Q3 2024 Earnings Conference Call

Certain comments in this presentation contain certain forward looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of Home Bancorp, Inc. and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumption, many of which are difficult to predict and generally are beyond the control of Home Bancorp, Inc. and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward looking statements: (1) economic and competitive conditions which could affect the volume of loan originations, deposit flows and real estate values; (2) the levels of noninterest income and expense and the amount of loan losses; (3) competitive pressure among depository institutions increasing significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general economic conditions, either nationally or in the markets in which Home Bancorp, Inc. is or will be doing business, being less favorable than expected; (6) political and social unrest, including acts of war or terrorism; (7) we may not fully realize all the benefits we anticipated in connection with our acquisitions of other institutions or our assumptions made in connection therewith may prove to be inaccurate; (8) cyber incidents or other failures, disruptions or security beaches; or (9) legislation or changes in regulatory requirements adversely affecting the business of Home Bancorp, Inc. Home Bancorp, Inc. undertakes no obligation to update these forward looking statements to reflect events or circumstances that occur after the date on which such statements were made. As used in this report, unless the context otherwise requires, the terms “we,” “our,” “us,” or the “Company” refer to Home Bancorp, Inc. and the term the “Bank” refers to Home Bank, N.A., a national bank and wholly owned subsidiary of the Company. In addition, unless the context otherwise requires, references to the operations of the Company include the operations of the Bank. For a more detailed description of the factors that may affect Home Bancorp’s operating results or the outcomes described in these forward-looking statements, we refer you to our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2023. Home Bancorp assumes no obligation to update the forward-looking statements made during this presentation. For more information, please visit our website www.home24bank.com. Non-GAAP Information This presentation contains financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). The Company's management uses this non-GAAP financial information in its analysis of the Company's performance. In this presentation, information is included which excludes acquired loans, intangible assets, impact of the gain (loss) on the sale of a banking center, the impact of merger-related expenses and one-time tax effects. Management believes the presentation of this non-GAAP financial information provides useful information that is helpful to a full understanding of the Company’s financial position and core operating results. This non-GAAP financial information should not be viewed as a substitute for financial information determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial information presented by other companies. | 2 Forward-Looking Statements

Headquarters: Lafayette, LA Ticker: HBCP (NASDAQ) History: • Founded in 1908 • IPO completed October 2008 • Six acquisitions completed since 2010 • 42 locations across Southern Louisiana, Western Mississippi and Houston Highlights: • Total Assets: $3.4 billion at September 30, 2024 • Market Cap: $355 million at October 15, 2024 • Ownership (S&P Global as of October 15, 2024) • Institutional: 44% • Insider/ESOP: 14% | 3 Our Company Total Assets $3.4B Total Loans $2.7B Total Deposits $2.8B

| 4 Our Markets

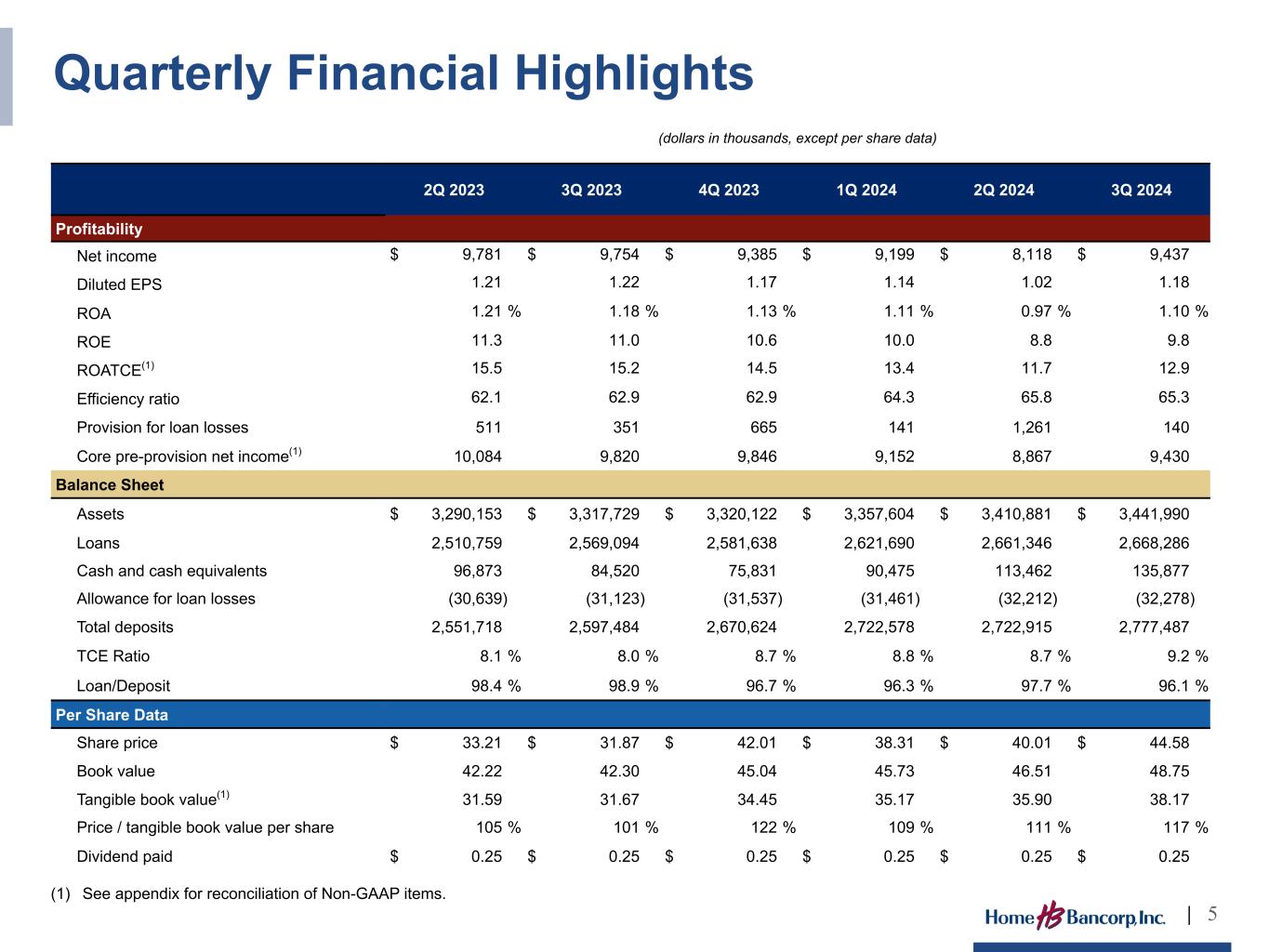

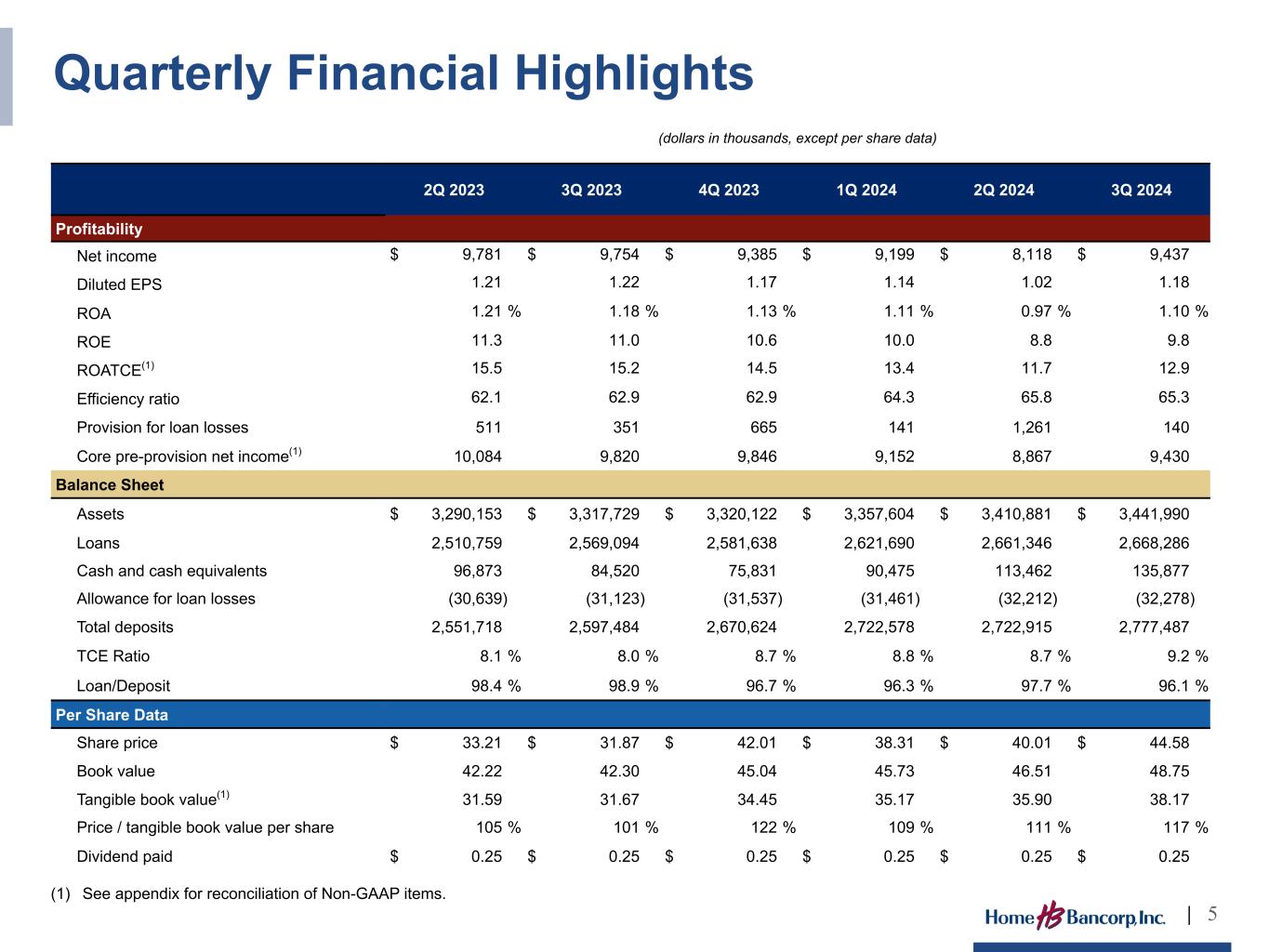

Quarterly Financial Highlights 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Profitability Net income $ 9,781 $ 9,754 $ 9,385 $ 9,199 $ 8,118 $ 9,437 Diluted EPS 1.21 1.22 1.17 1.14 1.02 1.18 ROA 1.21 % 1.18 % 1.13 % 1.11 % 0.97 % 1.10 % ROE 11.3 11.0 10.6 10.0 8.8 9.8 ROATCE(1) 15.5 15.2 14.5 13.4 11.7 12.9 Efficiency ratio 62.1 62.9 62.9 64.3 65.8 65.3 Provision for loan losses 511 351 665 141 1,261 140 Core pre-provision net income(1) 10,084 9,820 9,846 9,152 8,867 9,430 Balance Sheet Assets $ 3,290,153 $ 3,317,729 $ 3,320,122 $ 3,357,604 $ 3,410,881 $ 3,441,990 Loans 2,510,759 2,569,094 2,581,638 2,621,690 2,661,346 2,668,286 Cash and cash equivalents 96,873 84,520 75,831 90,475 113,462 135,877 Allowance for loan losses (30,639) (31,123) (31,537) (31,461) (32,212) (32,278) Total deposits 2,551,718 2,597,484 2,670,624 2,722,578 2,722,915 2,777,487 TCE Ratio 8.1 % 8.0 % 8.7 % 8.8 % 8.7 % 9.2 % Loan/Deposit 98.4 % 98.9 % 96.7 % 96.3 % 97.7 % 96.1 % Per Share Data Share price $ 33.21 $ 31.87 $ 42.01 $ 38.31 $ 40.01 $ 44.58 Book value 42.22 42.30 45.04 45.73 46.51 48.75 Tangible book value(1) 31.59 31.67 34.45 35.17 35.90 38.17 Price / tangible book value per share 105 % 101 % 122 % 109 % 111 % 117 % Dividend paid $ 0.25 $ 0.25 $ 0.25 $ 0.25 $ 0.25 $ 0.25 (1) See appendix for reconciliation of Non-GAAP items. | 5 (dollars in thousands, except per share data)

H om e B an k To ta l A ss et s ($ in m illi on s) 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Sep- 24 YTD 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Statewide Bank - $199 MM Guaranty Savings Bank - $257 MM Britton & Koontz Bank - $301 MM Bank of New Orleans - $346 MM St. Martin Bank & Trust - $597 MM CAGR = 12.6% as of September 30, 2024 | 6 Asset Growth Texan Bank - $416 MM

