Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-34088

Brink’s Home Security Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Virginia | 80-0188977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

8880 Esters Boulevard, Irving, TX 75063

(Address of principal executive offices)

(Zip Code)

(972) 871-3500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

| Common Stock, no par value | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2008, the Registrant’s common stock was not publicly traded.

As of March 26, 2009, there were issued and outstanding 45,769,171 shares of common stock.

Documents incorporated by reference: Part III incorporates information by reference from portions of the Registrant’s definitive 2009 Proxy Statement to be filed pursuant to Regulation 14A.

Table of Contents

BRINK’S HOME SECURITY HOLDINGS, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2008

TABLE OF CONTENTS

Table of Contents

| ITEM 1. | BUSINESS |

Overview

Brink’s Home Security Holdings, Inc., which was incorporated in Virginia in 2008, is a full service provider of residential and business security systems. We conduct business in one operating segment primarily through our operating subsidiary, Brink’s Home Security, Inc. (“Brink’s Home Security”), which markets, installs, services, and monitors security alarm systems throughout North America. We operate in more than 250 metropolitan areas and serve over 1.3 million customers in all 50 states and two Canadian provinces. We have developed a reputation for reliability and superior service by making high quality and affordable monitored alarm systems widely available to homeowners and businesses. We believe we are the second largest provider of security alarm monitoring services for residential and commercial properties in North America.

Brink’s Home Security was incorporated in Delaware in 1983 as a wholly owned subsidiary of The Brink’s Company (“BCO”) to address the growing home security market. Brink’s Home Security became a wholly-owned subsidiary of Holdings upon completion of the Spin-off transaction described below. As used in this Report, (a) references to “Holdings,” “Company,” “we,” “us” and “our” refer to Brink’s Home Security Holdings, Inc. and its consolidated subsidiaries, including Brink’s Home Security, after the Spin-off, and (b) references to the “Company” on a historical basis, prior to the Spin-off, refer to Brink’s Home Security and its consolidated subsidiaries, in each case unless the context requires otherwise.

The Spin-off

On September 12, 2008, the Board of Directors of BCO approved the separation of BCO into two independent, publicly traded companies through the distribution of 100% of the common stock of Brink’s Home Security, a wholly-owned subsidiary of BCO, to shareholders of BCO (the “Spin-off”). To effect the Spin-off, BCO transferred all outstanding shares of Brink’s Home Security to Holdings, another wholly owned subsidiary of BCO, through a series of transactions pursuant to a Separation and Distribution Agreement between BCO and Holdings. On October 31, 2008, BCO distributed all of the shares of Holdings to the stockholders of BCO at a ratio of one share of Holdings common stock for each share of BCO common stock held by each such holder as of the record date of October 21, 2008.

In connection with the Spin-off, the following key transactions or events occurred:

| • | Our Registration Statement on Form 10 was declared effective by the U.S. Securities and Exchange Commission on October 8, 2008. |

| • | BCO received a private letter ruling from the Internal Revenue Service and an opinion of counsel that the distribution of Holdings’ common stock qualified as a tax-free distribution for U.S. Federal income tax purposes. |

| • | On October 21, 2008, Holdings entered into a $75 million unsecured credit facility, with an option to increase to $125 million under certain conditions. |

| • | BCO contributed $50 million in cash to us on October 31, 2008, and all intercompany balances were forgiven. |

| • | BCO retained all assets and liabilities related to the qualified and non-qualified BCO defined benefit pension plans, and agreed to make all required payments under such plans to our current and former employees; |

| • | BCO agreed to indemnify us for any and all liabilities and expenses related to BCO’s former coal operations, including any health care coverage obligations. BCO also agreed to indemnify us for certain tax liabilities incurred prior to Spin-off. |

1

Table of Contents

| • | We entered into a Brand Licensing Agreement with a subsidiary of BCO. Under the agreement, we are entitled to use the Brink’s brand name and logos for no more than three years from the Spin-off date. Under the agreement, our licensing fees decreased to 1.25% of net revenues from the approximate 7% historical rate, and provided for BCO to acquire from us the third party licensing agreements that had historically contributed royalty income to us. |

| • | We entered into various other agreements with BCO, including a Non-Competition and Non-Solicitation Agreement, pursuant to which BCO agreed not to compete with us in the United States, Canada and Puerto Rico with respect to certain specified activities for a period of five years from the Spin-off date. |

On November 3, 2008, after completion of the Spin-off, we began trading “regular way” as an independent public company on the New York Stock Exchange under the symbol “CFL”, reflecting our corporate mission of creating “Customers For Life”.

Business Fundamentals

We serve a geographically diverse customer base of over 1.3 million subscribers located throughout the United States and Western Canada. Our primary customers are residents of single-family homes, which comprise more than 90% of our subscriber base. The majority of new customers is generated organically through our internal sales force, while the remainder is acquired through our authorized dealer program and through partnerships with leading home builders.

We view our business as having two key activities: managing our existing customer base and acquiring new customers. We operate our business with the goal of retaining customers for long periods of time to recoup the initial investment in new subscribers, achieving cash flow break-even in approximately four years. Management of the existing subscriber base is focused on low customer attrition, or customer disconnect rate, which has ranged from 6.4% to 7.5% annually over the past three years.

The predictability of our revenues has enabled us to generate stable cash flow from operations, a substantial portion of which is reinvested each year, at our discretion, to grow the subscriber base. Our ending subscriber base grew 6.3% in 2008, as compared to an 8.8% growth in 2007. Growing the subscriber base requires significant upfront cash investment, consisting primarily of direct materials and labor to install the security systems, direct sales costs, indirect sales costs, marketing costs, and administrative costs related to installation activities. For the last few years, our average total upfront cash outlay for a new customer security system installed by one of our field offices, including amounts expensed and capitalized, has ranged from approximately $1,350 to $1,550. This amount does not take into account upfront installation fees collected from customers, which, on average, have ranged from $300 to $350. Including these payments, our net cash cost per new installation in recent periods has ranged from $1,100 to $1,250. The economics of our installation business varies slightly depending on the customer acquisition channel.

On average, each of our existing 1.3 million subscribers pays us more than $31 per month in recurring cash revenue. We use the cash margin generated on that revenue to offset the initial investment made in new subscribers. Our focus on keeping customer disconnect rates low is fundamental to the success of our economic model.

See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information regarding monthly recurring revenue, subscriber growth, disconnect rates, and EBITDA from recurring services over the past three years

Marketing and Sales

To grow the subscriber base and to create brand awareness, we market our security systems through national television advertisements, internet advertising, yellow pages, direct mail, alliances with other consumer-based

2

Table of Contents

companies, inbound telemarketing, and sales specialists in both Company field offices and our dealer network. Our “direct response” marketing efforts are designed to generate and direct telephone calls and internet traffic into our centralized inbound telemarketing sales group. In addition, on a localized basis, we participate in many different types of local events to promote our services to prospective customers, including home shows, family expos, retail events, and various industry trade shows and meetings.

