UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HOTEL MANAGEMENT SYSTEMS, INC.

(Exact name of Registrant as specified in its charter)

| Nevada | 7372 | 26-2477977 |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

| 8600 Starboard Dr., #1143, Las Vegas, Nevada | | 89117 |

| (Name and address of principal executive offices) | | (Zip Code) |

| | | |

Registrant's telephone number, including area code: (702) 335-4531 | | |

| | | |

| Approximate date of commencement of proposed sale to the public: | As soon as practicable after the effective date of this Registration Statement. | |

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box.|__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__|

Non-accelerated filer |__| Smaller reporting company |X|

CALCULATION OF REGISTRATION FEE

| | | | |

| Common Stock | 1,500,000 | 0.01 | $15,000 | $0.59 |

| (1) | This price was arbitrarily determined by Hotel Management Systems, Inc. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

COPIES OF COMMUNICATIONS TO:

Hotel Management Systems, Inc.

Attn: John Baumbauer, President and CEO

8600 Starboard Dr., #1143, Las Vegas, Nevada 89117

Ph: (702) 335-4531

PROSPECTUS

HOTEL MANAGEMENT SYSTEMS, INC.

1,500,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

SUBJECT TO COMPLETION, Dated May 29, 2008

This prospectus relates to our offering of 1,500,000 new shares of our common stock at an offering price of $0.01 per share. The offering will commence promptly after the date of this prospectus and close no later than 120 days after the date of this prospectus. However, we may extend the offering for up to 90 days following the 120 day offering period. We will pay all expenses incurred in this offering. The shares are being offered by us on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes. The Maximum Offering amount is 1,500,000 shares ($15,000).

The offering is a self-underwritten offering; there will be no underwriter involved in the sale of these securities. We intend to offer the securities through our officers and Directors, who will not be paid any commission for such sales.

| | Offering Price | Underwriting Discounts and Commissions | Proceeds to Company |

| Per Share | $0.01 | None | $0.01 |

| Total (maximum offering) | $15,000 | None | $15,000 |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.01 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board. Although we intend to apply for quotation of our common stock on the NASD Over-The-Counter Bulletin Board through a market maker, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled “Risk Factors” starting on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus is: May 29, 2008

Hotel Management Systems, Inc.

We were incorporated as Hotel Management Systems, Inc. on April 15, 2008 in the State of Nevada for the purpose of developing, perfecting, and marketing a proprietary hotel management software known as “Hotel Management Tool.”

We are a development stage company and have not generated any revenues to date. As of April 30, 2008, we had $5,500 in current assets and no current liabilities. Accordingly, we had working capital of $5,500 as of April 30, 2008. Our current working capital is not sufficient to enable us to implement our business plan as set forth in this prospectus. For these and other reasons, our independent auditors have raised substantial doubt about our ability to continue as a going concern. Accordingly, we will require additional financing, including the equity funding sought in this prospectus.

We are offering for sale to investors a maximum of 1,500,000 shares of our common stock at an offering price of $0.01 per share (the “Offering”). Our business plan is to use the proceeds of this offering for the development and marketing of the Hotel Management Tool software product. However, our management has retained discretion to use the proceeds of the Offering for other uses. The minimum investment amount for a single investor is $250 for 25,000 shares. The shares are being offered by us on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. The proceeds of this offering will be immediately available to us for our general business purposes. The Maximum Offering amount is 1,500,000 shares ($15,000).

Our principal executive offices are located at 8600 Starboard Dr., #1143, Las Vegas, NV 89117. Our phone number is (702) 335-4531.

Our fiscal year end is April 30.

The Offering

| Securities Being Offered | Up to 1,500,000 shares of our common stock. |

| | |

| Offering Price | The offering price of the common stock is $0.01 per share. There is no public market for our common stock. We cannot give any assurance that the shares offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares in our stock. We intend to apply to the NASD over-the-counter bulletin board, through a market maker that is a licensed broker dealer, to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders. |

| | |

| Minimum Number of Shares To Be Sold in This Offering | n/a |

| | |

| Maximum Number of Shares To Be Sold in This Offering | 1,500,000 |

| | |

| Securities Issued and to be Issued | 5,500,000 shares of our common stock are issued and outstanding as of the date of this prospectus. Our sole officer and director, Mr. John Baumbauer, owns an aggregate of 100% of the common shares of our company and therefore have substantial control. Upon the completion of this offering, our officers and directors will own an aggregate of approximately 78.57% of the issued and outstanding shares of our common stock if the maximum number of shares is sold. |

| | |

| Number of Shares Outstanding After The Offering If All The Shares Are Sold | 7,000,000 |

| Use of Proceeds | If we are successful at selling all the shares we are offering, our proceeds from this offering will be approximately $15,000. We intend to use these proceeds to execute our business plan. |

| | |

| Offering Period | The shares are being offered for a period up to 120 days after the date of this Prospectus, unless extended by us for an additional 90 days. |