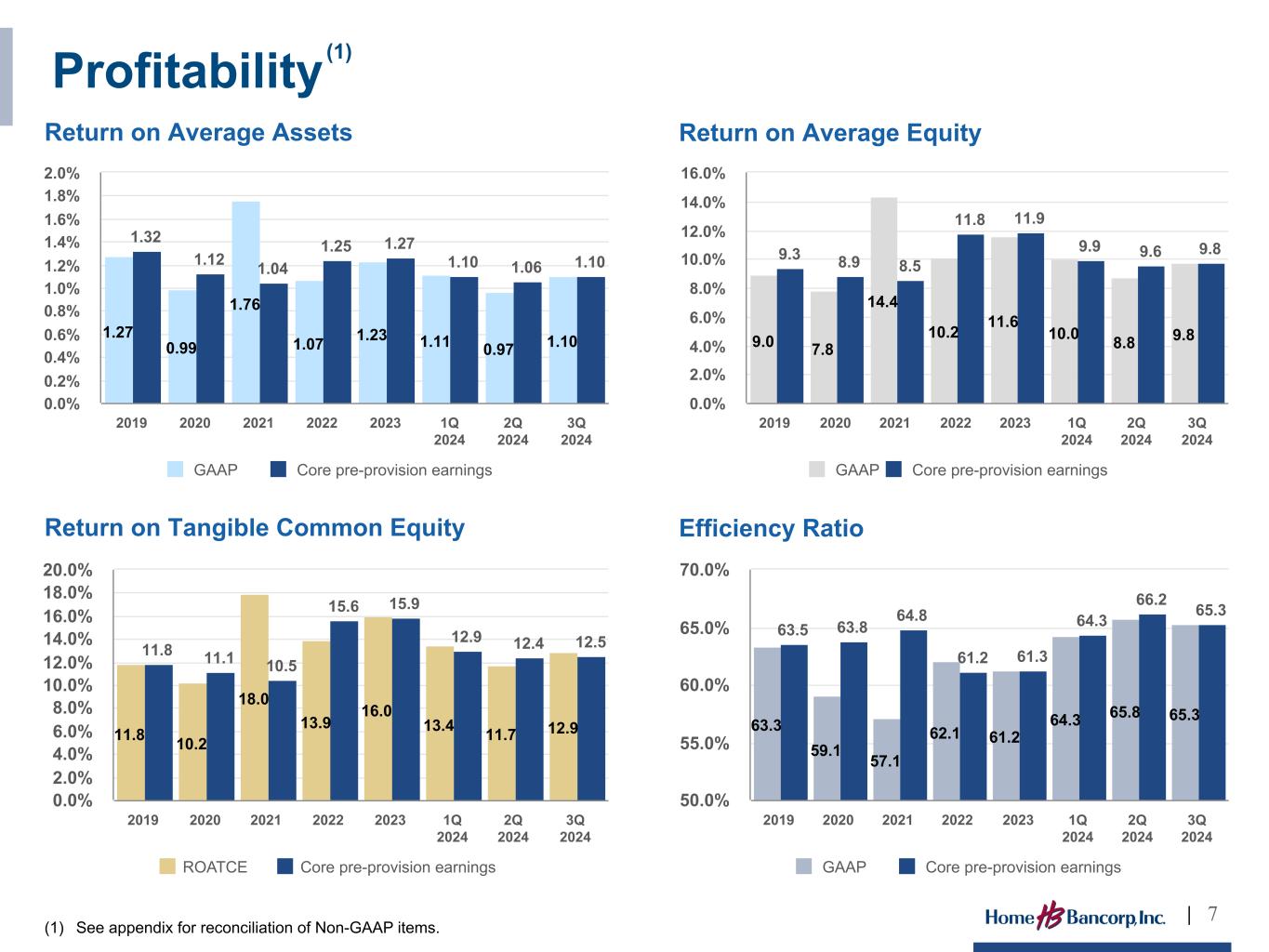

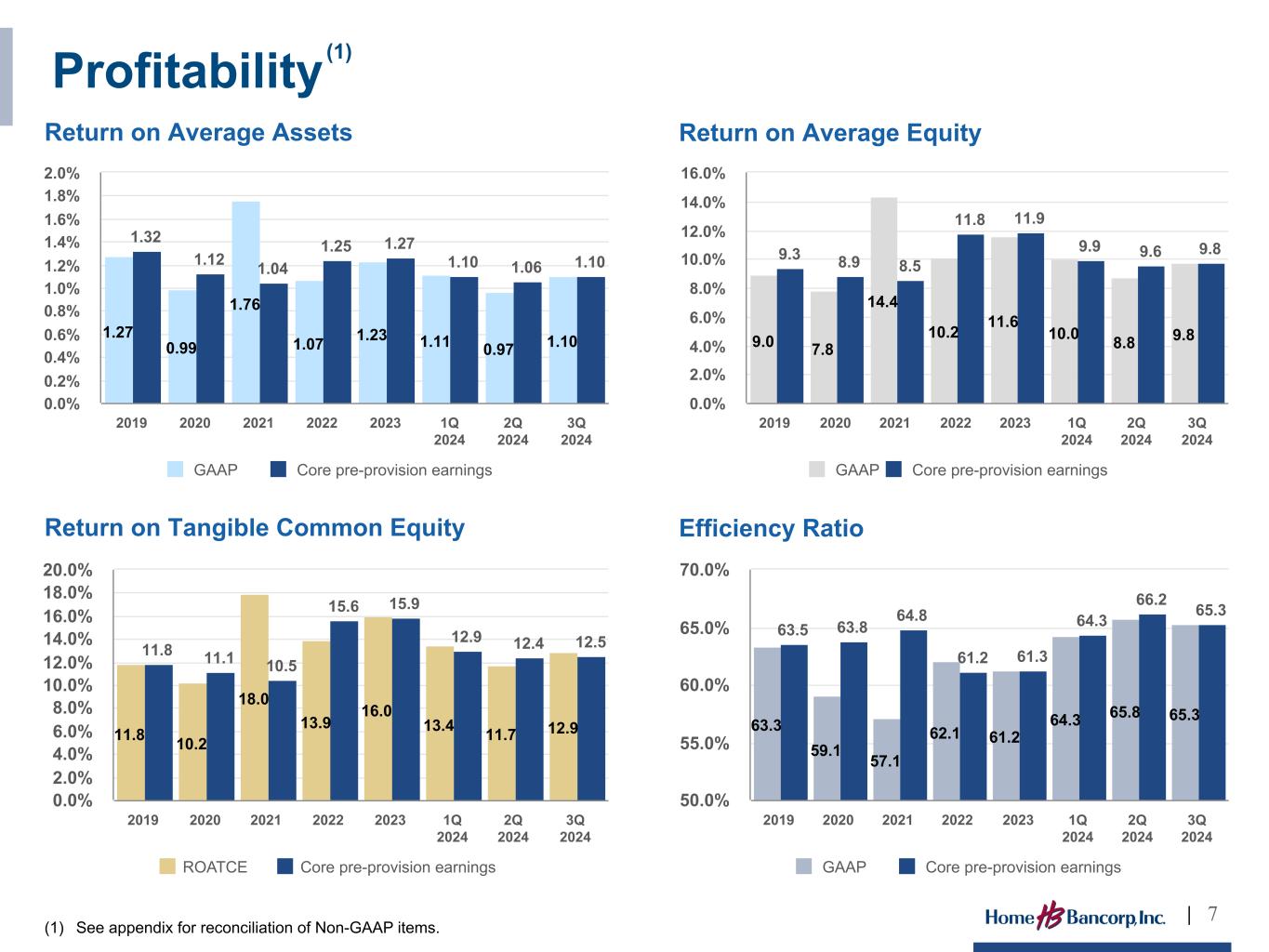

Profitability 1.27 0.99 1.76 1.07 1.23 1.11 0.97 1.10 1.32 1.12 1.04 1.25 1.27 1.10 1.06 1.10 GAAP Core pre-provision earnings 2019 2020 2021 2022 2023 1Q 2024 2Q 2024 3Q 2024 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% Return on Average Assets 9.0 7.8 14.4 10.2 11.6 10.0 8.8 9.8 9.3 8.9 8.5 11.8 11.9 9.9 9.6 9.8 GAAP Core pre-provision earnings 2019 2020 2021 2022 2023 1Q 2024 2Q 2024 3Q 2024 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Return on Average Equity 11.8 10.2 18.0 13.9 16.0 13.4 11.7 12.9 11.8 11.1 10.5 15.6 15.9 12.9 12.4 12.5 ROATCE Core pre-provision earnings 2019 2020 2021 2022 2023 1Q 2024 2Q 2024 3Q 2024 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Return on Tangible Common Equity 63.3 59.1 57.1 62.1 61.2 64.3 65.8 65.3 63.5 63.8 64.8 61.2 61.3 64.3 66.2 65.3 GAAP Core pre-provision earnings 2019 2020 2021 2022 2023 1Q 2024 2Q 2024 3Q 2024 50.0% 55.0% 60.0% 65.0% 70.0% Efficiency Ratio (1) See appendix for reconciliation of Non-GAAP items. (1) | 7

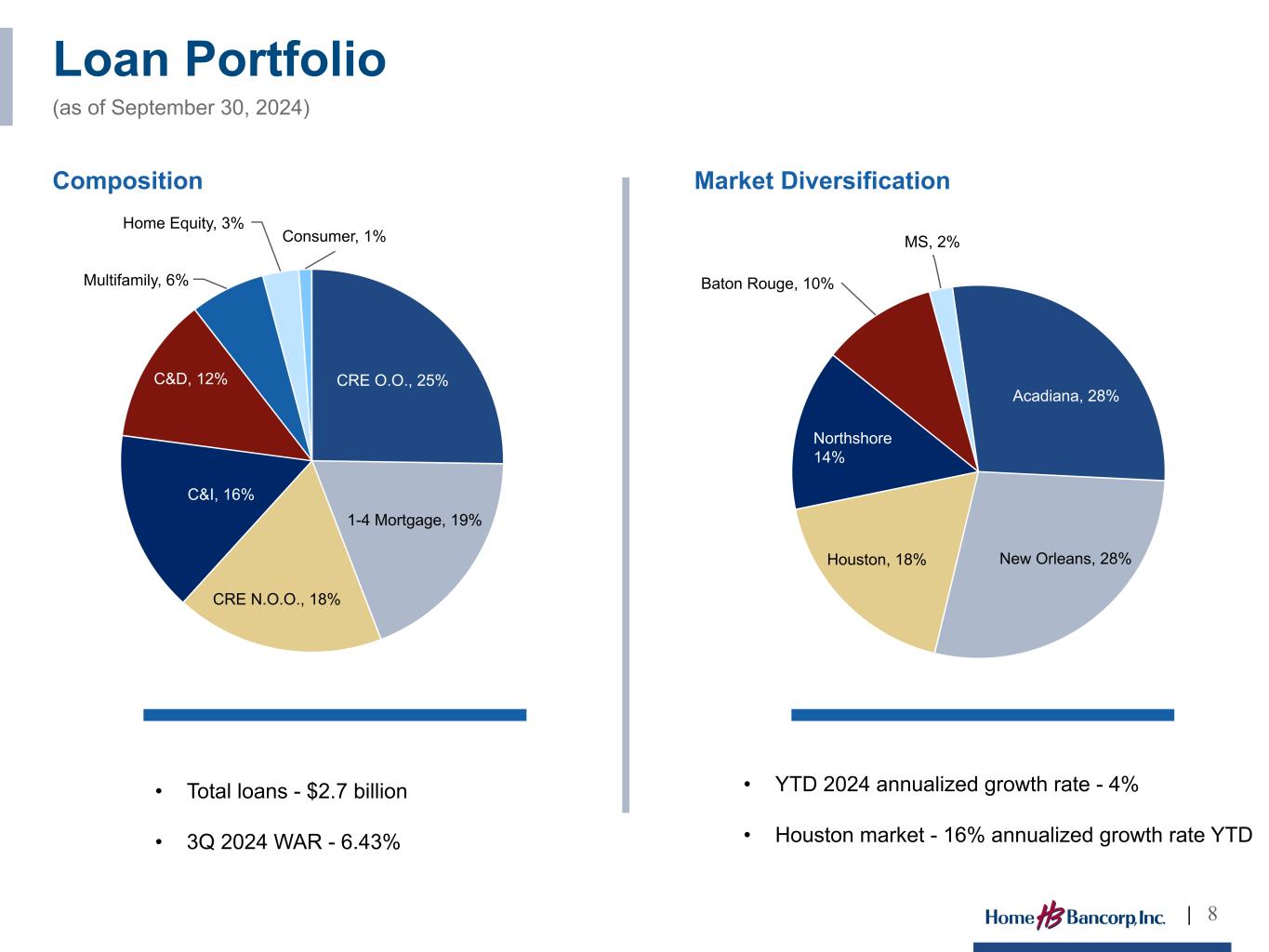

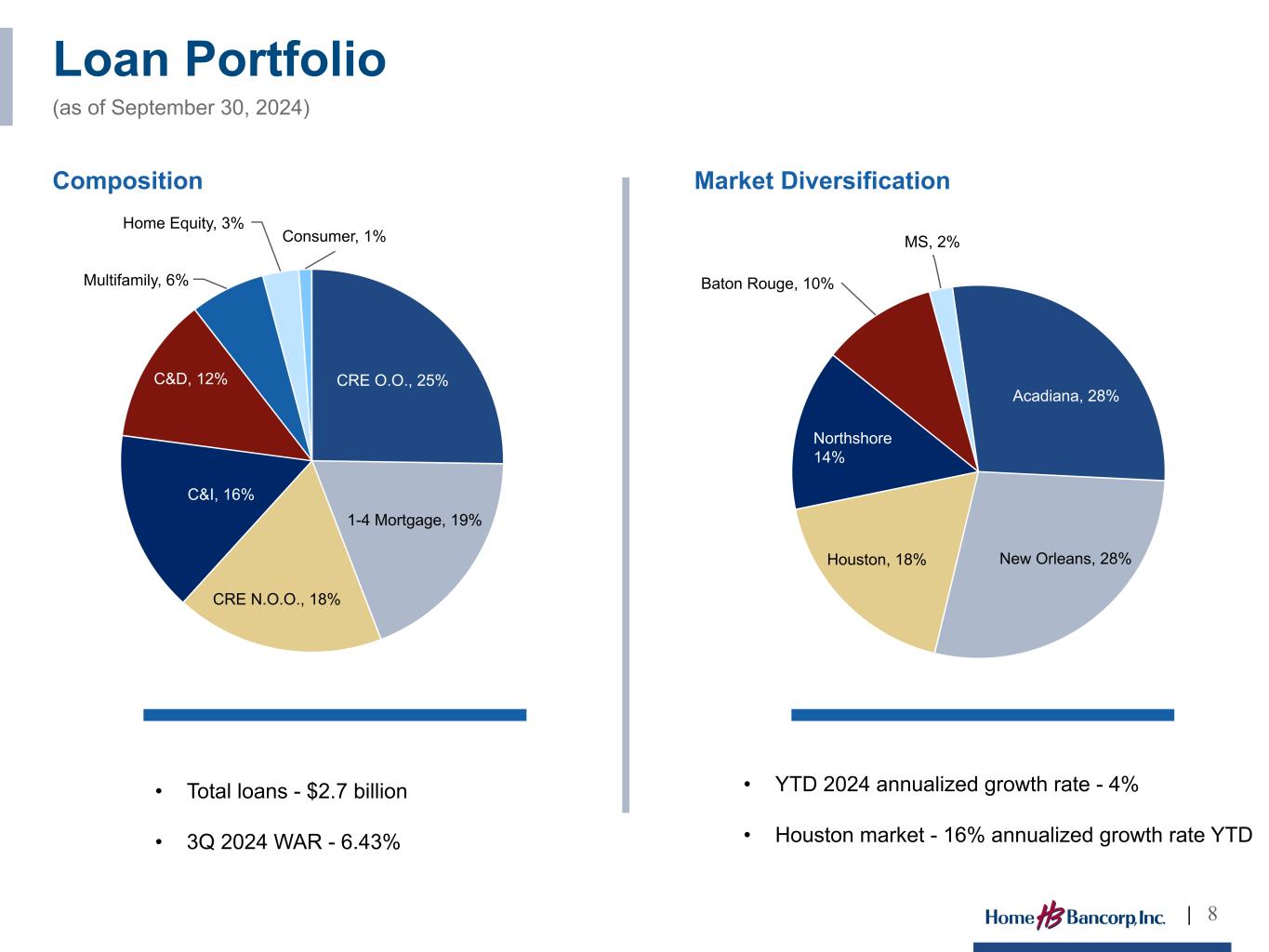

Loan Portfolio (as of September 30, 2024) CRE O.O., 25% 1-4 Mortgage, 19% CRE N.O.O., 18% C&I, 16% C&D, 12% Multifamily, 6% Home Equity, 3% Consumer, 1% Composition Market Diversification Acadiana, 28% New Orleans, 28%Houston, 18% Northshore 14% Baton Rouge, 10% MS, 2% • Total loans - $2.7 billion • 3Q 2024 WAR - 6.43% • YTD 2024 annualized growth rate - 4% • Houston market - 16% annualized growth rate YTD | 8