Sales are generally closed over the phone by the centralized sales group or by field sales personnel during on-site consultations with prospective customers. Our reliance on strict standards for our internal sales force and our dealers enables us to better control the sales process from inception to installation and manage the quality of customer service over the life of the contract. Other sales distribution channels include:

| • | our field sales force, which self-generates additional sales from prospective residential and commercial customers; |

| • | our authorized dealer network, which cost-effectively extends our reach into new geographic areas by aligning with select independent security installers; |

| • | strategic alliances with other service companies, including home inspection firms, which target new home owners early in the home buying process; |

| • | our Brink’s Home Technologies (“BHT”) division. BHT, which partners with large national and regional homebuilders to install home security systems, as well as home networking, communications, and home theater and entertainment systems, directly for the owners of new homes and homes under construction; and |

| • | our national account team, which generates sales from commercial clients with multiple locations. |

Although our business is concentrated in residential security, we also market and sell security systems and monitoring services to the commercial market. We believe that expansion of our commercial customer base is a significant growth opportunity for us. Commercial security customers represented approximately 5% of our total customer base as of December 31, 2008. We are continuing to develop additional capabilities and geographic reach in commercial security. During 2008, commercial installation volume grew by 7%, representing approximately 9% of new customer installations.

Services and Products

Monitoring services are generally governed by our standard Protective Service Agreement. Under this agreement, the customer pays the initial installation fees and is then obligated to make monthly payments for the remainder of the initial contract term. The standard term for our Protective Service Agreement is three years, which automatically renews for additional one year periods unless cancelled by either party, except in six states where state law requires the renewal period to be month-to-month. If a customer attempts to cancel the contract prior to the end of the initial or roll-over contract term or is otherwise in default, we have the right under the contract to receive from the customer an amount equal to all remaining monthly payments.

Monitoring services are generally billed monthly in advance. Approximately 45% of our subscribers pay us through automated payment methods. We periodically adjust the standard monthly monitoring rate charged to new subscribers. From time to time, we also may adjust the monthly rates of our existing subscribers who have completed their initial contract terms.

In addition to monitoring service, we provide technical service to our subscriber base for routine maintenance as well as installation of additional equipment. More than half of the subscriber base is enrolled in a service plan which generates recurring monthly revenues. Service contracts comprise the majority of service revenue, with on-call service fees constituting the balance of service revenue.

Generally, we retain ownership of the security equipment used in our monitoring services. However, certain products, installed primarily through our BHT and commercial distribution channels, may be sold directly to the

3

Table of Contents

customer. These products include video surveillance equipment, access control, commercial fire alarm systems, wiring for home communications networks, home theater systems, intercom, multi-room sound systems and some security systems.

We select, install and service high quality security products. Our customized control panel is manufactured by a third party to our rigorous specifications. This enhanced control panel and its family of related peripheral components are capable of supporting the vast majority of residential applications and a significant number of commercial applications. We offer a wide variety of high quality detection sensors which communicate with our control panel. These include motion detectors, glass break detectors, perimeter door and window sensors, and smoke and carbon monoxide detectors.

The majority of our subscribers use standard land-line telephone service as the primary communication method for alarm signals from their sites. However, the capability to provide alternative methods of communication of signals from subscribers’ control panels to our central monitoring stations has become increasingly important. We currently offer a variety of wireless alarm communication methods including cellular, digital radio, broadband internet , and voice over internal protocol.

Field Operations

We currently operate 68 field offices located throughout the United States and western Canada, from which locations we provide services for pre-defined ZIP code-based territories including sales calls, security system installations, and field service and repair. Our technical staff of approximately 1,100 technicians provides installation and service support from our field office locations. We have approximately 600 field sales consultants, each of whom completes comprehensive centralized training prior to conducting customer sales presentations. We staff our field offices to efficiently and effectively make sales calls, install security systems, and provide service support based on near-term activity forecasts for each market.

Dealer Network

To expand our geographic coverage and leverage our national advertising, we have an extensive dealer network, which consists of approximately 170 authorized dealers operating in 47 states. In 2008, our dealer network accounted for 21% of new customer installations and 13% of the total subscriber base. Authorized dealers are generally required to adhere to the same high quality standards for both installation and service support as Company-owned field offices.

We provide dealers with a full range of services designed to assist them in all aspects of their business including forwarding sales opportunities, sales and technician training, detailed weekly account summaries, sales support materials, and discounts on security system hardware and installation supplies purchased through our third-party distributor.

We purchase newly installed security systems and related monitoring contracts from our dealers. We conduct thorough due diligence on each dealer to ensure reliability and consistent high quality installations. Subscribers secured by our dealers are geographically diverse and are primarily single-family homeowners. In 2008, 9% of dealer installations were in commercial businesses.

Typically, we have a right of first refusal to purchase sites and related customer relationships sold by authorized dealers, but are not obligated to acquire these sites. Subscriber contracts typically have an initial term of three years and automatically renew on an annual basis. If a contract is canceled during an initial guarantee period, the dealer is required to reactivate the site and contract, or refund the purchase price. To help ensure the dealers’ obligations, we typically withhold a portion of the purchase price for each site.

4

Table of Contents

Monitoring Facilities and Services

Our two monitoring facilities are located in Irving, Texas, and Knoxville, Tennessee. We employ approximately 750 customer care and monitoring professionals, who have completed extensive initial training and continue to receive ongoing training. Both facilities hold Underwriters’ Laboratories (“UL”) listings as protective signaling services stations. UL specifications for monitoring centers cover building integrity, back-up computer and power systems, staffing, and standard operating procedures. Many jurisdictions have laws requiring that security alarms for certain buildings be monitored by UL-listed facilities. In addition, a UL listing is required by insurers of certain commercial customers as a condition of coverage. In the event of an emergency at one of our two monitoring facilities (e.g., fire, tornado, major interruption in telephone or computer service, or any other event affecting the functionality of the facility), all monitoring operations can be automatically transferred to the other facility. Additionally, many non-operator employees at each facility are cross-trained as operators, should there be a short-term or emergency need for additional monitoring operators.

Both of our monitoring facilities operate 24 hours a day on a year-round basis. Incoming alarm signals are routed via an internal communications network to the next available operator in either facility. Operators are quickly updated with information including the name and location of the customer and site, as well as the nature of the alarm signal. Depending upon the type of service specified by the customer contract, operators respond to emergency-related alarms by calling the customer by phone (for verification purposes) and relaying information to local fire or police departments, as necessary. Additional action may be taken by the operators as needed, depending on the specific situation.

Customer Care

We maintain a service culture aimed at creating “Customers for Life”, the basis for our stock market ticker “CFL”, because developing customer loyalty and retention are critical to our long-term success. We take a disciplined approach to selecting the right customers and providing high quality customer service. The customer selection process focuses on evaluating the customer’s ability to honor the standard three-year contract through pre-sale credit evaluation. To maintain our high standard of customer service, we provide high quality training to call center employees, field employees, and dealer personnel, and we continually measure and monitor key operating and financial metrics. We have received awards for our monitoring and customer service, including six consecutive years of recognition by J.D. Power and Associates for delivering “An Outstanding Customer Service Experience” for call center operations and customer satisfaction excellence.

