SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended May 31, 2010

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number: 000-53711

AMICO GAMES CORP.

(Exact name of registrant as specified in its charter)

| Nevada | | 98-0579264 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Room North-02, 9th Floor, Flat A,

No. 89 Zhongshan Avenue West, Tianhe District,

Guangzhou, Canton Province, China 510630

(Address of principal executive offices)

(86) 20 8556 2666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was require to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

APPLICABLE ONLY TO CORPORATE ISSUERS

As of July 12, 2010, the registrant had 219,000,000 shares of common stock outstanding.

Table of Contents

The unaudited consolidated interim financial statements of Amico Games Corp. (the “Company”, “Amico”, “we”, “our”, “us”) follow. All currency references in this report are to U.S. dollars unless otherwise noted.

Financial Statement Index

| Consolidated Balance Sheets as of May 31, 2010 (Unaudited) and August 31, 2009 | F-1 |

| Consolidated Statements of Operations for the three and nine months ended May 31, 2010 and May 31, 2009 (Unaudited) | F-2 |

| Consolidated Statements of Cash Flows for the nine months ended May 31, 2010 and May 31, 2009 (Unaudited) | F-3 |

| Consolidated Statements of Stockholders’ Equity for the nine months ended May 31, 2010 (Unaudited) and the year ended August 31, 2009 | F-4 |

| Notes to the Consolidated Financial Statements (Unaudited) | F-5 |

Consolidated Balance Sheets

| | | May 31, 2010 | | | Aug. 31, 2010 | |

| | | (Unaudited) | | | | |

| Current Assets | | | | | | |

| Cash and cash equivalents | | $ | 351,997 | | | $ | 191,470 | |

| Accounts receivable, net | | | 335,380 | | | | 390,082 | |

| Prepaid expenses and other receivables | | | 45,061 | | | | 30,636 | |

| Total Current Assets | | | 732,438 | | | | 612,188 | |

| | | | | | | | | |

| Property, plant and equipment, net | | | 62,885 | | | | 31,474 | |

| Intangible assets & deferred charges | | | 516 | | | | 517 | |

| Total Assets | | $ | 795,839 | | | $ | 644,179 | |

| | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Payables and accrued liabilities | | $ | 17,206 | | | $ | 10,592 | |

| Dividend payable | | | - | | | | 289,203 | |

| Due to related parties (S/T) | | | 13,181 | | | | 13,176 | |

| Income taxes payable | | | 15,981 | | | | - | |

| Other taxes payable | | | 10,865 | | | | 5,500 | |

| Wages payable | | | 58,478 | | | | 72,178 | |

| Deferred tax liabilities | | | 63,441 | | | | 52,322 | |

| Loan facility | | | 26,008 | | | | - | |

| Total Current Liabilities | | | 205,160 | | | | 442,971 | |

| | | | | | | | | |

| | | | | | | | | |

| Total Liabilities | | $ | 205,160 | | | $ | 442,971 | |

| | | | | | | | | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | |

| Preferred stock, 100,000,000 shares authorized, $0.00001 par value; none issued and outstanding | | $ | - | | | $ | - | |

| Common stock, 300,000,000* and 600,000,000 shares authorized, $0.00001 par value;163,500,000* | | | | | | | | |

| and 219,000,000 issued and outstanding at August 31, 2009 and May 31, 2010, respectively | | | 2,190 | | | | 1,635 | |

| Additional paid in capital | | | 280,158 | | | | 106,713 | |

| Accumulated other comprehensive income | | | 12,150 | | | | 12,344 | |

| Retained earnings | | | 296,181 | | | | 80,516 | |

| Total Stockholders' Equity | | | 590,679 | | | | 201,208 | |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | $ | 795,839 | | | $ | 644,179 | |

*The amounts have been retroactively adjusted to reflect the three-for-one stock split in the form of 200% stock dividend effected April 29, 2010

The accompanying notes are an integral part of these financial statements.

Consolidated Statements of Operations

| | | For the Three Months Ended | | | For the Nine Months Ended | |

| | | May 31, | | | May 31, | |

| | | 2010 | | | 2009 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | |

| Revenue | | $ | 501,550 | | | $ | 324,249 | | | $ | 1,427,152 | | | $ | 868,876 | |

| Operating Costs and Expenses: | | | | | | | | | | | | | | | | |

| Selling expenses | | | 83,084 | | | | 116,416 | | | | 390,480 | | | | 248,457 | |

| A&G expenses | | | 190,418 | | | | 164,544 | | | | 781,114 | | | | 576,620 | |

| Depreciation of property, plant and equipment | | | 3,523 | | | | 3,637 | | | | 12,209 | | | | 11,170 | |

| Total operating costs and expenses | | | 277,025 | | | | 284,597 | | | | 1,183,803 | | | | 836,247 | |

| Income (Loss) From Operations | | | 224,525 | | | | 39,652 | | | | 243,349 | | | | 32,629 | |

| | | | | | | | | | | | | | | | | |

| Interest income | | | (136 | ) | | | (67 | ) | | | (528 | ) | | | (520 | ) |

| Interest expenses | | | 105 | | | | 252 | | | | 1,127 | | | | 275 | |

| | | | | | | | | | | | | | | | | |

| Income (Loss) Before Income Taxes | | | 224,556 | | | | 39,467 | | | | 242,750 | | | | 32,874 | |

| Income Tax Expense | | | | | | | | | | | | | | | | |

| Current | | | 4,527 | | | | 3,544 | | | | 27,085 | | | | 8,219 | |

| | | | | | | | | | | | | | | | | |

| Net Income (Loss) | | $ | 220,029 | | | | 35,923 | | | $ | 215,665 | | | $ | 24,655 | |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Income | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | (501 | ) | | | 586 | | | | (194 | ) | | | 738 | |

| Comprehensive Income | | $ | 219,528 | | | $ | 36,509 | | | $ | 215,471 | | | $ | 25,393 | |

| | | | | | | | | | | | | | | | | |

| Earnings Per Share, Basic and Diluted | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | | |

| Weighted Average Shares Outstanding, Basic and Diluted | | | 219,000,000 | | | | 163,500,000 | | | | 194,387,912 | | | | 163,500,000 | |

The accompanying notes are an integral part of these financial statements.

