Fiscal Year | | | | |

2009 | | High Bid | | Low Bid |

| | | | |

Fourth Quarter: 01-01-09 to 03-31-09 | | $0.00 | | $0.00 |

Third Quarter: 10-01-08 to 12-31-08 | | $0.00 | | $0.00 |

Second Quarter: 07-01-08 to 9-30-0 | | $0.00 | | $0.00 |

First Quarter: 04-01-08 to 6-30-08 | | $0.00 | | $0.00 |

|

Fiscal Year | | | | |

2008 | | High Bid | | Low Bid |

| | | | |

Fourth Quarter: 01-01-08 to 03-31-08 | | $0.00 | | $0.00 |

Third Quarter: 10-01-07 to 12-31-07 | | $0.00 | | $0.00 |

Second Quarter: 07-01-07 to 9-30-07 | | $0.00 | | $0.00 |

First Quarter: 04-01-07 to 6-30-07 | | $0.00 | | $0.00 |

- 10 -

Of the 8,000,000 shares of common stock outstanding as of March 31, 2009, 5,000,000 shares were owned by our sole officer and director. These shares may only be resold in compliance with Rule 144 of the Securities Act of 1933.

Holders

At March 31, 2009, we had 41 shareholders of record of our common stock.

Status of our public offering

On July 25, 2008, the SEC declared our Form S-1 registration statement effective (SEC File no. 333-151693) allowing us to sell 3,000,000 shares of common stock minimum, 5,000,000 shares of common stock maximum at an offering price of $0.02 per share. There was no underwriter involved in our public offering. In December, 2008, the Company completed its public offering by issuing 3,000,000 shares of common stock and raising $60,000 (before issuance costs of $15,416). As of March 31, 2009, the Company has 8,000,000 total shares issued and outstanding. There were no underwriters or broker-dealers involved in the public offering. We raised $60,000 in gross proceeds. Since completing our public offering, we have used $56,095 of the proceeds as follows: legal and accounting fees of $29,425; Geology fees $12,096; and administrative fees of $14,574.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section Rule 15(g)of the Securities Exchange Act of 1934

Our Company's shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

- 11 -

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid" and "offer" quotes, a dealers "spread" and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

Stock Option Grants

To date, we have not granted any stock options.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This section of this report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

We are a start-up, exploration stage corporation and have not yet generated or realized any revenues from our business operations.

Our auditor has issued a going concern opinion. This means that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues and no revenues are anticipated until we begin removing and selling minerals. There is no assurance we will ever reach this point. Accordingly, we must raise cash from sources other than the sale of minerals found on the property. That cash must be raised from other sources. Our only other source for cash at this time is investments by other. We must raise cash to implement our project and stay in business.

We will be conducting research in the form of exploration of the property. Our exploration program is explained in as much detail as possible in the business section of our prospectus. We are not going to buy or sell any plant or significant equipment during the next twelve months.

Access is provided by several trails, tertiary and secondary roads near the property.

- 12 -

Our exploration target is to find an ore body containing gold. Our success depends upon finding mineralized material. This includes a determination by our consultant if the property contains reserves. Mineralized material is a mineralized body, which has been delineated by appropriate spaced drilling or underground sampling to support sufficient tonnage and average grade of metals to justify removal. If we don't find mineralized material or we can't remove mineralized material, either because we do not have the money to do it or because it is not economically feasible to do it, we will cease operations and you will lose your investment.

The property is undeveloped raw land. Limited exploration in the form of obtaining surface samples, has been conducted. To our knowledge, the property has never been mined. The only event that has occurred is the recording of the property by David Zamida and a physical examination of the property by Emad Petro, our sole officer and director. The registration of the claims was included in the $5,000 paid to Mr. Zamida. No additional payments were made or are due to Mr. Zamida for his services, with the exception of a 1% smelter royalty. The claims were recorded in our name.

We do not intend to hire additional employees at this time. All of the work on the property will be conduct by unaffiliated independent contractors that we will hire. The independent contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material.

PHASE 1A - Work Completed:

Destiny Minerals is an exploration stage corporation engaged in the search of mineralizations from mineral deposits or reserves, which are not in either the development or production stage. The business plan is solely to explore one mineral property and if successful look at other exploration situations.