Our employees are trained to provide high quality service through prompt handling of calls and quick resolution of most subscriber issues. We use a customized information system that quickly and accurately provides our customer care specialists with technical and administrative information regarding customers and their security systems, including detailed account and site history. This system enables our personnel to resolve most customer issues with a single contact. Our emphasis on customer service results in fewer false alarms, more satisfied customers, and better customer retention rates. Customer care specialists answer non-emergency telephone calls regarding service, billing and alarm activation issues. Our two monitoring centers provide telephone and Internet coverage 24 hours a day on a year-round basis. To ensure that technical service requests are handled promptly and professionally, all requests are routed through our customer contact centers. Customer care specialists help customers resolve minor service and operating issues related to security systems. In many cases, the customer care specialist is able to remotely resolve technical issues by downloading data directly into the alarm panel at the site. When an issue is not correctable from the customer contact center, our specialist can schedule a field technician service appointment during the same phone call.

Suppliers

We do not manufacture the equipment used in our security systems. Equipment is purchased from a limited number of suppliers and distributors. We maintain minimal inventories of equipment at each field office. Safety stock on certain key items is maintained by third-party distributors to cover minor supply chain disruptions. We do not anticipate any major interruptions in our supply chain.

5

Table of Contents

Industry Trends and Competition

The home security industry has historically been very stable, with revenue growth at an estimated compounded annual rate of 8% over the 2003-2008 timeframe. We have grown revenue at an average annual rate of 11% over the last six years. This time period includes the housing correction that began in 2006. We believe the factors driving this growth include heightened security concerns about crime rates, an aging and wealthier population, an increase in dual income households, increased business travel, and changes in personal time away from the home.

The security monitoring industry is highly fragmented, with the top five companies comprising only about 40% of the total market. Remaining competitors include more than 14,000 local and regional companies, the vast majority of which generate annual revenue of less than $500,000. We believe our primary competitors with national scope include:

| • | ADT Security Services, Inc., a part of Tyco International, Ltd. |

| • | Protection One, Inc. |

| • | Monitronics International, Inc. |

| • | Stanley Security Solutions, a part of The Stanley Works |

We generally are recognized as the second largest provider of monitored security services to residential and commercial properties in North America.

The North American monitored residential and commercial security industry was estimated to have revenues of approximately $14 billion in 2007. We believe that security industry penetration of single-family owner-occupied housing is relatively low, estimated at approximately 20%, providing significant opportunity for future growth and increased market share. We believe the differentiating factors contributing to our growth over the past several years are our focus on obtaining high quality customers, providing centralized training to all field personnel and dealer representatives, standardized security systems, and a service culture aimed at creating “Customers for Life”. At an estimated $8 billion, the commercial market is larger than the estimated $6 billion residential market, but commercial customers comprise only about 5% of our subscriber base.

Success in the residential and commercial markets depends on a variety of factors including company reputation, market visibility, service quality, product quality, price, and the ability to identify and solicit prospective customers. There is substantial competitive pressure on installation fees and monitoring rates. Several significant competitors offer installation prices that match or are lower than our prices. Other competitors charge significantly more for installation but may charge less for monitoring. We believe that our monitoring and service rates are competitive compared to rates offered by other major security companies.

Trademarks

One of our competitive strengths has been our brand name recognition. Effective upon the Spin-off, we entered into a licensing agreement that entitles us to use the Brink’s brand name until the earlier of October 31, 2011, or when we cease to actively use the Brink’s brand and terminate the license. We incur a 1.25% royalty rate on net revenues for the use of the Brink’s brand name. We are engaged in a comprehensive initiative to introduce a new brand name in the third quarter of 2009. We will likely continue to make use of the Brink’s brand name in conjunction with our new brand name until our new brand name has established a high level of brand awareness and responsiveness from potential customers. See further discussion under “Risk Factors”, Item 1A and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Employees

We employ more than 3,400 people, and we believe our employee relations are good.

6

Table of Contents

Government Regulation and Other Regulatory Matters

Our U.S. operations are subject to various federal, state and local consumer protection laws, licensing laws, and other laws and regulations. Most states have licensing laws that apply specifically to the alarm industry. In certain jurisdictions, we must obtain licenses or permits in order to comply with standards governing employee selection, training and business conduct. Our Canadian operations are subject to the national laws of Canada, and the provincial laws of British Columbia and Alberta.

Our business relies primarily on the use of standard fixed-wireline telephone service to transmit alarm signals. Fixed-wireline telephone companies, the cost of telephone lines, and the type of equipment used in telephone line transmission are regulated by the federal and state governments. The Federal Communications Commission and state public utilities commissions regulate the operation and use of wireless telephone and radio frequencies.

Our advertising and sales practices are regulated by the U.S. Federal Trade Commission and state consumer protection laws. In addition, we are subject to certain administrative requirements and laws of the jurisdictions in which we operate. These laws and regulations include restrictions on the manner in which we promote the sale of our security alarm services and require us to provide purchasers of our services with rescission rights.

Some local government authorities have adopted or are considering various measures aimed at reducing false alarms. Such measures include requiring permits for individual alarm systems; revoking such permits following a specified number of false alarms; imposing fines on alarm customers or alarm monitoring companies for false alarms; limiting the number of times police will respond to alarms at a particular location after a specified number of false alarms; and requiring additional verification of an alarm signal before the police respond.

The alarm industry is also subject to requirements imposed by various insurance, approval, listing and standards organizations. Depending upon the type of customer, the type of security service provided, and the requirements of the applicable local governmental jurisdiction, adherence to the requirements and standards of such organizations is mandatory in some instances and voluntary in others.

There can be no assurance as to whether new or revised laws impacting our business will be enacted or whether, if enacted, the laws would not have a material and adverse effect on us. The failure to comply with such regulations may result in the imposition of material fines, penalties, or injunctions and could require us to alter our business practices in a manner that we may deem to be unacceptable, which could slow our growth opportunities.

Available Information

We maintain an internet website under the namewww.brinkshomesecurity.com. We make available, free of charge, on our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after providing such reports to the SEC.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other documents with the SEC under the Securities Exchange Act, as amended. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an internet website that contains reports proxy and information statements, and other information regarding issuers, including Brink’s Home Security Holdings, Inc., that file electronically with the Sec. The public can obtain any document we file with the SEC atwww.sec.gov. Information contained on, or connected to, our website is not incorporated by reference into this Form 10-K and should not be considered part of this report or any other filing that we make with the SEC.

7

Table of Contents

Executive Officers

Robert B. Allen, President, Chief Executive Officer and Director — 55, has served as President of Brink’s Home Security, a wholly-owned subsidiary of the Company, since April 2001, and as President and Chief Executive Officer of the Company since September 2008. Mr. Allen also served as Executive Vice President and Chief Operating Officer of the Company from August 1999 through March 2001. Prior to joining the Company, Mr. Allen was Executive Vice President — Sales and Marketing for Aegis Communications, a provider of business process outsourcing. Prior to Aegis, he was Chief Operating Officer for ATC Communications Group, a telemarketing company, in Irving, Texas, and spent more than 16 years in various management positions with Pepsico, Inc. Mr. Allen received his Bachelor of Arts degree in Psychology from Dartmouth College and his Masters of Business Administration with concentrations in Finance and Marketing from the University of Chicago.