Consolidated Statements of Cash Flows

| | | For the Nine Months Ended | |

| | | May 31, | |

| | | 2010 | | | 2009 | |

| | | | | | | |

| Operating activities | | | | | | |

| Net Income | | $ | 215,665 | | | $ | 24,655 | |

| Adjustments to reconcile net loss to net cash | | | | | | | | |

| provided by (used in) operating activities: | | | | | | | | |

| Depreciation expense | | | 12,209 | | | | 11,170 | |

| Amortization of intangible assets | | | 1 | | | | 60 | |

| Common stock issued for services | | | 174,000 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable, net | | | 54,702 | | | | (159,061 | ) |

| Prepaid expenses and other receivables | | | (14,425 | ) | | | 107,558 | |

| Accounts payable and accrued liabilities | | | 14,260 | | | | (126,301 | ) |

| Deferred tax | | | 11,119 | | | | 8,210 | |

| Due to related parties | | | 5 | | | | (16,081 | ) |

| | | | | | | | | |

| Net cash provided by (used in) operating activities | | | 467,536 | | | | (149,790 | ) |

| Investing activities | | | | | | | | |

| Property, plant and equipment additions | | | (43,619 | ) | | | (6,086 | ) |

| | | | | | | | | |

| Net cash used in investing activities | | | (43,619 | ) | | | (6,086 | ) |

| Financing activities | | | | | | | | |

| Payment of dividend | | | (289,203 | ) | | | - | |

| Proceeds from borrowings on loan facility | | | 105,000 | | | | - | |

| Principal payments on loan facility | | | (78,992 | ) | | | - | |

| Net cash used in financing activities | | | (263,195 | ) | | | - | |

| | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | (195 | ) | | | 740 | |

| | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | 160,527 | | | | (155,136 | ) |

| | | | | | | | | |

| Cash and cash equivalents, beginning of year | | | 191,470 | | | | 297,808 | |

| | | | | | | | | |

| | | | | | | | | |

| Cash and cash equivalents, end of year | | $ | 351,997 | | | $ | 142,672 | |

| | | | | | | | | |

| Supplemental Disclosures | | | | | | | | |

| Interest paid | | $ | 1,127 | | | $ | 275 | |

| Income taxes paid | | $ | 11,433 | | | $ | - | |

The accompanying notes are an integral part of these financial statements.

Consolidated Statements of Stockholders' Equity

For the Nine Months Ended May 31, 2010 (Unaudited) and the Year Ended August 31, 2009

| | |

| | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | Additional Paid-In Capital | | | Accumulated Other Comprehensive Income | | | Accumulated Deficit | | | Total | |

| | | Shares | | | Par ($0.00001) | |

| Balance as of August 31, 2008 | | | 163,500,000 | | | $ | 1,635 | | | $ | 395,916 | | | $ | 11,810 | | | $ | (116,979 | ) | | $ | 292,382 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the year | | | | | | | | | | | | | | | | | | | 197,495 | | | | 197,495 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | | | | | | | | | | | | | 534 | | | | | | | | 534 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividend | | | | | | | | | | | (289,203 | ) | | | | | | | | | | | (289,203 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of August 31, 2009 | | | 163,500,000 | | | $ | 1,635 | | | $ | 106,713 | | | $ | 12,344 | | | $ | 80,516 | | | $ | 201,208 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Effect of reverse merger | | | 54,600,000 | | | | 546 | | | | (546 | ) | | | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares issued for services | | | 900,000 | | | | 9 | | | | 173,997 | | | | | | | | | | | | 174,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the nine months ending | | | | | | | | | | | | | | | | | | | 215,665 | | | | 215,665 | |

| Foreign currency translation adjustment | | | | | | | | | | | | | | | (194 | ) | | | | | | | (194 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of May 31, 2010 (unaudited) | | | 219,000,000 | | | $ | 2,190 | | | $ | 280,158 | | | $ | 12,150 | | | $ | 296,181 | | | $ | 590,679 | |

The accompanying notes are an integral part of these financial statements.

AMICO GAMES CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

May 31, 2010

NOTE 1 – ORGANIZATION, NATURE OF BUSINESS, and BASIS OF PRESENTATION

Organization and Nature of Business

The Company was incorporated under the name of Destiny Minerals Inc. on February 12, 2008 under the laws of the State of Nevada. On September 23, 2009, the Company filed an amendment to its articles of incorporation to change the name to Amico Games Corp. (“Amico Games” or “the Company”).

On December 31, 2009, the Company closed a reverse merger with Vodafun Limited (“Vodafun”). Vodafun has no other material operations except a series of contractual arrangements with Galaxy Software (Guangzhou) Limited (“Galaxy”), a private-owned company incorporated under the laws of the People’s Republic of China on November 15, 2001 with a registered capital of RMB 3,000,000 that was fully paid up.

On December 31, 2009, the Company closed the transactions contemplated by the Share Exchange Agreement and acquired Vodafun Limited (“Vodafun”), a company incorporated under the laws of British Virgin Islands on January 8, 2009, as its wholly owned subsidiary. Vodafun has entered into a series of contractual obligations with Galaxy Software (Guangzhou) Limited (“Galaxy”), a company incorporated under the laws of the People’s Republic of China (“China”) that is engaged in the business of developing and operating cellphone multiplayer games for the Chinese market, as well as the holders of 100% of the voting shares of Galaxy.

The Company’s relationship with Galaxy and its shareholders is governed by a series of contractual arrangements among Vodafun, Galaxy and the 100% holders of the share capital of Galaxy (the “Galaxy Shareholders”) entered on April 15, 2009. The contractual arrangements include Consulting Services Agreement, Business Operating Agreement, Equity Pledge Agreement, Exclusive Option Agreement, and Voting Right Proxy Agreement. Under the laws of China, the contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of China.