Summary Financial Information

| Balance Sheet Data | Fiscal Year Ended April 30, 2008 (audited) |

| | |

| Cash | $ | 5,500 |

| Total Assets | | 5,500 |

| Liabilities | | 0 |

| Total Stockholder’s Equity (Deficit) | | 5,500 |

| | | |

Statement of Operations |

| Revenue | $ | 0 |

| Net Profit (Loss) for Reporting Period | | 0 |

You should consider each of the following risk factors and any other information set forth herein and in our reports filed with the SEC, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

We have only recently completed the initial version of our “Hotel Management Tool” software and have only recently begun to demonstrate and test the software in a live hotel operation. Extensive testing and perfection of the software has yet to occur, and we have not yet begun to market our

system to hotel and motel operators. As a result, we have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on April 15, 2008, and to date have been involved primarily in organizational and early planning activities. We have not earned any revenues as of the date of this prospectus, and thus face a high risk of business failure.

We currently do not have any active operations and we have no income. Our business plan calls for expenses related to software testing and perfection, marketing, and other start-up costs. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing beyond the initial equity financing sought through this offering will be subject to a number of factors, including our ability to show strong early revenues and a growing rate of adoption of our software system in the market. These factors may make the most desirable timing, amount, and terms or conditions of additional financing unavailable to us.

Prior to our earning significant revenues, we anticipate that we will incur increased operating expenses. We expect to incur continuing losses into the foreseeable future. Our accumulated deficit will continue to increase as we continue to incur losses. We may not be able to earn profits or continue operations if we are unable to generate significant revenues. There is no history upon which to base any assumption as to the likelihood that we will be successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We have earned no revenue since our inception, which makes it difficult to evaluate whether we will operate profitably. We have not attained profitable operations and are dependent upon obtaining financing or generating revenue from operations to continue operations for the next twelve months. As of April 30, 2008, we had cash in the amount of $5,500. Our future is dependent upon our ability to obtain financing or upon future profitable operations. We are currently seeking equity financing through this offering. We reserve the right to seek additional funds through private placements of our common stock and/or through debt financing. Our ability to raise additional financing is unknown. We do not have any formal commitments or arrangements for the advancement or loan of funds. For these reasons, our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern. As a result, there is an increased risk that you could lose the entire amount of your investment in our company.

The shares are being offered by us on a "best efforts" basis without benefit of a private placement agent. However, we reserve the right to enter into agreement with one or more broker-dealers to

sell the shares, with such broker-dealers receiving sales commissions of up to 10% of the price of the shares. We can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, our business plans and prospects could be adversely affected.

Our future financial performance depends on our successful and timely development, introduction and market acceptance of our new software product, together with additional upgrades and improvements. The lifecycle of our product is difficult to predict because the market for our product is characterized by rapid technological change, changing customer needs and evolving industry standards. The introduction of products or computer systems employing new technologies and emerging industry standards could render our product obsolete and unmarketable, or cause customers to defer orders for our product.

In addition, our software must be highly scalable, or able to accommodate substantial increases in the number of users. If our customers cannot successfully implement large-scale deployments, or if they determine that our products cannot accommodate large-scale deployments, we could experience customer dissatisfaction and find it more difficult to obtain new customers or to sell additional products to our existing customers.

The size of a new customer’s initial order may be relatively small and may include a limited number of user licenses. In order to grow revenues, we will depend on sales of additional user licenses to our existing customers as well as sales of new licenses to new customers. Therefore, it is important that our customers are satisfied with their initial product implementations and that they believe that expanded use of the product they purchased will provide them with additional benefits.

Our products may integrate with many different disparate systems operated by our customers. As a result, although we do not typically perform special or custom coding or connections to other systems, data migrations and integration with our customers’ systems require integration with the existing computer systems and software programs used by our customers. If this integration proves to be complex, time consuming or expensive, or causes delays in the deployment of our products, customers may become dissatisfied with our products, resulting in reduced sales, decreased revenues and damage to our reputation.

The market for hospitality management software is intensely competitive and we expect competition to increase in the future. We will compete with large and small companies that provide products and services that are similar in some aspects to our products and services. These companies may develop new technologies in the future that are perceived as more effective or cost

efficient than the technologies developed by us. Some of these companies also have longer operating histories, greater name recognition, access to larger customer bases and significantly greater financial, technical and marketing resources than we do. As a result, they may be able to adapt more quickly to new or emerging technologies and changes in customer requirements or to devote greater resources to the promotion and sale of their products than we will. In addition, they may have established or may establish financial or strategic relationships among themselves, with existing or potential customers, resellers or other third parties and rapidly acquire significant market share. If we cannot compete effectively, we may experience future price reductions, reduced gross margins and loss of market share, any of which will materially adversely affect our business, operating results and financial condition.

To attract customers we may have to develop a brand identity and increase awareness of our technology and product. To increase brand awareness, we expect to significantly increase our expenditures for marketing initiatives. However, these activities may not result in significant revenue and, even if they do, any revenue may not offset the expenses incurred in building brand recognition. Moreover, despite these efforts, we may not be able to increase awareness of our brand, which would have a material adverse effect on our results of operations.