John S. Davis, Senior Vice President — General Counsel and Secretary — 52, has served as Senior Vice President — General Counsel of the Company since May 2008. During the year prior to joining the Company, Mr. Davis was a consultant for Major, Lindsey & Africa, a legal search firm. Mr. Davis also served as Executive Vice President and General Counsel for Carreker Corporation, a software and consulting company, from April 2005 through May 2007. Prior to Carreker, Mr. Davis was Senior Vice President, General Counsel and Secretary for Dave & Buster’s Inc., a restaurant and entertainment company, for over three years. Mr. Davis received his JD from the University of Texas School of Law and his bachelor’s degree in Journalism from the University of Texas at Austin.

Shawn L. Lucht, Senior Vice President — Strategy and Corporate Development — 42, has served as Senior Vice President — Strategy and Corporate Development of the Company since May 2008. Mr. Lucht began his career with the Company in June of 1991. He has held a variety of management roles of increasing responsibility during his tenure with the Company including Vice President — Brink’s Home Technologies and Vice President — Business Development. Mr. Lucht received both his Bachelor of Business Administration and Masters of Business Administration from the University of Texas at Arlington.

Steven E. Neace, Senior Vice President — Field Operations — 50, has served as Senior Vice President — Field Operations of the Company since March 1996. Mr. Neace joined the Company in September 1990 and has served in various management capacities within the organization, including: Branch Manager, Director of Customer Relations and Vice President — National Operations. Mr. Neace received a Bachelor of Science degree in Business Administration from Arizona State University.

Stacey V. Rapier, Senior Vice President — Human Resources — 44, has served as Senior Vice President — Human Resources of the Company since July 2007. Ms. Rapier also served as Vice President — Human Resources of the Company from January 2001 to June 2007. Prior to joining the Company, Ms. Rapier held the position of Vice President of People & Corporate Services for The M/A/R/C Group, a marketing and research company, for two years and Vice President of People Development for AT&T Wireless from 1996 to 1999. Ms. Rapier received her Bachelor of Science in Business Administration from the University of Kansas.

Dwayne R. Sigler, Senior Vice President — Marketing — 53, has served as the Senior Vice President — Marketing since he joined the Company in May 2000. Prior to joining the Company, Mr. Sigler served as the Vice President of Marketing for Giant Eagle, a grocery retailer, from 1999 to 2000 and was Vice President of Marketing at GNC, a nutrition products retailer, from 1996 to 1999. Mr. Sigler received his Bachelor of Science in Marketing from Pace University and his Masters of Business Administration from the University of Pennsylvania — Wharton School of Business.

Robert D. Trotter, Senior Vice President and Chief Information Officer — 47, has served as Senior Vice President and Chief Information Officer of the Company since July 2007. Mr. Trotter served as Vice President — Information Technology from September of 2001 through June 2007. Prior to joining the Company, Mr. Trotter

8

Table of Contents

served as the Vice President/CIO for Vartec Telecom from 1998 to 2001. Mr. Trotter received his BBA in Business Computer Information Systems from the University of North Texas.

Carole L. Vanyo, Senior Vice President — Customer Operations — 47, has served as Senior Vice President — Customer Operations of the Company since September 2001. Ms. Vanyo joined the Company in May of 1998 as Vice President — Customer Operations. Prior to joining the Company, Ms. Vanyo was the Director of Customer Care for AT&T Wireless from 1995 to 1998. Ms. Vanyo received her Bachelor of Science in Business Administration from the University of Arizona.

Stephen C. Yevich, Senior Vice President and Chief Financial Officer — 53, has served as Senior Vice President and Chief Financial Officer of the Company since August 2001. He joined the Company in May 1998 as Senior Vice President — Finance and also served as Treasurer from February 2000 through June 2008. Prior to joining the Company, Mr. Yevich was Chief Financial Officer for Communications Expo, an electronics retailer, from 1996 to 1998 and served as Controller for Michael’s Stores, and arts and crafts retailer, from 1988 to 1996. Mr. Yevich received his Bachelor of Science in Accounting and Business Administration from Washington and Lee University and his Masters of Management with concentrations in Finance and MIS from Northwestern University.

| ITEM 1A. | RISK FACTORS |

We are exposed to risks in the operation of our business. Some of these risks are common to all companies doing business in the industry in which we operate and some are unique to our business. These risk factors should be considered carefully when evaluating our business. The occurrence of one or more of these events could significantly and adversely affect our business, prospects, financial condition, and results of operations or cash flows.

We are a new independent public company which has increased our expenses and administrative workload.

Following the Spin-off, we began operating as a stand-alone publicly traded company. Expenses as a result of our being a public company include additional amounts for legal and accounting services, governance and compliance costs, Board of Director fees and expenses, transfer agent fees, additional insurance costs, printing and filing fees and amounts for treasury, tax, investor and public relations. Other than short-term transition services charges which are expected to be approximately $0.3 million, we will no longer incur an allocated corporate expense charge from BCO, which was $4.1 million for the ten months ended October 31, 2008, $8.0 million in 2007 and $7.1 million in 2006. Securities laws and applicable exchange listing requirements impose various requirements on public companies, including requiring changes in corporate governance practices. Difficulties in complying with such laws and other legal and accounting requirements applicable to public companies could adversely affect our market value.

We are subject to contractual limitations on the use of the Brink’s brand name and may not achieve similar brand recognition upon the roll out of our new brand.

Prior to the Spin-off, we operated as a subsidiary of BCO, and marketed our products and services using the Brink’s brand name and logos. In connection with the Spin-off, we entered into a Brand Licensing Agreement with a subsidiary of BCO that grants us the right to use certain trademarks, including trademarks that contain the word Brink’s, in the United States, Canada and Puerto Rico in connection with the provision of certain products and services. These rights will extend for up to no more than three years (that is, until October 31, 2011) (hereinafter, the “License Period”), subject to certain terms and conditions, after which we will no longer have the right to use the Brink’s name. In addition, following the expiration of a five-year non-compete agreement between us and BCO on October 31, 2013, BCO will be able to operate a separate alarm monitoring business using the Brink’s name in the United States, Canada and Puerto Rico.

9

Table of Contents

Limitations on our use of the Brink’s brand could adversely affect our business and profitability.

During the License Period, we will establish a new brand name for our business. In doing so, we will incur substantial costs associated with developing and marketing our new brand. There is uncertainty regarding the timing, duration and the amount of expense that may be incurred in the branding effort. We anticipate an incremental investment that could range from $100 to $150 million, primarily marketing expense, spread out over a minimum of 24 months after the rollout of the new brand commences, which we currently expect will begin in the third quarter of 2009. These estimates are dependent on general economic and strategic marketing decisions that will be made during the development and rollout of the new brand. As we introduce our new brand name to potential and existing customers, there is some risk that the volume of new installations and the disconnect rate could be negatively impacted. Despite our efforts, we may not be successful in achieving an acceptable level of recognition of our new brand. If we are not successful in achieving recognition for our new brand, our competitive position may be weakened and we may lose market share. However, these risks may be mitigated as we currently anticipate using the Brink’s brand name concurrent with our new brand during the initial phases of the launch of our new brand in the third quarter of 2009.