Galaxy is an information technology company primarily specialized in developing and operating cell phone multiplayer games in mainland China. Galaxy is a leading developer of cell phone games that are networked to serve a population of multiplayer users and delivered across JAVATM and WAP platforms over 3G and 2.5G mobile telecommunication network in China. Currently, Galaxy mainly distributes its mobile games on the QQ Game Platform in China and is developing its own game platform with as well as a separate platform with 3G compatibility.

Basis of Presentation

The accompanying consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s consolidated financial statements include the financial statements of Vodafun Limited and Galaxy Software (Guangzhou) Limited. All significant intercompany accounts and transactions have been eliminated in consolidation.

These interim unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information, and with the rules and regulations of the United States Securities and Exchange Commission to Form 10-Q and Article 10 of Regulation S-X. They do not include all of the information and footnotes required by generally accepted accounting principles for complete consolidated financial statements. Therefore, these consolidated financial statements should be read in conjunction with the Company’s audited financial statements and notes thereto for the year ended August 31, 2009 and notes thereto contained in the Report on Form 8-K of the Company as filed with the United States Securities and Exchange Commission (the “SEC”) on January 4, 2010.

The consolidated financial statements included herein are unaudited; however, they contain all normal recurring accruals and adjustments that, in the opinion of management, are necessary to present fairly the Company’s financial position at May 31, 2010 and 2009, and the results of its operations and cash flows for the nine month periods ended May 31, 2010 and 2009. The results of operations for the period ended May 31, 2010 are not necessarily indicative of the results to be expected for future quarters or the full year.

Galaxy is considered a variable interest entity (“VIE”), and Vodafun, the Company’s wholly owned subsidiary, is the primary beneficiary. The Company’s relationships with Galaxy and its shareholders are governed by a series of contractual arrangements between the Company and Galaxy, which is an operating company in the PRC. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. On April 15, 2009, Vodafun entered into the following contractual arrangements with Galaxy:

(1) Consulting Services Agreement. Pursuant to the consulting services agreement between Vodafun and Galaxy, dated April 15, 2009, Vodafun has the exclusive right to provide Galaxy with consulting services and daily operations, including general business operations in relation to the cell phone game development, human resources, research and development, and business growth, and support the daily operation costs and daily expenses. Galaxy pays an annual consulting service fee to Vodafun that is equal to 100% of Galaxy’s net revenue for such year, based on the annual financial statements. This agreement shall remain in force unless otherwise terminated. Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement. All intercompany transactions, including this service fee, have been eliminated in the consolidated financial statements presented.

(2) Business Operating Agreement. Pursuant to the business operating agreement among Vodafun and Galaxy, dated April 15, 2009, Vodafun provides Galaxy guidance and instruction on Galaxy’s daily operations, financial management and employment issues. Vodafun has the right to appoint or remove Galaxy’s directors and executive officers. In addition, Vodafun agrees to guarantee Galaxy’s performance under any agreements or arrangements relating to its business arrangement with any third party. Upon the request of Galaxy, Vodafun agrees to provide loans to support its operation’s capital requirements and to provide guarantee if the Company needs to apply for loans from a third party. In return, Galaxy agrees to pledge its accounts receivable and all of its assets to Vodafun. The term of this agreement is ten years; and may be extended or terminated only by 30-day prior written notice served by Vodafun (or its designated party). Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement.

(3) Equity Pledge Agreement. Under the equity pledge agreement between Vodafun and Galaxy, dated April 15, 2009, Galaxy’s 100% shareholders pledged all of their equity interests in Galaxy to Vodafun to guarantee its performance of its obligations under the Business Operating Agreement. If Galaxy or its shareholders breaches their respective contractual obligations, Vodafun, as Pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The 100% shareholders of Galaxy also agreed that upon occurrence of any event of default, Vodafun shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the 100% shareholders of Galaxy to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that Vodafun may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. The 100% shareholders of Galaxy agreed not to dispose of the pledged equity interests or take any actions that would prejudice Vodafun’s interest. This equity pledge agreement shall expire two years after Galaxy’s obligations under the Consulting Services Agreement have been fulfilled. Vodafun is entitled to assign to a wholly-owned subsidiary, if one were set up in the future, all the rights to the Company as stipulated in this agreement.

(4) Exclusive Option Agreement. Under the exclusive option agreement between Vodafun and Galaxy, dated on April 15, 2009, all the shareholders of Galaxy irrevocably granted to Vodafun (or its designated person) an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in Galaxy for the minimum amount of consideration permitted by applicable PRC law. Vodafun (or its designated person) has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years from April 15, 2009 and may be extended prior to its expiration by written agreement of the parties.

(5) Voting Right Proxy Agreement. Under the voting right proxy agreement between Vodafun and Galaxy, dated on April 15, 2009, all shareholders of Galaxy agreed to irrevocably grant Vodafun with the right to exercise the 100% shareholders of Galaxy’s voting rights and their other rights, including the attendance at and the voting of the all the shares held by 100% shareholders of Galaxy at shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and its Articles of Association, including but not limited to the rights to sell or transfer all or any of his equity interests of the Galaxy, and appoint and vote for the directors and Chairman as the authorized representative of the shareholders of the Galaxy. The proxy agreement may be terminated by joint consent of the parties or upon 30-day written notice from Vodafun.

The accounts of Galaxy are consolidated in the accompanying financial statements pursuant to generally accepted accounting standards pertaining to variable interest entities (“VIE”). As a VIE, Galaxy’s sales are included in the Company’s total sales, its income from operations is consolidated with the Company’s, and the Company’s net income includes all of Galaxy’s net income. The Company does not have any non-controlling interest and accordingly, did not subtract any net income in calculating the net income attributable to the Company. Because of the contractual arrangements, the Company had a pecuniary interest in Galaxy that requires consolidation of the Company’s and Galaxy’s financial statements.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as well as the reported amounts of revenues and expenses.. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Stock Split

On April 29, 2010, the Company effected a three-for-one stock split in the form of a 200% stock dividend of common stock to stockholders of record as of May 7, 2010. All share and per share information referred to in the consolidated financial statements has been retroactively adjusted to reflect the stock split.

Reclassifications

Certain amounts in the prior period financial statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported losses.