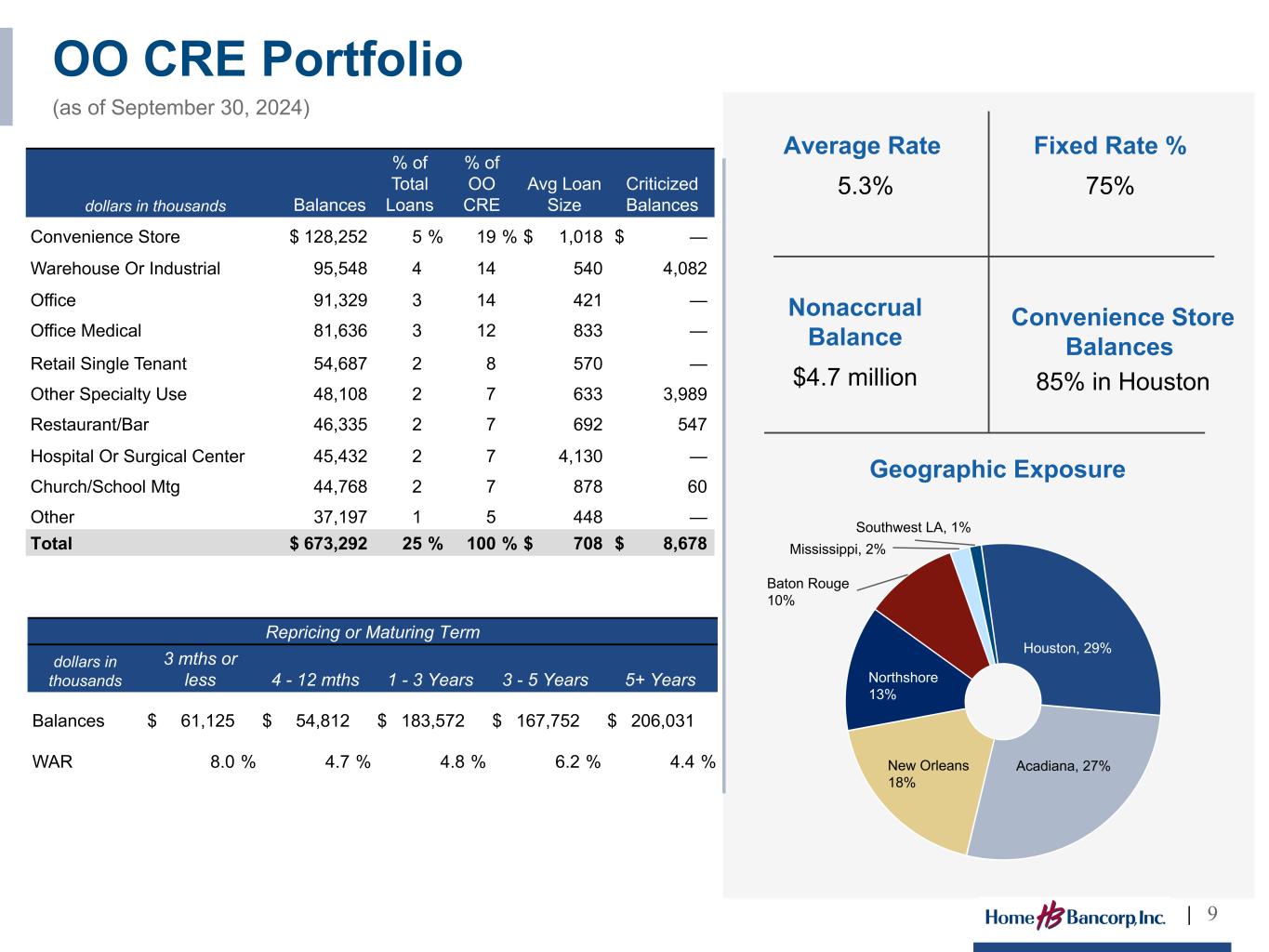

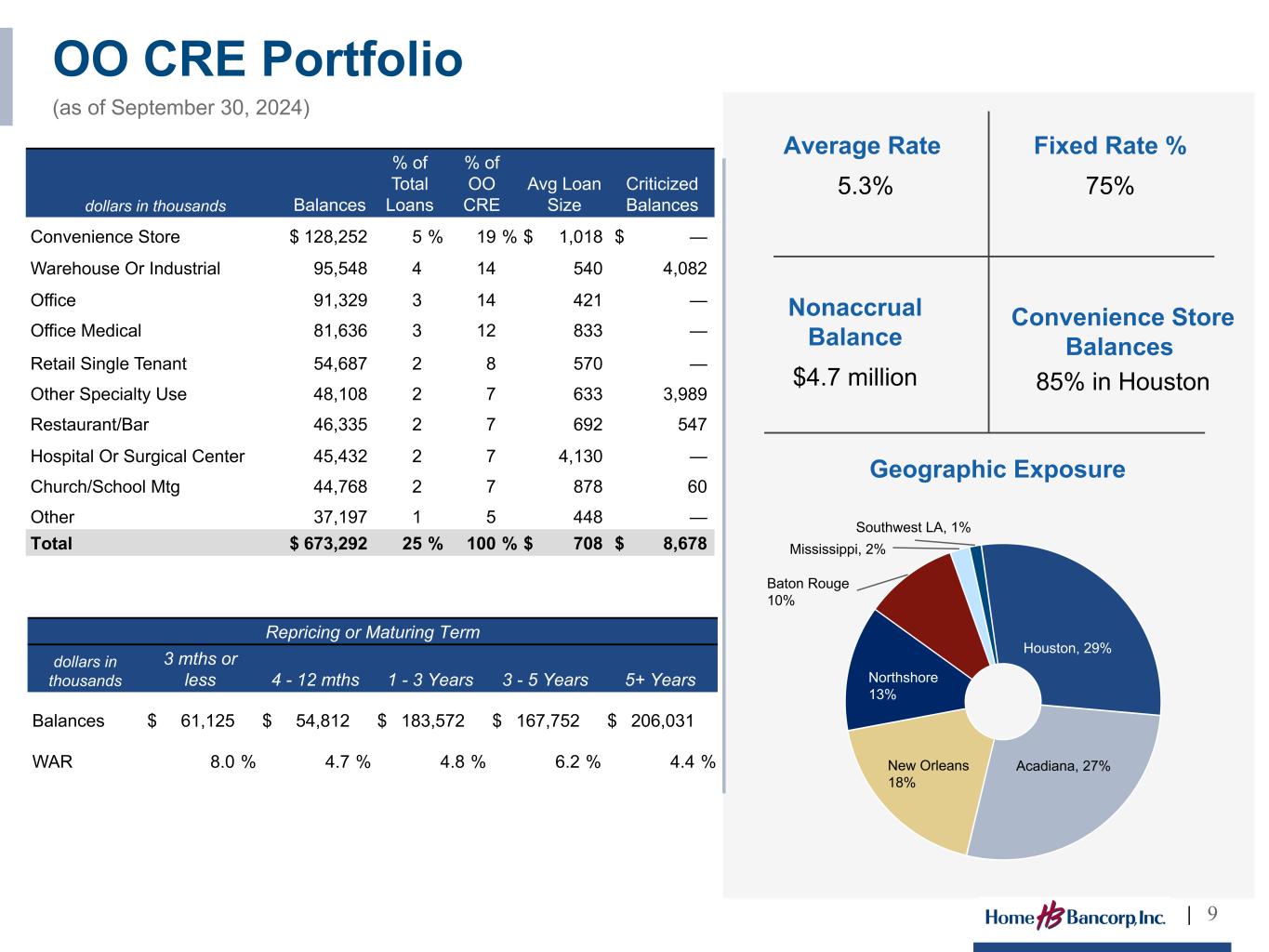

OO CRE Portfolio (as of September 30, 2024) Geographic Exposure Houston, 29% Acadiana, 27%New Orleans 18% Northshore 13% Baton Rouge 10% Mississippi, 2% Southwest LA, 1% | 9 dollars in thousands Balances % of Total Loans % of OO CRE Avg Loan Size Criticized Balances Convenience Store $ 128,252 5 % 19 % $ 1,018 $ — Warehouse Or Industrial 95,548 4 14 540 4,082 Office 91,329 3 14 421 — Office Medical 81,636 3 12 833 — Retail Single Tenant 54,687 2 8 570 — Other Specialty Use 48,108 2 7 633 3,989 Restaurant/Bar 46,335 2 7 692 547 Hospital Or Surgical Center 45,432 2 7 4,130 — Church/School Mtg 44,768 2 7 878 60 Other 37,197 1 5 448 — Total $ 673,292 25 % 100 % $ 708 $ 8,678 Repricing or Maturing Term dollars in thousands 3 mths or less 4 - 12 mths 1 - 3 Years 3 - 5 Years 5+ Years Balances $ 61,125 $ 54,812 $ 183,572 $ 167,752 $ 206,031 WAR 8.0 % 4.7 % 4.8 % 6.2 % 4.4 % Average Rate 5.3% Fixed Rate % 75% Convenience Store Balances 85% in Houston Nonaccrual Balance $4.7 million

NOO CRE Portfolio, including Multifamily (as of September 30, 2024) Geographic Exposure New Orleans 35% Northshore 23% Houston 21% Acadiana 14% Baton Rouge 6% Other, 1% | 10 dollars in thousands Balances % of Total Loans % of NOO CRE Avg Loan Size Criticized Balances Multifamily $ 169,443 6 % 27 % $ 1,210 $ 930 Retail Multi-tenant 133,217 5 21 1,514 454 Multi Use Facility 76,397 3 12 1,273 — Office 73,605 3 11 981 2,139 Hotel/Motel 55,822 2 9 765 6,636 Warehouse or Industrial 52,268 2 8 645 — Other 34,651 1 5 488 — Other Specialty Use 18,150 1 3 648 — Retail Single Tenant 12,901 1 2 430 — Hospital or Surgical Center 12,848 1 2 1,428 — Total $ 639,302 24 % 100 % $ 1,246 $ 10,159 Repricing or Maturing Term dollars in thousands 3 mths or less 4 - 12 mths 1-3 years 3-5 Years 5+ Years Balances $ 117,798 $ 45,345 $ 231,050 $ 148,004 $ 97,105 WAR 7.1 % 5.4 % 4.8 % 6.6 % 4.6 % Average Rate 5.6% Fixed Rate % 76% Nonaccrual Balance $2.4 million

CRE Non-Medical Office Exposure (as of September 30, 2024) | 11 Nonaccrual Balance One NOO loan - $639,000 Total Non-Medical Office Loans $164.9 million or 6.2% of total loans NOO Geographic Exposure Baton Rouge 1.0% Houston 0.8% Norths hore 0.4% Acadiana 0.3% New Orle n s 0.2% dollars in thousands Balances % of Total Loans Avg Loan Size Criticized Baton Rouge $ 27,188 1.0 % $ 1,295 $ — Houston 22,462 0.9 2,042 — Northshore 9,385 0.4 1,043 — Acadiana 7,781 0.3 371 — New Orleans 6,579 0.2 658 2,139 Mississippi 209 — 209 — Total NOO Office $ 73,604 2.8 % $ 1,008 $ 2,139 dollars in thousands Balances % of Total Loans Avg Loan Size Criticized Acadiana $ 30,421 1.1 % $ 461 $ — Northshore 21,562 0.8 539 — Houston 12,720 0.5 509 — New Orleans 12,175 0.5 358 — Southwest LA 11,251 0.4 536 — Mississippi 2,144 0.1 143 — Baton Rouge 1,057 — 176 — Total OO Office $ 91,329 3.4 % $ 441 $ — OO Office Exposure NOO Office Exposure Average Remaining Maturity NOO 5.9 yrs OO 7.6 yrs Average Rate NOO 5.2% OO 5.3%

Commercial & Industrial (as of September 30, 2024) | 12 Nonaccrual Balance $777,000 LOC Utilization Rate 50% Average Rate 7.6% Geographic Exposure Acadiana 38% Baton Rouge 16% New Orleans 11% Northshore 10% Houston 8% Other 7% Southwest LA 7% Natchez 3% dollars in thousands Balances % of C&I % of Loans Criticized Balances Professional Services $ 51,924 13 % 1.9 % $ 45 Finance and Insurance 51,559 12 1.9 1,344 Retail 37,923 9 1.4 432 Manufacturing 36,935 9 1.4 78 Healthcare 35,491 9 1.3 142 Real Estate Leasing 34,225 8 1.3 — Construction 33,780 8 1.3 20 Transportation 30,114 7 1.1 41 Oil & Gas Extraction 27,853 7 1.0 — Agriculture 20,938 5 0.8 — Other 52,011 13 1.9 19 Totals $ 412,753 100 % 15.5 % $ 2,121 Repricing or Maturing Term dollars in thousands 3 mths or less 4 -12 Mths 1 - 3 Years 3 - 5 Years 5+ Years Balances $ 219,650 $ 20,288 $ 37,391 $ 70,035 $ 65,389 WAR 8.6 % 7.4 % 6.4 % 6.7 % 5.7 % Fixed Rate % 44%

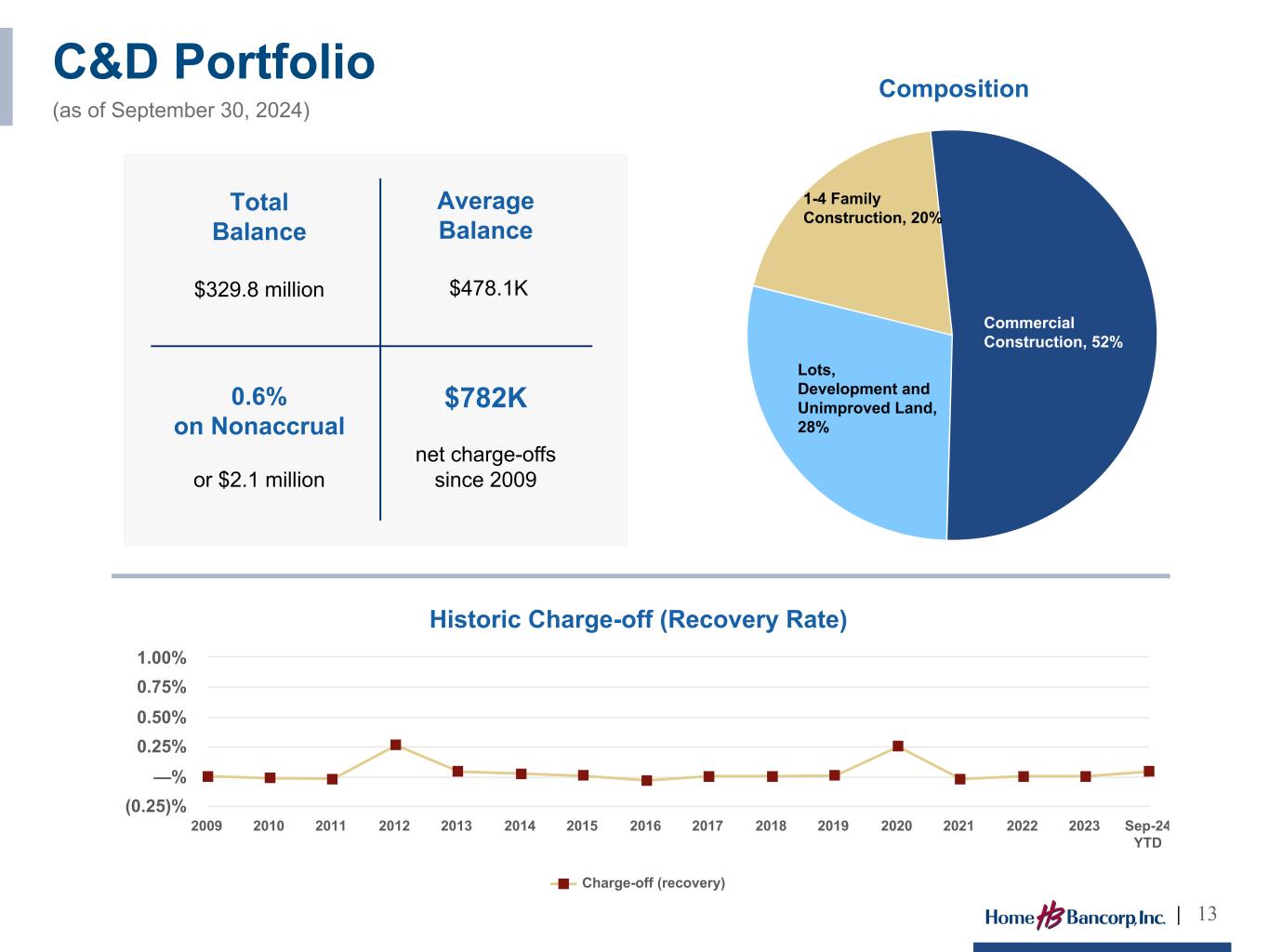

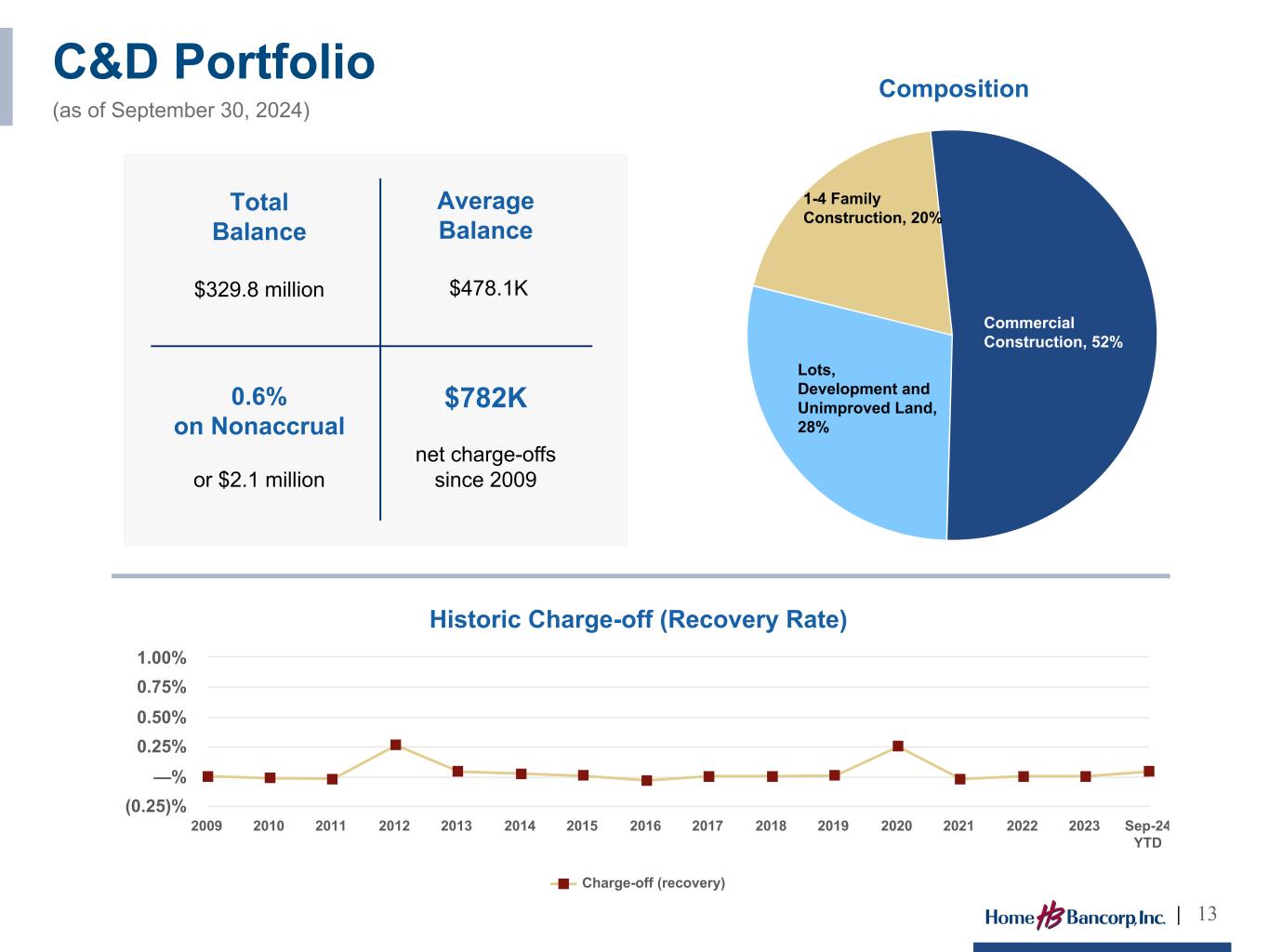

C&D Portfolio (as of September 30, 2024) Commercial Construction, 52% Lots, Development and Unimproved Land, 28% 1-4 Family Construction, 20% Composition | 13 Historic Charge-off (Recovery Rate) Charge-off (recovery) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD (0.25)% —% 0.25% 0.50% 0.75% 1.00% Total Balance $329.8 million Average Balance $478.1K $782K net charge-offs since 2009 0.6% on Nonaccrual or $2.1 million