In April 2008, Destiny Minerals decided to acquire the Valrennes property from Mr. Zamida. The property shows by its emplacement an excellent potential for gold and base metals mineralizations, which characterize the Joutel Mining Camp host of several past gold, silver, copper and zinc deposits and producers. Although no significant values of precious and base metals were obtained from our 2 surface outcrop samples. The property remains strategically well located for mineral exploration.

On the Valrennes property, three (3) important métallotectes were recognized. The stratigraphic volcano-sedimentary units would be favourable hosts for VMS-type mineralizations; structural (faults, folds) and thermodynamic métallotectes such as young or later intrusions make it favourable for structural and hydrothermal controls; and vein-type injections.

- 13 -

RECOMMENDATIONS

Following the results obtained in the past in the area and on the property, the authors recommend an exploration program in three (3) phases. Phase 1 will consist of linecutting and ground geophysical surveys on the grid line; reconnaissance mapping and sampling for a total of $60,000. If warranted, Phase 2 will consist of geochemical soil survey and power stripping will be necessary to permit detailed mapping and sampling of the mineralized zones with coincident structures and geophysical conductors for a total of $108,000. If warranted, Phase 3 will consist of diamond drilling to follow up on the results obtained during previous Phases with final work report totalling $312,000.A total budget of $ 480,000 is recommended.

PHASE 1: BASIC EXPLORATION WORK

- Linecutting (50 km at $420/km) 21 000 $

- Magnetometric survey (42 km at $100/km) 4 200 $

- IP survey (14 km at $1200/km) 16 800 $

- Mapping and sampling on the grid line

1 geologist and 1 technician: 12 days at $1500/day 18 000 $

Total Phase 1: 60 000 $

PHASE 2: SOIL GEOCHEMISTRY AND DETAILED MAPPING

- Rock sampling and analysis

100 samples at $50/sample 5 000 $

- Soil geochemical survey (600 samples at $50/sample) 30 000 $

- Power stripping on outcropping priority showings on the grid line

10 days at 3000$/day (all inclusive) 30 000 $

- Logistic supplies (transportation, lodging, eating, etc.) 25 000 $

- Data synthesis and digitalization 8 000 $

- Follow up work report with maps and figures 15 000 $

Total Phase 2: 108 000 $

- 14 -

PHASE 3: DIAMOND DRILLING (NQ SIZE)

-Diamond Drilling (NQ size) on coinciding structural, geophysical, geological, geochemical anomalies and follow-up on the best values obtained in Phases 3 and 4:

10 DDHs (2000 m @ 140$/m) all inclusive2 280 000 $

- Data synthesis and digitalization 12 000 $

- Work report with color maps and figures 20 000 $

Total Phase 3: 312 000 $

Total Phases 1 to 3: 480 000 $

Plan of Operation for the Next Twelve Months

Management is evaluating the results of the geology report to determine what additional work should be done on the property, if any. Currently, that is the Company's only plan and it does not have plans to do any else.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We are an exploration stage corporation and have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

To meet our need for cash, we raised money through a public offering. The money we raised will be applied to the items set forth in the Use of Proceeds section of our prospectus. If we find mineralized material and it is economically feasible to remove the mineralized material, we will attempt to raise additional money through a subsequent private placement, public offering or through loans. If we can't or don't raise more money, we will cease operations. If we cease operations, we don't know what we will do and we don't have any plans to do anything else.

Our financial statements have been prepared on a going concern basis. Realization value may be substantially different from carrying values as shown and these financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should Destiny be unable to continue as a going concern. As of March 31, 2009, Destiny has a working capital deficiency, has not generated revenues and has accumulated losses of $56,095 since inception. The continuation of Destiny as a going concern is

- 15 -

dependent upon the continued financial support from its shareholders, the ability of Destiny Minerals to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding Destiny's ability to continue as a going concern.

Our sole officer and director has advanced us $53,138 for operating expenses associated with our offering and has agreed to pay the cost of reclamation of the property should mineralized material not be found thereon. The foregoing agreement is oral; there is nothing in writing to evidence the same. While our sole officer has agreed to advance the funds, the agreement is unenforceable as a matter of law, since there is no consideration for the same. At the present time, we have not made any arrangements to raise additional cash, other than what was raised through our public offering.

From inception through March 31, 2008, we issued 5,000,000 shares of our common stock and received $50.