The hospitality management software industry is characterized by technological advances, changes in customer requirements, frequent new product introductions and enhancements and evolving industry standards in computer hardware and software technology. As a result, we must continually change and improve our products in response to changes in operating systems, application software, computer and communications hardware, networking software, programming tools and computer language technology. The introduction of products embodying new technologies and the emergence of new industry standards may render existing products obsolete or unmarketable. Our future operating results will depend upon our ability to enhance our current product and to develop and introduce new products on a timely basis that address the increasingly sophisticated needs of our customers and that keep pace with technological developments, new competitive product offerings and emerging industry standards. If we do not respond adequately to the need to develop and introduce new products or enhancements of our existing product in a timely manner in response to changing market conditions or customer requirements, our operating results may be materially diminished.

Software products occasionally contain errors or defects, especially when they are first introduced or when new versions are released. We cannot be certain that our product is currently or will be completely free of defects and errors. We could lose revenue as a result of product defects or errors, including defects contained in third-party products that enable our products to work. In addition,

the discovery of a defect or error in a new version or product may result in the following consequences, among others:

| • | delayed shipping of the product; |

| | |

| • | delay in or failure to ever achieve market acceptance; |

| | |

| • | diversion of development resources; |

| | |

| • | damage to our reputation; |

| | |

| • | product liability claims; and |

| | |

| • | increased service and warranty costs. |

If we are unable to develop a product that is free of defects or errors or if our product is not able to scale across an enterprise or is perceived to be too complex to scale across an enterprise, our business, results of operations and financial condition could be harmed.

Because our software product is designed for use by hotels and motels, economic conditions affecting the travel and tourism industry in general may have a substantial effect on our customers’ willingness to invest in new software products like ours. Consumer demand for travel and lodging is particularly sensitive to downturns in the economy. Changes in consumer preferences or discretionary consumer spending brought about by factors such as fears of war, future acts of terrorism, general economic conditions, disposable consumer income, fears of recession and changes in consumer confidence in the economy could reduce customer demand for lodging and travel services. A significant downturn in the lodging and tourism industry could adversely affect our ability to successfully market and sell our new hotel management software system to hotel and motel operators.

Mr. Baumbauer, our sole officer and director, devotes 15 to 20 hours per week to our business affairs. We do not have an employment agreement with Mr. Baumbauer, nor do we maintain a key man life insurance policy for him. Currently, we do not have any full or part-time employees. If the demands of our business require the full business time of Mr. Baumbauer, it is possible that he may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Mr. Baumbauer is our president, chief financial officer and sole director. He currently owns 100% of the outstanding shares of our common stock, and, upon completion of this offering, will own 78.57% of our outstanding common stock if the maximum number of shares are sold. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of our assets, the interests of Mr. Baumbauer may still differ from the interests of the other stockholders.

Our ability to compete will depend upon our proprietary software technology. We rely on trade secret and copyright laws to protect our intellectual property. Despite our efforts to protect our intellectual property, a third party could copy or otherwise obtain our software or other proprietary information without authorization, or could develop software competitive to ours. Our means of protecting our proprietary rights may not be adequate and our competitors may independently develop similar technology or duplicate our product.

We may have to resort to litigation to enforce our intellectual property rights, to protect our trade secrets or know-how, or to determine their scope, validity or enforceability. Enforcing or defending our proprietary technology could be expensive, could cause the diversion of our resources, and may not prove successful. Our protective measures may prove inadequate to protect our proprietary rights, and any failure to enforce or protect our rights could cause us to lose a valuable asset.

The software industry is characterized by the existence of a large number of patents, trademarks and copyrights, and by frequent litigation based upon allegations of infringement or other violations of intellectual property rights. We may be constrained by the intellectual property of others. Any claims, regardless of their merit, could be time-consuming and distracting to management, result in costly litigation or settlement, cause product development or release delays or require us to enter into costly royalty or licensing agreements.

The Sarbanes-Oxley Act of 2002 was enacted in response to public concerns regarding corporate accountability in connection with recent accounting scandals. The stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility, to provide for enhanced penalties for accounting and auditing improprieties at publicly traded companies, and to protect investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The Sarbanes-Oxley Act generally applies to all companies that file or are required to file periodic reports with the SEC, under the Securities Exchange Act of 1934. Upon becoming a public company, we will be required to comply with the Sarbanes-Oxley Act and it is costly to remain in compliance with the federal securities regulations. Additionally, we may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles. Significant costs incurred as a result of becoming a public company could divert the use of finances from our operations resulting in our inability to achieve profitability.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTC Bulletin Board. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

In addition to the "penny stock" rules described below, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

The initial public offering price of the common stock was determined by us arbitrarily. The price is not based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market. The price may not be indicative of the market price, if any, for the common stock in the trading market after this offering. The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management's attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder's ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder's risk of losing some or all of his investment.