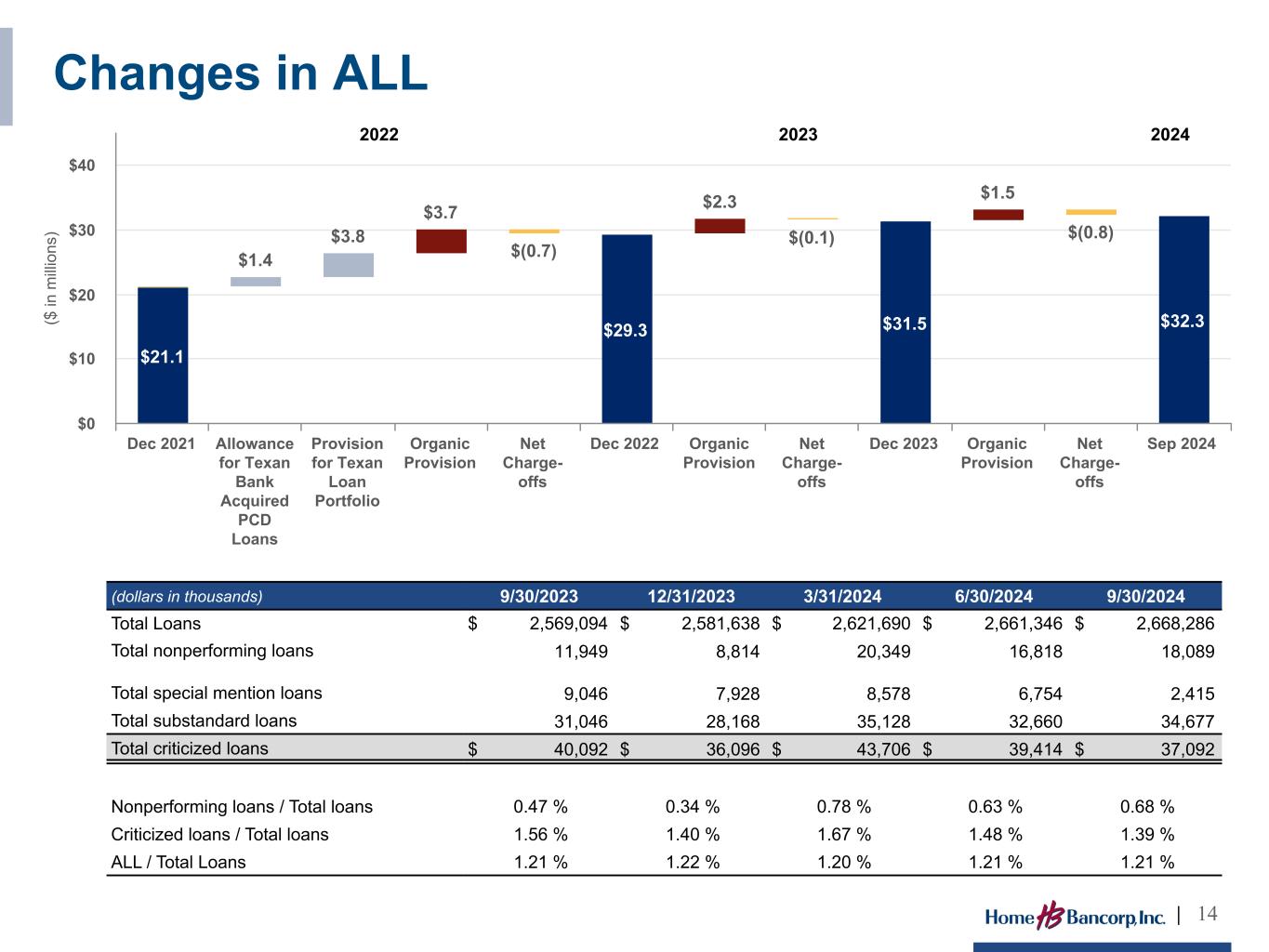

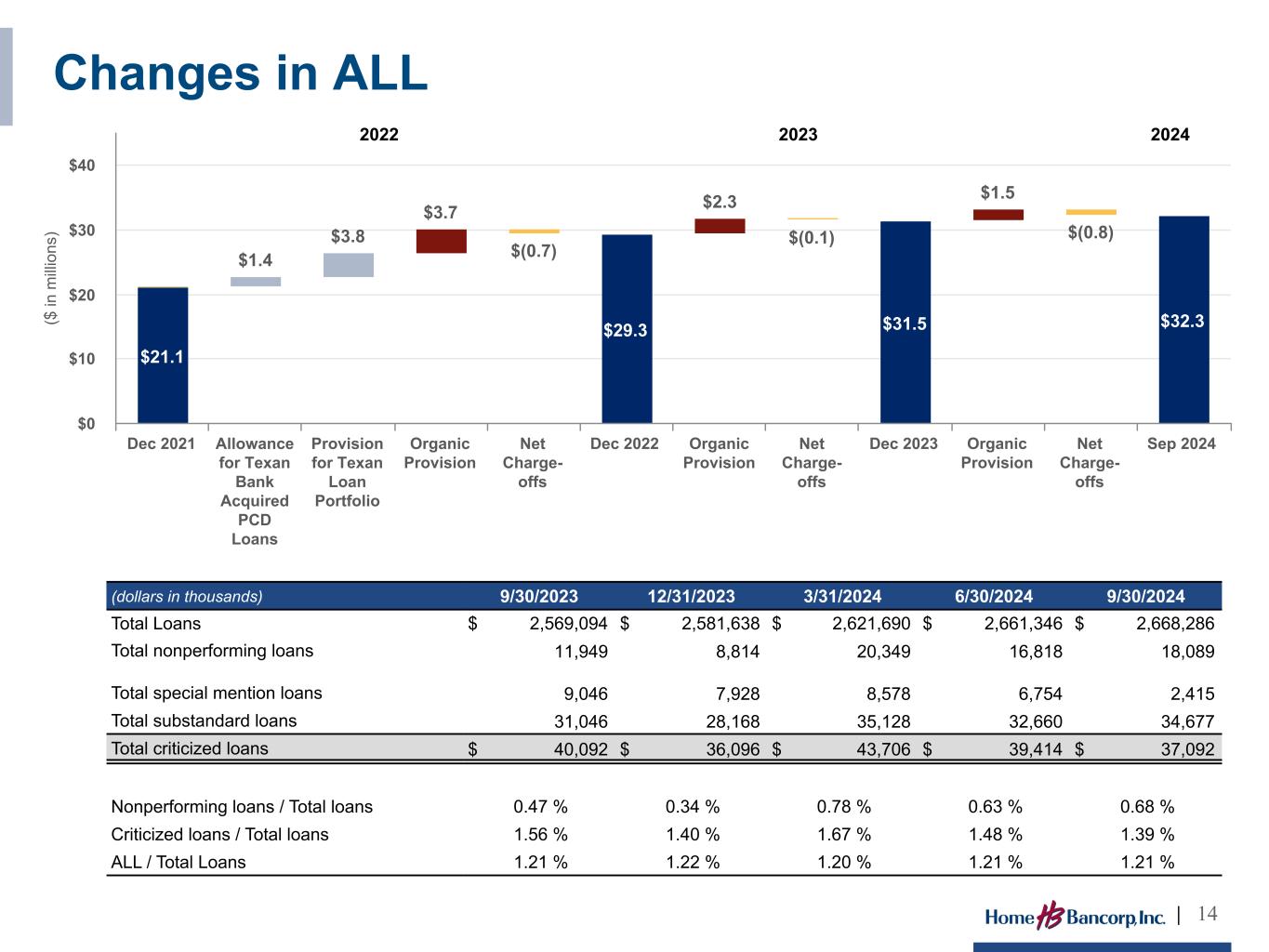

($ in m illi on s) $1.4 $3.8 $3.7 $(0.7) $2.3 $(0.1) $1.5 $(0.8) $21.1 $29.3 $31.5 $32.3 Dec 2021 Allowance for Texan Bank Acquired PCD Loans Provision for Texan Loan Portfolio Organic Provision Net Charge- offs Dec 2022 Organic Provision Net Charge- offs Dec 2023 Organic Provision Net Charge- offs Sep 2024 $0 $10 $20 $30 $40 2023 (dollars in thousands) 9/30/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 Total Loans $ 2,569,094 $ 2,581,638 $ 2,621,690 $ 2,661,346 $ 2,668,286 Total nonperforming loans 11,949 8,814 20,349 16,818 18,089 Total special mention loans 9,046 7,928 8,578 6,754 2,415 Total substandard loans 31,046 28,168 35,128 32,660 34,677 Total criticized loans $ 40,092 $ 36,096 $ 43,706 $ 39,414 $ 37,092 Nonperforming loans / Total loans 0.47 % 0.34 % 0.78 % 0.63 % 0.68 % Criticized loans / Total loans 1.56 % 1.40 % 1.67 % 1.48 % 1.39 % ALL / Total Loans 1.21 % 1.22 % 1.20 % 1.21 % 1.21 % 20242021 Changes in ALL | 14 2022

1.16 1.21 1.30 0.77 0.49 0.34 0.31 0.53 1.01 0.72 0.75 0.40 0.28 0.14 0.20 0.40 NPAs / Total Assets Originated NPAs / Total Assets 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% NPAs / Assets title 0.00 0.15 0.09 0.12 0.09 0.03 0.00 0.04 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD 0.00% 0.05% 0.10% 0.15% 0.20% Net Charge-offs / YTD Average Loans 57 63 63 165 146 267 304 176 ALL / NPAs 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD 0% 50% 100% 150% 200% 250% 300% 350% ALL / NPAs 1.74 1.94 1.73 1.03 0.83 0.41 0.52 0.97% 0.82 0.87 1.32 0.74 0.57 0.32 0.36 0.94% Past Due Loans / Loans Originated Past Due / Originated Loans 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% Loans Past Due Credit Quality Trends | 15

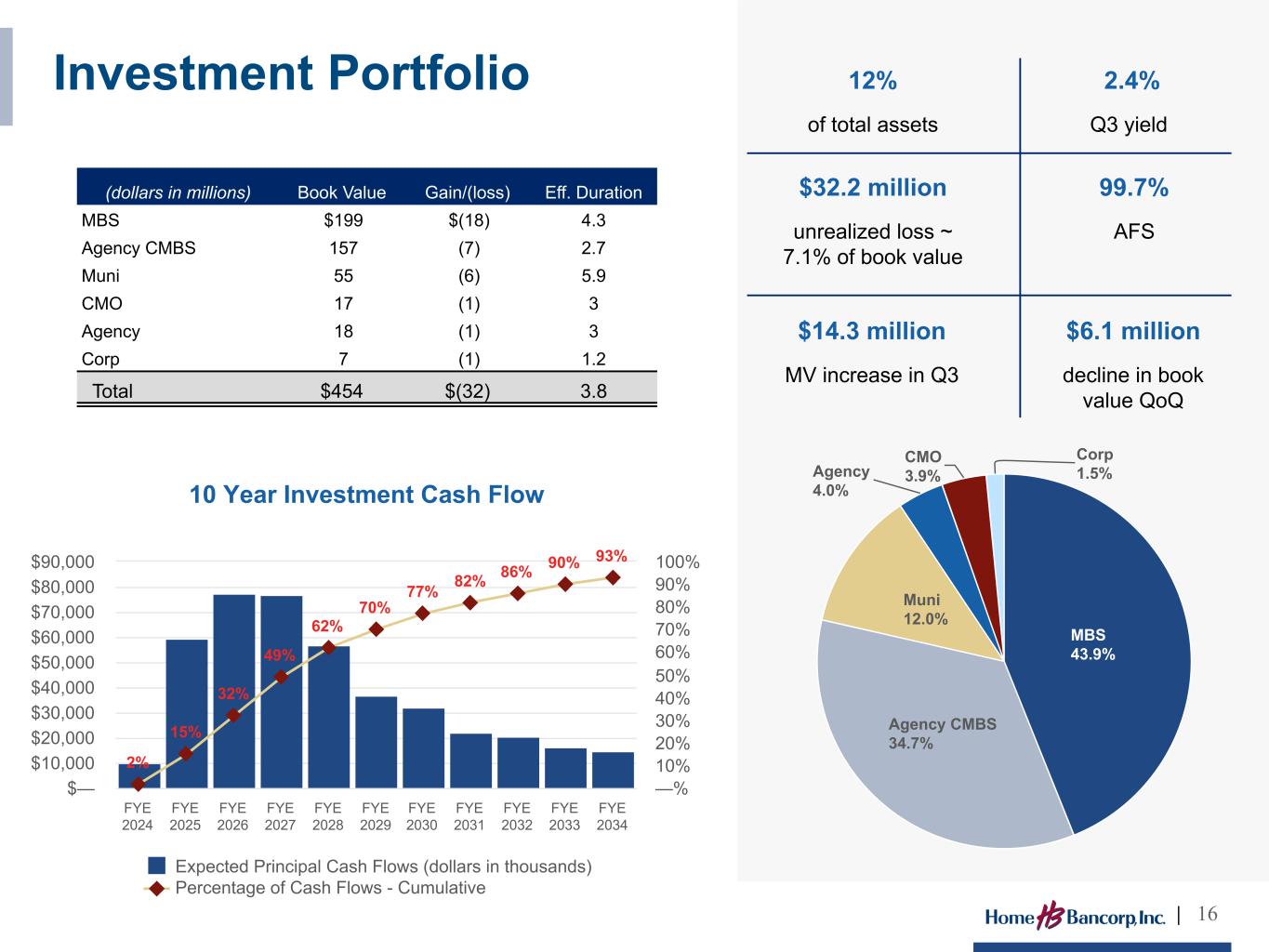

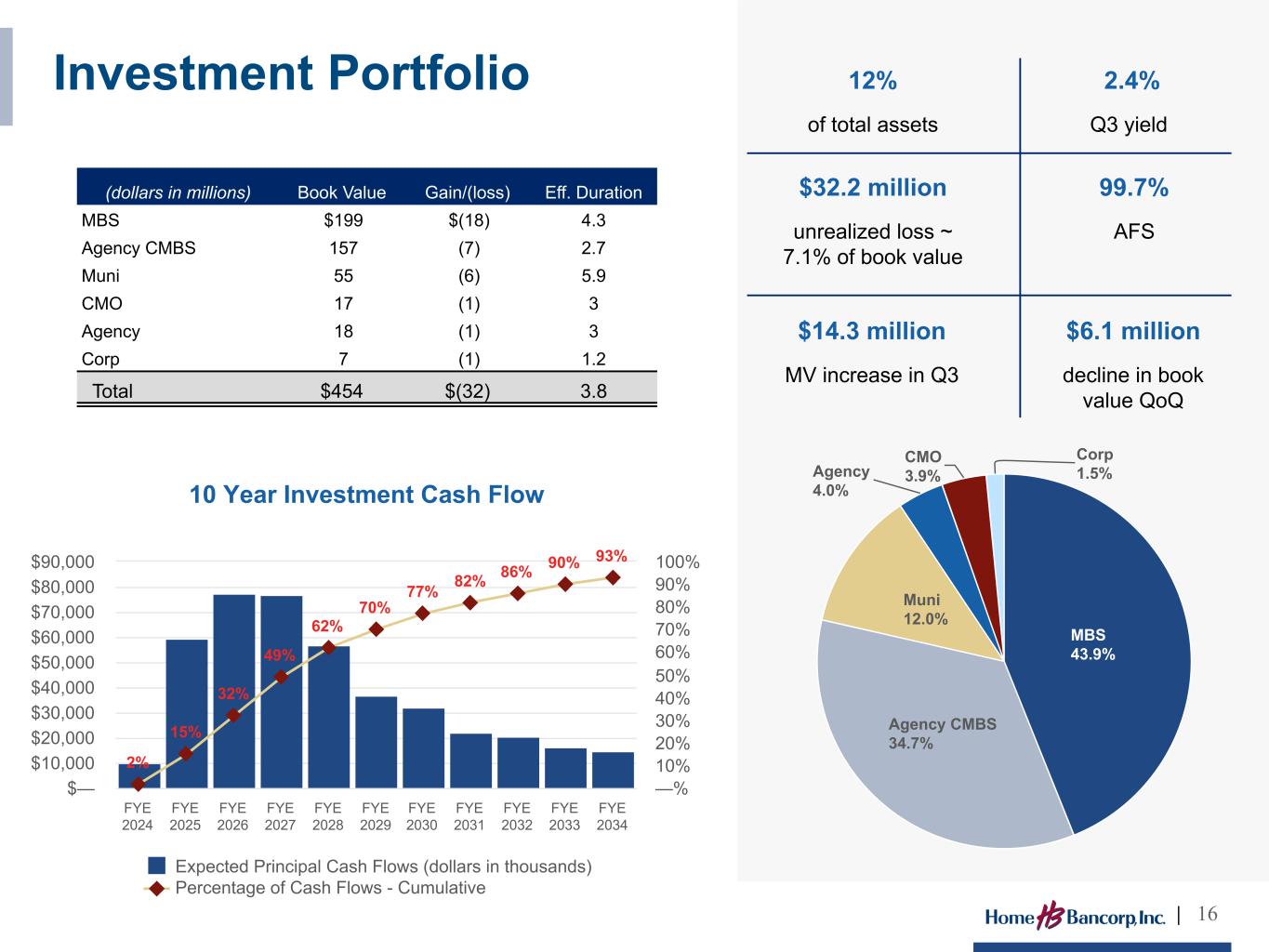

Investment Portfolio | 16 (dollars in millions) Book Value Gain/(loss) Eff. Duration MBS $199 $(18) 4.3 Agency CMBS 157 (7) 2.7 Muni 55 (6) 5.9 CMO 17 (1) 3 Agency 18 (1) 3 Corp 7 (1) 1.2 Total $454 $(32) 3.8 10 Year Investment Cash Flow 2% 15% 32% 49% 62% 70% 77% 82% 86% 90% 93% Expected Principal Cash Flows (dollars in thousands) Percentage of Cash Flows - Cumulative FYE 2024 FYE 2025 FYE 2026 FYE 2027 FYE 2028 FYE 2029 FYE 2030 FYE 2031 FYE 2032 FYE 2033 FYE 2034 $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 —% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% MBS 43.9% Agency CMBS 34.7% Muni 12.0% Agency 4.0% CMO 3.9% Corp 1.5% 12% of total assets 2.4% Q3 yield $32.2 million unrealized loss ~ 7.1% of book value 99.7% AFS $14.3 million MV increase in Q3 $6.1 million decline in book value QoQ