Subsequent Events

The Company has evaluated subsequent events through the date that the financial statements were issued, which was July 15, 2010, the date of the Company’s Quarterly Report on Form 10-Q for the period ended May 31, 2010.

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, cash on deposit with various financial institutions in the PRC, and all highly-liquid investments with original maturities of three months or less at the time of purchase. The Company did not have any cash equivalents as of May 31, 2010 and August 31, 2009.

Accounts Receivable

Accounts receivable are carried at original invoice amount less an estimate made for doubtful accounts based on a review of all outstanding amounts on a monthly basis. Management judgment and estimates are made in connection with establishing the allowance for doubtful accounts. Specifically, the Company analyzes the aging of accounts receivable balances, historical bad debts, customer concentrations, customer credit-worthiness, current economic trends and changes in our customer payment terms. Significant changes in customer concentration or payment terms, deterioration of customer credit-worthiness or weakening in economic trends could have a significant impact on the collectibility of receivables and the Company’s operating results. The company’s allowance for doubtful accounts is $0 at May 31, 2010 and August 31, 2009.

Property and Equipment

Property and equipment are recorded at cost and depreciated using the straight-line method, with an estimated 0% salvage value of original cost, over the estimated useful lives of the assets as follows:

| Office equipment | 5 years |

| Electronic equipment | 5 years |

| Furniture | 5 years |

| Automobiles | 5 years |

Expenditures for repairs and maintenance, which do not improve or extend the expected useful lives of the assets, are expensed as incurred while major replacements and improvements are capitalized.

When property or equipment is retired or disposed of, the cost and accumulated depreciation are removed from the accounts, with any resulting gains or losses being included in net income or loss in the year of disposition.

Intangible Assets and Long-Lived Assets

The Company has one category of intangible assets, application fee for the copyright of cell phone games, which is amortized using the straight-line method over approximately 10 years, which is the estimated economic life of the asset. The company evaluates long-lived assets for impairment annually.

Revenue Recognition

The Company generally recognizes revenue when its products are sold and splits the revenue earned with its partners that provide the platform for its software applications, the largest of which is Shenzhen Tencent Computer System Co., Ltd (“Tencent”). As of May 31, 2010, there were four cell phone games of the Company in operation, which are Miracle Journey to the West, Journey to the West Online, Fantasy Wulin, and Miracle Jiutian. These games are downloadable to the mobile hand set of the end users for free. Revenue is recognized when the end users purchase virtual in-game goods to enhance the competence of their game characters or send text messages to other game players. At the time of purchase of these virtual goods or the use of text messages, the following criteria of SAB 104 are met: 1) an arrangement exists, 2) the sales prices is fixed and determinable, 3) goods and services have been delivered, and 4) collectability is reasonably assured. At this point, the revenue earnings process is complete and revenue is recognized. There are no dual revenue components and their revenue process is complete and therefore no revenue deferral is necessary.

Comprehensive Income

The Company has adopted the standard issued by the FASB, Reporting Comprehensive Income, which establishes standards for reporting and displaying comprehensive income, its components, and accumulated balances in a full-set of general-purpose financial statements. Accumulated other comprehensive income represents the accumulated balance of foreign currency translation adjustments.

Foreign Currency Translation

The functional currency of the Company is the Renminbi (“RMB”), the PRC’s currency. The Company maintains its financial statements using the functional currency. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency at rates of exchange prevailing at the balance sheet dates. Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Exchange gains or losses arising from foreign currency transactions are included in the determination of net income (loss) for the respective periods.

For financial reporting purposes, the financial statements of the Company, which are prepared using the RMB, are translated into the Company’s reporting currency, United States Dollars. Balance sheet accounts are translated using the closing exchange rate in effect at the balance sheet date and income and expense accounts are translated using the average exchange rate prevailing during the reporting period. Adjustments resulting from the translation, if any, are included in accumulated other comprehensive income (loss) in stockholder’s equity.

The exchange rates for the balance sheets in effect at May 31 2010 and August 31, 2009 were RMB 1 for $0.146459 and $0.1464, respectively.The average rates used to convert income and expense for nine months ended May 31, 2010 and 2009 were RMB 1 for $0.146469 and $0.146308, respectively.

Stock Options and Similar Equity Instruments

The Company is required to recognize expense of options or similar equity instruments issued to employees using the fair-value-based method of accounting for stock-based payments in compliance with the standard issued by the FASB "Share-Based Payment". The standard covers a wide range of share-based compensation arrangements including share options, restricted share plans, performance-based awards, share appreciation rights, and employee share purchase plans. Application of this pronouncement requires significant judgment regarding the assumptions used in the selected option pricing model, including stock price volatility and employee exercise behavior. Most of these inputs are either highly dependent on the current economic environment at the date of grant or forward-looking over the expected term of the award. The Company does not have any instruments subject to compliance with this standard.

Income Taxes

The Company accounts for income taxes in accordance with the standard issued by the FASB, and related FASB interpretation . In accordance with this standard, deferred tax assets and liabilities are determined based on differences between the financial statement and tax basis of assets and liabilities and net operating loss and credit carryforwards using enacted tax rates in effect for the year in which the differences are expected to impact taxable income. A valuation allowance is established, when necessary, to reduce deferred tax assets to the amount that is more likely than not to be realized.

Earnings Per Share

The Company has adopted the provisions of standard issued by the FASB which provides for the calculation of basic and diluted earnings or loss per share. Basic loss per share includes no dilution and is computed by dividing income or loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted loss per share reflects the potential dilution of securities that could share in the earnings or losses of the entity. The Company does not have any potentially issuable shares. For the nine months ended May 31, 2010 and 2009, basic and diluted earnings (loss) per share are $0.00 and $0.00, respectively.

Fair Value of Financial Instruments

The Company adopted the standard issued by the FASB, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The carrying amounts reported in the balance sheets for cash, accounts receivable, loans payable, and accounts payable and accrued expenses, approximate their fair market value based on the short-term maturity of these instruments.