Our board of directors may determine to authorize and issue shares of preferred stock in the future. Our board of directors has the power to establish the dividend rates, liquidation preferences, voting rights, redemption and conversion terms and privileges with respect to any series of preferred stock. The issuance of any shares of preferred stock having rights superior to those of the common

stock may result in a decrease in the value or market price of the common stock. Holders of preferred stock may have the right to receive dividends, certain preferences in liquidation and conversion rights. The issuance of preferred stock could, under certain circumstances, have the effect of delaying, deferring or preventing a change in control of us without further vote or action by the stockholders and may adversely affect the voting and other rights of the holders of common stock.

Short selling occurs when a person sells shares of stock which the person does not yet own and promises to buy stock in the future to cover the sale. The general objective of the person selling the shares short is to make a profit by buying the shares later, at a lower price, to cover the sale. Significant amounts of short selling, or the perception that a significant amount of short sales could occur, could depress the market price of our common stock. In contrast, purchases to cover a short position may have the effect of preventing or retarding a decline in the market price of our common stock, and together with the imposition of the penalty bid, may stabilize, maintain or otherwise affect the market price of our common stock. As a result, the price of our common stock may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued at any time. These transactions may be effected on over-the-counter bulletin board or any other available markets or exchanges. Such short selling if it were to occur could impact the value of our stock in an extreme and volatile manner to the detriment of our shareholders.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on Nasdaq). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required order to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

The net proceeds to us from the sale of up to 1,500,000 shares of common stock offered at a public offering price of $0.01 per share will vary depending upon the total number of shares sold. The following table summarizes the anticipated application of the proceeds we will receive from this Offering if the maximum number of shares is sold:

| | Amount Assuming Maximum Offering | | Percent of Maximum |

| GROSS OFFERING | $ | 15,000 | | 100.0% |

Commission 1 | $ | 0 | | 0.0% |

| Net Proceeds | $ | 15,000 | | 100.0% |

| USE OF NET PROCEEDS | | | | |

Product Development and Marketing 2 | $ | 10,000 | | 66.67% |

General and Administrative 3 | $ | 5,000 | | 33.33% |

| TOTAL APPLICATION OF NET PROCEEDS | $ | 15,000 | | 100.0% |

1 Commissions: Shares will be offered and sold by us without special compensation or other remuneration for such efforts. We do not plan to enter into agreements with finders or securities broker-dealers who are members of the National Association of Securities Dealers whereby the finders or broker-dealers would be involved in the sale of the Shares to the investors. Shares will be sold directly by us, and no fee or commission will be paid.

2 Product Development and Marketing: We intend to use between approximately $10,000 of the net proceeds of this Offering to further develop and perfect our Hotel Management Tool software and to market the new product to hotel and motel operators.

3 General and Administrative: A portion of the proceeds will be used to pay general administrative expenses such as legal, accounting, phone, gasoline, office supplies, and other general overhead items.

The $0.01 per share offering price of our common stock was arbitrarily chosen by management. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value. We intend to apply to the NASD over-the-counter bulletin board for the quotation of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price.

The historical net tangible book value as of April 30, 2008 was $5,500 or $0.001 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of April 30, 2008. Adjusted to give effect to the receipt of net proceeds from the sale of the maximum of 1,500,000 shares of common stock for $15,000, net tangible book value will be approximately $0.003 per share. This will represent an immediate increase of approximately $0.002 per share to

existing stockholders and an immediate and substantial dilution of approximately $0.007 per share, or approximately 70%, to new investors purchasing our securities in this offering. Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering.

The following table sets forth as of April 30, 2008, the number of shares of common stock purchased from us and the total consideration paid by our existing stockholders and by new investors in this offering if new investors purchase the maximum offering, assuming a purchase price in this offering of $0.01 per share of common stock.

| | Number | Percent | Amount |

| Existing Stockholders | 5,500,000 | 78.57% | $5,500 |

| New Investors | 1,500,000 | 21.43% | $15,000 |

| Total | 7,000,000 | 100.00% | $20,500 |

There Is No Current Market for Our Shares of Common Stock

There is currently no market for our shares. We cannot give you any assurance that the shares you purchase will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares you purchase are not traded or listed on any exchange. After the effective date of the registration statement, we intend to have a market maker file an application with the National Association of Securities Dealers, Inc. to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

The OTC Bulletin Board is maintained by the National Association of Securities Dealers. The securities traded on the Bulletin Board are not listed or traded on the floor of an organized national or regional stock exchange. Instead, these securities transactions are conducted through a telephone and computer network connecting dealers in stocks. Over-the-counter stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Even if our shares are quoted on the OTC Bulletin Board, a purchaser of our shares may not be able to resell the shares. Broker-dealers may be discouraged from effecting transactions in our shares because they will be considered penny stocks and will be subject to the penny stock rules. Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on NASD brokers-dealers who make a market in a "penny stock." A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or "accredited investor" (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transactions is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon brokers-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market, assuming one develops.