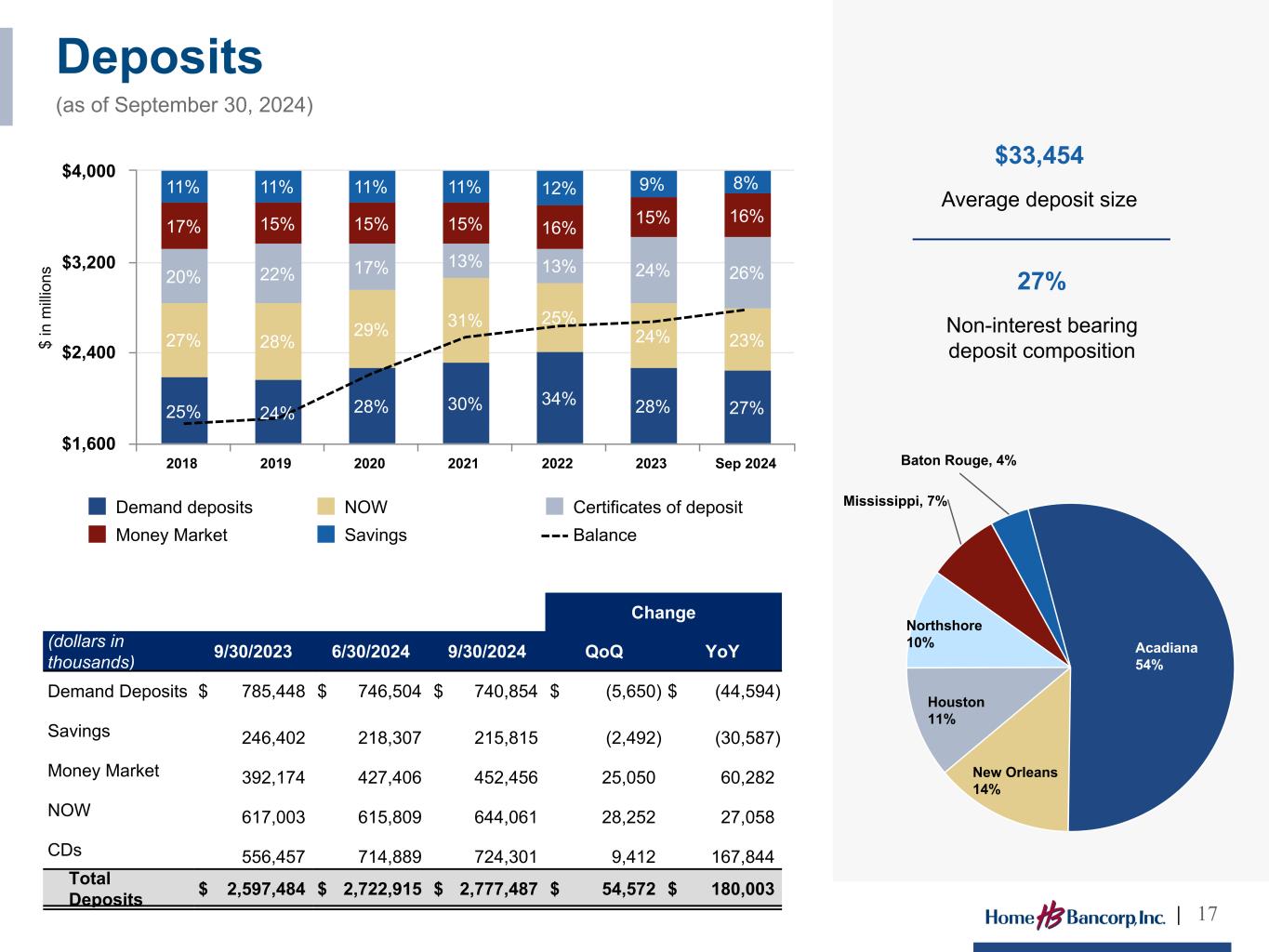

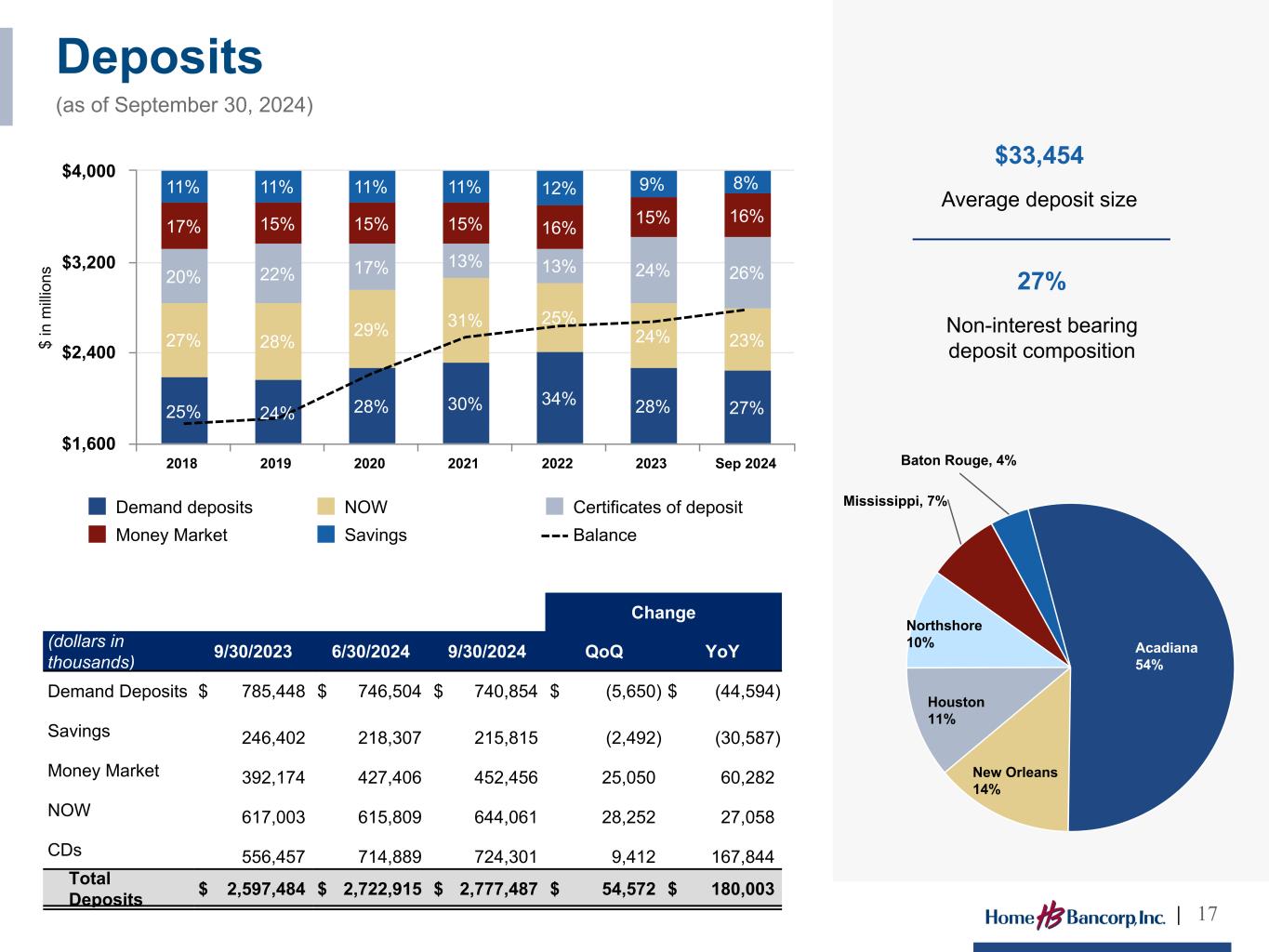

Acadiana 54% New Orleans 14% Houston 11% Northshore 10% Mississippi, 7% Baton Rouge, 4% $ in m illi on s 25% 24% 28% 30% 34% 28% 27% 27% 28% 29% 31% 25% 24% 23% 20% 22% 17% 13% 13% 24% 26% 17% 15% 15% 15% 16% 15% 16% 11% 11% 11% 11% 12% 9% 8% Demand deposits NOW Certificates of deposit Money Market Savings Balance 2018 2019 2020 2021 2022 2023 Sep 2024 $1,600 $2,400 $3,200 $4,000 Change (dollars in thousands) 9/30/2023 6/30/2024 9/30/2024 QoQ YoY Demand Deposits $ 785,448 $ 746,504 $ 740,854 $ (5,650) $ (44,594) Savings 246,402 218,307 215,815 (2,492) (30,587) Money Market 392,174 427,406 452,456 25,050 60,282 NOW 617,003 615,809 644,061 28,252 27,058 CDs 556,457 714,889 724,301 9,412 167,844 Total Deposits $ 2,597,484 $ 2,722,915 $ 2,777,487 $ 54,572 $ 180,003 Deposits (as of September 30, 2024) | 17 $33,454 Average deposit size 27% Non-interest bearing deposit composition

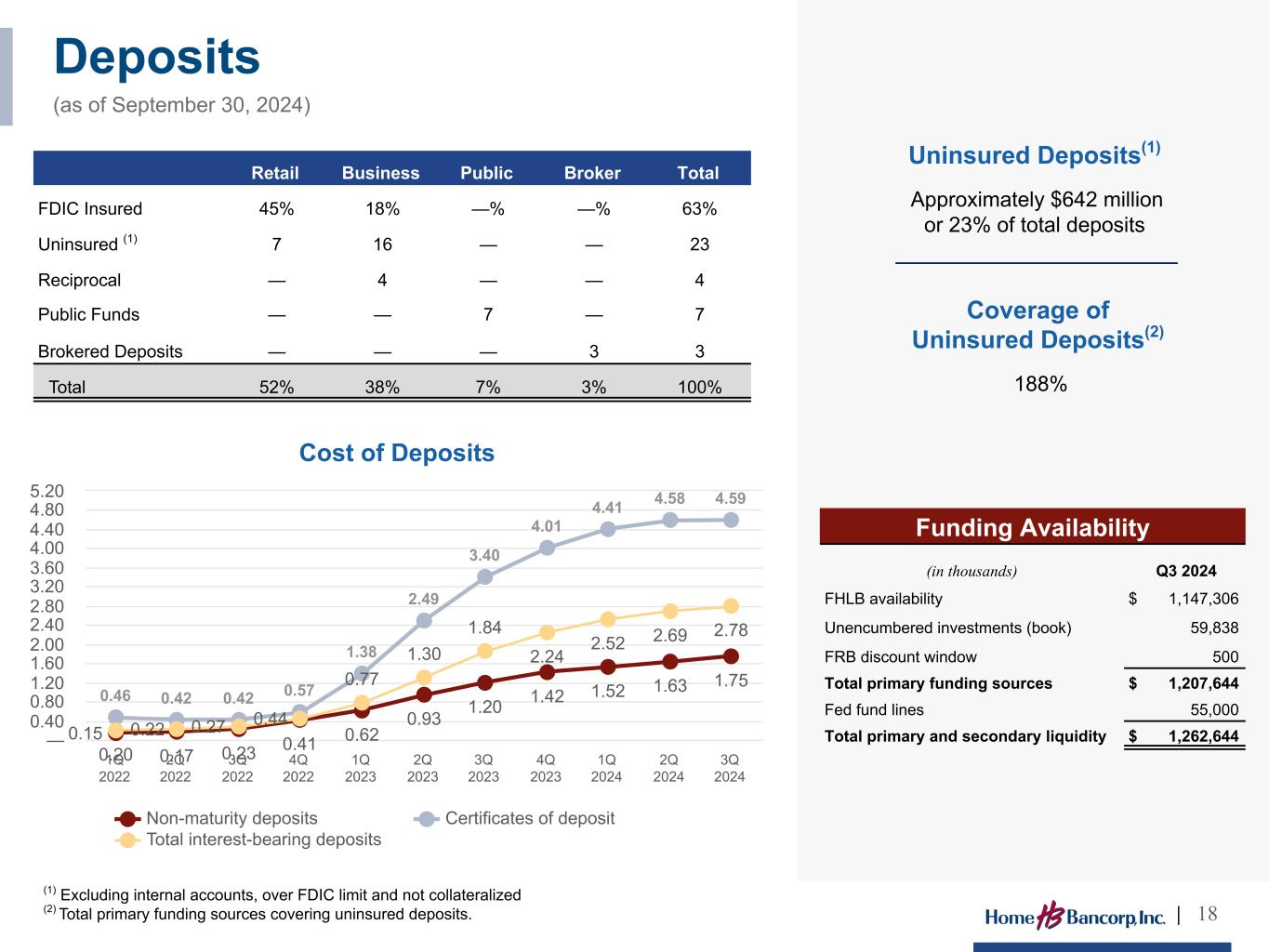

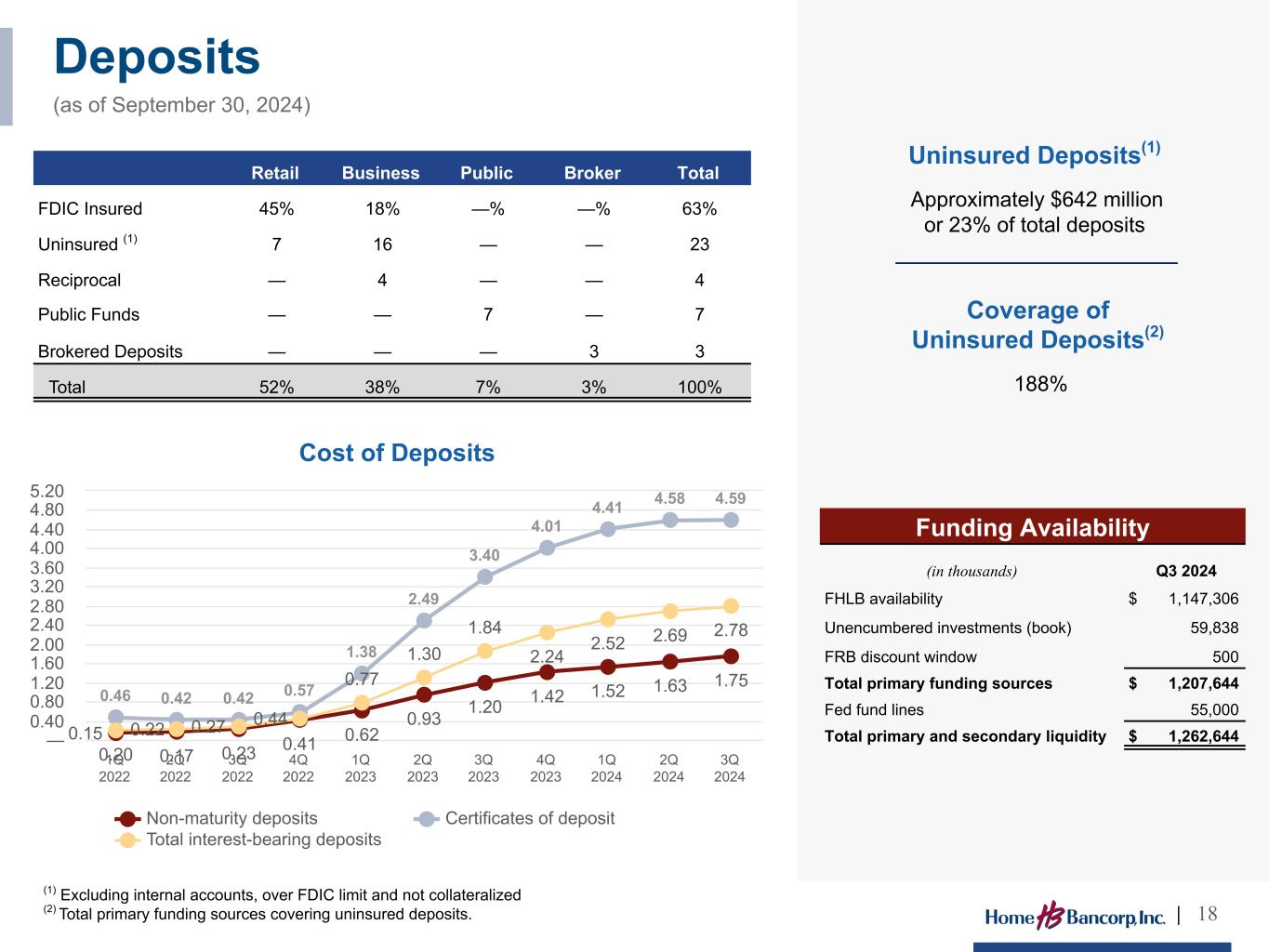

Deposits (as of September 30, 2024) | 18 Retail Business Public Broker Total FDIC Insured 45% 18% —% —% 63% Uninsured (1) 7 16 — — 23 Reciprocal — 4 — — 4 Public Funds — — 7 — 7 Brokered Deposits — — — 3 3 Total 52% 38% 7% 3% 100% Cost of Deposits 0.15 0.17 0.23 0.41 0.62 0.93 1.20 1.42 1.52 1.63 1.75 0.46 0.42 0.42 0.57 1.38 2.49 3.40 4.01 4.41 4.58 4.59 0.20 0.22 0.27 0.44 0.77 1.30 1.84 2.24 2.52 2.69 2.78 Non-maturity deposits Certificates of deposit Total interest-bearing deposits 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 — 0.40 0.80 1.20 1.60 2.00 2.40 2.80 3.20 3.60 4.00 4.40 4.80 5.20 (1) Excluding internal accounts, over FDIC limit and not collateralized (2) Total primary funding sources covering uninsured deposits. Funding Availability (in thousands) Q3 2024 FHLB availability $ 1,147,306 Unencumbered investments (book) 59,838 FRB discount window 500 Total primary funding sources $ 1,207,644 Fed fund lines 55,000 Total primary and secondary liquidity $ 1,262,644 Uninsured Deposits(1) Approximately $642 million or 23% of total deposits Coverage of Uninsured Deposits(2) 188%

4.11 4.38 4.18 3.94 3.75 3.69 3.64 3.66 3.71 3.66 3.71 3.76 NIM 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 Jul- 24 Aug- 24 Sep- 24 3.40% 3.60% 3.80% 4.00% 4.20% 4.40% 4.60% NIM (TE) 5.17 5.43 5.67 5.82 5.95 6.08 6.18 6.28 6.43 Loan Yield 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 5.00% 6.00% 7.00% Yield on Loans 0.46 0.70 1.33 1.91 2.37 2.62 2.79 2.93 3.02 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 0.0% 1.0% 2.0% 3.0% 4.0% Cost of Interest-Bearing Liabilities Yields | 19 $135 million borrowing under Federal Reserve BTFP at a cost of 4.76% and no Short-term FHLB advances at September 30, 2024 NIM 3.71% for the quarter ended September 2024 2.03% Cost of total deposits for the quarter ended September 2024 MonthQuarter