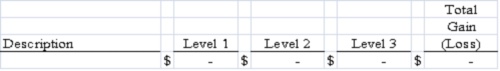

The following table presents assets and liabilities that are measured and recognized at fair value as of May 31, 2010 and August 31, 2009 on a non-recurring basis:

The standard issued by the FASB concerning the fair value option for financial assets and liabilities, became effective for the Company on January 1, 2008. The standard establishes a fair value option that permits entities to choose to measure eligible financial instruments and certain other items at fair value at specified election dates. A business entity shall report unrealized gains and losses on items for which the fair value options have been elected in earnings at each subsequent reporting date. For the periods ended May 31, 2010 and August 31, 2009, there were no applicable items on which the fair value option was elected.

Concentrations of Credit Risk

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC's economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

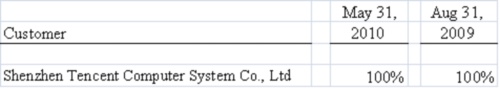

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash and trade accounts receivable. All of the Company’s cash is maintained with state-owned banks within the People’s Republic of China of which no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts. A significant portion of the Company's sales are credit sales which are primarily to customers whose ability to pay is dependent upon the industry economics prevailing in these areas. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk. Approximately all of the accounts receivable at May 31 2010 and August 31, 2009 consisted of amounts due from one customer-Shenzhen Tencent Computer System Co., Ltd. These amounts were $335,380 and $390,082, respectively.

Recent Accounting Pronouncements

In June 2009, the FASB issued a new standard regarding the accounting for transfers of financial assets amending the existing guidance on transfers of financial assets to, among other things, eliminate the qualifying special-purpose entity concept, include a new unit of account definition that must be met for transfers of portions of financial assets to be eligible for sale accounting, clarify and change the derecognition criteria for a transfer to be accounted for as a sale, and require significant additional disclosure. For the Company, this standard is effective for new transfers of financial assets beginning September 1, 2010. Because the Company historically does not have significant transfers of financial assets, the adoption of this standard is not expected to have a material impact on the Company’s consolidated results of operations or financial condition.

In June 2009, the FASB issued a new standard that revises the consolidation guidance for variable-interest entities. The modifications include the elimination of the exemption for qualifying special purpose entities, a new approach for determining who should consolidate a variable-interest entity, and changes to when it is necessary to reassess who should consolidate a variable-interest entity. For the Company, this standard was effective September 1, 2010. The adoption of this standard is not expected to have a material impact on the Company’s consolidated results of operations or financial condition.

In October 2009, the FASB issued ASU No. 2009-13, “Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force,” that provides amendments to the criteria for separating consideration in multiple-deliverable arrangements. As a result of these amendments, multiple-deliverable revenue arrangements will be separated in more circumstances than under existing U.S. GAAP. The ASU does this by establishing a selling price hierarchy for determining the selling price of a deliverable. The selling price used for each deliverable will be based on vendor-specific objective evidence if available, third-party evidence if vendor-specific objective evidence is not available, or estimated selling price if neither vendor-specific objective evidence nor third-party evidence is available. A vendor will be required to determine its best estimate of selling price in a manner that is consistent with that used to determine the price to sell the deliverable on a standalone basis. This ASU also eliminates the residual method of allocation and will require that arrangement consideration be allocated at the inception of the arrangement to all deliverables using the relative selling price method, which allocates any discount in the overall arrangement proportionally to each deliverable based on its relative selling price. Expanded disclosures of qualitative and quantitative information regarding the application of the multiple-deliverable revenue arrangement guidance are also required under the ASU. The ASU does not apply to arrangements for which industry specific allocation and measurement guidance exists, such as long-term construction contracts and software transactions. For the Company, ASU No. 2009-13 is effective beginning September 1, 2010. The Company may elect to adopt the provisions prospectively to new or materially modified arrangements beginning on the effective date or retrospectively for all periods presented. The Company is currently evaluating the impact of this standard on its Company’s consolidated results of operations and financial condition.

In October 2009, the FASB issued ASU No. 2009-14, “Certain Revenue Arrangements That Include Software Elements—a consensus of the FASB Emerging Issues Task Force,” that reduces the types of transactions that fall within the current scope of software revenue recognition guidance. Existing software revenue recognition guidance requires that its provisions be applied to an entire arrangement when the sale of any products or services containing or utilizing software is considered more than incidental to the product or service. As a result of the amendments included in ASU No. 2009-14, many tangible products and services that rely on software will be accounted for under the multiple-element arrangements revenue recognition guidance rather than under the software revenue recognition guidance. Under the ASU, the following components would be excluded from the scope of software revenue recognition guidance: the tangible element of the product, software products bundled with tangible products where the software components and non-software components function together to deliver the product’s essential functionality, and undelivered components that relate to software that is essential to the tangible product’s functionality. The ASU also provides guidance on how to allocate transaction consideration when an arrangement contains both deliverables within the scope of software revenue guidance (software deliverables) and deliverables not within the scope of that guidance (non-software deliverables). For the Company, ASU No. 2009-14 is effective beginning September 1, 2010. The Company is currently evaluating the impact of this standard on the its consolidated results of operations and financial condition.

In January 2010, the FASB issued ASU No. 2010-6, “Improving Disclosures About Fair Value Measurements”, that amends existing disclosure requirements under ASC 820 by adding required disclosures about items transferring into and out of Levels 1 and 2 in the fair value hierarchy; adding separate disclosures about purchases, sales, issuances, and settlements relative to Level 3 measurements; and clarifying, among other things, the existing fair value disclosures about the level of disaggregation. For the Company, this ASU is effective beginning September 1, 2010, except for the requirement to provide Level 3 activity of purchases, sales, issuances, and settlements on a gross basis, which is effective beginning September 1, 2011. Since this standard impacts disclosure requirements only, its adoption will not have a material impact on the Company’s consolidated results of operations or financial condition.

In March 2010, the FASB ratified a consensus of the FASB Emerging Issues Task Force that recognizes the milestone method as an acceptable revenue recognition method for substantive milestones in research or development arrangements. This consensus would require its provisions be met in order for an entity to recognize consideration that is contingent upon achievement of a substantive milestone as revenue in its entirety in the period in which the milestone is achieved. In addition, this consensus would require disclosure of certain information with respect to arrangements that contain milestones. For the Company, this guidance would be required prospectively beginning September 1, 2010. The Company is currently evaluating the impact of this consensus on its consolidated results of operations and financial condition.