The Offering will be Sold by Our Officers and Directors

We are offering up to a total of 1,500,000 shares of common stock. The offering price is $0.01 per share. The offering will be for a period of 120 days from the effective date and may be extended for an additional 90 days if we choose to do so. In our sole discretion, we have the right to terminate the offering at any time, even before we have sold the 1,500,000 shares. There are no specific events which might trigger our decision to terminate the offering.

The shares are being offered by us on a “best efforts” basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes.

We cannot assure you that all or any of the shares offered under this prospectus will be sold. No one has committed to purchase any of the shares offered. Therefore, we may sell only a nominal amount of shares, in which case our ability to execute our business plan might be negatively impacted. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason. Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Certificates for shares purchased will be issued and

distributed by our transfer agent promptly after a subscription is accepted and "good funds" are received in our account.

If it turns out that we have not raised enough money to effectuate our business plan, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and are not successful, we will have to suspend or cease operations.

We will sell the shares in this offering through our officers and Directors. The officers and Directors engaged in the sale of the securities will receive no commission from the sale of the shares nor will they register as broker-dealers pursuant to Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3(a) 4-1. Rule 3(a) 4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. Our officers and Directors satisfy the requirements of Rule 3(a) 4-1 in that:

| 1. | They are not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his or her participation; and |

| | |

| 2. | They are not compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| | |

| 3. | They are not, at the time of their participation, an associated person of a broker- dealer; and |

| | |

| 4. | They meet the conditions of Paragraph (a)(4)(ii) of Rule 3(a)4-1 of the Exchange Act, in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) are not brokers or dealers, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every twelve (12) months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). |

As long as we satisfy all of these conditions, we are comfortable that we will be able to satisfy the requirements of Rule 3(a)4-1 of the Exchange Act notwithstanding that a portion of the proceeds from this offering will be used to pay the salaries of our officers and Directors.

As our officers and Directors will sell the shares being offered pursuant to this offering, Regulation M prohibits the Company and its officers and Directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our officers and Directors from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We have no intention of inviting broker-dealer participation in this offering.

Offering Period and Expiration Date

This offering will commence on the effective date of this prospectus, as determined by the Securities and Exchange Commission and continue for a period of 120 days. We may extend the offering for an additional 90 days unless the offering is completed or otherwise terminated by us. Funds received from investors will be counted towards the minimum subscription amount only if the form of payment, such as a check, clears the banking system and represents immediately available funds held by us prior to the termination of the 120-day subscription period, or prior to the termination of the extended subscription period if extended by our Board of Directors.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must deliver a check or certified funds for acceptance or rejection. The minimum investment amount for a single investor is $250 for 25,000 shares. All checks for subscriptions must be made payable to "Hotel Management Systems, Inc.”

Right to Reject Subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

Our authorized capital stock consists of 90,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000 shares of preferred stock, par value $0.001 per share. As of May 15, 2008, there were 5,500,000 shares of our common stock issued and outstanding. Our shares are currently held by one (1) stockholder of record. We have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing fifty percent (50%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger

or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our board of directors may become authorized to authorize preferred shares of stock and to divide the authorized shares of our preferred stock into one or more series, each of which must be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our articles of incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including, but not limited to, the following:

| 1. | The number of shares constituting that series and the distinctive designation of that series, which may be by distinguishing number, letter or title; |

| 2. | The dividend rate on the shares of that series, whether dividends will be cumulative, and if so, from which date(s), and the relative rights of priority, if any, of payment of dividends on shares of that series; |

| 3. | Whether that series will have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights; |

| 4. | Whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors determines; |

| 5. | Whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption, including the date or date upon or after which they are redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates; |

| 6. | Whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; |

| 7. | The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights of priority, if any, of payment of shares of that series; |

| 8. | Any other relative rights, preferences and limitations of that series |

Provisions in Our Articles of Incorporation and By-Laws That Would Delay, Defer or Prevent a Change in Control

Our articles of incorporation authorize our board of directors to issue a class of preferred stock commonly known as a "blank check" preferred stock. Specifically, the preferred stock may be issued from time to time by the board of directors as shares of one (1) or more classes or series. Our board of directors, subject to the provisions of our Articles of Incorporation and limitations imposed by law, is authorized to adopt resolutions; to issue the shares; to fix the number of shares; to change the number of shares constituting any series; and to provide for or change the following: the voting powers; designations; preferences; and relative, participating, optional or other special rights, qualifications, limitations or restrictions, including the following: dividend rights, including whether dividends are cumulative; dividend rates; terms of redemption, including sinking fund

provisions; redemption prices; conversion rights and liquidation preferences of the shares constituting any class or series of the preferred stock.

In each such case, we will not need any further action or vote by our shareholders. One of the effects of undesignated preferred stock may be to enable the board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a tender offer, proxy contest, merger or otherwise, and thereby to protect the continuity of our management. The issuance of shares of preferred stock pursuant to the board of director's authority described above may adversely affect the rights of holders of common stock. For example, preferred stock issued by us may rank prior to the common stock as to dividend rights, liquidation preference or both, may have full or limited voting rights and may be convertible into shares of common stock. Accordingly, the issuance of shares of preferred stock may discourage bids for the common stock at a premium or may otherwise adversely affect the market price of the common stock.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the

State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Marvin Longabaugh, Esq., our independent legal counsel, has provided an opinion on the validity of our common stock.