The terms of our tax matters agreement with BCO may reduce our strategic and operating flexibility.

The Tax Matters Agreement we entered into with BCO, as a part of the Spin-off, provides for certain limitations on our ability to pursue strategic or other transactions that may maximize the value of our business and may discourage or delay a change of control that may be considered favorable to our shareholders. Under the Tax Matters Agreement, during the two-year period following the Spin-off, until October 31, 2010, we may not, unless certain conditions are satisfied, enter into or authorize (a) any transaction resulting in the acquisition of our stock or assets beyond certain thresholds, (b) any merger, (c) any issuance of equity securities beyond certain thresholds or (d) any repurchase of our common stock beyond certain thresholds.

If our Spin-off from BCO were to lose its tax-free status due to actions taken by us, we would be required to indemnify BCO for certain liabilities under our Tax Matters Agreement with BCO.

BCO received a private letter ruling from the IRS to the effect that, among other things, the Spin-off qualified for tax-free treatment under Section 355 of the Internal Revenue Code. The ruling was based upon representations by BCO that necessary conditions had been satisfied, and any inaccuracy in such representations could invalidate the ruling. If the IRS were to determine that the Spin-off does not qualify for tax-free treatment under Section 355 of the Code, then a U.S. holder that received our shares in the Spin-off would be treated as having received a distribution to the extent of the fair market value of the shares received on the Spin-off date. That distribution would be treated as taxable dividend income to the extent of such holder’s ratable share of the current and accumulated earnings and profits of BCO, if any. Any amount that exceeds such share of earnings and profits of BCO would be treated first as a tax-free return of capital to the extent of the U.S. holder’s adjusted tax basis in its shares of common stock of BCO (thus reducing such adjusted tax basis) with any remaining amounts being treated as capital gains.

Generally, taxes resulting from the Spin-off failing to qualify for tax-free treatment for U.S. Federal income tax purposes would be imposed on BCO and BCO’s shareholders. Under the Tax Matters Agreement, however, we would be required to indemnify BCO and its affiliates against all tax-related liabilities caused by such failure to the extent those liabilities arose as a result of an action taken by us or our affiliates or otherwise resulted from any breach of any representation, covenant or obligation of us or our affiliates under the Tax Matters Agreement or any other agreement entered into by us in connection with the Spin-off.

We are susceptible to downturns in the housing market and consumer discretionary income, which may inhibit our ability to sustain subscriber base growth rates.

Demand for alarm monitoring services is affected by the turnover in the housing market. Downturns in the rate of sale of new and existing homes, which we believe drives more than 50% of our new customer volume in

10

Table of Contents

any given year, would reduce opportunities to make sales of new security systems and services and reduce opportunities to take over existing security systems. With the extended slowdown in housing sales and the deterioration in the overall consumer environment, our new installation growth rate slowed during 2006 and 2007. We sustained a decline in new customer installations in 2008 as compared to 2007. In addition, current security alarm customers may decide to disconnect our services in an effort to reduce their monthly spending. Our long-term revenue growth rate depends on installations exceeding disconnects. If the housing market downturn is prolonged, our revenues and cash flow may be adversely affected.

We rely on a significant number of our subscribers remaining with us as customers for long periods of time.

We incur significant upfront cash costs for each new subscriber. It requires a substantial amount of time for us to receive cash payments (net of our recurring cash costs) from a particular subscriber that are sufficient to offset this upfront cost, with that period currently averaging approximately four years. Accordingly, our long-term profitability is dependent on our subscribers remaining with us as customers for long periods of time. This requires that we minimize our rate of subscriber disconnects, or attrition. Factors that can increase disconnects include customers who relocate and do not reconnect, problems with our service quality, an economic slowdown and the affordability of our service. If we fail to keep our subscribers for a sufficiently long period of time, our financial position and results of operations could be adversely affected.

Shifts in our customers’ choice of telecommunications services and equipment could adversely impact our business and require significant capital expenditures.

Certain elements of our operating model have historically relied on our customers’ continued selection and use of traditional land-line telecommunications to transmit alarm signals to our monitoring centers. There is a growing trend for customers to switch to the exclusive use of cell-phone, satellite, or internet communication technology in their homes and businesses, which requires customers to upgrade to alternative and often more expensive technologies to transmit alarm signals, which generally result in increased recurring revenues for us. This, however, could increase our customer attrition rates, slow down our new subscriber rates, or reduce our ability to attract a sufficient volume of new customers. In the future, we may not be able to successfully implement new technologies or adapt existing technologies to changing market demands. If we are unable to adapt timely to changing technologies, market conditions, or customer preferences, it could adversely affect our business.

We operate in a highly competitive industry.

The monitored security alarm industry is subject to significant competition and pricing pressures. We experience competitive pricing pressures on both installation fees and monitoring rates. Several significant competitors offer installation fees that match or are lower than our prices. Other competitors charge significantly more for installation but, in many cases, less for monitoring. Competitive pressure on monitoring and service fees is significant. We believe that the monitoring and service fees we offer are generally competitive with rates offered by other major security companies. Continued pricing pressure could adversely impact our customer base or pricing structure and have an adverse effect on our results of operations.

We also face potential competition from improvements in self-monitoring systems, which enable customers to monitor their home environment without third-party involvement. Advances in self-monitoring systems could progress to the point where we could be at a competitive disadvantage. Similarly, it is possible that one or more of our competitors could develop a significant technical advantage over us that allows them to provide additional service or better quality service or to lower their price, which could put us at a competitive disadvantage. Either development could adversely affect our growth and results of operations.

11

Table of Contents

We intend to pursue additional customer acquisition channels and strategic alliances, which may cause operating margins to suffer.

We intend to expand our presence in the commercial alarm installation and monitoring market. We will also continue to evaluate other business opportunities, including expanding our services, adding customer acquisition channels, and forming new alliances with companies to market our security systems and services. This could result in our cost of investment in new subscribers growing at a faster rate than installations and related recurring revenue. Additionally, any new alliances or customer acquisition channels could have higher cost structures than our current arrangements, which could reduce operating margins and require more working capital. In the event that working capital requirements exceeded operating cash flow, we might have to draw on our credit facility or pursue other external financing, which may not be readily available.

We rely on third party providers for the components of our security systems and any failure or interruption in products or services provided by these third parties could harm our ability to operate our business.

The components for the security systems that we install are manufactured by third parties. We are therefore susceptible to interruptions in supply and to the receipt of components that do not meet our high standards. Any financial or other difficulties our providers face may have negative effects on our business. We exercise little control over our suppliers, which increases our vulnerability to problems with the products and services they provide. Any interruption in supply could cause delays in installations and repairs and the loss of current and potential customers. Also, if a previously installed component were found to be defective, we might not be able to recover the costs associated with its repair or replacement, and the diversion of technical personnel to address such an issue could affect subscriber, revenue, and profit growth.

We are exposed to greater risks of liability for employee acts or omissions, or system failure, than may be inherent in other businesses.

If a subscriber believes that he or she has suffered harm to person or property due to an actual or alleged act or omission of one of our employees or security system failure, he or she may pursue legal action against us, and the cost of defending the legal action and of any judgment could be substantial. Substantially all of our customer contracts contain provisions limiting our liability; however, in the event of litigation with respect to such matters, it is possible that these limitations may be deemed not applicable.