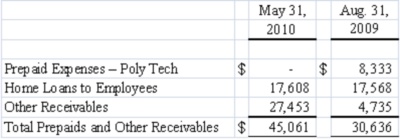

NOTE 3 – PREPAID EXPENSES AND OTHER RECEIVABLES

Prepaid expenses and other receivables totaled $45,061 and $30,636 as of May 31, 2010 and August 31, 2009, respectively, as follows:

The balances paid to Poly Tech were for consulting services provided the following fiscal year.

The loans made to employees were done as additional incentive for performance. The employee was allowed to use the loan for a down payment on a home. The loans are to be repaid in one year from the date of issuance and are non-interest bearing.

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consist of the following:

NOTE 5 – PAYABLES AND ACCRUED LIABILITIES

Payables and accrued liabilities totaled $17,026 and $10,592 as of May 31, 2010 and August 31, 2009. These accounts consist primarily of payables for consulting expenses incurred by the Company.

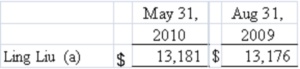

NOTE 6 – DUE TO RELATED PARTIES

Due to related parties consists of the following:

(a) Company’s shareholder.

The amount due to related parties represents loans payable that are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. The loans from related parties are to meet the Company’s operational needs. The Company has not recorded any imputed interest on the balances, as any amounts would be immaterial to the consolidated financial statements as of May 31, 2010 and August 31, 2009.

NOTE 7 – LOAN FACILITY

On October 7, 2009, the Company entered into an agreement whereby it has access to a $150,000 loan facility. Under the terms of the loan facility, any amounts borrowed would be due within 6 months of the original date of the agreement. The due date is April 7, 2010. The loan facility is non-interest bearing, except in the event of default, in which an interest rate of 9% per annum will be charged until the loan is repaid. The loan is currently past due, the Company imputed $351 interest for the nine months end May 31, 2010. The balance due under the loan facility as of May 31, 2010 is $26,008.

NOTE 8 – LEGAL PROCEEDINGS

There are no material legal proceedings pending against the Company.

NOTE 9 – CUSTOMER CONCENTRATIONS

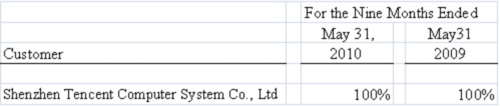

The Company’s accounts receivable by customer are as follows:

The Company’s revenue by customer are as follows:

NOTE 10 – BUSINESS COMBINATION

On December 31, 2009, the Company merged with Vodafun Limited (“Vodafun”). Pursuant to a Share Exchange Agreement, the Company issued 54,500,000 shares of common stock in exchange for all of the outstanding common stock of Vodafun (100 shares).

For accounting purposes, the merger has been treated as a recapitalization of the Company by Vodafun. Accordingly, the financial results presented for all periods prior to the merger date are those of Vodafun. This evaluation was conducted pursuant to generally accepted accounting standards as the former Vodafun shareholder has majority control of the Company subsequent to the merger through majority voting interest, controls the majority of the board of directors, and controls the majority of all management decisions. The Company spun off all assets and liabilities prior to the reverse merger. Vodafun’s equity structure has been restated to adopt the equity structure of the Company. As of the merger date, the financial statements include the combined operating results, assets and liabilities of the Company and Vodafun. As a result of the Company not having any assets at the time of the merger, purchase accounting does not apply. On the date of the merger, the Company was not a business, and there is no step up in basis required. Since the Company was inactive prior to the merger, it is not expected to constitute a significant part of the ongoing business of the combined company.

Forward Looking Statements

This quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including "could", "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report.

Reverse Merger

On December 31, 2009, we merged with Vodafun Limited (“Vodafun”). Pursuant to a Share Exchange Agreement, we issued 54,500,000 shares of common stock in exchange for all of the outstanding common stock of Vodafun (100 shares).

For accounting purposes, the merger has been treated as a recapitalization of us by Vodafun. Accordingly, the financial results presented for all periods prior to the merger date are those of Vodafun. This evaluation was conducted pursuant to generally accepted accounting standards as the former Vodafun shareholder has majority control of us subsequent to the merger through majority voting interest, controls the majority of the board of directors, and controls the majority of all management decisions. We spun off all assets and liabilities prior to the reverse merger. Vodafun’s equity structure has been restated to adopt our equity structure. As of the merger date, the financial statements include the combined operating results, assets and liabilities of us and Vodafun. As a result of us not having any assets at the time of the merger, purchase accounting does not apply. On the date of the merger, we were not a business, and there is no step up in basis required. Since we were inactive prior to the merger, it is not expected to constitute a significant part of the ongoing business of the combined company.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Overview

We primarily distribute our mobile phone games on the QQ Game Platform: China’s largest mobile game operation platform established by Shenzhen Tencent Computer System Co., Ltd (“Tencent”). We currently have three mobile phones operated on the QQ Game Platform: Miracle Journey to the West, Fantasy Wulin and Journey to the West Online. The WAP game Fantasy Wulin was launched in August 2008, and began to charge subscriber fees in 2009. The JAVA game Journey to the West Online was launched in May 2009 and began to charge subscriber fees afterward. Our high-quality and diversified products contributed to rapid increase of in-game consumption on QQ Game Platform.

| | | For the Nine months Ended May 31, | |

| | | 2010 | | | 2009 | | | Difference | | | Increase | |

| | | ($) | | | ($) | | | ($) | | | % | |

| Total In-game Consumption | | | 5,221,636 | | | | 3,131,772 | | | | 2,089,864 | | | | 67 | % |

| Miracle Journey to the West | | | 2,725,374 | | | | 3,045,371 | | | | -319,997 | | | | -11 | % |

| Fantasy Wulin | | | 363,175 | | | | 65,571 | | | | 297,604 | | | | 454 | % |

| Journey to the West Online | | | 2,133,086 | | | | 20,829 | | | | 2,112,257 | | | | 10141 | % |