As of the date of this report, the Company sold an additional 3,000,000 shares of common stock at $0.02 per share, raising a total of $60,000.

We issued 5,000,000 shares of common stock to our sole officer and director pursuant to the exemption from registration contained in Regulation S of the Securities Act of 1993. The purchase price of the shares was $50. This was accounted for as an acquisition of shares. Mr. Petro covered our initial expenses of $53,138 including incorporation, accounting and legal fees and for registering the property, all of which was paid directly to David Zamida; Geologica Groupe Conseil, our geological consultants; our attorney; and, our accountant. The amount owed to Mr. Petro is non-interest bearing, unsecured and due on demand. Further the agreement with Mr. Petro is oral and there is no written document evidencing the agreement.

As of March 31, 2009, our total assets were $41,677 and our total liabilities were $53,138.

Off Balance Sheet Arrangements

We have no off balance sheet arrangements.

Critical Accounting Policies

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ materially from those estimates. We believe that there are several accounting policies that are critical to understanding our historical and future performance, as these policies affect the reported amounts of revenue and the more significant areas involving management's judgments and estimates. These significant accounting policies relate to revenue recognition, valuation of long-lived assets and income taxes. These policies, and the related procedures, are described in detail below.

Revenue recognition

The Company's revenue will consist of obtaining the ability to find mineralized material that is economically feasible to extract from our property.

- 16 -

Impairment of long lived assets

Long-lived assets of the Company are reviewed for impairment whenever events or changes in circumstances indicate that their carrying value has become impaired, in accordance with the guidance established in Statement of Financial Accounting Standards ("SFAS") No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets. An impairment loss would be recognized when the carrying amount of an asset exceeds the estimated undiscounted future cash flows expected to result from the use of the asset and its eventual disposition. The amount of the impairment loss to be recorded is calculated by the excess of the asset's carrying value over its fair value. Fair value is generally determined using a discounted cash flow analysis.

Income taxes

The Company accounts for income taxes under the provisions of SFAS No. 109, Accounting for Income Taxes, which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company's financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. The effect on deferred income tax assets and liabilities of a change in income tax rates is included in the period that includes the enactment date. Valuation allowances are established when necessary to reduce deferred income tax assets to the amount expected to be realized.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

- 17 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors

Destiny Minerals, Inc.

(An Exploration Stage Company)

Ontario, Canada

We have audited the accompanying balance sheets of Destiny Minerals, Inc. ("Destiny") as of March 31, 2009 and 2008 and the related statements of expenses, cash flows and changes in stockholders' deficit for the year then ended and for the period from February 12, 2008 (inception) through March 31, 2009. These financial statements are the responsibility of Destiny's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatements. Destiny is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Destiny's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the ove rall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Destiny as of March 31, 2009 and 2008 and the results of its operations, its cash flows and changes in stockholders' deficit for the year then ended and the period from February 12, 2008 (inception) to March 31, 2009 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Destiny will continue as a going concern. As discussed in Note 2 to the financial statements, Destiny has no revenues and has accumulated losses since inception which raise substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MALONE & BAILEY, P.C.

www.malone-bailey.com

Houston, Texas

June 23, 2009

F-1

- 18 -

DESTINY MINERALS INC. |

(AN EXPLORATION STAGE COMPANY) |

BALANCE SHEETS |

| | | | |

| | March 31, | | March 31, |

ASSETS | | 2009

| | 2008

|

| CURRENT ASSETS | | | | |

Cash | $ | 41,677

| $ | 50

|

| | | | |

| TOTAL ASSETS | $ | 41,677

| $ | 50

|

| | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| | | | |

| CURRENT LIABILITIES | | | | |

| Advances from a related party | | 53,138

| | 22,025

|

| TOTAL LIABILITIES | | 53,138

| | 22,025

|

| | | | |

| COMMITMENTS AND CONTINGENCIES | | - | | - |

| | | | |

| STOCKHOLDERS' DEFICIT | | | | |

| | Preferred Stock, 100,000,000 shares authorized, $0.00001 par value | | | | |

| | None issued and outstanding | | - | | - |

| | Common stock, 100,000,000 shares authorized, $0.00001 par value; | | | | |

8,000,000 and 5,000,000 shares issued and outstanding, respectively | | 80 | | 50 |

| | Additional paid-in capital | | 44,554 | | - |

| | Deficit accumulated during exploration stage | | (56,095)

| | 22,025

|

| | TOTAL STOCKHOLDERS' DEFICIT | | (11,461)

| | (21,975)

|

| | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 41,677

| $ | 50

|

The accompanying notes are an integral part of these financial statements.