Rate Shock 1 Year % Change in NII 200 1.7% 100 1.0% (100) (1.5)% (200) (3.4)% % of assets 2019 2023 Q3 2024 Q3 Cash 2% 3% 4% Investments 12% 13% 12% Loans, excluding PPP 78% 77% 77% Other Assets 8% 7% 7% NMD - noninterest-bearing 20% 23% 22% NMD - interest-bearing 45% 38% 38% CDs 18% 17% 21% Total Deposits 83% 78% 81% Borrowings 2% 9% 5% Subordinated Debt —% 2% 2% Other 1% 1% 1% Equity 14% 10% 11% Loan portfolio effective duration ~ 2.2 (based on management estimates) Cost of 2Q2016 - 3Q2019 3Q2019 - 1Q2022 1Q2022 - 3Q2024 Interest-bearing deposits 36% 40% 49% Total deposits 27% 31% 36% Interest-bearing liabilities 33% 40% 53% Funding earning assets 23% 29% 37% Interest Rate Risk Forecasted Change in NII Liability Betas Historical Funding Betas Balance Sheet Composition | 20 Fed Funds Effective Cost of Deposits Cost of Funding Earning Assets Q1- 16 Q2- 16 Q3- 16 Q4- 16 Q1- 17 Q2- 17 Q3- 17 Q4- 17 Q1- 18 Q2- 18 Q3- 18 Q4- 18 Q1- 19 Q2- 19 Q3- 19 Q4- 19 Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 Q4- 21 Q1- 22 Q2- 22 Q3- 22 Q4- 22 Q1- 23 Q2- 23 Q3- 23 Q4- 23 Q1- 24 Q2- 24 Q3- 24 —% 1.00% 2.00% 3.00% 4.00% 5.00% Investment Portfolio effective duration = 3.7 38% of loan portfolio is variable

0.62 0.62 0.62 0.57 0.54 0.44 0.46 0.44 2017 2018 2019 2020 2021 2022 2023 Sep-24 YTD 0.40% 0.45% 0.50% 0.55% 0.60% 0.65% Noninterest Income(1) / Assets 2.79 2.83 2.87 2.53 2.41 2.51 2.52 2.57 2017 2018 2019 2020 2021 2022 2023 Sep- 24 YTD 2.00% 2.50% 3.00% 3.50% Noninterest Expense(1) / Assets (1) Excludes non-core items. See appendix for reconciliation of non-GAAP items. (dollars in thousands) 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Service fees and charges $ 1,277 $ 1,235 $ 1,254 $ 1,239 $ 1,291 Bank card fees 1,903 1,646 1,575 1,751 1,613 Gain on sale of loans 687 46 87 126 195 Loss on sale of assets, net — (7) 6 (2) (10) Other 532 558 627 641 603 Total noninterest income $ 4,399 $ 3,478 $ 3,549 $ 3,755 $ 3,692 (dollars in thousands) 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Compensation $ 12,492 $ 11,401 $ 12,170 $ 12,788 $ 13,058 Data processing 2,496 2,423 2,514 2,555 2,646 Occupancy 2,410 2,467 2,454 2,603 2,732 Provision for unfunded — 140 — (134) — Other 3,940 4,173 3,730 3,996 3,822 Total noninterest expense $ 21,338 $ 20,604 $ 20,868 $ 21,808 $ 22,258 Noninterest expense excl. provision for unfunded $ 21,338 $ 20,464 $ 20,868 $ 21,942 $ 22,258 Noninterest Income & Expense | 21

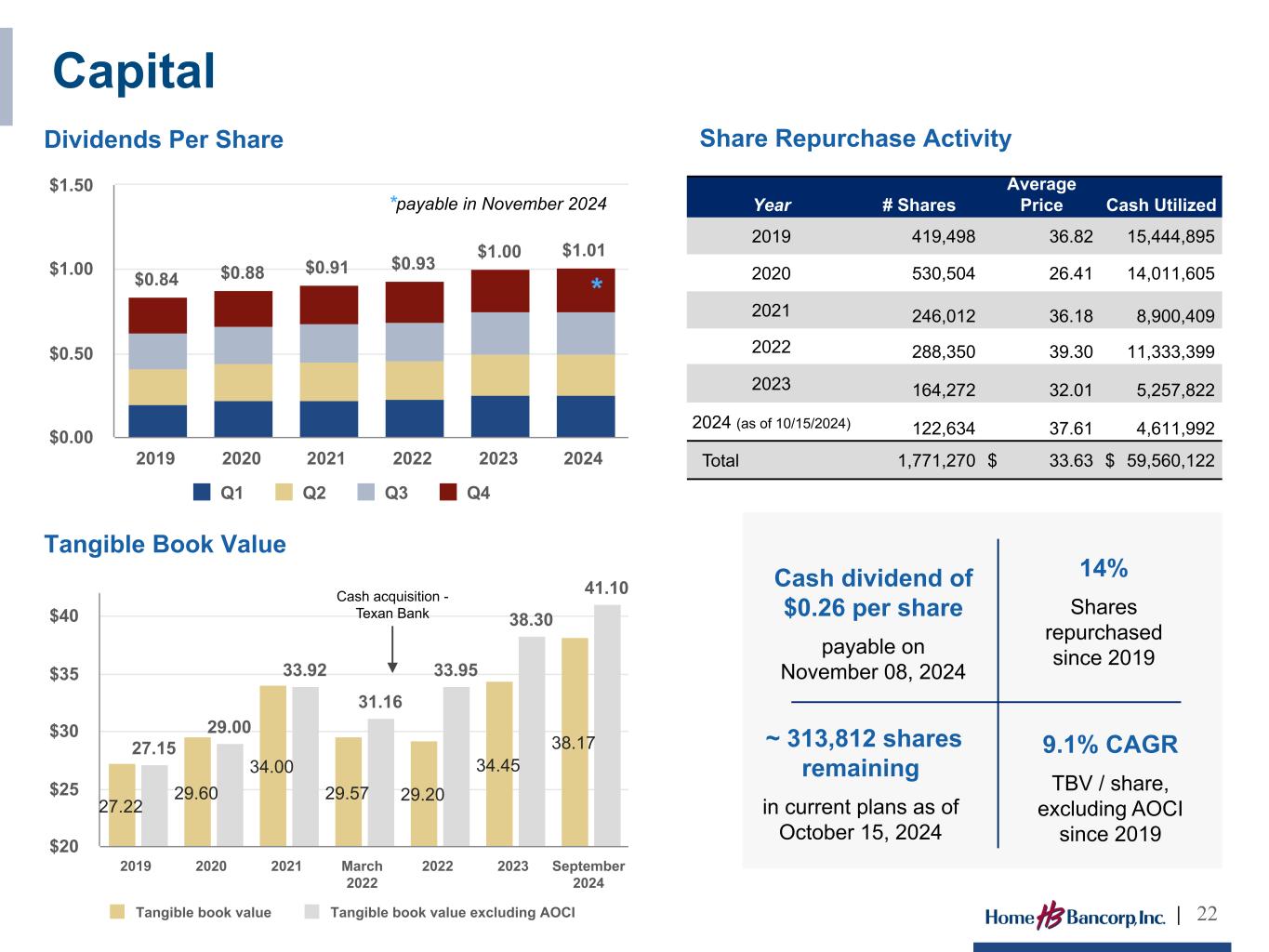

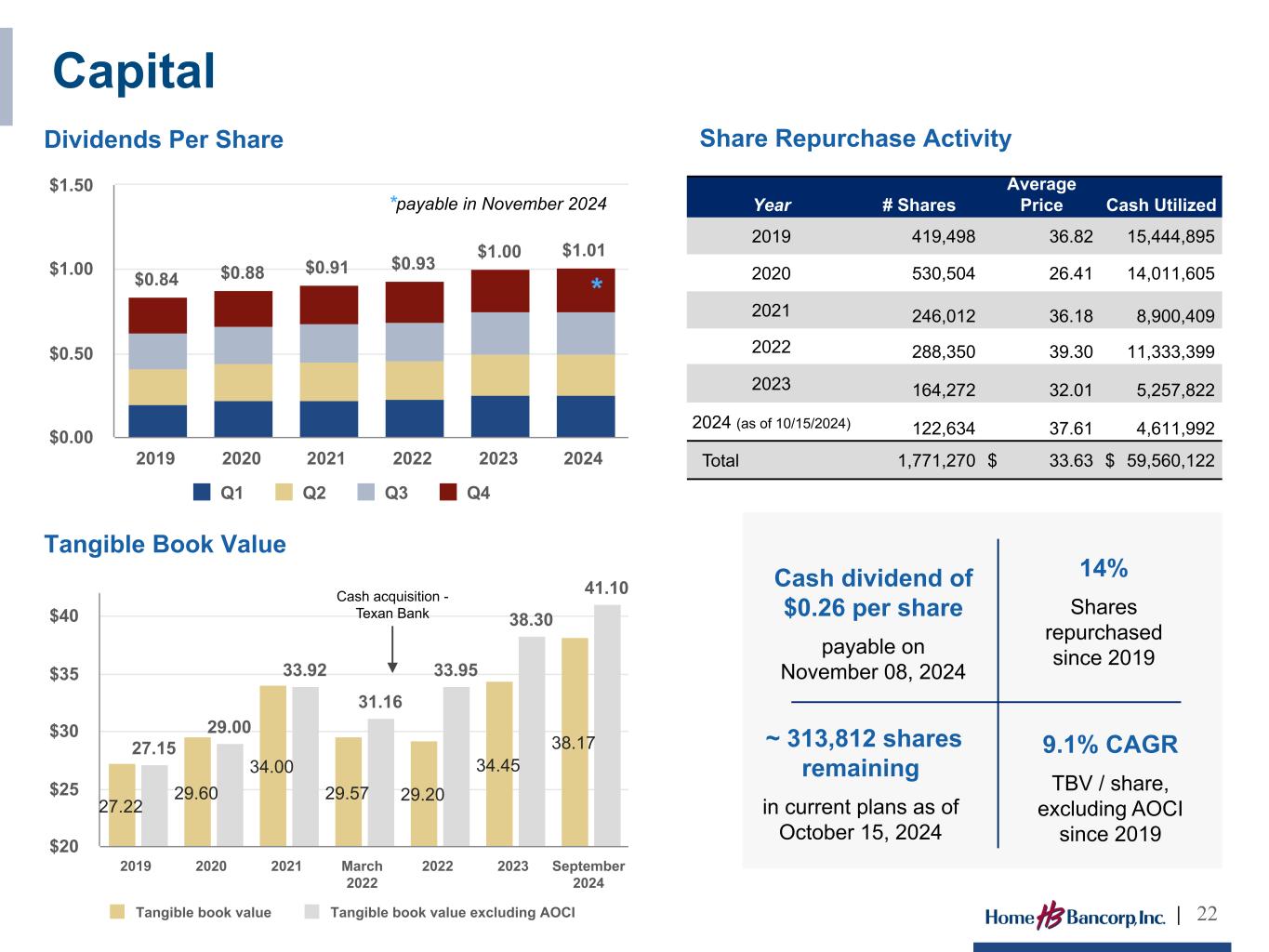

$0.84 $0.88 $0.91 $0.93 $1.00 $1.01 Q1 Q2 Q3 Q4 2019 2020 2021 2022 2023 2024 $0.00 $0.50 $1.00 $1.50 Dividends Per Share 27.22 29.60 34.00 29.57 29.20 34.45 38.1727.15 29.00 33.92 31.16 33.95 38.30 41.10 Tangible book value Tangible book value excluding AOCI 2019 2020 2021 March 2022 2022 2023 September 2024 $20 $25 $30 $35 $40 Tangible Book Value Share Repurchase Activity Year # Shares Average Price Cash Utilized 2019 419,498 36.82 15,444,895 2020 530,504 26.41 14,011,605 2021 246,012 36.18 8,900,409 2022 288,350 39.30 11,333,399 2023 164,272 32.01 5,257,822 2024 (as of 10/15/2024) 122,634 37.61 4,611,992 Total 1,771,270 $ 33.63 $ 59,560,122 Capital | 22 ~ 313,812 shares remaining in current plans as of October 15, 2024 New Share Repurchase Plan approved 405,000 14% Shares repurchased since 2019 9.1% CAGR TBV / share, excluding AOCI since 2019 Cash acquisition - Texan Bank Cash dividend of $0.26 per share payable on November 08, 2024 *payable in November 2024 *