We carry insurance of various types, including general liability and professional liability insurance in amounts we consider adequate and customary for our industry. Some of our insurance policies, and the laws of some states, may limit or prohibit insurance coverage for punitive or certain other types of damages, or liability arising from gross negligence. If we incur increased losses related to employee acts or omissions, or system failure, or if we are unable to obtain adequate insurance coverage at reasonable rates, or if we are unable to receive reimbursements from insurance carriers, our financial condition and results of operations could be adversely affected.

We could be assessed penalties for false alarms.

Some local governments impose assessments, fines, penalties and limitations on either subscribers or the alarm companies for false alarms. A few municipalities have adopted ordinances under which both permit and alarm dispatch fees are charged directly to the alarm companies. Our alarm service contracts generally allow us to pass these charges on to customers. If more local governments were to impose assessments, fines or penalties, our customers might find these additional charges prohibitive and the growth of our subscriber base could be adversely affected. Further, to the extent we are unable to pass assessments, fines and penalties on to our customers, our operating results could be adversely affected.

12

Table of Contents

Police departments could refuse to respond to calls from monitored security service companies.

Police departments in a limited number of U.S. cities do not respond to calls from monitored security service companies, either as a matter of policy or by local ordinance. We have offered affected customers the option of receiving response from private guard companies, in most cases through contracts with us, which increases the overall cost to customers. If more police departments were to refuse to respond or be prohibited from responding to calls from monitored security service companies, our ability to attract and retain subscribers could be negatively impacted and our results of operations and cash flow could be adversely affected.

Our business operates in a regulated industry.

Our operations and employees are subject to various U.S. federal, state and local consumer protection, licensing and other laws and regulations. Most states in which we operate have licensing laws directed specifically toward the monitored security services industry. Our business relies heavily upon wireline telephone service to communicate signals. Wireline telephone companies are currently regulated by both the federal and state governments. Our Canadian operation is subject to the laws of Canada, British Columbia and Alberta.

Changes in laws or regulations could require us to change the way we operate, which could increase costs or otherwise disrupt operations. In addition, failure to comply with any applicable laws or regulations could result in substantial fines or revocation of our operating permits and licenses. If laws and regulations were to change or we failed to comply, our business, financial condition and results of operations could be materially and adversely affected.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Statements preceded by, followed by or that otherwise include the words “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project,” “prospects,” “outlook,” and similar words or expressions, or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could” are generally forward-looking in nature and not historical facts. These forward looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any anticipated results, performance or achievements. We disclaim any intention to, and undertake no obligation to, revise any forward-looking statements, whether as a result of new information, a future event, or otherwise. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to risks inherent in our Spin-off from our former parent corporation, including increased costs and reduced profitability associated with operating as an independent company, the demand for our products and services, the ability to identify and execute further cost and operational improvements and efficiencies in our core business, the actions of competitors, our ability to successfully develop and market a new brand, our ability to identify strategic opportunities and integrate them successfully, our ability to maintain subscriber growth, the number of household moves, the level of home sales or new home construction, potential instability in housing credit markets, our estimated reconnection experience, our ability to cost-effectively develop or incorporate new systems or technology in a timely manner, our ability to balance the cost of acquiring customers with the profit from serving existing customers, our ability to keep disconnect rates relatively low, the availability and cost of capital, and general business conditions.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

Not applicable.

13

Table of Contents

| ITEM 2. | PROPERTIES |

We have 72 leased field offices and warehouse facilities located throughout the U.S. and one leased office in British Columbia, Canada. Our headquarters are located in Irving, Texas in a facility we own. This owned facility houses some of our administrative and technical support personnel. Additional personnel are located in portions of three nearby buildings in office spaces that are leased. Our headquarters also serve as one of our two central monitoring facilities. The second monitoring and service center, which we also own, is located near Knoxville, Tennessee.

The following table discloses our leased and owned facilities as of December 31, 2008.

| Facilities | ||||||

Region | Leased | Owned | Total | |||

U. S. | 72 | 2 | 74 | |||

Canada | 1 | — | 1 | |||

Total | 73 | 2 | 75 | |||

| ITEM 3. | LEGAL PROCEEDINGS |

We are involved in various lawsuits and claims in the ordinary course of business. We have recorded accruals for losses that are considered probable and reasonably estimable. We believe that the ultimate disposition of these matters will not have a material adverse effect on our liquidity or financial position; however, losses from these matters or changes in estimates of losses for these matters may result in income or expense in any one accounting period that is material in comparison to the earnings of that period.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

Not applicable.

14

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information and Holders

Our common stock began trading “regular way” on the New York Stock Exchange under the symbol “CFL” on November 3, 2008. As of March 26, 2009, there were approximately 2,043 holders of record of our common stock.

The table below sets forth the reported high and low sales prices for our common stock on the New York Stock Exchange for the period from November 3, 2008 through December 31, 2008.

| High | Low | |||||

2008 | ||||||

Fourth Quarter (Beginning November 3, 2008) | $ | 23.10 | $ | 13.15 | ||

Dividend Policy

We have not paid cash dividends and do not anticipate the payment of cash dividends on our common stock in the immediate future.

Equity Compensation Plan Information

The following table sets forth information about our common stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans as of December 31, 2008.

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants, and Rights (a) | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) | |||||||

Equity compensation plans not approved by security holders (1) | 1,231,364 | (2) | $ | 24.42 | (3) | 1,270,104 | (4) | |||

(1) | Includes common shares to be issued as awards under The Brink’s Home Security 2008 Equity Incentive Plan (“2008 Equity Plan”), Non-Employee Directors’ Equity Plan, Key Employees’ Deferred Compensation Program, and the Directors’ Stock Accumulation Plan. See Note 11 to the consolidated financial statements for additional information regarding these equity compensation plans. There have been no repurchases of common stock under the Company’s plans as of December 31, 2008. |

(2) | Included within the number of securities to be issued upon exercise are 783,964 unvested shares as of December 31, 2008. |

(3) | Does not include deferred compensation units, units under the Directors’ Stock Accumulation Plan, restricted stock units, and deferred stock units. |

(4) | The 2008 Equity Plan provides for a maximum of 1,000,000 common shares to be issued as awards plus the aggregate number of shares subject to converted awards. The Non-Employee Directors’ Equity Plan provides for a maximum of the sum of 500,000 shares to be issued as awards, the aggregate number of shares subject to the converted options, and the aggregate number of shares subject to the replacement deferred stock units. Note that restricted stock units are counted against the limit as two shares for every one share covered by the award under each of these plans. The Directors’ Stock Accumulation Plan provides for a maximum of 100,000 common shares to be issued as awards. The Key Employees’ Deferred Compensation Program and the Plan for Deferral of Directors’ Fees do not have a limit on the number of shares to be issued as awards. |

15

Table of Contents

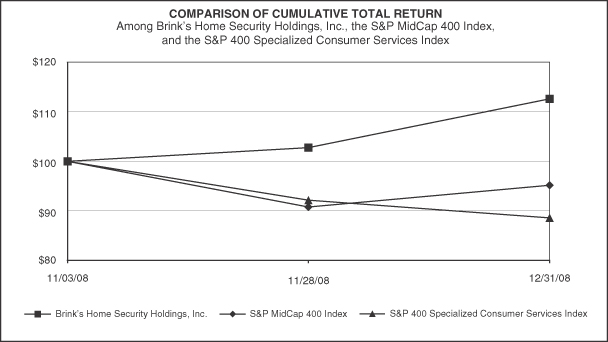

Performance Graph

The following graph compares the relative performance of the our common stock, the Standard & Poor’s Midcap 400 Stock Index and the Standard & Poor’s Midcap 400 GICS Specialized Consumer Services Sub-Index. This graph covers the period from November 3, 2008 (the first trade date immediately following the Spin-off), through December 31, 2008.