F-2

- 19 -

| | | Year Ended March 31, 2009

| | Year Ended March 31, 2008

| | For the Period from February 12, 2008 (Inception) through March 31, 2009

|

| | | | | | | |

EXPENSES | | | | | | |

| Legal and accounting | $ | 14,425 | $ | 15,000 | $ | 29,425 |

| Exploration and development | | 7,096 | | 5,000 | | 12,096 |

| General and administrative | | 12,549

| | 2,025

| | 14,574

|

| | | | | | |

NET LOSS | $ | (34,070)

| $ | (22,025)

| $ | (56,095)

|

| | | | | | |

| NET LOSS PER COMMON SHARE, BASIC AND DILUTED |

$

|

(0.01)

|

$

|

(0.00)

|

|

N/A

|

| | | | | | | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED | |

6,748,014

| |

5,000,000

| |

N/A

|

The accompanying notes are an integral part of these financial statements.

F-3

- 20 -

DESTINY MINERALS INC. |

(AN EXPLORATION STAGE COMPANY) |

STATEMENT OF CHANGES IN STOCKHOLDERS' DEFICIT |

|

| | Additional

Paid-in

Capital | Deficit

Accumulated

during Exploration Stage | Total

Stockholders'

Equity (Deficit) |

Common Stock |

Shares | | Amount | | | |

| | | | | | | | | |

Stock issued for cash at inception | 5,000,000 | $ | 50 | $ | - | $ | - | $ | 50 |

| | | | | | | | | |

Net loss | -

| | -

| | -

| | (22,025)

| | (22,025)

|

| | | | | | | | | |

Balance at March 31, 2008 | 5,000,000 | | 50 | | - | | (22,025) | | (21,975) |

| | | | | | | | | |

Issuance of common stock for cash at $0.02 per share ,net of offering costs of $15,416 |

3,000,000

| |

30

| |

44,554

| |

- -

| |

44,584

|

| | | | | | | | | |

Net Loss | -

| | -

| | -

| | (34,070)

| | (34,070)

|

| | | | | | | | | |

Balance at March 31, 2009 | 8,000,000

| | 80

| | 44,554

| | (56,095)

| | (11,461)

|

The accompanying notes are an integral part of these financial statements.

F-4

- 21 -

DESTINY MINERALS INC. |

(AN EXPLORATION STAGE COMPANY) |

STATEMENTS OF CASH FLOWS |

| | Year Ended

March 31, 2009

| | Year Ended

March 31, 2008

| | Accumulated from February 12, 2008 (Inception) through

March 31, 2009

|

| | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net loss | $ | (34,070)

| $ | (22,025)

| $ | (56,095)

|

Net cash used in operating activities | | (34,070)

| | (22,025)

| | (56,095)

|

| | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | |

| Proceeds from issuance of common stock | | 44,584 | | 50 | | 44,634 |

| Advances from a related party | | 31,113

| | 22,025

| | 53,138

|

Net cash provided by financing activities | | 75,697

| | 22,075

| | 97,772

|

| | | | | | |

Net change in cash | | 41,627 | | 50 | | 41,677 |

| | | | | | |

Cash, beginning of period | $ | 50

| $ | -

| $ | -

|

| | | | | | |

Cash, end of period | $ | 41,677

| $ | 50

| $ | 41,677

|

| | | | | | |

SUPPLEMENTAL DISCLOSURES | | | | | | |

| Interest paid | $ | -

| $ | -

| $ | -

|

| Income taxes paid | $ | -

| $ | -

| $ | -

|

The accompanying notes are an integral part of these financial statements.

F-5

- 22 -

NOTE 1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business. Destiny Minerals Inc. (the "Company") was incorporated in Nevada on February 12, 2008 and its principal business is the acquisition and exploration of mineral resources.

Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Acquisition, Exploration and Development Costs. Mineral property acquisition, exploration and related costs are expensedas incurred unless proven and probable reserves exist and the property may commercially be mined. When it has been determined that a mineral property can be economically developed, the costs incurred to develop such property, including costs to further delineate the ore body and develop the property for production, may be capitalized. In addition, the Company may capitalize previously expensed acquisition and exploration costs if it is later determined that the property can economically be developed. Interest costs, if any, allocable to the cost of developing mining properties and to constructing new facilities are capitalized until operations commence. Mine development co sts incurred either to develop new ore deposits, expand the capacity of operating mines, or to develop mine areas substantially in advance of current production are also capitalized. All such capitalized costs, and estimated future development costs, are then amortized using the units-of-production method over the estimated life of the ore body. Costs incurred to maintain current production or to maintain assets on a standby basis are charged to operations. Costs of abandoned projects are charged to operations upon abandonment. The Company evaluates, at least quarterly, the carrying value of capitalized mining costs and related property, plant and equipment costs, if any, to determine if these costs are in excess of their net realizable value and if a permanent impairment needs to be recorded. The periodic evaluation of carrying value of capitalized costs and any related property, plant and equipment costsare based upon expected future cash flowsand/or estimated salvage value in accordance with Statement of Financial Accounting Standards (SFAS) No. 144, "Accounting for Impairment or Disposal of Long-Lived Assets."

Earnings Per Share. The basic net loss per common share is computed by dividing the net loss by the weighted average number of common shares outstanding. Diluted net loss per common share is computed by dividing the net loss adjusted on an "as if converted" basis, by the weighted average number of common shares outstanding plus potential dilutive securities. For the period ended March 31, 2009, there were no potentially dilutive securities outstanding.

Revenue recognition. Destiny recognizes revenue when persuasive evidence of an arrangement exists, services have been rendered, the sales price is fixed or determinable, and collectibility is reasonably assured. This typically occurs when the product is shipped. For the period ended March 31, 2009, Destiny Minerals had no revenues.

F-6

- 23 -

DESTINY MINERALS INC. |

(AN EXPLORATION STAGE COMPANY) |

NOTES TO FINANCIAL STATEMENTS |

March 31, 2009 |

Cash and Cash Equivalents. For purposes of the statement of cash flows, Destiny Minerals considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Income Taxes. Destiny recognizes deferred tax assets and liabilities based on differences between the financial reporting and tax bases of assets and liabilities using the enacted tax rates and laws that are expected to be in effect when the differences are expected to be recovered. Destiny provides a valuation allowance for deferred tax assets for which it does not consider realization of such assets to be more likely than not.

Recently Issued Accounting Pronouncements. Destiny Minerals does not expect the adoption of recently issued accounting pronouncements to have a significant impact on its results of operations, financial position or cash flow.

NOTE 2. GOING CONCERN

These financial statements have been prepared on a going concern basis. Realization value may be substantially different from carrying values as shown and these financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should Destiny be unable to continue as a going concern. As of March 31, 2009, Destiny has a working capital deficiency, has not generated revenues and has accumulated losses of $56,095 since inception. The continuation of Destiny as a going concern is dependent upon the continued financial support from its shareholders, the ability of Destiny Minerals to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding Destiny's ability to continue as a going concern.

NOTE 3. RELATED PARTY TRANSACTIONS

On March 31, 2009, Destiny owed its president and sole director $53,138 for advances made to Destiny. The total amount is unsecured, non interest bearing, and has no specific terms for repayment.

NOTE 4. COMMON STOCK

On February 12, 2008, Destiny issued 5,000,000 common shares to its president and sole director at $0.00001 per share for $50.

In December 2008, the Company closed its public offering by issuing 3,000,000 shares at $0.02 per share for a total of $60,000 (before issuance costs of $15,416).

F-7

- 24 -

DESTINY MINERALS INC. |

(AN EXPLORATION STAGE COMPANY) |

NOTES TO FINANCIAL STATEMENTS |

March 31, 2009 |

NOTE 5. INCOME TAXES

Destiny uses the liability method, where deferred tax assets and liabilities are determined based on the expected future tax consequences of temporary differences between the carrying amounts of assets and liabilities for financial and income tax reporting purposes. Since inception, Destiny incurred net losses and, therefore, has no tax liability. The net deferred tax asset generated by the loss carry-forward has been fully reserved. The cumulative net operating loss carry-forward is approximately $56,000 at March 31, 2009, and will expire in the year 2029.