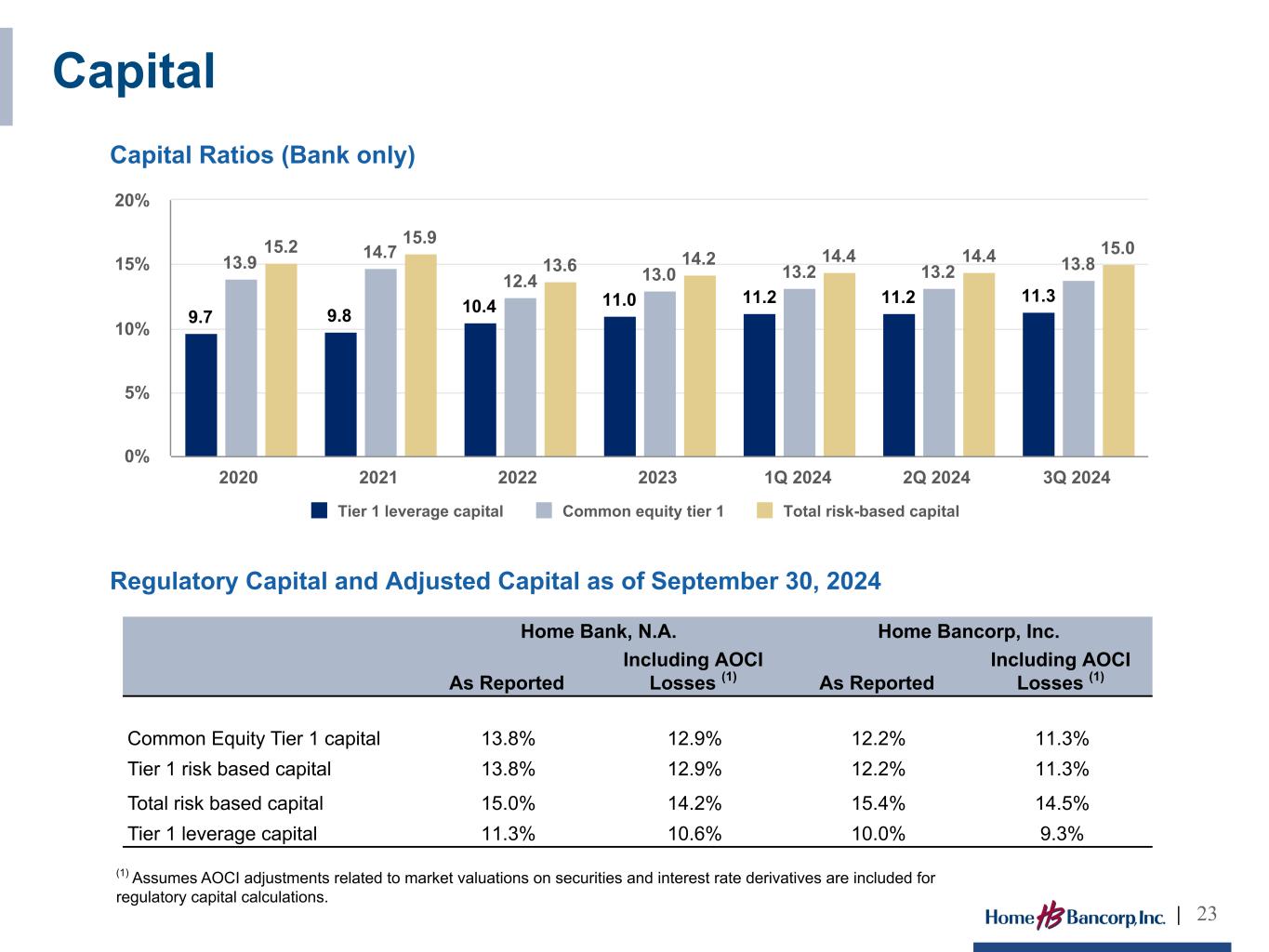

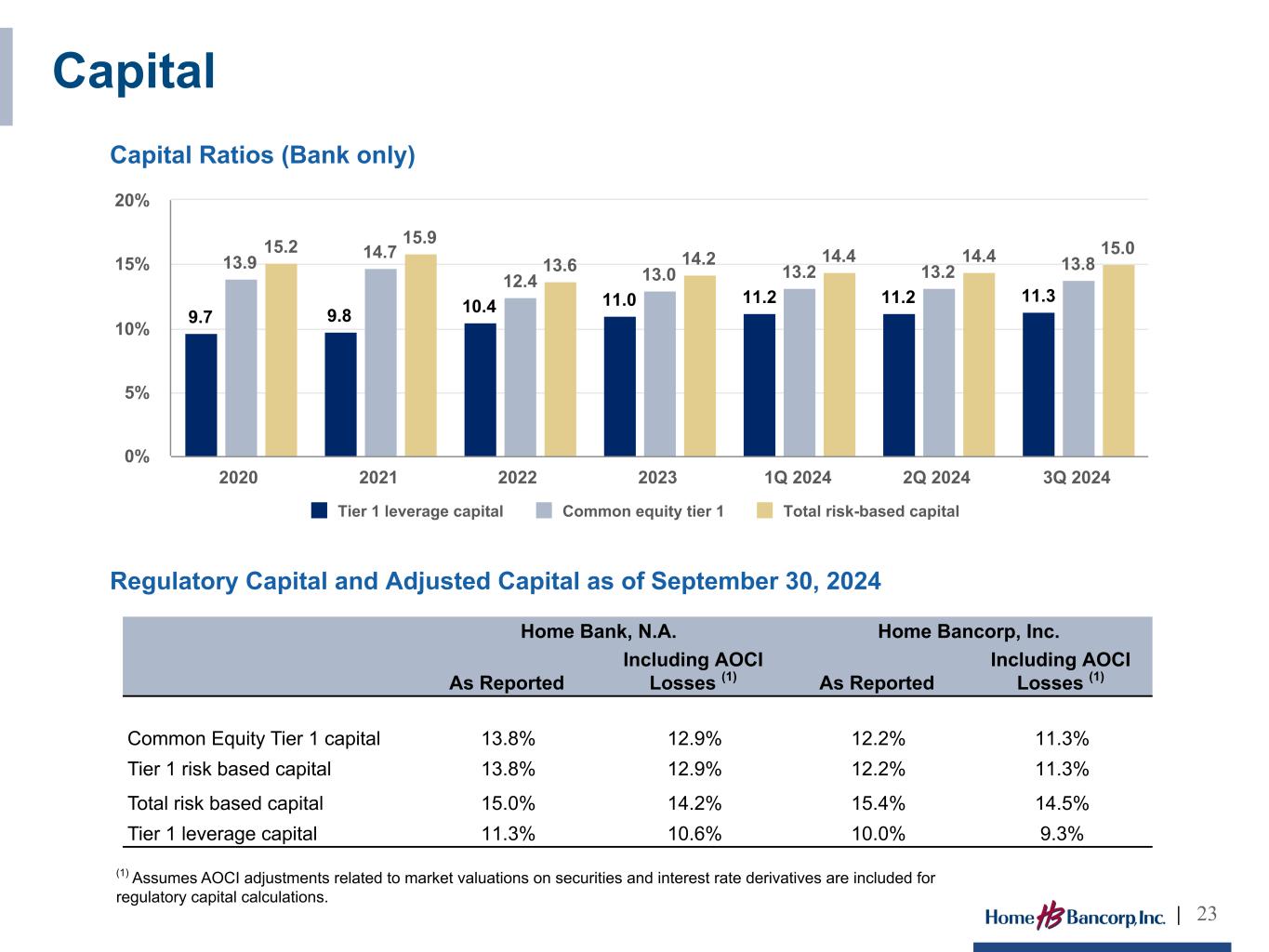

9.7 9.8 10.4 11.0 11.2 11.2 11.3 13.9 14.7 12.4 13.0 13.2 13.2 13.8 15.2 15.9 13.6 14.2 14.4 14.4 15.0 Tier 1 leverage capital Common equity tier 1 Total risk-based capital 2020 2021 2022 2023 1Q 2024 2Q 2024 3Q 2024 0% 5% 10% 15% 20% Capital Ratios (Bank only) Capital | 23 Home Bank, N.A. Home Bancorp, Inc. As Reported Including AOCI Losses (1) As Reported Including AOCI Losses (1) Common Equity Tier 1 capital 13.8% 12.9% 12.2% 11.3% Tier 1 risk based capital 13.8% 12.9% 12.2% 11.3% Total risk based capital 15.0% 14.2% 15.4% 14.5% Tier 1 leverage capital 11.3% 10.6% 10.0% 9.3% (1) Assumes AOCI adjustments related to market valuations on securities and interest rate derivatives are included for regulatory capital calculations. Regulatory Capital and Adjusted Capital as of September 30, 2024

Investment Perspective | 24

| 25

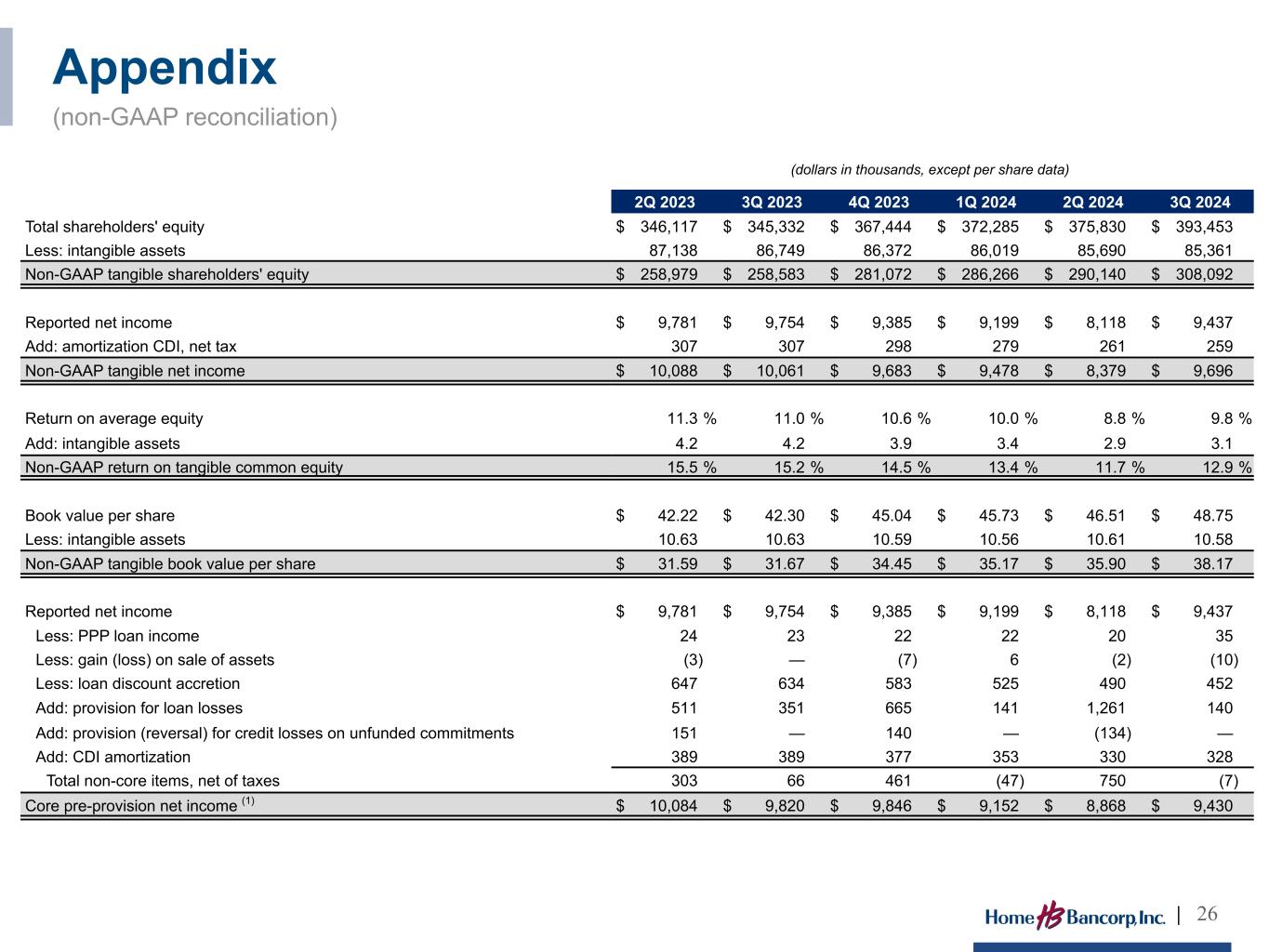

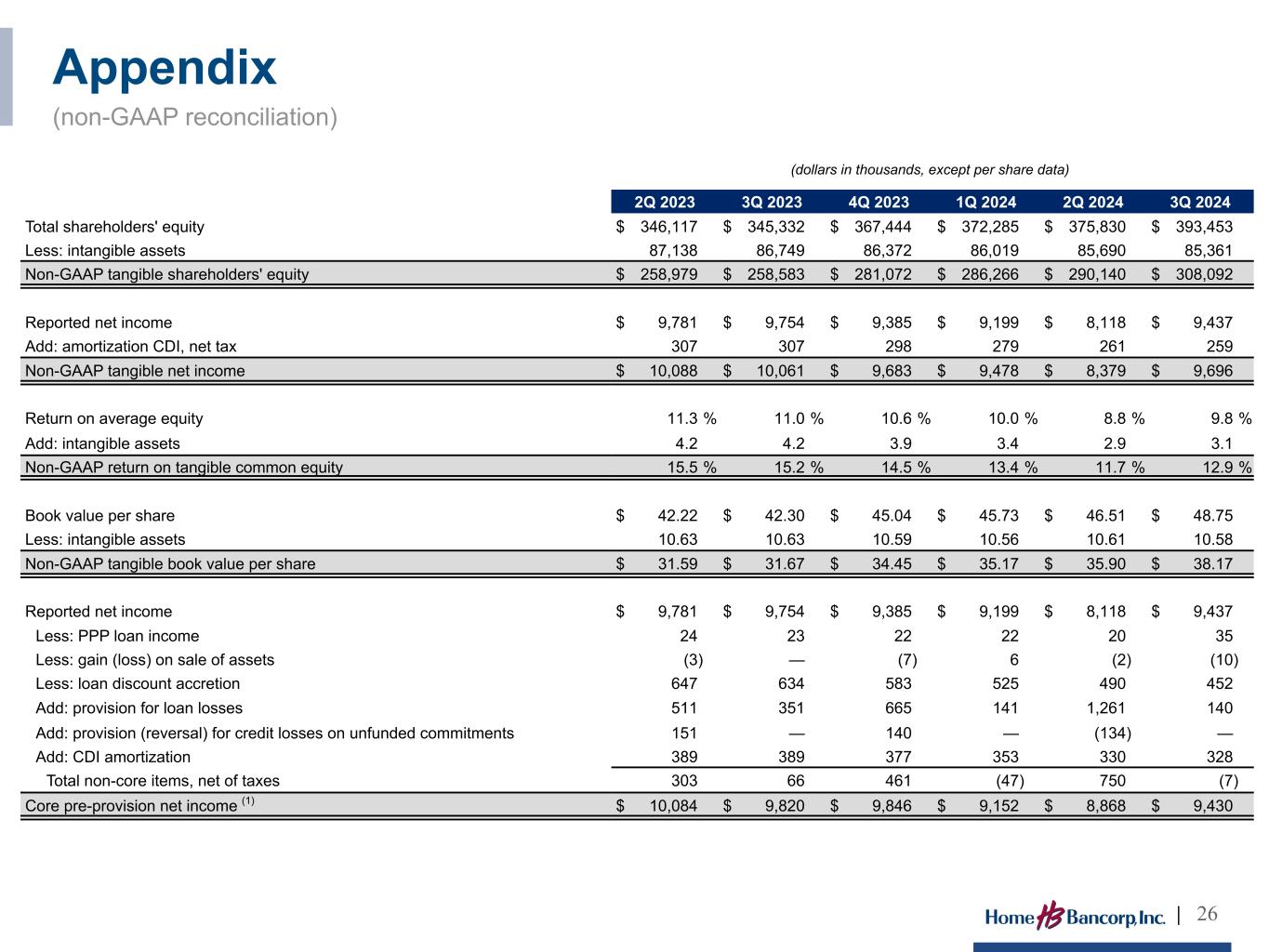

2Q 2023 3Q 2023 4Q 2023 1Q 2024 2Q 2024 3Q 2024 Total shareholders' equity $ 346,117 $ 345,332 $ 367,444 $ 372,285 $ 375,830 $ 393,453 Less: intangible assets 87,138 86,749 86,372 86,019 85,690 85,361 Non-GAAP tangible shareholders' equity $ 258,979 $ 258,583 $ 281,072 $ 286,266 $ 290,140 $ 308,092 Reported net income $ 9,781 $ 9,754 $ 9,385 $ 9,199 $ 8,118 $ 9,437 Add: amortization CDI, net tax 307 307 298 279 261 259 Non-GAAP tangible net income $ 10,088 $ 10,061 $ 9,683 $ 9,478 $ 8,379 $ 9,696 Return on average equity 11.3 % 11.0 % 10.6 % 10.0 % 8.8 % 9.8 % Add: intangible assets 4.2 4.2 3.9 3.4 2.9 3.1 Non-GAAP return on tangible common equity 15.5 % 15.2 % 14.5 % 13.4 % 11.7 % 12.9 % Book value per share $ 42.22 $ 42.30 $ 45.04 $ 45.73 $ 46.51 $ 48.75 Less: intangible assets 10.63 10.63 10.59 10.56 10.61 10.58 Non-GAAP tangible book value per share $ 31.59 $ 31.67 $ 34.45 $ 35.17 $ 35.90 $ 38.17 Reported net income $ 9,781 $ 9,754 $ 9,385 $ 9,199 $ 8,118 $ 9,437 Less: PPP loan income 24 23 22 22 20 35 Less: gain (loss) on sale of assets (3) — (7) 6 (2) (10) Less: loan discount accretion 647 634 583 525 490 452 Add: provision for loan losses 511 351 665 141 1,261 140 Add: provision (reversal) for credit losses on unfunded commitments 151 — 140 — (134) — Add: CDI amortization 389 389 377 353 330 328 Total non-core items, net of taxes 303 66 461 (47) 750 (7) Core pre-provision net income (1) $ 10,084 $ 9,820 $ 9,846 $ 9,152 $ 8,868 $ 9,430 Appendix (non-GAAP reconciliation) | 26 (dollars in thousands, except per share data)