Company/Index | November 3, 2008 | November 28, 2008 | December 31, 2008 | ||||||

Brink’s Home Security Holdings, Inc. | $ | 100 | $ | 102.72 | $ | 112.58 | |||

S&P MidCap 400 Index | 100 | 90.73 | 95.13 | ||||||

S&P 400 Specialized Consumer Services Index | 100 | 92.11 | 88.56 | ||||||

In each case, assumes a $100 investment immediately following November 3, 2008, the first trading day following the Spin-off, and reinvestment of all dividends, if any.

16

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected historical financial data and operating statistics presented below should be read in conjunction with our audited consolidated financial statements and accompanying notes, included in Item 8 herein, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 herein. The financial information may not be indicative of our future performance and does not necessarily reflect what the financial position and results of operations would have been had we operated as a separate, stand-alone entity during the periods presented, including changes that may occur as a result of the Spin-off, which occurred on October 31, 2008 and is discussed in Item 7 and Notes 1 and 2 to the consolidated financial statements.

Five Years in Review

(In millions, except where indicated) | 2008 | 2007 | 2006 | 2005 | 2004 | |||||||||||||||

Statement of Income Data | ||||||||||||||||||||

Revenues | $ | 532.3 | $ | 484.4 | $ | 439.0 | $ | 392.1 | $ | 345.6 | ||||||||||

Operating profit | 94.0 | 73.0 | 63.2 | 57.1 | 51.5 | |||||||||||||||

Net income | 57.1 | 44.2 | 36.3 | 36.0 | 33.1 | |||||||||||||||

Pro Forma Net Income per Common Share | ||||||||||||||||||||

Basic | $ | 1.25 | $ | 0.96 | $ | 0.79 | $ | 0.79 | $ | 0.72 | ||||||||||

Diluted | 1.25 | 0.96 | 0.79 | 0.78 | 0.72 | |||||||||||||||

Weighted average common shares outstanding (diluted) (in millions) | 45.8 | 45.9 | 45.9 | 45.9 | 45.9 | |||||||||||||||

Balance Sheet Data | ||||||||||||||||||||

Cash and cash equivalents | $ | 63.6 | $ | 3.3 | $ | 2.6 | $ | 3.4 | $ | 1.4 | ||||||||||

Property and equipment, net | 659.3 | 606.0 | 536.7 | 467.7 | 394.0 | |||||||||||||||

Total assets | 876.9 | 763.7 | 689.4 | 605.0 | 523.7 | |||||||||||||||

Long-term debt, less current maturities | — | — | — | — | 0.4 | |||||||||||||||

Shareholders’ equity | 482.0 | 405.5 | 357.6 | 318.9 | 283.0 | |||||||||||||||

Cash Flow data | ||||||||||||||||||||

Cash flow from operating activities | $ | 224.0 | $ | 183.7 | $ | 155.9 | $ | 119.1 | $ | 119.0 | ||||||||||

Cash flow from investing activities | (177.8 | ) | (175.8 | ) | (163.9 | ) | (162.2 | ) | (117.5 | ) | ||||||||||

Cash flow from financing activities | 14.2 | (7.3 | ) | 7.2 | 45.2 | (1.8 | ) | |||||||||||||

Other Financial and Operating Data | ||||||||||||||||||||

Monthly recurring revenue (a) | $ | 40.5 | $ | 37.2 | $ | 33.1 | $ | 29.1 | $ | 26.1 | ||||||||||

EBITDA from recurring services (normalized to 1.25% royalty rate) (b) | $ | 321.6 | $ | 290.0 | $ | 259.4 | $ | 236.9 | $ | 203.0 | ||||||||||

Average number of subscribers (in thousands) | 1,267.5 | 1,176.1 | 1,072.5 | 972.8 | 875.5 | |||||||||||||||

Average subscriber base growth (percentage) | 7.8 | 9.7 | 10.2 | 11.1 | 9.8 | |||||||||||||||

Ending number of subscribers (in thousands) | 1,301.6 | 1,223.9 | 1,124.9 | 1,018.8 | 921.4 | |||||||||||||||

Ending subscriber base growth (percentage) (c) | 6.3 | 8.8 | 10.4 | 10.6 | 10.5 | |||||||||||||||

Disconnect rate (percentage) (d) | 7.5 | 7.0 | 6.4 | 7.2 | 6.6 | |||||||||||||||

(a) | Monthly recurring revenue (“MRR”), a non-GAAP measure, is calculated based on the number of subscribers at period end multiplied by the average fee per subscriber earned in the last month of the period for contractual monitoring and maintenance services as discussed under the caption “Key Performance Measures — Monthly Recurring Revenues.” |

(b) | EBITDA from recurring services, a non-GAAP measure, is normalized as if the royalty rate had been 1.25% of net revenues, instead of the royalty rate of approximately 7% of revenues charged by BCO before the Spin-off, for all periods presented. This measure is reconciled below in the “Reconciliation of Non-GAAP Measures” section. |

17

Table of Contents

(c) | Calculated based on period ending subscribers. |

(d) | Calculated as a ratio, the numerator of which is customer cancellations, on an annualized basis, and the denominator of which is the average number of customers during the period. Customer relocations, reactivations and dealer charge backs of contract cancellations are excluded from the calculation. |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OPERATIONS

General

The following discussion, which presents the results of Brink’s Home Security Holdings, Inc. and its consolidated subsidiaries, should be read in conjunction with the accompanying consolidated financial statements and notes thereto for the years ended December 31, 2008 and 2007, and each of the years in the three-year period ended December 31, 2008, along with the five-year financial summary and operating statistics presented in Part II, Item 6, “Selected Financial Data,” the risk factors discussed in Part I, Item 1A, “Risk Factors,” and the cautionary statement regarding forward-looking information on page 13.

As used in this Report, (a) references to “Holdings,” “Company,” “we,” “us” and “our” refer to Brink’s Home Security Holdings, Inc. and its consolidated subsidiaries, including Brink’s Home Security, after the Spin-off, and (b) references to the “Company” on a historical basis, prior to the Spin-off, refer to Brink’s Home Security and its consolidated subsidiaries, in each case unless the context requires otherwise.

This discussion is intended to provide the reader with information that will assist in understanding our financial statements, the changes in certain key items in those financial statements from period to period, and the primary factors that accounted for those changes, how operating results affect our financial condition and results of our operations of the Company as a whole, as well as how certain accounting principles and estimates affect our financial statements. Unless otherwise indicated, all references to earnings per share (EPS) are on a diluted basis.