| | 2009

| | 2008

| |

| | | | | |

Statutory rate | | 34% | | 34% | |

Income taxes at statutory rate | | $ | 11,583

| | $ | 7,489

| |

| | | | | | | |

| | | 11,583 | | | 7,489 | |

Increase in valuation allowance | | | (11,583

| ) | | (7,489

| ) |

| | | | | | | |

Provision for income taxes | | $ | -

| | $ | -

| |

| | | | | | | |

Deferred Tax Assets and Liabilities: | | | | | | | |

Net operating loss carryforwards | | $ | 19,072 | | $ | 7,489 | |

| | | | | | | |

Valuation allowance | | | (19,072

| ) | | (7,489

| ) |

| | | | | | | |

Net deferred tax assets | | $ | -

| | $ | -

| |

NOTE 6. MINERAL PROPERTIES

We currently hold 100% interest in the Valrennes property. We purchased the nine claims comprising the Valrennes from an individual who serves as our consultant in Quebec. We own mining concessions for the property, which are subject to a 1% net smelter return on any production to this consultant. We paid the consultant $5,000 for the property and no royalties are due at this time. The property is in the exploration stage and has no proven or probable reserves.

F-8

- 25 -

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

There have been no disagreements on accounting and financial disclosures since inception through the date of this Form 10-K. Our financial statements for the period from inception to March 31, 2009, included in this report have been audited by Malone & Bailey, PC, as set forth in this annual report.

ITEM 9A(T). CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 ("Exchange Act"), the Company carried out an evaluation, with the participation of the Company's management, including the Company's Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO") (the Company's principal financial and accounting officer), of the effectiveness of the Company's disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company's CEO and CFO concluded that the Company's disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to the Company's man agement, including the Company's CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Management's Annual Report on Internal Control Over Financial Reporting.

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Our internal control system was designed to, in general, provide reasonable assurance to the Company's management and board regarding the preparation and fair presentation of published financial statements, but because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management assessed the effectiveness of the Company's internal control over financial reporting as of March 31, 2009. The framework used by management in making that assessment was the criteria set forth in the document entitled " Internal Control - Integrated Framework" issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that assessment, our management has determined that as of March 31, 2009, the Company's internal control over financial reporting was effective for the purposes for which it is intended.

- 26 -

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report. We expect to report on our assessment of internal controls over financial reporting as of March 31, 2010.

Changes in Internal Control over Financial Reporting

No change in our system of internal control over financial reporting occurred during the period covered by this report, fourth quarter of the fiscal year ended March 31, 2009 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Each of our directors serves until his or her successor is elected and qualified. Each of our officers is elected by the board of directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office.

The name, address, age and position of our present officers and directors are set forth below:

Name and Address | | Age | | Position(s) |

| | | | | |

Emad Petro

246 Horsham Avenue

North York, Ontario

Canada M2N 2A6 | | 34 | | President, principal executive officer, treasurer,

principal financial officer and sole member of the

board of directors |

The persons named above have held their offices/positions since inception of our company and are expected to hold their offices/positions until the next annual meeting of our stockholders.

Background of officers and directors

Since our inception on February 12, 2008, Emad Petro has been our president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors. From January 2003 to December 2003 Mr. Petro was employed as a room division manager with Western Hotel located in Toronto, Ontario. From April 2004 to September, 2006, Mr. Petro worked in the Wealth Management department of CIBC, a major financial services company in the areas of private banking, portfolio management and investment management.

- 27 -

From September 2006 to present day Mr. Petro is the managing partner of HotSpot Auto Parts, auto parts business located in Pickering, Ontario.

Involvement in Certain Legal Proceedings

Our director, executive officer and control persons have not been involved in any of the following events during the past five years:

| 1. | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| | |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| | |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we have no operations, at the present time, we believe the services of a financial expert are not warranted.

Audit Committee and Charter

We have a separately-designated audit committee of the board. Audit committee functions are performed by our board of directors. None of our directors are deemed independent. All directors also hold positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters; (3) establishing procedures for the confidential, anonymous submission by our employees of concerns regarding accounting and auditing matters; (4) engaging outside advisors; and, (5) funding for the outside auditory and any outside advisors engagement by the audit committee. A copy of the audit committee charter is filed as an exhibit to this report.

- 28 -

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code. A copy of the code of ethics is filed as an exhibit to this report.