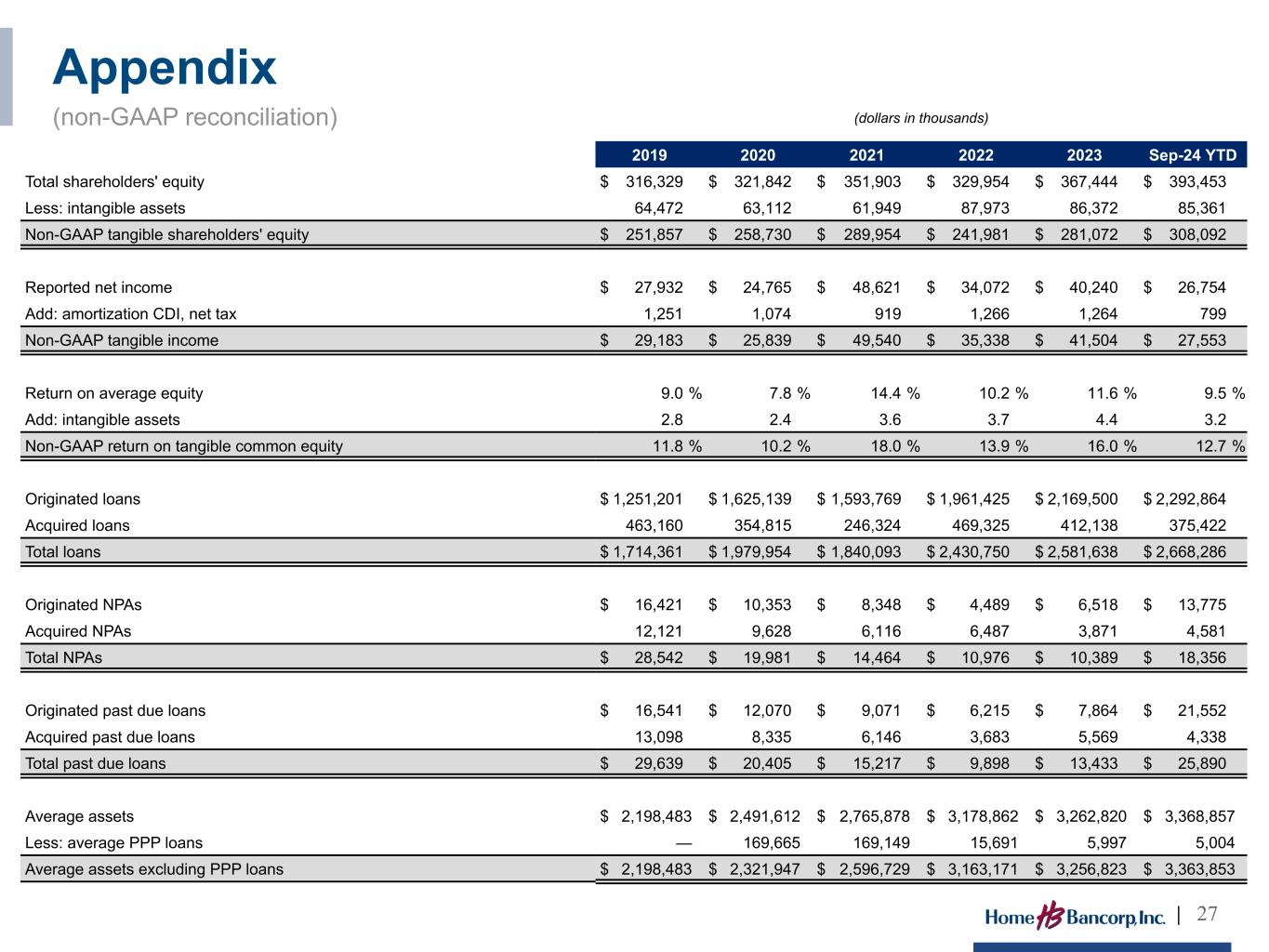

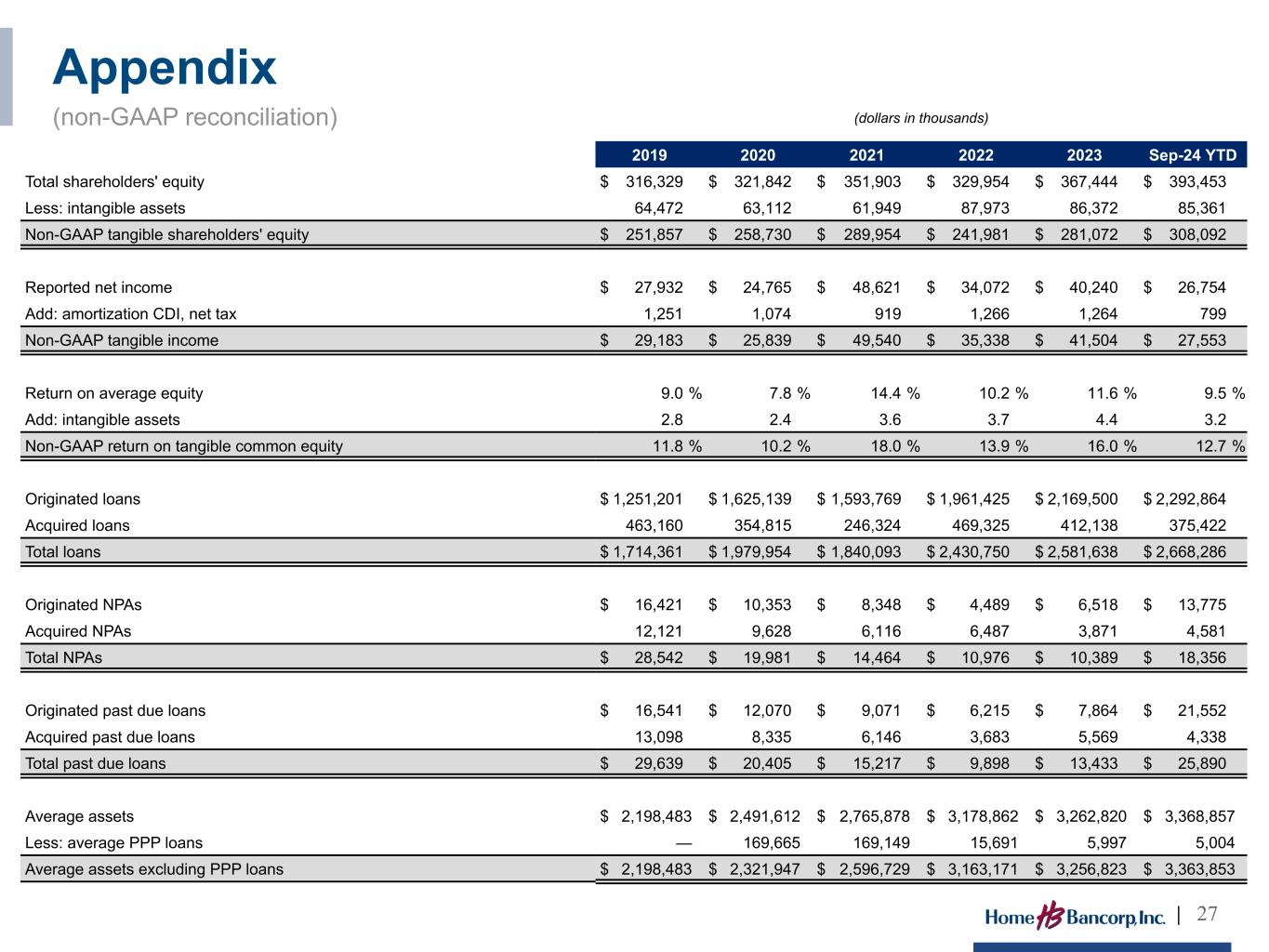

2019 2020 2021 2022 2023 Sep-24 YTD Total shareholders' equity $ 316,329 $ 321,842 $ 351,903 $ 329,954 $ 367,444 $ 393,453 Less: intangible assets 64,472 63,112 61,949 87,973 86,372 85,361 Non-GAAP tangible shareholders' equity $ 251,857 $ 258,730 $ 289,954 $ 241,981 $ 281,072 $ 308,092 Reported net income $ 27,932 $ 24,765 $ 48,621 $ 34,072 $ 40,240 $ 26,754 Add: amortization CDI, net tax 1,251 1,074 919 1,266 1,264 799 Non-GAAP tangible income $ 29,183 $ 25,839 $ 49,540 $ 35,338 $ 41,504 $ 27,553 Return on average equity 9.0 % 7.8 % 14.4 % 10.2 % 11.6 % 9.5 % Add: intangible assets 2.8 2.4 3.6 3.7 4.4 3.2 Non-GAAP return on tangible common equity 11.8 % 10.2 % 18.0 % 13.9 % 16.0 % 12.7 % Originated loans $ 1,251,201 $ 1,625,139 $ 1,593,769 $ 1,961,425 $ 2,169,500 $ 2,292,864 Acquired loans 463,160 354,815 246,324 469,325 412,138 375,422 Total loans $ 1,714,361 $ 1,979,954 $ 1,840,093 $ 2,430,750 $ 2,581,638 $ 2,668,286 Originated NPAs $ 16,421 $ 10,353 $ 8,348 $ 4,489 $ 6,518 $ 13,775 Acquired NPAs 12,121 9,628 6,116 6,487 3,871 4,581 Total NPAs $ 28,542 $ 19,981 $ 14,464 $ 10,976 $ 10,389 $ 18,356 Originated past due loans $ 16,541 $ 12,070 $ 9,071 $ 6,215 $ 7,864 $ 21,552 Acquired past due loans 13,098 8,335 6,146 3,683 5,569 4,338 Total past due loans $ 29,639 $ 20,405 $ 15,217 $ 9,898 $ 13,433 $ 25,890 Average assets $ 2,198,483 $ 2,491,612 $ 2,765,878 $ 3,178,862 $ 3,262,820 $ 3,368,857 Less: average PPP loans — 169,665 169,149 15,691 5,997 5,004 Average assets excluding PPP loans $ 2,198,483 $ 2,321,947 $ 2,596,729 $ 3,163,171 $ 3,256,823 $ 3,363,853 Appendix (non-GAAP reconciliation) | 27 (dollars in thousands)

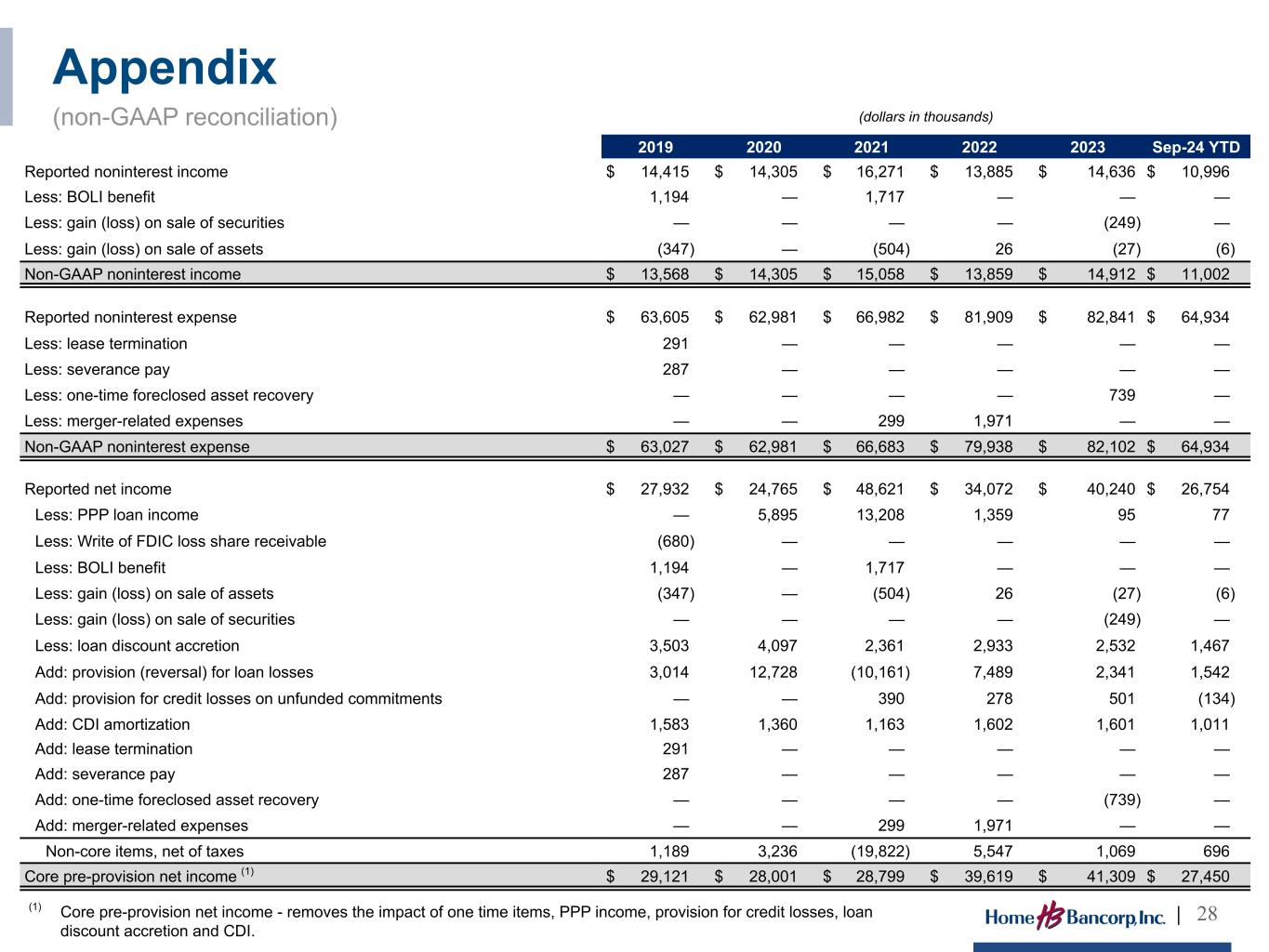

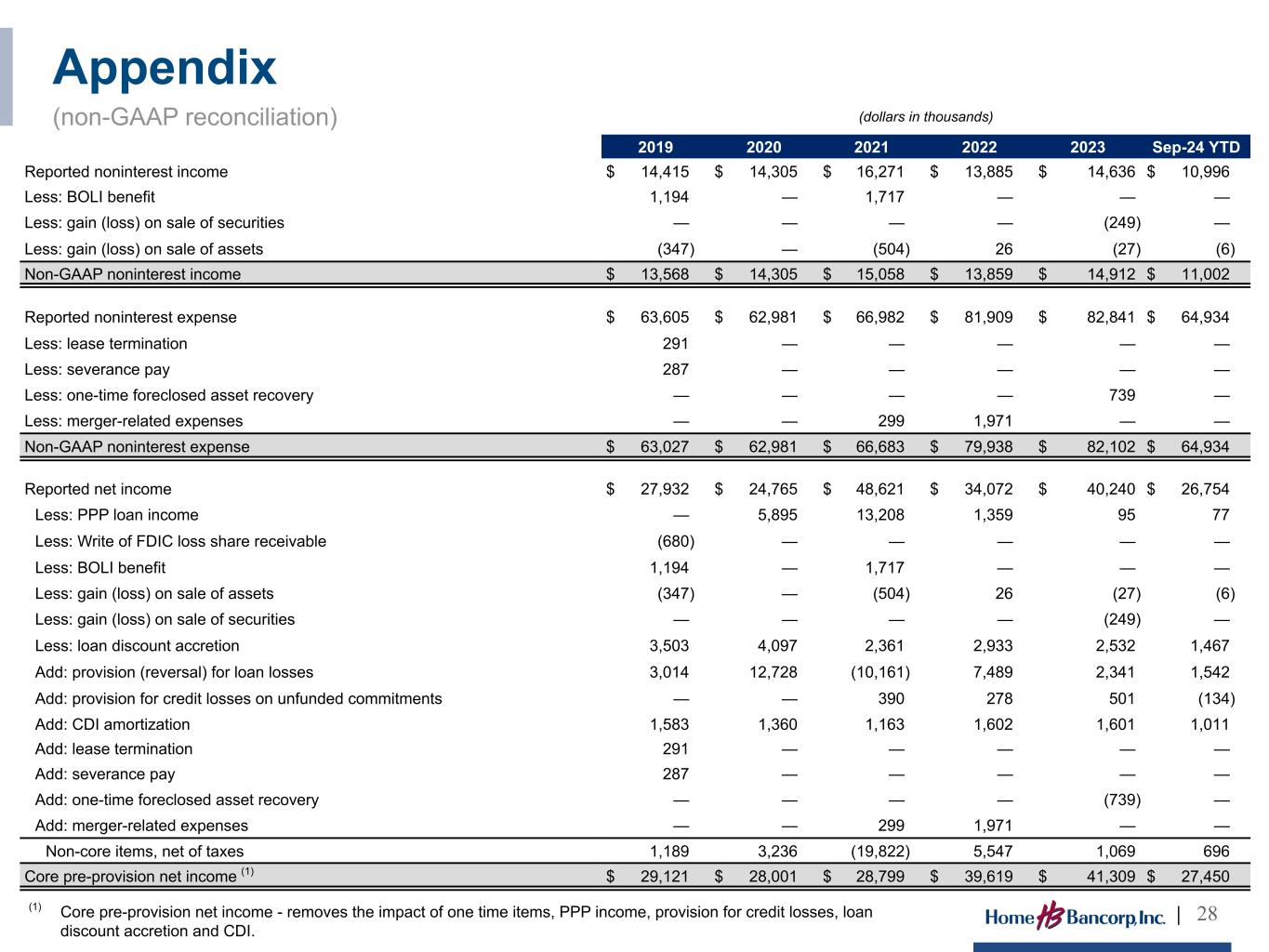

2019 2020 2021 2022 2023 Sep-24 YTD Reported noninterest income $ 14,415 $ 14,305 $ 16,271 $ 13,885 $ 14,636 $ 10,996 Less: BOLI benefit 1,194 — 1,717 — — — Less: gain (loss) on sale of securities — — — — (249) — Less: gain (loss) on sale of assets (347) — (504) 26 (27) (6) Non-GAAP noninterest income $ 13,568 $ 14,305 $ 15,058 $ 13,859 $ 14,912 $ 11,002 Reported noninterest expense $ 63,605 $ 62,981 $ 66,982 $ 81,909 $ 82,841 $ 64,934 Less: lease termination 291 — — — — — Less: severance pay 287 — — — — — Less: one-time foreclosed asset recovery — — — — 739 — Less: merger-related expenses — — 299 1,971 — — Non-GAAP noninterest expense $ 63,027 $ 62,981 $ 66,683 $ 79,938 $ 82,102 $ 64,934 Reported net income $ 27,932 $ 24,765 $ 48,621 $ 34,072 $ 40,240 $ 26,754 Less: PPP loan income — 5,895 13,208 1,359 95 77 Less: Write of FDIC loss share receivable (680) — — — — — Less: BOLI benefit 1,194 — 1,717 — — — Less: gain (loss) on sale of assets (347) — (504) 26 (27) (6) Less: gain (loss) on sale of securities — — — — (249) — Less: loan discount accretion 3,503 4,097 2,361 2,933 2,532 1,467 Add: provision (reversal) for loan losses 3,014 12,728 (10,161) 7,489 2,341 1,542 Add: provision for credit losses on unfunded commitments — — 390 278 501 (134) Add: CDI amortization 1,583 1,360 1,163 1,602 1,601 1,011 Add: lease termination 291 — — — — — Add: severance pay 287 — — — — — Add: one-time foreclosed asset recovery — — — — (739) — Add: merger-related expenses — — 299 1,971 — — Non-core items, net of taxes 1,189 3,236 (19,822) 5,547 1,069 696 Core pre-provision net income (1) $ 29,121 $ 28,001 $ 28,799 $ 39,619 $ 41,309 $ 27,450 (1) Core pre-provision net income - removes the impact of one time items, PPP income, provision for credit losses, loan discount accretion and CDI. Appendix (non-GAAP reconciliation) | 28 (dollars in thousands)

2018 2019 2020 2021 1Q2022 2022 2023 1Q2024 2Q2024 Sep-24 YTD Total shareholders' equity $ 304,040 $ 316,329 $ 321,842 $ 351,903 $ 337,504 $ 329,954 $ 367,444 $ 372,285 $ 375,830 $ 393,453 Less: intangible assets 66,055 64,472 63,112 61,949 87,569 87,973 86,372 86,019 85,690 85,361 Non-GAAP tangible shareholders' equity $ 237,985 $ 251,857 $ 258,730 $ 289,954 $ 249,935 $ 241,981 $ 281,072 $ 286,266 $ 290,140 $ 308,092 Less: AOCI (2,206) 692 5,274 744 (13,465) (39,307) (31,382) (33,501) (33,697) (23,635) Non-GAAP tangible shareholders' equity AOCI adjusted $ 240,191 $ 251,165 $ 253,456 $ 289,210 $ 263,400 $ 281,288 $ 312,454 $ 319,767 $ 323,837 $ 331,727 Shares Outstanding 9,459,050 9,252,418 8,740,104 8,526,907 8,453,014 8,286,084 8,158,281 8,140,380 8,081,344 8,070,539 Book value per share $ 32.14 $ 34.19 $ 36.82 $ 41.27 $ 39.93 $ 39.82 $ 45.04 $ 45.73 $ 46.51 $ 48.75 Less: intangible assets 6.98 6.97 7.22 7.27 10.36 10.62 10.59 10.56 10.61 10.58 Non-GAAP tangible book value per share $ 25.16 $ 27.22 $ 29.60 $ 34.00 $ 29.57 $ 29.20 $ 34.45 $ 35.17 $ 35.90 $ 38.17 Less: AOCI (0.23) 0.07 0.60 0.08 (1.59) (4.75) (3.85) (4.11) (4.17) (2.93) Non-GAAP tangible book value per share AOCI adjusted $ 25.39 $ 27.15 $ 29.00 $ 33.92 $ 31.16 $ 33.95 $ 38.30 $ 39.28 $ 40.07 $ 41.10 Appendix (non-GAAP reconciliation) | 29 (dollars in thousands except for per share data) )