We do plan on expanding our operations by developing additional game platforms under our independent control:

| ● | Self-Operation Game Platform. We have established a development team to develop our own game operation platform in 2009. The self-operation platform allow us to directly distribute and operate our mobile phone games, as well as provide payment channels to game users for payment. In March of 2010, we reached agreement with two of China’s largest third-party payment channels, YeePay and 19Pay, to support third-party payment channel for our mobile games. We plan to reduce our reliance on QQ Platform and generate more profit by developing its own game operation platform. |

| ● | 3G Game Platform. We plan to develop 3G game platform by cooperating with Chinese telecommunication operators. Since 2009, China Telecom and China Unicom, the largest two Chinese telecommunication operators, have been popularizing the 3G mobile network and promoting the popularity of 3G mobile phones in China. We have developed applications for the 3G network and are now in negotiations with China Telecom and China Unicom to distribute our mobile games in their 3G mobiles. |

Results of Operations

Our results of operations are summarized below:

| | | Three Months Ended May 31, 2010 ($) | | | Three Months Ended May 31, 2009 ($) | | | Nine Months Ended May 31, 2010 ($) | | | Nine Months Ended May 31, 2009 ($) | |

| Revenue | | | 501,550 | | | | 324,249 | | | | 1,427,152 | | | | 868,876 | |

| Expenses | | | 277,025 | | | | 284,597 | | | | 1,183,803 | | | | 836,247 | |

| Net Income from Operations | | | 220,029 | | | | 35,923 | | | | 215,665 | | | | 24,655 | |

| Earnings (Loss) Per Share | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Weighted Average Number Shares Outstanding | | | 219,000,000 | | | | 163,500,000 | | | | 194,387,912 | | | | 163,500,000 | |

Results of Operations for the three months ended May 31, 2010

| | | For the Three Months Ended May 31, | |

| | | 2010 | | | 2009 | | | Difference | | | Increase | |

| | | ($) | | | ($) | | | ($) | | | % | |

| Total Revenue | | | 501,550 | | | | 324,249 | | | | 177,301 | | | | 55 | % |

| Miracle Journey to the West | | | 262,852 | | | | 304,368 | | | | -41,516 | | | | -14 | % |

| Fantasy Wulin | | | 25,599 | | | | 15,068 | | | | 10,531 | | | | 70 | % |

| Journey to the West Online | | | 213,099 | | | | 4813 | | | | 208,286 | | | | 4328 | % |

During the three months ended May 31, 2010, we earned revenue of $501,500 compared to $324,249 during the same period in 2009. The revenues were generated through sales of our mobile phone games; an increase of 55%, which is primarily attributed to the sales revenue generated by our newly launched K-JAVA mobile game: Journey to the West Online.

| | | For the Three Months Ended February 28, | |

| | | 2010 | | | 2009 | | | Difference | |

| | | ($) | | | ($) | | | ($) | |

| Expenses | | | 277,025 | | | | 284,597 | | | | (7,572 | ) |

| Selling expenses | | | 83,084 | | | | 116,416 | | | | (33,332 | ) |

| A&G expenses | | | 190,418 | | | | 164,544 | | | | 25,874 | |

| Depreciation of property, plant and equipment | | | 3,523 | | | | 3,637 | | | | (114 | ) |

For the three months ended May 31, 2010 we registered a net income of $220,029. During the same period in 2009 we realized a net income of $35,923. Our expenses during the three month period ended May 31, 2010 consisted of $190,418 in general and administrative expenses, $83,084 in selling expenses, and $3,523 in depreciation. Comparatively, our expenses during the three month period ended May 31, 2009 consisted of $164,544 in general and administrative expenses, $116,416 in selling expenses, and $3,637 in depreciation. The decrease in expenses was mostly due to the decrease in marketing expenses.

Our earnings per share during the three months ended May 31, 2010 was $0.00 compared to $0.00 during the same period in 2009.

Our general and administrative expenses consist of professional fees, management fees, transfer agent fees, consulting fees, investor relations expenses and general office expenses, legal, accounting and auditing fees, and our general office expenses include bank charges, office maintenance, communication expenses, courier, postage, office supplies and rent.

Results of Operations for the Nine months Ended May 31, 2010 and 2009

| | | For the Nine months Ended May 31, | |

| | | 2010 | | | 2009 | | | Difference | | | Increase | |

| | | ($) | | | ($) | | | ($) | | | % | |

| Total Revenue | | | 1,427,152 | | | | 868,876 | | | | 558,276 | | | | 64 | % |

| Miracle Journey to the West | | | 829809 | | | | 848,697 | | | | -18,888 | | | | -2 | % |

| Fantasy Wulin | | | 88497 | | | | 15,366 | | | | 73,131 | | | | 476 | % |

| Journey to the West Online | | | 508846 | | | | 4,813 | | | | 504,033 | | | | 10472 | % |

During the nine months ended May 31, 2010, we earned revenue of $1,427,152 compared to $868,876 during the same period in 2009; an increase of 64%, which is primarily attributed to the sales revenue generated by our newly launched K-JAVA mobile game: Journey to the West Online.

| | | For the Nine months Ended May 31, | |

| | | 2010 | | | 2009 | | | Difference | |

| | | ($) | | | ($) | | | ($) | |

| Expenses | | | 1,183,803 | | | | 836,247 | | | | 347,556 | |

| Selling expenses | | | 390,480 | | | | 248,457 | | | | 142,023 | |

| A&G expenses: | | | 781,114 | | | | 576,620 | | | | 204,494 | |

| Depreciation of property, plant and equipment | | | 12,209 | | | | 11,170 | | | | 1,039 | |

For the nine months ended May 31, 2010 we registered net income from operations of $215,665. During the same period in 2009 we realized a net income of $24,655. Our expenses during the nine month period ended May 31, 2010 consisted of $781,114 in general and administrative expenses, $390,480 in selling expenses, and $12,209 in depreciation. Comparatively, our expenses during the nine month period ended May 31, 2009 consisted of $576,620 in general and administrative expenses, $248,457 in selling expenses, and $11,170 in depreciation. The increase in expenses during the nine month period ended May 31, 2010 was mostly due to an increase in professional fees which consisted primarily of stock based compensation of 300,000 shares, or $174,000.