Disclosure Committee and Charter

We have a disclosure committee and disclosure committee charter. Our disclosure committee is comprised of all of our officers and directors. The purpose of the committee is to provide assistance to the Chief Executive Officer and the Chief Financial Officer in fulfilling their responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports. A copy of the disclosure committee charter is filed as an exhibit to this report.

Section 16(a) of the Securities Exchange Act of 1934

As of the date of this report we are not subject to Section 16(a) of the Securities Exchange Act of 1934.

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us for the last three fiscal years ended March 31, 2009 and March 31, 2008. The compensation addresses all compensation awarded to, earned by, or paid to our named executive officers for the fiscal year ended March 31, 2009. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any.

Summary Compensation Table

| | | | | | Non- | Nonqualified | | |

| | | | | | Equity | Deferred | All | |

| | | | | | Incentive | Compensa- | Other | |

| | | | Stock | Option | Plan | tion | Compen- | |

Name and | | Salary | Bonus | Awards | Awards | Compensation | Earnings | sation | Total |

Principal Position | Year | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| | | | | | | | | | |

Emad Petro | 2009 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

President | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

We do not anticipate paying any salaries in 2009. We do not anticipate paying salaries until we have a defined ore body and begin extracting minerals from the ground.

- 29 -

Compensation of Directors

The members of our board of directors are not compensated for their services as directors. The board has not implemented a plan to award options to any directors. There are no contractual arrangements with any member of the board of directors. We have no director's service contracts.

Director's Compensation Table |

| | Fees | | | | | | | | | | | | |

| | Earned | | | | | | | | Nonqualified | | | | |

| | or | | | | | | Non-Equity | | Deferred | | | | |

| | Paid in | | Stock | | Option | | Incentive Plan | | Compensation | | All Other | | |

| | Cash | | Awards | | Awards | | Compensation | | Earnings | | Compensation | | Total |

Name | | (US$) | | (US$) | | (US$) | | (US$) | | (US$) | | (US$) | | (US$) |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) |

| | | | | | | | | | | | | | | |

Emad Petro | | 2009 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 |

Pension Benefits and Compensation Plans

We do not have any pension benefits or compensation plans.

Potential Payments Upon Termination or Change-in-Control

SEC regulations state that we must disclose information regarding agreements, plans or arrangements that provide for payments or benefits to our executive officers in connection with any termination of employment or change in control of the company. We currently have no employment agreements with any of our executive officer, nor any compensatory plans or arrangements resulting from the resignation, retirement or any other termination of any of our executive officers, from a change-in-control, or from a change in any executive officer's responsibilities following a change-in-control.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

As of the date hereof, we have not entered into employment contracts with any of our officers and do not intend to enter into any employment contracts until such time as it profitable to do so.

Indemnification

Under our Articles of Incorporation and Bylaws of the corporation, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if

- 30 -

the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth, as of the date of this report, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholders listed below have direct ownership of their shares and possess sole voting and dispositive power with respect to the shares.

Name and Address

Beneficial Owner [1] | Number of Shares Before the Offering | Percentage of Ownership Before the Offering | Number of Shares After Offering Assuming all of the Shares are Sold | Percentage of Ownership After the Offering Assuming all of the Shares are Sold |

| | | | | |

Emad Petro

246 Horsham Avenue

North York, Ontario

Canada M2N 2A6 | 5,000,000 | 100% | 5,000,000 | 62.50% |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

No director, executive officer, principal shareholder holding at least 5% of our common shares, or any family member thereof, had any material interest, direct or indirect, in any transaction, or proposed transaction, since the beginning of our company's fiscal year ended March 31, 2009.

Director Independence

Our common stock is quoted on the Over-the-Counter Bulletin Board, which does not have director independence requirements. Under NASDAQ rule 4200(a)(15), a director is not considered to be independent if he or she is also an executive officer or employee of the corporation. Mr. Emad Petro is our chief executive officer, president, and a member of the board of directors. As a result, we do not have any independent directors.

- 31 -

As a result of our limited operating history and limited resources, our management believes that we will have difficulty in attracting independent directors. In addition, we would be likely be required to obtain directors and officers insurance coverage in order to attract and retain independent directors. Our management believes that the costs associated with maintaining such insurance is prohibitive at this time.