Moore & Associates, Chtd., Certified Public Accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Moore & Associates, Chtd. has presented their report with respect to our audited financial statements. The report of Moore & Associates, Chtd. is included in reliance upon their authority as experts in accounting and auditing.

Principal Place of Business

Our principal offices are located at 8600 Starboard Dr., #1143 Las Vegas, Nevada 89117.

Company Overview

We were incorporated as “Hotel Management Systems” on April 15, 2008, in the State of Nevada for the purpose of developing, perfecting and marketing our proprietary software program, the “Hotel Management Tool” or “HMT.” Our HMT software is designed to allow hotel or motel operators and their employees to manage the day-to-day operations of their business through a single system which coordinates the various operational functions of the enterprise. Ours is a scalable application that can grow with the customer’s business by adding additional capacity and accommodating more robust data base systems as the user’s operations expand. The product offers a tiered security system, is self-updating, and is fully customizable to the specific needs of the customer.

Our founder and executive officer, John Baumbauer, has been developing HMT over the past year. Currently, the product is being tested and demonstrated at a motel in Las Vegas, Nevada. As the product continues to be used in a real-world environment, we are able to make incremental improvements, develop additional features, and remedy any bugs or glitches which are discovered.

Through this offering, we are seeking funding for the purpose of completing the development and perfection of our unique software and for launching an initial marketing campaign targeted to small hotel and motel operators.

The “Hotel Management Tool” Software

The “Hotel Management Tool” software offers hotel operators a single software platform which integrates all major aspects of the day-to-day management of their enterprise. Although the HMT is fully customizable and able to incorporate additional modules, our standard version will feature three basic modules that deal with those hotel operating functions which can be most easily improved by the use of our software platform: Product and Supplies Management, Employee Data, and Employment Counseling and Reporting.

Product and Supplies Management

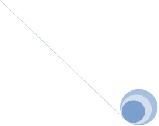

This module of the HMT software will allow hotel management to track and manage its inventory of supplies and in-room products like shampoo, soap, and similar items. All of the supplies and in-room products commonly used by the hotel can be input into a database which will contain any necessary item or catalog numbers for each individual product. The hotel’s management will also input unit cost and a desired minimum and maximum quantity of hand for each product:

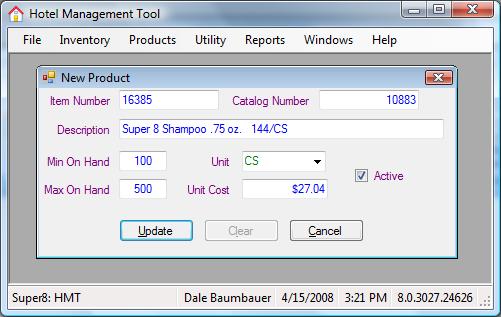

On a daily or other periodic basis, the hotel’s employees will then record inventory through the use of a count worksheet:

The hotel’s quantity on hand is then updated in a separate screen. As the minimum quantity on

hand is approached, the HMT will know which products to re-order and in what quantity to order them and will produce the appropriate product order:

Employee Data Management

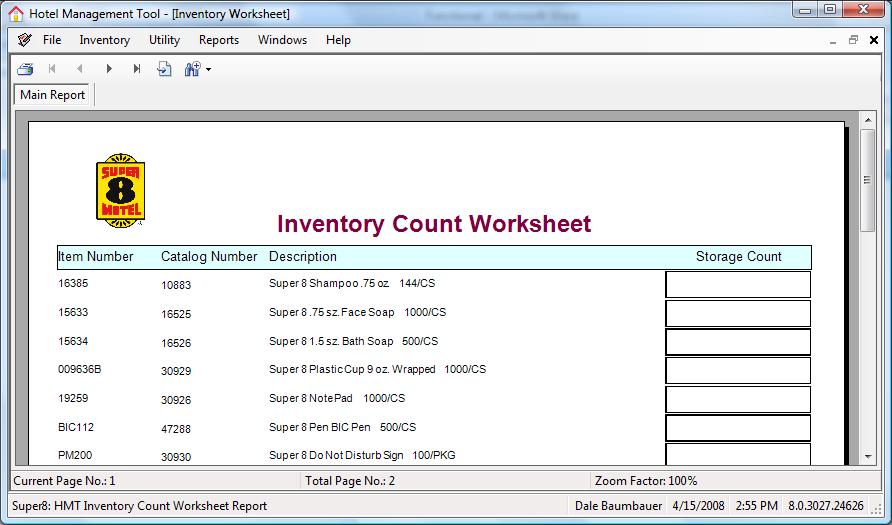

This module of the HMT software will allow for easy maintenance of a complete and user-friendly employee database. Through a series of screens, the employee’s personal information, contact and emergency information, and work-related information can be easily input and maintained by management:

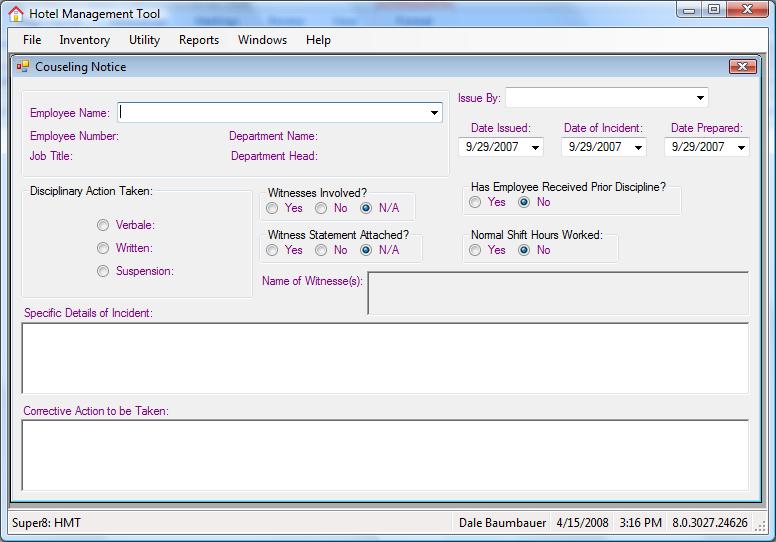

Employment Counseling and Reporting

The third standard module to be included in the HMT software will allow hotel management to accurately record and track employee disciplinary incidents and any related counseling sessions with employees through a user-friendly data screen:

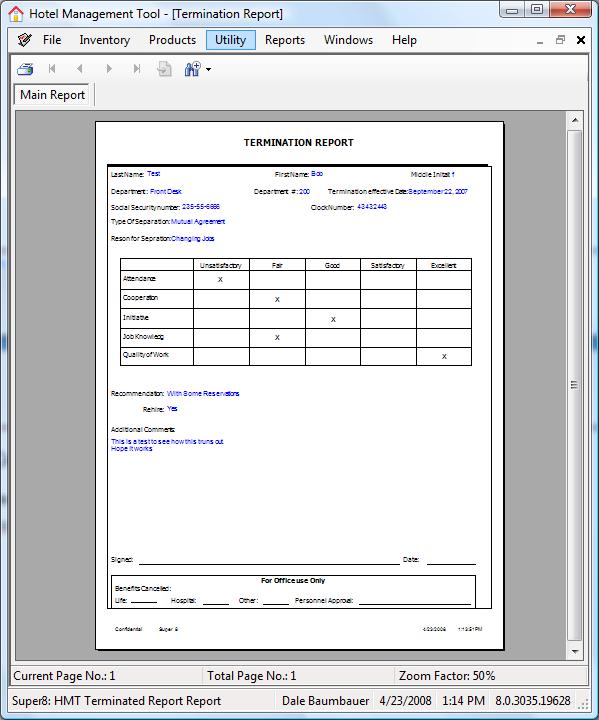

In the event that an employee must be terminated, a full record and evaluation of the employee’s attendance, cooperation, initiative, job knowledge, and over work quality can be easily input by management. The HMT will then generate a written report that can be given to the employee. The employee will sign a receipt of the report, which can be stored in the hotel’s permanent records:

Additional Standard Features

Together with the standard set of functions summarized above, the HMT offers some important standard features:

| · | Self-updating: The HMT automatically checks for newer versions of the software, available upgrades, and software updates. The software is updated automatically on a continuous basis, ensuring maximum performance and user satisfaction. |

| · | Tiered Security: The HMT features a tiered security system with a separate login and set of security credentials for each employee of the hotel who will be using the program. Management can easily structure these security credentials to allow different levels and types of access to the HMT’s different functions depending upon the level of each employee’s security credentials. |

| · | Fully Scalable: The HMT is fully scalable, which means that its capacity can grow and expand with the customer’s business. The software can easily add additional capacity and new features and can accommodate more robust database systems as the customer’s business operations become larger and more complex. |

Customization and Additional Modules Available

In addition to the 3 standard modules described above, the HMT can easily accommodate additional segments dealing with different aspects of the hotel and motel business. The core of the program is designed to operate as hub, with different sets of functions that can be added or subtracted to the core system like spokes on a wheel. Nearly every operating hotel already uses some type of reservation software and some type of employee timekeeping software. Once they have begun using our standard product, however, many customers may desire a more total and cost-effective integration of their operations. Additional modules that are ready to add-on to the HMT at the customer’s request include the following:

| · | Room inventory and reservations system |

| · | Employee timekeeping and payroll |

| · | Online product ordering from key suppliers |

Pricing and Revenue Model

Our intended pricing structure will feature a base purchase price for the standard version of the HMT software, with an extra charge for each additional module requested by the customer. We will also charge a small monthly license fee for all maintenance and updates of the software and for storage of the customer’s data:

| Standard version: | $1,500 |

| | |

| Each additional module: | $500-$1,000 depending on specifications |

| | |

Monthly fee Including data storage: | $20 per month per site |

| | |

Monthly fee if Customer stores own data: | $8 per month per site |

The customer’s ongoing contract for maintenance, updates, and data storage will be renewable annually at the option of the customer. Larger customers will substantial data storage needs or complex customizations may be charged higher fees. We believe this pricing model will position us well to compete for the business of smaller hotel and motel operators (i.e.: those with ten or fewer sites) who may be looking for a flexible and effective management software solution at lower price than that typically charged by larger competitors in the field.