Our earnings per share during the nine months ended May 31, 2010 was $0.00 compared to $0.00 during the same period in 2009.

Liquidity and Capital Resources

As of May 31, 2010 we had cash of $351,997 in our bank accounts and a working capital surplus of $527,278.

For the nine months ended May 31, 2010, we had net cash of $467,536 provided by operating activities, compared to net cash of $149,790 spent on operating activities during the same period in 2009. The increase of the cash provided by operating activities for the nine months ended May 31, 2010 was primarily due to net income increased by $191,010, and non-cash expenses of $174,000 for common stock issued service.

During the nine months ended May 31, 2010, we spent $43,619 on investing activities compared to $6,086 spent during the same period in 2009. These amounts were spent on purchases of equipment.

During the nine months ended May 31, 2010, we spent net cash of $263,195 on financing activities, compared to no cash received during the same period in fiscal 2009. The cash spent in 2010 consisted of a dividend of $289,203 being paid out, proceeds from borrowings on loan facility of $105,000 and principal payments on loan facility of $78,992

Our cash level increased by $160,527 during the nine months ended May 31, 2010.

We anticipate that we will meet our ongoing cash requirements by retaining income as well as through equity or debt financing. We plan to cooperate with various individuals and institutions to acquire the financing required to produce and distribute our products and anticipate this will continue until we accrue sufficient capital reserves to finance all of our productions independently.

We estimate that our expenses over the next 12 months will be approximately $2,150,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Description | Estimated Completion Date | Estimated Expenses ($) |

| Legal and accounting fees | 12 months | 150,000 |

| Selling expenses | 12 months | 500,000 |

| Investor relations and capital raising | 12 months | 100,000 |

| Salaries and consulting fees | 12 months | 200,000 |

| Fixed asset purchases | 12 months | 300,000 |

| General and administrative expenses | 12 months | 900,000 |

| Total | | 2,150,000 |

We intend to meet our cash requirements for the next 12 months through a combination of retained earnings, debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement financings. If we are not able to successfully complete any private placement financings, we plan to cooperate with film and television producers or obtain shareholder loans to meet our cash requirements. However, there is no assurance that any such financing will be available or if available, on terms that will be acceptable to us.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Inflation

The amounts presented in the financial statements do not provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than reported if the effects of inflation were reflected either by charging operations with amounts that represent replacement costs or by using other inflation adjustments.

Audit Committee

The functions of the audit committee are currently carried out by our Board of Directors, who has determined that we do not have an audit committee financial expert on our Board of Directors to carry out the duties of the audit committee. The Board of Directors has determined that the cost of hiring a financial expert to act as a director and to be a member of the audit committee or otherwise perform audit committee functions outweighs the benefits of having a financial expert on the audit committee.

Critical Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as well as the reported amounts of revenues and expenses. Actual results could differ from these estimates.

Revenue Recognition

We generally recognize revenue when our products are sold and split the revenue earned with our partners that provide the platform for our software applications, the largest of which is Shenzhen Tencent Computer System Co., Ltd (“Tencent”). As of May 31, 2010, there were four cell phone games of the Company in operation, which are Miracle Journey to the West, Journey to the West Online, Fantasy Wulin, and Miracle Jiutian. These games are downloadable to the mobile hand set of the end users for free. Revenue is recognized when the end users purchase virtual in-game goods to enhance the competence of their game characters or send text messages to other game players. At the time of purchase of these virtual goods or the use of text messages, the following criteria of SAB 104 are met: 1) an arrangement exists, 2) the sales prices is fixed and determinable, 3) goods and services have been delivered, and 4) collectability is reasonably assured. At this point, the revenue earnings process is complete and revenue is recognized. There are no dual revenue components and their revenue process is complete and therefore no revenue deferral is necessary.

Earnings Per Share

We have adopted the provisions of standard issued by the FASB which provides for the calculation of basic and diluted earnings or loss per share. Basic loss per share includes no dilution and is computed by dividing income or loss available to common stockholders by the weighted average number of common shares outstanding for the period. Diluted loss per share reflects the potential dilution of securities that could share in the earnings or losses of the entity. We do not have any potentially issuable shares. For the nine months ended May 31, 2010 and 2009, basic and diluted earning (loss) per share are $0.00 and $0.00, respectively.

Not applicable.

Disclosure Controls

We carried out an evaluation, under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)). Based upon that evaluation, our principal executive officer and principal financial officer concluded that, as of the end of the period covered in this report, our disclosure controls and procedures were not effective at ensuring that information required to be disclosed in reports filed under the Securities and Exchange Act of 1934 is recorded, processed, summarized and reported within the required time periods and is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. This determination was a result of our external auditor needing to post adjustments to our financial statements.

Our management, including our principal executive officer and principal financial officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error or fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. We performed additional analysis and other post-closing procedures in an effort to ensure our consolidated financial statements included in this quarterly report have been prepared in accordance with generally accepted accounting principles. Accordingly, management believes that the financial statements included in this report fairly present in all material respects our financial condition, results of operations and cash flows for the periods presented.

Changes in Internal Control

There were no changes in our internal control over financial reporting (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act) during the quarterly period covered by this report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

We are not aware of any legal proceedings to which we are a party or of which our property is the subject. None of our directors, officers, affiliates, any owner of record or beneficially of more than 5% of our voting securities, or any associate of any such director, officer, affiliate or security holder are (i) a party adverse to us in any legal proceedings, or (ii) have a material interest adverse to us in any legal proceedings. We are not aware of any other legal proceedings that have been threatened against us.

None.

None.

None.

| Exhibit Number | Exhibit Description |

| |

| |

| |

| |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | AMICO GAMES CORP. |

| | (Registrant) |

| | |

| Date: July 15, 2010 | /s/Peter Liu |

| | Peter Liu |

| | President, Chief Executive Officer |

| | (Principal Executive Officer) |

| | |

| Date: July 15, 2010 | /s/Wing Kuen Ha |

| | Wing Kuen Ha |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

10