Board of Directors

Our board of directors facilitates its exercise of independent supervision over management by endorsing the guidelines for responsibilities of the board as set out by regulatory authorities on corporate governance in the United States. Our board's primary responsibilities are to supervise the management of our company, to establish an appropriate corporate governance system, and to set a tone of high professional and ethical standards.

The board is also responsible for:

- selecting and assessing members of the Board;

- choosing, assessing and compensating the Chief Executive Officer of our company, approving the compensation of all executive officers and ensuring that an orderly management succession plan exists;

- reviewing and approving our company's strategic plan, operating plan, capital budget and financial goals, and reviewing its performance against those plans;

- adopting a code of conduct and a disclosure policy for our company, and monitoring performance against those policies;

- ensuring the integrity of our company's internal control and management information systems;

- approving any major changes to our company's capital structure, including significant investments or financing arrangements; and

- reviewing and approving any other issues which, in the view of the Board or management, may require Board scrutiny.

Nomination of Directors

The board is responsible for identifying new director nominees. In identifying candidates for membership on the board, the board takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity and the extent to which the candidate would fill a present need on the board. As part of the process, the board, together with management, is responsible for conducting background searches, and is empowered to retain search firms to assist in the nominations process. Once candidates have gone through a screening process and met with a number of the existing directors, they are formally put forward as nominees for approval by the board.

- 32 -

Assessments

The board intends that individual director assessments be conducted by other directors, taking into account each director's contributions at board meetings, service on committees, experience base, and their general ability to contribute to one or more of our company's major needs. However, due to our stage of development and our need to deal with other urgent priorities, the board has not yet implemented such a process of assessment.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit fees

The aggregate fees billed for the two most recently completed fiscal periods ended March 31, 2009 and March 31, 2008 for professional services rendered by Malone & Bailey, PC, registered public accountants, for the audit of our annual financial statements, quarterly reviews of our interim financial statements and services normally provided by the independent accountant in connection with statutory and regulatory filings or engagements for these fiscal periods were as follows:

| | Year Ended

March 31,

2009 | Year Ended

March 31,

2008 |

Audit Fees | $12,500 | $5,000 |

Audit Related Fees | - | - |

Tax Fees | - | - |

All Other Fees | -

| -

|

Total | $12,500

| $5,000

|

In the above table, "audit fees" are fees billed by our company's external auditor for services provided in auditing our company's annual financial statements for the subject year along with reviews of interim quarterly financial statements and involvement with various in arrears filing earlier in 2009. "Audit-related fees" are fees not included in audit fees that are billed by the auditor for assurance and related services that are reasonably related to the performance of the audit review of our company's financial statements. "Tax fees" are fees billed by the auditor for professional services rendered for tax compliance, tax advice and tax planning. "All other fees" are fees billed by the auditor for products and services not included in the foregoing categories.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Effective May 6, 2003, the Securities and Exchange Commission adopted rules that require that before our auditor is engaged by us to render any auditing or permitted non-audit related service, the engagement be:

- 33 -

-approved by our audit committee; or

-entered into pursuant to pre-approval policies and procedures established by the audit committee, provided the policies and procedures are detailed as to the particular service, the audit committee is informed of each service, and such policies and procedures do not include delegation of the audit committee's responsibilities to management.

We do not have an audit committee. Our entire board of directors pre-approves all services provided by our independent auditors.

The pre-approval process has just been implemented in response to the new rules. Therefore, our board of directors does not have records of what percentage of the above fees were pre-approved. However, all of the above services and fees were reviewed and approved by the entire board of directors either before or after the respective services were rendered.

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

- 34 -

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the city of North York, Ontario, Canada, on this 26th day of June, 2009.

| | DESTINY MINERALS INC. |

| | |

| | BY: | EMAD PETRO |

| | | Emad Petro, President, Principal Executive Officer, Secretary, Treasurer, Principal Financial Officer, Principal Accounting Officer and sole member of the Board of Directors. |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following person on behalf of the Registrant and in the capacities.

Signature | | Title | | Date |

|

EMAD PETRO | | President, Principal Executive Officer, Treasurer, | | June 26, 2009 |

Emad Petro | | Principal Accounting Officer, Principal Financial | | |

| | Officer, and sole member of the Board of Director | | |

- 35 -

EXHIBIT INDEX

- 36 -