Competition

The field of hotel management software is flooded with an array of options which focus primarily on room reservations and room inventory management. We will face several larger and more established competitors. In addition, many larger hotel and motel chains use proprietary systems built-for-hire to suit their particular operations. We intend to focus our efforts on small independent hotels, motels, inns, and bed-and-breakfast properties. We believe or HMT software will be well-positioned to compete for the business of these operators because of the following advantages:

| · | Our software is fully scalable. A hotel or motel owner can purchase a basic product for relatively low cost that will be able to grow with the enterprise if and when it expands. |

| · | Our software is able to integrate all functions of the enterprise, not just reservations and room inventory management. We believe this all-in-one capability will appeal to smaller customers with limited staff and resources for managing and integrating different functions of the enterprise by hand or through the use of multiple software products. |

| · | We are a small company that will be focused on responsive and timely customer service. |

Intellectual Property

We have applied for copyright registration of the HMT software and we intend to aggressively assert our rights under trade secret, unfair competition, trademark and copyright laws to protect our intellectual property, including software design, proprietary software code and related technologies, product research and concepts and recognized trademarks. These rights will be protected through

the acquisition of copyright and trademark registrations, the maintenance of trade secrets, the development of trade dress, and, where appropriate, litigation against those who are, in our opinion, infringing these rights.

While there can be no assurance that registered trademarks and copyrights will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations applicable to our planned operations. We are subject to the laws and regulations which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes.

Employees

We have no other employees other than our sole officer and director, John Baumbauer. Mr. Baumbauer is our President, CEO, CFO, and sole member of the Board of Directors. Mr. Baumbauer oversees all responsibilities in the areas of corporate administration, product development, and marketing. As our planned operations commence and as we begin to generate revenues, we may expand our current management in the future to retain skilled directors, officers, and employees with experience relevant to our business focus.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

We do not own any real property. We maintain our corporate office at 8600 Starboard Dr., #1143 Las Vegas, Nevada 89117.

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Nevada is John Baumbauer, 8600 Starboard Dr., #1143 Las Vegas, Nevada 89117.

No Public Market for Common Stock

There is presently no public market for our common stock. We anticipate making an application for trading of our common stock on the NASD over the counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. We can provide no assurance that our shares will be traded on the bulletin board, or if traded, that a public market will materialize.

The Securities Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;(b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities' laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;(d) contains a toll-free telephone number for inquiries on disciplinary actions;(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and;(f) contains such other information and is in such form, including language, type, size and format, as the Commission shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with; (a) bid and offer quotations for the penny stock;(b) the compensation of the broker-dealer and its salesperson in the transaction;(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, because our common stock is subject to the penny stock rules, stockholders may have difficulty selling those securities.

Holders of Our Common Stock

Currently, we have one (1) holder of record of our common stock.

Rule 144 Shares

None of our common stock is currently available for resale to the public under Rule 144.

In general, under Rule 144 as currently in effect, a person who has beneficially owned shares of a company's common stock for at least one year is entitled to sell within any three month period a number of shares that does not exceed the greater of:

| 1. | one percent of the number of shares of the company's common stock then outstanding; or |

| 2. | the average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale. |

Sales under Rule 144 are also subject to manner of sale provisions and notice requirements and to the availability of current public information about the company.

Under Rule 144(k), a person who is not one of the company's affiliates at any time during the three months preceding a sale, and who has beneficially owned the shares proposed to be sold for at least two years, is entitled to sell shares without complying with the manner of sale, public information, volume limitation or notice provisions of Rule 144.

Stock Option Grants

To date, we have not granted any stock options.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

| 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Index to Financial Statements:

MOORE & ASSOCIATES, CHARTERED

ACCOUNTANTS AND ADVISORS

PCAOB REGISTERED

To the Board of Directors

Hotel Management Systems, Inc.

(A Development Stage Company)

We have audited the accompanying balance sheet of Hotel Management Systems, Inc. (A Development Stage Company) as of April 30, 2008, and the related statements of operations, stockholders’ equity and cash flows from inception on April 15, 2008 through April 30, 2008. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Hotel Management Systems, Inc. (A Development Stage Company) as of April 30, 2008, and the related statements of operations, stockholders’ equity and cash flows from inception on April 15, 2008 through April 30, 2008, in conformity with accounting principles generally accepted in the United States of America.