The Spin-off

The spin-off of Holdings by The Brink’s Company (“BCO”) was completed on October 31, 2008 through a distribution of 100% of the common stock of Holdings to the holders of record of BCO’s common stock (the “Spin-off”). The Spin-off was pursuant to a Separation and Distribution Agreement by which BCO contributed to Holdings all of the assets and liabilities associated with the Brink’s Home Security business. BCO distributed all shares of Holdings as a one-for-one stock dividend on BCO’s common stock on October 31, 2008 to BCO’s shareholders of record as of October 21, 2008.

In connection with the Spin-off, the following key transactions or events occurred:

| • | Our Registration Statement on Form 10 was declared effective by the U.S. Securities and Exchange Commission on October 8, 2008. |

| • | BCO received a private letter ruling from the Internal Revenue Service and an opinion of counsel that the distribution of our common stock qualified as a tax-free distribution for U.S. Federal income tax purposes. |

| • | On October 21, 2008, we entered into a $75 million unsecured credit facility, with an option, under certain conditions, to increase it to $125 million. |

| • | BCO contributed $50 million in cash to us on October 31, 2008 and all intercompany balances were forgiven. |

18

Table of Contents

| • | BCO retained all assets and liabilities related to the qualified and non-qualified BCO defined benefit pension plans, and agreed to make all required payments under such plans to our current and former employees. |

| • | BCO agreed to indemnify us for any and all liabilities and expenses related to BCO’s former coal operations, including any health care coverage obligations. BCO also agreed to indemnify us for certain tax liabilities incurred prior to Spin-off. |

| • | We entered into a Brand Licensing Agreement with a subsidiary of BCO. Under the agreement, we are entitled to use the Brink’s brand name and logos for no more than three years. Under the agreement, our licensing fees decreased to 1.25% of net revenues from the approximate 7% historical rate, and provided for BCO to acquire the third party licensing agreements that had historically contributed royalty income to us. |

| • | We entered into various agreements with BCO, including a Non-Competition and Non-Solicitation Agreement, pursuant to which BCO agreed not to compete with us in the United States, Canada and Puerto Rico with respect to certain specified activities for a period of five years from the Spin-off date. |

On November 3, 2008, after completion of the Spin-off, our stock began trading “regular way” as an independent public company on the New York Stock Exchange under the symbol “CFL”, reflecting our corporate mission of creating “Customers For Life”.

Overview

We provide monitored security alarm services in North America for owner-occupied, single-family residences and, to a lesser extent, commercial properties. We typically install and own the on-site security alarm systems and charge fees to monitor and service the systems. We attribute our success to our focus on quality service, customer retention, and a disciplined approach to growth. We believe our business is a premium provider of services in the markets that we serve.

We have continued to grow over the past several years due to our ability to attract and retain customers by providing quality services while operating as efficiently as possible. Revenues are fairly predictable as substantially all monitoring service revenues are driven by three-year monitoring contracts that generally include automatic one-year renewal clauses. Over the past three years, recurring revenues have been approximately 90% of total revenues. Our primary customers are residents of single-family homes, which comprise approximately 93% of our subscriber base. We have limited exposure to new home construction with 6% of new subscribers in 2008 being generated from our Brink’s Home Technology (“BHT”) division, which partners with selected major homebuilders in the United States. Our small but growing presence in the commercial market includes more than 65,000 business customers, about 5% of our total subscriber base. The remaining 2% of subscribers reside in multi-family sites.

The business environment in which we operate can change quickly. We must quickly adapt to changes in the competitive landscape and local market conditions. To be successful, we must be able to balance, on a market-by-market basis, the effects of changing demand on the utilization of our resources. We operate on a centralized basis, but allow enough flexibility so local management can adjust operations to the particular circumstances of its market.

We measure financial performance on a long-term basis. We create value by focusing on yielding solid returns on capital, growing our revenues and earnings, and generating cash flows sufficient to fund our growth.

Factors Affecting Operating Results

We view our business as having two key activities: acquiring new customers and managing our existing customer base. We manage our business around these two activities, and many of our performance metrics are

19

Table of Contents

focused on one or both of these activities. We view success in our business as being dependent upon successfully balancing our efforts against both activities. We focus on investing wisely in subscriber growth that will generate positive future returns to shareholders, as well as on generating substantial current profit on the recurring services we provide to our existing customers.

We employ a consistent and disciplined economic decision-making framework to evaluate our existing customer acquisition channels and to prioritize growth opportunities based on the expected cash flows over the life of the customer relationship. This framework takes into account three key elements of cash flow: net customer acquisition cost, ongoing recurring customer cash flow and the annualized customer attrition or disconnect rate. In our evaluations of opportunities, we consider the full range of costs incurred in the customer relationship life cycle, including administrative costs and non-security capital expenditures not directly related to acquiring or servicing customers.

We have historically focused our marketing efforts on “direct response” advertising, projecting a range of advertising messages across multiple media channels to attract the attention of potential customers when they are in the “buying mode.” Potential customers are receptive to initiating security alarm service generally as the result of a major change in personal circumstance, such as a household or business relocation, an increase in (or the perception of an increase in) local criminal activity, or a change in family size (such as the birth of a child or death of a spouse) or activity (such as increased travel by the head of household). Our marketing efforts are designed to direct potential customers into one of our customer acquisition channels, where we qualify the potential customers and attempt to sell them an appropriate level of service to meet their needs. In order to increase efficiency and effectiveness of our customer acquisition efforts, we focus on controlling initial marketing, sales and installation costs by matching sales representative staffing levels with the number of sales leads, and the size of the technician workforce with available installation volume. We monitor the net customer acquisition cost across our customer acquisition channels closely and control both the upfront cash installation investment (all costs, regardless of whether expensed, capitalized, or deferred) and the net investment in new subscribers expensed as a period cost, offsetting a significant portion of our profit from recurring services in arriving at our operating profit in any given period.

Under our standard Protective Service Agreement with residential customers, the customer pays the initial installation fees and is then obligated to make monthly payments throughout the contract term. The standard term for our Protective Service Agreement is three years, which automatically renews for additional one year periods unless cancelled by either party, except in six states where state law requires the renewal period to be month-to-month. If a customer cancels the contract prior to the end of the contract term, or is otherwise in default, we have the right under the contract to receive from the customer an amount equal to all remaining monthly payments.

The customer acquisition process in our BHT operations differ from our traditional customer acquisition model. Working directly with major national, regional, and local home builders, BHT markets and installs residential security systems, as well as a variety of low-voltage security, home networking, communications and entertainment options, into homes under construction. BHT currently does business with eight of the top ten residential home builders in the United States. The BHT activation process consists of three phases: the “pre-wire” phase of early construction wiring for security systems, and potential non-security low-voltage applications in certain markets; the “trim-out” phase when security system (and in some cases other low-voltage) components are installed in the house as it nears completion; and activation of monitored security service contracts with initial homeowners. In 2008, BHT accounted for approximately 6% of our new subscribers and conducted operations in 22 markets located across the United States.